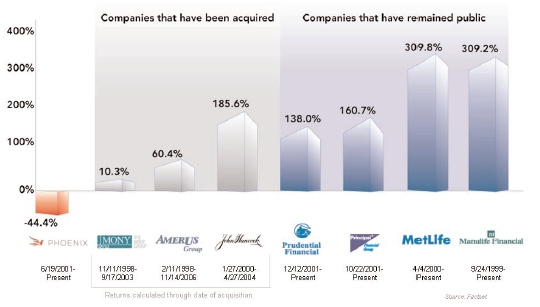

Not only has Phoenix’s stock price fallen, but the company’s insurance rating has been downgraded on five separate occasions since the IPO by major rating agencies, which affects the security of its policies. As the following graph reveals, the financial strength (“claims paying”) rating is now much lower than it was before the conversion from a mutual to a public stock company.

DONA YOUNG’S $49 MILLION CONTRACT FOR A “WALK AWAY” PAYOUT

While shareholders and policyholders have suffered declining performance and ratings, the management of the company has been generously paid. Phoenix’s 2008 Proxy statement, which you will shortly be receiving from the company, reveals that Chief Executive Officer Dona Young:

† had her total compensation for 2007 increased to $4.9 million, during a year in which the company’s stock price fell 25.3%.

† now has a total “walk-away” package of compensation arrangements that would pay her no less than $49 million1 if she left the company after a change of control.

At The Phoenix Companies, this compensation generosity is not limited to the CEO. This year’s Phoenix Proxy statement reveals that the Board has permitted the “Supplemental” pension plan for senior executives to grow to $141 million. This plan is a direct unfunded liability of the company that ranks ahead of shareholders.

We believe it is clear that the Board of Directors has failed to exercise effective and responsible oversight on your behalf. Instead, shareholders have been left with losses, policyholders have been left with downgraded ratings for their policies and management has been enriched.

We believe that The Phoenix Companies needs truly independent Directors who will bring accountability to management. Therefore we are proposing three Directors, Carl Santillo, John Clinton, and Augustus Oliver for election at this year’s annual meeting. These candidates all have significant insurance or financial experience. We believe that, collectively, they have deeper, more substantive industry expertise than the three incumbent Board members that we are seeking to replace, who have all been members of the Board’s Compensation Committee during the period that the compensation packages discussed in this letter were approved.

WE NEED YOU TO VOTE FOR NEW DIRECTORS TO PROTECT YOUR

INVESTMENT AND SAFEGUARD YOUR POLICY

You might be surprised to learn thatthe current Board and senior executives of Phoenix —including CEO Dona Young — collectively own barely half of one percent of the stock of the company.In fact, several incumbent directors do not own even a single share of Phoenix stock. The directors that we are proposing have meaningful ownership and interests fully aligned with yours.

The election of Directors will take place at Phoenix’s Annual Meeting of shareholders on May 2, 2008. This meeting will provide an important opportunity for you to vote for new, independent Directors.

In the next few weeks, you will receive materials from us showing you how to vote for the new Directors on theWHITEcard. Please note that these materials will be separate from the materials you receive from The Phoenix Companies, recommending that you vote for their incumbent directors. We encourage you not to return any Blue card that Phoenix may send to you.

1Includes Pension, Supplemental Pension, Excess Investment Plan, Deferred Restricted Stock Units, Deferred Dividends, Base Severance, Incentive Severance, 2007 Annual Incentive, 2005-2007 LTIP, 2006-2008 LTIP, 2007-2009 LTIP, Unvested Performance-Contingent RSU’s, Unvested Service-Based RSU’s, Unvested Stock Options, Incremental Non-Qualified Company Match, Non-Qualified Pension Lump Sum, and 280G Tax Gross-Up (for excise taxes on Excess Parachute Payments).

Remember, the Board of The Phoenix Companies does not appoint its Directors, they must be elected by shareholders. This year you have a real choice, and can vote for new Directors nominated by Oliver Press Partners who are independent and aligned with your interests.

In order to cast your vote for the new Directors, you can simply complete theWHITEproxy card that you will receive shortly and return it as instructed. In the meanwhile, you can learn more about Phoenix’s performance issues, our proposals to address these issues, and our Board candidates atwww.RaiseThePhoenix.com.

We appreciate your support, and if you need assistance or have any questions, please call our Proxy Solicitor, MacKenzie Partners, Inc., toll-free at (800) 322-2885 or collect at (212) 929-5500.

Sincerely,

Augustus K. Oliver

Clifford Press

If you have any questions or require assistance in voting your WHITE proxy card, please call MacKenzie Partners at the phone numbers listed below.

105 Madison Avenue

New York, NY 10016

phoenixproxy@mackenziepartners.com

Call Collect: (212) 929-5500

or

Toll Free: (800) 322-2885

ADDITIONAL INFORMATION

Oliver Press Partners, LLC (“Oliver Press”) filed a preliminary proxy statement with the Securities and Exchange Commission (the “SEC”). Oliver Press will prepare and file with the SEC a definitive proxy statement and may file other solicitation materials. THE PHOENIX COMPANIES, INC.’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE 2008 ANNUAL MEETING WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. THESE MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. Shareholders may also obtain free copies of the proxy statement and other documents filed by Oliver Press in connection with the annual meeting by directing a request to: MacKenzie Partners, Inc. by calling Toll-Free (800) 322-2885 or by e-mail at phoenixproxy@macken-ziepartners.com.

OLIVER PRESS PARTICIPANT INFORMATION

IN ACCORDANCE WITH RULE 14A-12(A)(1)(I) OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED, INFORMATION REGARDING THE IDENTITY OF THE PERSONS WHO MAY, UNDER SEC RULES, BE DEEMED TO BE PARTICIPANTS IN THE SOLICITATION OF SHAREHOLDERS AND THEIR INTERESTS ARE SET FORTH IN THE PRELIMINARY PROXY STATEMENT THAT WAS FILED BY OLIVER PRESS WITH THE SEC.