UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| x | Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended September 30, 2008.

or

| o | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from _____________________ to ____________________ .

Commission File Number 000-51760

CHINA BIO-IMMUNITY CORPORATION

(Exact name of registrant as specified in its charter)

Nevada | | 20-2815911 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

No. 36 ShengMing 2nd Road

DD Port, Dalian

People’s Republic of China, 116620

(Address of Principal Executive Offices including zip code)

86 411 87407598

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ðo

Indicate by check mark if the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company.

Large Accelerated Filer o Accelerated Filer o

Non-Accelerated Filer o. (Do not check if a smaller reporting company) Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act). Yes oð Nox

There were 15,000,001 shares of the Registrant’s Common Stock issued and outstanding on November 14, 2008, par value $0.001per shares.

CHINA BIO-IMMUNITY CORPORATION

INDEX TO FORM 10-Q

| | | | | PAGE |

PART I. | | FINANCIAL INFORMATION | | |

| | | ITEM 1. FINANCIAL STATEMENTS | | 1-18 |

| | | ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | 19-29 |

| | | ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | | 30 |

| | | ITEM 4. CONTROLS AND PROCEDURES | | 30 |

PART II. | | OTHER INFORMATION | | |

| | | ITEM 1. LEGAL PROCEEDINGS | | 31 |

| | | ITEM 1A. RISK FACTORS | | 31 |

| | | ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | | 31 |

| | | ITEM 3. DEFAULTS UPON SENIOR SECURITIES | | 31 |

| | | ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS | | 31 |

| | | ITEM 5. OTHER INFORMATION | | 31 |

| | | ITEM 6. EXHIBITS | | 32 |

| SIGNATURES | | 33 |

Item I FINANCIAL STATEMENTS

CHINA BIO-IMMUNITY CORPORATION

(FORMERLY EASY GOLF CORPORATION) AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| | | September 30, 2008 | | December 31, 2007 | |

| | | (Unaudited) | | | |

ASSETS | | | | | |

CURRENT ASSETS | | | | | |

| Cash and cash equivalents | | $ | 13,946,737 | | $ | 6,837,792 | |

| Accounts receivable | | | 5,707,994 | | | 3,659,399 | |

| Inventories | | | 6,704,695 | | | 4,969,151 | |

| Prepayments | | | 1,046,942 | | | 619,434 | |

| Other receivables and other assets | | | 40,800 | | | 22,446 | |

| Due from related party | | | 384,432 | | | | |

| Deferred taxes | | | 505,457 | | | | |

| Total Current Assets | | | 28,337,057 | | | 16,108,222 | |

| | | | | | | | |

LONG-TERM ASSETS | | | | | | | |

| Plant and equipment, net | | | 12,598,146 | | | 10,958,371 | |

| Land use rights, net | | | 3,747,963 | | | 1,336,444 | |

| Technology, net | | | 1,051,744 | | | 1,112,891 | |

| Deferred taxes | | | 1,959 | | | | |

| Total Long-Term Assets | | | 17,399,812 | | | 13,407,706 | |

| | | | | | | | |

TOTAL ASSETS | | $ | 45,736,869 | | $ | 29,515,928 | |

See the accompanying notes to condensed consolidated financial statements

CHINA BIO-IMMUNITY CORPORATION

(FORMERLY EASY GOLF CORPORATION) AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| | | September 30, 2008 | | December 31, 2007 | |

| | | (Unaudited) | | | |

| | | | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | |

CURRENT LIABILITIES | | | | | |

| Accounts payable and accrued expenses | | $ | 2,858,598 | | $ | 1,573,069 | |

| Customer deposits | | | 39,009 | | | 186,650 | |

| Income taxes payable | | | 2,281,200 | | | 487,851 | |

| Short-term loans | | | 7,333,206 | | | 5,749,801 | |

| Deferred revenue | | | 103,304 | | | 95,994 | |

| Due to related companies | | | | | | 1,375,641 | |

| Deferred taxes | | | 194,660 | | | 572,771 | |

| Total current liabilities | | | 12,809,977 | | | 10,041,777 | |

| | | | | | | | |

LONG-TERM LIABILITIES | | | | | | | |

| Deferred taxes | | | 143,103 | | | 73,443 | |

| Total long-term liabilities | | | 143,103 | | | 73,443 | |

TOTAL LIABILITIES | | | 12,953,080 | | | 10,115,220 | |

| | | | | | | | |

SHAREHOLDERS’ EQUITY | | | | | | | |

Common stock, $.001 par value; 50,000,000 shares authorized; 15,000,001 and 13,246,697 shares, issued and outstanding at September 30, 2008 and December 31, 2007, respectively | | | 15,000 | | | 13,247 | |

| Additional paid-in capital | | | 7,348,081 | | | 6,027,516 | |

Retained earnings (the restricted portion is $2,930,563 and $1,776,364 at September 30, 2008 and at December 31, 2007, respectively) | | | 21,715,633 | | | 11,542,904 | |

| Accumulated other comprehensive income | | | 3,705,075 | | | 1,817,041 | |

| Total Shareholders' Equity | | | 32,783,789 | | | 19,400,708 | |

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | | $ | 45,736,869 | | $ | 29,515,928 | |

See the accompanying notes to condensed consolidated financial statements

CHINA BIO-IMMUNITY CORPORATION

(FORMERLY EASY GOLF CORPORATION) AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

(UNAUDITED)

| | | Three Months Ended September 30, | | Nine Months Ended September 30, | |

| | | 2008 | | 2007 | | 2008 | | 2007 | |

| | | | | | | | | | |

REVENUES | | $ | 9,599,685 | | $ | 12,722,324 | | $ | 22,741,065 | | $ | 18,241,343 | |

COST OF GOODS SOLD | | | 1,429,477 | | | 2,657,594 | | | 5,920,636 | | | 3,895,165 | |

GROSS PROFIT | | | 8,170,208 | | | 10,064,730 | | | 16,820,429 | | | 14,346,178 | |

| Selling expenses | | | 65,693 | | | 94,396 | | | 218,600 | | | 252,871 | |

| General and administrative expenses | | | 2,133,347 | | | 677,571 | | | 4,098,457 | | | 1,493,191 | |

| Total operating expenses | | | 2,199,040 | | | 771,967 | | | 4,317,057 | | | 1,746,062 | |

INCOME FROM OPERATIONS | | | 5,971,168 | | | 9,292,763 | | | 12,503,372 | | | 12,600,116 | |

| | | | | | | | | | | | | | |

OTHER INCOME (EXPENSES), NET | | | | | | | | | | | | | |

| Interest expense, net | | | (130,132 | ) | | (103,102 | ) | | (397,663 | ) | | (300,082 | ) |

| Investment income | | | | | | | | | 83,372 | | | | |

| Other income (expenses), net | | | 285,879 | | | (1,553 | ) | | 742,228 | | | 100,392 | |

| Government grant | | | | | | | | | 110,787 | | | | |

| Total other income (expenses), net | | | 155,747 | | | (104,655 | ) | | 538,724 | | | (199,690 | ) |

| | | | | | | | | | | | | | |

INCOME FROM OPERATIONS BEFORE TAXES | | | 6,126,915 | | | 9,188,108 | | | 13,042,096 | | | 12,400,426 | |

INCOME TAX EXPENSE | | | 1,788,349 | | | 1,335,865 | | | 2,869,367 | | | 1,818,136 | |

NET INCOME | | | 4,338,566 | | | 7,852,243 | | | 10,172,729 | | | 10,582,290 | |

OTHER COMPREHENSIVE INCOME | | | | | | | | | | | | | |

| Foreign currency translation gain | | | 256,952 | | | 11,047 | | | 1,888,034 | | | 592,884 | |

OTHER COMPREHENSIVE INCOME | | | 256,952 | | | 11,047 | | | 1,888,034 | | | 592,884 | |

COMPREHENSIVE INCOME | | $ | 4,595,518 | | $ | 7,863,290 | | $ | 12,060,763 | | $ | 11,175,174 | |

WEIGHTED AVERAGE SHARES OUTSTANDING, BASIC | | | 14,337,642 | | | 13,246,697 | | | 13,610,345 | | | 13,246,697 | |

WEIGHTED AVERAGE SHARES OUTSTANDING, DILUTED | | | 14,378,685 | | | 13,246,697 | | | 13,624,026 | | | 13,246,697 | |

NET INCOME PER SHARE, BASIC | | $ | 0.30 | | $ | 0.59 | | $ | 0.75 | | $ | 0.80 | |

NET INCOME PER SHARE, DILUTED | | $ | 0.30 | | $ | 0.59 | | $ | 0.75 | | $ | 0.80 | |

See the accompanying notes to condensed consolidated financial statements

CHINA BIO-IMMUNITY CORPORATION

(FORMERLY EASY GOLF CORPORATION) AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS’ EQUITY

(UNAUDITED)

| | | Common Stock | | | | | | | | | |

| | | Number of shares | | Par value | | Additional Paid-in Capital | | Retained Earnings | | Accumulated Other Comprehensive Income | | Total | |

BALANCE AT JANUARY 1, 2008 | | | 13,246,697 | | $ | 13,247 | | $ | 6,027,516 | | $ | 11,542,904 | | $ | 1,817,041 | | $ | 19,400,708 | |

| Issuance of warrants in reverse merger | | | | | | | | | 826,479 | | | | | | | | | 826,479 | |

| Recapitalization | | | 1,753,304 | | | 1,753 | | | 494,086 | | | | | | | | | 495,839 | |

| Net income | | | | | | | | | | | | 10,172,729 | | | | | | 10,172,729 | |

| Foreign currency translation gain | | | | | | | | | | | | | | | 1,888,034 | | | 1,888,034 | |

BALANCE AT SEPTEMBER 30, 2008 | | | 15,000,001 | | $ | 15,000 | | $ | 7,348,081 | | $ | 21,715,633 | | $ | 3,705,075 | | $ | 32,783,789 | |

See the accompanying notes to condensed consolidated financial statements

CHINA BIO-IMMUNITY CORPORATION

(FORMERLY EASY GOLF CORPORATION) AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | | Nine Months Ended September 30, | |

| | | 2008 | | 2007 | |

CASH FLOWS FROM OPERATING ACTIVITIES | | | | | |

| Net income | | $ | 10,172,729 | | $ | 10,582,290 | |

| Adjustments to reconcile net income to | | | | | | | |

| net cash provided by operating activities: | | | | | | | |

| Depreciation and amortization | | | 957,764 | | | 683,881 | |

| Gain on disposal of equipment | | | | | | (3,887 | ) |

| Fair value of warrants issued for reverse merger | | | 826,479 | | | | |

| Investment income | | | (83,372 | ) | | | |

| Deferred taxes | | | (815,867 | ) | | 591,192 | |

| Changes in operating assets and liabilities: | | | | | | | |

| (Increase) Decrease In: | | | | | | | |

| Accounts receivable | | | (2,048,595 | ) | | (1,977,716 | ) |

| Inventories | | | (1,735,544 | ) | | (1,842,499 | ) |

| Other receivables and other assets | | | (18,352 | ) | | 1,526 | |

| Prepayments | | | (427,139 | ) | | (984,612 | ) |

| Increase (Decrease) In: | | | | | | | |

| Accounts payable and accrued expenses | | | 1,126,880 | | | 1,076,654 | |

| Customer deposits | | | (147,641 | ) | | 459,137 | |

| Deferred revenue | | | 7,310 | | | 79,380 | |

| Taxes payable | | | 1,793,349 | | | 595,354 | |

| Net cash provided by operating activities | | | 9,608,001 | | | 9,260,700 | |

| | | | | | | | |

CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | |

| Proceeds from disposal of investment securities | | | 83,372 | | | | |

| Purchase of construction in progress | | | | | | (108,189 | ) |

| Purchase of land use right | | | (2,292,873 | ) | | | |

| Purchases of plant and equipment | | | (1,418,491 | ) | | (854,157 | ) |

| Cash acquired in reverse merger | | | 80,521 | | | | |

| Proceeds from disposal of equipment | | | | | | 17,015 | |

| Net cash used in investing activities | | | (3,547,471 | ) | | (945,331 | ) |

| | | | | | | | |

CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | |

| Dividend paid | | | | | | (3,893,525 | ) |

| Advances from related company | | | | | | 654,442 | |

| Repayments from related company | | | | | | 654,442 | |

| Advances to a related party | | | (384,432 | ) | | | |

| Repayments to related companies | | | (1,375,641 | ) | | (15,065 | ) |

| Proceeds from short-term bank loans | | | 8,295,076 | | | | |

| Repayments of short-term bank loans | | | (7,150,927 | ) | | | |

| Net cash used in financing activities | | | (615,924 | ) | | (2,599,706 | ) |

| | | | | | | | |

NET INCREASE IN CASH AND CASH EQUIVALENTS | | | 5,444,606 | | | 5,715,663 | |

| Effect of exchange rate changes on cash and cash equivalents | | | 1,664,339 | | | 89,328 | |

| Cash and cash equivalents, beginning of period | | | 6,837,792 | | | 620,936 | |

CASH AND CASH EQUIVALENTS AT END OF PERIOD | | $ | 13,946,737 | | $ | 6,425,927 | |

SUPPLEMENTARY CASH FLOW INFORMATION | | | | | | | |

| Interest paid | | $ | 443,535 | | $ | 314,358 | |

| Income tax paid | | $ | 1,995,056 | | $ | 234,919 | |

See the accompanying notes to condensed consolidated financial statements

CHINA BIO-IMMUNITY CORPORATION

(FORMERLY EASY GOLF CORPORATION) AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2008

(UNAUDITED)

NOTE 1 - PRINCIPAL ACTIVITIES AND ORGANIZATION

China Bio-Immunity Corporation (the “Company”) was incorporated in the state of Utah as Thrust Resources, Inc. on July 16, 1981. On April 22, 2005, pursuant to a merger CHHB changed its domicile to Nevada. On February 11, 2008, the Company changed its name to China Bio-Immunity Corporation (formerly known as Easy Golf Corporation).

Effective April 7, 2008, the Company completed a one-for-two (1-for-2) reverse stock split of its outstanding shares of common stock (the “Reverse Split”). As a result of the Reverse Spilt, the total number of outstanding shares of the Company’s common stock was reduced from 3,506,428 to 1,753,304. All share and per share amounts have been adjusted for all periods to reflects the reverse stock split.

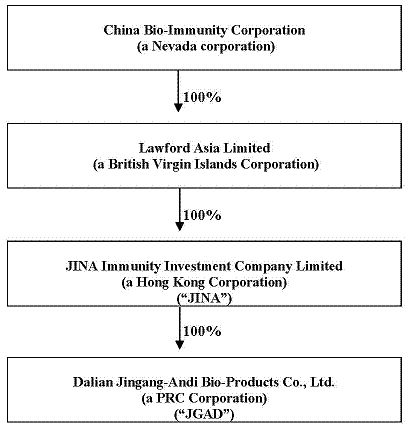

On August 6, 2008, the Company entered into a Share Exchange Agreement (“Exchange Agreement”) with Lawford Asia Limited (“Lawford”), and the shareholders of Lawford (the “Lawford Shareholders”). As a result the share exchange, the Company acquired all of the issued and outstanding securities of Lawford, an inactive holding company, from the Lawford Shareholders in exchange for 13,246,697 newly-issued shares of the Company’s common stock, par value $0.001 per share (“Common Stock”), representing 88.31% of the Company’s issued and outstanding Common Stock (the “Share Exchange”). As a result of the Share Exchange, Lawford and its wholly owned subsidiaries, JINA Immunity Investment Company Limited (“JINA”), and Dalian Jingang-Andi Bio-Products Company Limited (“JGAD”), became wholly owned subsidiaries of the Company. This transaction was accounted for as a “reverse merger” with Lawford deemed to be the accounting acquirer and the Company as the legal acquirer. Consequently, the assets and liabilities and the historical operations that will be reflected in the financial statements for periods prior to the Share Exchange will be those of Lawford’s operating subsidiary, JGAD and will be recorded at the historical cost basis of JGAD. After completion of the Share Exchange, the Company’s consolidated financial statements includes the assets and liabilities of both the Company and JGAD, the historical operations of JGAD and the operations of the Company and its subsidiaries from the closing date of the Share Exchange. Also see Note 11.

Lawford was incorporated on January 15, 2008 under the laws of the British Virgin Islands as a holding company, for the purposes of owning 100% of the capital stock of JINA. JINA was incorporated on October 15, 2007 under the laws of Hong Kong for the purpose of owning 100% of the capital stock of JGAD, a corporation incorporated on March 26, 2002 under the laws of the People’s Republic of China (“PRC”). Following the approval by the relevant governmental authorities in the PRC, JINA acquired a 100% ownership interest in JGAD. As a result of the transaction, JGAD became a wholly-owned subsidiary of JINA, which in turn is a wholly-owned subsidiary of Lawford. JGAD engages in the development, manufacturing, and distribution of vaccine products. As a result of the Exchange Agreement, the Company succeeded to the business of JGAD as its sole line of business.

CHINA BIO-IMMUNITY CORPORATION

(FORMERLY EASY GOLF CORPORATION) AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2008

(UNAUDITED)

NOTE 2 - BASIS OF PRESENTATION

The unaudited condensed consolidated financial statements of the Company have been prepared in accordance with generally accepted accounting principles for interim financial information and pursuant to the rules and regulations of the Securities and Exchange Commission (SEC) applicable to Quarterly Reports on Form 10-Q. Accordingly, they do not include all the information and footnotes required by accounting principles generally accepted in the United States for complete financial statements. However, such information reflects all adjustments (consisting solely of normal recurring adjustments), which are, in the opinion of management, necessary for the fair presentation of the consolidated financial position and the consolidated results of operations. Results shown for interim periods are not necessarily indicative of the results to be obtained for a full year. The condensed consolidated balance sheet information as of December 31, 2007 was derived from the audited financial statements included in the Company’s Current Report on Form 8−K filed with the SEC on August 6, 2008. These interim financial statements should be read in conjunction with that report.

NOTE 3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation

The condensed consolidated financial statements include the accounts of China Bio-Immunity Corporation and the following subsidiaries:

| (i) | Lawford (an inactive holding company, 100% subsidiary of the Company) |

| (ii) | JINA (an inactive holding company,100% subsidiary of Lawford) |

| (iii) | JGAD (100% subsidiary of JINA). |

Intercompany accounts and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reporting period. Management makes these estimates using the best information available at the time the estimates are made; however actual results when ultimately realized could differ from those estimates.

CHINA BIO-IMMUNITY CORPORATION

(FORMERLY EASY GOLF CORPORATION) AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2008

(UNAUDITED)

NOTE 3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Revenue Recognition

Revenues represent the invoiced value of goods sold recognized upon the shipment of goods to customers. Revenues are recognized when all of the following criteria are met:

| · | Persuasive evidence of an arrangement exists, |

| · | The seller’s price to the buyer is fixed or determinable, and |

| · | Collectability is reasonably assured. |

Research and Development

Research and development costs are expensed as incurred. For the nine months ended September 30, 2007 engineers and technical staff were involved in the production of our products as well as on-going research. The Company did not segregate the portion of the salaries relating to research and development from the portion relating to production. The total salaries were included in cost of goods sold. From January 1, 2008 going forward, engineers and technical staff have been significantly involved in on-going research. The segregated portion of the salaries relating to research and development from the portion relating to production were recorded in research and development in general and administrative expenses. Research and development expenses included in the general and administrative expenses for the nine months ended September 30, 2008 and 2007 were $760,447 and $111,942, respectively.

Retirement Benefits

Retirement benefits in the form of contributions under defined contribution retirement plans to the relevant authorities in the PRC are charged to expense as incurred. The retirement benefits expenses for the nine months ended September 30, 2008 and 2007 were $331,904 and $134,886 respectively and were included in general and administrative expenses.

Deferred Revenue

Deferred revenue is recognized when grants are received or collectible from the PRC government to the Company for assisting its technical research and development. The amount is recognized as revenue when the Company incurred the relevant research and development expenses.

The deferred revenue at September 30, 2008 and December 31, 2007 was $103,304 and $95,994, respectively.

CHINA BIO-IMMUNITY CORPORATION

(FORMERLY EASY GOLF CORPORATION) AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2008

(UNAUDITED)

NOTE 3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Foreign Currency Translation

The accompanying unaudited condensed consolidated financial statements are presented in United States dollars. The functional currency of the operating entity of the Company, JGAD, is the Renminbi (RMB). Capital accounts of the financial statements are translated into United States dollars (USD) from RMB at their historical exchange rates when the capital transactions occurred. Assets and liabilities are translated at the exchange rates as of balance sheet date. Income and expenditures are translated at the average exchange rate of the period.

| | | September 30 | |

| | | 2008 | | 2007 | |

| Periods ended RMB: US$ exchange rate | | 6.8183 | | 7.5108 | |

| Average RMB: US$ exchange rate for the three months ended | | 6.8390 | | 7.5635 | |

| Average RMB: US$ exchange rate for the nine months ended | | 6.9921 | | 7.6401 | |

The RMB is not freely convertible into foreign currency and all foreign exchange transactions must take place through authorized institutions. No representation is made that the RMB amounts could have been, or could be, converted into USD at the rates used in translation.

Earnings Per Share

Basic earnings per share are computed by dividing income available to common shareholders by the weighted-average number of common shares outstanding during the period. Diluted earnings per share is computed similar to basic earnings per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive.

CHINA BIO-IMMUNITY CORPORATION

(FORMERLY EASY GOLF CORPORATION) AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2008

(UNAUDITED)

NOTE 3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Earnings Per Share (Continued)

Basic and diluted earnings per share are calculated as follows:

| | | THREE MONTHS ENDED | | NINE MONTHS ENDED | |

| | SEPTEMBER 30, | | SEPTEMBER 30, | |

| | 2008 | | 2007 | | 2008 | | 2007 | |

| | | (Unaudited) | | (Unaudited) | | (Unaudited) | | (Unaudited) | |

| Basic: | | | | | | | | | |

| Net income | | $ | 4,338,566 | | $ | 7,852,243 | | $ | 10,172,729 | | $ | 10,582,290 | |

| Weighted average | | | | | | | | | | | | | |

| shares outstanding | | | 14,337,642 | | | 13,246,697 | | | 13,610,345 | | | 13,246,697 | |

| | | | | | | | | | | | | | |

| Basic earnings per | | | | | | | | | | | | | |

| share | | $ | 0.30 | | $ | 0.59 | | $ | 0.75 | | $ | 0.80 | |

| | | | | | | | | | | | | | |

| Diluted: | | | | | | | | | | | | | |

| Net income | | $ | 4,338,566 | | $ | 7,852,243 | | $ | 10,172,729 | | $ | 10,582,290 | |

| Weighted average | | | | | | | | | | | | | |

| shares outstanding | | | 14,337,642 | | | 13,246,697 | | | 13,610,345 | | | 13,246,697 | |

| Effect of dilutive | | | | | | | | | | | | | |

| securities: | | | | | | | | | | | | | |

| Warrants | | | 41,043 | | | — | | | 13,681 | | | — | |

| | | | | | | | | | | | | | |

| Diluted weighted | | | | | | | | | | | | | |

| average shares | | | | | | | | | | | | | |

| outstanding | | | 14,378,685 | | | 13,246,697 | | | 13,624,026 | | | 13,246,697 | |

| | | | | | | | | | | | | | |

| Diluted earnings per | | | | | | | | | | | | | |

| share | | $ | 0.30 | | $ | 0.59 | | $ | 0.75 | | $ | 0.80 | |

CHINA BIO-IMMUNITY CORPORATION

(FORMERLY EASY GOLF CORPORATION) AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2008

(UNAUDITED)

NOTE 3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Fair Value of Financial Instruments

The Company’s financial instruments include cash and cash equivalents, restricted cash, accounts receivables, prepayments, other receivables, due from a related party, accounts payable, other payables and accrued expenses, customer deposits, taxes payable, due to related companies, short-term loans, and deferred revenue. Management has estimated that the carrying amount approximates their fair value due to their short-term nature or long-term debt interest rates approximate the current market rates.

New Accounting Pronouncements

In December 2007, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting Standards (“SFAS”) No. 141 (R), Business Combination,. SFAS No. 141 (R) requires an acquirer to measure the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree at their fair values on the acquisition date, with goodwill being the excess value over the net identifiable assets acquired. The calculation of earnings per share will continue to be based on income amounts attributable to the parent. SFAS No. 141 (R) is effective for financial statements issued for fiscal years beginning after December 15, 2008. Early adoption is prohibited. SFAS 141 (R) will significantly affect the accounting for future business combinations and we will determine the accounting as new combinations occur.

In December 2007, the FASB issued SFAS No. 160, Noncontrolling Interests in Consolidated Financial Statements. This Statement establishes accounting and reporting standards that require the ownership interests in subsidiaries’ non-parent owners be clearly presented in the equity section of the balance sheet; requires the amount of consolidated net income attributable to the parent and to the noncontrolling interest be clearly identified and presented on the face of the consolidated statement of income; requires that changes in a parent’s ownership interest while the parent retains its controlling financial interest in its subsidiary be accounted for consistently; requires that when a subsidiary is deconsolidated, any retained noncontrolling equity investment in the former subsidiary be initially measured at fair value and the gain or loss on the deconsolidation of the subsidiary be measured using the fair value of any noncontrolling equity; requires that entities provide disclosures that clearly identify the interests of the parent and the interests of the noncontrolling owners. This Statement is effective as of the beginning of an entity’s first fiscal year that begins after December 15, 2008. The Company has not determined the impact, if any, SFAS No. 160 will have on its consolidated financial statements.

CHINA BIO-IMMUNITY CORPORATION

(FORMERLY EASY GOLF CORPORATION) AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2008

(UNAUDITED)

NOTE 3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

New Accounting Pronouncements (Continued)

In March 2008, the FASB issued SFAS No. 161, "Disclosures about Derivative Instruments and Hedging Activities" ("SFAS No. 161"), which amends SFAS No.133 and expands disclosures to include information about the fair value of derivatives, related credit risks and a company's strategies and objectives for using derivatives. SFAS No. 161 is effective for fiscal periods beginning on or after November 15, 2008. The Company is currently in the process of assessing the impact that SFAS No. 161 will have on the disclosures in its consolidated financial statements.

NOTE 4 - INVENTORIES

Inventories are summarized as follows:

| | | September 30, | | December 31, | |

| | | 2008 | | 2007 | |

| | | (Unaudited) | | | |

| Raw materials | | $ | 1,842,076 | | $ | 264,318 | |

| Special materials | | | 427,727 | | | — | |

| Work in progress | | | 3,291,943 | | | 3,996,795 | |

| Packing materials | | | 612,751 | | | 119,476 | |

| Finished goods | | | 530,198 | | | 588,562 | |

| Inventories | | $ | 6,704,695 | | $ | 4,969,151 | |

NOTE 5 - LAND USE RIGHTS

Land use rights consist of the followings:

| | | September 30, | | December 31, | |

| | | 2008 | | 2007 | |

| | | (Unaudited) | | | |

| Cost of land use rights | | $ | 3,878,000 | | $ | 1,425,043 | |

| Less: Accumulated amortization | | | (130,037 | ) | | (88,599 | ) |

| Land use rights, net | | $ | 3,747,963 | | $ | 1,336,444 | |

As of September 30, 2008, the net book value of land use rights was $1,314,113. These rights were pledged as collateral for bank loans. See also Note 8.

On April 2, 2008, the Company acquired a new land use right from Dalian Haitai Holding Company Limited for cash, amounting to $2,292,873. The right has an expected useful life of 46 years and expires on August 28, 2054. As of September 30, 2008 the Company was under the application process for Land Use Right Certificate.

Amortization expense for the nine months ended September 30, 2008 and 2007 was $41,438 and $20,437, respectively.

CHINA BIO-IMMUNITY CORPORATION

(FORMERLY EASY GOLF CORPORATION) AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2008

(UNAUDITED)

NOTE 6 - TECHNOLOGY

Technology consists of the followings:

| | | September 30, | | December 31, | |

| | | 2008 | | 2007 | |

| | | (Unaudited) | | | |

| Vero technology | | $ | 2,199,962 | | $ | 2,053,501 | |

| Less: Accumulated amortization | | | (1,148,218 | ) | | (940,610 | ) |

| Vero technology, net | | $ | 1,051,744 | | $ | 1,112,891 | |

The technology was contributed by the Company’s previous shareholder, Shenyang Andi Bio-Products Company Limited on March 21, 2002 in exchange for a 30% interest in the Company. The Vero technology was recorded at fair value as determined by an independent appraiser.

Amortization expense for the nine months ended September 30, 2008 and 2007 was $207,608 and $189,999, respectively.

NOTE 7 - PLANT AND EQUIPMENT

Plant and equipment consists of the followings:

| | | September 30, | | December 31, |

| | | 2008 | | 2007 |

| | | (Unaudited) | | | |

| At Cost: | | | | | | |

| Buildings | | $ | 2,253,378 | | $ | 2,062,214 |

| Machinery and equipment | | | 11,089,817 | | | 9,146,414 |

| Motor vehicles | | | 1,400,278 | | | 1,209,068 |

| Office equipment | | | 137,792 | | | 115,077 |

| | | | 14,881,265 | | | 12,532,773 |

| Less: Accumulated depreciation | | | | | | |

| Buildings | | | (189,150) | | | (140,476) |

| Machinery and equipment | | | (1,676,110) | | | (1,215,226) |

| Motor vehicles | | | (353,421) | | | (171,807) |

| Office equipment | | | (64,438) | | | (46,893) |

| | | | (2,283,119) | | | (1,574,402) |

| Plant and equipment, net | | $ | 12,598,146 | | $ | 10,958,371 |

As of September 30, 2008, the net book value of plant and equipment was $11,477,935. Plant and equipment was pledged as collateral for bank loans. See also Note 8.

Depreciation expense for the nine months ended September 30, 2008 and 2007 was $708,718 and $473,444, respectively.

CHINA BIO-IMMUNITY CORPORATION

(FORMERLY EASY GOLF CORPORATION) AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2008

(UNAUDITED)

NOTE 8 - SHORT-TERM LOANS

Two short term bank loans were obtained from Wanli Credit Corporation Union of Dalian Development Zone (the “Union”) amounting to $6,159,893 (RMB42,000,000) and $1,173,313 (RMB8,000,000) in September 2007 and January 2008, respectively. On September 25, 2008 the loans were repaid.

On September 27, 2008 the Company obtained a new loan from the Union amounting to $7,333,206 (RMB50,000,000). The loan is secured by the Company’s plant and equipment and land use rights and bears an interest rate released by the People’s Bank of China from time to time (6.723% as of September 30, 2008). The loan matures on September 26, 2009.

Interest expense for the nine months ended September 30, 2008 and 2007 was $405,422 and $314,358 respectively.

NOTE 9 - RELATED PARTY TRANSACTIONS

(I) Due to Related Companies

| | | September 30, | | December 31, | |

| | | 2008 | | 2007 | |

| | | (Unaudited) | | | |

| Current: | | | | | |

| Dalian Jingang Group Company Limited (a) | | | | | |

| - Interest bearing loan | | $ | — | | $ | 684,500 | |

| - Short-term advances | | | | | | 684,501 | |

| Dalian Jingang Hotel (b) | | | | | | 6,640 | |

| | | | | | | | |

| | $ | | | $ | 1,375,641 | |

| a. | As of December 31, 2007, the Company owed $684,501 to Dalian Jingang Group Company Limited (“Jingang Group”). The amount was unsecured, interest-free and repayable on demand. Jingang Group is a shareholder of the Company. |

During 2006, the Company obtained a loan from Jingang Group, bearing a variable interest rate released by the People’s Bank of China (6.56% as of December 31, 2007). The loan is unsecured and has a fixed repayment date on December 31, 2008. As of December 31, 2007, the loan balance was $684,500 (RMB 5,000,000).

As of September 30, 2008, the Company repaid $684,500 (RMB 5,000,000) as an early repayment of the loan.

| b. | As of December 31, 2007, the Company owed $6,640 to Dalian Jingang Hotel (“DJH”). Jingang Group, a shareholder of the Company, is also a shareholder of DJH. The amounts were unsecured, interest-free, and repayable on demand. |

CHINA BIO-IMMUNITY CORPORATION

(FORMERLY EASY GOLF CORPORATION) AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2008

(UNAUDITED)

NOTE 9 - RELATED PARTIES TRANSACTIONS (CONTINUED)

(II) Due from a related party

| | | September 30, | | December 31, | |

| | | 2008 | | 2007 | |

| | | (Unaudited) | | | |

| Current: | | | | | |

| Earn System Investment Limited | | $ | 384,432 | | $ | — | |

As of September 30, 2008, the Company loaned $384,432 to Earn System Investment Limited, which is controlled by a director of the Company. The amount was unsecured, interest-free and repayable on demand.

NOTE 10 - TAXES

(a) Corporation Income Tax (“CIT”)

In 2007, the Company enjoyed a preferential tax rate of 15% in CIT as the Company was considered a high technology company by the Chinese government. After the launch of new CIT law on January 1, 2008, all companies are required to reapply for the high technology company certificate in order to enjoy the preferential tax rate of 15%. As of September 30, 2008, the Company was in the process of applying for the high technology company certificate. Before the approval from the government, the Company is subject to CIT rate of 25%.

The Company’s income tax expense differs from the expected tax expense for the nine months ended September 30, 2008 and 2007 (computed by applying the CIT rate of 25% and 33%, respectively, to income before taxes) as follows:

| | | 2008 | | 2007 | |

| | | (Unaudited) | | (Unaudited) | |

| Computed “expected” expense | | $ | 3,240,394 | | $ | 4,092,141 | |

| Permanent difference | | | | | | | |

| Non-deductible tax loss | | | (362,446 | ) | | | |

| Effect of preferential tax rate | | | — | | | (2,232,078 | ) |

| Other | | | (8,581 | ) | | (41,927 | ) |

| Income tax expense | | $ | 2,869,367 | | $ | 1,818,136 | |

The provision for income taxes for the nine months ended September 30, 2008 and 2007 is summarized as follows:

| | | 2008 | | 2007 | |

| | | (Unaudited) | | (Unaudited) | |

| Current | | $ | 3,439,863 | | $ | 1,434,558 | |

| Deferred | | | (570,496 | ) | | 383,578 | |

| Total | | $ | 2,869,367 | | $ | 1,818,136 | |

CHINA BIO-IMMUNITY CORPORATION

(FORMERLY EASY GOLF CORPORATION) AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2008

(UNAUDITED)

NOTE 10 - TAXES (CONTINUED)

The tax effects of temporary differences that give rise to the Company’s net deferred tax assets and liabilities as of September 30, 2008 and December 31, 2007 are as follows:

| | | September 30, | | December 31, | |

| | | 2008 | | 2007 | |

| | | (Unaudited) | | | |

| Deferred tax liabilities | | | | | |

| Current: | | | | | |

| Investment income | | $ | 82,070 | | $ | 60,366 | |

| Accrued welfare | | | 5,843 | | | 11,960 | |

| Other expenses | | | 106,747 | | | | |

| Cost of goods sold | | | — | | | 500,445 | |

| | | | 194,660 | | | 572,771 | |

| Long-term: | | | | | | | |

| Depreciation | | | 143,103 | | | 73,443 | |

| Total deferred tax liabilities | | $ | 337,763 | | $ | 646,214 | |

| | | | | | | | |

| Deferred tax assets | | | | | | | |

| Current: | | | | | | | |

| Cost of goods sold | | $ | 505,457 | | $ | | |

| Long-term: | | | | | | | |

| Amortization | | | 1,959 | | | | |

| Total deferred tax assets | | $ | 507,416 | | $ | | |

The Company adopted the provisions of Financial Accounting Standards Board (“FASB”) Interpretation No. 48, “Accounting for Uncertainty in Income Taxes - an Interpretation of FASB Statement No. 109,” (“FIN 48”), on January 1, 2007. The Company did not have any material unrecognized tax benefits and there was no effect on its financial condition or results of operations as a result of implementing FIN 48.

(b) Value Added Tax (“VAT”)

Corporations or individuals who sell commodities, engage in repair and maintenance or import or export goods in the PRC are subject to a value added tax in accordance with the PRC laws. The value added tax standard rate for vaccine products is 6% of the gross sales price. The Company is exempted from the VAT as it is deemed a Welfare Organization under tax law in the PRC in 2008 and 2007.

The VAT payables as of September 30, 2008 and December 31, 2007 was $230,529 and $117,571, respectively, and are included in other payables and accrued expenses.

CHINA BIO-IMMUNITY CORPORATION

(FORMERLY EASY GOLF CORPORATION) AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2008

(UNAUDITED)

NOTE 10 - TAXES (CONTINUED)

(c) Tax Holiday Effect

In 2007, the Company was subject to a preferential rate of 15%.

The new tax regulations took effect on January 1, 2008, pursuant to which the unified CIT rate of 25% would apply to all corporations including the Company. Under the new tax law the Company’s ability to use the favorable CIT rate of 15% designed specifically for high-technology industry companies, will be reassessed at the end of the year. Before the Company obtains the certificate confirming the Company’s qualification as a high-technology company, the applicable CIT rate is 25%.

For the nine months ended September 30, 2008 and 2007 taxable income before income tax expense was $12,961,575 and $12,400,426, respectively. Income tax expense related to China income for the nine months ended September 30, 2008 and 2007 was $2,869,367 and $1,818,136, respectively.

The effect of the income tax expense exemptions and reductions available to the Company for the nine months ended September 30, 2008 and 2007 is as follows:

| | | September 30, 2008 | | September 30, 2007 | |

| | | (Unaudited) | | (Unaudited) | |

| Tax holiday effect | | $ | — | | $ | 2,232,078 | |

| Basic net income per share excluding tax holiday effect | | $ | | | $ | 0.63 | |

NOTE 11 - WARRANTS

Pursuant to the terms of the Exchange Agreement, the Company issued 100,000 warrants with an exercise price of $0.50 per share to J. Michael Coombs on August 22, 2008, a majority shareholder of the Company before the reverse merger, to purchase shares of common stock. The warrants expire on August 22, 2013. The Company recorded the fair value of the warrants issued $907,000 less the cash received in the reverse merger of $80,521 to general and administrative expenses for the three and nine months ended September 30, 2008.

CHINA BIO-IMMUNITY CORPORATION

(FORMERLY EASY GOLF CORPORATION) AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2008

(UNAUDITED)

NOTE 11 - WARRANTS (CONTINUED)

| | | Warrants Granted | | Weighted Average Exercise Price | |

| | | (Unaudited) | | (Unaudited) | |

| Outstanding as of December 31, 2007 | | | — | | | | |

| Granted | | | 100,000 | | $ | 0.50 | |

| Exercised | | | | | | | |

| Cancelled | | | | | | | |

| Outstanding as of September 30, 2008 | | | 100,000 | | $ | 0.50 | |

As of September 30, 2008 the weighted average remaining contractual life of warrants outstanding is 4.89 years. The fair value of the warrants was $907,000 which was accounted by the Black-Scholes Option Pricing Model with the following assumptions:

| Risk free interest rate | | | 3.139 | % |

| Expected life | | | 5 years | |

| Expected volatility | | | 42.863 | % |

| Expected dividend yield | | | 0 | % |

Item 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This Quarterly Report on Form 10-Q includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We have based these forward-looking statements on our current expectations and projections about future events. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about us that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “continue,” or the negative of such terms or other similar expressions. Factors that might cause or contribute to such a discrepancy include, but are not limited to, those described under “Risk Factors” in our Form 8-K filed with the Securities and Exchange Commission (“SEC”) on August 6, 2008. The following discussion should be read in conjunction with our Financial Statements and related Notes thereto included elsewhere in this report.

Company Overview

China Bio-Immunity Corporation (the “Company” or “we”), a Nevada corporation, is a leading provider of Rabies and Mumps vaccines in the People’s Republic of China (“PRC”). Our goal is to become the leader in research, development, manufacture and commercialization of vaccine-based therapeutics and prophylactics in the PRC and to expand our product distribution to international markets. Our human vaccine products and product candidates have been designed to address large markets with significant unmet medical needs for populous infectious diseases. We currently market three products, and have six products in our product development pipeline which we anticipate will help us in achieving our goal.

We currently market Rabies Vaccine (Vero cell) for human use (“Rabies Liquid Vaccine”), Rabies Vaccine (Vero cell) for human use, Freeze-dried (“Rabies Powder Vaccine”), and Mumps Vaccine. According to the Ministry of Health statistics, in 2007 we manufactured 21% of the total Rabies vaccine dosages manufactured and imported in the PRC, and 41.5% of the total mumps dosages manufactured and imported in the PRC. In addition, in 2007 we accounted for approximately 21.9% of the total Rabies vaccine market and 22.0% of the total mumps vaccine market. Our products are distributed through a net work of approximately 80 wholesale distributors strategically located in 24 provinces throughout the PRC. The distributors in turn distribute our vaccines to approximately 3,100 Centers for Disease Control and Prevention (“CDCs”) in the PRC.

Our product pipeline currently includes six vaccine-based therapeutics and prophylactics for both the prevention and treatment of various viruses and infections. Of these, four are currently in Phase III clinical trials: Varicella vaccine, Rubella vaccine, Split Influenza vaccine for Adults, and Split Influenza vaccine for Children. We have applied for clinical research for an Anti-Rabies Immunoglobulin Wash, and have a Mumps/Rubella combination vaccine in preclinical trial. We believe that each of these product candidates, if successfully developed and approved, will address significant market opportunities.

We were incorporated in the state of Utah as Thrust Resources, Inc. on July 16, 1981. On April 22, 2005, pursuant to a merger the Company changed its domicile to Nevada. On February 11, 2008, the Company changed its name to China Bio-Immunity Corporation (formerly known as Easy Golf Corporation). On August 6, 2008, the Company entered into a Share Exchange Agreement (“Exchange Agreement”) with Lawford Asia Limited (“Lawford”), and the shareholders of Lawford (the “Lawford Shareholders”). As a result the share exchange, the Company acquired all of the issued and outstanding securities of Lawford, an inactive holding company, from the Lawford Shareholders in exchange for 13,246,697 newly-issued shares of the Company’s common stock, par value $0.001 per share (“Common Stock”), representing 88.31% of the Company’s issued and outstanding Common Stock (the “Share Exchange”). As a result of the Share Exchange, Lawford and its wholly owned subsidiaries, JINA Immunity Investment Company Limited (“JINA”), and Dalian Jingang-Andi Bio-Products Company Limited (“JGAD”), became wholly owned subsidiaries of the Company. This transaction was accounted for as a “reverse merger” with Lawford deemed to be the accounting acquirer and the Company as the legal acquirer. Consequently, the assets and liabilities and the historical operations that will be reflected in the financial statements for periods prior to the Share Exchange will be those of Lawford’s operating subsidiary, JGAD and will be recorded at the historical cost basis of JGAD. After completion of the Share Exchange, the Company’s consolidated financial statements includes the assets and liabilities of both the Company and JGAD, the historical operations of JGAD and the operations of the Company and its subsidiaries from the closing date of the Share Exchange.

Lawford was incorporated on January 15, 2008 under the laws of the British Virgin Islands as a holding company, for the purposes of owning 100% of the capital stock of JINA. JINA was incorporated on October 15, 2007 under the laws of Hong Kong for the purpose of owing 100% of the capital stock of JGAD, a corporation incorporated on March 26, 2002 under the laws of the People’s Republic of China (“PRC”). Following the approval by the relevant governmental authorities in the PRC, JINA acquired a 100% ownership interest in JGAD. As a result of the transaction, JGAD became a wholly owned subsidiary of JINA, which in turn is a wholly owned subsidiary of Lawford. JGAD engages in the development, manufacturing, and distribution of vaccine products. As a result of the Share Exchange, the Company succeeded to the business of JGAD as its sole line of business.

The Chart below depicts the corporate structure of the Company as of the date of this 10-Q. The Company owns 100% of the capital stock of Lawford and has no other direct subsidiaries. Lawford owns 100% of the capital stock of JINA and has no other direct subsidiaries. JINA owns 100% of the capital stock of JGAD and has no other subsidiaries. JGAD has no subsidiaries

Critical Accounting Policies and Estimates

The unaudited condensed consolidated financial statements of the Company have been prepared in accordance with generally accepted accounting principles for interim financial information and pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”) applicable to Quarterly Reports on From 10-Q. Accordingly, they do not include all the information and footnotes required by accounting principles generally accepted in the United States for complete financial statements. However, such information reflects all adjustments (consisting solely of normal recurring adjustments), which are, in the opinion of management, necessary for the fair presentation of the consolidated financial position and the consolidated results of operations. Results shown for interim periods are not necessarily indicative of the results to be obtained for a full year. The condensed consolidated balance sheet information as of December 31, 2007 was derived from the audited financial statements included in the Company’s Current Report on Form 8−K filed with the SEC on August 6, 2008. These interim financial statements should be read in conjunction with that report.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reporting period. Management makes these estimates using the best information available at the time the estimates are made; however actual results when ultimately realized could differ from those estimates.

| · | Revenues represent the invoiced value of goods sold recognized upon the shipment of goods to customers. Revenues are recognized when all of the following criteria are met: |

| · | Persuasive evidence of an arrangement exists, |

| · | The seller’s price to the buyer is fixed or determinable, and |

| · | Collectability is reasonably assured. |

Inventories

Inventories consisting of raw materials, packing materials, special materials, work-in-progress and finished goods are stated at the lower of cost or market value. Finished goods are comprised of direct materials, direct labor and an appropriate proportion of overhead.

Land Use Rights

According to the law of China, the government owns all the land in China. Companies or individuals are authorized to possess and use the land only through land use right granted by the Chinese government. Land use rights are being amortized using the straight-line method over the lease term of 50 years.

Impairment of Long-Term Assets

Long-term assets of the Company are reviewed annually as to whether their carrying value has become impaired, pursuant to the guidelines established in Statement of Financial Accounting Standards (“SFAS”) No. 144. The Company considers assets to be impaired if the carrying value exceeds the future projected cash flows from the related operations. The Company also re-evaluates the periods of amortization to determine whether subsequent events and circumstances warrant revised estimates of useful lives. There were no impairments for the nine months ended September 30, 2008 and 2007.

New Accounting Pronouncements

In December 2007, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting Standards (“SFAS”) No. 141 (R), Business Combination. SFAS No. 141 (R) requires an acquirer to measure the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree at their fair values on the acquisition date, with goodwill being the excess value over the net identifiable assets acquired. The calculation of earnings per share will continue to be based on income amounts attributable to the parent. SFAS No. 141 (R) is effective for financial statements issued for fiscal years beginning after December 15, 2008. Early adoption is prohibited. We are aware that our accounting for minority interest will change and we are considering those effects now but believe the effects will only be a reclassification of minority interest from mezzanine equity to our shareholders’ equity section in the balance sheet. SFAS 141 (R) will significantly affect the accounting for future business combinations and we will determine the accounting as new combinations occur.

In December 2007, the FASB issued SFAS No. 160, Noncontrolling Interests in Consolidated Financial Statements. This Statement establishes accounting and reporting standards that require the ownership interests in subsidiaries’ non-parent owners be clearly presented in the equity section of the balance sheet; requires the amount of consolidated net income attributable to the parent and to the noncontrolling interest be clearly identified and presented on the face of the consolidated statement of income; requires that changes in a parent’s ownership interest while the parent retains its controlling financial interest in its subsidiary be accounted for consistently; requires that when a subsidiary is deconsolidated, any retained noncontrolling equity investment in the former subsidiary be initially measured at fair value and the gain or loss on the deconsolidation of the subsidiary be measured using the fair value of any noncontrolling equity; requires that entities provide disclosures that clearly identify the interests of the parent and the interests of the noncontrolling owners. This Statement is effective as of the beginning of an entity’s first fiscal year that begins after December 15, 2008. The Company has not determined the impact, if any, SFAS No. 160 will have on its consolidated financial statements.

In March 2008, the FASB issued SFAS No. 161, "Disclosures about Derivative Instruments and Hedging Activities" ("SFAS No. 161"), which amends SFAS No.133 and expands disclosures to include information about the fair value of derivatives, related credit risks and a company's strategies and objectives for using derivatives. SFAS No. 161 is effective for fiscal periods beginning on or after November 15, 2008. The Company is currently in the process of assessing the impact that SFAS No. 161 will have on the disclosures in its consolidated financial statements.

Results of Operations

The following discussion and analysis provides information that we believe is relevant to an assessment and understanding of our results of operations for the three months and nine months ended September 30, 2008. The following discussion should be read in conjunction with the unaudited condensed consolidated Financial Statements and related Notes appearing elsewhere in this Form.

Our financial statements are stated in US Dollars and are prepared in accordance with generally accepted accounting principles of the United States (“GAAP”).

Results of Operation for CHHB for the Three Months Ended September 30, 2008 Compared to the Three Months Ended September 30, 2007.

Revenues

During the three months ended September 30, 2008, we had $9.60 million in revenue as compared to $12.72 million in revenue during the three months ended September 30, 2007, representing a decrease of $3.12 million or approximately 24.53%. The decrease in revenue was primarily attributable to two factors:

| i) | The decrease in sales of Rabies Powder Vaccine—Rabies Powder Vaccine sales in the three months ended September 30, 2008 was $0.37 million as compared to $3.06 million in the three months ended September 30, 2007, representing a decrease of $2.69 million or approximately 87.91%. Rabies Powder Vaccine accounted for only 3.80% of the total revenue for the three months ended September 30, 2008, compared to 24.08% of the total revenue in the same period of 2007. This decrease was attributable to two primary factors. First, in November 2007 we applied to Liaoning Provincial Food and Drug Administration to change the expiration time of the Rabies Powder Vaccine product from 12 months to 30 months. The application was approved in January 2008. We started to manufacture the Rabies Powder Vaccines in early February 2008 using the new drug approval. The Rabies Powder Vaccine production cycle, including the internal quality control tests and the external batch release approval process, usually takes six to eight months. As a result, we manufactured significantly fewer doses of the vaccine to meet the market demand in the third quarter. Second, the Rabies Powder Vaccine has to be sold with separately packaged 0.5 ml/dose injection water, which the Company purchases from external vendors. During the first half year of 2008 there was a significant shortage of the 0.5 ml/dose injection water in the market, which in turn limited our sales. Since July 2008 we have completely resolved this shortage by contracting with an additional injection water vendor. |

| ii) | The decrease in sales of the Rabies Liquid Vaccine—Rabies Liquid Vaccine sales in the three months ended September 30, 2008 was $8.74 million as compared to $9.05 million in the three months ended September 30, 2007, representing a decrease of $0.31 million, or approximately 3.43%. The decrease was primarily due to the restrictions on air and railway transportation during the Beijing Olympic Games. During the six weeks of Olympic and Paralympics games between early August and late September, all liquid products were restricted on aircrafts or railway trains, which negatively impacted our Rabies Liquid Vaccine’s distribution and sales. |

During the three months ended September 30, 2008, approximately $8.74 million of the total revenue was attributable to sales of Rabies Liquid Vaccine, approximately $0.37 million was attributable to sales of Rabies Powder Vaccine, and approximately $0.50 million was attributable to sales of Mumps Vaccine.

During the three months ended September 30, 2007, approximately $9.05 million of the total revenue was attributable to sales of Rabies Liquid Vaccine, approximately $3.06 million was attributable to sales of Rabies Powder Vaccine, and approximately $0.61 million was attributable to sales of Mumps Vaccine.

The following chart illustrates the amount, percentages and changes in our revenue generated by sales of Rabies Liquid Vaccine, Rabies Powder Vaccine, and Mumps Vaccine for the three months ended September 30, 2008, as compared to the three months ended September 30, 2007:

| | | Three Months Ended | | Three Months Ended | |

| | | September 30, 2008 | | September 30, 2007 | |

| | | Revenue | | % of Revenue | | Revenue | | % of Revenue | |

| Sales of Rabies Liquid Vaccine | | $ | 8,738,933 | | | 91.04 | % | $ | 9,051,284 | | | 71.14 | % |

| Sales of Rabies Powder Vaccine | | $ | 365,199 | | | 3.80 | % | $ | 3,063,164 | | | 24.08 | % |

| Sales of Mumps Vaccine | | $ | 495,553 | | | 5.16 | % | $ | 607,876 | | | 4.78 | % |

Total Revenue | | $ | 9,599,685 | | | 100 | % | $ | 12,722,324 | | | 100 | % |

Costs of Goods Sold

The cost of goods sold for the three months ended September 30, 2008 was $1.43 million as compared to $2.66 million for the three months ended September 30, 2007, representing a decrease of $1.23 million, or approximately 46.24%. Although the decrease in revenues resulted in a decrease in the cost of goods sold, the significant decrease in the cost of goods sold was primarily due to two factors. In the third quarter of 2008 we automated the purification process, which greatly improved our product capacity and enabled us to capitalize on the economy of scales. Second, we have improved our rabies virus harvest frequency from 2 times to 3 times in the third quarter, which significantly increased product output and reduced the unit cost of our rabies products.

Gross Profit

The gross profit for the three months ended September 30, 2008 was $8.17 million as compared to $10.06 million for the three months ended September 30, 2007, representing a decrease of $1.89 million, or approximately 18.79%. The decrease in gross profit was mainly due to the decrease in sales, partially offset by a greater decrease in the cost of goods sold.

During the three months ended September 30, 2008, of the $8.17 million total gross profit, approximately $7.45 million was attributable to sales of Rabies Liquid Vaccine, approximately $0.31 million was attributable to sales of Rabies Powder Vaccine, and approximately $0.42 million was attributable to sales of Mumps Vaccine.

During the three months ended September 30, 2007, of the $10.06 million total gross profit, approximately $6.95 million was attributable to sales of Rabies Liquid Vaccine, approximately $2.66 million was attributable to sales of Rabies Powder Vaccine, and approximately $0.46 million was attributable to sales of Mumps Vaccine.

The following chart illustrates the amount, percentages and changes in our gross profit generated by sales of Rabies Liquid Vaccine, Rabies Powder Vaccine and Mumps Vaccine for the three months ended September 30, 2008, as compared to the three months ended September 30, 2007:

| | | Three Months Ended | | Three Months Ended | |

| | | September 30, 2008 | | September 30, 2007 | |

| | | Gross Profit | | % of Gross Profit | | Gross Profit | | % of Gross Profit | |

| Rabies Liquid Vaccine | | $ | 7,447,970 | | | 91.16 | % | $ | 6,946,189 | | | 69.02 | % |

| Rabies Powder Vaccine | | $ | 306,844 | | | 3.76 | % | $ | 2,662,281 | | | 26.45 | % |

| Mumps Vaccine | | $ | 415,394 | | | 5.08 | % | $ | 456,260 | | | 4.53 | % |

Gross Profit | | $ | 8,170,208 | | | 100 | % | $ | 10,064,730 | | | 100 | % |

Gross Margin

During the three months ended September 30, 2008, we had an overall gross margin of 85.11%. During the three months ended September 30, 2007, we had an overall gross margin of 79.11%. The increase of gross margin was attributable to greater revenue mix of high margin Rabies Liquid Vaccine products, and the decrease in unit cost of goods sold.

The following chart illustrates the gross margins of our Rabies Liquid Vaccine, Rabies Powder Vaccine and Mumps Vaccine for the three months ended September 30, 2008, as compared to the three months ended September 30, 2007:

| | | Three Months Ended | | Three Months Ended | |

| | | September 30, 2008 | | September 30, 2007 | |

| | | Gross Margin | | Gross Margin | |

| Rabies Liquid Vaccine | | | 85.23 | % | | 76.74 | % |

| Rabies Powder Vaccine | | | 84.02 | % | | 86.91 | % |

| Mumps Vaccine | | | 83.82 | % | | 75.06 | % |

Operating Expenses

During the three months ended September 30, 2008, we incurred operating expenses of $2.20 million, as compared to operating expenses of $0.77 million for the three months ended September 30 2007, representing an increase of $1.43 million, or approximately 185.71%. The operating expenses are divided into Selling Expenses and General and Administrative Expenses, both of which are discussed below:

Selling Expenses: Selling expenses totaled $0.07 million for the three months ended September 30, 2008 as compared to $0.09 million for the three months ended September 30, 2007, representing a decrease of $0.02 million, or 22.22%. The decrease in the selling expenses was primarily due to the decrease of sales, as well as the decrease in traveling and marketing expenses due to strong brand recognition as compared to the same period in 2007.

General and Administrative Expenses: General and Administrative expenses (“G&A”) totaled $2.13 million for the three months ended September 30, 2008 as compared to $0.68 million for the three months ended September 30, 2007, representing an increase of $1.45 million, or 213.24%. The significant increase in G&A expenses was primarily due to the increase in professional fees and other expenses required of a United States publicly listed company.

The G&A expenses also included a non-recurring non-cash warrant expense of $826,479 that was related to the acquisition of the majority of shares of the shell company in December 2007.

Income Tax Expense

Our operations are conducted by our PRC based subsidiary, JGAD. At the current time JGAD is the only entity that generates taxable income and is subject to the PRC income taxes. In 2007 we were subject to a preferential rate of 15%.

The new tax regulations have been in effect since January 1, 2008 and require the unified Corporation Income Tax (“CIT”) rate of 25% applying to all corporations including our company. Under the new tax law, our ability to receive the favorable CIT rate of 15% specifically for high-technology industry will be reassessed at the end of the year. Until the company obtains the certificate of high-technology company, the applicable CIT rate of 25% is being used to calculate our income tax expenses.

For the three months ended September 30, 2008 and 2007 taxable income before income tax expense was $6.13 million and $9.19 million, respectively. Income tax expense related to China income for the three months ended September 30, 2008 and 2007 was $1.79 million and $1.34 million, respectively.

Net Income

During the three months ended September 30, 2008, our net income was $4.34 million, compared to the $7.85 million in the same period in 2007, representing a decrease of $3.51 million, or approximately 44.71%. The decrease in net income was attributable to the decrease in revenue, and the increase in G&A expenses and tax expenses.

Results of Operation for CHHB for the Nine Months Ended September 30, 2008 Compared to the Nine Months Ended September 30, 2007.

Revenues

During the nine months ended September 30, 2008, we had $22.74 million in revenue as compared to $18.24 million in revenue during the nine months ended September 30, 2007, representing an increase of $4.50 million or approximately 24.67%. The increase in revenue was primarily due to the strong sales we experienced in the first two quarters of 2008 as a result of our competitive pricing and high brand recognition.

During the nine months ended September 30, 2008, of the $22.74 million total revenue, approximately $19.94 million was attributable to sales of Rabies Liquid Vaccine, approximately $0.54 million was attributable to sales of Rabies Powder Vaccine, and approximately $2.26 million was attributable to sales of Mumps Vaccine.

During the nine months ended September 30, 2007, of the $18.24 million total revenue, approximately $13.82 million was attributable to sales of Rabies Liquid Vaccine, approximately $3.44 million was attributable to sales generated by Rabies Powder Vaccine, and approximately $0.98 million was attributable to sales of Mumps Vaccine.

The following chart illustrates the amount, percentages and changes in our revenue generated by sales of Rabies Liquid Vaccine, Rabies Powder Vaccine, and Mumps Vaccine for the nine months ended September 30, 2008, as compared to the nine months ended September 30, 2007:

| | | Nine Months Ended | | Nine Months Ended | |

| | | September 30, 2008 | | September 30, 2007 | |

| | | Revenue | | % of Revenue | | Revenue | | % of Revenue | |

| Sales of Rabies Liquid Vaccine | | $ | 19,943,574 | | | 87.70%$ | | | 13,815,136 | | | 75.74 | % |

| Sales of Rabies Powder Vaccine | | $ | 542,477 | | | 2.39%$ | | | 3,439,736 | | | 18.86 | % |

| Sales of Mumps Vaccine | | $ | 2,255,014 | | | 9.91%$ | | | 986,471 | | | 5.40 | % |

Total Revenue | | $ | 22,741,065 | | | 100%$ | | | 18,241,343 | | | 100 | % |

Costs of Goods Sold

The cost of goods sold for the nine months ended September 30, 2008 was $5.92 million, as compared to $3.90 million for the nine months ended September 30, 2007, representing an increase of $2.02 million, or approximately 51.79%. The increase in cost of goods sold was primarily due to three factors: 1) the increase in sales; 2) the increased labor costs due to accrued year-end bonuses; and 3) the increased cost of packing materials.

Gross Profit

The gross profit for the nine months ended September 30, 2008 was $16.82 million as compared to $14.35 million for the nine months ended September 30, 2007, representing an increase of $2.47 million or approximately 17.21%. The increase in gross profit was primarily due to the increase in sales revenue, slightly offset by the greater percentage increase in cost of goods sold.

During the nine months ended September 30, 2008, of the $16.82 million total gross profit, approximately $15.10 million was attributable to gross profit generated by sales of our Rabies Liquid Vaccine, approximately $0.45 million was attributable to gross profit generated by sales of our Rabies Powder Vaccine, and approximately $1.27 million was attributable to gross profit generated by our Mumps Vaccine.

During the nine months ended September 30, 2007, of the $14.35 million total gross profit, approximately $10.91 million was attributable to gross profit generated by sales of our Rabies Liquid Vaccine, approximately $2.98 million was attributable to gross profit generated by sales of our Rabies Powder Vaccine, and approximately $0.46 million was attributable to gross profit generated by our Mumps Vaccine.

The following chart illustrates the amount, percentages and changes in our gross profit generated by sales of Rabies Liquid Vaccine, Rabies Powder Vaccine and Mumps Vaccine for the nine months ended September 30, 2008, as compared to the nine months ended September 30, 2007:

| | | Nine Months Ended | | Nine Months Ended | |

| | | September 30, 2008 | | September 30, 2007 | |

| | | Gross Profit | | % of Gross Profit | | Gross Profit | | % of Gross Profit | |

| Rabies Liquid Vaccine | | $ | 15,103,827 | | | 89.79 | % | $ | 10,909,795 | | | 76.05 | % |

| Rabies Powder Vaccine | | $ | 448,539 | | | 2.67 | % | $ | 2,976,642 | | | 20.75 | % |

| Mumps Vaccine | | $ | 1,268,063 | | | 7.54 | % | $ | 459,741 | | | 3.20 | % |

Gross Profit | | $ | 16,820,429 | | | 100 | % | $ | 14,346,178 | | | 100 | % |

Gross Margin

During the nine months ended September 30, 2008, we had an overall gross margin of 73.97%, compared to the overall gross margin of 78.65% in the same period last year.

The decrease of gross margin for the nine months ended September 30, 2008 was attributable to two factors: 1) the decrease of sales price of the Rabies Liquid Vaccine in the first half year of 2008 due to greater competition as a result of more batch release approvals for our rivals; and 2) the increase in cost of goods sold due to higher labor and raw material costs.

| | | Nine Months Ended | | Nine Months Ended | |

| | | September 30, 2008 | | September 30, 2007 | |

| | | Gross Margin | | Gross Margin | |

| Rabies Liquid Vaccine | | | 75.73 | % | | 78.97 | % |

| Rabies Powder Vaccine | | | 82.68 | % | | 86.54 | % |

| Mumps Vaccine | | | 56.23 | % | | 46.60 | % |

Operating Expenses

During the nine months ended September 30, 2008, we incurred operating expenses of $4.32 million, as compared to operating expenses of $1.75 million for the nine months ended September 30 2007, representing an increase of $2.57 million, or approximately 146.86%. The increase of operating expenses was mainly due to the increase of the general and administrative expenses related to being a publicly listed company.

Selling Expenses: Selling expenses totaled $0.22 million for the nine months ended September 30, 2008 as compared to $0.25 million for the nine months ended September 30, 2007, representing a decrease of $0.03 million, or 12%. The decrease in selling expenses was mainly due to the decreased traveling and marketing expenses as a result of high brand name recognition. There were more traveling and marketing activities in 2007 in an effort to establish our JGAD brand and market our products throughout the PRC.

General and Administrative Expenses: General and Administrative expenses (“G&A”) totaled $4.10 million for the nine months ended September 30, 2008 as compared to $1.49 million for the nine months ended September 30, 2007, representing an increase of $2.61 million, or 175.17%. The significant increase of the G&A expenses was primarily due to the increase of professional fees and other expenses required of a U.S. listed company.

The G&A expenses also included a non-recurring non-cash warrant expense of $826,479 that was related to the acquisition of the majority of shares of the shell company in December 2007.

Income Tax Expense

Our operations are conducted by our PRC based subsidiary, JGAD. At the current time JGAD is the only entity that generates taxable income and is subject to PRC income taxes. In 2007 we were subject to a preferential rate of 15%.

The new tax regulations have been in effect since January 1, 2008 and require the unified Corporation Income Tax (“CIT”) rate of 25% applying to all corporations including our company. Under the new tax law, our ability to use the favorable CIT rate of 15% designed specifically for high-technology industry companies will be reassessed at the end of the year. Before the Company obtains the certificate confirming the Company’s qualification as a high-technology company, the applicable CIT rate of 25% is being used to calculate our income tax expenses.

For the nine months ended September 30, 2008 and 2007 taxable income before income tax expense was $13.04 million and $12.40 million, respectively. Income tax expense related to China income for the nine months ended September 30, 2008 and 2007 was $2.87 million and $1.82 million, respectively.

Net Income

During the nine months ended September 30, 2008, our net income was $10.17 million, compared to the $10.58 million in the same period last year, representing a decrease of approximately $0.41 million, or 3.88%. The decrease of net income was mainly due to the increased cost of goods sold, G&A expenses and tax expenses.

Liquidity and Capital Resources

We finance our operations primarily through operating cash flows and one short term bank loan. We do not expect to change our capital resources materially during the next twelve months, and anticipates the existing cash and cash equivalents on hand together with the net cash flows generated from our business activities will be sufficient to meet our working capital requirements for on-going projects and to sustain the business operations for the next twelve months.

Cash: As of September 30, 2008, we had cash and cash equivalents of $13,946,737, as compared to $6,837,792 at December 31, 2007, an increase of $7,108,945, or approximately 103.97%. The increase in the cash and cash equivalents from December 31, 2007 to September 30, 2008 was primarily attributable to the increase in net income.

Cash Flow

Operating Activities: Net cash of $9,608,001 was provided by operating activities during the nine months ended September 30, 2008, compared to net cash of $9,260,700 provided in operating activities during the nine months ended September 30, 2007, representing an increase of $347,301. The increase in net cash provided by our operating activities was primarily attributable to the decrease in prepayments and the increase in taxes payable.

Investing Activities: During the nine months ended September 30, 2008, the net cash used in investing activities was $3,547,471 as compared to net cash used in investing activities of $945,331 for the nine months ended September 30, 2007, representing an increase of $2,602,140. The change in net cash used by investing activities was primarily attributable to the increase in capital expenditure, mainly related to the purchase of the land use right and equipments.

Financing Activities: During the nine months ended September 30, 2008, the net cash used in financing activities was $615,924 as compared to net cash used in financing activities of $2,599,706 for the nine months ended September 30, 2007, representing a decrease of $1,983,782. The change in net cash provided by financing activities was primarily attributable to the dividends paid to JGAD’s shareholders in 2007.

Item 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

As a smaller reporting company, we are not required to provide the information required by this item.

Item 4. CONTROLS AND PROCEDURES