Exhibit 99.1

Exhibit 99.1

Commodity Exchange-Traded Products

Nuveen Diversified Commodity Fund

The Investment Case for Commodities

Web Presentation June 5, 2012

To Access Webinar Audio:

Participant Dial-In: 866.381.6294 Conference ID: 82458523

This presentation is for informational purposes only and is not a solicitation to buy or sell Fund shares. The Fund is not offering any new shares for sale; existing shares trade on the NYSE MKT.

nuveen diversified commodity fund (cfd)

Disclosures

The Nuveen Diversified Commodity Fund (the “Fund”) is a commodity pool managed by Nuveen Commodities

Asset Management, LLC (“NCAM”), a commodity pool operator registered with the Commodity Futures Trading

Commission (“CFTC”) and a member of the National Futures

Association (“NFA”).

The Fund is not a mutual fund, a closed-end fund, or any other type of “investment company” within the

meaning of the Investment Company Act of 1940, as amended (the “1940 Act”), and is not subject to

regulation thereunder. The CFTC has not passed upon the merits of participating in this pool nor has the CFTC

passed on the adequacy or accuracy of this presentation or the Fund’s information statement.

The Fund’s information statement is updated from time to time pursuant to CFTC requirements, and is available at

the Fund’s website (http://www.nuveen.com). The Fund also files annual reports on Form 10-K, quarterly reports

on Form 10-Q, and reports on Form 8-K with the Securities and Exchange Commission (“SEC”), and the reports are

also available at the Fund’s website (http://www.nuveen.com) and at the SEC’s website (http://www.sec.gov).

Investing in the Fund involves significant risks. Please see “Special Risk Considerations” on slides

18–21 of this presentation and “Risk Factors” in the Fund’s information statement and annual report on Form 10-K

for more information.

• Fund shares are subject to investment risk, including the possible loss of the entire amount of

your investment.

• Investments in commodity futures contracts and options on commodity futures contracts have a high degree of

price variability, and are subject to rapid and substantial price changes.

• The Fund may not be able to achieve its investment objective.

Certain statements made in this presentation by or on behalf of the Fund constitute forward-looking statements

within the meaning of the federal securities laws, including statements regarding the Fund’s future performance,

as well as management’s expectations, beliefs, intentions or plans relating to the future. Management believes

that these forward-looking statements are reasonable. However, the Fund cannot guarantee that its actual results

will be consistent with the forward-looking statements and you should not place undue reliance on them. These statements are based on current expectations and speak only as of the date they are made. The Fund undertakes

no obligation to publicly update or revise any forward-looking statement, whether as a result of future events, new

information or otherwise. Important factors regarding the Fund that may cause results to differ from expectations

are included in the Fund’s annual report on Form 10-K for the year ended December 31, 2011, under Item 1A. Risk

Factors, and in the Fund’s other filings with the SEC.

nuveen diversified commodity fund (cfd) 2

Gresham: Innovative Commodities Management

A Pioneer in Commodities Investing

— TAP® strategy inception January 1987

A Proven Commodities Market Leader

— Approximately $14 Bn in Assets (3/31/12)

— #2 Largest Institutional Commodities Manager

as ranked by Pensions & Investments(1)

A Partner with Nuveen

— Operates independently while benefiting from

Nuveen’s shared resources

(1) Ranked by institutional commodity assets under management (excluding gold) as of 12/31/11. These rankings do not encompass

the universe of all commodity trading advisors.

nuveen diversified commodity fund (cfd)

The Commodity Futures Markets

• Deep, Liquid Markets: Approximately $94 trillion of commodity futures traded in

2011 worldwide (1)

• Exchange-Traded Liquidity: Futures are tax-advantaged “Section 1256” contracts (2)

• Investment Universe: Over 100 commodities

• Six Principal Commodity Groups:

Energy Industrial Metals Livestock Agriculturals Foods and Fibers Precious Metals

(1) | | According to Standard & Poor’s. |

(2) CFD’s portfolio is composed primarily of tax-advantaged commodity investments that are subject to a special characterization rule which treats gains and losses as

60% long-term capital and 40% short-term capital. See Glossary on slide 17 of this presentation for full description of Section 1256 Contracts.

Transactions in commodity futures contracts carry a high degree of risk. Investments in commodity futures contracts and options on

commodity futures contracts have a high degree of price variability and are subject to rapid and substantial price changes. The Fund could

incur significant losses on its commodity investments. The return performance of the Fund’s commodity futures contracts may not parallel the

performance of the commodities or indices that serve as the basis for the options bought or sold by the Fund; this basis risk may reduce the

Fund’s overall returns. For further discussion of the risks, please review “Special Risk Considerations” on slides 18–21 of this presentation and

“Risk Factors” in the Fund’s information statement and annual report on Form 10-K.

nuveen diversified commodity fund (cfd)

The Investment Case for Commodities

• Diversified commodity futures strategies have offered

competitive returns over time when compared with the returns

of U.S. equities, foreign equities and U.S. bonds.

• Commodity returns have historically demonstrated low

correlations with the returns of other asset classes, including

U.S. equities, foreign equities and U.S. bonds, and provided

portfolio diversification.

• Diversified long-only commodity strategies may provide a

more consistent hedge against inflation than U.S. equities,

foreign equities or U.S. bonds.

Transactions in commodity futures contracts carry a high degree of risk. You should carefully consider whether your financial

condition permits you to participate in a commodity pool, where futures and options trading can quickly lead to large losses as

well as gains, and sharply reduce the net asset value of your interest in the pool. For further discussion of the risks, please review

“Special Risk Considerations” on slides 18–21 of this presentation and “Risk Factors” in the Fund’s information statement and

annual report on Form 10-K.

nuveen diversified commodity fund (cfd)

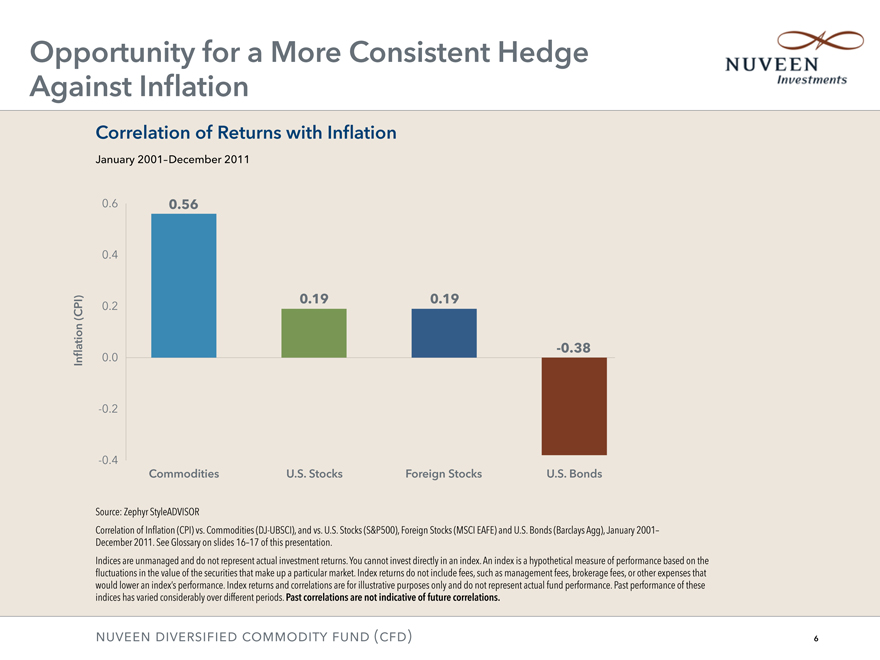

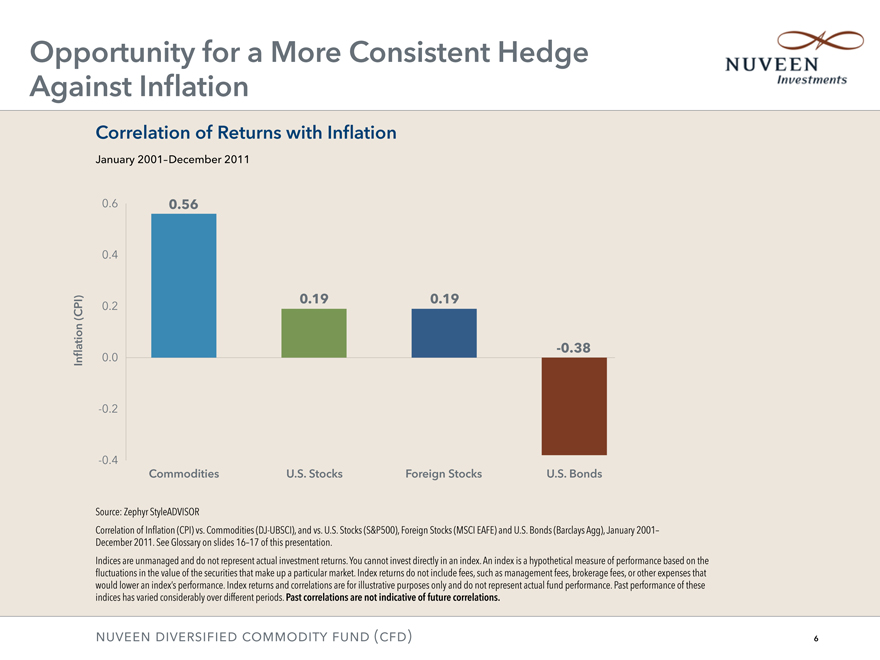

Opportunity for a More Consistent Hedge

Against Inflation

Correlation of Returns with Inflation

January 2001–December 2011

Inflation (CPI)

-0.4

-0.2

0.0

0.2

0.4

0.6

0.56

0.19

0.19

-0.38

Commodities

U.S. Stocks

Foreign Stocks

U.S. Bonds

Source: Zephyr StyleADVISOR

Correlation of Inflation (CPI) vs. Commodities (DJ-UBSCI), and vs. U.S. Stocks (S&P500), Foreign Stocks (MSCI EAFE) and U.S. Bonds (Barclays Agg), January 2001–

December 2011. See Glossary on slides 16–17 of this presentation.

Indices are unmanaged and do not represent actual investment returns. You cannot invest directly in an index. An index is a hypothetical measure of performance based on the

fluctuations in the value of the securities that make up a particular market. Index returns do not include fees, such as management fees, brokerage fees, or other expenses that

would lower an index’s performance. Index returns and correlations are for illustrative purposes only and do not represent actual fund performance. Past performance of these

indices has varied considerably over different periods. Past correlations are not indicative of future correlations.

nuveen diversified commodity fund (cfd)

2012 Commodity Market Outlook

Gresham expects:

Increased return volatility and wider return dispersion for

individual commodities in the near-term.

Commodity prices are likely to appreciate as a result of

increased government spending, higher inflation and a lower-valued

U.S. dollar.

U.S. economy throughout much of 2012 will be in a sustained

low to moderate growth environment where interest rates are

held at historically low levels.

Gresham will closely monitor the macroeconomic landscape to

determine if, when and how monetary stimulus may impact risk capital

flows and the overall commodity markets.

nuveen diversified commodity fund (cfd)

Advantages of Active Commodity Management

Direct investment in futures

Opportunistic implementation versus indices

Seeks to minimize market impact

Informed contract selection and weighting

Interim rebalancing

NUVEEN DIVERSIFIED COMMODITY FUND (CFD)

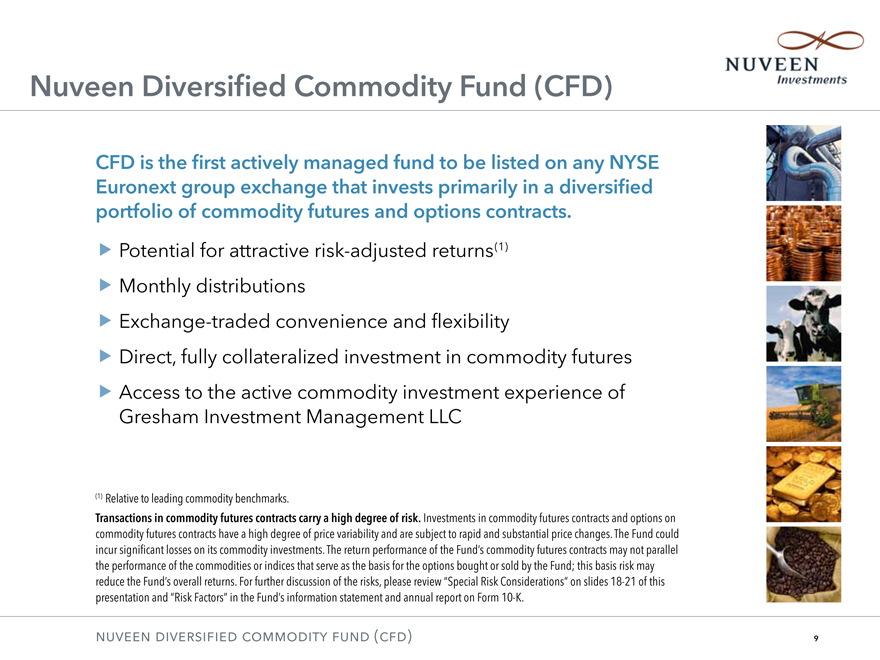

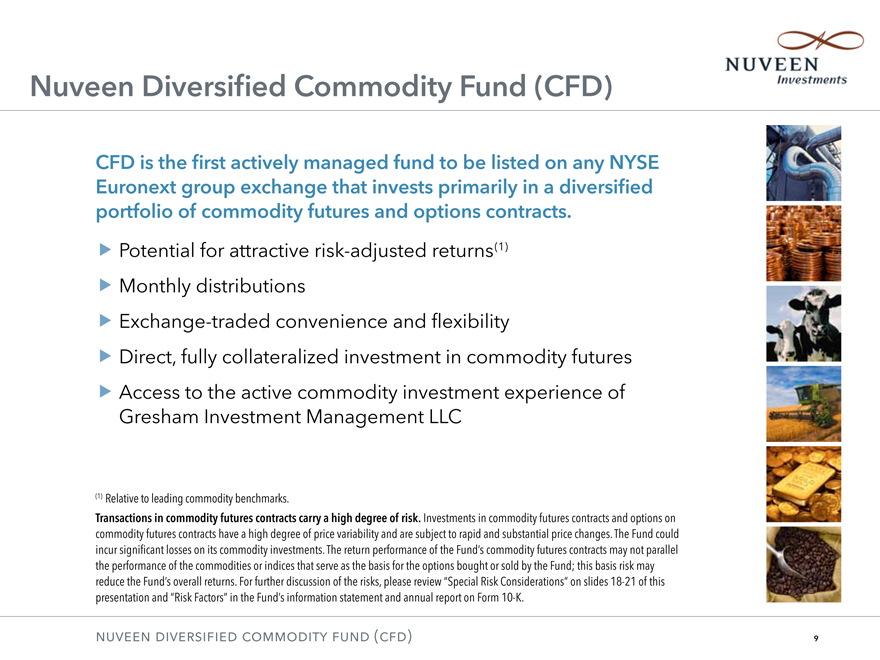

Nuveen Diversified Commodity Fund (CFD)

CFD is the first actively managed fund to be listed on any NYSE Euronext group exchange that invests primarily in a diversified portfolio of commodity futures and options contracts.

? Potential for attractive risk-adjusted returns(1)

Monthly distributions

Exchange-traded convenience and flexibility

Direct, fully collateralized investment in commodity futures

Access to the active commodity investment experience of Gresham Investment Management LLC

(1) | | Relative to leading commodity benchmarks. |

Transactions in commodity futures contracts carry a high degree of risk. Investments in commodity futures contracts and options on commodity futures contracts have a high degree of price variability and are subject to rapid and substantial price changes. The Fund could incur significant losses on its commodity investments. The return performance of the Fund’s commodity futures contracts may not parallel the performance of the commodities or indices that serve as the basis for the options bought or sold by the Fund; this basis risk may reduce the Fund’s overall returns. For further discussion of the risks, please review “Special Risk Considerations” on slides 18-21 of this presentation and “Risk Factors” in the Fund’s information statement and annual report on Form 10-K.

nuveen diversified commodity fund (cfd)

9

Diversified Portfolio of Commodities

Energy Industrial Livestock Agriculturals Foods and Precious

Metals Fibers Metals

Crude Oil Copper Live Cattle Soybeans Sugar Gold

Heating Oil Aluminum Lean Hogs Wheat Coffee Silver

Natural Gas Nickel Feeder Cattle Corn Cotton Platinum

Unleaded Gas Zinc Soybean Meal Cocoa Palladium

Lead Soybean Oil

Source: Gresham Investment Management, LLC.

Transactions in commodity futures contracts carry a high degree of risk. Investments in commodity futures contracts and options on commodity futures contracts have a high degree of price variability and are subject to rapid and substantial price changes. The Fund could incur significant losses on its commodity investments. The return performance of the Fund’s commodity futures contracts may not parallel the performance of the commodities or indices that serve as the basis for the options bought or sold by the Fund; this basis risk may reduce the Fund’s overall returns. For further discussion of the risks, please review “Special Risk Considerations” on slides 18-21 of this presentation and “Risk Factors” in the Fund’s information statement and annual report on Form 10-K.

NUVEEN DIVERSIFIED COMMODITY FUND (CFD)

10

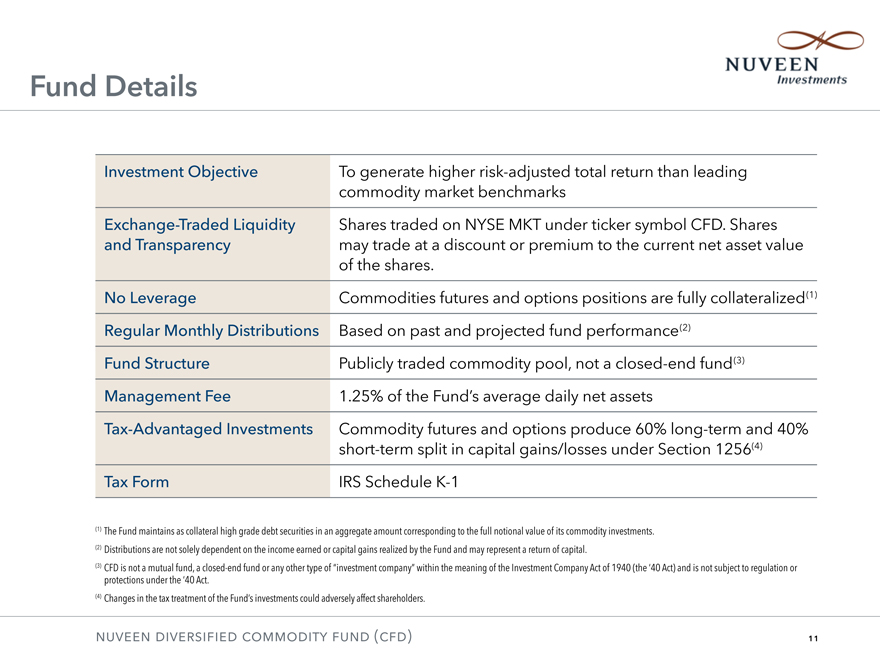

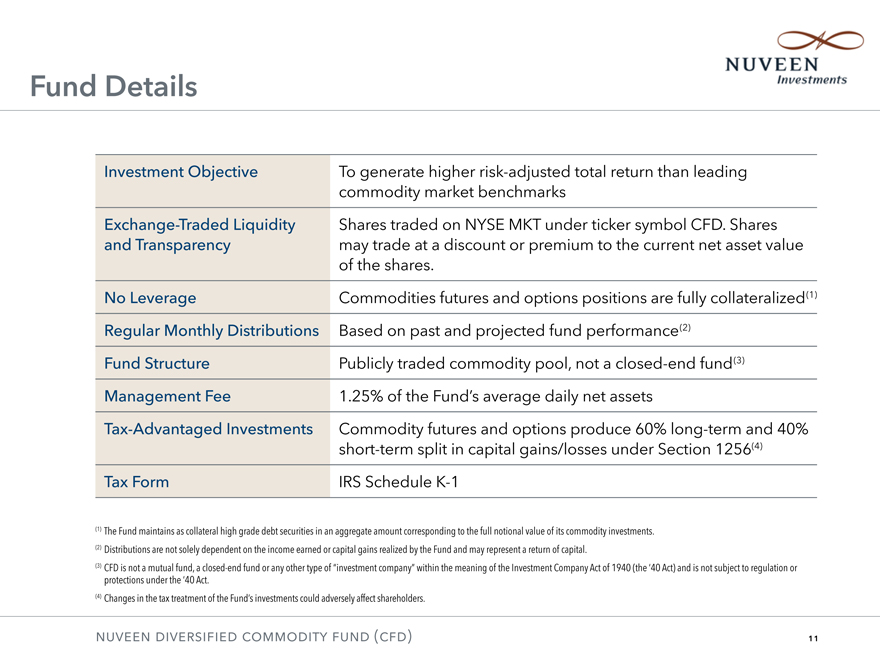

Fund Details

Investment Objective To generate higher risk-adjusted total return than leading

commodity market benchmarks

Exchange-Traded Liquidity Shares traded on NYSE MKT under ticker symbol CFD. Shares

and Transparency may trade at a discount or premium to the current net asset value

of the shares.

No Leverage Commodities futures and options positions are fully collateralized(1)

Regular Monthly Distributions Based on past and projected fund performance(2)

Fund Structure Publicly traded commodity pool, not a closed-end fund(3)

Management Fee 1.25% of the Fund’s average daily net assets

Tax-Advantaged Investments Commodity futures and options produce 60% long-term and 40%

short-term split in capital gains/losses under Section 1256(4)

Tax Form IRS Schedule K-1

(1)The Fund maintains as collateral high grade debt securities in an aggregate amount corresponding to the full notional value of its commodity investments.

(2)Distributions are not solely dependent on the income earned or capital gains realized by the Fund and may represent a return of capital.

(3)CFD is not a mutual fund, a closed-end fund or any other type of “investment company” within the meaning of the Investment Company Act of 1940 (the ‘40 Act) and is not subject to regulation or protections under the ‘40 Act.

(4)Changes in the tax treatment of the Fund’s investments could adversely affect shareholders.

NUVEEN DIVERSIFIED COMMODITY FUND (CFD)

11

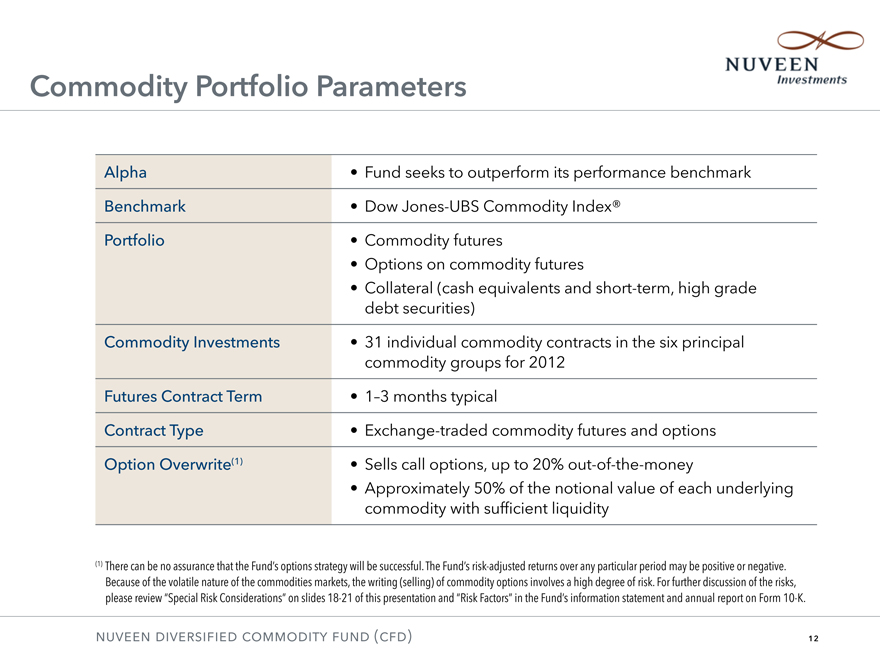

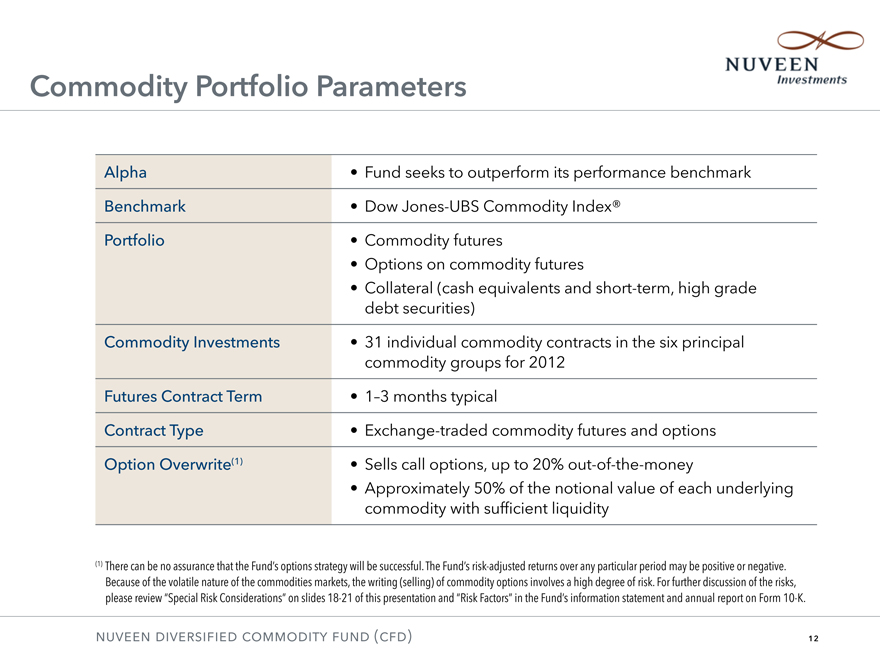

Commodity Portfolio Parameters

Alpha •Fund seeks to outperform its performance benchmark

Benchmark •Dow Jones-UBS Commodity Index®

Portfolio •Commodity futures

•Options on commodity futures

•Collateral (cash equivalents and short-term, high grade

debt securities)

Commodity Investments •31 individual commodity contracts in the six principal

commodity groups for 2012

Futures Contract Term •1–3 months typical

Contract Type •Exchange-traded commodity futures and options

Option Overwrite(1) •Sells call options, up to 20% out-of-the-money

•Approximately 50% of the notional value of each underlying

commodity with sufficient liquidity

There can be no assurance that the Fund’s options strategy will be successful. The Fund’s risk-adjusted returns over any particular period may be positive or negative. Because of the volatile nature of the commodities markets, the writing (selling) of commodity options involves a high degree of risk. For further discussion of the risks, please review “Special Risk Considerations” on slides 18-21 of this presentation and “Risk Factors” in the Fund’s information statement and annual report on Form 10-K.

NUVEEN DIVERSIFIED COMMODITY FUND (CFD)

12

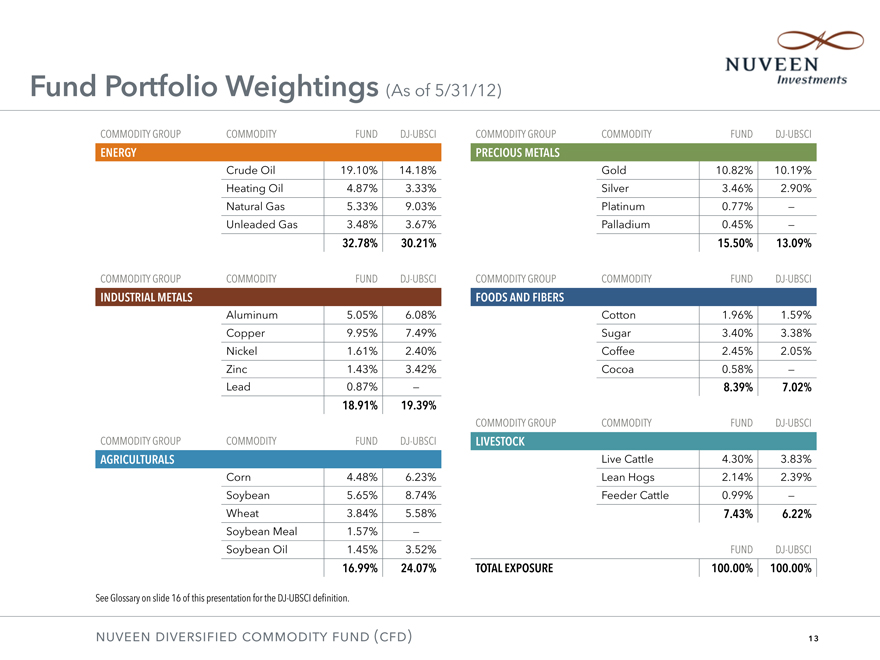

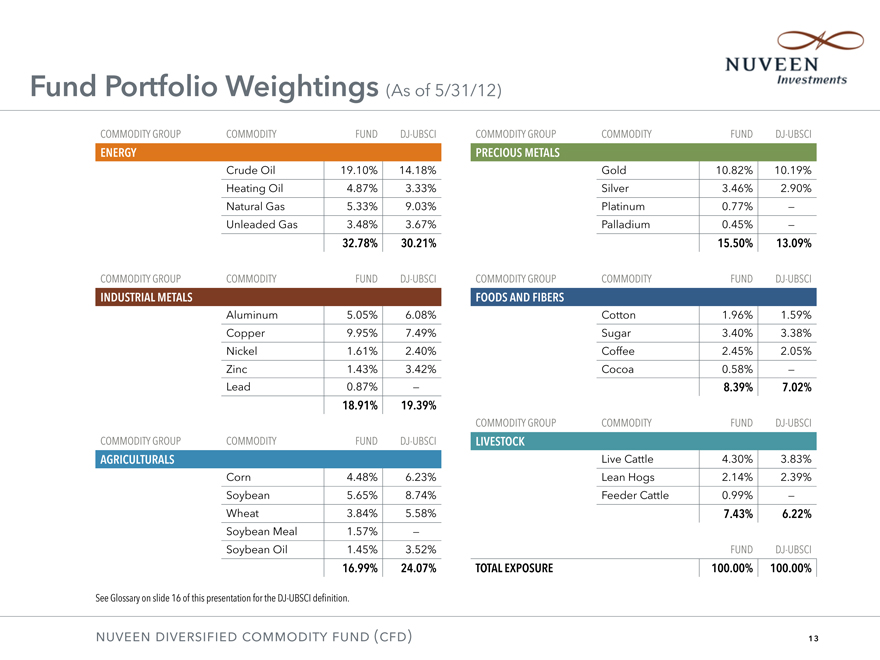

Fund Portfolio Weightings (As of 5/31/12)

COMMODITY GROUP COMMODITY FUND DJ-UBSCI

ENERGY

Crude Oil 19.10% 14.18%

Heating Oil 4.87% 3.33%

Natural Gas 5.33% 9.03%

Unleaded Gas 3.48% 3.67%

COMMODITY GROUP COMMODITY FUND DJ-UBSCI

INDUS TRIAL METALS

Aluminum 5.05% 6.08%

Copper 9.95% 7.49%

Nickel 1.61% 2.40%

Zinc 1.43% 3.42%

Lead 0.87% -

COMMODITY GROUP COMMODITY FUND DJ-UBSCI

AGRICULTURALS

Corn 4.48% 6.23%

Soybean 5.65% 8.74%

Wheat 3.84% 5.58%

Soybean Meal 1.57% -

Soybean Oil 1.45% 3.52%

COMMODITY GROUP COMMODITY FUND DJ-UBSCI

PRECIOUS METALS

Gold 10.82% 10.19%

Silver 3.46% 2.90%

Platinum 0.77% -

Palladium 0.45% -

COMMODITY GROUP COMMODITY FUND DJ-UBSCI

FOODS AND FIBERS

Cotton 1.96% 1.59%

Sugar 3.40% 3.38%

Coffee 2.45% 2.05%

Cocoa 0.58% -

COMMODITY GROUP COMMODITY FUND DJ-UBSCI

LIVESTOCK

Live Cattle 4.30% 3.83%

Lean Hogs 2.14% 2.39%

Feeder Cattle 0.99% -

FUND DJ-UBSCI

TOTAL EXPOSURE 100.00% 100.00%

See Glossary on slide 16 of this presentation for the DJ-UBSCI definition.

NUVEEN DIVERSIFIED COMMODITY FUND (CFD)

13

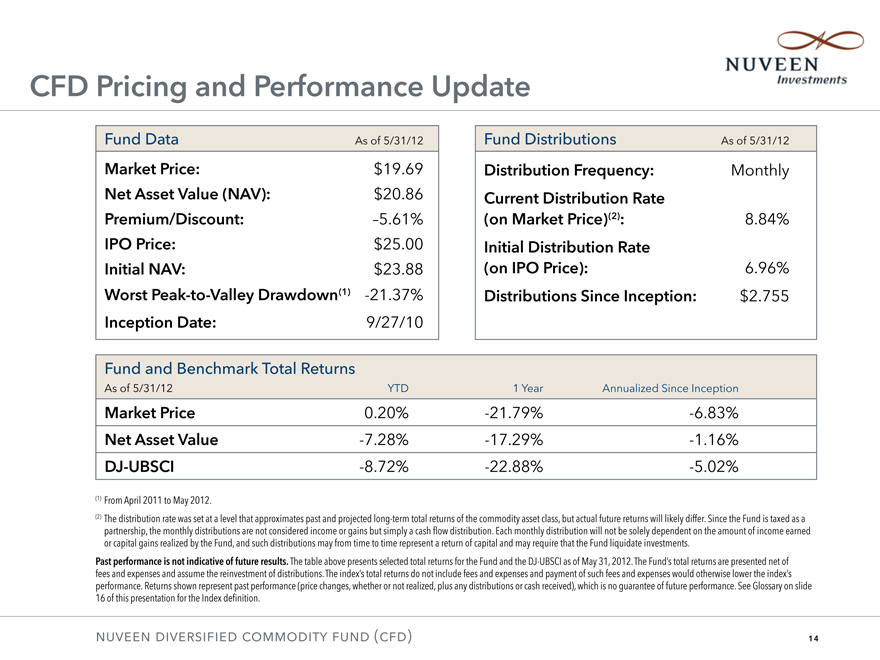

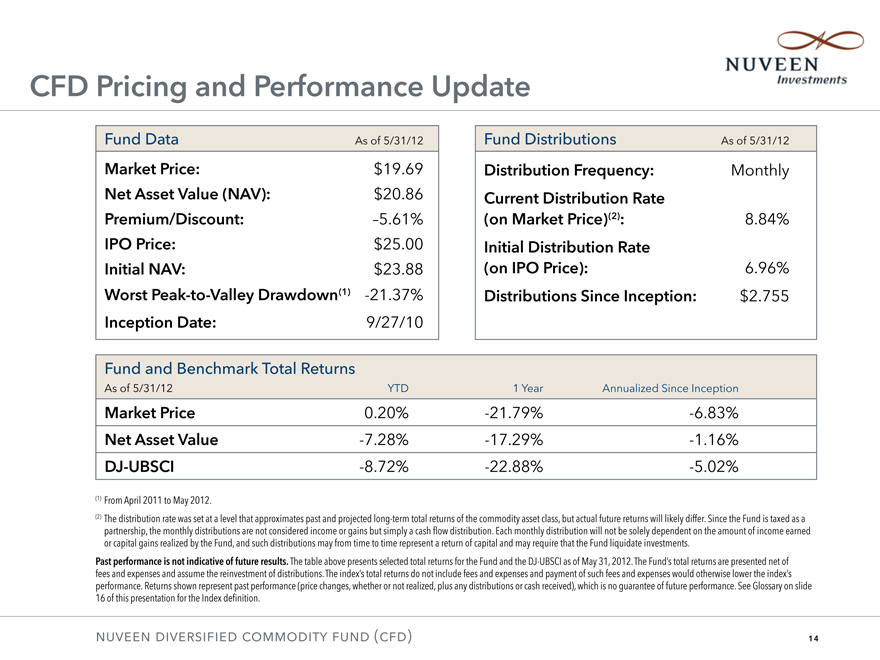

CFD Pricing and Performance Update

Fund Data As of 5/31/12 Fund Distributions As of 5/31/12

Market Price: $19.69 Distribution Frequency: Monthly

Net Asset Value (NAV): $20.86 Current Distribution Rate

Premium/Discount: –5.61%(on Market Price)(2): 8.84%

IPO Price: $25.00 Initial Distribution Rate

Initial NAV: $23.88(on IPO Price): 6.96%

Worst Peak-to-Valley Drawdown(1) -21.37% Distributions Since Inception: $2.755

Inception Date: 9/27/10

Fund and Benchmark Total Returns

As of 5/31/12 YTD 1 Year Annualized Since Inception

Market Price 0.20% -21.79% -6.83%

Net Asset Value -7.28% -17.29% -1.16%

DJ-UBSCI -8.72% -22.88% -5.02%

(1) | | From April 2011 to May 2012. |

(2) The distribution rate was set at a level that approximates past and projected long-term total returns of the commodity asset class, but actual future returns will likely differ. Since the Fund is taxed as a partnership, the monthly distributions are not considered income or gains but simply a cash flow distribution. Each monthly distribution will not be solely dependent on the amount of income earned or capital gains realized by the Fund, and such distributions may from time to time represent a return of capital and may require that the Fund liquidate investments.

Past performance is not indicative of future results. The table above presents selected total returns for the Fund and the DJ-UBSCI as of May 31, 2012. The Fund’s total returns are presented net of fees and expenses and assume the reinvestment of distributions. The index’s total returns do not include fees and expenses and payment of such fees and expenses would otherwise lower the index’s performance. Returns shown represent past performance (price changes, whether or not realized, plus any distributions or cash received), which is no guarantee of future performance. See Glossary on slide 16 of this presentation for the Index definition.

NUVEEN DIVERSIFIED COMMODITY FUND (CFD)

14

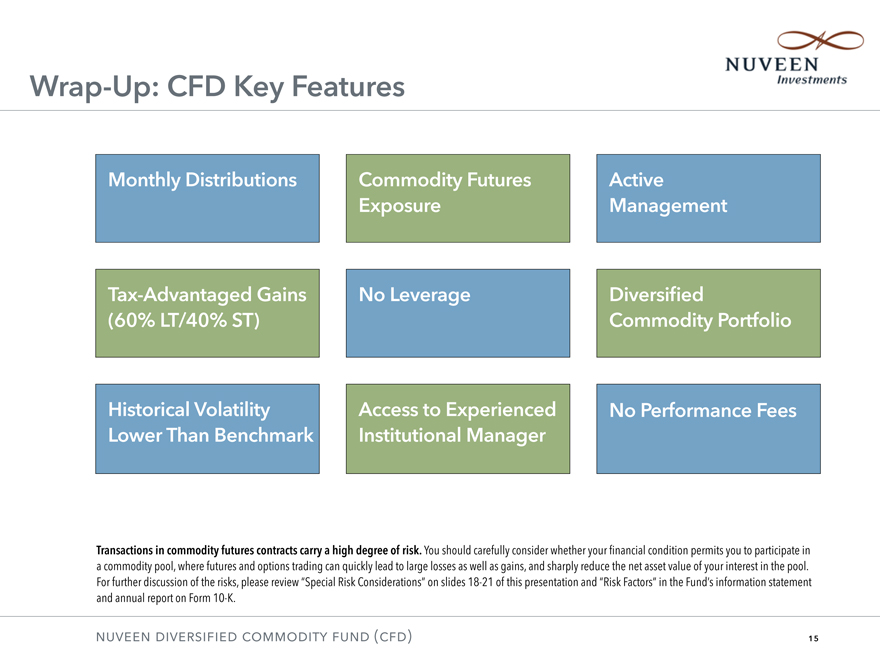

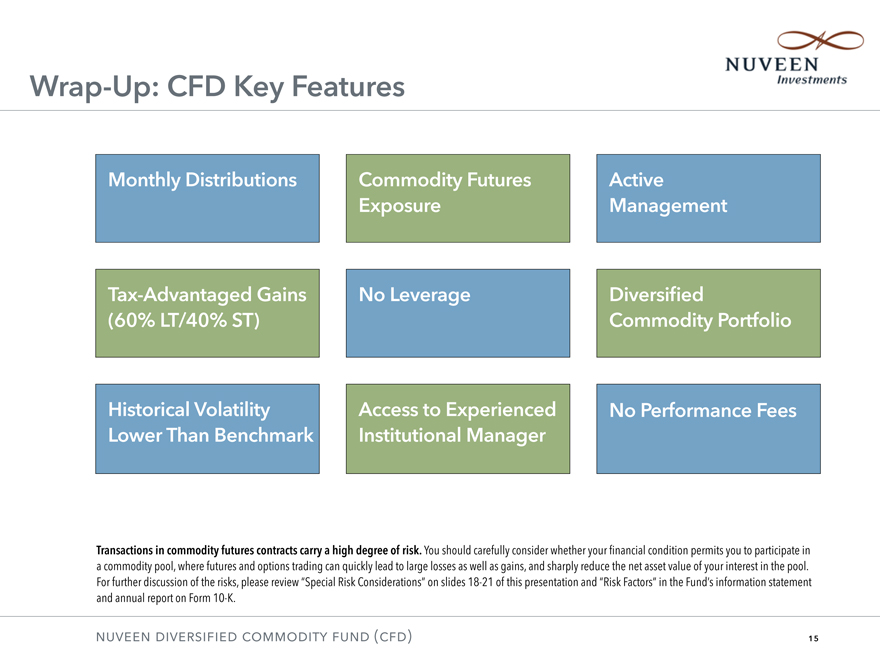

Wrap-Up: CFD Key Features

Monthly Distributions Commodity Futures Active

Exposure Management

Tax-Advantaged Gains No Leverage Diversified

(60% LT/40% ST) Commodity Portfolio

Historical Volatility Access to Experienced No Performance Fees

Lower Than Benchmark Institutional Manager

Transactions in commodity futures contracts carry a high degree of risk. You should carefully consider whether your financial condition permits you to participate in a commodity pool, where futures and options trading can quickly lead to large losses as well as gains, and sharply reduce the net asset value of your interest in the pool. For further discussion of the risks, please review “Special Risk Considerations” on slides 18-21 of this presentation and “Risk Factors” in the Fund’s information statement and annual report on Form 10-K.

NUVEEN DIVERSIFIED COMMODITY FUND (CFD)

15

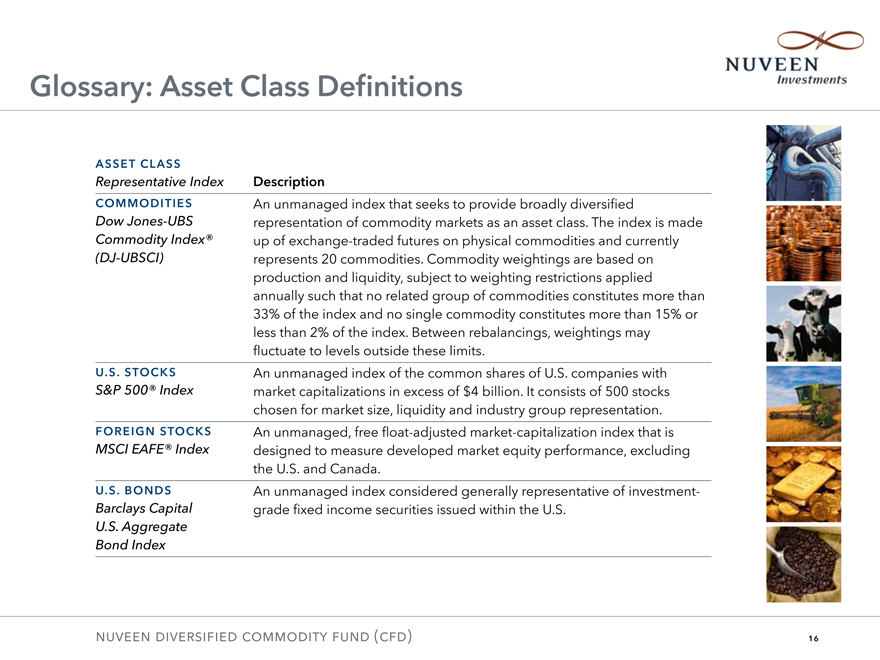

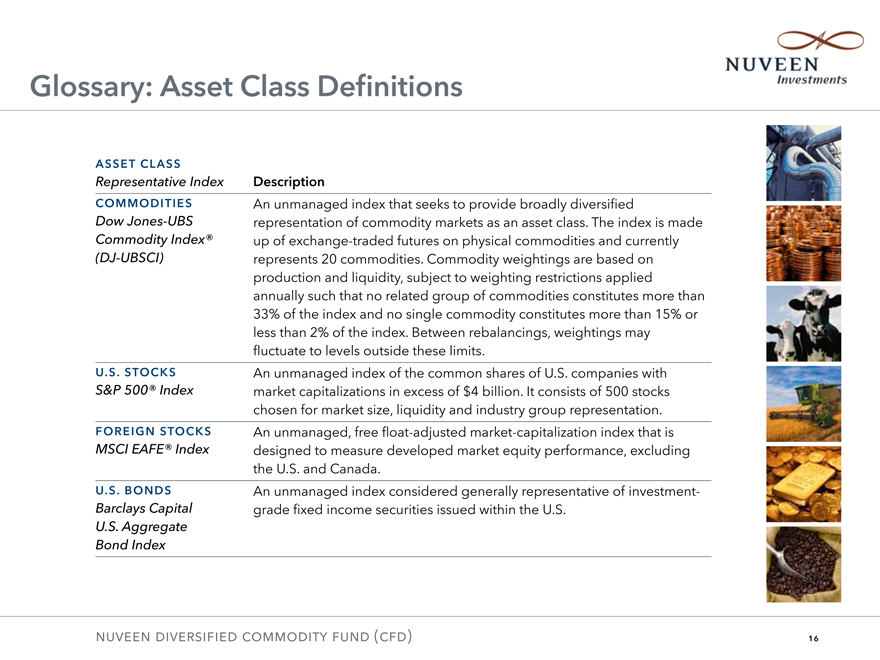

Glossary: Asset Class Definitions

Asset Clas

Representative Index Description

Comodities

Dow Jones-UBS

Commodity Index®

(DJ-UBSCI)

An unmanaged index that seeks to provide broadly diversified

representation of commodity markets as an asset class. The index is made

up of exchange-traded futures on physical commodities and currently

represents 20 commodities. Commodity weightings are based on

production and liquidity, subject to weighting restrictions applied

annually such that no related group of commodities constitutes more than

33% of the index and no single commodity constitutes more than 15% or

less than 2% of the index. Between rebalancings, weightings may

fluctuate to levels outside these limits.

U.S. Stocks

S&P 500® Index

An unmanaged index of the common shares of U.S. companies with

market capitalizations in excess of $4 billion. It consists of 500 stocks

chosen for market size, liquidity and industry group representation.

Foreign Stocks

MSCI EAFE® Index

An unmanaged, free float-adjusted market-capitalization index that is

designed to measure developed market equity performance, excluding

the U.S. and Canada.

U.S. Bonds

Barclays Capital

U.S. Aggregate

Bond Index

An unmanaged index considered generally representative of investmentgrade

fixed income securities issued within the U.S.

NUVEEN DIVERSIFIED COMMODITY FUND (CFD)

16

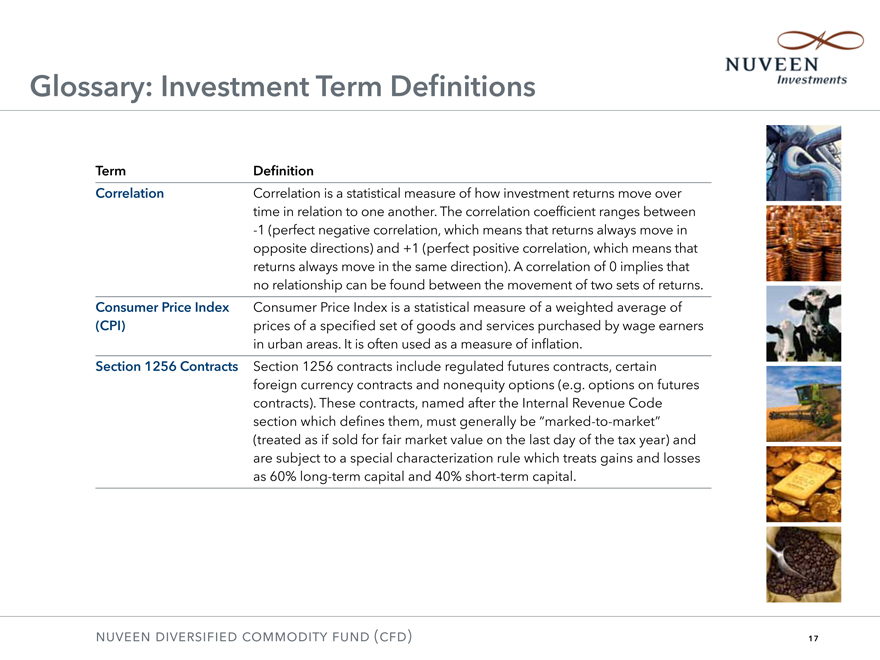

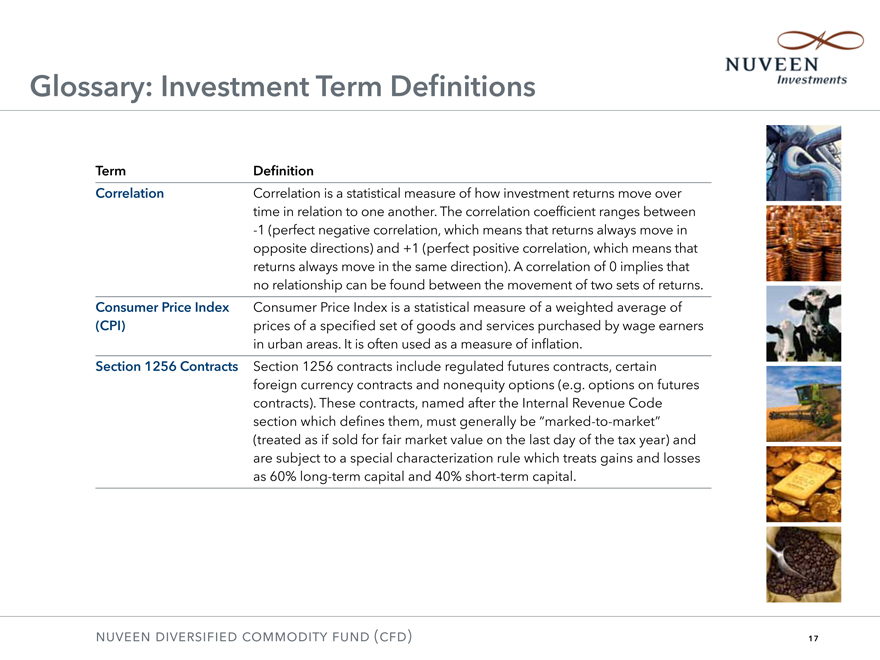

Glossary: Investment Term Definitions

Term Definition

Correlation Correlation is a statistical measure of how investment returns move over

time in relation to one another. The correlation coefficient ranges between

-1 (perfect negative correlation, which means that returns always move in

opposite directions) and +1 (perfect positive correlation, which means that

returns always move in the same direction). A correlation of 0 implies that

no relationship can be found between the movement of two sets of returns.

Consumer Price Index

(CPI)

Consumer Price Index is a statistical measure of a weighted average of

prices of a specified set of goods and services purchased by wage earners

in urban areas. It is often used as a measure of inflation.

Section 1256 Contracts Section 1256 contracts include regulated futures contracts, certain

foreign currency contracts and nonequity options (e.g. options on futures

contracts). These contracts, named after the Internal Revenue Code

section which defines them, must generally be “marked-to-market”

(treated as if sold for fair market value on the last day of the tax year) and

are subject to a special characterization rule which treats gains and losses

as 60% long-term capital and 40% short-term capital.

NUVEEN DIVERSIFIED COMMODITY FUND (CFD)

17

Special Risk Considerations

An investment in the Fund involves special risk considerations, which are

summarized on the following slides. A more extensive discussion of these

risks appears in the Fund’s information statement.

The Fund may not be able to achieve its investment objective.

An investment in the Fund’s shares is subject to investment risk, including the possible loss of the entire

amount that you invest.

• Investments in commodity futures contracts and options on commodity futures contracts have a high

degree of price variability and are subject to rapid and substantial price changes. The Fund may incur

significant losses on its commodity investments.

• The net asset value of each share will change as fluctuations occur in the market value of the Fund’s

portfolio. Investors should be aware that the public trading price of a share may be different from the

net asset value of a share.

• If the Fund experiences more losses than gains during the period you hold shares, you will experience

a loss for the period even if the Fund’s historical performance is positive.

• There can be no assurance that the Fund’s options strategy will be successful. The Fund intends to

use options on commodity futures contracts to enhance the Fund’s risk-adjusted total returns. The

Fund may seek to protect its commodity futures contracts positions in the event of a market decline in

those positions by purchasing commodity put options that are “out-of-the-money.” The Fund’s use of

options, however, may not provide any, or only partial, protection for modest market declines.

NUVEEN DIVERSIFIED COMMODITY FUND (CFD)

18

Special Risk Considerations (continued)

• As the writer of call options for which a premium is received, the Fund will forego the right to any

appreciation in the value of each commodity futures contract in its portfolio that effectively underlies

a call option to the extent the value of the commodity futures contract exceeds the exercise price of

such option on or before the expiration date.

• The return performance of the Fund’s commodity futures contracts may not parallel the performance

of the commodities or indices that serve as the basis for the options bought or sold by the Fund.

• The investment decisions of the commodity subadvisor may be modified, and commodity contract

positions held by the Fund may have to be liquidated at disadvantageous times or prices, to avoid

exceeding regulatory “position limits,” potentially subjecting the Fund to substantial losses.

• The CFTC has recently withdrawn relief previously granted to Gresham from position limits with

respect to certain agricultural commodities (soybeans, corn and wheat) in which Gresham invests

under TAP®. The CFTC has recently implemented final regulations that impose position limits and

limit formulas on 28 physical commodity futures and options contracts, including energy and metals

contracts, and on physical commodity swaps that are economically equivalent to such contracts. These

and any additional position limits imposed in the future could limit the Fund’s ability to implement its

investment strategy.

• The Fund is subject to numerous conflicts of interest, including those that arise because:

– the Fund’s commodity subadvisor, commodity brokers and their principals and affiliates may execute

trades in commodity futures contracts and options on commodity futures contracts for their own

accounts and accounts of other customers that may compete with orders placed for the Fund;

commodity contract positions established for the benefit of the Fund may be aggregated with the

positions held by the commodity subadvisor, its principals or affiliates for their own accounts and

NUVEEN DIVERSIFIED COMMODITY FUND (CFD)

19

Special Risk Considerations (continued)

the accounts of other customers for the purposes of determining “position limits,” and there can

be no assurance that the commodity subadvisor will choose to liquidate the Fund’s positions in a

proportionate manner in the event of mandatory liquidation of positions held by the commodity

subadvisor (or its principals or affiliates) to comply with position limits or for other reasons;

– the manager has less of an incentive to replace either the collateral subadvisor or the commodity

subadvisor because both are affiliates of the manager; and

each of the managers and the subadvisors resolve conflicts of interest as they arise based on their

judgment and analysis of the particular issue.

• The Fund currently expects that up to 30% of its net assets invested in commodity futures contracts

and options on commodity futures contracts may be in non-U.S. markets. Some non-U.S. markets

present risks because they are not subject to the same degree of regulation as their U.S. counterparts.

• Regardless of its investment performance, the Fund will incur fees and expenses, including brokerage

and management fees. A management fee will be paid by the Fund even if the Fund experiences a net

loss for the full year.

• The Fund may need to liquidate some of its investments in order to make distributions, and such

liquidation could be at times or on terms different than those the Fund would otherwise select, which

could have an adverse effect on the Fund’s results.

• Unlike most other Nuveen-sponsored funds, the Fund is not a mutual fund, a closed-end fund or

any other type of “investment company” within the meaning of the 1940 Act, and is not subject

to regulation thereunder nor afforded the protections of the 1940 Act. As such, the Independent

Committee of NCAM, which serves the audit and nominating committee functions for the Fund, does

not have the scope of authority mandated to a board of directors under the 1940 Act. Based on the

NUVEEN DIVERSIFIED COMMODITY FUND (CFD)

20

Special Risk Considerations (continued)

Fund’s structure, its (i) potential for the realization of the greatest gains and (ii) exposure to the largest

risk of loss will always be from its commodity investments and options strategy. Shareholders will have

no rights to participate in the Fund’s management other than the right in limited circumstances to

remove or replace the manager. Therefore, Fund shareholders will have to rely on the judgment of the

manager and the subadvisors to manage the Fund.

• The Fund’s shares do not represent a deposit or obligation of, and are not guaranteed or endorsed by,

any bank or other insured depository institution, and are not federally insured by the Federal Deposit

Insurance Corporation, the Federal Reserve Board or any other governmental agency.

Please see the Fund information at www.nuveen.com/CommodityInvestments for a complete description of

these and other risks. Nuveen does not offer tax or legal advice. Please consult with your tax or legal advisor

before investing.

The preceding discussion is not intended to be used, and cannot be used by any person, for the purpose of

avoiding United States federal tax penalties, and is presented in connection with the promotion or marketing

of the Fund. Each investor should seek advice based on such person’s particular circumstances from an

independent tax advisor.

The information contained in this presentation and in the information statement may be changed. This

presentation is for informational purposes only and is not a solicitation to buy or sell Fund shares. The Fund is

not offering any new shares for sale; existing shares trade on the NYSE MKT.

NUVEEN DIVERSIFIED COMMODITY FUND (CFD)

21