UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Hughes Communications, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount previously paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

11717 Exploration Lane

Germantown, MD 20876

March 19, 2009

Fellow Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Hughes Communications, Inc. (the “Company”), which will be held on Wednesday, April 15, 2009 at 10:00 a.m., Eastern Time, at the Company’s headquarters located at 11717 Exploration Lane, Germantown, Maryland 20876.

The attached Notice of Annual Meeting of Stockholders and the Proxy Statement describe the formal business to be transacted at the Annual Meeting. Officers of the Company will be present at the Annual Meeting to respond to any questions that stockholders may have regarding the business to be transacted. In addition, the Annual Meeting will include management’s report on the Company’s financial performance for the year ended December 31, 2008.

Your vote is very important regardless of the number of shares you own. Whether or not you expect to attend the Annual Meeting, please read the Proxy Statement and provide instructions for voting your shares by mail, telephone or via the Internet so that your shares will be represented. Returning the proxy card by mail or voting your shares by telephone or the Internet will not prevent you from voting in person at the meeting, but will ensure that your vote is counted if you are unable to attend.

On behalf of the Board of Directors of the Company and all of our employees, we thank all of our stockholders for your continued interest and support.

Sincerely yours,

Pradman P. Kaul

Chief Executive Officer and President

11717 Exploration Lane

Germantown, MD 20876

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on April 15, 2009

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the Annual Meeting of the Stockholders (the “Annual Meeting”) of Hughes Communications, Inc. (the “Company”) will be held on Wednesday, April 15, 2009 at 10:00 a.m., Eastern Time, at the Company’s headquarters located at 11717 Exploration Lane, Germantown, Maryland 20876.

The purpose of the Annual Meeting is to consider and vote upon the following matters:

| | 1. | To elect seven (7) directors to hold office until the next Annual Meeting of Stockholders of the Company and until their successors are elected and qualified; |

| | 2. | To approve an amendment to the Hughes Communications, Inc. 2006 Equity and Incentive Plan; |

| | 3. | To approve the Hughes Network Systems, LLC Amended and Restated Bonus Unit Plan; |

| | 4. | To ratify the appointment of Deloitte & Touche LLP as the independent registered public accountant of the Company for the year ending December 31, 2009; and |

| | 5. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

The Board of Directors of the Company has established March 6, 2009 as the record date for the determination of stockholders entitled to receive notice of and to vote at the Annual Meeting and any adjournments or postponements thereof. Only those stockholders of record as of the close of business on that date will be entitled to vote at the Annual Meeting. In the event there are insufficient votes for a quorum or to approve or ratify any of the foregoing proposals at the time of the Annual Meeting, we may adjourn the Annual Meeting in order to permit further solicitation of proxies.

By Order of the Board of Directors,

Dean A. Manson,

Secretary

March 19, 2009

HUGHES COMMUNICATIONS, INC.

PROXY STATEMENT

Annual Meeting of Stockholders

April 15, 2009

Table of Contents

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

This Proxy Statement, the proxy card, and the combined 2008 Annual Report to Stockholders and Annual Report on Form 10-K for the year ended December 31, 2008 are being made available to you on or about March 19, 2009. The Board of Directors (the “Board of Directors”) of Hughes Communications, Inc. (the “Company”) is soliciting your proxy to vote your shares at the 2009 Annual Meeting of Stockholders of the Company (the “Annual Meeting”). The Board of Directors is soliciting your proxy to give all stockholders of record the opportunity to vote on matters that will be presented at the Annual Meeting. This Proxy Statement provides you with information on these matters to assist you in voting your shares.

Pursuant to rules adopted by the Securities and Exchange Commission (“SEC”), we are providing access to our proxy materials over the Internet. Our proxy materials are available at www.proxyvote.com. You must have your proxy card available when you access the website.

Date, Time and Place

The Annual Meeting will be held on Wednesday, April 15, 2009 at 10:00 a.m., Eastern Time, at the Company’s headquarters located at 11717 Exploration Lane, Germantown, Maryland 20876.

Purpose of the Annual Meeting

The purpose of the Annual Meeting is to consider and vote upon the following matters:

| | 1. | To elect seven (7) directors to hold office until the Company’s next Annual Meeting of Stockholders and until their successors are elected and qualified; |

| | 2. | To approve an amendment to the Hughes Communications, Inc. 2006 Equity and Incentive Plan (the “2006 Plan”); |

| | 3. | To approve the Hughes Network Systems, LLC Amended and Restated Bonus Unit Plan (the “Bonus Unit Plan”); |

| | 4. | To ratify the appointment of Deloitte & Touche LLP (“Deloitte & Touche”) as the independent registered public accountant of the Company for the year ending December 31, 2009; and |

| | 5. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Record Date; Stockholders Entitled to Vote

The close of business on March 6, 2009 has been established by the Board of Directors as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting or any adjournments or postponements of the Annual Meeting.

At the close of business on the record date, there were 21,604,520 shares of our common stock outstanding and entitled to vote held by approximately 846 holders of record and approximately 9,440 beneficial holders. Each share of our common stock entitles the holder to one vote at the Annual Meeting on all matters properly presented at the meeting.

A complete list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder at our headquarters at 11717 Exploration Lane, Germantown, Maryland 20876 for purposes pertaining to the Annual Meeting, during normal business hours for a period of ten (10) days prior to the Annual Meeting and at the time and place of the Annual Meeting.

1

Quorum

A quorum, consisting of the holders of one-third of the shares of the Company’s issued and outstanding capital stock entitled to vote as of the record date, must be present in person or by proxy before any action may be taken at the Annual Meeting. We count abstentions and broker “non-votes” as present and entitled to vote for the purposes of determining a quorum. A broker “non-vote” occurs when a stockholder fails to provide voting instructions to his or her broker for shares held in “street name” (i.e. shares held in a broker, bank or other nominee account). Under those circumstances, a stockholder’s broker may be authorized to vote for the stockholder on some routine items, but is prohibited from voting on other items. Those items for which a stockholder’s broker cannot vote result in broker “non-votes.”

Votes Required

Vote Required to Elect the Directors (Proposal 1)

The seven (7) nominees for director receiving the greatest number of votes, cast in person or by proxy by holders of our capital stock entitled to vote at the meeting, will be elected as directors.

Vote Required to Approve the Amendment to the 2006 Plan (Proposal 2)

The affirmative vote of a majority of votes, cast in person or by proxy by holders of our capital stock entitled to vote at the meeting, is required to approve the amendment to the 2006 Plan.

Vote Required to Approve the Bonus Unit Plan (Proposal 3)

The affirmative vote of a majority of votes, cast in person or by proxy by holders of our capital stock entitled to vote at the meeting, is required to approve the Bonus Unit Plan.

Vote Required to Ratify the Appointment of Our Independent Registered Public Accountant (Proposal 4)

The affirmative vote of a majority of votes, cast in person or by proxy by holders of our capital stock entitled to vote at the meeting, is required to ratify the appointment of Deloitte & Touche as our independent registered public accountant for the year ending December 31, 2009.

Treatment of Abstentions, Not Voting and Incomplete Proxies

If a stockholder abstains from voting on Proposal 1, it will have no effect. If a stockholder abstains from voting on Proposal 2, 3, or 4, it will have the same effect as a vote against the proposal. If a stockholder does not return a proxy card or does not submit a vote by Internet or telephone, it will have no effect on the vote for Proposals 1, 2, 3, or 4. If a proxy card is returned without indication as to how to vote, the stock represented by that proxy will be considered to be voted in favor of Proposals 1, 2, 3 and 4.

Voting of Proxies

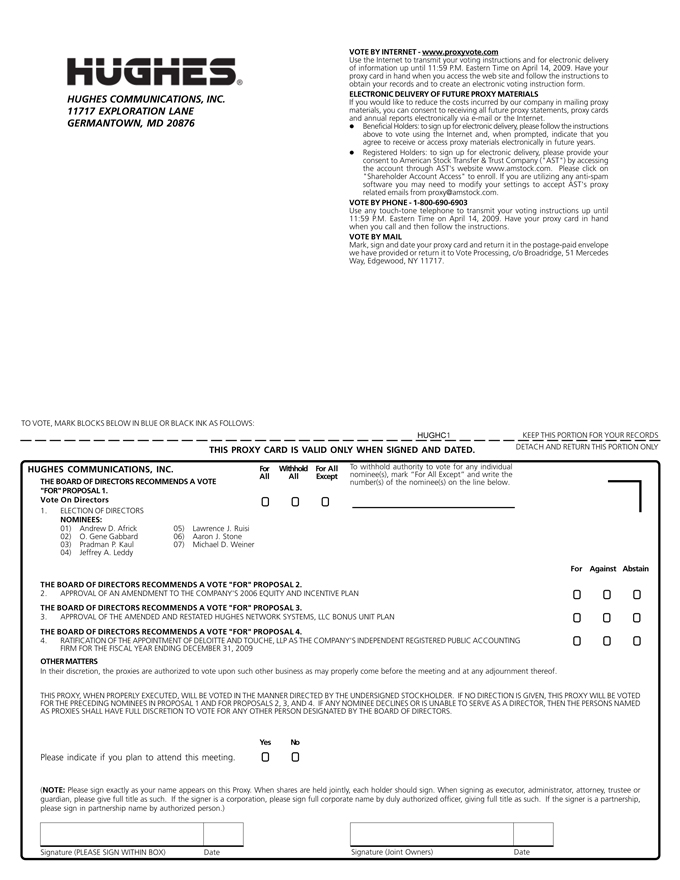

Giving a proxy means that you authorize the persons named in the proxy card to vote your shares at the Annual Meeting in the manner directed by you. All shares voted via the Internet or by telephone by 11:59 p.m. Eastern Time on April 14, 2009 or represented by a properly executed proxy card received prior to the Annual Meeting (and not revoked) will be voted at the Annual Meeting in the manner specified by the holders thereof. You may vote by mail, via the Internet, by telephone, or in person at the Annual Meeting.

| | • | | Mail. To vote by mail, complete and return the proxy card in the enclosed envelope. The envelope requires no additional postage if mailed in the United States. |

| | • | | Internet. To vote via the Internet, go to www.proxyvote.com. Have your proxy card available and follow the instructions for voting that appear on the website to transmit your voting instructions and for |

2

| | electronic delivery of information up until 11:59 p.m. Eastern Time on April 14, 2009. If you vote via the Internet, you should be aware that you may incur costs to access the Internet, such as usage charges from telephone companies or Internet service providers, and that these costs must be borne by the stockholder. |

| | • | | Telephone. To vote by telephone, call 1-800-690-6903. Have your proxy card available and use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time on April 14, 2009. |

The Internet and telephone voting procedures are designed to verify stockholders’ identities, allow stockholders to give voting instructions and confirm that their instructions have been recorded properly. Stockholders who vote by Internet or telephone need not return a proxy card by mail.

If you hold your shares in street name through a bank, broker or other intermediary, you are a “beneficial owner” of our common stock. In order to vote your shares, you must give voting instructions to your bank, broker or other intermediary who is the “nominee holder” of your shares. We ask brokers, banks and other nominee holders to obtain voting instructions from the beneficial owners of shares that are registered in the nominee’s name. Proxies that are transmitted by nominee holders on behalf of beneficial owners will count toward a quorum and will be voted as instructed by the nominee holder.

Every stockholder’s vote is important. Accordingly, you should provide your voting instructions to the Company by mail, telephone or the Internet or to your broker or other nominee, whether or not you plan to attend the Annual Meeting in person.

Revoking Your Proxy or Changing Your Vote

Whether stockholders submit their proxies by Internet, telephone or mail, a stockholder has the power to revoke his or her proxy or change his or her vote at any time prior to the date of the Annual Meeting. You can revoke your proxy or change your vote by:

| | • | | sending either (i) a written notice of the revocation of your proxy or (ii) an executed proxy card bearing a date later than your original proxy by mail to our Secretary, Dean A. Manson, at 11717 Exploration Lane, Germantown, Maryland 20876 for receipt prior to the Annual Meeting; |

| | • | | submitting another proxy with a later date than your original proxy (either by Internet, telephone or mail); or |

| | • | | attending the Annual Meeting and voting in person, which will automatically cancel any proxy previously given. |

Solicitation of Proxies

This solicitation is being made on behalf of our Board of Directors. We will pay the costs related to the printing and mailing of this Proxy Statement and soliciting and obtaining the proxies, including the cost of reimbursing brokers, banks and other financial institutions for forwarding proxy materials to their customers. We have retained Broadridge Financial Solutions, Inc. (“Broadridge”) to aid in the solicitation of proxies and to verify records relating to the solicitation. Broadridge will receive a fee for its services of approximately $18,300 plus associated costs and expenses.

Attending the Meeting

Stockholders and persons holding proxies from stockholders may attend the Annual Meeting. Seating, however, is limited and will be available on a first-come, first-served basis. If you plan to attend the Annual Meeting, please bring valid photo identification and proof of ownership of your shares of our common stock to the Annual Meeting. Examples of acceptable proof of ownership include a letter from your bank or broker stating that you owned shares of our capital stock as of the close of business on March 6, 2009 or a brokerage account statement indicating that you owned shares of our capital stock as of the close of business on March 6, 2009.

3

CORPORATE GOVERNANCE

Director Independence

Our common stock is listed on the National Association of Securities Dealers Automated Quotations System Global Select Market (NASDAQ). NASDAQ rules generally require that a majority of our directors and all of the members of our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee be independent. We rely on the controlled company exception contained in NASDAQ Marketplace Rule 4350 for exemption from these independence requirements. Pursuant to NASDAQ Marketplace Rule 4350, a company of which more than 50% of the voting power is held by an individual, a group or another company is exempt from the requirements that its board of directors consist of a majority of independent directors and that the compensation committee and nominating committee of such company be comprised solely of independent directors. As of March 6, 2009, Apollo Investment Fund IV, L.P. and its affiliates (collectively, “Apollo”) had approximately 57.44% of the voting power of the Company, which qualifies the Company as a controlled company eligible for exemption under the rule.

In making its determination of independence, the Board of Directors considers certain categorical standards of independence as set forth in stock exchange corporate governance rules and all relevant facts and circumstances to ascertain whether there is any relationship between a director and the Company that, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment by the director in carrying out the responsibilities of the director. Under these standards and criteria, our Board of Directors has determined that O. Gene Gabbard, Lawrence Ruisi and Michael Weiner are independent as defined in applicable Securities and Exchange Commission (“SEC”) and NASDAQ rules and regulations and that each constitutes an “Independent Director” as defined in NASDAQ Marketplace Rule 4200.

Disclosure Committee

The current members of the Disclosure Committee include: Pradman Kaul, Chief Executive Officer and President; Grant A. Barber, Executive Vice President and Chief Financial Officer; Dean A. Manson, Senior Vice President, General Counsel and Secretary; T. Paul Gaske, Executive Vice President; Bahram Pourmand, Executive Vice President; Adrian Morris, Executive Vice President; Thomas J. McElroy, Chief Accounting Officer; and Deepak V. Dutt, Vice President, Treasurer and Investor Relations Officer. The following officers of Hughes Network Systems, LLC (“HNS”), our wholly-owned subsidiary, also serve on the Disclosure Committee: Sandi Kerentoff, Senior Vice President, Human Resources and Administration; John McEwan, Senior Vice President-Operations; and Shane Shrader, Director of Internal Audit. The Disclosure Committee is governed by a written charter. Among its tasks, the Disclosure Committee discusses and reviews disclosure issues to reasonably ensure compliance by the Company with our Disclosure Control and Procedure Policy and the rules and regulations of the SEC regarding public disclosure and to provide complete and accurate disclosure to our stockholders and the public.

Code of Ethics

We have adopted a written code of ethics, the “Amended and Restated Code of Ethics for Chief Executive and Senior Financial Officers,” which is applicable to our principal executive officer, principal financial officer, principal accounting officer or controller and other executive officers who perform similar functions (each, a “Selected Officer”). Our code of ethics is available on our website at www.hughes.com or you may request a free copy of our code of ethics from:

Hughes Communications, Inc.

11717 Exploration Lane

Germantown, MD 20876

Attn: Sandi Kerentoff

4

To date, there have been no waivers under our code of ethics. We intend to disclose any changes in or waivers from our code of ethics applicable to any Selected Officer by filing a Form 8-K.

Stockholder Communications with Directors

Any interested stockholder desiring to communicate with our non-management directors may contact them through our Secretary, Dean A. Manson, whose address is Hughes Communications, Inc. 11717 Exploration Lane, Germantown, Maryland 20876.

SECURITY OWNERSHIP INFORMATION

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth information regarding the beneficial ownership of the Company’s common stock as of March 6, 2009 by (i) each person known to beneficially own more than 5% of our common stock; (ii) each current director and nominee for director; (iii) each of our named executive officers; and (iv) all of our directors and named executive officers as a group. No individual director, nominee for director or named executive officer owns more than 1% of the outstanding shares of our common stock. Except as otherwise indicated, each individual named has sole investment and voting power with respect to the shares owned.

| | | | | | | |

Title of Class | | Name of Beneficial Owner | | Number of

Shares | | Percentage of

Class | |

Common Stock | | Apollo Investment Fund IV, L.P.(1)(2) Two Manhattanville Road Purchase, New York 10577 | | 12,408,611 | | 57.44 | % |

Common Stock | | Harbinger Capital Partners(3) Master Fund I, Ltd. c/o International Fund Services Third Floor Bishop Square Redmonds Hill; Dublin, Ireland L2 | | 1,165,486 | | 5.39 | % |

Common Stock | | Bank of America Corporation(4) 100 North Tryon Street, Floor 25 Charlotte, North Carolina 28255 | | 1,251,825 | | 5.79 | % |

Common Stock | | Solus Alternative Asset Management LP(5) 430 Park Avenue New York, NY 10022 | | 2,150,000 | | 9.95 | % |

Common Stock | | Pradman P. Kaul(6) | | 9,032 | | * | |

Common Stock | | Grant Barber(7) | | 15,111 | | * | |

Common Stock | | T. Paul Gaske(8) | | 9,406 | | * | |

Common Stock | | Adrian Morris(9) | | 9,477 | | * | |

Common Stock | | Bahram Pourmand(10) | | 9,477 | | * | |

Common Stock | | Andrew D. Africk(11) | | 50,000 | | * | |

Common Stock | | O. Gene Gabbard(12) | | 25,000 | | * | |

Common Stock | | Jeffrey A. Leddy(13) | | 100,000 | | * | |

Common Stock | | Lawrence J. Ruisi(14) | | 25,000 | | * | |

Common Stock | | Aaron J. Stone(15) | | 37,500 | | * | |

Common Stock | | Michael D. Weiner(16) | | 37,500 | | * | |

Common Stock | | Members of the board of directors and executive officers as a group (11 persons)(17) | | 327,503 | | 1.51 | % |

| * | Indicates beneficial ownership of less than 1%. |

| (1) | Consists of 10,164,416 shares of common stock beneficially owned by Apollo Investment Fund IV, L.P., 417,834 shares of common stock owned by AP/RM Acquisition, LLC, 512,198 shares of stock beneficially owned by Apollo Overseas Partners IV, L.P., 527,730 shares of common stock beneficially owned by ST/RRRR LLC and 786,433 shares of common stock beneficially owned by AIF IV/RRRR LLC. |

| (2) | Andrew Africk and Aaron Stone, members of our Board of Directors and the Board of Managers of Hughes Network System, LLC and associated with Apollo Advisors IV, L.P., disclaim beneficial ownership of the 12,408,611 shares of our common stock that are beneficially owned by Apollo. |

5

| (3) | Based on the Schedule 13G/A filed with the Securities and Exchange Commission (“SEC”) on March 6, 2009 by Harbinger Capital Partners Master Fund I, Ltd. Consists of 1,165,486 shares of our common stock owned by Harbinger Capital Partners Master Fund I, Ltd., which may be deemed to share beneficial ownership with Harbinger Capital Partners Offshore Manager, L.L.C., HMC Investors, L.L.C., Harbert Management Corporation, Philip Falcone, Raymond J. Harbert and Michael D. Luce. |

| (4) | Based on Schedule 13G filed with the SEC on February 12, 2009 by Bank of America Corporation. Consists of (i) 1,001,825 shares of our common stock owned by Bank of America Corporation which may be deemed to share beneficial ownership with NB Holdings Corporation, BAC North America Holding Company and BANA Holding; (ii) 2,442 shares of our common stock owned by Bank of America Corporation which may be deemed to share beneficial ownership with Bank of America, N.A.; (iii) 1,635 shares of our common stock owned by Bank of America Corporation which may be deemed to share beneficial ownership with Columbia Management Group, LLC; (iv) 550 shares of our common stock owned by Bank of America Corporation which may be deemed to share beneficial ownership with Columbia Management Advisors, LLC; (v) 250,000 shares of our common stock owned by Bank of America Corporation which may be deemed to share beneficial ownership with NMS Services, Inc.; and (vi) 807 shares of our common stock owned by Bank of America Corporation which may be deemed to share beneficial ownership with Banc of America Investment Advisors, Inc. |

| (5) | Based on Schedule 13G/A filed with the SEC on February 17, 2009 by Solus Alternative Asset Management LP. Consists of 2,150,000 shares of our common stock owned by Solus Alternative Asset Management LP which may be deemed to share beneficial ownership with Solus GP LLC and Christopher Pucillo. |

| (6) | Consists of 8,969 shares, net of shares withheld for the payment of taxes, of our common stock granted as restricted stock that vested on March 24, 2008 under the 2006 Equity and Incentive Plan (the “Plan”) and 63 shares of our common stock received upon the exchange of HNS Class B membership interests on May 28, 2008. Mr. Kaul also owns 1,073 HNS Class B membership interests, which are subject to time or performance vesting requirements as set forth in his employment agreement with us. |

| (7) | Consists of 15,000 shares of common stock received by Mr. Barber upon the exercise of options granted under the Plan and 111 shares of our common stock received upon the exchange of HNS Class B membership interests on May 28, 2008. Mr. Barber also owns 400 HNS Class B membership interests, which are subject to time vesting requirements as set forth in his employment agreement with us. |

| (8) | Consists of 9,351 shares, net of shares withheld for the payment of taxes, of our common stock granted as restricted stock that vested on March 24, 2008 under the Plan and 55 shares of our common stock received upon the exchange of HNS Class B membership interests on May 28, 2008. Mr. Gaske also owns 465 HNS Class B membership interests, which are subject to time or performance vesting requirements as set forth in his employment agreement with us. |

| (9) | Consists of 9,351 shares, net of shares withheld for the payment of taxes, of our common stock granted as restricted stock that vested on March 24, 2008 under the Plan and 126 shares of our common stock received upon the exchange of HNS Class B membership interests on May 28, 2008. Mr. Morris also owns 359 HNS Class B membership interests, which are subject to time or performance vesting requirements as set forth in his employment agreement with us. |

| (10) | Consists of 9,351 shares, net of shares withheld for the payment of taxes, of our common stock granted as restricted stock that vested on March 24, 2008 under the Plan and 126 shares of our common stock received upon the exchange of HNS Class B membership interests on May 28, 2008. Mr. Pourmand also owns 359 HNS Class B membership interests, which are subject to time or performance vesting requirements as set forth in his employment agreement with us. |

| (11) | Includes options to purchase 3,750 shares of our common stock, which are currently exercisable and 25,000 shares of restricted stock granted under the Plan. Andrew Africk is a principal of Apollo Advisors IV, L.P., which together with an affiliated investment manager, serves as the manager of Apollo. Mr. Africk disclaims beneficial ownership of the 12,408,611 shares of our common stock that are beneficially owned by Apollo. |

| (12) | Consists of 25,000 shares of restricted stock granted under the Plan. |

| (13) | Includes options to purchase 20,000 shares of our common stock which are currently exercisable and 15,000 shares of restricted stock granted under the Plan. Mr. Leddy also owns 600 HNS Class B membership interests, which are subject to time or performance vesting requirements as set forth in a restricted unit purchase agreement between Mr. Leddy and HNS. |

| (14) | Consists of 25,000 shares of restricted stock granted under the Plan. |

| (15) | Includes options to purchase 12,500 shares of our common stock which are currently exercisable and 25,000 shares of restricted stock granted under the Plan. Aaron Stone is a partner of Apollo Advisors IV, L.P., which together with an affiliated investment manager, serves as the manager of Apollo. Mr. Stone disclaims beneficial ownership of the 12,408,611 shares of our common stock that are beneficially owned by Apollo. |

| (16) | Consists of 25,000 shares of restricted stock granted under the Plan and options to purchase 12,500 shares of our common stock which are currently exercisable. |

| (17) | Messrs. Africk and Stone, members of our Board of Directors and HNS’ Board of Managers and associated with Apollo Advisors IV, L.P., disclaim beneficial ownership of the 12,408,611 shares of our common stock that are beneficially owned by Apollo. See footnote numbers 1, 11 and 15 above. Includes options to purchase an aggregate of 36,250 shares of our common stock that are currently exercisable. |

6

The Company owns 100% of the Class A, or voting, membership interests of Hughes Network Systems, LLC, a Delaware limited liability company (“HNS”). Certain of our directors, nominees for director and executive officers own Class B, or non-voting, membership interests in HNS. The following table sets forth information regarding the beneficial ownership of HNS’ Class B membership interests as of March 6, 2009 by: (i) each current director and nominee for director; (ii) each of our named executive officers; and (iii) all of our directors and named executive officers as a group. Except as otherwise indicated, each individual named has sole investment power with respect to the shares owned.

| | | | | | | |

Title of Class | | Name of Beneficial Owner | | Number of

Units | | Percentage

of Class | |

HNS Class B membership interests | | Pradman P. Kaul(1) | | 1,073 | | 29.35 | % |

HNS Class B membership interests | | Grant Barber(2) | | 400 | | 10.94 | % |

HNS Class B membership interests | | T. Paul Gaske(3) | | 465 | | 12.72 | % |

HNS Class B membership interests | | Adrian Morris(4) | | 359 | | 9.82 | % |

HNS Class B membership interests | | Bahram Pourmand(5) | | 359 | | 9.82 | % |

HNS Class B membership interests | | Jeffrey A. Leddy(6) | | 600 | | 16.41 | % |

| | | | | | | |

HNS Class B membership interests | | Members of the board of managers and executive officers as a group (6 persons) | | 3,256 | | 89.06 | % |

| | | | | | | |

| (1) | Consists of 1,073 of our Class B membership interests which are subject to time or performance vesting requirements as set forth in Mr. Kaul’s employment agreement. Mr. Kaul also owns 8,969 shares, net of shares withheld for the payment of taxes, of our common stock granted as restricted stock that vested on March 24, 2008 under the Plan and 63 shares of our common stock received upon the exchange of HNS Class B membership interests on May 28, 2008. |

| (2) | Consists of 400 of our Class B membership interests which are subject to time or performance vesting requirements as set forth in Mr. Barber’s employment agreement. Mr. Barber also owns 15,000 shares of our common stock granted as options he exercised under the Plan and 111 shares of our common stock received upon the exchange of HNS Class B membership interests on May 28, 2008. |

| (3) | Consists of 465 of our Class B membership interests which are subject to time or performance vesting requirements as set forth in Mr. Gaske’s employment agreement. Mr. Gaske also owns 9,351 shares, net of shares withheld for the payment of taxes, of our common stock granted as restricted stock that vested on March 24, 2008 under the Plan and 55 shares of our common stock received upon the exchange of HNS Class B membership interests on May 28, 2008. |

| (4) | Consists of 359 of our Class B membership interests which are subject to time or performance vesting requirements as set forth in Mr. Morris’ employment agreement. Mr. Morris also owns 9,351 shares, net of shares withheld for the payment of taxes, of our common stock granted as restricted stock that vested on March 24, 2008 under the Plan and 126 shares of our common stock received upon the exchange of HNS Class B membership interests on May 28, 2008. |

| (5) | Consists of 359 of our Class B membership interests which are subject to time or performance vesting requirements as set forth in Mr. Pourmand’s employment agreement. Mr. Pourmand also owns 9,351 shares, net of shares withheld for the payment of taxes, of our common stock granted as restricted stock that vested on March 24, 2008 under the Plan and 126 shares of our common stock received upon the exchange of HNS Class B membership interests on May 28, 2008. |

| (6) | Consists of 600 of our Class B membership interests which are subject to time or performance vesting requirements as set forth in a restricted unit purchase agreement between Mr. Leddy and us. Mr. Leddy also owns 100,000 shares of our common stock including vested options to purchase 20,000 shares of HCI common stock. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our officers and directors and persons who own more than ten percent of a registered class of our equity securities to file reports of ownership and changes in ownership with the SEC and to furnish us with copies of the forms.

Pursuant to Section 16(a) of the Securities Exchange Act of 1934, none of our directors or executive officers failed to file on a timely basis any Form 3, 4 or 5 with the SEC in 2008.

7

PROPOSAL 1. ELECTION OF DIRECTORS

The Board of Directors determines the number of directors that serve on our Board of Directors, which under our Bylaws must consist of not less than one (1) and not more than nine (9) members. The Board of Directors has currently fixed the number at seven (7) members.

Each of the seven (7) nominees, if elected, will serve one year until the Company’s 2010 Annual Meeting of Stockholders and until a successor has been elected and qualified. Each nominee was recommended by the Board of Directors and has consented to be named and to continue to serve if elected. If any of the nominees becomes unavailable for election for any reason, the proxies will be voted for the other nominees and for any substitutes.

Nominees for Director

| | |

Name | | Principal Occupations |

Pradman P. Kaul Director, Chief Executive Officer and President Age: 62 | | Mr. Kaul has been our Chief Executive Officer (“CEO”) and President as well as a member of our Board of Directors since February 2006, and has been HNS’ CEO and President since 2000. Mr. Kaul was appointed to, and has served as Chairman of, HNS’ Board of Managers since April 22, 2005. Previously, Mr. Kaul served as the Chief Operating Officer, Executive Vice President and Director of Engineering of HNS. Before joining HNS in 1973, Mr. Kaul worked at COMSAT Laboratories in Clarksburg, Maryland. Mr. Kaul received a Bachelor of Science degree in Electrical Engineering from The George Washington University and a Master of Science degree in Electrical Engineering from the University of California at Berkeley. He holds numerous patents and has published articles and papers on a variety of technical topics concerning satellite communications. Mr. Kaul is a member of the National Academy of Engineering and serves on the Board of Directors of Primus Telecom in the United States. |

| |

Andrew D. Africk Director Age: 42 | | Mr. Africk has been a director since December 2005. Mr. Africk is a senior partner of Apollo Advisors, L.P., which, together with its affiliates, acts as managing general partner of the Apollo Investment Funds, a series of private securities investment funds, where he has worked since 1992. Mr. Africk also serves on the Board of Directors of Hughes Telematics and SOURCECORP, Incorporated. Mr. Africk serves as the chairman of our Nominating and Corporate Governance Committee and our Compensation Committee and also serves on HNS’ Board of Managers. |

| |

O. Gene Gabbard Director Age: 68 | | Mr. Gabbard has been a director since June 2006. He is a private investor who has more than 25 years of general management experience in the telecommunications and technology sectors. Mr. Gabbard is a member of the board of directors of COLT Telecom, SA, Luxembourg, a pan-European provider of business communications services. He is also a member of the Board of Directors of Knology, Inc., West Point, Georgia, Trillion Partners, Austin, Texas and NetCracker, Inc., Waltham, Massachusetts. From August 1990 to January 1993, Mr. Gabbard was Executive Vice President and Chief Financial Officer of MCI Communications Corporation. Mr. Gabbard serves on our Audit Committee. |

8

| | |

Name | | Principal Occupations |

Jeffrey A. Leddy Director Age: 53 | | Mr. Leddy has been a director since our formation in June 2005. Mr. Leddy was our President from our formation in June 2005 until February 2006 and our Chief Executive Officer from November 2005 until February 2006. Mr. Leddy is currently the Chief Executive Officer of Hughes Telematics. He previously served as SkyTerra’s Chief Executive Officer and President from April 2003 through December 2006, having served as its President and Chief Operating Officer since October 2002 and its Senior Vice President of Operations since June 2002. From September 1980 to December 2001, Mr. Leddy worked for EMS Technologies, most recently as a Vice President. Mr. Leddy also serves on the Board of Directors of Hughes Telematics and Hughes Systique Corporation and on the Board of Managers of HNS. Mr. Leddy served on our Compensation Committee from August 6, 2008 to March 4, 2009. |

| |

Lawrence Ruisi Director Age: 60 | | Mr. Ruisi has been a director since June 2006. He is a private investor/consultant and also serves on the Board of Governors of Sound Shore Medical Center where he was Chairman from 2002 to 2006. Mr. Ruisi also serves on the boards of directors of Innkeepers USA, a privately held hotel real estate investment trust and Adaptec, Inc., a data storage provider to OEMs. Mr. Ruisi has over twenty years of experience in the entertainment industry during which he held various senior executive positions. He was Chief Executive Officer and President of Loews Cineplex Entertainment from 1998 to 2002, Executive Vice President of Sony Pictures Entertainment from 1991 to 1998, Senior Vice President of Columbia Pictures Entertainment from 1987 to 1990 and Senior Vice President Finance and Vice President and Controller of Tri-Star Pictures from 1983 to 1987. Mr. Ruisi started his career in public accounting and worked for Price Waterhouse & Co. from 1970 to 1983. Mr. Ruisi serves as the chairman of our Audit Committee. |

| |

Aaron J. Stone Director Age: 36 | | Mr. Stone has been a director since December 2005. Mr. Stone is a senior partner of Apollo Advisors, L.P. which, together with its affiliates, acts as managing general partner of the Apollo Investment Funds, a series of private securities investment funds, where he has worked since 1997. Mr. Stone also serves on the Board of Directors of AMC Entertainment Inc. and Connections Academy, LLC, and on the Board of Managers of HNS. Mr. Stone serves on our Compensation Committee and Nominating and Corporate Governance Committee. |

| |

Michael Weiner Director Age: 56 | | Mr. Weiner has been a director since December 2005. Mr. Weiner has been Chief Legal Officer and General Counsel of Ares Management since September 2006. Previously, Mr. Weiner was employed with Apollo Advisors, L.P. and Apollo Real Estate Advisors and served as general counsel of the Apollo organization from 1992 to September 2006. Prior to joining Apollo, Mr. Weiner was a partner in the law firm of Morgan, Lewis & Bockius specializing in securities law, public and private financings, and corporate and commercial transactions. Mr. Weiner serves on our Audit Committee. |

The Board of Directors recommends a voteFOR the election of each of the nominees.

9

Composition of the Board of Directors

Our Board of Directors currently consists of seven (7) members. We currently do not have a chairman. Our Board of Directors is elected annually, and each director holds office for a one-year term.

Board of Directors and Board of Directors Committee Meetings; Annual Meeting Attendance

During 2008, our Board of Directors held four regular meetings and one special meeting. The Board of Directors has the authority to appoint committees to perform certain management and administration functions. Our Board of Directors currently has an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. All directors, with the exception of Stephen Clark, attended at least 75% of the meetings of the Board of Directors and the meetings of the board committees on which they served during 2008.

The Company does not have a policy regarding board members’ attendance at the Company’s Annual Meeting of Stockholders; however, directors are invited to attend the meetings. One member of the Board of Directors, Pradman Kaul, attended the Company’s 2008 Annual Meeting of Stockholders.

Audit Committee

The Audit Committee selects, on behalf of our Board of Directors, an independent registered public accounting firm to be engaged to audit our financial statements, discusses with the independent auditors their independence, reviews and discusses the audited consolidated financial statements with the independent auditors and management and recommends to our Board of Directors whether the audited consolidated financial statements should be included in our Annual Reports on Form 10-K to be filed with the SEC. The Audit Committee is governed by a written charter approved by our Board of Directors which is available on the Investor Relations page of our website at www.hughes.com. The members of our Audit Committee are Messrs. Ruisi, Gabbard and Weiner. Mr. Ruisi serves as chairman of the Audit Committee. Our Board of Directors has determined that each member of the Audit Committee is an independent director and that Mr. Ruisi is an “audit committee financial expert” under the requirements of NASDAQ and the SEC. During 2008, the Audit Committee held six meetings.

Compensation Committee

The Compensation Committee reviews and either approves, on behalf of the Board of Directors, or recommends to the Board of Directors for approval (i) the annual salaries and other compensation of our executive officers and (ii) individual stock and stock option grants for our executive officers. The Compensation Committee also provides assistance and recommendations with respect to our compensation policies and practices and assists with the administration of our compensation plans. The current members of our Compensation Committee are Messrs. Africk and Stone. Mr. Africk serves as the chairman of the Compensation Committee. The Compensation Committee operates under a written charter adopted by our Board of Directors which is available on the Investor Relations page of our website at www.hughes.com. During 2008, the Compensation Committee held one meeting.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee: (i) assists the Board of Directors in identifying individuals qualified to serve as members of the Board of Directors; (ii) develops and recommends to the Board of Directors a set of corporate governance principles for the Company; and (iii) oversees the evaluation of the Board of Directors. The members of the Nominating and Corporate Governance Committee are Messrs. Africk and Stone. Mr. Africk serves as the chairman of the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is governed by a written charter approved by our Board of Directors which is available on the Investor Relations page of our website at www.hughes.com. During 2008, the Nominating and Corporate Governance Committee held one meeting.

10

The Nominating and Corporate Governance Committee uses a variety of methods for identifying and evaluating all nominees for director. Candidates may come to the attention of the committee through current directors, members of management, stockholders and other persons. The committee, to date, has not engaged a professional search firm. Candidates for director are evaluated at meetings of the committee. Nominees for director are selected on the basis of, among other criteria, experience, knowledge, skills, expertise, integrity, understanding and familiarity with our business, products or markets or similar business products or markets, and willingness to devote adequate time and effort to board responsibilities. The committee may establish additional criteria and is responsible for assessing the appropriate balance of criteria required of directors. All nominees are evaluated by the committee using the same criteria notwithstanding whether the nominee was recommended by a stockholder or otherwise.

Compensation of Directors

Each of our non-employee directors receives an annual retainer for service on our Board of Directors, along with expenses incurred in connection with attending each meeting. Three members of our Board of Directors, Messrs. Africk, Leddy and Stone, also serve on the HNS Board of Managers but receive no compensation for doing so. Mr. Kaul serves on the Board of Directors of the Company and the Board of Managers of HNS and receives no compensation for doing so. On February 5, 2009, the Company granted 15,000 shares of restricted stock to each of our non-employee directors. The restricted stock awards vest pro-rata over three years. The following table sets forth a summary of the compensation we paid to our non-employee directors for the year ended December 31, 2008.

| | | | | | | | | | | | | | | | | |

Name | | Fees

Earned or

Paid in

Cash

($) | | Stock

Awards

($)(1) | | Option

Awards

($) | | Non-Equity

Incentive Plan

Compensation

($) | | Change in

Pension

Value and

Nonqualified

Deferred

Compensation

($) | | All Other

Compensation

($) | | Total

($) |

Andrew D. Africk(2) | | $ | 20,000 | | $ | 86,667 | | – | | – | | – | | – | | $ | 106,667 |

Stephen H. Clark(3) | | | 10,380 | | | 20,423 | | – | | – | | – | | – | | | 30,803 |

O. Gene Gabbard(4) | | | 20,000 | | | 112,500 | | – | | – | | – | | – | | | 132,500 |

Jeffrey A. Leddy(5) | | | 20,000 | | | – | | – | | – | | – | | – | | | 20,000 |

Lawrence J. Ruisi(6) | | | 20,000 | | | 112,500 | | – | | – | | – | | – | | | 132,500 |

Aaron J. Stone(7) | | | 20,000 | | | 86,667 | | – | | – | | – | | – | | | 106,667 |

Michael D. Weiner(8) | | | 20,000 | | | 86,667 | | – | | – | | – | | – | | | 106,667 |

| (1) | Amount included in our share-based compensation for 2008 expense for awards granted in 2006. |

| (2) | Mr. Africk became a member of our Board of Directors on February 21, 2006. His compensation is $5,000 per quarter. Mr. Africk received a restricted stock award on February 21, 2006 for 10,000 shares. This award vests over three years: 33.34% on February 21, 2007, 33.33% on February 21, 2008 and 33.33% on February 21, 2009. The grant date fair market value of the restricted stock was $26.00 per share, or $260,000 for the total award value. |

| (3) | Mr. Clark became a member of our Board of Directors on March 7, 2006 and ceased being a member on July 7, 2008. His compensation was $5,000 per quarter. Mr. Clark was had no reimbursements for board meeting expenses in 2008. Mr. Clark received a restricted stock award on March 7, 2006 for 10,000 shares. This award was scheduled to vest over three years: 33.34% on March 7, 2007, 33.33% on March 7, 2008 and 33.33% on March 7, 2009. The grant date fair market value of the restricted stock was $33.50 per share, or $335,000 for the total award value. Upon ceasing to be a director, Mr. Clark forfeited the 33.33% of the restricted stock that was scheduled to vest on March 7, 2009. The amount listed represents the amount expensed for 2008. |

| (4) | Mr. Gabbard became a member of our Board of Directors on June 16, 2006. His compensation is $5,000 per quarter. Mr. Gabbard was also reimbursed $2,580 in board meeting expenses in 2008. Mr. Gabbard received a restricted stock award on June 16, 2006 for 10,000 shares. This award vests over three years: 33.34% on June 16, 2007, 33.33% on June 16, 2008 and 33.33% on June 16, 2009. The grant date fair market value of the restricted stock was $33.75 per share, or $337,500 for the total award value. |

| (5) | Mr. Leddy became a member of our Board of Directors on February 21, 2006. His compensation is $5,000 per quarter. In 2008, Mr. Leddy was also reimbursed $1,044 in board meeting expenses. |

| (6) | Mr. Ruisi became a member of our Board of Directors on June 16, 2006. His compensation is $5,000 per quarter. Mr. Ruisi was also reimbursed $5,313 in board meeting expenses in 2008. Mr. Ruisi received a restricted stock award on June 16, 2006 for 10,000 shares. This award vests over three years: 33.34% on June 16, 2007, 33.33% on June 16, 2008 and 33.33% on June 16, 2009. The grant date fair market value of the restricted stock was $33.75 per share, or $337,500 for the total award value. |

11

| (7) | On February 21, 2006, Mr. Stone became a member of our Board of Directors. His compensation is $5,000 per quarter. Mr. Stone received a restricted stock award on February 21, 2006 for 10,000 shares. This award vests over three years: 33.34% on February 21, 2007, 33.33% on February 21, 2008 and 33.33% on February 21, 2009. The grant date fair market value of the restricted stock was $26.00 per share, or $260,000 for the total award value. |

| (8) | Mr. Weiner became a member of our Board of Directors on February 21, 2006. His compensation is $5,000 per quarter. Mr. Weiner was also reimbursed $6,307 in board meeting expenses in 2008. Mr. Weiner received a restricted stock award on February 21, 2006 for 10,000 shares. This award vests over three years: 33.34% on February 21, 2007, 33.33% on February 21, 2008 and 33.33% on February 21, 2009. The grant date fair market value of the restricted stock was $26.00 per share, or $260,000 for the total award value. |

12

INFORMATION CONCERNING OUR EXECUTIVE OFFICERS

Information concerning Pradman P. Kaul, Chief Executive Officer, President and director, is set forth above under “Proposal 1. Election of Directors—Nominees for Director.”

| | |

Name | | Principal Occupations |

Grant A. Barber Executive Vice President and Chief Financial Officer Age: 49 | | Mr. Barber has been our Executive Vice President and Chief Financial Officer since February 2006 and has served as the Executive Vice President and Chief Financial Officer of HNS since January 2006. From 2003 to 2006, Mr. Barber served first as Controller and then Executive Vice President and Chief Financial Officer for Acterna, Inc., a global manufacturer of test and measurement equipment for the Telco and Cable markets located in Germantown, Maryland. From 1984 through 2002, Mr. Barber served in various senior financial positions with Nortel Networks in the United States, Canada, France and England. Mr. Barber received his Bachelor degree in Business Administration from Wilfrid Laurier University and is a Canadian chartered accountant. |

| |

T. Paul Gaske Executive Vice President Age: 55 | | Mr. Gaske has been our Executive Vice President since February 2006 and has also served as HNS’ Executive Vice President, North American division since 1999. Mr. Gaske joined HNS in 1977. Mr. Gaske has held a variety of engineering, marketing, and business management positions throughout his career. Mr. Gaske holds a Bachelor of Science degree in Electrical Engineering from the University of Maryland and a Master of Science degree in Computer Science from Johns Hopkins University in Baltimore, Maryland. He is a member of the Institute of Electrical and Electronics Engineering (IEEE), a published author on satellite networking technologies and markets and the holder of numerous patents in satellite communications and broadband networking. |

| |

Bahram Pourmand Executive Vice President Age: 62 | | Mr. Pourmand has been our Executive Vice President since February 2006 and has also served as HNS’ Executive Vice President, International Division since 1993. Mr. Pourmand joined HNS in 1979 and is currently responsible for all aspects of HNS’ international operations, including oversight of profit and loss, marketing, product development and strategic direction for HNS’ global activities. Prior to joining HNS, Mr. Pourmand was a director with Rockwell International in Dallas, Texas. Mr. Pourmand has a Bachelor of Science degree in Electrical Engineering from Texas Tech University and a Master of Science degree in Electrical Engineering from Southern Methodist University. |

| |

Adrian Morris Executive Vice President Age: 54 | | Mr. Morris has been our Executive Vice President and HNS’ Executive Vice President, Engineering since February 2006. Prior to that, Mr. Morris had been Senior Vice President of Engineering since 1996. His career began with HNS in 1982 as a hardware design engineer and he has held a variety of technical and management positions throughout his career. Mr. Morris received a Bachelor of Science degree from Trinity College Dublin and a Master of Science degree in Digital Techniques from Heriot Watt University, Edinburgh. Prior to joining HNS, he worked for Ferranti Electronics and Electro Optics Division. Mr. Morris is a co-inventor for a number of patents in digital communications and has authored several published papers. He is also a member of the IEEE. |

13

| | |

Name | | Principal Occupations |

Dean A. Manson Senior Vice President,General Counsel andSecretary Age: 42 | | Mr. Manson has been our and HNS’ Senior Vice President, General Counsel and Secretary since August 2007, prior to which he was our Vice President, General Counsel and Secretary since February 2006 and HNS’ Vice President, General Counsel and Secretary since November 2004. Mr. Manson also serves as a director or officer for several of our subsidiaries. Before joining HNS in June 2000 as Assistant Vice President, Legal, Mr. Manson was associated with the law firm of Milbank, Tweed, Hadley & McCloy LLP. Mr. Manson earned a Bachelor of Science degree in Engineering from Princeton University and a Juris Doctorate degree from Columbia University School of Law. |

| |

Thomas J. McElroy Chief Accounting Officer Age:53 | | Mr. McElroy has been our Chief Accounting Officer since February 2006. In August 2007, he was appointed Senior Vice President and Controller of HNS and is responsible for all financial accounting and reporting matters for HNS and its global consolidated operations. From June 2006 to September 2007, he was HNS’ Vice President and Controller. Prior to joining HNS in January 1988 as a Director of Finance, Mr. McElroy was a Senior Manager in the audit group for Price Waterhouse & Co. in Washington, DC from 1977 to 1988. He received his Bachelor of Science degree in Accounting from St. Francis University. |

| |

Deepak V. Dutt Vice President, Treasurer and Investor Relations Officer Age: 64 | | Mr. Dutt has been our Vice President, Treasurer and Investor Relations Officer since March 2007. Mr. Dutt has served as Vice President and Treasurer of HNS since January 2001 and as Investor Relations Officer since February 2008. Mr. Dutt joined HNS in July 1993 and has held various positions in finance since then, including corporate planning, international finance, treasury and an international assignment as Chief Financial Officer of a subsidiary of the Company where he played a lead role in its start-up and in taking it public. Prior to joining our Company, Mr. Dutt served in various positions in the U.S. and overseas at IBM Corporation in sales, marketing and finance. He received a Bachelor of Science degree in Engineering from the University of Poona, India. |

| |

Cleo V. Belmonte Assistant Secretary Age: 31 | | Ms. Belmonte has been our Assistant Secretary since March 2007 and Senior Counsel, Securities of HNS since joining the Company in January 2007. Prior to joining HNS, from 2002 to 2006, Ms. Belmonte was an associate with the law firms of Pillsbury Winthrop Shaw Pittman LLP and Patton Boggs LLP where she practiced securities and general corporate law. Ms. Belmonte received Bachelor of Science degrees in Multinational Business Operations, Marketing and Business Management from Florida State University. Ms. Belmonte received a Juris Doctorate degree from the Georgetown University Law Center. |

14

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Overview of Compensation Program

The Compensation Committee of our Board of Directors, which we refer to as the Compensation Committee, is responsible for establishing, implementing and continually monitoring the Company’s executive compensation program, including the compensation of our Chief Executive Officer (Pradman Kaul), Chief Financial Officer (Grant Barber), and our three other most highly compensated executive officers (Paul Gaske, Bahram Pourmand and Adrian Morris). We refer to these executives as our named executive officers elsewhere in this Proxy Statement. Generally, the types of compensation and benefits provided to our named executive officers are similar to those provided to other officers of the Company. All of our named executive officers are officers and employees of the Company and also provide services to Hughes Network Systems, LLC (“HNS”), our wholly owned subsidiary. All Compensation earned by our named executive officers is paid by the Company, which in turn bills HNS for 98% of the base salaries and all other compensation of our named executive officers plus a 2% service fee. The remaining 2% of the base salaries and other compensation paid to our named executive officers is expensed by and for services to the Company.

Compensation Objectives and Philosophy

The primary objective of our executive compensation program is to closely align the compensation paid to executive officers, including our named executive officers, with the short-term and long-term performance of the Company and to allow the Company to attract, retain and motivate key executives with talent critical to drive long-term success and create stockholder value. The Compensation Committee seeks to achieve this objective by linking a substantial portion of the executive’s total compensation to the achievement of the Company’s financial and operational goals. Our executive compensation program is designed to provide for both guaranteed and incentive compensation based on the Company’s performance, to motivate our executives to achieve the business goals set by the Company and to reward the executives for achieving these goals. Guaranteed compensation consists primarily of base salary. Incentive compensation consists of annual performance bonuses and equity compensation.

Our Compensation Committee evaluates individual and Company performance with a goal of setting compensation at levels that the Compensation Committee believes are competitive with executives in companies of similar size and industry while also reviewing internal comparisons (including performance and levels of responsibility). The Compensation Committee believes that base salaries should be competitive to attract and retain qualified executive officers, that executive officers should be provided with stock ownership opportunities to align their interests with those of the Company’s stockholders and that incentive compensation should be based primarily on the accomplishment of the Company’s performance goals in the interest of building a cohesive management team. We believe that our current executive compensation program provides an overall level of target compensation and compensation opportunity that is appropriate as a relatively new public company. The Compensation Committee’s long term goal is for total compensation for our named executive officers to be at or slightly above the market of our peer group companies, however if a particular officer is far above or below the market, the committee’s goal is to bring that individual in line with the market over time.

Elements of Compensation

Our executive compensation program consists of the following key elements:

| | • | | annual performance bonuses |

| | • | | perquisites and other compensation |

15

Our executive officers also participate in the Company’s and HNS’ other benefit plans on the same terms as other employees. Our benefit plans include medical and dental coverage, long and short term disability coverage and basic life insurance equal to two times annual base salary. In addition, Pradman Kaul, our Chief Executive Officer, receives enhanced medical coverage for which he has no premium payment and no co-payments. This benefit was in place prior to the assumption of his employment agreement by the Company and the Company has agreed to continue to provide this benefit.

Base Salary—Base salaries for our named executive officers are established at the beginning of the term of each executive’s employment agreement based on the executive’s responsibilities and a comparison to competitive market levels for the executive’s job function. The base salaries of our named executive officers are reviewed on an annual basis by the Compensation Committee and at the time of a promotion or a significant change in responsibility. Factors considered for salary increases, although informally applied, are individual and corporate performance, individual level of responsibility, inflation, and contributions to the Company’s overall success. Based on these factors, the Compensation Committee granted salary increases for 2008 equal to 5% of each named executive officer’s 2007 base salary. The Compensation Committee has not yet determined if salary increases will be granted to our named executive officers for 2009.

Annual Performance Bonuses—Our Annual Incentive Plan (the “AIP”) is an annual performance bonus program adopted by the Compensation Committee under our 2006 Equity and Incentive Plan. The AIP is designed to provide cash awards to our executive officers for achieving the Company’s financial and operational goals. The Compensation Committee believes that as an executive’s level of seniority and responsibility within the Company increases, a greater percentage of the executive’s compensation should be tied to the Company’s performance. Our named executive officers and other officers of the Company and HNS participate in the AIP. Annual performance bonuses awarded under the AIP are reviewed and approved by the Compensation Committee and are paid in cash in a lump sum in the first quarter following the completion of each fiscal year. Annual performance bonuses for 2008 were awarded to all of our named executive officers. Pursuant to his employment agreement and the AIP, each executive officer is eligible to receive an annual performance bonus up to an amount equal to a specified percentage of the executive’s annual base salary, which we refer to as the executive’s bonus target. For 2008, based on seniority and level of responsibility, the Compensation Committee set the bonus targets for each of our named executive officers at 100% for Pradman Kaul, 70% for Paul Gaske, and 60% for each of Grant Barber, Adrian Morris and Bahram Pourmand.

The Compensation Committee annually determines a bonus pool for the year based on each executive’s target bonus amount and competitive market levels among the Company’s peer group (as discussed under “Targeted Compensation”) and makes awards under the AIP based on the level to which the Company’s performance targets that are set by the Compensation Committee are met. The Compensation Committee may increase the annual performance bonus paid to the executive up to an additional 50% of the executive’s target bonus amount if the Company’s performance targets are exceeded. The Company performance targets to be used are established at the beginning of each fiscal year. For 2008, the performance target components were HNS’ revenue of $1,075 million, adjusted EBITDA of $150 million, and cash balance of $75.7 million (which we refer to collectively as the Company Performance Targets) and a subjective factor (based on overall Company performance) to be determined by the Compensation Committee. If HNS achieves the annual budgeted amount for each of the Company Performance Targets, the Compensation Committee will award 100% of the bonus pool to the executives that participate in the AIP, with HNS’ revenue, adjusted EBITDA, and cash balance and the subjective factor weighted at 30%, 40%, 15%, and 15%, respectively. If any of the Company Performance Targets fall below 90% of the budgeted amount, no weight will be awarded for that target.

16

For 2008, the Compensation Committee awarded the following percentages of each named executive officer’s 2008 base salary under the AIP: 112% to Pradman Kaul, 78% to Paul Gaske, and 68% to each of Grant Barber, Bahram Pourmand and Adrian Morris. The actual 2008 AIP amounts awarded to each of our named executive officers are shown in the Summary Compensation Table. The following table sets forth the percentage of the bonus pool that the Compensation Committee could award based on the targets established by the Compensation Committee for 2008 AIP awards:

| | | | | | | | | | | | |

| | | Percentage of Budget Amount Achieved | |

| | | 90% | | | 95% | | | 100% | | | 110% | |

Revenue | | 12 | % | | 21 | % | | 30 | % | | 45 | % |

Adjusted EBITDA(1) | | 0 | % | | 30 | % | | 40 | % | | 60 | % |

Cash balance | | 9 | % | | 12 | % | | 15 | % | | 22.5 | % |

Subjective | | 0 | % | | 8 | % | | 15 | % | | 22.5 | % |

| | | | | | | | | | | | |

Total | | 21 | % | | 71 | % | | 100 | % | | 150 | % |

| | | | | | | | | | | | |

| | (1) | Adjusted EBITDA is defined as earnings (losses) before interest, income taxes, depreciation, amortization, equity incentive plan compensation and other adjustments permitted by the debt instruments of HNS. For the fiscal year ended December 31, 2008, Adjusted EBITDA excludes from GAAP net income of HNS the effects of interest, income taxes, depreciation, amortization, equity incentive compensation, and long-term cash retention compensation. HNS’ adjusted EBITDA is calculated from our audited financial statements by beginning with GAAP net income and (i) adding back interest expense; income tax expense; depreciation and amortization; equity plan compensation expense; and long-term cash retention compensation; then (ii) subtracting interest income. Interest expense and income tax expense appear as line items on the Consolidated Statement of Operations. Depreciation and amortization appear as line items on the Consolidated Statement of Cash Flows. The long-term cash retention compensation ($13.2 million for the year ended December, 31, 2008) and equity plan compensation expense ($5.2 million for the year ended December 31, 2008) appear on the Consolidated Statement of Operations as part of general and administrative expense. |

The following table sets forth the actual performance by HNS for each of the Company Performance Targets established by the Compensation Committee for 2008 AIP awards and the corresponding AIP payout associated with each target (dollars in millions):

| | | | | | | | | |

| | | Actual

Performance | | Performance % | | | Payout | |

Revenue | | $ | 1,059.90 | | 99 | % | | 27 | % |

Adjusted EBITDA | | $ | 155.40 | | 104 | % | | 47 | % |

Cash balance | | $ | 100.30 | | 132 | % | | 23 | % |

Subjective | | | – | | – | | | 15 | % |

| | | | | | | | | |

Total | | | | | | | | 112 | % |

| | | | | | | | | |

Equity Compensation—Our equity compensation is entirely incentive based compensation and is designed to serve as a retention tool and to provide a long-term incentive to employees directly related to the success of the Company. Our named executive officers are eligible to participate in our 2006 Equity and Incentive Plan which provides for equity awards including restricted stock, stock options, stock appreciation rights and other equity based awards. Each named executive officer is reviewed annually by the Compensation Committee to determine if an equity award is appropriate and the level of any such award, however, the Compensation Committee does not anticipate making awards of equity compensation each year.

On April 24, 2008 each of our named executive officers were awarded options to purchase our common stock under the 2006 Equity and Incentive Plan. Mr. Kaul was awarded 100,000 options and each of Messrs. Barber, Gaske, Pourmand and Morris were awarded 25,000 options. These options are subject to time vesting restrictions and vest 50% on April 24, 2010, 25% on April 24, 2011, and 25% on April 24, 2012. The options have an exercise price of $54.00, the closing price of our common stock on April 24, 2008, the grant date of the options.

17

In addition to equity compensation that may be granted under the 2006 Equity and Incentive Plan, pursuant to their employment agreements, each of our named executive officers was granted awards of HNS Class B membership interests. Each of Messrs. Kaul, Gaske, Pourmand and Morris were granted Class B membership interests upon the original execution of their employment agreements with HNS in 2005 and Mr. Barber was granted Class B membership interests upon the execution of his employment agreement with the Company in 2006. See “Grants of Plan Based Awards—HNS Class B Membership Interests”.

Perquisites and Other Compensation—We provide our named executive officers with perquisites and other personal benefits that the Company and the Compensation Committee believe are reasonable and consistent with the Company’s overall executive compensation program to better enable the Company to attract and retain superior employees for key positions. The Compensation Committee annually reviews the levels of perquisites and other personal benefits provided to our named executive officers. Our named executive officers are provided with the following perquisites, which include, without limitation:

| | • | | Car allowance in the amount of $15,702 per year for Mr. Kaul and $13,438 per year for each of Messrs. Barber, Gaske, Pourmand, and Morris. |

| | • | | Financial planning services are provided to Mr. Kaul and Mr. Gaske. These services were in place prior to the assumption of their employment agreements by the Company and the Company has agreed to continue to provide these services. |

| | • | | Enhanced medical coverage is provided to Mr. Kaul, for which he has no premium payment and no co-payments. This benefit was in place prior to the assumption of Mr. Kaul’s employment agreement by the Company and the Company has agreed to continue to provide this benefit. |

Common Stock Ownership Guidelines

We believe that broad-based share ownership by our employees, including our named executive officers, is the most effective method to deliver superior stockholder returns by increasing the alignment between the interests of our employees and our stockholders. We do not, however, have a formal requirement for share ownership by any group of employees.

18

Targeted Compensation

Target total compensation for each named executive officer is established by the Compensation Committee primarily based on peer group data. Members of management do not play a role in establishing the target compensation for our named executive officers; however, management recommends to the Compensation Committee the Company Performance Targets that are used to determine the annual performance bonus payments under the AIP. The Compensation Committee, may, in its discretion, use or modify the Company Performance Targets recommended by management. Beginning in 2007, the Company utilized Equilar, a market leader for benchmarking executive and director compensation, to create reports showing the percentile position of each named executive officer compared to the selected peer group for base salary, total cash compensation and total direct compensation. Equilar is an on-line tool used by consultants and companies to obtain competitive information from proxy data. The peer group used for the Equilar benchmarking tool includes: American Tower Corp., CenturyTel, Earthlink, Frontier Communications, Gemstar, Global Crossing, Loral Space & Communications, Mediacom Communications, Primus Telecommunications, RCN Corp., SAVVIS, TW Telecom, ViaSat, and XO Holdings. The peer group used consists of companies against which management and the Compensation Committee believe the Company competes for executive talent and stockholder investment. In making compensation decisions, the Compensation Committee reviews the reports generated by Equilar and compares each element of total compensation against the peer group companies with the goal of setting compensation for our named executive officers at levels similar to that of the peer group companies. The Equilar report for 2008 showed the following results when we were compared to the peer group companies:

| | | | | | | | | | |

Position | | Executive | | Officer

Comparison | | HCI Compared to Competitive

Market – Proxy Data |

| | | | Base

Salary

Percentile | | Total Cash

Compensation

Percentile | | Total Direct

Compensation

Percentile(1) |

Chief Executive Officer and President | | Pradman Kaul | | CEO | | 23rd | | 32nd | | 33rd |

Executive Vice President | | T. Paul Gaske | | 2nd highest paid | | 18th | | 41st | | 39th |

Executive Vice President | | Bahram Pourmand | | 3rd highest paid | | 67th | | 71st | | 48th |

Executive Vice President | | Adrian Morris | | 4th highest paid | | 71st | | 69th | | 57th |

Chief Financial Officer | | Grant Barber | | CFO | | 47th | | 53rd | | 36th |

| (1) | Includes intrinsic annualized value of each named executive officer’s interest in the Company through their HNS Class B membership interests. Also includes all compensation received by the executive, including awards under the 2006 Equity and Incentive Plan, averaged over the vesting period. |

The Compensation Committee believes that as an executive’s level of seniority and responsibility within the Company increases, a greater percentage of the executive’s compensation should be tied to the Company’s performance. Accordingly, the Compensation Committee set total compensation targets for 2008 as the following:

| | | | | | |

| | | Base Salary as a %

of Total

Compensation | | Bonus Target as a %

of Total

Compensation | | Equity Target as a %

of Total

Compensation(1) |

Chief Executive Officer and President | | 23% | | 23% | | 54% |

Chief Financial Officer – Executive Vice President | | 36% | | 22% | | 42% |

Executive Vice Presidents | | 32% | | 21% | | 47% |

| (1) | Includes intrinsic annualized value of each named executive officer’s interest in HNS through their HNS Class B membership interests. Also includes all compensation received by the executive, including awards under the 2006 Equity and Incentive Plan, averaged over the vesting period. |

19

Termination and Change of Control Benefits

The Compensation Committee has determined the appropriate levels of payments to be made to our named executive officers upon the termination of their employment, including a termination of employment in connection with a change in control of the Company, to provide the executive officer with adequate income during the period that the executive may not compete with the Company, pursuant to the provisions of his employment agreement, and while seeking other employment. The Company does not make any payments to our named executive officers, or accelerate the vesting of any equity compensation awards granted to such officers solely on the basis of a change in control of the Company. Payments are triggered only if the executive is terminated within one year following a change in control of the Company. See “—Potential Payments upon Termination and Change in Control.”

Section 162(m)

Under Section 162(m) of the Internal Revenue Code of 1986 (the “Code”), as interpreted by IRS Notice 2007-49, a public company generally may not deduct compensation in excess of $1.0 million paid to its chief executive officer and the three most highly compensated executive officers (other than the chief executive officer and the chief financial officer). Qualifying performance-based compensation will not be subject to the deduction limitation if certain requirements are met.

Our Compensation Committee generally structures our and HNS’ compensation programs, where feasible, to minimize or eliminate the impact of the limitations of Section 162(m) of the Code. However, the Compensation Committee reserves the right to use its judgment to authorize compensation payments that do not comply with the exemptions in Section 162(m) of the Code when it believes that such payments are appropriate and in the best interests of the stockholders, after taking into consideration changing business conditions or the officer’s performance. With respect to awards intended to qualify as performance-based compensation under Section 162(m) of the Code, no payment may be made under our compensation program prior to certification by the Compensation Committee that the applicable performance goals have been attained. The Company believes that the compensation paid under our compensation program in 2008 is fully deductible for federal income tax purposes.

20

Summary Compensation Table