As filed with the Securities and Exchange Commission on Februray 6, 2006

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SB-2

REGISTRATION STATEMENT

UNDER THE

SECURITIES ACT OF 1933

PHYSICIANS REMOTE SOLUTIONS, INC.

(Name of Small Business Issuer in its charter)

| | |

Florida |

7372 |

22-3914075 |

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

5 Ridge Road

Cos Cob, CT 06807

203-622-1848

(Address and Telephone Number of Principal Executive Offices and Principal Place of Business)

Gary Cella

5 Ridge Road

Cos Cob, CT 06807

203-622-1848

(Name, Address and Telephone Number of Agent for Service)

Copies to:

Jonathan B. Reisman, Esq.

Reisman & Associates, P.A.

6975 NW 62nd Terrace

Parkland, Florida 33067

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box.

CALCULATION OF REGISTRATION FEE

| | | | |

Title of each class of securities to be registered |

Amount to be registered |

Proposed maximum offering price per Share |

Proposed maximum aggregate offering price |

Amount of registration fee |

Common Stock, $0.00001 par value |

1.000,000 shares (1) |

$.25 |

$250,000 |

$26.75 |

Common Stock, $0.00001 par value |

2,858,000 shares (2) | $.65 |

$1,857,700 |

$198.78 |

(1)

To be offered by the Small Business Issuer.

(2)

To be offered by selling stockholders.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Prospectus

Physicians Remote Solutions, Inc.

3,858,000 shares of Common Stock

| | |

|

|

| | Per Share | Total |

Initial Offering Price to Public |

$.25 |

$250,000 |

Commissions |

-0- |

-0- |

Proceeds to Physicians Remote Solutions, Inc. |

$.25 |

$250,000 |

There has never been a public market for our common stock and we have arbitrarily determined the offering price.

We are offering the shares on a best efforts basis through our president who will not be compensated for offering the shares.

In addition to the 1,000,000 shares that we are offering through this prospectus, 2,858,000 shares of our common stock may be offered and sold from time to time by selling stockholders. We will not receive any proceeds from the shares sold by the selling stockholders.

The selling stockholders may sell their shares at an initial public offering price of $.65 per share. Subsequent to the time, if any, that our shares are listed on the over-the counter Bulletin Board, the selling stockholders may sell their shares in one or more transactions on the over-the-counter market, in negotiated transactions, or through a combination of those methods of distribution, at prices related to prevailing market prices or at negotiated prices.

Each of the selling stockholders may be deemed to be an “underwriter” as that term is defined in the Securities Act of 1933.

An investment in the shares involves substantial risks and is highly speculative. See “Risk Factors” beginning on page 6 of this prospectus.

This prospectus is not an offer to sell any securities and neither we nor the selling stockholders are soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2006

In making a decision whether to buy our common stock, you should only rely on the information contained in this prospectus. We have not authorized anyone to provide you with any different or other information. The information in this prospectus may only be accurate on the date of this prospectus.

TABLE OF CONTENTS

PROSPECTUS SUMMARY | 4 |

Our proposed business | 4 |

Corporate information | 5 |

Our offering | 5 |

Summary Financial Information | 5 |

RISK FACTORS | 6 |

FOWARD LOOKING STATEMENTS | 10 |

DILUTION | 11 | USE OF PROCEEDS | 11 |

DIVIDEN POLICY | 12 |

MANAGEMENT'S PLAN OF OPERATION | 12 |

PROPOSED BUSINESS | 12 |

SECURITY OWNERSHIP OF CERTAIN BENEFICAIL OWNERS AND MANAGEMENT | 24 |

CERTAIN TRANSACTIONS | 25 |

DESCRIPTION OF COMMON STOCK | 25 |

SHARE ELIGIBLE FOR FUTURE SALES | 26 |

SELLING SHAREHOLDERS | 26 |

PLANS FOR DISTRIBUTION | 27 |

LEGAL PROCEEDINGS | 28 |

IMDEMNIFICATION | 28 |

LEGAL MATTERS | 29 |

EXPERTS | 29 |

ADDITIONAL INFORMATION | 29 |

FINANCIAL STATEMENTS | F-1 |

No person has been authorized to give any information or to make any representations in connection with this offering other than those contained in this prospectus and, if given or made, such other information and representations must not be relied upon as having been authorized by us. Neither the delivery of this prospectus nor any sale made will, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus or that the information contained in this prospectus is correct as of any time subsequent to its date. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the registered securities to which it relates. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy such securities in any circumstances in which such offer or solicitation is unlawful.

PROSPECTUS SUMMARY

You should read the entire prospectus carefully before making an investment decision. Unless the context otherwise indicates, in this prospectus, references to “we,” “us” and “our” refer to Physicians Remote Solutions, Inc. and our wholly owned subsidiary, Voxtec Products, Inc.

Our proposed business

Subject to the conditions described elsewhere in this prospectus, we have obtained the exclusive

4

rights to manufacture and sell a telephone based voice activated billing and records entry system designed for use by physicians. The system is called “DR SPEAK.” The DR SPEAK system is intended to permit physicians to simplify and expedite their billing procedures by processing detailed billing information and related claims by telephone from any location.

The DR SPEAK system was conceived by Christina Del Pin M.D., a board-certified general surgeon as well as an author and lecturer on practice management issues. Dr. Del Pin is the spouse of our president. We believe that if the DR SPEAK system functions as designed, it will simplify the entry of patient information and the processing of billing claims by physicians and provide the flexibility for physicians to enter patient data and submission of claims by telephone from any location in approximately five minutes.

Because final testing of the DR SPEAK system has not been completed and certain problems arose during the initial testing and no sales of the system have yet been made, we can not assure you that the system will function as designed or that it will achieve any degree of commercial acceptance. If the results obtained after the completion of testing the DR SPEAK system are favorable, we intend to have the system manufactured and market the system to physicians. Our ability to do so, however, may be limited by the amount of capital available to us for those purposes.

Corporate information

We are a Florida corporation formed on April 5, 2005. Our executive offices are located at 5 Ridge Road, Cos Cob, Connecticut 06807 and our telephone number is 203-622-1848.

Our offering

Common stock offered by us

1,000,000 shares. The minimum purchase is 4,000 shares.

Initial public offering price of shares

being offered by us

$.25 per share.

Common stock to be

outstanding after the

offering

11,775,000 shares if 1,000,000 shares are sold by us.

Use of proceeds

We intend to use the net proceeds primarily for marketing, working capital and general corporate purposes.

Common Stock to be offered

2,858,000 shares.

by the selling stockholders

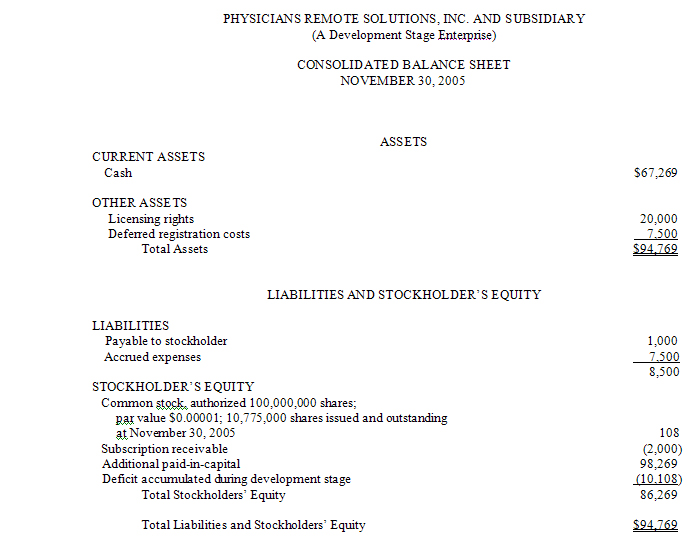

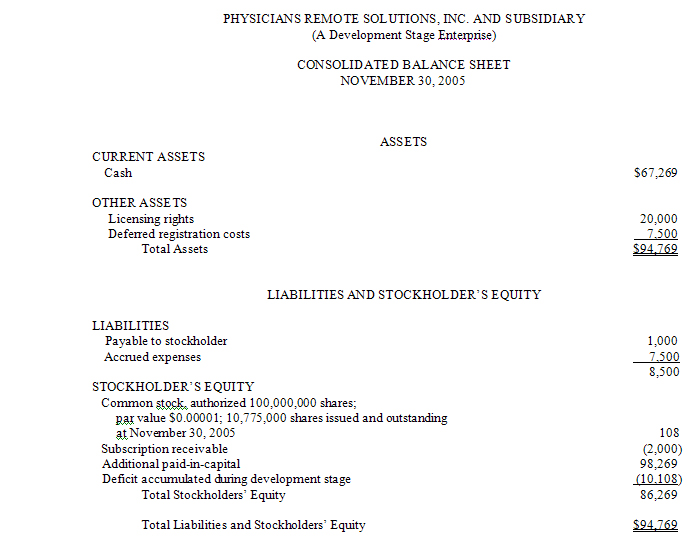

SUMMARY CONSOLIDATED FINANCIAL INFORMATION

The summary financial information set forth below is derived from and should be read in conjunction with Management’s Plan of Operation and our consolidated financial statements, including the notes thereto, appearing elsewhere in this Prospectus.

5

November 30, 2005 (Audited)

Balance Sheet

Total Assets

$94,769

Total Liabilities

8,500

Total Stockholders’ Equity

86,269

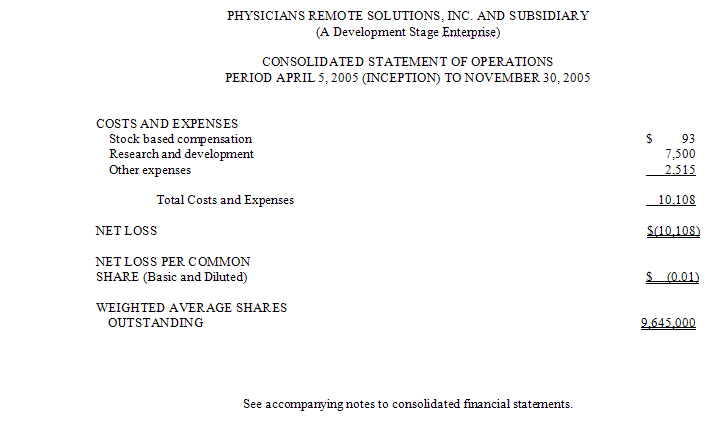

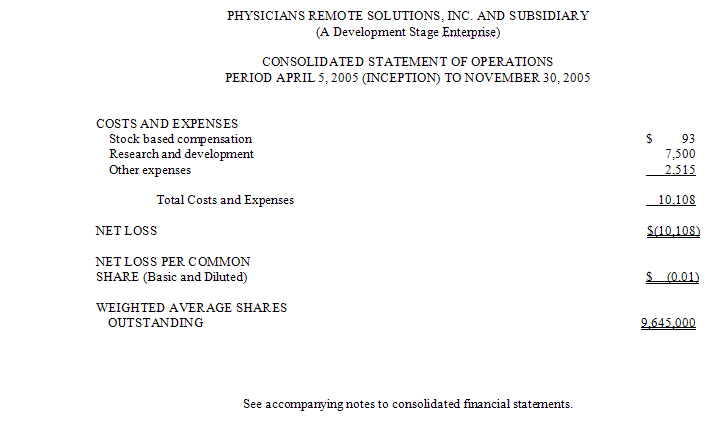

Period April 5, 2005 (Inception)

To November 30, 2005 (Audited)

Statement of Operations

Total Cost and Expenses

$ 10,108

Net Loss

(10,108)

RISK FACTORS

An investment in our common stock involves substantial risks. You should consider carefully the following information about these risks, together with the financial and other information contained in this prospectus, before you decide whether to buy our common stock. If any of these risks actually occur, our business, financial condition and results of operations would likely suffer. In such case, you might lose all or part of your investment.

Because we have no operating history and none of our officers has had any prior experience in the management of a company similar to our’s, there is no basis on which you can evaluate our proposed business and prospects. We were incorporated in April 2005 and have never had any operations.

Although our financial statements have been prepared assuming that we will continue as a going concern, we are not now a going concern and if we fail to become a going concern, you can expect to lose your investment in our common stock. The report of our independent auditor refers to the uncertainty of our becoming a going concern.

Because of the limited capital available to us, we may not have sufficient capital to operate our business or remain in existence for more than six months, in either of which cases you can expect to lose your investment. We do not have the capital required to engage in our proposed business. Furthermore, we will incur legal and accounting expenses to comply with our reporting obligations to the SEC and we will be obligated to pay our operating expenses as they arise. If we fail to pay the required annual fees to the state of Florida, we will be dissolved and cease to exist.

We believe that in order for us to complete testing of the DR SPEAK system and begin to market the system on a national level, we will require additional capital of approximately $100,000. There can be no assurance that our estimate is not too low. Furthermore, we cannot assure you that we will obtain adequate funding, if any, or that the terms of any such funding will not be unfavorable to us. It is difficult and very often impossible for development stage companies to obtain adequate financing on any terms.

6

If we raise additional funds through the issuance of our equity securities, the percentage ownership of our stockholders will be reduced, we may undergo a change in control and stockholders may experience dilution which could substantially diminish the value of their common stock. One of the factors which generally affects the market price of publicly traded equity securities is the number of shares outstanding in relationship to assets, net worth, earnings or anticipated earnings and other financial items. In the event that a public market in our shares develops and is sustained, a material amount of dilution can be expected to cause the market price of our shares to decline. Furthermore, the public perception of future dilution can have the same effect even if the actual dilution does not occur.

We expect to compete with many larger, established and well financed companies, substantially all of which have greater financial resources, technical expertise and managerial capabilities than we do. Our success is dependant in significant part upon our ability to effectively compete with those companies. We expect the competition to be intense in areas of price and quality.

The intense competition we expect to encounter may result in our right to manufacture and market the DR SPEAK system to become worthless. Intensity of competition is a function of the number and relative market strengths of competitors. There are numerous competitors in the fields we intend to enter with developed product lines and established consumer followings. Any level of actual or perceived negative comparative advantage between the DR SPEAK system and competitors’ products by our potential customers can make the DR SPEAK system unsaleable and therefore worthless in the marketplace.

Because our executive officers will devote only a portion of their time to us, they may not have sufficient time to effectively mange our affairs. We may determine that full time management is necessary although we may not have sufficient funds to employ executive officers on a full time basis.

If we are unable to effectively manage our anticipated growth, our business, financial condition and results of operations will suffer and our business could fail. If we are successful in marketing the DR SPEAK system, our growth will place a significant strain on our financial and managerial resources. As part of our anticipated growth, we may have to implement new operational and financial systems and procedures and controls to expand, train and manage employees. If the systems, procedures and controls do not function as planned, our ability to remain in business may be significantly impaired. The impairment could result in the failure of our business.

Because the DR SPEAK system has been subject to only limited testing, we do not know if it will function as designed. During the initial testing, problems arose in connection with voice recognition and recording and transmission of data. Although we believe that the problems have been corrected, there can be no assurance that other problems will not arise. If, after completion of testing, the DR SPEAK system does not function substantially as designed, you can expect to lose your investment in our shares.

7

Because no patent has been issued with respect to the DR SPEAK system, the related intellectual property may not be protected. Although Dr. Del Pin has filed an application for a patent with the United States Patent and Trademark Office, there can be no assurance that a patent will be issued, or if issued, that it will include any meaningful claims. Furthermore the validity of issued patents are frequently challenged by others. In the absence of patent protection, third parties may independently develop similar technology which could undercut our market position, if any, particularly if the third party has greater experience and resources than we do. In addition, any measures that we may take to protect the technology may prove inadequate, which could result in the eventual use of Dr. Del Pin’s proprietary technology by competitors.

Because of our limited resources, we may be unable to protect a patent or to challenge others who may infringe upon a patent. Because many holders of patents have substantially greater resources than we do and patent litigation is very expensive, we may not have the resources necessary to challenge successfully the validity of patents held by others or withstand claims of infringement or challenges to any patent Dr. Del Pin may obtain. Even if we prevail, the cost and management distraction of litigation could have a material adverse effect on us.

Our business decisions will likely be made without the benefit of detailed feasibility studies, independent analysis or market surveys and, therefore, may not be beneficial to us.Detailed feasibility studies, independent analysis or market surveys are widely used to provide a comprehensive view of market conditions and promotional activities. In their absence, we may not be aware of many very important facts and circumstances concerning our proposed business. Our belief that the DR SPEAK system can achieve market acceptance is based solely on the subjective judgment of Dr. Del Pin.

Unless we generate sufficient revenues to achieve profitability, you can expect to lose your investment in our common stock. Even if we do achieve profitability, we cannot assure you that we can sustain or increase profitability in the future. We cannot assure you that even if the DR SPEAK system functions as designed, that it will produce any meaningful revenues or profits.

If we do not make the required minimum sales of the DR SPEAK system, we will lose our right of exclusivity which could significantly diminish the value of the rights we have acquired form Dr. Del Pin. We believe that the right of exclusivity is material to us. In order to maintain the right, we mustmake the required minimum sales of the DR SPEAK system as described elsewhere in this prospectus. We cannot now determine if we will be able to make the minimum amount of sales, if any. If we fail to do so, we will lose the exclusive rights and Dr. Del Pin will be able to sell the DR SPEAK system directly or through other companies which may have substantially greater financial and managerial resources than we do. If the DR SPEAK system is successfully marketed by others, the value of the rights we have acquired from Dr. Del Pin will be significantly diminished.

If the use of the DR SPEAK system subjects physicians and others to violations of the Federal Health Insurance Portability and Accountability Act of 1996 (HIPAA), including regulations governing the confidentiality and integrity of protected health information (PHI), we could incur severe legal and financial liabilities and lose any positive business reputation we may

8

otherwise have had.Federal regulations under HIPAA governing the confidentiality and integrity of PHI are complex and are evolving rapidly. As the regulations mature and become better defined, we anticipate that they may directly affect the use of the DR SPEAK system, although we cannot fully predict the impact. We may be required to modify the DR SPEAK system to facilitate our customer’s compliance with these regulations, but there can be no assurance that we will be able to do so in a timely, complete or cost effective manner. Achieving compliance with the regulations could be costly and distract management’s attention from our operations. In addition, development of related federal and state regulations and policies regarding the confidentiality of health information or other matters could adversely negatively affect our proposed business.

Because we do not presently intend to acquire and maintain commercial product liability insurance,we may be exposed to claims and litigation. We may not be financially able to defend any such claims or litigation or we may be subject to judgments which may be for amounts greater than our ability to pay.

If security and legal liability concerns make potential customers unwilling to utilize the DR SPEAK system to transmit medical information electronically, we may not be able to sell any DR SPEAK Systems.Potential customers may choose not to utilize the DR SPEAK system because of concerns related to the electronic transfer and management of PHI, including: security of PHI being transferred; errors in the transmission of PHI; legal liability for data security failures or transmission errors and regulatory burdens imposed on healthcare participants who transfer PHI electronically.

Because of the concentration of ownership of our common stock by a small number of stockholders, it is unlikely that any other holder of common stock will be able to affect our management or direction. On January 28, 2006, two of our stockholders were deemed to beneficially own approximately 71% of our outstanding common stock. Accordingly, if these stockholders act together as a group, they would be able to control the outcome of stockholder votes, including votes concerning the election of directors, the adoption or amendment of provisions in our articles of incorporation and bylaws and the approval of significant corporate transactions. The existence of ownership concentrated in a few persons may have the effect of delaying or preventing a change in management or voting control. Furthermore, the interests of our controlling stockholders could conflict with those of our other stockholders.

If a viable public market for our shares does not develop, you will not be able to easily sell your shares, if at all. There has not been and may never be a public market for our shares and we cannot assure you that a public market will ever develop. We cannot predict the extent, if any, to which investor interest in our company will lead to the development of a viable trading market in our shares.

The large number of shares eligible for public sale after this offering can be expected to adversely affect the prices that will prevail in the trading market, if one develops. Sales of significant amounts of our shares in the public market or the perception that such sales will occur,

9

can materially adversely affect the market price of the shares, if any, or our ability to raise capital through future offerings of equity securities.

Because our common stock is considered to be a “penny stock,” our stockholders’ ability to sell their shares in a public market may be significantly impaired by the SEC’s penny stock rules. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules generally require that prior to a transaction in a penny stock the broker-dealer make a special written determination that the penny stock is a suit able investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that is or becomes subject to the penny stock rules. In addition the burdens imposed upon broker-dealers by the penny stock rules may discourage broker-dealers from effecting transactions in our common stock, which could severely limit its liquidity.

FORWARD-LOOKING STATEMENTS

Many statements made or incorporated by reference in this prospectus are “forward-looking statements.” These forward-looking statements include statements about:

·

our ability to engage in operations

·

our ability to have the DR SPEAK system manufactured in commercial quantities

·

the efficacy of the DR SPEAK system

·

our capital needs

·

the competitiveness of the business in our industry

·

our strategies

·

other statements that are not historical facts

When used in this prospectus, the words “anticipate,” “believe,” “expect,” “estimate,” “intend” and similar expressions are generally intended to identify forward-looking statements. Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause our actual results to differ materially from those expressed or implied by these forward-looking statements, including:

·

changes in general economic and business conditions

·

changes in HIPAA regulations and requirements

·

actions of our competitors

·

the time and expense involved in development activities

·

changes in our business strategies

·

other factors discussed in the “Risk Factors” section and elsewhere in this prospectus

10

The forward-looking statements in this prospectus reflect what we currently anticipate will happen. What actually happens could differ materially from what we currently anticipate will happen. We are not promising to make any public announcement when we think forward-looking statements in this prospectus are no longer accurate whether as a result of new information, what actually happens in the future or for any other reason.

DILUTION

The following table sets forth certain information relating to the immediate and substantial dilution in our net tangible book value to be absorbed by purchasers of the shares being offered by us.

| | |

|

AMOUNT IF 250,000 SHARES ARE SOLD |

AMOUNT IF 1,000,000 SHARES ARE SOLD |

Net tangible book value per share on November 30, 2005 | $58,769 | $58,769 |

Net tangible book value per share on November 30, 2005 if shares offered by this prospectus were sold on that date | $113,769 | 301,269 |

Amount of increase in net tangible book value per share attributable to cash payments made by purchasers of the shares being offered | $55,000 | $242,500 |

Amount of the immediate dilution from the aggregate public offering price which will be absorbed by purchasers | $227,579 | $222,042 |

Cash contribution of purchasers | $62,500 | $250,000 |

| | | |

Price per share paid by officers, directors, founders and affiliates | $.002 | $.002 |

Price per share to be paid by purchasers of shares to be sold by us in this offering | $.25 | $.25 |

The immediate and substantial dilution could adversely affect the value of the shares.

USE OF PROCEEDS

The proceeds we will receive from the sale of 1,000,000 shares to be offered by us will be $250,000 or $62,500 if 250,000 shares are sold. We intend to use the net proceeds in the order of priority shown in the following table:

11

| | |

|

AMOUNT IF 250,000 SHARES ARE SOLD |

AMOUNT IF 1,000,000 SHARES ARE SOLD |

Gross proceeds |

$62,500 | $250,000 |

Estimated offering expenses | $15,000 | $ 15,000 |

Testing and marketing of DR SPEAK system | $40,000 | $205,000 |

Working capital and other corporate purposes | $ 7,500 | $ 30,000 |

DIVIDEND POLICY

We have never declared or paid any cash dividends on our capital stock and do not anticipate paying any cash dividends on our capital stock in the foreseeable future. Future dividends, if any, will be determined by our Board of Directors. In addition, we may incur indebtedness in the future which may prohibit or effectively restrict the payment of dividends, although we have no current plans to do so.

MANAGEMENT’S PLAN OF OPERATION

The following should be read in conjunction with our financial statements and the related notes that appear elsewhere in this prospectus. The discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to these differences include, but are not limited to, those discussed below and elsewhere in this prospectus, particularly under the caption “Risk Factors.”

We believe that our present capital will satisfy our cash requirements for approximately six months. During that period we intend to continue to test the DR SPEAK system and begin marketing efforts. Our initial marketing will be represented primarily by print advertisements, direct mailings and participation at trade shows. The extent that we are able to engage in marketing efforts is dependant upon the amount of capital; available to us.

We intend to install three to six beta testing units on the computer systems of practicing physicians who volunteer for such purpose. We anticipate that our evaluation of the results will lead to changes in the functionality and operation of the DR SPEAK system.

If we do not generate sufficient sales to meet our expenses and planned marketing efforts, we will attempt to obtain additional capital.

We will purchase one or two lap-top computers which has been budgeted under marketing allocations.

If the DR SPEAK systems functions as we anticipate and sales commence, we expect to hire two full time employees.

We have no off-balance sheet arrangements.

PROPOSED BUSINESS

Background

Subject to the conditions described below, we have obtained the exclusive rights to manufacture

12

and sell a telephone based voice activated billing and records entry system designed for use by physicians. The system is called “DR SPEAK.” The DR SPEAK system was conceived by Christina Del Pin M.D., a board-certified general surgeon as well as an author and lecturer on practice management issues. We believe that if the DR SPEAK system functions as designed, it will simplify the entry of patient information and the processing of billing claims by physicians and provide the flexibility for physicians to enter patient data and submission of claims by telephone in approximately five minutes.

Because many physicians are often away from their office environment, devoting sufficient time to record billing information is often difficult. The DR SPEAK system has been designed to permit a physician to call via telephone into a computer system with a modem and answer some basic questions in natural English. The computer software is designed to store a record of a patient encounter (voice and text), and also generate a bill or claim. When paired with Pro 32 software, Medicare’s preferred electronic billing software, the medical claims can then be submitted to many major insurance carriers electronically.

A test version of the DR SPEAK system was displayed at the 2003 American College of Surgeons Clinical College in Chicago. At that time, the proposed selling price was $5,000. Although Dr. Del Pin has advised us that the concept and operation of the DR SPEAK system appeared to have been generally well received by the attendees, most sales prospects considered the price to be prohibitive and no systems were sold. In order to significantly reduce the cost of the DR SPEAK system, the operating system has been changed, no hardware will be sold with the system and an interactive voice recognition (IVR) system is now used that is included in the Windows XP operating system. Although we have not yet determined the price at which we will offer the DR SPEAK system to prospective customers, we anticipate that it will not exceed $2,000.

Acquisition of Exclusive Rights

We have purchased the exclusive rights to manufacture the DR SPEAK system and sell the DR SPEAK system in the United States from Dr. Del Pin. We also obtained the use of any and all trade names, trademarks and copyrights held by Dr. Del Pin or subsequently acquired by her relating to the DR SPEAK system. The purchase price consisted of 200,000 shares of our common stock and our agreement to pay Dr. Del Pin a royalty of $200 for each sale of a DR SPEAK System made by or on behalf of us. Royalty payments will become due and payable thirty days subsequent to the end of the calendar quarter in which the proceeds of the respective sales are collected by us or on our behalf.

In connection with our acquisition of the exclusive rights, Dr Del Pin has agreed to provide consulting services to us to the extent we request until June 30, 2007. The services to be provided are limited to ten hours per month. We have agreed to reimburse Dr. Del Pin for any expenses incurred by her in rendering the services to us if the expenses are first approved by us.

Our agreement, as amended, with Dr. Del Pin provides that unless we sell a minimum of 250 DR SPEAK systems on or before June 30, 2007 with the minimum of 250 Systems to increase by 20%

13

above the previous twelve month’s minimum for each twelve month period beginning July 1st of each year thereafter, Dr. Del Pin shall have the right to terminate our exclusive rights. If our exclusive rights are terminated because we fail to meet the minimum sales quotas, we may continue to sell the DR SPEAK systems on a non-exclusive basis.

Subsequent to our purchase, we paid $15,000 for the addition of a Simplified Billing Module or SBM to the DR SPEAK system. See “Proposed Business - Agreements with GetAGeek, Inc.”below.

Because Dr. Del Pin is the spouse of our president, our agreement with her cannot be considered as being negotiated at arms length.

Reasons for the Development of the DR SPEAK System

General

Dr. Del Pin has advised us that the administration of medical billing is one of the major costs of managing a medical practice. She has found that in her own practice the cost to process each claim averages between $7 to $10.

The cash flow of a medical practice can seriously be affected by reimbursement delays resulting from slow claim processing and claim rejections. Costs of maintaining a medical practice have increased significantly in recent years.

Medical practices that process claims either by paper or electronically generally have several expensive options available:

·

They can employ multiple staff members to process claim forms.

·

They can hire a freelance medical biller, often at a charge of a minimum of 2% of billings.

·

They can hire an outside medical billing service, often at a charge 5% or more of billings.

·

They can pay for medical record transcription often at a cost that often exceeds $1 per page.

HIPAA/Medicare compliance

The Health Insurance Portability and Accountability Act of 1996 (HIPAA) is the code designated as the national standard for reporting medical and dental services. All health and dental claims submitted through Medicaid, Medicare and private insurance plans must be HIPAA complaint.

According to Medicare, approximately 92% of physicians currently participate in Medicare. Since October 2003, Medicare has required medical practices with ten or more full-time employees to file claims electronically. We believe that a significant number of relatively

14

small medical practices with a high rate of out-patient servicing do not utilize electronic processing of claims. Those practices who are Medicare providers will be the initial target market for sales of the DR SPEAK SYSTEM

Human Error

According to Medicare, in 2004, Medicare issued remittance advices in connection with more than 26 million electronically filed claims and 43 million manually filed claims due to incorrect or missing information, which resulted in billions of dollars of additional late paid claims to doctors and hospitals. Human error is an inherent problem with the current medical billing procedures especially when a staff member rather than the physician enters the claim information. The claim information may be based on handwritten notes or transcriptions and are prone to typographical errors. The chance of an error increases with the number of staff members and the processing time involved in handling the claim.

Out-Patient Billing

According to a study dated 2001 by the Center for Health Policy Research, most self-employed physicians spend 15% to 55% of their patient visitations and time spent on patient care outside of their office. Time spent by medical specialists such as general surgeons and cardiologists outside of their office frequently exceeds 55%. When outside of their office, many physicians carry complex local and regional fee schedules for different third-party providers. Many must obtain a photocopy of the patient’s insurance card and chart for every visit. Some physicians utilize voice-activated recorders or other electronic devises to collect the patient information but find that they still must manually enter claim information in their offices. Dr. Del Pin has advised us that, if the DR SPEAK system functions as designed, it will significantly reduce the time spent by physicians who currently do not use electronic means to enter p atient and billing information into their records.

Development and Testing of the DR SPEAK system

Dr. Del Pin sought a solution to the problems described above, many of which she encountered in her own surgical practice. In January 2002, Dr. Del Pin contracted with GetAGeek, Inc. to create an IVR system and supporting database and structures for a telephone-based billing entry system that was later to become the DR SPEAK system. GetAGeek also agreed to provide the digital recording and implementation of all prompts as provided by Dr. Del Pin. Dr. Del Pin paid GetAGeek $13,650 to develop, test and deploy the 2003 version of DR SPEAK system. GetAGeek first delivered a prototype of the DR SPEAK system to Dr. Del Pin in May 2003. In addition, Dr. Del Pin purchased software licenses at a cost of $2,595 which are required to implement the DR SPEAK system.

Dr. Del Pin began the initial testing of the DR SPEAK system in May, 2003. The test was less successful than hoped. Because of problems encountered during the testing, Dr. Del Pin to the best of her recollection believes only approximately 65% of claim information was entered. Among the problems which arose during the testing were:

15

·

certain words beginning with a vowel were not recognized

·

certain months were misidentified.

·

dates of birth were not correctly identified

·

numbers such as fifty and twenty were misidentified.

·

some insurance and medical names and terms were not correctly recognized.

·

if insurance information was not already in the official list, the DR SPEAK system did not recognize it.

·

after pushing the pound sign on a touchtone keypad, there was an unacceptable pause before the next entry was requested

·

some sounds were misidentified

·

some diagnosis items were miscoded

·

the voice player experienced technical problems

·

when the DR SPEAK SYSTEM disconnected the user for poor entry, it did not reset for the next call.

·

Data did not import perfectly to Pro 32 software

·

Difficulty with end user telephone and modem connections

Dr. Del Pin has advised us that subsequent to the initial testing, the problems relating to the use of the DR SPEAK system have been corrected to her satisfaction although further testing is required. Because, however, the DR SPEAK system has not been further tested nor manufactured in commercial quantities or used in any meaningful degree by persons other than Dr. Del Pin, we cannot assure you that the DR SPEAK system will function as designed or will attain any degree of commercial acceptance.

We have been advised by Dr. Del Pin that she has expended approximately $20,000 in connection with the development of the DR SPEAK system, including professional fees paid or payable to her intellectual property counsel. Dr. Del Pin has further advised us that she expended approximately $13,000 in connection with one trade show at which the DR SPEAK system was exhibited.

Operation of the DR SPEAK System

DR SPEAK users can directly install the software onto their computers in the same manner as many other readily available software programs are installed. Users insert the DR SPEAK disk in their CD drive and the program will load within a few minutes. When the computer is on and the IVR is activated, users may access the computer program by telephone via their modem. DR SPEAK does not automatically integrate with existing databases or medical practice programs. Users must either export patient and claim data from the existing program or enter it manually.

For electronic claim submission, the Medicare provider user should be licensed independently to utilize the Pro 32 software.

The DR SPEAK system includes an administrative tool which allows the user to enter and edit data on the DR SPEAK system including patient and insurance records, system parameters, and most

16

importantly, to review, print or import to PC-ACE Pro 32 medical claims for electronic submission to payers.

The voice-recognition training component of the DR SPEAK system is an independent system which is not proprietary to the DR SPEAK system. Microsoft provides a training mini-application as part of the speech engine installed on the Windows XP operating system. By asking the user to read a few pages of selected literature, it extracts recognition settings for the system. The voice training generally requires about 20 minutes to complete. Users can return to the speech engine at any time for additional voice recognition training for more effective recognition .

The appropriate local and regional Medicare fee schedule for each user can be entered by the user. Fee schedules for most private insurance plans are based upon a percentage of the Medicare fee schedule. DR SPEAK allows users to enter the private insurance company fee schedules.

After the system is properly installed in the user’s computer with the included software, the requisite information is entered using the administrative tool. After completing the voice training program, the system is ready for use by the user.

When the user contacts the DR SPEAK system by telephone, the system will prompt the user for proper user identification and then basic patient demographics. The user will then identify the date of service, the place of service and procedure and or diagnosis information. The system will save all of the information to its database. Medicare allows up to seven procedure codes to be billed on one claim. The user can use keywords to expedite the diagnosis and procedure code fields. DR SPEAK offers an easy-to-use voice-lookup of both diagnosis and procedure codes. DR SPEAK additionally links the procedures to the appropriate local and regional fee schedules to correctly bill.

The following is an illustrative example of the interactive nature of the DR SPEAK system:

| | | |

DR SPEAK Says | User’s Response | Or Touch Tone |

User name please: | Doctor Smith | 8888 |

Pass code: | One two three four | 1234 |

It’s good to hear from you again Doctor Smith. |

What is the patient’s 9 digit ID or full name | Doe John | 123 456 789 |

The selected patient is Doe John. Is that correct? | Yes | 1 |

Patient’s date of birth: | May twenty-eighth, nineteen seventy eight | 05 28 1978 |

17

| | | |

For patient notes, press 1. To enter a claim press 2. To select another patient, press 3. | Two | 2 |

What was the date of service? | Yesterday | |

September 22, 2005 , is that correct? | Yes | 1 |

Place of service? (Prompts for user-entered names of places) | Clifton Memorial | 11 |

Clifton Memorial, is that correct? | Yes | 1 |

Using key words, we will now determine the procedure. Say code, if you know the procedure code number. |

Procedure key word please. | Code | |

What is the procedure number? | Three three five one zero | 33510 |

For procedure 33510 Coronary artery bypass, vein only; single coronary venous graft say yes, to hear the next match say no. | Yes | 1 |

We’ll now get some diagnosis key words. Say, code, if you know the diagnosis number. |

Diagnosis key word please. | Heart |

Heart, is that correct? | Yes |

Diagnosis key word please. | Pulmonary |

Pulmonary, is that correct? | Yes |

For diagnosis 415, Acute pulmonary heart disease, say yes, to hear the next match say no. | Yes |

Great. |

Would you like to enter a secondary diagnosis? | No |

Another procedure? | No |

Would you like to select another patient? | No |

Thank you for calling. |

During the entry of the diagnosis, the DR SPEAK system may not understand one or more of the keywords. The user could answer “no”if the keyword was recognized incorrectly to try it again. DR SPEAK takes each accepted keyword and searches the database of diagnosis or procedure

18

descriptions and attempts to find matches. If the number of matches is greater than five, the DR SPEAK system will ask for another keyword to find an exact match of less than five matches.

If the user had answered “no”to the diagnosis 415 as shown above, DR SPEAK would have gone on to the next diagnosis which also matched a key word. If DR SPEAK cannot locate a match after three attempts, it will record the user’s diagnosis description as an audio file on the computer.

This audio file is then available for playback during the claim review process. When using the administrative tool to review a claim, any fields on the form where audio was recorded will appear green. The user can then click on that field to hear what was recorded. As an example, when entering the name of a new patient over the telephone, the DR SPEAK system will not understand the name of the patient and will record certain new patient information for later transcribing. New patients can be entered into the system over the telephone or by using the administrative tool.

We believe that the DR SPEAK system when coupled with Medicare’s Pro 32 software provides a high level of error prevention by seeking to eliminate the primary causes of human error in claims processing through the following measures:

·

Critical responses are telephonically repeated to the user after each step.

·

A hard copy of the responses can be printed for the user to verify claim information.

·

The error prevention already designed into Medicare’s Pro 32 software can locate inconsistencies missed during the first two error prevention opportunities.

Electronic Submission Of Claims

Once the data regarding the patient is submitted to the DR SPEAK system, the data fields fill with the appropriate information such as the patient’s name and address and health insurance information. In order to submit claims electronically, each claim must be reviewed by the administrator or physician and then checked off as completed. The claim is then automatically sent to the system’s export bin.

If the export icon is clicked, a drop down box appears containing the names of all the patients whose information has been sent to the export bin. The user can then click on the patient claim to be exported and click export on the Pro 32 desktop. If there are any errors or adjustments the Pro 32 software will tell highlight the fields. Once the claim is “clean,” it is saved for electronic dispatch. When so directed by the user, each claim is electronically sent to the appropriate health insurance company and to Medicare.

19

Our Agreements with GetAGeek, Inc.

We have entered into an agreement with GetAGeek pursuant to which GetAGeek, as manufacturer, will provide duplication services of our software for distribution to our prospective customers. We will provide blank pre-printed CD ROMS to GetAGeek in connection with the duplication service. GetAGeek will ship printed software documentation as provided by us to be included with a CD ROM enclosed in a binder which will also be provided by us.

GetAGeek will also provide technical support to each of our customers for a period of thirty days after the customer has installed the software. GetAGeek has agreed to provide one dedicated technical support representative for every twenty DR SPEAK systems we sell that subscribe to a service contract beyond the thirty days. We have not yet determined the terms or the price of any service contracts. The technical support will be conducted verbally over the telephone and by remote control of the customer’s system.

We have agreed to pay GetAGeek for its services at the rate of $140 for each DR SPEAK system we sell. Although GetAGeek will not bill us for any additional costs without our prior written approval, unforeseen difficulties, on-site visits, technological feasibility, and third party involvement can and may increase our overall costs.

In September 2005, we entered into an agreement with GetAGeek to add a Simplified Billing Module or SBM to the DR SPEAK system for which we paid $15,000. Because most of our prospective customers have bookkeeping programs which they utilize, the SBM was designed to provide the following limited bookkeeping functions:

·

Post payments to the system including:

o

patient name and account number;

o

payment type (credit card, check or cash);

o

process of payment (regular or insurance payment);

o

check number;

o

amount paid; and

o

attribute to particular bill(s)

·

Print patient statements and bills on pre-printed letterhead or blank with basic letterhead automatically generated.

·

Print patient detail in a statement form.

·

Print Date of Service bills.

20

·

Report Generation including:

o

Outstanding accounts aged up to 120 days from the initial date of the claim;

o

Billing for date range – amount of billing generated by provider by date range;

o

Account report - all billing history for specific patient account; and

o

Insurance Carrier - amount(s) submitted, collected by month and date range.

·

Account Maintenance – allows for specific modification of patient balance and adjustments.

·

Posting adjustments to a bill and the reason for the adjustment.

Intellectual Property

On June 10, 2004, Dr. Del Pin filed a patent application for the DR SPEAK system with the United States Patent and Trademark Office. Since the patent application was filed, no substantive communication from the United States Patent and Trademark Office has been received by or on behalf of Dr. Del Pin relating to her application. The claims made in the patent application do not encompass all aspects of the system. For example, the IVR component of the system is included in Microsoft’s Windows XP operating system.

There can be no assurance that any patent will be issued, or if issued, that it will include any meaningful claims. Furthermore, the validity of issued patents is frequently challenged by others. One or more patent applications may have been filed by others previous to Dr. Del Pin’s filing which encompass the same or similar claims. If Dr. Del Pin does not receive a patent which provides adequate protection, we may not be able to manufacture our proposed products in our intended manner.

If a patent is issued, Dr. Del Pin may be unable to protect the patent or to challenge others who may infringe upon a patent. Because many holders of patents of software systems have substantially greater resources than either we or Dr. Del Pin possess and patent litigation is very expensive, neither we nor Dr. Del Pin may have the resources necessary to challenge successfully the validity of patents held by others or withstand claims of infringement or challenges to any patent she may obtain. Even if we are able to fund the litigation and prevail, the cost and management distraction of litigation could have a material adverse effect on us.

Because software systems developed by others are covered by a large number of patents and patent applications, infringement actions may be instituted against us if we use or are suspected of using technology, processes or other subject matter that is claimed under patents of others. An adverse outcome in any future patent dispute could subject us to significant liabilities to third parties, require disputed rights to be licensed or require us to cease using the infringed technology.

21

The United States Trademark Office has issued a Notice of Allowance for the trademark “DR SPEAK.” If Dr. Del Pin timely files a Statement of Use and submits a proper specimen of the mark, the mark will become registered. We cannot assure you that Dr. Del Pin will make the requisite filing and submission.

If trade secrets and other means of protection upon which we or Dr. Del Pin may rely do not adequately protect us, the intellectual property may become available to others. Although we may rely on trade secrets, copyright law, employee and third-party nondisclosure agreements and other protective measures to protect some of our intellectual property, these measures may not provide meaningful protection to us.

Marketing

Our initial target market is the approximately 200,000 physicians in practices with eight or fewer practitioners with a high rate of out-patient servicing. We consider surgeons, cardiologists, radiologists and anesthesiologists in small practices as our optimal target market.

We intend to initially market the DR SPEAK system through advertisements in medical trade journals and attendance at trade shows, Advertisements of the type that we intend to use in the trade journals which we select range in cost from approximately $549 to $7550 per issue.

We believe that our cost for exhibiting the DR SPEAK system at a typical trade show will be approximately $6,000 to $20,000.

If sufficient funds become available to us, we intend to hire personnel to sell the DR SPEAK system to physicians through personal solicitation at their offices.

Competition

We are aware of more than 100 companies offering electronic medical billing software. Most do not offer voice activated feature and also require manually date entry of the claim information that can take up to forty-five minutes per claim to process. There are a small number of voice-activated medical billing programs but they either simply offer a microphone at a computer or a voice activated tape recorder that still has to be transcribed. We do not believe that any of them offers the ease of operation as does the DR SPEAK system and most importantly, claims submission over the telephone.

If we are successful in marketing the DR SPEAK system, we expect to encounter intense competition from others. Substantially all of our potential competitors will have significantly greater experience, resources and managerial capabilities than we do and may be able to develop a similar or superior product.

22

Employees

We have no employees other than our executive officers. To the extent we have sufficient capital, we may seek to hire sales and marketing personnel. In addition, if we are successful, we intend to hire a full time chief financial officer.

Facilities

Our president has agreed to provide office space to us at no charge through June 30, 2006.

MANAGEMENT

Executive Officers and Directors

The following sets forth certain information with respect to our executive officers and directors. Each director holds such position until the next annual meeting of our shareholders and until his respective successor has been elected and qualifies.

| | |

Name |

Age |

Positions |

Gary Cella | 48 | President and Director. |

Lee Hanover | 44 | Vice President, Secretary and Director |

Alfred Cella | 75 | Treasurer and Director |

Martin Horowitz | 48 | Director |

Any of our directors may be removed with or without cause at any time by the vote of the holders of not less than a majority of our then outstanding common stock. Officers are elected annually by the Board of Directors. Any of our officers may be removed with or without cause at any time by our Board of Directors.

Gary Cella has been our president and a director since April 2005 and is one of our founders. For more than five years, he has been a self employed marketing and sales consultant. Mr. Cella’s consulting services to his clients have included advice on marketing, advertising, product and market expansion and sources of capital. From April 2001 to December 2003, Mr. Cella was the president of New England Acquisitions, Inc. which company unsuccessfully sought to market medical devices and personal care products. From 2000 to 2002 , Mr. Cella was a vice president, secretary, treasurer and a member of the Board of Directors of Accelerated Globalization, Inc., a development stage company which sought to provide strategic business solutions to small and middle sized companies seeking to expand their markets to other portions of the world. Mr. Cella believes that Accelerated Glo balization, Inc. ceased doing business subsequent to 2002.

Lee Hanover has been our vice president, secretary and a director since June 2005. Since November 2005, Mr. Hanover has been employed by Lerner, Cumbo & Associates as an incoming telephone sales representative. From February 1990 to June 2004, Mr. Hanover was a credit card customer specialist with JP Morgan/Chase.

23

Alfred Cella has been our treasurer and a director since June 2005. He has been a self employed managerial consultant for more than five years.

Martin Horowitz has been a director since June 2005. For more than five years, he has been a self employed computer consultant.

Alfred Cella is Gary Cella’s father. Lee Hanover and Martin Horowitz are brothers.

Executive Compensation

Gary Cella has agreed to serve as our president without any cash compensation until at least June 30, 2006. We have no agreements relating to compensation with our other executive offices. The compensation of our executive officers will be determined by our Board of Directors.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of January 30, 2006 with respect to any person who is known to us to be the beneficial owner of more than 5% of our common stock, which is the only class of our outstanding voting securities, and as to our common stock beneficially owned by our directors and officers and directors as a group:

| | |

Name and address of Beneficial Owner (1) |

Number of Shares Beneficially Owned(2) |

Approximate Percent of Class(2) |

Gary Cella 5 Ridge Road Cos Cob, CT 06807 |

3,921,000 (3) |

36.4 % (3) |

Jonathan B. Reisman 6975 NW 62nd Terrace Parkland, FL 33067 |

3,721,000 |

34.5 % |

Lee Hanover 11 Pam Drive Commack, NY 11725 | 125,000 | 1.2% |

Alfred Cella 25 Barn Swallow Court Manorville, NY 11949 | 75,000 | .7 % |

Martin Horowitz 3240 Claremore Avenue Long Beach, CA 90808 | 75,000 | .7% |

Officers and directors as a Group (4 persons) (4) |

4,196,000 |

38.9% |

_________________

24

(1)

Unless otherwise noted below, we believe that all persons named in the table have sole voting and investment power with respect to all shares of common stock beneficially owned by them.

(2)

For purposes hereof, a person is deemed to be the beneficial owner of securities that can be acquired by such person within 60 days from the date hereof upon the exercise of warrants or options or the conversion of convertible securities. Each beneficial owner’s percentage ownership is determined by assuming that any such warrants, options or convertible securities that are held by such person (but not those held by any other person) and which are exercisable within 60 days from the date hereof, have been exercised.

(3)

Includes 200,000 shares owned by Dr. Del Pin, Mr. Cella’s spouse., to which shares Mr. Cella disclaims any beneficial interest.

(4)

See notes above.

CERTAIN TRANSACTIONS

In April 2005, we issued 1,500,000 shares of common stock each to Gary Cella and Jonathan B. Reisman for a nominal consideration. In connection with the issuance, (a) Mr. Cella agreed to be our president without any cash compensation until at June 30 , 2006, and (b) Reisman & Associates, P.A., an affiliate of Mr. Reisman, agreed to assist us in preparing the registration statement of which this prospectus is a part without any cash compensation.

As described above, we have purchased from Dr. Del Pin, the spouse of Gary Cella, the exclusive rights to manufacture the DR SPEAK system and sell the DR SPEAK system in the United States.

We have issued 75,000, 125,000 and 75,000 shares to Alfred Cella, Lee Hanover and Martin Horowitz, respectively for serving on our Board of Directors and, in the case of Mr. Hanover, for serving as an officer.

DESCRIPTION OF COMMON STOCK

Our authorized capital stock consists of 100,000,000 shares of common stock, $.00001 par value.

The holders of outstanding shares of our common stock are entitled to receive dividends out of assets legally available therefor at such times and in such amounts, if any, as our Board of Directors from time to time may determine. Holders of common stock are entitled to one vote for each share held on all matters submitted to a vote of stockholders which means that the holders of a majority of the shares voted can elect all of the directors then standing for election. Holders of the common stock are not entitled to preemptive rights and the common stock is not subject to conversion or redemption.

25

Our directors and executive officers beneficially own approximately 40% of our outstanding shares. These stockholders may be able to effectively determine the outcome of stockholder votes, including votes concerning the election of directors, amendments to our charter and bylaws, and the approval of significant corporate transactions such as a merger or a sale of our assets. In addition, their controlling influence could have the effect of delaying, deferring or preventing a change in control of our company.

Control-Share Acquisitions

We may become subject to the control-share acquisition provisions of the Florida Business Corporation Act. Those provisions could have the effect of discouraging offers to acquire us and of increasing the difficulty of consummating any such offer. The provisions may also discourage bids for our common stock at a premium over the market price.

Transferagent

The transfer agent for our common stock is Florida Atlantic Stock Transfer, Inc., 7130 Nob Hill Road, Tamarac, Florida 33321.

SHARES ELIGIBLE FOR FUTURE SALE

Prior to this offering, there has not been any public market for our common stock. Sales of substantial amounts of our common stock in the public market, or the perception that such sales could occur, could adversely affect prevailing market prices, if any, of our common stock and could impair our future ability to raise capital through the sale of equity securities.

In general, pursuant to Rule 144 under the Securities Act of 1933 any person who owns shares that were acquired from us at least one year prior to the proposed sale may publicly sell, within any three-month period beginning 90 days after the date of this prospectus, a number of shares that does not exceed the greater of:

·

1% of the number of shares of our common stock then outstanding or

·

the average weekly trading volume of the common stock on Nasdaq during the four calendar weeks preceding the filing of a notice on Form 144 with respect to such sale.

Shares may generally be sold by non-affiliates without restriction that were acquired from us at least two years prior to the proposed sale. Any shares purchased by our affiliates in this offering and subsequently publicly sold by those affiliates will not be subject to the one year holding period. Sales under Rule 144 are also subject to certain manner of sale provisions and notice requirements and to the availability of current public information about us.

SELLING STOCKHOLDERS

The following table sets forth information as of the date of this prospectus with respect to the common stock held by each selling stockholder:

| | | | |

Name of Selling Stockholder |

Shares of Common Stock Owned |

Number of Shares Being Offered |

Shares of Common Stock to be Owned After the Offering |

Percentage of Outstanding Shares of Common Stock to be Owned After the Offering (assuming the sale of all shares being offered by the selling stockholders) |

Anthony Abruscato | 200,000 | 200,000 | -0- | -0- |

Todd Brook | 130,000 | 130,000 | -0- | -0- |

Juan Carlos Canales | 50,000 | 50,000 | | |

Luis Canales | 25,000 | 25,000 | -0- | -0- |

Michael Canning | 25,000 | 25,000 | -0- | -0- |

Derek Christian | 300,000 | 300,000 | -0- | -0- |

Mike Conneely | 400,000 | 400,000 | -0- | -0- |

Anthony Cort | 50,000 | 50,000 | -0- | -0- |

Robert Cutler III | 20,000 | 20,000 | -0- | -0- |

Phillip Galles | 50,000 | 50,000 | -0- | -0- |

Barry Lederer | 100,000 | 100,000 | -0- | -0- |

Dean G. Lubatt | 50,000 | 50,000 | -0- | -0- |

Samuel Lubatt | 120,000 | 120,000 | -0- | -0- |

Steven V. Mihaljevic | 150,000 | 150,000 | -0- | -0- |

Cono Onorato | 25,000 | 25,000 | -0- | -0- |

James Onorato | 25,000 | 25,000 | -0- | -0- |

Alan Polsky | 400,000 | 400,000 | -0- | -0- |

Richard Schreiber | 123,000 | 123,000 | -0- | -0- |

Terri Smith | 100,000 | 100,000 | -0- | -0- |

Patricia Stewart | 305,000 | 305,000 | -0- | -0- |

David Teresi | 25,000 | 25,000 | -0- | -0- |

Robert Vecchio | 25,000 | 25,000 | -0- | -0- |

Brian Welsh | 160,000 | 160,000 | -0- | -0- |

| | | | | |

Total | | | -- | |

26

Mr. Schreiber and Ms. Stewart each received equity and cash finder’s fees in connection with our private placement of 1 million shares which concluded in November 2005. In addition, Ms. Stewart received a cash and equity finder’s fee in connection with a private sale of shares by our founders and also purchased shares from them.

PLANS OF DISTRIBUTION

Our Offering

We are offering 1,000,000 shares on a best efforts basis. The minimum purchase is 4,000 shares.

We are making the offering through our president who will not be compensated for offering the shares. We will however, reimburse him for all expenses incurred by him in connection with the offering, which we believe will not exceed $3,500. Because we are offering the shares through our president without the use of a professional securities underwriting firm, there will be significantly less due diligence performed in conjunction with this offering than would be performed in an underwritten offering.

Prior to this offering, there has been no market for our common stock. The public offering price for the shares was determined solely by us and may be substantially higher than the prices that will prevail in the trading market, if one develops. Among the factors we considered in determining the public offering price were the absence of a record of operations, our current financial condition, our future prospects, the inexperience of our executive officers, and the general condition of the equity securities market.

If a public market develops for our common stock, trading in the common stock will be subject to the requirements of applicable rules under the Securities Exchange Act of 1934 which require additional disclosure by broker-dealers in connection with any trades involving the common stock. Those rules require the delivery, prior to any transaction in the common stock, of a disclosure schedule explaining the penny stock market and associated risks, and impose various sales practice requirements on broker-dealers who sell the common stock to persons other than established customers and accredited investors (generally institutions). For these types of transactions, the broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to sale. The additional burdens imposed upon broker-dealers may discourage broker-dealers from effect ing transactions in our common stock, which could severely limit its liquidity.

27

The Selling Stockholders’ Offering

Shares may be sold from time to time directly by the selling stockholders at $.65 per share. Subsequent to the time, if any, that are shares are listed on the over-the counter Bulletin Board, the selling stockholders may sell their shares in one or more transactions on the over-the-counter market, in negotiated transactions, or through a combination of those methods of distribution, at prices related to prevailing market prices or at negotiated prices. Alternatively, the selling stockholders may, from time to time, offer the shares through underwriters, dealers or agents, who may receive compensation in the form of underwriting discounts, concessions or commissions from the selling stockholders for whom they may act as agent. The selling stockholders and any underwriters, dealers or agents that participate in the distribution of common stock may be deemed to be underwriters, and any commissions or concessions received by any such underwriters, dealers or agents may be deemed to be underwriting discounts and commissions under the Securities Act of 1933.We will not receive any proceeds from shares sold by the selling stockholders.

LEGAL PROCEEDINGS

There are no pending or threatened legal proceedings to which we are a party or of which any of our property is the subject or, to our knowledge, any proceedings contemplated by governmental authorities.

INDEMNIFICATION

We have agreed to indemnify our executive officers and directors to the fullest extent permitted by the Florida Business Corporation Act. The Act permits us to indemnify any person who is, or is threatened to be made, a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by us or in our right) by reason of the fact that the person is or was an officer or director or is or was serving at our request as an officer or director. The indemnity may include expenses (including attorney’s fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with the action, suit or proceeding, provided that he acted in good faith and in a manner he reasonably believed to be in or not opposed to our best interests, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful. We may indemnify officers and directors in an action by us or in our right under the same conditions, except that no indemnification is permitted without judicial approval if the officer or director is adjudged to be liable to us. Where an officer or director is successful on the merits or otherwise in the defense of any action referred to above, we must indemnify him against the expenses which he actually and reasonably incurred. The indemnification provisions of the Florida Business Corporation Act are not exclusive of any other rights to which an officer or director may be entitled under our bylaws, by agreement, vote, or otherwise.

Insofar as indemnification arising under the Securities Act of 1933 may be permitted to our directors, officers and controlling persons pursuant to the foregoing provisions or otherwise, we have been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

28

LEGAL MATTERS

The validity of the shares of common stock offered by this prospectus have been passed upon for us by Reisman & Associates, P.A. to the extent set forth in that firm’s opinion filed as an exhibit to the registration statement. Jonathan B. Reisman is the president and sole stockholder of that firm and owns 3,721,000 of our shares and may be considered our co-founder.

EXPERTS

Our financial statements, as of November 30, 2005 and for the period from our inception to November 30, 2005, included in this prospectus have been audited by Meyler & Company LLC, independent registered public accounting firm, as set forth on their report thereon appearing elsewhere in this prospectus, and are included in reliance upon such report given upon the authority of such firm as experts in accounting and auditing.

ADDITIONAL INFORMATION

We have electronically filed a registration statement on Form SB-2 with the SEC with respect to the shares of common stock to be sold in this offering. This prospectus, which forms a part of that registration statement, does not contain all of the information included in the registration statement. Certain information is omitted and you should refer to the registration statement and its exhibits. With respect to references made in this prospectus to any contract or other document, the references are not necessarily complete and you should refer to the exhibits attached to the registration statement for copies of the actual contract or document. You may read and copy the registration statement and other materials we file with the SEC at the SEC=s Public Reference Room at 100 F Street, NE., Washington, D.C. 20549. The public may obtain information on the operation of the Public Refere nce Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy statements and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is http://www.sec.gov.

Upon the effectiveness of the registration statement of which this prospectus is a part, we will become subject to the information and reporting requirements of the Securities Exchange Act of 1934 and will file periodic reports and other information with the SEC.

We intend to furnish our stockholders with annual reports containing audited financial statements.

29

PHYSICIANS REMOTE SOLUTIONS, INC. AND SUBSIDIARY

(A Development Stage Enterprise)

CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD APRIL 5, 2005 (INCEPTION)

TO NOVEMBER 30, 2005

Table of Contents

Report of Independent Registered Public Accounting Firm

F 1

Consolidated Balance Sheet

F 2

Consolidated Statement of Operations

F 3

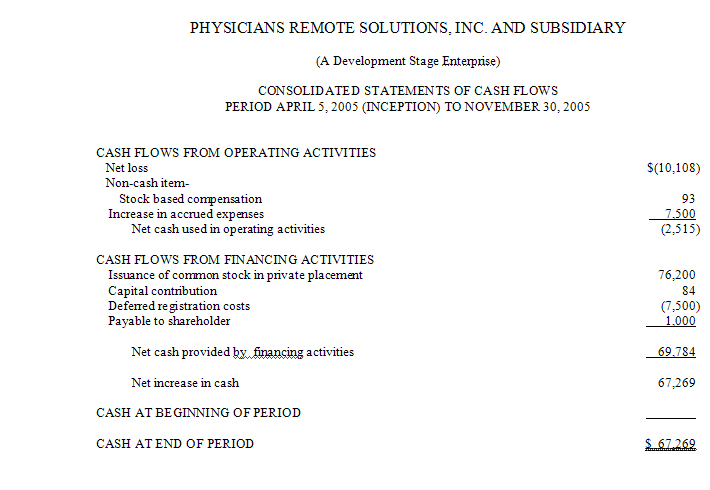

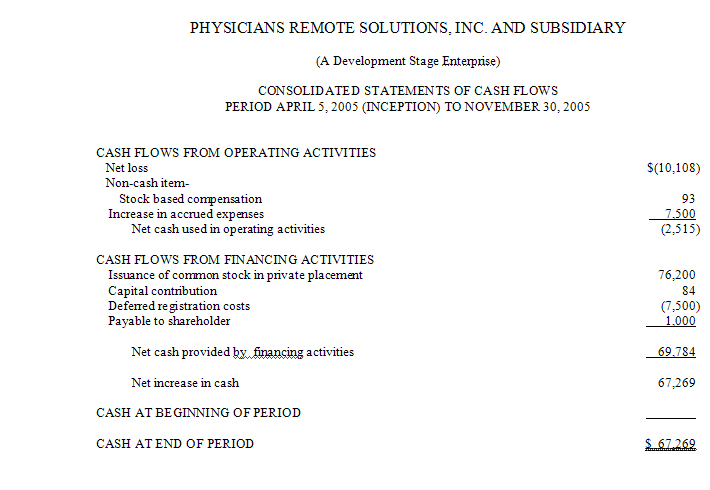

Consolidated Statement of Cash Flows

F 4

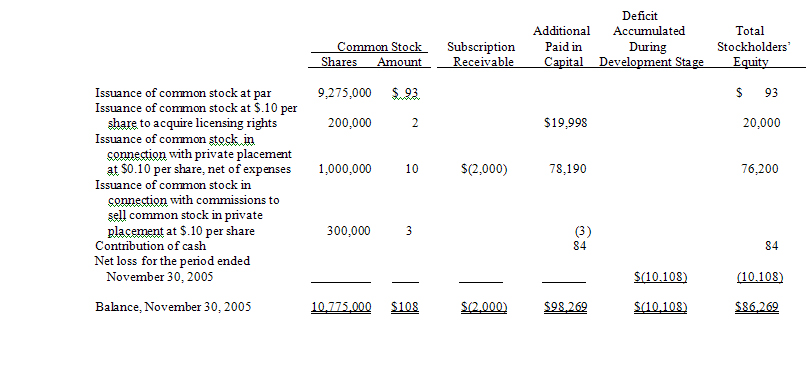

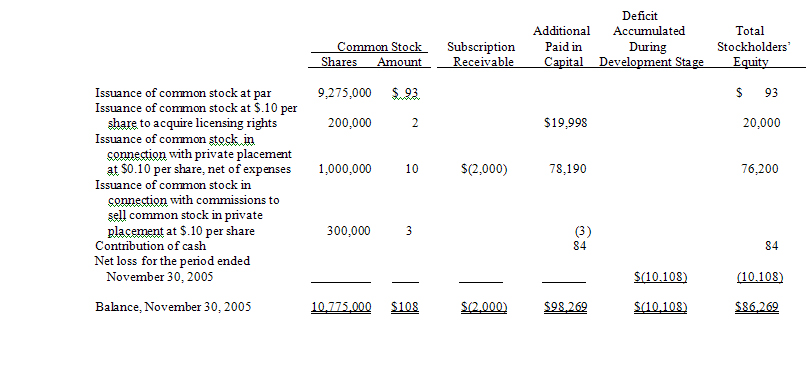

Consolidated Statement of Stockholders’ Equity

F 5

Notes to Consolidated Financial Statements

F 6

MEYLER & COMPANY, LLC

CERTIFIED PUBLIC ACCOUNTANTS

ONE ARIN PARK

1715 HIGHWAY 35

MIDDLETOWN, NJ 07748

Report of Independent Registered Public Accounting Firm

To the Board of Directors

and Stockholders

Physicians Remote Solutions, Inc. and Subsidiary

Cos Cob, CT 06807

We have audited the accompanying consolidated inception balance sheet of Physician Remote Solutions, Inc. and Subsidiary as of November 30, 2005 and the related consolidated statements of operations and stockholder’s equity, and cash flows for the period April 5, 2005 (inception) to November 30, 2005. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Physicians Remote Solutions, Inc. and Subsidiary as of November 30, 2005, and the results of its operations and its cash flows for the period April 5, 2005 (inception) to November 30, 2005 in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note B of the notes to the consolidated financial statements, the Company is newly incorporated and to date has had no operating activities. Management’s plans, in regard to subsequent operating activities, are also described in Note B.

/s/ Meyler & Company, LLC

Middletown, NJ

January 9, 2006

F-1

See accompanying notes to consolidated financial statements.

F-2

F-3

See accompanying notes to consolidated financial statements.

F-4

PHYSICIANS REMOTE SOLUTIONS, INC. AND SUBSIDIARY

(A Development Stage Enterprise)

CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY