Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-119612

WORLD MONITOR TRUST III | ||||||||

2,812,500 Series J Units of | 937,500 Series J Units of | |||||||

Beneficial Interest, Class I | Beneficial Interest, Class II | |||||||

The Series J Units of World Monitor Trust III trade speculatively in U.S. and international futures and forward contracts, as more fully discussed in the Prospectus. Trading on behalf of Series J commenced on or about December 1, 2005.

Series J Units are issued as of the beginning of each month and such Units may be redeemed as of the last business day of each month, beginning with the first month-end following their sale. Exchanges will not be allowed from Class I to Class II orvice-versa. Class I Units redeemed prior to the first anniversary of their purchase will be subject to a redemption charge equal to the product of (i) the Net Asset Value per Unit on the redemption date of the Units being redeemed, multiplied by (ii) the number of months remaining before the first anniversary of the date such Units were purchased, multiplied by (iii) 1/12th of 2.00%. There is no redemption charge for Class I Units on or after the first anniversary of their purchase. There is no redemption charge for any Class II Units.

Series J Units are offered as of the beginning of each month and will be offered continuously until all of Series J’s Units that are registered are sold. The Managing Owner may terminate the offering of Series J Units at any time. Kenmar Securities Inc., the Selling Agent, and the Correspondent Selling Agents will use their best efforts to sell the Units offered, which means that they are not required to purchase any Units or sell any specific number or dollar amount of Units.

Designation: | Number of Units: | Advisor(s): | Program: | |||

Series J, Class I | 2,812,500 | Graham Capital Management, L.P. Eagle Trading Systems Inc. Ortus Capital Management Limited/Ortus Capital Management (Cayman) Ltd. | Global Diversified Program at 150% Leverage Momentum Program Major Currency Program | |||

Series J, Class II | 937,500 | Graham Capital Management, L.P. | Global Diversified Program at 150% Leverage | |||

| Eagle Trading Systems Inc. | Momentum Program | |||||

| Ortus Capital Management Limited/Ortus Capital Management (Cayman) Ltd. | Major Currency Program | |||||

These are speculative securities. Before you decide whether to invest in Series J, read this entire Prospectus carefully and consider “The Risks You Face” section beginning on page 15. In particular you should be aware that:

• Futures, forward and options trading is volatile and highly leveraged and, as a result, even a small movement in market prices could cause large losses.

• Series J will rely on its Advisors for success.

• You could lose all or substantially all of your investment.

• No secondary market exists for the Series J Units and such Units may be redeemed monthly and may result in redemption charges as described above. | • Many of the instruments to be traded by Series J are not regulated by the Commodity Futures Trading Commission and Series J will not receive the protections that are provided by such regulation with respect to such instruments.

• Investors will pay substantial fees in connection with their investment in Series J, including asset-based fees of up to 6.17% per annum for Class I Unitholders and up to 4.17% per annum for Class II Unitholders as well as incentive fees payable to each Advisor equal to 20% of net profits generated by such Advisor on a cumulative high water mark basis. |

Minimum Investment: | Regular Accounts of the Trust:$5,000; IRAs, other tax-exempt accounts, and existing investors of the Trust: $2,000 |

These securities have not been approved or disapproved by the Securities and Exchange Commission or any state securities commission nor has the Securities and Exchange Commission or any state securities commission passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense. THE COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN THESE POOLS NOR HAS THE COMMISSION PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS.

April30, 2008 (Not for use after January 31, 2009)

Table of Contents

Investor Suitability

Purchaser understands that the purchase of Units may be made only by persons who, at a minimum, have (i) a net worth of at least $250,000 (exclusive of home, furnishings and automobiles) or (ii) an annual gross income of at least $70,000 and a net worth of at least $70,000 (exclusive of home, furnishings and automobiles). Residents of the following states must meet the requirements set forth below (“net worth” for such purposes is in all cases is exclusive of home, furnishings and automobiles). In addition, Purchaser may not invest more than 10% of his or her net worth (in all cases exclusive of home, furnishings and automobiles) in the Trust.

| 1. | Arizona — Net worth of at least $250,000 or a net worth of at least $75,000 and an annual income of at least $75,000. |

| 2. | California — Net worth of at least $250,000 exclusive of home, home furnishings and automobiles and an annual income of at least $65,000 or, in the alternative, a net worth of at least $500,000 exclusive of home, home furnishings and automobiles. |

| 3. | Kansas — Net worth (excluding purchaser’s home, house furnishing, and automobiles) of at least $250,000 or a net worth (excluding the values of purchaser’s home, home furnishings and automobiles) of at least $70,000 and an annual taxable income of at least $70,000. It is recommended by the Office of the Kansas Securities Commission that Kansas investors not invest, in the aggregate, more than 10% of their liquid net worth in this and similar direct participation investments. Liquid net worth is defined as that portion of net worth which consists of cash, cash equivalents and readily marketable securities. |

| 4. | Kentucky—Net worth of at least $300,000 or a net worth of at least $85,000 and an annual income of at least $85,000. |

| 5. | Minnesota — “Accredited investors,” as defined in Rule 501(a) under the Securities Act of 1933. |

| 6. | Oregon — Net worth of home, furnishings and automobiles of at least $500,000 or a net worth of home, furnishings and automobiles of at least $250,000 and an annual taxable income of at least $65,000. |

[Remainder of page left blank intentionally]

-ii-

Table of Contents

COMMODITY FUTURES TRADING COMMISSION

RISK DISCLOSURE STATEMENT

YOU SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS YOU TO PARTICIPATE IN A COMMODITY POOL. IN SO DOING, YOU SHOULD BE AWARE THAT FUTURES AND OPTIONS TRADING CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS GAINS. SUCH TRADING LOSSES CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND CONSEQUENTLY THE VALUE OF YOUR INTEREST IN THE POOL. IN ADDITION, RESTRICTIONS ON REDEMPTIONS MAY AFFECT YOUR ABILITY TO WITHDRAW YOUR PARTICIPATION IN THE POOL.

FURTHER, COMMODITY POOLS MAY BE SUBJECT TO SUBSTANTIAL CHARGES FOR MANAGEMENT, AND ADVISORY AND BROKERAGE FEES. IT MAY BE NECESSARY FOR THOSE POOLS THAT ARE SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL TRADING PROFITS TO AVOID DEPLETION OR EXHAUSTION OF THEIR ASSETS. THIS DISCLOSURE DOCUMENT CONTAINS A COMPLETE DESCRIPTION OF EACH EXPENSE TO BE CHARGED TO THIS POOL BEGINNING ON PAGE 78 AND A STATEMENT OF THE PERCENTAGE RETURN NECESSARY TO BREAK EVEN, THAT IS, TO RECOVER THE AMOUNT OF YOUR INITIAL INVESTMENT, AT PAGES 11 THROUGH 12 AND 77.

THIS BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS NECESSARY TO EVALUATE YOUR PARTICIPATION IN ANY OF THESE COMMODITY POOLS. THEREFORE, BEFORE YOU DECIDE TO PARTICIPATE IN ANY OF THESE COMMODITY POOLS, YOU SHOULD CAREFULLY STUDY THIS DISCLOSURE DOCUMENT, INCLUDING A DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF THIS INVESTMENT, AT PAGES 15 THROUGH 22.

YOU SHOULD ALSO BE AWARE THAT THESE COMMODITY POOLS MAY TRADE FOREIGN FUTURES OR OPTIONS CONTRACTS. TRANSACTIONS ON MARKETS LOCATED OUTSIDE THE UNITED STATES, INCLUDING MARKETS FORMALLY LINKED TO A UNITED STATES MARKET, MAY BE SUBJECT TO REGULATIONS THAT OFFER DIFFERENT OR DIMINISHED PROTECTION TO THE POOL AND ITS PARTICIPANTS. FURTHER, UNITED STATES REGULATORY AUTHORITIES MAY BE UNABLE TO COMPEL THE ENFORCEMENT OF THE RULES OF REGULATORY AUTHORITIES OR MARKETS IN NON-UNITED STATES JURISDICTIONS WHERE TRANSACTIONS FOR THE POOL MAY BE EFFECTED.

THIS PROSPECTUS DOES NOT INCLUDE ALL OF THE INFORMATION OR EXHIBITS IN THE TRUST’S AND EACH SERIES’ REGISTRATION STATEMENT. YOU CAN READ AND COPY THE ENTIRE REGISTRATION STATEMENT AT THE PUBLIC REFERENCE FACILITIES MAINTAINED BY THE SEC IN WASHINGTON, D.C.

SERIES J FILES QUARTERLY AND ANNUAL REPORTS WITH THE SEC. YOU CAN READ AND COPY THESE REPORTS AT THE SEC PUBLIC REFERENCE FACILITIES AT 100 F STREET NE, WASHINGTON, D.C. 20549. PLEASE CALL THE SEC AT 1-800-SEC-0330 FOR FURTHER INFORMATION.

SERIES J’S FILINGS ARE POSTED AT THE SEC WEBSITE AT http://www.sec.gov.

-iii-

Table of Contents

Notes to Cover Page (cont’d)

REGULATORY NOTICES

NO DEALER, SALESMAN OR ANY OTHER PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION NOT CONTAINED IN THIS PROSPECTUS, AND, IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE TRUST, PREFERRED INVESTMENT SOLUTIONS CORP., THE SELLING AGENT, THE CORRESPONDENT SELLING AGENTS, THE ADVISORS OR ANY OTHER PERSON.

THIS PROSPECTUS DOES NOT CONSTITUTE AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY THE SECURITIES OFFERED HEREBY TO ANY PERSON OR BY ANYONE IN ANY JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION MAY NOT LAWFULLY BE MADE.

THE BOOKS AND RECORDS OF THE TRUST AND SERIES J WILL BE MAINTAINED AT ITS PRINCIPAL OFFICE, 900 KING STREET, SUITE 100, RYE BROOK, NEW YORK 10573, TELEPHONE NUMBER (914) 307-7000, AS WELL AS THE OFFICES OF SPECTRUM GLOBAL FUND ADMINISTRATION, L.L.C., OR SPECTRUM, THE ADMINISTRATOR OF THE TRUST AND SERIES J, AT 33 W. MONROE, STE. 1000, CHICAGO, IL 60603, TELEPHONE NUMBER (312) 697-9900 AND 8415 PULSAR PLACE, SUITE 400, COLUMBUS, OH 43240, TELEPHONE NUMBER (614) 410-6560. UNITHOLDERS WILL HAVE THE RIGHT, DURING NORMAL BUSINESS HOURS, TO HAVE ACCESS TO AND COPY (UPON PAYMENT OF REASONABLE REPRODUCTION COSTS) SUCH BOOKS AND RECORDS IN PERSON OR BY THEIR AUTHORIZED ATTORNEY OR AGENT. EACH MONTH, PREFERRED INVESTMENT SOLUTIONS CORP. WILL DISTRIBUTE REPORTS TO ALL UNITHOLDERS OF SERIES J SETTING FORTH SUCH INFORMATION RELATING TO SUCH SERIES AS THE COMMODITY FUTURES TRADING COMMISSION, OR THE CFTC, AND THE NATIONAL FUTURES ASSOCIATION, OR THE NFA, MAY REQUIRE TO BE GIVEN TO THE PARTICIPANTS IN COMMODITY POOLS WITH RESPECT TO SERIES J AND ANY SUCH OTHER INFORMATION AS PREFERRED INVESTMENT SOLUTIONS CORP. MAY DEEM APPROPRIATE. THERE WILL SIMILARLY BE DISTRIBUTED TO UNITHOLDERS OF SERIES J, GENERALLY BY MARCH 31 OF THE TRUST’S FISCAL YEAR, CERTIFIED AUDITED FINANCIAL STATEMENTS AND THE TAX INFORMATION RELATING TO SERIES J NECESSARY FOR THE PREPARATION OF UNITHOLDERS’ ANNUAL FEDERAL INCOME TAX RETURNS.

THE DIVISION OF INVESTMENT MANAGEMENT OF THE SECURITIES AND EXCHANGE COMMISSION REQUIRES THAT THE FOLLOWING STATEMENT BE PROMINENTLY SET FORTH HEREIN: “WORLD MONITOR TRUST III AND SERIES J ARE NOT A MUTUAL FUND OR ANY OTHER TYPE OF INVESTMENT COMPANY WITHIN THE MEANING OF THE INVESTMENT COMPANY ACT OF 1940, AS AMENDED, AND IS NOT SUBJECT TO REGULATION THEREUNDER.”

-iv-

Table of Contents

Table of Contents

-v-

Table of Contents

-vi-

Table of Contents

-vii-

Table of Contents

This summary of all material information provided in this Prospectus is intended for quick reference only. The remainder of this Prospectus contains more detailed information; you should read the entire Prospectus, including the Statement of Additional Information and all exhibits to the Prospectus, before deciding to invest in Series J Units. This Prospectus is intended to be used beginning April 30, 2008

World Monitor Trust III, or the Trust, was formed as a Delaware Statutory Trust on September 28, 2004, with separate series, or each, a Series, of units of beneficial interest, or the Units. Its term will expire on December 31, 2054 (unless terminated earlier in certain circumstances). The principal offices of the Trust and Preferred Investment Solutions Corp., or the Managing Owner, are located at 900 King Street, Suite 100, Rye Brook, New York 10573, and their telephone number is (914) 307-7000.

The Trust’s Units will be offered in one (1) Series: Series J. The Trust may issue additional Series of Units in the future. The Series J Units are separated into two classes, or each, a Class, of Units. Series J:

| • | engages in the speculative trading of a diversified portfolio of futures, forward (including interbank foreign currencies) and options contracts and other derivative instruments and may, from time to time, engage in cash and spot transactions; |

| • | will segregate its assets from the assets of other Series (if any) and will maintain separate, distinct records from such other Series (if any), and account for its assets separately from any other Series; |

| • | calculates its net assets and the Net Asset Value of its Units separately from any other Series; |

| • | has an investment objective of increasing the value of its Units over the long term (capital appreciation), while controlling risk and volatility; and |

| • | offers Units in two Classes—Class I and Class II. |

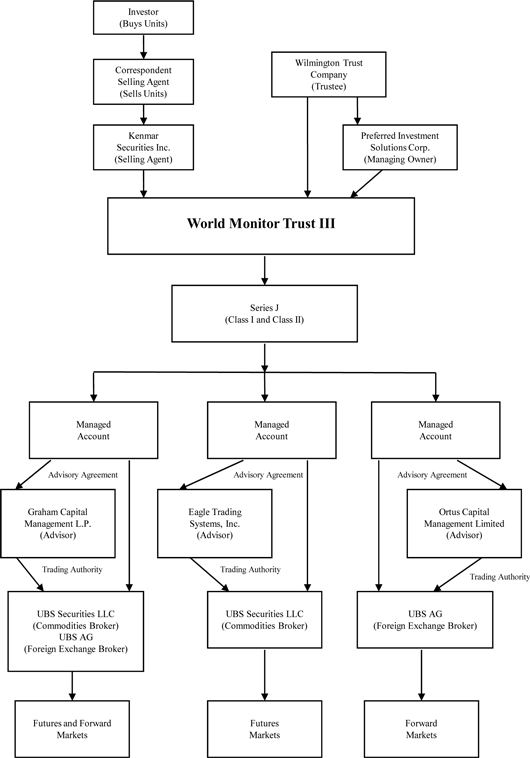

Series J has entered into managed account agreements with Advisors that manage the portion of the assets of Series J allocated to such Managed Account and make the trading decisions in respect of the assets of Series J allocated to such Managed Accounts.

Class I Units and Class II Units

• | Series J pays a Service Fee in respect of the Class I Units, monthly in arrears, equal to 1/12th of 2.00% (2.00% per annum) of the Net Asset Value per Unit of the outstanding Class I Units as of the beginning of the month. The Service Fee is paid directly by Series J to the Selling Agent. The Selling Agent is responsible for paying all service fees owing to the Correspondent Selling Agents. The Correspondent Selling Agents are entitled to receive from the Selling Agent an initial service fee equal to 2.00% of the initial Net Asset Value per Unit of each Class I Unit sold by them, payable on the date such Class I Units are purchased and, commencing with the thirteenth month after the purchase of a Class I Unit, an ongoing monthly service fee equal to 1/12th of 2.00% (2.00% per annum) of the Net Asset Value per Unit as of the beginning of the month of the Class I Units sold by them. In addition to the above Service Fee, Series J pays to the Selling Agent a Sales Commission, monthly in arrears, equal to 1/12th of 1.00% (1.00% per annum) of the Net Asset Value per Unit of the outstanding Class I Units as of the beginning of the month. |

| • | Class II Units may only be offered to investors who are represented by approved Correspondent Selling Agents who are directly compensated by the investor for services rendered in connection with an investment in Series J (such arrangements commonly referred to as “wrap-accounts”). Investors who purchase Class II Units of Series J are not charged any Service Fee. |

-1-

Table of Contents

SUMMARY (cont’d)

However, Series J pays to the Selling Agent a Sales Commission, monthly in arrears, equal to 1/12th of 1.00% (1.00% per annum) of the Net Asset Value per Unit of the outstanding Class II Units as of the beginning of the month.

Trading for Series J is directed by the following:

| • | Graham Capital Management, L.P., or Graham, pursuant to its Global Diversified at 150% Leverage program, which is a technical, systematic, global macro program. |

| • | Eagle Trading Systems Inc., or Eagle, pursuant to its Momentum Program, which is a technical, systematic global macro program. |

| • | Ortus Capital Management Limited and Ortus Capital Management (Cayman) Limited, collectively Ortus, pursuant to its Major Currency Program, which is a systematic currency program. |

(Through April 30, 2007, the portion of Series J’s assets allocated to Ortus were traded by Bridgewater Associates, Inc., or Bridgewater, pursuant to its Aggressive Pure Alpha Futures Only – A, No Benchmark Program, which is a fundamental, systematic, global macro program. Performance and other information relating to Series J through April 30, 2007 reflects the fact that Bridgewater, and not Ortus, directed a portion of Series J’s assets.)

The assets of Series J are allocated equally among each of Graham, Eagle and Ortus, and Series J rebalances its exposure quarterly to maintain an equal exposure to each of them. One-third of the assets of Series J are traded by each of Graham, Eagle and Ortus pursuant to the programs set forth above. We sometimes refer to Series J as the Balanced Series.

An investment in Series J Units of the Trust is speculative and involves a high degree of risk.

| • | The Trust and Series J have a limited operating history. Therefore, a potential investor has only a limited performance history to serve as a factor for evaluating an investment in the Trust and Series J. |

| • | The Managing Owner may select and allocate Series J’s assets to new trading advisors or different programs of the Advisors at any time. It is expected that Series J will at all times maintain an equal exposure (rebalanced quarterly) to each of the trading advisors who from time to time are responsible for managing the assets of Series J and making the trading decisions in respect of Series J’s assets. However, the Managing Owner is under no obligation to cause Series J to maintain such proportional exposures or quarterly rebalancing. Unitholders of the Trust are fully dependent upon the Managing Owner’s ability to select such trading advisors or programs. |

| • | Past performance is not necessarily indicative of future results; all or substantially all of an investment in a Series could be lost. |

| • | The trading of Series J is highly leveraged and takes place in very volatile markets. |

| • | Series J is subject to the fees and expenses described herein and will be successful only if significant profits are achieved. To break even, and prior to any applicable redemption charge, Series J must generate the below trading profits: |

| • | Series J, Class I: 6.90% |

| • | Series J, Class II: 4.50% |

• | There can be no assurance that Series J will achieve profits, significant or otherwise. Class I Units redeemed before the first anniversary of their sale will be subject to a redemption charge equal to the product of (i) the Net Asset Value per Unit on the redemption date of the Units being redeemed, multiplied by (ii) the number of months remaining before the first anniversary of the date such Units were purchased, multiplied by 1/12th of 2.00%. |

| • | Certain general types of market conditions — in particular, trendless periods without major price movements — significantly reduce the potential for certain Advisors to trade successfully. |

| • | The incentive fee to be paid to the Advisors may encourage the Advisors to take riskier or more speculative positions than they might otherwise. |

-2-

Table of Contents

SUMMARY (cont’d)

| • | Because Series J pays incentive fees to each of the Advisors who manage assets of Series J based upon the profitability of the trading of such Advisors individually, and not based upon the profitability of Series J as a whole, Series J could pay incentive fees to Advisors in respect of periods during which Series J, as a whole, was not profitable. |

| • | Certain conflicts of interest exist between the Managing Owner, the Advisors, the Clearing Broker, the Futures Broker and Executing Brokers, the Selling Agent, the Correspondent Selling Agents, and others and the Unitholders. These conflicts include allocation of the Managing Owner’s resources, other business activities of the Advisors, selection of executing brokers, execution of trades, the incentive fees, recommendations as to the purchase or sale of Units, proprietary trading and other clients of the Managing Owner and the Advisors and other conflicts. The Managing Owner has not established any formal procedure to resolve conflicts of interest. Consequently, investors will be dependent on the good faith of the respective parties subject to such conflicts to resolve them equitably. Although the Managing Owner attempts to monitor these conflicts, it is extremely difficult, if not impossible, for the Managing Owner to ensure that these conflicts do not, in fact, result in adverse consequences to a Series of the Trust. |

Wilmington Trust Company, or the Trustee, a Delaware banking corporation, is the Trust’s sole trustee. The Trustee delegated to the Managing Owner all of the power and authority to manage the business and affairs of the Trust and has only nominal duties and liabilities to the Trust.

Series J is a separate investment portfolio. Series J will trade under the management of each of three Advisors and will allocate its assets to such Advisors in equal proportions, rebalanced quarterly.

The Managing Owner has substantial experience in selecting and monitoring trading advisors, asset allocation and overall portfolio design using quantitative and qualitative methods. The Advisors trade entirely independently of each other, implementing proprietary strategies in the markets of their choice. Series J has access to global futures, forward (including interbank foreign currencies) and options trading with the ability rapidly to deploy and redeploy its capital across different sectors of the global economy.

In addition to selecting Advisors, the Managing Owner monitors the trading activity and performance of each Advisor and adjusts the overall leverage at which Series J trades. The commitment of Series J to its Advisor(s) may exceed 100% of such Series’ total equity if the Managing Owner decides to strategically allocate notional equity to such Advisor(s). This may result in increased profits or larger losses than would otherwise result. There likely will be periods in the markets during which it is unlikely that any Advisor will be profitable. By having the ability to leverage Series J’s market commitment to below its actual equity during such periods, the Managing Owner could help preserve capital while awaiting more favorable market cycles.

Under the Trust’s Declaration of Trust, Wilmington Trust Company, the Trustee, has delegated to the Managing Owner the exclusive management and control of all aspects of the business of each Series of the Trust. The Trustee has no duty or liability to supervise or monitor the performance of the Managing Owner, nor does the Trustee have any liability for the acts or omissions of the Managing Owner.

In addition to monitoring the trading and performance of the Advisors, the Managing Owner also performs ongoing due diligence with respect to the Advisors. If the Managing Owner determines that an Advisor has departed from its program or stated trading methodology or has exceeded its stated risk parameters, the Managing Owner, on behalf of the Trust, will take such actions as it deems appropriate which may include terminating such Advisor. Similarly, if the Managing Owner’s ongoing due diligence leads the Managing Owner to determine that it is in the best interests of the Trust to terminate an Advisor, it will do so. If the Managing Owner concludes, based upon its perception of market or economic conditions, that it is appropriate to allocate assets of Series J to a different trading program run by an Advisor, it will do so. The Managing Owner may select a replacement Advisor if any Advisor resigns or is terminated.

There can be no assurance that Series J will achieve its rate of return or diversification objective or avoid substantial losses. These pools have a limited performance history.

-3-

Table of Contents

SUMMARY (cont’d)

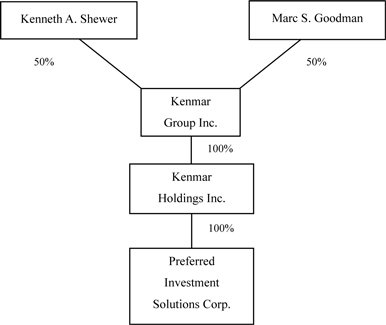

Preferred Investment Solutions Corp.

Preferred Investment Solutions Corp., a Delaware corporation, serves as Managing Owner of the Trust and each Series. The Managing Owner originally was formed in 1983 as a New York corporation and was formerly known as Kenmar Advisory Corp. Its predecessor and affiliates have been sponsoring and managing single- and multi-advisor funds for over two decades. As of February 29, 2008, the Managing Owner and its affiliates were acting as trading manager for commodity pools, funds of hedge funds and accounts with total capital (excluding “notional” funds) of approximately $4.2 billion of discretionary and non-discretionary assets, of which approximately $168.5 million was invested in commodity pools operated by the Managing Owner. Effective October 1, 2004, the Managing Owner assumed responsibility as the commodity pool operator and managing owner of nine (9) public commodity pools and four open-ended investment companies, which were exempted commodity pools in Ireland. Effective as of February 29, 2008, the Managing Owner serves as the commodity pool operator and managing owner of seven (7) public commodity pools (including Series J) and one open-ended investment company, which is an exempted commodity pool in Ireland.

The principal office of the Trust is c/o Preferred Investment Solutions Corp., 900 King Street, Suite 100, Rye Brook, New York 10573. The telephone number of the Trust and the Managing Owner is (914) 307-7000.

See “Performance of Commodity Pools Operated by the Managing Owner and its Affiliates” for the performance of other commodity pools managed by the Managing Owner and its affiliates.

The Advisors are all well-established in the managed futures and/or foreign exchange (FX) industry and have, in the past, demonstrated the ability to make substantial profits in a wide range of different market conditions. These Advisors, collectively, represent a range of technical, systematic, fundamental and discretionary methodologies, with extensive experience trading both proprietary and client capital. The Advisors were selected based upon the Managing Owner’s evaluation of each Advisor’s trading strategies, risk management, portfolio composition and past performance, as well as how each Advisor’s strategies, portfolio and performance complement and differ from those of the other Advisors. The Managing Owner is authorized to utilize the services of additional trading advisors for a Series or to employ additional trading programs of the Advisors, although the Managing Owner has no current intention to do so. The Managing Owner is authorized to allocate the assets of Series J unequally among the Advisors or to other trading advisors or other programs of the Advisors, although the Managing Owner has no current intention to do so. The Managing Owner invests 100% of the proceeds from the offering of Series J Units equally among the Managed Accounts, and the Advisor corresponding to each Managed Account apply all such proceeds for trading purposes. It is currently contemplated that 100% of additional capital raised on behalf of Series J will continue to be invested equally in the Managed Accounts. The Advisors are not affiliated with the Trust, the Trustee or the Managing Owner. If an Advisor’s trading reaches a level where certain position limits restrict its trading, that Advisor will modify its trading instructions for the Trust and its other accounts in a good faith effort to achieve an equitable treatment of all accounts. As of the date of this Prospectus, neither the Advisors nor any of their principals currently have any beneficial interest in the Trust, but some or all of such persons may acquire such an interest in the future.

UBS Securities LLC, or UBS Securities, serves as clearing broker to the Trust on behalf of Series J. In its capacity as clearing broker, UBS Securities executes and clears Series J’s futures, forward and options transactions and performs certain administrative services for the Trust on behalf of Series J.

The Selling Agent; The Correspondent Selling Agents

Kenmar Securities Inc., or the Selling Agent, a Delaware corporation and an affiliate of the Managing Owner, acts as a selling agent for the Trust. The Managing Owner and the Selling Agent intend to appoint certain other broker-dealers registered under the Securities Exchange Act of 1934, as amended, and members of the National Association of Securities Dealers, Inc., or the NASD, as additional selling agents, or Correspondent Selling Agents. The Selling Agent and the Correspondent Selling Agents use their “best efforts” to sell Units. This means that the Selling Agent and the Correspondent Selling Agents are not required to purchase any Units or sell any specific number or

-4-

Table of Contents

SUMMARY (cont’d)

dollar amount of Units but will use their best efforts to sell the Units offered.

Spectrum Global Fund Administration, L.L.C., or Spectrum, a Delaware limited liability company located at 33 West Monroe – Suite 1000, Chicago, IL, USA, 60603, is the administrator of the Trust and provides certain administration and accounting services pursuant to the terms of a Services Agreement with the Trust effective November 1, 2007.

Headquartered in Chicago, IL, Spectrum was founded in 1998, and currently services approximately 230 clients and US$27 billion in alternative investment assets across all strategies. Spectrum employs over 200 professionals, with offices in Columbus, Ohio; New York; and Cayman Islands. While smaller and less well known than other fund administrators, Spectrum utilizes superior internally-developed accounting systems, strong operational processes and controls, and the depth of managerial experience and knowledge.

Pursuant to the Services Agreement, Spectrum performs or supervises the performance of services necessary for the operation and administration of the Trust (other than making investment decisions), including administrative and accounting services. Spectrum also calculates Net Asset Value and the Net Asset Value per Unit.

The Services Agreement shall continue in force from launch for a period of eighteen months unless terminated on ninety (90) days’ prior written notice by either party to the other party. If not terminated, the Services Agreement will renew itself for successive one-year terms subject to re-negotiation of the terms of compensation and services.

The Services Agreement provides for indemnification of Spectrum and its directors, officers and employees from and against any and all liabilities, obligations, losses, damages, penalties, actions, judgments suits, costs, expenses or disbursements of any kind or nature whatsoever (other than those resulting from fraud, negligence or willful misconduct on its part or on the part of its directors, officers, servants or agents) which may be imposed on, incurred by or asserted against Spectrum in performing its obligations or duties under the Services Agreement.

The fees payable to Spectrum are referred to in Fees and Expenses below.

Although the Managing Owner has unlimited liability for any obligations of Series J that exceed Series J’s Net Assets, your investment in Series J is part of the assets of that Series, and it will therefore be subject to the risks of Series J’s trading. You cannot lose more than your investment in Series J, and you will not be subject to the losses or liabilities of Series J in which you have not invested. We have received an opinion of counsel that each Series will be entitled to the benefits of the limitation on inter-series liability under the Delaware Statutory Trust Act. Each Unit, when purchased in accordance with the Trust Declaration, shall, except as otherwise provided by law, be fully-paid and non-assessable.

The debts, liabilities, obligations, claims and expenses of Series J will be enforceable against the assets of that Series only, and not against the assets of the Trust generally or the assets of any other Series (if any), and, unless otherwise provided in the Trust Declaration, none of the debts, liabilities, obligations and expenses incurred, contracted for or otherwise existing with respect to the Trust generally or any other Series thereof will be enforceable against the assets of Series J.

An investment in the Trust is speculative and involves a high degree of risk. The Trust is not suitable for all investors. The Managing Owner offers the Trust as an opportunity to diversify an investor’s entire investment portfolio. The Trust also offers the potential for profit subject to commensurate risk and volatility. An investment in the Trust should only represent a limited portion of your overall portfolio. There can be no assurance that Series J will achieve its objective. To subscribe for Series J Units:

| • | You must have at a minimum (1) a net worth (exclusive of your home, home furnishings and automobiles) of at least $250,000 or (2) a net worth, similarly calculated, of at least $70,000 and an annual gross income of at least $70,000. A number of states impose on their residents substantially higher suitability standards than the minimums described above. Before |

-5-

Table of Contents

SUMMARY (cont’d)

investing, you should review the minimum suitability requirements for your state of residence, which are described in “State Suitability Requirements” in “Subscription Requirements” attached as Exhibit B to the Statement of Additional Information. These suitability requirements are, in each case, regulatory minimums only, and just because you meet such requirements does not mean that an investment in the Units is suitable for you; |

| • | You may not invest more than 10% of your net worth, exclusive of your home, furnishings and automobiles, in Series J; |

| • | Individual retirement accounts, or IRAs, Keogh and other employee benefit plans are subject to special suitability requirements and should not invest more than 10% of their assets in Series J. |

What You Must Understand Before You Subscribe

You should not subscribe for Series J Units unless you understand:

| • | the fundamental risks and possible financial losses of the investment; |

| • | the trading strategies to be followed in Series J; |

| • | the tax consequences of this investment; |

| • | the tax consequences of any decision to sell securities to subscribe for Units; |

| • | the fees and expenses to which you will be subject; and |

| • | your rights and obligations as a Unitholder. |

To subscribe for Series J Units: You will be required to complete and submit to the Trust a Subscription Agreement and Power of Attorney in the form of Exhibit C hereto. The Managing Owner in its sole discretion may, for good cause, waive notice deadlines for subscriptions.

Any subscription may be rejected in whole or in part by the Managing Owner for any reason or for no reason.

Your Minimum Subscription and Unit Pricing

Minimum required subscriptions and Unit prices are as follows:

| • | Your minimum initial subscription is $5,000, or, if you are a Benefit Plan Investor (including an IRA), your minimum initial subscription is $2,000; |

| • | Each Series’ Units are offered and sold at their month-end Net Asset Value, and existing Unitholders are able to purchase additional Units. The minimum price for an additional purchase is $2,000; and |

| • | If you are a resident of Texas and you are a Benefit Plan Investor, your minimum initial subscription is $5,000. |

Organizational and initial offering expenses have been paid by the Managing Owner, subject to reimbursement by the Trust, without interest, in 36 monthly payments during each of the first 36 months of the Trust’s operations;provided, however, that

| • | in no event shall the Managing Owner be entitled to reimbursement for such expenses in an aggregate amount in excess of 2.5% of the aggregate amount of all subscriptions accepted by the Trust during the initial offering period and the first 36 months of the Trust’s operations; and |

| • | in no event shall the amount of any payment in any month for reimbursement of such expenses, together with any similar payment in such month for reimbursement of offering expenses subsequently incurred, in the aggregate, exceed 0.50% per annum of the Net Asset Value of a Series as of the beginning of such month. |

If Series J terminates prior to completion of the foregoing reimbursement, or the full amount of such expenses has not been fully reimbursed by the end of such 36 month period, the Managing Owner will not be entitled to receive any further reimbursement in respect of such expenses and Series will have no

-6-

Table of Contents

SUMMARY (cont’d)

further obligation to make reimbursement payments in respect of such expenses.

Series J Units are offered as of the beginning of each month and will continue to be offered until the maximum amount of Series J Units that are registered are sold. The Managing Owner may suspend or terminate the offering of Series J Units at any time or extend the offering by registering additional Units.

Subscription Effective Dates; Transfer of Units

The effective date of all accepted subscriptions, whether you are a new subscriber to Series J or an existing Unitholder in Series J who is purchasing additional Units in that Series, is the first business day of the next month commencing five (5) Business Days after the day in which your Subscription Agreement is received by the Managing Owner on a timely basis by 10:00 AM New York City Time, or NYT. For example, for a subscription to be effective on Friday, August 1, 2008, your Subscription Agreement would have to be received by the Managing Owner on Friday, July 25, 2008 by 10:00 AM NYT. The Managing Owner may, in its sole discretion and for good cause, change such notice requirement upon written notice to you.

The Trust Declaration restricts the transferability and assignability of Series J Units. There is not now, nor is there expected to be, a primary or secondary trading market for Series J Units.

To redeem Units, Unitholders may contact their Correspondent Selling Agent (in writing if required by such Correspondent Selling Agent). Correspondent Selling Agents must notify the Managing Owner in writing in order to effectuate redemptions of the Units. A signature guarantee may be required by your Correspondent Selling Agent or the Managing Owner. However, a Unitholder who no longer has a Correspondent Selling Agent account must request redemption in writing (signature guaranteed unless waived by the Managing Owner) by corresponding with the Managing Owner.

A Unitholder may redeem any or all of his or her Units as of the close of business on the last Business Day of any calendar month — beginning with the end of the first month following such Unitholder’s purchase of such Units — at Net Asset Value, provided that the Request for Redemption is received by the Managing Owner by 10:00 AM New York time at 900 King Street, Suite 100, Rye Brook, New York 10573, at least five (5) Business Days prior to the end of such month excluding the last Business Day of the month. A redemption will be effective as of the close of business on the last Business Day of any calendar month. For example, if the last Business Day of the month is a Friday, notice must be received by the Managing Owner by 10:00 AM New York time on Friday of the immediately preceding week. The Managing Owner may, in its sole discretion and for good cause, waive notice deadlines for redemptions. Your minimum redemption request may be the lesser of either $1,000 or ten (10) Units; provided that, if you are redeeming less than all your Units, your remaining Units in Series J must have an aggregate Net Asset Value of at least $5,000. If you only redeem some of your Units and as a result, your account balances fall below the minimum investment amount (i.e., $5,000) you may be compulsorily redeemed at the Managing Owner’s sole discretion.

Segregated Accounts/Interest Income

Except for that portion of Series J’s assets used as margin to maintain that Series’ forward currency contract positions, the proceeds of the offering for Series J are deposited in cash in segregated accounts in the name of the Trust on behalf of Series J at the Clearing Broker or another eligible financial institution in accordance with CFTC segregation requirements. The Trust on behalf of Series J is credited with 100% of the interest earned on its average net assets on deposit with the Clearing Broker or such other financial institution each month. In an attempt to increase interest income earned, the Managing Owner also may invest non-margin assets in U.S. government securities (which include any security issued or guaranteed as to principal or interest by the United States), or any certificate of deposit for any of the foregoing, including U.S. treasury bonds, U.S. treasury bills and issues of agencies of the United States government, and certain cash items such as money market funds, certificates of deposit (under nine months) and time deposits or other instruments permitted by applicable rules and regulations. Currently, the rate of interest expected to be earned is estimated to be 1.15% per annum, although such interest income is variable based on short-term interest rates.

-7-

Table of Contents

SUMMARY (cont’d)

| Management Fee | Series J pays to the Managing Owner in arrears a monthly management fee equal to 1/12th of 0.50% (0.50% per annum) of the Net Asset Value of Series J as of the beginning of the month. | |

| Advisors’ Fees | Series J pays to Graham in arrears a monthly base fee equal to 1/12th of 2.50% (2.50% per annum) on portion of the assets of Series J under the management of Graham as of the end of the month. Series J pays to each of Eagle and Ortus in arrears a monthly base fee equal to 1/12th of 2.00% (2.00% per annum) on the portion of the assets of Series J under the management of such Advisors as of the end of the month. Each Series pays an incentive fee of 20% of “New High Net Trading Profits” generated by such Advisor, including realized and unrealized gains and losses thereon, as of the close of business on the last day of each calendar quarter. Series J pays such incentive fee separately with respect to each of its Advisors based on “New High Net Trading Profits” generated by such Advisor, regardless of the profitability of Series J as a whole. The incentive fees are paid quarterly in arrears. | |

| Sales Commission | Series J pays the Selling Agent a Sales Commission, monthly in arrears, equal to 1/12th of 1.00% (1.00% per annum) of the Net Asset Value per Unit of the outstanding Series J Units as of the beginning of each month. | |

| Brokerage Commissions and Fees | Series J pays to the Clearing Broker all brokerage commissions, including applicable exchange fees, NFA fees, give-up fees, pit brokerage fees and other transaction related fees and expenses charged in connection with Series J’s trading activities. On average, total charges paid to the Clearing Broker are expected to be less than $10.00 per round-turn trade, although the Clearing Broker’s brokerage commissions and trading fees will be determined on a contract-by-contract basis. The Managing Owner does not expect brokerage commissions and fees to exceed 1.50% of the Net Asset Value of Series J in any year. | |

| Extraordinary Fees and Expenses | Series J pays all its extraordinary fees and expenses, if any, and its allocable portion of all extraordinary fees and expenses of the Trust generally, if any, as determined by the Managing Owner. Such extraordinary fees and expenses, by their nature, are unpredictable in terms of timing and amount. Series J could conceivably be liable for such fees and expenses up to the entire amount of its net assets. | |

| Routine Operational, Administrative and Other Ordinary Expenses | Series J pays all of its routine operational, administrative and other ordinary expenses and its allocable share of all routine operational, administrative and other ordinary expenses of the Trust generally, as determined by the Managing Owner including, but not limited to, accounting and computer services, the fees and expenses of the Trustee, legal and accounting fees and expenses, tax preparation expenses, filing fees, printing, mailing and duplication costs. Such routine expenses are currently estimated to be 0.75% for Series J. The Managing Owner expects that as the Net Asset Value of Series J increases, the routine operational, administrative and other ordinary expenses of Series J will decline as a percentage of Series J’s Net Asset Value. | |

-8-

Table of Contents

SUMMARY (cont’d)

| Organization and Offering Expenses | Expenses incurred in connection with the organization of the Trust and the initial offering of Units were $1,454,441, of which $1,384,181 was allocated to Series J. Such organizational and initial offering expenses were paid by the Managing Owner, subject to reimbursement by the Trust, without interest, in 36 monthly payments during each of the first 36 months of the Trust’s operations;provided,however, that in no event shall the Managing Owner be entitled to reimbursement for such expenses in an aggregate amount in excess of 2.5% of the aggregate amount of all subscriptions accepted by the Trust during the initial offering period and the first 36 months of the Trust’s operations. If Series J terminates prior to completion of the foregoing reimbursement, or the full amount of such expenses has not been fully reimbursed by the end of such 36-month period, the Managing Owner will not be entitled to receive any further reimbursement in respect of such expenses from such Series. As of February 29, 2008, Series J has reimbursed the Managing Owner $735,896 for organization and initial offering expenses.

The Managing Owner also is responsible for the payment of all offering expenses of Series J incurred after the Initial Offering Period;provided,however, that the amount of such offering expenses paid by the Managing Owner shall be subject to reimbursement by Series J, without interest, in up to 36 monthly payments during each of the first 36 months following the month in which such expenses were paid by the Managing Owner. If Series J terminates prior to the completion of any such reimbursement, or the full amount of such expenses has not been fully reimbursed by the end of such 36-month period, the Managing Owner will not be entitled to receive any unreimbursed portion of such expenses outstanding as of the date of such termination. Through February 29, 2008, expenses incurred in connection with ongoing offering of Series J Units are $1,142,522, of which $1,085,360 has been allocated to Series J. Ongoing offering costs incurred through November 30, 2006 in the amount of $599,062 will not be reimbursed to the Managing Owner. Through February 29, 2008, no reimbursement has been paid to the Managing Owner for ongoing offering cost incurred for the period December 1, 2006 through February 29, 2008 in the amount of $486,298.

In no event will the aggregate amount of payments by Series J in any month in respect of reimbursement of organizational and offering expenses exceed 0.50% per annum of the Net Asset Value of Series J as of the beginning of such month. | |

| Service Fees | Class I

The Trust pays to the Selling Agent a Service Fee in respect of the Class I Units of Series J, monthly in arrears, equal to 1/12th of 2.00% (2.00% per annum) of the Net Asset Value per Unit of the outstanding Class I Units at the beginning of the month, for services provided to the Trust and its Unitholders. The Service Fee is compensation which remains payable with respect to the Class I Units for as long as such Units are outstanding.

Class II

Investors who purchase Class II Units are not charged any Service Fee in respect of such Class II Units. Class II Units may only be offered to investors who are represented by approved Correspondent Selling Agents who are directly compensated by the investor for services rendered in connection with an investment in the Trust (such arrangements commonly referred to as “wrap-accounts”). | |

-9-

Table of Contents

SUMMARY (cont’d)

| Redemption Charge | There is no redemption charge in respect of Class II Units.

A Class I Unitholder who redeems a Class I Unit prior to the first anniversary of the purchase of such Unit will be subject to a redemption charge in an amount equal to the product of (i) the Net Asset Value per Unit on the redemption date of the Units being redeemed, multiplied by (ii) the number of months remaining before the first anniversary of the date such Units were purchased, multiplied by (iii) 1/12th of 2.00%. Redemption charges do not reduce Net Asset Value or New High Net Trading Profit for any purpose, only the amount that Unitholders receive upon redemption.

In the event that an investor acquires Series J Units at more than one closing date, the redemption charge will be calculated on a “first-in, first-out” basis for redemption purposes (including determining the amount of any applicable redemption charge). |

[Remainder of page left blank intentionally.]

-10-

Table of Contents

SUMMARY (cont’d)

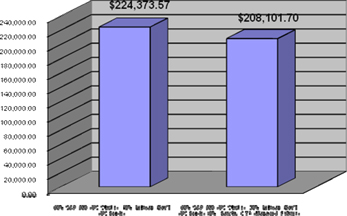

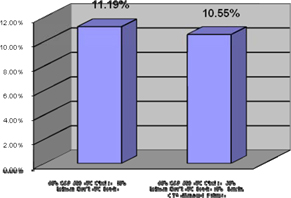

The following summary displays the estimated amount of all fees and expenses that are anticipated to be incurred by a new investor in each Class of Series J during the first twelve months. In each case, the total estimated cost and expense load is expressed as a percentage of $5,000, the amount of minimum investment in the Trust (other than IRAs or Benefit Plan Investors).

Series J, Class I: 6.90% (or $344.77 for each $5,000 invested); and

Series J, Class II: 4.50% (or $224.77 for each $5,000 invested).

The Managing Owner will make distributions to you at its discretion. Because the Managing Owner does not presently intend to make ongoing distributions, your income tax liability for the profits of Series J Units in which you have invested will, in all likelihood, exceed any distributions you receive from Series J.

The Trust’s fiscal year ends on December 31 on each year.

Audited financial statements for Series J as of and for the year ended December 31, 2007 is included in the Statement of Additional Information included with this Prospectus beginning on page F-1.

See the “Glossary of Defined Terms” on page GL-1 for page references to certain key terms used in this Prospectus and the Statement of Additional Information.

In the opinion of counsel, Series J of the Trust will be classified as a partnership for federal income tax purposes and, based on the type of income expected to be earned by Series J, will not be treated as a “publicly traded partnership” taxable as a corporation. Unitholders of Series J will pay tax each year on their allocable share of Series J’s taxable income, if any, whether or not they receive any distributions from Series J or redeem any Units. Substantially all of the trading gains and losses of Series J will be treated as capital gains or losses for tax purposes; interest income received by Series J will be treated as ordinary income.

The “Breakeven Table” on the following page indicates the approximate percentage and dollar returns required for the redemption value of an initial $5,000 investment in the Series J Units to equal the amount originally invested twelve (12) months after issuance.

The “Breakeven Table,” as presented, is an approximation only. The capitalization of Series J of the Trust does not directly affect the level of its charges as a percentage of Net Asset Value, other than (i) Administrative Expenses, (ii) Organizational and Offering Expenses (which are assumed for purposes of the “Breakeven Table” to equal the maximum permissible percentage of Series J’s average beginning of month Net Asset Value), and (iii) Brokerage Commissions.

[Remainder of page left blank intentionally.]

-11-

Table of Contents

SUMMARY (cont’d)

“Breakeven Table”

| Series J10 Class I | Series J10 Class II | |||||||||||||

Expense1 | $ | % | $ | % | ||||||||||

Managing Owner Management Fee | $ | 25 | 0.50 | % | $ | 25 | 0.50 | % | ||||||

Advisor’s Base Fee | $ | 108 | 2.17 | % | $ | 108 | 2.17 | % | ||||||

Advisor’s Incentive Fee3 | $ | 45 | 0.90 | % | $ | 25 | 0.50 | % | ||||||

Service Fee Reimbursement4 | $ | 100 | 2.00 | % | N/A | N/A | ||||||||

Sales Commission5 | $ | 50 | 1.00 | % | $ | 50 | 1.00 | % | ||||||

Administrative Expense6 | $ | 37 | 0.75 | % | $ | 37 | 0.75 | % | ||||||

Organization and Offering Expense Reimbursement7 | $ | 25 | 0.50 | % | $ | 25 | 0.50 | % | ||||||

Brokerage Commissions8 | $ | 11 | 0.23 | % | $ | 11 | 0.23 | % | ||||||

Interest Income9 | $ | (58 | ) | (1.15 | )% | $ | (58 | ) | (1.15 | )% | ||||

12-Month Break Even | $ | 345 | 6.90 | % | $ | 225 | 4.50 | % | ||||||

| 1. | The foregoing breakeven analysis assumes that the Units have a constant month-end Net Asset Value. Calculations are based on $5,000 as the Net Asset Value per Unit. See “Charges” beginning on page 78 for an explanation of the expenses included in the “Breakeven Table.” |

| 2. | Class II Units may be offered and sold only to investors who are represented by approved Correspondent Selling Agents who are directly compensated by the investor for services rendered in connection with an investment in the Trust (such arrangements commonly referred to as “wrap-accounts”). Class II Unitholders are not charged any Service Fee. |

| 3. | Based on assumptions herein, the Advisor’s Incentive Fee is 0.90% for Class I and 0.50% for Class II. |

4. | Investors who redeem all or a portion of their Class I Units of Series J before the first anniversary of the purchase of such Units will be subject to a redemption charge (which amount is reflected in this Service Fee item) in an amount equal to the product of (i) the Net Asset Value per Unit on the redemption date of the Units being redeemed, multiplied by (ii) the number of months remaining before the first anniversary of the date such Units were purchased, multiplied by (iii) 1/12th of 2.00%. |

5. | Each Unit purchased pays to Kenmar Securities Inc. in arrears a monthly Sales Commission equal to 1/12th of 1.00% (1.00% per annum) of the Net Asset Value of the outstanding Units as of the beginning of the month. |

| 6. | Administrative expenses are currently estimated to be 0.75%. Actual expenses may be higher or lower. The Managing Owner expects that as the Net Asset Value of Series J increases, the administrative expenses of Series J will decline as a percentage of Series J’s Net Asset Value. |

| 7. | Expense levels are assumed to be at maximum amount. Actual expenses may be lower. |

| 8. | Although the actual rates of brokerage commissions and transaction related fees and expenses are the same for all Advisors, the total amount of brokerage commissions and trading fees varies from Advisor to Advisor based upon the trading frequency of the Advisors and the specific futures contracts traded. The estimates presented in the table above are prepared using historical data about the Advisors’ trading activities. |

| 9. | Interest income is currently estimated to be earned at a rate of 1.15%, although such interest income is variable based on short-term interest rates. |

| 10. | For purposes of this breakeven analysis, we have assumed (i) that the Advisors will have identical performance and identical incentive fees, (ii) that the Advisors will generate a weighted average rate of brokerage commissions and other expenses equal to 0.23%, and (iii) a weighted average Advisor’s base fee of 2.17%. In actuality, the Advisors’ performance and incentive fees will be divergent among the Advisors, the Advisors will generate a weighted average rate of brokerage commissions and other expenses which could be higher or lower than 0.23% and, because Advisors’ base fees are assessed monthly while Series J will rebalance quarterly, weighted average Advisors’ base fees could be higher or lower than 2.17%. |

-12-

Table of Contents

SUMMARY (cont’d)

As of the end of each month and as of the end of each Fiscal Year, the Managing Owner will furnish you with those reports required by the CFTC and the National Futures Association, or the NFA, including, but not limited to, an annual audited financial statement certified by independent public accountants and any other reports required by any other governmental authority, such as the SEC, that has jurisdiction over the activities of the Trust. You also will be provided with appropriate information to permit you to file your Federal and state income tax returns with respect to your Units.

Cautionary Note Regarding Forward-Looking Statements

This Prospectus includes forward-looking statements within the meaning of the safe harbor from civil liability provided for such statements by the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934) that reflect the Managing Owner’s current expectations about the future results, performance, prospects and opportunities of the Trust. The Managing Owner has tried to identify these forward-looking statements by using words such as “may,” “will,” “expect,” “anticipate,” “believe,” “intend,” “should,” “estimate” or the negative of those terms or similar expressions. These forward-looking statements are based on information currently available to the Managing Owner and are subject to a number of risks, uncertainties and other factors, both known, such as those described in “The Risks You Face” and elsewhere in this Prospectus, and unknown, that could cause the Trust’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements.

You should not place undue reliance on any forward-looking statements. Except as expressly required by the federal securities laws, the Managing Owner undertakes no obligation to publicly update or revise any forward-looking statements or the risks, uncertainties or other factors described in this Prospectus, as a result of new information, future events or changed circumstances or for any other reason after the date of this Prospectus.

THE UNITS ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK.

[Remainder of page left blank intentionally.]

-13-

Table of Contents

WORLD MONITOR TRUST III ORGANIZATIONAL CHART

-14-

Table of Contents

This section includes the principal risk that you will face with an investment in Series J.

| (1) | You Should Not Rely on Past Performance in Deciding Whether to Buy Units |

Each Advisor selected by the Managing Owner to manage the assets of Series J has a performance history through the date of its selection. You must consider, however, the uncertain significance of past performance, and you should not rely on the Advisors’ or the Managing Owner’s records to date for predictive purposes. You should not assume that any Advisor’s future trading decisions will create profit, avoid substantial losses or result in performance for Series J that is comparable to that Advisor’s or to the Managing Owner’s past performance. In fact, as a significant amount of academic study has shown, futures funds more frequently than not under-perform the past performance records included in their prospectuses.

Because you and other investors will acquire, exchange and redeem Units at different times, you may experience a loss on your Units even though Series J as a whole is profitable and even though other investors in Series J experience a profit. The past performance of Series J may not be representative of your investment experience in it.

The assets of Series J are:

| • | segregated from the assets of other Series (if any); and |

| • | valued and accounted for separately from any other Series. |

Consequently, the past performance of Series J has no bearing on the past performance of any other Series.

The Trust has a limited operating history upon which to evaluate your investment in Series J. Although past performance is not necessarily indicative of future results, if the Trust had a material amount of performance history, such performance history might provide you with more information on which to evaluate an investment in the Trust. Because the Trust has no material performance history, you will have to make your decision to invest in Series J without such information.

| (2) | Price Volatility May Possibly Cause the Total Loss of Your Investment |

Futures and forward contracts have a high degree of price variability and are subject to occasional rapid and substantial changes. Consequently, you could lose all or substantially all of your investment in a Series of the Trust.

| (3) | Speculative and Volatile Markets Combined With Highly Leveraged Trading May Cause the Trust to Incur Substantial Losses |

The markets in which Series J trades are speculative, highly leveraged and involve a high degree of risk. Each Advisor’s trading considered individually involves a significant risk of incurring large losses, and there can be no assurance that Series J will not incur such losses.

Futures and forward prices are volatile. Volatility increases risk, particularly when trading with leverage. Trading on a highly leveraged basis, as does Series J, even in stable markets involves risk; doing so in volatile markets necessarily involves a substantial risk of sudden, significant losses. Due to such leverage, even a small movement in price could cause large losses for the Trust. Market volatility will increase the potential for large losses.Market volatility and leverage mean that Series J could incur substantial losses, potentially impairing its equity base and ability to achieve its long-term profit objectives even if favorable market conditions subsequently develop.

In addition to the leveraged trading described above, the Managing Owner has the ability to further increase the leverage of Series J by allocating notional equity to one or more of its Advisors (in a maximum amount of up to 20% of Series J’s Net Asset Value), which would then permit such Advisor(s) to trade the account of Series J as if more equity were committed to such accounts than is, in fact, the case. Although the Managing Owner has the option to allocate additional notional equity to an Advisor, the Managing Owner has no current plans to do so.

| (4) | Fees and Commissions are Charged Regardless of Profitability and May Result in Depletion of Trust Assets |

Series J is subject to the fees and expenses described herein which are payable irrespective of profitability in addition to performance fees which

-15-

Table of Contents

are payable to each Advisor based on such Advisor’s profitability and not on the profitability of Series J as a whole. Such fees and expenses include asset-based fees of up to 6.17% per annum for Class I Unitholders and up to 4.17% per annum for Class II Unitholders as well as incentive fees equal to 20% of net profits on a cumulative high water mark basis. Included in these charges are brokerage fees and operating expenses. On Series J’s forward trading, “bid-ask” spreads are incorporated into the pricing of Series J’s forward contracts by its counterparties in addition to the brokerage fees paid by Series J. It is not possible to quantify the “bid-ask” spreads paid by Series J because Series J cannot determine the profit its counterparty is making on the forward trades into which it enters. Consequently, the expenses of Series J could, over time, result in significant losses to your investment therein. You may never achieve profits, significant or otherwise.

| (5) | Market Conditions May Impair Profitability |

The trading systems used by certain Advisors are technical, trend-following methods. The profitability of trading under these systems depends on, among other things, the occurrence of significant price trends which are sustained movements, up or down, in futures and forward prices. Such trends may not develop; there have been periods in the past without price trends.The likelihood of the Units being profitable could be materially diminished during periods when events external to the markets themselves have an important impact on prices. During such periods, Advisors’ historic price analysis could establish positions on the wrong side of the price movements caused by such events.

Graham and Eagle employ technical programs.

| (6) | Discretionary Trading Strategies May Incur Substantial Losses |

Discretionary traders, while they may utilize market charts, computer programs and compilations of quantifiable fundamental information to assist them in making trading decisions, make such decisions on the basis of their own judgment and “trading instinct,” not on the basis of trading signals generated by any program or model. Such traders may be more prone to subjective judgments that may have greater potentially adverse effects on their performance than systematic traders, which emphasize eliminating the effects of “emotionalism” on their trading. Reliance on trading judgment may, over time, produce less consistent trading results than implementing a systematic approach. Discretionary traders, like trend-following traders, are unlikely to be profitable unless major price movements occur. Discretionary traders are highly unpredictable, and can incur substantial losses even in apparently favorable markets.

As of the date of this Prospectus, none of the Advisors are employing discretionary strategies on behalf of Series J, although each Advisor reserves the right to make discretionary decisions.

| (7) | Systematic Trading Strategies May Incur Substantial Losses |

A systematic trader will generally rely to some degree on judgmental decisions concerning, for example, what markets to follow and commodities to trade, when to liquidate a position in a contract which is about to expire and how large a position to take in a particular commodity. Although these judgmental decisions may have a substantial effect on a systematic trader’s performance, such trader’s primary reliance is on trading programs or models that generate trading signals. The systems utilized to generate trading signals are changed from time to time (although generally infrequently), but the trading instructions generated by the systems being used are followed without significant additional analysis or interpretation. Therefore, systematic trading may incur substantial losses by failing to capitalize on market trends that their systems would otherwise have exploited by applying their generally mechanical trading systems by judgmental decisions of employees. Furthermore, any trading system or trader may suffer substantial losses by misjudging the market. Systematic traders tend to rely on computerized programs, and some consider the prospect of disciplined trading, which largely removes the emotion of the individual trader from the trading process, advantageous. Due to their reliance upon computers, systematic traders are generally able to incorporate a significant amount of data into a particular trading decision. However, when fundamental factors dominate the market, trading systems may suffer rapid and severe losses due to their inability to respond to such factors until such factors have had a sufficient effect on the market to create a trend of enough magnitude to generate a reversal of trading signals, by which time a precipitous price change may already be in progress, preventing liquidation at anything but substantial losses.

The programs utilized by Graham Eagle and Ortus are systematic trading strategies.

-16-

Table of Contents

| (8) | Decisions Based Upon Fundamental Analysis May Not Result in Profitable Trading |

Traders that utilize fundamental trading strategies attempt to examine factors external to the trading market that affect the supply and demand for a particular futures and forward contracts in order to predict future prices. Such analysis may not result in profitable trading because the analyst may not have knowledge of all factors affecting supply and demand, prices may often be affected by unrelated factors, and purely fundamental analysis may not enable the trader to determine quickly that previous trading decisions were incorrect. In addition, because of the breadth of fundamental data that exists, a fundamental trader may not be able to follow developments in all such data, but instead may specialize in analyzing a narrow set of data, requiring trading in fewer markets. Consequently, a fundamental trader may have less flexibility in adverse markets to trade other futures and forward markets than traders that do not limit the number of markets traded as a result of a specialized focus.

Ortus utilizes trading strategies that incorporate fundamental data on behalf of its program.

| (9) | Increase in Assets Under Management May Affect Trading Decisions |

Many of the Advisors’ current equity under management is at or near its all-time high. As of February 29, 2008 Graham, Eagle and Ortus each managed approximately $5.2 billion, $2.5 billion and $1.8 billion, respectively. Graham and Ortus are near their all time high with respect to assets under management. The more equity an Advisor manages, the more difficult it may be for that Advisor to trade profitably because of the difficulty of trading larger positions without adversely affecting prices and performance. Accordingly, such increases in equity under management may require one or more of the Advisors to modify trading decisions for Series J that could have a detrimental effect on your investment.

| (10) | You Cannot be Assured of the Advisors’ Continued Services Which May Be Detrimental to the Trust |

You cannot be assured that any Advisor will be willing or able to continue to provide advisory services to Series J for any length of time. There is severe competition for the services of qualified trading advisors, and Series J may not be able to retain satisfactory replacement or additional trading advisors on acceptable terms or a current Advisor may require Series J to pay higher fees in order to be able to retain such Advisor. The Managing Owner may either terminate an Advisor upon 30 days’ prior written notice, or upon shorter notice, if for cause. Each Advisor has the right to terminate the Advisory Agreement in its discretion at any time for cause.

| (11) | Limited Ability to Liquidate Your Investment |

There is no secondary market for the Units. While the Units have redemption, there are restrictions, and possible fees assessed. For example, Units may be redeemed only as of the close of business on the last Business Day of a calendar month provided a Request for Redemption is received at least five (5) Business Days prior to the end of such month excluding the last Business Day of the month. In addition, Units of Class I may be subject to redemption charges if redeemed prior to the first anniversary of their issuance in an amount equal to the product of (i) the Net Asset Value per Unit on the redemption date of the Units being redeemed, multiplied by (ii) the number of months remaining before the first anniversary of the date such Units were purchased, multiplied by (iii) 1/12th of 2.00%.

Transfers of Units are subject to limitations, such as thirty (30) days’ advance notice of any intent to transfer. Also, the Managing Owner may deny a request to transfer if it determines that the transfer may result in adverse legal or tax consequences for the Trust or Series J.

| (12) | Possible Illiquid Markets May Exacerbate Losses |

Futures and forward positions cannot always be liquidated at the desired price. It is difficult to execute a trade at a specific price when there is a relatively small volume of buy and sell orders in a market. A market disruption, such as when foreign governments may take or be subject to political actions which disrupt the markets in their currency or major exports, can also make it difficult to liquidate a position. Periods of illiquidity have accrued from time-to-time in the past, such as in connection with Russia’s default on its sovereign debt in 1998. Such periods of illiquidity and the events that trigger them are difficult to predict and there can be no assurance that any Advisor will be able to do so.

There can be no assurance that market illiquidity will not cause losses for a Series of the

-17-

Table of Contents

Trust. The large size of the positions which an Advisor is expected to acquire for Series J increases the risk of illiquidity by both making its positions more difficult to liquidate and increasing the losses incurred while trying to do so.

Generally, Eagle has not historically allocated more than 10% of its assets under management pursuant to its Eagle Momentum Program to over-the-counter instruments. Graham allocates 100% of the assets allocated to it for foreign exchange trading to over-the-counter instruments. Ortus expects to allocate 100% of the assets allocated to it to over-the-counter instruments. The risk of loss due to potentially illiquid markets is more acute in respect of over-the-counter instruments than in respect of exchange-traded instruments because the performance of those contracts is not guaranteed by an exchange or clearinghouse and the Series will be at risk to the ability of the counterparty to the instrument to perform its obligations thereunder. Because these markets are not regulated, there are no specific standards or regulatory supervision of trade pricing and other trading activities that occur in those markets.

| (13) | Because Series J Does Not Acquires Any Asset with Intrinsic Value, the Positive Performance of Your Investment Is Wholly Dependent Upon an Equal and Offsetting Loss |

Futures and forward trading is a risk transfer economic activity. For every gain there is an equal and offsetting loss rather than an opportunity to participate over time in general economic growth. Unlike most alternative investments, an investment in Series J does not involve acquiring any asset with intrinsic value. Overall stock and bond prices could rise significantly and the economy as a whole prospers while Series J trades unprofitably.

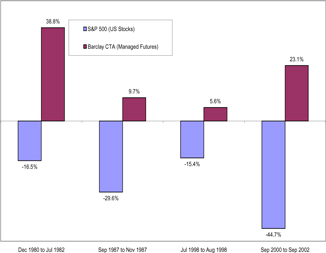

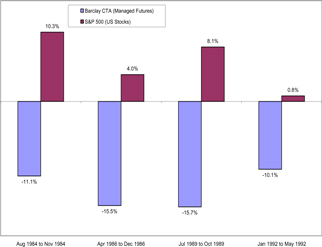

| (14) | Failure of Futures and Foreign Exchange Trading to be Non-Correlated to General Financial Markets Will Eliminate Benefits of Diversification |

Historically, managed futures and foreign exchange generally have been non-correlated to the performance of other asset classes such as stocks and bonds. Non-correlation means that there is no statistically valid relationship between the past performance of futures and forward contracts on the one hand and stocks or bonds on the other hand. Non-correlation should not be confused with negative correlation, where the performance would be exactly opposite between two asset classes. Because of this non-correlation, Series J can be expected to be automatically profitable during unfavorable periods for the stock market, orvice-versa. The futures and forward markets are fundamentally different from the securities markets in that for every gain in futures and forward trading, there is an equal and offsetting loss. If Series J does not perform in a manner non-correlated with the general financial markets or does not perform successfully, you will obtain no diversification benefits by investing in the Units and Series J may have no gains to offset your losses from other investments.

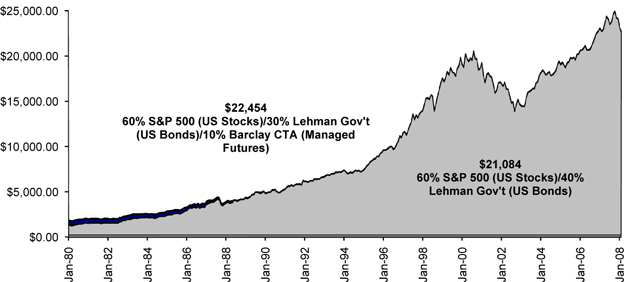

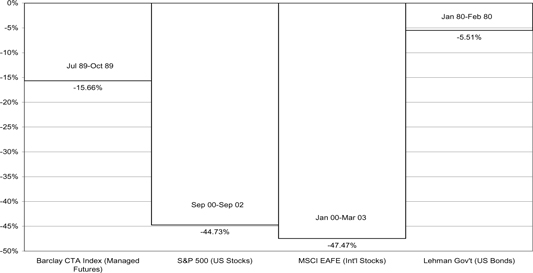

| (15) | Broad Indices May Perform Quite Differently From Individual Investments |

In the discussion under “Investment Factors,” the concepts of overall portfolio diversification and non-correlation of asset classes are discussed and illustrated by the use of a generally accepted index that represents each asset category. Stocks are represented by the S&P 500 Index and MSCI EAFE Index; bonds are represented by the Lehman Long-Term Government Bond Index; futures funds are represented by the Barclay CTA Index, and currencies are represented by the Barclay Currency Index. Because each index is a dollar-weighted average of the returns of multiple underlying investments, the overall index return and risk may be quite different from the return of any individual investment. For example, the “Barclay CTA Index” is an unweighted index that attempts to measure the performance of the CTA industry. The Index measures the combined performance of all CTAs that have more than four years of past performance. For purposes of calculating the Index, the first four years of a CTA’s performance history is ignored. Accordingly, such index reflects the volatility and risk of loss characteristics of a very broadly diversified universe of advisors and not of a single fund or advisor. Therefore, the performance of Series J will be different than that of the Barclay CTA Index and the Barclay Currency Index.

| (16) | Advisors Trading Independently of Each Other May Reduce Profit Potential and Insurance Risks Through Offsetting Positions |

The Advisors trade entirely independently of each other. Two Advisors may, from time to time, take opposite positions, eliminating any possibility that an investor that holds Units in Series J may profit from these positions considered as a whole but incurring the usual expenses associated with taking

-18-

Table of Contents

such positions. The Advisors’ programs may, at times, be similar to one another thereby negating the benefits of investing in more than one Advisor by purchasing Units of Series J, which may, in fact, increase risk. Two or more Advisors may compete with each other to acquire the same position, thereby increasing the costs incurred by each of them to take such position. It is also possible that two or more Advisors, although trading independently, could experience drawdowns at the same time, thereby negating the potential benefit associated with exposure to more than one Advisor and more than one program. Series J’s multi-advisor structure will not necessarily control the risk of speculative futures or forward trading. Multi-advisor funds may have significant volatility and risk despite being relatively diversified among trading advisors.