Exhibit 3.1

\

\

AMENDED AND RESTATED ARTICLES OF INCORPORATION. OF AVALON DEVELOPMENT ENTERPRISES, INC. A Florida Corporation Charles P. Godels certifies that: - l ,..,, r j; - ,( r f) . r - n :;:,,::o = ·c:,::I"" \ n :i:, - ...... U) I (/)"; <11 r" - "Tl r rn mo Cl = - n - T ƒ i , - u; - .. o : - : l :; ,:: - Or< ƒ • - 1 :;:,, 1. Charles P. Godels is the duly elected and acting President and duly elected and acting Secretary of the corporation herein above named. 2. The Articles of Incorporation of the corporation shall be amended and restated to read in full as follows: ARTICLE I. The name of the corporation shall be Avalon Development Enterprises, Inc. and shall be governed by Title XXXVI Chapter 607 of the Florida Statutes. ARTICLE II. The nature of the business of the corporation shall be to engage in any lawful activity permitted by the laws of the State of Florida, and desirable to support the continued existence of the corporation. ARTICLE ill. The total authorized capital stock of the corporation shall be Seventy - Five million (75,000,000) shares of $.0l par value common stock, all or any part of which capital stock may be paid for in cash, in property or in labor and services at a fair valuation to be fixed by the Board of Directors. Such stock may be issued from time to time without any action by the stockholders for such consideration as may be fixed from time to time by the Board of Directors, and shares so issued, the full consideration for which has been paid or delivered shall be deemed the fully paid up stock, and the holder of such shares shall not be liable for any further payment thereof. Each share of stock shall have voting privileges and will be eligible for dividends. ARTICLE IV. The amount of capital with which this corporation shall commence shall be One Hundred Dollars and NO/!00 ($200.00). Page - 1 -

ARTICLEV. The corporation shall have perpetual existence. ARTICLE VI. The principal place of business of this corporation shall be: 770 First Avenue North St. Petersburg, Florida 33701 Located in Pinellas County, Florida. The corporation shall have the power to establish other offices both within and without the State of Florida. The registered agent and the office of the resident agent shall be as follows: Charles P. Godels: 770 First Avenue North, St. Petersburg, Florida 33701. ARTICLE Vil. The governing board of this corporation shall be known as Directors, which shall consist of not less than one (]) Director and not more than fifteen (15) directors and the number of directors may from time to time be increased or decreased in such manner as shall be provided by the By - Laws of this corporation, provided that the number of directors shall not be reduced to less than one (1) Director. The election of directors shall be on an annual basis. Each of the said Directors shall be of full and legal age. A quorum for the transaction of business shall be a simple majority of the Directors so qualified and present at a meeting. Meetings of the Board of Directors may be held within or without the State of Florida and members of the Board of Directors need not be stockholders. ARTICLE VIII. The names and post office addresses of the Board of Directors of the corporation are: Charles P. Godels: 770 First Avenue North, St. Petersburg, Florida 33701 Madanna Yovino: 6103 Zelma Road, Lutz, Florida 35558 Laura L. Larsen: 7524 17 th Lane N., St. Petersburg, Florida 33702 Michael T. Jones: 135 Laughing Gull Lane, Palm Harbor, Florida 34683 David E. Dunn: 329 Allenview Drive, Mechanicsburg, Pennsylvania 17055 ARTICLE IX. The names and post office addresses of the Officers, subject to this Charter and the By - Laws of the corporation and the laws of the State of Florida, shall hold office for the first year of business Page - 2 -

or until removal, resignation or an election is held by the Board of Directors for the election of the officers and or the successors have been duly elected and qualified are: Charles P. Godels: 770 First Avenue North, St. Petersburg, Florida 33701 Madanna Yovino: 6103 Zelma Road, Lutz, Florida 35558 Laura L. Larsen: 7524 17 th Lane N., St. Petersburg, Florida 33702 Laura L. Larsen: 7524 17 th Lane N., St. Petersburg, Florida 33702 David E. Dunn: 329 Allenview Drive, Mechanicsburg, Pennsylvania 17055 ARTICLEX. The names and post office addresses of the subscribers to these Articles of Incorporation are: Charles P. Godels; 770 First Avenue North, St. Petersburg, Florida 33701. Madanna Yovino; 6103 Zelma Road, Lutz, Florida 35558 Laura L. Larsen; 7524 17 th Lane N., St. Pekrsburg, Florida 33702 Laura L Larsen: 7524 17 th Lane N., St. Petersburg, Florida 33702 David E. Dunn: 329 Allenview Drive, Mechanicsburg, Pennsylvania 17055 ARTICLE XI. It is specified that the date when the corporate existence of the corporation shall commence is the date of filing by the Secretary of State of these Articles of Incorporation. The undersigned, being the original incorporator hereinbefore named, for the purpose of forming a corporation to do business both within and without the State of Florida, and in pursuance of the general corporation law of the State of Florida, does make and file this certificate, hereby declaring and certifying the facts hereinabove stated are true, and accordingly has hereunto set his hand this 1st day of December 1, 2005. I further declare under penalty of perjury under the laws of the State of Florida that the maters set forth in this Amended and Restated Articles of Incorporation are true and correct to the best of my knowledge. · / , h . odels, C a Board DONE and DATED this 1st day of December, 2005. Page - 3 -

STATE OF FLORIDA ) ) ss COUNTY OF PINELLAS ) On this 1st Day of December, 2005, personally appeared before me, a Notary Public in and for said County and State, Charles P. Godels, President of Avalon Development Enterprises, Inc.,who proved to be the above named officer and acknowledged that he executed the above instrument freely and voluntarily for the uses and purposes therein mentioned for, and on behalf of said corporation and under its corporate seal. SUBSCRIBED and SWORN to before me this 1st Day of December, 2005. NOTARY, UBLIC, i County and State. VERA N. REBHOU MY COMMlSSION # DD - 4 EXPIRES: October 4, 2008 i!oodedThnJ Notaty Pibllc lfndlnwlttrs STATE OF FI.:ORIDA ) ) ss COUNTY OF PINELLAS ) On this 1st Day of December, 2005, personally appeared before me, a Notary Public in and for said County and State, Laura L. Larsen, Secretary of Avalon Development Enterprises, Inc.,who proved to be the above named officer and acknowledged that she executed the above instrument freely and voluntarily for the uses and purposes therein mentioned for, and on behalf of said corporation and under its corporate seal. SUBSCRIBED and SWORN to before me this 1st Day of December, 2005. ' - -- d_ d. · BLIC, in County and State. VERA N.REBHO!..Z MY COMMISSION IOO:J.1489.1 EXPIRES: Oc!ober 4, 2008 Sondei::ITiuuNtf.arjPl.lb!k.Undtr.vrtlan Page - 4 -

SPECIAL MEETING OFTHE BOARD OF DIRECTORS OF AVALON DEVELOPMENT CORPORATION The undersigned, constituting the members of the Board of Directors of Avalon Development Corporation, a Florida corporation (the "Corporation"), pursuant to Sections 607 . 0702 (l)(a)( 4 )(b) I, 2 , 3 and 607 . 0706 of the Florida Statutes, Title XXXVI, Section 607 Corporations, hereby convene this special meeting ofthe Board of Directors at 770 First Avenue North, St . Petersburg, Florida 33701 on this 1 day of December, 2005 to discuss the recapitalization of the authorized shares and the par value of the stock of the corporation . Notice of this meeting has been waived and a copy of said waiver shall be attached to these minutes and placed in the corporate minute book . Each shareholder has been authorized to attend in person or by electronic means such as telephone . WHEREAS, the current Board of Directors believes it is in the best interest of the Corporation to move the corporation forward from a small service corporation toan operational company. To accomplish this goal the company is proposing a capital stock reorganization. This will include the changing of the par value of the corporation's stock to a par value of $0.01 per share from its present value of $ I.00 The Board of Directors is proposing increasing the authorized capital stock to 75,000,000 shares of common stock at the same time. After discussing the proposed stock recapitalization the following resolutions have been adopted after appropriate motions were duly made and seconded. BE IT RESOLVED, that in a change in the authorized capital stock to 75,000,000 shares be, and the same hereby is approved. IT IS FlJRTHER RESOLVED, that a change in par value to $0.01 per share be, and the same hereby is approved. IT IS FURTHER RESOLVED, that the Board of Directors hereby direct that the appropriate officer(s) are hereby authorized to carryout these resolutions on behalf of the Corporation and are authorized . empowered, and directed, in the name of and on beltalf of the Corporation, to execute and deliver all documents, to make all payments, and to perform any other act as may be necessary from time to time to carry out the purpose and intent of these resolutions . All such acts and doings of all officers which are consistent with the purposes of this resolution are hereby authorized, approved, ratified, and confirmed in all respects ; and IT IS FURTHER RESOLVED, that these Resolutions may be signed in as many counter parts as necessary and each counter part will be accepted as if all parties had signed; and IN WITNESS WHEREOF, the undersigned have executed this document effective as of the date first

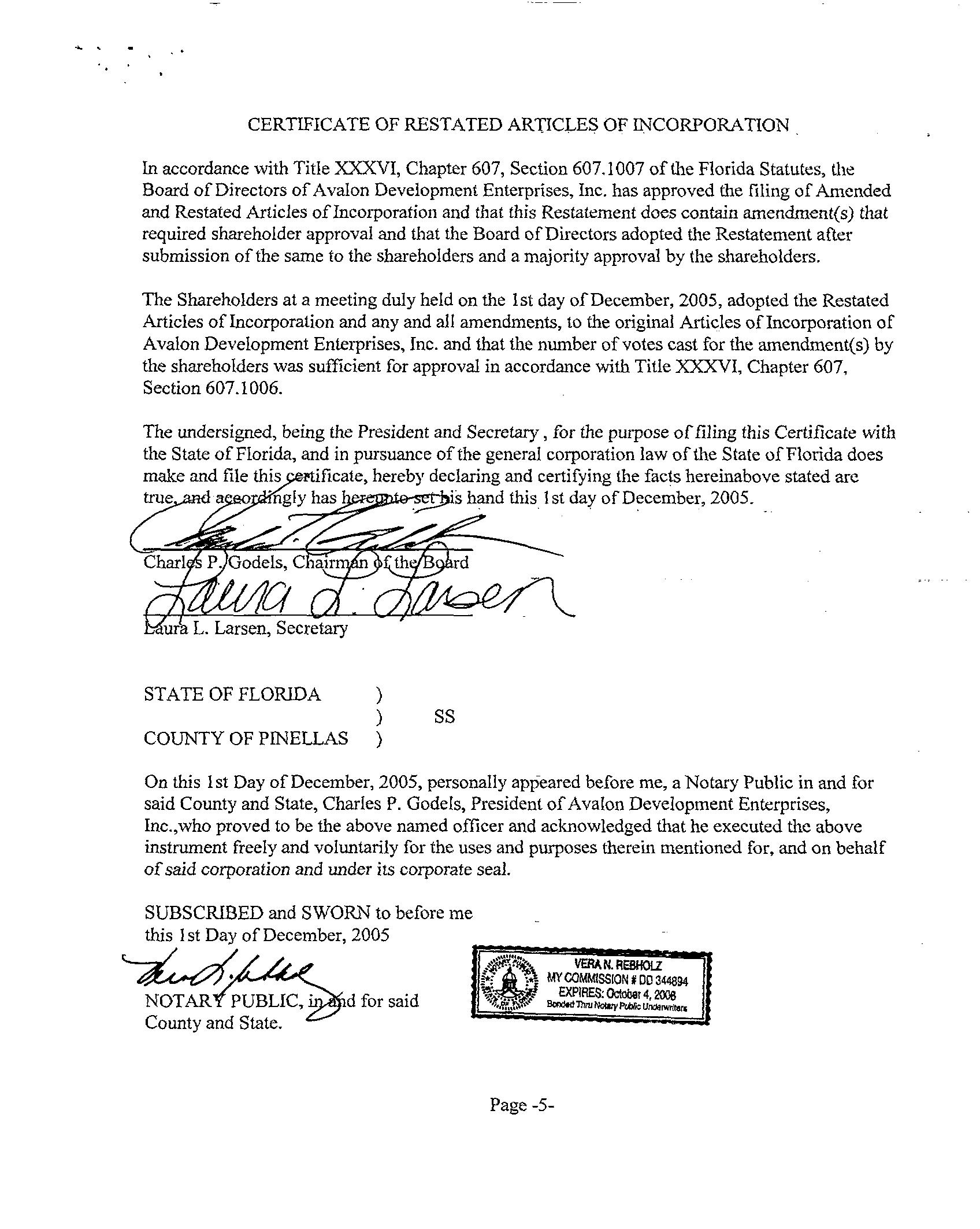

CERTIFICATE OF RESTATED ARTICLES OF INCORPORATION. In accordance with Title XXXVI, Chapter 607, Section 607.1007 of the Florida Statutes, the Board of Directors of Avalon Development Enterprises, Inc. has approved the filing of Amended and Restated Articles of Incorporation and that this Restatement does contain amendment(s) that required shareholder approval and that the Board of Directors adopted the Restatement after submission of the same to the shareholders and a majority approval by the shareholders. The Shareholders at a meeting duly held on the 1st day of December, 2005, adopted the Restated Articles of Incorporation and any and all amendments, to the original Articles oflncorporation of Avalon Development Enterprises, Inc. and that the number of votes cast for the amendment(s) by the shareholders was sufficient for approval in accordance with Title XXXVI, Chapter 607, Section 607.1006. The undersigned, being the President and Secretary, for the purpose of filing this Certificate with the State of Florida, and in pursuance of the general corporation law of the State of Florida does make and file this ificate, hereby declaring and certifying the facts hereinabove stated arc a !Oi,;H'i· ngly has ·s hand this I st day of December, 2005. STATE OF FLORIDA ) ) ss COUNTY OF PINELLAS ) On this !st Day of December, 2005, personally appeared before me, a Notary Public in and for said County and State, Charles P. Godels, President of Avaion Development Enterprises, Inc.,who proved to be the above named officer and acknowledged that he executed the above instrument freely and voluntarily for the uses and purposes therein mentioned for, and on behalf of said corporation and under its corporate seal. SUBSCRIBED and SWORN to before me this Ist Day of December, 2005 dforsaid County and State. VERAN.REBHO!Z MYCOMMISSION I DD 344894 EXPIRES: October 4, 2006 BmdtdThru Nol&') - Pto1k: U/U!rwtiten; Page - 5 -

STATE OF FLORIDA ) ) ss COUNTY OF PINELLAS ) On this 1st Day of December, 2005, personally appeared before me, a Notary Public in and for said County and State, Laura L. Larsen, Secretary of Avalon Development Enterprises, Inc.,who proved to be the above named officer and acknowledged that she executed the above instrument freely and voluntarily for the uses and purposes therein mentioned for, and on behalf of said corporation and under its corporate seal. SUBSCRIBED and SWORN to before me this 1st Day ofDecerober, 2005. :rsaid County and State. VERA N.REBHOI.Z MYCOMMISSION #OO EXP(f \ ES:Oc \ <lbol4, 200 \ I BondodToruNowyPtb/1,;Uo:IIIWrittrs Page - 6 -

WRITTEN ACCEPTANCE BY REGISTERED AGENT I, Charles P. Godels, the undersigned, being the registered_ agent for AVALON . DEVELOPMENT ENiERPRISES, INC., do·hereby state that I am familiar with and accept the duties and responsibilities as registered agent for the said corporation. I hereby declare and certify the facts hereinabove stated are true, and accordingly hereunto set my hand this 1st day of STATE OF FLORIDA ) ) ss COUNTY OF PINELLAS ) forsaid County and State. On this Ist Day of December, 2005, personally appeared before me, a Notary Public in and for said County and State, Charles P. Godels, registered agent of Avalon Development Enterprises, Inc., who proved to be the above named registered agent and acknowledged that he executed the above instrument freely and voluntarily for the uses and purposes therein mentioned for, and on behalf of said corporation and under its corporate seal. SUBSCRIBED and SWORN to before me this 1st Day of December, 2005. 'll:l \ l.N. l' \ ES!IOlZ MYCOMMISSION# 00Ul894 EXPIRES: (Jctober 4 0 . i:!Th!UNow't'NikU!"lllam,_ Page - 7 -

MAR.26.2007 4:35PM Mu. 26. 2007 8:52AM C S C 00000000 NO. 160 P. 2 No. 5498 P. 2 .ARTICLES OF AMENDMENT TO . All.TIO.ES O F · o Il ' , fCOlll'OltAUON AY,,l•• Jl!ycloo.. ont Eotttprl....Jn,c. hrsoaal to tho pravislon of SootloD 607.1006, Florida s - - , lb!s l'lorida pl'0llt r;o,poml!on adopCS tho iollowblg lfflicles ot mnondl!Jd ro the a,r,icles of!ncorpcnlloo: l'lllST: Amwdawal adopted (lndi4:a!e Ollldea llllllll>e:r beillg amonded, addod or dolettd) P.AlW.'IRAPH I OF ARTl'CI.Bl,NAWii!SAMBNDl::PTO.READASFOIJ.0WS: 1t.onam• otdio CoUljlCIO;)' Is htnbyamemed to: (jaaagZbauOIDboi T.teoou,, rac. SJl:CONJ>, Tl I'>' •m,. hem provides 1llr au • lumgo, ro<lasolficalioa or - nali.,.. ot i;sucd sbar.a, p.n,vls:iou lw implcniorrt!ug dio ltnot colUll.fncd Iii die 111D111tdmlilt ..., as follows: :;: l,'; Ir,·, ::3 , - ,.: :t;,.:;:: - _; :x :J:r:1 > l"O'UllTH, Ac!Dpl!QA_ c,r Amondment: D "Ibo llllllllldmcnl(•) was/were approved 1>;, the sllarcholdmi. D The munhor ot votes ea:it, mr g:; - .I •) wasiwei,, snfllclom approvll. . • 0 The ,i) .,..,,,,_, appr<>>ed b)' the rha,elioldr:rs through ?01uJS gruup.<. n,,, mllll b,e ooperai,,Jy provi,:d for ,ach VOl:mi gro - ap - .ntittod to separa! <Ill \ 111.sz.... IIPUOl<lm=1(•): • • . : - · :, . ., • • 0 j;! . •• ._, ·,: . . - ; en "'l"ho n""' ƒ "" ot vote•, casc.. tbr Oui 11t11ondiuen!{s) waa/werc sntlleiont . ltir ep --- ' - ----- · - v<>lll,ggroup 6Zf• 'Ibo a,oend,,11,DJ:(o) ....,.,... adoptocl i,y lho Boon! of l);m,turs wilh<:ut IClicll &11d lhardloldef 1"alW.CI was not • 0• th,, amenclmm(•} - 0 & t y he o; wldloui sbonhol<le:r aodon and lhoreho!dor aelian..,... Dot requ;, - ,.i. - dm :::h &i:J/UJ) 0 of die Boa,d <>( Dlrect,,ts, l're!ident ot olbo1' oflioot it Allm t (By tb• Chair=n or Vice adopted t,y the sbarcholdets) • , ........ ' . - . .,, ::.. .· .! •,'; ,;, ... \ •. '.'(• ; - - .: , ' .Aibm Qrqnberg TJll'ed or pnun,d. 111111!0 Plffi'.SIDRNT Till•

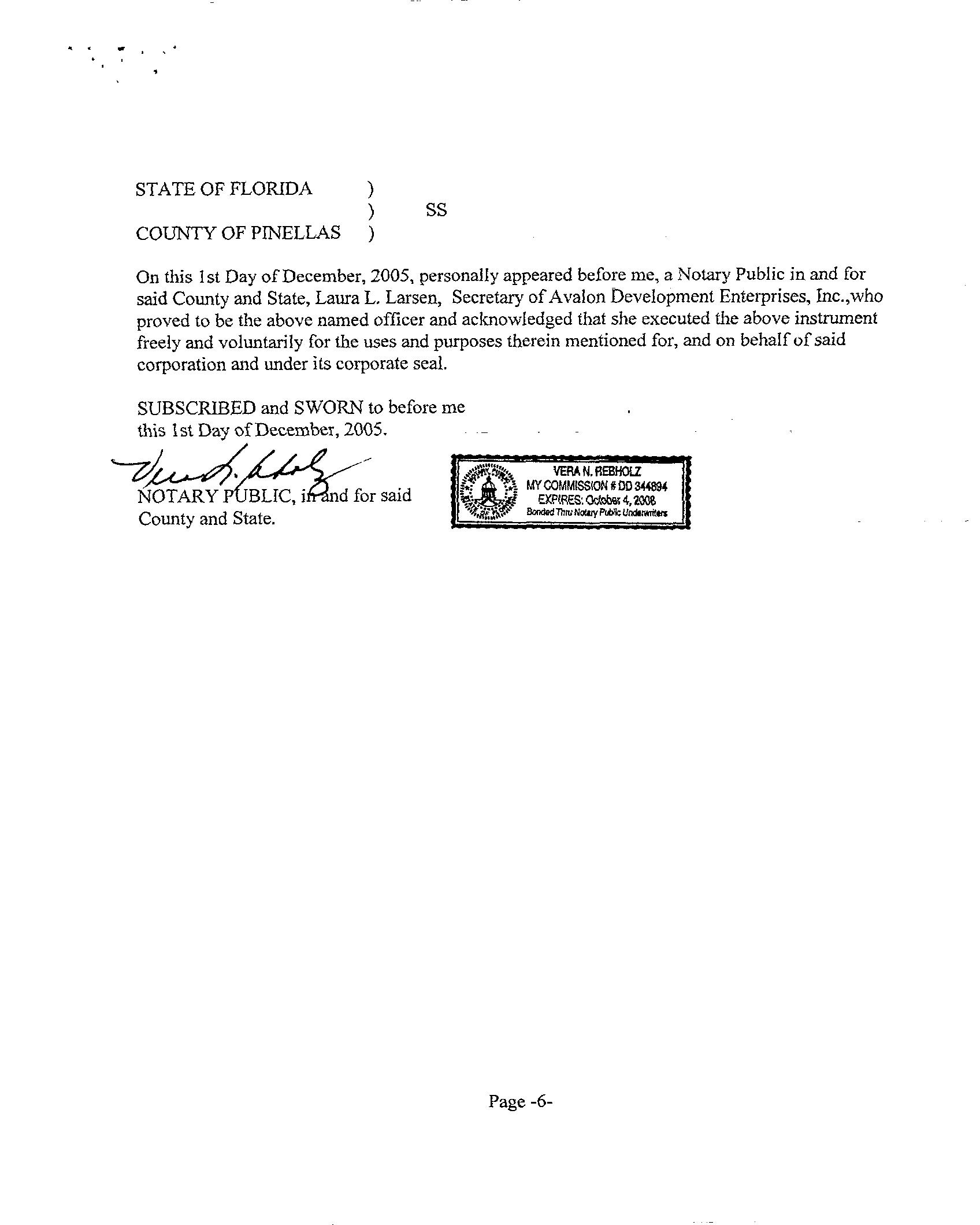

J - AN. 26. 2009 11: 53AM C S C NO. 340 P. 3 ARTICLES OF A..' \ .1ENDME:NT TO ARTICLES OF INCOR..PORATlON OF GUANGZHOU GLOB.. \ L TELECOM, INC. Pursuant to the provisions of Section 607.I006, Florida Statutes, the undersigned corporation, GUANOZHOU GLOBAL TELECOM, INC. (the "Company") adopts the followim - ! Artkles of Amendment to its Articles of!ncorporatlo11. Article I. Amendment A.rticles Three of the Articles of Incorporation of the Corporation is hereby amended as follows: "The total authorized capital stock of the COl'l)Oration shall be One Billion (1,000,000,000) shares ofS.01 par value common stock, allot any part of which capital stock may be paid for in cash, in property or in labor and services at a fair valuation to be fixed by the Board of Directors. Such stock may be issued from time to time without any ac.tlon by the stockholders for such consideration as may be fixed fi. - om time to time by the Board - of Directors, and shares so issued, the full consideraiion for which has been paid or deli \ •ered shall be deemed the fully paid up srock, and lhe holder of such shares shall not be liable for any further payment thereof. Each share of stock shall have voting privileges and will be eligible for dividends." Arti<;!e H. Dare Amendment Adooted The amendment set forth.in these Articles of /1.mendment was adopted on December 16, 2008. Article Ill. Shareholder Approval of Amendment The amendmem set forth in r . 'tese Articles of Amendment was proposed by the Col'l)oration's Board of Directors and approved by the shareholders by a vote sufficient for :. pproval of the amendment . The undersi ed execu1ed this document on the date shovm below. By::_ J · J.ir,:., ':7.k l r.,, V Name: Yankuan Li Title: CEO &. President Date: Januatv :> I, 2009

03/07/2012 17:43 VC0RP (FAX)845 818 3588 P.003/006 , Art1c1H or Ame11dmer1t to Arrfalos Of Jncorporatio Ŷ of (Nnm, 9fCgrpgr11.t(on ns currnntlY nld with lhP Elotfdll pept. gt Stat!) Guangzhou Global Telecom, Inc. (Document Number or Corpo"tlon (If known) Purs1,111nt to th,; provt1ions af scc1l0n 607,1006, Florid Ŷ Statures, thl1 F1,>t - lJ11 P,·Qfit Corporation adQptl the t'otlow!na amondment(s) ro it1 Anicl:s of lneorporatlon: A, 1remendlng nn.ms, f - Rtcr the IIC \ Y nnme of tJu; coroornt!gn; - C - - h - - i , n - a - : , T - , e - - l e - , t - e , - c - h ,, . H , - - o . l . d , . i ; n , . g , ; , . Inc _ . , ,...,, .,... - :: - - : - ------------- ,,, - ---- , - - ,.!,! , yew ,ram, must bt d111l11gu/1hobl• and aonlal" the word 11 corporotlan, 11 ,.t:ompa, ,. OI' "lncarporot•d" DI' IM ab ,:,//011;:;;,; ..Corp., H "Im:.," Qr Co.," 01' lllt tkslgnn1l011 "Corp." "Inc." ƒ '' "C'o"'. A prqfmltmal corpo,•tm'on 11amc mn.rt a;maf11;1'1 /·;' ( - 0< ward "'t:hartsred," •prqfeSJlonal auocla110,1," or the abt» it11Jo11 ,.P.A... B, lntse,new prfnclp&J PfflEt edduu, tt npptlcgbler (Prlno/plli ol/loa addr.su MUVT BR A STWT dPDWS) --------------- _,.. - ;; t:. r.; :_ ' CO ,l::,. :ir S> c. Enter ntw mailing nddrc11, lf ppplfr - pblq; (Malling addroa MAY RP.A POSr OF{'{<;1i BOX/ D. ttnmsnd!M tht carluocad 111f!nt andt9r n:ahtusd ofOso pddrn1 in florlde, smtsc tlu1 name r.fthSI DS'Y nrrlltscsd egont nnd/or the new rsvhtscsd emst P.ddmu Nnms eCMsw Rrttsrt:ad 4eeuc Naw B«vtswnd OH1AAddPYr - ------- ƒ "",: - : - ------- PJorJcl. (Clo,) (Zip Codr) New Reehtcred Aont'f † leontnrs, lfchnnglnp RHIJtl!orfd Arent; I htlr,by accept t/11! appoJ11tme11t ,u r,:fsW'Cd agcut. I nm familiar with 011d a pl 1/ur obllcr,t10111 of tho po1lt/c11. S/g11nlW't! ef Now Rl'!gittcrrd Ag 11t,V d1nnglng c.n N Pnge 1 or4

03/07/2012 17: 44 '¥'CO P (FAX)845 818 3588 P.004/006 If nmcndlna the 0fficc:r1 pd/or Dlrtctor1, enter the dtlc nad namo of each ornoor/dlrccror being ren1ovcd and title, ni.nte. and ftddrcss of cDCb Offlre:r nnd/or Dimtcr belDK nddod: (Aunr:/1 addlt"m(lf 1h1111, lfJ11:ca.ua1") Pl1tU« 11ot4 ti! o.tflccn'dlnrr:tar tllla by t/lajira, /cucrqftl1<! o.a?ce: tllfe: P ,,., Pruldant; Y• Vied P1iuldt:nt; T - Th,o,111yr; S= Stt1Wa1,.: D• Dirte1or: TR"" Tm.Jtaa: C • Chainrran or Clc, - k,· CEO .,. Cl,Jef Lm,r/ 1 - a O . fflci,, ; CFO Chief 1 '/ 11 a 11 c/o/ 0 . /fl=' - If an o . (Jlc,rfd ; , . mr holtf . r mo, - a thn 11 on, dtl •. list thaJlrsl i • tttr o/ •• ch qf/ 1 ƒ " lrdd . Prt : srtm,u, rnasur r, Director wa 11 ld ba PTO . Chairs,zs . Jhould bt 110 ied in tlu :. fr,ll, ; J 1 vll 1 gmcmm : r . Or,·Nm/, ; ,Jo/m Drn t 1 listed m the PST 011 d Mike Joua l 111 ,r '" tlir : V . Tht : re 11 a cl,u Mlk 11 Jana l mw Iha r : orpormton, Sally Smith I . J 1 tnm,d tltt V ,md S . Tires« 1 ho 11 /d bd 110 l d m Jahn Do,, P 1 ' a, a Cltrmga, Mlh Jo 11 u . JI n, R,maw :. a 1 td Sally Smllh, SP a . r nn Add, n Ejcample; <LChonge Y. 2(Rc.roaw S:l ..K Add 3) _Chango Add Remove - 4) _ainna• Add Rem1:>ve .!) _Chango Add Remove 6) Chon1111 Add Remove

03/07/2012 17: 44 CORP (FAX)845 818 3588 P.005/006 1 ., 1 l It. Jf nmandlns De nddlnq sddltfppol Artfeles, enter ehgnptc,) bsrs: ( ottach addll/01u,/ ,,,.,,.,, (fn,caun'i')· (Bo sp,cl/lc) l". If nn l'lmpndm,nt erex!dn for nn axchtang , l'PrJonlOrntfen QC snnc11llntton of 111ued 1har1L PCPYldoo, fnr lm 1 m•ntjng lhe emcndmsot Jtnor sont111nad tn fhp msnrtmont u,cln (f/m,t appllt:n /,. hJd/cn,, NIA) P•&•J or4

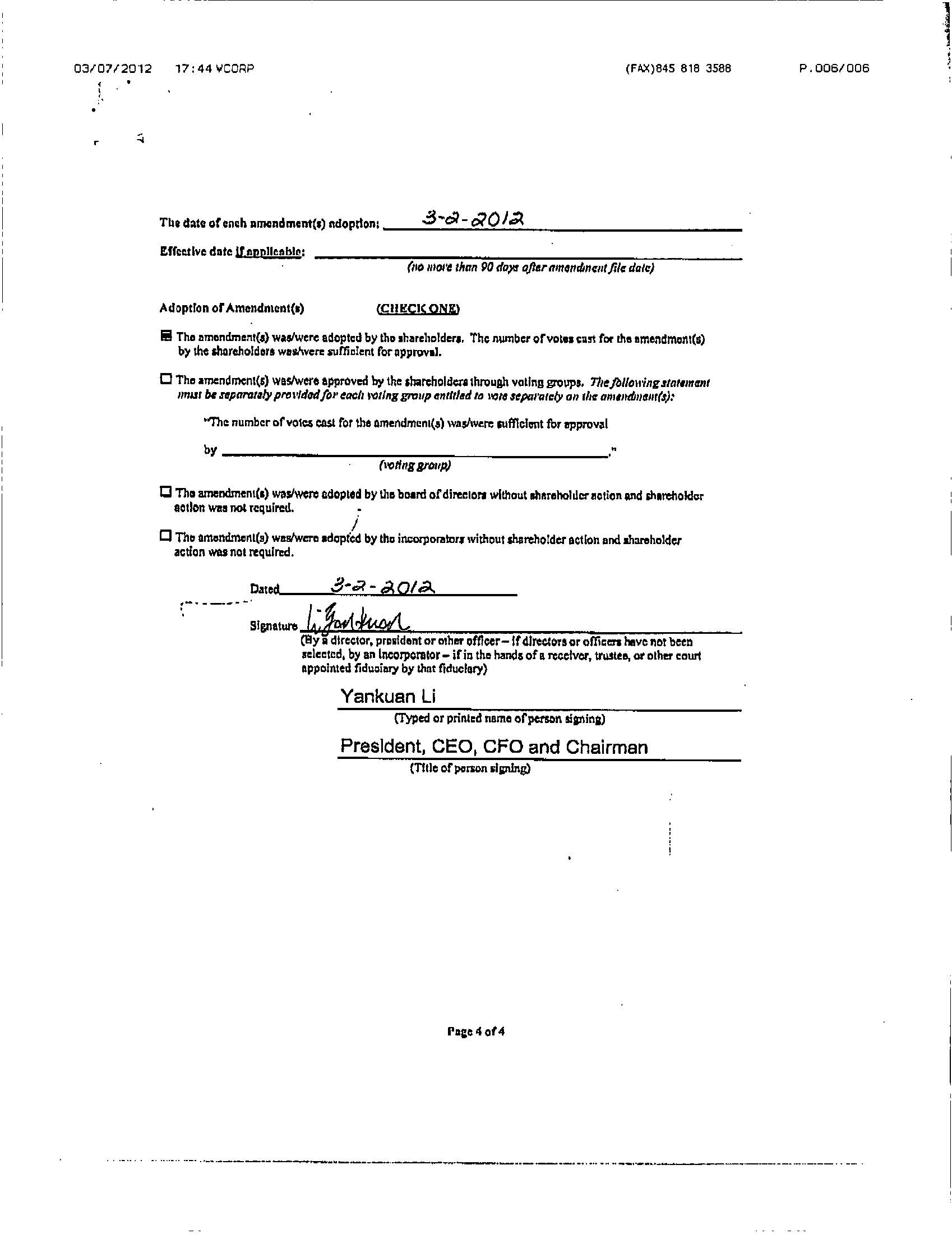

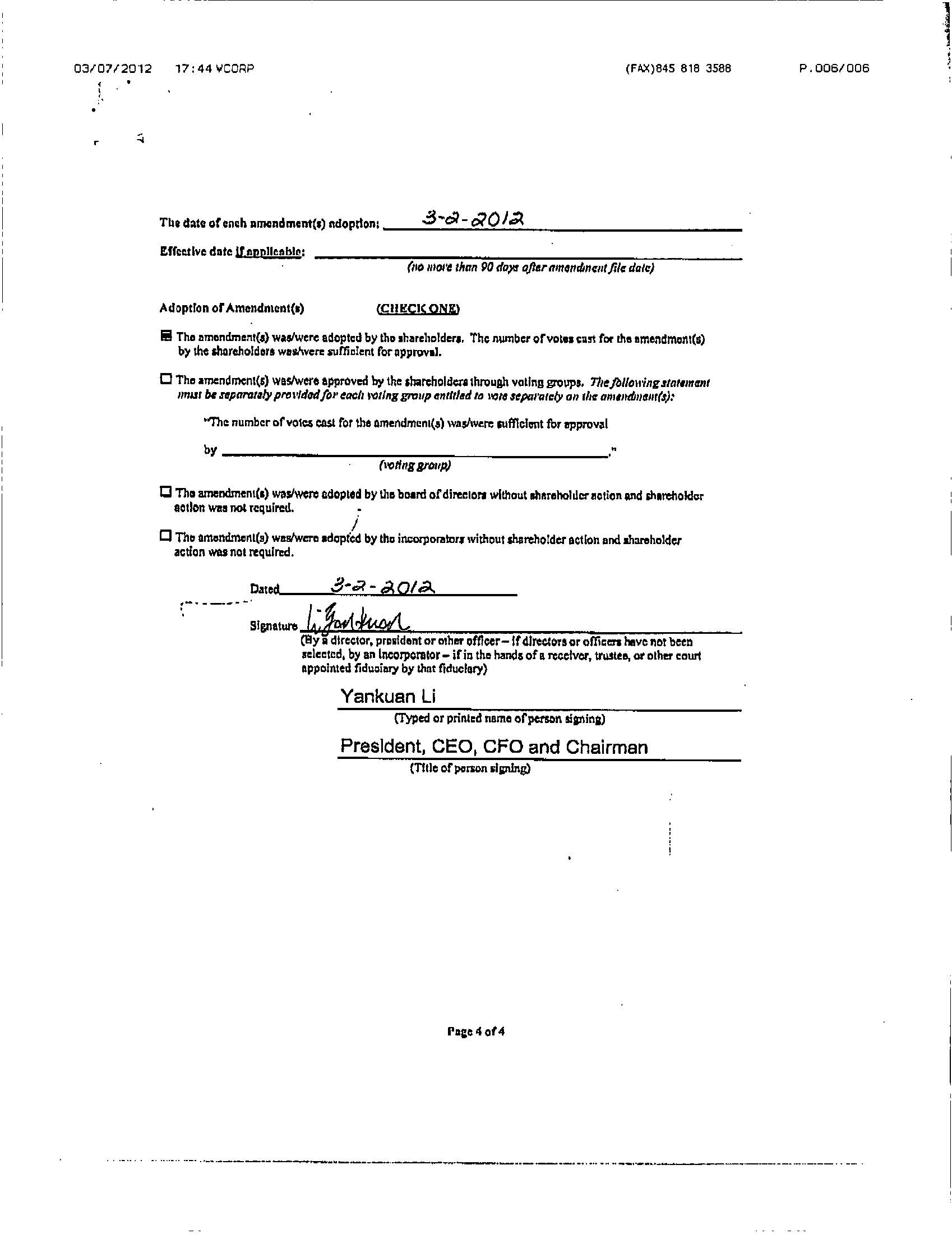

03/0712012 17: 44 VC0RP (F/ \ X)845 818 3588 Tbo dot• or,n,h omondm,nt(s) rulop ono 3_·_·61_ - - 'ol" - ' - - O= - - J - ------------- !.ffcctlvc date l[npnllcnhlt! : (110 mo,•a than PO cfo?3 afl11rnmottdmc11t/ilc dale) Adoption or Amendn10nt(•) (Clll!Cl(QNIU Iii Tha .nmcndment(.s) wae.i'were adopted by tha 1hareholdcr1, The Jl \ Ullbcr orvotn ca:n for the amendmonl(G) by thfl sharcholdara: wet/were aruffioient ror approv•J. D Tho amcnam<:nt(s) was/were approvod by the shardioldcr• through voting !lrolll'•• T/i,jbl/011ing,tnllmlfllt 1mu1 tJ. npara11ly prtJ1•tdadfo1•tach , - arlng group ,mtitJad to l'CU uparatr:ly all 1l1tt am,ntlmam(s): •"The number ofvo1e1cast ror the nmet'ldmi::n1( - ,) was/were sufflchmt fbr 11J'PfDYil hy (• HngfV011pJ j □ Tha amendmen1(1) wa wcrc adopted by lhe board or direclora without lhnrehohlcr1101ion and sh1reholdor action was not required, □ Thi, amcndmer1t(s) was/were 1doptCd by thu incorponitcrf without shareholder action ond ahareholdcr action wunot required. 0.1,d. .;;.., P - - c;.o?,;_ - .. e . 3e1.O...,_l,::e,;.,.. . _ - - • - Signature l; M, , : - • - (By a dtre,1or, pra1ldent or mher officer - tf di rec.to - rs ar officm ._vc r,ot been sclcct d, by an lncoiporator - ir ia the hands of a TCcc1vcr, tr..atta, ot other court nppolnted fiduoioey hf lhnt fiduclot)') Yankuan Li (Typed or printed name ofpers0n. siatiirta) President, CEO, CFO and Chairman (Titlo orpomm ,IJ1JU111J) P,006/006 · - ·········· --------- · ---- - .. - · ---- · - .

2020 FLORIDA PROFIT CORPORATION REINSTATEMENT DOCUMENT# P99000028316 Entity Name: CHINA TELETECH HOLDING, INC. Current Principal Place of Business: 7339 E WILLIAMS DR, UNIT 26496 SCOTTSDALE, AZ 85255 Current Mailing Address: PO BOX 26496 SCOTTSDALE, AZ 85255 US FEI Number: 59 - 3565377 Name and Address of Current Registered Agent: REGISTERED AGENTS, INC. 7901 4TH ST N STE. 300 ST. PETERSBURG, FL 33702 US Certificate of Status Desired: Yes The above named entity submits this statement for the purpose of changing its registered office or registered agent, or both, in the State of Florida. SIGNATURE: BILL HAVRE 10/28/2020 Electronic Signature of Registered Agent Date Officer/Director Detail : I hereby certify that the information indicated on this report or supplemental report is true and accurate and that my electronic signature shall have the same legal effect as if made under oath; that I am an officer or director of the corporation or the receiver or trustee empowered to execute this report as required by Chapter 607, Florida Statutes; and that my name appears above, or on an attachment with all other like empowered . SIGNATURE: RHONDA KEAVENEY CEO Electronic Signature of Signing Officer/Director Detail Date FILED Oct 28, 2020 Secretary of State 0023819122CR 10/28/2020 Title DIRECTOR, CEO, SECRETARY, TREASURER KEAVENEY, RHONDA PO BOX 26496 SCOTTSDALE AZ 85255 Name Address City - State - Zip:

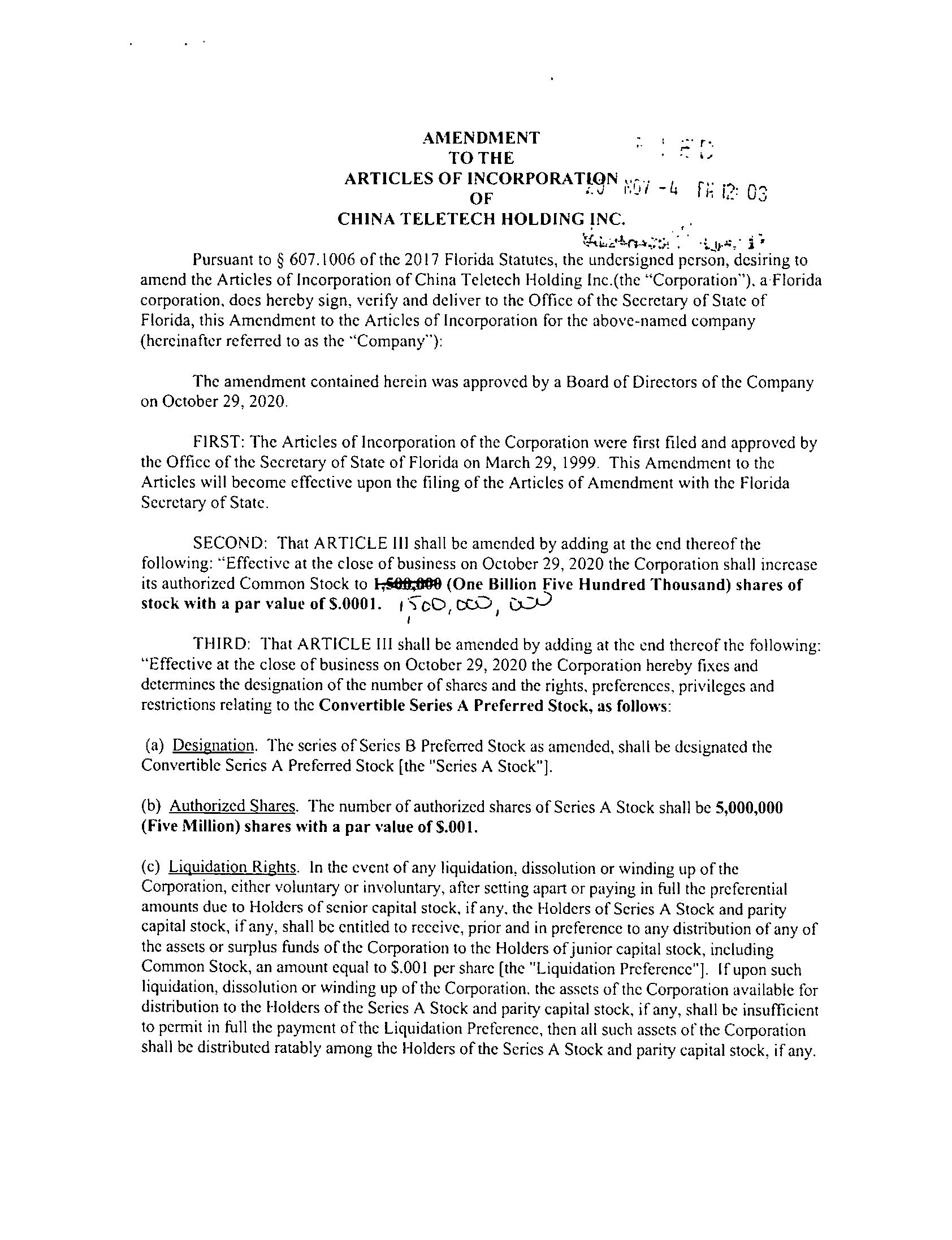

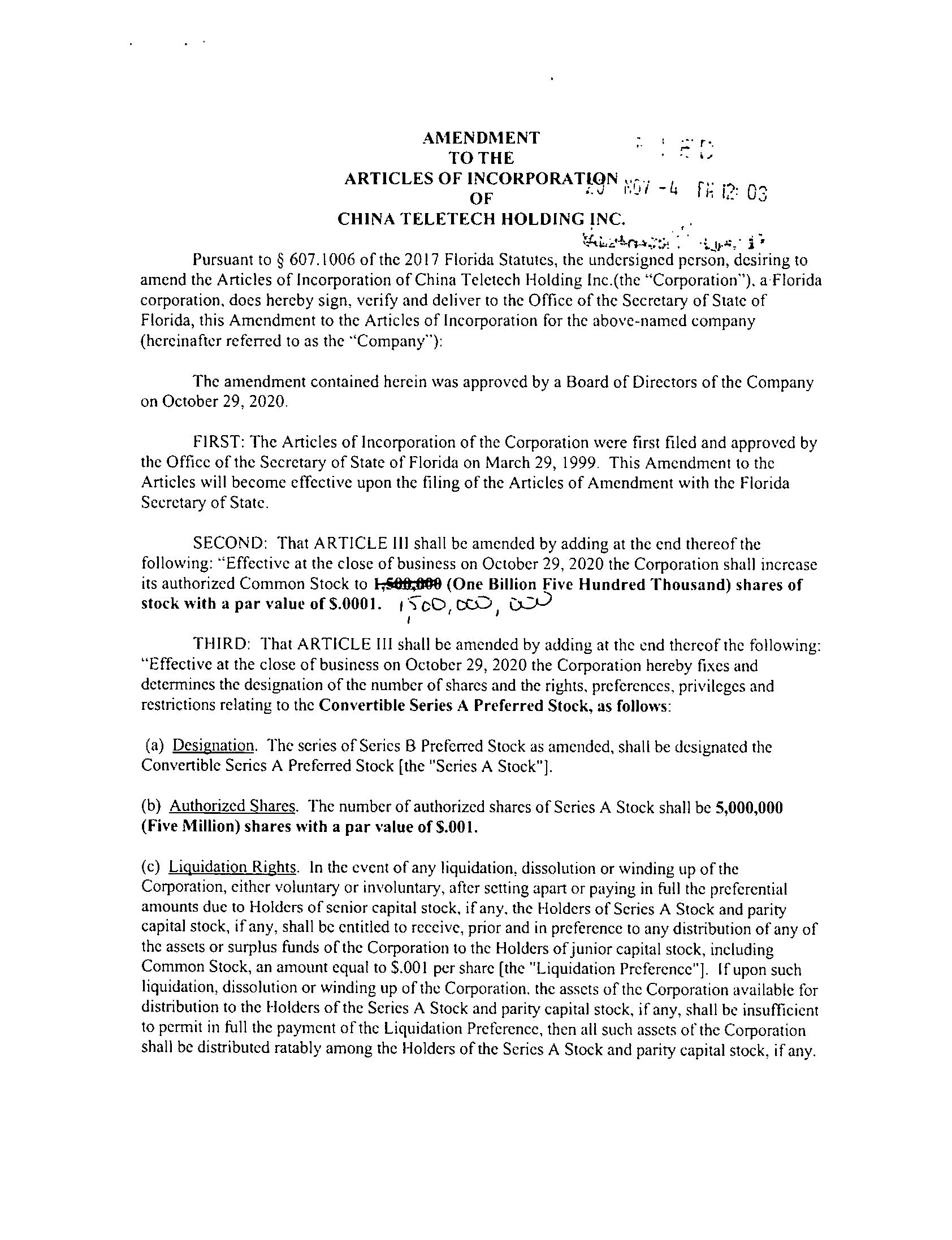

AMENDMENT TO THE : ;.:: r·. ARTICLES OF INCORPORATL<JN ",,i OF '· ,·._ - CHINA TELETECH HOLDING /NC. 4 f" ·?· Q'7: h I,.· ~ , k:::.•!., - µ.' \ :·: .:• ·t.,1,..i:" • j .._ Pursuant to † 607. I 006 of the 2017 Florida Statutes, the undersigned person, desiring to amend the Articles of Incorporation of China Telctcch Holding lnc.(thc "Corporation"). a Florida corporation, docs hereby sign, verify and deliver to the Office of the Secretary of State of Florida, this Amendment to the Articles of Incorporation for the above - named company (hereinafter referred to as the ·'Company"): The amendment contained herein was approved by a Board of Directors of the Company on October 29, 2020. FIRST: The Articles of Incorporation of the Corporation were first filed and approved by the Office of the Secretary of State of Florida on March 29, 1999. This Amendment to the Articles will become effective upon the filing of the Articles of Amendment with the Florida Secretary of State. SECOND: That ARTICLE Ill shall be amended by adding at the end thereof the following: "Effective at the close of business on October 29, 2020 the Corporation shall increase its authorized Common Stock to I, † 8ft;JIOO (One Billion Five Hundred Thousand) shares of stock with a par value of $.000 I. 1·;; - cD, cc0, wJ I THIRD: That ARTICLE Ill shall be amended by adding at the end thereof the following: "Effective at the close of business on October 29, 2020 the Corporation hereby fixes and determines the designation of the number of shares and the rights, preferences. privileges and restrictions relating to the Convertible Series A Preferred Stock, as follows: (a) Designation. The series of Series B Preferred Stock as amended, shall be designated the Convertible Series A Preferred Stock [the "Series A Stock"]. (b) Authorized Shares. The number of authorized shares of Series A Stock shall be 5,000,000 (Five Million) shares with a par value of $.00 I. (c) Liquidation Rights. In the event of any liquidation, dissolution or winding up of the Corporation, either voluntary or involuntary, after setting apan or paying in full the preferential amounts due to Holders of senior capital stock, if any, the Holders of Series A Stock and parity capital stock, if any, shall be entitled to receive, prior and in preference to any distribution of any of the assets or surplus funds of the Corporation to the Holders of junior capital stock, including Common Stock, an amount equal to $.001 per share (the "Liquidation Preference"]. If upon such liquidation, dissolution or winding up of the Corporation. the assets of the Corporation available for distribution to the Holders of the Series A Stock and parity capital stock, if any, shall be insufficient to permit in full the payment ofthc Liquidation Preference, then all such assets of the Corporation shall be distributed ratably among the Holders of the Series A Stock and parity capital stock, if any.

Neither the consolidation or merger of the Corporation nor the sale, lease or transfer by the Corporation of all or a part of its assets shall be deemed a liquidation, dissolution or winding up of the Corporation for purposes of this Section (c). (d) Dividends. The Series A Stock is not entitled to receive any dividends in any amount during which such shares arc outstanding. (c) Conversion Rights. Each share of Series A Stock shall be convertible, at the option of the Holder, into 1,000 (One Thousand) fully paid and non - assessable shares of the Corporation's Common Stock. The foregoing conversion calculation shall be hereinafter referred to as the "Conversion Ratio." (i) Conversion Procedure. Upon wrinen notice to the Holder, the Holder shall effect conversions by surrendering the certificatc(s) representing the Preferred Series A Stock to be converted to the Corporation, together with a forrn of conversion notice satisfactory to the Corporation, which shall be irrevocable. Not later than five [5] business days after the conversion date, the Corporation will deliver to the Holder, (i) a certificate or certificates, which shall be subject to restrictive legends, representing the number of shares of Common Stock being acquired upon the conversion; provided. however, that the Corporation shall not be obligated to issue such certificates until the Series A Stock is delivered to the Corporation. If the Corporation does not deliver such certificate(s) by the date required under this paragraph (c) (i), the Holder shall be entitled by wrinen notice to the Corporation at any time on or before receipt of such certificate(s), to receive 100 Series A Stock shares for every week the Corporations fails to deliver Common Stock to the Holder. (ii) Adjustments on Stock Splits, Dividends and Distributions . lfthe Corporation, at any time while any Series A Stock is outstanding, (a) shall pay a stock dividend or otherwise make a distribution or distributions on shares of its Common Stock payable in shares of its capital stock [whether payable in shares of its Common Stock or of capital stock of any class], (b) subdivide outstanding shares of Common Stock into a larger number of shares. (c) combine outstanding shares of Common Stock into a smaller number of shares, or (d) issue reclassification of shares of Common Stock for any shares of capital stock of the Corporation, the Conversion Ratio shall be adjusted by multiplying the number of shares of Conunon Stock issuable by a fraction of which the numerator shall be the number of shares of Common Stock of the Corporation outstanding after such event and of which the denominator shall be the number of shares of Conunon Stock outstanding before such event. Any adjustment made pursuant to this paragraph (e)(iii) shall become effective immediately atier the record date for the detcnnination of stockholders entitled to receive such dividend or distribution and shall become effective immediately after the effective date in the case of a subdivision, combination or reclassification. Whenever the Conversion Ratio is adjusted pursuant to this paragraph, the Corporation shall promptly mail to the Holder a notice setting forth the Conversion Ratio after such adjustment and setting forth a brief statement of the facts requiring such adjustment. (iii) Adjustments on Reclassifications, Consolidations and Mergers. In case of reclassification of the Common Stock, any consolidation or merger of the Corporation with or into another person, the sale or transfer of all or substantially all of the assets of the Corporation or any compulsory share exchange pursuant to which the Common Stock is converted into other securities,

cash or property, then each Holder of Series A Stock then outstanding shall have the right thereafter to convert such Series B Stock only into the shares of stock and other securities and property receivable upon or deemed to be held by Holders of Common Stock following such reclassification, consolidation, merger, sale, transfer or share exchange, and the Holder shall be entitled upon such event to receive such amount of securities or property as the shares of the Common Stock into which such Series A Stock could have been converted immediately prior to such reclassification, consolidation, merger, sale, transfer or share exchange would have been entitled. The tcrtns of any such consolidation, merger, sale, transfer or share exchange shall include such tcrtns so as to continue to give to the Holder the right to receive the securities or property set forth in this paragraph (c)(iv) upon any conversion following such consolidation, merger, sale, transfer or share exchange. This provision shall similarly apply to successive reclassifications, consolidations, mergers, sales, transfers or share exchanges. (iv) Fractional Shares; Issuance Expenses. Upon a conversion of Series A Stock, the Corporation shall not be required to issue stock certificates representing fractions of shares of Common Stock but shall issue that number of shares of Common Stock rounded to the nearest whole number. The issuance of certificates for shares of Common Stock on conversion of Series A Stock shall be made without charge to the Holder for any documentary stamp or similar taxes that may be payable in respect of the issue or delivery of such certificate, provided that the Corporation shall not be required to pay any tax that may be payable in respect of any transfer involved in the issuance and delivery of any such certificate upon conversion in a name other than that of the Holder, and the Corporation shall not be required to issue or deliver such certificates unless or until the person or persons requesting the issuance thereof shall have paid to the Corporation the amount of such tax or shall have established to the satisfaction of the Corporation that such tax has been paid. (f) Voting Rights. Except as otherwise expressly provided herein or as required by law, the Holders of shares of Series A Stock shall be entitled to vote on any and all matters considered and voted upon by the Corporation's Common Stock. The Holders of the Series A Stock shall be entitled to 1,000 (One Thousand) votes per share of Series A Stock. (g) Reservation of Shares of Common Stock . The Corporation covenants that it will at all times reserve and keep available out of its authorized and unissued Common Stock solely for the purpose of issuance upon conversion of Series A Stock as herein provided, free from preemptive rights or any other actual contingent purchase rights of persons other than the Holders of Series A Stock. such number of shares of Common Stock as shall be issuable upon the conversion of the outstanding Series A Stock. If at any time the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all outstanding Series A Stock, the Corporation will take such corporate action necessary to increase its authorized shares of Common Stock to such number as shall be sufficient for such purpose. The Corporation covenants that all shares of Common Stock that shall be so issuable shall, upon issue, be duly and validly authorized, issued and fully paid and non - assessable. All other aspects of Article Ill shall remain unchanged.

IN WITNESS WHEREOF, the Company has caused these Articles of Amendment to the Articles of Incorporation to be signed by Rhonda Keaveney, its Chief Executive Officer, this 29 th day of October 2020 . Rhonda Keaveney Chief Executive Officer

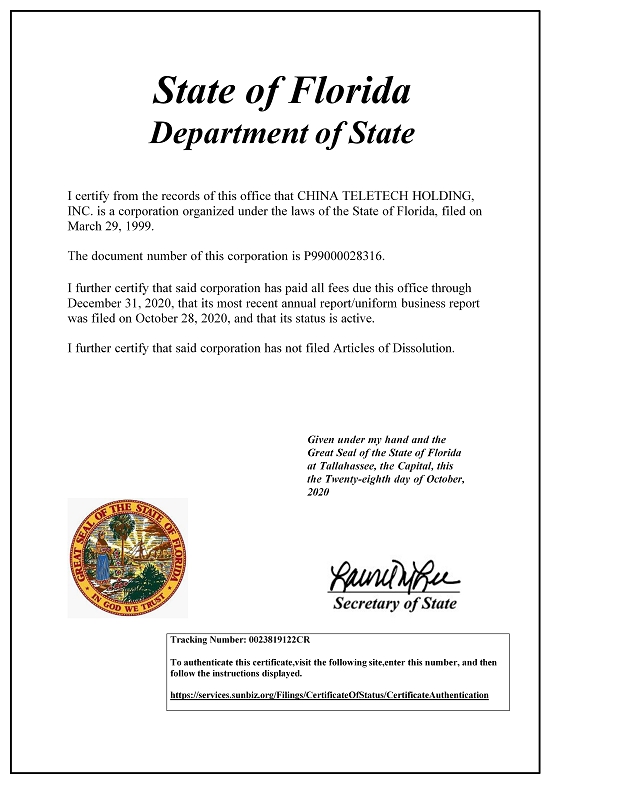

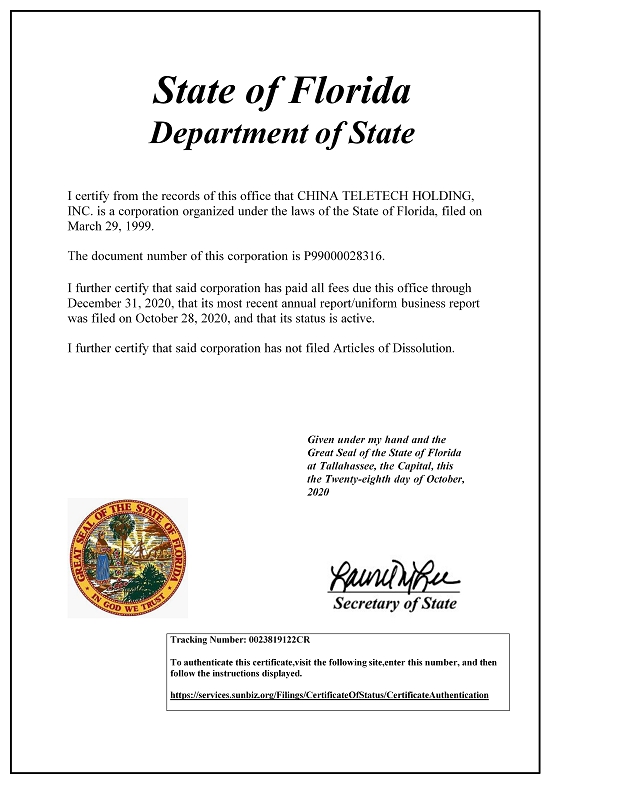

State of Florida Department of State I certify from the records of this office that CHINA TELETECH HOLDING, INC. is a corporation organized under the laws of the State of Florida, filed on March 29, 1999. The document number of this corporation is P99000028316. I further certify that said corporation has paid all fees due this office through December 31, 2020, that its most recent annual report/uniform business report was filed on October 28, 2020, and that its status is active. I further certify that said corporation has not filed Articles of Dissolution. Given under my hand and the Great Seal of the State of Florida at Tallahassee, the Capital, this the Twenty - eighth day of October, 2020 Tracking Number: 0023819122CR To authenticate this certificate,visit the following site,enter this number, and then follow the instructions displayed. https://services.sunbiz.org/Filings/CertificateOfStatus/CertificateAuthentication

AMENDMENT TO THE : ;.:: r·. ARTICLES OF INCORPORATL<JN ",,i OF '· ,·._ - CHINA TELETECH HOLDING /NC. 4 f" ·?· Q'7: h I,.· ~ , k:::.•!., - µ.' \ :·: .:• ·t.,1,..i:" • j .._ Pursuant to † 607. I 006 of the 2017 Florida Statutes, the undersigned person, desiring to amend the Articles of Incorporation of China Telctcch Holding lnc.(thc "Corporation"). a Florida corporation, docs hereby sign, verify and deliver to the Office of the Secretary of State of Florida, this Amendment to the Articles of Incorporation for the above - named company (hereinafter referred to as the ·'Company"): The amendment contained herein was approved by a Board of Directors of the Company on October 29, 2020. FIRST: The Articles of Incorporation of the Corporation were first filed and approved by the Office of the Secretary of State of Florida on March 29, 1999. This Amendment to the Articles will become effective upon the filing of the Articles of Amendment with the Florida Secretary of State. SECOND: That ARTICLE Ill shall be amended by adding at the end thereof the following: "Effective at the close of business on October 29, 2020 the Corporation shall increase its authorized Common Stock to I, † 8ft;JIOO (One Billion Five Hundred Thousand) shares of stock with a par value of $.000 I. 1·;; - cD, cc0, wJ I THIRD: That ARTICLE Ill shall be amended by adding at the end thereof the following: "Effective at the close of business on October 29, 2020 the Corporation hereby fixes and determines the designation of the number of shares and the rights, preferences. privileges and restrictions relating to the Convertible Series A Preferred Stock, as follows: (a) Designation. The series of Series B Preferred Stock as amended, shall be designated the Convertible Series A Preferred Stock [the "Series A Stock"]. (b) Authorized Shares. The number of authorized shares of Series A Stock shall be 5,000,000 (Five Million) shares with a par value of $.00 I. (c) Liquidation Rights. In the event of any liquidation, dissolution or winding up of the Corporation, either voluntary or involuntary, after setting apan or paying in full the preferential amounts due to Holders of senior capital stock, if any, the Holders of Series A Stock and parity capital stock, if any, shall be entitled to receive, prior and in preference to any distribution of any of the assets or surplus funds of the Corporation to the Holders of junior capital stock, including Common Stock, an amount equal to $.001 per share (the "Liquidation Preference"]. If upon such liquidation, dissolution or winding up of the Corporation. the assets of the Corporation available for distribution to the Holders of the Series A Stock and parity capital stock, if any, shall be insufficient to permit in full the payment ofthc Liquidation Preference, then all such assets of the Corporation shall be distributed ratably among the Holders of the Series A Stock and parity capital stock, if any.

Neither the consolidation or merger of the Corporation nor the sale, lease or transfer by the Corporation of all or a part of its assets shall be deemed a liquidation, dissolution or winding up of the Corporation for purposes of this Section (c). (d) Dividends. The Series A Stock is not entitled to receive any dividends in any amount during which such shares arc outstanding. (c) Conversion Rights. Each share of Series A Stock shall be convertible, at the option of the Holder, into 1,000 (One Thousand) fully paid and non - assessable shares of the Corporation's Common Stock. The foregoing conversion calculation shall be hereinafter referred to as the "Conversion Ratio." (i) Conversion Procedure. Upon wrinen notice to the Holder, the Holder shall effect conversions by surrendering the certificatc(s) representing the Preferred Series A Stock to be converted to the Corporation, together with a forrn of conversion notice satisfactory to the Corporation, which shall be irrevocable. Not later than five [5] business days after the conversion date, the Corporation will deliver to the Holder, (i) a certificate or certificates, which shall be subject to restrictive legends, representing the number of shares of Common Stock being acquired upon the conversion; provided. however, that the Corporation shall not be obligated to issue such certificates until the Series A Stock is delivered to the Corporation. If the Corporation does not deliver such certificate(s) by the date required under this paragraph (c) (i), the Holder shall be entitled by wrinen notice to the Corporation at any time on or before receipt of such certificate(s), to receive 100 Series A Stock shares for every week the Corporations fails to deliver Common Stock to the Holder. (ii) Adjustments on Stock Splits, Dividends and Distributions . lfthe Corporation, at any time while any Series A Stock is outstanding, (a) shall pay a stock dividend or otherwise make a distribution or distributions on shares of its Common Stock payable in shares of its capital stock [whether payable in shares of its Common Stock or of capital stock of any class], (b) subdivide outstanding shares of Common Stock into a larger number of shares. (c) combine outstanding shares of Common Stock into a smaller number of shares, or (d) issue reclassification of shares of Common Stock for any shares of capital stock of the Corporation, the Conversion Ratio shall be adjusted by multiplying the number of shares of Conunon Stock issuable by a fraction of which the numerator shall be the number of shares of Common Stock of the Corporation outstanding after such event and of which the denominator shall be the number of shares of Conunon Stock outstanding before such event. Any adjustment made pursuant to this paragraph (e)(iii) shall become effective immediately atier the record date for the detcnnination of stockholders entitled to receive such dividend or distribution and shall become effective immediately after the effective date in the case of a subdivision, combination or reclassification. Whenever the Conversion Ratio is adjusted pursuant to this paragraph, the Corporation shall promptly mail to the Holder a notice setting forth the Conversion Ratio after such adjustment and setting forth a brief statement of the facts requiring such adjustment. (iii) Adjustments on Reclassifications, Consolidations and Mergers. In case of reclassification of the Common Stock, any consolidation or merger of the Corporation with or into another person, the sale or transfer of all or substantially all of the assets of the Corporation or any compulsory share exchange pursuant to which the Common Stock is converted into other securities,

cash or property, then each Holder of Series A Stock then outstanding shall have the right thereafter to convert such Series B Stock only into the shares of stock and other securities and property receivable upon or deemed to be held by Holders of Common Stock following such reclassification, consolidation, merger, sale, transfer or share exchange, and the Holder shall be entitled upon such event to receive such amount of securities or property as the shares of the Common Stock into which such Series A Stock could have been converted immediately prior to such reclassification, consolidation, merger, sale, transfer or share exchange would have been entitled. The tcrtns of any such consolidation, merger, sale, transfer or share exchange shall include such tcrtns so as to continue to give to the Holder the right to receive the securities or property set forth in this paragraph (c)(iv) upon any conversion following such consolidation, merger, sale, transfer or share exchange. This provision shall similarly apply to successive reclassifications, consolidations, mergers, sales, transfers or share exchanges. (iv) Fractional Shares; Issuance Expenses. Upon a conversion of Series A Stock, the Corporation shall not be required to issue stock certificates representing fractions of shares of Common Stock but shall issue that number of shares of Common Stock rounded to the nearest whole number. The issuance of certificates for shares of Common Stock on conversion of Series A Stock shall be made without charge to the Holder for any documentary stamp or similar taxes that may be payable in respect of the issue or delivery of such certificate, provided that the Corporation shall not be required to pay any tax that may be payable in respect of any transfer involved in the issuance and delivery of any such certificate upon conversion in a name other than that of the Holder, and the Corporation shall not be required to issue or deliver such certificates unless or until the person or persons requesting the issuance thereof shall have paid to the Corporation the amount of such tax or shall have established to the satisfaction of the Corporation that such tax has been paid. (f) Voting Rights. Except as otherwise expressly provided herein or as required by law, the Holders of shares of Series A Stock shall be entitled to vote on any and all matters considered and voted upon by the Corporation's Common Stock. The Holders of the Series A Stock shall be entitled to 1,000 (One Thousand) votes per share of Series A Stock. (g) Reservation of Shares of Common Stock . The Corporation covenants that it will at all times reserve and keep available out of its authorized and unissued Common Stock solely for the purpose of issuance upon conversion of Series A Stock as herein provided, free from preemptive rights or any other actual contingent purchase rights of persons other than the Holders of Series A Stock. such number of shares of Common Stock as shall be issuable upon the conversion of the outstanding Series A Stock. If at any time the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all outstanding Series A Stock, the Corporation will take such corporate action necessary to increase its authorized shares of Common Stock to such number as shall be sufficient for such purpose. The Corporation covenants that all shares of Common Stock that shall be so issuable shall, upon issue, be duly and validly authorized, issued and fully paid and non - assessable. All other aspects of Article Ill shall remain unchanged.

IN WITNESS WHEREOF, the Company has caused these Articles of Amendment to the Articles of Incorporation to be signed by Rhonda Keaveney, its Chief Executive Officer, this 29 th day of October 2020 . Rhonda Keaveney Chief Executive Officer

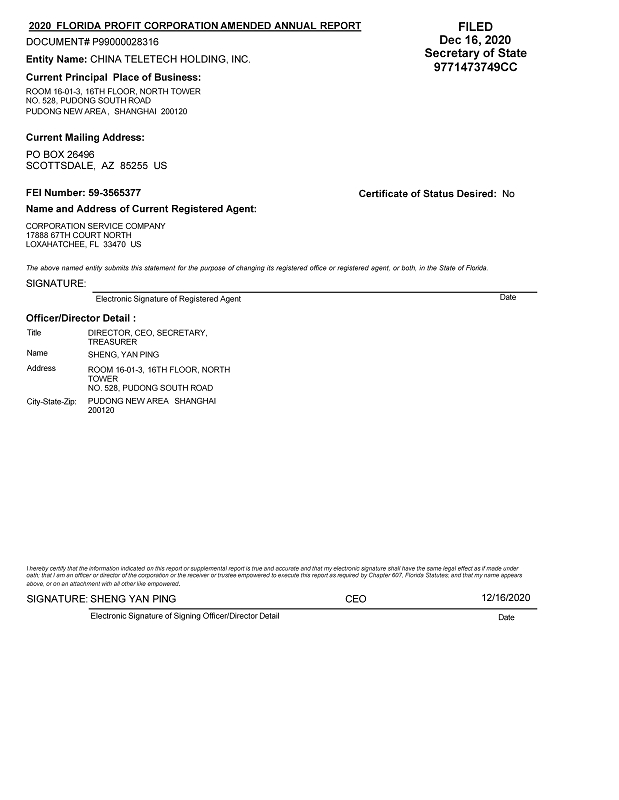

2020 FLORIDA PROFIT CORPORATION AMENDED ANNUAL REPORT DOCUMENT# P99000028316 Entity Name: CHINA TELETECH HOLDING, INC. Current Principal Place of Business: ROOM 16 - 01 - 3, 16TH FLOOR, NORTH TOWER NO. 528, PUDONG SOUTH ROAD PUDONG NEW AREA , SHANGHAI 200120 Current Mailing Address: PO BOX 26496 SCOTTSDALE, AZ 85255 US FEI Number: 59 - 3565377 Name and Address of Current Registered Agent: CORPORATION SERVICE COMPANY 17888 67TH COURT NORTH LOXAHATCHEE, FL 33470 US Certificate of Status Desired: No The above named entity submits this statement for the purpose of changing its registered office or registered agent, or both, in the State of Florida. SIGNATURE: Electronic Signature of Registered Agent Date Officer/Director Detail : I hereby certify that the information indicated on this report or supplemental report is true and accurate and that my electronic signature shall have the same legal effect as if made under oath; that I am an officer or director of the corporation or the receiver or trustee empowered to execute this report as required by Chapter 607, Florida Statutes; and that my name appears above, or on an attachment with all other like empowered . SIGNATURE: SHENG YAN PING CEO Electronic Signature of Signing Officer/Director Detail Date FILED Dec 16, 2020 Secretary of State 9771473749CC 12/16/2020 Title DIRECTOR, CEO, SECRETARY, TREASURER SHENG, YAN PING ROOM 16 - 01 - 3, 16TH FLOOR, NORTH TOWER NO. 528, PUDONG SOUTH ROAD PUDONG NEW AREA SHANGHAI 200120 Name Address City - State - Zip:

\

\