SOS Limited

Building 6, East Seaview Park

298 Haijing Road, Yinzhu Street

West Coast New District, Qingdao City, Shandong Province

People’s Republic of China

December 13, 2022

VIA EDGAR

Michelle Miller

U.S. Securities and Exchange Commission

Division of Corporation Finance

Office of Finance

100 F Street, N.E.

Mail Stop 4631

Washington, DC 20549

| | Re: | SOS Limited |

| | | Form 20-F for the fiscal period ending December 31, 2020 |

| | | Filed May 5, 2021 Form 20-F/A for the fiscal period ending December 31, 2020 Filed October 12, 2021 Form 20-F/A for the fiscal period ending December 31, 2020 Filed January 7, 2022 Form 20-F for the fiscal period ending December 31, 2021 Filed May 2, 2022 |

| | | File No. 001-38051 |

Dear Ms. Miller:

SOS Limited (the “Company”, “SOS,” “we”, “us” or “our”) hereby supplementally transmits its response to the letter received from the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”), dated October 20, 2022 regarding our annual report on Form 20-F previously submitted on May 2, 2022 (the “Form 20-F”). For ease of reference, we have repeated the Commission’s comments in this response and numbered them accordingly.

Form 20-F for the fiscal period ending December 31, 2021

Introduction, page iii

| 1. | We note your disclosure that “China” or the “PRC” refers to the People’s Republic of China, excluding, for the purposes of your annual report only, Hong Kong and Macau, your primary reference to China and or the PRC in your risk factors with regard to operating, regulatory, legal, and governmental authorities and the flow of capital contributions/loans and or dividends/distributions through China SOS Limited, your wholly-owned subsidiary located in Hong Kong, and your PRC subsidiaries and the consolidated VIEs as reflected in your diagram on page 11. Please address the following: |

| ● | Either remove the exclusion of Hong Kong and Macau from your definition of China or the PRC and clarify that the same legal and operational risks associated with operations in China also apply to operation in Hong Kong or disclose how any regulatory actions related to data security or anti-monopoly concerns in Hong Kong or Macau have or may impact the company’s ability to conduct its business, accept foreign investments, or list on a U.S. or foreign exchange. |

| ● | Provide risk factor disclosure to explain whether there are any commensurate laws or regulations in Hong Kong or Macau which result in oversight over data security and explain how this oversight impacts your business and to what extent you believe you are compliant with the regulations or policies that have been issued. |

| ● | Expand your “Enforceability of Civil Liability” discussion to address enforceability of civil liabilities in Hong Kong and Macau. |

Provide us with your proposed disclosure.

Response: In response to the Staff’s comment, please see the revised disclosure below.

| ● | “China” or the “PRC” refers to the People’s Republic of China, excluding, for the purposes of this annual report only, Taiwan; |

Part 1, page 1

| 2. | We note your response and revised disclosures in the 2021 Form 20-F in response to prior comment 1. Please address the following: |

| ● | Revise references of “our VIE”, “the Company’s VIE” and “our VIE agreements” on pages 1, 3, 7, 26, 27, 30, 36 and 55 to “the VIE(s)” to reflect the contractual nature of the VIE agreements. |

| ● | Remove your disclosures on pages 1, 2 and 26 that “the assets and liabilities of the VIE are treated as our assets and liabilities and the results of operations of the VIE are treated in all aspects as if they were the results of our operations” and “under generally accepted accounting principles in the United States (“U.S. GAAP”), the assets and liabilities of the VIE are treated as our assets and liabilities and the results of operations of the VIE are treated in all aspects as if they were the results of our operations” and instead disclose the conditions you satisfied for consolidation of the VIE under U.S. GAAP. |

Provide us with your proposed disclosure.

Response: In response to the Staff’s comment, please see the revised disclosure below.

| ● | Page 1 - The VIE Agreements may not be effective in providing control over the VIE. |

| | | |

| ● | Page 3 - The VIE Agreements may not be effective in providing control over the VIE. |

| | | |

| ● | Page 7 - Our ADSs are shares of our Cayman Islands holding company instead of shares of the VIE in China. |

| | | |

| ● | Page 26 - Because of the practical restrictions on direct foreign equity ownership imposed by provincial government authorities, we must rely on contractual rights through the VIE structure to effect control over and management of the VIE, which exposes us to the risk of potential breach of contract by the shareholders of the VIE. |

| | | |

| ● | Page 27 - If the PRC courts or regulatory authorities determine that our contractual arrangements are in violation of applicable PRC laws, rules or regulations, the VIE Agreements will become invalid or unenforceable, and the VIE will not be treated as VIE entities and we will not be entitled to treat the VIE’s assets, liabilities and results of operations as our assets, liabilities and results of operations, which could effectively eliminate the assets, revenue and net income of the VIE from our balance sheet, which would most likely require us to cease conducting our business and would result in the delisting of our ADSs from the New York Stock Exchange and a significant impairment in the market value of our ADSs. |

| | | |

| ● | Page 27 - As all of the VIE Agreements with the VIE are governed by the PRC laws and provide for the resolution of disputes through arbitration in the PRC, they would be interpreted in accordance with PRC law and any disputes would be resolved in accordance with PRC legal procedures. |

| | | |

| ● | Page 30 - In any of these cases, it will be uncertain whether the VIE Agreements will be deemed to be in violation of the market access requirements for foreign investment under the PRC laws and regulations. |

| | | |

| ● | Page 36 - In addition, the PRC tax authorities may require us to adjust our taxable income under the contractual arrangements our WFOEs currently have in place with the VIEs in a manner that would materially and adversely affect their ability to pay dividends and other distributions to us. |

| ● | Page 55 - Total assets and liabilities presented on the Company’s consolidated balance sheets and revenue, expense, net income presented on consolidated statement of operations and comprehensive income as well as the cash flow from operating, investing and financing activities presented on the consolidated statement of cash flows are substantially the financial position, operation and cash flow of the VIE and the VIE’s subsidiaries. |

We are a Cayman Islands holding company conducting a portion of our operations in China through Qingdao SOS Industrial Holding Co., Ltd., a variable interest entity (“VIE”), and its subsidiaries. Investors of our ADSs are not investing in the VIE. Neither we nor our subsidiaries own any share in the VIE. Instead, for accounting purposes, we control and receive the economic benefits of the VIE’s business operation through a series of contractual arrangements, also known as VIE Agreements, dated May 14, 2020, which enables us to consolidate the financial results of the VIE and its subsidiaries in our consolidated financial statements under U.S. GAAP. The consolidation of the VIEs under U.S. GAAP are limited to the following conditions that we have met: (i) we controls the VIE through power to govern the activities which most significantly impact the VIE’s economic performance, (ii) We are contractually obligated to absorb losses of the VIE that could potentially be significant to the VIE, and (iii) we are entitled to receive benefits from the VIE that could potentially be significant to the VIE. Only if we meet the aforementioned conditions for consolidation of the VIE under U.S. GAAP, will we be deemed as the primary beneficiary of the VIE, and the VIE will be treated as our consolidated affiliated entities for accounting purposes.

| 3. | Please enhance your disclosure at the onset of Part 1 to disclose that uncertainty with regard to the PRC regulatory environment could cause the value of your ADS to significantly decline in value or become worthless. Provide us with your proposed disclosure. |

Response: In response to the Staff’s comment, please see the revised disclosure below.

Uncertainties in the PRC legal system and the interpretation and enforcement of PRC laws and regulations could limit the legal protections available to you and us, hinder our ability and the ability of any holder of our securities to offer or continue to offer such securities, result in a material adverse change to our business operations, and damage our reputation, which would materially and adversely affect our financial condition and results of operations and cause our ADSs to significantly decline in value or become worthless.

Item 3. Key Information, page 2

| 4. | We note your response prior comment 2 and your proposed enhanced disclosures. Please address the following: |

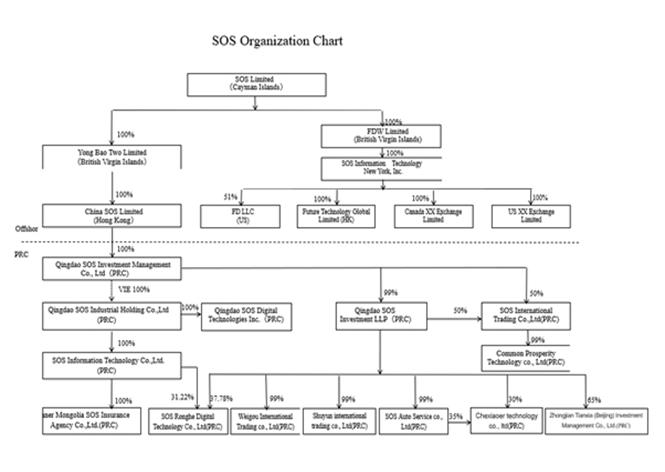

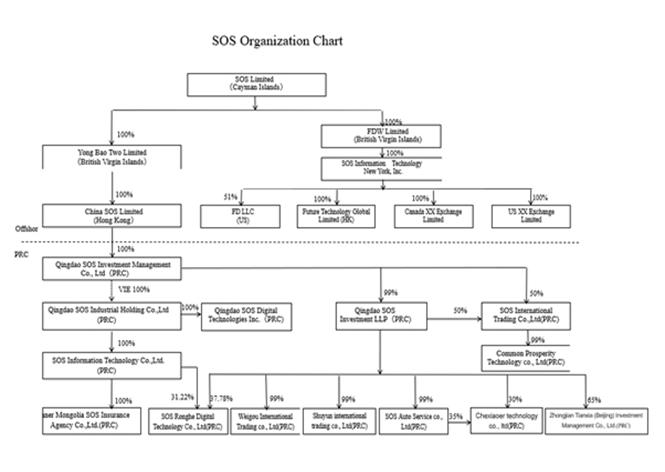

| ● | Currently your SOS Organization Chart diagram reflects solid lines between all entities. Revise to present dashed lines for your VIE contractual agreements to clearly differentiate from your equity interests. |

Clarify the legal entity of “the operating entity in China” in the related SOS Organization Chart diagram disclosures and reflect with an arrow from and to, the ability to pay dividends and other distributions of equity as well as consulting and service fees.

| ● | You disclose that subsidiaries inside China refers to the VIE’s subsidiaries, including SOS Information Technology Co., Ltd (“SOSIT”), Inner Mongolia SOS Insurance Agency Co., Ltd (“IMSOS”); and directly owned subsidiaries including SOS International Trading Co., Ltd (“SOSINT”), Qingdao SOS Investment LLP (“SOSIL”), Qingdao SOS Digital Technologies Ltd. (“SOSDT”), Common Prosperity Technology Co., Ltd. (“SOSCP”), SOS Ronghe Digital Technology Co., Ltd. (“SOSRD”), Weigou International Trading Co., Ltd (“SOSWI”), Shuyun International Trading Co., Ltd (“SOSSI”), SOS Auto Service Co., Ltd. (“SOSAS”), and Chexiaoer Technology Co., Ltd (“SOSCX”). Please reconcile this disclosure to your definition of variable interest entity(ies) on page iii, to your disclosures on page F-7 of entities, legal structure and or contractual relationship, including that SOSRD is a 31.22% subsidiary of SOSIT versus the 69% how Qingdao Enterprise Co. Ltd is reflected on page 4, to your related disclosures beginning on page F-28. |

| ● | Clarify your disclosures that as of December 31, 2021 and 2020, the VIE accounted for an aggregate of 99% and 100%, respectively, of your consolidated total assets, 99% and 100% respectively, of your consolidated total liabilities, and 100% and 100% respectively, of your consolidated total net revenues since your consolidating financial schedules on pages F-30 through F-38 and the VIE column reflect immaterial activity for the periods presented. |

| ● | Disclose in Item 3., consolidating schedules of your financial position and operations, together with related cash flows consistent with your audited consolidating financial schedules on pages F-30 through F-38. |

| ● | Disclose a roll-forward of investments in subsidiaries outside China, in WFOE and in China SOS that reconciles beginning and or ending balance, plus or minus equity in earnings of VIEs, equity in earnings of subsidiaries, foreign currency translation and other in arriving at investments in subsidiaries outside China, in WFOE and in China SOS prior to consolidation/elimination adjustments as of December 31, for the periods presented. Provide us with your proposed disclosure. |

Response: In response to the Staff’s comment, please see the revised disclosures below.

| ● | We revised the SOS organization chart diagram on page 4 and page 54. Please see the following diagram. |

| ● | The above organization chart shows all operating entities in China. Each intermediate parent company is able to pay dividends or distribute equity interest to its immediate subsidiary except for Qingdao SOS Investment Management Co., Ltd, which has a VIE arrangement with its immediate subsidiary, Qingdao SOS Industrial Holding Co., Ltd.; for fund transferred among VIE & non-VIE entities, the transaction could be facilitated by providing and receiving consulting or service fees via transfer pricing schemes. |

| ● | Beginning on page F-28, we have presented two separate segment reporting: net revenue by product lines and financial results by the Company, SOS China Ltd, WFOE, VIEs, subsidiaries inside China and subsidiaries outside China. |

| o | For Segmental Revenue Reporting by product lines, revenue of insurance marketing was generated from the subsidiary inside China called SOSIT; revenue of commodity trading was generated from the subsidiaries of mainly SOSINT; revenue of cryptocurrency mining was generated by SOS China Ltd. All other entities are conduit entities, inactive, having few transactions, or are newly incorporated. |

| o | Reconciling financial result reporting by the Company, SOS China Ltd, WOFE, VIEs, subsidiaries inside China and subsidiaries outside China: SOS China Ltd is the operating entity for the crypto-currency mining business, SOSIT, a subsidiary inside China is the operating entity for insurance marketing, and SOSINT is the operating entity for commodity trading business. All other entities are conduit entities, inactive, having few transactions, or are newly incorporated. |

| ● | Referring to F-32, for the year ended December 31, 2021, SOSIT, a VIE’s subsidiary inside China was the only entity operating the insurance marketing business in mainland PRC and other legal entities in the consolidated financial statements are either conduit entities or have few transactions, which is why it is disclosed as 99% and 99% of consolidated total assets and consolidated total liabilities, respectively. Referring to F-35, for the year ended December 31, 2020, SOSIT, a VIE’s subsidiary inside China was the only entity operating insurance marketing business in mainland PRC and other legal entities in the consolidated financial statements are either conduit entities or have few transactions, which is why it is disclosed as 100% and 100% of consolidated total assets and consolidated total liabilities, respectively. |

| ● | Please refer to the amended 20-F for the year ended December 31, 2021. |

| ● | In the amended 20-F for the fiscal year ended December 31, 2020, the roll-forward of investment was removed in response to the SEC’s letter in January 2021; The Company believes that the segmental Consolidated Balance Sheet by the Company, SOS China Ltd, WOFE, VIEs, Subsidiaries inside China and Subsidiaries outside China that was added to the amended 2021 annual report filed in May 2022 can provide more clarity and additional information to readers. For each year’s segmental balance sheet there is a section to show how long-term investment has been eliminated with adjustment narration per pages F-30 to F-38. Investment in China SOS Ltd, subsidiaries inside China, subsidiaries outside China etc. have corresponding adjustments. Furthermore, shareholders’ equity is also presented by the Company, China SOS Ltd, subsidiaries inside China, subsidiaries outside China etc. |

| 5. | We note your disclosure on page 4, that the consolidated VIEs can only distribute dividends upon approval of the shareholders after they have met the PRC requirements for appropriation to the statutory reserves and until such reserves reach 50% of its registered capital. Please enhance your disclosures to define registered capital and disclose the reserve requirement for the periods consistent with the consolidated financial statements included in your Form 20-F. Provide us with your proposed disclosure. |

Response: In response to the Staff’s comment, please see the revised disclosures below.

Pursuant to the law applicable to China’s foreign investment enterprises, an operating entity that is a foreign investment enterprise in the PRC has to make appropriation from its after-tax profit, as determined under PRC GAAP, to reserve funds including (i) general reserve fund, (ii) enterprise expansion fund and (iii) staff bonus and welfare fund. The appropriation to the general reserve fund must be at least 10% of the after-tax profits calculated in accordance with PRC GAAP. Appropriation is not required if the reserve fund has reached 50% of the total capital contribution to be paid-in by shareholders (the “Registered Capital”) of the operating company. Appropriation to the other two reserve funds is at the discretion of the operating company in China. General reserve fund and statutory surplus fund are restricted for set off against losses, expansion of production and operation or increase in Registered Capital of the respective companies. These reserves are not transferable to the Company in the form of cash dividends, loans or advances. These reserves are therefore not available for distribution except in liquidation.

As of December 31, 2021 and 2020, the Group has not accrued any money in the reserve fund.

| 6. | In your Risk Factors Summary on page 7, please conform your summary to include all risk factors identified in Item 3. Key Information – D. Risk Factors – “Risks Relating to Our Corporate Structure” and “Risks Relating to Doing Business in China” and cross reference each of these individual risks to its relevant detailed risk factor in Item 3.D. Provide us with your proposed disclosure. |

Response: In response to the Staff’s comment, please see the revised disclosures below.

Risk Factors Summary

Investing in our ADSs involves a high degree of risk. Below is a summary of material factors that make an investment in our ADSs speculative or risky. Importantly, this summary does not address all of the risks that we face. Please refer to the information contained in and incorporated by reference under the heading “Risk Factors” on page 9 of this prospectus and under similar headings in the other documents that are filed with the SEC, and incorporated by reference into this prospectus for additional discussion of the risks summarized in this risk factor summary as well as other risks that we face. These risks include, but are not limited to, the following:

Risks Related to Our Corporate Structure

Risks and uncertainties related to our corporate structure include, but are not limited to, the following:

| ● | We do not have direct ownership of our operating entities in China, but have control rights and the rights to the assets, property, and revenue of the VIE through VIE Agreements, which may not be effective in providing control over the VIE (see “Risk Factors—Risks Related to our Corporate Structure—We do not have direct ownership of our operating entities in China, but have control rights and the rights to the assets, property, and revenue of the VIE through VIE Agreements, which may not be effective in providing control over the VIE”); |

| ● | Because we are a Cayman Islands holding company and conduct our business through the VIE in China, if we fail to comply with applicable PRC law, we could be subject to severe penalties and our business could be adversely affected (see “Risk Factors—Because we are a Cayman Islands holding company and conduct our business through the VIE in China, if we fail to comply with applicable PRC law, we could be subject to severe penalties and our business could be adversely affected”); |

| ● | We may have difficulty in enforcing any rights we may have under the VIE Agreements in PRC (see “Risk Factors— We may have difficulty in enforcing any rights we may have under the VIE Agreements in PRC”); |

| ● | The approval of the China Securities Regulatory Commission and other compliance procedures may be required in connection with offerings of our ADSs, and, if required, we cannot predict whether we will be able to obtain such approval. As a result, both you and us face uncertainty about future actions by the PRC government that could significantly affect the operating company’s financial performance and the enforceability of the VIE Agreements (see “Risk Factors—The approval of the China Securities Regulatory Commission and other compliance procedures may be required in connection with offerings of our ADSs, and, if required, we cannot predict whether we will be able to obtain such approval. As a result, both you and us face uncertainty about future actions by the PRC government that could significantly affect the operating company’s financial performance and the enforceability of the VIE Agreements”); |

| ● | PRC laws and regulations governing our current business operations are sometimes vague and uncertain and any changes in such laws and regulations may impair our ability to operate profitable (see “Risk Factors— PRC laws and regulations governing our current business operations are sometimes vague and uncertain and any changes in such laws and regulations may impair our ability to operate profitable”); |

| ● | Regulations relating to offshore investment activities by PRC residents may limit our ability to acquire PRC companies and could adversely affect our business (see “Risk Factors—Regulations relating to offshore investment activities by PRC residents may limit our ability to acquire PRC companies and could adversely affect our business”); |

| ● | Uncertainties exist with respect to the interpretation and implementation of the Foreign Investment Law and how it may impact the viability of our current corporate structure, corporate governance and business operations (see “Risk Factors—Uncertainties exist with respect to the interpretation and implementation of the Foreign Investment Law and how it may impact the viability of our current corporate structure, corporate governance and business operations.”); |

Risks Related to Doing Business in China

Risks and uncertainties related to doing business in China include, but are not limited to, the following:

| ● | Governmental control of currency conversion may limit our ability to utilize our net revenue effectively and our ability to transfer cash between our PRC subsidiaries and us, across borders, and to investors and affect the value of your investment (see “Risk Factors—Governmental control of currency conversion may limit our ability to utilize our net revenue effectively and our ability to transfer cash between our PRC subsidiaries and us, across borders, and to investors and affect the value of your investment”); |

| ● | Our ADSs may be delisted under the Holding Foreign Companies Accountable Act if the PCAOB is unable to inspect our auditors for three consecutive years beginning in 2021. The delisting of our ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment (see “Risk Factors—Our ADSs may be delisted under the Holding Foreign Companies Accountable Act if the PCAOB is unable to inspect our auditors for three consecutive years beginning in 2021. The delisting of our ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment”); |

| ● | The recent joint statement by the SEC and an act passed by the U.S. Senate and the U.S. House of Representatives, all call for additional and more stringent criteria to be applied to emerging market companies. These developments could add uncertainties to our offering, business operations, share price and reputation. (see “Risk Factors—The recent joint statement by the SEC and an act passed by the U.S. Senate and the U.S. House of Representatives, all call for additional and more stringent criteria to be applied to emerging market companies. These developments could add uncertainties to our offering, business operations, share price and reputation”); |

| ● | The approval of the CSRC and other compliance procedures may be required, and, if required, we cannot predict whether we will be able to obtain such approval (see “Risk Factors—The approval of the CSRC and other compliance procedures may be required, and, if required, we cannot predict whether we will be able to obtain such approval”); |

| ● | Failure to comply with laws and regulations applicable to our business could subject us to fines and penalties and could also cause us to lose customers or otherwise harm our business (see “Risk Factors— Failure to comply with laws and regulations applicable to our business could subject us to fines and penalties and could also cause us to lose customers or otherwise harm our business”); |

| ● | If we cease to qualify as a foreign private issuer, we would be required to comply fully with the reporting requirements of the Exchange Act applicable to U.S. domestic issuers, and we would incur significant additional legal, accounting and other expenses that we would not incur as a foreign private issuer (see “Risk Factors—If we cease to qualify as a foreign private issuer, we would be required to comply fully with the reporting requirements of the Exchange Act applicable to U.S. domestic issuers, and we would incur significant additional legal, accounting and other expenses that we would not incur as a foreign private issuer”); |

| ● | We may fail to obtain, maintain and update licenses and permits necessary to conduct our operations in the PRC, and our business may be materially and adversely affected as a result of any changes in the laws and regulations governing the VATS industry in the PRC (see “Risk Factors—We may fail to obtain, maintain and update licenses and permits necessary to conduct our operations in the PRC, and our business may be materially and adversely affected as a result of any changes in the laws and regulations governing the VATS industry in the PRC”); |

| ● | We may rely principally on dividends and other distributions on equity paid by our wholly foreign-owned entities, or WFOEs, to fund any cash and financing requirements we may have, and any limitation on the ability of our WFOEs to pay dividends to us could have a material adverse effect on our ability to conduct our business (see “Risk Factors—We may rely principally on dividends and other distributions on equity paid by our wholly foreign-owned entities, or WFOEs, to fund any cash and financing requirements we may have, and any limitation on the ability of our WFOEs to pay dividends to us could have a material adverse effect on our ability to conduct our business”); |

| ● | Adverse changes in China’s economic, political and social conditions, as well as laws and government policies, may materially and adversely affect our business, financial condition, results of operations and growth prospects (see “Risk Factors—Adverse changes in China’s economic, political and social conditions, as well as laws and government policies, may materially and adversely affect our business, financial condition, results of operations and growth prospects”); |

| ● | Uncertainties in the interpretation and enforcement of PRC laws and regulations could limit the legal protections available to you and us (see “Risk Factors— Uncertainties in the interpretation and enforcement of PRC laws and regulations could limit the legal protections available to you and us”); |

| ● | Uncertainties with respect to the PRC legal system could affect us (see “Risk Factors—Uncertainties with respect to the PRC legal system could affect us”); |

| ● | Failure to comply with PRC regulations regarding the registration requirements for employee share ownership plans or share option plans may subject the PRC plan participants or us to fines and other legal or administrative sanctions (see “Risk Factors—Failure to comply with PRC regulations regarding the registration requirements for employee share ownership plans or share option plans may subject the PRC plan participants or us to fines and other legal or administrative sanctions”); |

| ● | Failure to make adequate contributions to various employee benefit plans as required by PRC regulations may subject us to penalties (see “Risk Factors—Failure to make adequate contributions to various employee benefit plans as required by PRC regulations may subject us to penalties”); |

| ● | The enforcement of the Labor Contract Law of the People’s Republic of China, or the PRC Labor Contract Law, and other labor-related regulations in the PRC may increase our labor costs, impose limitations on our labor practices and adversely affect our business and our results of operations (see “Risk Factors—The enforcement of the Labor Contract Law of the People’s Republic of China, or the PRC Labor Contract Law, and other labor-related regulations in the PRC may increase our labor costs, impose limitations on our labor practices and adversely affect our business and our results of operations”); |

| ● | It may be difficult to effect service of process upon us, our directors or our executive officers that reside in China or to enforce any judgments obtained from non-PRC courts or bring actions against them or us in China (see “Risk Factors—It may be difficult to effect service of process upon us, our directors or our executive officers that reside in China or to enforce any judgments obtained from non-PRC courts or bring actions against them or us in China”); |

| ● | The recent joint statement by the SEC and the Public Company Accounting Oversight Board, or the PCAOB, and an act signed into law all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our offering, business operations, share price and reputation (see “Risk Factors—The recent joint statement by the SEC and the Public Company Accounting Oversight Board, or the PCAOB, and an act signed into law all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our offering, business operations, share price and reputation”); |

| 7. | Please revise your proposed disclosure in Item 3 to include a separate “Enforceability of Civil Liability” section regarding the ability to impose liability on officers and directors located in Hong Kong and China consistent with your risk factor disclosure on pages 39 of your 2021 Form 20-F. Provide us with your proposed disclosure. |

Response: In response to the Staff’s comment, please see the revised disclosures below.

Enforceability of Civil Liability

We are an exempted company limited by shares incorporated under the laws of Cayman Islands. We conduct substantially all of our operations in China and substantially all of our assets are located in China. In addition, a majority of our directors and executive officers reside within China, and most of the assets of these persons are located within China. None of our directors and executive officers resides in Hong Kong, and their assets are primarily located outside Hong Kong. As a result, it may be difficult or impossible for you to effect service of process within the United States upon these individuals, or to bring an action against us or against these individuals in the United States in the event that you believe your rights have been infringed under the U.S. federal securities laws or otherwise. Even if you are successful in bringing an action of this kind, the laws of Cayman Islands and of the PRC may render you unable to enforce a judgment against our assets or the assets of our directors and officers.

There is no statutory enforcement in the Cayman Islands of judgments obtained in the federal or state courts of the United States (and the Cayman Islands are not a party to any treaties for the reciprocal enforcement or recognition of such judgments), however, the courts of the Cayman Islands will, at common law, recognize and enforce a foreign money judgment of a foreign court of competent jurisdiction without any re-examination of the merits of the underlying dispute based on the principle that a judgment of a competent foreign court imposes upon the judgment debtor an obligation to pay the liquidated sum for which such judgment has been given, provided such judgment (a) is given by a foreign court of competent jurisdiction, (b) imposes on the judgment debtor a liability to pay a liquidated sum for which the judgment has been given, (c) is final, (d) is not in respect of taxes, a fine or a penalty, and (e) was not obtained in a manner and is not of a kind the enforcement of which is contrary to natural justice or the public policy of the Cayman Islands. However, the Cayman Islands courts are unlikely to enforce a judgment obtained from the U.S. courts under civil liability provisions of the U.S. federal securities law if such judgment is determined by the courts of the Cayman Islands to give rise to obligations to make payments that are penal or punitive in nature. Because such a determination has not yet been made by a court of the Cayman Islands, it is uncertain whether such civil liability judgments from U.S. courts would be enforceable in the Cayman Islands. A Cayman Islands court may stay enforcement proceedings if concurrent proceedings are being brought elsewhere.

The recognition and enforcement of foreign judgments are provided for under the PRC Civil Procedures Law. PRC courts may recognize and enforce foreign judgments in accordance with the requirements of the PRC Civil Procedures Law based either on treaties between China and the country where the judgment is made or on principles of reciprocity between jurisdictions. China does not have any treaties or other forms of reciprocity with the United States that provide for the reciprocal recognition and enforcement of foreign judgments. In addition, according to the PRC Civil Procedures Law, the PRC courts will not enforce a foreign judgment against us or our director and officers if they decide that the judgment violates the basic principles of PRC laws or national sovereignty, security or public interest. As a result, it is uncertain whether and on what basis a PRC court would enforce a judgment rendered by a court in the United States.

| 8. | Please disclose at the onset of Item 3, the risk to the underlying operations of the VIE of the ability and or impact to relocate and or reproduce operating activities elsewhere should operating in the PRC become prohibitive. Provide us with your proposed disclosure. |

Response: In response to the Staff’s comment, please see the revised disclosures below.

If the underlying operations of the VIE become prohibited in China, we may be subject to sanctions imposed by PRC laws relating to, among others, data security and our remaining business operations in China may also become negatively affected. We could also be subject to severe penalties or be forced to relinquish our interests in those operations, which would result in a material adverse change to our business operations, and materially and adversely affect our financial condition and results of operations and cause our ADSs to significantly decline in value or become worthless.

Item 5. Operating and Financial Review and Prospects, page 55

| 9. | You disclose that the Company has not provided any financial support to the VIE and the VIE’s subsidiaries for the years ended at December 31, 2021 and 2020. Please clarify this disclosure based on inter-company account activity presented in the consolidating cash flows on pages F-32, F-35 and F-38 and clarify your reference to “the Company.” Provide us with your proposed disclosure. |

Response: In response to the Staff’s comment, please see our response below.

During the year of 2020, there were no inter-company cash activities per page F-35. SOS Limited (the “Company”) completed its first round of financing through a registered offering on Form F-3 on December 24, 2020 for net proceeds of US$3.6 million, which were deposited into the Company’s wholly owned subsidiary’s bank account at HSBC in Hong Kong. The Company did not have any means to finance the VIE and its subsidiaries before December 24, 2020.

The Company did several rounds of registered offerings which led to the inflow of funds for the year ended December 31, 2021. The Company instructed its investors to transfer the funds to the bank accounts of its wholly owned subsidiaries, China SOS Ltd., incorporated in Hong Kong and SOS Information Technology New York Inc., incorporated in New York. The VIE and its subsidiaries in China received an aggregate of US$197 million per page F-32 not from the Company directly, but from its wholly owned subsidiaries Qingdao SOS Investment Management Co., Ltd. and China SOS Ltd.

We thank the Staff for its review of the foregoing. If you have further comments, we ask that you forward them by electronic mail to our counsel, Joan Wu at jwu@htflawyers.com or by telephone at 212-530-2208.

[Signature page follows]

| | Very truly yours, |

| | |

| | /s/ Yandai Wang |

| | Yandai Wang

Chief Executive Officer |

| cc: | Hunter Taubman Fischer & Li LLC |

11