April 3, 2018 Fourth Quarter 2017 Earnings Presentation 155 159 181

Disclaimer The information in this presentation is provided to you by China Rapid Finance Limited (the “Company”) solely for informational purposes and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument of the Company, or to participate in any investment activity or trading strategy, nor may it or any part of it form the basis of or be relied on in connection with any contract or commitment whatsoever, in the United States or anywhere else. The information included herein was obtained from various sources, including certain third parties, and has not been independently verified. This presentation does not constitute legal, regulatory, accounting or tax advice to you. This presentation does not constitute and should not be considered as any form of financial opinion or recommendation by the Company or any other party. No representations, warranties or undertakings, express or implied, are made and no reliance should be placed on the accuracy, fairness or completeness of the information, sources or opinions presented or contained in this presentation. By viewing or accessing the information contained in this presentation, you hereby acknowledge and agree that neither the Company, nor any of its directors, officers, employees, advisers, nor any of its representatives, affiliates, associated persons or agents accepts any responsibility for or makes any representation or warranty, express or implied, with respect to the truth, accuracy, fairness, completeness or reasonableness of the information contained in, and omissions from, these materials and that that neither the Company, nor any of its directors, officers, employees, advisers, nor any of its representatives, affiliates, associated persons or agents accepts any liability whatsoever for any loss howsoever arising from any information presented or contained in these materials. The information presented or contained in this presentation is subject to change without notice and its accuracy is not guaranteed. This presentation contains statements that constitute forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include descriptions regarding the intent, belief or current expectations of the Company or its officers about the future. Such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ materially from those in the forward-looking statements as a result of various factors and assumptions, many of which are beyond the Company’s control. A description of risks relating to the Company appears in section “Risk Factors” of the Company‘s prospectus dated April 27, 2017 and filed with the Securities and Exchange Commission on April 28, 2017. Neither the Company, nor any of its directors, officers, employees, advisers, nor any of its representatives, affiliates, associated persons or agents has any obligation to, nor do any of them undertake to, revise or update the forward-looking statements contained in this presentation to reflect future events or circumstances. This presentation contains certain financial projections. These financial projections relate to future performance and reflect the Company’s views as at the date of this presentation and are subject to known and unknown risks, uncertainties and assumptions that may cause future results, performance or achievements to differ materially from those expected. The Company believes the expectations reflected in these financial projections are reasonable but no assurance can be given that these expectations will prove to be correct and these financial projections should not be relied upon. The Company cannot guarantee future results, level of activities, performance or achievements, including, but not limited to borrowing activities on its platform, including size of loans and repeat borrowing rate, borrower attrition rate, the Company’s ability to maintain its existing fee rates. Consequently, the Company makes no representation that the actual results achieved will be the same in whole or in part as those set out in the financial projections.

Use Technology to Fulfill the Lifetime Consumer Credit Needs of China’s Emerging Middle Class Our Mission

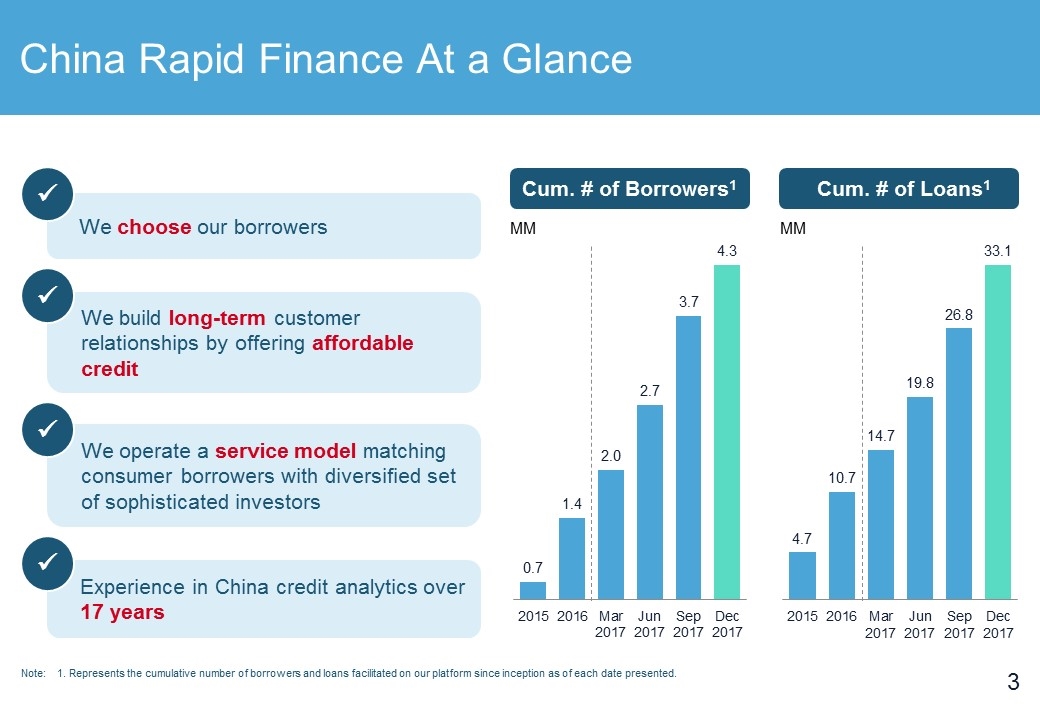

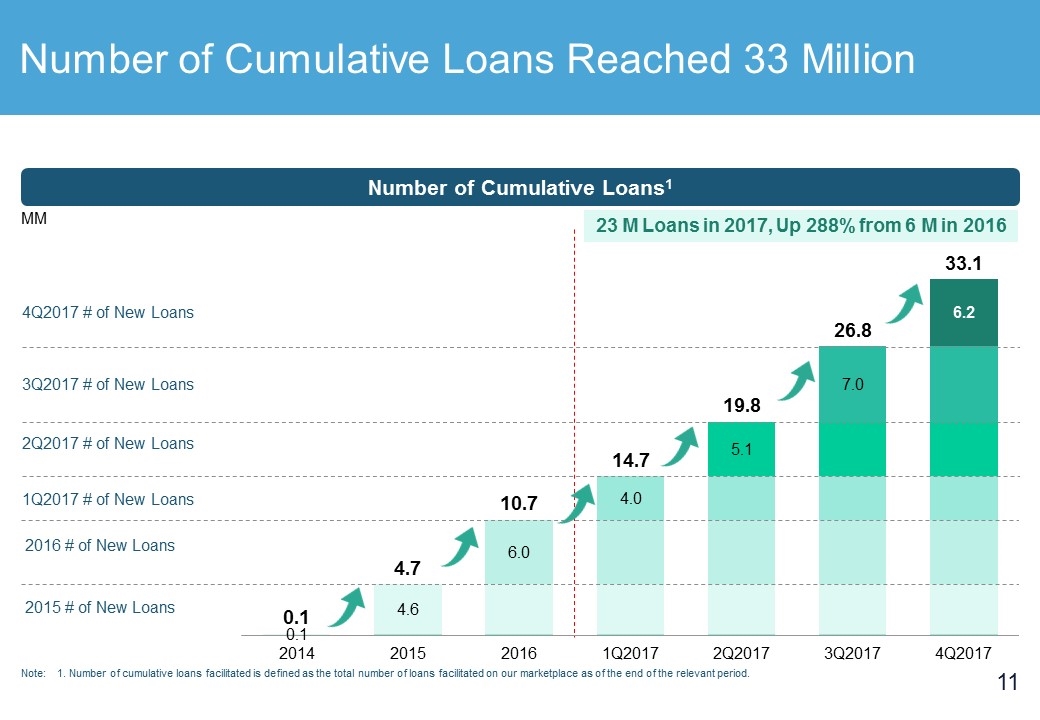

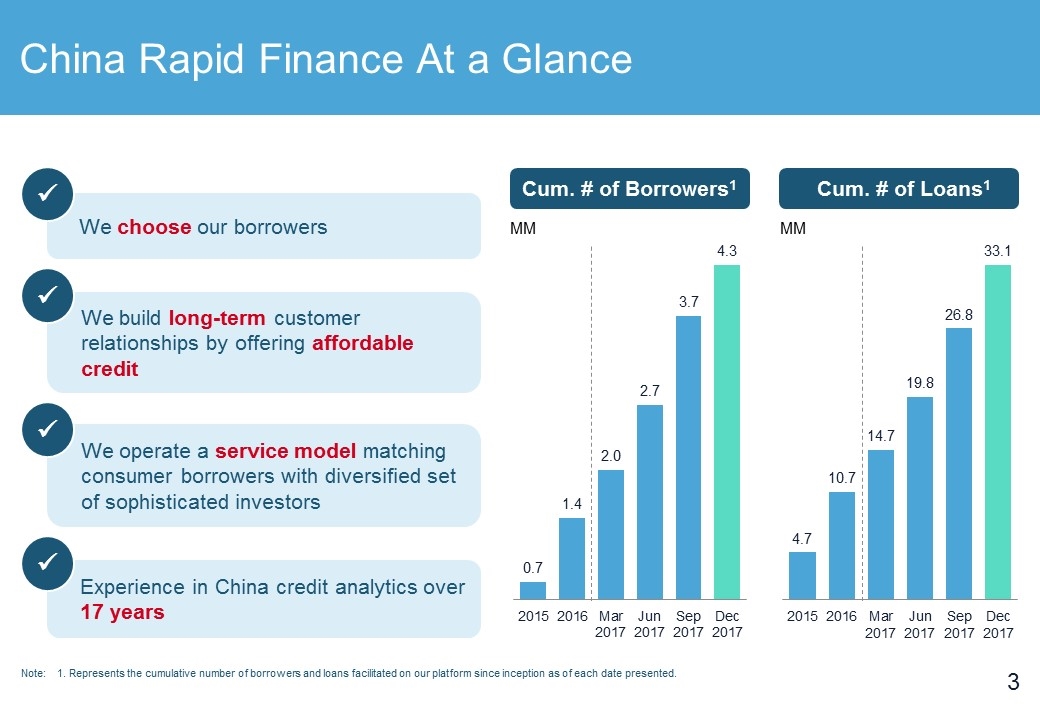

China Rapid Finance At a Glance Note: 1. Represents the cumulative number of borrowers and loans facilitated on our platform since inception as of each date presented. We choose our borrowers ü We build long-term customer relationships by offering affordable credit ü We operate a service model matching consumer borrowers with diversified set of sophisticated investors ü Experience in China credit analytics over 17 years ü MM Cum. # of Borrowers1 MM Cum. # of Loans1

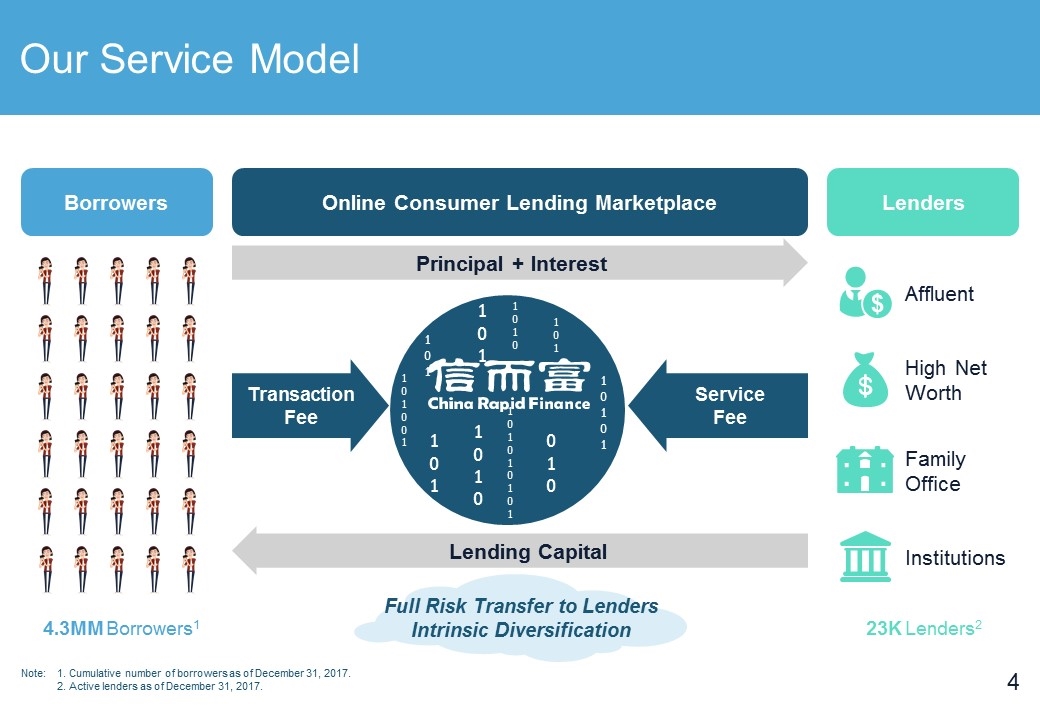

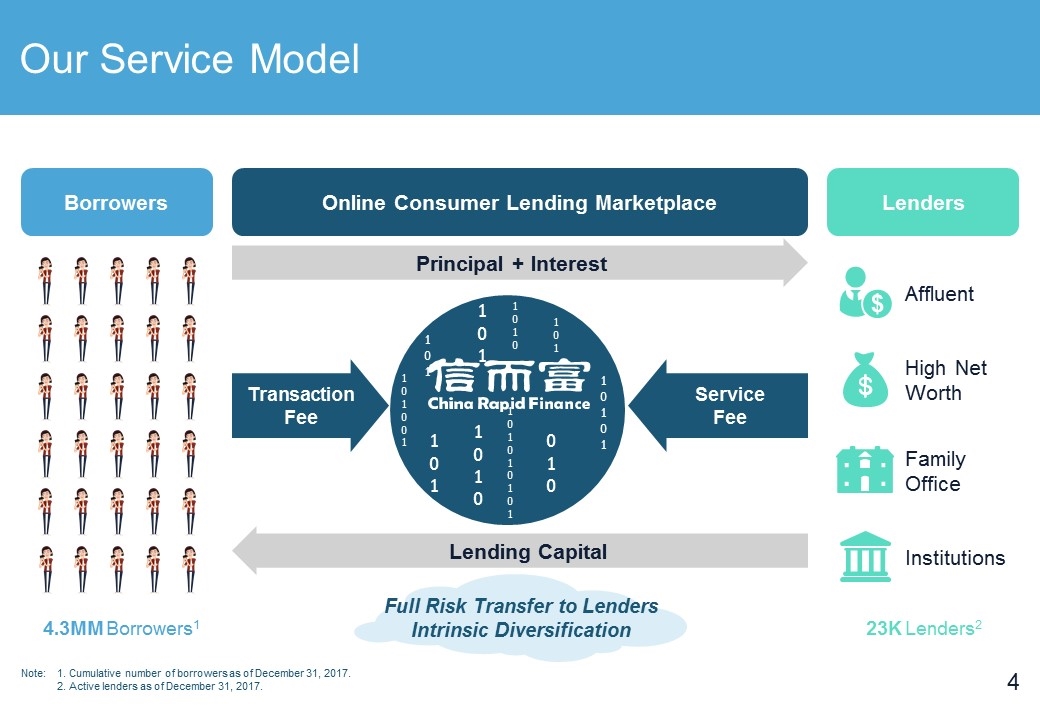

Our Service Model 4.3MM Borrowers1 Borrowers 23K Lenders2 High Net Worth Family Office Institutions Affluent Lenders Principal + Interest 0 1 0 1 0 1 1 0 1 0 Transaction Fee Service Fee 1 0 1 0 1 1 0 1 0 1 0 1 0 1 1 0 1 0 1 0 1 0 0 1 1 0 1 1 0 1 1 0 1 Full Risk Transfer to Lenders Intrinsic Diversification Online Consumer Lending Marketplace Lending Capital Note: 1. Cumulative number of borrowers as of December 31, 2017. 2. Active lenders as of December 31, 2017.

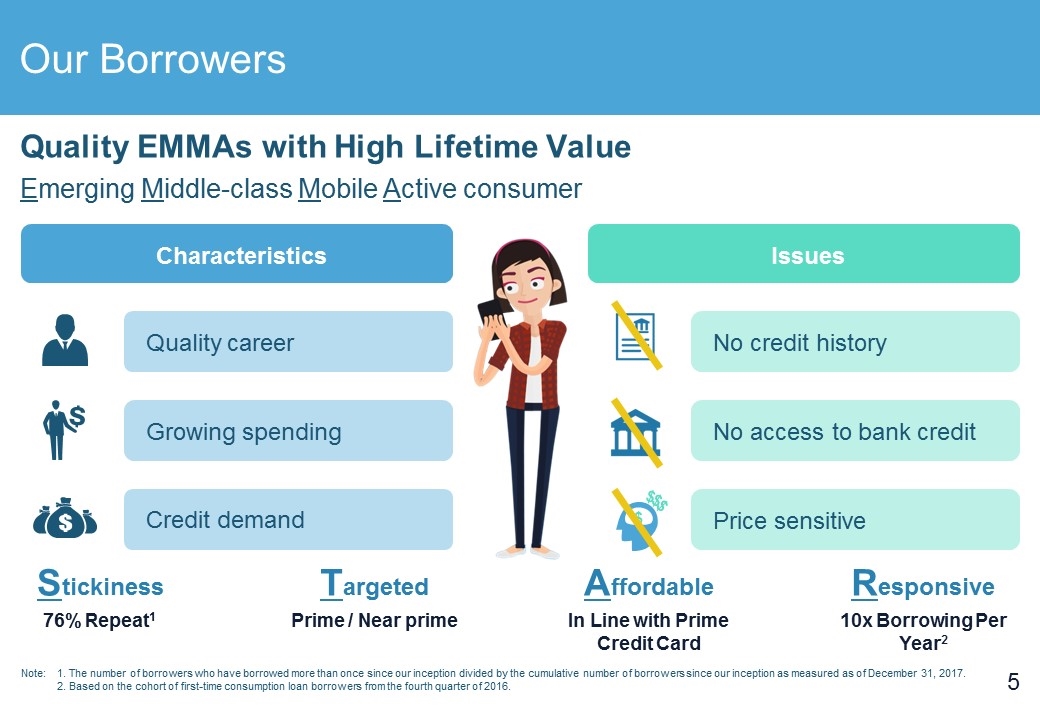

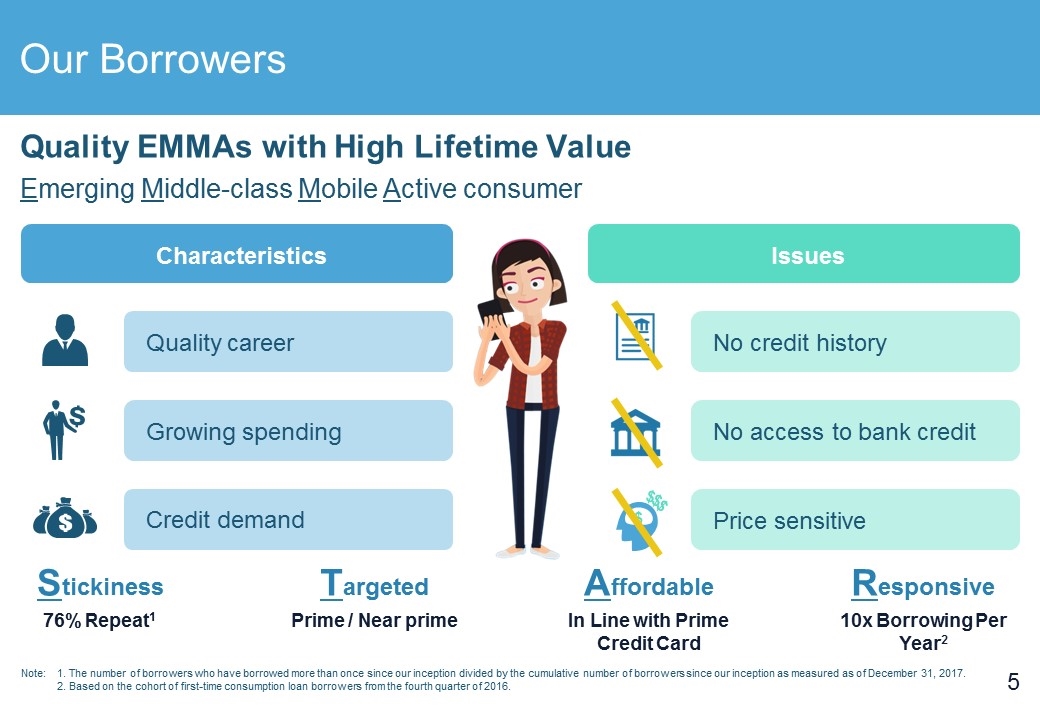

Our Borrowers Quality EMMAs with High Lifetime Value Emerging Middle-class Mobile Active consumer $ $ $ $ Characteristics Quality career Growing spending Credit demand No credit history No access to bank credit Price sensitive Stickiness 76% Repeat1 Targeted Prime / Near prime Affordable In Line with Prime Credit Card Responsive 10x Borrowing Per Year2 Note: 1. The number of borrowers who have borrowed more than once since our inception divided by the cumulative number of borrowers since our inception as measured as of December 31, 2017. 2. Based on the cohort of first-time consumption loan borrowers from the fourth quarter of 2016. Issues

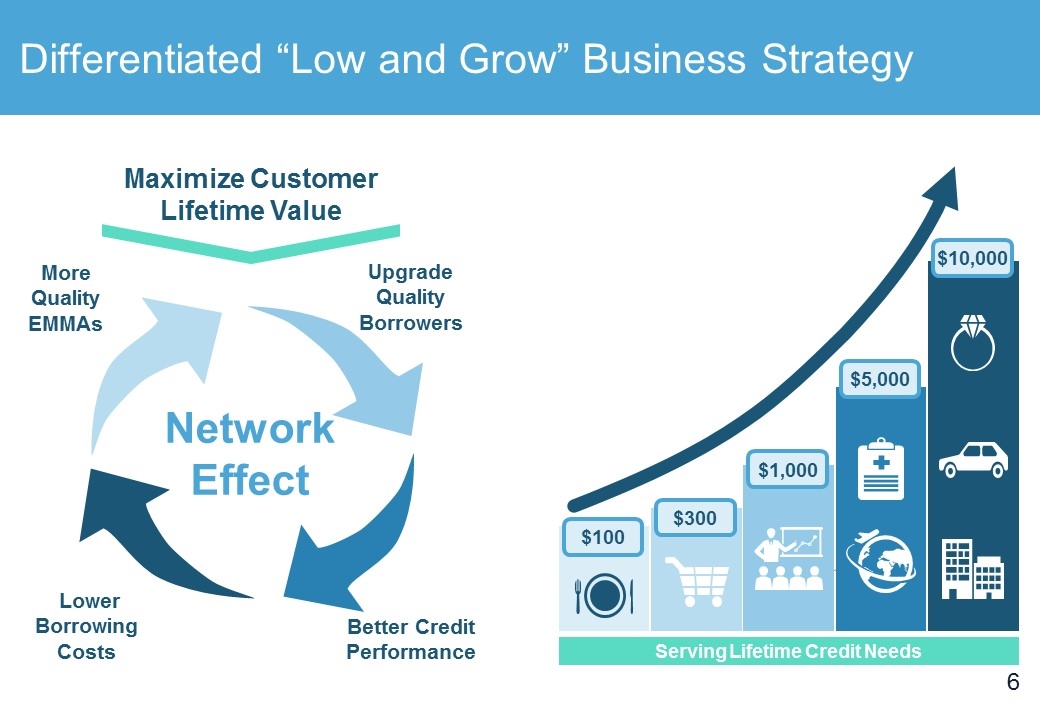

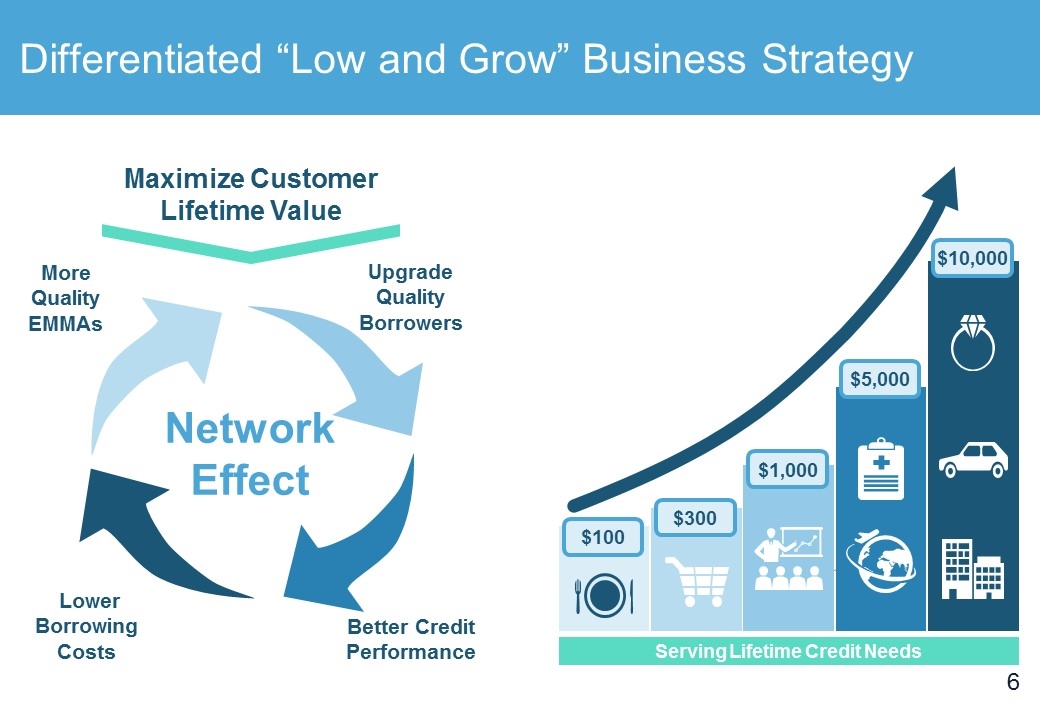

Differentiated “Low and Grow” Business Strategy Typical Profile 1 Upgrade Quality Borrowers Better Credit Performance Lower Borrowing Costs More Quality EMMAs Network Effect Maximize Customer Lifetime Value $1,000 $5,000 $100 $10,000 $300 Serving Lifetime Credit Needs

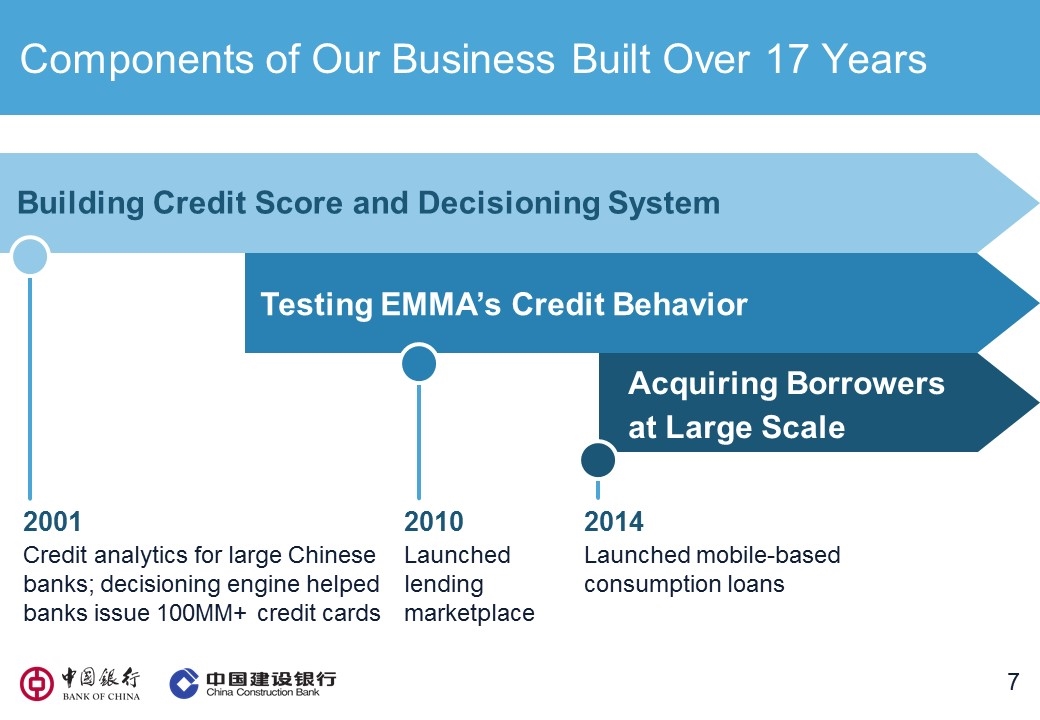

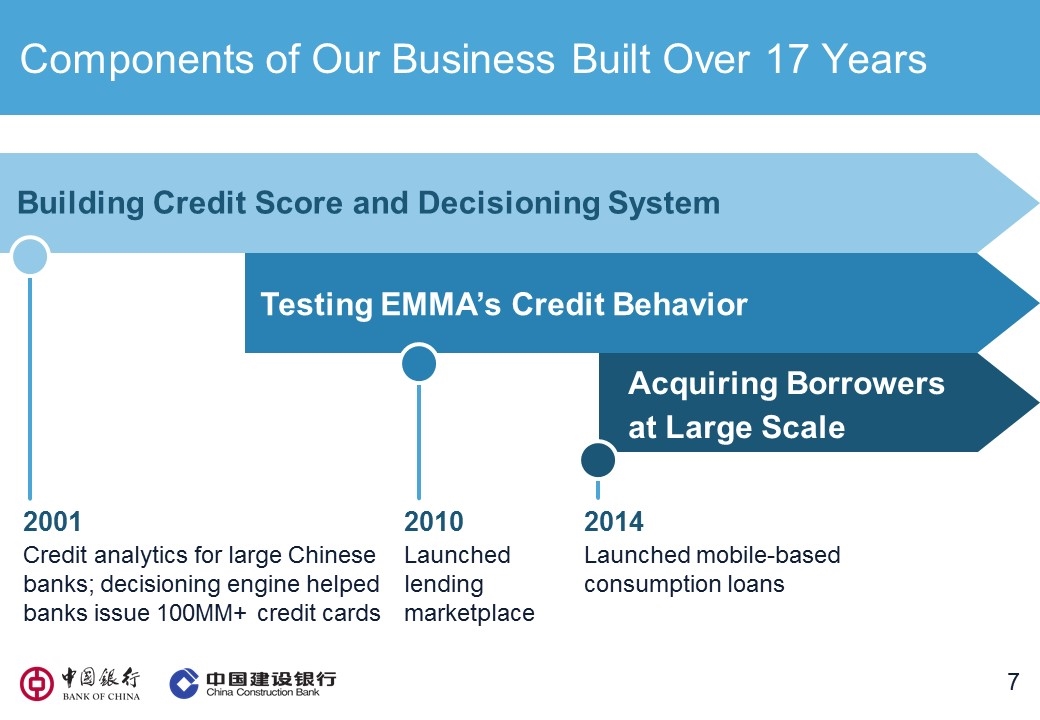

Components of Our Business Built Over 17 Years 2001 Credit analytics for large Chinese banks; decisioning engine helped banks issue 100MM+ credit cards 2014 Launched mobile-based consumption loans Building Credit Score and Decisioning System Acquiring Borrowers at Large Scale 2010 Launched lending marketplace Testing EMMA’s Credit Behavior

Fourth Quarter and Full Year 2017 Operating Results

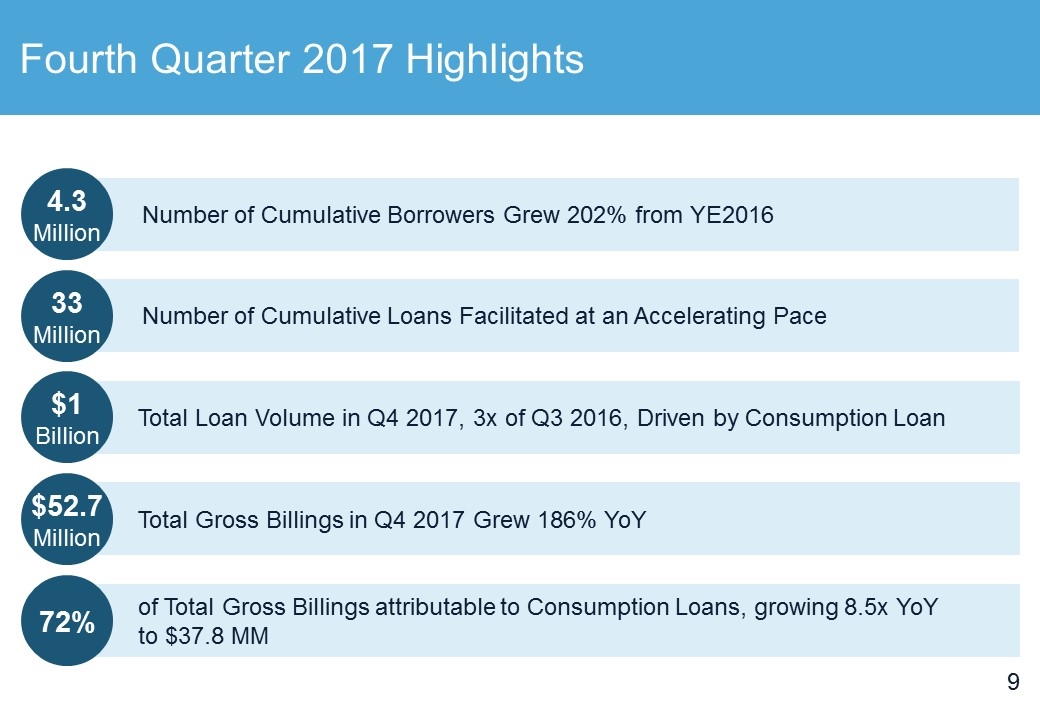

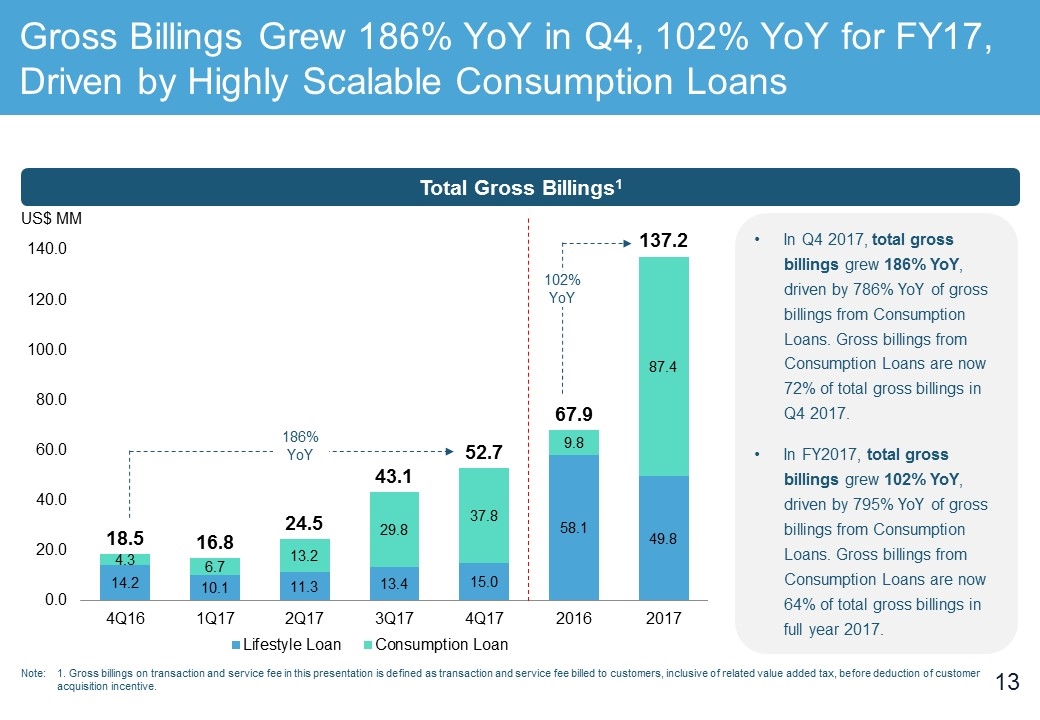

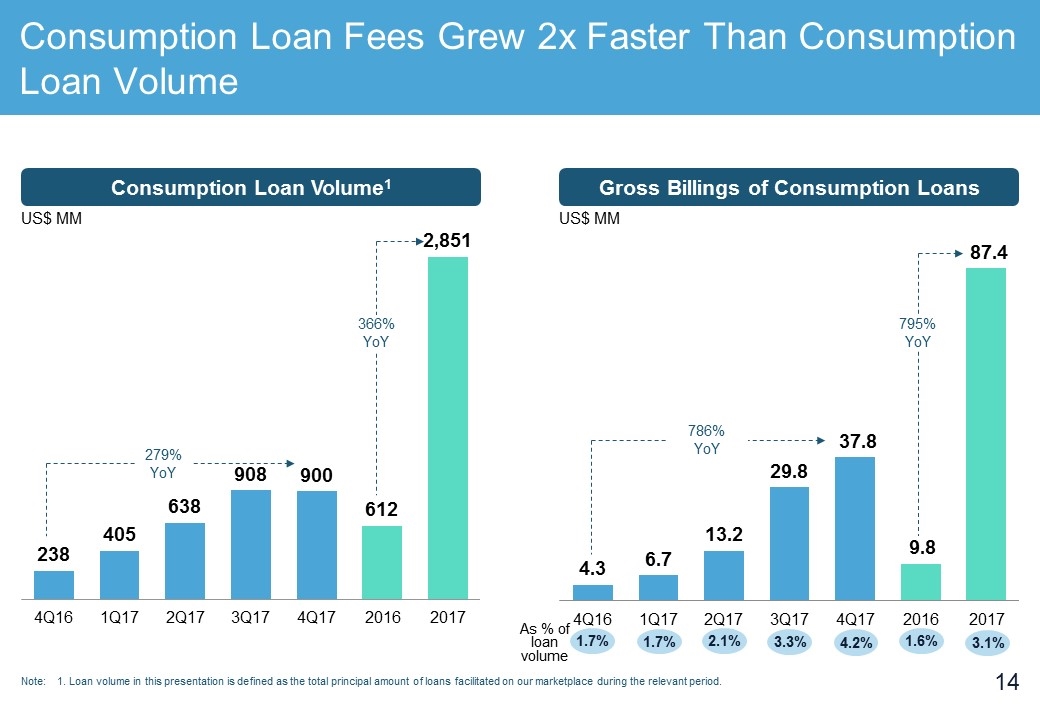

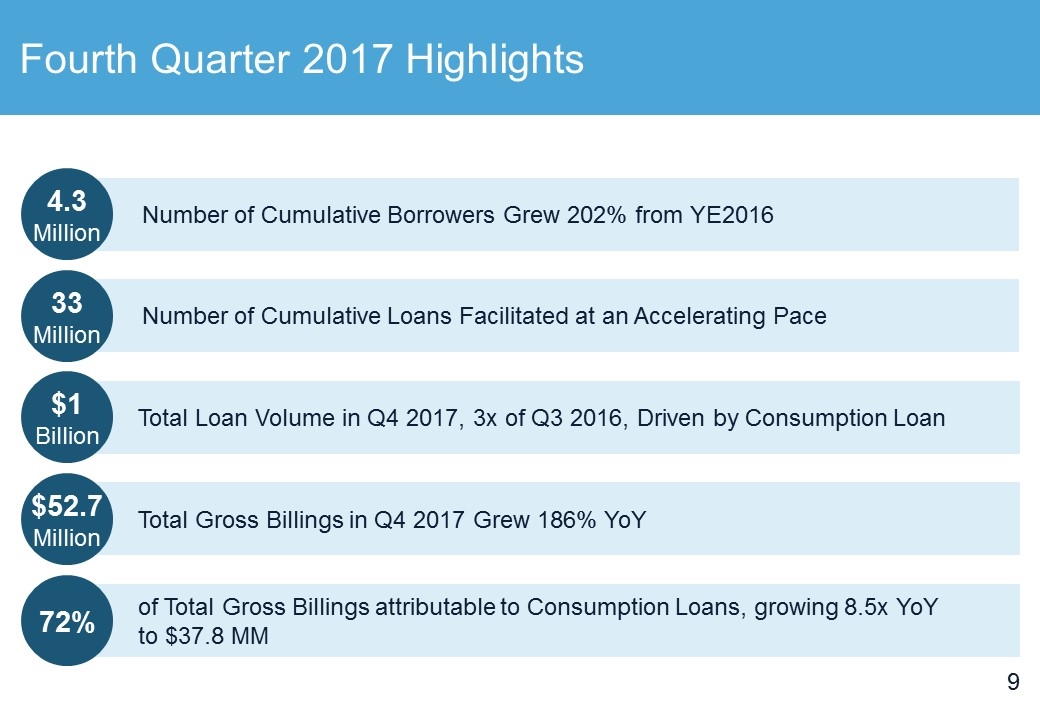

Fourth Quarter 2017 Highlights of Total Gross Billings attributable to Consumption Loans, growing 8.5x YoY to $37.8 MM Number of Cumulative Borrowers Grew 202% from YE2016 Number of Cumulative Loans Facilitated at an Accelerating Pace Total Gross Billings in Q4 2017 Grew 186% YoY Total Loan Volume in Q4 2017, 3x of Q3 2016, Driven by Consumption Loan 4.3 Million 33 Million $1 Billion $52.7 Million 72%

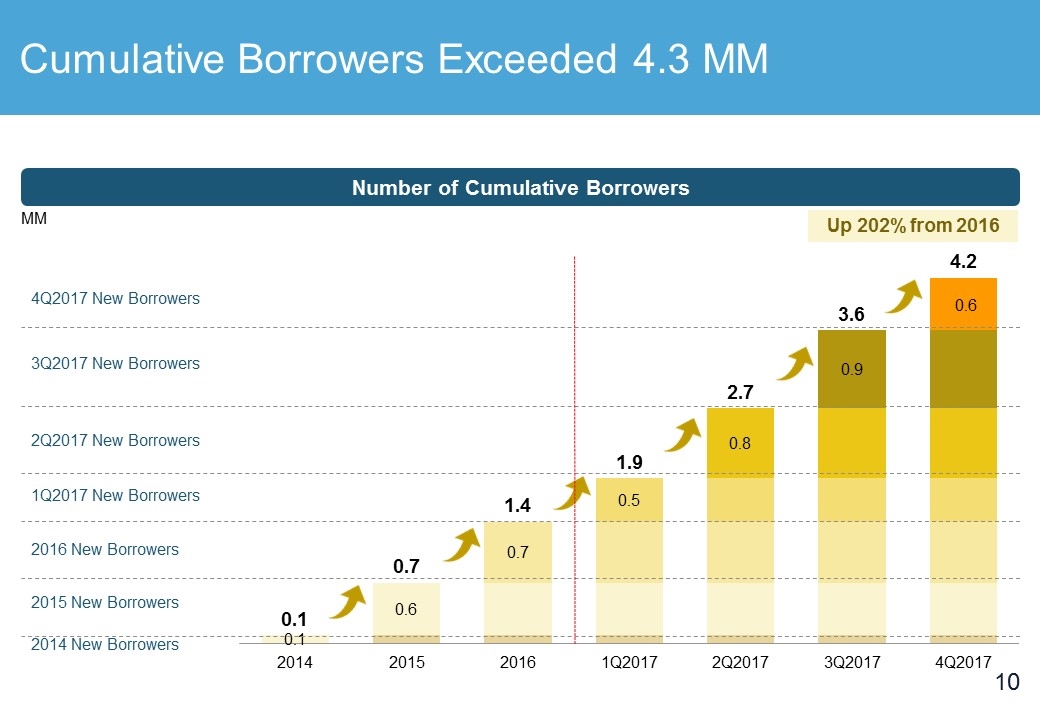

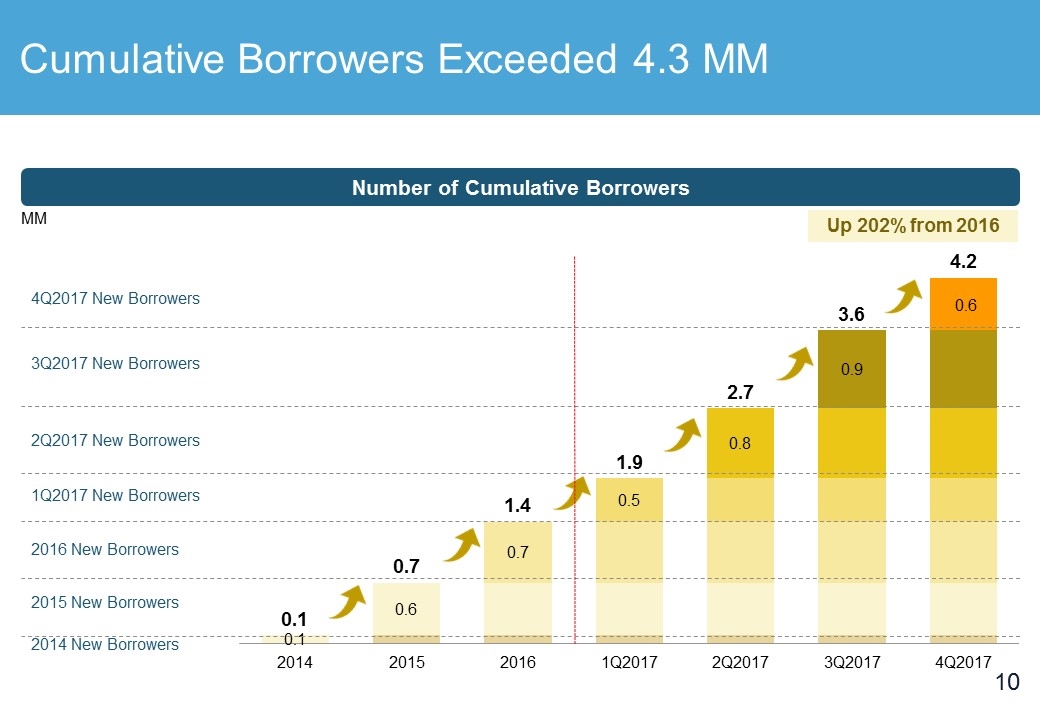

Cumulative Borrowers Exceeded 4.3 MM Number of Cumulative Borrowers MM Up 202% from 2016

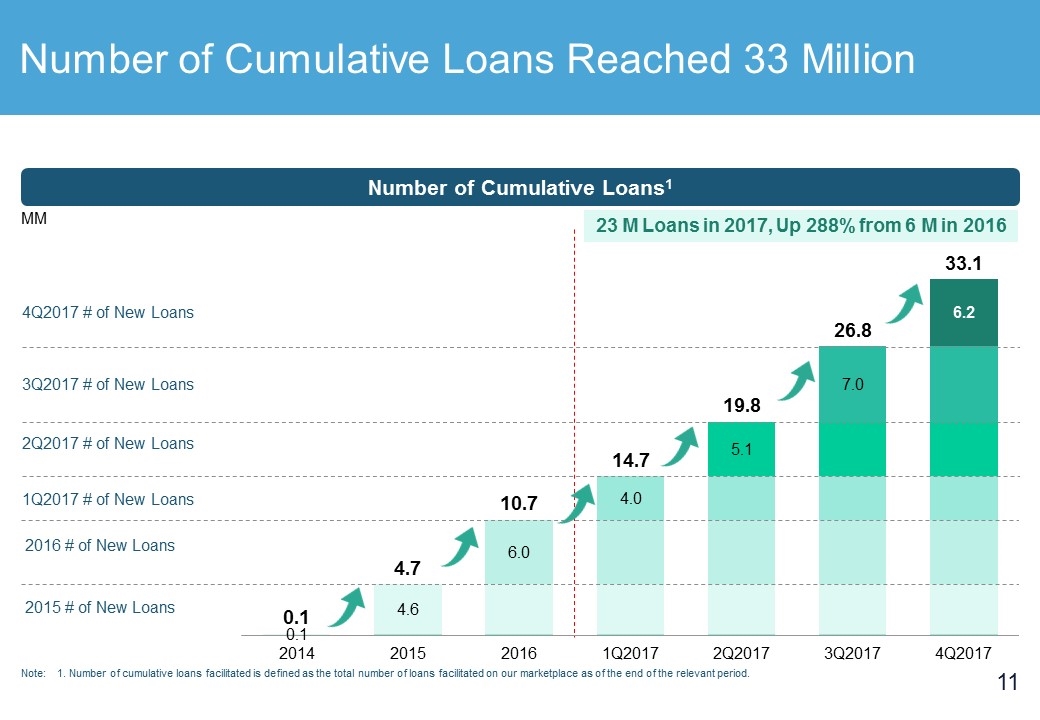

Number of Cumulative Loans Reached 33 Million 2Q2017 # of New Loans 1Q2017 # of New Loans 2016 # of New Loans 2015 # of New Loans 3Q2017 # of New Loans Note: 1. Number of cumulative loans facilitated is defined as the total number of loans facilitated on our marketplace as of the end of the relevant period. Number of Cumulative Loans1 MM 23 M Loans in 2017, Up 288% from 6 M in 2016 4Q2017 # of New Loans

Fourth Quarter 2017 Financial Results

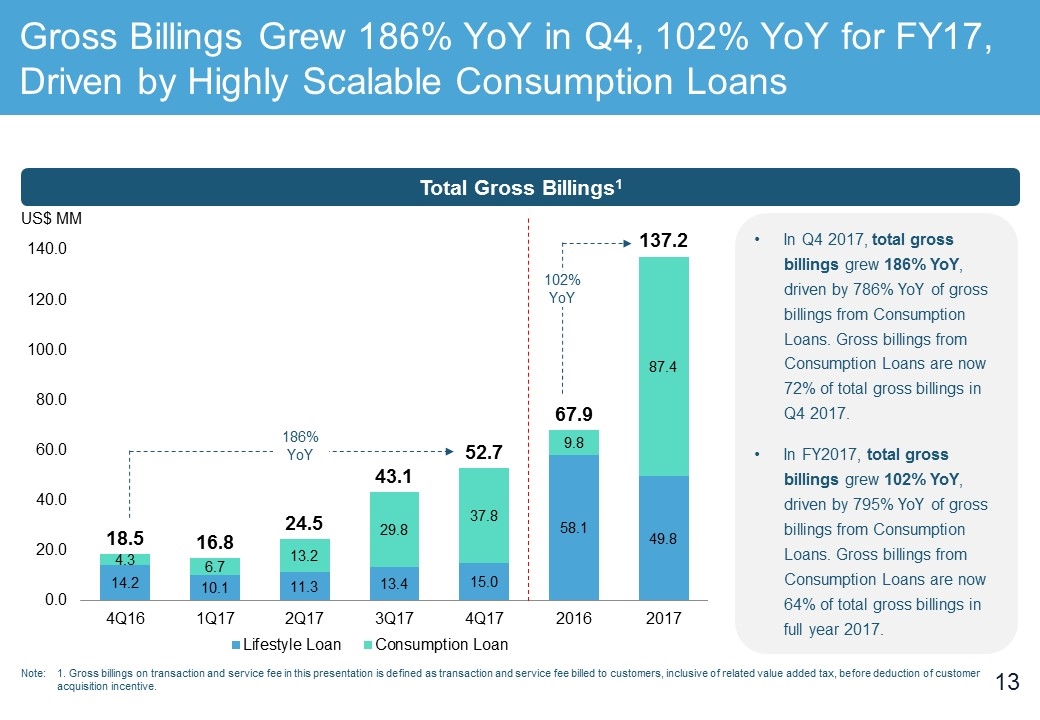

Gross Billings Grew 186% YoY in Q4, 102% YoY for FY17, Driven by Highly Scalable Consumption Loans In Q4 2017, total gross billings grew 186% YoY, driven by 786% YoY of gross billings from Consumption Loans. Gross billings from Consumption Loans are now 72% of total gross billings in Q4 2017. In FY2017, total gross billings grew 102% YoY, driven by 795% YoY of gross billings from Consumption Loans. Gross billings from Consumption Loans are now 64% of total gross billings in full year 2017. 186% YoY Note: 1. Gross billings on transaction and service fee in this presentation is defined as transaction and service fee billed to customers, inclusive of related value added tax, before deduction of customer acquisition incentive. Total Gross Billings1 US$ MM 102% YoY

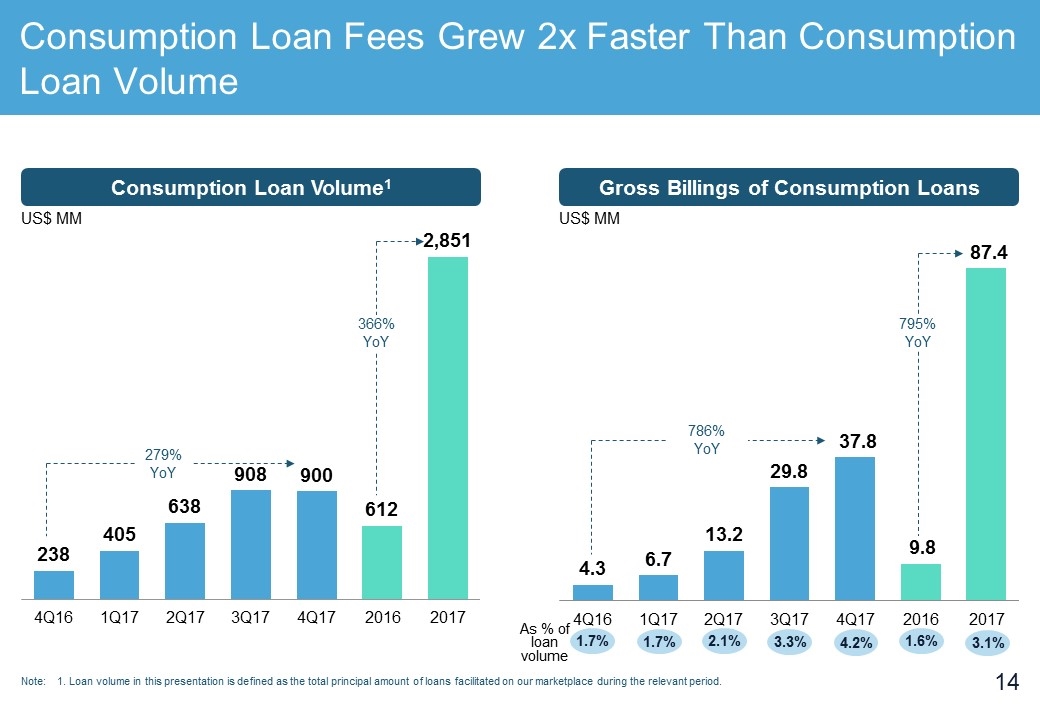

Consumption Loan Fees Grew 2x Faster Than Consumption Loan Volume As % of loan volume 786% YoY 1.7% 1.7% 3.3% 4.2% 2.1% 279% YoY Note: 1. Loan volume in this presentation is defined as the total principal amount of loans facilitated on our marketplace during the relevant period. Consumption Loan Volume1 US$ MM Gross Billings of Consumption Loans US$ MM 1.6% 3.1% 366% YoY 795% YoY

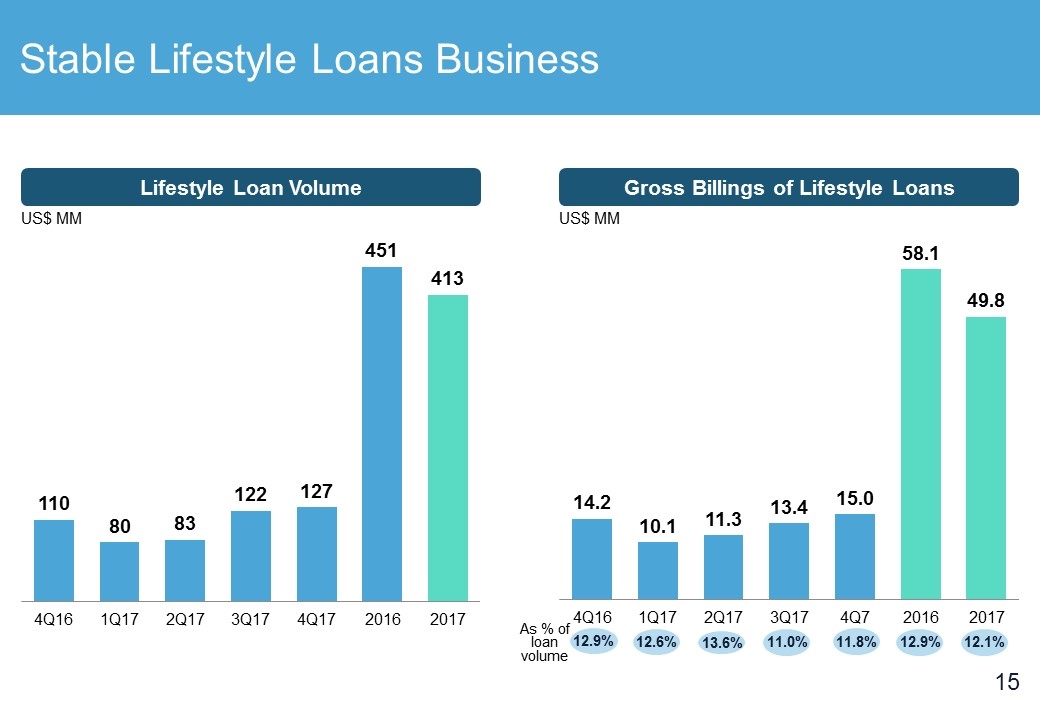

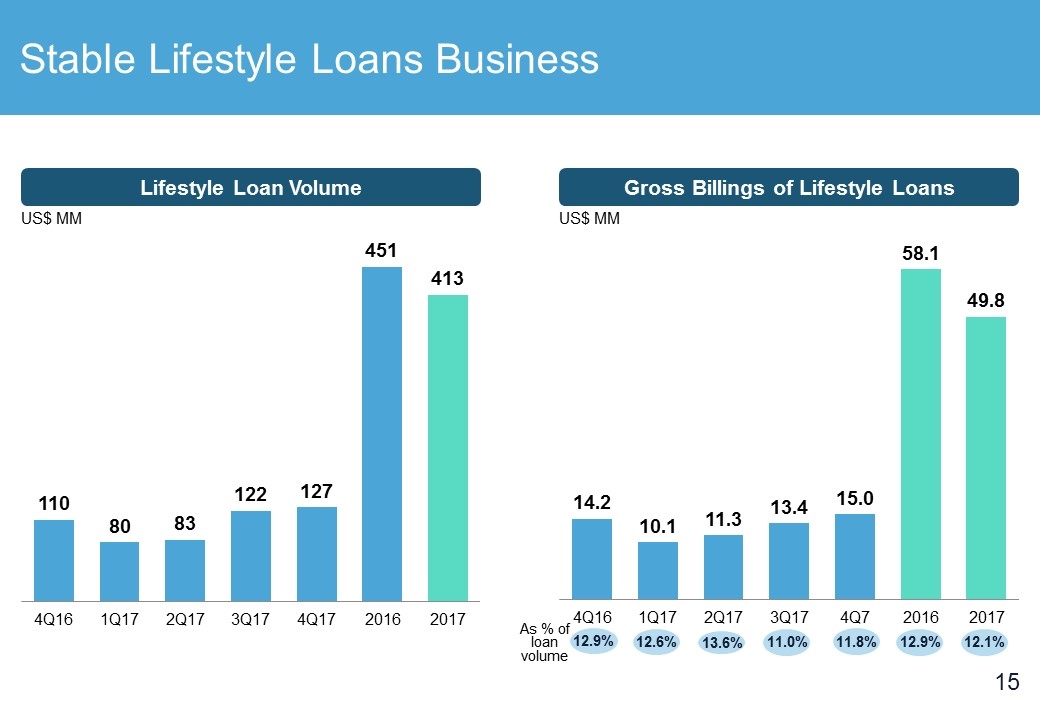

Stable Lifestyle Loans Business Lifestyle Loan Volume US$ MM Gross Billings of Lifestyle Loans US$ MM As % of loan volume 12.9% 12.6% 11.0% 11.8% 13.6% 12.9% 12.1%

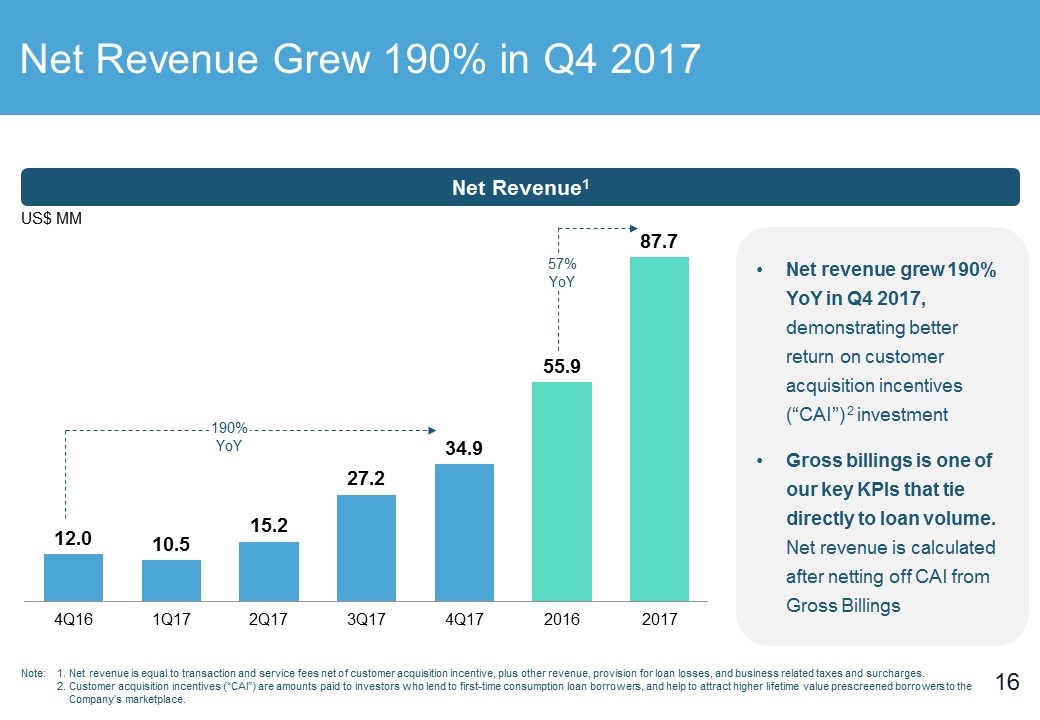

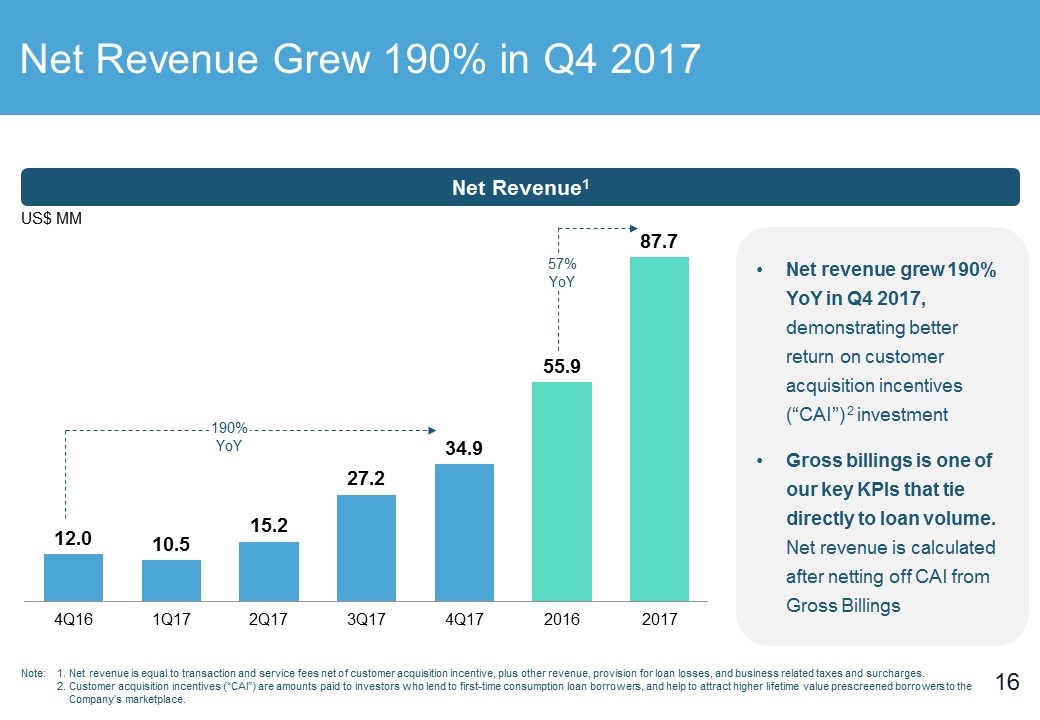

Net Revenue Grew 190% in Q4 2017 190% YoY Note: 1. Net revenue is equal to transaction and service fees net of customer acquisition incentive, plus other revenue, provision for loan losses, and business related taxes and surcharges. 2. Customer acquisition incentives (“CAI”) are amounts paid to investors who lend to first-time consumption loan borrowers, and help to attract higher lifetime value prescreened borrowers to the Company’s marketplace. Net revenue grew 190% YoY in Q4 2017, demonstrating better return on customer acquisition incentives (“CAI”) 2 investment Gross billings is one of our key KPIs that tie directly to loan volume. Net revenue is calculated after netting off CAI from Gross Billings Net Revenue1 US$ MM 57% YoY

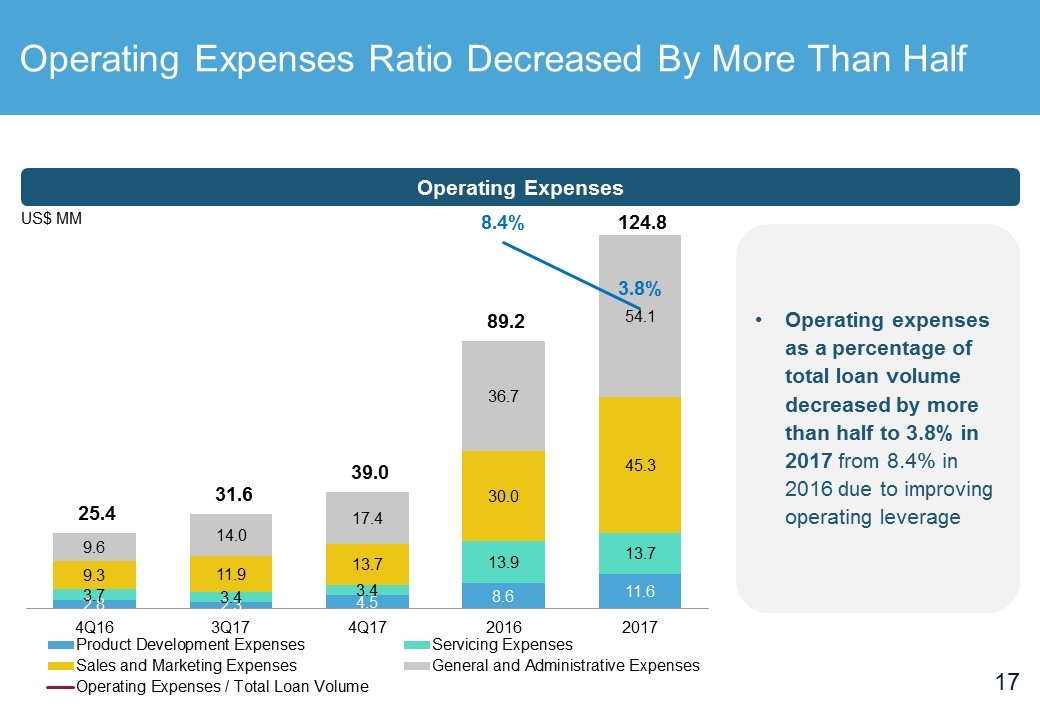

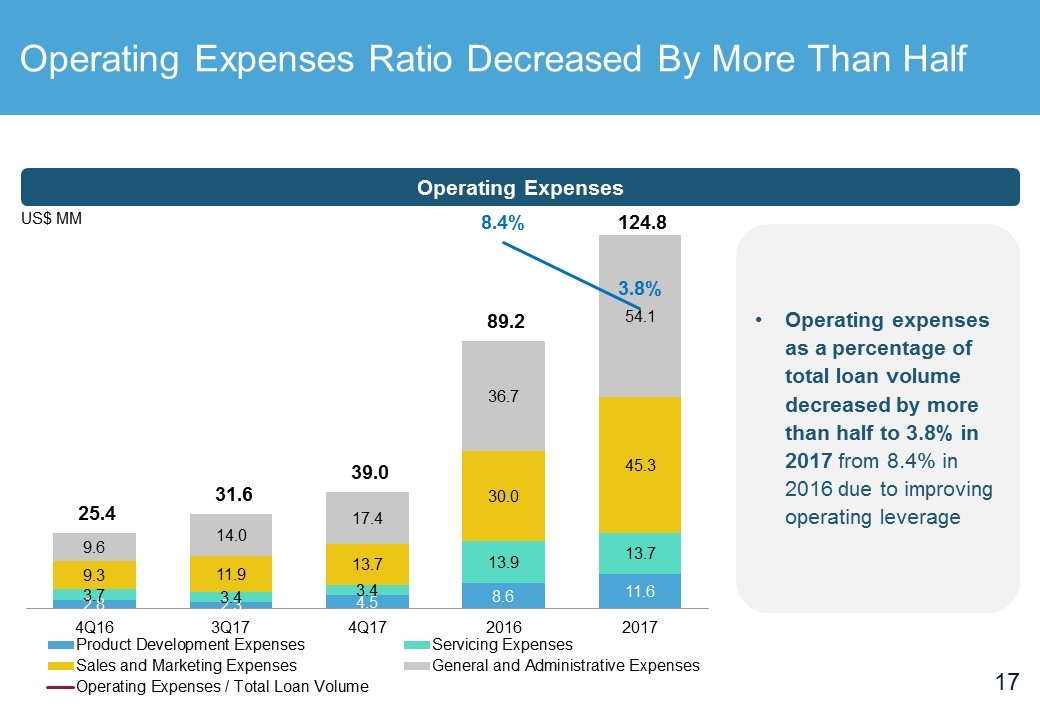

Operating Expenses Ratio Decreased By More Than Half Operating Expenses US$ MM Operating expenses as a percentage of total loan volume decreased by more than half to 3.8% in 2017 from 8.4% in 2016 due to improving operating leverage

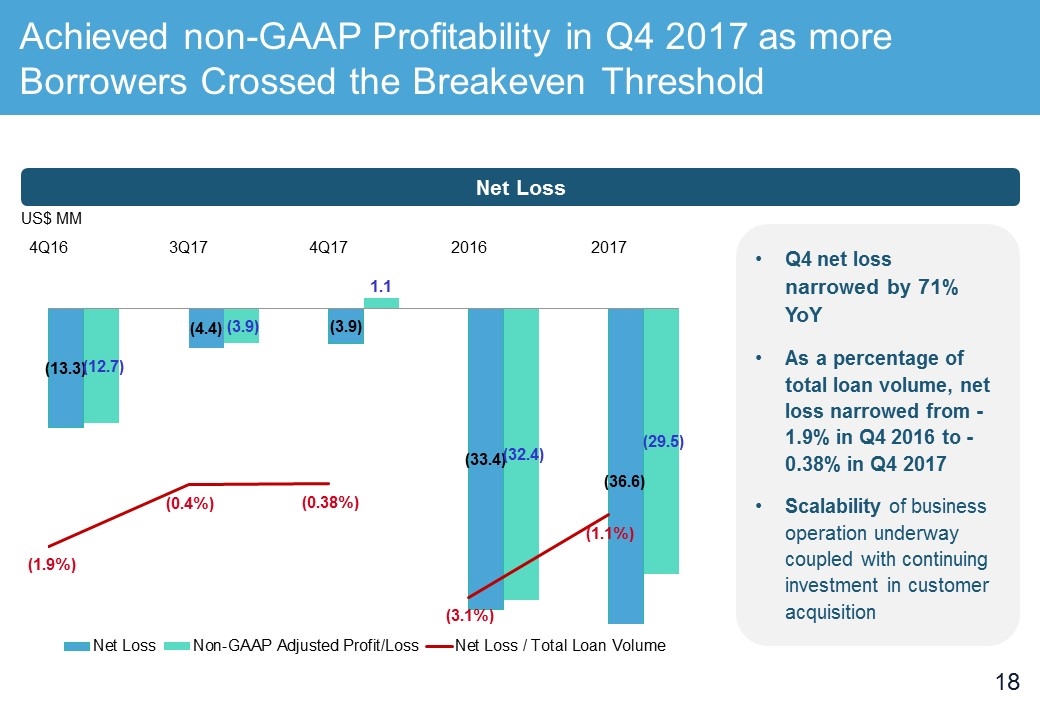

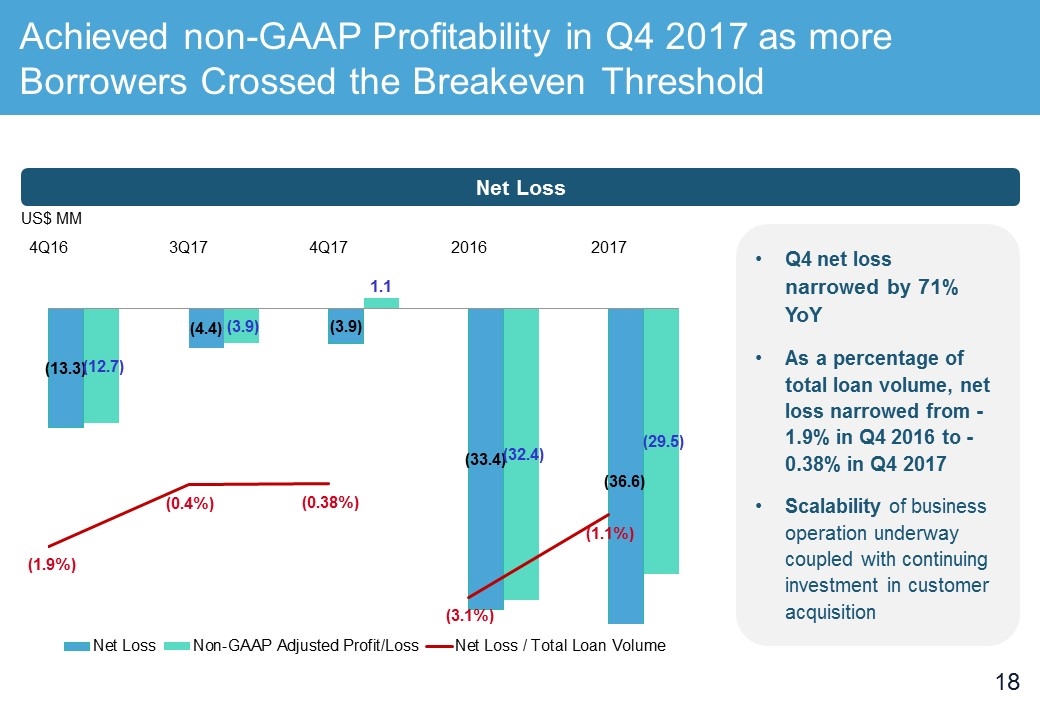

Achieved non-GAAP Profitability in Q4 2017 as more Borrowers Crossed the Breakeven Threshold Net Loss US$ MM Q4 net loss narrowed by 71% YoY As a percentage of total loan volume, net loss narrowed from -1.9% in Q4 2016 to -0.38% in Q4 2017 Scalability of business operation underway coupled with continuing investment in customer acquisition

Unique Low & Grow Strategy and Business Model

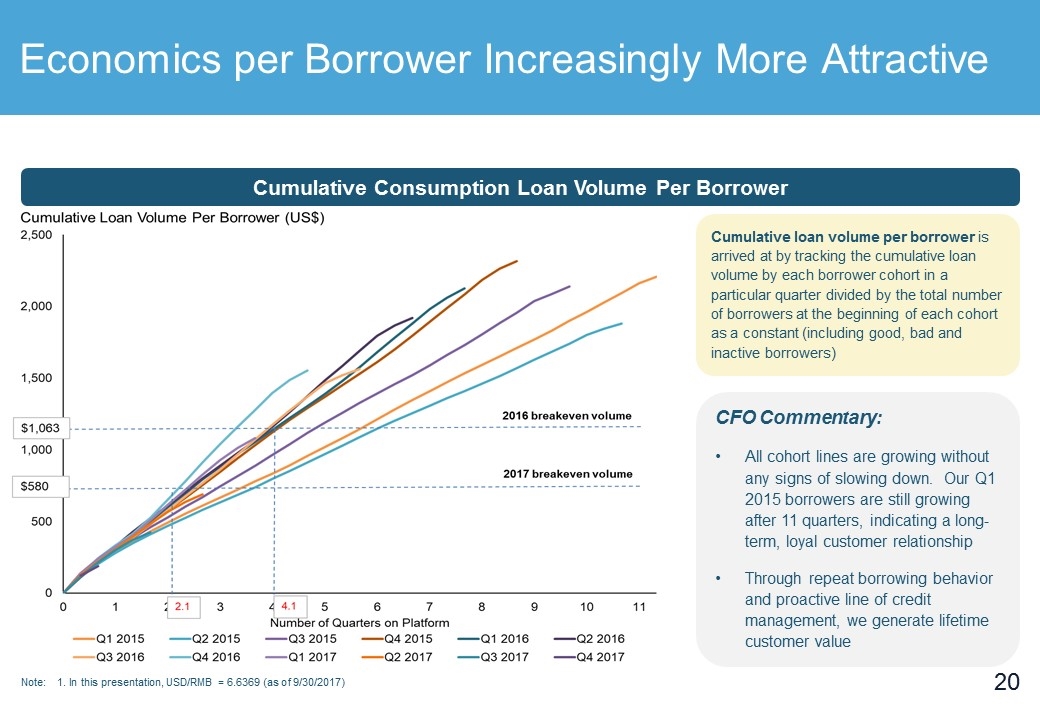

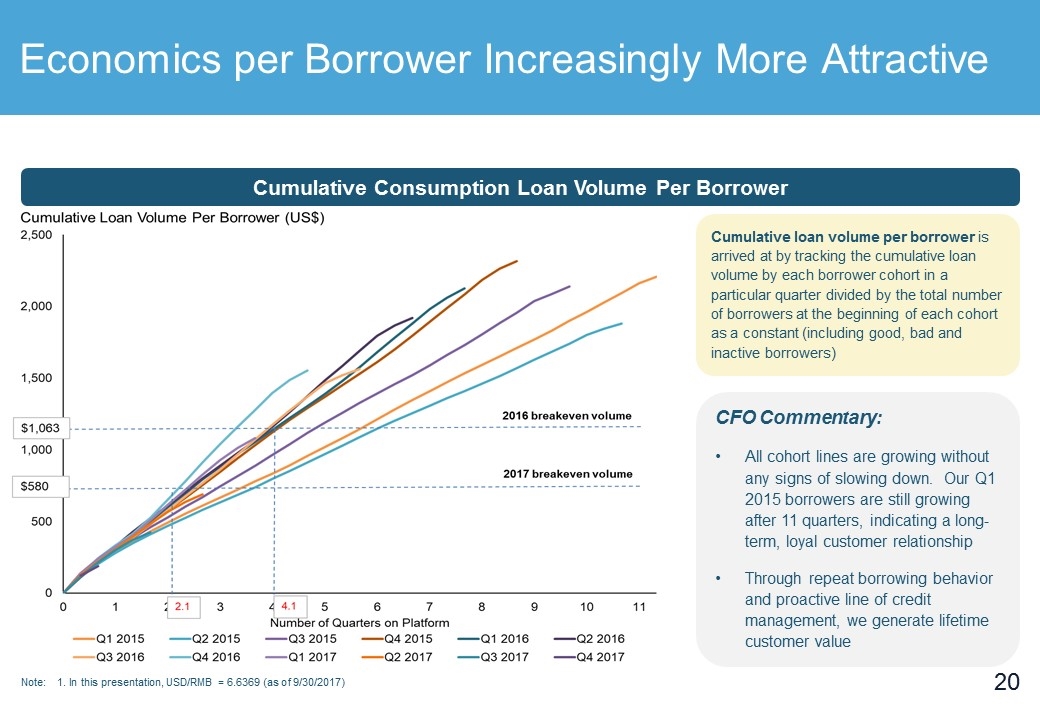

CFO Commentary: All cohort lines are growing without any signs of slowing down. Our Q1 2015 borrowers are still growing after 11 quarters, indicating a long-term, loyal customer relationship Through repeat borrowing behavior and proactive line of credit management, we generate lifetime customer value Economics per Borrower Increasingly More Attractive Cumulative loan volume per borrower is arrived at by tracking the cumulative loan volume by each borrower cohort in a particular quarter divided by the total number of borrowers at the beginning of each cohort as a constant (including good, bad and inactive borrowers) Note: 1. In this presentation, USD/RMB = 6.6369 (as of 9/30/2017) Cumulative Consumption Loan Volume Per Borrower

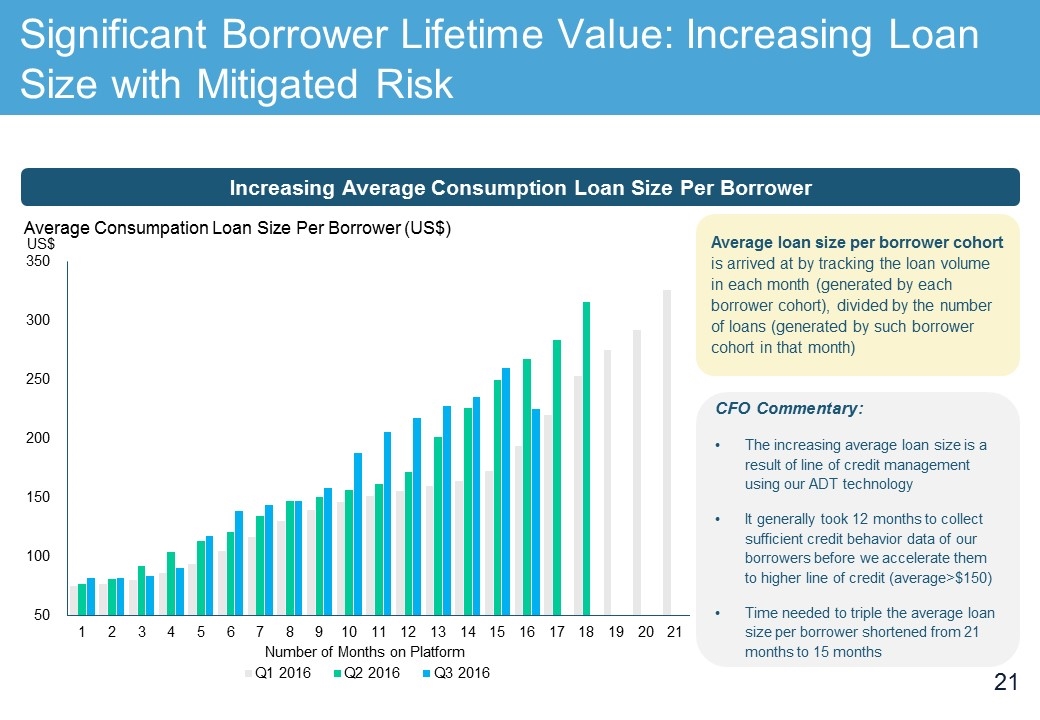

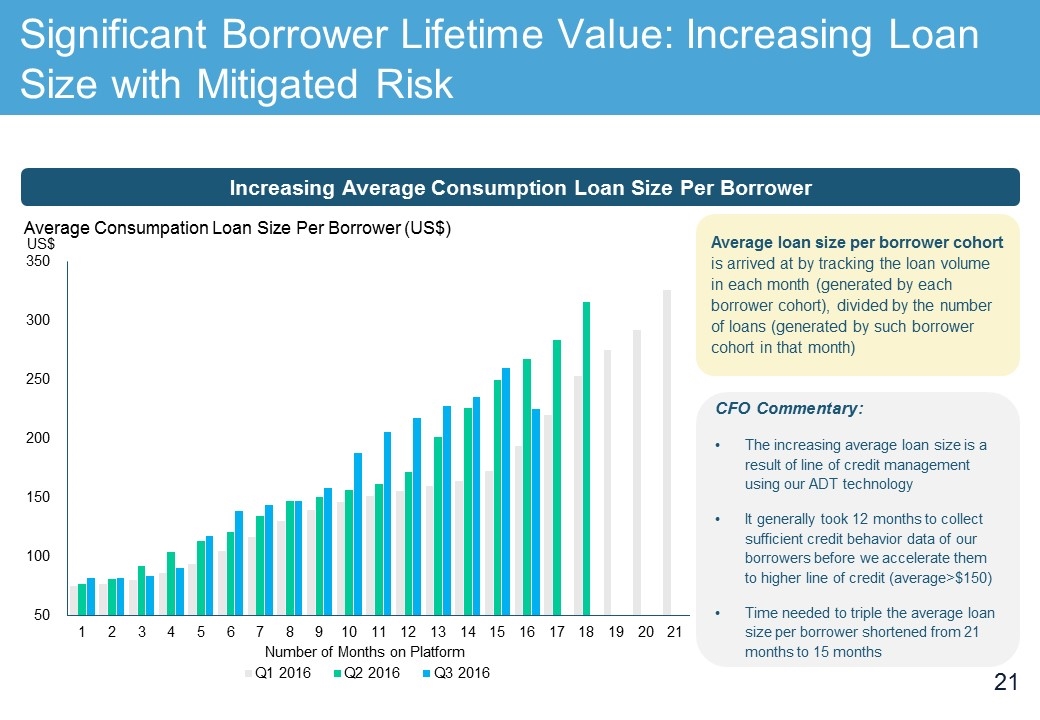

Significant Borrower Lifetime Value: Increasing Loan Size with Mitigated Risk CFO Commentary: The increasing average loan size is a result of line of credit management using our ADT technology It generally took 12 months to collect sufficient credit behavior data of our borrowers before we accelerate them to higher line of credit (average>$150) Time needed to triple the average loan size per borrower shortened from 21 months to 15 months Average loan size per borrower cohort is arrived at by tracking the loan volume in each month (generated by each borrower cohort), divided by the number of loans (generated by such borrower cohort in that month) Increasing Average Consumption Loan Size Per Borrower

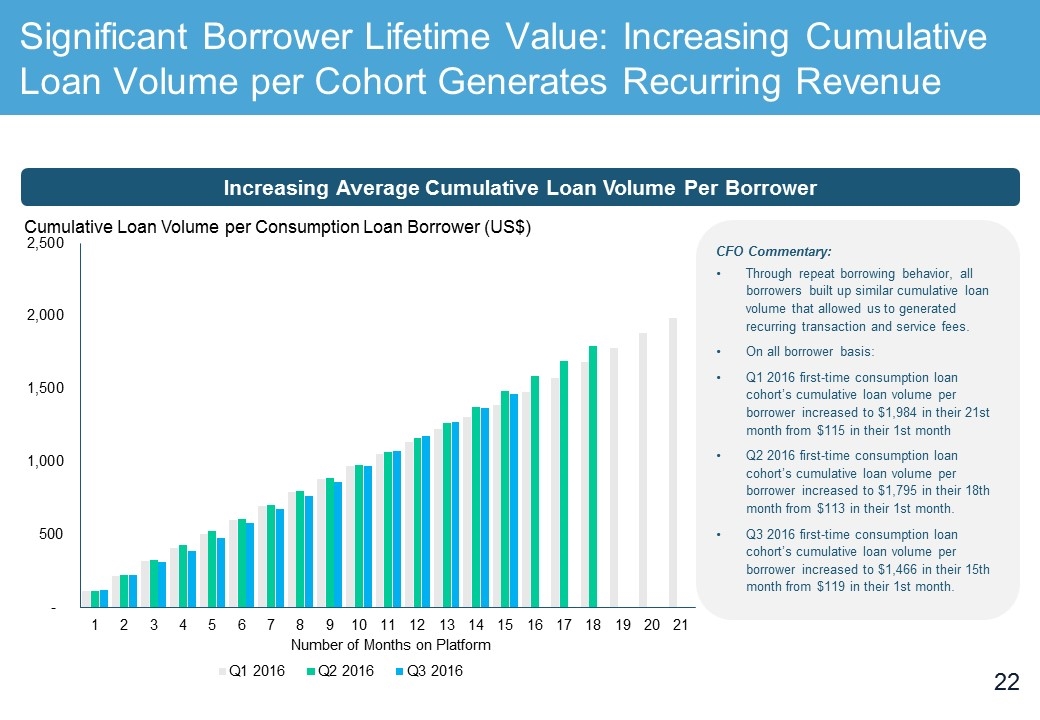

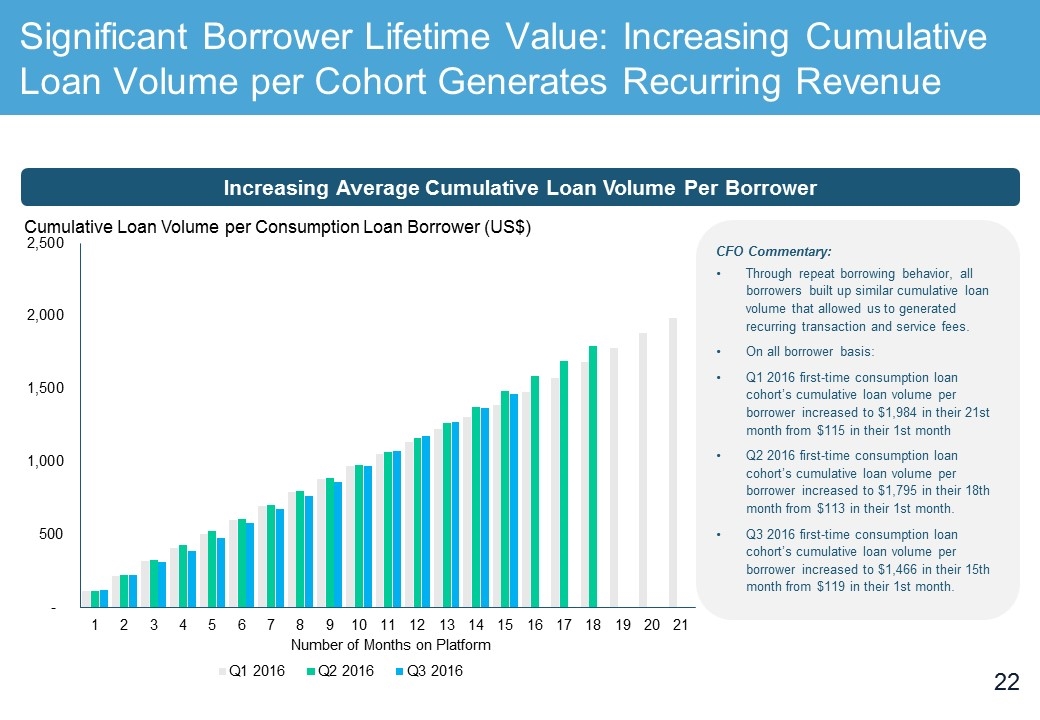

Significant Borrower Lifetime Value: Increasing Cumulative Loan Volume per Cohort Generates Recurring Revenue CFO Commentary: Through repeat borrowing behavior, all borrowers built up similar cumulative loan volume that allowed us to generated recurring transaction and service fees. On all borrower basis: Q1 2016 first-time consumption loan cohort’s cumulative loan volume per borrower increased to $1,984 in their 21st month from $115 in their 1st month Q2 2016 first-time consumption loan cohort’s cumulative loan volume per borrower increased to $1,795 in their 18th month from $113 in their 1st month. Q3 2016 first-time consumption loan cohort’s cumulative loan volume per borrower increased to $1,466 in their 15th month from $119 in their 1st month. Increasing Average Cumulative Loan Volume Per Borrower

Appendix

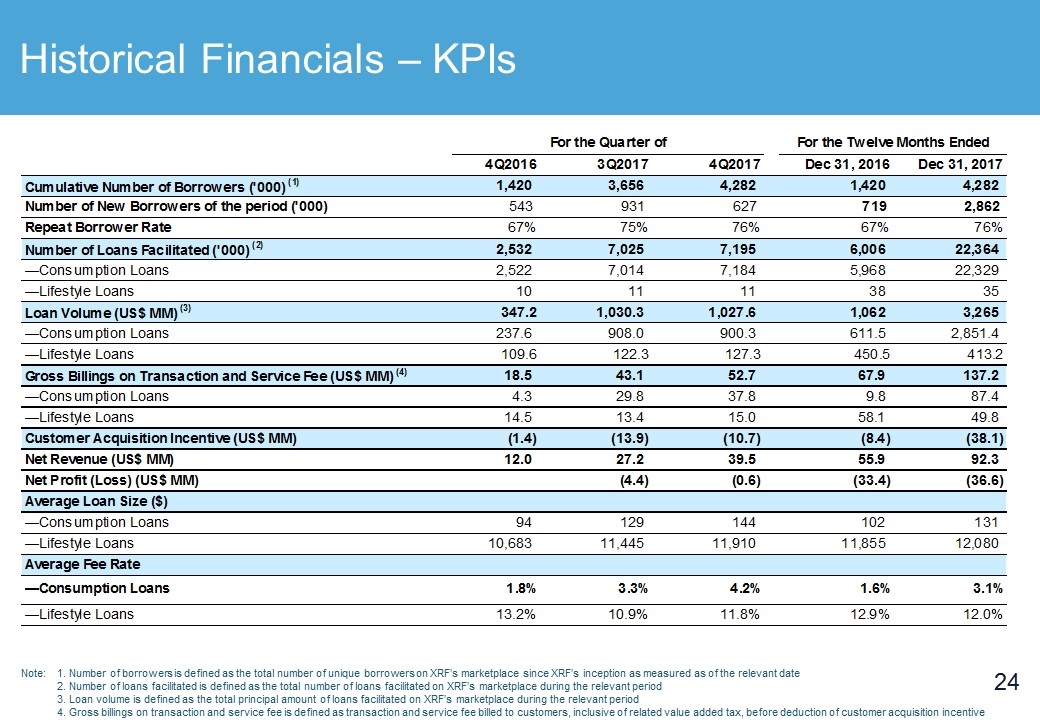

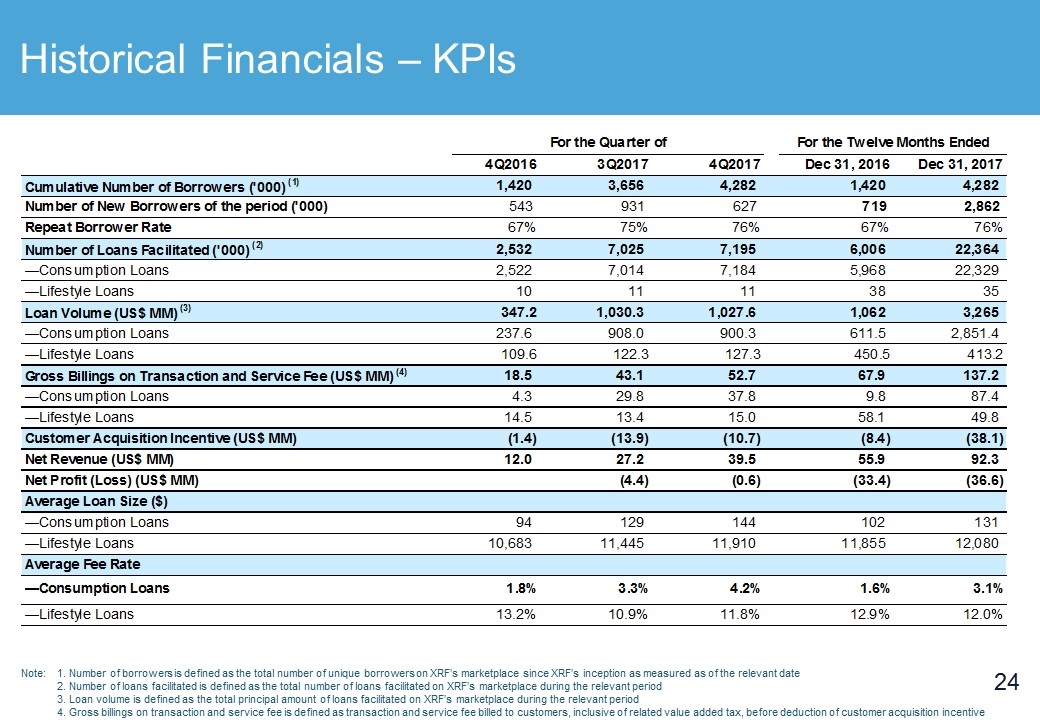

Historical Financials – KPIs Note: 1. Number of borrowers is defined as the total number of unique borrowers on XRF’s marketplace since XRF’s inception as measured as of the relevant date 2. Number of loans facilitated is defined as the total number of loans facilitated on XRF’s marketplace during the relevant period 3. Loan volume is defined as the total principal amount of loans facilitated on XRF’s marketplace during the relevant period 4. Gross billings on transaction and service fee is defined as transaction and service fee billed to customers, inclusive of related value added tax, before deduction of customer acquisition incentive

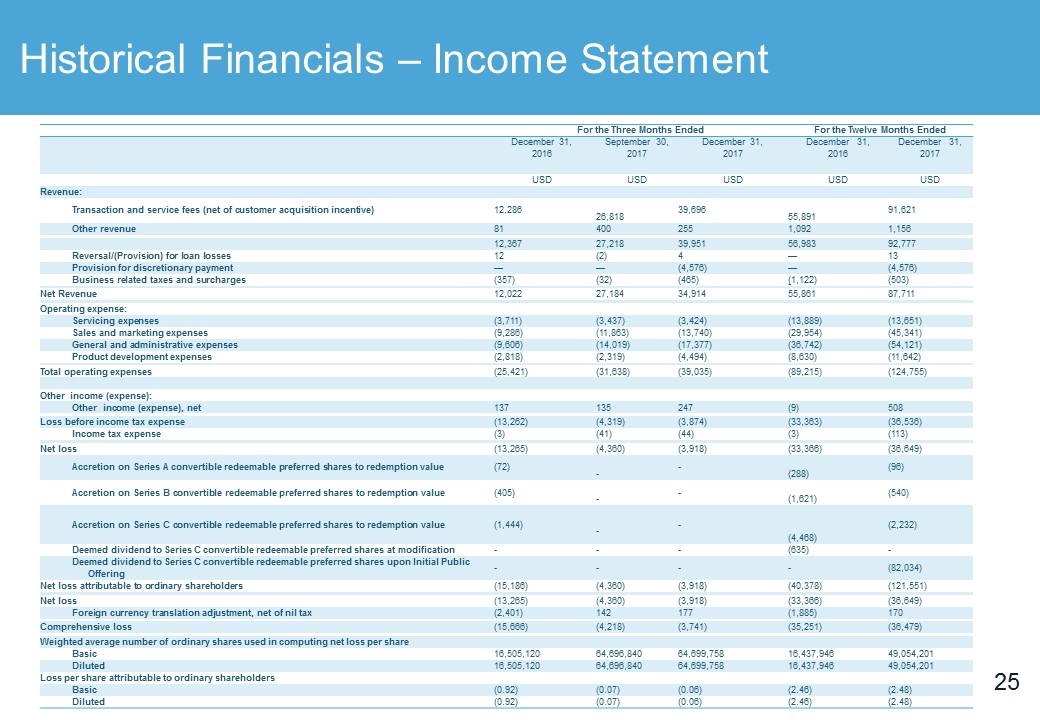

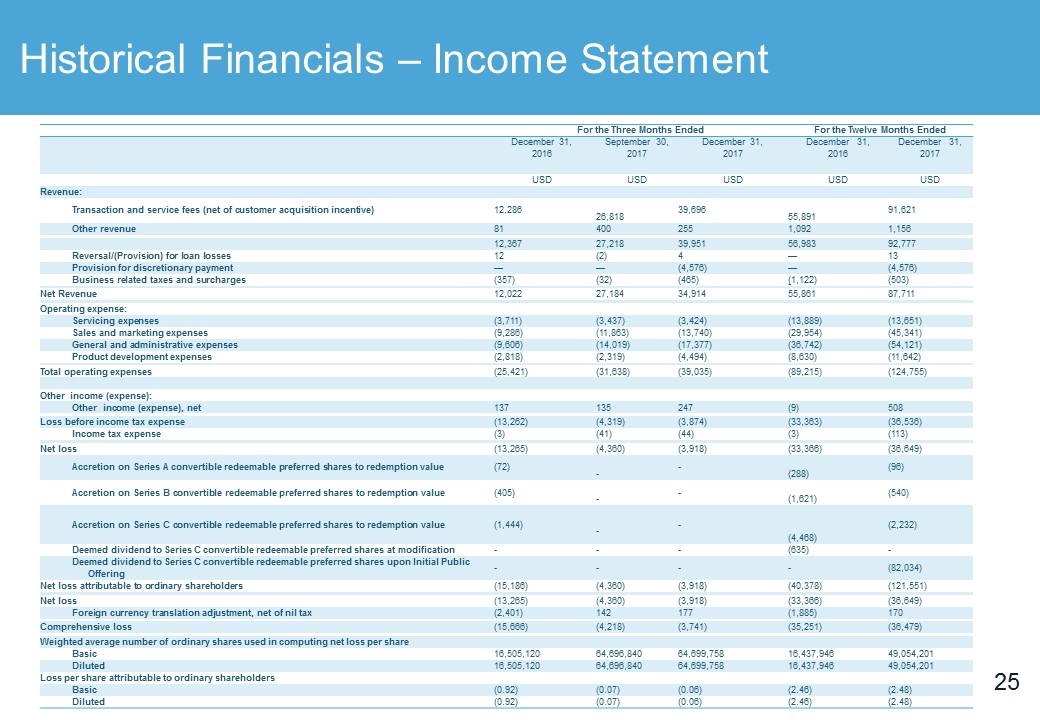

Historical Financials – Income Statement For the Three Months Ended For the Twelve Months Ended December 31, 2016 September 30, 2017 December 31, 2017 December 31, 2016 December 31, 2017 USD USD USD USD USD Revenue: Transaction and service fees (net of customer acquisition incentive) 12,286 26,818 39,696 55,891 91,621 Other revenue 81 400 255 1,092 1,156 12,367 27,218 39,951 56,983 92,777 Reversal/(Provision) for loan losses 12 (2) 4 — 13 Provision for discretionary payment — — (4,576) — (4,576) Business related taxes and surcharges (357) (32) (465) (1,122) (503) - Net Revenue 12,022 27,184 34,914 55,861 87,711 Operating expense: Servicing expenses (3,711) (3,437) (3,424) (13,889) (13,651) Sales and marketing expenses (9,286) (11,863) (13,740) (29,954) (45,341) General and administrative expenses (9,606) (14,019) (17,377) (36,742) (54,121) Product development expenses (2,818) (2,319) (4,494) (8,630) (11,642) Total operating expenses (25,421) (31,638) (39,035) (89,215) (124,755) Other income (expense): Other income (expense), net 137 135 247 (9) 508 Loss before income tax expense (13,262) (4,319) (3,874) (33,363) (36,536) Income tax expense (3) (41) (44) (3) (113) Net loss (13,265) (4,360) (3,918) (33,366) (36,649) Accretion on Series A convertible redeemable preferred shares to redemption value (72) - - (288) (96) Accretion on Series B convertible redeemable preferred shares to redemption value (405) - - (1,621) (540) Accretion on Series C convertible redeemable preferred shares to redemption value (1,444) - - (4,468) (2,232) Deemed dividend to Series C convertible redeemable preferred shares at modification - - - (635) - Deemed dividend to Series C convertible redeemable preferred shares upon Initial Public Offering - - - - (82,034) Net loss attributable to ordinary shareholders (15,186) (4,360) (3,918) (40,378) (121,551) Net loss (13,265) (4,360) (3,918) (33,366) (36,649) Foreign currency translation adjustment, net of nil tax (2,401) 142 177 (1,885) 170 Comprehensive loss (15,666) (4,218) (3,741) (35,251) (36,479) Weighted average number of ordinary shares used in computing net loss per share Basic 16,505,120 64,696,840 64,699,758 16,437,946 49,054,201 Diluted 16,505,120 64,696,840 64,699,758 16,437,946 49,054,201 Loss per share attributable to ordinary shareholders Basic (0.92) (0.07) (0.06) (2.46) (2.48) Diluted (0.92) (0.07) (0.06) (2.46) (2.48)

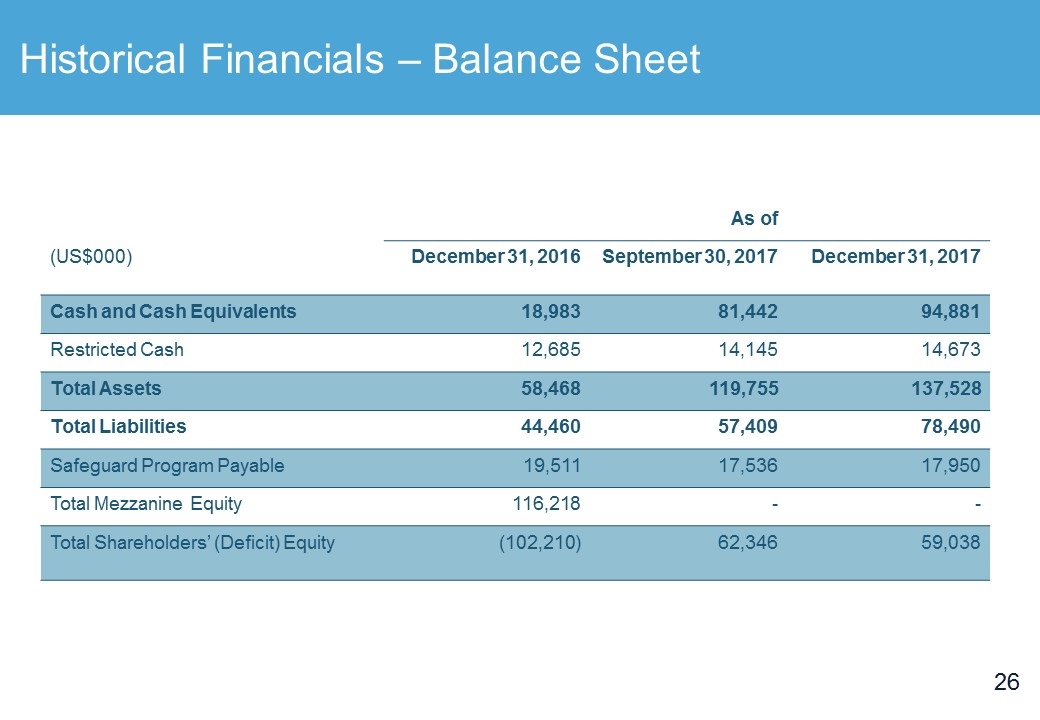

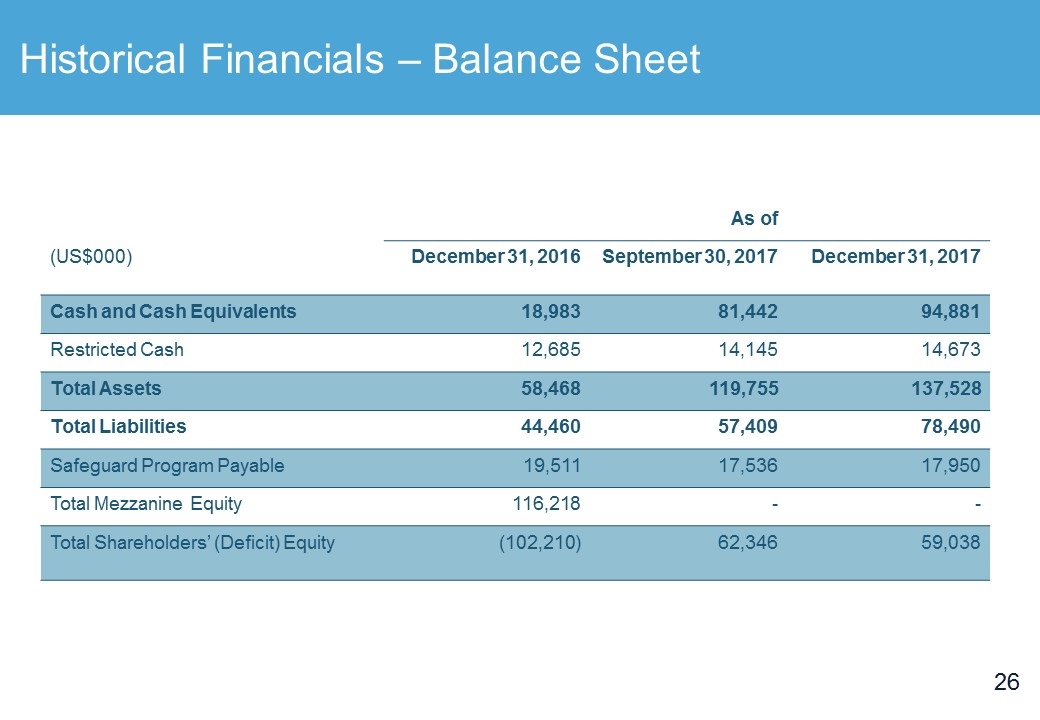

Historical Financials – Balance Sheet As of (US$000) December 31, 2016 September 30, 2017 December 31, 2017 Cash and Cash Equivalents 18,983 81,442 94,881 Restricted Cash 12,685 14,145 14,673 Total Assets 58,468 119,755 137,528 Total Liabilities 44,460 57,409 78,490 Safeguard Program Payable 19,511 17,536 17,950 Total Mezzanine Equity 116,218 - - Total Shareholders’ (Deficit) Equity (102,210) 62,346 59,038