November 20, 2018 XRF 3Q 2018 RESULTS 155 159 181 Exhibit 99.2

Forward Looking Statements The information in this presentation is provided to you by China Rapid Finance Limited (the “Company”) solely for informational purposes and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument of the Company, or to participate in any investment activity or trading strategy, nor may it or any part of it form the basis of or be relied on in connection with any contract or commitment whatsoever, in the United States or anywhere else. The information included herein was obtained from various sources, including certain third parties, and has not been independently verified. This presentation does not constitute legal, regulatory, accounting or tax advice to you. This presentation does not constitute and should not be considered as any form of financial opinion or recommendation by the Company or any other party. No representations, warranties or undertakings, express or implied, are made and no reliance should be placed on the accuracy, fairness or completeness of the information, sources or opinions presented or contained in this presentation. By viewing or accessing the information contained in this presentation, you hereby acknowledge and agree that neither the Company, nor any of its directors, officers, employees, advisers, nor any of its representatives, affiliates, associated persons or agents accepts any responsibility for or makes any representation or warranty, express or implied, with respect to the truth, accuracy, fairness, completeness or reasonableness of the information contained in, and omissions from, these materials and that that neither the Company, nor any of its directors, officers, employees, advisers, nor any of its representatives, affiliates, associated persons or agents accepts any liability whatsoever for any loss howsoever arising from any information presented or contained in these materials. The information presented or contained in this presentation is subject to change without notice and its accuracy is not guaranteed. This presentation contains statements that constitute forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include descriptions regarding the intent, belief or current expectations of the Company or its officers about the future. Such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ materially from those in the forward-looking statements as a result of various factors and assumptions, many of which are beyond the Company’s control. A description of risks relating to the Company appears in the section “Risk Factors” of the Company‘s Form 20-F annual report dated April 30, 2018 and filed with the Securities and Exchange Commission on April 30, 2018. Neither the Company, nor any of its directors, officers, employees, advisers, nor any of its representatives, affiliates, associated persons or agents has any obligation to, nor do any of them undertake to, revise or update the forward-looking statements contained in this presentation to reflect future events or circumstances. This presentation contains certain financial projections. These financial projections relate to future performance and reflect the Company’s views as at the date of this presentation and are subject to known and unknown risks, uncertainties and assumptions that may cause future results, performance or achievements to differ materially from those expected. The Company believes the expectations reflected in these financial projections are reasonable but no assurance can be given that these expectations will prove to be correct and these financial projections should not be relied upon. The Company cannot guarantee future results, level of activities, performance or achievements, including, but not limited to borrowing activities on its platform, size of loans and repeat borrowing rate, borrower attrition rate, the Company’s ability to maintain its existing fee rates, and lender and borrower use of the Company’s platform. Consequently, the Company makes no representation that the actual results achieved will be the same in whole or in part as those set out in the financial projections.

Regulatory and Market Conditions Well-positioned for the registration process Completed the submission of self-inspection documents Look forward to completing the next verification steps Transaction volume decreased significantly across the industry We launched new trust fund programs and have more in the pipeline The confidence and the trustworthiness of the industry will improve in the near future

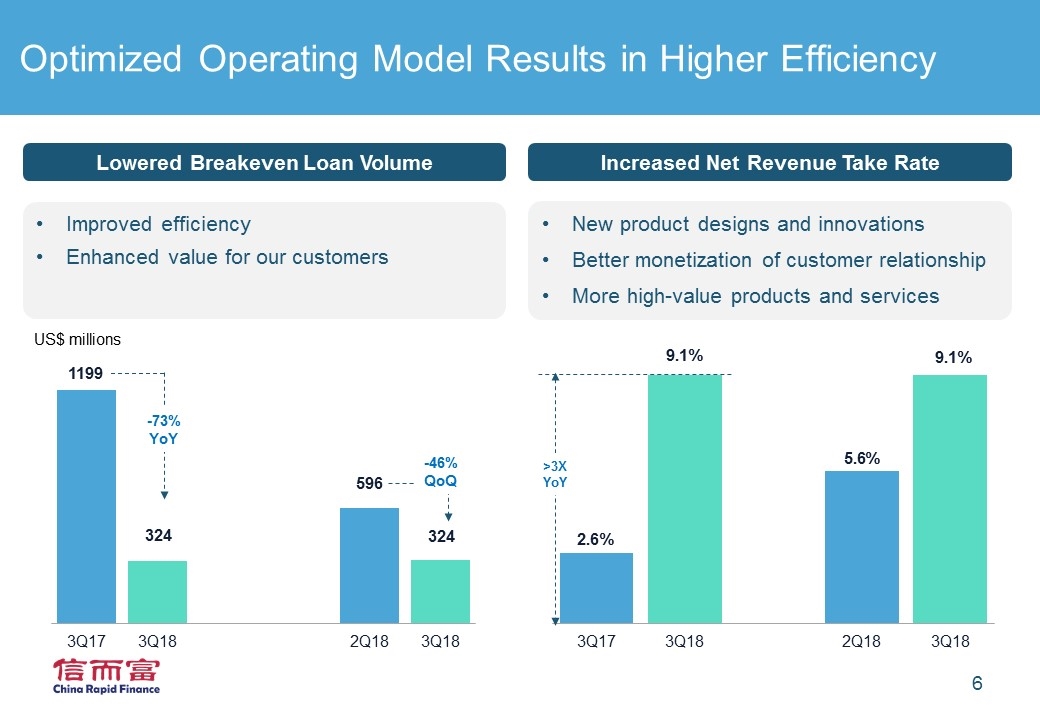

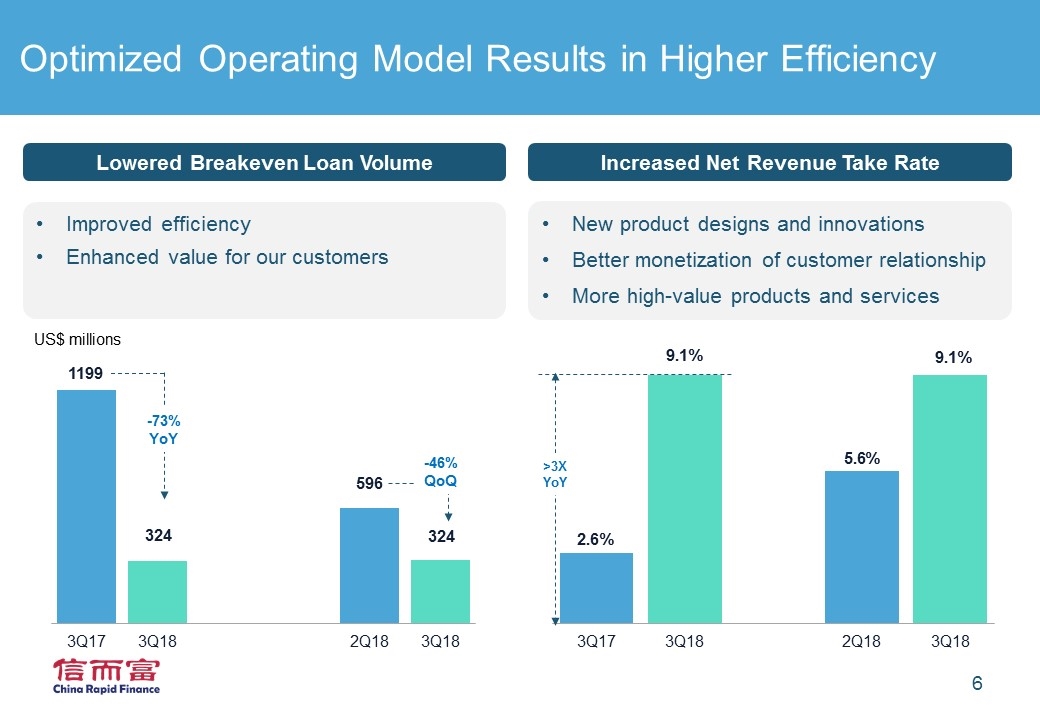

Optimizing Our Business Model Operating results reflect the regulatory uncertainties impacting our industry Profitability remains flat despite the significant drop in loan volume Our Initiatives Improvement in Risk Management Tightened risk management and improved asset quality Annualized loss rate of consumption loans improved Reduction of Operating Expenditures Reduced OPEX by $4.2 million QoQ, total $8 million in the last two quarters Expansion and Diversification of Product Offerings Net revenue take rate tripled to 9.1% YoY and increased from 5.6% in Q2 Breakeven loan volume reduced 73% YoY Leadership Growth Add more talent to our leadership team and prepare for the future

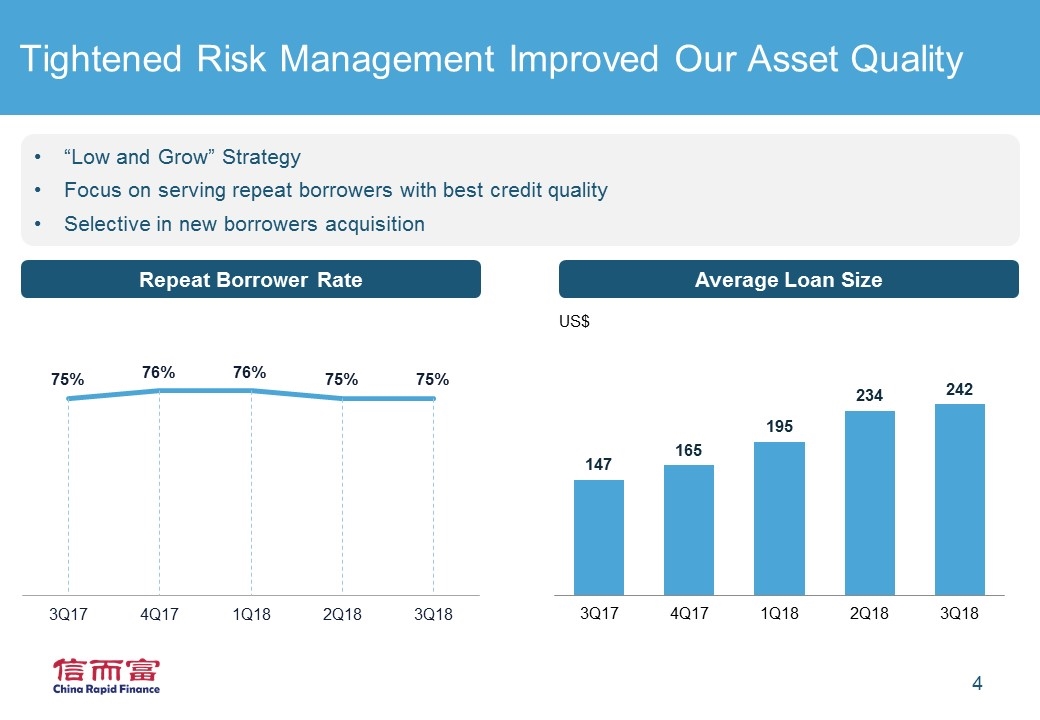

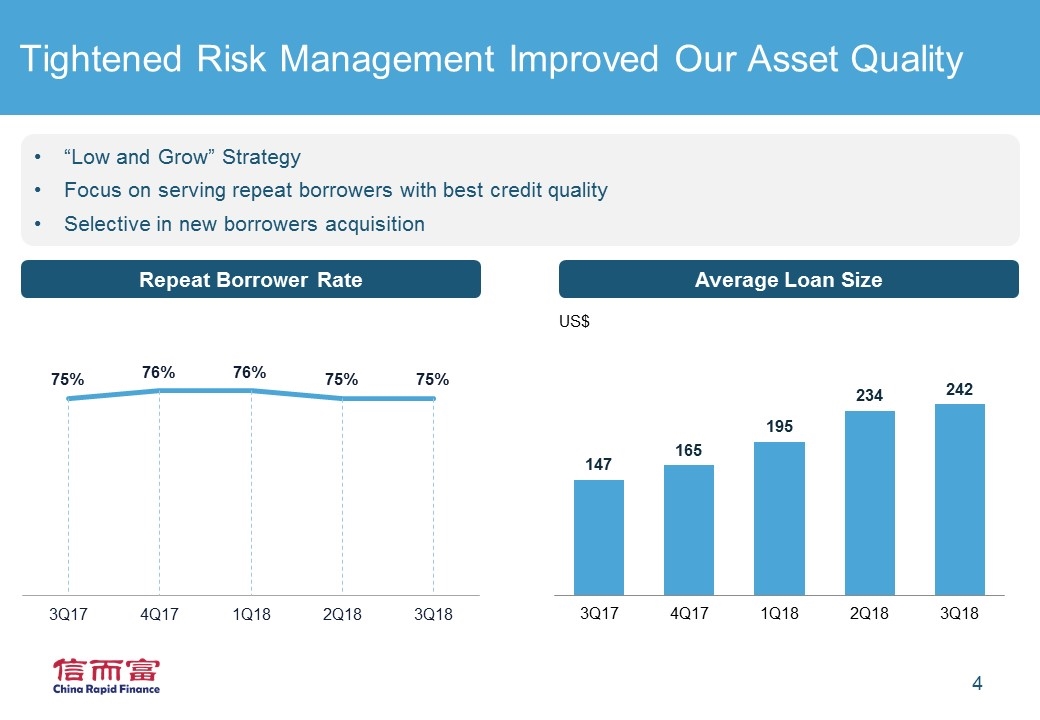

Tightened Risk Management Improved Our Asset Quality Repeat Borrower Rate Average Loan Size “Low and Grow” Strategy Focus on serving repeat borrowers with best credit quality Selective in new borrowers acquisition US$

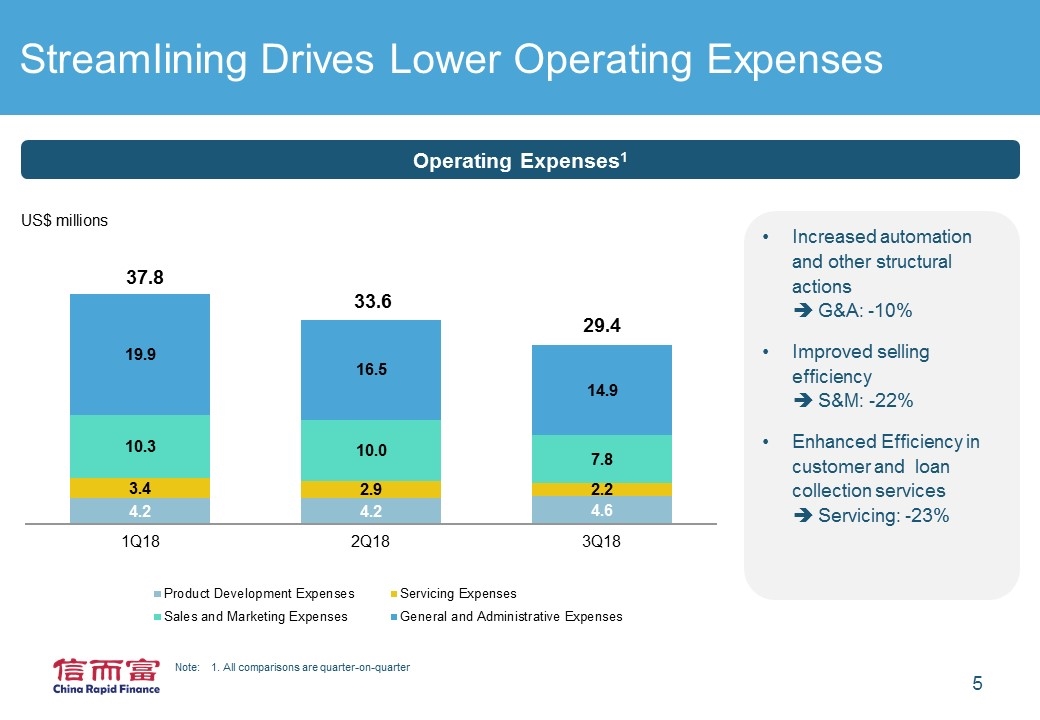

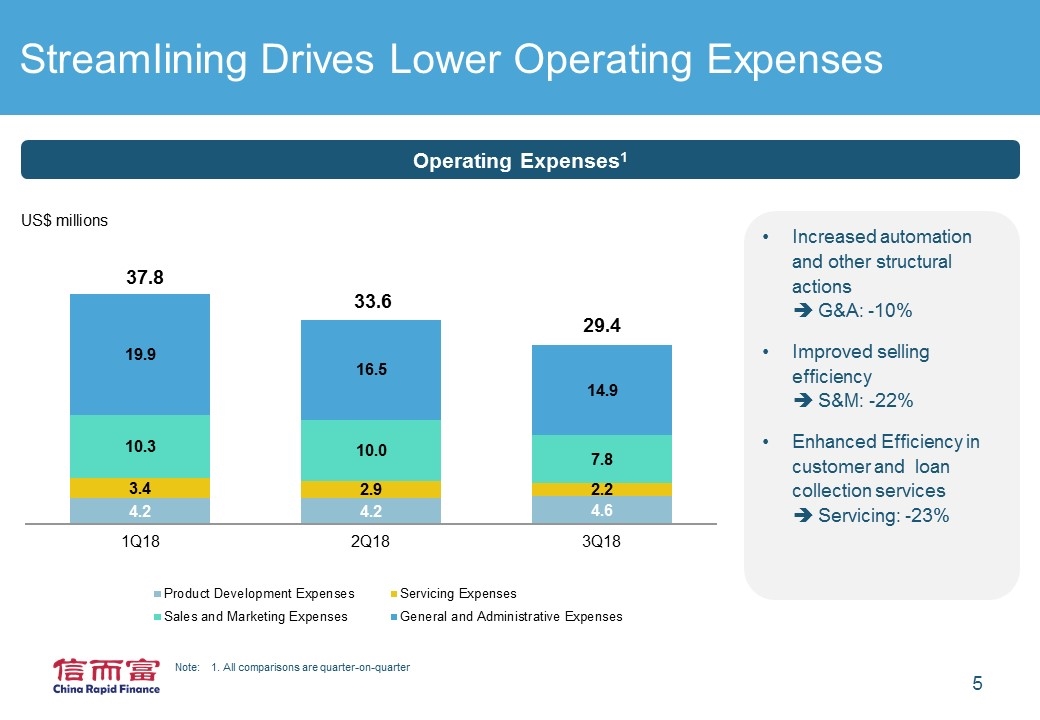

Streamlining Drives Lower Operating Expenses Increased automation and other structural actions è G&A: -10% Improved selling efficiency è S&M: -22% Enhanced Efficiency in customer and loan collection services è Servicing: -23% Updated: Numbers, 3Q17, 3Q18, Operating Expenses1 US$ millions Note: 1. All comparisons are quarter-on-quarter

Optimized Operating Model Results in Higher Efficiency US$ millions Improved efficiency Enhanced value for our customers -73% YoY >3X YoY Lowered Breakeven Loan Volume Increased Net Revenue Take Rate New product designs and innovations Better monetization of customer relationship More high-value products and services -46% QoQ

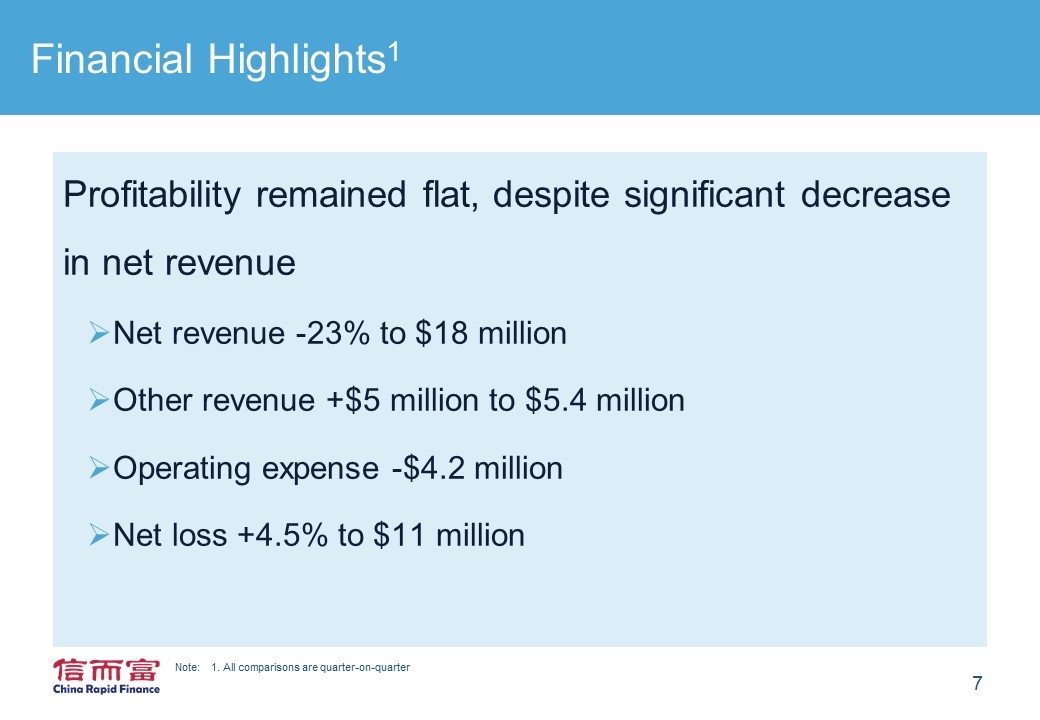

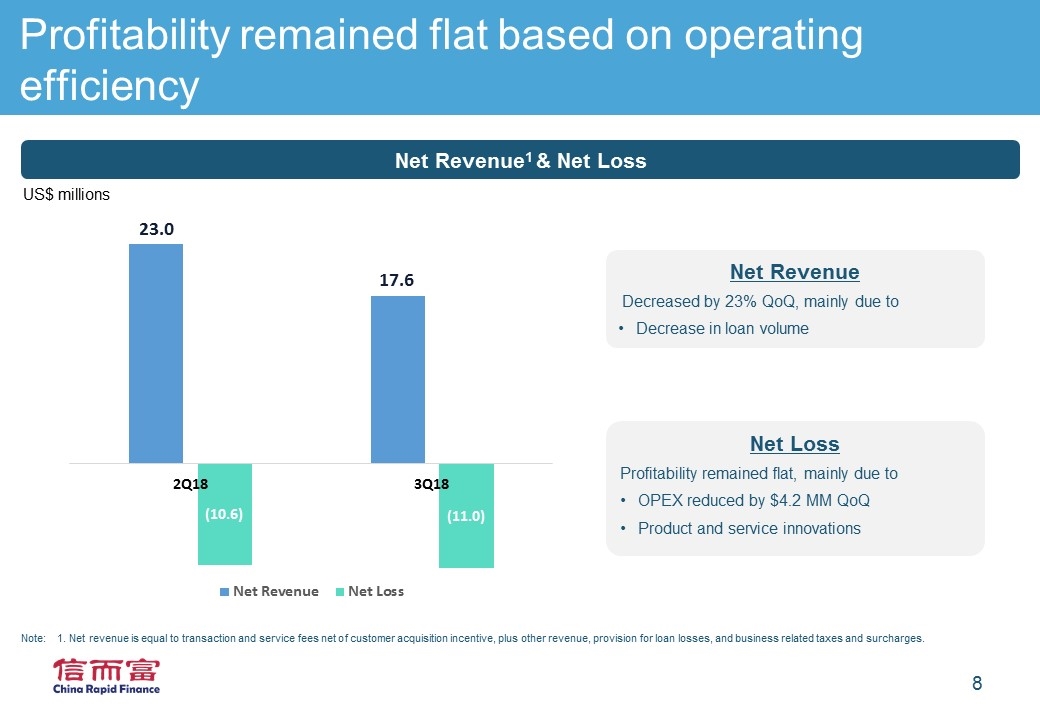

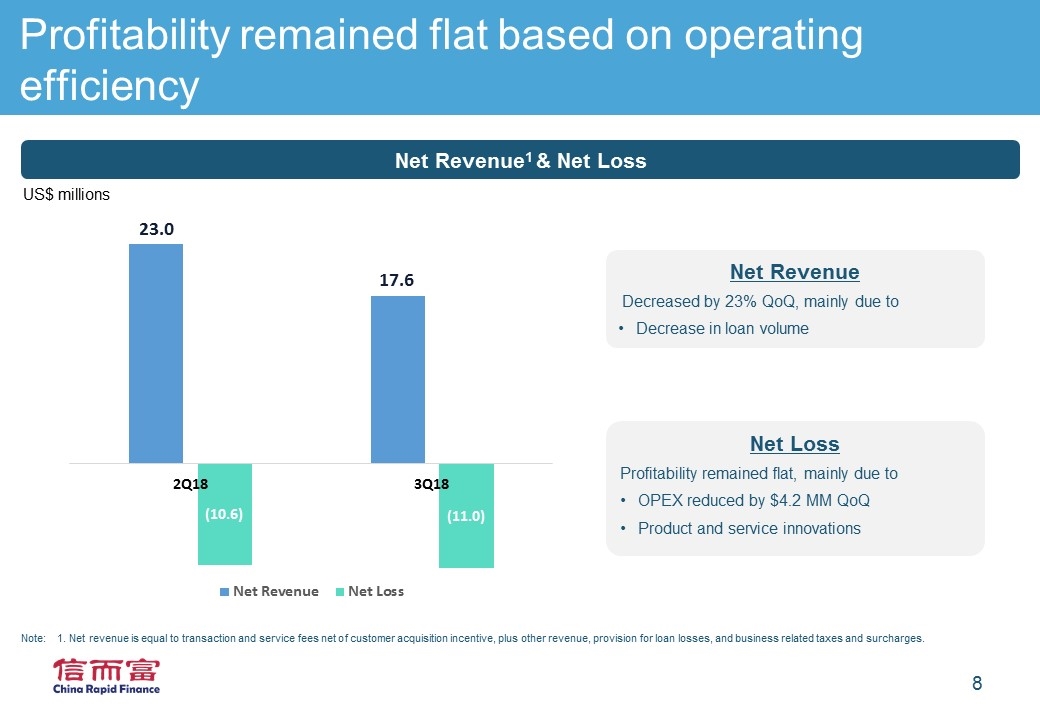

Financial Highlights1 Profitability remained flat, despite significant decrease in net revenue Net revenue -23% to $18 million Other revenue +$5 million to $5.4 million Operating expense -$4.2 million Net loss +4.5% to $11 million Updated Net revenue & Gross billings & Operating expense Note: 1. All comparisons are quarter-on-quarter

Profitability remained flat based on operating efficiency Net Revenue1 & Net Loss US$ millions Updated: Numbers in 3Q18 Note: 1. Net revenue is equal to transaction and service fees net of customer acquisition incentive, plus other revenue, provision for loan losses, and business related taxes and surcharges. Net Revenue Decreased by 23% QoQ, mainly due to Decrease in loan volume Net Loss Profitability remained flat, mainly due to OPEX reduced by $4.2 MM QoQ Product and service innovations

Appendix

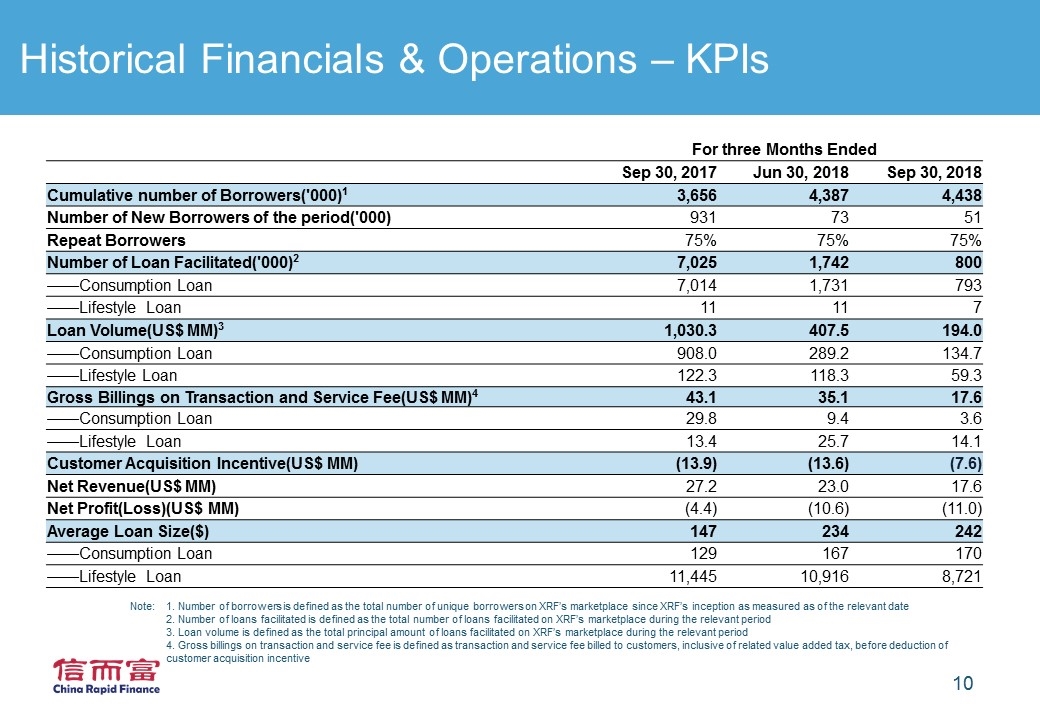

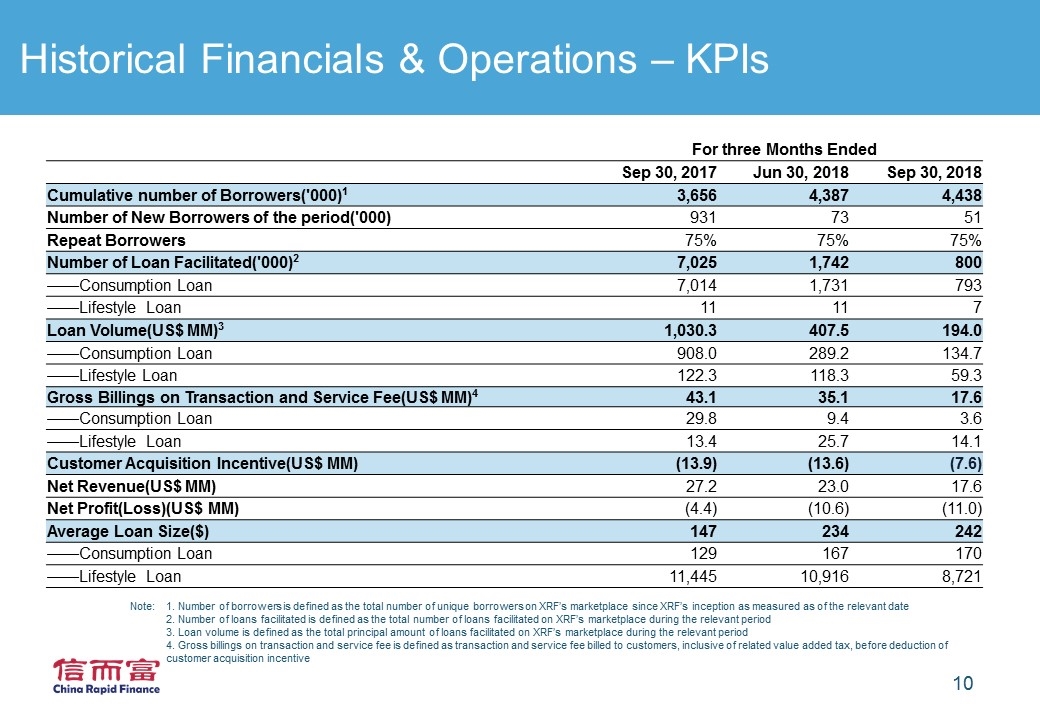

Historical Financials & Operations – KPIs Note: 1. Number of borrowers is defined as the total number of unique borrowers on XRF’s marketplace since XRF’s inception as measured as of the relevant date 2. Number of loans facilitated is defined as the total number of loans facilitated on XRF’s marketplace during the relevant period 3. Loan volume is defined as the total principal amount of loans facilitated on XRF’s marketplace during the relevant period 4. Gross billings on transaction and service fee is defined as transaction and service fee billed to customers, inclusive of related value added tax, before deduction of customer acquisition incentive For three Months Ended Sep 30, 2017 Jun 30, 2018 Sep 30, 2018 Cumulative number of Borrowers('000)1 3,656 4,387 4,438 Number of New Borrowers of the period('000) 931 73 51 Repeat Borrowers 75% 75% 75% Number of Loan Facilitated('000)2 7,025 1,742 800 ——Consumption Loan 7,014 1,731 793 ——Lifestyle Loan 11 11 7 Loan Volume(US$ MM)3 1,030.3 407.5 194.0 ——Consumption Loan 908.0 289.2 134.7 ——Lifestyle Loan 122.3 118.3 59.3 Gross Billings on Transaction and Service Fee(US$ MM)4 43.1 35.1 17.6 ——Consumption Loan 29.8 9.4 3.6 ——Lifestyle Loan 13.4 25.7 14.1 Customer Acquisition Incentive(US$ MM) (13.9) (13.6) (7.6) Net Revenue(US$ MM) 27.2 23.0 17.6 Net Profit(Loss)(US$ MM) (4.4) (10.6) (11.0) Average Loan Size($) 147 234 242 ——Consumption Loan 129 167 170 ——Lifestyle Loan 11,445 10,916 8,721

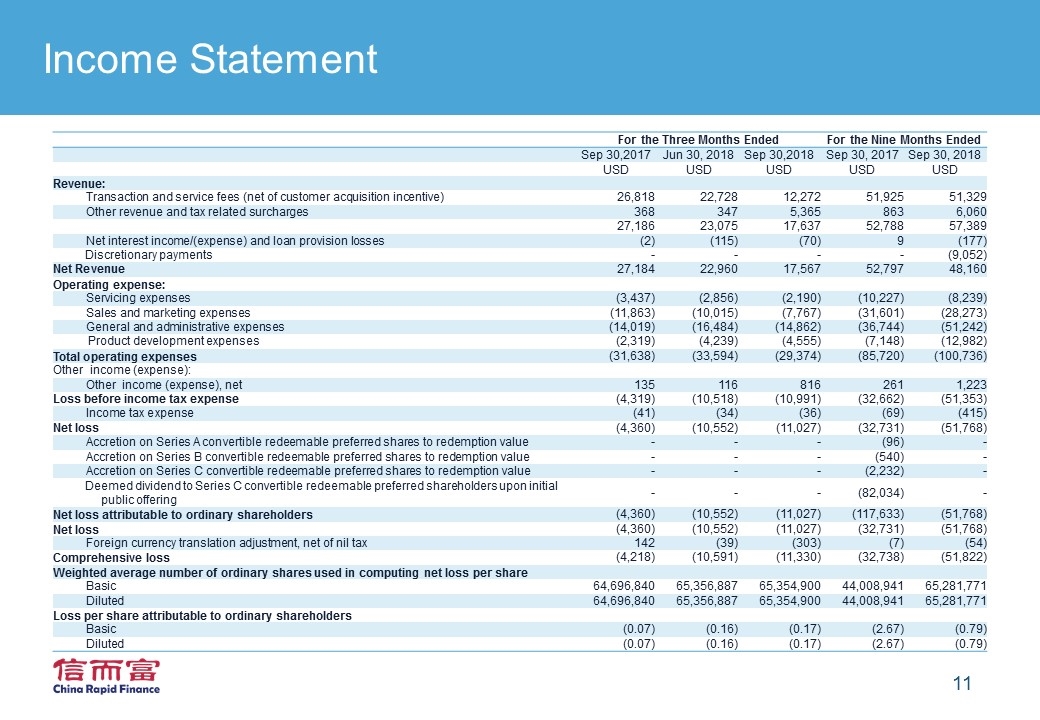

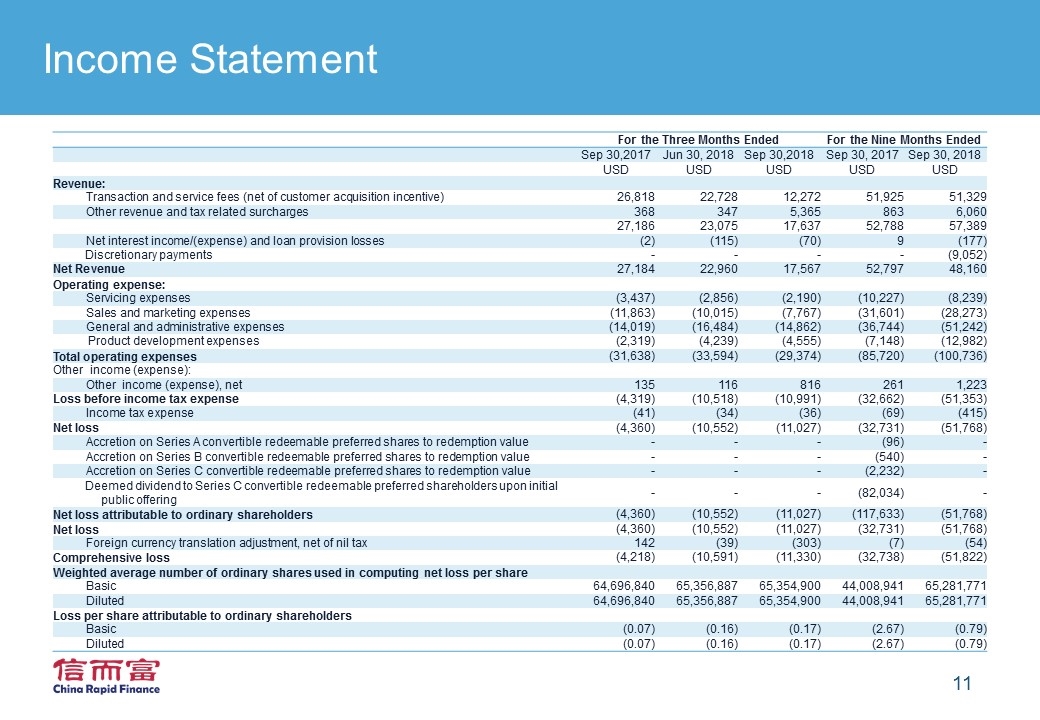

Income Statement For the Three Months Ended For the Nine Months Ended Sep 30,2017 Jun 30, 2018 Sep 30,2018 Sep 30, 2017 Sep 30, 2018 USD USD USD USD USD Revenue: Transaction and service fees (net of customer acquisition incentive) 26,818 22,728 12,272 51,925 51,329 Other revenue and tax related surcharges 368 347 5,365 863 6,060 27,186 23,075 17,637 52,788 57,389 Net interest income/(expense) and loan provision losses (2) (115) (70) 9 (177) Discretionary payments - - - - (9,052) Net Revenue 27,184 22,960 17,567 52,797 48,160 Operating expense: Servicing expenses (3,437) (2,856) (2,190) (10,227) (8,239) Sales and marketing expenses (11,863) (10,015) (7,767) (31,601) (28,273) General and administrative expenses (14,019) (16,484) (14,862) (36,744) (51,242) Product development expenses (2,319) (4,239) (4,555) (7,148) (12,982) Total operating expenses (31,638) (33,594) (29,374) (85,720) (100,736) Other income (expense): Other income (expense), net 135 116 816 261 1,223 Loss before income tax expense (4,319) (10,518) (10,991) (32,662) (51,353) Income tax expense (41) (34) (36) (69) (415) Net loss (4,360) (10,552) (11,027) (32,731) (51,768) Accretion on Series A convertible redeemable preferred shares to redemption value - - - (96) - Accretion on Series B convertible redeemable preferred shares to redemption value - - - (540) - Accretion on Series C convertible redeemable preferred shares to redemption value - - - (2,232) - Deemed dividend to Series C convertible redeemable preferred shareholders upon initial public offering - - - (82,034) - Net loss attributable to ordinary shareholders (4,360) (10,552) (11,027) (117,633) (51,768) Net loss (4,360) (10,552) (11,027) (32,731) (51,768) Foreign currency translation adjustment, net of nil tax 142 (39) (303) (7) (54) Comprehensive loss (4,218) (10,591) (11,330) (32,738) (51,822) Weighted average number of ordinary shares used in computing net loss per share Basic 64,696,840 65,356,887 65,354,900 44,008,941 65,281,771 Diluted 64,696,840 65,356,887 65,354,900 44,008,941 65,281,771 Loss per share attributable to ordinary shareholders Basic (0.07) (0.16) (0.17) (2.67) (0.79) Diluted (0.07) (0.16) (0.17) (2.67) (0.79)

Use Technology to Fulfill the Lifetime Consumer Credit Needs of China’s Emerging Middle Class Our Mission

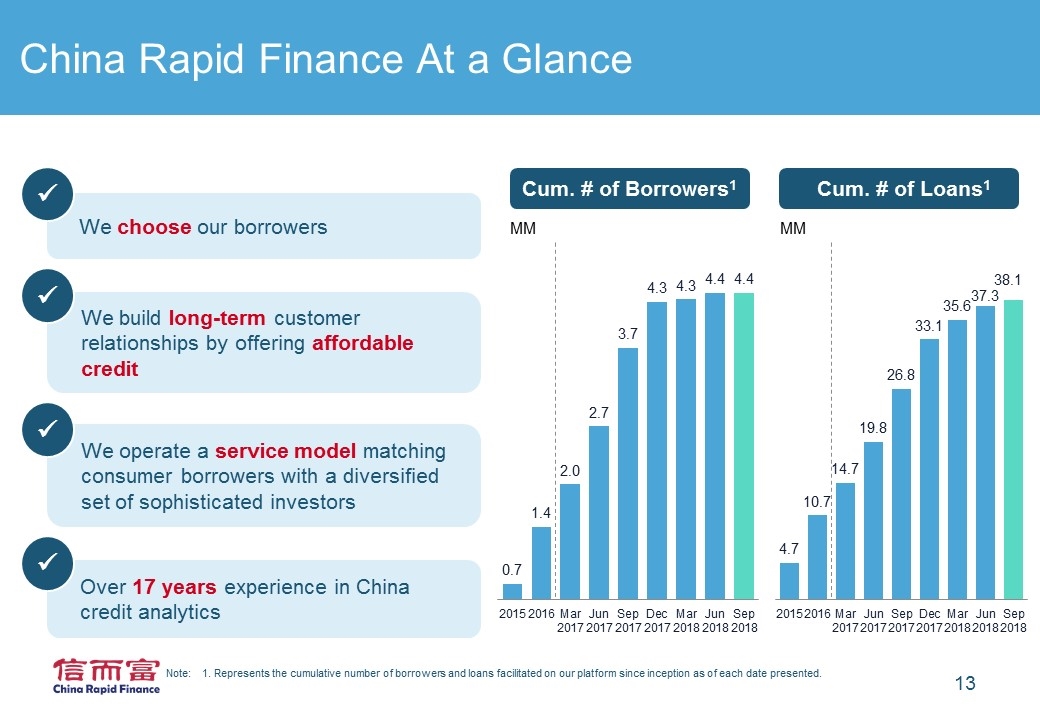

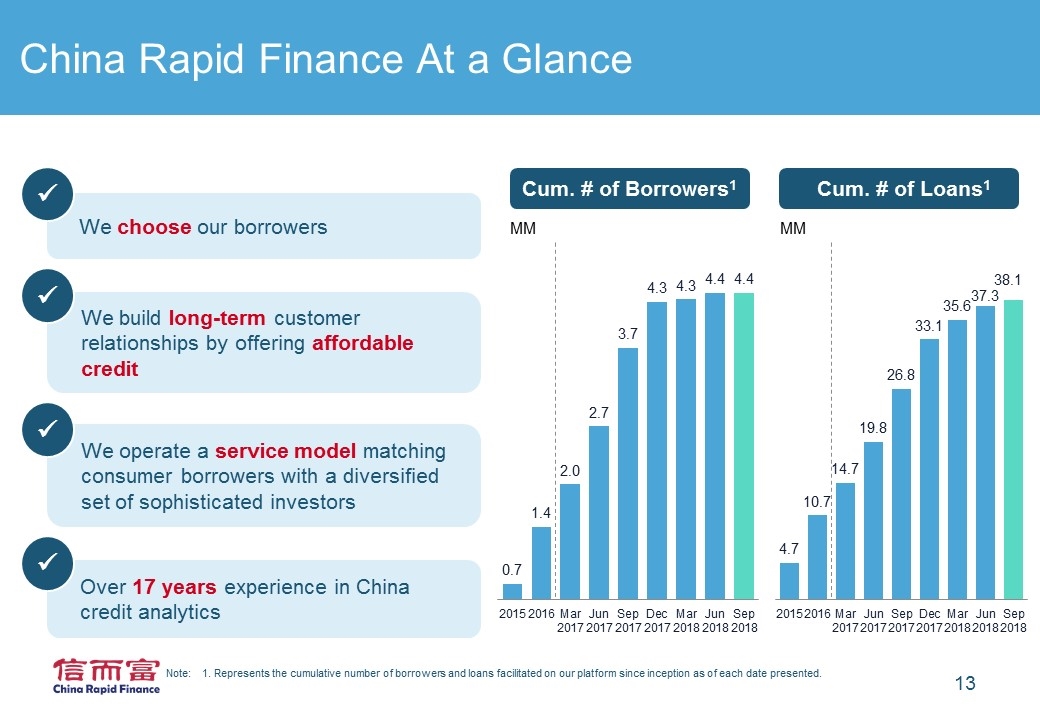

China Rapid Finance At a Glance Note: 1. Represents the cumulative number of borrowers and loans facilitated on our platform since inception as of each date presented. We choose our borrowers ü We build long-term customer relationships by offering affordable credit ü We operate a service model matching consumer borrowers with a diversified set of sophisticated investors ü Over 17 years experience in China credit analytics ü MM Cum. # of Borrowers1 MM Cum. # of Loans1 Updated: # of Borrowers in 3Q18; # of Loans in 3Q18

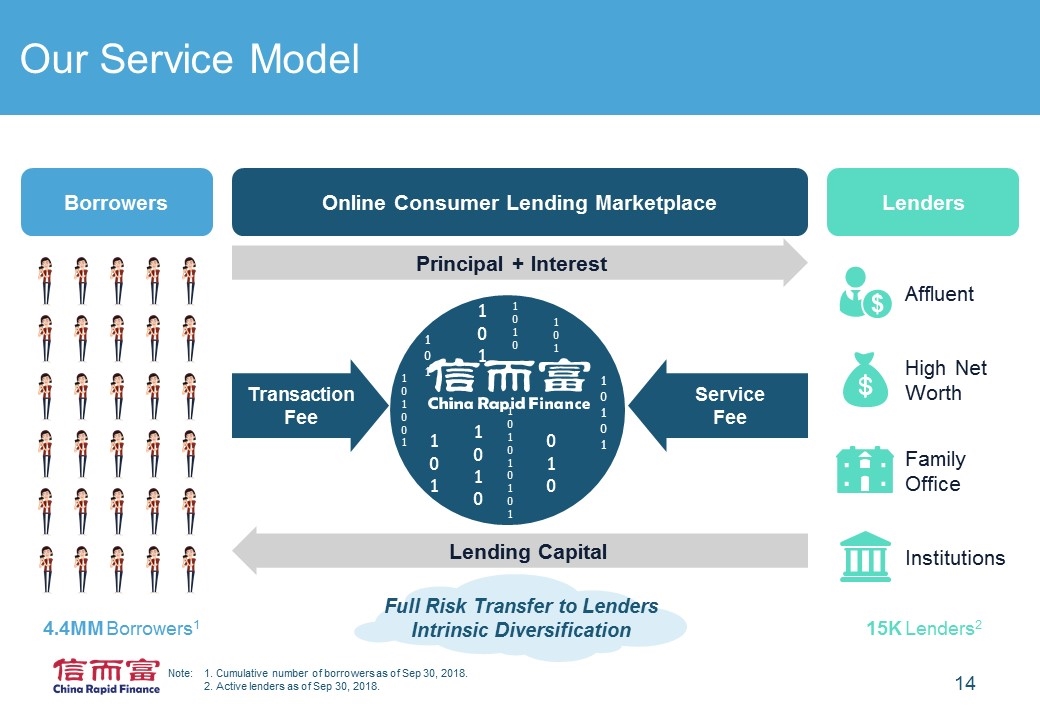

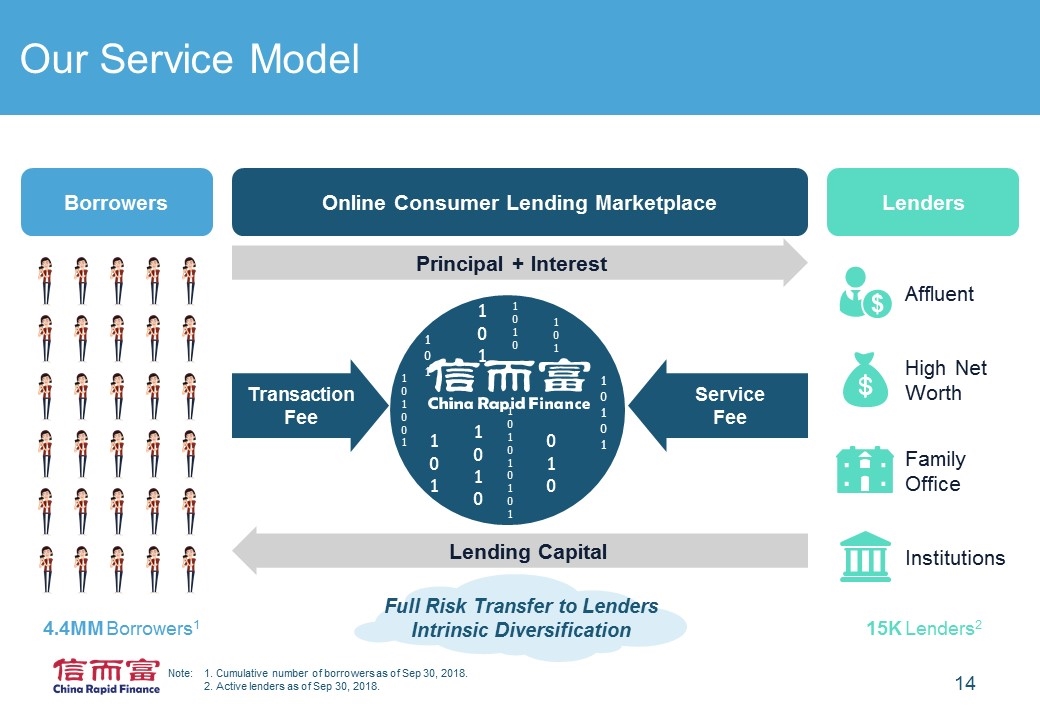

Our Service Model Borrowers High Net Worth Family Office Institutions Affluent Lenders Principal + Interest 0 1 0 1 0 1 1 0 1 0 Transaction Fee Service Fee 1 0 1 0 1 1 0 1 0 1 0 1 0 1 1 0 1 0 1 0 1 0 0 1 1 0 1 1 0 1 1 0 1 Online Consumer Lending Marketplace Lending Capital Full Risk Transfer to Lenders Intrinsic Diversification 4.4MM Borrowers1 15K Lenders2 Note: 1. Cumulative number of borrowers as of Sep 30, 2018. 2. Active lenders as of Sep 30, 2018.

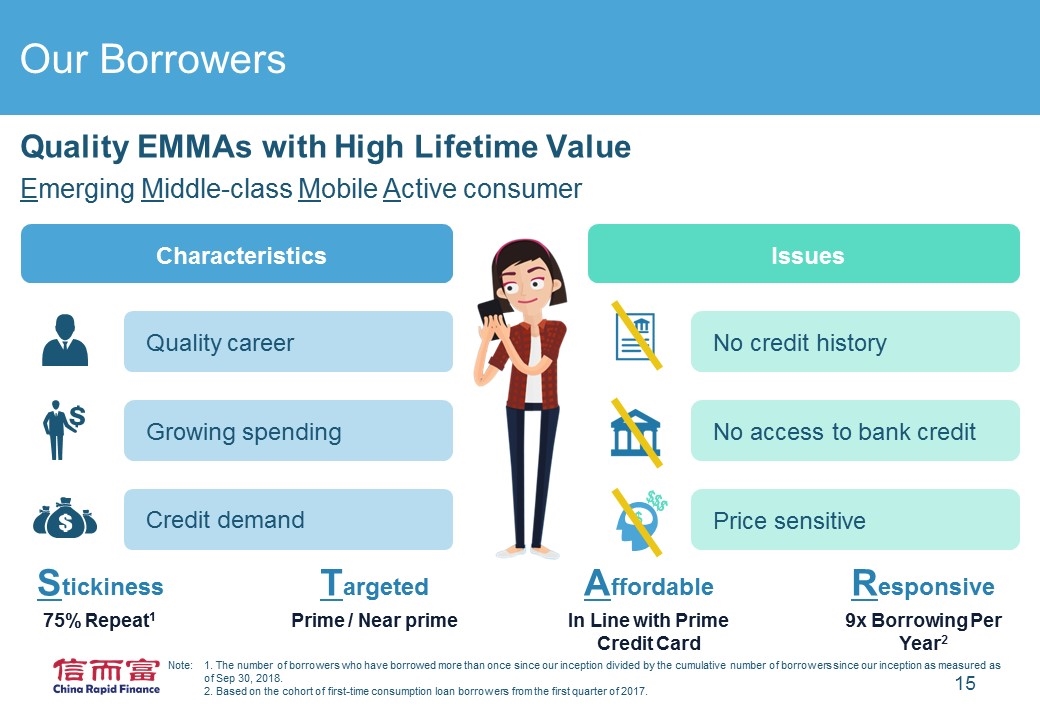

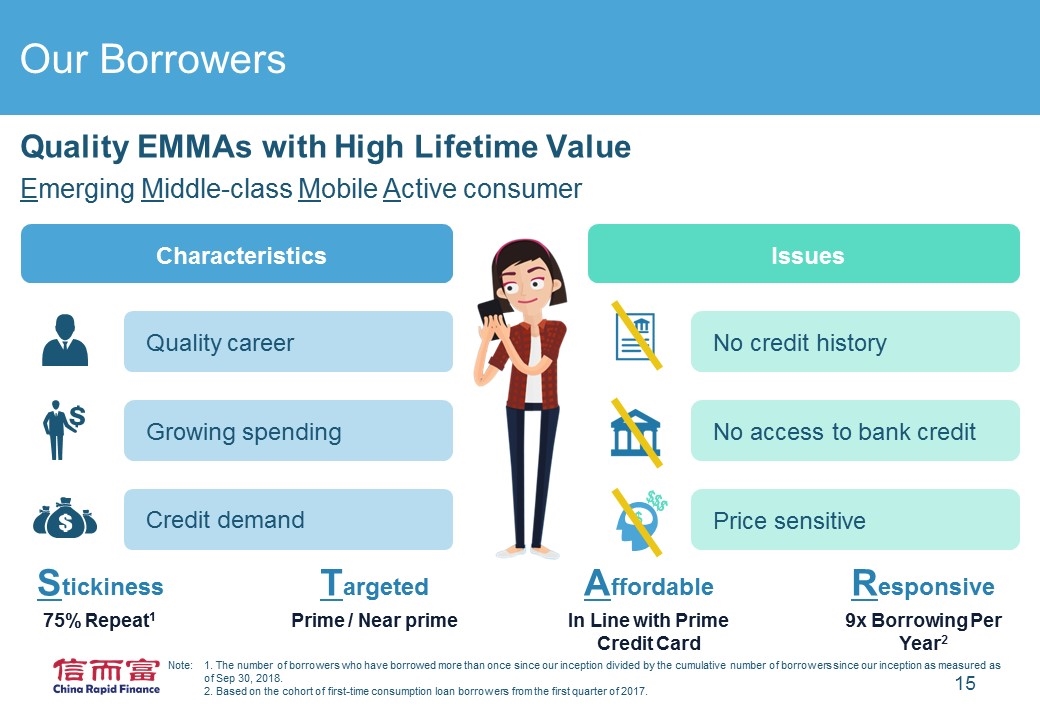

Our Borrowers Quality EMMAs with High Lifetime Value Emerging Middle-class Mobile Active consumer $ $ $ $ Characteristics Quality career Growing spending Credit demand No credit history No access to bank credit Price sensitive Stickiness 75% Repeat1 Targeted Prime / Near prime Affordable In Line with Prime Credit Card Responsive 9x Borrowing Per Year2 Note: 1. The number of borrowers who have borrowed more than once since our inception divided by the cumulative number of borrowers since our inception as measured as of Sep 30, 2018. 2. Based on the cohort of first-time consumption loan borrowers from the first quarter of 2017. Issues Updated: N/A

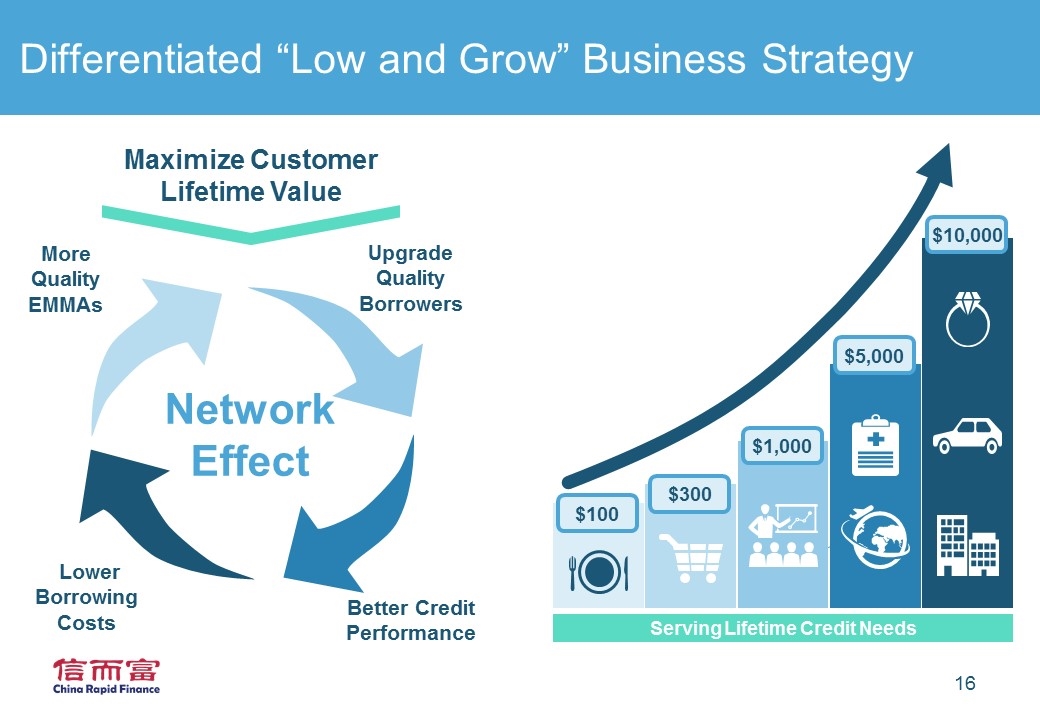

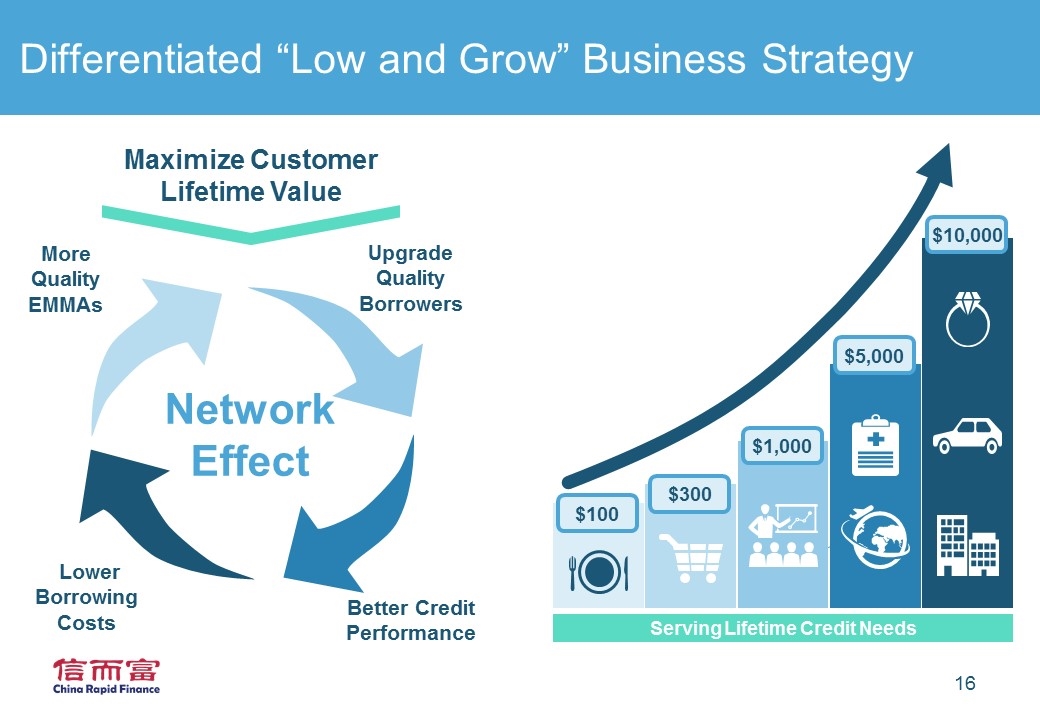

Differentiated “Low and Grow” Business Strategy Typical Profile 1 Upgrade Quality Borrowers Better Credit Performance Lower Borrowing Costs More Quality EMMAs Network Effect Maximize Customer Lifetime Value $1,000 $5,000 $100 $10,000 $300 Serving Lifetime Credit Needs

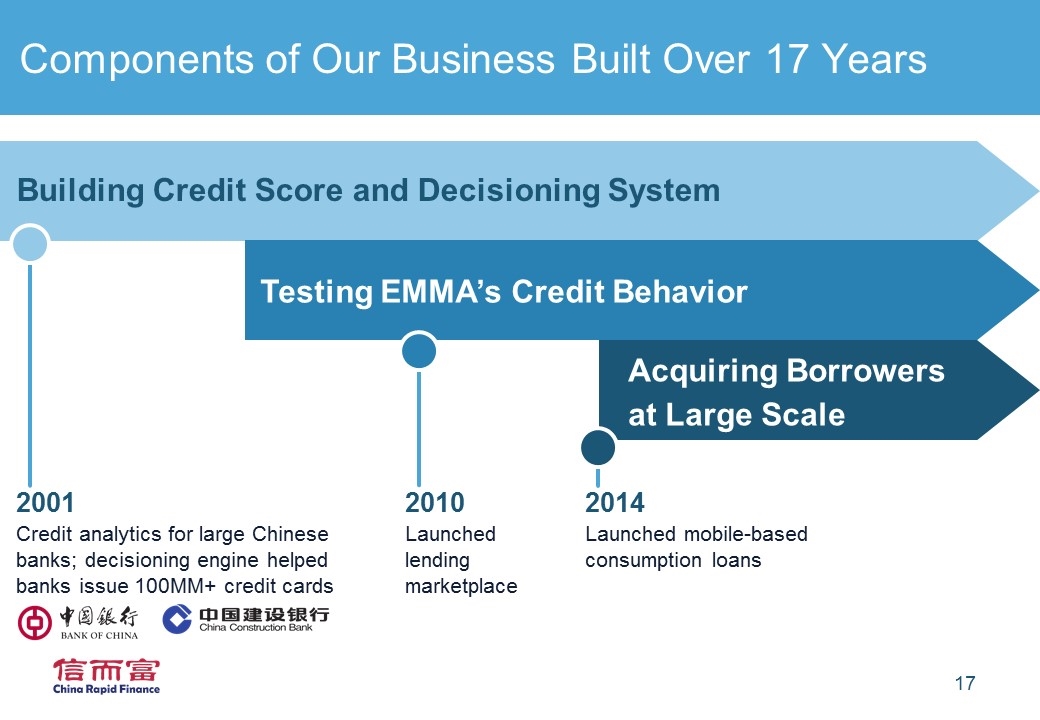

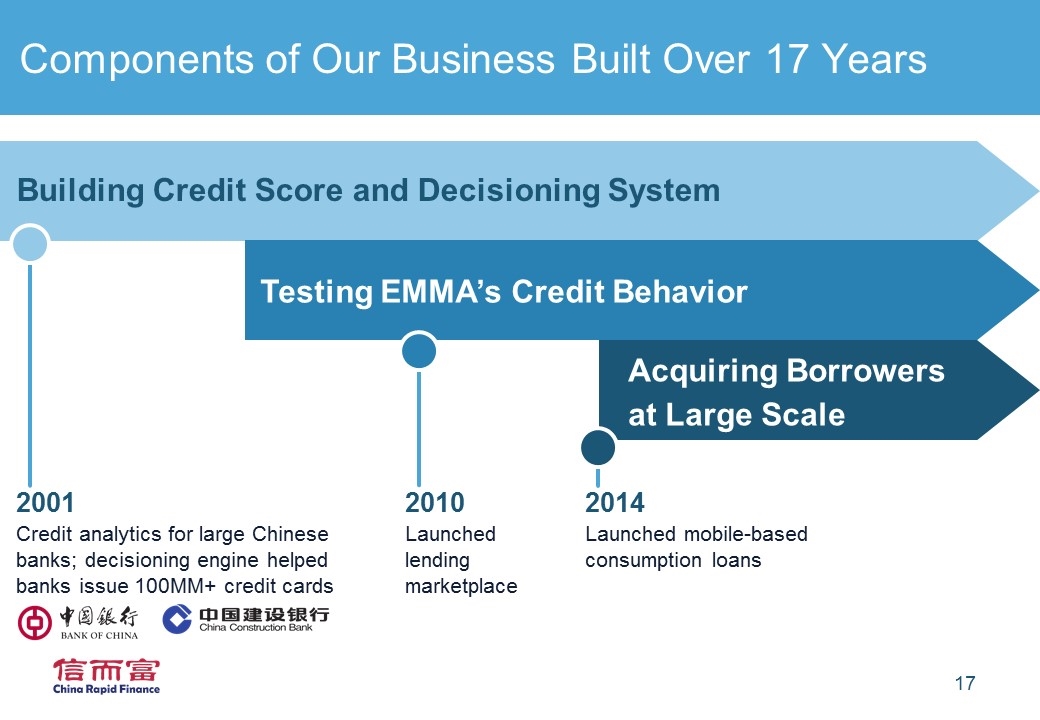

Components of Our Business Built Over 17 Years 2001 Credit analytics for large Chinese banks; decisioning engine helped banks issue 100MM+ credit cards 2014 Launched mobile-based consumption loans Building Credit Score and Decisioning System Acquiring Borrowers at Large Scale 2010 Launched lending marketplace Testing EMMA’s Credit Behavior