As filed with the Securities and Exchange Commission August 30, 2007

File No. 333-145520

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Pre-Effective

Amendment No. 2

STERLING MINING COMPANY

(Exact name of registrant as specified in its charter)

| | | | |

| Idaho | | 1000 | | 82-0300575 |

(State or Other Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Code Number) | | (IRS Employer Identification No.) |

609 Bank Street, Wallace, ID 83873

(208)-556-0227

(Address and telephone number of registrant’s principal offices)

James N. Meek, CFO

2201 Government Way, Suite E, Coeur d’Alene, ID 83814

(208) 666-4070

(Name, address and telephone number of agent for service)

Copies to:

Mark E. Lehman, Esq.

Joseph Broom, Esq.

Parsons Behle & Latimer

201 South Main Street, Suite 1800, Salt Lake City, UT 84111

Telephone: (801) 532-1234/ Fax: (801) 536-6111

Approximate date of commencement of proposed sale to the public: As soon as practicable after the registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

| Title of Each Class Of Securities to be Registered | | Amount to be

Registered (1) | | Proposed

Maximum

Offering Price

Per Unit (1) | | Proposed

Maximum

Aggregate

Offering Price | | Amount of

Registration Fee |

| | | | |

Common Stock $0.05 par value (2) | | 9,204,354 shares | | $3.94 | | $36,265,155 | | $1,114 |

| | | | |

Common Stock $0.05 par value (3) | | 367,792 shares | | $3.94 | | $1,449,101 | | $45 |

| | | | |

Common Stock $0.05 par value (4) | | 6,328,558 shares | | $4.25 | | $26,896,372 | | $826 |

| | | | |

Common Stock $0.05 par value (5) | | 35,000 shares | | $3.94 | | $137,900 | | $5 |

| | | | |

Common Stock $0.05 par value (6) | | 292,500 shares | | $4.50 | | $1,316,250 | | $41 |

| | | | |

Common Stock $0.05 par value (7) | | 5,585,792 shares | | $3.94 | | $22,008,021 | | $676 |

| | | | |

Common Stock $0.05 par value (8) | | 508,539 shares | | $3.94 | | $2,003,644 | | $62 |

| | | | |

Common Stock $0.05 par value (9) | | 4,037,098 shares | | $4.10 | | $16,552,102 | | $509 |

| | | | | | | | |

| | | | |

Total | | 26,359,633 shares | | | | $106,628,545 | | $3,278 |

| (1) | There are 20,163,737 shares of common stock of the registrant issued and outstanding held by non-affiliates of the registrant, exclusive of all securities sold in the transactions pursuant to which securities are being registered for resale under this registration statement on a delayed or continuous basis pursuant to Rule 415. The amount shares underlying options and warrants that are registered also includes such additional shares as may be issued as a result of the anti-dilution provisions of the options and warrants in accordance with Rule 416 under the Securities Act of 1933. The offering price and gross offering proceeds are estimated solely for the purpose of calculating the registration fee in accordance with paragraphs (c) and (g)(3) of Rule 457 under the Securities Act of 1933. |

| (2) | These shares are registered on behalf of selling security holders who acquired the shares in separate transaction in November 2006, January 2007, April 2007, and August 2007. |

| (3) | These shares are registered on behalf of selling security holders who hold outstanding warrants to purchase 367,792 shares of common stock at an exercise price of $3.75 per share that expire 90 days following the effective date of this registration statement. |

| (4) | These shares are registered on behalf of selling security holders who hold outstanding warrants to purchase common stock at an exercise price of $4.25 per share consisting of 2,374,908 warrants that expire November 15, 2008, and 3,953,650 warrants that expire January 18, 2009. |

| (5) | These shares are registered on behalf of selling security holders who hold outstanding options to purchase 35,000 units at a price of $3.60 per unit that expire April 30, 2009. Each unit consists of one share of common stock and one-half warrant, each warrant to purchase an additional one share of common stock at an exercise price of $4.50 per share that expires April 30, 2009. |

| (6) | These shares are registered on behalf of selling security holders who hold outstanding warrants and who may acquire warrants under the option described in Note (4), above, to purchase common stock at an exercise price of $4.50 per share that expire April 30, 2009. |

| (7) | These shares are registered on behalf of selling security holders who hold outstanding special warrants convertible for no additional consideration to 5,585,792 units. Each unit consists of one share of common stock and one-half warrant, each warrant to purchase an additional share of common stock at an exercise price of $4.10 per share that expires August 2, 2009. |

| (8) | These shares are registered on behalf of selling security holders who hold outstanding options to purchase 776,589 units at a price of $3.25 per unit that expire August 2, 2009. Each unit consists of one share of common stock and one-half warrant, each warrant to purchase an additional share of common stock at an exercise price of $4.10 per share that expires April 30, 2009. |

| (9) | These shares are registered on behalf of selling security holders who hold outstanding warrant s and may acquire warrants under the special warrants and options described in Notes (6) and (7), above, to purchase common stock at an exercise price of $4.10 per share that expire August 2, 2009. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

Subject to completion: August 30, 2007

Prospectus

STERLING MINING COMPANY

This prospectus covers 26,359,633 shares of the common stock of Sterling Mining Company that may be sold from time to time by the persons listed under the caption “Selling Security Holders,” beginning on page 66. The 26,359,633 shares consist of the following:

| | • | | 5,343,543 shares from a private placement primarily in the United States completed on January 5, 2007. Sterling Mining issued in the placement 2,600,843 common shares, warrants to purchase 367,792 common shares at an exercise price of $3.75 that expire 90 days following the date of this prospectus, and warrants to purchase 2,374,908 common shares at an exercise price of $4.25 per share that expire November 15, 2008. |

| | • | | 7,907,300 shares from a private placement primarily in Canada completed on January 18, 2007. Sterling Mining issued in the placement 3,953,650 common shares, warrants to purchase 3,953,650 common shares at an exercise price of $4.25 that expire January 18, 2009, and options to purchase 258,650 units for $2.30 per unit, each unit consisting of one common share and one common stock purchase warrant exercisable at $4.25 per share that expires January 18, 2009. |

| | • | | 877,500 shares from a private placement in Canada completed on April 30, 2007. Sterling Mining issued in the placement 550,000 common shares, warrants to purchase 292,500 common shares at an exercise price of $4.50 that expire April 30, 2009 and options to purchase 35,000 units for $3.60, each unit consisting of one common share and one-half common stock warrant exercisable at $4.50 per share that expires on April 30, 2009. |

| | • | | 3,132,353 shares from a private placement primarily in the United States completed on August 2, 2007. Sterling Mining issued in the placement 1,979,861 common shares, warrants to purchase 989,931 common shares at an exercise price of $4.10 that expire August 2, 2009, and options to purchase 108,374 units for $3.25 per unit, each unit consisting of one common share and one-half common stock purchase warrant exercisable at $4.10 per share that expires August 2, 2009. |

| | • | | 8,978,937 shares from a private placement in Canada completed on August 2, 2007. Sterling Mining issued in the placement 5,585,792 special warrants that will be converted without additional consideration upon the issuance of a receipt for a final prospectus in Canada to 5,585,792 common shares and warrants to purchase 2,792,896 common shares at an exercise price of $4.10 that expire August 2, 2009. Sterling also issued options to purchase 400,165 units for $3.25 per unit, each unit consisting of one common share and one-half common stock purchase warrant exercisable at $4.10 per share that expires August 2, 2009. |

| | • | | 120,000 shares issued in November, 2006 for the acquisition of a mineral property. |

Sterling Mining will receive the proceeds of the exercise of options and warrants described above, if exercised. Sterling Mining will not receive any proceeds or benefit from resale of the shares by the selling security holders.

Quotations for our common stock are reported on the OTC Bulletin Board under the symbol “SRLM.” On August 28, 2007, the closing bid price for our common stock was $3.36 per share.

See “Risk Factors” beginning on page 3 for information you should consider before you purchase shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2007.

TABLE OF CONTENTS

ii

SUMMARY OF PROSPECTUS

| | |

Sterling Mining’s Business: | | Sterling Mining Company is engaged in the business of acquiring, exploring, and developing mineral properties, primarily those containing silver and associated base and precious metals. Sterling’s principal mining property is the Sunshine Mine in Idaho, United States. Sterling has developed and implemented a multiphase plan to return the Sunshine Mine to long-term sustainable production. Sterling also has interests in the Barones project and other projects and prospects in Mexico, Montana and Idaho. Sterling was incorporated under the laws of the State of Idaho on February 3, 1903. Our head office is located at 609 Bank Street, Wallace, Idaho 83873, and we maintain a second administrative office at 2201 Government Way, Suite E, Coeur d’Alene, ID 83814. Our telephone number is (208) 666-4070. |

| |

Summary of Selected Financial Information: | | The following tables set forth selected financial data for each of the years in the three-year period ended December 31, 2006. The consolidated statement of operations data and balance sheet data are derived from the audited Consolidated Financial Statements of Sterling. The following selected financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Consolidated Financial Statements, including the notes thereto. |

| | Consolidated Statement of Operations Data: |

| | | | | | | | | | | | |

| | | Year Ended

December 31, | | | Year Ended

December 31, | | | Year Ended

December 31, | |

| | | 2006 | | | 2005 | | | 2004 | |

Net Revenues | | $ | 887,524 | | | $ | 491,716 | | | $ | 62,873 | |

Loss from operations | | $ | (6,568,432 | ) | | $ | (4,255,611 | ) | | $ | (5,001,375 | ) |

Net income (loss) | | $ | (5,230,395 | ) | | $ | (4,548,957 | ) | | $ | (5,529,707 | ) |

Net income (loss) per share: | | | | | | | | | | | | |

Basic | | $ | (0.24 | ) | | $ | (0.26 | ) | | $ | (0.36 | ) |

Diluted | | $ | (0.24 | ) | | $ | (0.26 | ) | | $ | (0.36 | ) |

| | |

| | Consolidated Balance Sheet Data: |

| | | | | | | | |

| | | Year Ended

December 31,

2006 | | Year Ended

December 31,

2005 | | Year Ended

December 31,

2004 |

Total assets | | $ | 20,920,367 | | 3,655,506 | | $ | 3,681,847 |

Current liabilities | | | 5,861,656 | | 849,378 | | | 1,024,579 |

Long-term obligations | | | 519,763 | | — | | | — |

Cash dividends per common share | | $ | — | | — | | $ | — |

| | |

| | Quarterly Information |

| |

| | The following tables set forth selected financial data for interim periods ended June 30, 2007. The consolidated statement of operations data and balance sheet data are derived from the unaudited Consolidated Financial Statements of Sterling. The following selected financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Consolidated Financial Statements, including the notes thereto. |

Consolidated Statement of Operations Data:

| | | | | | | | |

| | | Six Months Ended

June 30, 2007 | | | Six Months Ended

June 30, 2006 | |

Net Revenues | | $ | 1,045,488 | | | $ | 597,033 | |

Loss from operations | | $ | (6,142,665 | ) | | $ | (2,862,964 | ) |

Net income (loss) | | $ | (5,921,008 | ) | | $ | (2,864,833 | ) |

Net Income (loss) per share | | | | | | | | |

Basic | | $ | (0.20 | ) | | $ | (0.14 | ) |

Diluted | | $ | (0.20 | ) | | $ | (0.14 | ) |

Consolidated Balance Sheet Data:

| | | |

| | | June 30, 2007 |

Total assets | | $ | 24,671,597 |

Current liabilities | | $ | 2,967,745 |

Long-term obligations | | $ | 505,832 |

Cash dividends per common share | | $ | -0- |

| | |

| |

| Risk Factors: | | Any involvement in the securities of Sterling involve a high degree of risk and is very speculative due to the nature of Sterling’s business and present stage of development. • As Sterling completes additional equity financings, the existing shareholders will experience dilution. • There is limited liquidity for Sterling’s common stock. • Sterling has limited recent operating history on which to evaluate its potential for future success. Sterling has also a history of net losses. • Sterling has limited capital and has minimal revenue to date and will thus need to obtain additional capital to continue operations. • Sterling may lose rights to properties if it fails to meet payment requirements or development or production schedules. • Sterling’s operations in Mexico are subject to risks associated with the conduct of business, in foreign countries. • Sterling could face environmental liabilities with respect to its Sunshine Mine that could have a significant adverse effect on Sterling’s results of operations. • Some of Sterling’s directors and officers may have conflicts of interest as a result of their involvement with other natural resource companies. • There can be no assurance that Sterling’s insurance will be sufficient. • Sterling is reliant upon key personnel. • Mineral exploration is by its nature speculative and capital intensive. • The title to some of the company’s properties may be uncertain or defective. • Exploration programs may not result in a commercial mining operation, resulting in expensing Sterling’s investments. • Sterling may be subject to risks and expenditures that may be financially burdensome in connection with the safety regulation of operations at the Sunshine Mine. • Sterling may be subject to environmental risks and land reclamation requirements for mineral properties that may be financially burdensome. |

2

| | |

| | • Sterling faces competition in the acquisition of mining properties and the recruitment and retention of qualified personnel. • Fluctuation in the price of silver can significantly affect the Company’s business and financial performance. See “Risk Factors.” |

| |

| The Offering | | Maximum shares that may be offered by selling security holders, assuming all options and warrants are exercised by the selling security holders: 26,359,633 shares of common stock Proceeds to Sterling assuming all options and warrants covering shares that may be offered by selling security holders are exercised: $48,067,950.95 Use of proceeds from option and warrant exercises: Rehabilitation of the Sunshine Mine and general working capital needs. |

RISK FACTORS

Risks Related to the Common Shares

As Sterling completes additional equity financings, the existing shareholders will experience dilution.

Sterling believes its working capital is sufficient, based on the current mine development plan, to complete the work required to commence production at the Sunshine Mine in December 2007. Sterling cannot predict at this time what level of production may be achieved, how it will impact revenue in 2008, or whether it will achieve positive cash flow from operations. Should unexpected events prevent commencement of production in 2007 as planned, or cash flow from operations not become positive in 2008 for any reason, Sterling may be required to seek additional equity or debt financing. Any additional equity financing that it obtains or the exercise of existing warrants would have the effect of diluting existing shareholders.

There is limited liquidity for the common shares that could have a depressive effect on the value of your investment.

The common shares are not currently listed on any exchange in the United States. On June 18, 2007, Sterling filed a non-offering prospectus in Ontario, Canada for the purpose of obtaining a listing on the Toronto Stock Exchange, but Sterling has yet to obtain that listing. Quotations for our common stock are published on the Over the Counter Bulletin Board. The OTC Bulletin Board is an unorganized, inter-dealer, over-the-counter market that provides significantly less liquidity than other markets. Purchasers of our common stock may, therefore, have difficulty selling their shares should they desire to do so, and the lack of liquidity could adversely affect the market price for the common stock.

3

Risks Related to the Business of Sterling

Sterling has a limited recent operating history on which to evaluate its potential for future success. Sterling also has a history of net losses.

Although Sterling was founded in 1903, it was reactivated in 1998 with substantial activity beginning in 2003. Sterling’s business since that time represents a limited operating history upon which shareholders or prospective shareholders can evaluate its business and prospects. Sterling has a history of net losses. Furthermore, since its reactivation in 2003, Sterling has not generated sufficient revenues to cover its expenses and costs. There is no assurance that Sterling will ever be able to generate sufficient revenues to render its operations profitable.

Sterling has limited capital and has minimal revenue to date and will thus need to obtain additional capital to continue operations.

Cumulative revenues over the five-year period ended December 31, 2006, were $1,454,761. During this period, we did not have significant revenues from operations until 2005. As a mineral exploration and development company, Sterling will sustain operating expenses without corresponding revenues. This will result in Sterling incurring significant net operating losses until it can bring a property into production or lease, joint venture or sell any property it holds or may acquire. Sterling will need to obtain additional financing in the future to fund exploration and development activities or acquisitions of additional properties or other interests that may be appropriate to enhance Sterling’s financial or operating interests. If Sterling’s exploration programs successfully locate an economic ore body, additional funds will be required to place it into commercial production. Substantial expenditures would be required to establish ore reserves through drilling, to develop metallurgical processes to extract the metals from the ore and to construct the mining and processing facilities at any site chosen for mining.

If Sterling fails to obtain additional financing, it will have to delay or cancel further exploration of properties it now holds or may acquire, and it could lose all of its interest in its properties. Sterling has historically raised capital through equity financing and it is expected Sterling will seek to raise additional capital in the future through equity or debt financing, joint ventures, production sharing arrangements or other means. There can be no assurance that Sterling will be able to obtain necessary financing in a timely manner on acceptable terms, if at all. If additional financing is not available, it may have to postpone the development of, or sell, one or more of its property interests.

Sterling may lose rights to properties if it fails to meet payment requirements or development or production schedules.

Sterling derives the rights to most of its mineral properties from unpatented mining claims, leaseholds, joint ventures or purchase option agreements, which require the payment of maintenance fees, rents, or purchase price installments, exploration expenditures, or other fees. In 2004, 2005 and 2006, these fees totaled $301,300, $302,800 and $332,800, respectively, and, based on properties in which Sterling currently has an interest, are expected to total $348,800 for 2007. If Sterling fails to make these payments when they are due, the rights to the various properties may lapse. There can be no assurance that Sterling will always make payments by the requisite payment dates. In addition, some contracts with respect to the mineral properties require development or production schedules. There can be no assurance that Sterling will be able to meet any or all of the development or production schedules. Sterling’s ability to purchase, transfer or sell rights to mineral properties may require government approvals or third party consents, which may not be granted.

Sterling’s operations in Mexico are subject to risks associated with the conduct of business in foreign countries.

Sterling conducts mining, development or exploration activities in the United States and Mexico. Our foreign mining investments are subject to the risks normally associated with the conduct of business in foreign countries. These risks may include invalidation of governmental permits, uncertain political and economic environments, arbitrary changes in laws or policies and limitations on foreign ownership. The occurrence of one or more of these risks could have a material and adverse effect on our interest and investment in foreign properties, or on the viability of affected foreign operations and our results of operations.

Sterling could face environmental liabilities with respect to its Sunshine Mine that could have a significant adverse effect on results of operations.

In 1994, Sunshine Mining and Refining Company (former owner of the Sunshine Mine) determined it was a potentially responsible party under the Comprehensive Environmental Response, Compensation and Liability Act of 1980 (“CERCLA”), and entered into a Consent Decree with the Environmental Protection Agency (“EPA”) and the State of Idaho concerning environmental

4

remediation obligations at the Bunker Hill Superfund site, a 21-square mile site located near Kellogg, Idaho. The 1994 Consent Decree (the “1994 Decree”) settled their response-cost responsibility under CERCLA at the Bunker Hill site. In August 2000, Sunshine Mining and Refining Company filed for Chapter 11 bankruptcy and in January 2001, the United States Federal District Court in Idaho approved a new Consent Decree between Sunshine Mining and Refining Company, the U.S. Government and the Coeur d’Alene Indian Tribe, which settled its environmental liabilities in the Coeur d’Alene River Basin and released it from further obligations under the 1994 Decree. Sterling inherited the Sunshine Mine obligations under the new Consent Decree when it acquired its interest in the property, which means Sterling may be required to pay royalties if the price of silver is at certain levels and Sterling begins recovering silver from the mine. Other properties acquired by Sterling that surround the Sunshine Mine are not subject to the royalty as Sterling is not a party to the Consent Decree. While Sterling does not expect the royalty payments will be significant in relation to operation of the mine or results of operations if and when production commences, this history highlights the fact that environmental regulation and litigation for past, present, or future mining operations can have significant effects on a mining company and its ability to operate successfully.

Some of Sterling’s directors and officers may have conflicts of interest as a result of their involvement with other natural resource companies, which could adversely affect the management of Sterling’s future operations and activities.

Some of Sterling’s directors and officers are directors or officers of other natural resource or mining-related companies. These associations may give rise to conflicts of interest from time to time. There is no assurance these conflicts will be resolved in favor or to the benefit of Sterling. If a conflict of interest situation arises and it is not resolved appropriately with respect to the interest of Sterling, the result could have an adverse effect on Sterling’s participation in business opportunities, the manner in which the operations of Sterling are managed, or Sterling’s results of operations.

Sterling’s insurance coverage for its mine operations is limited, so the occurrence of a substantial uninsured loss would have significant adverse effect on Sterling’s financial condition and results of operations.

Insurance coverage for Sterling’s mining operations now and in the future is limited by what is affordable to Sterling and by the types and limits of coverage available at rates that are reasonable in relation to the risk. Sterling’s insurance may not provide sufficient insurance coverage for losses related to property, business interruption, or liability. In addition, Sterling does not have coverage for certain environmental losses and other risks, as such coverage cannot be purchased at a commercially reasonable cost. If a substantial uninsured loss or liability should arise, the resulting expense would negatively impact results of operations and paying for the loss or liability would adversely affect the Sterling’s financial condition.

Risks Related to Our Industry

Mineral exploration is by its nature highly speculative and capital intensive, which increases the risk of loss of your investment.

Most of Sterling’s properties are considered mineral exploration properties. Mineral exploration is highly speculative and capital intensive. Most exploration efforts are not successful, in that they do not result in the discovery of mineralization of sufficient quantity or quality to be profitably mined. The operations of Sterling are also indirectly subject to all of the hazards and risks normally incident to mineral exploration. These risks include: insufficient ore reserves, fluctuations in production costs that may make mining of reserves uneconomic, significant environmental and other regulatory restrictions, labor disputes, geological problems, failure of pit walls or dams and the risks of injury to persons, property or the environment.

The titles to some of our properties may be uncertain or defective, thus risking our investment in such properties.

Certain of our United States mineral rights consist of “patented” and “unpatented” mining claims created and maintained in accordance with the U.S. General Mining Law of 1872. Unpatented mining claims are unique U.S. property interests, and are generally considered to be subject to greater title risk than other real property interests because the validity of unpatented mining claims is often uncertain. This uncertainty arises, in part, out of the complex federal and state laws and regulations that supplement the General Mining Law. Also, unpatented mining claims and related rights, including rights to use the surface, are subject to possible

5

challenges by third parties or contests by the federal government. The validity of an unpatented mining claim, in terms of both its location and its maintenance, is dependent on strict compliance with a complex body of federal and state statutory and decisional law. In addition, there are few public records that definitively control the issues of validity and ownership of unpatented mining claims. While we have no reason to believe that the existence and extent of any of our properties are in doubt, title to mining properties are subject to potential claims by third parties claiming an interest in them.

Exploration programs may not result in a commercial mining operation, resulting in expensing our investment with little or no chance of recovering the investment.

Mineral exploration involves significant risk because few explored properties contain bodies of ore that would be commercially economic to develop into producing mines. The determination of whether the extraction and production of mineral deposits are economic is affected by numerous factors beyond our control. These factors include market price fluctuations for precious metals, the proximity and capacity of natural resource markets, processing equipment and government regulations. If exploration programs do not result in the discovery of commercial ore, our investments in the properties will be expensed.

We may be subject to risks and expenditures that may be financially burdensome in connection with the safety and regulation of operations at the Sunshine Mine, which would adversely affect results of operations.

Our U.S. mining operations are subject to inspection and regulation by the Mine Safety and Health Administration of the United States Department of Labor (“MSHA”) under the provisions of the Mine Safety and Health Act of 1977. The Occupational Safety and Health Administration (“OSHA”) also has jurisdiction over safety and health standards not covered by MSHA. Our policy is to comply with applicable directives and regulations of MSHA and OSHA. We have has made and expects to make in the future, significant expenditures to comply with these laws and regulations. Changes to the current laws and regulations governing the operations and activities of mining companies, including changes to the U.S. General Mining Law of 1872, and permitting, environmental, title, health and safety, labor and tax laws, are actively considered from time to time. We cannot predict which changes may be considered or adopted and changes in these laws and regulations could have a material adverse impact on our business. Expenses associated with the compliance with new laws or regulations could be material. Further, increased expenses could prevent or delay exploration or mine development projects and could therefore affect future levels of mineral production.

We may be subject to environment risks and land reclamation requirements for mineral properties that may be financially burdensome.

We are subject to potential risks and liabilities associated with environmental compliance and the disposal of waste rock and materials that could occur as a result of its mineral exploration and production. To the extent that we are subject to environmental liabilities, the payment of such liabilities or the costs that we may incur to remedy any non-compliance with environmental laws would reduce funds otherwise available to us and could have a material adverse effect on our financial condition or results of operations. If we are unable to fully remedy an environmental problem, we might be required to suspend operations or enter into interim compliance measures pending completion of the required remedy. The potential exposure may be significant and could have a material adverse effect on our operations and financial condition. We have not purchased insurance for environmental risks (including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from exploration and production) because it is not generally available at a reasonable price or at all.

Although variable depending on location and the governing authority, land reclamation requirements are generally imposed on mineral exploration companies in order to minimize long term effects of land disturbance. Reclamation may include requirements to control dispersion of potentially deleterious effluents and to reasonably re-establish pre-disturbance land forms and vegetation. In order to carry out reclamation obligations imposed on Sterling in connection with its mineral exploration, Sterling must allocate financial resources that might otherwise be spent on further exploration programs.

The Company may be significantly affected by fluctuations in the price of silver.

The business and financial performance of the Company will be significantly affected by fluctuations in the price of silver. The price of silver is volatile, can fluctuate substantially and is affected by numerous factors that are beyond the control of Sterling,

6

including industrial and jewelry demand around the world, the strength of U.S. dollars and of other currencies, inflation and regional and global politics. If silver prices should decline significantly and remain at low market levels for a sustained period, the Company would be adversely affected and it may be unable to operate at a profit.

We face competition in the acquisition of mining properties and the recruitment and retention of qualified personnel, which could impair our ability to advance current and proposed operations and limit opportunities for growth.

We compete with other mineral exploration and mining companies, many of which have greater financial resources than we do, for the acquisition of mineral claims, leases and other mineral interests as well as for the recruitment and retention of qualified employees and other personnel. If we require and are unsuccessful in acquiring additional mineral properties or personnel, we will not be able to grow at the rate we desires or at all.

FORWARD LOOKING STATEMENTS

This non-offering prospectus (the “Prospectus”) may contain certain “forward-looking” statements within the meaning of certain securities laws, including the “safe harbour” provisions of theSecurities Act (Ontario) and the United States Private Securities Litigation Reform Act of 1995 and are based on expectations, estimates and projections as of the date of this Prospectus, which represent Sterling’s expectations or beliefs, including but not limited to, statements concerning its operations, economic performance, financial condition, growth and acquisition strategies, investments, and future operational plans. For this purpose, any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intent,” “could,” “estimate,” “might,” “plan,” “predict” or “continue” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. This information may involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from the future results, performance or achievements expressed or implied by any forward-looking statements.

This Prospectus contains forward-looking statements, many assuming that Sterling secures adequate financing and is able to continue as a going concern, including statements regarding, among other things, (a) Sterling’s plans for bringing the Sunshine Mine in Idaho back into silver production, (b) Sterling’s plans for developing and producing from its properties in Mexico, (c) Sterling’s plans for exploring out other mineral properties, (d) Sterling’s growth strategies, (e) anticipated trends in Sterling’s industry, (f) Sterling’s future financing plans, (g) Sterling’s anticipated need for working capital, (h) the impact of environmental laws, (i) the availability of labor and equipment, and (j) title to and rights to exploit Sterling’s mineral properties. These statements may be found under the sections entitled “General Development of the Business,” and “Management’s Discussion and Analysis” as well as in this Prospectus generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks discussed under the section entitled “Risk Factors” and matters described in this prospectus generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this prospectus will in fact occur.

Given these risks and uncertainties, readers are cautioned not to place undue reliance on Sterling’s forward-looking statements.

7

GLOSSARY OF TECHNICAL TERMS

The following is a glossary of selected mining terms used in the Prospectus that may be technical in nature:

| | |

| Adit: | | An opening driven horizontally into the side of a mountain or hill for providing access to a mineral deposit. |

| |

| Andesite: | | Dark, fine grained extrusive volcanic rock. |

| |

| Anticline: | | An arch or fold in layers of rock shaped like the crest of a wave. |

| |

| Assay: | | A chemical test performed on a sample of ores or minerals to determine the amount of valuable metals contained. |

| |

| Base Metal: | | Any non-precious metal (e.g. copper, lead, zinc, nickel, etc.). |

| |

| Bedding: | | The arrangement of sedimentary rocks in layers. |

| |

| Bornite: | | Copper sulfide mineral. A copper ore mineral. |

| |

| Breccia: | | A rock in which angular fragments are surrounded by a mass of fine-grained minerals. |

| |

| Caldera: | | A large basin shaped volcanic depression of a roughly circular shape. |

| |

| Chalcocite: | | Copper sulfide mineral. A primary copper ore mineral. |

| |

| Concentrate: | | A fine, powdery product of the milling process containing a high percentage of valuable metal. |

| |

| Conglomerate: | | A sedimentary rock consisting of rounded, water-worn pebble or boulders cemented into a solid mass. |

| |

| Contact: | | A geological term used to describe the line or plane along which two different rock formations meet. |

| |

| Core: | | The long cylindrical piece of rock, about an inch in diameter, brought to surface by diamond drilling. |

| |

| Crosscut: | | A horizontal opening driven from a shaft and (or near) right angles to the strike of a vein or another ore body. |

| |

| Deposit: | | A natural occurrence of mineral or mineral aggregate, in such quantity and quality to invite exploitation. |

| |

| Development: | | Work carried out for the purpose of opening up a mineral deposit and making the actual ore extraction possible. |

| |

| Diamond Drill: | | A rotary type of rock drill that cuts a core of rock that is recovered in long cylindrical sections, two centimeters or more in diameter. |

| |

| Dike | | A tabular body of igneous rock that has been injected while molten into a fissure. |

| |

| Dilution (mining): | | Rock that is, by necessity, removed along with the ore in the mining process, subsequently lowering the grade of the ore. |

| |

| Dip: | | The angle at which a vein, structure or rock bed is inclined from the horizontal as measured at right angles to the strike. |

| |

| Discordant: | | Non parallel contact between rock formations. |

8

| | |

| Dore: | | Unparted gold and silver poured into molds when molten to form buttons or bars. Further refining is necessary to separate the gold and silver. |

| |

| Drift: | | A horizontal underground opening that follows along the length of a vein or rock formation as opposed to a cross-cut which crosses the rock formation. |

| |

| Due Diligence: | | The degree of care and caution required before making a decision; loosely, a financial and technical investigation to determine whether an investment is sound. |

| |

| EPA: | | Environmental Protection Agency. A part of the United States government that enforces environmental laws and provides information and guidance to policy makers. |

| |

| Epithermal: | | Low temperature, hydrothermal, vein forming deposit created near the surface of the earth. |

| |

| Exploration: | | Work involved in searching for ore, usually by drilling or driving a drift. |

| |

| Fissure: | | An extensive crack, break or fracture in rocks. |

| |

| Footwall: | | The rock on the underside of a vein or ore structure. |

| |

| Flotation: | | The separation of the particles of a mass of pulverized ore according to their relative capacity for floating on a given liquid. |

| |

| Fracture: | | A break in the rock, the opening of which allows mineral bearing solutions to enter. A “cross-fracture” is a minor break extending at more-or-less right angles to the direction of the principal fractures. |

| |

| Galena: | | Lead sulfide, the most common ore mineral of lead. |

| |

| Gangue: | | Vein minerals that have no economic value. |

| |

| Grade: | | The average assay of a ton of ore, reflecting metal content. |

| |

| High Grade: | | Rich ore. As a verb, it refers to selective mining of the best ore in a deposit. |

| |

| Host Rock: | | The rock surrounding an ore deposit. |

| |

| Intrusive: | | Igneous rocks that crystallize below Earth’s surface. |

| |

| Level: | | The horizontal openings on a working horizon in a mine; it is customary to work mines from a shaft, establishing levels at regular intervals, generally about 50 meters or more apart. |

| |

| Limestone: | | A bedded, sedimentary deposit consisting chiefly of calcium carbonate. |

| |

| Lode: | | A mineral deposit in solid rock. |

| |

| LOM: | | Life of Mine. The period of time for which a mine may continue to operate. |

| |

| Mill: | | A processing plant that produces a concentrate of the valuable minerals or metals contained in an ore. The concentrate must then be treated in some other type of plant, such as a smelter, to affect recovery of the pure metal. |

| |

| Mineral: | | A naturally occurring homogeneous substance having definite physical properties and chemical composition and, if formed under favorable conditions, a definite crystal form. |

| |

| Mineralized Material or Deposit: | | A mineralized body which has been delineated by appropriate drilling and/or underground sampling to support a sufficient tonnage and average grade of |

9

| | |

| | metal(s) for potential development. Under SEC standards, such a deposit does not qualify as a reserve until a comprehensive evaluation, based upon unit cost, grade, recoveries, and other factors, conclude economic feasibility. |

| |

| Mineralization: | | The presence of potentially economic minerals in a specific area or geological formation. |

| |

| Net Profit Interest: | | A portion of the profit remaining after all charges, including taxes and bookkeeping charges (such as depreciation) have been deducted. |

| |

| NPDES: | | National Pollutant Discharge Elimination System. A permit program of the EPA that controls water pollution by regulating point sources that discharge pollutants into waters of the United States |

| |

| Orebody: | | A natural concentration of valuable material that can be extracted and sold at a profit. |

| |

| Ounce: | | A troy ounce. There are 14.5833 troy ounces in one pound. |

| |

| Patent: | | The ultimate stage of holding a mineral claim in the United States, after which no more assessment work is necessary because all mineral rights have been earned. |

| |

| Patented Mining Claim: | | A parcel of land originally located on federal lands as an unpatented mining claim under the General Mining Law, the title of which has been conveyed from the federal government to a private party pursuant to the patenting requirements of the General Mining Law. |

| |

| Prospect: | | A mining property, the value of which has not been determined by exploration. |

| |

| Reclamation: | | The restoration of a site after mining or exploration activity is completed. |

| |

| Recovery: | | The percentage of valuable metal in the ore that is recovered by metallurgical treatment. |

| |

| Reserves: | | The economically mineable part of a measured or indicated mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A reserve includes diluting materials and allowances for losses that may occur when the material is mined. |

| |

| Sample: | | A small portion of rock or a mineral deposit, taken so that the metal content can be determined by assaying. |

| |

| SEC | | The United States Securities and Exchange Commission. |

| |

| Sedex | | An abbreviation for sedimentary exhalative, which are ore deposits that are interpreted to have been formed by release of ore-bearing hydrothermal fluids into a water body resulting in the precipitation of ore. |

| |

| Shaft: | | A vertical or steeply inclined excavation for the purpose of opening and servicing a mine. It is usually equipped with a hoist at the top which lowers and raises a conveyance for handling personnel and materials. |

| |

| Shear or Shearing: | | The deformation of rocks by lateral movement along numerous parallel planes, generally resulting from pressure and producing such metamorphic structures as cleavage and schistosity. |

| |

| Silicified: | | Pore filling and mineral replacement by silica and silica minerals. |

10

| | |

| Stope: | | An underground excavation from which ore has been extracted either above or below mine level. |

| |

| Stratigraphy: | | Strictly, the description of bedded rock sequences; used loosely, the sequence of bedded rocks in a particular area. |

| |

| Stratabound: | | A mineral deposit confined to a single stratigraphic unit. Typically disseminated but can occur as veinlets. |

| |

| Strike: | | The direction, or bearing from true north, of a vein or rock formation measured on a horizontal surface. |

| |

| Sublevel: | | A level or working horizon in a mine between main working levels. |

| |

| Sulfide: | | A compound of sulfur and some other element. |

| |

| Syngenetic: | | A mineral deposit formed at the same time as the formation of the host rock. |

| |

| Tetrahedrite: | | A copper silver sulfide mineral. An important copper and silver ore mineral. |

| |

| Ton: | | A short ton. There are 2,000 pounds in a short ton. |

| |

| Unpatented Mining Claim: | | A parcel of property located on federal lands pursuant to the General Mining Law and the requirements of the state in which the unpatented claim is located, the paramount title of which remains with the federal government. The holder of a valid, unpatented lode mining claim is granted certain rights including the right to explore and mine such claim under the General Mining Law. |

| |

| Volcanic: | | Pertaining to the activities, structure, or rock types of a volcano. |

| |

| Vein: | | A mineralized zone having a more or less regular development in length, width and depth which clearly separates it from neighboring rock. |

| |

| Wall Rocks: | | Rock units on either side of an orebody. The hanging-wall and footwall rocks of an orebody. |

| |

| Waste: | | Barren rock in a mine, or mineralized material that is too low in grade to be mined and milled at a profit. |

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We have filed a registration statement on Form S-1 with respect to the common stock covered by this prospectus with the SEC in accordance with the Securities Act of 1933, and the rules and regulations enacted under its authority. This prospectus, which constitutes a part of the registration statement, does not contain all of the information included in the registration statement and its exhibits and schedules. Statements contained in this prospectus regarding the contents of any document referred to in this prospectus are not necessarily complete, and in each instance, we refer you to the full text of the document which is filed as an exhibit to the registration statement. Each statement concerning a document which is filed as an exhibit should be read along with the entire document. For further information regarding us and the common stock offered in this prospectus, we refer you to the registration statement and its exhibits and schedules, which may be inspected without charge at the SEC’s Public Reference Room at 100 F Street N.E., Washington, D.C. 20549. Please call the SEC at (800) 732-0330 for further information on the Public Reference Room.

We currently file periodic reports pursuant to the Securities Exchange Act of 1934. All of our reports, such as annual and quarterly reports, and other information, such as proxy statements, are filed electronically with the SEC. The SEC maintains a web site at (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding registrants that file electronically with the SEC. Copies of the reports, proxy statements, and other information may be read and copied at the SEC’s Public Reference Room.

11

On June 18, 2007, Sterling filed a non-offering prospectus in Ontario, Canada for the purpose of obtaining a listing on the Toronto Stock Exchange. As part of the filing process, Sterling was required to prepare and file a report on its properties, including the Sunshine Mine, in accordance with National Instrument 43-101, which is an instrument developed by the Canadian Securities Administrators and administered by the provincial securities commissions that governs how issuers in Canada disclose scientific and technical information about their mineral projects to the public. Sterling’s report filed in Canada contains statements and information regarding “proven reserves” and “probable reserves,” which cannot be disclosed in periodic reports or registration statements filed with the SEC under its rules regulations. The report filed in Canada also includes information regarding “measured resource,” “indicated resource,” and “inferred resource,” which are not terms recognized by the SEC for purposes of disclosure regarding mineral properties.Persons in the United States considering an investment in our common stock are cautioned not to place any reliance on the information regarding the mineral properties of Sterling presented in its report filed in Canada and to rely solely on the information presented in the prospectus for purposes of evaluating Sterling.

OUR BUSINESS

General

Sterling is engaged in the business of acquiring, exploring, and developing mineral properties, primarily those containing silver and associated base and precious metals.

Sterling was founded in 1903 by John Presley for the purpose of acquiring, exploring and developing mineral resource properties, primarily precious and associated base metals. Sterling initially staked the East-West Link claims which are still held by Sterling. In the first 30 years, early exploration included the driving of six tunnels onto the property. In 1951, Day Mines and later associated entities leased the key Sterling property for exploration purposes. In 1996, Coeur d’Alene Mines Corporation (through a subsidiary) leased the original Sterling East-West link claims. In 1998, Sterling embarked on an expansion program in the Silver Valley of Idaho to add silver exploration prospects. Beginning with 340 acres of mining claims, this expansion program reached a total of approximately 19,000 acres under control by ownership, lease or option by 2007.

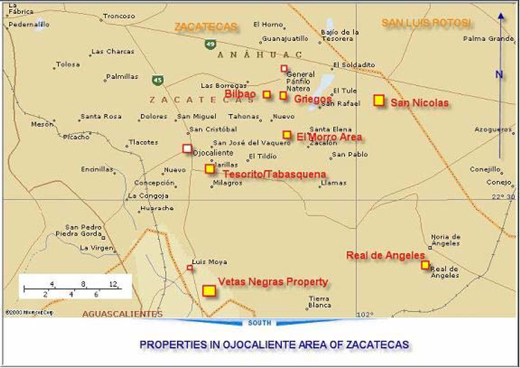

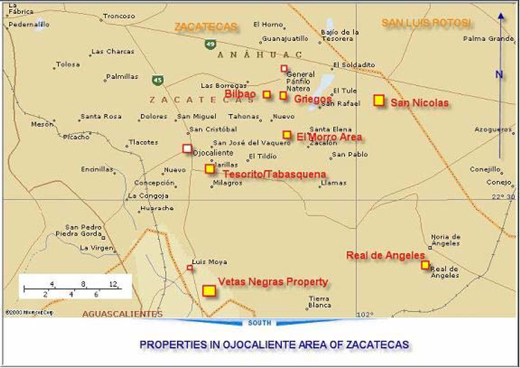

Sterling was essentially dormant in 2001 and 2002, and during this period had no revenues and incurred administrative expenses of approximately $40,000. In 2003, Sterling signed a lease with an option to purchase the Sunshine Mine, opening an office at the mine site. We began repairs and rehabilitation, began assembling a team to develop a new mine plan and business model for the mine, and in September 2003, began a surface exploration program. We also acquired various mineral leases in the Silver Valley area in Idaho and also in Montana. In 2004 and 2005, we began operations and exploration in the Zacatecas region of Mexico, acquiring several properties. In 2005, we began limited production of silver from the Barones plant in Mexico and continued the rehabilitation of the Sunshine Mine. During 2006, we began driving the Sterling Tunnel, purchased the tailing impoundment and completed a private placement of our securities to fund the activities.

Sterling is generally not affected by seasonality. The only seasonal affect on the Sunshine Mine could be a delay of supplies in the winter due to extreme snowfall preventing delivery of mine supplies.

Our Goals and Objectives

Sterling operates in two geographical locations or segments. The first is our exploration and development of mineral properties in the Northwestern part of the United States, where our principal focus is on rehabilitating and bringing back into production the Sunshine Mine in Idaho. The other geographical segment is in Mexico, where we are focusing on advancing the Barones project and exploration on its other prospects and projects in the state of Zacatecas, Mexico, and where we began processing tailings from the Barones property in 2005 to recover primarily silver.

Our mission is to become a significant publicly-traded primary silver mining company. Our business plan is to (i) expand silver assets and production; (ii) explore and develop the Sunshine Mine with an objective of eventual return to full and sustainable production; (iii) develop and implement a capitalization strategy to increase shareholder liquidity; and (iv) acquire or develop a pipeline of silver prospects and projects designed to provide leverage to silver and cash flow to support development of our flagship Sunshine Mine.

Sterling has identified the regional mineral geology of the Pacific Northwest, stretching from the U.S.-Canadian border south through Idaho then turning east into Montana, as a possible area for exploration and Sterling has particularly focused on the Coeur

12

d’Alene Mining District in Idaho. Within this district, the Company is seeking, through exploration or acquisition, to build a portfolio of assets ranging from exploration prospects to former producing mines. Sterling chose silver as the prime metal that it will seek to acquire and develop for several reasons, including the current supply-demand ratio.

Our primary objective is to return the Sunshine Mine to long-term sustainable production. From late 2005 to date, our activity with respect to the Sunshine Mine included finalization of the Phase III Mine Planning Study, infrastructure rehabilitation, underground rehabilitation of infrastructure, and expansion of the surface and underground “upper country” exploration program. The Phase III activities included the following: continued renovation and development of the Sunshine Mine; addition of experienced mining professionals with underground mining experience; assessment of the cost of putting the Mine into production; review of a conceptual mine plan by an independent engineering firm; and development of a current mine plan.

In 2004 and 2005, we began operations and exploration in the Zacatecas region of Mexico, acquiring several projects. In 2005, we produced silver from the Barones plant in Mexico and continued the rehabilitation of the Sunshine Mine. During 2006, the Company began drilling the Sterling Tunnel, which was completed in April 2007, and completed a private placement of common shares to fund the activities.

In 2004 and 2005, we began operations and exploration in the Zacatecas region of Mexico, acquiring several projects. In 2005, we produced silver from the Barones plant in Mexico. Our business plan for our Mexican properties includes the following: focus on expanding production through additional process and capital improvements at the Barones property; conduct ongoing metallurgical tests; drilling and evaluation of the properties in order to develop mineral resources; and seeking joint venture partners to participate in development. During 2006, we completed continued initial exploration activities to refine a development plan of the area.

Recent Developments

On October 20, 2006, we entered into a definitive purchase agreement with Essential Metals Corporation (“EMC”) to acquire the Big Creek tailings pond facility that we intend to use in conjunction with managing waste water from the Sunshine Mine and the operation of the ore concentrating mill for the mine. Under the agreement, we paid $4.5 million and conveyed a 16-acre parcel of land to EMC in exchange for the tailings pond property and related easements, water rights and permits. We paid an initial deposit of $100,000 earlier in October 2006, an additional payment of $500,000 on October 20, 2006, and a final payment of $3.9 million on January 22, 2007. On January 23, 2007, we received the title documents and related instruments pertaining to the tailings pond property and the transaction was closed.

In October 2006, we commenced a private offering solely to U.S. accredited investors of units at $2.70 per unit, each unit consisting of one common share, one warrant to purchase a common share at an exercise price of $4.25 per share that expires November 15, 2008, and one-quarter of a warrant to purchase a common share at an exercise price of $3.75 per share that expires on the latter of April 20, 2007 or 90 days following the effective date of a registration statement filed to permit resale of the common stock included in the units and underlying the warrants. On January 5, 2007, the offering was closed after the sale of 2,334,908 units at a gross purchase price of $6,304,250. The shares of common stock, warrants, and common stock underlying the warrants are being registered for resale as described in this prospectus.

On January 18, 2007, we closed an $8,498,500 private placement offering to institutional and accredited investors in Canada and the United States, consisting of 3,695,000 units at a price of $2.30 per unit. Each unit consists of one common share and one common share purchase warrant. Each warrant is exercisable for one common share at an exercise price of $4.25 that expires 24 months following the closing date of the offering. The common shares, warrants, and common shares underlying the warrants have not been registered under the Securities Act of 1933, or any state securities laws. Proceeds from the private placement were used to complete the purchase of the Big Creek tailings pond from EMC, and for ongoing rehabilitation and upgrade of the Sunshine Mine and general working capital purposes. The common shares sold to the purchasers and the common shares underlying the warrants are being registered for resale as described in this prospectus.

On April 30, 2007, Sterling Mining closed a $1,800,000 private placement offering consisting of 500,000 units at a price of US$3.60 per unit. Each unit was comprised of one common share of Sterling Mining and one-half common share purchase warrant.

13

Each warrant is exercisable for one common share at an exercise price of $4.50 for 24 months following the closing date of the offering. The shares of common stock, warrants, and common stock underlying have not been registered under the Securities Act of 1933, or any state securities laws. Proceeds from the private placement were used to fund the ongoing rehabilitation and upgrade of the Sunshine Mine and for general working capital purposes. The shares of common stock sold to the purchasers and the shares underlying the warrants are being registered for resale as described in this prospectus.

On August 2, 2007, Sterling Mining Company (“Sterling”) completed two private placement offerings that, in the aggregate, raised a total of $24,539,756. In Canada, Sterling Mining sold 5,585,792 special warrants at a price of $3.25 per warrant. Each special warrant is convertible into one common share of Sterling Mining and one-half of one common share purchase warrant. Conversion shall occur upon the issuance of a receipt for a final prospectus in Canada that qualifies the common shares and warrants. Each whole warrant is exercisable for one common share at an exercise price of $4.10 and expires August 2, 2009. In addition, in a second offering conducted primarily in the United States, Sterling Mining sold 1,964,902 units at the same price of $3.25 per unit. Each unit consists of one common and one-half of one warrant with the same terms as the warrants sold in Canada. The shares of common stock to be issued on conversion of the special warrants, the common shares sold to the purchasers, and the shares underlying the warrants are being registered for resale as described in this prospectus. The securities sold in the placements have not been registered under the Securities Act of 1933, or any state securities laws. Proceeds from the private placements will be used to fund the ongoing rehabilitation and upgrade of the Sunshine Mine and for general working capital purposes.

The Silver Market

Our primary focus is on exploration, development and production of silver. The worldwide demand for silver has exceeded newly-mined production for several years, the difference between demand and supply is primarily being made up by re-melting of bullion and silver coins, and recycling. Much of the future value and/or viability of Sterling will be partially dependent on the price of silver, which Sterling is unable to control. However, we believe, and have directed our business strategy accordingly, that if the demand for silver exceeds production and this situation continues, at some point there is a possibility for silver prices to increase. However, there is no assurance this will occur.

For over 10 years the silver market has exhibited a shortfall of newly mined supply to annual industrial demand, while above-ground inventories of silver appear to be declining. The shortfall has been met by scrap metal and recycling.

According to the Silver Institute, an international industry association of miners, refiners, fabricators and silver wholesalers, demand for silver has risen the past 15 years, increasing in the last five years to over 911 million ounces in 2005. New production and the recovery from scrap metal accounts for just over 828 million ounces, resulting in a significant shortfall of the metal. Increased demand is not only from the jewelry and photographic sectors, traditionally the largest users of silver, but also from growing demand for silver’s industrial uses in electrical devices and components such as computers and cellular telephones.

Approximately 71% of all newly mined silver comes as a by-product in the production of other metals such as gold or copper, thus to a certain degree this means that an increase in the price of silver does not automatically bring about an increase in production as it might other commodities

Newly mined production in 2005, according to the Silver Institute, was 641 million ounces, thus scrap metal, melting of existing silver and other sources have been meeting the shortfall, with a corresponding decline in inventories worldwide evidently occurring annually. The principal silver-producing countries are Mexico, Poland, Peru, Chile, the United States and Canada.

The Price of Silver and Sterling Mining Company

The price of silver can affect us in several ways. A low price of silver may permit Sterling to acquire silver assets at a lower cost than would otherwise be the case. However, a low silver price can have a depressing effect on Sterling’s stock price and thus reduce opportunities for selling equity to raise capital for exploration and development without unduly diluting current stockholders. An increasing price of silver can affect investors’ perceptions of the value of Sterling and its assets, and can render projects economical.

14

We believe a sustained silver price of $6.50 to $10 per ounce, depending on the project, is required to permit the possibility of production from our properties. The Company's profitability is subject to world silver prices. Should silver prices decline and stay at relatively low levels, this would impact the Company´s ability to operate profitability. There is no assurance that silver prices will stay at the current levels, but they may decline over time.

Silver has historically served as a medium of exchange, much like gold. The current principal uses of silver are for industrial uses including electrical and electronic components, batteries, computer chips, electrical contacts, high technology printing, photography, jewelry and silverware. Silver’s strength, malleability, ductility, thermal and electrical conductivity, sensitivity to light and ability to endure extreme changes in temperature combine to make silver a widely used industrial metal. Silver’s anti-bacterial properties also make it usable in medical technology and in water purification.

The following table sets forth the London Metal Exchange’s high and low prices of silver in U.S. dollars per ounce:

| | | | | | |

Year | | Silver |

| | High | | Low |

2000 | | $ | 5.45 | | $ | 4.57 |

2001 | | | 4.82 | | | 4.06 |

2002 | | | 5.10 | | | 4.23 |

2003 | | | 5.96 | | | 4.37 |

2004 | | | 8.29 | | | 5.49 |

2005 | | | 9.22 | | | 6.39 |

2006 | | | 14.94 | | | 8.83 |

2007* | | $ | 14.58 | | $ | 12.21 |

Employees

As of July 31, 2007, Sterling had 89 full-time employees in the United States and 50 full-time employees in Mexico. As circumstances require, Sterling intends to utilize the service of consultants to provide additional services to Sterling.

Competition

There is aggressive competition within the minerals industry to discover and acquire properties considered to have commercial potential. We compete for the opportunity to participate in promising exploration projects with other entities, such as Coeur d’Alene Mines Corporation and Hecla Mining Company, many of which have greater resources than us. In addition, we compete with such entities in efforts to obtain financing to explore and develop mineral properties.

We also encounter competition for the hiring of personnel, as the mining industry has a very tight labor situation for experienced mining professionals industry-wide. This competition affects our operations in Idaho, Montana and Mexico. Larger companies such as Coeur d’Alene Mines Corporation, Hecla Mining Company, Stillwater Mining Company, and Kinross Gold Corporation in the Pacific Northwest can offer better employment terms as compared to smaller companies such as Sterling.

We also compete for mine service companies, in particular drilling companies. Potential suppliers may choose to provide better terms and scheduling to larger companies in the industry.

15

Regulation

Our activities in the United States are subject to various federal, state, and local laws and regulations governing prospecting, development, production, labor standards, occupational health and mine safety, control of toxic substances and other matters involving environmental protection and taxation. It is possible that future changes in these laws or regulations could have a significant impact on our business, causing those activities to be economically reevaluated at that time.

In particular, the Sunshine Mine must follow the rules and regulations of numerous agencies. We hired a full-time Environmental Manager and a part-time Environmental Compliance Manager who was in a similar position at the former Sunshine Mining and Refining Company for over 30 years. We also have a full-time Safety Officer at the Sunshine Mine.

OUR PROPERTIES

Sterling’s material mineral property is the Sunshine Mine. Sterling has also mineral exploration properties in Mexico and Montana and other properties of lesser significance at this stage of its development.

SUNSHINE MINE

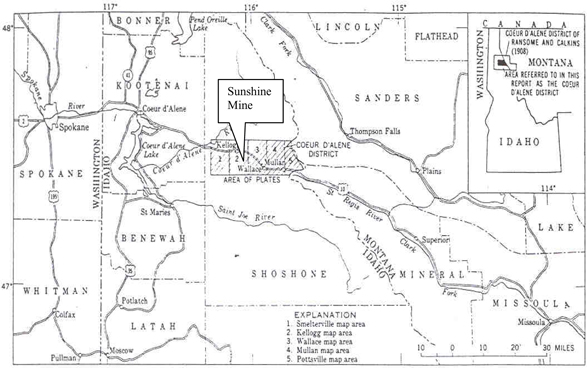

Location

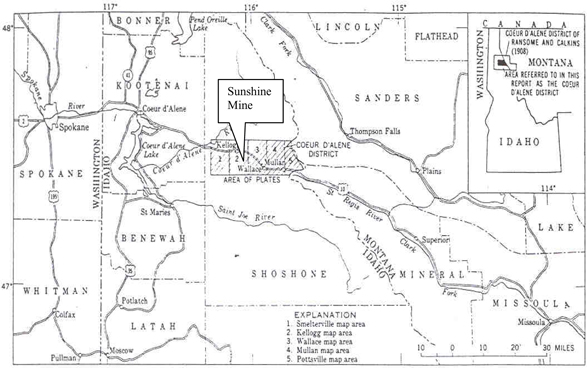

The Sunshine Mine is located within the well-known Coeur d’Alene Mining District of North Idaho at Big Creek, 40 miles east of Coeur d’Alene, Idaho, along U.S. Interstate 90 (Figure 1). The Jewell shaft, the mine’s main production shaft, is located in the Big Creek valley at Latitude 47 º, 30’, 6 ” North, Longitude 116 º, 4’, 10 ” West; near the base of a steep hill which lies to the east.

The mine’s mill and other infrastructure are located in proximity to the Jewell shaft.

16

Figure 1.Map showing location of the Coeur d’Alene mining district (Area of Plates),

Shoshone County, Idaho (from USGS Prof. Paper 445, 1964)

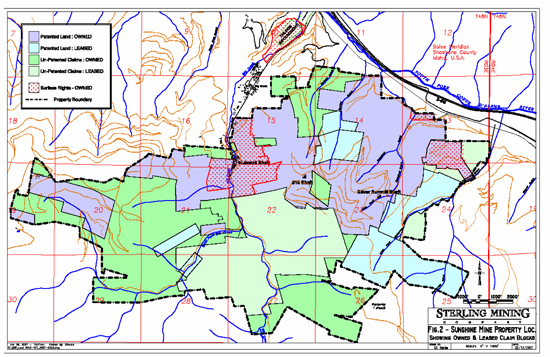

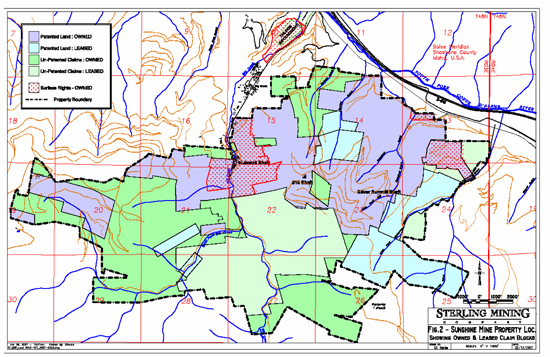

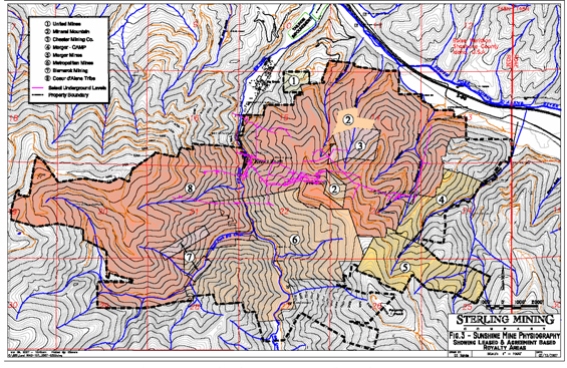

The mine ceased production in the first quarter of 2001 as a result of several factors, including the low price of silver and the lack of regular and consistent exploration and development activities. Sterling acquired control of the Sunshine Mine in June 2003 through a lease with option to purchase agreement from Sunshine Precious Metals Inc.. The Sunshine Mine property presently consists of both owned and leased blocks of 202 patented mining claims and 184 unpatented mining claims, for a mineral rights position of some 5,930 acres and four surface rights parcels of 423 acres. Figure 2 below shows the owned and leased claim blocks and the total of 423 acre owned surface rights. The property is situated partly or wholly in Sections 13, 14, 15, 16, 17, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28 and 29, Township 48 N. Range 03 E., Boise Meridian, Shoshone County, Idaho.

Property boundaries were initially defined by claim boundaries on the outermost claims of each individual property held. In the case of patented claims these were surveyed. In the case of unpatented claims, some of which may be very old, the boundaries were probably established by agreement between the land holders.

Figure 2 Sunshine Mine Owned and Leased Claim Blocks

17

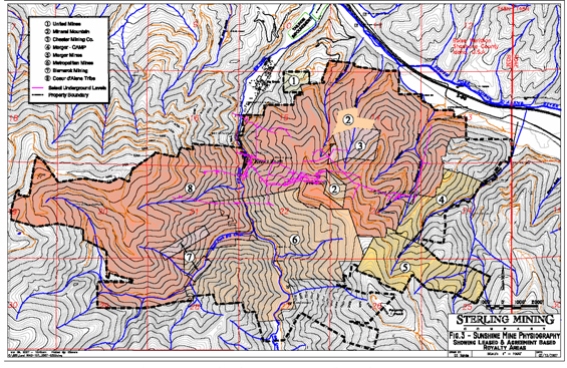

Figure 3 below shows the leased and agreement based royalty areas.

Figure 3 Leased and Agreement Based Royalty Areas

In late 1998, Sunshine Precious Metals implemented a Consent Agreement, which settled various issues with the EPA, the State of Idaho, and Coeur d’Alene Tribe to settle a Federal natural resource damage suit involving the active mining companies in some patented mining claims. Under the Consent Agreement portions of the property are subject to certain royalties that become payable, indexed on silver prices, during production.

On June 6, 2003 Sterling leased the Sunshine Mine and infrastructure, including historical records, from Sunshine Precious Metals for 15 years. Annual lease payments are $120,000 per year, payable in monthly increments. We assumed approximately $840,000 in outstanding county property tax liabilities and, in a separate transaction, purchased various items of equipment in exchange for a cash payment of $396,000, paid in six monthly installments. We have the option to purchase the property at a price ranging from $3.0 to $5.0 million, depending on the spot price of silver as of the date of exercise. The following Table 1 sets out the various claims that comprise the Sunshine property.

18

| | | | | | | | |

Table 1 Mineral Rights Comprising the Sunshine Mine |

| | | | |

Property | | Owner | | Patented Claims | | Unpatented Claims | | Acreage |

Sunshine | | SPMI | | 144 | | 47 | | 2940 |

Sunshine | | Sterling | | 6 | | 68 | | 1051 |

Metropolitan | | Metropolitan | | 2 | | 67 | | 1020 |

Chester | | Chester | | 6 | | | | 106 |

Bismark | | Western Continental | | 3 | | | | 62 |

Mineral Mountain | | Mineral Mountain | | 4 | | | | 46 |

Merger | | Merger | | 14 | | | | 356 |

Merger Camp | | Sterling Below 900 | | 21 | | | | 313 |

United Mines | | United Mines | | | | 2 | | 36 |

| | | | | | | | |

Total | | | | 202 | | 184 | | 5930 |

| | | | | | | | |

The Chester, Bismark, Merger, Mineral Mountain, Metropolitan and United Mines properties are included in the Sunshine Property group. For the most part, these properties were originally leased by Sunshine Precious Metals prior to its bankruptcy in 2001.

Chester and Bismark Group

In 2004, we leased the Chester and Bismark claim groups pursuant to a 25-year lease, renewable for an additional 25 years. The lease, which expires in 2029, requires the annual payment of 50,000 shares of our common stock, a $7,200 annual advance royalty payable in monthly installments, and a 4% Net Smelter Return. We have no work obligations under the lease. With respect to Chester Mining Company, we lease six patented mining claims covering 106 acres, which are part of the Sunshine Mine property. In October 2006, we entered into an agreement with Chester Mining Company under which we sold 50% of our interest in the Tabasquena Mine in Mexico for 600,000 restricted common shares of Chester Mining Company. Under a separate agreement, we issued 400,000 restricted shares of our common stock to a company controlled by an officer and director of Chester Mining in exchange for 675,000 outstanding common shares of Chester Mining. As a result of these transactions we now hold approximately 43% of the issued and outstanding common shares of Chester Mining, which management believes to be to the advantage of Sterling because of its leasehold interest in Chester Mining’s patented mining claims described above.

Mineral Mountain Group

In 2004, we leased the Mineral Mountain claim groups pursuant to a 25-year lease, renewable for an additional 25 years. The lease, which expires in 2029, required the issuance to the lessor of 30,000 shares of the Company’s common stock, and provides for an annual advance royalty payment of $3,600, and a 3% Net Smelter Return. We have no work obligations under the lease. As part of the lease, we received an option to buy up to 1,000,000 shares of the lessor.

Metropolitan Group

In 2004, we entered into an agreement pertaining to the Metropolitan claim groups, which expires when cancelled. The agreement provided for the issuance to the Company of 200,000 shares of the stock in the owner of the Metropolitan claim groups and an annual advance royalty payment by the Company to the lessor of $12,000.

19

The Metropolitan Mining Company property consists of 2 patented and 67 unpatented mineral lode claims. These claims lay immediately to the south of the primary workings of the Sunshine Mine and to the southwest of the ConSil Mine. The workings of the Metropolitan Mine are inaccessible. Several veins that have been mined at the Sunshine Mine have crossed or are projected to cross into Metropolitan property at depth.

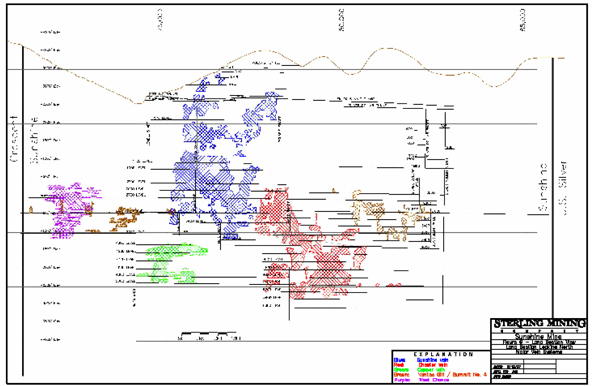

The Metropolitan Mine is located on the south limb of the Big Creek Anticline, in the south dipping rocks of the lower Wallace Formation. There are two veins in the Metropolitan Mine. The north and south veins. The north vein is characterized by a very narrow quartz band, accompanied by a two foot zone of intensely sheared rock with loose, muddy gouge on either wall. The quartz carries pyrite, minor siderite and occasional tetrahedrite and chalcopyrite. The vein strikes east-west and dips at approximately 45 to 60 degrees. The south vein is composed of a zone a few inches to three feet in width, made up of stringers of quartz carrying siderite and pyrite. Some tetrahedrite is found in the included country rock and in the adjacent hanging wall. The property also covers the Big Creek Fault Zone that separated the rocks of the Wallace and St. Regis Formations on the footwall from rocks of the Revett Formation on the hanging wall. It is likely that the north and south veins have never been explored in the more favorable quartzite units. It has been postulated that the north vein should intersect the quartzites of the Revett Formation around 2,700 feet. The south vein is projected to intersect with the Big Creek Fault at the 1,900 foot level and may host potential ore zones in the Revett Formation.