Exhibit 99.1

Exhibit 99.1

$350mm Senior Notes Offering April 2012

1

|

|

This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected. Among those risks, trends and uncertainties are our ability to find oil and natural gas reserves that are economically recoverable, the volatility of oil and natural gas prices and significantly depressed natural gas prices since the middle of 2008, the uncertain economic conditions in the United States and globally, the decline in the values of our properties that have resulted in and may in the future result in additional ceiling test write-downs, our ability to replace reserves and sustain production, our estimate of the sufficiency of our existing capital sources, our ability to raise additional capital to fund cash requirements for future operations, the uncertainties involved in prospect development and property acquisitions or dispositions and in projecting future rates of production or future reserves, the timing of development expenditures and drilling of wells, hurricanes and other natural disasters, including the impact of the oil spill in the Gulf of Mexico on our present and future operations, the impact of government regulation, and the operating hazards attendant to the oil and natural gas business. In particular, careful consideration should be given to cautionary statements made in the various reports we have filed with the Securities and Exchange Commission. We undertake no duty to update or revise these forward-looking statements.

2

Presenters

Mark Fischer Chief Executive Officer

& President

Joe Evans Chief Financial Officer

& Executive Vice President

3

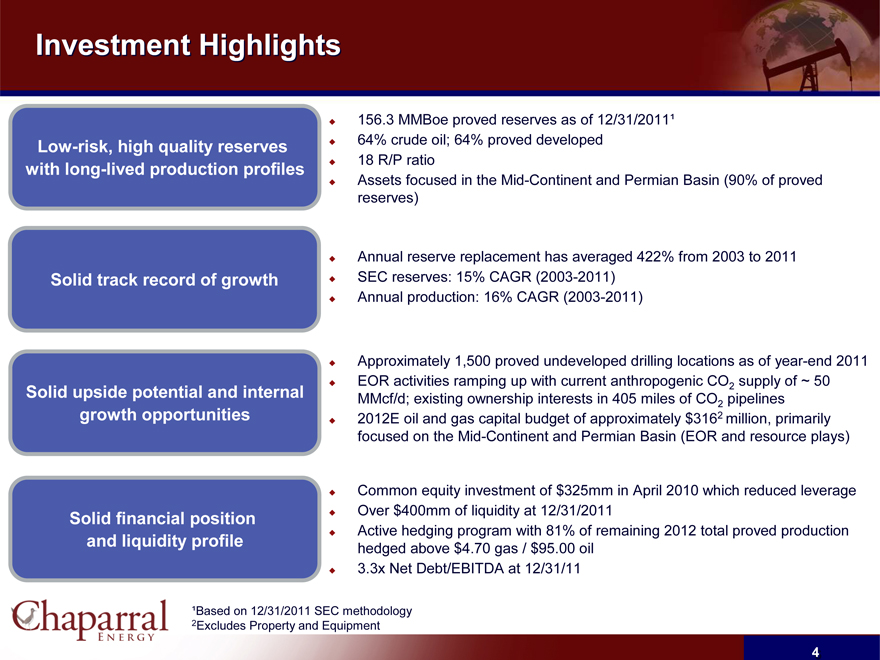

Investment Highlights

Low-risk, high quality reserves with long-lived production profiles

156.3 MMBoe proved reserves as of 12/31/2011¹ 64% crude oil; 64% proved developed

18 R/P ratio

Assets focused in the Mid-Continent and Permian Basin (90% of proved reserves)

Solid track record of growth

Annual reserve replacement has averaged 422% from 2003 to 2011 SEC reserves: 15% CAGR (2003-2011) Annual production: 16% CAGR (2003-2011)

Solid upside potential and internal growth opportunities

Approximately 1,500 proved undeveloped drilling locations as of year-end 2011 EOR activities ramping up with current anthropogenic CO2 supply of ~ 50

MMcf/d; existing ownership interests in 405 miles of CO2 pipelines

2012E oil and gas capital budget of approximately $3162 million, primarily focused on the Mid-Continent and Permian Basin (EOR and resource plays)

Solid financial position and liquidity profile

Common equity investment of $325mm in April 2010 which reduced leverage Over $400mm of liquidity at 12/31/2011 Active hedging program with 81% of remaining 2012 total proved production hedged above $4.70 gas / $95.00 oil 3.3x Net Debt/EBITDA at 12/31/11

¹Based on 12/31/2011 SEC methodology 2Excludes Property and Equipment

4

Chaparral Overview

Founded in 1988, Based in Oklahoma City

Core areas — Mid-Continent (Oklahoma) and Permian Basin (West Texas)

Oil-weighted producer (64% oil; 36% gas); R/P ratio 18 years

Third largest oil producer in Oklahoma

Stable 1P base with large 2P and 3P upside

Near-term growth potential through drilling in conventional & emerging plays

Long-term growth through CO EOR

2

Company Statistics

2011 Production (Boe/d) ~23,700

YE 2011 Proved Reserves (MMBoe)1 156.3

YE 2011 Proved Reserves PV-10 ($ in mm)1 $2,309

2011 EBITDA ($ in mm) $313

¹Based on 12/31/2011 SEC methodology

5

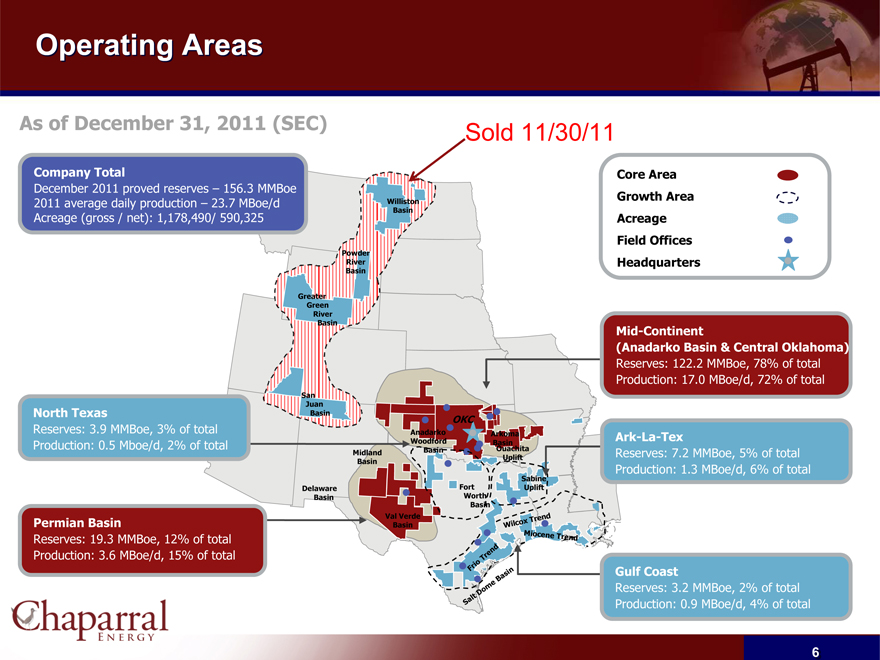

Operating Areas

As of December 31, 2011 (SEC)

Company Total

December 2011 proved reserves – 156.3 MMBoe 2011 average daily production – 23.7 MBoe/d Acreage (gross / net): 1,178,490/590,325

North Texas

Reserves: 3.9 MMBoe, 3% of total Production: 0.5 Mboe/d, 2% of total

Permian Basin

Reserves 19.3 MMBoe, 12% of total Production: 3.6 MBoe/d, 15% of total

Sold 11/30/11

Williston Basin

Powder River Basin

Greater Green River Basin

San Juan Basin

Midland Basin

Anadarko Woodford Basin OKC

Delaware Basin

Fort Worth Basin

Sabine, Uplift

Frio Trend

Miocene Trend

Arkoma Basin

Ouachita Uplift

Val Verde Basin

Salt Dome Basin

Wilcox Trend

Core Area

Growth Area

Acreage

Field Offices

Headquarters Mid-Continent

(Anadarko Basin & Central Oklahoma)

Reserves: 122.2 MMBoe, 78% of total Production: 17.0 MBoe/d, 72% of total

Ark-La-Tex

Reserves: 7.2 MMBoe, 5% of total Production: 1.3 MBoe/d, 6% of total

Gulf Coast

Reserves: 3.2 MMBoe, 2% of total Production: 0.9 MBoe/d, 4% of total

6

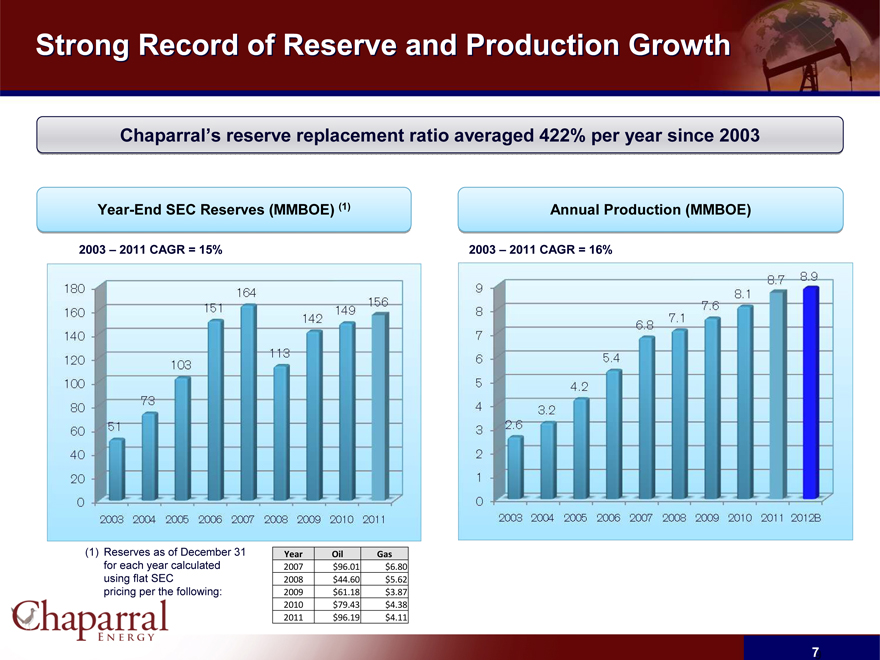

Strong Record of Reserve and Production Growth

Chaparral’s reserve replacement ratio averaged 422% per year since 2003

Year-End SEC Reserves (MMBOE) (1)

2003 – 2011 CAGR = 15%

180 160 140 120 100 80 60 40 20 0

51 73 103 151 164 113 142 149 156

2003 2004 2005 2006 2007 2008 2009 2010 2011

Annual Production (MMBOE)

2003 – 2011 CAGR = 16%

9 8 7 6 5 4 3 2 1 0

2.6 3.2 4.2 5.4 6.8 7.1 7.6 8.1 8.7 8.9

2003 2004 2005 2006 2007 2008 2010 2011 2012B

(1) Reserves as of December 31 for each year calculated using flat SEC pricing per the following:

Year Oil Gas

2007 $96.01 $6.80

2008 $44.60 $5.62

2009 $61.18 $3.87

2010 $79.43 $4.38

2011 $96.19 $4.11

7

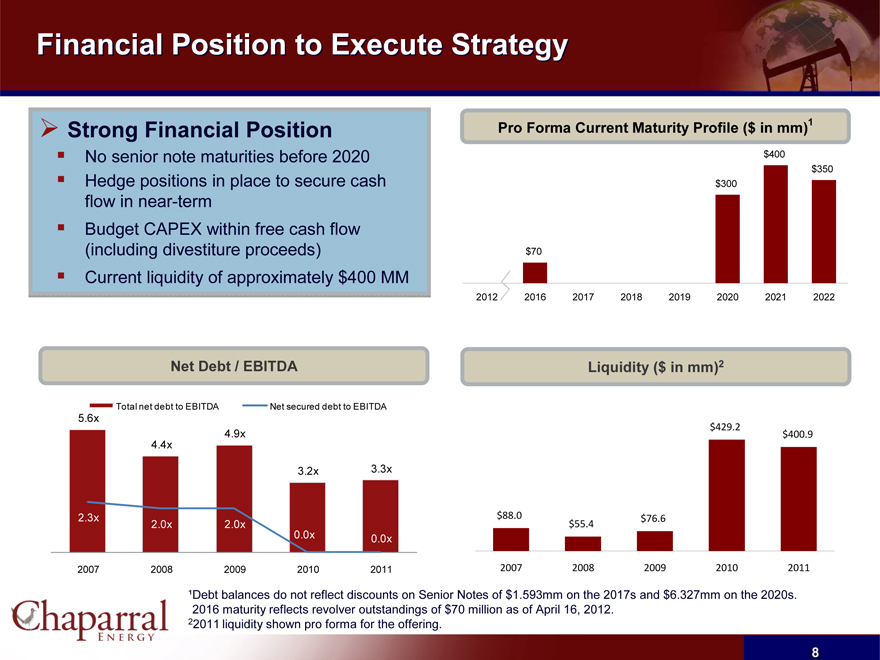

Financial Position to Execute Strategy

Strong Financial Position

No senior note maturities before 2020 Hedge positions in place to secure cash flow in near-term Budget CAPEX within free cash flow (including divestiture proceeds) Current liquidity of approximately $400 MM

Net Debt / EBITDA

Total net debt to EBITDA

Net secured debt to EBITDA

5.6x

2.3x

2007

4.4x

2.0x

2008

4.9x

2.0x

2009

3.2x

0.0x 2010

3.3x

0.0x 2011

1

Pro Forma Current Maturity Profile ($ in mm)

2012 2016 2017 2018 2019 2020 2021 2022

$70

$300

$400

$350

Liquidity ($ in mm)2

2007 2008 2009 2010 2011

$88.0 $55.4 $76.6 $429.2 $400.9

¹Debt balances do not reflect discounts on Senior Notes of $1.593mm on the 2017s and $6.327mm on the 2020s. 2016 maturity reflects revolver outstandings of $70 million as of April 16, 2012.

22011 liquidity shown pro forma for the offering.

8

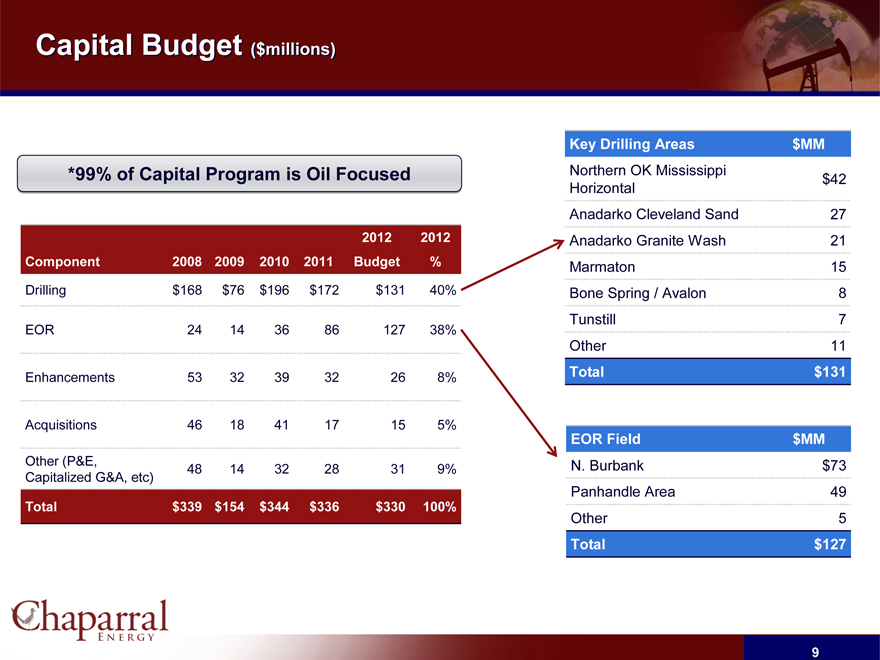

Capital Budget ($millions)

*99% of Capital Program is Oil Focused

2012 2012

Component 2008 2009 2010 2011 Budget%

Drilling $168 $76 $196 $172 $131 40%

EOR 24 14 36 86 127 38%

Enhancements 53 32 39 32 26 8%

Acquisitions 46 18 41 17 15 5%

Other (P&E,

48 14 32 28 31 9%

Capitalized G&A, etc)

Total $339 $154 $344 $336 $330 100%

Key Drilling Areas $MM

Northern OK Mississippi

$42

Horizontal

Anadarko Cleveland Sand 27

Anadarko Granite Wash 21

Marmaton 15

Bone Spring / Avalon 8

Tunstill 7

Other 11

Total $131

EOR Field $MM

N. Burbank $73

Panhandle Area 49

Other 5

Total $127

9

Resource Potential

10

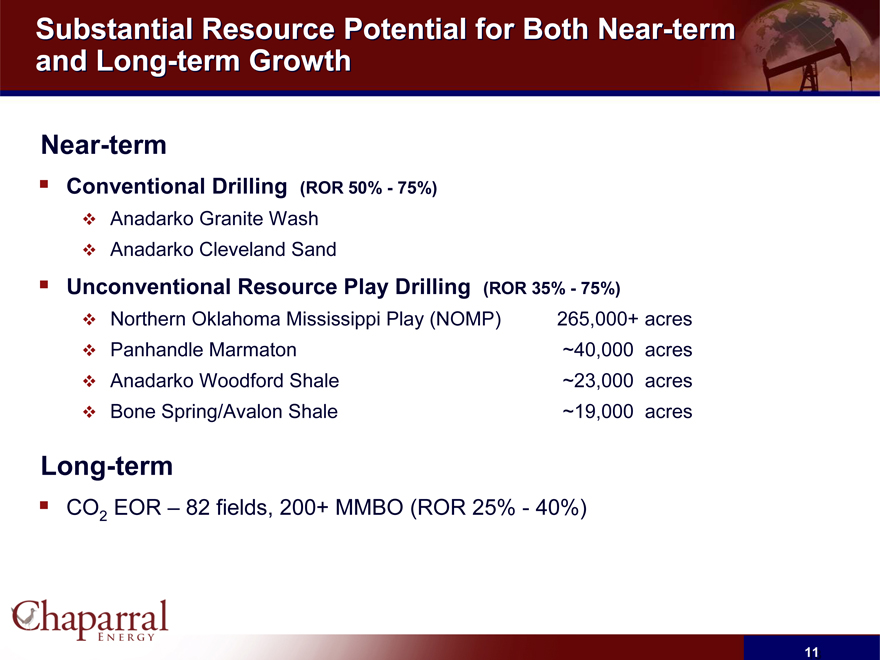

Substantial Resource Potential for Both Near-term and Long-term Growth

Near-term

Conventional Drilling (ROR 50%—75%)

Anadarko Granite Wash Anadarko Cleveland Sand

Unconventional Resource Play Drilling (ROR 35%—75%)

Northern Oklahoma Mississippi Play (NOMP) 265,000+ acres

Panhandle Marmaton ~40,000 acres

Anadarko Woodford Shale ~23,000 acres

Bone Spring/Avalon Shale ~19,000 acres

Long-term

CO2 EOR – 82 fields, 200+ MMBO (ROR 25%—40%)

11

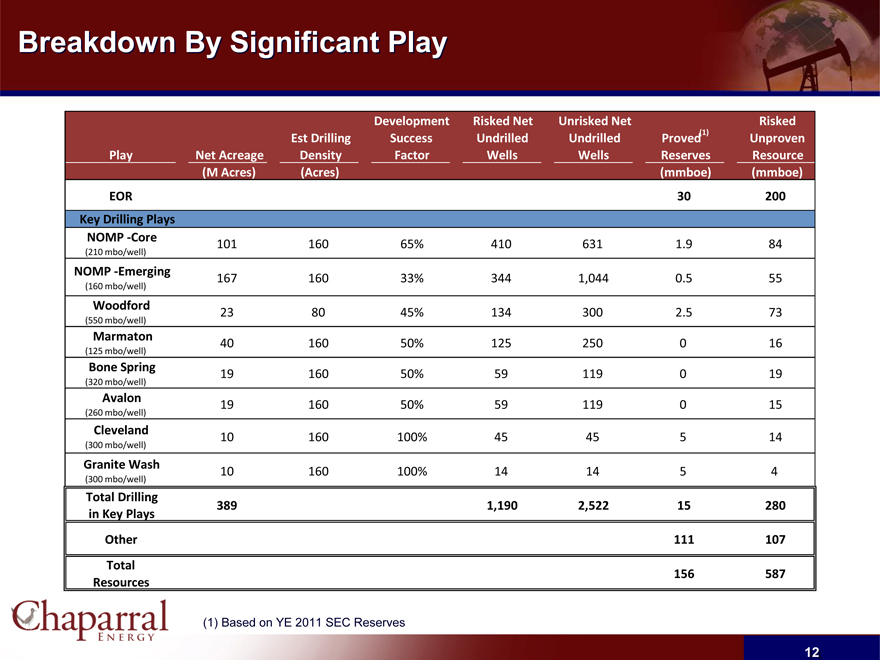

Breakdown By Significant Play

Play Net Acreage Est Drilling Density Development

Success factor

Risked Net Undrilled Wells Unrisked Net Undrilled Wells Proved(1) Reserves Risked Unproven Resource

(M Acres)(Acres)(mmboe)(mmboe)

EOR 30 200

Key Drilling Plays

NOMP -Core

(210 mbo/well) 101 160 65% 410 631 1.9 84

NOMP -Emerging

(160 mbo/well) 167 160 33% 344 1,044 0.5 55

Woodford

(550 mbo/well) 23 80 45% 134 300 2.5 73

Marmaton

(125 mbo/well) 40 160 50% 125 250 0 16

Bone Spring

(320 mbo/well) 19 160 50% 59 119 0 19

Avalon

(260 mbo/well) 19 160 50% 59 119 0 15

Cleveland

(300 mbo/well) 10 160 100% 45 45 5 14

Granite Wash

(300 mbo/well) 10 160 100% 14 14 5 4

Total Drilling in Key Plays 389 1,190 2,522 15 280

Other 111 107

Total Resources 156 587

(1) Based on YE 2011 SEC Reserves

12

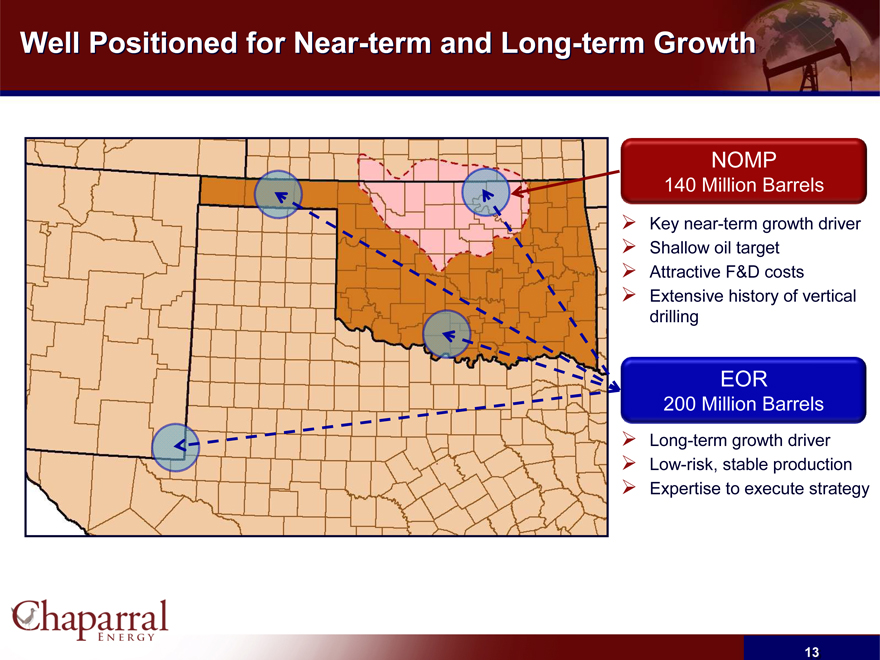

Well Positioned for Near-term and Long-term Growth

NOMP

140 Million Barrels

Key near-term growth driver Shallow oil target Attractive F&D costs Extensive history of vertical drilling

EOR

200 Million Barrels

Long-term growth driver Low-risk, stable production Expertise to execute strategy

13

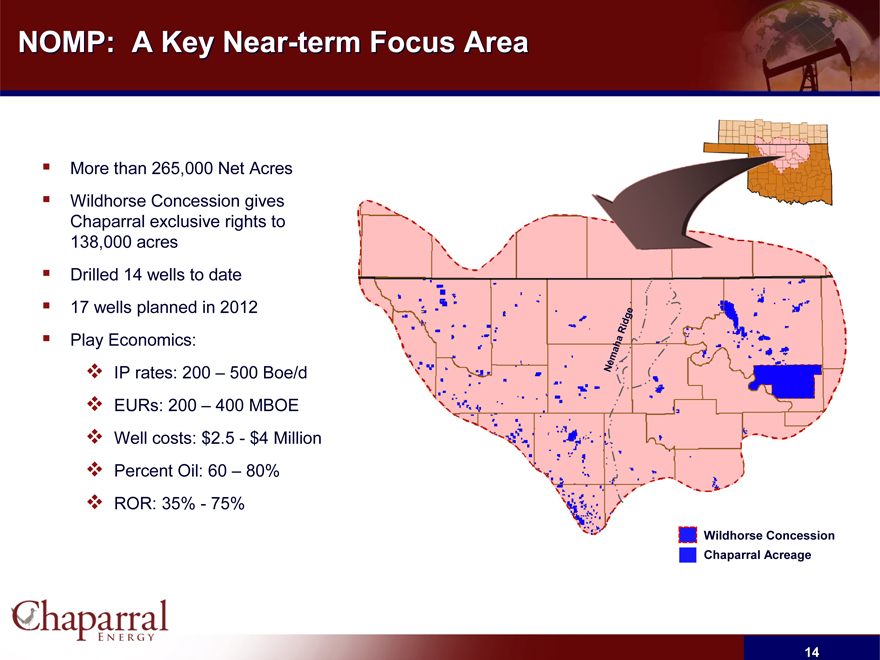

NOMP: A Key Near-term Focus Area

More than 265,000 Net Acres

Wildhorse Concession gives Chaparral exclusive rights to 138,000 acres

Drilled 14 wells to date 17 wells planned in 2012 Play Economics:

IP rates: 200 – 500 Boe/d EURs: 200 – 400 MBOE Well costs: $2.5—$4 Million Percent Oil: 60 – 80% ROR: 35%—75%

Nemaha Ridge

Wildhorse Concession Chaparral Acreage

14

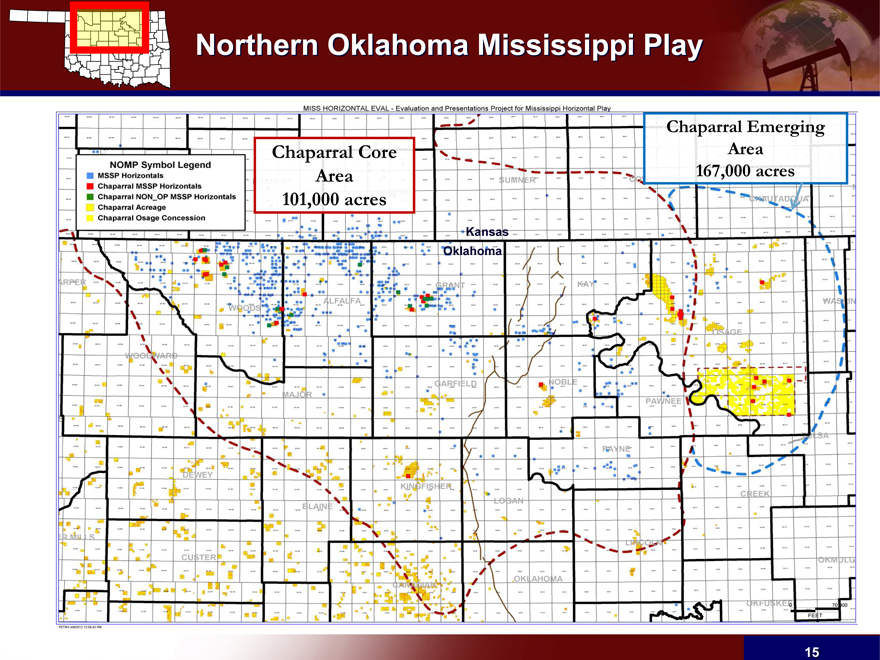

Northern Oklahoma Mississippi Play

MISS HORIZONTAL EVAL - Evaluation and Presentation Project for Mississippi Horizontal Play

NOMP Symbol Legend

MSSP Horizontals

Chaparral MSSP Horizontals

Chaparral NON_OP MSSP Horizontals

Chaparral Acreage

Chaparral Osage Concession

Chaparral Core Area 101,000 acres

Chaparral Emerging Area 167,000 acres

Kansas Oklahoma

15

Other Developing Drilling Plays

16

Bone Spring / Avalon

Chaparral Energy, LLC

Avalon Shale Position

19,000 Net Acres in West and Central Loving County, TX Upper and Lower Avalon Production Surrounding Acreage Block Over 80 Potential Avalon Drill Sites

Oil & NGL Rich Play High Initial Production Prime Acreage Position Large Development Opportunity Average Well Depth : 12,000 –12,250 Ft. (MD)

IP: 508 boe/d

Cum: 126,250 boe in 11 Mo’s

Avg. 377 boe/d past 11 Mo’s

Chaparral Energy, LLC TXL 17 #1H (Avalon Horiz) IP 450 Boe/d

Chaparral Energy, LLC TXL 29 #6H

Flowing back after frac

IP: 830 boe/d

No Avail. Prod. Data

IP: 425 boe/d

Cum: 96,440 BOE in 9 Mo’s

Avg. 411 boe/d past 9 Mo’s

IP: 572 boe/d

Cum: 67,872 boe in 7 Mo’s

Avg. 324 boe/d past 7 Mo’s

IP: 195 boe/d

Cum: 151,511 BOE in 15 Mo’s

Avg. 348 boe/d past 15 Mo’s

Well Legend

Brushy Canyon Horizontal

Avalon Shale Horizontal

Bone Spring Sand Horizontal

17

Marmaton Shelf Play

Johnston 1H-24 Completing

Leatherman 1H-14 2012 Location

Lamaster 1H-23 2012 Location

Chaparral Acreage

Marmaton Production

Net Acreage 40,000

EUR/well (MBoe) 150

Cost per Well ($MM) $3.6

Jay 1H-1098 2012 Location

Wright 1H-1099 2012 Location

18

Chaparral: A Growing Mid-Continent CO EOR Company

2

19

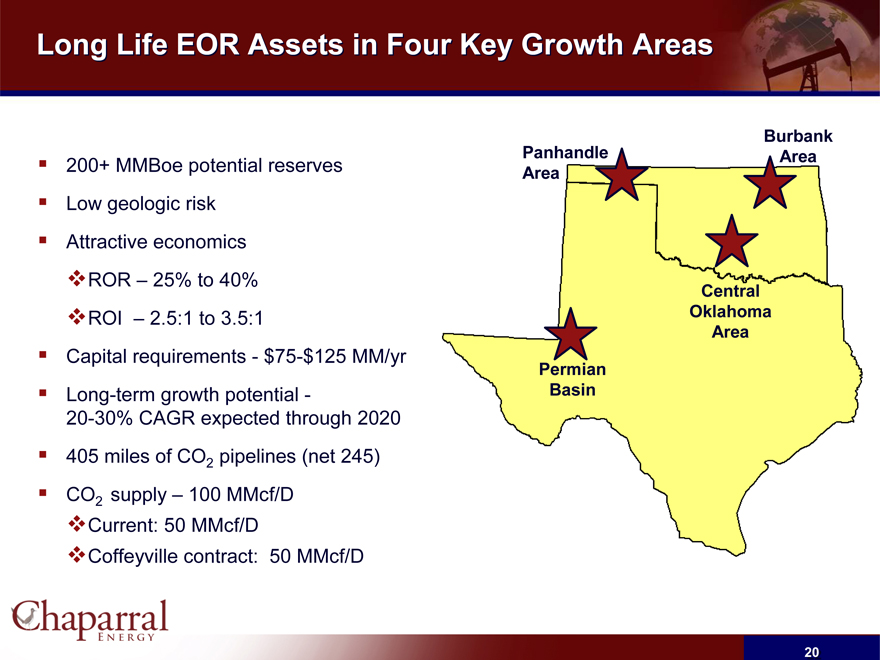

Long Life EOR Assets in Four Key Growth Areas

200+ MMBoe potential reserves Low geologic risk Attractive economics

ROR – 25% to 40%

ROI – 2.5:1 to 3.5:1

Capital requirements—$75-$125 MM/yr

Long-term growth potential -

20-30% CAGR expected through 2020

405 miles of CO2 pipelines (net 245) CO2 supply – 100 MMcf/D

Current: 50 MMcf/D

Coffeyville contract: 50 MMcf/D

Panhandle Area

Burbank Area

Central Oklahoma Area

Permian Basin

20

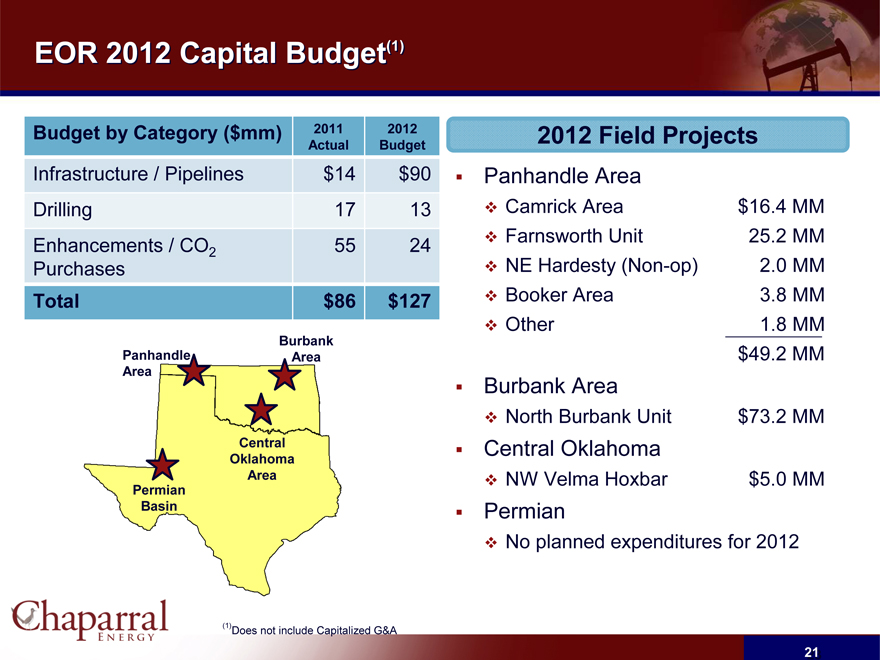

EOR 2012 Capital Budget(1)

Budget by Category ($mm) 2011 2012

Actual Budget

Infrastructure / Pipelines $14 $90

Drilling 17 13

Enhancements / CO2 55 24

Purchases

Total $86 $127

Panhandle Area

Burbank Area

Central Oklahoma Area

Permian Basin

2012 Field Projects

Panhandle Area

Camrick Area $16.4 MM

Farnsworth Unit 25.2 MM

NE Hardesty (Non-op) 2.0 MM

Booker Area 3.8 MM

Other 1.8 MM

$49.2 MM

Burbank Area

North Burbank Unit $73.2 MM

Central Oklahoma

NW Velma Hoxbar $5.0 MM

Permian

No planned expenditures for 2012

(1)

Does not include Capitalized G&A

21

Burbank Area Potential CO Projects

2

Burbank Area:

Net Potential: 100 MMBoe, 51% of total

Total OOIP 1,163 MMBO Primary Production 239 MMBO Secondary Recovery 211 MMBO Tertiary Potential 119 MMBO Net Tertiary Potential 100 MMBO

22

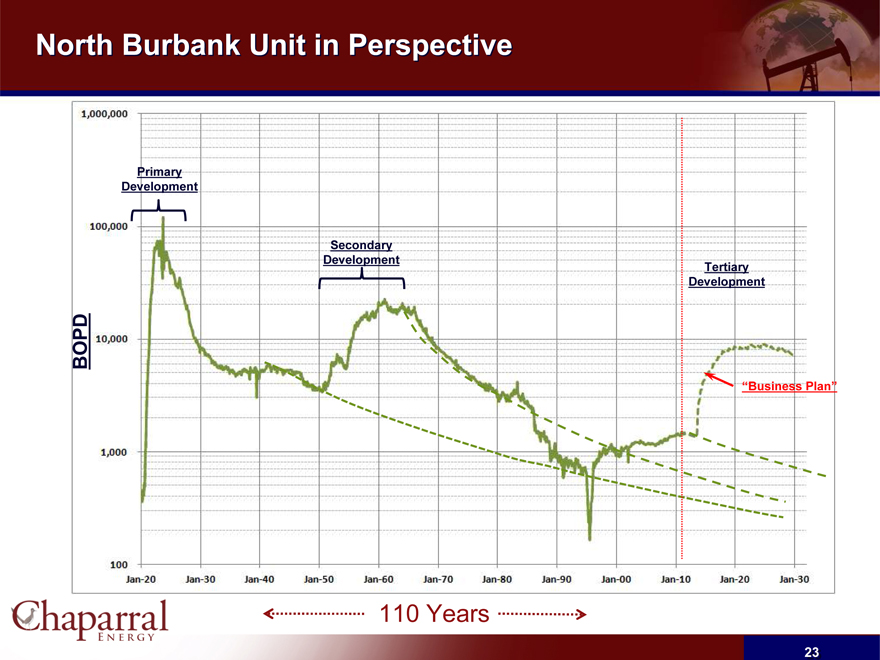

North Burbank Unit in Perspective

Primary Development

Secondary

Development

Tertiary Development

BOPD

1,000,000 100,000 10,000 1,000 100

Jan-20 Jan-30 Jan-40 Jan-50 Jan-60 Jan-70 Jan-80 Jan-90 Jan-00 Jan-10 Jan-20 Jan-30

110 Years

“Business Plan”

23

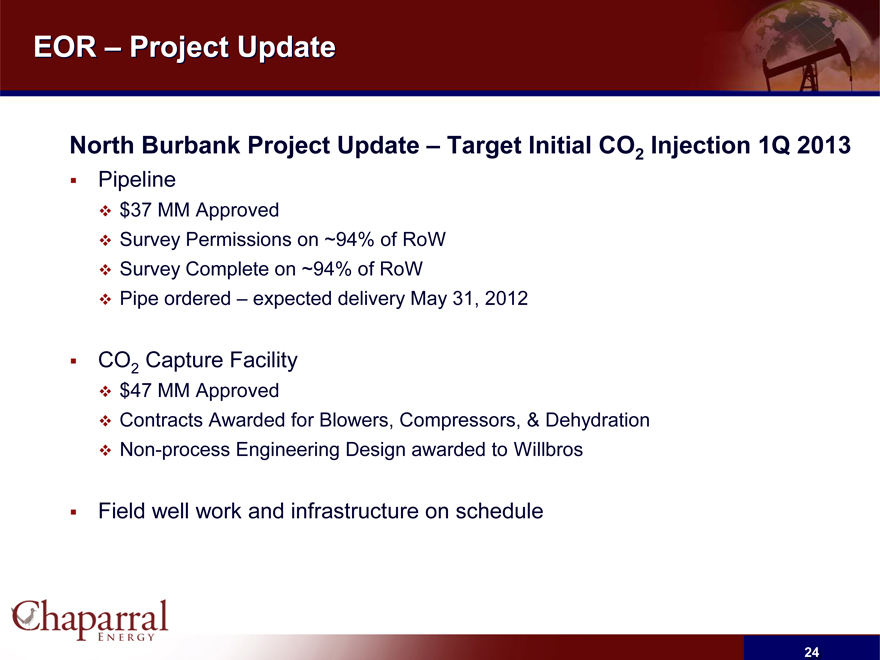

EOR – Project Update

North Burbank Project Update – Target Initial CO Injection 1Q 2013

2

Pipeline

$37 MM Approved

Survey Permissions on ~94% of RoW Survey Complete on ~94% of RoW

Pipe ordered – expected delivery May 31, 2012

CO Capture Facility

2

$47 MM Approved

Contracts Awarded for Blowers, Compressors, & Dehydration Non-process Engineering Design awarded to Willbros

Field well work and infrastructure on schedule

24

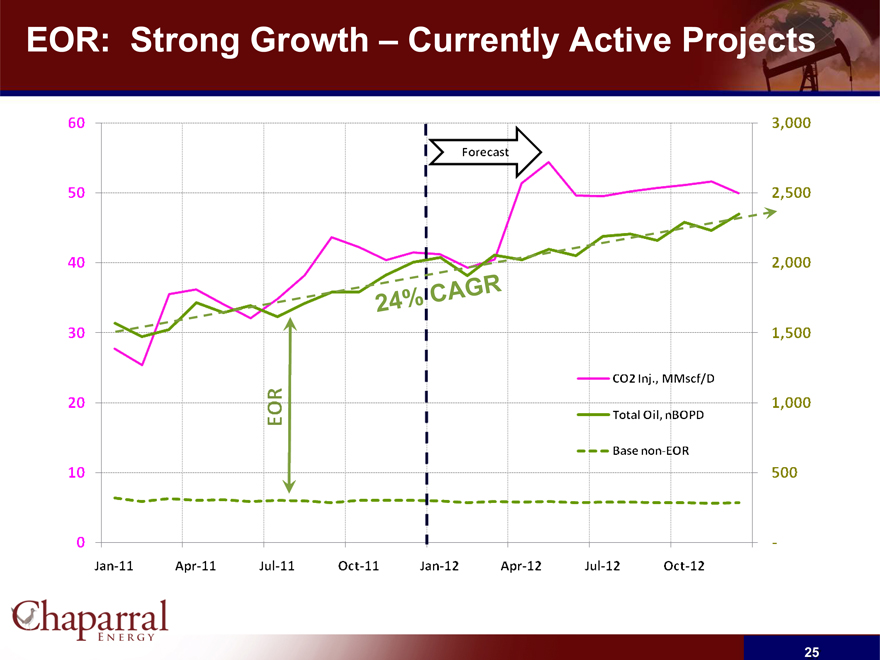

EOR: Strong Growth – Currently Active Projects

60 50 40 30 20 10 0

Jan-11 Apr-11 Jul-11 Oct-11

Jan-12 Apr-12 Jul-12 Oct-12

Forecast

24%CAGR

EOR

Co2 Inj., MMscf/D

Total Oil, nBOPD

Base non-EOR

3,000 2,500 2,000 1,500 1,000 500 –

25

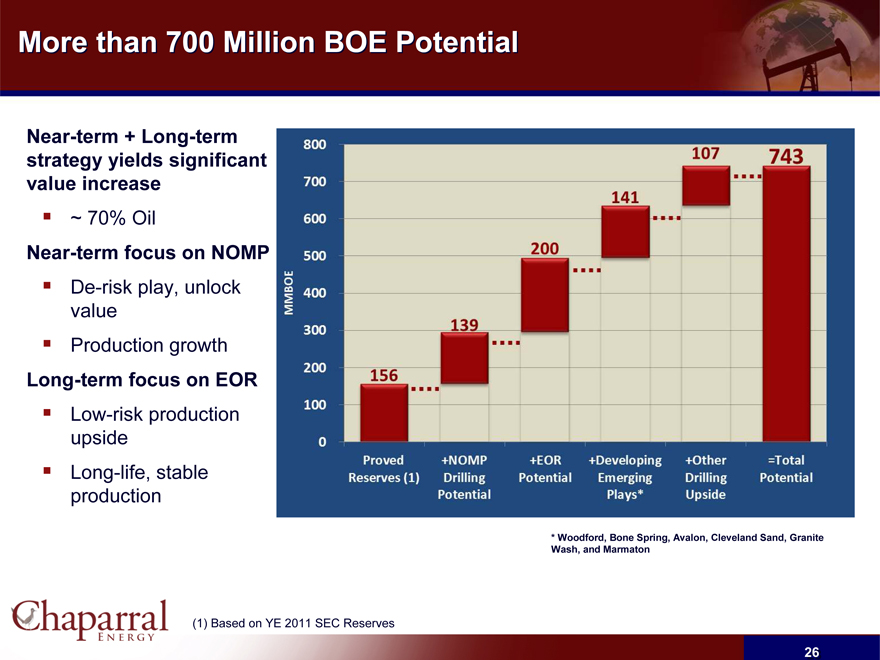

More than 700 Million BOE Potential

Near-term + Long-term strategy yields significant value increase

~ 70% Oil

Near-term focus on NOMP

De-risk play, unlock value

Production growth

Long-term focus on EOR

Low-risk production upside

Long-life, stable production

MMBOE

800 700 600 500 400 300 200 100 0

156 139 200 141 107 743

Proved Reserves (1)

+NOMP Drilling Potential

+EOR Potential

+Developing Emerging Plays *

+Other Drilling Upside

=Total Potential

* Woodford, Bone Spring, Avalon, Cleveland Sand, Granite Wash, and Marmaton

(1) Based on YE 2011 SEC Reserves

26

Financial Performance and Credit Statistics

27

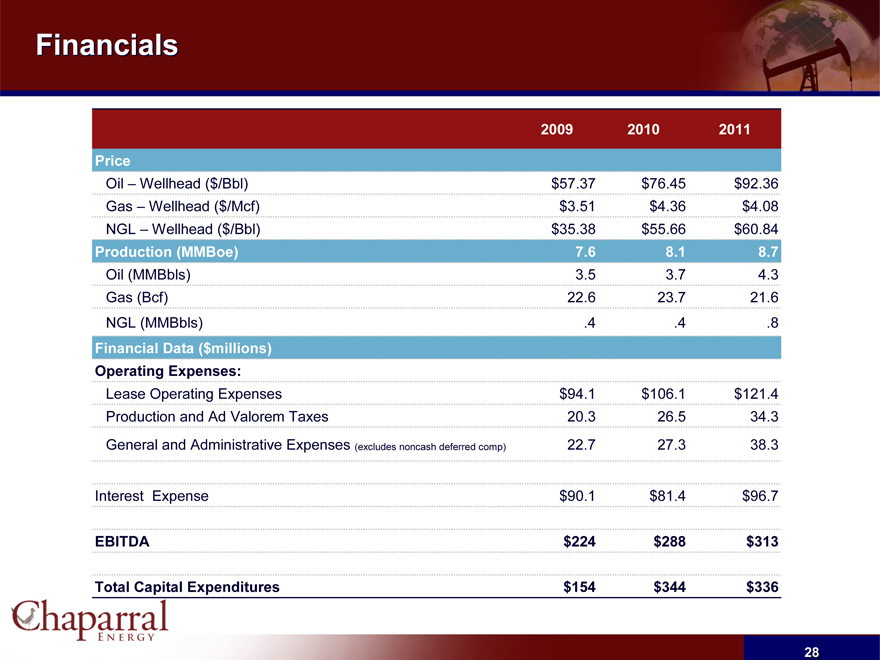

Financials

2009 2010 2011

Price

Oil – Wellhead ($/Bbl) $57.37 $76.45 $92.36

Gas – Wellhead ($/Mcf) $3.51 $4.36 $4.08

NGL – Wellhead ($/Bbl) $35.38 $55.66 $60.84

Production (MMBoe) 7.6 8.1 8.7

Oil (MMBbls) 3.5 3.7 4.3

Gas (Bcf) 22.6 23.7 21.6

NGL (MMBbls) .4 .4 .8

Financial Data ($millions)

Operating Expenses:

Lease Operating Expenses $94.1 $106.1 $121.4

Production and Ad Valorem Taxes 20.3 26.5 34.3

General and Administrative Expenses (excludes noncash deferred comp) 22.7 27.3 38.3

Interest Expense $90.1 $81.4 $96.7

EBITDA $224 $288 $313

Total Capital Expenditures $154 $344 $336

28

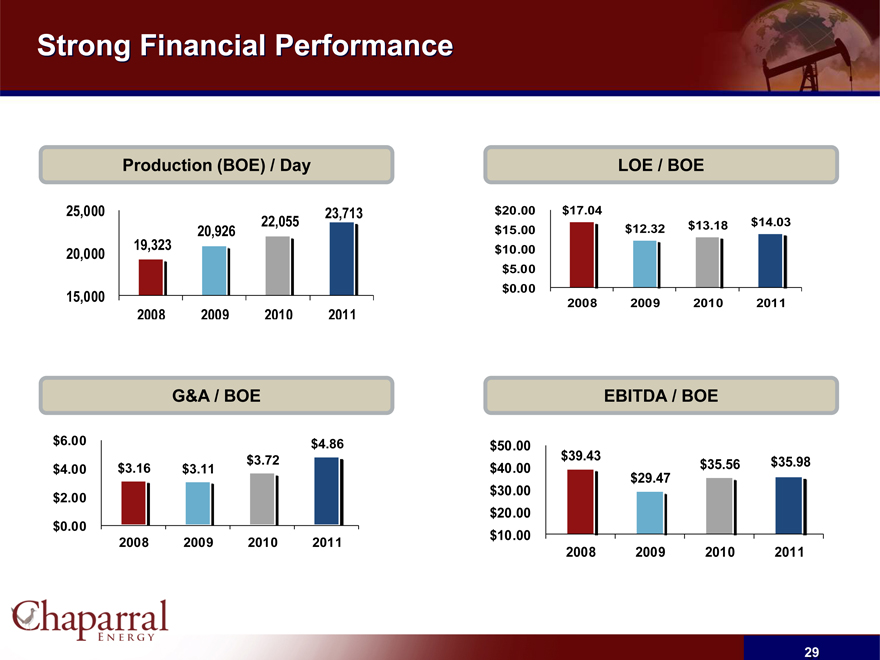

Strong Financial Performance

Production (BOE) / Day

25,000 20,000 15,000

19,323

20,926

22,055

23,713

2008 2009 2010 2011

LOE / BOE

$20.00 $15.00 $10.00 $5.00 $0.00

2008 2009 2010 2011

$17.04

$12.32

$13.18

$14.03

G&A / BOE

$6.00 $4.00 $2.00 $0.00

2008 2009 2010 2011

$3.16

$3.11

$3.72

$4.86

EBITDA / BOE

$50.00

$40.00

$30.00 $20.00

$10.00

2008 2009 2010 2011

$39.43

$29.47

$35.56

$35.98

29

2011 Results and 2012 Guidance

Operating Statistics

2011 Results 2012 Guidance

Capital Expenditures $336 million $330 million

Production 8.7 MMBoe 8.8 - 9.0 MMBoe

General and Administrative $4.86/Boe $5.00 - $5.50/Boe

Lease Operating Expense $14.03/Boe $14.25 - $14.75/Boe

30

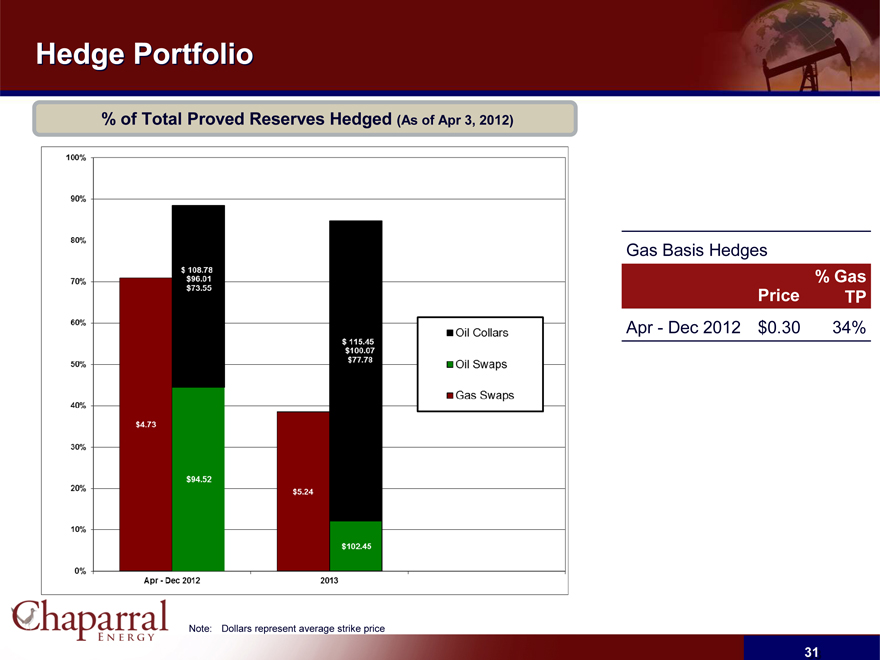

Hedge Portfolio

% of Total Proved Reserves Hedged (As of Apr 3, 2012)

100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0%

$4.73

$108.78

$96.01

$73.55

$94.52

$5.24

$115.45

$100.07

$77.78

$102.45

Apr - Dec 2012 2013

Oil Collars

Oil Swaps

Gas Swaps

Gas Basis Hedges

% Gas

Price TP

Apr - Dec 2012 $0.30 34%

Note: Dollars represent average strike price

31

Question & Answer

32