June 2017 J.P. Morgan 2017 Energy Equity Conference Exhibit 99.2

Statements made in these presentation slides and by representatives of Chaparral Energy (“Chaparral” or the “company”) during the course of this presentation that are not historical facts are “forward-looking statements.” These statements are based on certain assumptions and expectations made by the company, which reflect management’s experience, estimates and perception of historical trends, current conditions and anticipated future developments. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the company, which may cause actual results to differ materially from those implied or anticipated in the forward-looking statements. These include risks relating to financial performance and results, ability to improve our financial results and profitability following emergence from bankruptcy, availability of sufficient cash flow to execute our business plan, continued low or further declining commodity prices and demand for oil, natural gas and natural gas liquids, ability to hedge future production, ability to replace reserves and efficiently develop current reserves and the regulatory environment and other important factors that could cause actual results to differ materially from those anticipated or implied in the forward-looking statements. These and other important factors could cause actual results to differ materially from those anticipated or implied in the forward-looking statements. Please read “risk factors” in the company’s annual reports on Form 10-K, quarterly reports on Form 10-Q and other public filings. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information or future events. Forward-Looking Statements and Risk Factors Forward-Looking Statements and Risk Factors

General Overview

Transforming into a premier pure-play STACK company Approximately 110,000 net acres Capitalize on strong pipeline of economic opportunities Deliver solid operating margins and returns, even in a volatile commodity price environment Keys to superior performance Strong assets – focused STACK player Low-cost structure Operational excellence Prioritizing environmental, health and safety Premier operating team Strong foundation capable of excelling in a $40 - $60 per barrel environment Strong Assets, Low Cost Structure and Experienced Leadership with a Vision for Success The New Chaparral

Emerged from restructuring with a strong balance sheet Equitized $1.2 billion in debt and reduced annual interest expense by $110 million Enterprise Value: Approximately $1.2 billion Debt/Adjusted LTM EBITDA: Approximately 1.4x Recruited new, independent board with extensive industry experience Achieved total net production of 22.5 MBoe/d Q1 2017 58% oil, 14% NGLs and 28% natural gas 21% year-over-year increase in STACK production Lowered expenses continued in 2017 LOE/Boe decreased 16% in the STACK to $3.39/Boe in Q1 2017 Significant G&A cost reductions Announced plans to market EOR Assets Stock trading on OTCQB market under the symbol CHPE Continued Operational Excellence During Restructuring Recent Achievements

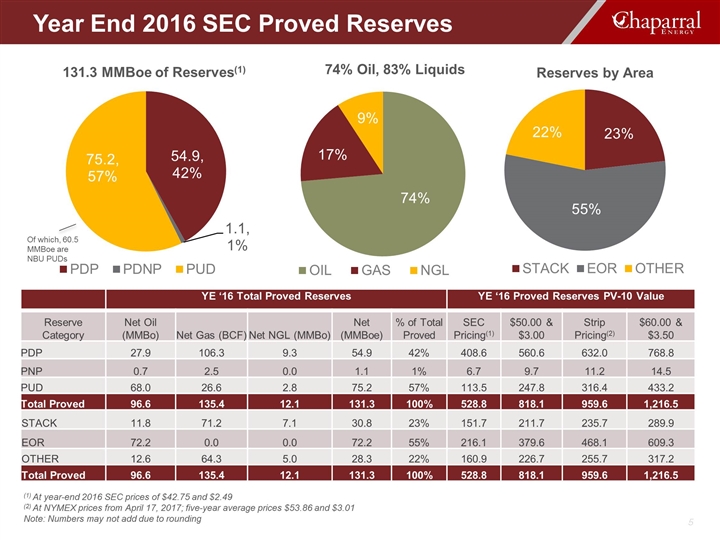

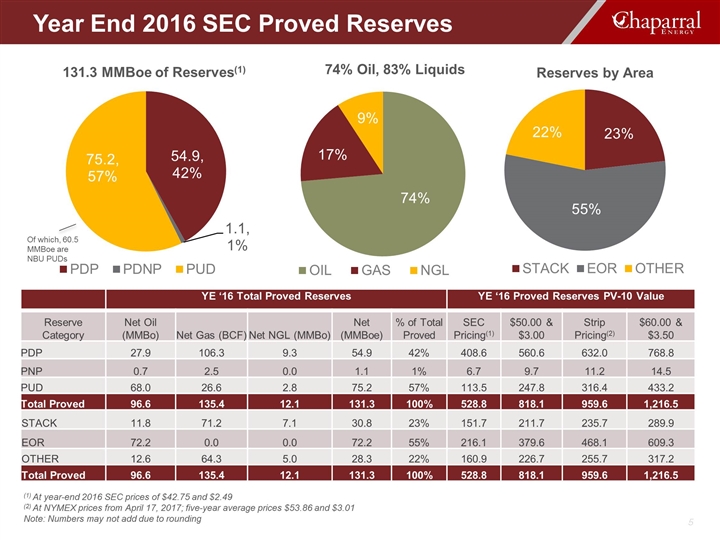

YE ‘16 Total Proved Reserves YE ‘16 Proved Reserves PV-10 Value Reserve Category Net Oil (MMBo) Net Gas (BCF) Net NGL (MMBo) Net (MMBoe) % of Total Proved SEC Pricing(1) $50.00 & $3.00 Strip Pricing(2) $60.00 & $3.50 PDP 27.9 106.3 9.3 54.9 42% 408.6 560.6 632.0 768.8 PNP 0.7 2.5 0.0 1.1 1% 6.7 9.7 11.2 14.5 PUD 68.0 26.6 2.8 75.2 57% 113.5 247.8 316.4 433.2 Total Proved 96.6 135.4 12.1 131.3 100% 528.8 818.1 959.6 1,216.5 STACK 11.8 71.2 7.1 30.8 23% 151.7 211.7 235.7 289.9 EOR 72.2 0.0 0.0 72.2 55% 216.1 379.6 468.1 609.3 OTHER 12.6 64.3 5.0 28.3 22% 160.9 226.7 255.7 317.2 Total Proved 96.6 135.4 12.1 131.3 100% 528.8 818.1 959.6 1,216.5 (1) At year-end 2016 SEC prices of $42.75 and $2.49 (2) At NYMEX prices from April 17, 2017; five-year average prices $53.86 and $3.01 Note: Numbers may not add due to rounding Of which, 60.5 MMBoe are NBU PUDs Year End 2016 SEC Proved Reserves

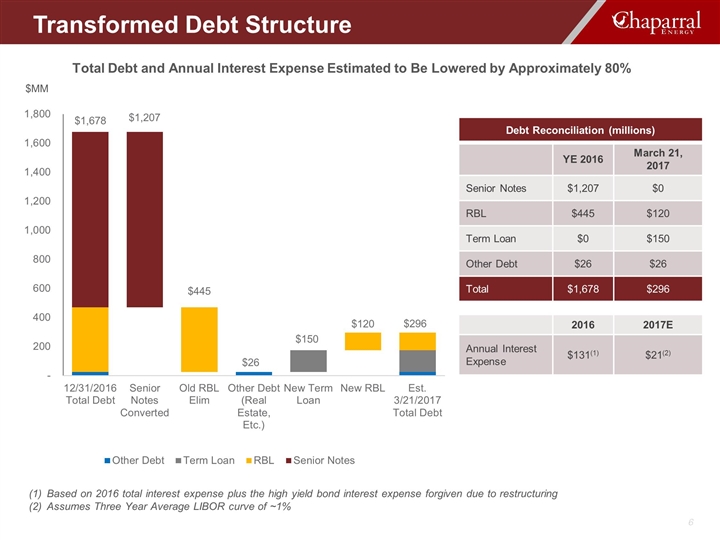

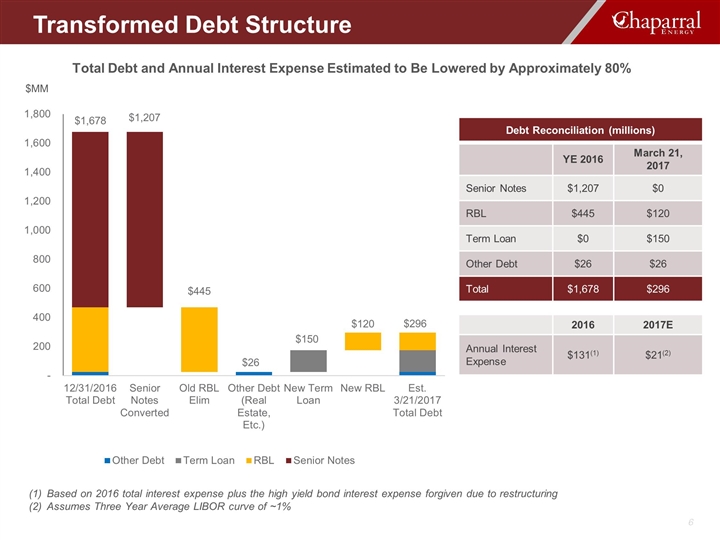

Total Debt and Annual Interest Expense Estimated to Be Lowered by Approximately 80% Debt Reconciliation (millions) YE 2016 March 21, 2017 Senior Notes $1,207 $0 RBL $445 $120 Term Loan $0 $150 Other Debt $26 $26 Total $1,678 $296 2016 2017E Annual Interest Expense $131(1) $21(2) Based on 2016 total interest expense plus the high yield bond interest expense forgiven due to restructuring Assumes Three Year Average LIBOR curve of ~1% $MM Transformed Debt Structure

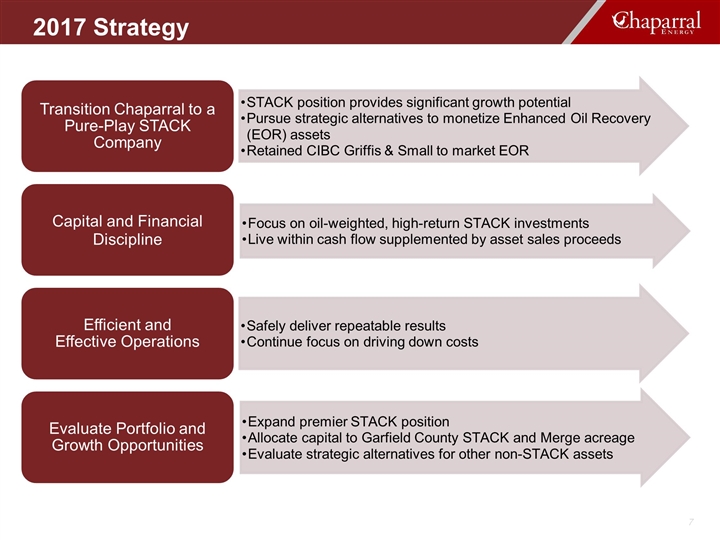

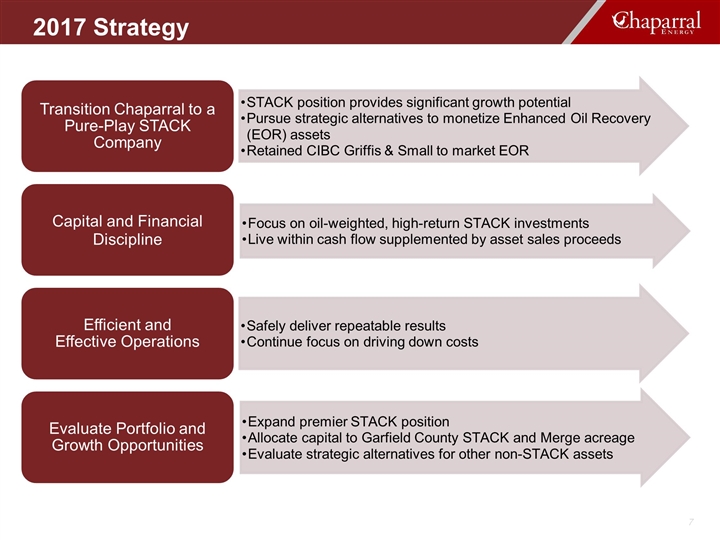

2017 Strategy Transition Chaparral to a Pure-Play STACK Company Efficient and Effective Operations Continue focus on driving down costs Evaluate Portfolio and Growth Opportunities STACK position provides significant growth potential Safely deliver repeatable results Expand premier STACK position Pursue strategic alternatives to monetize Enhanced Oil Recovery (EOR) assets Capital and Financial Discipline Retained CIBC Griffis & Small to market EOR Focus on oil-weighted, high-return STACK investments Live within cash flow supplemented by asset sales proceeds Evaluate strategic alternatives for other non-STACK assets Allocate capital to Garfield County STACK and Merge acreage

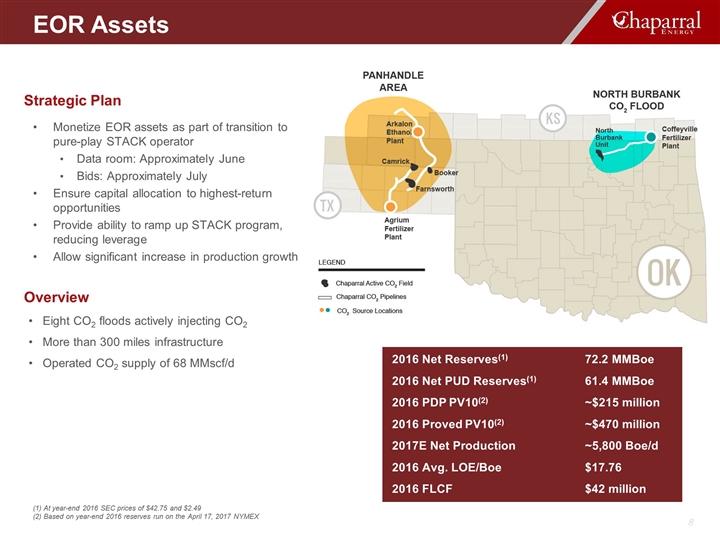

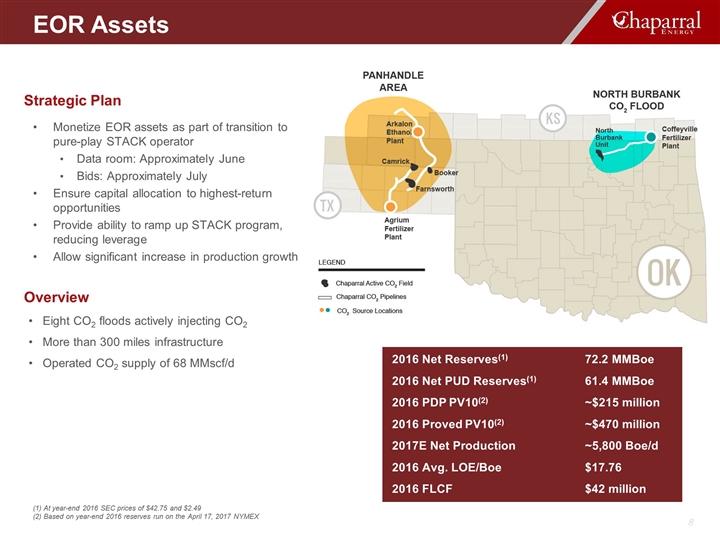

Monetize EOR assets as part of transition to pure-play STACK operator Data room: Approximately June Bids: Approximately July Ensure capital allocation to highest-return opportunities Provide ability to ramp up STACK program, reducing leverage Allow significant increase in production growth Strategic Plan Eight CO2 floods actively injecting CO2 More than 300 miles infrastructure Operated CO2 supply of 68 MMscf/d Overview (1) At year-end 2016 SEC prices of $42.75 and $2.49 (2) Based on year-end 2016 reserves run on the April 17, 2017 NYMEX EOR Assets 2016 Net Reserves(1) 72.2 MMBoe 2016 Net PUD Reserves(1) 61.4 MMBoe 2016 PDP PV10(2) ~$215 million 2016 Proved PV10(2) ~$470 million 2017E Net Production ~5,800 Boe/d 2016 Avg. LOE/Boe $17.76 2016 FLCF $42 million

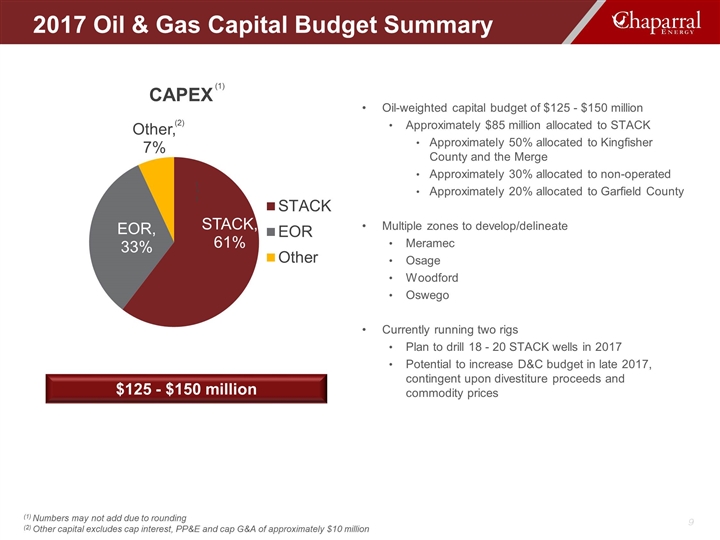

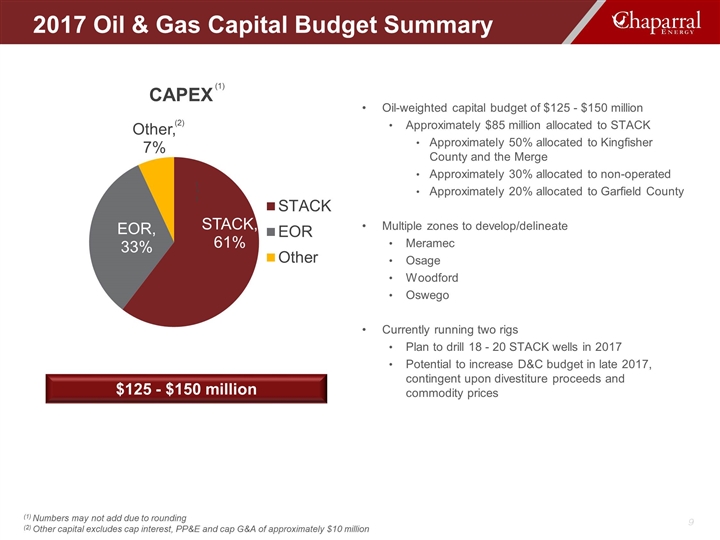

Oil-weighted capital budget of $125 - $150 million Approximately $85 million allocated to STACK Approximately 50% allocated to Kingfisher County and the Merge Approximately 30% allocated to non-operated Approximately 20% allocated to Garfield County Multiple zones to develop/delineate Meramec Osage Woodford Oswego Currently running two rigs Plan to drill 18 - 20 STACK wells in 2017 Potential to increase D&C budget in late 2017, contingent upon divestiture proceeds and commodity prices $125 - $150 million (1) 2017 Oil & Gas Capital Budget Summary (1) Numbers may not add due to rounding (2) Other capital excludes cap interest, PP&E and cap G&A of approximately $10 million (1) (2)

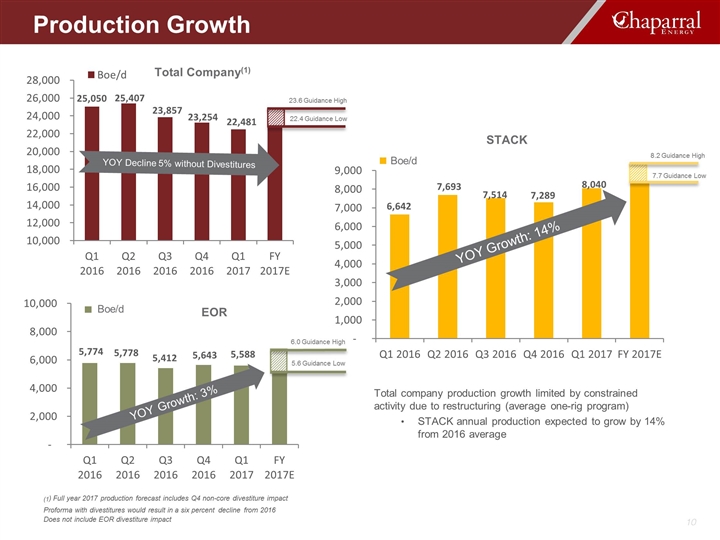

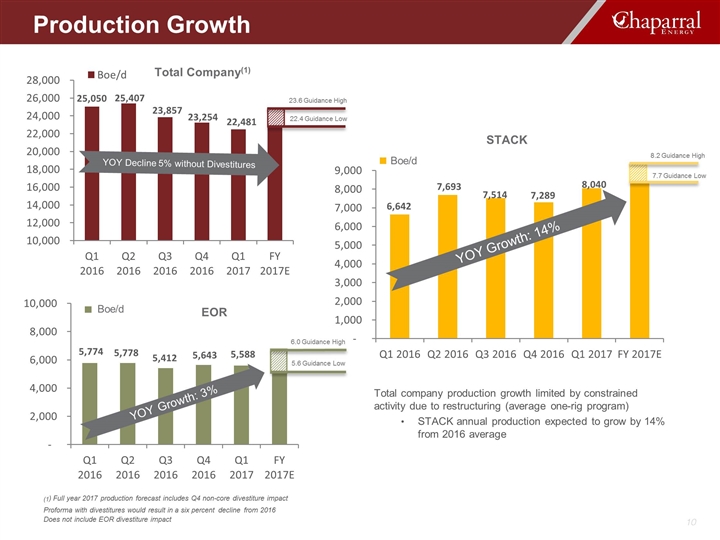

(1) Full year 2017 production forecast includes Q4 non-core divestiture impact Proforma with divestitures would result in a six percent decline from 2016 Does not include EOR divestiture impact Total company production growth limited by constrained activity due to restructuring (average one-rig program) STACK annual production expected to grow by 14% from 2016 average Total Company(1) EOR STACK 22.4 Guidance Low 23.6 Guidance High 7.7 Guidance Low 8.2 Guidance High Production Growth 5.6 Guidance Low 6.0 Guidance High YOY Growth: 3% YOY Decline 5% without Divestitures YOY Growth: 14% Boe/d Boe/d

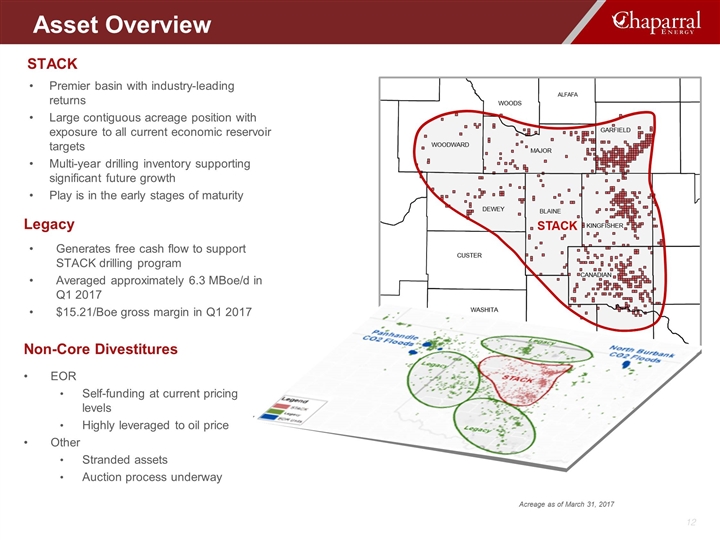

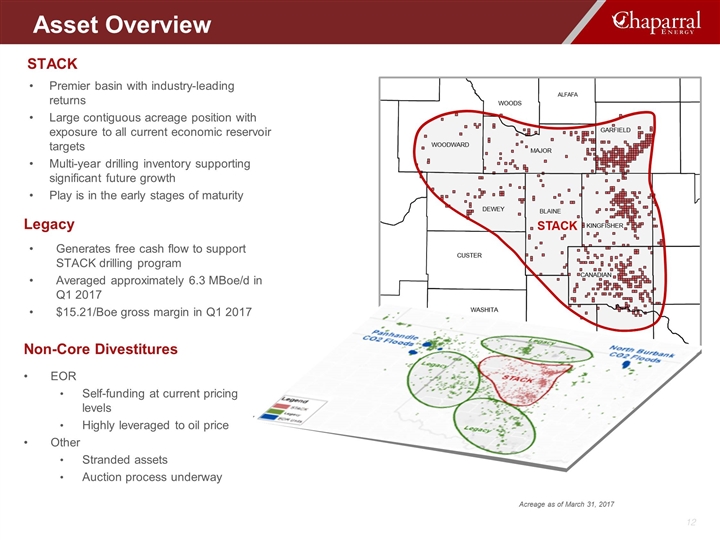

Asset Overview

EOR Self-funding at current pricing levels Highly leveraged to oil price Other Stranded assets Auction process underway Premier basin with industry-leading returns Large contiguous acreage position with exposure to all current economic reservoir targets Multi-year drilling inventory supporting significant future growth Play is in the early stages of maturity STACK Generates free cash flow to support STACK drilling program Averaged approximately 6.3 MBoe/d in Q1 2017 $15.21/Boe gross margin in Q1 2017 Legacy Non-Core Divestitures Acreage as of March 31, 2017 Asset Overview

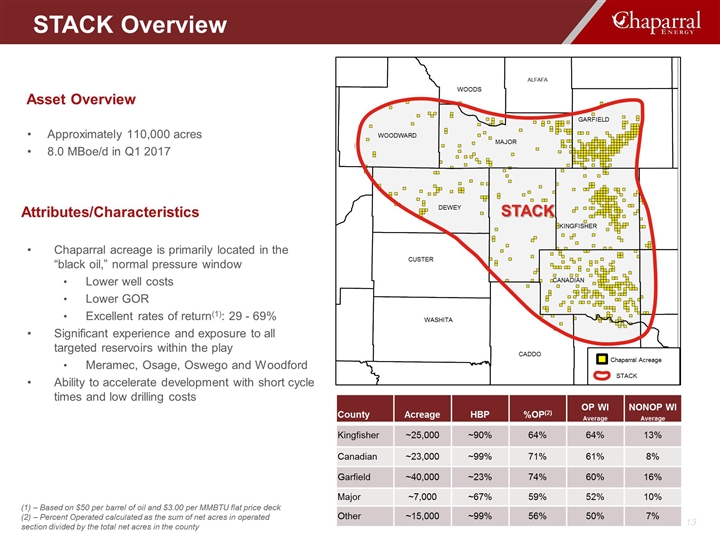

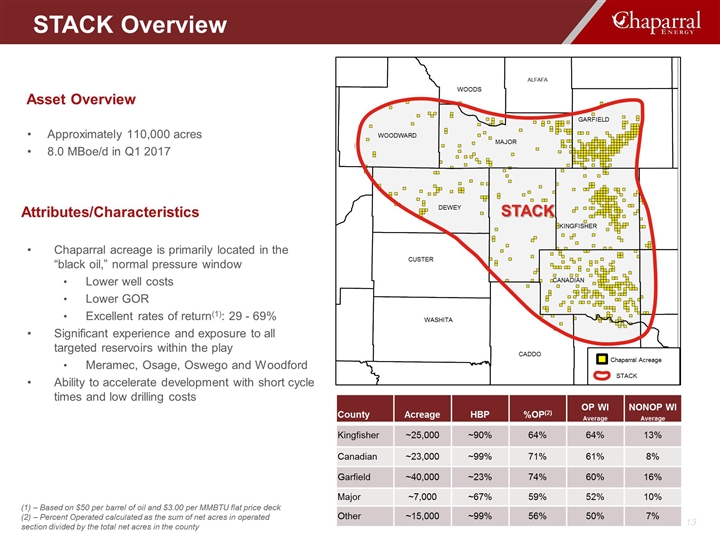

Approximately 110,000 acres 8.0 MBoe/d in Q1 2017 Asset Overview County Acreage HBP %OP(2) OP WI Average NONOP WI Average Kingfisher ~25,000 ~90% 64% 64% 13% Canadian ~23,000 ~99% 71% 61% 8% Garfield ~40,000 ~23% 74% 60% 16% Major ~7,000 ~67% 59% 52% 10% Other ~15,000 ~99% 56% 50% 7% Chaparral acreage is primarily located in the “black oil,” normal pressure window Lower well costs Lower GOR Excellent rates of return(1): 29 - 69% Significant experience and exposure to all targeted reservoirs within the play Meramec, Osage, Oswego and Woodford Ability to accelerate development with short cycle times and low drilling costs Attributes/Characteristics STACK WOODWARD ALFAFA GARFIELD WOODS KINGFISHER MAJOR DEWEY CANADIAN CUSTER WASHITA CADDO STACK Chaparral Acreage STACK Overview (1) – Based on $50 per barrel of oil and $3.00 per MMBTU flat price deck (2) – Percent Operated calculated as the sum of net acres in operated section divided by the total net acres in the county

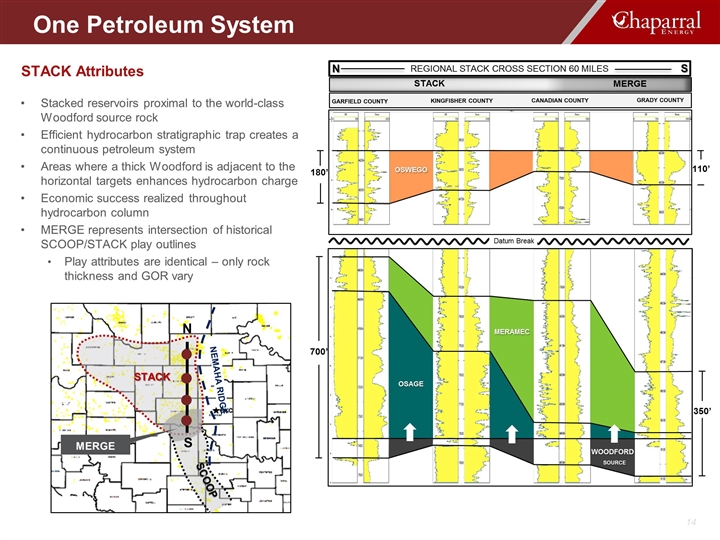

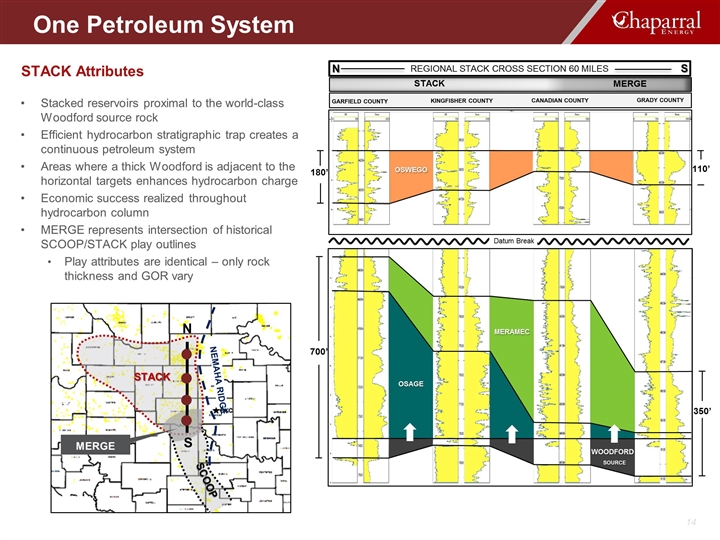

Stacked reservoirs proximal to the world-class Woodford source rock Efficient hydrocarbon stratigraphic trap creates a continuous petroleum system Areas where a thick Woodford is adjacent to the horizontal targets enhances hydrocarbon charge Economic success realized throughout hydrocarbon column MERGE represents intersection of historical SCOOP/STACK play outlines Play attributes are identical – only rock thickness and GOR vary STACK Attributes GARFIELD COUNTY KINGFISHER COUNTY CANADIAN COUNTY REGIONAL STACK CROSS SECTION 60 MILES N S STACK MERGE OSWEGO MERAMEC OSAGE WOODFORD SOURCE GRADY COUNTY 110’ 180’ 350’ 700’ Datum Break One Petroleum System STACK N SCOOP S NEMAHA RIDGE MERGE

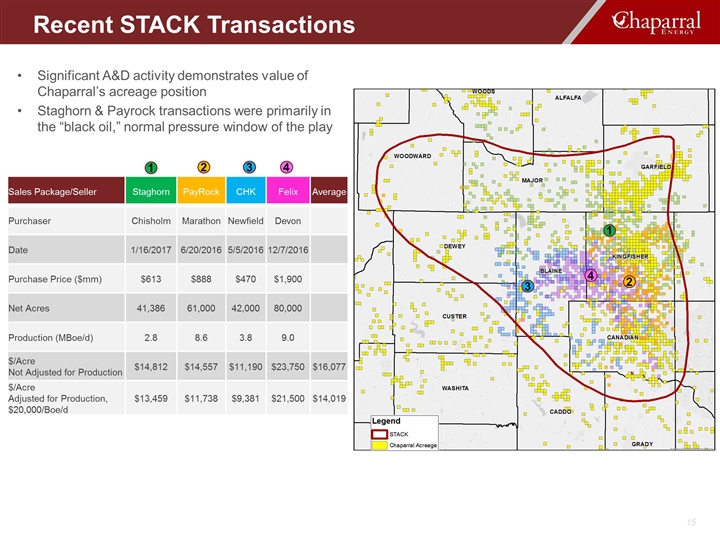

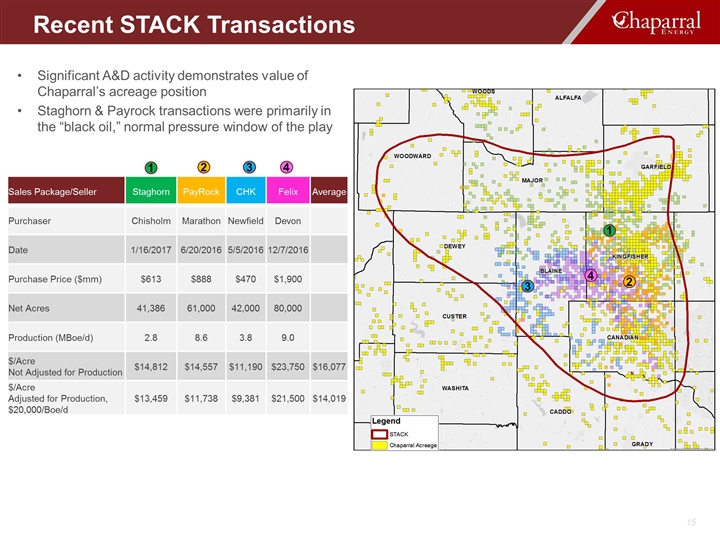

Sales Package/Seller Staghorn PayRock CHK Felix Average Purchaser Chisholm Marathon Newfield Devon Date 1/16/2017 6/20/2016 5/5/2016 12/7/2016 Purchase Price ($mm) $613 $888 $470 $1,900 Net Acres 41,386 61,000 42,000 80,000 Production (MBoe/d) 2.8 8.6 3.8 9.0 $/Acre Not Adjusted for Production $14,812 $14,557 $11,190 $23,750 $16,077 $/Acre Adjusted for Production, $20,000/Boe/d $13,459 $11,738 $9,381 $21,500 $14,019 Significant A&D activity demonstrates value of Chaparral’s acreage position Staghorn & Payrock transactions were primarily in the “black oil,” normal pressure window of the play 1 2 3 4 4 2 1 3 Recent STACK Transactions

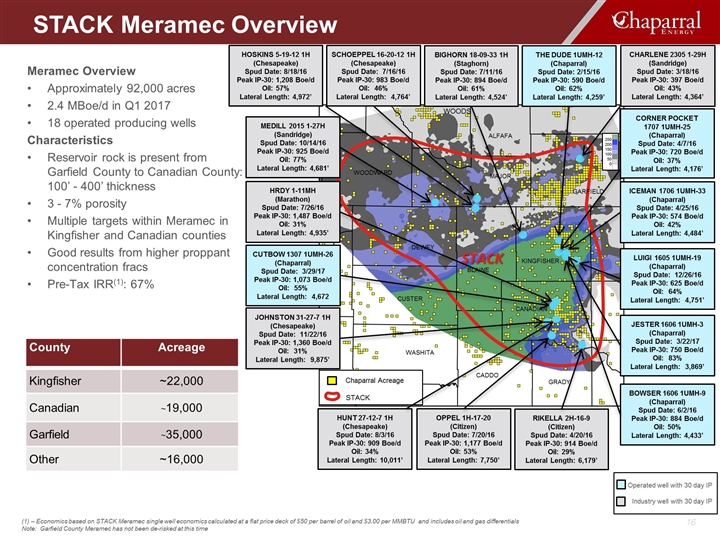

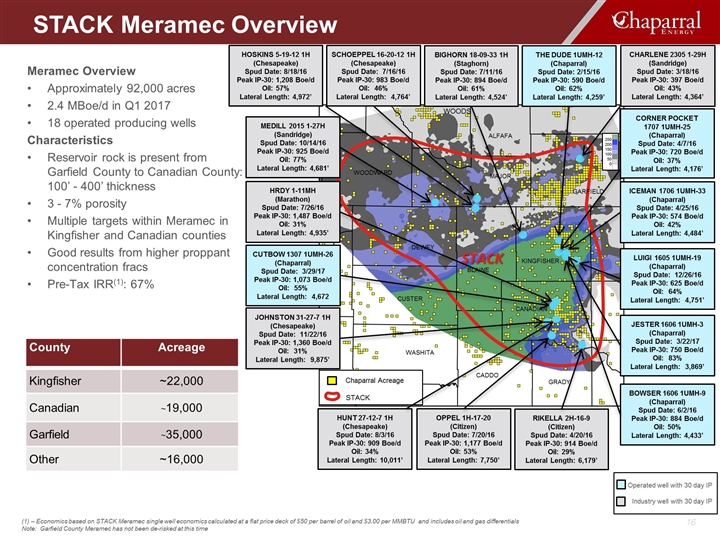

Meramec Overview Approximately 92,000 acres 2.4 MBoe/d in Q1 2017 18 operated producing wells Characteristics Reservoir rock is present from Garfield County to Canadian County: 100’ - 400’ thickness 3 - 7% porosity Multiple targets within Meramec in Kingfisher and Canadian counties Good results from higher proppant concentration fracs Pre-Tax IRR(1): 67% County Acreage Kingfisher ~22,000 Canadian ~19,000 Garfield ~35,000 Other ~16,000 STACK Chaparral Acreage STACK WOODWARD ALFAFA GARFIELD WOODS KINGFISHER MAJOR DEWEY BLAINE CANADIAN GRADY CUSTER WASHITA CADDO ICEMAN 1706 1UMH-33 (Chaparral) Spud Date: 4/25/16 Peak IP-30: 574 Boe/d Oil: 42% Lateral Length: 4,484’ BOWSER 1606 1UMH-9 (Chaparral) Spud Date: 6/2/16 Peak IP-30: 884 Boe/d Oil: 50% Lateral Length: 4,433’ CORNER POCKET 1707 1UMH-25 (Chaparral) Spud Date: 4/7/16 Peak IP-30: 720 Boe/d Oil: 37% Lateral Length: 4,176’ HOSKINS 5-19-12 1H (Chesapeake) Spud Date: 8/18/16 Peak IP-30: 1,208 Boe/d Oil: 57% Lateral Length: 4,972’ MEDILL 2015 1-27H (Sandridge) Spud Date: 10/14/16 Peak IP-30: 925 Boe/d Oil: 77% Lateral Length: 4,681’ HRDY 1-11MH (Marathon) Spud Date: 7/26/16 Peak IP-30: 1,487 Boe/d Oil: 31% Lateral Length: 4,935’ BIGHORN 18-09-33 1H (Staghorn) Spud Date: 7/11/16 Peak IP-30: 894 Boe/d Oil: 61% Lateral Length: 4,524’ THE DUDE 1UMH-12 (Chaparral) Spud Date: 2/15/16 Peak IP-30: 590 Boe/d Oil: 62% Lateral Length: 4,259’ CHARLENE 2305 1-29H (Sandridge) Spud Date: 3/18/16 Peak IP-30: 397 Boe/d Oil: 43% Lateral Length: 4,364’ OPPEL 1H-17-20 (Citizen) Spud Date: 7/20/16 Peak IP-30: 1,177 Boe/d Oil: 53% Lateral Length: 7,750’ RIKELLA 2H-16-9 (Citizen) Spud Date: 4/20/16 Peak IP-30: 914 Boe/d Oil: 29% Lateral Length: 6,179’ HUNT 27-12-7 1H (Chesapeake) Spud Date: 8/3/16 Peak IP-30: 909 Boe/d Oil: 34% Lateral Length: 10,011’ STACK Meramec Overview LUIGI 1605 1UMH-19 (Chaparral) Spud Date: 12/26/16 Peak IP-30: 625 Boe/d Oil: 64% Lateral Length: 4,751’ (1) – Economics based on STACK Meramec single well economics calculated at a flat price deck of $50 per barrel of oil and $3.00 per MMBTU and includes oil and gas differentials Note: Garfield County Meramec has not been de-risked at this time SCHOEPPEL 16-20-12 1H (Chesapeake) Spud Date: 7/16/16 Peak IP-30: 983 Boe/d Oil: 46% Lateral Length: 4,764’ JOHNSTON 31-27-7 1H (Chesapeake) Spud Date: 11/22/16 Peak IP-30: 1,360 Boe/d Oil: 31% Lateral Length: 9,875’ Operated well with 30 day IP Industry well with 30 day IP JESTER 1606 1UMH-3 (Chaparral) Spud Date: 3/22/17 Peak IP-30: 750 Boe/d Oil: 83% Lateral Length: 3,869’ CUTBOW 1307 1UMH-26 (Chaparral) Spud Date: 3/29/17 Peak IP-30: 1,073 Boe/d Oil: 55% Lateral Length: 4,672

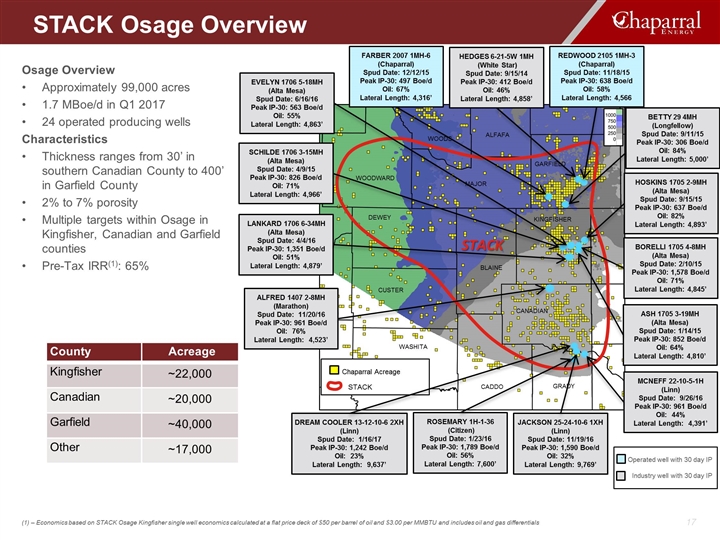

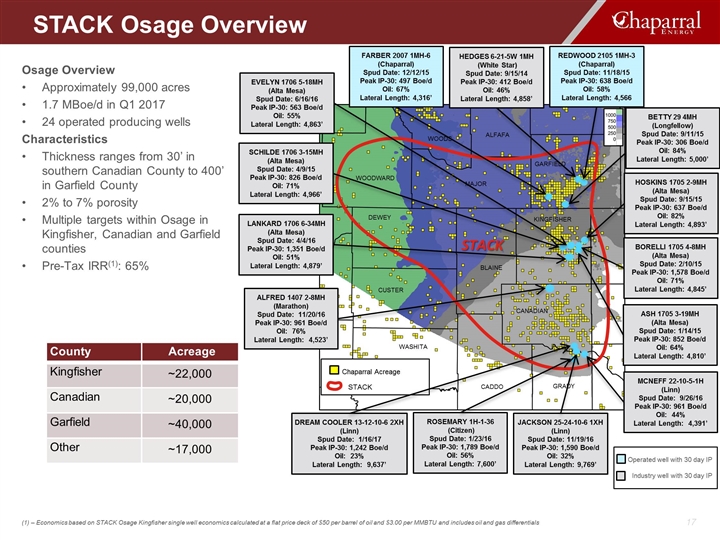

WOODWARD ALFAFA GARFIELD WOODS KINGFISHER MAJOR DEWEY BLAINE CANADIAN GRADY CUSTER WASHITA CADDO STACK STACK Chaparral Acreage Osage Overview Approximately 99,000 acres 1.7 MBoe/d in Q1 2017 24 operated producing wells Characteristics Thickness ranges from 30’ in southern Canadian County to 400’ in Garfield County 2% to 7% porosity Multiple targets within Osage in Kingfisher, Canadian and Garfield counties Pre-Tax IRR(1): 65% County Acreage Kingfisher ~22,000 Canadian ~20,000 Garfield ~40,000 Other ~17,000 (1) – Economics based on STACK Osage Kingfisher single well economics calculated at a flat price deck of $50 per barrel of oil and $3.00 per MMBTU and includes oil and gas differentials HEDGES 6-21-5W 1MH (White Star) Spud Date: 9/15/14 Peak IP-30: 412 Boe/d Oil: 46% Lateral Length: 4,858’ REDWOOD 2105 1MH-3 (Chaparral) Spud Date: 11/18/15 Peak IP-30: 638 Boe/d Oil: 58% Lateral Length: 4,566 LANKARD 1706 6-34MH (Alta Mesa) Spud Date: 4/4/16 Peak IP-30: 1,351 Boe/d Oil: 51% Lateral Length: 4,879’ EVELYN 1706 5-18MH (Alta Mesa) Spud Date: 6/16/16 Peak IP-30: 563 Boe/d Oil: 55% Lateral Length: 4,863’ SCHILDE 1706 3-15MH (Alta Mesa) Spud Date: 4/9/15 Peak IP-30: 826 Boe/d Oil: 71% Lateral Length: 4,966’ HOSKINS 1705 2-9MH (Alta Mesa) Spud Date: 9/15/15 Peak IP-30: 637 Boe/d Oil: 82% Lateral Length: 4,893’ BORELLI 1705 4-8MH (Alta Mesa) Spud Date: 2/10/15 Peak IP-30: 1,578 Boe/d Oil: 71% Lateral Length: 4,845’ ASH 1705 3-19MH (Alta Mesa) Spud Date: 1/14/15 Peak IP-30: 852 Boe/d Oil: 64% Lateral Length: 4,810’ JACKSON 25-24-10-6 1XH (Linn) Spud Date: 11/19/16 Peak IP-30: 1,590 Boe/d Oil: 32% Lateral Length: 9,769’ ROSEMARY 1H-1-36 (Citizen) Spud Date: 1/23/16 Peak IP-30: 1,789 Boe/d Oil: 56% Lateral Length: 7,600’ FARBER 2007 1MH-6 (Chaparral) Spud Date: 12/12/15 Peak IP-30: 497 Boe/d Oil: 67% Lateral Length: 4,316’ BETTY 29 4MH (Longfellow) Spud Date: 9/11/15 Peak IP-30: 306 Boe/d Oil: 84% Lateral Length: 5,000’ STACK Osage Overview MCNEFF 22-10-5-1H (Linn) Spud Date: 9/26/16 Peak IP-30: 961 Boe/d Oil: 44% Lateral Length: 4,391’ ALFRED 1407 2-8MH (Marathon) Spud Date: 11/20/16 Peak IP-30: 961 Boe/d Oil: 76% Lateral Length: 4,523’ DREAM COOLER 13-12-10-6 2XH (Linn) Spud Date: 1/16/17 Peak IP-30: 1,242 Boe/d Oil: 23% Lateral Length: 9,637’ Operated well with 30 day IP Industry well with 30 day IP

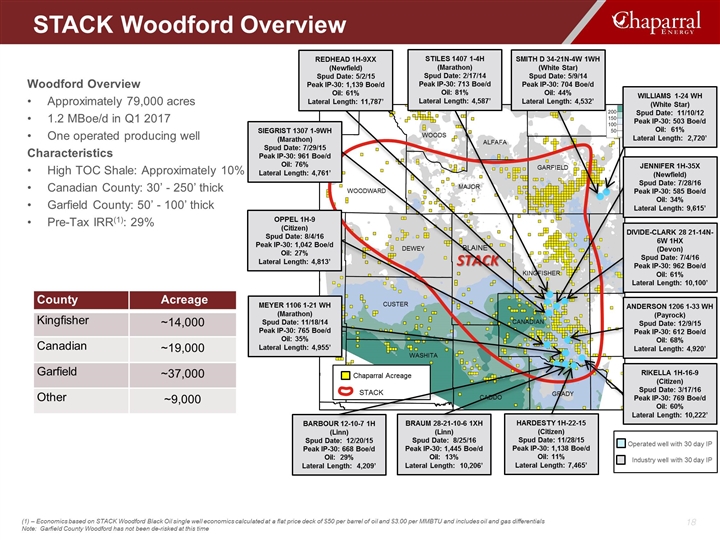

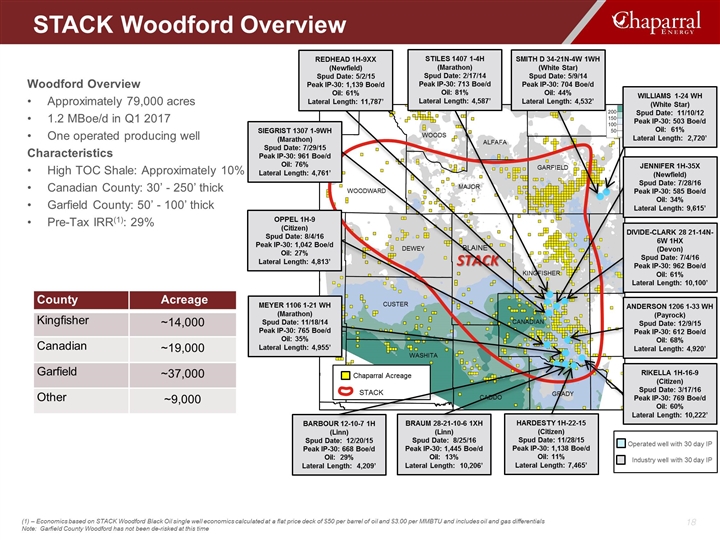

WOODWARD ALFAFA GARFIELD WOODS KINGFISHER MAJOR DEWEY BLAINE CANADIAN GRADY CUSTER WASHITA CADDO STACK Chaparral Acreage STACK Woodford Overview Approximately 79,000 acres 1.2 MBoe/d in Q1 2017 One operated producing well Characteristics High TOC Shale: Approximately 10% Canadian County: 30’ - 250’ thick Garfield County: 50’ - 100’ thick Pre-Tax IRR(1): 29% County Acreage Kingfisher ~14,000 Canadian ~19,000 Garfield ~37,000 Other ~9,000 MEYER 1106 1-21 WH (Marathon) Spud Date: 11/18/14 Peak IP-30: 765 Boe/d Oil: 35% Lateral Length: 4,955’ STILES 1407 1-4H (Marathon) Spud Date: 2/17/14 Peak IP-30: 713 Boe/d Oil: 81% Lateral Length: 4,587’ REDHEAD 1H-9XX (Newfield) Spud Date: 5/2/15 Peak IP-30: 1,139 Boe/d Oil: 61% Lateral Length: 11,787’ SIEGRIST 1307 1-9WH (Marathon) Spud Date: 7/29/15 Peak IP-30: 961 Boe/d Oil: 76% Lateral Length: 4,761’ OPPEL 1H-9 (Citizen) Spud Date: 8/4/16 Peak IP-30: 1,042 Boe/d Oil: 27% Lateral Length: 4,813’ ANDERSON 1206 1-33 WH (Payrock) Spud Date: 12/9/15 Peak IP-30: 612 Boe/d Oil: 68% Lateral Length: 4,920’ HARDESTY 1H-22-15 (Citizen) Spud Date: 11/28/15 Peak IP-30: 1,138 Boe/d Oil: 11% Lateral Length: 7,465’ RIKELLA 1H-16-9 (Citizen) Spud Date: 3/17/16 Peak IP-30: 769 Boe/d Oil: 60% Lateral Length: 10,222’ SMITH D 34-21N-4W 1WH (White Star) Spud Date: 5/9/14 Peak IP-30: 704 Boe/d Oil: 44% Lateral Length: 4,532’ DIVIDE-CLARK 28 21-14N-6W 1HX (Devon) Spud Date: 7/4/16 Peak IP-30: 962 Boe/d Oil: 61% Lateral Length: 10,100’ JENNIFER 1H-35X (Newfield) Spud Date: 7/28/16 Peak IP-30: 585 Boe/d Oil: 34% Lateral Length: 9,615’ STACK Woodford Overview (1) – Economics based on STACK Woodford Black Oil single well economics calculated at a flat price deck of $50 per barrel of oil and $3.00 per MMBTU and includes oil and gas differentials Note: Garfield County Woodford has not been de-risked at this time WILLIAMS 1-24 WH (White Star) Spud Date: 11/10/12 Peak IP-30: 503 Boe/d Oil: 61% Lateral Length: 2,720’ BARBOUR 12-10-7 1H (Linn) Spud Date: 12/20/15 Peak IP-30: 668 Boe/d Oil: 29% Lateral Length: 4,209’ BRAUM 28-21-10-6 1XH (Linn) Spud Date: 8/25/16 Peak IP-30: 1,445 Boe/d Oil: 13% Lateral Length: 10,206’ Operated well with 30 day IP Industry well with 30 day IP

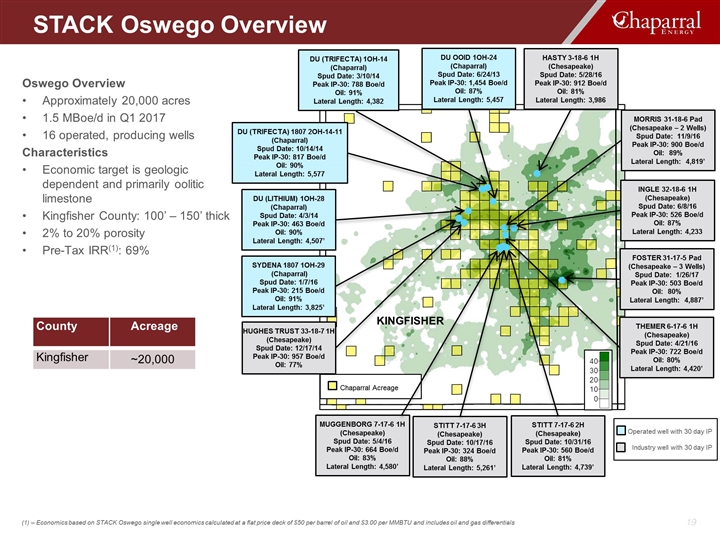

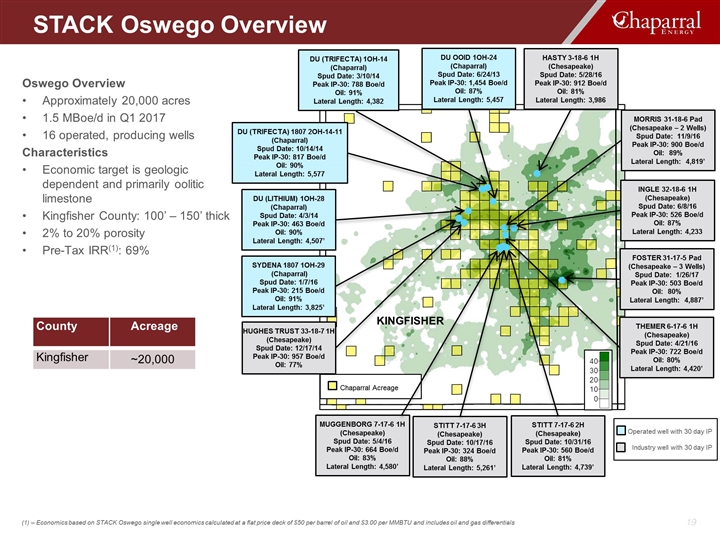

KINGFISHER Chaparral Acreage Oswego Overview Approximately 20,000 acres 1.5 MBoe/d in Q1 2017 16 operated, producing wells Characteristics Economic target is geologic dependent and primarily oolitic limestone Kingfisher County: 100’ – 150’ thick 2% to 20% porosity Pre-Tax IRR(1): 69% County Acreage Kingfisher ~20,000 DU (LITHIUM) 1OH-28 (Chaparral) Spud Date: 4/3/14 Peak IP-30: 463 Boe/d Oil: 90% Lateral Length: 4,507’ SYDENA 1807 1OH-29 (Chaparral) Spud Date: 1/7/16 Peak IP-30: 215 Boe/d Oil: 91% Lateral Length: 3,825’ HUGHES TRUST 33-18-7 1H (Chesapeake) Spud Date: 12/17/14 Peak IP-30: 957 Boe/d Oil: 77% HASTY 3-18-6 1H (Chesapeake) Spud Date: 5/28/16 Peak IP-30: 912 Boe/d Oil: 81% Lateral Length: 3,986 INGLE 32-18-6 1H (Chesapeake) Spud Date: 6/8/16 Peak IP-30: 526 Boe/d Oil: 87% Lateral Length: 4,233 THEMER 6-17-6 1H (Chesapeake) Spud Date: 4/21/16 Peak IP-30: 722 Boe/d Oil: 80% Lateral Length: 4,420’ DU (TRIFECTA) 1807 2OH-14-11 (Chaparral) Spud Date: 10/14/14 Peak IP-30: 817 Boe/d Oil: 90% Lateral Length: 5,577 DU (TRIFECTA) 1OH-14 (Chaparral) Spud Date: 3/10/14 Peak IP-30: 788 Boe/d Oil: 91% Lateral Length: 4,382 MUGGENBORG 7-17-6 1H (Chesapeake) Spud Date: 5/4/16 Peak IP-30: 664 Boe/d Oil: 83% Lateral Length: 4,580’ STITT 7-17-6 3H (Chesapeake) Spud Date: 10/17/16 Peak IP-30: 324 Boe/d Oil: 88% Lateral Length: 5,261’ STITT 7-17-6 2H (Chesapeake) Spud Date: 10/31/16 Peak IP-30: 560 Boe/d Oil: 81% Lateral Length: 4,739’ STACK Oswego Overview (1) – Economics based on STACK Oswego single well economics calculated at a flat price deck of $50 per barrel of oil and $3.00 per MMBTU and includes oil and gas differentials FOSTER 31-17-5 Pad (Chesapeake – 3 Wells) Spud Date: 1/26/17 Peak IP-30: 503 Boe/d Oil: 80% Lateral Length: 4,887’ MORRIS 31-18-6 Pad (Chesapeake – 2 Wells) Spud Date: 11/9/16 Peak IP-30: 900 Boe/d Oil: 89% Lateral Length: 4,819’ DU OOID 1OH-24 (Chaparral) Spud Date: 6/24/13 Peak IP-30: 1,454 Boe/d Oil: 87% Lateral Length: 5,457 Operated well with 30 day IP Industry well with 30 day IP

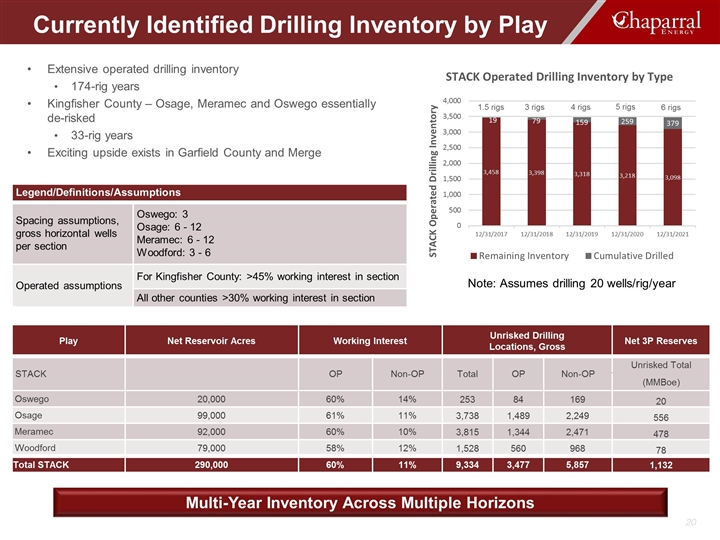

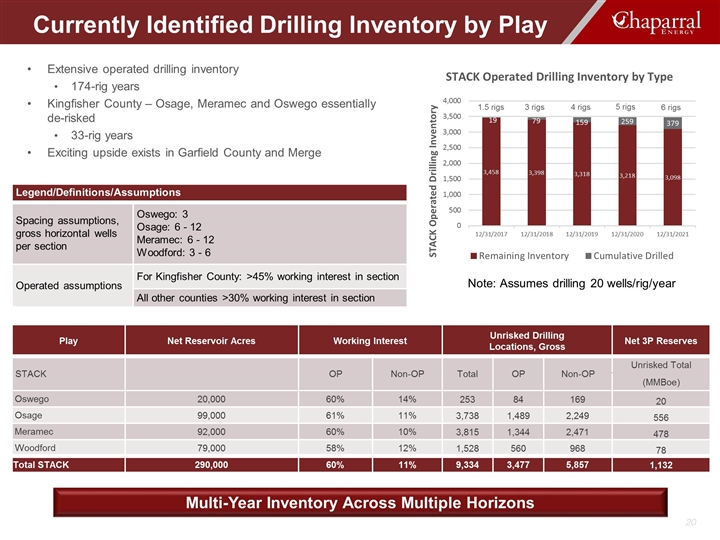

Extensive operated drilling inventory 174-rig years Kingfisher County – Osage, Meramec and Oswego essentially de-risked 33-rig years Exciting upside exists in Garfield County and Merge Legend/Definitions/Assumptions Spacing assumptions, gross horizontal wells per section Oswego: 3 Osage: 6 - 12 Meramec: 6 - 12 Woodford: 3 - 6 Operated assumptions For Kingfisher County: >45% working interest in section All other counties >30% working interest in section Play Net Reservoir Acres Working Interest Unrisked Drilling Locations, Gross Net 3P Reserves STACK OP Non-OP Total OP Non-OP Unrisked Total (MMBoe) Oswego 20,000 60% 14% 253 84 169 20 Osage 99,000 61% 11% 3,738 1,489 2,249 556 Meramec 92,000 60% 10% 3,815 1,344 2,471 478 Woodford 79,000 58% 12% 1,528 560 968 78 Total STACK 290,000 60% 11% 9,334 3,477 5,857 1,132 1.5 rigs 3 rigs 4 rigs 5 rigs 6 rigs Multi-Year Inventory Across Multiple Horizons Note: Assumes drilling 20 wells/rig/year Currently Identified Drilling Inventory by Play

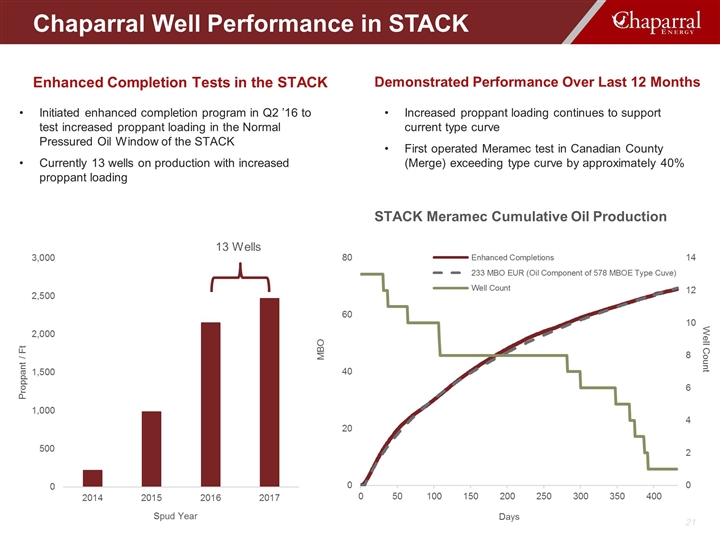

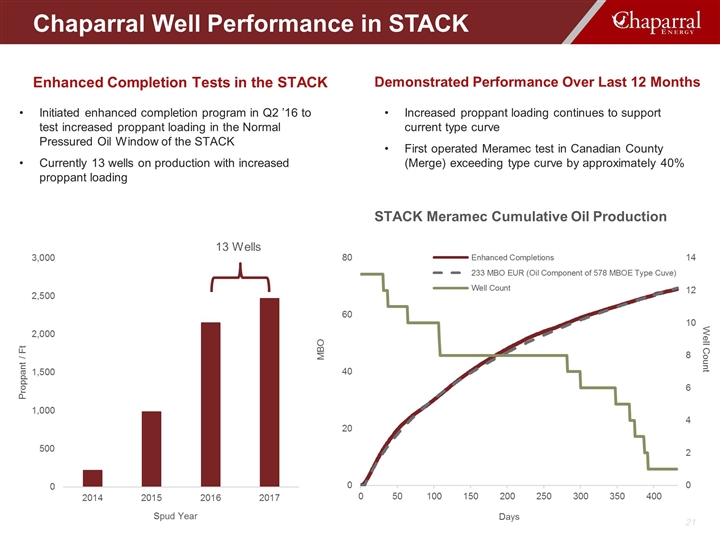

Chaparral Well Performance in STACK Enhanced Completion Tests in the STACK Initiated enhanced completion program in Q2 ’16 to test increased proppant loading in the Normal Pressured Oil Window of the STACK Currently 13 wells on production with increased proppant loading MBO Demonstrated Performance Over Last 12 Months Increased proppant loading continues to support current type curve First operated Meramec test in Canadian County (Merge) exceeding type curve by approximately 40% STACK Meramec Cumulative Oil Production Well Count Days Spud Year 13 Wells

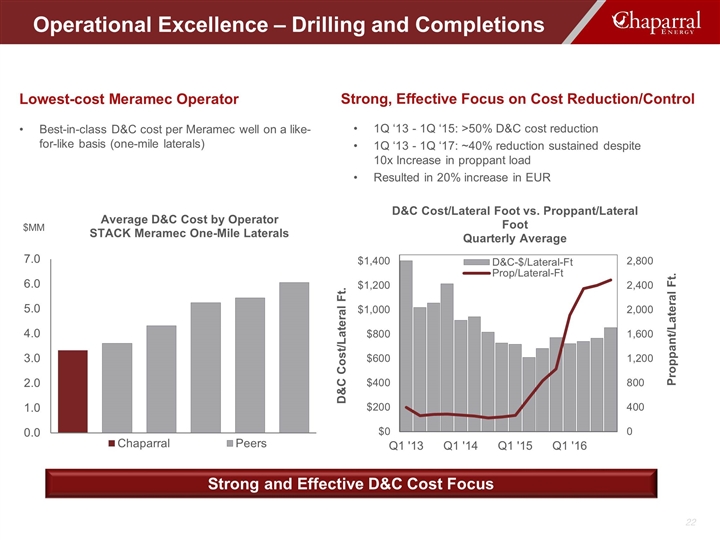

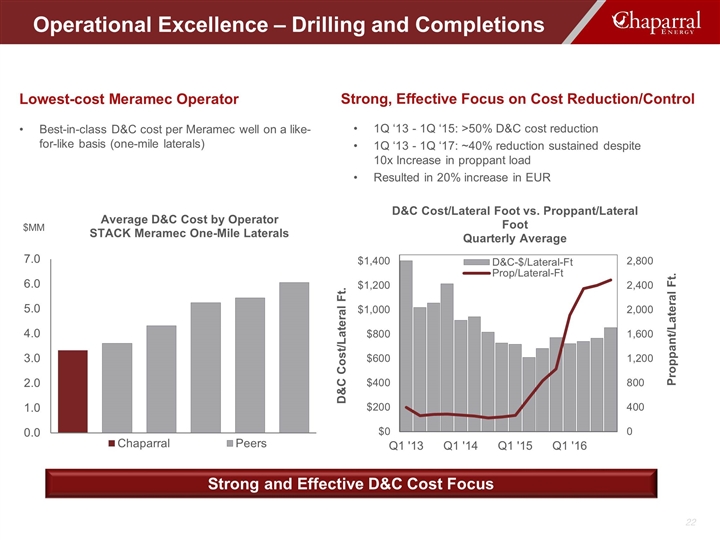

Best-in-class D&C cost per Meramec well on a like-for-like basis (one-mile laterals) 1Q ‘13 - 1Q ‘15: >50% D&C cost reduction 1Q ‘13 - 1Q ‘17: ~40% reduction sustained despite 10x Increase in proppant load Resulted in 20% increase in EUR Lowest-cost Meramec Operator Strong, Effective Focus on Cost Reduction/Control Strong and Effective D&C Cost Focus $MM Operational Excellence – Drilling and Completions

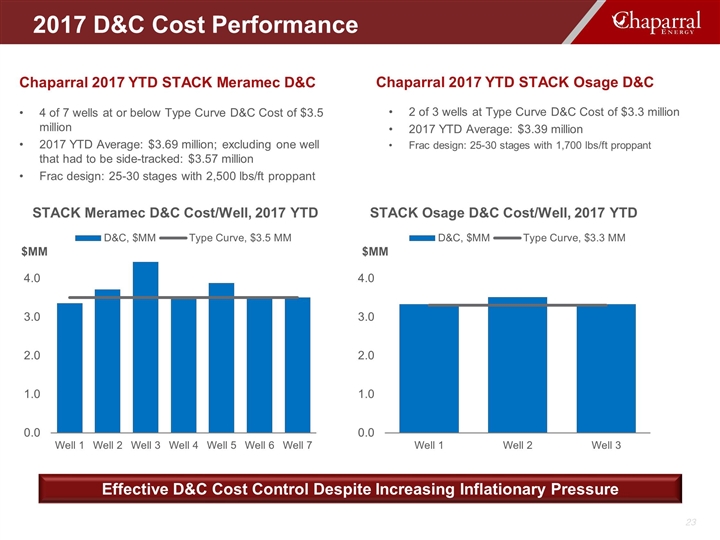

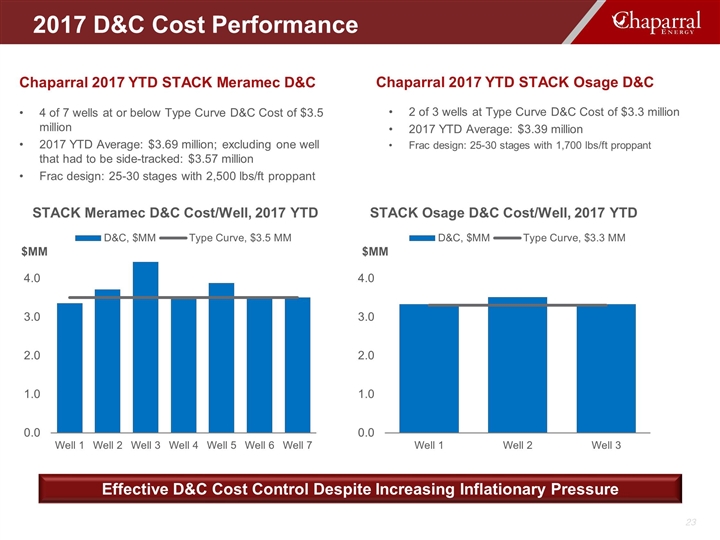

4 of 7 wells at or below Type Curve D&C Cost of $3.5 million 2017 YTD Average: $3.69 million; excluding one well that had to be side-tracked: $3.57 million Frac design: 25-30 stages with 2,500 lbs/ft proppant 2 of 3 wells at Type Curve D&C Cost of $3.3 million 2017 YTD Average: $3.39 million Frac design: 25-30 stages with 1,700 lbs/ft proppant Chaparral 2017 YTD STACK Meramec D&C Chaparral 2017 YTD STACK Osage D&C Effective D&C Cost Control Despite Increasing Inflationary Pressure 2017 D&C Cost Performance STACK Meramec D&C Cost/Well, 2017 YTD STACK Osage D&C Cost/Well, 2017 YTD

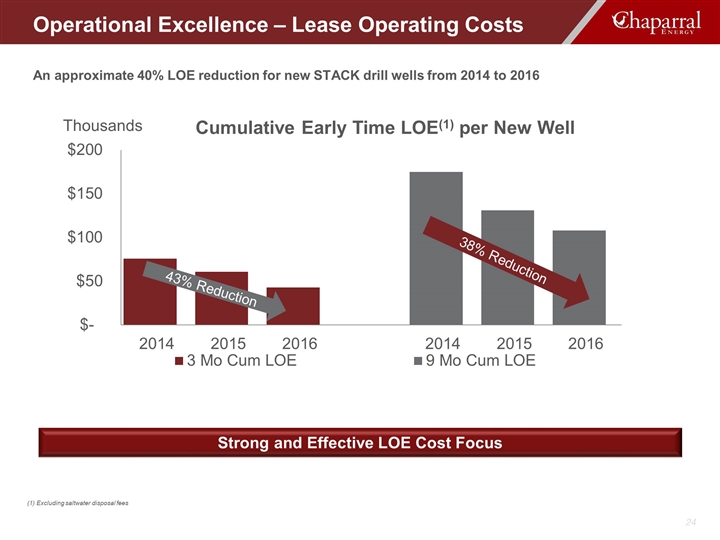

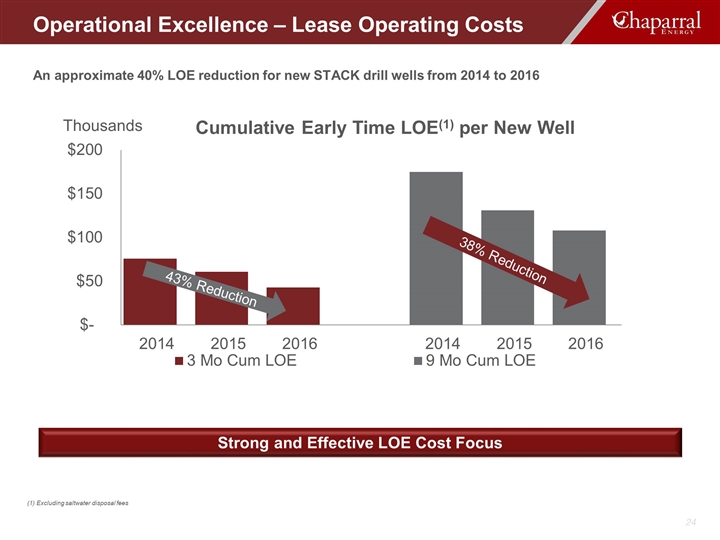

An approximate 40% LOE reduction for new STACK drill wells from 2014 to 2016 Strong and Effective LOE Cost Focus (1) Excluding saltwater disposal fees Operational Excellence – Lease Operating Costs

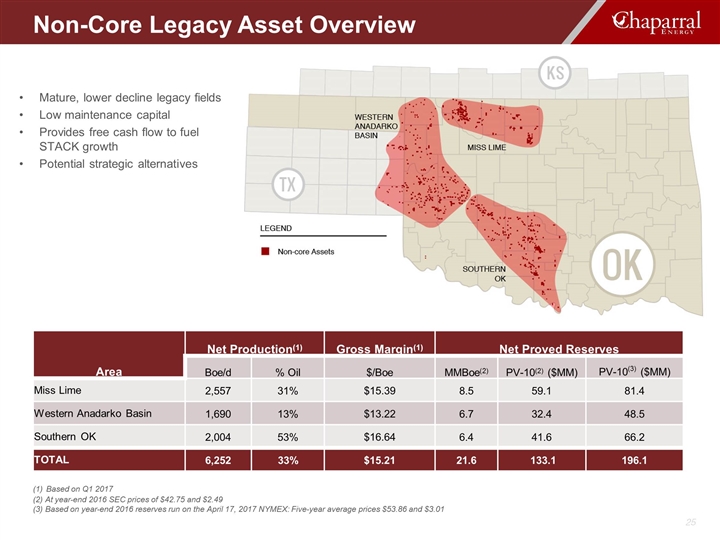

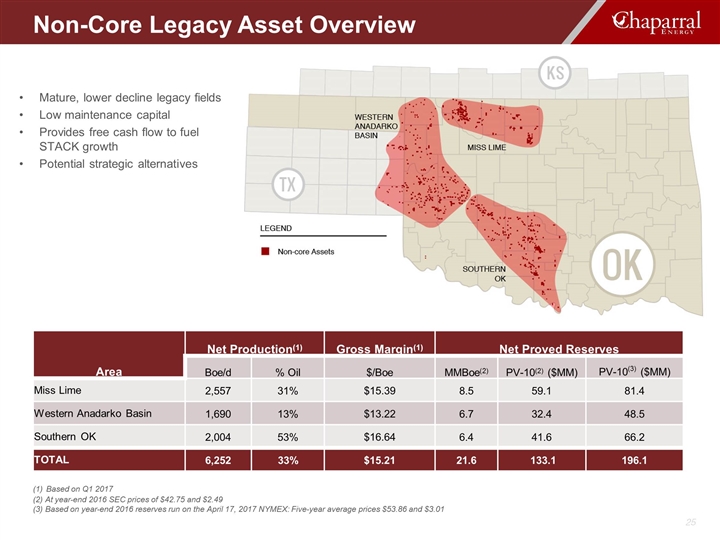

Mature, lower decline legacy fields Low maintenance capital Provides free cash flow to fuel STACK growth Potential strategic alternatives Area Net Production(1) Gross Margin(1) Net Proved Reserves Boe/d % Oil $/Boe MMBoe(2) PV-10(2) ($MM) PV-10(3) ($MM) Miss Lime 2,557 31% $15.39 8.5 59.1 81.4 Western Anadarko Basin 1,690 13% $13.22 6.7 32.4 48.5 Southern OK 2,004 53% $16.64 6.4 41.6 66.2 TOTAL 6,252 33% $15.21 21.6 133.1 196.1 (1) Based on Q1 2017 (2) At year-end 2016 SEC prices of $42.75 and $2.49 (3) Based on year-end 2016 reserves run on the April 17, 2017 NYMEX: Five-year average prices $53.86 and $3.01 Non-Core Legacy Asset Overview

Financial Overview

Maintain strong balance sheet Converted all long-term debt to equity As of March 31, 2017, approximately $122 million liquidity, which includes approximately $104 million available on revolver Maintain capital discipline Live within cash flow supplemented by asset sales proceeds Hedge significant production volumes to ensure cash flow Continue to focus on lowering cash operating costs per Boe Assets sales to fund additional STACK drilling Legacy non-core EOR assets Stock currently trading on OTCQB market under the symbol CHPE Financial Strategy

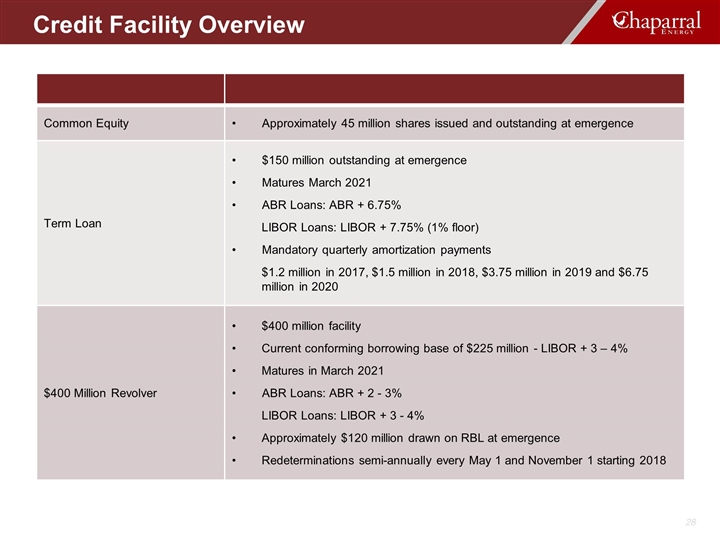

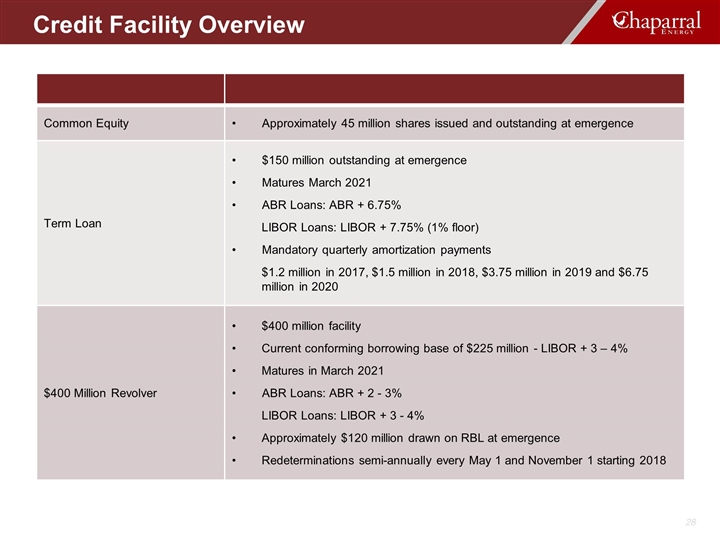

Common Equity Approximately 45 million shares issued and outstanding at emergence Term Loan $150 million outstanding at emergence Matures March 2021 ABR Loans: ABR + 6.75% LIBOR Loans: LIBOR + 7.75% (1% floor) Mandatory quarterly amortization payments $1.2 million in 2017, $1.5 million in 2018, $3.75 million in 2019 and $6.75 million in 2020 $400 Million Revolver $400 million facility Current conforming borrowing base of $225 million - LIBOR + 3 – 4% Matures in March 2021 ABR Loans: ABR + 2 - 3% LIBOR Loans: LIBOR + 3 - 4% Approximately $120 million drawn on RBL at emergence Redeterminations semi-annually every May 1 and November 1 starting 2018 Credit Facility Overview

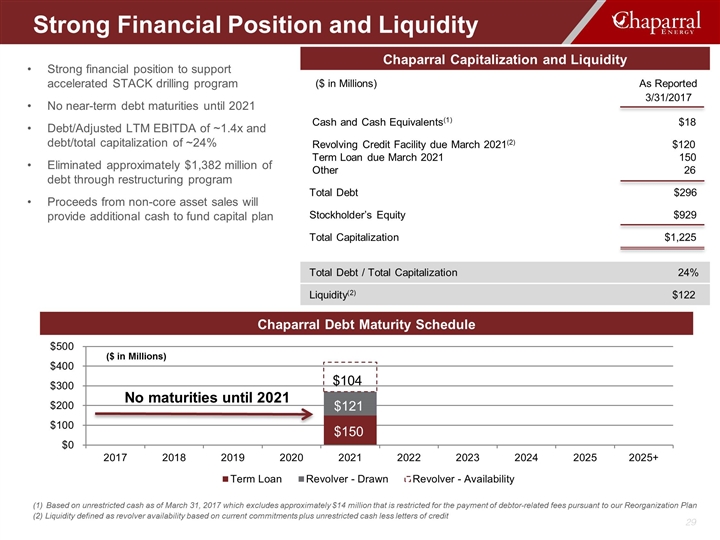

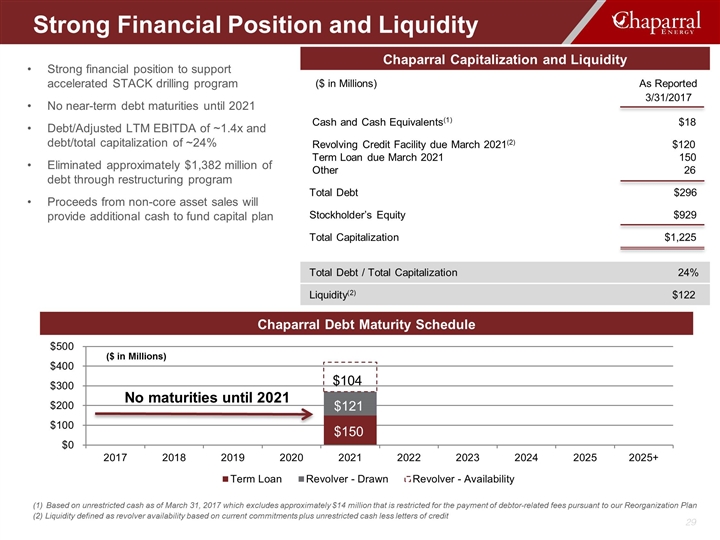

Strong Financial Position and Liquidity Strong financial position to support accelerated STACK drilling program No near-term debt maturities until 2021 Debt/Adjusted LTM EBITDA of ~1.4x and debt/total capitalization of ~24% Eliminated approximately $1,382 million of debt through restructuring program Proceeds from non-core asset sales will provide additional cash to fund capital plan Chaparral Capitalization and Liquidity ($ in Millions) As Reported 3/31/2017 Cash and Cash Equivalents(1) $18 Revolving Credit Facility due March 2021(2) $120 Term Loan due March 2021 150 Other 26 Total Debt $296 Stockholder’s Equity $929 Total Capitalization $1,225 Total Debt / Total Capitalization 24% Liquidity(2) $122 Chaparral Debt Maturity Schedule (1) Based on unrestricted cash as of March 31, 2017 which excludes approximately $14 million that is restricted for the payment of debtor-related fees pursuant to our Reorganization Plan (2) Liquidity defined as revolver availability based on current commitments plus unrestricted cash less letters of credit

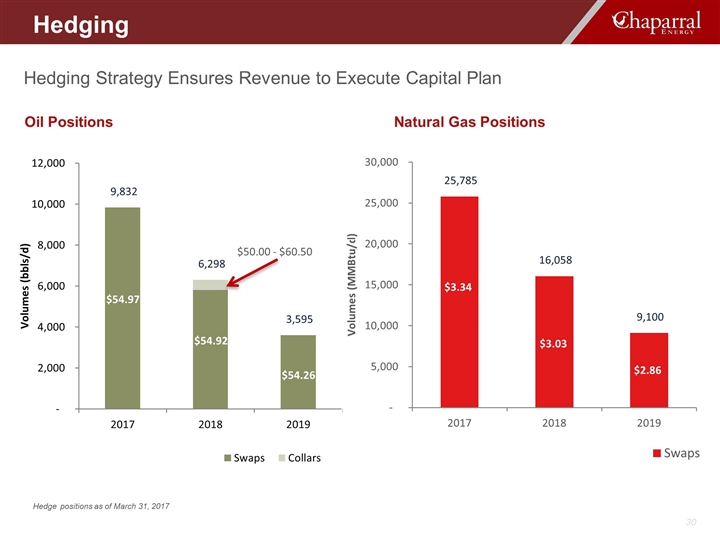

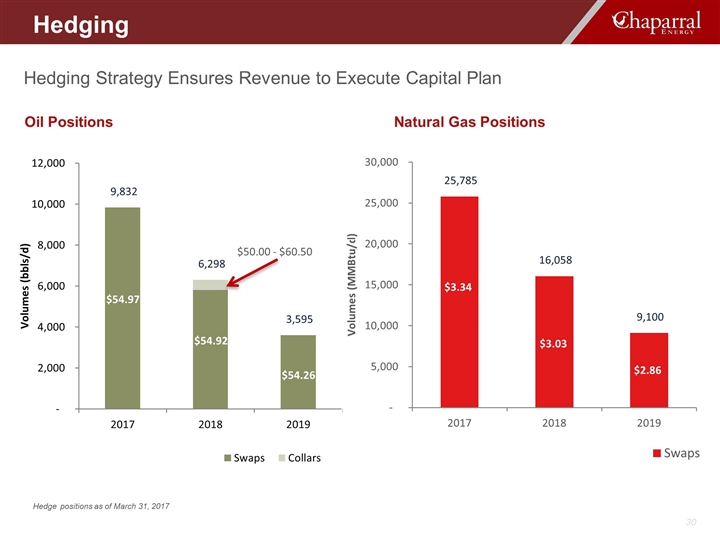

Hedging Strategy Ensures Revenue to Execute Capital Plan Oil Positions Natural Gas Positions Hedge positions as of March 31, 2017 Hedging $54.92 $54.26 $50.00 - $60.50 $54.97

Why Chaparral? Why Chaparral? Peer Leading Balance Sheet Execution-focused STACK Player Deep Inventory of High-return Drilling Prospects Strong Management Team with Excellent Track Record

Appendix

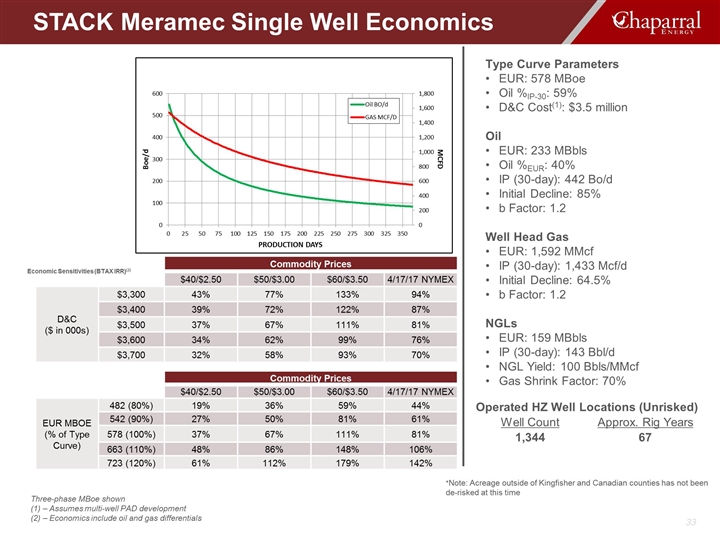

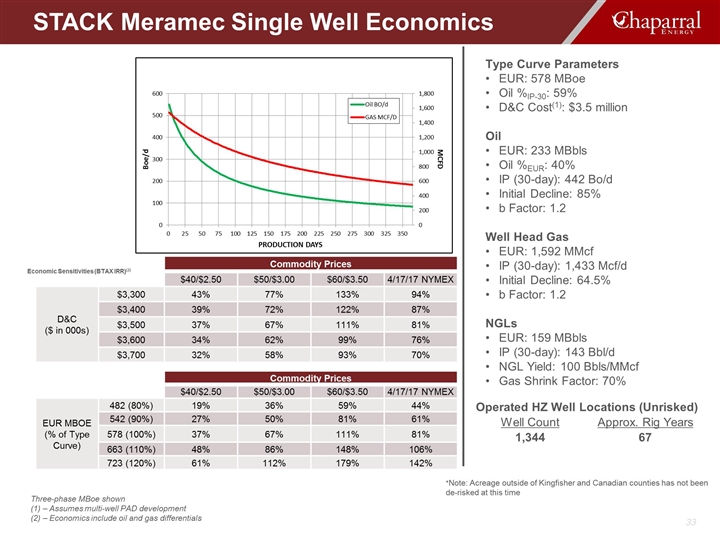

Type Curve Parameters EUR: 578 MBoe Oil %IP-30: 59% D&C Cost(1): $3.5 million Oil EUR: 233 MBbls Oil %EUR: 40% IP (30-day): 442 Bo/d Initial Decline: 85% b Factor: 1.2 Well Head Gas EUR: 1,592 MMcf IP (30-day): 1,433 Mcf/d Initial Decline: 64.5% b Factor: 1.2 NGLs EUR: 159 MBbls IP (30-day): 143 Bbl/d NGL Yield: 100 Bbls/MMcf Gas Shrink Factor: 70% Three-phase MBoe shown (1) – Assumes multi-well PAD development (2) – Economics include oil and gas differentials Commodity Prices $40/$2.50 $50/$3.00 $60/$3.50 4/17/17 NYMEX D&C ($ in 000s) $3,300 43% 77% 133% 94% $3,400 39% 72% 122% 87% $3,500 37% 67% 111% 81% $3,600 34% 62% 99% 76% $3,700 32% 58% 93% 70% Commodity Prices $40/$2.50 $50/$3.00 $60/$3.50 4/17/17 NYMEX EUR MBOE (% of Type Curve) 482 (80%) 19% 36% 59% 44% 542 (90%) 27% 50% 81% 61% 578 (100%) 37% 67% 111% 81% 663 (110%) 48% 86% 148% 106% 723 (120%) 61% 112% 179% 142% Economic Sensitivities (BTAX IRR)(2) Operated HZ Well Locations (Unrisked) Well Count Approx. Rig Years 1,344 67 STACK Meramec Single Well Economics *Note: Acreage outside of Kingfisher and Canadian counties has not been de-risked at this time

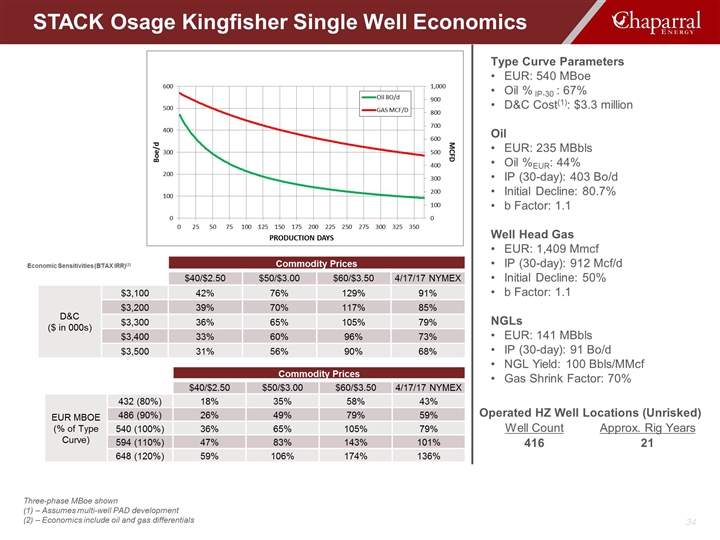

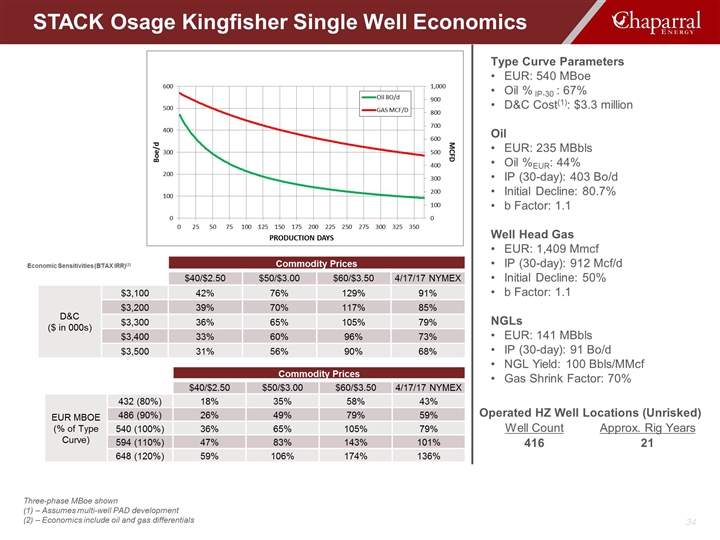

Type Curve Parameters EUR: 540 MBoe Oil % IP-30 : 67% D&C Cost(1): $3.3 million Oil EUR: 235 MBbls Oil %EUR: 44% IP (30-day): 403 Bo/d Initial Decline: 80.7% b Factor: 1.1 Well Head Gas EUR: 1,409 Mmcf IP (30-day): 912 Mcf/d Initial Decline: 50% b Factor: 1.1 NGLs EUR: 141 MBbls IP (30-day): 91 Bo/d NGL Yield: 100 Bbls/MMcf Gas Shrink Factor: 70% Three-phase MBoe shown (1) – Assumes multi-well PAD development (2) – Economics include oil and gas differentials Commodity Prices $40/$2.50 $50/$3.00 $60/$3.50 4/17/17 NYMEX D&C ($ in 000s) $3,100 42% 76% 129% 91% $3,200 39% 70% 117% 85% $3,300 36% 65% 105% 79% $3,400 33% 60% 96% 73% $3,500 31% 56% 90% 68% Commodity Prices $40/$2.50 $50/$3.00 $60/$3.50 4/17/17 NYMEX EUR MBOE (% of Type Curve) 432 (80%) 18% 35% 58% 43% 486 (90%) 26% 49% 79% 59% 540 (100%) 36% 65% 105% 79% 594 (110%) 47% 83% 143% 101% 648 (120%) 59% 106% 174% 136% Economic Sensitivities (BTAX IRR)(2) Operated HZ Well Locations (Unrisked) Well Count Approx. Rig Years 416 21 STACK Osage Kingfisher Single Well Economics

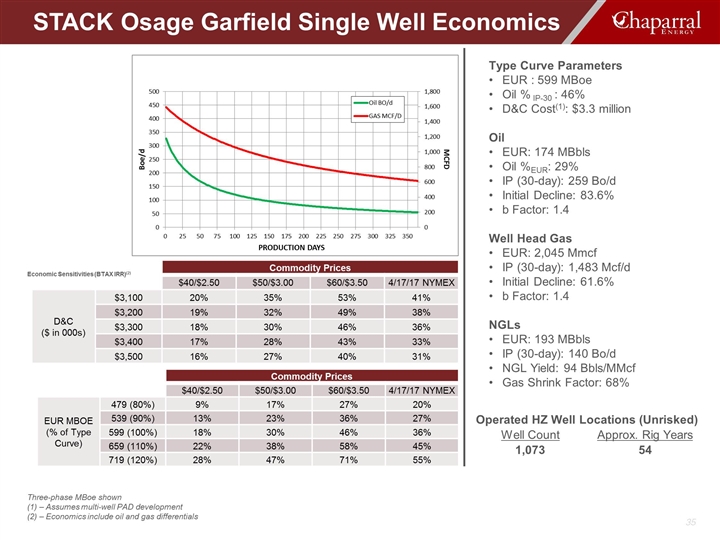

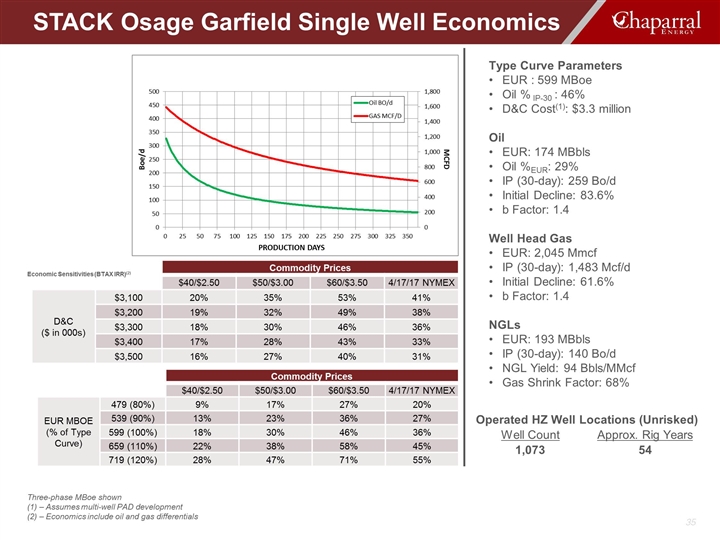

Type Curve Parameters EUR : 599 MBoe Oil % IP-30 : 46% D&C Cost(1): $3.3 million Oil EUR: 174 MBbls Oil %EUR: 29% IP (30-day): 259 Bo/d Initial Decline: 83.6% b Factor: 1.4 Well Head Gas EUR: 2,045 Mmcf IP (30-day): 1,483 Mcf/d Initial Decline: 61.6% b Factor: 1.4 NGLs EUR: 193 MBbls IP (30-day): 140 Bo/d NGL Yield: 94 Bbls/MMcf Gas Shrink Factor: 68% Three-phase MBoe shown (1) – Assumes multi-well PAD development (2) – Economics include oil and gas differentials Commodity Prices $40/$2.50 $50/$3.00 $60/$3.50 4/17/17 NYMEX D&C ($ in 000s) $3,100 20% 35% 53% 41% $3,200 19% 32% 49% 38% $3,300 18% 30% 46% 36% $3,400 17% 28% 43% 33% $3,500 16% 27% 40% 31% Commodity Prices $40/$2.50 $50/$3.00 $60/$3.50 4/17/17 NYMEX EUR MBOE (% of Type Curve) 479 (80%) 9% 17% 27% 20% 539 (90%) 13% 23% 36% 27% 599 (100%) 18% 30% 46% 36% 659 (110%) 22% 38% 58% 45% 719 (120%) 28% 47% 71% 55% Economic Sensitivities (BTAX IRR)(2) Operated HZ Well Locations (Unrisked) Well Count Approx. Rig Years 1,073 54 STACK Osage Garfield Single Well Economics

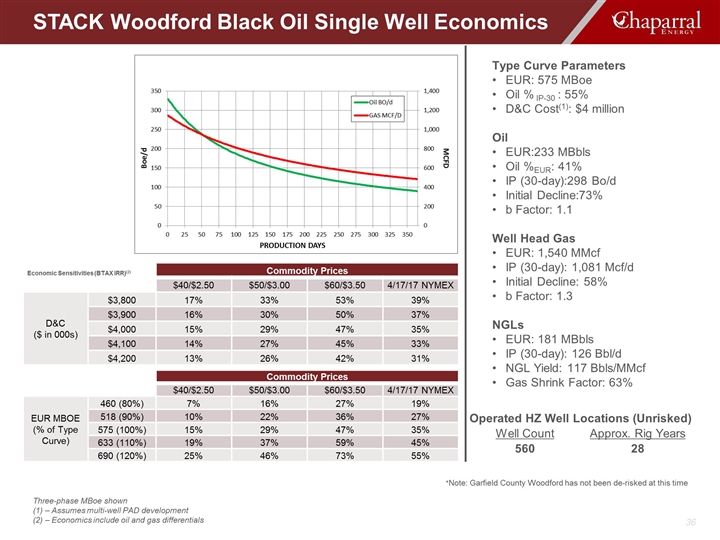

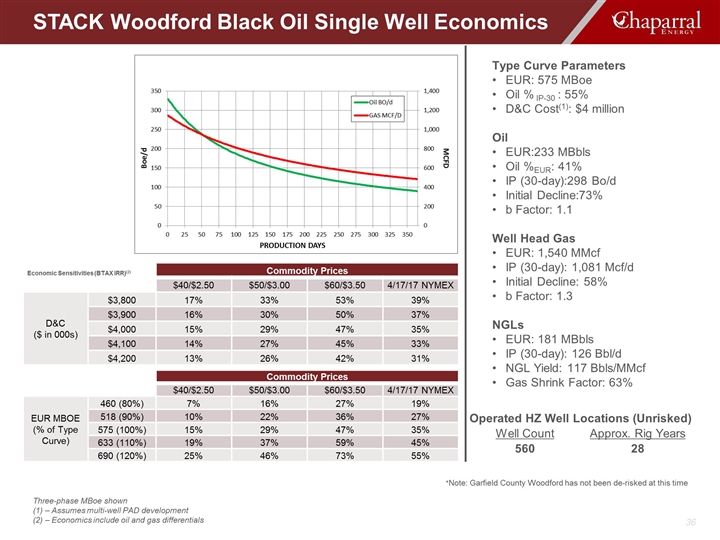

Type Curve Parameters EUR: 575 MBoe Oil % IP-30 : 55% D&C Cost(1): $4 million Oil EUR:233 MBbls Oil %EUR: 41% IP (30-day):298 Bo/d Initial Decline:73% b Factor: 1.1 Well Head Gas EUR: 1,540 MMcf IP (30-day): 1,081 Mcf/d Initial Decline: 58% b Factor: 1.3 NGLs EUR: 181 MBbls IP (30-day): 126 Bbl/d NGL Yield: 117 Bbls/MMcf Gas Shrink Factor: 63% Three-phase MBoe shown (1) – Assumes multi-well PAD development (2) – Economics include oil and gas differentials Commodity Prices $40/$2.50 $50/$3.00 $60/$3.50 4/17/17 NYMEX D&C ($ in 000s) $3,800 17% 33% 53% 39% $3,900 16% 30% 50% 37% $4,000 15% 29% 47% 35% $4,100 14% 27% 45% 33% $4,200 13% 26% 42% 31% Commodity Prices $40/$2.50 $50/$3.00 $60/$3.50 4/17/17 NYMEX EUR MBOE (% of Type Curve) 460 (80%) 7% 16% 27% 19% 518 (90%) 10% 22% 36% 27% 575 (100%) 15% 29% 47% 35% 633 (110%) 19% 37% 59% 45% 690 (120%) 25% 46% 73% 55% Economic Sensitivities (BTAX IRR)(2) Operated HZ Well Locations (Unrisked) Well Count Approx. Rig Years 560 28 STACK Woodford Black Oil Single Well Economics *Note: Garfield County Woodford has not been de-risked at this time

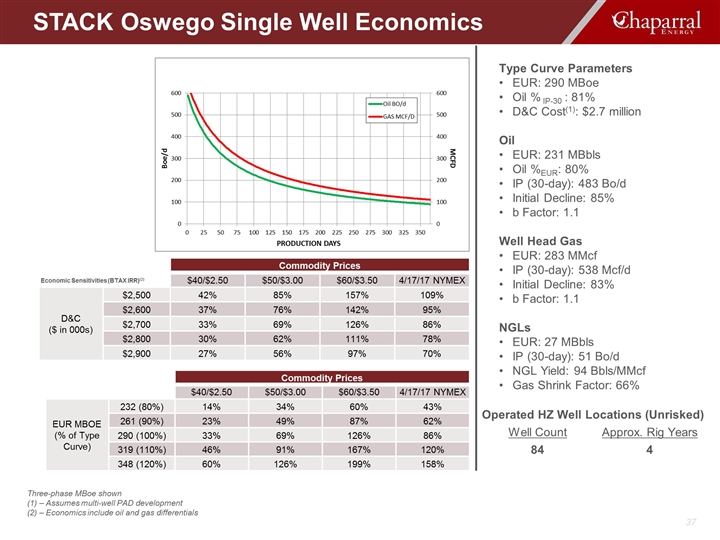

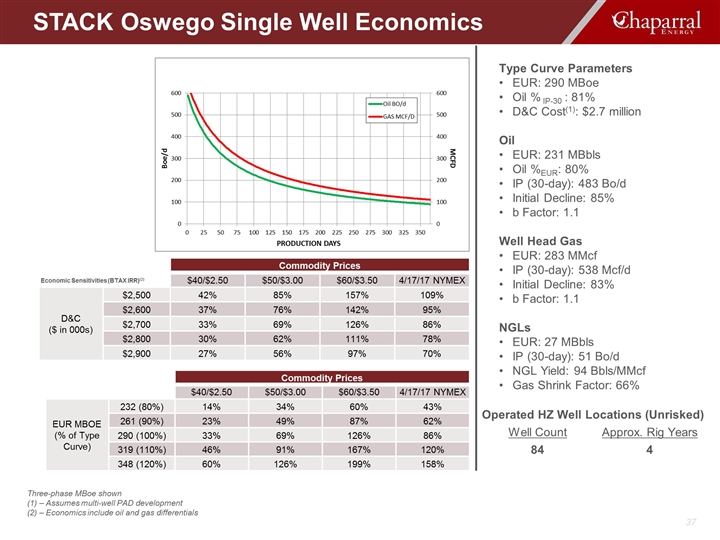

Type Curve Parameters EUR: 290 MBoe Oil % IP-30 : 81% D&C Cost(1): $2.7 million Oil EUR: 231 MBbls Oil %EUR: 80% IP (30-day): 483 Bo/d Initial Decline: 85% b Factor: 1.1 Well Head Gas EUR: 283 MMcf IP (30-day): 538 Mcf/d Initial Decline: 83% b Factor: 1.1 NGLs EUR: 27 MBbls IP (30-day): 51 Bo/d NGL Yield: 94 Bbls/MMcf Gas Shrink Factor: 66% Three-phase MBoe shown (1) – Assumes multi-well PAD development (2) – Economics include oil and gas differentials Commodity Prices $40/$2.50 $50/$3.00 $60/$3.50 4/17/17 NYMEX D&C ($ in 000s) $2,500 42% 85% 157% 109% $2,600 37% 76% 142% 95% $2,700 33% 69% 126% 86% $2,800 30% 62% 111% 78% $2,900 27% 56% 97% 70% Commodity Prices $40/$2.50 $50/$3.00 $60/$3.50 4/17/17 NYMEX EUR MBOE (% of Type Curve) 232 (80%) 14% 34% 60% 43% 261 (90%) 23% 49% 87% 62% 290 (100%) 33% 69% 126% 86% 319 (110%) 46% 91% 167% 120% 348 (120%) 60% 126% 199% 158% Economic Sensitivities (BTAX IRR)(2) Operated HZ Well Locations (Unrisked) Well Count Approx. Rig Years 84 4 STACK Oswego Single Well Economics

Company Production: 8.2 - 8.6 MMBoe Oil and Natural Gas Capital: $135 - $160 million Lease operating expense(LOE): $10.50 - $11.00 per Boe General and Administrative(G&A)(1): $3.40 - $4.20 per Boe Chaparral will review guidance after conclusion of strategic alternatives for EOR assets 2017 Guidance (1) – Normalized to exclude approximately $27 million of professional fees associated with the Chapter 11 bankruptcy process, as well as approximately $4.5 million for 2016 employee performance bonus that had to be expensed in 2017 due to bankruptcy accounting rules. 2017 Guidance

Investors Joe Evans Chief Financial Officer joe.evans@chaparralenergy.com 405-426-4590 Media Brandi Wessel Manager – Communications brandi.wessel@chaparralenergy.com 405-426-6657 Contact Information Contact Information Chaparral Energy, Inc. 701 Cedar Lake Boulevard Oklahoma City, OK 73114

James M. Miller, Sr. Vice President - Operations Mr. Miller joined Chaparral in 1996 as an operations engineer and has since been promoted to positions of increasing responsibility ,including his current role as senior vice president of operations. Prior to joining the company, Mr. Miller worked as a petroleum engineer for KEPCO Operating Inc. and Robert A Mason, where he was named vice president of production. Joseph O. Evans, Chief Financial Officer and Executive Vice President Mr. Evans joined Chaparral in 2005 as chief financial officer and executive vice president. Prior to joining Chaparral, he worked as a consultant and practiced public accounting with Evans Gaither & Assoc., served as senior vice president and financial advisor for First National Bank of Commerce and Deloitte & Touche, where he became an audit partner. K. Earl Reynolds, Chief Executive Officer and Director Mr. Reynolds joined Chaparral in 2011 as an executive vice president and chief operating officer before being named president in 2014 and chief executive officer in 2017. Prior to which, he served as the senior vice president of strategic development for Devon Energy, where he led the International Business Unit and was actively involved in strategic planning, as well as holding key leadership roles in domestic and international operations with Burlington Resources and Mobil Oil. Mr. Reynolds currently sits on the board for the Oklahoma City YMCA and the Oklahoma Independent Petroleum Association, where he serves as the Chairman of its Regulatory Committee. Executive Team

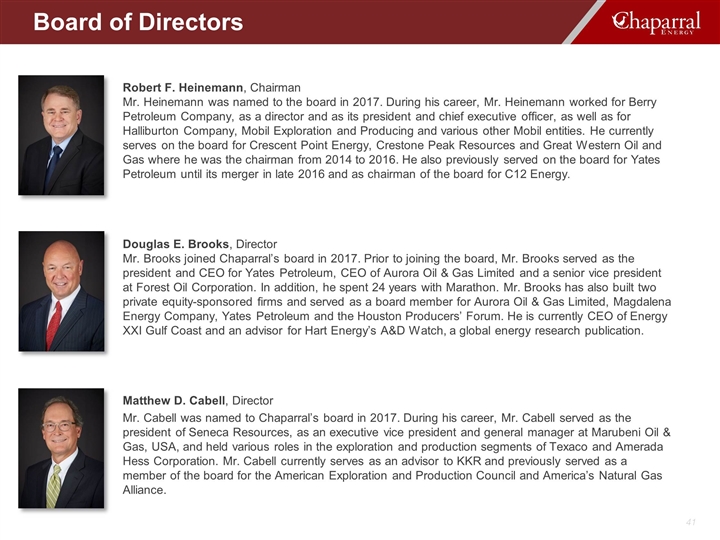

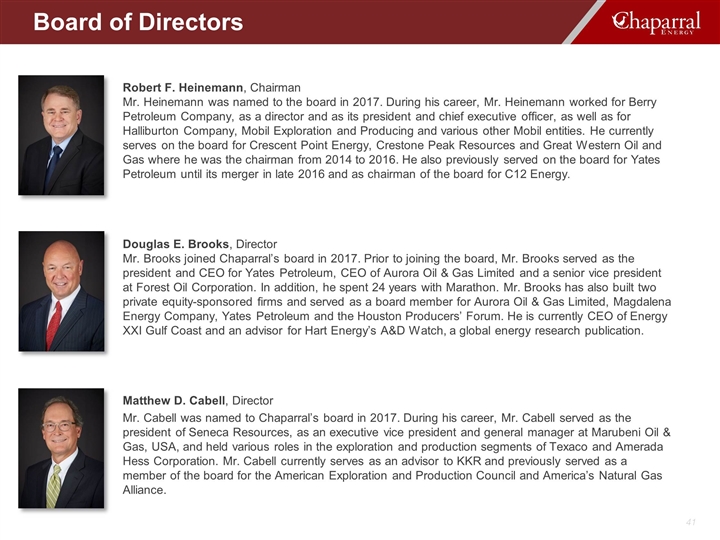

Matthew D. Cabell, Director Mr. Cabell was named to Chaparral’s board in 2017. During his career, Mr. Cabell served as the president of Seneca Resources, as an executive vice president and general manager at Marubeni Oil & Gas, USA, and held various roles in the exploration and production segments of Texaco and Amerada Hess Corporation. Mr. Cabell currently serves as an advisor to KKR and previously served as a member of the board for the American Exploration and Production Council and America’s Natural Gas Alliance. Douglas E. Brooks, Director Mr. Brooks joined Chaparral’s board in 2017. Prior to joining the board, Mr. Brooks served as the president and CEO for Yates Petroleum, CEO of Aurora Oil & Gas Limited and a senior vice president at Forest Oil Corporation. In addition, he spent 24 years with Marathon. Mr. Brooks has also built two private equity-sponsored firms and served as a board member for Aurora Oil & Gas Limited, Magdalena Energy Company, Yates Petroleum and the Houston Producers’ Forum. He is currently CEO of Energy XXI Gulf Coast and an advisor for Hart Energy’s A&D Watch, a global energy research publication. Robert F. Heinemann, Chairman Mr. Heinemann was named to the board in 2017. During his career, Mr. Heinemann worked for Berry Petroleum Company, as a director and as its president and chief executive officer, as well as for Halliburton Company, Mobil Exploration and Producing and various other Mobil entities. He currently serves on the board for Crescent Point Energy, Crestone Peak Resources and Great Western Oil and Gas where he was the chairman from 2014 to 2016. He also previously served on the board for Yates Petroleum until its merger in late 2016 and as chairman of the board for C12 Energy. Board of Directors

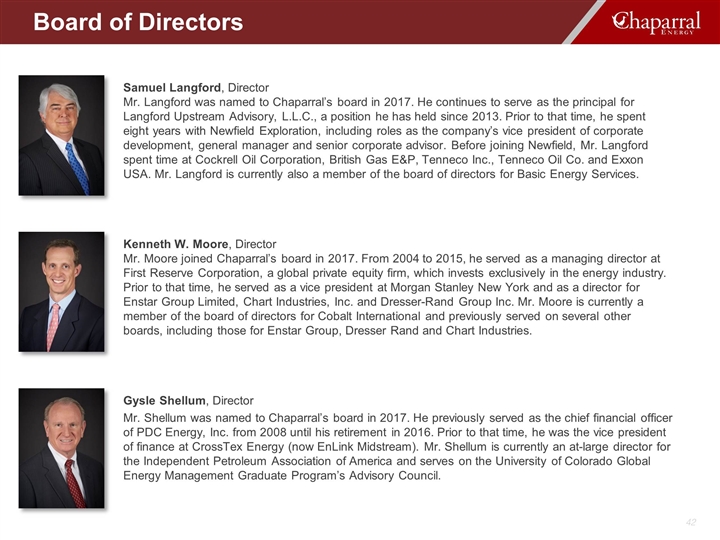

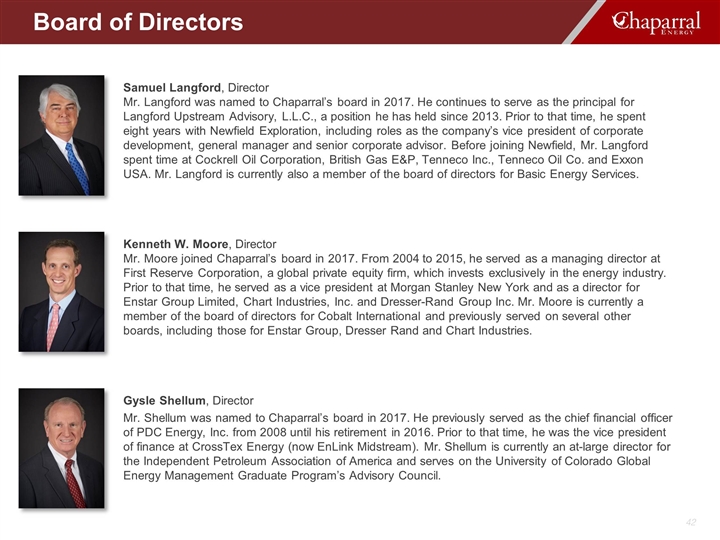

Gysle Shellum, Director Mr. Shellum was named to Chaparral’s board in 2017. He previously served as the chief financial officer of PDC Energy, Inc. from 2008 until his retirement in 2016. Prior to that time, he was the vice president of finance at CrossTex Energy (now EnLink Midstream). Mr. Shellum is currently an at-large director for the Independent Petroleum Association of America and serves on the University of Colorado Global Energy Management Graduate Program’s Advisory Council. Kenneth W. Moore, Director Mr. Moore joined Chaparral’s board in 2017. From 2004 to 2015, he served as a managing director at First Reserve Corporation, a global private equity firm, which invests exclusively in the energy industry. Prior to that time, he served as a vice president at Morgan Stanley New York and as a director for Enstar Group Limited, Chart Industries, Inc. and Dresser-Rand Group Inc. Mr. Moore is currently a member of the board of directors for Cobalt International and previously served on several other boards, including those for Enstar Group, Dresser Rand and Chart Industries. Samuel Langford, Director Mr. Langford was named to Chaparral’s board in 2017. He continues to serve as the principal for Langford Upstream Advisory, L.L.C., a position he has held since 2013. Prior to that time, he spent eight years with Newfield Exploration, including roles as the company’s vice president of corporate development, general manager and senior corporate advisor. Before joining Newfield, Mr. Langford spent time at Cockrell Oil Corporation, British Gas E&P, Tenneco Inc., Tenneco Oil Co. and Exxon USA. Mr. Langford is currently also a member of the board of directors for Basic Energy Services. Board of Directors

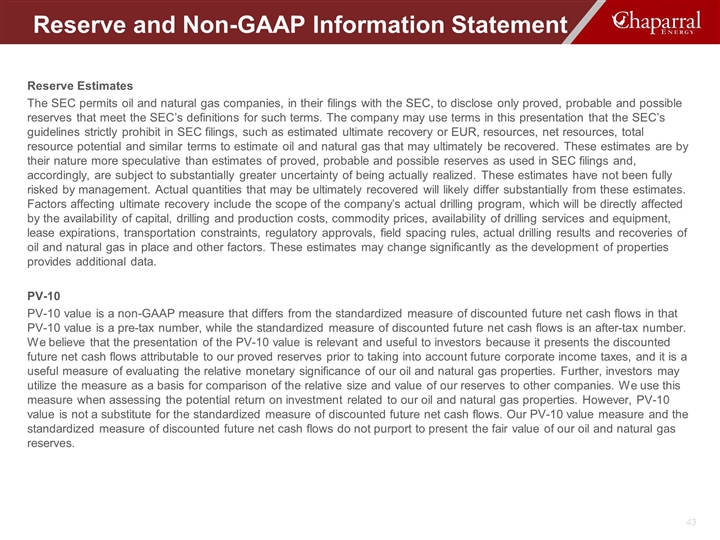

Reserve Estimates The SEC permits oil and natural gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves that meet the SEC’s definitions for such terms. The company may use terms in this presentation that the SEC’s guidelines strictly prohibit in SEC filings, such as estimated ultimate recovery or EUR, resources, net resources, total resource potential and similar terms to estimate oil and natural gas that may ultimately be recovered. These estimates are by their nature more speculative than estimates of proved, probable and possible reserves as used in SEC filings and, accordingly, are subject to substantially greater uncertainty of being actually realized. These estimates have not been fully risked by management. Actual quantities that may be ultimately recovered will likely differ substantially from these estimates. Factors affecting ultimate recovery include the scope of the company’s actual drilling program, which will be directly affected by the availability of capital, drilling and production costs, commodity prices, availability of drilling services and equipment, lease expirations, transportation constraints, regulatory approvals, field spacing rules, actual drilling results and recoveries of oil and natural gas in place and other factors. These estimates may change significantly as the development of properties provides additional data. PV-10 PV-10 value is a non-GAAP measure that differs from the standardized measure of discounted future net cash flows in that PV-10 value is a pre-tax number, while the standardized measure of discounted future net cash flows is an after-tax number. We believe that the presentation of the PV-10 value is relevant and useful to investors because it presents the discounted future net cash flows attributable to our proved reserves prior to taking into account future corporate income taxes, and it is a useful measure of evaluating the relative monetary significance of our oil and natural gas properties. Further, investors may utilize the measure as a basis for comparison of the relative size and value of our reserves to other companies. We use this measure when assessing the potential return on investment related to our oil and natural gas properties. However, PV-10 value is not a substitute for the standardized measure of discounted future net cash flows. Our PV-10 value measure and the standardized measure of discounted future net cash flows do not purport to present the fair value of our oil and natural gas reserves. Reserve and Non-GAAP Information Statement

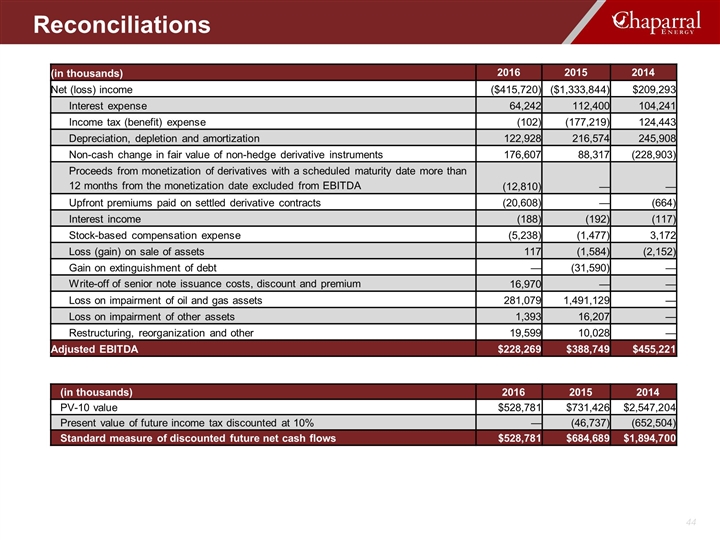

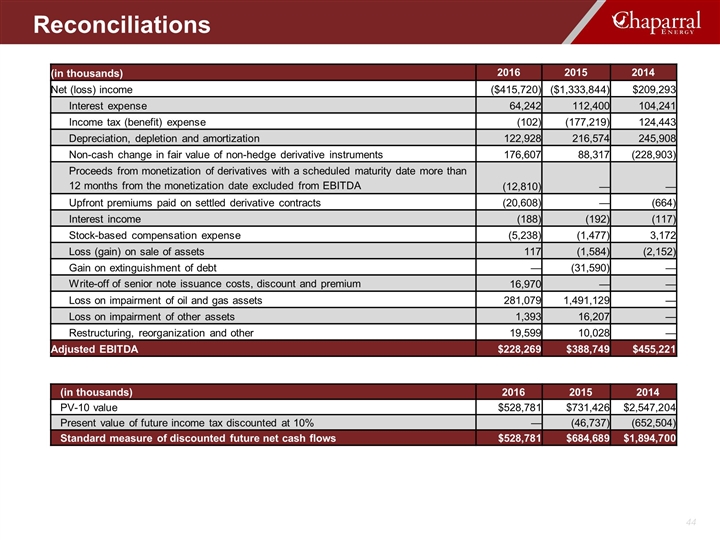

Reconciliations (in thousands) 2016 2015 2014 Net (loss) income ($415,720) ($1,333,844) $209,293 Interest expense 64,242 112,400 104,241 Income tax (benefit) expense (102) (177,219) 124,443 Depreciation, depletion and amortization 122,928 216,574 245,908 Non-cash change in fair value of non-hedge derivative instruments 176,607 88,317 (228,903) Proceeds from monetization of derivatives with a scheduled maturity date more than 12 months from the monetization date excluded from EBITDA (12,810) — — Upfront premiums paid on settled derivative contracts (20,608) — (664) Interest income (188) (192) (117) Stock-based compensation expense (5,238) (1,477) 3,172 Loss (gain) on sale of assets 117 (1,584) (2,152) Gain on extinguishment of debt — (31,590) — Write-off of senior note issuance costs, discount and premium 16,970 — — Loss on impairment of oil and gas assets 281,079 1,491,129 — Loss on impairment of other assets 1,393 16,207 — Restructuring, reorganization and other 19,599 10,028 — Adjusted EBITDA $228,269 $388,749 $455,221 (in thousands) 2016 2015 2014 PV-10 value $528,781 $731,426 $2,547,204 Present value of future income tax discounted at 10% — (46,737) (652,504) Standard measure of discounted future net cash flows $528,781 $684,689 $1,894,700 Reconciliations

THANK YOU