J.P. Morgan High Yield Conference

Miami, Florida

February 2012

This presentation contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected. Among those risks, trends and uncertainties are our ability to find oil and natural gas reserves that are economically recoverable, the volatility of oil and natural gas prices and significantly depressed natural gas prices since the middle of 2008, the uncertain economic conditions in the United States and globally, the decline in the values of our properties that have resulted in and may in the future result in additional ceiling test write-downs, our ability to replace reserves and sustain production, our estimate of the sufficiency of our existing capital sources, our ability to raise additional capital to fund cash requirements for future operations, the uncertainties involved in prospect development and property acquisitions or dispositions and in projecting future rates of production or future reserves, the timing of development expenditures and drilling of wells, hurricanes and other natural disasters, including the impact of the oil spill in the Gulf of Mexico on our present and future operations, the impact of government regulation, and the operating hazards attendant to the oil and natural gas business. In particular, careful consideration should be given to cautionary statements made in the various reports we have filed with the Securities and Exchange Commission. We undertake no duty to update or revise these forward-looking statements.

Company Representatives

Mark Fischer

Chief Executive Officer

& President

Joe Evans

Chief Financial Officer

& Executive Vice President

Earl Reynolds

Chief Operating Officer

& Executive Vice President

Diane Montgomery

Vice President

Finance/Investor Relations

Chaparral Overview

Founded in 1988, Based in Oklahoma City

Core areas — Mid-Continent (Oklahoma) and Permian Basin (W. Texas)

Oil-weighted producer (60% oil; 40% gas); R/P ratio 18 years

Third largest oil producer in Oklahoma

Stable 1P base with large 2P and 3P Upside

Near-term growth potential through drilling in conventional & emerging plays

Long-term growth through CO2 EOR

2011 Production (Boe/d) ~23,700

YE 2011 Proved Reserves (MMBoe)1 156.3

YE 2011 Proved Reserves PV-10 ($ in mm)1 $2,309

2011 Estimated EBITDA ($ mm) $310 - 315

¹Based on 12/31/2011 SEC methodology

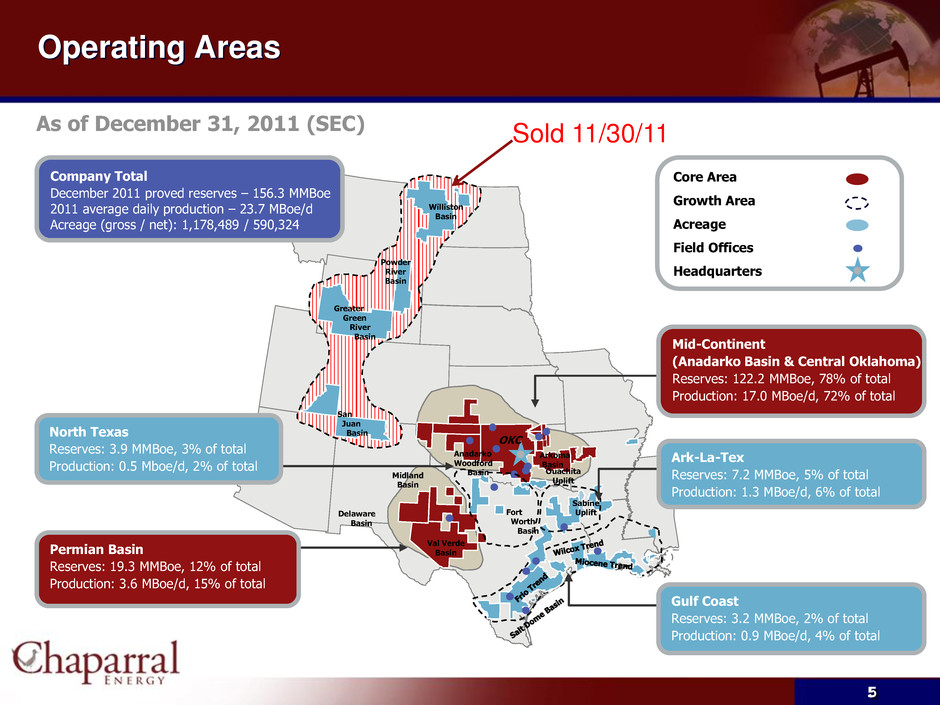

Operating Areas

As of December 31, 2011 (SEC)

Sold 11/30/11

Core Area

Growth Area

Acreage

Field Offices

Headquarters

Company Total

December 2011 proved reserves – 156.3 MMBoe

2011 average daily production – 23.7 MBoe/d

Acreage (gross / net): 1,178,489 / 590,324

Mid-Continent

(Anadarko Basin & Central Oklahoma)

Reserves: 122.2 MMBoe, 78% of total

Production: 17.0 MBoe/d, 72% of total

Permian Basin

Reserves: 19.3 MMBoe, 12% of total

Production: 3.6 MBoe/d, 15% of total

Ark-La-Tex

Reserves: 7.2 MMBoe, 5% of total

Production: 1.3 MBoe/d, 6% of total

North Texas

Reserves: 3.9 MMBoe, 3% of total

Production: 0.5 Mboe/d, 2% of total

Gulf Coast

Reserves: 3.2 MMBoe, 2% of total

Production: 0.9 MBoe/d, 4% of total

Strong Record of Reserve and Production Growth

Chaparral’s reserve replacement ratio averaged 422% per year since 2002

2003 – 2011 CAGR = 15%

2003 – 2011 CAGR = 16%

Financial Position to Execute Strategy

Strong Financial Position

No debt maturities before 2017

Hedge positions in place to secure cash flow in near term

Budget CAPEX within free cash flow (including divestiture proceeds)

Current Liquidity of approximately $400 MM

1) Note: Debt balances do not reflect discounts on Senior Notes of $1.658mm

on the 2017s and $6.441mm on the 2020s

Capital Budget ($millions)

*99% of Capital Program is Oil Focused

Resource Potential

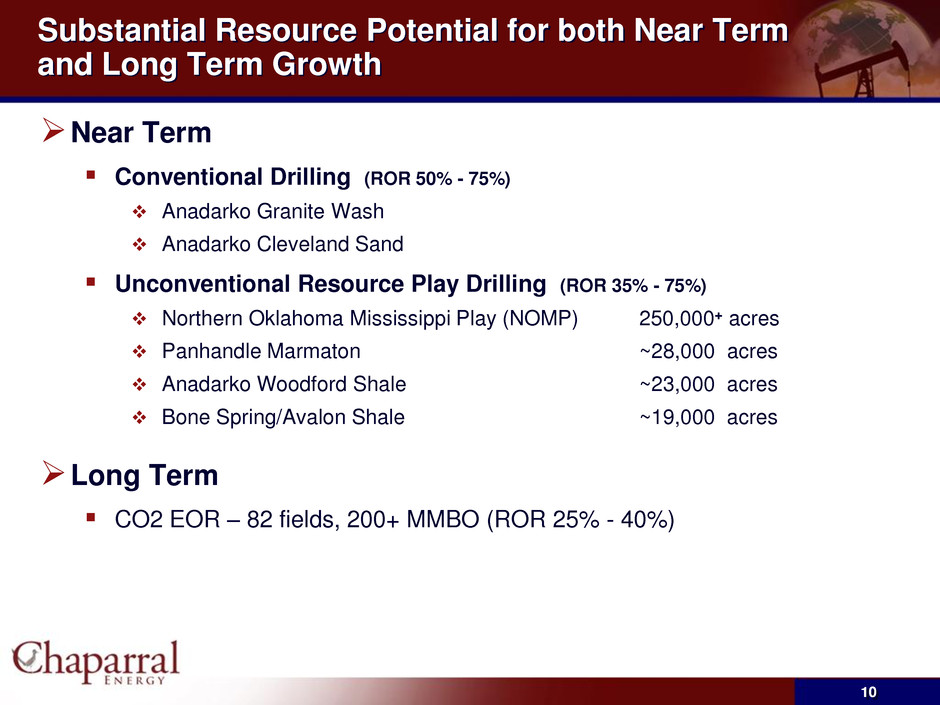

Substantial Resource Potential for both Near Term and Long Term Growth

Near Term

Conventional Drilling (ROR 50% - 75%)

Anadarko Granite Wash

Anadarko Cleveland Sand

Unconventional Resource Play Drilling (ROR 35% - 75%)

| |

| Northern Oklahoma Mississippi Play (NOMP) | 250,000+ acres |

| |

| Panhandle Marmaton | ~28,000 acres |

| |

| Anadarko Woodford Shale | ~23,000 acres |

| |

| Bone Spring/Avalon Shale | ~19,000 acres |

Long Term

CO2 EOR – 82 fields, 200+ MMBO (ROR 25% - 40%)

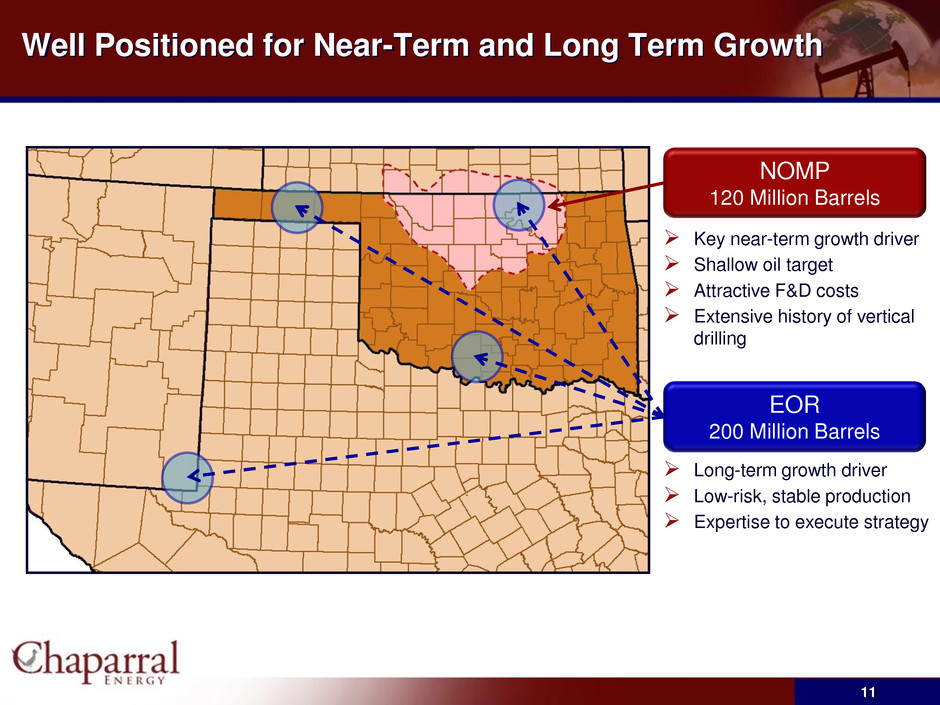

Well Positioned for Near-Term and Long Term Growth

NOMP

120 Million Barrels

Key near-term growth driver

Shallow oil target

Attractive F&D costs

Extensive history of vertical drilling

EOR

200 Million Barrels

Long-term growth driver

Low-risk, stable production

Expertise to execute strategy

NOMP: A Key Near-Term Focus Area

More than 250,000 Net Acres

Wildhorse Concession gives Chaparral exclusive rights to 138,000 acres

Drilled 14 wells to date

17 wells planned in 2012

Play Economics:

EURs: 200 – 400 MBOE

Well costs: $2.5 - $4 Million

Percent Oil: 60 – 80%

NOMP: Recent Results

NOMP West

Approximately 40,000 Net Acres

Significant industry activity in the play

Drilled 9 wells to date (2 Waiting on Completion)

Average IP 590 Boepd

46% Oil

NOMP East

218,000 Net Acres

In de-risking phase – industry activity increasing

Drilled 5 wells to date (2 Waiting on Completion)

Average IP 170 Boepd

70% Oil

Chaparral:A Growing Mid-Continent CO2 EOR Company

Long Life EOR Assets in Four Key Growth Areas

200+ MMBOe Potential Reserves

Low Geologic Risk

Attractive Economics

ROR – 25% to 40%

ROI – 2.5:1 to 3.5:1

Capital Requirements - $75-$125 MM/yr

Long-term growth potential - 20-30% CAGR expected through 2020

405 miles of CO2 Pipelines (net 245)

CO2 Supply – 100 MMcf/D

Current: 50 MMcf/D

Coffeyville Contract: 50 MMcf/D

Currently Owned CO2 Development Potential and Infrastructure

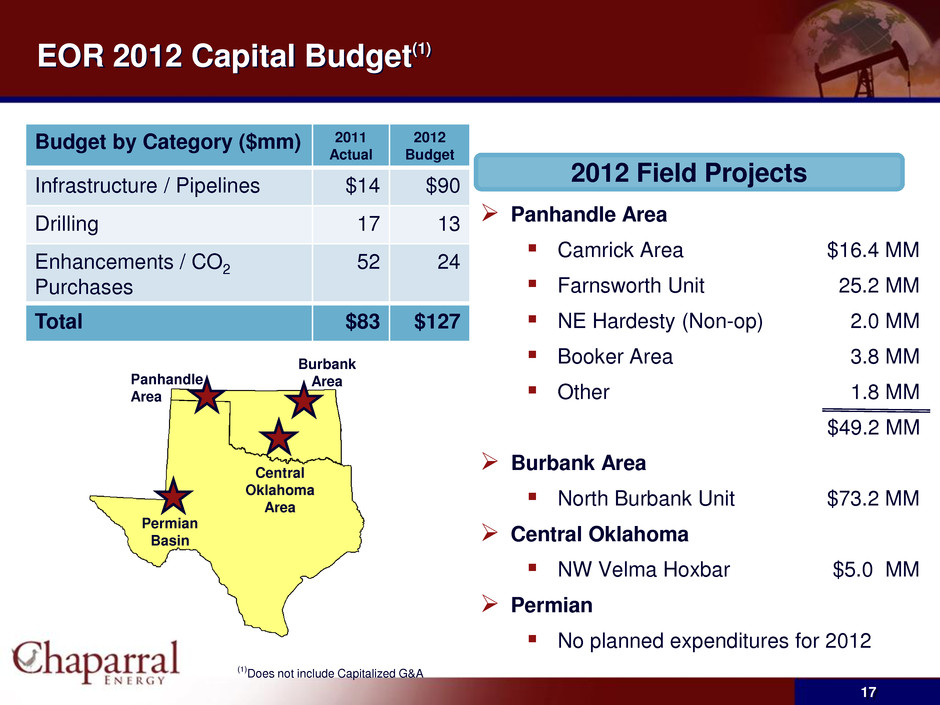

EOR 2012 Capital Budget(1)

2012 Field Projects

Panhandle Area

| |

| NE Hardesty (Non-op) | 2.0 MM |

$49.2 MM

Burbank Area

| |

| North Burbank Unit | $73.2 MM |

Central Oklahoma

No planned expenditures for 2012

(1)Does not include Capitalized G&A

PROCESSING RATE: The Key to Improved Rate of Return

CO2 Injection initiated Sep’07

Processing Rates Average 25% hcpv Inj./Yr

North Burbank CO2 Development

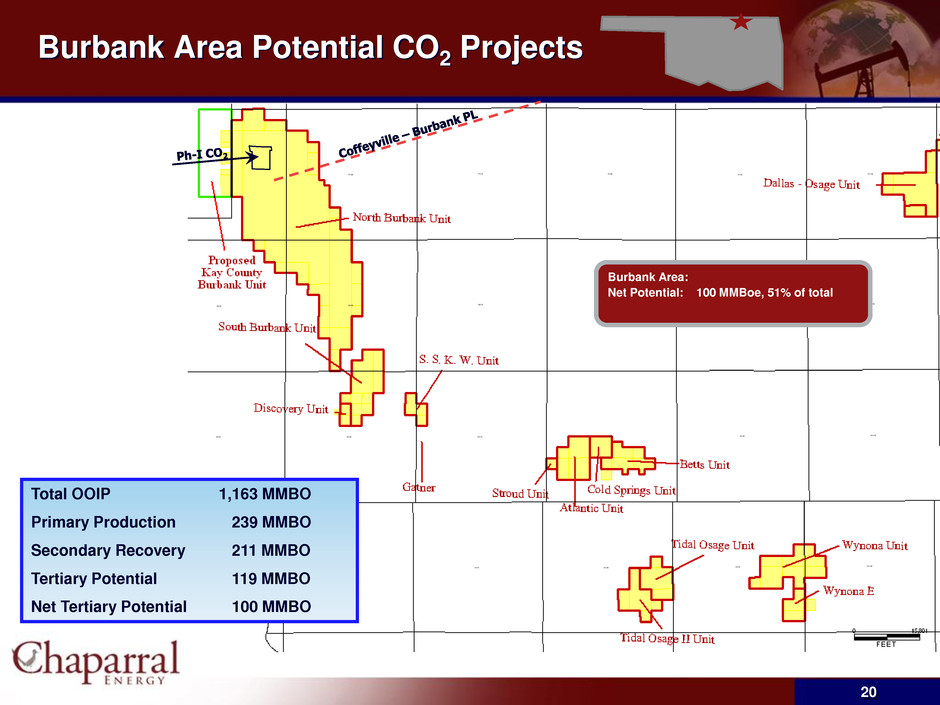

Burbank Area Potential CO2 Projects

“BURBANK” in Perspective

Other Recently Installed CO2 Injection Projects

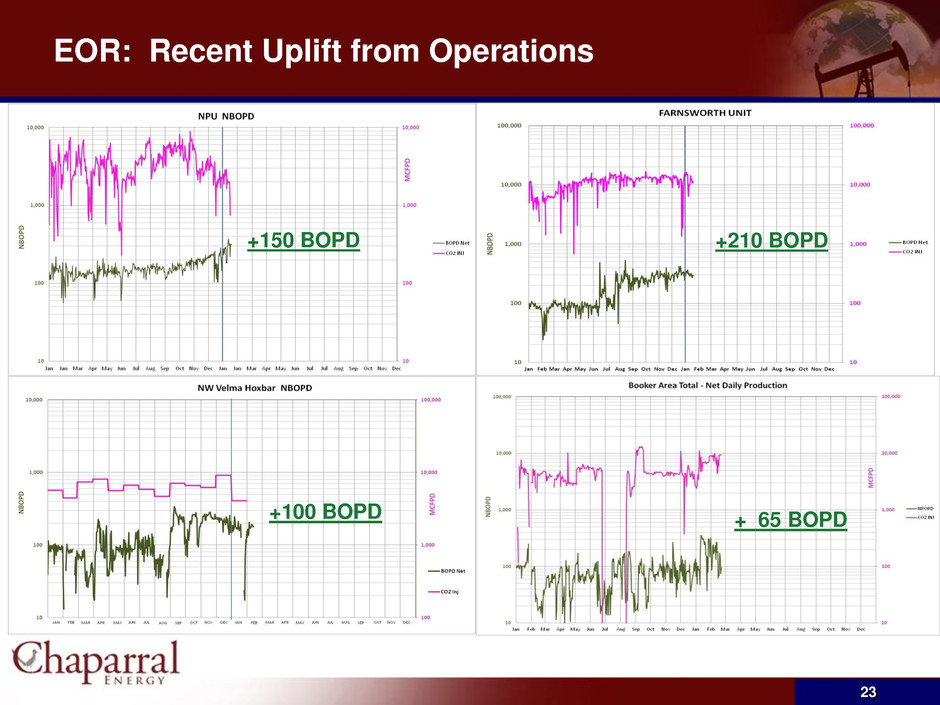

EOR: Recent Uplift from Operations

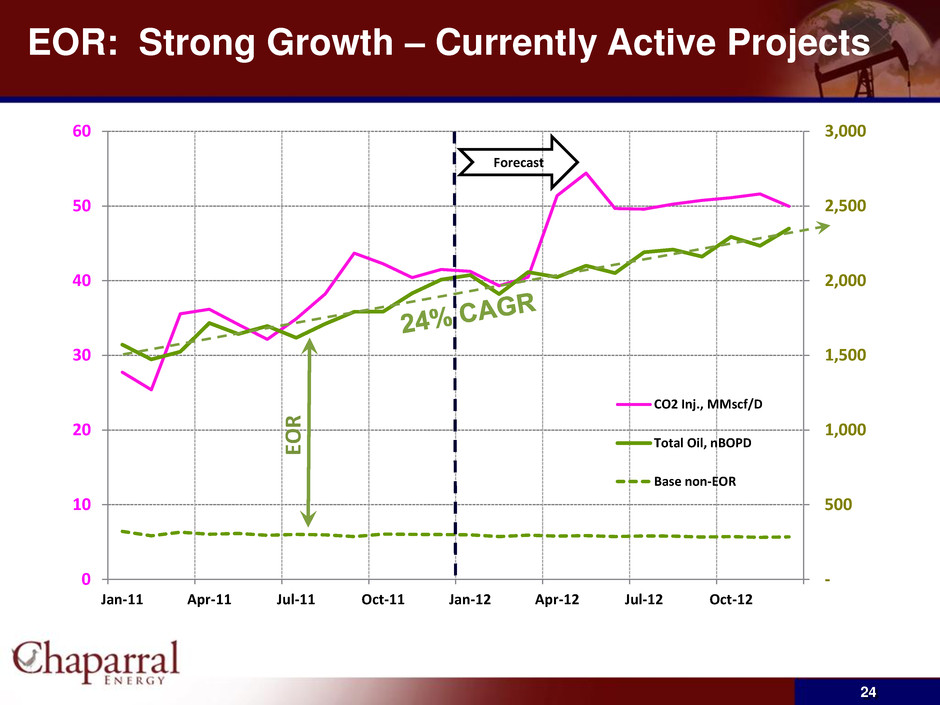

EOR: Strong Growth – Currently Active Projects

Other Developing Drilling Plays

Bone Spring / Avalon

Chaparral Energy, LLC

Avalon Shale Position

19,000 Net Acres in West and Central Loving County, TX

Upper and Lower Avalon Production Surrounding Acreage Block

Over 80 Potential Avalon Drill Sites

Oil & NGL Rich Play

High Initial Production

Prime Acreage Position

Large Development Opportunity

Average Well Depth : 12,000 – 12,250 Ft. (MD)

Panhandle Marmaton

Unit’s average 30 day IP + 238 BOE/D

Unit’s average reserves 130 MBOE (76% oil, 14% NGL, 10% gas)

Unit’s average CWC: $2.8 MM

Total 2012 Budgeted CAPEX: $5 MM to drill three wells

Average Depth to Marmaton 6600’

Chaparral continues to lease in the play and currently has ~28,000 confirmed net acres in the Emerging Marmaton Play

More than 700 Million BOE Potential

Near-term + Long-term strategy yields significant value increase

~ 70% Oil

Near-term focus on NOMP

De-risk play, unlock value

Production growth

Long-term focus on EOR

Low-risk production upside

Long-life, stable production

* Woodford, Bone Spring, Avalon, Cleveland Sand, Granite Wash, and Marmaton

Financial Performance, Projections and Credit Statistics

Financial Summary

Financial Metrics per BOE

2011 Estimates and 2012 Preliminary Guidance

Hedge Portfolio

Question & Answer