Investor Presentation March 2019 NYSE: CHAP 0

Forward-Looking Statements and Risk Factors This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Statements made in this presentation and by representatives of Chaparral Energy (the company) during the course of this presentation, which are not historical facts are forward- looking statements. These statements are based on certain assumptions and expectations made by the company, which reflect management’s experience, estimates and perception of historical trends, current conditions and anticipated future developments. Although the company believes these assumptions and expectations are reasonable, they are subject to a number of assumptions, risks and uncertainties, many of which are difficult to predict and are beyond the control of the company and which may cause actual results to differ materially from those implied or anticipated in the forward-looking statements. These include risks relating to financial performance and results, ability to improve our financial results and profitability following emergence from bankruptcy, availability of sufficient cash flow to execute our business plan, continued low or further declining commodity prices and demand for oil, natural gas and natural gas liquids, ability to hedge future production, ability to replace reserves and efficiently develop current reserves and the regulatory environment and other important factors that could cause actual results to differ materially from those anticipated or implied in the forward-looking statements. Initial production (IP) rates are discreet data points in each well’s productive history. These rates are sometimes actual rates and sometimes extrapolated or normalized rates. As such, the rates for a particular well may decline over time and change as additional data becomes available. Peak production rates are not necessarily indicative or predictive of future production rates or economic rates-of-return from such wells and should not be relied upon for such purpose. The ability of the company or the relevant operator to maintain expected levels of production from a well is subject to numerous risks and uncertainties, including those referenced and discussed above. In addition, methodology the company and other industry participants utilize to calculate peak IP rates may not be consistent and, as a result, the values reported may not be directly and meaningfully comparable. These and other important factors could cause actual results to differ materially from those anticipated or implied in the forward-looking statements. Please read risk factors in the company’s annual reports on form 10-K as amended, quarterly reports on form 10-Q and other public filings. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information or future events. This presentation includes financial measures that are not in accordance with generally accepted accounting principals (GAAP). For reconciliation of such measures to the most directly comparable GAAP measures in the appendix. NYSE: CHAP 1

Company Overview NYSE: CHAP 2

Chaparral Story High-growth, pure-play STACK/Merge oil company • 14.4 MBoe/d 2018 STACK production • 20.5 MBoe/d 2018 total production • 52% full year 2018 STACK production growth Premier, contiguous acreage position • 131,000 acres in world-class STACK Play STACK • Primarily in black oil, normal pressure window in Kingfisher, Garfield and Canadian counties Large resource base with deep inventory • 2018 proved reserves of 94.8 MMBoe, a 35% increase from 2017, adjusted for 2018 divestitures • 2018 STACK proved reserves increased 50% compared Merge to 2017 • Decades of high-return inventory Highly efficient, low-cost STACK assets Average Average STACK Held By County Operated Non-Operated Acreage Production • $25.59/Boe 2018 STACK cash margins WI WI • $4.86/Boe 2018 STACK LOE cost Kingfisher ~34,000 ~98% 72% 16% Canadian ~22,000 ~99% 66% 15% Strong balance sheet Garfield ~55,000 ~38% 64% 19% • No long-term maturities until December 2022 Major ~6,000 ~98% 52% 16% Other ~14,000 ~100% 51% 10% NYSE: CHAP 3

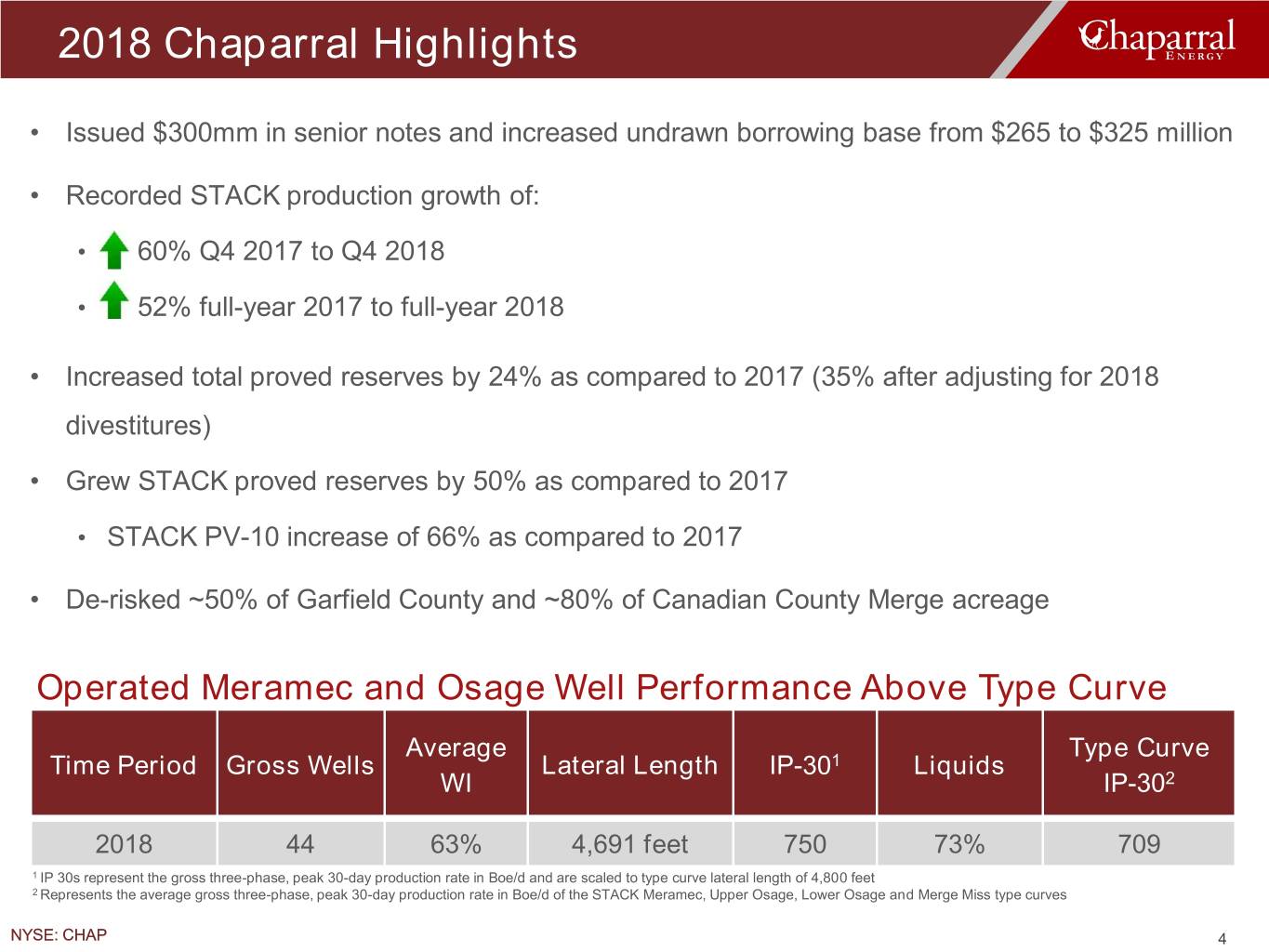

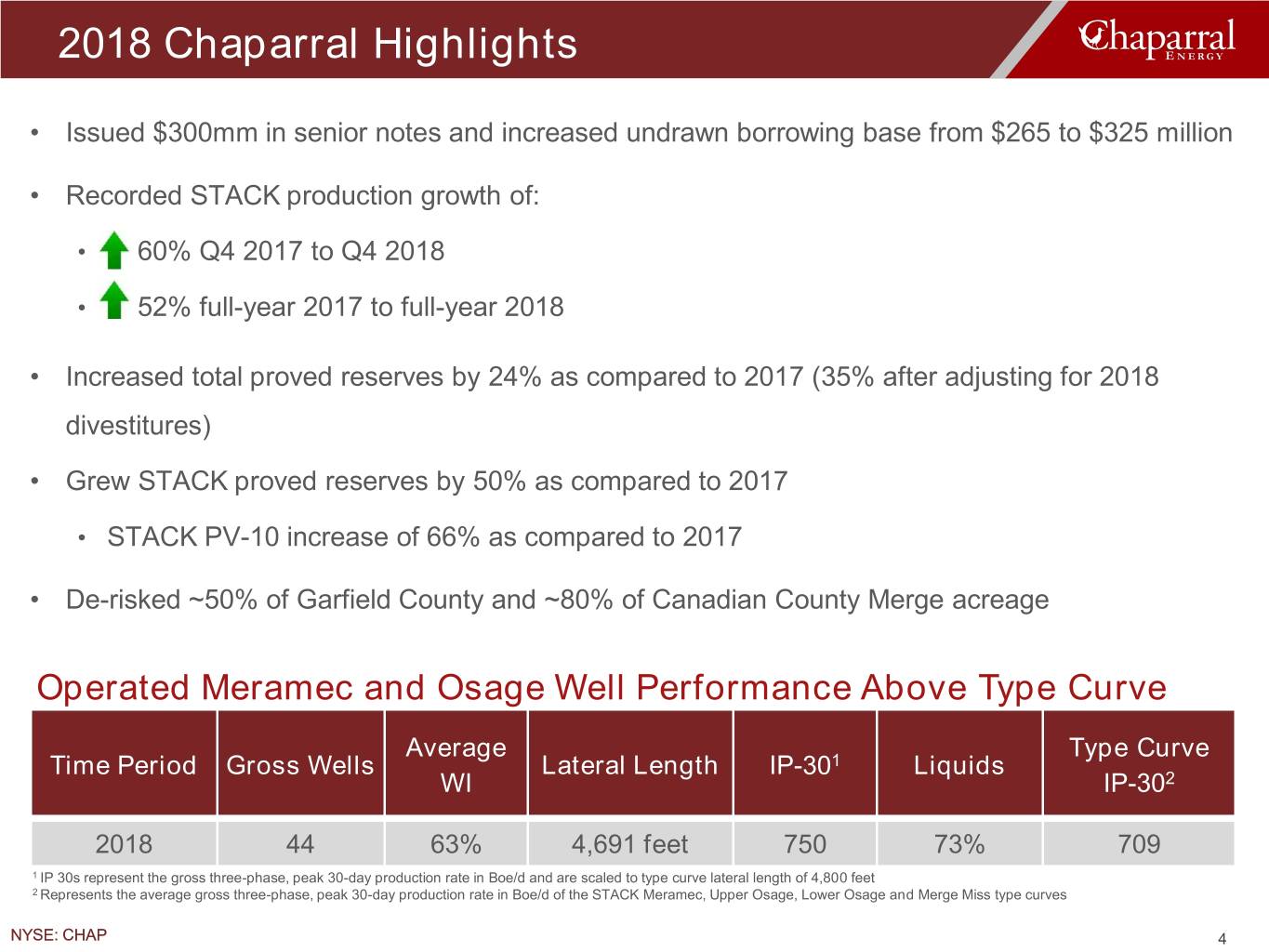

2018 Chaparral Highlights • Issued $300mm in senior notes and increased undrawn borrowing base from $265 to $325 million • Recorded STACK production growth of: • 60% Q4 2017 to Q4 2018 • 52% full-year 2017 to full-year 2018 • Increased total proved reserves by 24% as compared to 2017 (35% after adjusting for 2018 divestitures) • Grew STACK proved reserves by 50% as compared to 2017 • STACK PV-10 increase of 66% as compared to 2017 • De-risked ~50% of Garfield County and ~80% of Canadian County Merge acreage Operated Meramec and Osage Well Performance Above Type Curve Average Type Curve Time Period Gross Wells Lateral Length IP-301 Liquids WI IP-302 2018 44 63% 4,691 feet 750 73% 709 1 IP 30s represent the gross three-phase, peak 30-day production rate in Boe/d and are scaled to type curve lateral length of 4,800 feet 2 Represents the average gross three-phase, peak 30-day production rate in Boe/d of the STACK Meramec, Upper Osage, Lower Osage and Merge Miss type curves NYSE: CHAP 4

Year-End 2018 Proved Reserves Grew STACK year-end 2018 reserves by 50% Replaced 519% of 2018 STACK production at $7.80/Boe F&D cost 94.8 MMBoe of Reserves1 34% Oil, 61% Liquids Reserves by Area 1.9 27% 34% 53.6 74.1 20.7 39.3 39% PDP PDNP PUD OIL GAS NGL STACK OTHER YE ‘18 Proved Reserves YE ‘18 Total Proved Reserves PV-10 Reserve Net Oil Net Gas Net NGL Net % of Total SEC Strip Category (MMBo) (BCF) (MMBo) (MMBoe) Proved Pricing1 Pricing2 PDP 17.3 131.3 14.4 53.6 57% 517.1 411.4 PNP 0.7 4.1 0.5 1.9 2% 23.2 18.6 PUD 14.2 84.8 11.0 39.3 41% 154.1 79.8 Total Proved 32.3 220.2 25.8 94.8 100% 694.4 509.8 STACK 23.3 173.0 22.0 74.1 78% 519.5 376.2 OTHER 9.0 47.3 3.8 20.7 22% 174.9 133.6 Total Proved 32.3 220.2 25.8 94.8 100% 694.4 509.8 Total Proved Inc. 32.3 220.2 25.8 94.8 100% 686.4 501.8 ARO 1 At year-end 2018 SEC prices of $65.56 and $3.10 2 At February 28, 2019 NYMEX prices; five-year average prices of $56.20 and $2.80 Note: Numbers may not add due to rounding NYSE: CHAP 5

2019 Strategy PURE-PLAY • Accelerate development in Canadian County Merge STACK/MERGE • Define optimal spacing across de-risked acreage COMPANY • Continue delineation and de-risking of Garfield acreage RETURNS • Focus exclusively on maximizing stakeholder value FOCUSED • Achieve excellent returns from STACK/Merge drilling opportunities • Deliver safe, repeatable results and drive down costs TECHNICAL EXCELLENCE • Employ leading drilling and completion techniques • Improve operations, costs and returns with continuous learning STRONG, FLEXIBLE • Protect strong balance sheet to execute strategy CAPITAL • Provide sufficient liquidity through cash flow, hedging, borrowing STRUCTURE capacity, non-core asset sales and access to capital markets NYSE: CHAP 6

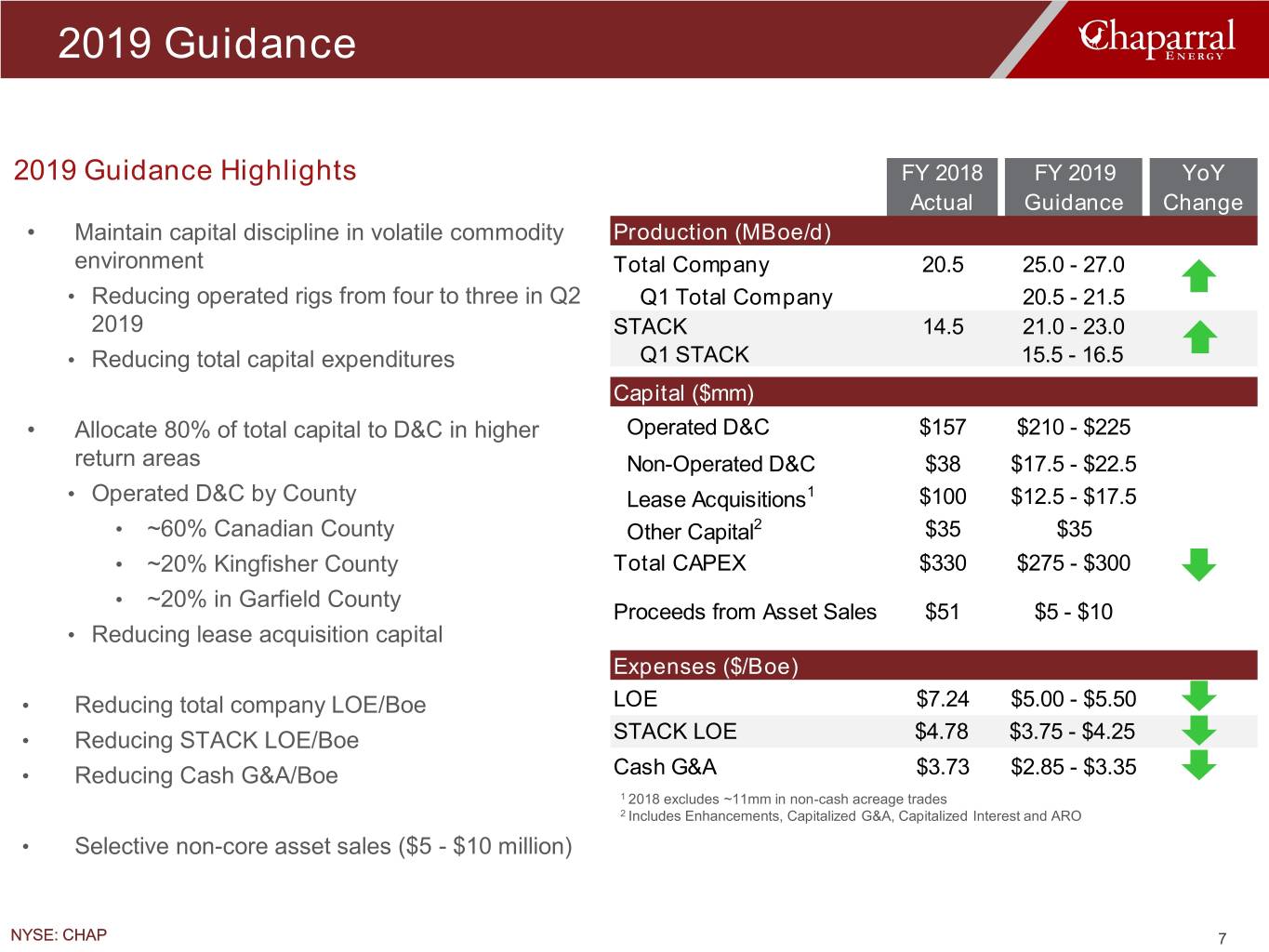

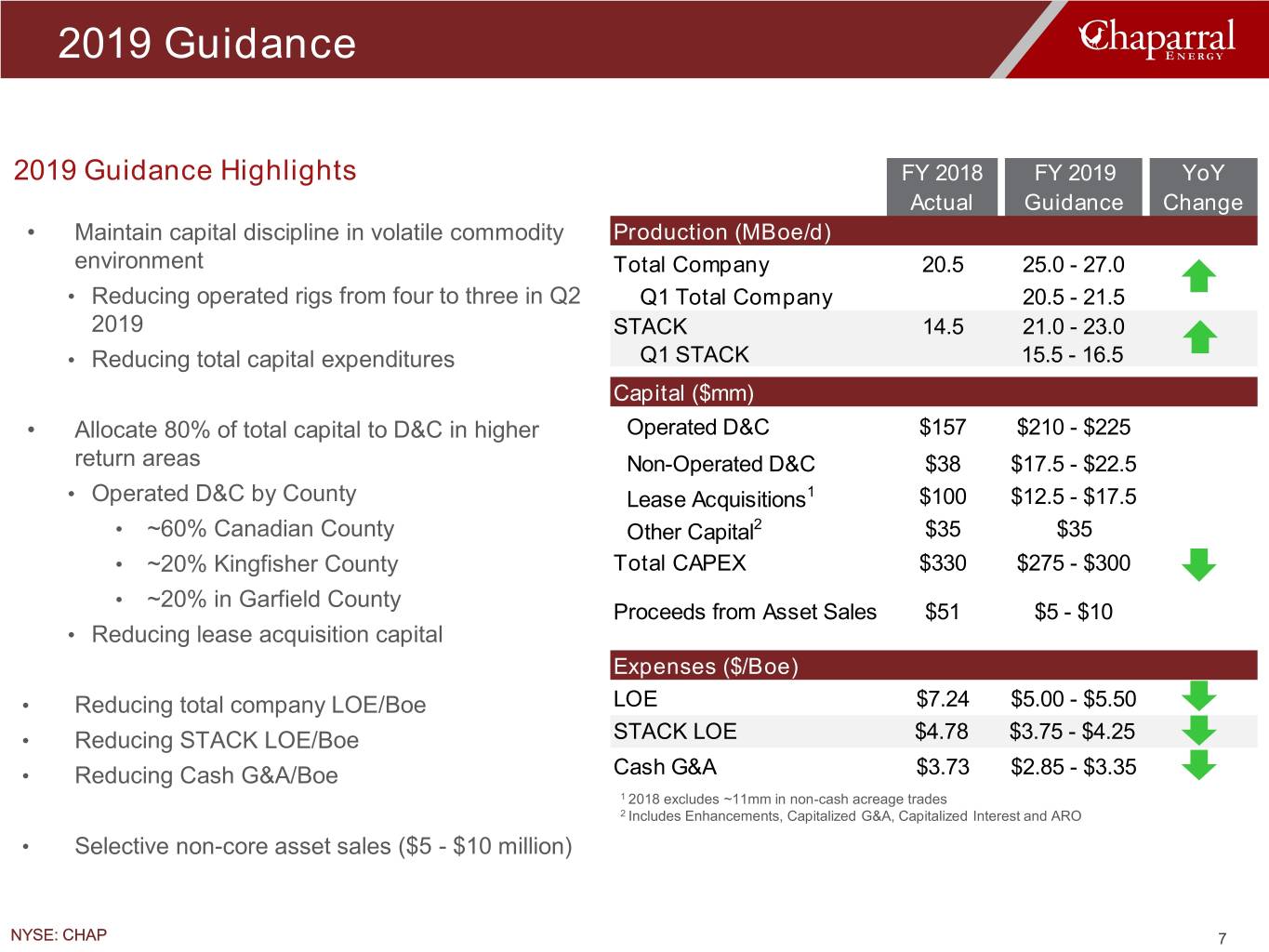

2019 Guidance 2019 Guidance Highlights FY 2018 FY 2019 YoY Actual Guidance Change • Maintain capital discipline in volatile commodity Production (MBoe/d) environment Total Company 20.5 25.0 - 27.0 • Reducing operated rigs from four to three in Q2 Q1 Total Company 20.5 - 21.5 2019 STACK 14.5 21.0 - 23.0 • Reducing total capital expenditures Q1 STACK 15.5 - 16.5 Capital ($mm) • Allocate 80% of total capital to D&C in higher Operated D&C $157 $210 - $225 return areas Non-Operated D&C $38 $17.5 - $22.5 • Operated D&C by County Lease Acquisitions1 $100 $12.5 - $17.5 • ~60% Canadian County Other Capital2 $35 $35 • ~20% Kingfisher County Total CAPEX $330 $275 - $300 • ~20% in Garfield County Proceeds from Asset Sales $51 $5 - $10 • Reducing lease acquisition capital Expenses ($/Boe) • Reducing total company LOE/Boe LOE $7.24 $5.00 - $5.50 • Reducing STACK LOE/Boe STACK LOE $4.78 $3.75 - $4.25 • Reducing Cash G&A/Boe Cash G&A $3.73 $2.85 - $3.35 1 2018 excludes ~11mm in non-cash acreage trades 2 Includes Enhancements, Capitalized G&A, Capitalized Interest and ARO • Selective non-core asset sales ($5 - $10 million) NYSE: CHAP 7

Operational Overview NYSE: CHAP 8

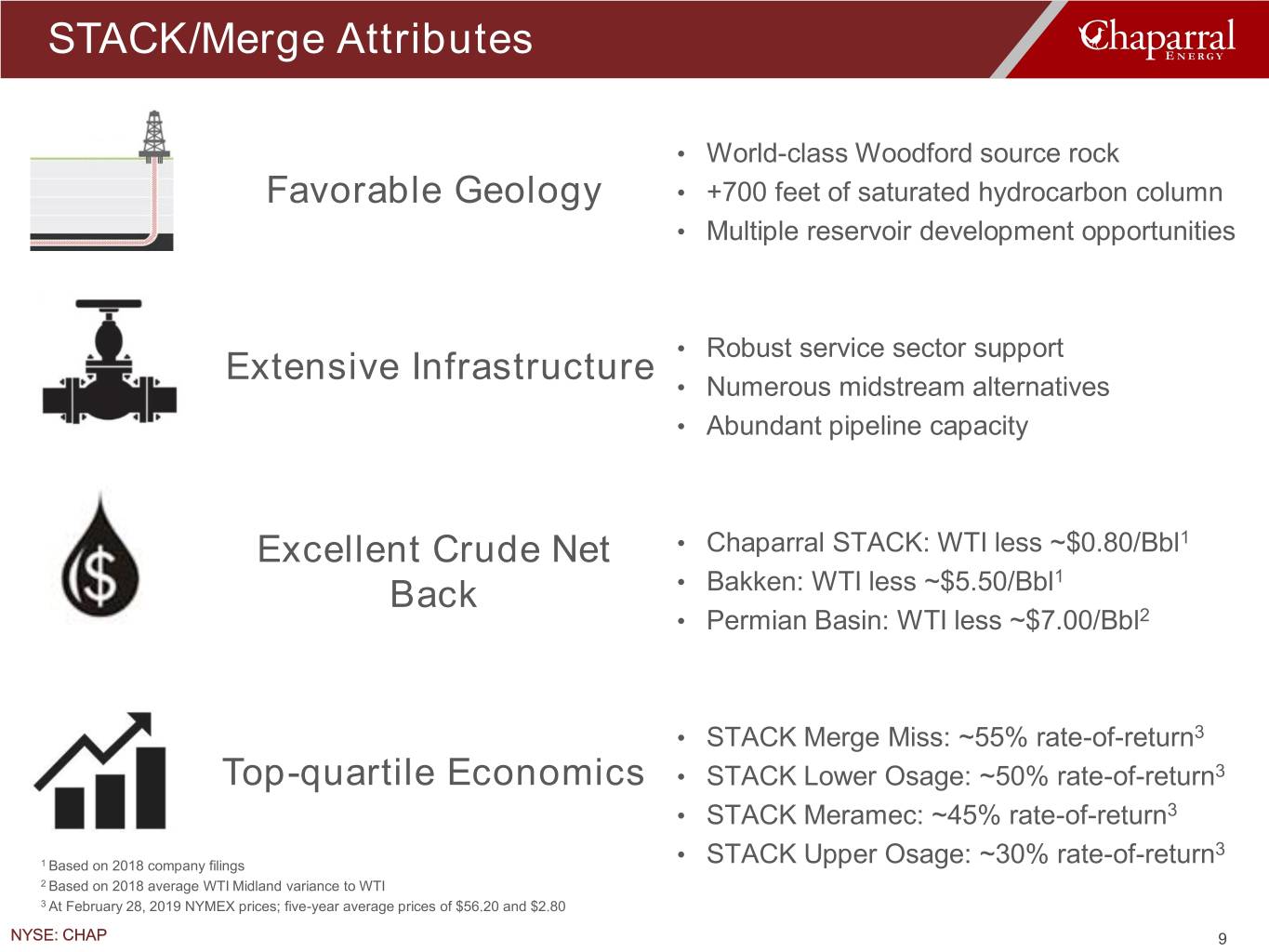

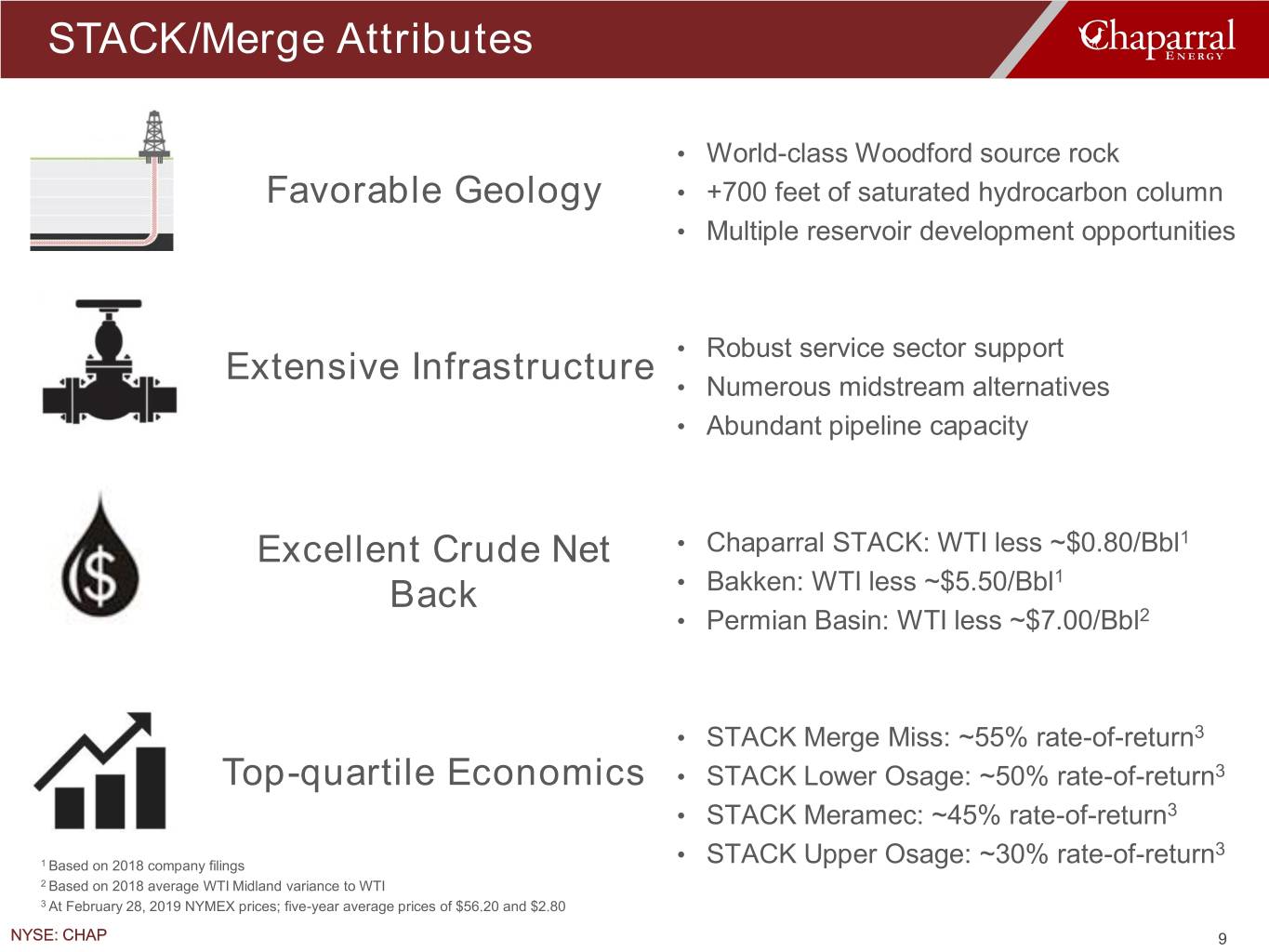

STACK/Merge Attributes • World-class Woodford source rock Favorable Geology • +700 feet of saturated hydrocarbon column • Multiple reservoir development opportunities • Robust service sector support Extensive Infrastructure • Numerous midstream alternatives • Abundant pipeline capacity Excellent Crude Net • Chaparral STACK: WTI less ~$0.80/Bbl1 1 Back • Bakken: WTI less ~$5.50/Bbl • Permian Basin: WTI less ~$7.00/Bbl2 • STACK Merge Miss: ~55% rate-of-return3 Top-quartile Economics • STACK Lower Osage: ~50% rate-of-return3 • STACK Meramec: ~45% rate-of-return3 3 1 Based on 2018 company filings • STACK Upper Osage: ~30% rate-of-return 2 Based on 2018 average WTI Midland variance to WTI • 3 At February 28, 2019 NYMEX prices; five-year average prices of $56.20 and $2.80 NYSE: CHAP 9

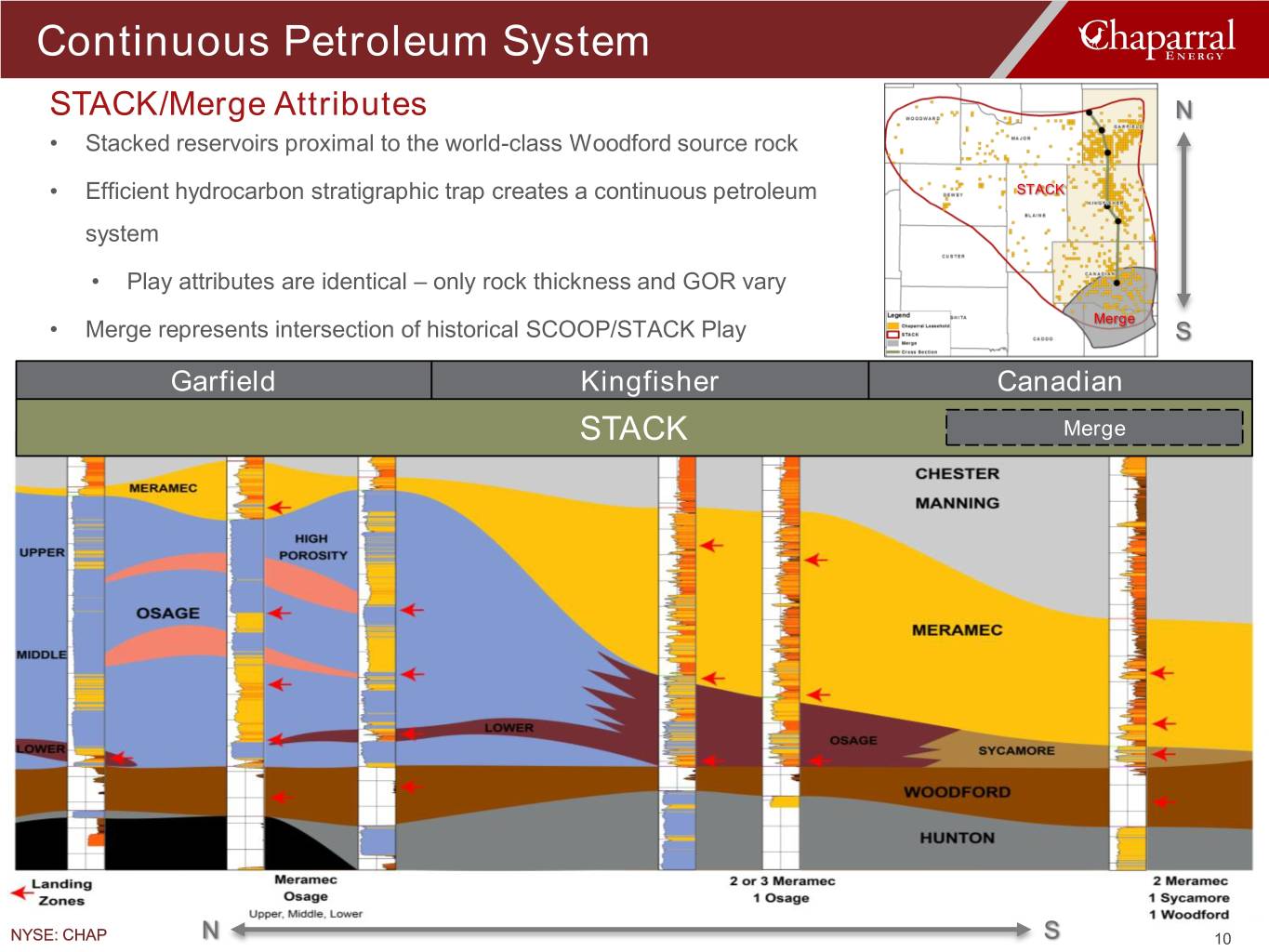

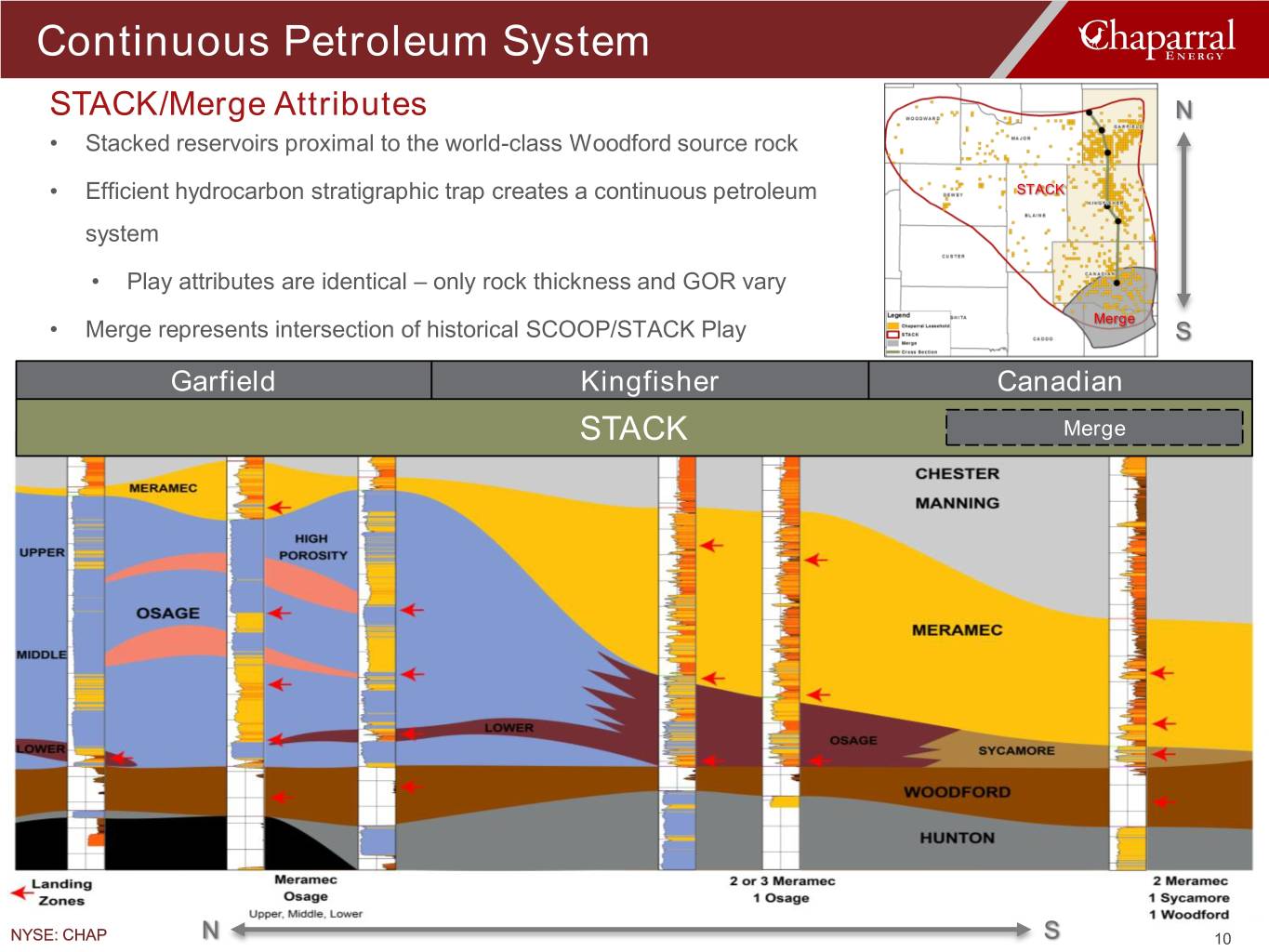

Continuous Petroleum System STACK/Merge Attributes N • Stacked reservoirs proximal to the world-class Woodford source rock • Efficient hydrocarbon stratigraphic trap creates a continuous petroleum STACK system • Play attributes are identical – only rock thickness and GOR vary Merge • Merge represents intersection of historical SCOOP/STACK Play S outlines Garfield Kingfisher Canadian STACK Merge NYSE: CHAP N S 10

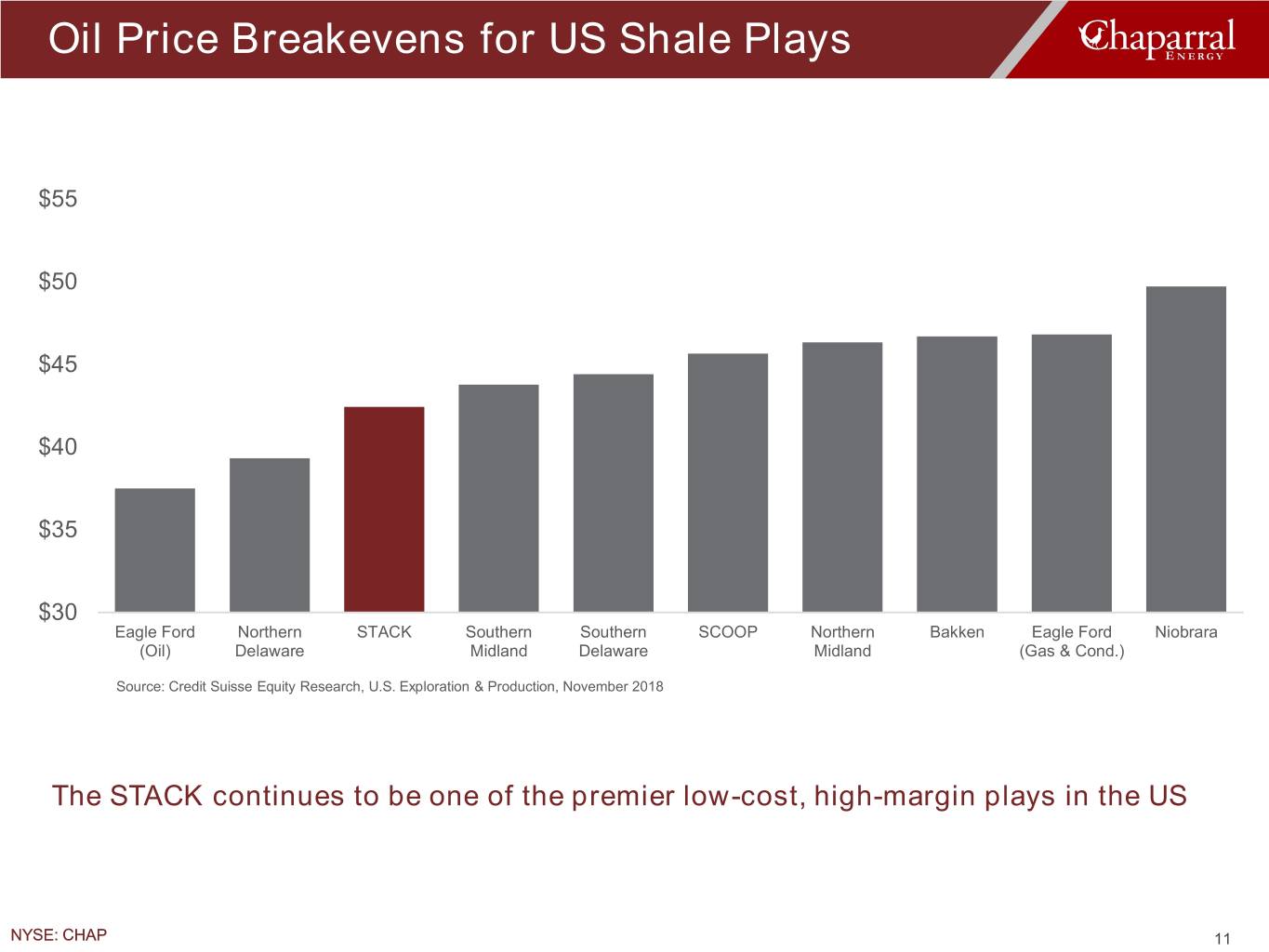

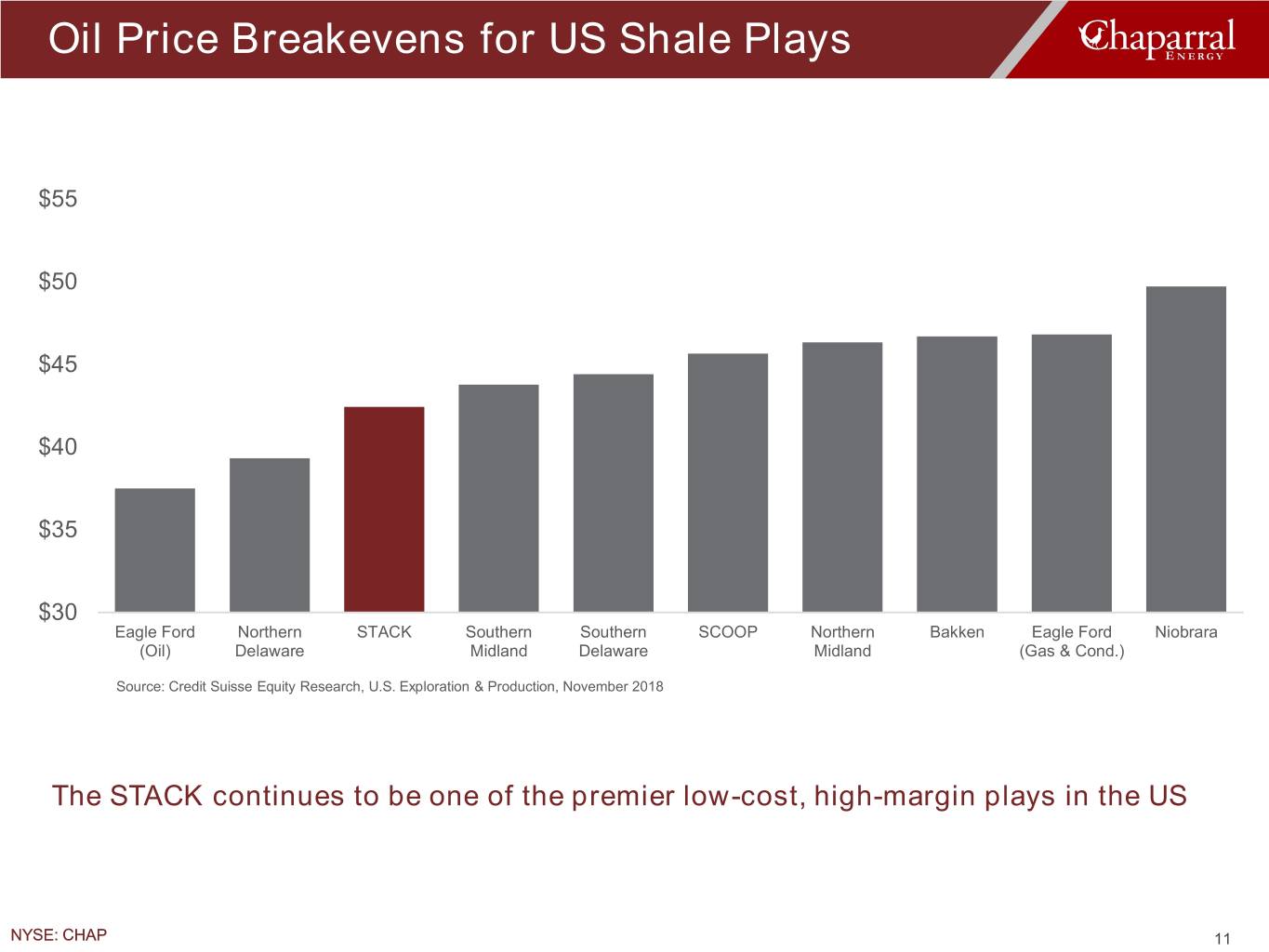

Oil Price Breakevens for US Shale Plays $55 $50 $45 $40 $35 $30 Eagle Ford Northern STACK Southern Southern SCOOP Northern Bakken Eagle Ford Niobrara (Oil) Delaware Midland Delaware Midland (Gas & Cond.) Source: Credit Suisse Equity Research, U.S. Exploration & Production, November 2018 The STACK continues to be one of the premier low-cost, high-margin plays in the US NYSE: CHAP 11

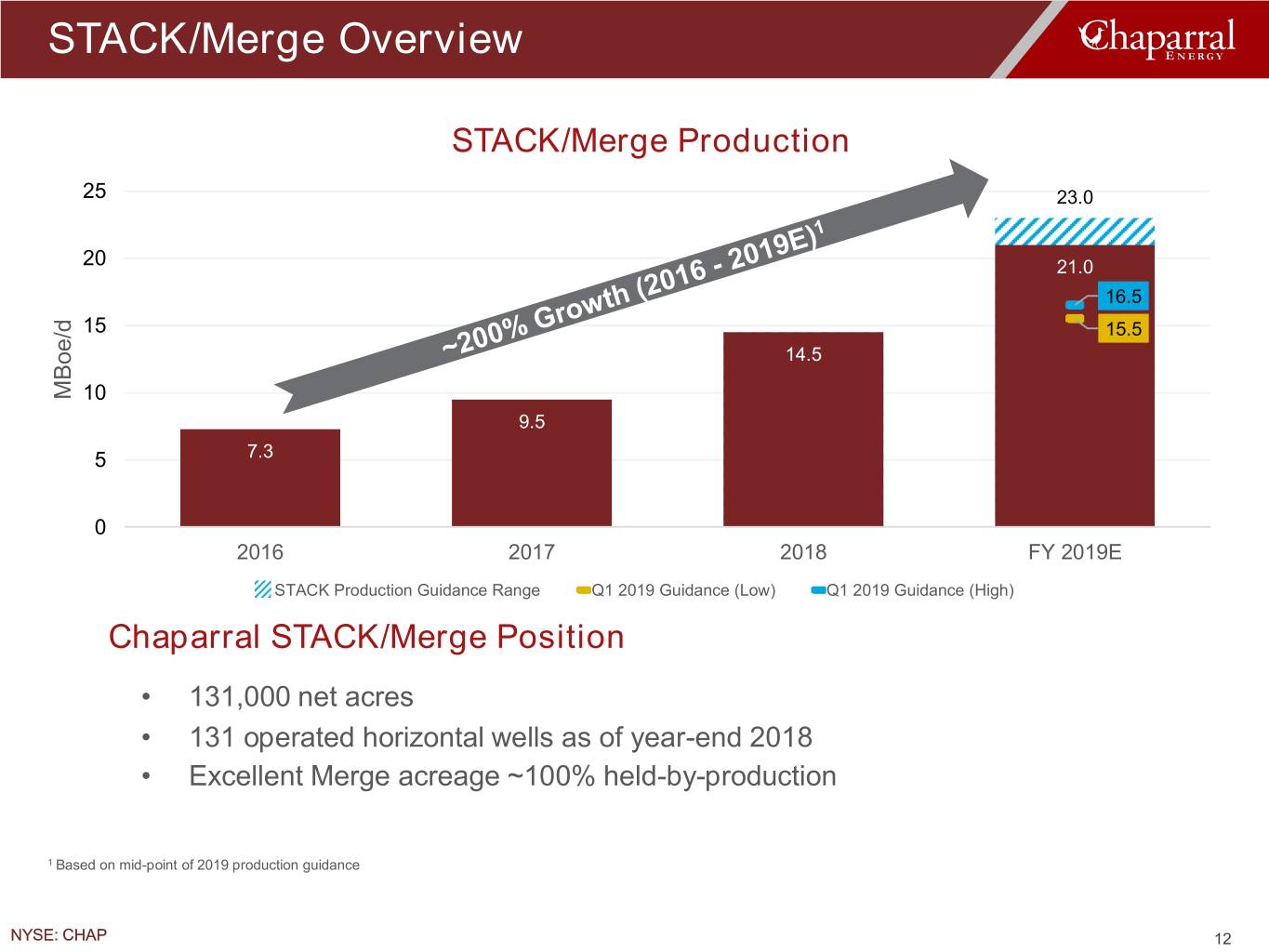

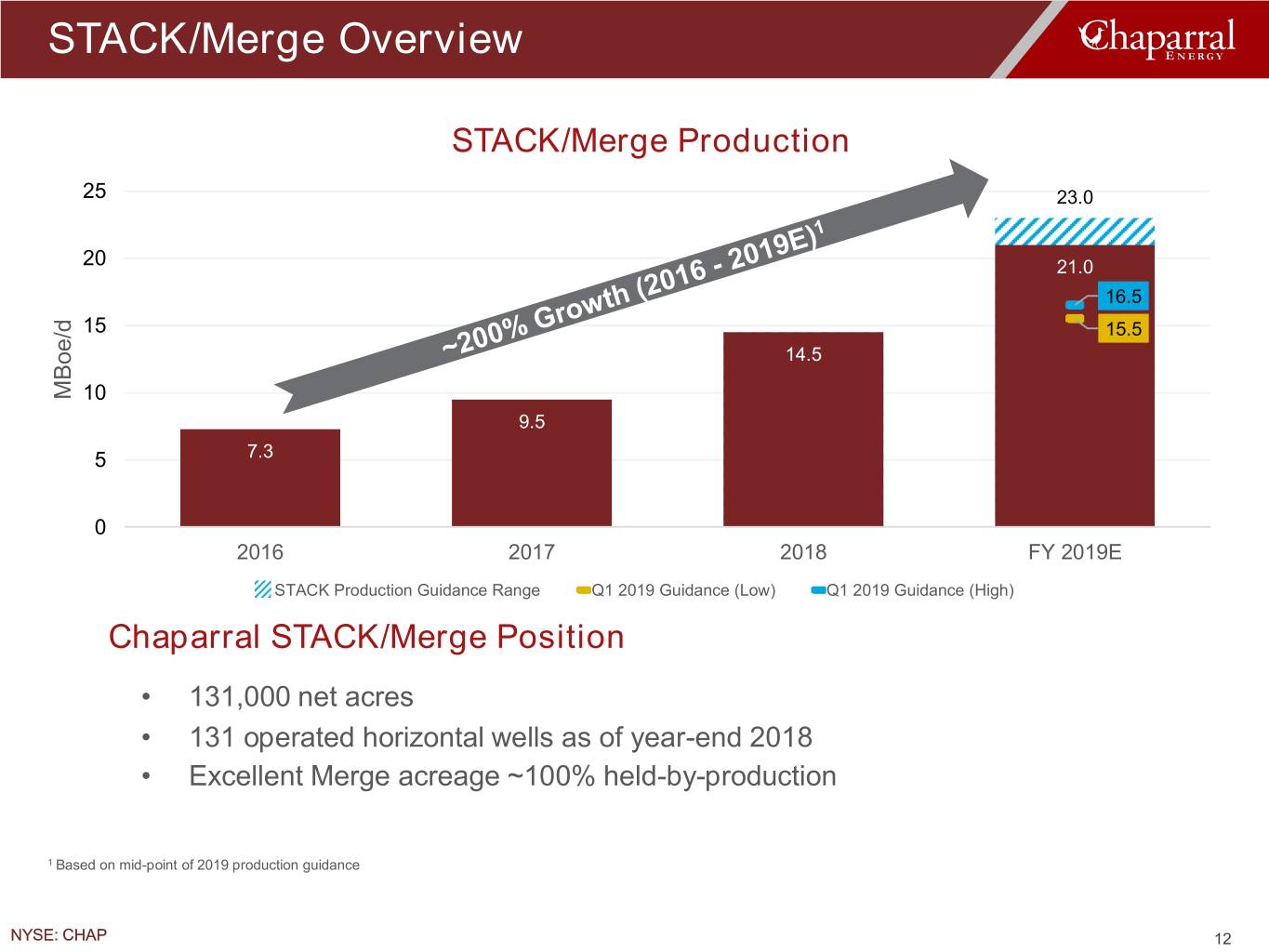

STACK/Merge Overview STACK/Merge Production 25 23.0 20 21.0 16.5 15 15.5 14.5 MBoe/d 10 9.5 5 7.3 0 2016 2017 2018 FY 2019E STACK Production Guidance Range Q1 2019 Guidance (Low) Q1 2019 Guidance (High) Chaparral STACK/Merge Position • 131,000 net acres • 131 operated horizontal wells as of year-end 2018 • Excellent Merge acreage ~100% held-by-production 1 Based on mid-point of 2019 production guidance NYSE: CHAP 12

Operational Excellence – Drilling and Completions Strong, Effective Focus on Cost Control • Chaparral Osage and Meramec D&C represents top tier in normal pressure STACK • Low well cost and consistent production results produce excellent returns D&C Cost Comparison ($/lateral foot) $1,400 $1,200 $1,000 D&C ($/lateral foot) avg. $800 $600 $400 $200 $- Peer 1 CHAP Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Source: Company presentations Note 1: CHAP includes average for Osage and Meramec and assumes multi-well pad development Note 2: Peers include AMR, CLR, DVN, JONE, MRO, and XEC NYSE: CHAP 13

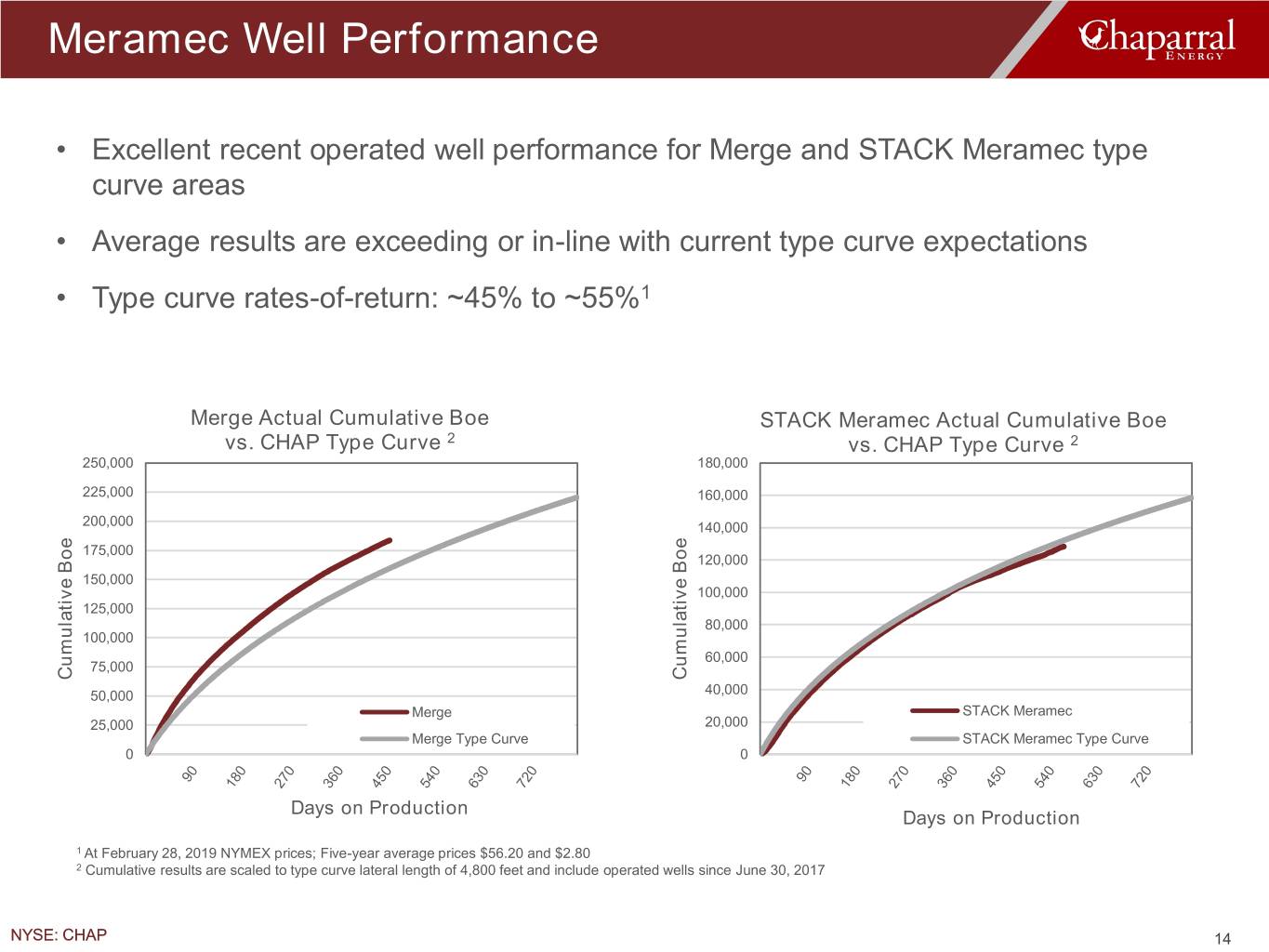

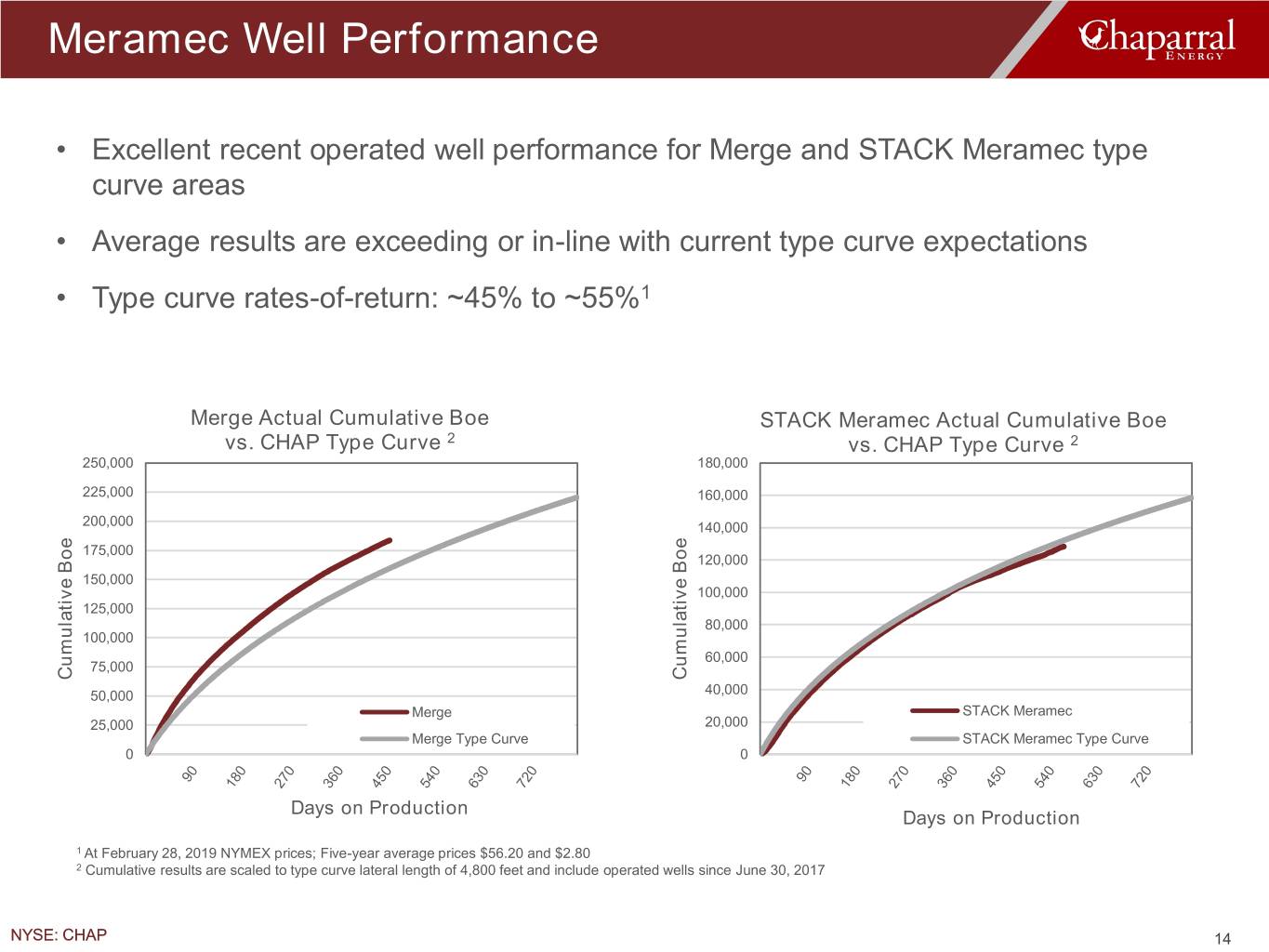

Meramec Well Performance • Excellent recent operated well performance for Merge and STACK Meramec type curve areas • Average results are exceeding or in-line with current type curve expectations • Type curve rates-of-return: ~45% to ~55%1 Merge Actual Cumulative Boe STACK Meramec Actual Cumulative Boe vs. CHAP Type Curve 2 vs. CHAP Type Curve 2 250,000 180,000 225,000 160,000 200,000 140,000 175,000 120,000 Boe 150,000 Boe 100,000 125,000 80,000 100,000 60,000 75,000 Cumulative Cumulative Cumulative Cumulative 50,000 40,000 Merge STACK Meramec 25,000 20,000 Merge Type Curve STACK Meramec Type Curve 0 0 Days on Production Days on Production 1 At February 28, 2019 NYMEX prices; Five-year average prices $56.20 and $2.80 2 Cumulative results are scaled to type curve lateral length of 4,800 feet and include operated wells since June 30, 2017 NYSE: CHAP 14

Osage Well Performance • Strong recent operated well performance for Upper and Lower Osage type curve areas • Average results are exceeding or in-line with current type curve expectations • Type curve rates-of-return: ~30% to ~50%1 Upper Osage Actual Cumulative Boe Lower Osage Actual Cumulative Boe vs. CHAP Type Curve 2 vs. CHAP Type Curve 2 225,000 180,000 200,000 160,000 175,000 140,000 150,000 120,000 Boe Boe 125,000 100,000 100,000 80,000 75,000 60,000 Cumulative Cumulative Cumulative Cumulative 50,000 40,000 Upper Osage 25,000 20,000 Lower Osage Upper Osage Type Curve Lower Osage Type Curve 0 0 Days on Production Days on Production 1 At February 28, 2019 NYMEX prices; five-year average prices of $56.20 and $2.80 2 Cumulative results are scaled to type curve lateral length of 4,800 feet and include operated wells since June 30, 2017 NYSE: CHAP 15

Strong Culture of Continuous Learning • Science and technology driven collaborative approach • Process of continuous improvement drives results Science Learnings Technology Results Execution Key Spacing Principals • Development design strives for balance of maximum ROR and NPV • Targeting/well density • Earth model derived from 3D seismic • Frac design for enhanced near wellbore SRV • Manage parent well communication risk • Frac efficiency diagnostics for continuous learning NYSE: CHAP 16

Systematic Approach to Spacing Development Canadian Kingfisher Denali King Koopa • Meramec partial spacing test • Meramec/Osage partial spacing test • Minimal inter-well communication • Minimal inter-well communication • Parent at pre-infill rates Foraker • Nearest child frac impacted • Meramec full section development • Woodford partial spacing test Jester • Build on Denali results • Meramec/Osage partial spacing test • Incorporated King Koopa learnings Kingfisher Non-Operated Hennessey Unit • 15 spacing tests • Meramec/Osage partial spacing test • Learn from others • Minimal capital exposure Optimized Development Plan Initial Indications Six to Eight Meramec/Osage Wells per Section NYSE: CHAP 17

Financial Overview NYSE: CHAP 18

Financial Strategy • Maintain balance sheet strength • Target net debt to adjusted EBITDA ratio of approximately 2.5x or less • Supplement cash flow with proceeds from non-core asset sales • Development plan funding available due to ample liquidity • $37 million in cash as of Q4-2018 plus undrawn revolver ($325mm borrowing base) • Significant capital spend flexibility with no long-term commitments • Allocate capital based on strategic and rate-of-return priorities • Allocate capital to high-return STACK/Merge assets • Held-by-production acreage and delineation of Canadian and Garfield counties • Manage commodity price risk through hedging program • Program includes crude oil and natural gas, as well as gas basis, NGLs and crude oil roll contracts NYSE: CHAP 19

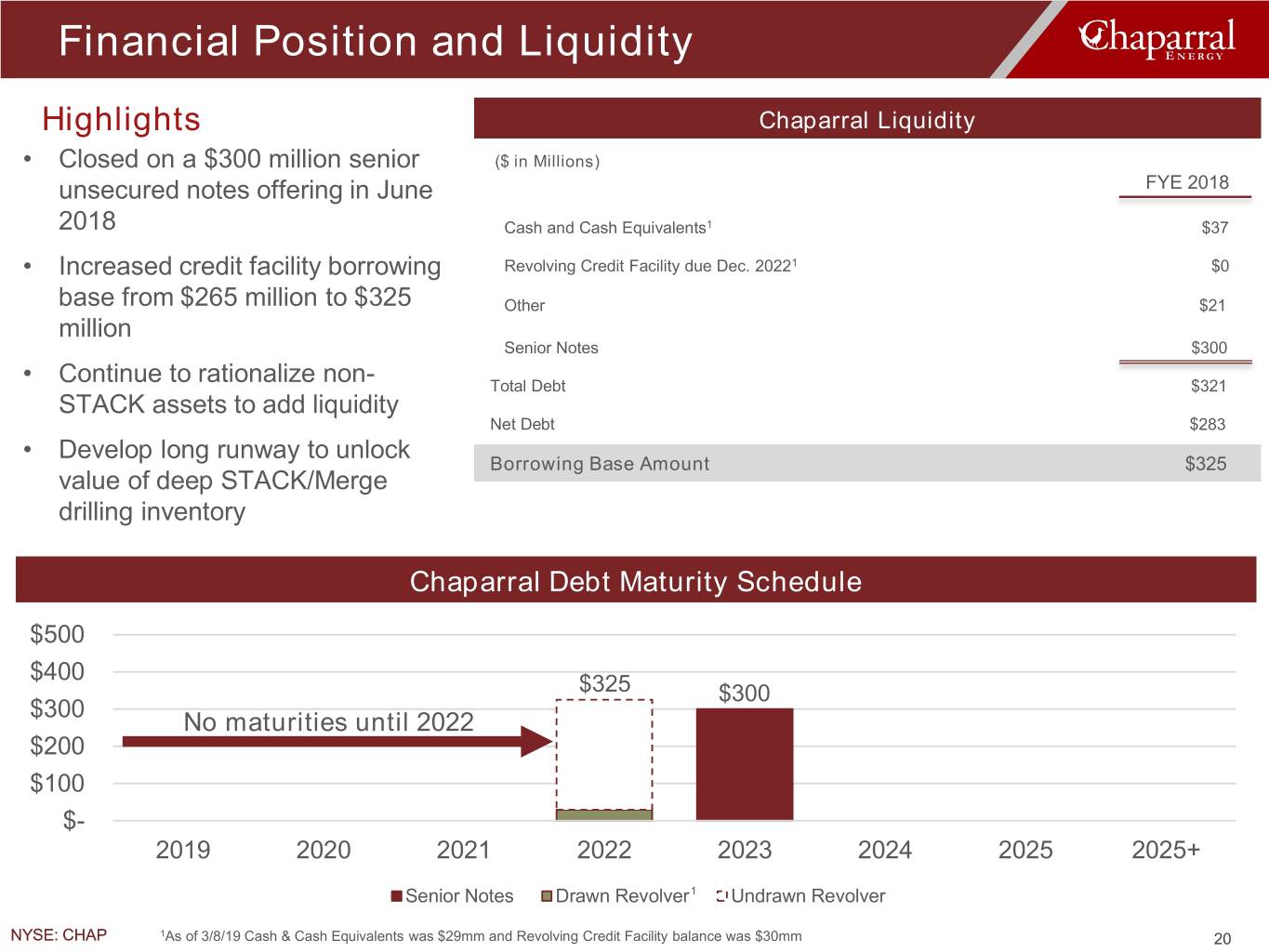

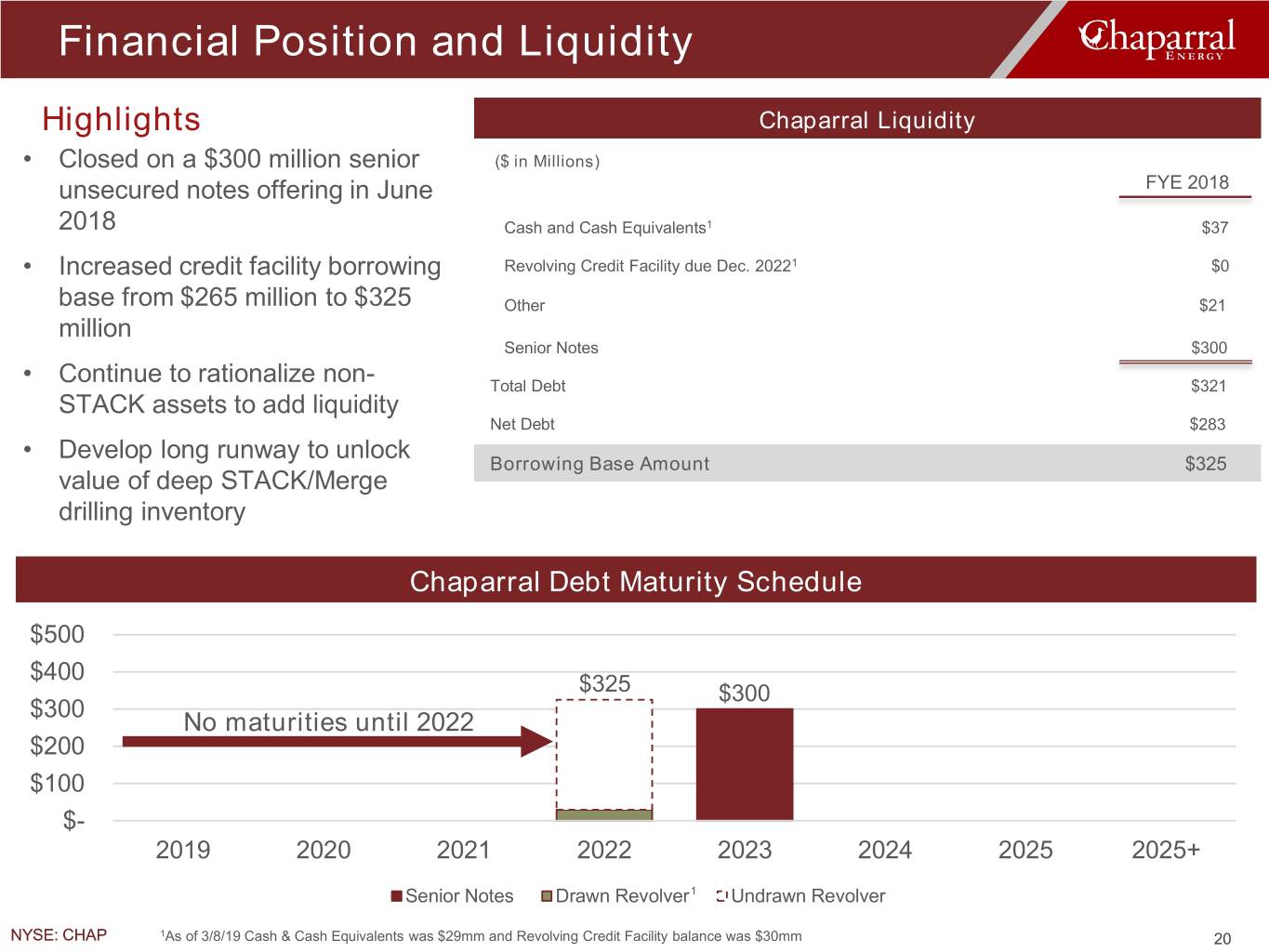

Financial Position and Liquidity Highlights Chaparral Liquidity • Closed on a $300 million senior ($ in Millions) unsecured notes offering in June Actual FYE 2018 2018 Cash and Cash Equivalents1 $37 • Increased credit facility borrowing Revolving Credit Facility due Dec. 20221 $0 base from $265 million to $325 Other $21 million Senior Notes $300 • Continue to rationalize non- Total Debt $321 STACK assets to add liquidity Net Debt $283 • Develop long runway to unlock Borrowing Base Amount $325 value of deep STACK/Merge drilling inventory Chaparral Debt Maturity Schedule $500 $400 $325 $300 $300 No maturities until 2022 $200 $100 $- 2019 2020 2021 2022 2023 2024 2025 2025+ Senior Notes Drawn Revolver1 Undrawn Revolver NYSE: CHAP 1As of 3/8/19 Cash & Cash Equivalents was $29mm and Revolving Credit Facility balance was $30mm 20

Why Chaparral? Strong Balance Sheet Experienced Execution-focused, Management with Pure-play STACK Excellent Track Operations Record Deep Inventory of High-return Drilling Prospects NYSE: CHAP 21

Appendix NYSE: CHAP 22

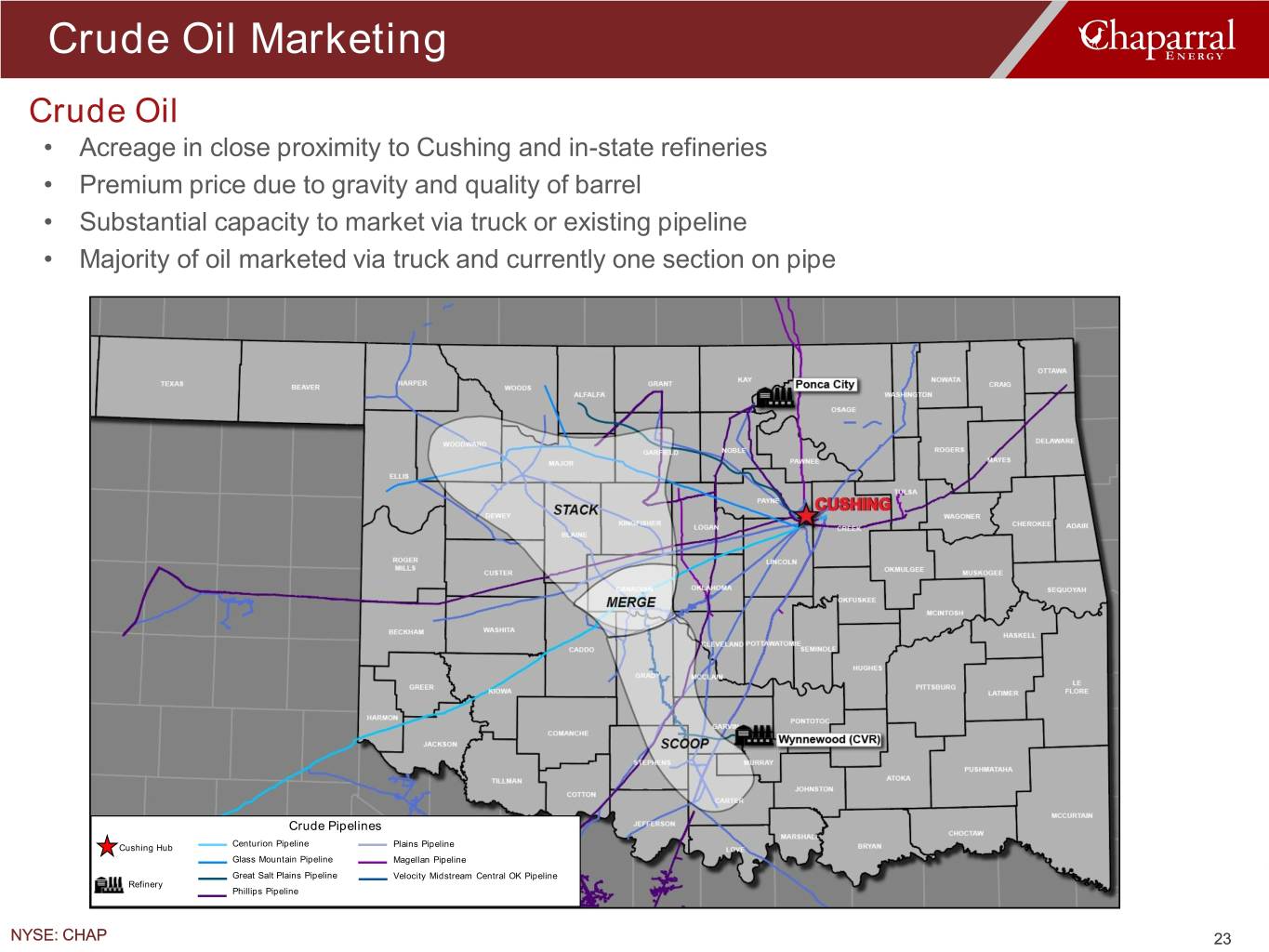

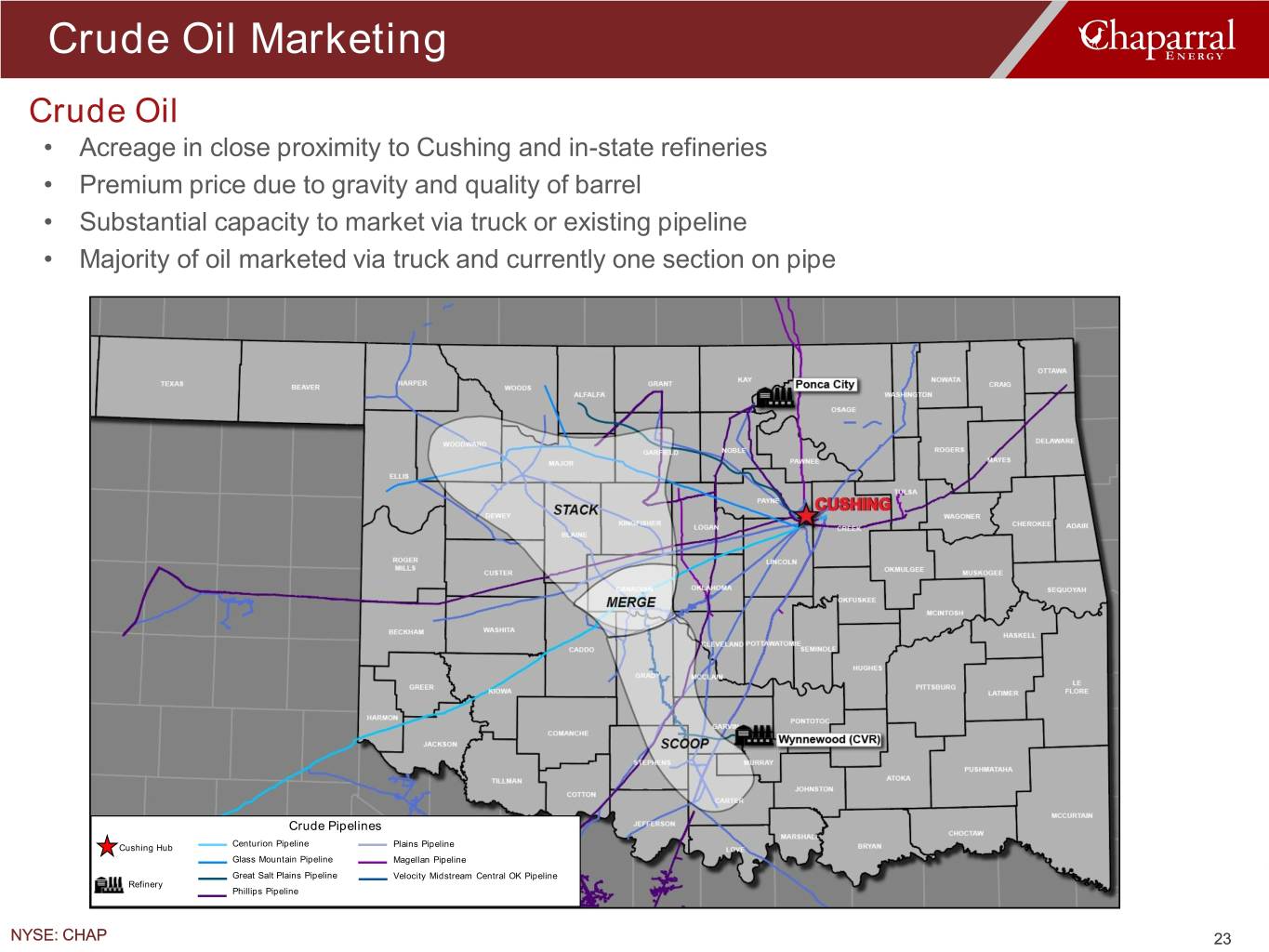

Crude Oil Marketing Crude Oil • Acreage in close proximity to Cushing and in-state refineries • Premium price due to gravity and quality of barrel • Substantial capacity to market via truck or existing pipeline • Majority of oil marketed via truck and currently one section on pipe Crude Pipelines Cushing Hub Centurion Pipeline Plains Pipeline Glass Mountain Pipeline Magellan Pipeline Great Salt Plains Pipeline Velocity Midstream Central OK Pipeline Refinery Phillips Pipeline NYSE: CHAP 23

Natural Gas & NGL Marketing Natural Gas and NGL • Midstream super system, with multiple plants and residue outlets • Residue and NGL agreements with midstream operators who have firm transportation • Approximately 50/50 NGL markets and pricing split between Conway and Mt. Belvieu • Incremental capacity of 1.4 Bcf/d to Gulf Coast markets expected in Q4 2019 (Midship) NYSE: CHAP 24

Commodity Realizations Crude Oil Differentials Oil & NGL Realizations as % of WTI 99% 93% 96% • Proximity to numerous markets provides better CHAP $80 100% net back as compared to other basins $70 90% 80% • STACK crude oil quality meets Oklahoma refineries $60 70% specification $50 60% • New trucking terminals and pipeline infrastructure $40 50% have reduced transportation costs, providing better net $30 40% 44% back at the wellhead 37% 30% $20 35% as Realizations % 20% WTI Average Daily Settle Daily Average WTI $10 10% NGL Differentials $0 0% 2016 2017 2018 • Increased pipeline capacity to the Gulf Coast to new WTI NGL % Oil % markets • Increased Gulf Coast demand, with new petrochemical crackers coming online Natural Gas Realizations as % of HH • Access to Mont Belvieu and increased NGL export $4.00 100% 85% 87% capacity provided increased pricing to STACK $3.50 77% 90% 80% $3.00 70% Natural Gas Differentials $2.50 60% $2.00 50% • Increased supply from STACK/SCOOP and other $1.50 40% basins competing for pipeline capacity has caused 30% $1.00 Mid-Continent to widen 20% as Realizations % $0.50 • New pipeline capacity out of STACK/SCOOP to south Settle Daily Average HH 10% $0.00 0% and Gulf Coast will provide price strength for the basin 2016 2017 2018 Henry Hub Gas % NYSE: CHAP 25

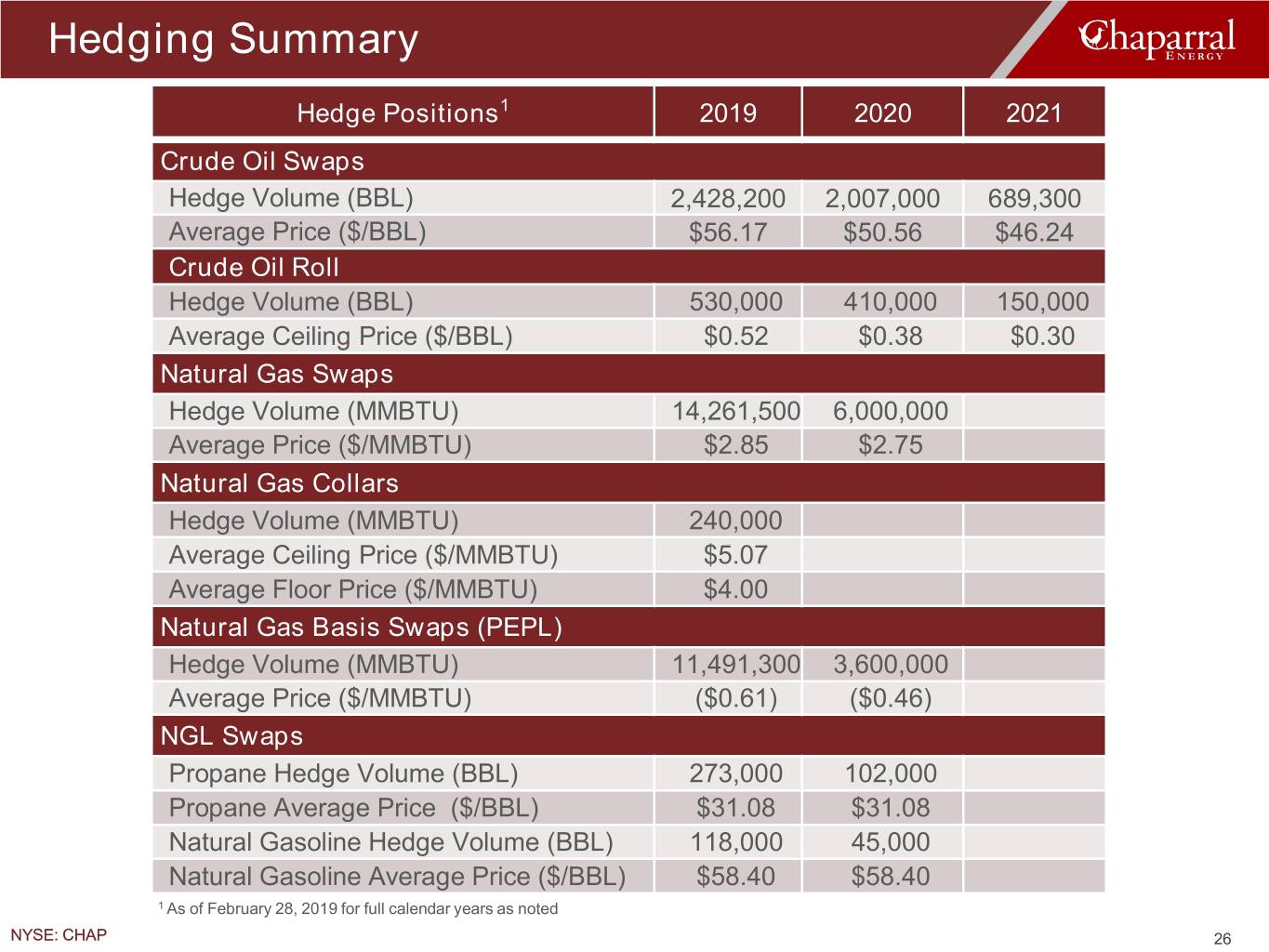

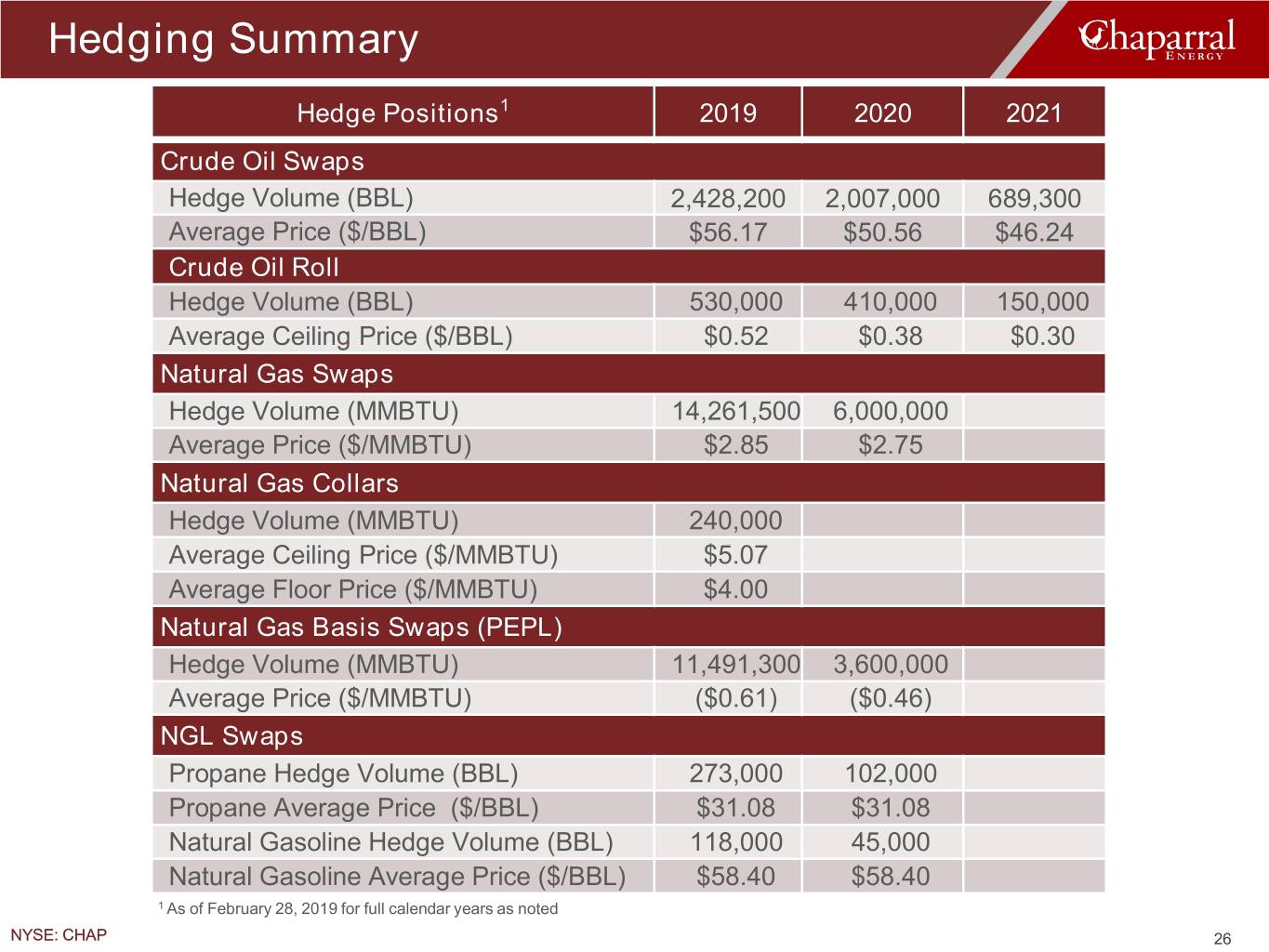

Hedging Summary Hedge Positions1 2019 2020 2021 Crude Oil Swaps Hedge Volume (BBL) 2,428,200 2,007,000 689,300 Average Price ($/BBL) $56.17 $50.56 $46.24 Crude Oil Roll Hedge Volume (BBL) 530,000 410,000 150,000 Average Ceiling Price ($/BBL) $0.52 $0.38 $0.30 Natural Gas Swaps Hedge Volume (MMBTU) 14,261,500 6,000,000 Average Price ($/MMBTU) $2.85 $2.75 Natural Gas Collars Hedge Volume (MMBTU) 240,000 Average Ceiling Price ($/MMBTU) $5.07 Average Floor Price ($/MMBTU) $4.00 Natural Gas Basis Swaps (PEPL) Hedge Volume (MMBTU) 11,491,300 3,600,000 Average Price ($/MMBTU) ($0.61) ($0.46) NGL Swaps Propane Hedge Volume (BBL) 273,000 102,000 Propane Average Price ($/BBL) $31.08 $31.08 Natural Gasoline Hedge Volume (BBL) 118,000 45,000 Natural Gasoline Average Price ($/BBL) $58.40 $58.40 1 As of February 28, 2019 for full calendar years as noted NYSE: CHAP 26

Core STACK & Merge Type Curve Overview STACK Osage, Meramec & Merge Miss North South Lower Upper Meramec Merge Woodford Woodford Osage Osage Lateral Length (ft.) 4,800 4,800 4,800 4,800 4,800 4,800 Well Cost ($mm) $4.0 $4.5 $4.4 $4.4 $3.9 $4.1 Well Cost ($/ft.) $833 $938 $917 $917 $813 $854 Total EUR (MBoe) 584 1,023 579 1,456 629 853 % Liquids 70% 66% 72% 62% 70% 54% IP-30 612 881 475 736 599 744 Single Well Economics STACK Woodford 70% 60% 50% 40% 30% IRR IRR % 20% 10% 0% Meramec Merge North South Lower Upper Woodford Woodford Osage Osage $50.00/$2.75 $55.00/$3.00 $60.00/$3.25 2/28 NYMEX NYSE: CHAP 27

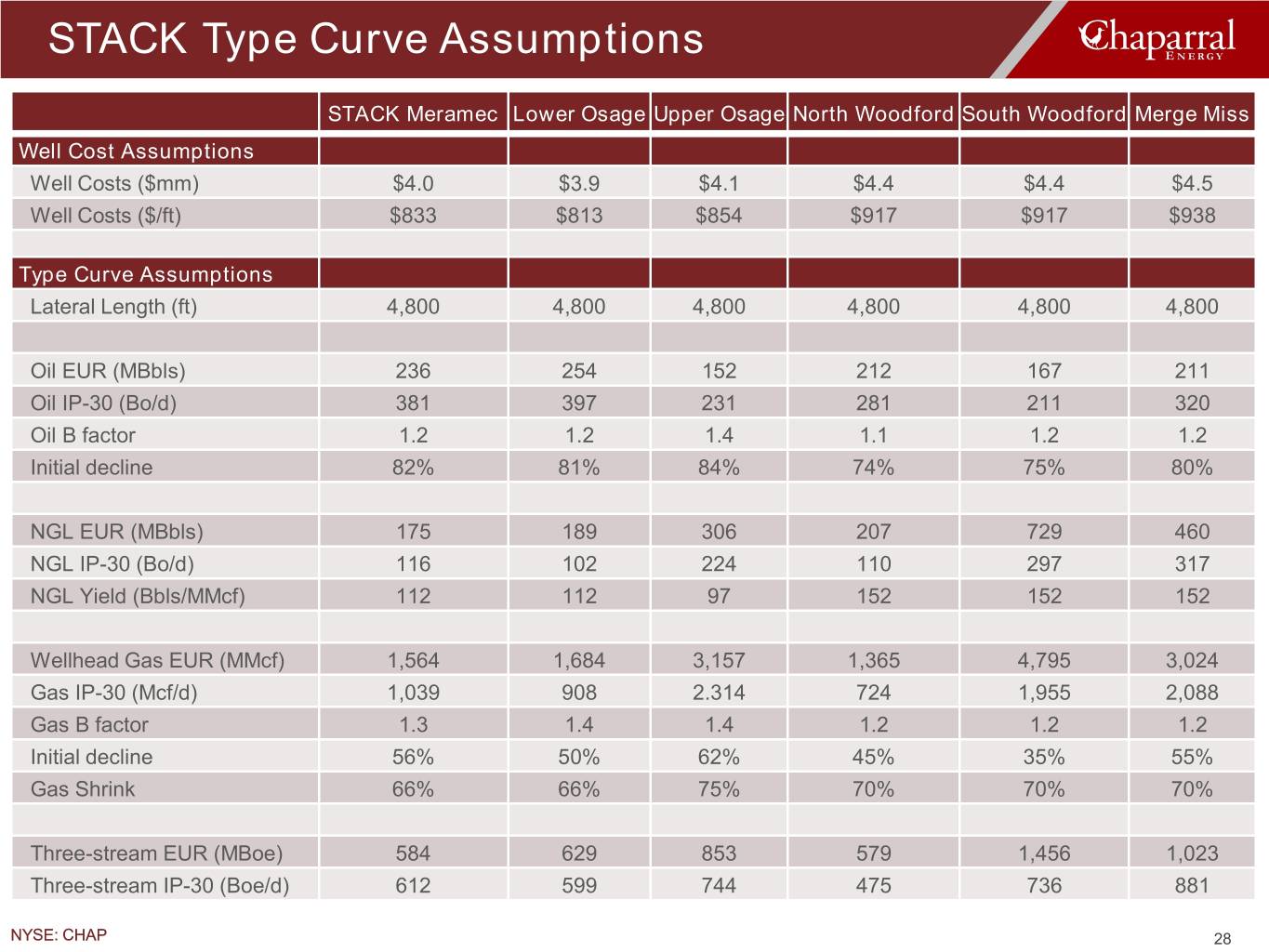

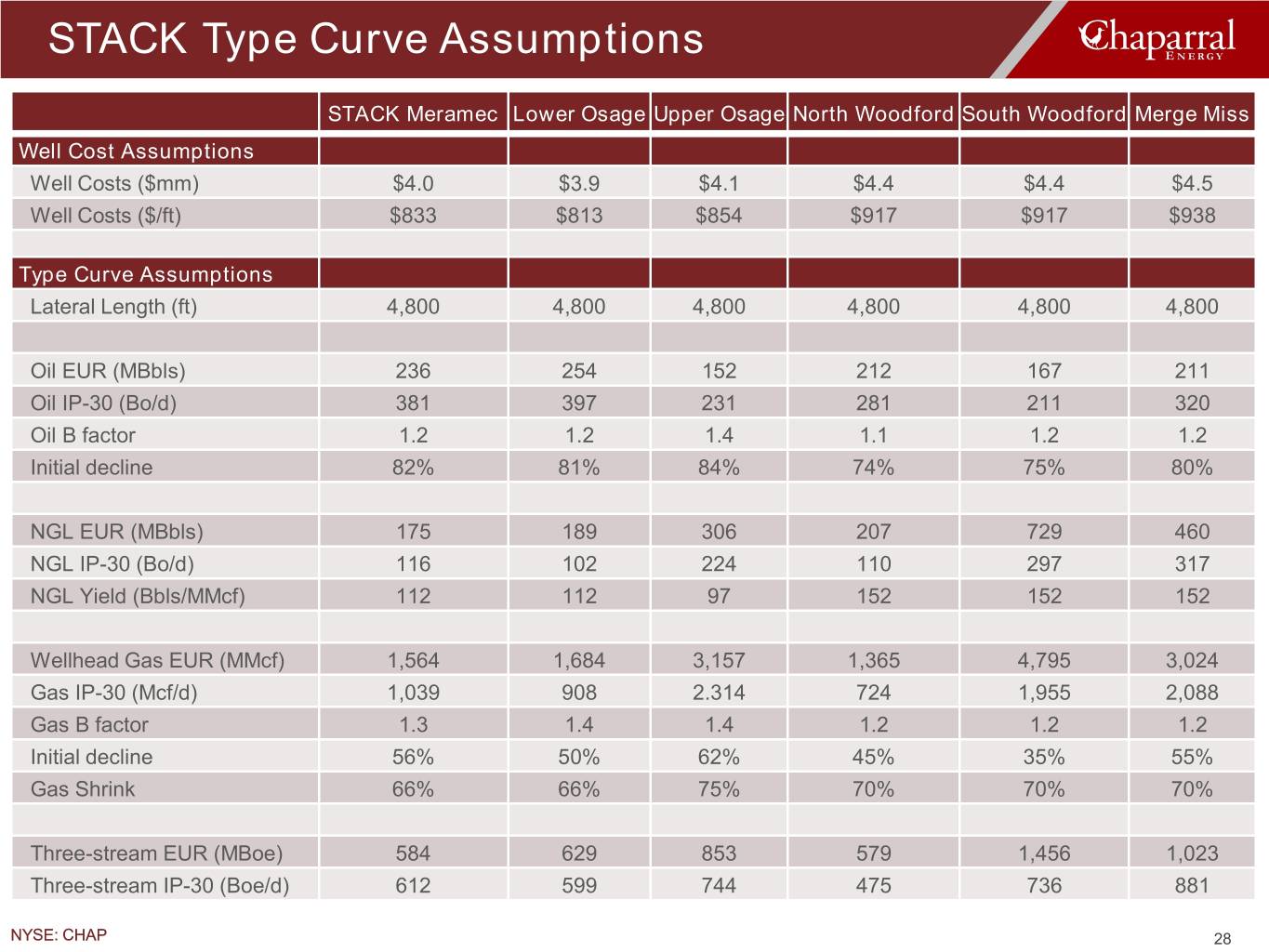

STACK Type Curve Assumptions STACK Meramec Lower Osage Upper Osage North Woodford South Woodford Merge Miss Well Cost Assumptions Well Costs ($mm) $4.0 $3.9 $4.1 $4.4 $4.4 $4.5 Well Costs ($/ft) $833 $813 $854 $917 $917 $938 Type Curve Assumptions Lateral Length (ft) 4,800 4,800 4,800 4,800 4,800 4,800 Oil EUR (MBbls) 236 254 152 212 167 211 Oil IP-30 (Bo/d) 381 397 231 281 211 320 Oil B factor 1.2 1.2 1.4 1.1 1.2 1.2 Initial decline 82% 81% 84% 74% 75% 80% NGL EUR (MBbls) 175 189 306 207 729 460 NGL IP-30 (Bo/d) 116 102 224 110 297 317 NGL Yield (Bbls/MMcf) 112 112 97 152 152 152 Wellhead Gas EUR (MMcf) 1,564 1,684 3,157 1,365 4,795 3,024 Gas IP-30 (Mcf/d) 1,039 908 2.314 724 1,955 2,088 Gas B factor 1.3 1.4 1.4 1.2 1.2 1.2 Initial decline 56% 50% 62% 45% 35% 55% Gas Shrink 66% 66% 75% 70% 70% 70% Three-stream EUR (MBoe) 584 629 853 579 1,456 1,023 Three-stream IP-30 (Boe/d) 612 599 744 475 736 881 NYSE: CHAP 28

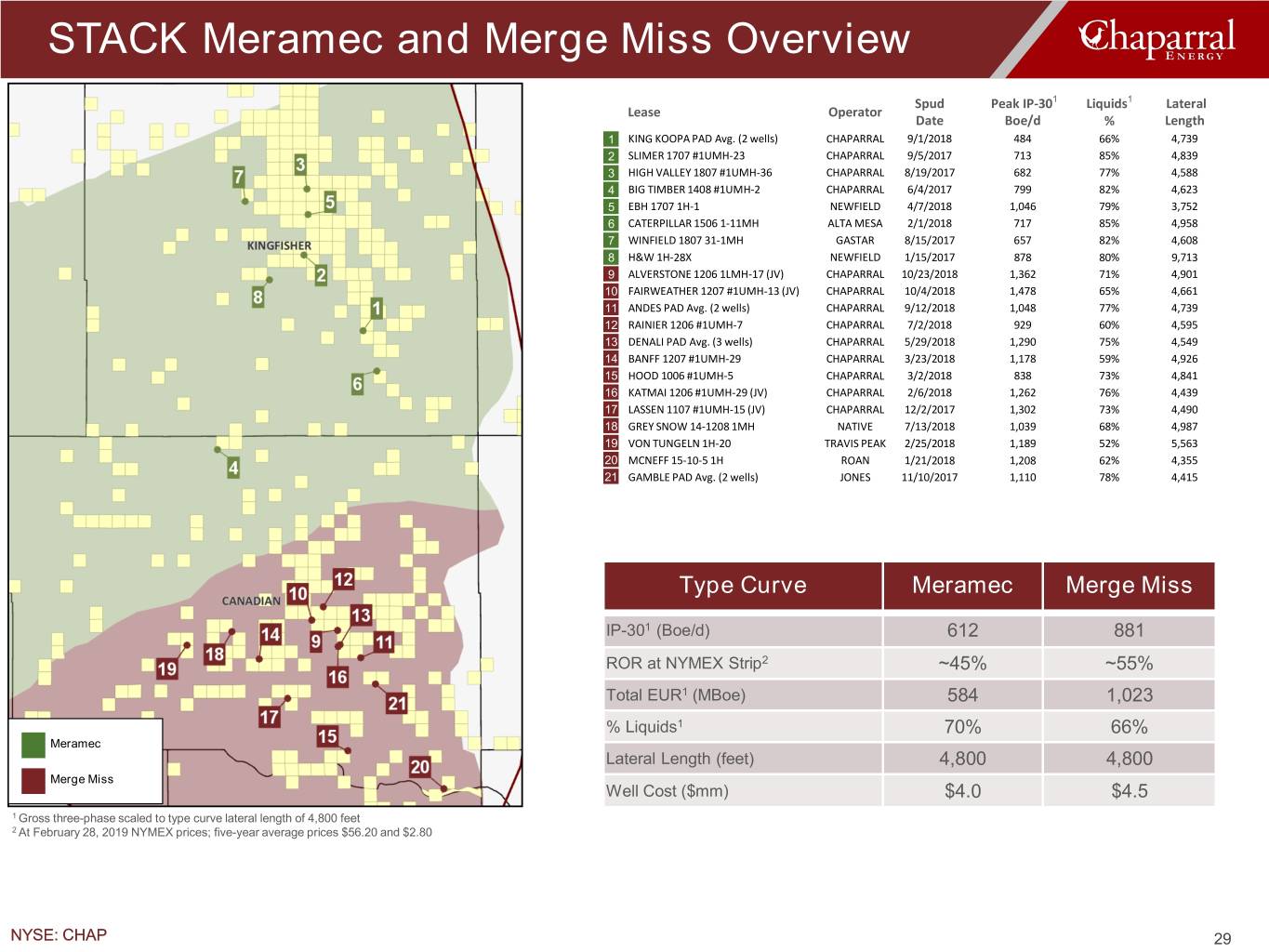

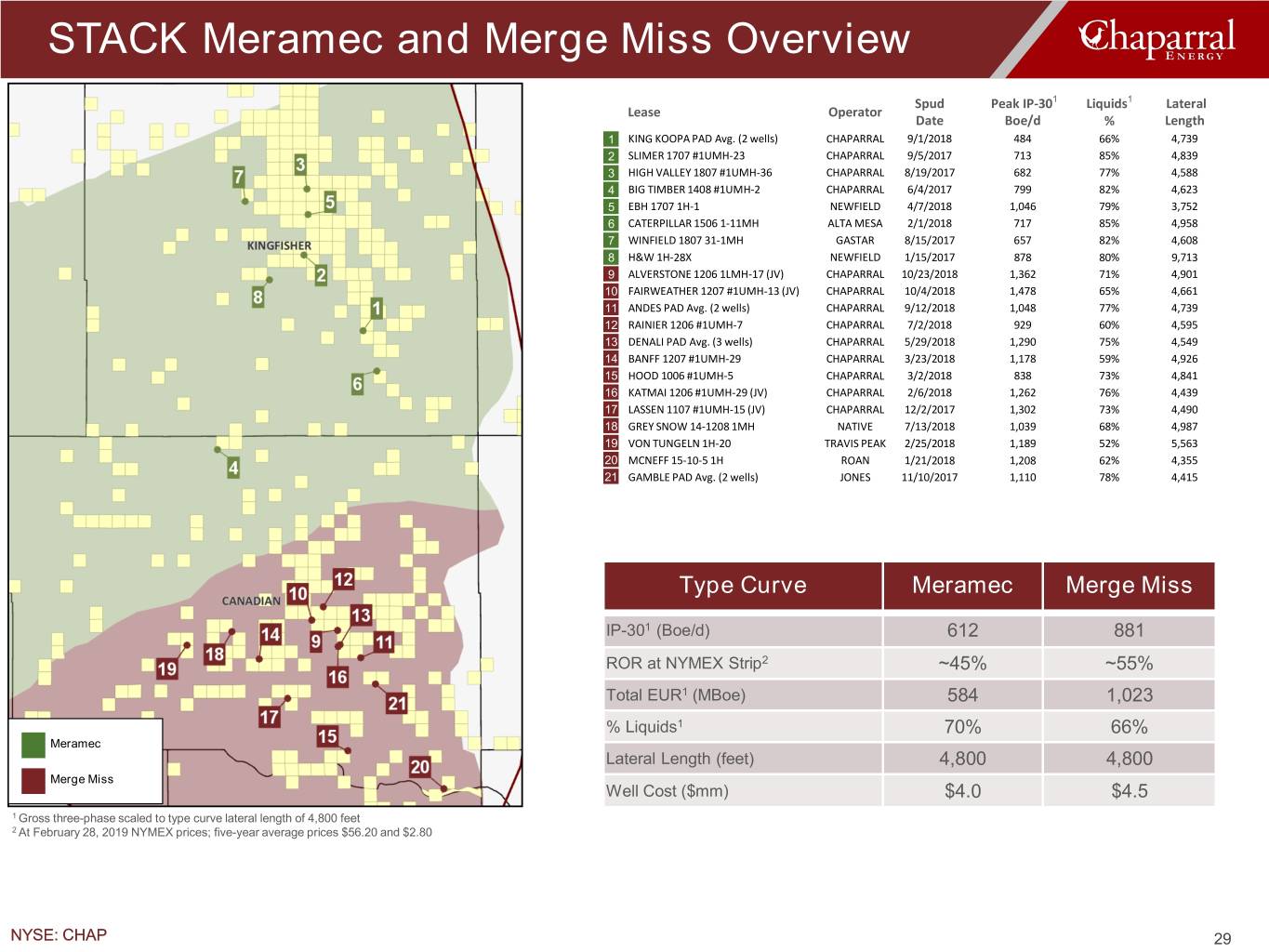

STACK Meramec and Merge Miss Overview Spud Peak IP-301 Liquids1 Lateral Lease Operator Date Boe/d % Length 1 KING KOOPA PAD Avg. (2 wells) CHAPARRAL 9/1/2018 484 66% 4,739 2 SLIMER 1707 #1UMH-23 CHAPARRAL 9/5/2017 713 85% 4,839 3 HIGH VALLEY 1807 #1UMH-36 CHAPARRAL 8/19/2017 682 77% 4,588 4 BIG TIMBER 1408 #1UMH-2 CHAPARRAL 6/4/2017 799 82% 4,623 5 EBH 1707 1H-1 NEWFIELD 4/7/2018 1,046 79% 3,752 6 CATERPILLAR 1506 1-11MH ALTA MESA 2/1/2018 717 85% 4,958 7 WINFIELD 1807 31-1MH GASTAR 8/15/2017 657 82% 4,608 8 H&W 1H-28X NEWFIELD 1/15/2017 878 80% 9,713 9 ALVERSTONE 1206 1LMH-17 (JV) CHAPARRAL 10/23/2018 1,362 71% 4,901 10 FAIRWEATHER 1207 #1UMH-13 (JV) CHAPARRAL 10/4/2018 1,478 65% 4,661 11 ANDES PAD Avg. (2 wells) CHAPARRAL 9/12/2018 1,048 77% 4,739 12 RAINIER 1206 #1UMH-7 CHAPARRAL 7/2/2018 929 60% 4,595 13 DENALI PAD Avg. (3 wells) CHAPARRAL 5/29/2018 1,290 75% 4,549 14 BANFF 1207 #1UMH-29 CHAPARRAL 3/23/2018 1,178 59% 4,926 15 HOOD 1006 #1UMH-5 CHAPARRAL 3/2/2018 838 73% 4,841 16 KATMAI 1206 #1UMH-29 (JV) CHAPARRAL 2/6/2018 1,262 76% 4,439 17 LASSEN 1107 #1UMH-15 (JV) CHAPARRAL 12/2/2017 1,302 73% 4,490 18 GREY SNOW 14-1208 1MH NATIVE 7/13/2018 1,039 68% 4,987 19 VON TUNGELN 1H-20 TRAVIS PEAK 2/25/2018 1,189 52% 5,563 20 MCNEFF 15-10-5 1H ROAN 1/21/2018 1,208 62% 4,355 21 GAMBLE PAD Avg. (2 wells) JONES 11/10/2017 1,110 78% 4,415 Type Curve Meramec Merge Miss IP-301 (Boe/d) 612 881 ROR at NYMEX Strip2 ~45% ~55% Total EUR1 (MBoe) 584 1,023 % Liquids1 70% 66% Meramec Lateral Length (feet) 4,800 4,800 Merge Miss Well Cost ($mm) $4.0 $4.5 1 Gross three-phase scaled to type curve lateral length of 4,800 feet 2 At February 28, 2019 NYMEX prices; five-year average prices $56.20 and $2.80 NYSE: CHAP 29

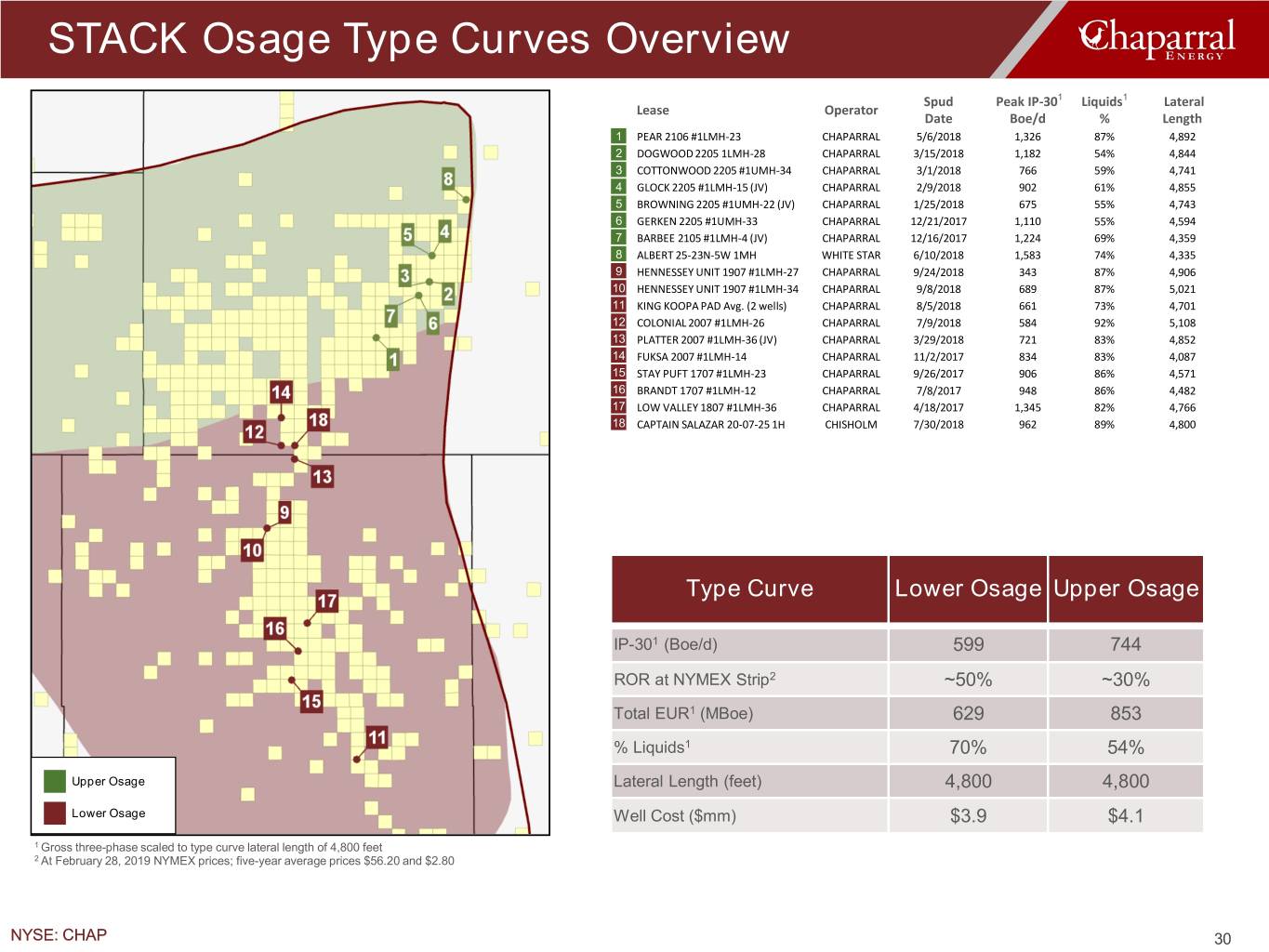

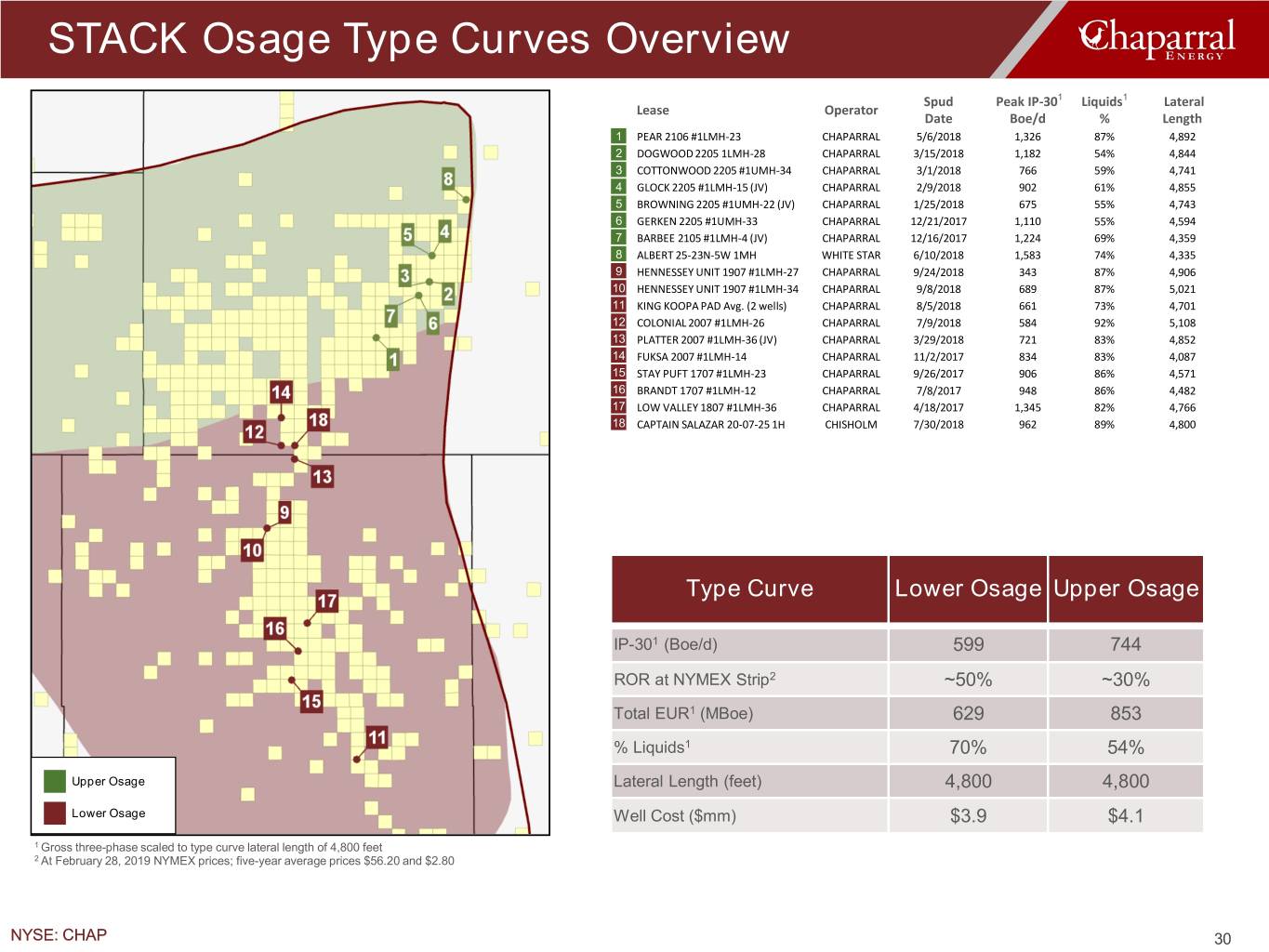

STACK Osage Type Curves Overview Spud Peak IP-301 Liquids1 Lateral Lease Operator Date Boe/d % Length 1 PEAR 2106 #1LMH-23 CHAPARRAL 5/6/2018 1,326 87% 4,892 2 DOGWOOD 2205 1LMH-28 CHAPARRAL 3/15/2018 1,182 54% 4,844 3 COTTONWOOD 2205 #1UMH-34 CHAPARRAL 3/1/2018 766 59% 4,741 4 GLOCK 2205 #1LMH-15 (JV) CHAPARRAL 2/9/2018 902 61% 4,855 5 BROWNING 2205 #1UMH-22 (JV) CHAPARRAL 1/25/2018 675 55% 4,743 6 GERKEN 2205 #1UMH-33 CHAPARRAL 12/21/2017 1,110 55% 4,594 7 BARBEE 2105 #1LMH-4 (JV) CHAPARRAL 12/16/2017 1,224 69% 4,359 8 ALBERT 25-23N-5W 1MH WHITE STAR 6/10/2018 1,583 74% 4,335 9 HENNESSEY UNIT 1907 #1LMH-27 CHAPARRAL 9/24/2018 343 87% 4,906 10 HENNESSEY UNIT 1907 #1LMH-34 CHAPARRAL 9/8/2018 689 87% 5,021 11 KING KOOPA PAD Avg. (2 wells) CHAPARRAL 8/5/2018 661 73% 4,701 12 COLONIAL 2007 #1LMH-26 CHAPARRAL 7/9/2018 584 92% 5,108 13 PLATTER 2007 #1LMH-36 (JV) CHAPARRAL 3/29/2018 721 83% 4,852 14 FUKSA 2007 #1LMH-14 CHAPARRAL 11/2/2017 834 83% 4,087 15 STAY PUFT 1707 #1LMH-23 CHAPARRAL 9/26/2017 906 86% 4,571 16 BRANDT 1707 #1LMH-12 CHAPARRAL 7/8/2017 948 86% 4,482 17 LOW VALLEY 1807 #1LMH-36 CHAPARRAL 4/18/2017 1,345 82% 4,766 18 CAPTAIN SALAZAR 20-07-25 1H CHISHOLM 7/30/2018 962 89% 4,800 Type Curve Lower Osage Upper Osage IP-301 (Boe/d) 599 744 ROR at NYMEX Strip2 ~50% ~30% Total EUR1 (MBoe) 629 853 % Liquids1 70% 54% Upper Osage Lateral Length (feet) 4,800 4,800 Lower Osage Well Cost ($mm) $3.9 $4.1 1 Gross three-phase scaled to type curve lateral length of 4,800 feet 2 At February 28, 2019 NYMEX prices; five-year average prices $56.20 and $2.80 NYSE: CHAP 30

STACK Woodford Type Curves Overview Spud Peak IP-301 Liquids1 Lateral Lease Operator Date Boe/d % Length 1 CUTTHROAT 1307 1WH-13 CHAPARRAL 2/11/2017 588 76% 4,225 2 GLACIER 11-14-12-6 1HX JONES 12/31/2017 463 63% 9,890 3 ACADIA 13-12-12-6-1HX JONES 12/9/2017 581 65% 7,277 4 EVEREST 1107 #1WH-24 (JV) CHAPARRAL 2/12/2018 451 59% 4,451 5 KATMAI 1206 #1WH-29 (JV) CHAPARRAL 1/4/2018 430 61% 4,086 6 LASSEN 1107 #1WH-15 (JV) CHAPARRAL 11/24/2017 499 64% 4,021 7 OLYMPUS 1107 #1WH-10 (JV) CHAPARRAL 11/13/2017 462 58% 4,122 8 FRANK EATON 36-1-11-6 1XH ROAN 2/3/2018 454 79% 9,941 9 LOUDERMILK 1H-32-29 ROAN 12/3/2017 490 60% 10,182 10 ASHCRAFT 1-19H CIMAREX 9/20/2017 847 60% 4,625 11 COWBOY 1H-34-3 ROAN 8/30/2017 402 60% 9,282 12 CANNONBALL 1208 24-1WH 89 ENERGY LLC 7/21/2017 769 62% 4,639 13 RAFTER J 1H-17-20 ROAN 7/16/2017 1,059 57% 8,423 14 ROSEWOOD 16-12-7 3H JONES 7/3/2017 932 69% 4,465 North South Type Curve Woodford Woodford IP-301 (Boe/d) 475 736 ROR at NYMEX Strip2 ~30% ~50% Total EUR1 (MBoe) 579 1,456 % Liquids1 72% 62% North Woodford Lateral Length (feet) 4,800 4,800 South Woodford Well Cost ($mm) $4.4 $4.4 1 Gross three-phase scaled to type curve lateral length of 4,800 feet 2 At February 28, 2019 NYMEX prices; five-year average prices $56.20 and $2.80 NYSE: CHAP 31

Non-Core Legacy Asset Overview • Mature legacy fields • Low-maintenance capital • Provides free cash flow to fuel STACK growth • Potential strategic alternatives Net Production1 Gross Margin1 Net Proved Reserves Area Boe/d % Oil $/Boe MMBoe2 PV-102 ($mm) PV-103 ($mm) Miss Lime 1,878 28% $18.53 7.4 $53.2 $37.3 Western Anadarko Basin 950 14% $15.54 4.6 $28.1 $22.8 Southern OK 1,700 60% $22.40 7.8 $87.1 $68.3 Other 515 41% $10.94 0.9 $6.5 $5.2 TOTAL 5,043 43% $18.49 20.7 $174.9 $133.6 TOTAL Incl. ARO $170.2 $128.9 1 Q4 2018 actuals 2 At year-end 2018 SEC prices of $65.56 and $3.10 3 Based on year-end 2018 reserves run on February 28, 2019 NYMEX prices; Five-year average prices $56.20 and $2.80 NYSE: CHAP 32

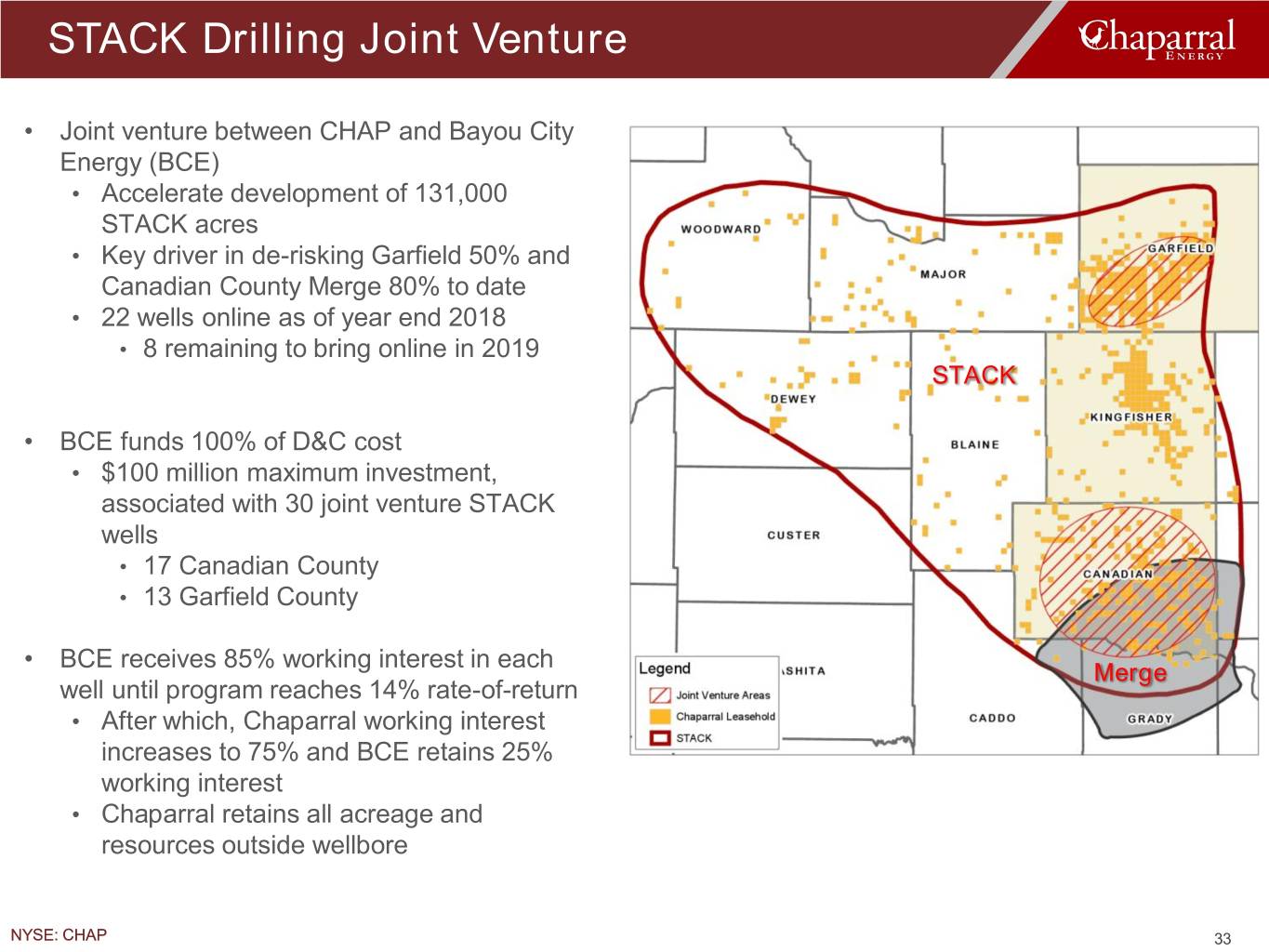

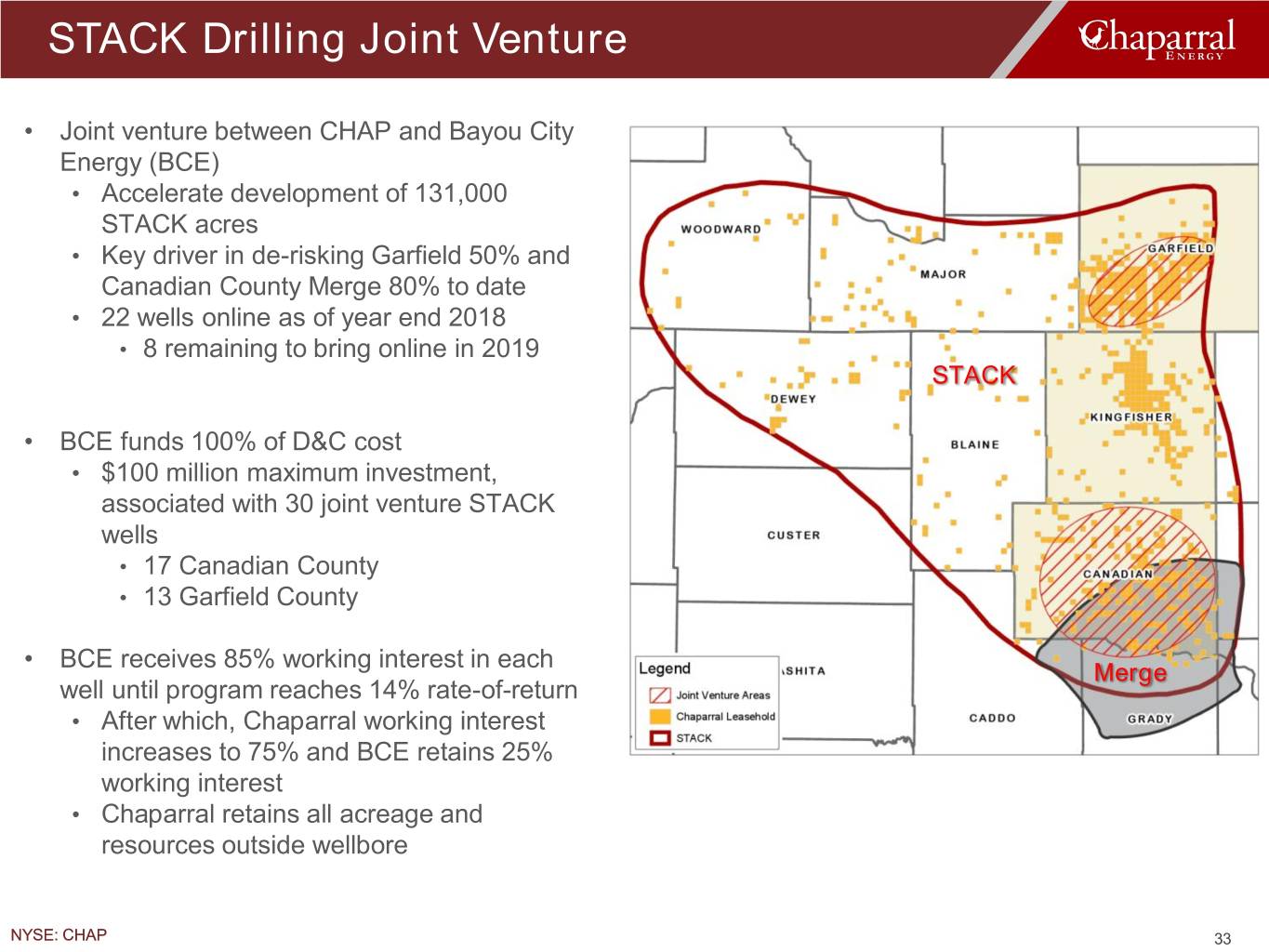

STACK Drilling Joint Venture • Joint venture between CHAP and Bayou City Energy (BCE) • Accelerate development of 131,000 STACK acres • Key driver in de-risking Garfield 50% and Canadian County Merge 80% to date • 22 wells online as of year end 2018 • 8 remaining to bring online in 2019 STACK • BCE funds 100% of D&C cost • $100 million maximum investment, associated with 30 joint venture STACK wells • 17 Canadian County • 13 Garfield County • BCE receives 85% working interest in each Merge well until program reaches 14% rate-of-return • After which, Chaparral working interest increases to 75% and BCE retains 25% working interest • Chaparral retains all acreage and resources outside wellbore NYSE: CHAP 33

Reserve and Non-GAAP Information Statement Reserve Estimates The SEC permits oil and natural gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves that meet the SEC’s definitions for such terms. The company may use terms in this presentation that the SEC’s guidelines strictly prohibit in SEC filings, such as estimated ultimate recovery or EUR, resources, net resources, total resource potential and similar terms to estimate oil and natural gas that may ultimately be recovered. These estimates are by their nature more speculative than estimates of proved, probable and possible reserves as used in SEC filings and, accordingly, are subject to substantially greater uncertainty of being actually realized. These estimates have not been fully risked by management. Actual quantities that may be ultimately recovered will likely differ substantially from these estimates. Factors affecting ultimate recovery include the scope of the company’s actual drilling program, which will be directly affected by the availability of capital, drilling and production costs, commodity prices, availability of drilling services and equipment, lease expirations, transportation constraints, regulatory approvals, field spacing rules, actual drilling results and recoveries of oil and natural gas in place and other factors. These estimates may change significantly as the development of properties provides additional data. The company’s production forecasts and expectations for future periods are dependent upon many assumptions, including estimates of production decline rates and results of future drilling activity which is subject to commodity price fluctuations and changes in drilling costs. PV-10 PV-10 value is a non-GAAP measure that differs from the standardized measure of discounted future net cash flows in that PV-10 value is a pre-tax number, while the standardized measure of discounted future net cash flows is an after-tax number. We believe that the presentation of the PV-10 value is relevant and useful to investors because it presents the discounted future net cash flows attributable to our proved reserves prior to taking into account future corporate income taxes, and it is a useful measure of evaluating the relative monetary significance of our oil and natural gas properties. Further, investors may utilize the measure as a basis for comparison of the relative size and value of our reserves to other companies. We use this measure when assessing the potential return on investment related to our oil and natural gas properties. However, PV-10 value is not a substitute for the standardized measure of discounted future net cash flows. Our PV-10 value measure and the standardized measure of discounted future net cash flows do not purport to present the fair value of our oil and natural gas reserves. F&D Finding and development (“F&D”) costs are non-GAAP metrics commonly used by the company, as well as analysts and investors, to measure and evaluate the company’s cost of adding proved reserves. STACK F&D costs are computed below by dividing exploration and development capital costs incurred, excluding capitalized interest and expenses, for the indicated period by proved reserve extensions and discoveries, and revisions (excluding price revisions) for that same period. Due to various factors, historical F&D costs do not reflect the cost or timing of future production of new reserves and therefore may not be a reliable predictor of future results. For example, development costs may be recorded in periods after the periods in which the related reserves are recorded. In addition, changes in commodity prices can affect the magnitude of recorded increases (or decreases) in reserves independent of the related costs of such increases. As a result of the foregoing factors and various factors that could materially affect the timing and amounts of future increases in reserves and the timing and amounts of future costs, future F&D costs may differ materially from those set forth below. The methods used by the company to calculate its F&D costs may differ significantly from methods used by other companies to compute similar measures. As a result, the company’s F&D costs may not be comparable to similar measures provided by other companies. NYSE: CHAP 34

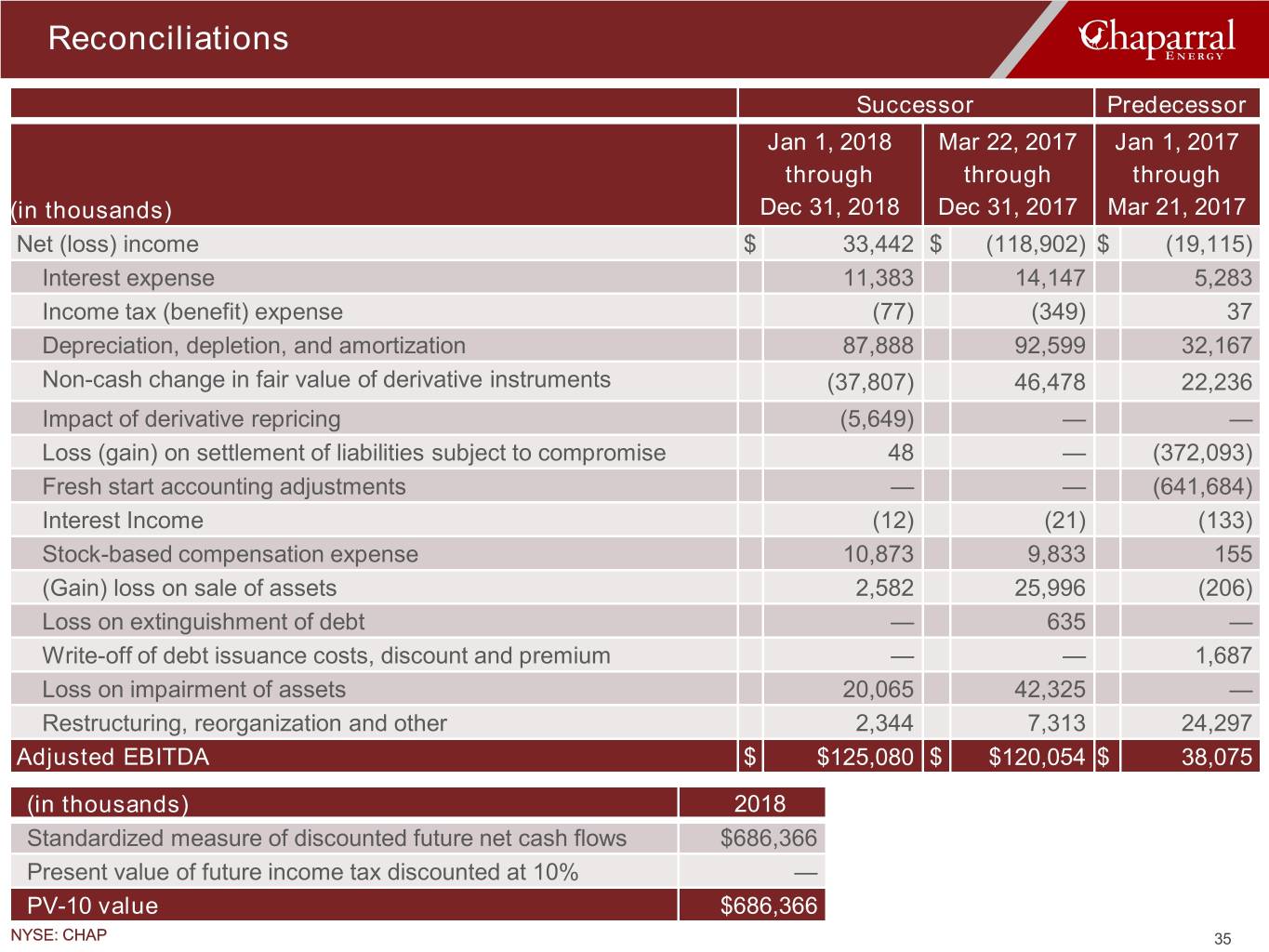

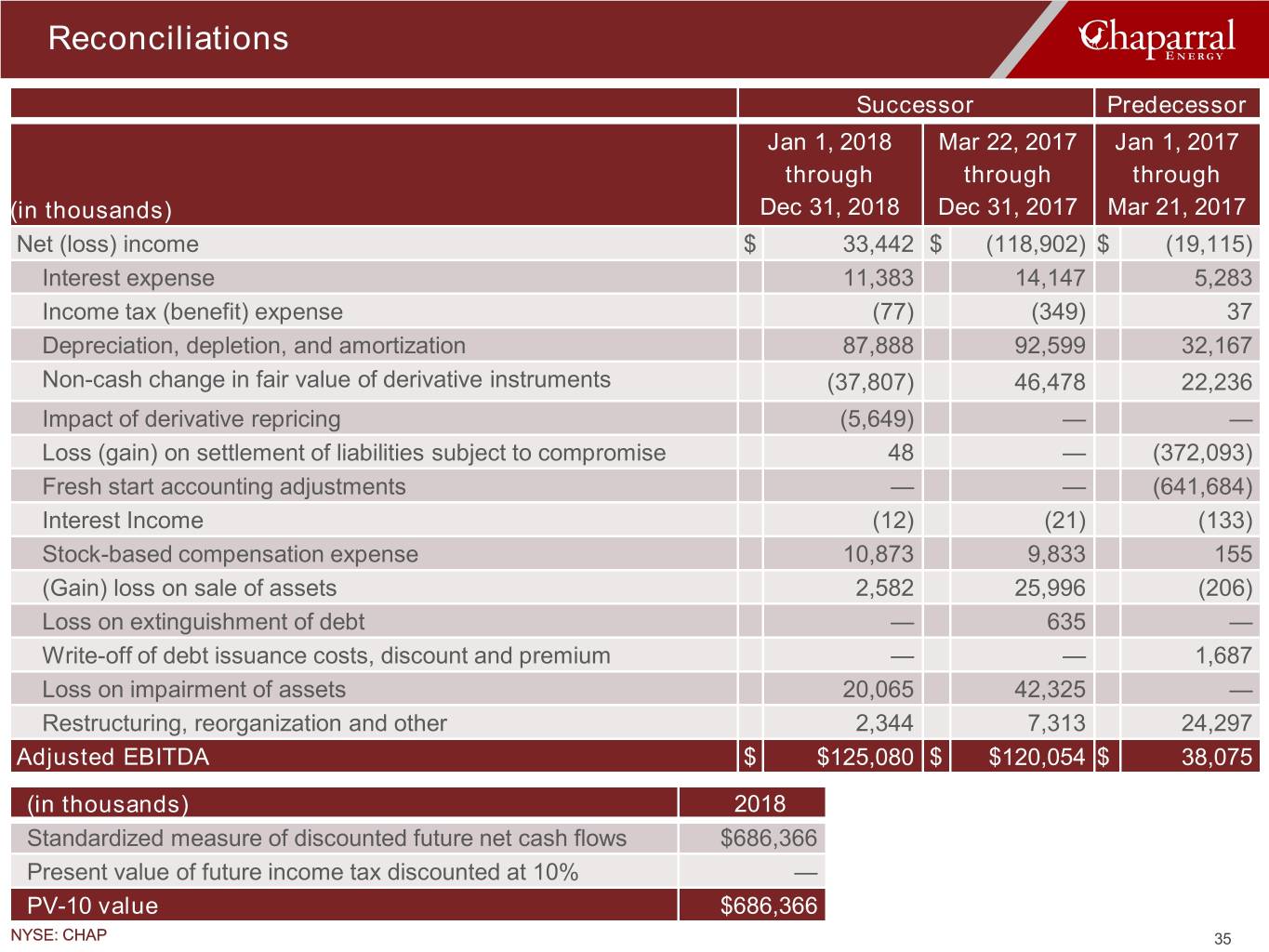

Reconciliations Successor Predecessor Jan 1, 2018 Mar 22, 2017 Jan 1, 2017 through through through (in thousands) Dec 31, 2018 Dec 31, 2017 Mar 21, 2017 Net (loss) income $ 33,442 $ (118,902) $ (19,115) Interest expense 11,383 14,147 5,283 Income tax (benefit) expense (77) (349) 37 Depreciation, depletion, and amortization 87,888 92,599 32,167 Non-cash change in fair value of derivative instruments (37,807) 46,478 22,236 Impact of derivative repricing (5,649) — — Loss (gain) on settlement of liabilities subject to compromise 48 — (372,093) Fresh start accounting adjustments — — (641,684) Interest Income (12) (21) (133) Stock-based compensation expense 10,873 9,833 155 (Gain) loss on sale of assets 2,582 25,996 (206) Loss on extinguishment of debt — 635 — Write-off of debt issuance costs, discount and premium — — 1,687 Loss on impairment of assets 20,065 42,325 — Restructuring, reorganization and other 2,344 7,313 24,297 Adjusted EBITDA $ $125,080 $ $120,054 $ 38,075 (in thousands) 2018 Standardized measure of discounted future net cash flows $686,366 Present value of future income tax discounted at 10% — PV-10 value $686,366 NYSE: CHAP 35

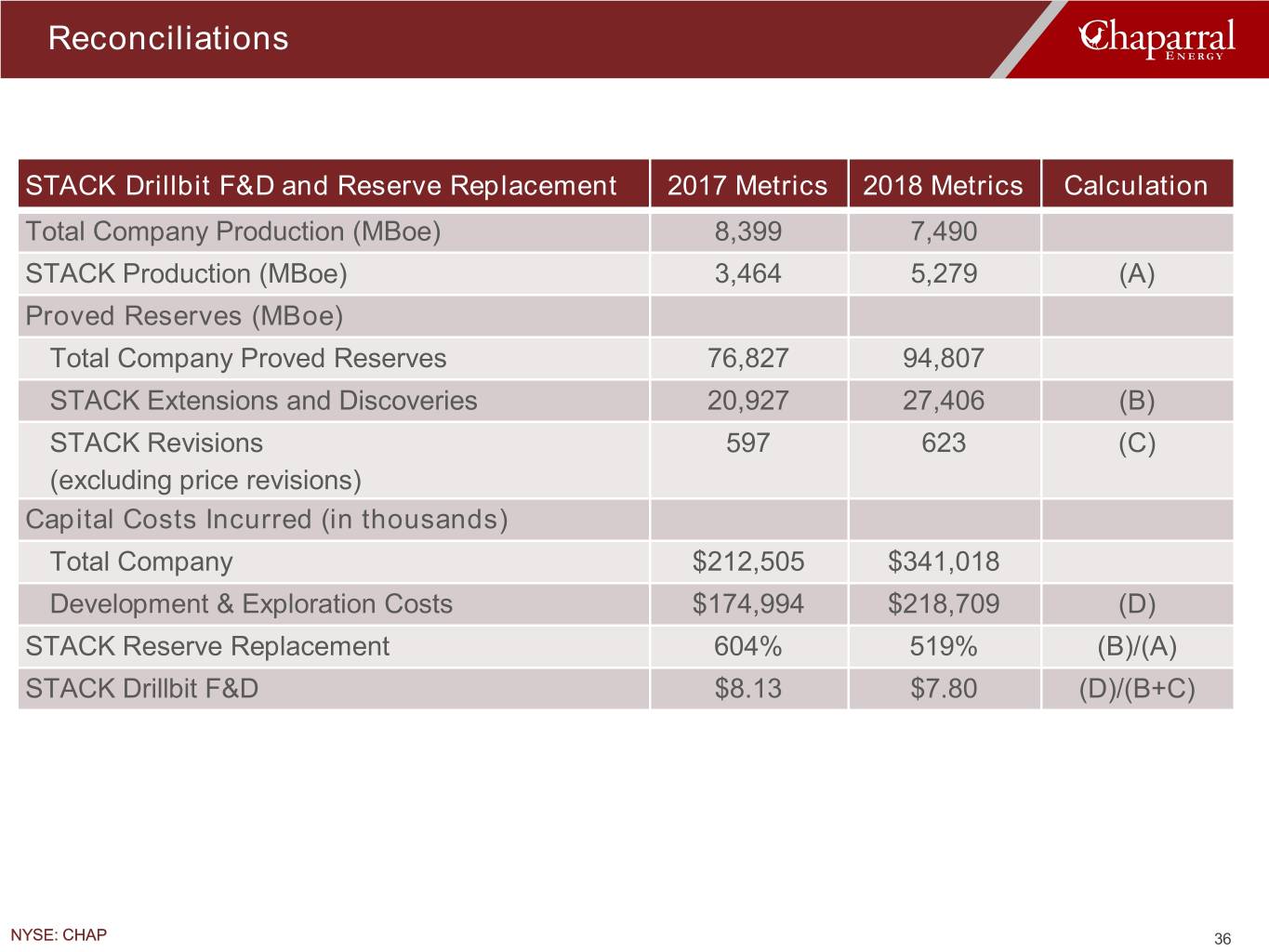

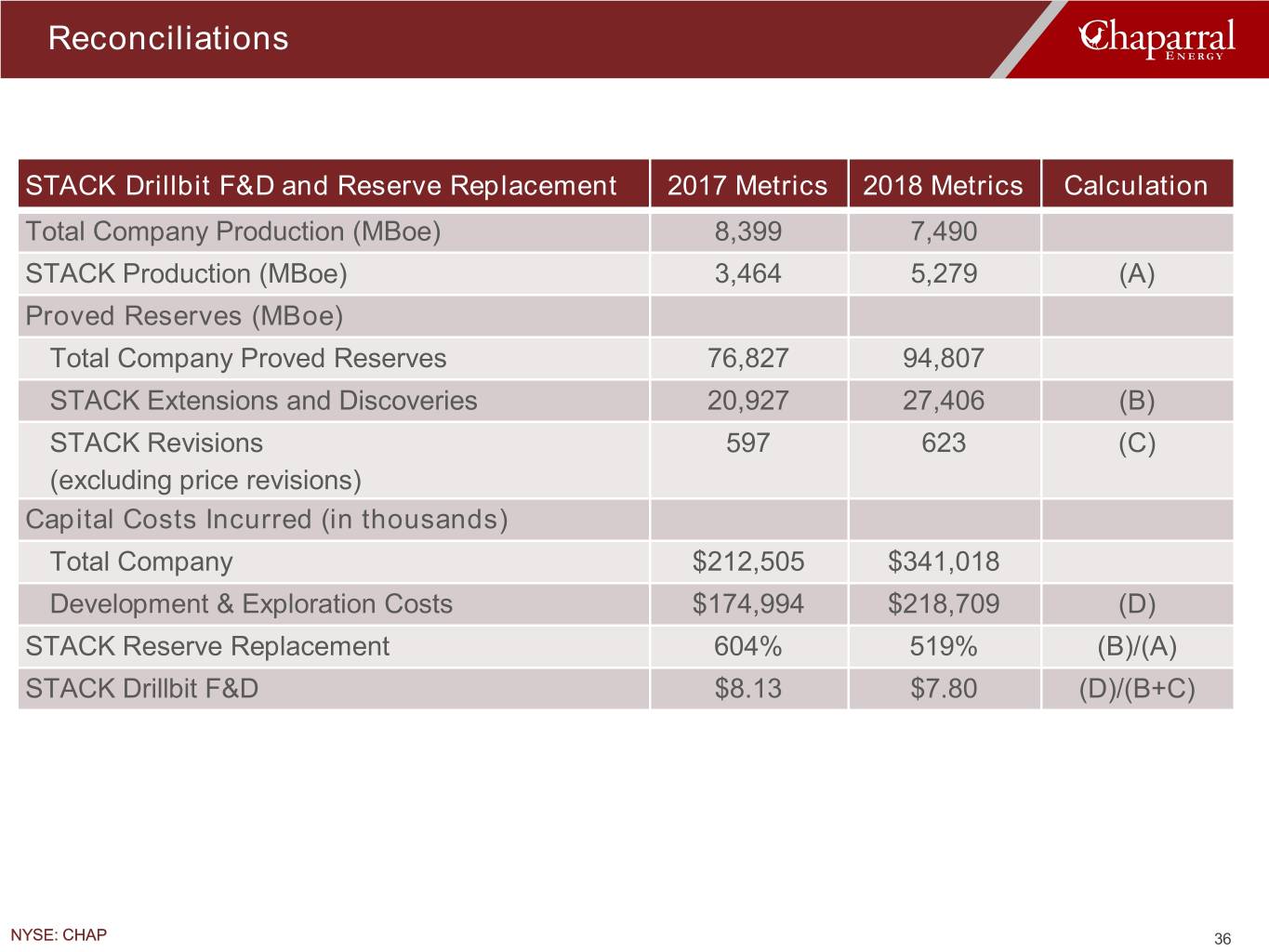

Reconciliations STACK Drillbit F&D and Reserve Replacement 2017 Metrics 2018 Metrics Calculation Total Company Production (MBoe) 8,399 7,490 STACK Production (MBoe) 3,464 5,279 (A) Proved Reserves (MBoe) Total Company Proved Reserves 76,827 94,807 STACK Extensions and Discoveries 20,927 27,406 (B) STACK Revisions 597 623 (C) (excluding price revisions) Capital Costs Incurred (in thousands) Total Company $212,505 $341,018 Development & Exploration Costs $174,994 $218,709 (D) STACK Reserve Replacement 604% 519% (B)/(A) STACK Drillbit F&D $8.13 $7.80 (D)/(B+C) NYSE: CHAP 36

Contact Information Chaparral Energy, Inc. 701 Cedar Lake Boulevard Oklahoma City, OK 73114 Investors Media Scott Pittman Brandi Wessel Chief Financial Officer Manager – Communications investor.relations@chaparralenergy.com brandi.wessel@chaparralenergy.com 405-426-6700 405-426-6657 NYSE: CHAP 37

ENERGIZING America’s Heartland NYSE: CHAP chaparralenergy.com NYSE: CHAP 38