Acquisition of

NHRA Pro Racing

by

HD Partners Acquisition Corporation

Investor Presentation

The attached presentation was filed with the Securities and Exchange Commission as part of the Form 8-K/A filed by HD Partners Acquisition

Corporation (“HD Partners” or “HDP”) on October 5, 2007. HDP is holding presentations for its stockholders regarding its proposed purchase of

certain assets of the National Hot Rod Association (“NHRA”), as described in an earlier Schedule 14A filed by HDP on July 17, 2007 and

subsequently amended on September 11, 2007 which describes the acquisition in more detail.

Morgan Joseph & Co. Inc. (“Morgan Joseph”), the managing underwriter of HDP’s initial public offering (“IPO”) consummated in June 2006, is

assisting HDP in these efforts and will receive an advisory fee equal to $300,000. In addition, Morgan Joseph, as representative of the

underwriters, is entitled to receive deferred underwriting fees of $3 million upon consummation of this transaction. HDP and its directors and

executive officers may be deemed to be participants in the solicitation of proxies for the special meeting of HDP’s stockholders to be held to

approve this transaction. To date, Morgan Joseph’s activities have not included actions that would deem such a firm to be engaged in the

solicitation of proxies for HDP, although the firm may be so engaged in the future.

Stockholders of HDP and other interested persons are advised to read HDP’s preliminary proxy statement, as amended, and definitive proxy

statement, when available, in connection with HDP’s solicitation of proxies for the special meeting to approve the acquisition because these

proxy statements will contain important information. Such persons can also read HDP’s final prospectus, dated June 1, 2006, as well as

periodic reports, for more information about HDP, its officers and directors, and their individual and group security ownership in HDP, and

interest in the successful consummation of this business combination. Stockholders may also refer to the HDP proxy statement for information

about Morgan Joseph’s security holdings in HDP. The definitive proxy statement will be mailed to stockholders as of a record date to be

established for voting on this transaction. Stockholders will also be able to obtain a copy of the definitive proxy statement, the final prospectus

and other periodic reports filed with the Securities and Exchange Commission, without charge, by visiting the Securities and Exchange

Commission’s Internet site at (http://www.sec.gov).

2

Safe Harbor

This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995, about HDP,NHRA and their combined business after completion of the proposed transaction. Forward-

looking statements are statements that are not historical facts. Such forward-looking statements, based upon the

current beliefs and expectations of HDP’s management, are subject to risks and uncertainties, which could cause actual

results to differ from the forward-looking statements. The following factors, among others, could cause actual results to

differ from those set forth in the forward-looking statements: continued compliance with government regulations;

changing legislation or regulatory environments; requirements or changes affecting the businesses in which NHRA is

engaged; auto racing and sports industry trends, including factors affecting supply and demand; NHRA’s dependence

on attendance and sponsorships; labor and personnel relations; NHRA’s revenue and profitability; changing

interpretations of generally accepted accounting principles; and general economic conditions, as well as other relevant

risks detailed in HDP’s filings with the Securities and Exchange Commission, including its report on form 10-K for the

period ended December 31, 2006. The information set forth herein should be read in light of such risks. Neither HDP,

nor NHRA assumes any obligation to update the information contained in this presentation.

This presentation contains disclosures of EBITDA for certain periods, which is a non-GAAP financial measure within the

meaning of Regulation G promulgated by the Securities and Exchange Commission. Management believes that

EBITDA, or earnings before interest, taxes, depreciation and amortization, is an appropriate measure of evaluating

operating performance and liquidity, because it reflects the resources available for strategic opportunities including,

among others, investments in the business and strategic acquisitions. The disclosure of EBITDA may not be

comparable to similarly titled measures reported by other companies. EBITDA should be considered in addition to, and

not as a substitute for, or superior to, operating income, cash flows, revenue, or other measures of financial

performance prepared in accordance with generally accepted accounting principles.

3

Contents

Background and Highlights

NHRA Overview

Growth Opportunities & Strategy

Financial Overview

4

Background

In June 2006, HD Partners Acquisition Corporation (HD Partners)

raised gross proceeds of $150M

On May 30, 2007, HD Partners entered into a definitive agreement with

the National Hot Rod Association (NHRA) to purchase substantially all

of the NHRA’s professional drag racing series/assets as well as a

broad set of exclusive commercialization rights

The assets will be held by NHRA Pro Racing, a wholly-owned

subsidiary of HD Partners

The transaction is expected to close in late 2007

5

Transaction Highlights

NHRA Pro Racing is a unique entertainment asset with a well

recognized brand

World’s preeminent drag racing series

49% television viewership increase from 2000 to 2006

HD Partners management is uniquely qualified to maximize

NHRA’s potential

Built DIRECTV into the nation’s leading provider of digital television,

with approximately 12.2 million customers and $7.7 billion in revenues

Developed and successfully marketed many innovative sports products,

such as NFL Sunday Ticket and NBA League Pass

HD’s plan projects doubling EBITDA within three years

Significant “low-hanging fruit” to harvest

Excludes expected impact of future acquisitions

6

Selectively Acquiring Profitable Assets

with Greatest Growth Potential

Continued

Association

Expertise Will

Benefit Both

Entities

Acquiring

Leaving Behind

POWERade Drag Racing Series

and All NHRA Pro Racing Activities

Exclusive, Worldwide License

To NHRA Brand for Pro Racing Activities,

Licensing and Sponsorships

NHRA Owned Tracks

Gainesville, Atlanta, Columbus, Indianapolis

Approximately $50 million of real estate

Media Exploitation Rights

Broadcast TV/Radio, DVD, Photos,

Internet, Mobile, Gaming, Pro-focused

Publications

Exclusive Merchandise Rights

NHRA Pro and Generic NHRA Products

NHRA.com Website

Association provided shared access

Sportsman/Amateur Racing

National Dragster Magazine

Nostalgia/Reunion Events

Youth/Educational Programs

Racing Operations

Sanctioning

7

Transaction Summary

Transaction enterprise value: $121M (1)

$100M cash

$11.5M in assumed debt

$9.5M in HD Partners’ common equity

Includes real estate of approximately $50 million

NHRA Pro Racing Management Structure

Eddy Hartenstein: Chairman

Tom Compton: President and CEO

14 years with NHRA

President and CEO since 2000

Robert Meyers: Chief Financial Officer

Larry Chapman, Steve Cox and Bruce Lederman to provide dedicated

executive support for new initiatives

Consulting contract with NHRA’s current EVP and General Manager

8

NHRA Overview

What is the NHRA?

The world’s largest motorsports organization

5,000+ events annually

1.5 million side-by-side races per year

300,000 participants

140 NHRA Member Tracks

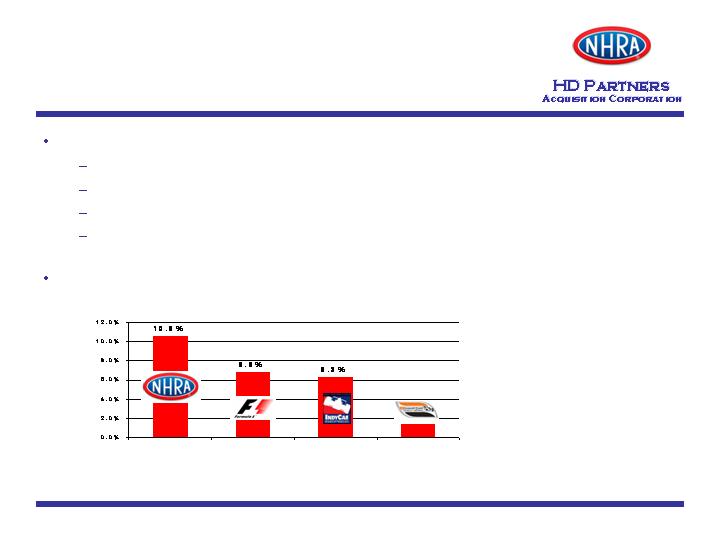

# 2 motorsport in the US after NASCAR

ESPN Sports Poll 2006:

What is your favorite type

of racing? (NASCAR 57%)

10

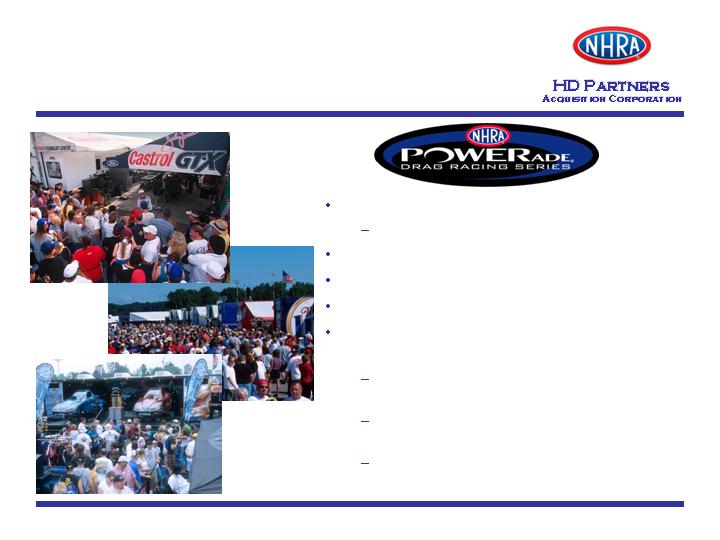

NHRA Professional Drag

Racing Series

23 national events per year

Over 80 days of racing

Up to 125,000 spectators per event

35 of top 50 DMAs

One-of-a-kind fan and sponsor access

All national events televised on ESPN2

and in high definition on ESPN2-HD

Over 4 hours of programming every race

weekend

49% viewership increase between 2000

and 2006

Continued significant viewership growth

during 2007

11

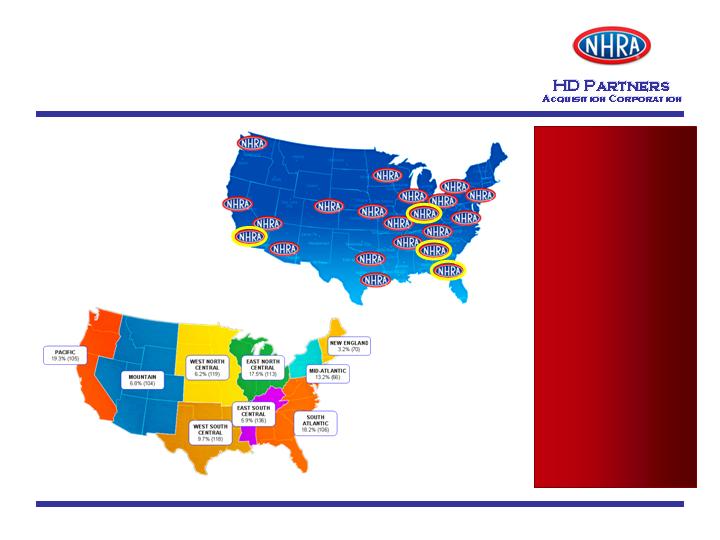

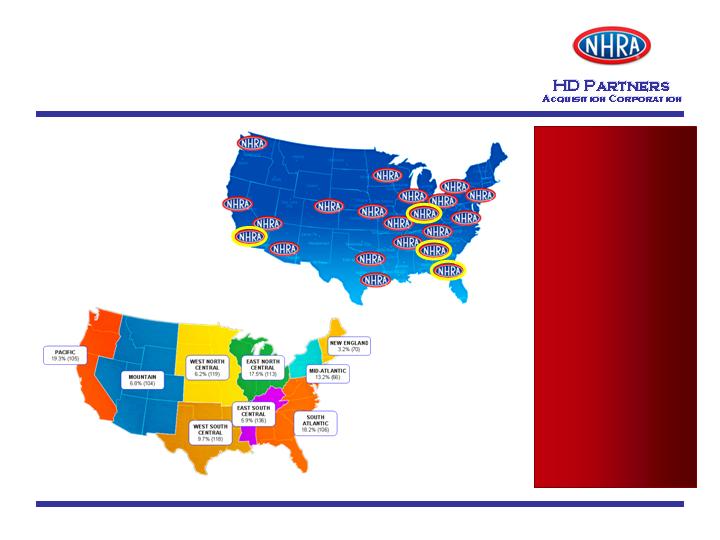

Large Nationwide Fan Base

National Event

Locations

NATIONAL EVENTS

1.

Los Angeles, CA**

2.

Phoenix, AZ

3.

Gainesville, FL**

4.

Houston, TX*

5.

Las Vegas, NV

6.

Atlanta, GA**

7.

St. Louis, MO*

8.

Topeka, KS

9.

Chicago, IL

10.

Englishtown, NJ

11.

Norwalk, OH

12.

Bristol, TN

13.

Denver, CO*

14.

Seattle, WA*

15.

Sonoma, CA

16.

Minneapolis, MN*

17.

Reading, PA

18.

Indianapolis, IN**

19.

Memphis, TN*

20.

Dallas, TX

21.

Richmond, VA

22.

Las Vegas, NV

23.

Los Angeles, CA**

Not a NASCAR Nextel

Cup market

** NHRA Owned/Leased Track

Balanced and

Diverse Fan

Base

Distribution

Source: Scarborough Research 2006 (Fan = Very or Somewhat interested)

12

Energetic and Diverse Racer Community

TONY PEDREGON

Funny Car

JR TODD

Top Fuel

ANTRON BROWN

Pro Stock Motorcycle

ANGELLE SAMPEY

Pro Stock Motorcycle

ASHLEY FORCE

Funny Car

MELANIE TROXEL

Top Fuel

JOHN FORCE

Funny Car

BRANDON BERNSTEIN

Top Fuel

PEGGY LLEWELLYN

Pro Stock Motorcycle

13

Increased Presence in

Mainstream Media

Driving Force TV Series on A&E

NHRA Race Day on ESPN2

American Dragster TV Series on ESPN2

Ashley Force on Jay Leno

Good Morning America Segment

AOL’s Hottest Athlete: Ashley Force

14

Chicago, IL

Bristol, TN

Las Vegas, NV

Indianapolis, IN

15

Powerful Fan and Sponsor

Experience

16

Growth Opportunities & Strategy

NHRA’s Past, Present & Future

Past

Grassroots nonprofit

membership organization;

run by and for hardcore

enthusiasts

Present

Utilizing highly profitable

professional race series

to support amateur

events & other non-profit

association activities

Future

Branded multimedia

entertainment platform

that serves established

fan base while attracting

new fans

50+ year ownership by non-profit organization – with non-profit goals

Profit-oriented

public company

18

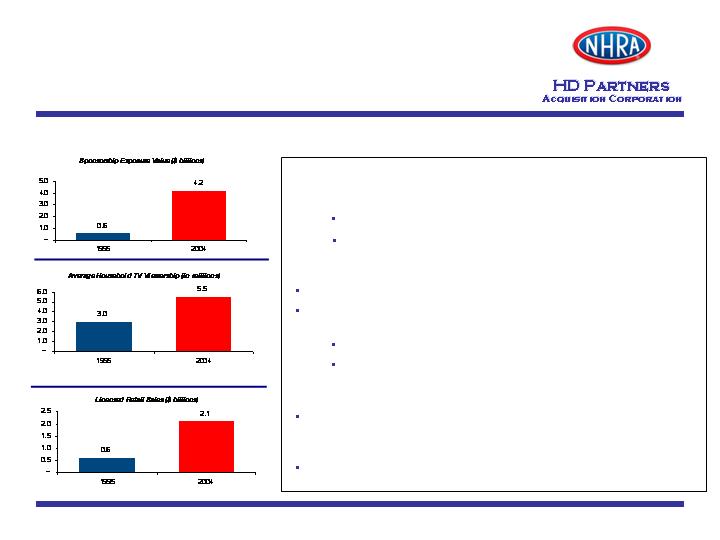

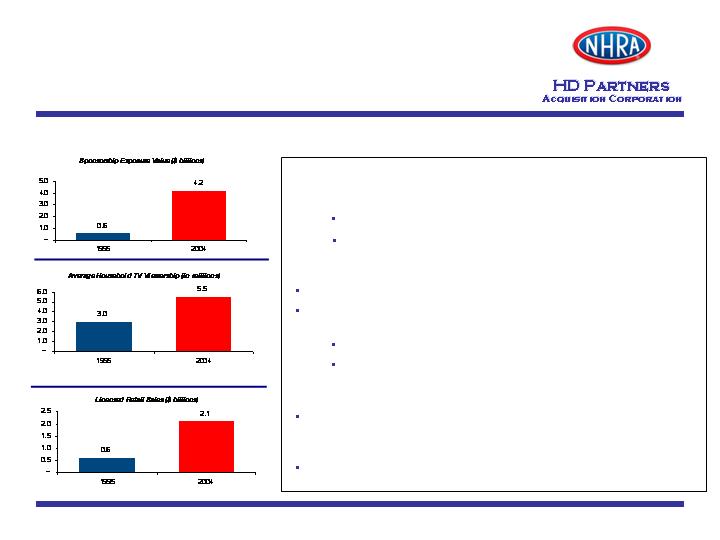

Key Ingredients for NASCAR’s Success:

Example:

NASCAR’s Emergence as Force in

Mainstream Sports and Media

Sponsor Expansion

Tremendous sponsor expansion over the past decade

1995: Winston, Skoal, STP, CITGO and Camel.

Today: AOL, Duracell, Gillette, Home Depot and NEXTEL / Sprint

Mainstream Entertainment Integration

In the past, exposure limited to news and sports television

Over past decade, NASCAR has integrated into mainstream

entertainment as a lifestyle brand

TV (MTV, Saturday Night Live, and reality TV)

Feature films such as Talladega Nights: The Ballad of Ricky Bobby

Competitive Formats / Dramatic Stories

Implementation of Winston / NEXTEL series formats has generated

greater fan interest, led to the addition of new events and tracks and

increased media coverage

NASCAR has successfully marketed the stories behind key drivers –

increasing appeal of the sport to more casual fans

Source: NASCAR Brand and Consumer Marketing Memo (2005)

19

Introduce New National Events – increase the current 23 national events by targeting

underserved regions

Reach new fans and expand the overall brand presence

Geographic expansion enhances sponsorship value

Targeted opportunities for international expansion

Plans for a new 24th National Event for 2008 season were announced on September 1, 2007

Expand and leverage fan base

Use increased advertising and sponsor promotions to expand event attendance and viewership

Enhance average revenue per spectator across various customer touch points

Opportunity:

Expand NHRA’s Exposure and

Leverage Fan Base

Significant EBITDA growth can be created through expansion

of National Event-related economics

Initiative EBITDA Contribution

Introduce New National Event $500K per event (average) (1)

Increase Paid Attendance $1M per incremental 5% (2)

Increase Paid Attendee Revenue $500K per incremental $1 spend (3)

(1) Assumes non-owned track (2) Increase against 2006 paid attendance (3) Increase against 2006 paid attendees

20

Quality sponsors from outside racing are increasingly attached to the sport

Significant unfilled opportunities in proven auto racing sponsorship categories

Opportunity:

Diversify Sponsors & Fill Key

Sponsorship Categories

Current Unfilled

Categories

Banking

Big Box Electronics

Consumer Electronics

Consumer Packaged Goods

Home Improvement

Information Technology

Internet Services

Pharmaceuticals

Quick Service Restaurants

Satellite Radio

Satellite TV

Wireless Products

Existing Automotive /

Racing Sponsors

Existing Consumer

Products Sponsors

21

HDP’s Advantage:

Leverage Management’s Extensive

Contact Network

DIRECTV experience provides high level contacts at many logical NHRA

partners

Consumer electronics retailers

Video and broadband distribution platforms

Television broadcasters and programmers

Emerging distribution platforms

Consumer electronics manufacturers

Auto manufacturers

Additional web of contacts through Board of Directors representation

XM Satellite Radio

Consumer Electronics Association

Thomson Multimedia

SanDisk

HDP Team will exploit an extensive network of

contacts to expand the NHRA reach and visibility

Successful Track Record of Strategic Partnering to Grow

Brand Recognition, Sales, and Customer Enthusiasm

22

Opportunity:

Expand Licensing, Merchandising &

Multimedia Revenues

Revamp and re-launch licensing and merchandising initiatives

Exploit NHRA’s potential as a lifestyle brand

Re-launch NHRA.com to enhance multimedia experience, online sales offerings and

advertising potential

Launch new publications and membership programs

License new products and services in proven auto enthusiast categories

NASCAR has licensed over 3,500 products and services

Establish presence in relevant retail venues

Management believes that merchandise spend rates can be significantly increased

NASCAR-branded products generated license fees of over $300M in 2005

Expand multimedia offerings; commercially exploit substantial video and

photo archive

Over 20,000 hours of previously unreleased video

Photo archive covering the entire 50+ year history of the sport

Introduce new DVD series

Other branded entertainment services have demonstrated ability to drive substantial revenue

and EBITDA through targeted DVD sales (e.g. WWE sold 3M video units generating $42.6M in

gross revenue in 2006)

Multiple untapped multimedia platform opportunities available

23

HDP’s Advantage:

Pioneers in Developing Multimedia

Revenue Opportunities

Developed and successfully marketed many innovative sports products

Out-of-market sports packages

Unique pay-per-view programming (Behind-the scenes)

Pioneered promotional programs linking key national retailers and special event

programming (e.g., Shania Twain, NFL Sunday Ticket)

Established first-of-a-kind relationships with national telephone operators (AT&T,

Verizon, Bell South) to integrate video offering with communication products

24

Growth Momentum is Accelerating

Substantial fan base growth in 2007

Overall growth in paid attendance of 9.5% (1)

Race event television viewership increase of over 8.0% (1)

Transaction is serving as catalyst for new initiatives

Announced new national event for 2008

Major sponsors renewed for 2008; new sponsor deals in process

2007 Year-in-Review DVD to be on sale in Mid-November

Other DVD / Video products in development for 2008 release

(1) Comparison of first 19 events of 2007 to first 19 events of 2006, excluding Brainerd for which numbers are not available.

25

Well-Capitalized Platform for Aggressive

Sports Media Expansion Opportunities

NHRA Pro Racing Opportunities

Upgrades to owned and non-owned track facilities

Strategic acquisition of new tracks

Ancillary racing assets

Complimentary media assets (hard and electronic)

Automotive enthusiast assets

Emerging sports media aggregation opportunities

Significant capabilities to expand revenues and leverage cost

efficiencies across multiple event-based businesses

Exploit efficiencies in infrastructure, event co-location and marketing

Enhance value to sponsors

Bundle media exploitation rights

26

Financial Overview

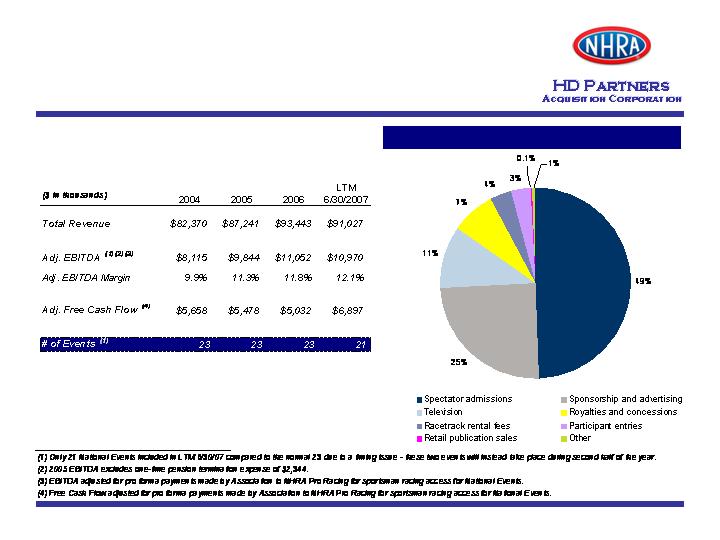

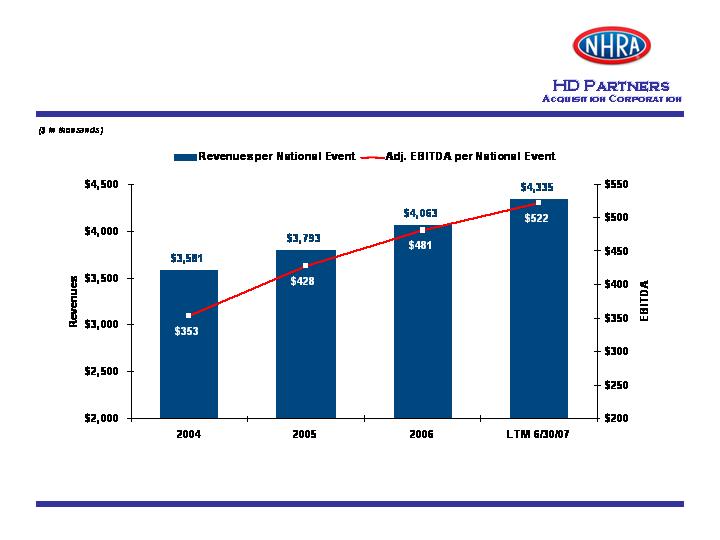

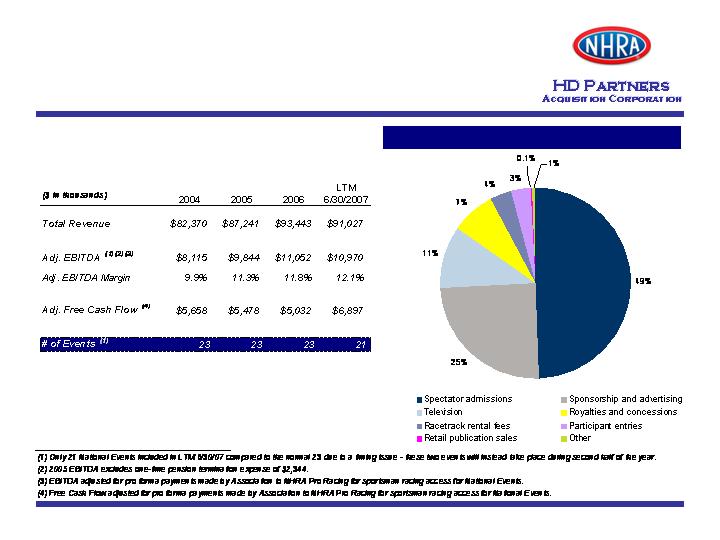

NHRA Pro Racing Financial

Overview

2006 Revenue

28

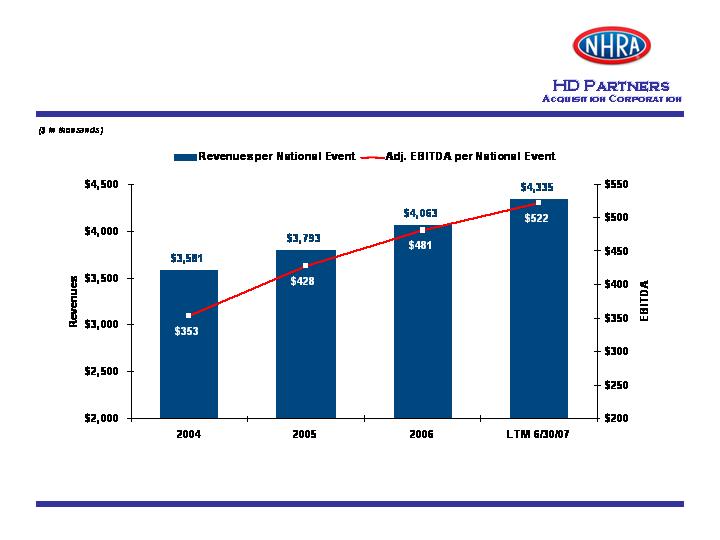

NHRA Pro Racing Financial

Overview

29

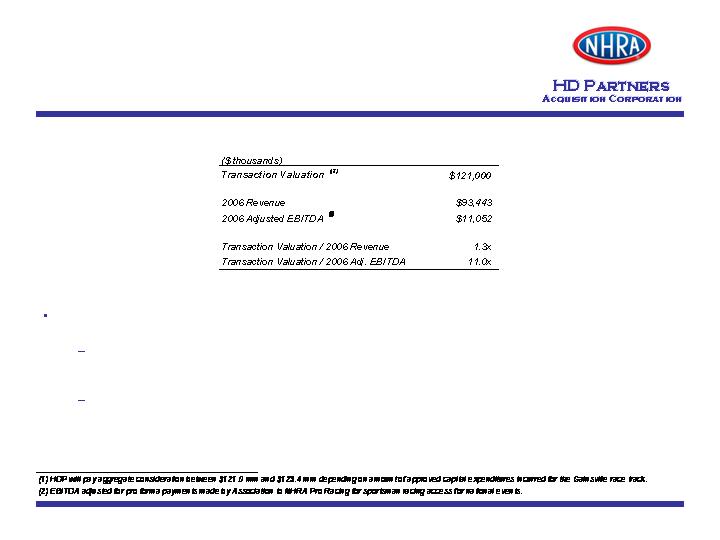

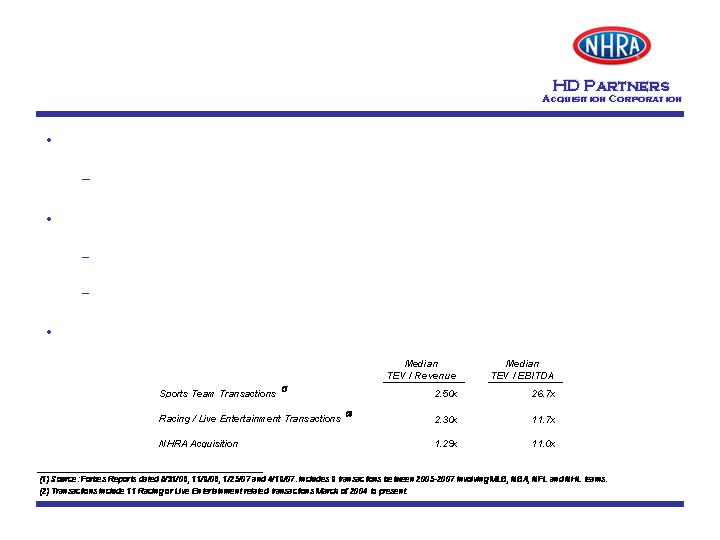

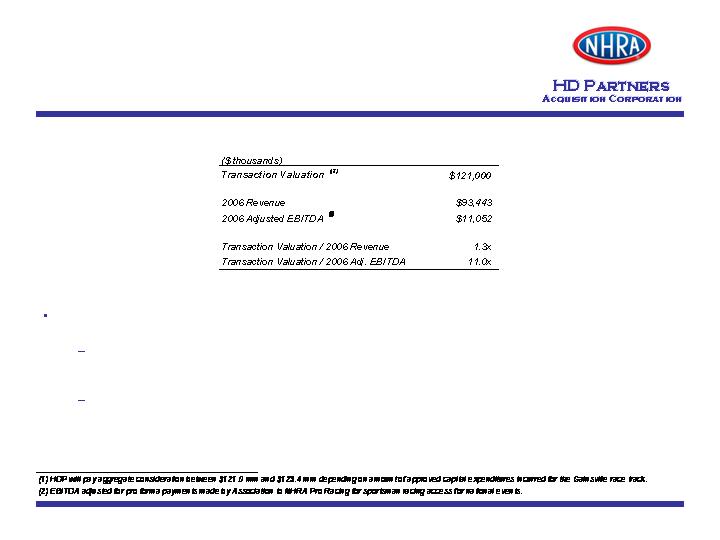

NHRA Acquisition Summary

The table illustrates the NHRA transaction valuation and multiples based on 2006 results:

LTM 6/30/07 Revenue and Adjusted EBITDA numbers only account for 21 events rather than the full

23 events because of schedule differences

The additional 2 events will occur in the third quarter of 2007 and will be reflected in the LTM

numbers at that time

30

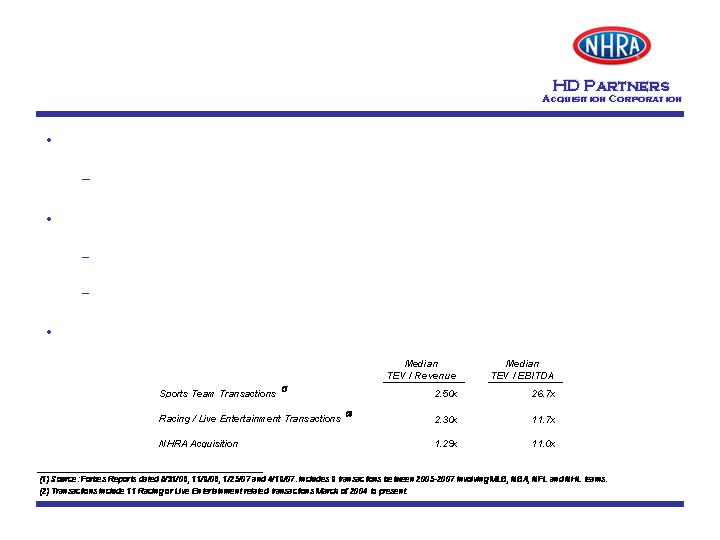

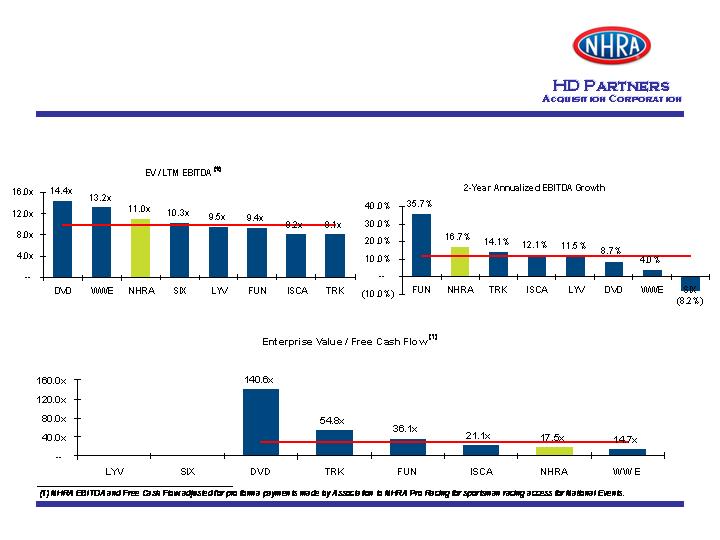

Comparable Valuation

Overview

The most relevant comparables are multi-media branded entertainment

companies

Characterized by established brand name, brand extension potential and multiple outlets for

distribution and consumption

Few direct comparables to NHRA; reviewed valuation for sports media assets,

racetrack operators and live entertainment companies

Most sports media assets are privately held and command substantial premiums in private

ownership transactions

Racetrack operators lack the substantial growth and brand extension characteristics that the

NHRA commands

The following table presents an overview of comparable transaction valuations:

31

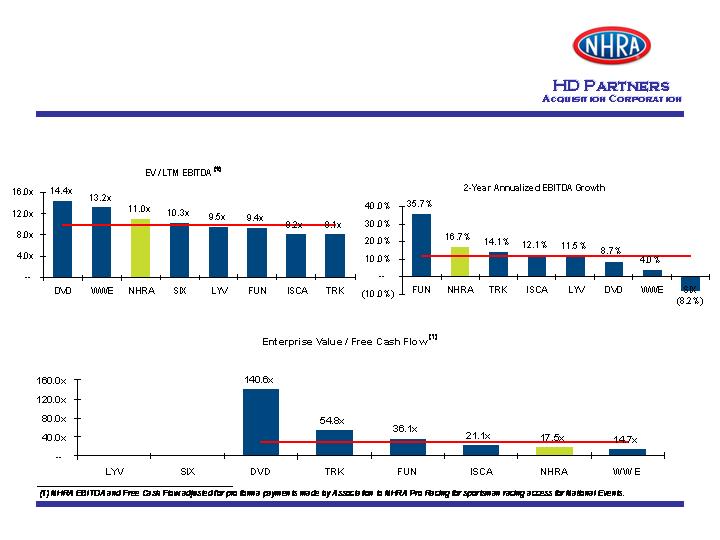

Public Comparable Companies

Growth and Valuation Comparison

… and the valuation is substantially lower than most on a free cash flow basis

The acquisition multiple is slightly higher

than most comparables…

Median: 9.9x

… but NHRA has grown faster than most of the

comparables…

Median: 11.8%

Negative Free

Cash Flow

Median: 28.6x

Negative Free

Cash Flow

32

Conclusion

Acquisition establishes a compelling

sports media asset foundation with the

capital and expertise to build a unique

entertainment platform

33