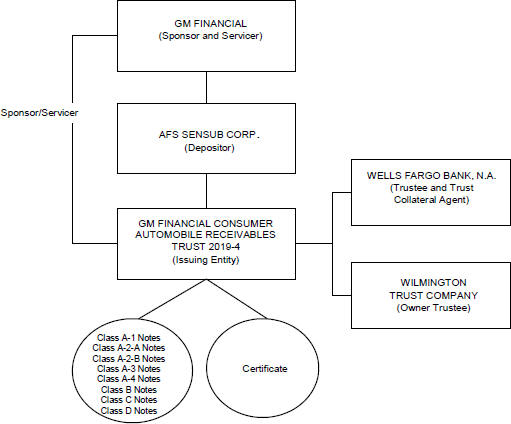

The owner trustee is not an affiliate of any of the depositor, the sponsor, the servicer, the issuing entity or the trustee. However, the owner trustee and one or more of its affiliates may, from time to time, engage in arm’s length transactions with the depositor, the sponsor, the trustee, or affiliates of any of them, that are distinct from its role as owner trustee, including transactions both related and unrelated to the securitization of automobile loan contracts.

The trustee is not an affiliate of any of the depositor, the sponsor, the servicer, the issuing entity or the owner trustee. However, the trustee and one or more of its affiliates may, from time to time, engage in arm’s length transactions with the depositor, the sponsor, the owner trustee, the sponsor or affiliates of any of them, that are distinct from its role as trustee, including transactions both related and unrelated to the securitization of automobile loan contracts. In addition, the trustee is an affiliate of Wells Fargo Securities, LLC, one of the underwriters.

The sponsor, the depositor and the servicer are affiliates and also engage in other transactions with each other involving securitizations and sales of automobile loan contracts.

Credit Risk Retention

The risk retention regulations in Regulation RR of the Exchange Act require the sponsor, either directly or through its majority-owned affiliates, to retain a 5% economic interest in the credit risk of the automobile loan contracts. The depositor is a wholly-owned subsidiary of the sponsor and intends to retain an “eligible horizontal residual interest” in the issuing entity issued as part of this securitization transaction, and, to the extent described below under “—Retained Eligible Vertical Interest”, an “eligible vertical interest” in each class of notes, to satisfy the sponsor’s obligations under Regulation RR.

As described further below, should retention of the “eligible horizontal residual interest” fail to satisfy the sponsor’s risk retention obligations under Regulation RR as determined by the sponsor at or prior to the time of pricing, the depositor would also expect to retain an “eligible vertical interest” in the form of a percentage of each class of notes in an amount necessary for the sum of the fair value of the “eligible horizontal residual interest” and the amount of the “eligible vertical interest” to at least equal the required risk retention amount. The portion of the notes that are retained in order to satisfy the requirements of Regulation RR will not be transferred, hedged or financed except as permitted by Regulation RR.

Retained Eligible Horizontal Residual Interest

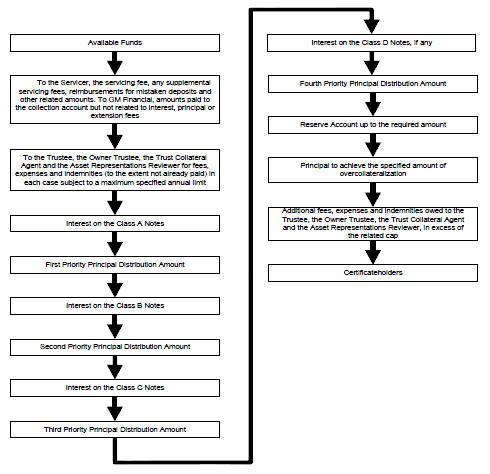

In general, the residual interest in the issuing entity represents the rights to the overcollateralization, amounts remaining in the reserve account and excess spread, in all cases to the extent those amounts are eligible for distribution in accordance with the Transaction Documents and are not needed to make payments on the notes or cover losses on the automobile loan contracts. Because the residual interest is subordinated to each class of notes and is only entitled to amounts that are not needed on a distribution date to make payments on the notes or to make other required payments or deposits according to the priorities of payments described in “Description of the Transaction Documents—Distributions—Distribution Date Payments” and “—Distribution Date Payments after an Event of Default,” the residual interest absorbs all losses on a given distribution date on the automobile loan contracts by reduction of, first, the excess spread, second, the overcollateralization and, third, the amounts in the reserve account, before any losses are incurred by the notes. See “Description of the Transaction Documents—Credit Enhancement” for a description of the credit enhancement available for the notes, including the excess spread, overcollateralization and reserve account. The Class D Notes are the most subordinate class of notes and will absorb all losses after the residual interest.

The depositor’s retention of the residual certificate (which represents the residual interest in the issuing entity) and, to the extent necessary, the Class D Notes (collectively, the “retained interest”) are intended to satisfy the requirements for an “eligible horizontal residual interest” under Regulation RR. The depositor, or another majority-owned affiliate of the sponsor, is required to retain, and will retain, this

124