Certain Relationships and Related Transactions

In the ordinary course of business from time to time, the sponsor and its affiliates have business relationships and agreements with affiliates of the owner trustee and the trustee, including commercial banking, committed credit facilities, underwriting agreements, hedging agreements and financial advisory services, all on arm’s length terms and conditions.

The owner trustee is not an affiliate of any of the depositor, the sponsor, the servicer, the issuing entity or the trustee. However, the owner trustee and one or more of its affiliates may, from time to time, engage in arm’s length transactions with the depositor, the sponsor, the trustee, or affiliates of any of them, that are distinct from its role as owner trustee, including transactions both related and unrelated to the securitization of automobile loan contracts.

The trustee is not an affiliate of any of the depositor, the sponsor, the servicer, the issuing entity or the owner trustee. However, the trustee and one or more of its affiliates may, from time to time, engage in arm’s length transactions with the depositor, the sponsor, the owner trustee, the sponsor or affiliates of any of them, that are distinct from its role as trustee, including transactions both related and unrelated to the securitization of automobile loan contracts.

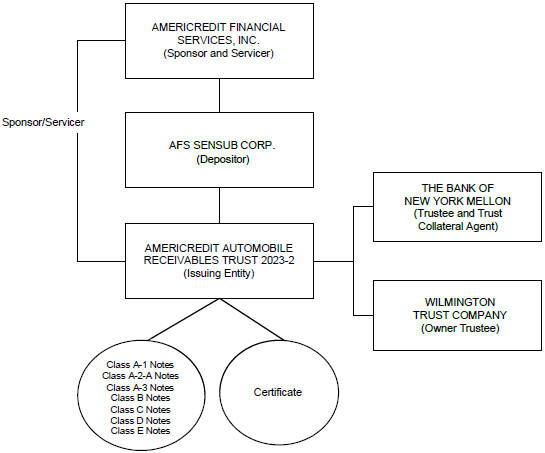

The sponsor, the depositor and the servicer are affiliates and also engage in other transactions with each other involving securitizations and sales of automobile loan contracts.

Credit Risk Retention

The risk retention regulations in Regulation RR of the Exchange Act require the sponsor, either directly or through its majority-owned affiliates, to retain a 5% economic interest in the credit risk of the automobile loan contracts as of the closing date. The depositor, a wholly-owned subsidiary of the sponsor, intends to retain an “eligible horizontal residual interest” in the issuing entity issued as part of this securitization transaction to satisfy the sponsor’s obligations under Regulation RR.

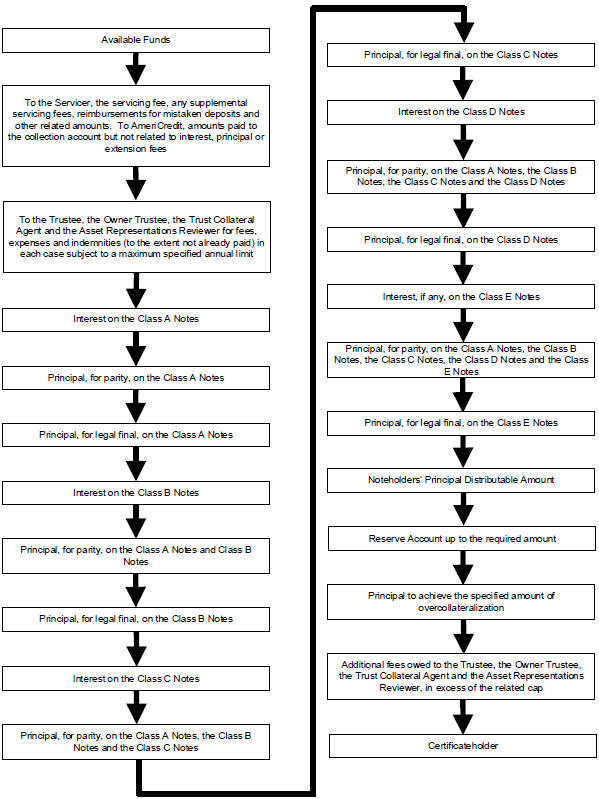

In general, the residual interest in the issuing entity represents the rights to the overcollateralization, amounts remaining in the reserve account and excess spread, in all cases to the extent those amounts are eligible for distribution in accordance with the transaction documents and are not needed to make payments on the notes or cover losses on the automobile loan contracts. Because the residual interest is subordinated to each class of notes and is only entitled to amounts that are not needed on a distribution date to make payments on the notes or to make other required payments or deposits according to the priorities of payments described in “Description of the Transaction Documents—Distributions—Distribution Date Payments” and “—Distribution Date Payments after an Event of Default,” the residual interest absorbs all losses on a given distribution date on the automobile loan contracts by reduction of, first, the excess spread, second, the overcollateralization and, third, the amounts in the reserve account, before any losses are incurred by the notes. See “Description of the Transaction Documents—Credit Enhancement” for a description of the credit enhancement available for the notes, including the excess spread, overcollateralization and reserve account. The Class E Notes are the most subordinate class of notes and will absorb losses after the residual interest, and the Class D Notes will absorb losses after the Class E Notes, to the extent necessary.

The depositor’s retention of the residual certificate, which represents the residual interest in the issuing entity, is intended to satisfy the requirements for an “eligible horizontal residual interest” under Regulation RR. The fair value of the residual interest will represent at least 5% of the sum of the fair value of the notes and the residual interest on the closing date. The depositor, or another majority-owned affiliate of the sponsor, is required to retain, and intends to retain, this residual interest until the latest of (i) two years from the closing date, (ii) the date the Pool Balance is one-third or less of the initial Pool Balance, or (iii) the date the principal amount of the notes is one-third or less of the original principal

116