QuickLinks -- Click here to rapidly navigate through this documentFiled Pursuant to Rule 424(b)(1)

Registration No. 333-131220

414,652,171 Series B Shares

Grupo Aeroportuario del Pacífico, S.A. de C.V.

Common Stock

in the form of American

Depositary Shares (ADSs)

and Series B Shares

290,256,520 Series B shares are initially being offered in the United States and elsewhere outside of Mexico in the form of ADSs and Series B shares. An additional 124,395,651 Series B shares are being concurrently offered in Mexico.

In the international offering, the initial offering price for each ADS is US$21.00, and the initial offering price for each Series B share is US$2.10, reflecting the ratio of 10 Series B shares per ADS. In the Mexican offering, the initial offering price for each Series B share is Ps.22.03, which is the approximate peso equivalent of the international offering price per Series B share of US$2.10, based on an exchange rate of Ps.10.4885 per US$1.00.

The selling stockholder is selling all of the ADSs and Series B shares. We will not receive any proceeds from this global offering.

Prior to this global offering, there has been no public market for the ADSs or Series B shares. The ADSs have been approved for listing on the New York Stock Exchange under the symbol "PAC" and the Series B shares have been approved for listing on the Mexican Stock Exchange under the symbol "GAP."

Investing in the ADSs or Series B shares involves risks. See "Risk Factors" on page 20.

| | Price to

Public

| | Underwriting

Discounts and

Commissions

| | Proceeds to

Selling Stockholder

|

|---|

| Per ADS | | US$21.00 | | US$0.22890 | | US$20.77110 |

| Per Series B share | | US$2.10 | | US$0.02289 | | US$2.07711 |

| Total | | US$609,538,692 | | US$6,643,971.74 | | US$602,894,720.26 |

The selling stockholder has granted an option, exercisable for 30 days, to the international underwriters to purchase up to 43,538,480 additional Series B shares and to the Mexican underwriter to purchase up to 18,659,349 additional Series B shares.

The underwriters are offering the ADSs and the Series B shares subject to various conditions and may reject all or part of any order, without notice. Delivery of the ADSs and the Series B shares is expected to be made on or about March 1, 2006.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The Series B shares have been registered in the Mexican National Securities Registry maintained by the Mexican National Banking and Securities Commission. Such registration is not a certification as to the investment quality of the securities, the solvency of the issuer or the accuracy or completeness of the information contained in this prospectus.

Credit Suisse

| Citigroup | | Deutsche Bank | | Santander Investment |

The date of this prospectus is February 23, 2006

TABLE OF CONTENTS

| PRESENTATION OF FINANCIAL INFORMATION | | 2 |

EXCHANGE RATES |

|

3 |

INDUSTRY AND OTHER DATA |

|

4 |

SUMMARY |

|

5 |

| |

THE COMPANY |

|

5 |

| |

THE GLOBAL OFFERING |

|

12 |

| |

SUMMARY CONSOLIDATED FINANCIAL INFORMATION |

|

16 |

RISK FACTORS |

|

20 |

BUSINESS STRATEGY |

|

38 |

USE OF PROCEEDS |

|

42 |

CAPITALIZATION |

|

42 |

DILUTION |

|

43 |

MARKET INFORMATION |

|

43 |

DIVIDEND POLICY |

|

49 |

SELECTED CONSOLIDATED FINANCIAL INFORMATION |

|

51 |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

55 |

BUSINESS |

|

90 |

REGULATORY FRAMEWORK |

|

131 |

MANAGEMENT |

|

145 |

RELATED PARTY TRANSACTIONS |

|

153 |

PRINCIPAL STOCKHOLDERS AND SELLING STOCKHOLDER |

|

155 |

DESCRIPTION OF CAPITAL STOCK |

|

158 |

DESCRIPTION OF AMERICAN DEPOSITARY RECEIPTS |

|

172 |

TAXATION |

|

178 |

UNDERWRITING |

|

181 |

NOTICE TO CANADIAN RESIDENTS |

|

187 |

FORWARD-LOOKING STATEMENTS |

|

188 |

WHERE YOU CAN FIND MORE INFORMATION |

|

189 |

ENFORCEABILITY OF CIVIL LIABILITIES |

|

190 |

VALIDITY OF SECURITIES |

|

190 |

EXPERTS |

|

190 |

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS |

|

F-1 |

You should rely only on the information contained in this document. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to sell these securities. The information contained in this document is accurate on the date of this document and may no longer be accurate at the time of the delivery of this prospectus or any sale of the ADSs or Series B shares.

NOTICE TO UNITED KINGDOM RESIDENTS

This offering is only being made to persons in the United Kingdom whose ordinary activities involve them in acquiring, holding, managing or disposing of investments (as principal or agent) for the purposes of their businesses or otherwise in circumstances which have not resulted and will not result in an offer to the public in the United Kingdom within the meaning of the Public Offers of Securities Regulations 1995 or the UK Financial Services and Markets Act 2000, or FSMA, and each underwriter has only communicated or caused to be communicated and will only communicate or cause to be communicated any invitation or inducement to engage in investment activity (within the meaning of section 21 of FSMA) received by it in connection with the issue or sale of the ADSs in circumstances in which section 21(1) of FSMA does not apply to Grupo Aeroportuario del Pacifico, S.A. de C.V. Each of the underwriters agrees and acknowledges that it has complied and will comply with all applicable provisions of FSMA with respect to anything done by it in relation to the ADSs in, from or otherwise involving the United Kingdom.

PRESENTATION OF FINANCIAL INFORMATION

Our audited financial statements are prepared in accordance with accounting principles generally accepted in Mexico (Mexican GAAP), which differ in certain significant respects from accounting principles generally accepted in the United States (U.S. GAAP). For example, Mexican GAAP provides for the recognition of certain effects of inflation by restating non-monetary assets and non-monetary liabilities using the Mexican Consumer Price Index, restating the components of stockholders' equity using the Mexican Consumer Price Index and recording gains or losses in purchasing power from holding monetary liabilities or assets. Mexican GAAP also requires the restatement of all financial statements to constant Mexican pesos as of the date of the most recent balance sheet presented. Our audited financial statements for the years ended December 31, 2004, 2003 and 2002 and all other financial information contained herein with respect to the years ended December 31, 2004, 2003, 2002, 2001 and 2000 are accordingly presented in constant pesos with purchasing power as of December 31, 2004, unless otherwise noted. Our audited interim financial statements for the nine-month period ended September 30, 2005, which include comparative unaudited financial information for the nine-month period ended September 30, 2004, and all other financial information presented herein with respect to the nine-month periods ended September 30, 2005 and 2004 are presented in constant pesos with purchasing power as of September 30, 2005. The difference in the purchasing power of the peso at December 31, 2004 as compared to the purchasing power of the peso at September 30, 2005 was 1.7%, which we do not consider to be material or to materially affect financial results as presented herein. For a more detailed discussion of these differences as they relate to our business, see Note 22 to our audited year-end financial statements and Note 21 to our audited interim financial statements for the nine-month period ended September 30, 2005.

References in this prospectus to "dollars," "U.S. dollars", "$" or "U.S. $" are to the lawful currency of the United States. References in this prospectus to "pesos", "Pesos" or "Ps." are to the lawful currency of Mexico. We publish our financial statements in pesos.

This prospectus contains translations of certain peso amounts to U.S. dollars at specified rates solely for your convenience. These translations do not mean that the peso amounts actually represent such dollar amounts or could be converted into U.S. dollars at the rate indicated. Unless otherwise indicated, we have translated these U.S. dollar amounts from pesos at the exchange rate of Ps. 10.791 per U.S. $1.00, the Federal Reserve noon buying rate on September 30, 2005.

2

EXCHANGE RATES

The following table sets forth, for the periods indicated, the high, low, average and period-end, free-market exchange rate expressed in pesos per U.S. dollar. The average annual rates presented in the following table were calculated by using the average of the exchange rates on the last day of each month during the relevant period. The data provided in this table are based on noon buying rates published by the Federal Reserve Bank of New York for cable transfers in Mexican pesos. We have not restated the rates in constant currency units. All amounts are stated in pesos. We make no representation that the Mexican peso amounts referred to in this prospectus could have been or could be converted into U.S. dollars at any particular rate or at all.

Exchange Rates

Year Ended December 31,

| | High

| | Low

| | Average(1)

| | Period End

|

|---|

| 1999 | | 10.60 | | 9.24 | | 9.56 | | 9.48 |

| 2000 | | 10.09 | | 9.18 | | 9.47 | | 9.62 |

| 2001 | | 9.97 | | 8.95 | | 9.33 | | 9.16 |

| 2002 | | 10.43 | | 9.00 | | 9.75 | | 10.43 |

| 2003 | | 11.41 | | 10.11 | | 10.85 | | 11.24 |

| 2004 | | 11.64 | | 10.81 | | 11.31 | | 11.15 |

| 2005 | | 11.41 | | 10.41 | | 10.88 | | 10.63 |

| | August 2005 | | 10.90 | | 10.58 | | 10.69 | | 10.79 |

| | September 2005 | | 10.89 | | 10.68 | | 10.79 | | 10.79 |

| | October 2005 | | 10.94 | | 10.69 | | 10.84 | | 10.79 |

| | November 2005 | | 10.77 | | 10.57 | | 10.68 | | 10.77 |

| | December 2005 | | 10.77 | | 10.41 | | 10.63 | | 10.63 |

| | January 2006 | | 10.64 | | 10.44 | | 10.54 | | 10.44 |

| | February 2006 (through February 23) | | 10.52 | | 10.43 | | 10.49 | | 10.51 |

- (1)

- Average of month-end rates or daily rates, as applicable.

Source: Federal Reserve noon buying rate.

Except for the period from September through December 1982, during a liquidity crisis, the Mexican Central Bank has consistently made foreign currency available to Mexican private-sector entities (such as us) to meet their foreign currency obligations. Nevertheless, in the event of renewed shortages of foreign currency, there can be no assurance that foreign currency would continue to be available to private-sector companies or that foreign currency needed by us to service foreign currency obligations or to import goods could be purchased in the open market without substantial additional cost.

Fluctuations in the exchange rate between the peso and the U.S. dollar will affect the U.S. dollar value of securities traded on the Mexican Stock Exchange, including the Series B shares and, as a result, will likely affect the market price of the ADSs. Such fluctuations will also affect the U.S. dollar conversion by the depositary of any cash dividends paid in pesos on Series B shares represented by ADSs.

On February 23, 2006, the Federal Reserve noon buying rate was Ps. 10.505 per U.S. $1.00.

3

INDUSTRY AND OTHER DATA

This prospectus contains certain statistical and other information regarding international and Mexican airports. This information has been derived or extracted, as noted, from publications of the Mexican Bureau of Civil Aviation and the Airport and Auxiliary Services Agency.

This prospectus also includes certain demographic and tourism data that have been extracted or derived from publications of the World Tourism Organization, the Mexican Ministry of Tourism, the Mexican Central Bank, the Mexican National Institute of Statistics, Geography and Informatics, the Mexican National Institute of Migration, the Mexican Bureau of Civil Aviation, the Association of the Development of Timeshares and the Los Cabos Hotel Association. All population data for Mexico included in this prospectus are based on estimated population data as of 2004 published by the Mexican National Institute of Statistics, Geography and Informatics in 2000 or information published by the Mexican National Population Council. All information included in this prospectus that is identified as having been derived or extracted from these institutions is included herein on the authority of such sources as public official documents.

All information in this prospectus relating to an airport's percentage of international passengers is based on the number of that airport's passengers arriving from and departing to foreign destinations relative to the total number of passengers served by that airport, unless otherwise specified. All information in this prospectus relating to an airport's percentage of domestic passengers is based on the number of that airport's passengers arriving from and departing to domestic destinations relative to the total number of passengers served by that airport. Accordingly, this information reflects the place of origin or destination of passengers as opposed to their residence.

When we refer to "terminal passengers" we are referring to the sum of all arriving and departing passengers on commercial and general aviation flights, other than transit passengers. "Transit passengers", or through passengers, are those who generally are not required to change aircraft while on a multiple-stop itinerary, who generally do not disembark their aircraft to enter the terminal building. When we refer to "total passengers" we are referring to the sum of terminal passengers plus transit passengers. When we refer to "commercial aviation passengers," we are referring to the sum of terminal and transit passengers, excluding general aviation passengers, such as those on private non-commercial aircraft. System-wide data in Mexico are based on commercial aviation passengers, but we generally measure our operations based on terminal passengers.

When we refer to "air traffic movements" we are referring to the sum of all aircraft arrivals and departures of any kind at an airport.

This prospectus includes references to "workload units," which are units measuring an airport's passenger traffic volume and cargo volume. A workload unit currently is equivalent to one terminal passenger or 100 kilograms (220 pounds) of cargo.

As used in this prospectus, "maximum rate" refers to the maximum amount of revenues per workload unit that an airport may earn annually from services subject to price regulation pursuant to the terms of our concessions and applicable Mexican law. Each airport's maximum rates are adjusted periodically to reflect changes in the Mexican producer price index (excluding petroleum). For a detailed discussion of the relevance of the maximum rates to our business, see "Regulatory Framework—Aeronautical Services Regulation."

Unless otherwise indicated, the information contained in this prospectus assumes that the underwriters' over-allotment option to purchase an additional 62,197,829 Series B shares from the selling stockholder is not exercised and that AMP has not exercised any of its options to acquire our shares. For further information regarding the options to purchase additional shares, see "Underwriting" and "Principal Stockholders and Selling Stockholder."

At a shareholders' meeting held on February 2, 2006, our shareholders agreed to effect a reverse stock split whereby one new share of capital stock was issued in exchange for each outstanding 28.5558 shares of capital stock. Unless otherwise noted herein, all share and per-share data in this prospectus have been adjusted to reflect the reverse stock split for all periods presented.

4

SUMMARY

This summary highlights selected information from this prospectus and may not contain all of the information that is important to you. This prospectus includes specific terms of the ADSs and the Series B shares that the selling stockholder is offering, as well as information regarding our business and detailed financial information. You should read the entire prospectus carefully, including the risk factors and financial statements.

Grupo Aeroportuario del Pacifico, S.A. de C.V. is a holding company that conducts all of its operations through its subsidiaries. Grupo Aeroportuario del Pacifico, S.A. de C.V. and each of its subsidiaries are organized under the laws of Mexico. The terms "we," "our" and "us" in this prospectus refer to Grupo Aeroportuario del Pacifico, S.A. de C.V., together with its subsidiaries, and to properties and assets that we own or operate, unless otherwise specified.

THE COMPANY

Introduction

We were incorporated in 1998 as part of the Mexican government's program for the opening of Mexico's airports to private investment. We hold concessions to operate, maintain and develop 12 airports in the Pacific and Central regions of Mexico. Each of our concessions has a term of 50 years beginning on November 1, 1998. The term of each of our concessions may be extended by the Ministry of Communications and Transportation under certain circumstances for up to 50 additional years. As operator of the 12 airports under our concessions, we charge airlines, passengers and other users fees for the use of the airports' facilities. We also derive rental and other income from commercial activities conducted at our airports, such as the leasing of space to restaurants and retailers.

Our Operations

We operate 12 airports, which serve two major metropolitan areas (Guadalajara and Tijuana), several tourist destinations, such as Puerto Vallarta, Los Cabos, La Paz and Manzanillo, and a number of mid-sized cities, such as Hermosillo, Leon, Guanajuato, Silao, Morelia, Aguascalientes, Mexicali and Los Mochis. Our airports are located in 9 of the 31 Mexican states, covering a territory of approximately 566,000 square kilometers (approximately 216,000 square miles), with a population of approximately 26 million according to the Mexican National Population Council (Consejo Nacional de Poblacion). All of our airports are designated as international airports under Mexican law, meaning that they are all equipped to receive international flights and maintain customs, refueling and immigration services managed by the Mexican government.

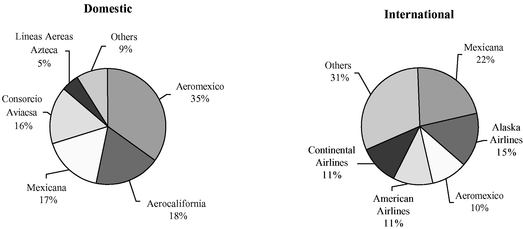

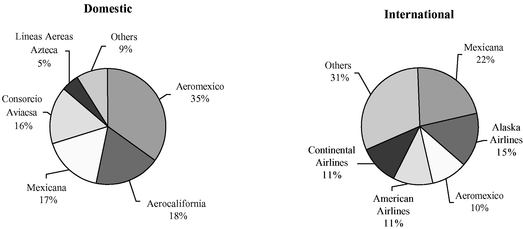

Six of our airports rank among the top ten busiest airports in Mexico based on commercial aviation passenger traffic, according to data published by the Mexican Bureau of Civil Aviation (Direccion General de Aeronautica Civil) in 2004. According to figures of the Mexican Bureau of Civil Aviation, our commercial aviation passenger traffic accounted for approximately 26.4% and 27% of all arriving and departing commercial aviation passengers in Mexico in 2004 and the first nine months of 2005, respectively.

5

The following table sets forth the top ten airports in Mexico by commercial aviation passenger traffic in 2004:

Principal Mexican Airports by Passenger Traffic

Airport

| | 2004 Commercial

Aviation Passengers

(thousands)

|

|---|

| Mexico City | | 22,940 |

| Cancun | | 10,011 |

| Guadalajara* | | 5,375 |

| Monterrey | | 4,288 |

| Tijuana* | | 3,382 |

| Puerto Vallarta* | | 2,271 |

| Los Cabos* | | 1,826 |

| Hermosillo* | | 1,197 |

| Bajio* | | 1,029 |

| Merida | | 931 |

- *

- Indicates airports operated by us.

Source: Mexican Bureau of Civil Aviation

In 2004, we recorded revenues of Ps. 2,190.4 million (U.S. $203.0 million) and net income of Ps. 387.3 million (U.S. $35.9 million). In the first nine months of 2004, we recorded revenues of Ps. 1,653.7 million (U.S.$153.2 million) and net income of Ps. 355.9 million (U.S.$33.0 million), while in the first nine months of 2005, we recorded revenues of Ps. 1,909.5 (U.S. $177.0 million) and net income of Ps. 521.2 million (U.S. $48.3 million). Our airports handled approximately 17.5 million terminal passengers in 2004, making us the largest private airport operator in the Americas. In the first nine months of 2004 and 2005, our airports handled 13.2 million terminal passengers and 14.3 million terminal passengers, respectively.

Our airports serve several major international routes, including Guadalajara-Los Angeles, which ranked as the second busiest international route in Mexico by total number of passengers in 2004 according to the Mexican Bureau of Civil Aviation. In addition, our airports serve major resort destinations such as Puerto Vallarta and Los Cabos, which are among the most popular destinations in Mexico visited by tourists from California. Our airports also serve major domestic routes, including Guadalajara-Mexico City, which was the country's third busiest route in 2004, handling over 1.4 million total passengers that year, according to the Mexican Bureau of Civil Aviation. Other top-five domestic routes in terms of total passenger traffic include Mexico City-Tijuana and Guadalajara-Tijuana, according to the Mexican Bureau of Civil Aviation.

Two of our airports, Guadalajara International Airport and Tijuana International Airport, serve major metropolitan areas. Guadalajara is the second largest city in Mexico, with a population of more than four million in the greater metropolitan area, and Tijuana is the fifth largest city in Mexico, with a population of approximately 1.5 million. In addition, Tijuana, which is located near the Mexico-U.S. border, is a popular destination for Mexicans traveling to or returning from the United States. In 2004 and the first nine months of 2005, Guadalajara International Airport and Tijuana International Airport together represented approximately 50.2% and 47.7%, respectively, of our terminal passenger traffic and 47.5% and 44.3%, respectively, of our total revenues.

Four of our airports, Puerto Vallarta International Airport, Los Cabos International Airport, La Paz International Airport and Manzanillo International Airport, serve popular Mexican tourist destinations. Of these tourist destinations, Puerto Vallarta and Los Cabos are the largest, with Puerto Vallarta constituting Mexico's second largest international tourist destination and Los Cabos the third

6

largest in terms of visitors in 2004, according to the Mexican National Institute of Migration (Instituto Nacional de Migracion). Puerto Vallarta attracted approximately 2.3 million terminal passengers in 2004, while Los Cabos attracted approximately 1.8 million terminal passengers in that year. In 2004 and the first nine months of 2005, our Puerto Vallarta and Los Cabos International Airports together represented 23.4% and 27%, respectively, of our terminal passengers and 28.4% and 32.3%, respectively, of our total revenues.

Mexico was the eighth largest tourist destination in the world in 2004 in terms of international arriving tourists (20.6 million), according to the World Tourism Organization. Within Latin America and the Caribbean, Mexico ranked first in 2004 in terms of number of foreign visitors and income from tourism, according to the World Tourism Organization. The tourism industry is one of the largest generators of foreign exchange in the Mexican economy, contributing U.S. $10.8 billion in 2004, according to the Mexican Ministry of Tourism.

The remaining six airports in our group serve mid-sized cities—Hermosillo, Leon, Morelia, Aguascalientes, Mexicali and Los Mochis—with diverse economic activities. These cities are industrial centers (Hermosillo, Leon, Aguascalientes and Mexicali) and/or the hubs of important agricultural regions (Leon, Morelia and Los Mochis). Of these six airports, Hermosillo International Airport has the highest passenger traffic volume (1.2 million terminal passengers in 2004).

The following table provides summary data for each of our 12 airports for the year ended December 31, 2004 and for the nine months ended September 30, 2005:

| |

| | Year ended December 31, 2004

| | Nine months ended September 30, 2005

|

|---|

Airport

| | Type of area served

| | Terminal passengers

| | Revenues

| | Revenues per terminal passenger(1)

| | Terminal passengers

| | Revenues

| | Revenues per terminal passenger(1)

|

|---|

| |

| | Number

(in millions)

| | %

| | (millions of pesos)

| | %

| | (pesos)

| | Number

(in millions)

| | %

| | (million of pesos)

| | %

| | (pesos)

|

|---|

| Guadalajara International Airport | | Large, metropolitan city(2) | | 5.4 | | 30.8 | % | 737.7 | | 33.7 | % | 136.8 | | 4.2 | | 29.5 | % | 603.7 | | 31.6 | % | 142.9 |

| Tijuana International Airport | | Large, metropolitan city | | 3.4 | | 19.4 | | 303.5 | | 13.9 | | 89.5 | | 2.6 | | 18.2 | | 241.5 | | 12.6 | | 92.4 |

| Puerto Vallarta International Airport | | Tourist destination | | 2.3 | | 13.0 | | 310.3 | | 14.2 | | 136.1 | | 2.0 | | 14.3 | | 301.6 | | 15.8 | | 147.3 |

| Los Cabos International Airport | | Tourist destination | | 1.8 | | 10.4 | | 312.6 | | 14.3 | | 171.1 | | 1.8 | | 12.8 | | 315.9 | | 16.5 | | 172.8 |

| Hermosillo International Airport | | Mid-sized city(3) | | 1.2 | | 6.9 | | 117.8 | | 5.4 | | 96.8 | | 0.9 | | 6.4 | | 97.9 | | 5.1 | | 106.6 |

| Bajio International Airport | | Mid-sized city | | 1.0 | | 6.0 | | 133.5 | | 6.1 | | 127.7 | | 0.8 | | 5.8 | | 114.7 | | 6.0 | | 137.0 |

| Morelia International Airport | | Mid-sized city | | 0.6 | | 3.5 | | 77.4 | | 3.5 | | 126.8 | | 0.5 | | 3.5 | | 70.2 | | 3.7 | | 139.4 |

| La Paz International Airport | | Tourist destination | | 0.4 | | 2.5 | | 56.5 | | 2.6 | | 129.1 | | 0.3 | | 2.4 | | 47.7 | | 2.5 | | 139.3 |

| Aguascalientes International Airport | | Mid-sized city | | 0.4 | | 2.1 | | 40.5 | | 1.8 | | 111.3 | | 0.3 | | 1.9 | | 33.0 | | 1.7 | | 120.6 |

| Mexicali International Airport | | Mid-sized city | | 0.5 | | 3.1 | | 52.2 | | 2.4 | | 97.3 | | 0.4 | | 2.9 | | 41.9 | | 2.2 | | 100.1 |

| Los Mochis International Airport | | Mid-sized city | | 0.2 | | 1.3 | | 25.2 | | 1.2 | | 112.7 | | 0.2 | | 1.1 | | 18.3 | | 1.0 | | 118.8 |

| Manzanillo International Airport | | Tourist destination | | 0.2 | | 1.1 | | 23.2 | | 1.1 | | 121.5 | | 0.2 | | 1.2 | | 23.1 | | 1.2 | | 129.3 |

| | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| TOTAL: | | 17.5 | | 100.0 | % | 2,190.4 | | 100.0 | % | 125.0 | | 14.3 | | 100.0 | % | 1,909.5 | | 100.0 | % | 133.2 |

| | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

- (1)

- Revenues per terminal passenger are calculated by dividing the total revenues for each airport by the number of terminal passengers for each airport.

- (2)

- The Mexican National Population Council defines a large city as a city with a population greater than one million people.

- (3)

- The Mexican National Population Council defines a mid-sized city as a city with a population between 100,000 and one million people.

The Ministry of Communications and Transportation of Mexico has recently granted concessions to four new airlines, which we understand will operate as low-cost carriers. We expect that the addition of

7

these airlines will increase our passenger traffic volume. In addition, pursuant to an amended bilateral aviation agreement between Mexico and the United States, the number of carriers eligible to operate routes between twelve specified Mexican airports (including three airports operated by us) and any U.S. city will be increased in 2006 from two Mexican and two U.S. carriers to three Mexican and three U.S. carriers, which we expect will generate additional future growth in our passenger traffic. The amended bilateral agreement will enter into effect once all necessary governmental approvals have been obtained. We also expect to achieve additional future growth as a result of the increase, beginning in October 2007, of carriers operating routes between our Guadalajara International Airport and any city in the U.S. pursuant to the amended bilateral agreement, from two Mexican and two U.S. carriers to three Mexican and three U.S. carriers. There can be no assurance that any of these developments will increase our passenger traffic volume.

Our principal executive headquarters are located at Avenida Mariano Otero No. 1249-B, Torre Pacifico, Piso 6, Guadalajara, Jalisco, Mexico, 44530. This is also the business address of the directors and officers identified under "Management—Directors" and "Management—Executive Officers" below. Our telephone number is + (5233) 3880-1100.

Investment by Aeropuertos Mexicanos del Pacifico, S.A. de C.V.

In 1999, as part of the first stage in the process of opening Mexico's airports to private investment, the Mexican government sold a 15% equity interest in us to Aeropuertos Mexicanos del Pacifico, S.A. de C.V. pursuant to a public bidding process. We refer to Aeropuertos Mexicanos del Pacifico as "AMP." This offering is the second stage of the opening of our airports to private investment.

The following are AMP's current stockholders:

- •

- AENA Desarrollo Internacional, S.A., or AENA, owns 25.5% of AMP. AENA is a wholly owned subsidiary of Aeropuertos Espanoles y Navegacion Aerea, a Spanish state-owned company that manages all airport operations in Spain. Aeropuertos Espanoles y Navegacion Aerea operates 47 airports in Spain, handling approximately 166 million total passengers in Spain in 2004, making it one of the largest airport operators in the world. Pursuant to the privatization guidelines published by the Mexican government during the first phase of our privatization, requiring our strategic stockholder to have, among other qualifications, an operating partner and a Mexican partner, AENA is one of AMP's two key partners, acting as its operating partner. In addition to its investment in AMP, AENA also directly manages four other airports in Latin America. In addition, AENA owns 10.0% of Airport Concessions and Development Limited, which owns a British airport company that operates thirteen airports in Europe, North America and Latin America through ownership, concession or management arrangements. In 2004, AENA had total revenue of approximately U.S.$1.5 billion.

- •

- Controladora Mexicana de Aeropuertos, S.A. de C.V., or Controladora Mexicana, owns 25.5% of AMP. Controladora Mexicana is a Mexican joint venture company 50% owned by Pal Aeropuertos, S.A. de C.V., and 50% owned by Promotora Aeronautica del Pacifico, S.A. de C.V. Pal Aeropuertos, S.A. de C.V. is a Mexican special purpose vehicle owned by Eduardo Sanchez Navarro Redo, an individual Mexican investor with substantial interests in Mexican real estate. Promotora Aeronautica del Pacifico, S.A. de C.V. is a Mexican special purpose vehicle owned by Laura Diez Barroso Azcarraga and her husband, Carlos Laviada Ocejo. Mrs. Diez Barroso has extensive experience in the magazine publishing industry and currently serves on the boards of directors of Telefonos de Mexico, S.A. de C.V., Grupo Financiero Inbursa S.A. and Royal Caribbean Cruises Ltd. Mr. Laviada Ocejo, an individual Mexican investor with substantial interests in real estate development and automobile dealerships in Mexico City, currently serves on the board of directors of Toyota Mexico Dealers A.C. Pursuant to the privatization guidelines discussed above, Controladora Mexicana is AMP's second key partner, acting as its Mexican partner. Controladora Mexicana recently acquired its interest in AMP from Aeropuertos del Pacifico Noroeste, S.A. de C.V., or Pacifico Noroeste, which is no longer a shareholder of AMP.

8

The Mexican antitrust authorities have conditioned their recent approval of this sale on the disposition by the shareholders of Controladora Mexicana of any direct or indirect equity interest they hold in Grupo Mexicana de Aviacion, S.A. de C.V., or Grupo Mexicana, the owner of Mexicana and Click airlines, or its subsidiaries. See "Business—Opening of Mexican Airports to Investment—Investment by AMP" and "Principal Stockholders and Selling Stockholders," as well as "Risk Factors—The failure of the shareholders of Controladora Mexicana to comply with certain conditions imposed by the Mexican unitrust authorities could have a material adverse effect on us or the value of our securities."

- •

- Desarrollo de Concesiones Aeroportuarias, S.A., or DCA, a subsidiary of Actividades de Construcciones y Servicios, S.A., owns 34.42% of AMP. Actividades de Construcciones y Servicios is one of Europe's major construction companies and an operator of various infrastructure projects under concessions in industries including airports, trains, toll roads, ports and car parking on four continents. Actividades de Construccion y Servicios is the largest operator of concessions in Latin America and one of the largest operators of concessions (based on number of concessions) in the world. In July 2005, Actividades de Construccion y Servicios acquired 22.073% of Grupo Union FENOSA, S.A, the majority shareholder of Inversora, and Actividades de Construccion y Servicios, S.A. recently acquired an additional 6.26% stake in Grupo Union FENOSA, S.A. Actividades de Construccion y Servicios also owns 24.83% of Abertis Infraestructuras, S.A., the majority shareholder of Airport Concessions and Development Limited. Actividades de Construccion y Servicios is listed on the Madrid Stock Exchange and had a market capitalization of €8.7 billion as of December 5, 2005.

- •

- Inversora del Noroeste, S.A. de C.V., or Inversora, owns 14.58% of AMP. Inversora is a Mexican company controlled by Grupo Union FENOSA, S.A., a Spanish energy utility company with a strong international presence of approximately 24,000 employees in 28 countries and four continents. The company is involved in the generation, transmission, distribution and marketing of energy, in telecommunications and in professional services. Grupo Union FENOSA, S.A.'s largest shareholder is Actividades de Construccion y Servicios, S.A., the parent corporation of DCA. Grupo Union FENOSA, S.A. is listed on the Madrid Stock Exchange and had a market capitalization of €9.8 billion as of December 5, 2005.

In 1999, AMP paid the Mexican government a total of Ps. 2,453.4 million (nominal pesos, excluding interest) (U.S. $261 million based on the exchange rate in effect on the date of AMP's bid) in exchange for:

- •

- All of our Series BB shares, representing 15% of our outstanding capital stock;

- •

- an option to subscribe for up to 5% of newly issued Series B shares; and

- •

- the right and obligation to enter into various agreements with us and the Mexican government, including a participation agreement setting forth the rights and obligations of each of the parties involved in the privatization (including AMP), a 15-year technical assistance agreement setting forth AMP's right and obligation to provide technical assistance to us in exchange for an annual fee, and a shareholders' agreement under terms established during the public bidding process. These agreements are described in greater detail under "Principal Stockholders and Selling Stockholder" and "Related Party Transactions."

Under the technical assistance agreement, AMP provides management and consulting services and transfers industry expertise and technology to us in exchange for a fee, which in 2004 amounted to Ps. 75.5 million (U.S. $7 million). This agreement is more fully described in "Related Party Transactions."

Pursuant to our bylaws, AMP (as holder of our Series BB shares) has the right to appoint and remove our chief executive officer, our chief financial officer, our chief operating officer and our commercial director, to elect four members of our board of directors and to designate 20% of the members of each board committee (or one member in the case of any committee consisting of fewer

9

than five members). AMP (as holder of our Series BB shares) also has the right pursuant to our bylaws to veto certain actions requiring approval of our stockholders (including the payment of dividends, the amendment of our bylaws and the amendment of its right to appoint certain members of our senior management). These rights are not subject to the technical assistance agreement and the participation agreement remaining in effect. If at any time before August 25, 2014 AMP were to hold less than 7.65% of our capital stock in the form of Series BB shares, it would lose its veto rights (but its other special rights would be unaffected). If at any time after August 25, 2014 AMP were to hold less than 7.65% of our capital stock in the form of Series BB shares, such shares must be converted into Series B shares, which would cause AMP to lose all of its special rights. As long as AMP retains at least 7.65% of our capital stock in the form of Series BB shares, whether before or after August 25, 2014, all of its special rights will remain in place. Pursuant to our bylaws, the technical assistance agreement and the participation agreement, AMP may not transfer more than 49% of its Series BB shares until after August 25, 2009. The rights and obligations of AMP in our management are described under "Management—Committees," "Description of Capital Stock" and "Principal Stockholders and Selling Stockholders."

The remaining 85% of our outstanding capital stock was transferred on August 25, 1999 by the Mexican government to a Mexican trust established by Nacional Financiera, S.N.C., or NAFIN, a Mexican national credit institution and development bank owned and controlled by the Mexican government. NAFIN is acting as trustee of this trust pursuant to the instructions of the Ministry of Communications and Transportation. This trust is the selling stockholder in this global offering, which is the second stage of our privatization. The net proceeds from the sale of shares held by the selling stockholder are payable to the Mexican government.

Principal Terms of Our Concessions

Master Development Programs

Every five years, we are required to submit to the Ministry of Communications and Transportation for approval a master development program for each of our concessions describing, among other matters, our strategy, our traffic forecasts and our expansion, modernization and maintenance plans. Each master development program is required to be updated and resubmitted for approval to the Ministry of Communications and Transportation every five years. Upon such approval, the master development program is binding and deemed to constitute part of the relevant concession. Any major construction, renovation or expansion of an airport generally may only be made pursuant to a concession holder's master development program and upon approval by the Ministry of Communications and Transportation. In December 2004, the Ministry of Communications and Transportation approved the master development programs for each of our airports for the 2005 to 2009 period. These five-year programs will be in effect from January 1, 2005 until December 31, 2009.

We believe that we complied with the investment obligations set forth in our previous master development programs for each of our airports for the years 2000 through 2004. We expect the Ministry of Communications and Transportation will formally determine during the first six months of 2006 whether we complied with our obligations for the five-year period ended December 31, 2004. If the Ministry of Communications and Transportation determines that we did not comply with our obligations under each of our master development programs, we may be subject to sanctions. See "Regulatory Framework—Penalties and Termination and Revocation of Concession and Concession Assets."

Aeronautical Services Regulation

The majority of our revenues are derived from providing aeronautical services, which generally are related to the use of our airport facilities by airlines and passengers. Our aeronautical revenues principally consist of a fee for each departing passenger, aircraft landing fees, an aircraft parking fee, a

10

fee for the transfer of passengers from the aircraft to the terminal building and a security charge for each departing passenger.

Since January 1, 2000, all of our revenues from aeronautical services have been subject to a price regulation system established by the Ministry of Communications and Transportation. This price regulation system establishes a "maximum rate" for each airport for every year in a five-year period. In 2004, approximately 82.4% of our total revenues were earned from aeronautical services, which are subject to regulation under our maximum rates. The "maximum rate" is the maximum amount of revenues per "workload unit" that may be earned at an airport each year from regulated revenue sources. Under this regulation, a workload unit is equivalent to one terminal passenger or 100 kilograms (220 pounds) of cargo. We are able to set the specific prices for each aeronautical service at each of our airports every six months (or more frequently if accumulated inflation since the last adjustment exceeds 5%), as long as the combined revenue from regulated services at an airport does not exceed the maximum rate per workload unit at that airport on an annual basis. Since our aggregate revenues resulting from regulated services are not otherwise restricted, increases in passenger and cargo traffic increase the workload units used to determine our maximum rates and therefore permit greater revenues overall within each five-year period for which maximum rates are established.

The maximum rates for each of our airports were initially established by the Ministry of Communications and Transportation through December 31, 2004 and are reflected in the terms of our concessions. For subsequent five-year periods, each airport's maximum rate is to be determined by the Ministry of Communications and Transportation every five years based on a general framework established in our concessions. This framework includes, among other factors to be used in determining our maximum rates, projections of an airport's revenues, operating costs and capital expenditures, as well as the estimated cost of capital related to regulated services and projected annual efficiency adjustments determined by the Ministry of Communications and Transportation.

In December 2004, the Ministry of Communications and Transportation determined the maximum rates for our airports for the 2005 to 2009 period. For further information on the maximum rates applicable to our airports, see "Regulatory Framework—Principal Terms of Our Concessions—Aeronautical Services Regulation" and "Risk Factors—Risks Related to Our Operations."

Our revenues from non-aeronautical services, including revenues that we earn from most commercial activities in our terminals, are not regulated under this price regulation system, and are therefore not subject to a ceiling. As a result of the different treatment afforded aeronautical and non-aeronautical revenues, we refer to this system as a "dual-till" system. For a description of how we classify our revenues into aeronautical and non-aeronautical services, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Classification of Revenues."

Fourth Quarter Outlook

We estimate that our airports served approximately 19.1 million terminal passengers in 2005, which represents a 9.2% increase over 2004. Of our total terminal passengers in 2005, we estimate that approximately 11.5 million were domestic passengers and 7.6 million were international passengers. We estimate that domestic and international terminal passenger traffic in 2005 was 1.0% and 24.7% higher, respectively, than in 2004.

During the first nine months of 2005, our revenues, operating income and net income increased by 15.5%, 31.4% and 46.5%, in each case as compared to the corresponding period in 2004. We expect revenues and operating income for 2005 to increase relative to 2004 at rates modestly below the increases we experienced in those line items for the first nine months of 2005, while we believe the increase in net income will exceed the percentage increase for the first nine months of 2005.

Our estimates are based on preliminary, unaudited data. Our actual audited results of operations for 2005 could differ from these estimates.

11

THE GLOBAL OFFERING

| Global Offering | | The selling stockholder is offering 290,256,520 Series B shares in the form of ADSs and Series B shares in the United States and elsewhere outside of Mexico and 124,395,651 Series B shares in Mexico. Each ADS represents 10 Series B shares. |

U.S. and International Offering |

|

290,256,520 Series B shares in the form of ADSs or, if you so choose, Series B shares. |

Mexican Offering |

|

124,395,651 Series B shares. |

Selling Stockholder |

|

All of the Series B shares are being offered by the selling stockholder, which, prior to this global offering, held 476,850,000 Series B shares, representing all of the then-outstanding Series B shares and 85% of our outstanding capital stock. The selling stockholder is a trust established by the Ministry of Communications and Transportation with NAFIN, a Mexican development bank owned and controlled by the Mexican government. NAFIN is trustee of the selling stockholder. If all of the Series B shares are sold (and the over-allotment option is exercised in full), the Mexican government will cease to have any ownership interest in us. |

Initial Offering Price |

|

In the international offering, the initial offering price for each ADS is U.S. $21.00. The initial offering price for each Series B share is U.S. $2.10, reflecting the ratio of 10 Series B shares per ADS. In the Mexican offering, the initial offering price for each Series B share is Ps. 22.03, which is the approximate peso equivalent of the international offering price per Series B share of US $2.10, based on an exchange rate of Ps. 10.4885 per US$1.00. |

Listings |

|

The ADSs have been approved for listing on the New York Stock Exchange under the symbol "PAC" and the Series B shares have been approved for listing on the Mexican Stock Exchange (Bolsa Mexicana de Valores, S.A. de C.V.) under the symbol "GAP." |

Lock-up Provision |

|

We, the selling stockholder and AMP have agreed not to issue or sell any Series B shares or ADSs for 180 days from the date of this prospectus. For more information regarding these lock-up provisions, see "Underwriting" and "Principal Stockholders and Selling Stockholder." |

Over-allotment |

|

The selling stockholder has granted an option, exercisable for 30 days, to the international underwriters to purchase up to 43,538,480 additional Series B shares in the form of ADSs or Series B shares and to the Mexican underwriter to purchase up to 18,659,349 additional Series B shares to cover over-allotments. |

|

|

|

12

Use of Proceeds |

|

We will not receive any proceeds from this global offering. The net proceeds from the sale of ADSs and Series B shares sold in this global offering are payable to the selling stockholder. |

Capital Stock |

|

476,850,000 Series B shares and 84,150,000 Series BB shares of our common stock will be outstanding after this global offering. Since all of the Series B shares to be sold in the global offering are being sold by the selling stockholder, the number of Series B shares and Series BB shares outstanding will not change as a result of this global offering. |

|

|

AMP has an option to subscribe for newly issued Series B shares. This option was originally exercisable in three tranches, the first two of which have expired unexercised. Pursuant to the remaining tranche, AMP has the right to subscribe for 1% of our total capital stock outstanding at the time of the exercise, determined on a fully diluted basis. The remaining tranche may be exercised through August 25, 2006. For further information regarding AMP's option, see "Principal Stockholders and Selling Stockholder." |

Voting Rights |

|

Each Series B share will entitle the holder to one vote at any stockholders' meeting, including voting at meetings to elect members of our board of directors. ADS holders may instruct the depositary how to exercise the voting rights of the shares represented by the ADSs. The depositary has agreed that, if we so request, it will mail notices of stockholders' meetings that it receives from us to holders of ADSs and explain the procedures necessary to exercise voting rights. We will use our best efforts to request that the depositary notify you of upcoming votes and ask for your instructions. For a more complete discussion of the depositary's role and your voting rights, see "Description of American Depositary Receipts." |

Ownership Limitations |

|

Under our bylaws, except in limited circumstances, no person or group of related persons (as defined therein) may own more than 10% of our Series B shares. AMP beneficially owns all of our outstanding Series BB shares, which represent 15% of our outstanding capital stock, although the shares are held in a trust that allows AMP to vote only the portion of its shares representing up to 10% of our capital stock. For more information regarding this trust, see "Principal Stockholders and Selling Stockholder." The Mexican Airport Law, the concessions and the Mexican Communications Law also impose certain other share ownership limitations on air carriers and foreign governments. For a discussion of these limitations, see "Description of Capital Stock—Stockholder Ownership Restrictions and Antitakeover Protection." |

|

|

|

13

Special Rights of Series BB Stockholder |

|

The Series BB shares held by AMP provide it with certain rights under our bylaws, which are in addition to the rights of holders of Series B shares. Pursuant to our bylaws, AMP (as holder of our Series BB shares) has the right to appoint and remove our chief executive officer, our chief financial officer, our chief operating officer and our commercial director, to elect four members of our board of directors and to designate 20% of the members of each board committee (or one member of any committee consisting of fewer than five |

|

|

members). AMP (as holder of our Series BB shares) also has the right pursuant to our bylaws to veto certain actions requiring approval of our stockholders (including the payment of dividends, the amendment of our bylaws and the amendment of its right to appoint certain members of our senior management). These rights are not subject to the technical assistance agreement and the participation agreement remaining in effect. If at any time before August 25, 2014 AMP were to hold less than 7.65% of our capital stock in the form of Series BB shares, it would lose its veto rights (but its other special rights would be unaffected). If at any time after August 25, 2014 AMP were to hold less than 7.65% of our capital stock in the form of Series BB shares, such shares must be converted into Series B shares, which would cause AMP to lose all of its special rights. As long as AMP retains at least 7.65% of our capital stock in the form of Series BB shares, whether before or after August 25, 2014, all of its special rights will remain in place. Pursuant to our bylaws, the technical assistance agreement and the participation agreement, AMP may not transfer more than 49% of its Series BB shares until after August 25, 2009. For more information regarding AMP's rights and obligations, see "Management—Committees," "Description of Capital Stock" and "Principal Stockholders and Selling Stockholder." |

Dividends |

|

We paid aggregate dividends of Ps. 269.9 million in 2003, Ps. 283.8 million in 2004 and Ps. 1.04 billion (constant pesos) in 2005. We did not make any dividend payments in 2002. |

|

|

Our shareholders adopted a new dividend policy at the general extraordinary shareholders' meeting held on April 15, 2005. Under the policy, our annual dividend is expected to consist of two components. The first component is a fixed amount, which is expected to be Ps. 450 million in 2005 (for the dividend expected to be paid in 2006) and is expected to increase gradually in future years. Second, the dividend policy contemplates that we will additionally distribute any cash and temporary investments we hold (as reflected in our balance sheet as of the month-end prior to the dividend payment, after deducting the fixed component) in excess of our "minimum cash balance." For purposes of our policy, the "minimum cash |

|

|

|

14

|

|

balance" is the amount of cash and temporary investments that our board of directors determines is necessary to cover the minimum amount of expenses and investments expected to be incurred in the fiscal year during which the dividend payment is made and the subsequent fiscal year. Dividends are expected to be payable in cash and in one or more payments as determined in the relevant general ordinary shareholders meeting approving the dividend. |

|

|

The declaration, amount and payment of dividends pursuant to the policy described above are subject to (i) compliance with applicable law regarding the declaration and payment of dividends with respect to any year including the establishment of the statutory legal reserve fund, and (ii) the absence of any adverse effect on our business plan for the current or subsequent fiscal year as a result of the payment of any dividend. We cannot assure you that we will continue to pay dividends or that future dividends will be comparable to our previous dividends. Our ability to pay dividends may be restricted by our obligations under a credit agreement with Scotiabank Inverlat, S.A., to which several of our operating subsidiaries are parties. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources." Our dividend policy may also be amended at any time by our shareholders. To the extent that we declare and pay dividends or make any other distribution in respect of our outstanding Series B shares, the ADS holders on the relevant date will be entitled to receive dividends or distributions payable in respect of the Series B shares underlying their ADSs. The delivery of dividends or distributions to ADS holders will be subject to the terms of our deposit agreement with the depositary. Cash dividends generally will be paid to the depositary in pesos, except as otherwise provided in this prospectus. Under current applicable Mexican law, any dividend we pay to non-Mexican holders of our Series B shares and ADSs, including the depositary, will not be subject to a dividend withholding tax. For more information regarding our dividend policy and withholding taxes, see "Dividend Policy" and "Taxation." |

15

SUMMARY CONSOLIDATED FINANCIAL INFORMATION

The following tables present our summary consolidated financial information for each of the periods indicated. This information should be read in conjunction with, and is qualified in its entirety by reference to, our financial statements, including the notes thereto, as well as "Management's Discussion and Analysis of Financial Condition and Results of Operations" included elsewhere in this prospectus. Our financial statements are prepared in accordance with Mexican GAAP, which differs in certain significant respects from U.S. GAAP. Note 22 to our audited financial statements for the years ended December 31, 2004, 2003 and 2002 and Note 21 to our audited financial statements for the nine-month period ended September 30, 2005 provides 1) a summary of the principal differences between Mexican GAAP and U.S. GAAP as they relate to our business; 2) a reconciliation to U.S. GAAP of net income and stockholders' equity; and 3) condensed financial statements under U.S. GAAP and additional U.S. GAAP disclosure information.

Mexican GAAP provides for the recognition of certain effects of inflation by restating non-monetary assets and non-monetary liabilities using the Mexican National Consumer Price Index, restating the components of stockholders' equity using the Mexican National Consumer Price Index and recording gains or losses in purchasing power from holding monetary liabilities or assets. Mexican GAAP also requires the restatement of all financial statements to constant Mexican pesos as of the date of the most recent balance sheet presented. Our audited financial statements for the years ended December 31, 2004, 2003 and 2002 and all other financial information contained herein with respect to the years ended December 31, 2004, 2003, 2002, 2001 and 2000 are accordingly presented in constant pesos with purchasing power as of December 31, 2004, unless otherwise noted. Our audited interim financial statements for the nine-month period ended September 30, 2005, which include comparative unaudited financial information for the nine-month period ended September 30, 2004, and all other financial information presented herein with respect to the nine-month periods ended September 30, 2005 and 2004 are presented in constant pesos with purchasing power as of September 30, 2005. The difference in the purchasing power of the peso at December 31, 2004 as compared to the purchasing power of the peso at September 30, 2005 was 1.7%, which we do not consider to be material or to materially affect our financial results as presented herein. Our results of operations for the nine-month period ended September 30, 2005 are not necessarily indicative of our expected results of operations for the year ended December 31, 2005 and should not be construed as such.

16

| Year ended December 31,

| | Nine months ended September 30,

| |

|---|

| 2000

| | 2001

| | 2002

| | 2003

| | 2004

| | 2004

| | 2004

| | 2005

| | 2005

| |

|---|

| (thousands of pesos)(1)

| | (thousands of

dollars)(2)

| | (thousands of pesos)(1)

| | (thousands of

dollars)(2)

| |

|---|

| Statement of income data: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Mexican GAAP | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Aeronautical services(3) | Ps. | 1,574,587 | | Ps. | 1,607,228 | | Ps. | 1,524,331 | | Ps. | 1,631,208 | | Ps. | 1,805,263 | | U.S.$ | 167,293 | | Ps. | 1,373,621 | | Ps. | 1,557,283 | | U.S.$ | 144,314 | |

| | Non-aeronautical services(4) | | 140,355 | | | 175,118 | | | 196,992 | | | 288,895 | | | 385,110 | | | 35,688 | | | 280,050 | | | 352,202 | | | 32,638 | |

| | | | Total revenues | | 1,714,942 | | | 1,782,346 | | | 1,721,323 | | | 1,920,103 | | | 2,190,373 | | | 202,981 | | | 1,653,671 | | | 1,909,485 | | | 176,952 | |

| Operating costs: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Cost of services:(5) | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Employee costs | | N/A | | | 254,683 | | | 254,166 | | | 257,733 | | | 266,934 | | | 24,737 | | | 204,839 | | | 209,192 | | | 19,386 | |

| | | Maintenance | | N/A | | | 117,187 | | | 98,409 | | | 94,550 | | | 101,386 | | | 9,395 | | | 71,179 | | | 73,478 | | | 6,809 | |

| | | Safety, security & insurance | | N/A | | | 57,226 | | | 68,785 | | | 76,385 | | | 84,040 | | | 7,788 | | | 63,558 | | | 64,085 | | | 5,939 | |

| | | Utilities | | N/A | | | 48,723 | | | 49,107 | | | 53,454 | | | 61,832 | | | 5,730 | | | 44,326 | | | 48,968 | | | 4,538 | |

| | | Other | | N/A | | | 88,672 | | | 57,019 | | | 79,440 | | | 95,702 | | | 8,869 | | | 83,897 | | | 62,147 | | | 5,759 | |

| | | | Total cost of services | | 549,164 | | | 566,491 | | | 527,486 | | | 561,562 | | | 609,894 | | | 56,519 | | | 467,799 | | | 457,870 | | | 42,431 | |

| | Technical assistance fees(6) | | 79,623 | | | 78,732 | | | 57,027 | | | 64,522 | | | 75,537 | | | 7,000 | | | 56,103 | | | 68,386 | | | 6,337 | |

| | Government concession fees(7) | | 83,381 | | | 88,127 | | | 84,908 | | | 95,245 | | | 108,788 | | | 10,081 | | | 82,099 | | | 94,875 | | | 8,792 | |

| Depreciation and amortization: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Depreciation(8) | | 21,041 | | | 41,608 | | | 50,316 | | | 74,780 | | | 94,652 | | | 8,771 | | | 71,239 | | | 76,771 | | | 7,114 | |

| | | Amortization(9) | | 439,381 | | | 443,915 | | | 443,848 | | | 444,224 | | | 460,013 | | | 42,629 | | | 341,805 | | | 377,772 | | | 35,008 | |

| | | | Total depreciation and amortization | | 460,422 | | | 485,523 | | | 494,164 | | | 519,004 | | | 554,665 | | | 51,400 | | | 413,044 | | | 454,543 | | | 42,122 | |

| | | | | Total operating costs | | 1,172,590 | | | 1,218,872 | | | 1,163,585 | | | 1,240,333 | | | 1,348,884 | | | 125,000 | | | 1,019,045 | | | 1,075,674 | | | 99,682 | |

| Income from operations | | 542,352 | | | 563,474 | | | 557,738 | | | 679,770 | | | 841,489 | | | 77,981 | | | 634,626 | | | 833,811 | | | 77,270 | |

| | Net comprehensive financing income (expense) | | 54,232 | | | 29,517 | | | 31,611 | | | 23,314 | | | (14,269 | ) | | (1,323 | ) | | (1,816 | ) | | 24,502 | | | 2,271 | |

| | Other income (expense) | | 12,119 | | | 15,273 | | | (55,316 | ) | | (10 | ) | | (2,372 | ) | | (220 | ) | | 2,781 | | | 622 | | | 58 | |

| Income before income taxes, employee statutory profit sharing and cumulative effect of change in accounting principle | | 608,703 | | | 608,264 | | | 534,033 | | | 703,074 | | | 824,848 | | | 76,438 | | | 635,591 | | | 858,935 | | | 79,599 | |

| | | Income tax and employee statutory profit sharing expense | | (192,194 | ) | | (200,513 | ) | | (306,124 | ) | | (391,774 | ) | | (461,861 | ) | | (42,800 | ) | | (304,495 | ) | | (337,710 | ) | | (31,296 | ) |

| | Cumulative effect of change in accounting principle(10) | | 0 | | | 0 | | | 0 | | | 0 | | | 24,342 | | | 2,256 | | | 24,762 | | | 0 | | | 0 | |

| Consolidated net income | | 416,509 | | | 407,751 | | | 227,909 | | | 311,300 | | | 387,329 | | | 35,894 | | | 355,858 | | | 521,225 | | | 48,303 | |

| Basic and diluted earnings per share before cumulative effect of change in accounting principle | Ps. | 0.7424 | | Ps. | 0.7268 | | Ps. | 0.4063 | | Ps. | 0.5549 | | Ps. | 0.6470 | | U.S.$ | 0.0600 | | Ps. | 0.5902 | | Ps. | 0.9291 | | U.S.$ | 0.0861 | |

| Basic and diluted earnings per share generated by cumulative effect of change in accounting principle | Ps. | 0.0000 | | Ps. | 0.0000 | | Ps. | 0.0000 | | Ps. | 0.0000 | | Ps. | 0.0434 | | U.S.$ | 0.0040 | | Ps. | 0.0441 | | Ps. | 0.0000 | | U.S.$ | 0.0000 | |

| Basic and diluted earnings per share(11) | Ps. | 0.7424 | | Ps. | 0.7268 | | Ps. | 0.4063 | | Ps. | 0.5549 | | Ps. | 0.6904 | | U.S.$ | 0.0640 | | Ps. | 0.6343 | | Ps. | 0.9291 | | U.S.$ | 0.0861 | |

| Basic and diluted earnings per ADS(11) | Ps. | 7.4244 | | Ps. | 7.2683 | | Ps. | 4.0625 | | Ps. | 5.5490 | | Ps. | 6.9043 | | U.S.$ | 0.6398 | | Ps. | 6.3433 | | Ps. | 9.2910 | | U.S.$ | 0.8610 | |

| Dividends per share(12) | U.S.$ | 0.0854 | | U.S.$ | 0.0000 | | U.S.$ | 0.0000 | | U.S.$ | 0.0446 | | U.S.$ | 0.0469 | | | | | U.S.$ | 0.0477 | | U.S.$ | 0.1717 | | | | |

| Dividends per ADS(12) | U.S.$ | 0.8539 | | U.S.$ | 0.0000 | | U.S.$ | 0.0000 | | U.S.$ | 0.4459 | | U.S.$ | 0.4689 | | | | | U.S.$ | 0.4769 | | U.S.$ | 1.7173 | | | | |

U.S. GAAP: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues | | | | | | | | | | Ps. | 1,910,103 | | Ps. | 2,186,496 | | U.S.$ | 202,622 | | Ps. | 1,659,155 | | Ps. | 1,885,749 | | U.S.$ | 174,752 | |

| Income from operations | | | | | | | | | | | 987,941 | | | 1,140,014 | | | 105,645 | | | 859,580 | | | 1,068,626 | | | 99,029 | |

| Consolidated net income (loss) | | | | | | | | | | | 513,185 | | | (115,871 | ) | | (10,738 | ) | | 474,980 | | | 679,338 | | | 62,952 | |

| Basic earnings (loss) per share(11) | | | | | | | | | | Ps. | 0.9217 | | Ps. | (0.2081 | ) | U.S.$ | (0.0193 | ) | Ps. | 0.8531 | | Ps. | 1.2201 | | U.S.$ | 0.1131 | |

| Diluted earnings (loss) per share(13) | | | | | | | | | | Ps. | 0.9148 | | Ps. | (0.2081 | ) | U.S.$ | (0.0193 | ) | Ps. | 0.8467 | | Ps. | 1.2109 | | U.S.$ | 0.1122 | |

| Basic earnings (loss) per ADS(11) | | | | | | | | | | Ps. | 9.2168 | | Ps. | (2.0810 | ) | U.S.$ | (0.1929 | ) | Ps. | 8.5306 | | Ps. | 12.2009 | | U.S.$ | 1.1307 | |

| Diluted earnings (loss) per ADS(13) | | | | | | | | | | Ps. | 9.1477 | | Ps. | (2.0810 | ) | U.S.$ | (0.1929 | ) | Ps. | 8.4667 | | Ps. | 12.1094 | | U.S.$ | 1.1222 | |

17

| | Year ended December 31,

| | Nine months ended September 30,

| |

|---|

| | 2000

| | 2001

| | 2002

| | 2003

| | 2004

| | 2004

| | 2004

| | 2005

| | 2005

| |

|---|

| | (thousands of pesos)(1)

| | (thousands of

dollars)(2)

| | (thousands of pesos)(1)

| | (thousands of

dollars)(2)

| |

|---|

| Other operating data (unaudited): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total terminal passengers (thousands of passengers)(14) | | | 16,387 | | | 16,149 | | | 15,294 | | | 16,444 | | | 17,516 | | | 17,516 | | | 13,214 | | | 14,340 | | | 14,340 | |

| | Total air traffic movements (thousands of movements) | | | 383 | | | 387 | | | 378 | | | 382 | | | 390 | | | 390 | | | 290 | | | 311 | | | 311 | |

| | Total revenues per terminal passenger(15) | | Ps. | 105 | | Ps. | 110 | | Ps. | 113 | | Ps. | 117 | | Ps. | 125 | | U.S.$ | 11 | | Ps. | 125 | | Ps. | 133 | | U.S.$ | 12 | |

| Other data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EBITDA: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated net income under Mexican GAAP | | Ps. | 416,509 | | Ps. | 407,751 | | Ps. | 227,909 | | Ps. | 311,300 | | Ps. | 387,329 | | U.S. $ | 35,894 | | Ps. | 355,858 | | Ps. | 521,225 | | U.S. $ | 48,303 | |

| Minus: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Net comprehensive financing income (expense) | | | 54,232 | | | 29,517 | | | 31,611 | | | 23,314 | | | (14,269 | ) | | (1,323 | ) | | (1,816 | ) | | 24,502 | | | 2,271 | |

| Plus: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Income tax and employee statutory profit sharing expense | | | 192,194 | | | 200,513 | | | 306,124 | | | 391,774 | | | 461,861 | | | 42,800 | | | 304,495 | | | 337,710 | | | 31,296 | |

| | Depreciation and amortization | | | 460,422 | | | 485,523 | | | 494,164 | | | 519,004 | | | 554,665 | | | 51,400 | | | 413,044 | | | 454,543 | | | 42,122 | |

| EBITDA(16) | | Ps. | 1,014,893 | | Ps. | 1,064,270 | | Ps. | 996,586 | | Ps. | 1,198,764 | | Ps. | 1,418,124 | | U.S.$ | 131,417 | | Ps. | 1,075,213 | | Ps. | 1,288,976 | | U.S.$ | 119,450 | |

| Balance sheet data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Mexican GAAP: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Cash and temporary investments | | Ps. | 956,085 | | Ps. | 984,643 | | Ps. | 1,040,310 | | Ps. | 1,028,516 | | Ps. | 1,188,941 | | U.S.$ | 110,179 | | Ps. | 961,014 | | Ps. | 868,771 | | U.S.$ | 80,509 | |

| | Total current assets | | | 1,465,215 | | | 1,190,413 | | | 1,310,128 | | | 1,498,781 | | | 1,552,421 | | | 143,862 | | | 1,352,029 | | | 1,245,696 | | | 115,438 | |

| | Airport concessions, net | | | 18,347,500 | | | 18,001,926 | | | 17,656,385 | | | 17,310,832 | | | 16,954,966 | | | 1,571,214 | | | 17,344,958 | | | 16,951,498 | | | 1,570,892 | |

| | Rights to use airport facilities, net | | | 2,764,026 | | | 2,674,400 | | | 2,584,768 | | | 2,495,141 | | | 2,405,517 | | | 222,918 | | | 2,469,656 | | | 2,378,517 | | | 220,417 | |

| | Total assets | | | 23,883,396 | | | 23,361,116 | | | 23,704,334 | | | 23,670,660 | | | 23,873,192 | | | 2,212,322 | | | 24,152,150 | | | 23,782,126 | | | 2,203,886 | |

| | Current liabilities | | | 997,718 | | | 67,690 | | | 178,647 | | | 101,989 | | | 185,844 | | | 17,221 | | | 99,387 | | | 200,674 | | | 18,598 | |

| | Total liabilities | | | 997,718 | | | 67,690 | | | 182,995 | | | 107,980 | | | 207,032 | | | 19,183 | | | 117,065 | | | 227,256 | | | 21,061 | |

| | Total stockholders' equity(17) | | | 22,885,678 | | | 23,293,426 | | | 23,521,339 | | | 23,562,680 | | | 23,666,160 | | | 2,193,139 | | | 24,035,085 | | | 23,554,870 | | | 2,182,825 | |

| | U.S. GAAP: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Cash and cash equivalents | | | | | | | | | | | | 871,068 | | | 946,857 | | | 87,745 | | | 729,897 | | | 807,724 | | | 74,852 | |

| | Total current assets | | | | | | | | | | | | 1,638,768 | | | 1,680,319 | | | 155,715 | | | 1,492,154 | | | 1,370,234 | | | 126,979 | |

| | Assets under capital lease ("Rights to use airport facilities" under Mexican GAAP) | | | | | | | | | | | | 2,387,238 | | | 2,272,713 | | | 210,612 | | | 2,340,901 | | | 2,224,433 | | | 206,138 | |

| | Total assets | | | | | | | | | | | | 11,747,878 | | | 11,465,044 | | | 1,062,464 | | | 12,150,132 | | | 11,359,961 | | | 1,052,726 | |

| | Current liabilities | | | | | | | | | | | | 101,989 | | | 186,173 | | | 17,253 | | | 99,507 | | | 205,091 | | | 19,006 | |

| | Total liabilities | | | | | | | | | | | | 113,824 | | | 216,734 | | | 20,085 | | | 117,509 | | | 264,430 | | | 24,505 | |

| | Total stockholders' equity(17) | | | | | | | | | | | | 11,634,054 | | | 11,248,310 | | | 1,042,379 | | | 12,032,623 | | | 11,095,531 | | | 1,028,221 | |

| Other data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Mexican GAAP: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Net resources provided by operating activities | | Ps. | 865,124 | | Ps. | 763,137 | | Ps. | 644,082 | | Ps. | 571,519 | | Ps. | 1,166,785 | | U.S.$ | 108,127 | | Ps. | 818,476 | | Ps. | 972,995 | | U.S.$ | 90,168 | |

| | Net resources used in financing activities | | | (21,394 | ) | | (495,508 | ) | | (84,186 | ) | | (269,959 | ) | | (283,849 | ) | | (26,304 | ) | | (288,731 | ) | | (1,039,573 | ) | | (96,338 | ) |

| | Net resources used in investing activities | | | (572,053 | ) | | (239,071 | ) | | (504,229 | ) | | (313,354 | ) | | (722,511 | ) | | (66,957 | ) | | (614,937 | ) | | (274,042 | ) | | (25,395 | ) |

| | Increase (decrease) in cash and temporary investments | | | 271,677 | | | 28,558 | | | 55,667 | | | (11,794 | ) | | 160,425 | | | 14,866 | | | (85,192 | ) | | (340,620 | ) | | (31,565 | ) |

| | U.S. GAAP:(18) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Net cash provided by operating activities | | | | | | | | | | | | 442,787 | | | 1,101,596 | | | 102,085 | | | 757,291 | | | 1,162,287 | | | 107,709 | |

| | Net cash used in investing activities | | | | | | | | | | | | (313,354 | ) | | (708,668 | ) | | (65,672 | ) | | (602,522 | ) | | (271,252 | ) | | (25,137 | ) |

| | Net cash used in financing activities | | | | | | | | | | | | (269,959 | ) | | (283,849 | ) | | (26,304 | ) | | (288,731 | ) | | (1,039,573 | ) | | (96,337 | ) |

| | Effect of inflation accounting | | | | | | | | | | | | (28,716 | ) | | (33,290 | ) | | (3,085 | ) | | (22,191 | ) | | (6,881 | ) | | (638 | ) |

| | (Decrease) increase in cash and cash equivalents | | | | | | | | | | | | (169,242 | ) | | 75,789 | | | 7,024 | | | (156,153 | ) | | (155,419 | ) | | (14,402 | ) |

- (1)

- The years ended December 31, 2000, 2001, 2002, 2003 and 2004 are expressed in constant pesos with purchasing power as of December 31, 2004, except as otherwise noted. The nine months ended September 30, 2005 and 2004 are expressed in constant pesos with purchasing power as of September 30, 2005. Per share peso amounts are expressed in pesos (not thousands of pesos).

18

- (2)

- Translated into dollars at the rate of Ps. 10.7910 per U.S. dollar, the U.S. Federal Reserve noon buying rate for Mexican pesos at September 30, 2005. The U.S. dollar equivalent information should not be construed to imply that the peso amounts represent, or could have been or could be converted into, U.S. dollars at such rates or at any other rate. Per share dollar amounts are expressed in dollars (not thousands of dollars). Operating data expressed in units indicated.

- (3)

- Revenues from aeronautical services principally consist of a fee for each departing passenger, aircraft landing fees based on the aircraft's weight and arrival time, an aircraft parking fee, a fee for the transfer of passengers from the aircraft to the terminal building and a security charge for each departing passenger, and other sources of revenues subject to regulation under our maximum rates.

- (4)

- Revenues from non-aeronautical services consist of sources of revenues not subject to regulation under our maximum rates, and consist of revenues from car parking charges, leasing of commercial space to tenants, advertising, taxis and other ground transportation providers and other miscellaneous sources of revenues. Pursuant to our concessions and to the Airport Law and the regulations thereunder, parking services are currently excluded from regulated services under our maximum rates, although the Ministry of Communications and Transportation could decide to regulate such rates.

- (5)

- Cost of services line item was calculated only as a total for 2000.

- (6)

- Beginning January 1, 2000, we began paying AMP a technical assistance fee under the technical assistance agreement entered into in connection with AMP's purchase of its Series BB shares. This fee is described in "Business—Opening of Mexican Airports to Investment—Investment by AMP."

- (7)

- Beginning November 1, 1998, each of our subsidiary concession holders is required to pay a concession fee to the Mexican government under the Mexican Federal Duties Law for the use of public domain assets pursuant to the terms of its concession. The concession fee is currently 5% of each concession holder's gross annual revenues.

- (8)

- Reflects depreciation of fixed assets.

- (9)

- Reflects amortization of concessions, rights to use airport facilities, recovered long-term leases and parking lots.

- (10)

- Represents the gain that resulted from the application of Mexican GAAP Bulletin C-10 governing derivative financial instruments and other hedging operations. See note 3a. to our audited financial statements.

- (11)

- Based on the ratio of 10 Series B shares per ADS. For Mexican GAAP purposes, based on 561,000,000 weighted average common shares outstanding in each period. For U.S. GAAP purposes, based on 556,792,500 weighted average common shares outstanding in each period.

- (12)

- Peso amounts were Ps. 0.9214 per share in 2000, Ps. 0.4812 per share in 2003, Ps. 0.5060 per share in 2004, Ps. 0.5147 per share for the nine months ended September 30, 2004 and Ps. 1.8531 per share for the nine months ended September 30, 2005 and Ps. 9.2139 per ADS in 2000, Ps. 4.8121 per ADS in 2003, Ps. 5.0597 per ADS in 2004, Ps. 5.1467 per ADS for the nine moths ended September 30, 2004 and Ps. 18.5307 for the nine months ended September 30, 2005.

- (13)

- Based on the ratio of 10 Series B shares per ADS. Based on 561,000,000 weighted average common shares and common share equivalents outstanding for the year ended December 31, 2003 and for the nine-month periods ended September 30, 2005 and 2004, and 556,792,500 weighted average common shares and common share equivalents outstanding for the year ended December 31, 2004.

- (14)

- Includes arriving and departing passengers as well as transfer passengers (passengers who arrive at our airports on one aircraft and depart on a different aircraft). Excludes transit passengers (passengers who arrive at our airports but generally depart without changing aircraft).

- (15)

- Total revenues for the period divided by terminal passengers for the period. Expressed in pesos (not thousands of pesos)

- (16)

- EBITDA represents net income minus net comprehensive financing income plus income taxes, asset tax, employee statutory profit sharing and depreciation and amortization. EBITDA should not be considered as an alternative to net income, as an indicator of our operating performance, or as an alternative to cash flow as an indicator of liquidity. Our management believes that EBITDA provides a useful measure of our performance that is widely used by investors and analysts to evaluate our performance and compare it with other companies. In making such comparisons, however, you should bear in mind that EBITDA is not defined and is not a recognized financial measure under Mexican GAAP or U.S. GAAP and that it may be calculated differently by different companies. EBITDA as presented in this table is not equivalent to our operating income (prior to deducting depreciation and amortization and the technical assistance fee), which is used as the basis for calculation of the technical assistance fee we pay to AMP.

- (17)

- Total stockholders' equity under Mexican GAAP reflects the value assigned to our concessions. Under U.S. GAAP, no value has been assigned to our concessions.

- (18)