Exhibit 99.1

Strategic Combination Transaction with LISTED CORR NYSE February 5, 2021

Disclaimer Forward Looking StatementsThis presentation contains certain statements that may include "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included herein are "forward-looking statements." Although CorEnergy believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including, among others, failure to realize the anticipated benefits of the Transaction or Internalization (as further described in this presentation); the risk that CPUC approval is not obtained, is delayed or is subject to unanticipated conditions that could adversely affect CorEnergy or the expected benefits of the Transaction, risks related to the uncertainty of the projected financial information with respect to Crimson, the failure to receive the required approvals by existing CorEnergy stockholders; the risk that a condition to the closing of the Internalization may not be satisfied, CorEnergy’s ability to consummate the Internalization, and those factors discussed in CorEnergy’s reports that are filed with the Securities and Exchange Commission. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Other than as required by law, CorEnergy does not assume a duty to update any forward-looking statement. In particular, any distribution paid in the future to our stockholders will depend on the actual performance of CorEnergy, its costs of leverage and other operating expenses and will be subject to the approval of CorEnergy’s Board of Directors and compliance with leverage covenants.Non-GAAP Financial MeasuresThis document includes certain non-GAAP financial measures that are not prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and that may be different from non-GAAP financial measures used by other companies. CorEnergy believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating the Transaction. These non-GAAP measures should not be considered in isolation from, or as an alternative to, financial measures determined in accordance with GAAP. Additionally, to the extent that forward-looking non-GAAP financial measures are provided, including EBITDA, they are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation.

Disclaimer Additional Information and Where to Find ItThe issuance of CorEnergy common stock upon conversion of CorEnergy preferred stock in connection with the Transaction as described in this presentation (the “Stock Issuance”) and the Internalization will be submitted to the stockholders of CorEnergy for their consideration. In connection with the Stock Issuance and Internalization, CorEnergy intends to file a proxy statement and other documents with the SEC. INVESTORS AND CORENERGY STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) REGARDING THE STOCK ISSUANCE AND INTERNALIZATION AND OTHER DOCUMENTS RELATING TO THE TRANSACTIONS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE STOCK ISSUANCE AND INTERNALIZATION. The proxy statement and other relevant documents (when they become available), and any other documents filed by CorEnergy with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, stockholders may obtain free copies of the documents filed with the SEC by CorEnergy through its website at corenergy.reit. The information on CorEnergy’s website is not, and shall not be deemed to be a part hereof or incorporated into this or any other filings with the SEC. You may also request them in writing, by telephone or via the Internet at: CorEnergy Infrastructure Trust, Inc., Investor Relations, 877-699-CORR (2677), info@corenergy.reit. Participants in the SolicitationCorEnergy, the Manager and their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from CorEnergy’s stockholders in respect of the Stock Issuance and Internalization. Information about CorEnergy’s directors and executive officers is available in CorEnergy’s definitive proxy statement, prepared in connection with CorEnergy’s 2020 annual meeting of stockholders and will be set forth in the proxy statement in respect of the Stock Issuance and Internalization when it is filed with the SEC. Other information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of proxies from CorEnergy’s stockholders in connection with the Stock Issuance and Internalization, including a description of their direct or indirect interests, by security holdings or otherwise, in CorEnergy will be set forth in the proxy statement in respect of the Stock Issuance and Internalization when it is filed with the SEC. You can obtain free copies of these documents, which are filed with the SEC, from CorEnergy using the contact information above.

CorEnergy Management Introduction John GrierFounder of Crimson, Executive Vice President and Chief Operating Officer of CorEnergy Robert WaldronCFO of Crimson, Executive Vice President and Chief Financial Officer of CorEnergy David SchulteCo-Founder, CEO and President of CorEnergy Rick KreulPresident, MoGas, LLC & MoWood, LLC Larry AlexanderPresident, Crimson California Becky SandringExecutive Vice President, Secretary & Treasurer Kristin LeitzeChief Accounting Officer

The first REIT operator of critical infrastructure assets Long-lived assets producing stable cash flowsAssets consist of Crimson’s California crude transportation systems and CORR’s MoGas/Omega natural gas transportation systemsFavorable market fundamentals across asset bases drive predictable cash flowMajority of assets operated under regulated rate making authoritiesDiverse, credit-worthy customer base 1. 2021 EBITDA will be reconciled to GAAP metrics in periodic reports 2. Common stock dividends are subject to approval by the board of directors Experienced management teams, significant stockholder alignmentExtensive history of operating assets safely in highly regulated areasProven track record of acquiring assets and improving operationsCrimson management team rolling equity; common dividends subordinated for up to 3 yearsProposed internalization of external manager (Corridor) for equity consideration Use of CORR’s innovative PLRTax efficient REIT structure provides direct investor access to infrastructure cash flowsCrimson’s assets fit REIT criteria of stability and appropriate growthSuitable for continued consolidation of similar assets REIT structure can enable participation in energy transition from fossil fuels to alternative energy Strong balance sheet and scale with ability to grow organicallyExpected run rate EBITDA of $50-$52 million annualized from Q2 20211 Targeted debt-to-EBITDA ratio of <4.0x1Initial annualized dividend of $0.20, targeting $0.35-$0.40 upon a return to pre-COVID market conditions in California, with near term commercial opportunities providing upside2Opportunities for capture of additional volumes utilizing pipeline excess capacity, low capital expenditure system expansions, bolt-on strategic acquisitions and footprint expansion

MoGas is a 263-mile FERC-regulated natural gas pipeline near St. Louis, MOOperated by CORR since 201494% of revenue is from take-or-pay transportation contracts with investment-grade customers with on average 10 years remaining on contractsOmega is a natural gas distribution system serving a strategically important US military base with growing demandOperated by CORR since 2006In third 10-year contract with 6 years remainingLegacy GIGS asset was transferred to seller as part of transaction considerationEliminates need for CORR to restructure GIGS contracts and avoids potential litigation Legacy MoGas and Omega pipeline systems transport and deliver natural gas to LDCs and end-users St. Louis Omega CorEnergy Legacy Infrastructure Assets Infrastructure assets provide utility-like functions with durable revenues

John Grier, formed Crimson Resource Management (“CRM”), an upstream company, in 1986, began investing in midstream assets in 2004In 2010, CRM was separated into upstream and midstream companies with Grier owning the midstream assets, now known as Crimson MidstreamIn January of 2020, Crimson was effectively split into two business segments, Gulf and California. The entities functioned as two separate companies with different management teams and minimal employee overlap.In February 2021 CorEnergy announced the acquisition of Crimson California 2016 Crimson Has Been Built Primarily Through Relationships with the Supermajors 1986 John Grier formed Crimson Resource Management, an upstream company 2008 Acquisition of two crude gathering systems from Conoco in Southern California 2011 Acquisition of crude gathering system in Southern California from Chevron 2014 Acquisition of Delta North pipeline (Gulf), a legacy Chevron asset, for $19mm Acquisition of KLM pipeline (California) from Chevron for $120mm 2019 Crimson separates the company into two businesses; New Gulf CEO hired 2004 CRM acquires first midstream business; three gathering systems in California from Shell 2010 CRM separates into upstream and midstream businesses 2012 Acquisition of 9 key Gulf pipelines from Shell for $108mm; NGP makes equity investment (24% interest) 2015 Acquisition of SMIGS & SLOPS pipelines (Gulf) from ExxonMobil for $15mm Acquisition of Bonefish pipelines (Gulf) from ExxonMobil for $175mm 2020 Acquisition of San Pablo Bay pipeline and associated assets (California) from Shell for $112mm 7

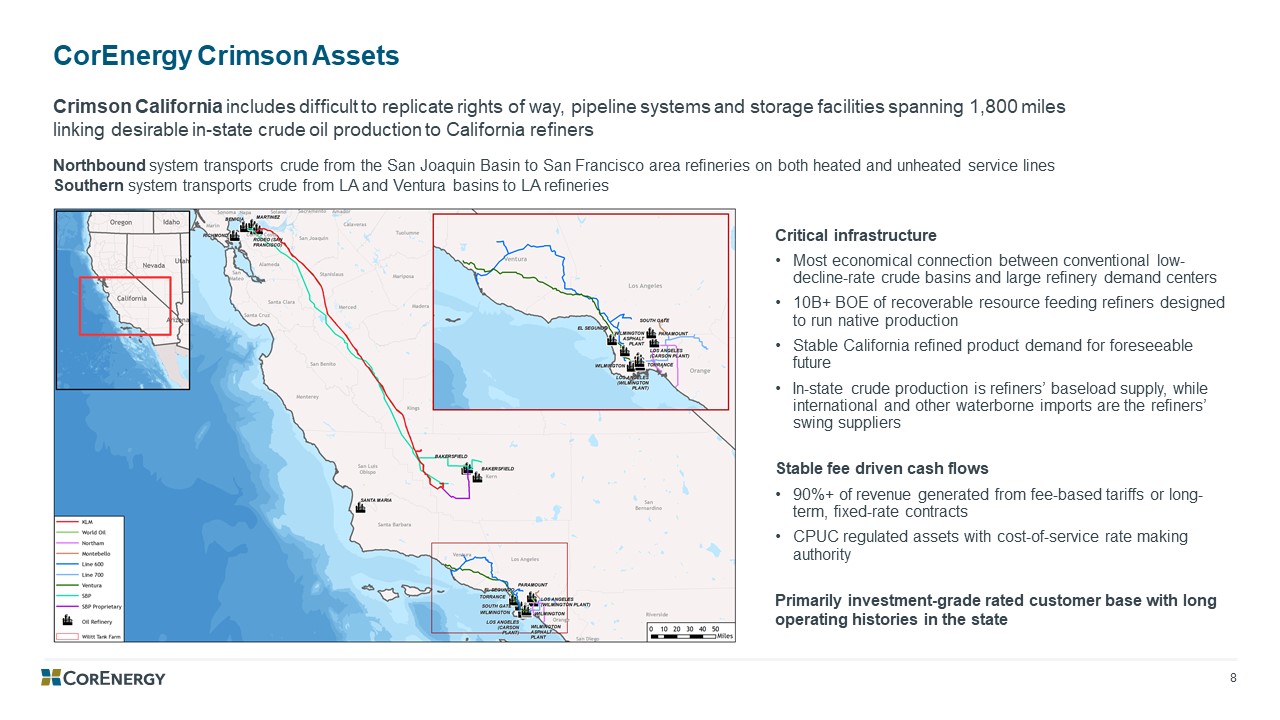

Crimson California includes difficult to replicate rights of way, pipeline systems and storage facilities spanning 1,800 miles linking desirable in-state crude oil production to California refinersNorthbound system transports crude from the San Joaquin Basin to San Francisco area refineries on both heated and unheated service linesSouthern system transports crude from LA and Ventura basins to LA refineries Critical infrastructureMost economical connection between conventional low-decline-rate crude basins and large refinery demand centers10B+ BOE of recoverable resource feeding refiners designed to run native productionStable California refined product demand for foreseeable future In-state crude production is refiners’ baseload supply, while international and other waterborne imports are the refiners’ swing suppliersStable fee driven cash flows90%+ of revenue generated from fee-based tariffs or long-term, fixed-rate contractsCPUC regulated assets with cost-of-service rate making authorityPrimarily investment-grade rated customer base with long operating histories in the state CorEnergy Crimson Assets

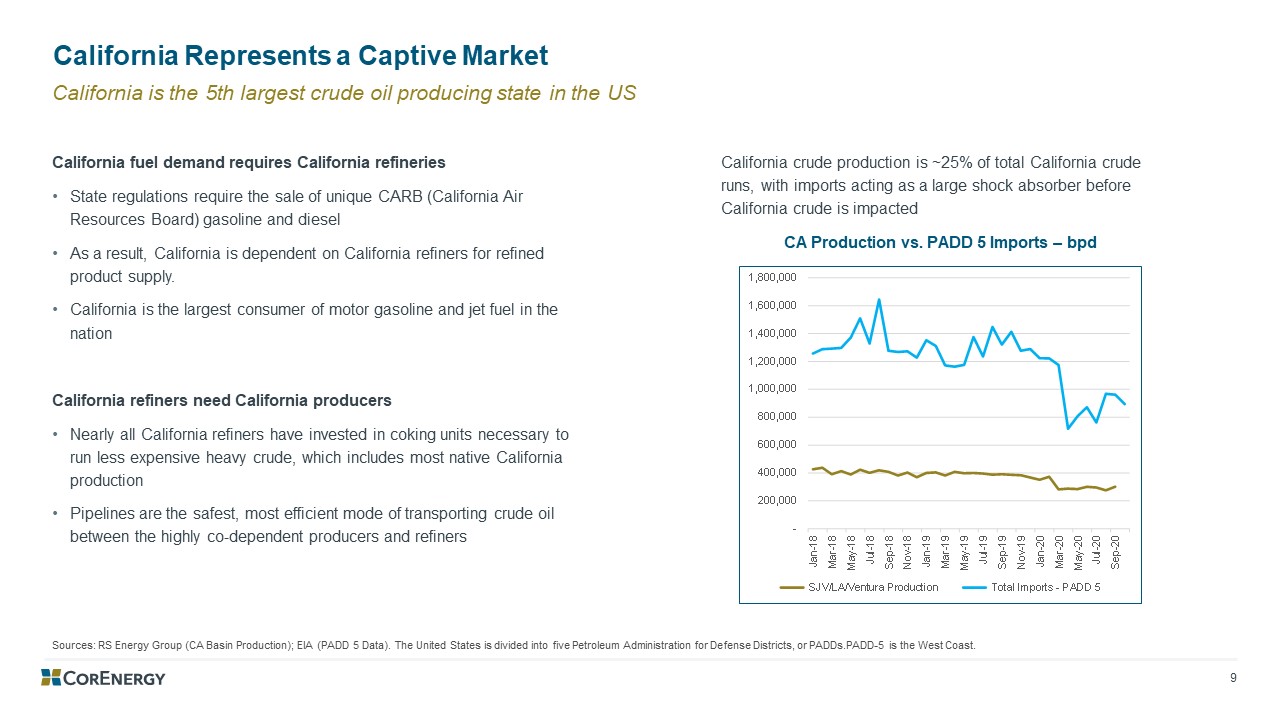

California crude production is ~25% of total California crude runs, with imports acting as a large shock absorber before California crude is impacted California fuel demand requires California refineriesState regulations require the sale of unique CARB (California Air Resources Board) gasoline and dieselAs a result, California is dependent on California refiners for refined product supply. California is the largest consumer of motor gasoline and jet fuel in the nationCalifornia refiners need California producers Nearly all California refiners have invested in coking units necessary to run less expensive heavy crude, which includes most native California productionPipelines are the safest, most efficient mode of transporting crude oil between the highly co-dependent producers and refiners CA Production vs. PADD 5 Imports – bpd California is the 5th largest crude oil producing state in the US California Represents a Captive Market Sources: RS Energy Group (CA Basin Production); EIA (PADD 5 Data). The United States is divided into five Petroleum Administration for Defense Districts, or PADDs.PADD-5 is the West Coast.

In their 9/25/2020 report, IHS (after internal combustion engine vehicle ban announcement), forecasted PADD 5 demand to remain flat from 2021 – 2025, then decline 1.6% annually between 2025 and 2050; primarily due to a reduction in gasoline demand. According to the EIA, California is responsible for approximately 2/3 of PADD 5 demand. Long Term Demand Even with Energy Transition Positioned for long-term energy transitionCurrent and future long-term utility as the energy industry evolvesOpportunities to repurpose existing pipelines or add new pipelines to provide conduits for energy transportation and connectivity to storageAbility to transport other products, such as renewable fuels, including other environmentally friendly substancesOver 1,800 miles of California rights-of-way, much of which allows for multi-use and are difficult to replicateFee properties and leases which could accommodate renewable energy build-outPossibilities for long-term contracted fiber optic cable pathways

Control center remotely monitors and controls all pipeline systems and critical equipmentSCADA is installed on all line segmentsState-of-the-art leak detection able to automatically identify issuesSatellite data transmission from all field locationsOperator training meets or exceeds training and certification requirements of all regulatory agencies Maintenance program compliant with all regulatory requirements (CSFM / DOT), including cathodic protection on all pipe segments and smart pigging utilized over hydrotesting wherever possibleSmart pigging on 95% of all pipeline segmentsInspection program complies with all regulatory requirements, including ILI Inspections, hydrotests and stand-up testsIntegrity management (“IM”) plans developed for all pipeline segments State-of-the-art 24/7 control center, best-in-class maintenance and inspection program Crimson’s Proven Operating Expertise

Financial and Transaction Details

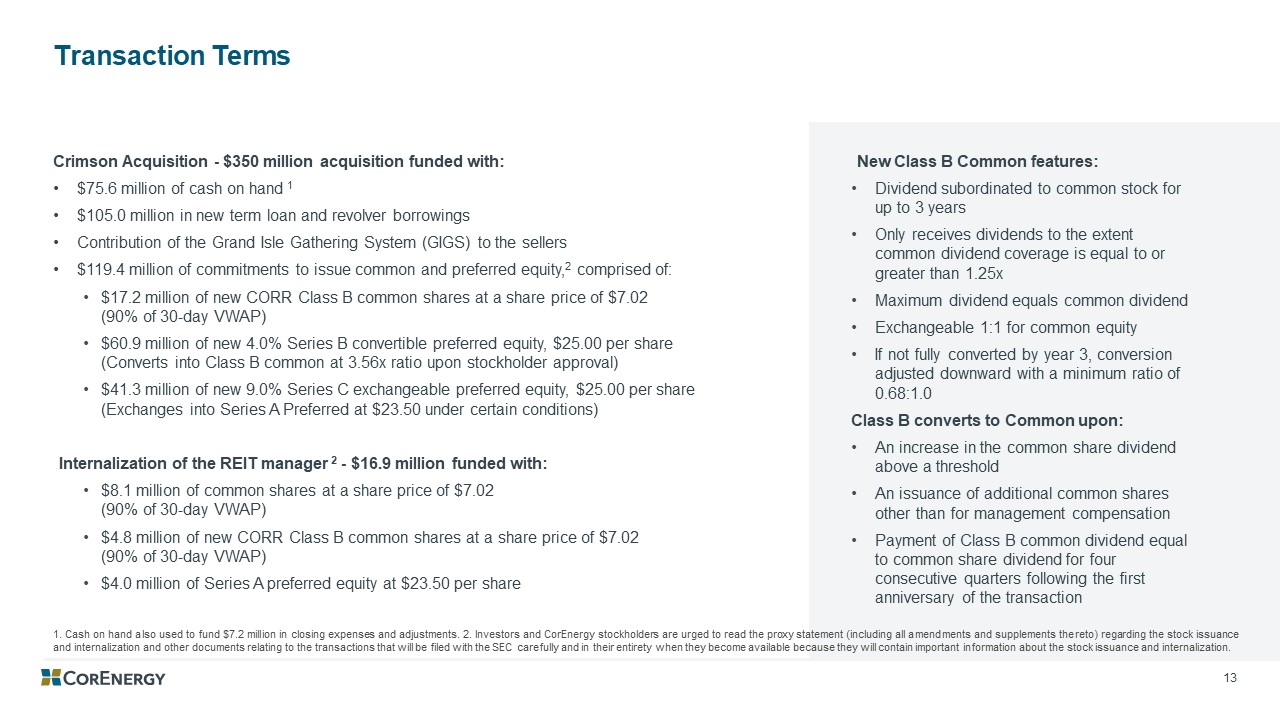

Transaction Terms Crimson Acquisition - $350 million acquisition funded with: $75.6 million of cash on hand 1 $105.0 million in new term loan and revolver borrowings Contribution of the Grand Isle Gathering System (GIGS) to the sellers $119.4 million of commitments to issue common and preferred equity,2 comprised of: $17.2 million of new CORR Class B common shares at a share price of $7.02 (90% of 30-day VWAP)$60.9 million of new 4.0% Series B convertible preferred equity, $25.00 per share (Converts into Class B common at 3.56x ratio upon stockholder approval)$41.3 million of new 9.0% Series C exchangeable preferred equity, $25.00 per share (Exchanges into Series A Preferred at $23.50 under certain conditions)Internalization of the REIT manager 2 - $16.9 million funded with: $8.1 million of common shares at a share price of $7.02 (90% of 30-day VWAP)$4.8 million of new CORR Class B common shares at a share price of $7.02 (90% of 30-day VWAP)$4.0 million of Series A preferred equity at $23.50 per share 1. Cash on hand also used to fund $7.2 million in closing expenses and adjustments. 2. Investors and CorEnergy stockholders are urged to read the proxy statement (including all amendments and supplements thereto) regarding the stock issuance and internalization and other documents relating to the transactions that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information about the stock issuance and internalization. New Class B Common features: Dividend subordinated to common stock for up to 3 yearsOnly receives dividends to the extent common dividend coverage is equal to or greater than 1.25xMaximum dividend equals common dividendExchangeable 1:1 for common equityIf not fully converted by year 3, conversion adjusted downward with a minimum ratio of 0.68:1.0Class B converts to Common upon: An increase in the common share dividend above a thresholdAn issuance of additional common shares other than for management compensationPayment of Class B common dividend equal to common share dividend for four consecutive quarters following the first anniversary of the transaction

Capitalization Illustration Revolver has undrawn availability of $25 millionTerm Loan amortization scheduled at $8.0 million per year5.875% Unsecured Convertible Senior Notes due 20257.735% Cumulative Redeemable Series A Preferred 4.0%, PIK option, Series B Convertible Preferred converts into Class B Common Stock at a 3.56x ratio9.0% Series C Exchangeable Preferred converts into Series A Preferred at a 1.06x ratioClass B Common Stock exchangeable into Common Stock at a 1:1 ratio subject to meeting conversion tests 1. The Series C Exchangeable Preferred Stock, Series B Convertible Preferred Stock and Class B Common Stock represent the equity consideration of the Grier members in Crimson Midstream Holdings LLC, which will be reflected as a noncontrolling interest in CorEnergy’s consolidated financial statements. 2. Pro forma converted column is for illustration purposes only. Investors and CorEnergy stockholders are urged to read the proxy statement (including all amendments and supplements thereto) regarding the stock issuance and internalization and other documents relating to the transactions that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information about the stock issuance and internalization.

Operating OutlookRevenue expected to be $130-$135 million annualizing both CORR’s legacy assets and Crimson’s assets for 2021Internalization of manager to result in approximately $2.0 million of annualized SG&A savings from pro forma management fee of $5.5 million1 Expected run rate combined EBITDA of $50-$52 million on an annualized basis beginning in Q2 20212 Maintenance capital expenditures expected to be in the range of $10-$11 million in 2021Initial annualized dividend of $0.20, targeting $0.35-$0.40 upon a return to pre-COVID market conditions in California, with near term commercial opportunities providing upside3Leverage and Balance Sheet MetricsLow total leverage at closing of 4.4x expected EBITDA; senior secured leverage of 2.1xTerm Loan amortization scheduled at $8.0 million per year facilitates deleveraging to a target of < 4.0x by FYE 20221 to create financial flexibility and reduce risk CORR Outlook 1. Investors and CorEnergy stockholders are urged to read the proxy statement (including all amendments and supplements thereto) regarding the stock issuance and internalization and other documents relating to the transactions that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information about the stock issuance and internalization. 2. 2021 EBITDA will be reconciled to GAAP metrics in periodic reports 3. Common stock dividends are subject to approval by the board of directors

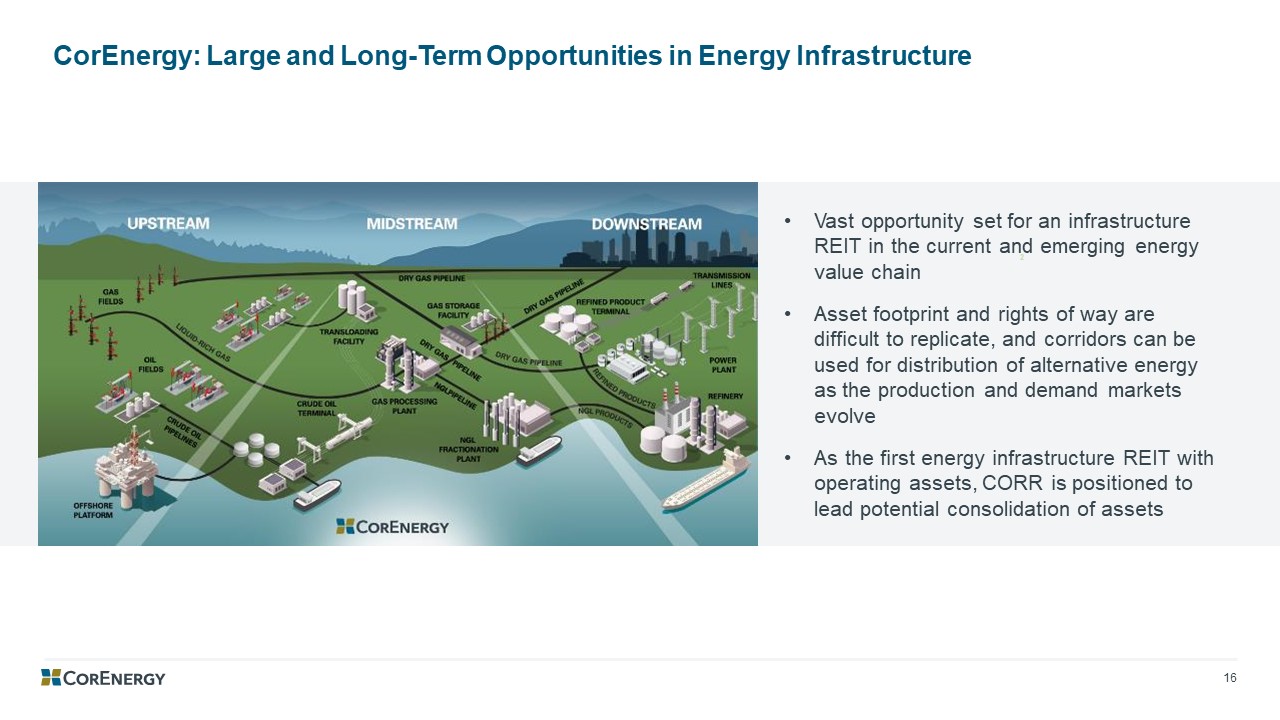

CorEnergy: Large and Long-Term Opportunities in Energy Infrastructure 1 2 Vast opportunity set for an infrastructure REIT in the current and emerging energy value chainAsset footprint and rights of way are difficult to replicate, and corridors can be used for distribution of alternative energy as the production and demand markets evolveAs the first energy infrastructure REIT with operating assets, CORR is positioned to lead potential consolidation of assets 3

Appendix

Governance Updates and Transaction Process Closing of the Crimson acquisition will occur in two partsCORR initially acquires 49.5% of Crimson pending CPUC approval for 100% anticipated in Q3 2021Use of REIT structure enables Crimson stockholders’ economics to mirror full conversion from first closingCORR stockholders will vote on approval of issuance of Class B common stock underlying Series B Convertible Preferred1Disclosure of Crimson financial information Form 8-K with historical financial information within 75 daysCORR Form 10-K subsequent event disclosure CORR 2021 Form 10-Q filings – will include consolidated financialsProxy statement filing in advance of stockholder meeting 1. Investors and CorEnergy stockholders are urged to read the proxy statement (including all amendments and supplements thereto) regarding the stock issuance and internalization and other documents relating to the transactions that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information about the stock issuance and internalization. CORR proposes to internalize its manager, Corridor Trust1Replace external management fee with internal SG&A expensesEstimated expense reduction of $2.0 million annualizedCORR stockholder vote required1

Becky SandringExecutive Vice President, Secretary & TreasurerMs. Sandring has over 20 years of experience in the energy industry with expertise in business valuations, project and corporate finance, process efficiency and implementation of complex REIT and GAAP structures. Prior to CorEnergy, Ms. Sandring was a Vice President with The Calvin Group. Ms. Sandring held various roles at Aquila Inc, and its predecessors. Dave SchulteChairman, Chief Executive Officer & PresidentMr. Schulte has over 25 years of investment experience, including nearly 20 years in the energy industry. Mr. Schulte was a co-founder and Managing Director of Tortoise Capital Advisors, an investment advisor with $16 billion under management. and a Managing Director at Kansas City Equity Partners (KCEP). Before joining KCEP, he spent five years in investment banking at the predecessor of Oppenheimer & Co. John GrierChief Operating OfficerMr. Grier has more than 35 years of experience in the oil and gas industry. He was Founder and President of Crimson Resource Management, Crimson Pipeline’s predecessor, and oversaw its acquisition strategy, including more than 20 acquisitions from major oil companies. Before founding Crimson, he spent five years at Mobil Oil, where he held a number of engineering and management positions. Robert WaldronChief Financial OfficerMr. Waldron has more than 15 years of experience in finance, accounting and capital markets. Prior to joining Crimson, he spent eight years in investment banking at Citigroup and UBS, focused on midstream client merger & acquisition activities, banking, and finance. Previously, Mr. Waldron worked 6 years at Dow Chemical in corporate R&D. Rick KreulPresident, MoGas, LLC & MoWood, LLCMr. Kreul, a mechanical engineer with more than 35 years of energy industry experience, serves as President of CorEnergy’s wholly-owned subsidiaries, MoWood, LLC and MoGas Pipeline, LLC. Previously, Mr. Kreul served as Vice President of Energy Delivery for Aquila, Inc., Vice President for Inergy, L.P., and various engineering and management roles with Mobil Oil. Kristin LeitzeChief Accounting OfficerMs. Leitze has nearly 15 years of experience in the accounting profession. Previously, Ms. Leitze was Director and Manager of SEC Reporting and Compliance at CVR Energy, a diversified holding company engaged in the petroleum refining and nitrogen fertilizer manufacturing industries. She is a C.P.A. and has served as an auditor with PricewaterhouseCoopers, LLP. Larry AlexanderPresident, Crimson CaliforniaMr. Alexander, a mechanical engineer with more than 35 years of midstream experience, serves as President of Crimson Pipeline. Prior to joining Crimson, Mr. Alexander spent 25 years at Shell Pipeline in various senior positions including construction and project management, joint ventures, operations management, inspection, budget development, EH&S, business development, and tariff policy CorEnergy Senior Management

For additional information: CorEnergy Infrastructure Trust, Inc. Investor RelationsDebbie Hagen or Matt Kreps877-699-CORR (2677)info@corenergy.reit