Execution Version LIQUIDS GATHERING SYSTEM SUBLETTE COUNTY, WYOMING PURCHASE AND SALE AGREEMENT BY AND BETWEEN PINEDALE CORRIDOR, LP AS SELLER AND ULTRA WYOMING, LLC AS BUYER DATED JUNE 28, 2020 KE 69366071

TABLE OF CONTENTS Page ARTICLE I DEFINITIONS ........................................................................................................ 1 Section 1.1 Definitions .................................................................................................. 1 Section 1.2 Certain Interpretive Provisions ............................................................... 6 ARTICLE II PURCHASE AND SALE ...................................................................................... 7 Section 2.1 Purchase and Sale ..................................................................................... 7 Section 2.2 Purchase Price ........................................................................................... 7 ARTICLE III TITLE MATTERS; CONSENTS ....................................................................... 7 Section 3.1 Title............................................................................................................. 7 Section 3.2 Consents ..................................................................................................... 7 ARTICLE IV SELLER’S REPRESENTATIONS .................................................................... 8 Section 4.1 Incorporation/Qualification ..................................................................... 8 Section 4.2 Power and Authority ................................................................................ 8 Section 4.3 Authorization and Enforceability ............................................................ 9 Section 4.4 Liability for Brokers’ Fees ....................................................................... 9 Section 4.5 No Bankruptcy .......................................................................................... 9 Section 4.6 Litigation .................................................................................................... 9 Section 4.7 Taxes........................................................................................................... 9 Section 4.8 Ownership ................................................................................................ 10 Section 4.9 Preferential Rights .................................................................................. 10 Section 4.10 Consents ................................................................................................... 10 Section 4.11 Good Faith ............................................................................................... 10 Section 4.12 Survival .................................................................................................... 10 Section 4.13 Disclaimers............................................................................................... 11 ARTICLE V BUYER’S REPRESENTATIONS ..................................................................... 11 Section 5.1 Incorporation and Qualification ............................................................ 11 Section 5.2 Power and Authority .............................................................................. 11 Section 5.3 Authorization and Enforceability .......................................................... 11 Section 5.4 Liability for Brokers’ Fees ..................................................................... 12 Section 5.5 Litigation .................................................................................................. 12 Section 5.6 Consents ................................................................................................... 12 Section 5.7 Good Faith ............................................................................................... 12 Section 5.8 Survival .................................................................................................... 12 ARTICLE VI COVENANTS AND AGREEMENTS .............................................................. 12 Section 6.1 Conduct of Parties................................................................................... 12 Section 6.2 Fees and Expenses ................................................................................... 13 Section 6.3 Restructuring Efforts.............................................................................. 13 Section 6.4 Survival .................................................................................................... 13 Section 6.5 Termination of Prior Agreements ......................................................... 14 ii

ARTICLE VII TAX MATTERS ............................................................................................... 14 Section 7.1 Apportionment of Property Tax Liability ............................................ 14 Section 7.2 Property Tax Reports and Returns ....................................................... 14 Section 7.3 Sales Taxes ............................................................................................... 14 Section 7.4 Federal Tax Reporting ........................................................................... 14 Section 7.5 Like Kind Exchange ............................................................................... 15 ARTICLE VIII CONDITIONS PRECEDENT TO CLOSING ............................................. 15 Section 8.1 Seller’s Conditions Precedent ................................................................ 15 Section 8.2 Buyer’s Conditions Precedent ............................................................... 16 ARTICLE IX RIGHT OF TERMINATION ........................................................................... 16 Section 9.1 Termination ............................................................................................. 16 ARTICLE X CLOSING ............................................................................................................. 17 Section 10.1 Date of Closing ........................................................................................ 17 Section 10.2 Time and Place of Closing ...................................................................... 17 Section 10.3 Closing Obligations ................................................................................. 17 ARTICLE XI ASSUMPTION OF OBLIGATIONS AND INDEMNIFICATION .............. 18 Section 11.1 Buyer’s Assumption of Liabilities and Obligations ............................. 18 Section 11.2 Indemnification ....................................................................................... 18 Section 11.3 Survival .................................................................................................... 19 Section 11.4 Procedure ................................................................................................. 19 Section 11.5 No Insurance; Subrogation .................................................................... 20 Section 11.6 Reservation as to Non-Parties ................................................................ 20 Section 11.7 Consequential Damages.......................................................................... 20 Section 11.8 No Derivative Liability ........................................................................... 21 Section 11.9 Attorneys’ Fees ........................................................................................ 21 ARTICLE XII MISCELLANEOUS ......................................................................................... 21 Section 12.1 Expenses ................................................................................................... 21 Section 12.2 Notices ...................................................................................................... 21 Section 12.3 Amendments ............................................................................................ 22 Section 12.4 Assignment............................................................................................... 22 Section 12.5 Counterparts/PDF and Fax Signatures ................................................ 22 Section 12.6 GOVERNING LAW; JURISDICTION, VENUE; JURY WAIVER .................................................................................................. 23 Section 12.7 Entire Agreement .................................................................................... 23 Section 12.8 Binding Effect .......................................................................................... 23 Section 12.9 No Third-Party Beneficiaries ................................................................. 23 Section 12.10 Time of the Essence ................................................................................. 23 Section 12.11 No Waiver ................................................................................................ 23 Section 12.12 Waiver of Trial by Jury .......................................................................... 23 Section 12.13 Further Assurances ................................................................................. 24 iii

EXHIBITS Exhibit A: Assignment of Jensen Easements to Ultra Resources Exhibit B: BLM Request for Consent to Assignment to Ultra Resources Exhibit C: List of BLM Easements Exhibit D: BLM Easements Assignment to Ultra Resources / BLM Filing Exhibit E: BLM Easements Assignment to Ultra Resources / County Filing Exhibit F: Map of Pipelines and Gathering Facilities Exhibit G: Bill of Sale Exhibit H: Release of Nerd Farm Easement and Transfer of Improvements Exhibit I: Non-Foreign Affidavit Exhibit J: Form of Mutual Release and Exculpation Exhibit K: Memorandum of Termination iv

PURCHASE AND SALE AGREEMENT This Purchase and Sale Agreement (this “Agreement”), is made as of June 28, 2020 (“Execution Date”), by and between PINEDALE CORRIDOR, LP, a Delaware limited partnership (“Seller”) whose address is 1100 Walnut Street, Suite 3350, Kansas City, Missouri 64106 and ULTRA WYOMING, LLC, a Delaware limited liability company (“Buyer”) whose address is 116 Inverness Drive East, Suite 400, Englewood, CO 80112. Seller and Buyer may be referred to individually as a “Party” or collectively as the “Parties.” RECITALS Seller owns all right, title and interest in and to the Assets (as defined in this Agreement) located in the Pinedale Anticline in Sublette County, Wyoming, as more fully described in this Agreement. Buyer desires to purchase, and Seller desires to sell and convey, the Assets pursuant to and in accordance with the terms and conditions of this Agreement. As a result of the Bankruptcy Case, each Party has determined that the Purchase Price (as defined in this Agreement) is fair value to be paid by the Buyer for the Assets. As a part of the Bankruptcy Case (as defined in this Agreement) the Parties have determined, for the reasons reflected in the relevant 9019 motion filed in the Bankruptcy Case relating to the Assets, to enter into this Agreement in settlement of ongoing disputes and litigation. AGREEMENT In consideration of the mutual promises, covenants and warranties contained herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Buyer and Seller agree as follows: ARTICLE I DEFINITIONS Section 1.1 Definitions. The following terms shall have the meanings set forth below: Affiliate: With respect to a specified Person, (a) any Subsidiary of that Person, and (b) any Person that directly, or indirectly through one or more intermediaries, Controls or is Controlled by or is under common Control with, the specified Person. Assets: The Liquids Gathering System and the Personal Property. Assignment of Jensen Easements to Ultra Resources: The Assignment of Easements and Transfer of Improvements (LGS) (Jensen Easements) to be executed by Seller and Ultra Resources and with their signatures acknowledged, in the form attached to this Agreement as Exhibit A. 1

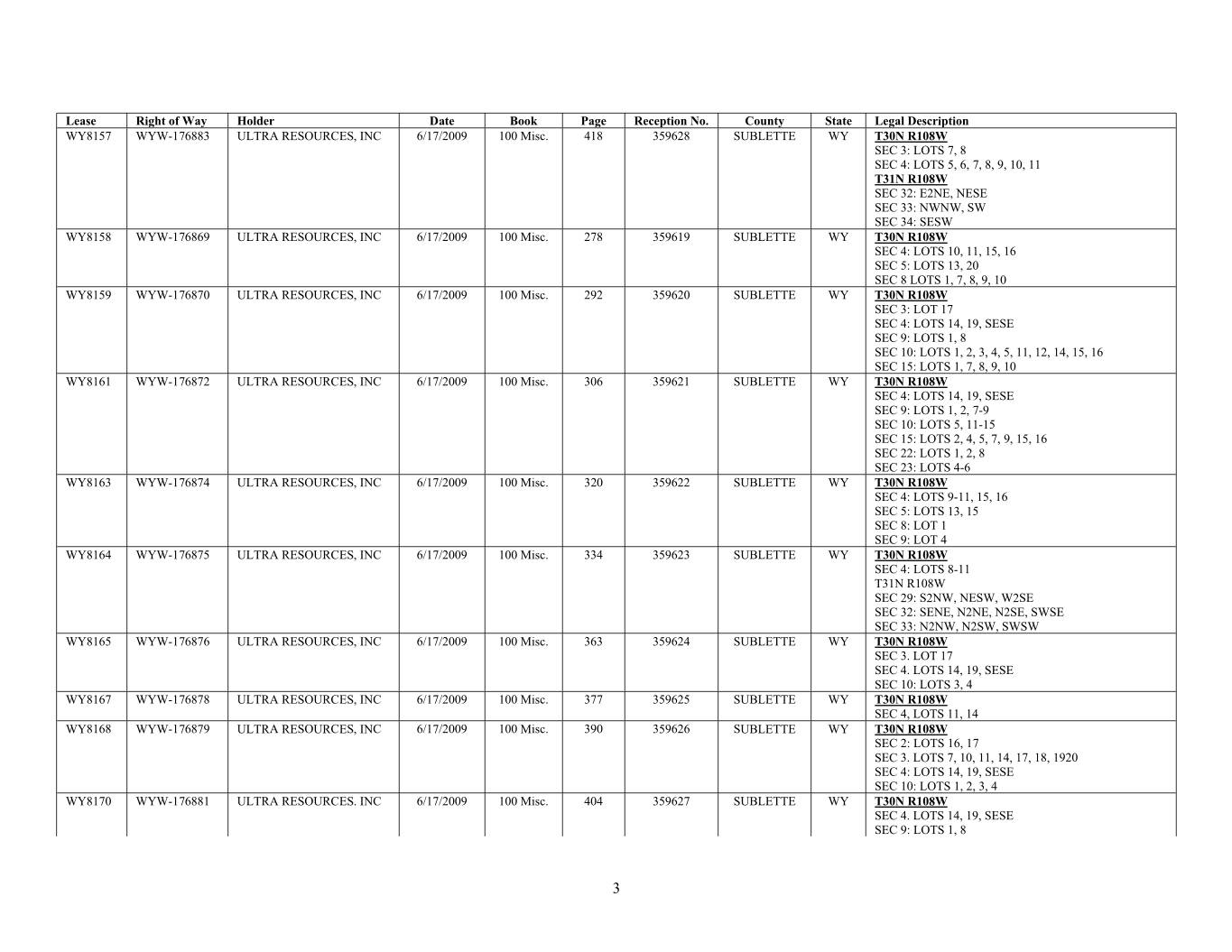

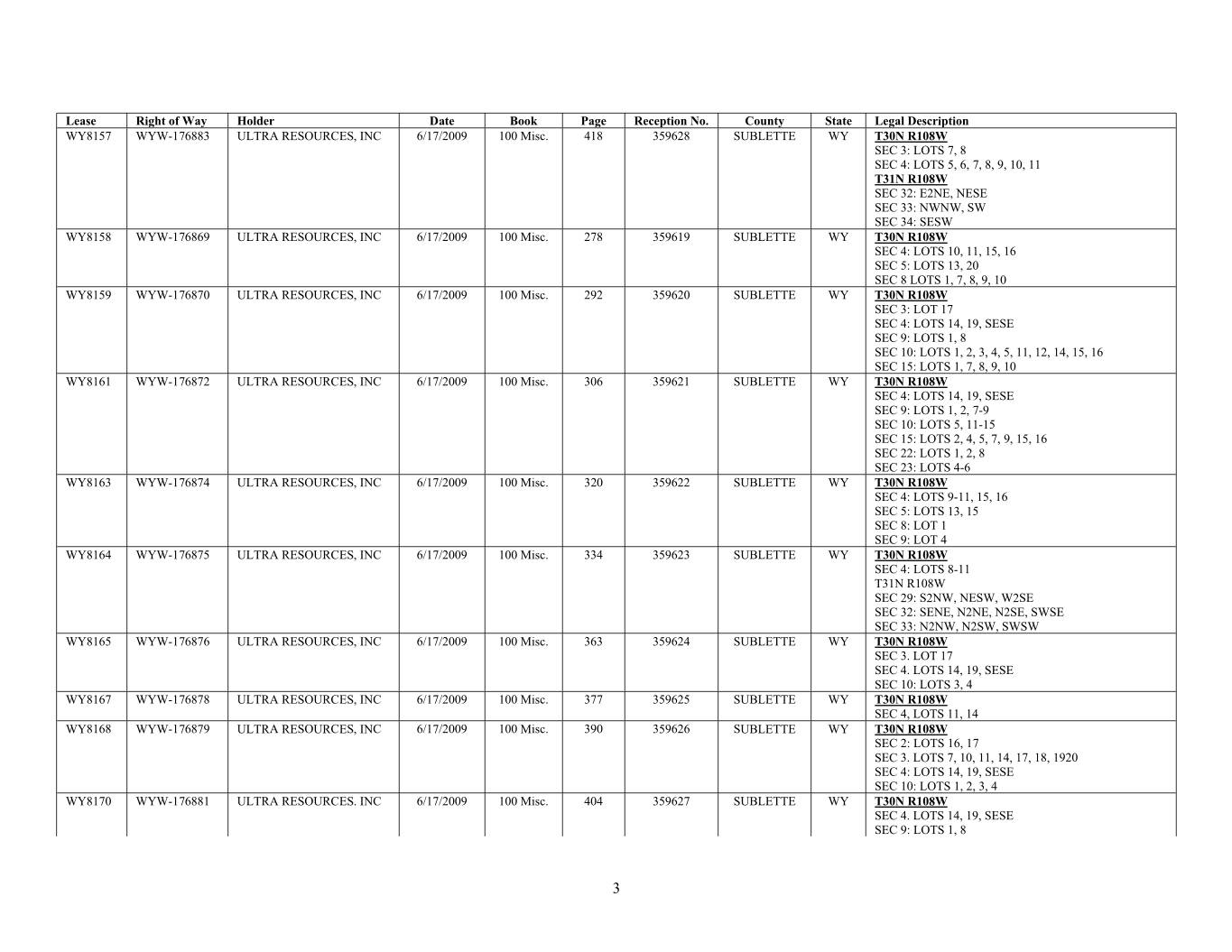

Bankruptcy Case: The cases commenced by Buyer under chapter 11 of the Bankruptcy Code in the Bankruptcy Court, styled In re: Ultra Petroleum Corp., et al., jointly administered under Case No. 20-32631, and pending before the Bankruptcy Court. Bankruptcy Court: The United States Bankruptcy Court for the Southern District of Texas. Bill of Sale: The Bill of Sale executed by Seller and Buyer in the form attached to this Agreement as Exhibit G. BLM: The United States Department of the Interior Bureau of Land Management, Wyoming State Office. BLM Consent: The consent of BLM to the BLM Easement Assignments to Buyer, in response to the BLM Request for Consent to Assignment to Ultra Resources. BLM Easements Assignment to Ultra Resources: The assignment by Seller to Ultra Resources of all of Seller’s right, title and interest under the BLM Easements pursuant to (a) the Application for Transportation and Utility Systems and Facilities on Federal Lands to be executed by Seller and Buyer, in the form attached to this Agreement as Exhibit D, and (b) the Assignment of Easements and Transfer of Improvements (LGS) (BLM Easements) to be executed by Seller and Ultra Resources and with their signatures acknowledged, in the form attached to this Agreement as Exhibit E. BLM Easements: The easements, rights of way and agreements listed in Exhibit C, which shall be assigned to Ultra Resources pursuant to the BLM Easements Assignment to Ultra Resources. BLM Request for Consent to Assignment to Ultra Resources: The form of request for BLM’s consent to the BLM Easements Assignment to Ultra Resources, a copy of which request is attached to this Agreement as Exhibit B. Business Day: Any day other than a Saturday, Sunday or any day that is a national banking holiday in the United States. Buyer Closing Deliveries: (i) The BLM Easements Assignment to Ultra Resources, executed by Ultra Resources and with its signature acknowledged; (ii) the BLM Request for Consent to Assignment to Ultra Resources, executed by Ultra Resources; (iii) the Assignment of Jensen Easements to Ultra Resources, executed by Ultra Resources and with its signature acknowledged; (iv) the Release of Nerd Farm Easement and Transfer of Improvements, executed by Ultra Resources and with its signature acknowledged; (v) the Bill of Sale, executed by Buyer; (vi) the Mutual Release and Exculpation, executed by Buyer; (vii) Memorandum of Termination, executed by Buyer and with its signature acknowledged; and (viii) evidence of the receipt of Bankruptcy Court approval in connection with the Bankruptcy Case as referenced in Section 8.2(d). Buyer Closing Payments: The Purchase Price in Current Funds, and to the extent payable at Closing, any Taxes that Buyer is required to pay as a result of Closing under Section 7.3 of this Agreement, any recording fees or costs to record the Recorded Documents in the Real Estate Records or to file with BLM the BLM Assignment to Buyer. 2

Closing Deliveries: The Seller Closing Deliveries and the Buyer Closing Deliveries. Code: the Internal Revenue Code of 1986, as amended. All references to the Code, Treasury Regulations or other governmental pronouncements shall be deemed to include references to any applicable successor regulations or amending pronouncements. Current Funds: Wire transfers of immediately available funds to Seller. Easement Rights: Collectively, the right, title and interest in the BLM Easements conveyed to Ultra Resources under the BLM Easements Assignment to Ultra Resources, the right, title and interest in the Jensen Easements conveyed to Ultra Resources under the Assignment of Jensen Easements to Ultra Resources, and the Release of Nerd Farm Easement and Transfer of Improvements (but exclusive of the Improvements transferred pursuant to the Nerd Farm Easement). Easements: The BLM Easements, the Jensen Easements and the Release of Nerd Farm Easement and Transfer of Improvements. GAAP: means generally accepted accounting principles in effect in the United States of America from time to time or at a specific time if so specified in this Agreement. Improvements: All of the improvements and fixtures used directly in connection with the Liquids Gathering System, including, without limitation, any and all surface or subsurface pipelines, surface or subsurface machinery and equipment, line pipe, pipe connections, fittings, flanges, welds, or other interconnections, valves, control and monitoring equipment, cathodic or electrical protection units, by-passes, regulators, drips, treating equipment, dehydration equipment, separation equipment, processing equipment, condensate and water storage tanks and other storage facilities, generators, gas compressors, vapor recovery units, combustors, flares, storage sheds, towers, gas and electric fixtures, radiators and heaters. Indebtedness: With respect to a Person, such Person’s (a) liabilities for borrowed money, (b) liabilities for the deferred purchase price of property acquired by it (excluding accounts payable arising in the ordinary course of businesses), (c) obligations that are required to be accounted for as capital leases on a balance sheet under GAAP (and the amount of such obligations shall be the capitalized amount thereof determined in accordance with GAAP), and (d) guaranty obligations with respect to liabilities of another Person of the type described in the preceding subsections (a)- (c). Interim Period: The period from and including the Execution Date until the Closing Date. Jensen Easements: The following easements: (a) that certain Grant of Pipeline Easements dated June 24, 2010, recorded in Book 95, Page 423 of the Records of the Sublette County Clerk’s Office, Sublette County, Wyoming, from Mary Kay Jensen, as grantor, to Ultra Resources, as grantee, and (b) that certain Grant of Pipeline Easements dated June 24, 2010, in Book 95, Page 418 of the Records of the Sublette County Clerk’s Office, Sublette County, Wyoming, from Mary Kay Jensen, as personal representative of the Estate of John Wayne Jensen, individually, as grantor, to Ultra Resources, as grantee, as both such easements were assigned by Ultra Resources to Seller pursuant to the BLM and Jensen Easements Assignment to Seller. 3

Land: The land underlying, subject to and covered by the Easement Rights. Lien: Any mortgage lien, deed of trust lien, vendor’s lien, security interest, mechanic’s or materialman’s lien, or other lien. Lien Releases: A release (in forms acceptable to Buyer) of Liens made by Seller affecting the Assets. Liquids Gathering System: Generally, the system of pipelines and central gathering facilities highlighted on the map attached as Exhibit F, together with the related equipment that is capable of gathering, separating, collecting, and delivering for sale or transport, condensate and water, together with associated natural gas, produced from natural gas and oil wells, along with any other structures, pipelines, gathering lines or other equipment useful in gathering, collecting or delivering condensate and water, together with associated natural gas and are located in the Pinedale Anticline Field in Sublette County, Wyoming, including, specifically, the Easement Rights and the Improvements. Loan Documents: The Second Amended and Restated Term Credit Agreement dated December 29, 2017 to which the Seller is a party, the related mortgage, and all other security documents related thereto. Material Adverse Effect: Any circumstance, change, or effect that, individually or in the aggregate, is materially adverse to the ownership, operation, or financial condition of the Assets, taken as a whole. Mutual Release and Exculpation: The Form of Mutual Release and Exculpation to be executed by the appropriate Persons in the form attached to this Agreement as Exhibit J. Non-Foreign Affidavit: The Non-Foreign Affidavit (Federal) in the form attached to this Agreement as Exhibit I, executed by Seller, and equivalent forms, if any, required by the State of Wyoming. Outside Closing Date: The earlier of (a) July 30, 2020 and (b) three (3) Business Days after approval from the Bankruptcy Court to proceed with the transactions contemplated herein, or such other date as may be mutually agreed in writing by Buyer and Seller. Person: Any individual, firm, corporation, partnership, limited liability company, incorporated or unincorporated association, joint venture, governmental authority or any other entity of any kind. Personal Property: (a) The monitoring equipment located in or on the Liquids Gathering System, (b) the computer hardware located in the centralized monitoring building for each central gathering facility constituting a portion of the Liquids Gathering System to which such monitoring equipment connects, (c) the wires and other connectors for such monitoring equipment between such computer hardware and such monitoring equipment, (d) all office furniture in each centralized monitoring building for each central gathering facility, (e) engineering drawings and plans and specifications in Seller’s possession for the Liquids Gathering System except to the extent assignment thereof is prohibited by contract or applicable law, (f) as-built drawings and surveys of the Liquids Gathering System in Seller’s possession, (g) to the extent assignable, the other 4

Records and (h) any and all other equipment, personal property, rights-of-way, permits that were used or held for use in connection with the Liquids Gathering System. Records: The following information, to the extent in Seller’s Possession: all engineering drawings or plans of or covering the Liquids Gathering System or any component thereof, site assessments and environmental reports regarding or covering the Liquids Gathering System or any component thereof, manuals relating to the operation of the Assets, and “as-built” surveys of the pipelines and drawings of the Liquids Gathering System. Release of Nerd Farm Easement and Transfer of Improvements: The Release of Nerd Farm Easement and Transfer of Improvements in the form attached to this Agreement as Exhibit H. Representatives: Those Persons including, without limitation, officers, directors, employees, accountants, attorneys, consultants, independent contractors, agents, stockholders, members, partners, actual or potential financing sources, investment advisers, and investment bankers, with a need to know confidential information in order to evaluate the Transaction. Seller Closing Deliveries: (i) The BLM Easements Assignment to Ultra Resources, executed by Seller and with its signature acknowledged; (ii) the BLM Request for Consent to Assignment to Ultra Resources, executed by Seller; (iii) the Assignment of Jensen Easements to Ultra Resources, executed by Seller and with its signature acknowledged; (iv) the Release of Nerd Farm Easement and Transfer of Improvements, executed by Seller and with its signature acknowledged; (v) the Bill of Sale, executed by Seller; (vi) the Non-Foreign Affidavit executed by Seller; (vii) the Lien Releases, executed by Seller and the applicable lien holder; (viii) the Mutual Release and Exculpation, executed by Seller; and (ix) the Memorandum of Termination, executed by Seller and with its signature acknowledged. Seller’s Knowledge: As of any date, the then current actual knowledge of Seller’s officers or directors as of such date, and not any implied, imputed or constructive knowledge of such individuals, and without any independent investigation or inquiry having been made or any implied duty to investigate, make any inquiries or review any information. Any use of the qualification of Seller’s Knowledge shall in no event give rise to any personal liability on the part of any officers or directors of Seller or its Affiliates on account of any breach of any representation or warranty made by Seller herein. No broker, agent or Person other than Seller is authorized to make any representation or warranty for or on behalf of Seller. Seller’s Possession: With respect to information, records and materials, only such information, records and materials as may be in the actual possession or control of Seller or its Affiliates, and without including any information or materials in the possession or control of a third Person or any other agent of Seller or its Affiliates. Subsidiary: With respect to any Person (the “parent”) at any date, any corporation, limited liability company, partnership, association or other entity the accounts of which would be consolidated with those of the parent in the parent’s consolidated financial statements if such financial statements were prepared in accordance with generally accepted accounting principles as of such date, as well as any other corporation, limited liability company, partnership, association or other entity (a) of which securities or other ownership interests representing more than fifty percent 5

(50%) of the equity or more than fifty percent (50%) of the ordinary voting power or, in the case of a partnership, more than fifty percent (50%) of the general partnership interests are, as of such date, owned, controlled or held, or (b) that is, as of such date, otherwise Controlled, by the parent or one or more subsidiaries of the parent or by the parent and one or more subsidiaries of the parent Survival Period: The period beginning on the Closing Date and ending six (6) months following the Closing Date. Tax or Taxes: (a) all federal, state, local or foreign income, gross receipts, license, payroll, employment, excise, severance, stamp, occupation, premium, windfall profits, environmental, customs, duties, capital stock, franchise, profits, withholding, social security (or similar), unemployment, disability, real property, personal property, sales, use, transfer, escheat, registration, value added, alternative or add-on minimum, estimated or any other taxes, unclaimed property liabilities, any payments in lieu of taxes or other similar payments, charges, fees, levies, imposts, customs or duties of any kind whatsoever, that are imposed by a Taxing Authority, including any interest, penalty, or addition thereto, whether disputed or not and including any obligations to indemnify or otherwise assume or succeed to the tax liability of any other Person or (b) any liability for the payment of any taxes, interest, penalty, addition to tax or like additional amount resulting from the application of Treasury Regulation Section 1.1502-6 or comparable federal, state or local laws. Tax Return: any return, declaration, report, claim for refund, property rendition or information return or statement relating to Taxes, including any schedule or attachment thereto and including any amendment thereof. Taxing Authority: a governmental entity having jurisdiction over the assessment, determination, collection, or other imposition of any Tax. Treasury Regulations: the regulations promulgated by the United States Treasury Department under the Code. Ultra Resources: Ultra Resources, Inc., a Delaware corporation. Section 1.2 Certain Interpretive Provisions. As used in this Agreement: (a) the word “or” is not exclusive and the word “including” is not limiting, (b) references to a law include any rule or regulation issued under the law and any amendment to the law, rule or regulation, (c) whenever the words “include,” “includes,” or “including” appear, they shall be deemed to be followed by the words “without limitation,” (d) personal pronouns shall be deemed to include the other genders and the singular shall include the plural and vice versa, and (e) the words “herein,” “hereof” and “hereunder” and other words of similar import refer to this Agreement as a whole and not to any particular Article, Section or other subdivision. Wherever a period of time is stated in this Agreement as commencing or ending on specified dates, such period of time shall be deemed (i) inclusive of such stated commencement and ending dates, and (ii) to commence at 12:00 A.M. Central Time on such stated commencement date and to end at 11:59 P.M. Central Time on such stated ending date. Unless the context otherwise requires, (A) any definition or reference to any agreement, instrument or other document shall be construed as referring to such agreement, instrument or other document as from time to time amended, supplemented or 6

otherwise modified (subject to any restrictions on such amendments, supplements or modifications set forth herein), (B) subject to restrictions on assignment set forth herein, any reference herein to any Person shall be construed to include such Person’s successor and assigns, and (C) any reference to any law shall include all statutory and regulation provisions consolidating, amending, replacing or interpreting such law and reference to any law or regulation shall, unless otherwise specified, refer to such law or regulation as amended, modified or supplemented from time to time. Section headings herein are included for convenience of reference only and shall not affect the interpretation of this Agreement or any other document executed in connection herewith. In the event that any event hereunder is to occur, or a time period is to expire, on a date which is not a Business Day, such event shall occur or such time period shall expire on the next succeeding Business Day. ARTICLE II PURCHASE AND SALE Section 2.1 Purchase and Sale. Seller agrees to sell the Assets to Buyer, and Buyer agrees to purchase the Assets from Seller, pursuant to, and subject to the terms and conditions of, this Agreement. Section 2.2 Purchase Price. The purchase price for the Assets shall be Eighteen Million U.S. Dollars (U.S. $18,000,000) (the “Purchase Price”). If the transaction contemplated by this Agreement (“Transaction”) closes, Buyer agrees to pay to Seller the Purchase Price at Closing in Current Funds. ARTICLE III TITLE MATTERS; CONSENTS Section 3.1 Title. Except for Seller’s Warranties, neither Seller nor any of its Affiliates makes any representation or warranty, express, implied, statutory or otherwise, with respect to Seller’s title to any of the Assets, except by, through and under Seller and its Affiliates, but not otherwise, and Buyer hereby acknowledges and agrees that Buyer has no claim or remedy against Seller or its Affiliates, or their respective successors or assigns, for any defect of title relating to the Assets, including but not limited to any lien, encumbrance, claim, defect in or object to real property title, and the existence or non-existence of any leases, easements or rights-of-way, except those claims or rights against the Assets that arise by, through and under Seller and its Affiliates, but not otherwise. Seller agrees to assign to Buyer all rights, claims, and causes of action on title warranties given or made by Seller’s respective predecessors, and that Buyer is specifically subrogated to all rights which Seller may have against its predecessors, to the extent that Seller may legally transfer such rights and grant such subrogation. Section 3.2 Consents. (a) Buyer and Seller acknowledge that BLM consent to the assignment of a right of way or easement from BLM is customarily not requested or obtained until after the closing of the actual assignment of such right of way or easement. Buyer and Seller shall use commercially reasonable efforts after Closing to obtain the BLM Consent, through submission of the BLM Request for Consent to Assignment to Buyer in the form attached hereto as Exhibit B with such 7

changes to such form as may be required by changes in applicable law or regulations after the Execution Date. Buyer shall pay any costs or expenses assessed by BLM in connection with such BLM Request for Consent to Assignment to Buyer, and Seller shall not be obligated to incur any out-of-pocket expenses or obligations to obtain the BLM Consent. (b) Except for the BLM Consent, if prior to Closing Seller or Buyer discovers a consent necessary for the valid assignment of the Assets, or a portion thereof, required by either (a) the contract or agreement granting or creating Seller’s rights in an Asset component (other than a consent to assignment of the Records or any part of the Records, which shall not be considered an Additional Required Consent) or (b) a law applicable to the transfer of an Asset component from Seller to Buyer hereunder (other than the BLM Request for Consent to Assignment to Buyer) (each, and except for the BLM Consent, an “Additional Required Consent”) such Party shall promptly notify the other of the need for such Additional Required Consent, the Seller and Buyer shall use commercially reasonable efforts to obtain such Additional Required Consent. Unless and until any such Additional Required Consent is obtained, to the extent permitted by applicable law, the Parties will cooperate in good faith to establish an arrangement reasonably satisfactory to Buyer and Seller under which Buyer would obtain the claims, rights and benefits associated with the Assets (or portion thereof) affected by such Additional Required Consents (the “Non- Assignable Assets”) and under which Seller would enforce for the benefit of Buyer any and all claims, rights and benefits of Seller associated with the Non-Assignable Assets against a third party thereto. Nothing in this Section 3.2 shall be deemed to constitute an agreement by Buyer to exclude from the Assets any of the Non-Assignable Assets. Seller will convey such Non- Assignable Assets to Buyer promptly upon receipt of the requisite Additional Required Consents with the Closing Date for such Non-Assignable Assets being adjusted appropriately, but subject in all other respects to the terms and conditions of this Agreement. Buyer shall pay any costs or expenses incurred to obtain any Additional Required Consent (which for the avoidance of doubt, does not include any consents under the Loan Documents); provided, however, that in no event shall Buyer be responsible for any out-of-pocket attorney’s fees incurred by Seller with respect to any Additional Required Consent. ARTICLE IV SELLER’S REPRESENTATIONS Seller represents and warrants to Buyer as of the Execution Date and as of the Closing Date the following: Section 4.1 Incorporation/Qualification. Seller is a Delaware limited partnership, duly organized, validly existing and in good standing under the laws of the State of Delaware and is qualified to conduct business in Wyoming. Section 4.2 Power and Authority. Seller has all requisite power and authority to own the Assets and to carry on its business as presently conducted and to execute and deliver this Agreement and perform its respective obligations under this Agreement. The execution and delivery of this Agreement and consummation of the Transaction and the fulfillment of and compliance with the terms and conditions hereof will not violate, or be in conflict with, any material provision of its governing documents or any material provision of any agreement or instrument to which it is a party or by which it is bound (other than the Loan Documents) or, to 8

Seller’s Knowledge, any judgment, decree, order, statute, rule or regulation applicable to it, subject, however, to approval by the Bankruptcy Court in connection with the Bankruptcy Case. Section 4.3 Authorization and Enforceability. The execution, delivery and performance of this Agreement and the Transaction have been duly and validly authorized by all requisite partnership action on behalf of Seller. This Agreement constitutes Seller’s legal, valid and binding obligation, enforceable in accordance with its terms, subject however, to the effects of bankruptcy, insolvency, reorganization, moratorium and similar laws for the protection of creditors, as well as to general principles of equity, regardless whether such enforceability is considered in a proceeding in equity or at law. Section 4.4 Liability for Brokers’ Fees. Seller has not incurred any liability, contingent or otherwise, for brokers’ or finders’ fees relating to the Transaction for which Buyer shall have any responsibility whatsoever. Section 4.5 No Bankruptcy. There are no bankruptcy proceedings pending, being contemplated by or, to Seller’s Knowledge, threatened in writing against Seller. The Assets contemplated to be transferred, conveyed and sold by Seller pursuant to the terms set forth in this Agreement and in the assignments contemplated by this Agreement are being sold for reasonably equivalent value. Section 4.6 Litigation. To Seller’s Knowledge, as of the date of this Agreement there are no actions, suits, or proceedings pending against Seller or any of the Assets in any court or by or before any federal, state, municipal or other governmental agency that would affect Seller’s ability to consummate the Transaction or have a Material Adverse Effect. To Seller’s Knowledge, (a) there are no ongoing governmental investigations or written governmental inquiries pending or threatened in writing against the Assets that would affect Seller’s ability to consummate the Transaction, and (b) as of the date of this Agreement, there are no actions, suits or proceedings threatened in writing against Seller or any of the Assets that would affect Seller’s ability to consummate the Transaction. As of the date of this Agreement, Seller is not subject to any outstanding injunction, judgment, settlement, order, decree, ruling or charge that would reasonably be expected to have a Material Adverse Effect. Section 4.7 Taxes. (a) Seller has (i) duly and timely filed or caused to be filed all Tax Returns required to be filed by or with respect to Seller or, to Seller’s Knowledge, with respect to the Assets with the appropriate Taxing Authority, and, to Seller’s Knowledge, each such Tax Return is complete and correct in all material respects and (ii) paid all Taxes due or claimed to be due by a Taxing Authority (whether or not shown as due on a filed Tax Return) and except for any Taxes to be paid by Buyer or its Affiliates pursuant to the LGS Lease (as defined below) from or with respect to Seller which, in the case of clauses (i) and (ii) above, if unpaid would result in the filing of a lien against the Assets for Taxes. (b) To Seller’s Knowledge, there are not pending any, and Seller has received no written notice of any currently proposed, material adjustments by any Taxing Authority in connection with any Tax Returns relating to the Assets which if unpaid would result in the filing 9

of a lien against the Assets for Taxes and no waiver or extension of any statute of limitations as to any federal, state, local or foreign Tax matter relating to the Assets has been given by or requested from Seller with respect to any Tax year. (c) To Seller’s Knowledge, there are no liens for Taxes upon any of the Assets except liens for Taxes not yet due and payable. (d) Seller does not have any liability for any unpaid Taxes of any other Person under Treasury Regulation Section 1.1502-6 (or any similar provision of United States state, local, or foreign Law), as a result of being a member of a consolidated or combined group (other than a consolidated or combined group with a common parent with Seller), as a transferee, by contract, or otherwise. Section 4.8 Ownership. Seller has not transferred, assigned, pledged or conveyed its rights as “grantee” or “holder” under the BLM Easements or the Jensen Easements. Seller owns the Improvements and Personal Property free and clear of all Liens (or, without limiting Seller’s obligation to deliver Lien Releases at Closing, will own such Assets free and clear of all Liens on the Closing Date assuming complete termination of the Loan Documents) which secure Indebtedness. Section 4.9 Preferential Rights. Seller has not granted to any third party a preferential right to purchase any Asset. Section 4.10 Consents. Except for (a) the BLM Consent, (b) any Additional Required Consent that may be discovered after the Execution date, and (c) the Loan Documents and the LGS Lease, Seller is not a party to any agreement or proceeding requiring the consent of a third party to transfer or assign the Assets. Section 4.11 Good Faith. This Agreement has been proposed, negotiated and entered into by Seller in good faith and on an arm’s length basis. Buyer has no control or undue influence over Seller, and this Agreement and the transfer and sale of the Assets contemplated hereunder have been negotiated and consummated with procedural and substantive fairness as to all decision making processes and requirements. Section 4.12 Survival. Seller’s representations and warranties set forth in this Article IV (collectively, the “Seller Warranties”) (a) are made as of the Execution Date, (b) are remade as of the Closing Date, (c) shall not be deemed to be merged into or waived by the Closing Deliveries, and (d) shall survive Closing only for the Survival Period. If Buyer first learns of a breach of Seller’s Warranties prior to Closing, Buyer’s remedies shall be governed solely and exclusively by Section 8.2. Notwithstanding anything to the contrary in this Agreement, in the event Buyer elects to proceed to Closing notwithstanding Buyer’s knowledge of the existence of a breach by Seller with respect to any Seller Warranties, Buyer shall be deemed to have waived each such breach and any and all rights and remedies in connection therewith. Seller shall have no liability or obligation to Buyer with respect to the breach of any representation or warranty of which Buyer first learns after Closing unless Buyer delivers written notice to Seller of the alleged breach prior to the end of the Survival Period, which notice must include the information described in clauses (i), (ii) and (iii) of Section 11.4(a). 10

Section 4.13 Disclaimers. SELLER’S EXPRESS REPRESENTATIONS AND WARRANTIES SET FORTH IN THIS AGREEMENT ARE EXCLUSIVE AND ARE IN LIEU OF ALL OTHER REPRESENTATIONS AND WARRANTIES, EXPRESS, IMPLIED, STATUTORY OR OTHERWISE. SELLER EXPRESSLY DISCLAIMS ANY AND ALL SUCH OTHER REPRESENTATIONS AND WARRANTIES. WITHOUT LIMITATION OF THE FOREGOING AND EXCEPT AS EXPRESSLY SET FORTH HEREIN, SELLER’S INTEREST IN THE ASSETS TO BE CONVEYED TO ULTRA RESOURCES SHALL BE CONVEYED PURSUANT HERETO WITHOUT (i) ANY WARRANTY, COVENANT OR REPRESENTATION WHETHER EXPRESS, IMPLIED, STATUTORY OR OTHERWISE RELATING TO TITLE TO THE ASSETS (OTHER THAN BY, THROUGH OR UNDER SELLER), THE CONDITION, QUANTITY, QUALITY, EXISTENCE OF DEFECTS, FITNESS FOR A PARTICULAR PURPOSE, CONFORMITY TO THE MODELS OR SAMPLES OF MATERIALS OR MERCHANTABILITY OF ANY EQUIPMENT OR PROPERTY OR ITS FITNESS FOR ANY PURPOSE OR (ii) ANY OTHER EXPRESS, IMPLIED, STATUTORY OR OTHER WARRANTY OR REPRESENTATION WHATSOEVER. BUYER IS RELYING SOLELY UPON ITS OWN INSPECTION OF THE ASSETS, AND, SUBJECT TO BUYER’S EXPRESS RIGHTS UNDER THIS AGREEMENT AND THE OTHER TRANSACTION DOCUMENTS, BUYER AND ULTRA RESOURCES SHALL ACCEPT ALL OF THE SAME IN THEIR “AS IS”, “WHERE IS” CONDITION, “WITH ALL FAULTS”. ARTICLE V BUYER’S REPRESENTATIONS Buyer represents and warrants to Seller as of the Execution Date and as of the Closing Date the following: Section 5.1 Incorporation and Qualification. Buyer is a Delaware limited liability company, duly organized, validly existing and in good standing under the laws of the State of Delaware and on the Closing Date will be qualified to conduct business in Wyoming. Section 5.2 Power and Authority. Buyer has all requisite power and authority to execute and deliver this Agreement and perform its obligations under this Agreement. The execution and delivery of this Agreement and consummation of the Transaction and the fulfillment of and compliance with the terms and conditions hereof will not violate, or be in conflict with, any material provision of its governing documents or any material provision of any agreement or instrument to which it is a party or by which it is bound, or, to its knowledge, any judgment, decree, order, statute, rule or regulation applicable to it, subject, however, to the approval by the Bankruptcy Court in connection with the Bankruptcy Case. Section 5.3 Authorization and Enforceability. The execution, delivery and performance of this Agreement and the Transaction have been duly and validly authorized by all requisite company action on behalf of Buyer. This Agreement constitutes Buyer’s legal, valid and binding obligation, enforceable in accordance with its terms, subject, however, to the effects of bankruptcy, insolvency, reorganization, moratorium and similar laws for the protection of creditors, as well as to general principles of equity, regardless whether such enforceability is considered in a proceeding in equity or at law. 11

Section 5.4 Liability for Brokers’ Fees. Buyer has not incurred any liability, contingent or otherwise, for brokers’ or finders’ fees relating to the Transaction for which Seller shall have any responsibility whatsoever. Section 5.5 Litigation. To Buyer’s Knowledge, there are no actions, suits, or proceedings pending against Buyer or any of the Assets in any court or by or before any federal, state, municipal or other governmental agency that would affect Buyer’s ability to consummate the Transaction or have a Material Adverse Effect. To Buyer’s Knowledge, (a) there are no ongoing governmental investigations or written governmental inquiries pending or threatened in writing against the Assets that would affect Buyer’s ability to consummate the Transaction, and (b) there are no actions, suits or proceedings threatened in writing against Buyer or any of the Assets that would affect Buyer’s ability to consummate the Transaction. Neither Buyer nor any of its Affiliates are subject to any outstanding injunction, judgment, settlement, order, decree, ruling or charge that would reasonably be expected to have a Material Adverse Effect. Section 5.6 Consents. Except for the Bankruptcy Court approval in connection with the Bankruptcy Case referenced in Section 8.2(d) below, Buyer is not a party to any agreement or proceeding requiring the consent of a third party to complete the Transaction. Section 5.7 Good Faith. This Agreement has been proposed, negotiated and entered into by Buyer in good faith and on an arm’s length basis. Seller has no control or undue influence over Buyer, and this Agreement and the transfer and sale of Assets contemplated hereunder have been negotiated and consummated with procedural and substantive fairness as to all decision making processes and requirements. Section 5.8 Survival. Buyer’s representations and warranties under this Agreement (collectively, the “Buyer Warranties”) (a) are made as of the Execution Date, (b) are remade as of the Closing Date, (c) shall not be deemed to be merged into or waived by the Closing Deliveries, and (d) shall survive Closing only for the Survival Period. If Seller first learns of the breach prior to Closing, Seller’s remedies shall be governed solely and exclusively by Section 8.1. Notwithstanding anything to the contrary in this Agreement, in the event Seller elects to proceed to Closing notwithstanding Seller’s knowledge of the existence of a breach by Buyer with respect to any Buyer Warranties, Seller shall be deemed to have waived each such breach and any and all rights and remedies in connection therewith. Buyer shall have no liability or obligation to Seller with respect to the breach of any representation or warranty of which Seller first learns after Closing unless Seller delivers written notice to Buyer of the alleged breach prior to the end of the Survival Period, which notice must include the information described in clauses (i), (ii) and (iii) of Section 11.4(a). ARTICLE VI COVENANTS AND AGREEMENTS Section 6.1 Conduct of Parties. (a) Activities of Parties During Interim Period. Each Party agrees that, during the Interim Period, without the prior written consent of the other Party, it shall: 12

(i) Not sell, transfer, lease, encumber, or create a Lien on, exchange, or otherwise dispose of any of the Assets (other than the sale of worn-out or obsolete equipment, spare parts, or minor or insignificant Assets); (ii) take no action to adversely impact any material federal, state and local governmental licenses, permits, orders, exemptions, waivers, authorizations, certificates, consents and applications with respect to the ownership and operation of the Assets; (iii) not grant in favor of any Person a preferential purchase right to purchase any Assets; (iv) not remove from the Liquids Gathering System any portion of the Liquids Gathering System except for replacement, substitution or upgrades of the Liquids Gathering System in the ordinary course of its operations and except such as would not diminish the operational capability of the Liquids Gathering System as it existed on the Execution Date; or (v) not agree, whether in writing or otherwise, or attempt to do any of the foregoing. (b) Additional Buyer Obligations During Interim Period. Buyer agrees that, during the Interim Period, Buyer shall use commercially reasonable efforts to: (i) secure the financial resources to close the Transaction, and (ii) obtain the Bankruptcy Court approval in connection with the Bankruptcy Case referenced in Section 8.2(d) below. Section 6.2 Fees and Expenses. Except as otherwise provided in this Agreement, all fees and expenses, including fees and expenses of counsel, financial advisors, investment and equity advisors, real estate and other brokers and agents, and accountants, incurred in connection with this Agreement and the Transactions shall be paid by the Party (or their applicable Affiliate) incurring such fee or expense. The provisions of this Section 6.2 shall survive termination of this Agreement and Closing. Section 6.3 Restructuring Efforts. Seller shall not oppose, impede, or take any other action to interfere with Buyer’s plan of reorganization, restructuring efforts, or the Bankruptcy Case, as long as Buyer complies with the terms of this Agreement. Section 6.4 Survival. The covenants and agreements of the Parties under Section 6.1 shall only survive until Closing. If Buyer first learns of a breach by Seller of any other covenant or agreement in this Article VI prior to Closing, Buyer’s remedies shall be governed solely and exclusively by Section 8.2. If Seller first learns of the breach prior to Closing, Seller’s remedies shall be governed solely and exclusively by Section 8.1. Any liability or obligation of any Party with respect to the breach of any covenant or agreement under this Article VI shall lapse and be of no further force or effect with respect to any matters not described in a written notice delivered to such Party by the other Party on or prior to the end of the Survival Period, which notice must include the information described in clauses (i), (ii) and (iii) of Section 11.4(a). 13

Section 6.5 Termination of Prior Agreements. The Parties agree that, effective as of, and conditioned upon, the Closing, all previous agreements and transaction documents entered into with respect to that certain Purchase and Sale Agreement by and between Seller and Buyer (f/k/a Ultra Wyoming, Inc.), dated December 7, 2012, including, for the avoidance of doubt that certain Lease by and between Ultra Wyoming LGS, LLC and Seller, dated December 20, 2012 (the “LGS Lease”), are each deemed terminated as of the Closing (such terminated agreements and documents, the “Terminated Agreements”). Notwithstanding anything herein to the contrary, assuming Closing occurs on or prior to the Outside Closing Date, Buyer shall not be responsible for rental payments to Seller under the LGS Lease from and after June 30, 2020. ARTICLE VII TAX MATTERS Section 7.1 Apportionment of Property Tax Liability. “Property Taxes” means all ad valorem and property taxes and obligations assessed by a Taxing Authority against the Assets or based upon the ownership of the Assets, but excluding income, franchise or similar taxes. All Property Taxes assessed against the Assets shall be paid by the Buyer. Seller shall be responsible for filing its 2020 Limited Partnership Annual Report with the State of Wyoming and paying any taxes due thereunder. Section 7.2 Property Tax Reports and Returns. Buyer agrees to file, or cause to be filed, all Tax Returns required to be filed that are applicable to the ownership of the Assets, for all Property Taxes related to the Assets attributable to the term of the LGS Lease. Buyer also agrees to file all Tax Returns applicable to ownership of the Assets for all Property Taxes related to the period of time on and after the Closing Date. The Parties will cooperate with each other after the Closing Date in connection with audits and other proceedings with respect to Property Taxes relating to the ownership of the Assets, and Seller shall not be obligated to incur any out-of-pocket expenses as a part of such cooperation. Section 7.3 Sales Taxes. Buyer shall be liable for and shall indemnify Seller for, any sales and use taxes, conveyance, transfer and recording fees and real estate transfer stamps or taxes (including any related interest, penalties or legal costs) that may be imposed on any transfer of the Assets pursuant to this Agreement. If required by applicable law, Seller shall, in accordance with applicable law, calculate any sales or similar taxes that are required to be paid as a result of the transfer of the Assets to Buyer and Buyer shall promptly pay such taxes. If Seller receives notice that any sales or use taxes are due, Seller shall promptly forward such notice to Buyer for handling. Section 7.4 Federal Tax Reporting. Buyer and Seller will comply, to the extent required pursuant to the procedural requirements of Section 1060 of the Code and the Treasury Regulations promulgated thereunder, with respect to the allocation of the Purchase Price among the Assets. Buyer and Seller agree that they will not take any Tax position inconsistent with allocations made in this Agreement, if any, provided, however, that (a) Buyer’s cost for the Assets may differ from the total amount allocated thereunder to reflect Buyer’s capitalized transaction costs so allocated, and (b) Seller’s amount realized on the sale of the Assets may differ from the total amount so allocated to reflect Seller’s transaction costs that reduce the amount realized. The Parties will promptly inform one another of any challenge by any Taxing Authority to any allocation made pursuant to this Section 7.4 and agree to consult and keep one another informed 14

with respect to the status of, and any discussion, proposal or submission with respect to, such challenge. Section 7.5 Like Kind Exchange. Seller may desire to have its transfer of one or more of the Assets to Buyer qualify as a deferred like kind exchange within the meaning of Section 1031 of the Code and the Treasury Regulations promulgated thereunder, including for the avoidance of doubt, Proposed Treasury Regulation Section 1.1031(a)-3(a)(2)(ii)(c). Further, either Seller or Buyer may desire to effectuate a deferred like kind exchange through the use of an intermediary in the manner described in Example 4 of Treasury Regulation Section 1.1031(k)-1(g)(8) or other applicable provisions. Each Party shall reasonably cooperate with the other Party in effectuating such a deferred like kind exchange through the use of such an intermediary, including consenting to an assignment of any or all of the exchanging Party’s rights under this Agreement to an intermediary. Such other Party, however, shall have no obligation to locate, contract for or take title to any property that the exchanging Party may wish to buy or to incur any cost, expense, indebtedness, liability or other obligation of any kind as a part of such other Party’s agreement to reasonably cooperate. ARTICLE VIII CONDITIONS PRECEDENT TO CLOSING Section 8.1 Seller’s Conditions Precedent. The obligations of Seller at the Closing are subject to the satisfaction or waiver at or prior to the Closing of the following conditions precedent (collectively, the “Seller’s Conditions”): (a) (i) The representations and warranties of Buyer made in this Agreement will be true and correct in all material respects as of the Closing Date, as if remade on the Closing Date (without duplication of any materiality qualifiers within the representations and warranties themselves); and (ii) Buyer shall have performed or complied in all material respects with all of the covenants and agreements required of Buyer or its Affiliates under this Agreement to be performed at or prior to Closing; (b) No Additional Required Consent, which has not been obtained, would cause Closing of the Transaction to be in violation of applicable law; (c) No order has been entered by any court or governmental agency having jurisdiction over the Parties or the subject matter of this Agreement that restrains or prohibits the Transaction and that remains in effect at the time of Closing; (d) Buyer shall have delivered at Closing all Buyer Closing Deliveries and have paid all Buyer Closing Payments unless Buyer’s failure to deliver the Buyer Closing Deliveries and pay the Buyer Closing Payments results from Buyer’s termination of this Agreement as a result of its termination rights under Section 8.2 below as a result of a failure of Buyer’s Conditions; and (e) The Bankruptcy Court shall have approved in connection with the Bankruptcy Case the Transaction contemplated by this Agreement. Notwithstanding anything set forth in this Agreement to the contrary, if any Seller’s Condition has not been satisfied by the Closing Date, then Seller may, as Seller’s sole and 15

exclusive remedy with respect to such Seller’s Condition, either (1) terminate this Agreement, in which case the Parties shall have no further rights or obligations hereunder except those which expressly survive termination or (2) proceed to Closing, in which case such Seller’s Condition shall be deemed to be waived for all purposes. Section 8.2 Buyer’s Conditions Precedent. The obligations of Buyer at the Closing are subject to the satisfaction or waiver at or prior to the Closing of the following conditions precedent (collectively, the “Buyer’s Conditions”): (a) (i) The representations and warranties of Seller made in this Agreement will be true and correct in all material respects as of the Closing Date, as if remade on the Closing Date (without duplication of any “materiality” qualifiers in the representations and warranties themselves); and (ii) Seller shall have performed or complied in all material respects with all of the covenants and agreements required of Seller under this Agreement to be performed at or prior to Closing; (b) No Additional Required Consent, which has not been obtained, would cause Closing of the Transaction to be in violation of applicable law which would result in (1) criminal liability to Buyer or Seller or (ii) a material civil fine or penalty to Buyer or Seller; (c) No order has been entered by any court or governmental agency having jurisdiction over the Parties or the subject matter of this Agreement that restrains or prohibits the Transaction and that remains in effect at the time of Closing; (d) The Bankruptcy Court shall have approved in connection with the Bankruptcy Case the Transaction contemplated by this Agreement; and (e) Seller shall have delivered at Closing all Seller Closing Deliveries unless Seller’s failure to deliver the Seller Closing Deliveries results from Seller’s termination of this Agreement as a result of its termination rights under Section 8.1 above as a result of a failure of Seller’s Conditions. Notwithstanding anything set forth in this Agreement to the contrary, if any Buyer’s Condition has not been satisfied by the Closing Date, then Buyer may, as Buyer’s sole and exclusive remedy with respect to such Buyer’s Condition, either (1) terminate this Agreement, in which case the Parties shall have no further rights or obligations hereunder except those which expressly survive termination, or (2) proceed to Closing, in which case such Buyer’s Condition shall be deemed to be waived for all purposes. ARTICLE IX RIGHT OF TERMINATION Section 9.1 Termination. This Agreement may be terminated in accordance with the following provisions: (a) by mutual written consent of Seller and Buyer, in which case this Agreement shall terminate and the Parties shall have no further rights or obligations hereunder except those which expressly survive termination; 16

(b) as otherwise expressly provided in this Agreement including Article VIII hereof; or (c) by either Party, if the Closing has not occurred by the Outside Closing Date. Upon termination of this Agreement, the Parties shall remain subject to the terms of the LGS Lease and may pursue any rights and remedies available to each Party under the LGS Lease. ARTICLE X CLOSING Section 10.1 Date of Closing. The “Closing” will be held on June 30, 2020, or such date as Buyer and Seller mutually agree in writing, but in any event on or before the Outside Closing Date (the “Closing Date”). Section 10.2 Time and Place of Closing. The Closing shall be held at such time and place as Buyer and Seller may agree in writing and shall be effective as of 12:01 a.m. central time on the Closing Date. Section 10.3 Closing Obligations. At Closing, the following events shall occur, each being a condition precedent to the others and each being deemed to have occurred simultaneously with the others: (a) Seller shall execute and deliver, or cause to be executed and delivered, to Buyer the Seller Closing Deliveries; (b) Buyer shall deliver the Purchase Price to the account at a bank designated by Seller, for the benefit of Seller or Seller’s lender, in Current Funds, and Buyer shall pay the Taxes required to be paid by Buyer in connection with the Closing under Section 7.3 of this Agreement and Buyer shall pay the other Buyer Closing Payments as required hereby, (c) Buyer shall execute and deliver, or cause to be executed and delivered, to Seller the Buyer Closing Deliveries and pay the Buyer Closing Payments; (d) Seller shall deliver to Buyer copies of all Additional Required Consents obtained prior to Closing pursuant to Section 3.2 of this Agreement; (e) Seller and Buyer shall cause the following documents (collectively, the “Recorded Documents”) to be recorded in the applicable real estate records of Sublette County, Wyoming (the “Real Estate Records”), in the following order: (i) the BLM Easement Assignment to Ultra Resources, (ii) the Assignment of Jensen Easements to Ultra Resources, (iii) the Release of Nerd Farm Easement and Transfer of Improvements; (iv) the Lien Releases, and (v) a memorandum of termination of the LGS Lease (the “Memorandum of Termination”) and Buyer shall pay all fees and costs for such recording; and (f) Seller, as agent for Buyer for this limited purpose, shall deliver to BLM and provide to Buyer (i) the BLM Easement Assignment to Ultra Resources which is not a Recorded 17

Document and (ii) the BLM Request for Consent to Assignment to Ultra Resources, and Buyer shall pay all fees and costs for such filing. ARTICLE XI ASSUMPTION OF OBLIGATIONS AND INDEMNIFICATION Section 11.1 Buyer’s Assumption of Liabilities and Obligations. Without limiting Buyer’s rights to indemnity under this Article XI, from and after Closing, Buyer assumes and hereby agrees to fulfill, perform, pay and discharge (or cause to be fulfilled, performed, paid and discharged) all obligations and liabilities, known or unknown, with respect to the Assets regardless of whether such obligations or liabilities arose prior to, on or after Closing (all of said obligations and liabilities, the “Assumed Obligations”). Section 11.2 Indemnification. For the purposes of this Article XI, “Loss” or “Losses” means any actual losses, costs, expenses (including court costs, reasonable fees and expenses of attorneys, technical experts and expert witnesses and the cost of investigation), liabilities, damages, demands, suits, claims, and sanctions of every kind and character (including civil fines) arising from, related directly or indirectly or reasonably incident to matters indemnified against, excluding however any special, consequential, punitive or exemplary damages, loss of profits, any Loss incurred as a result of the indemnified party indemnifying a third party, or diminution in value of the Assets unless caused directly and exclusively by Seller or an Affiliate of Seller. After the Closing, the Parties shall indemnify each other as follows: (a) Seller’s Indemnification of Buyer. Seller assumes all risk, liability, obligation and Losses in connection with, and shall indemnify, save and hold harmless Buyer, its officers, directors, employees and agents, from and against all Losses which arise from or in connection with (i) any matter for which Seller has agreed to indemnify Buyer under this Agreement, and (ii) any breach of representations, warranties, covenants, or agreements by Seller under this Agreement which are not waived or deemed waived under Section 12.1, 4.12 or 8.2 of this Agreement or this Article XI of this Agreement. The Seller’s obligations under this Section 11.2(a) are limited as provided in Section 11.3. (b) Buyer’s Indemnification of Seller. Buyer assumes all risk, liability, obligation and Losses in connection with, and Buyer shall indemnify, release save and hold harmless Seller, its officers, directors, employees and agents, from and against all Losses which arise from or in connection with (i) any matter for which Buyer has agreed to indemnify Seller under this Agreement, (ii) any breach of representations, warranties, covenants, or agreements by Buyer under this Agreement which are not waived or deemed waived under Section 12.1, Section 5.8 and Section 8.1 of this Agreement or this Article XI of this Agreement, and (iii) the Assumed Obligations. The Buyer’s obligations under this Section 11.2(b) are limited as provided in Section 11.3. (c) Sole and Exclusive Remedy. THE INDEMNITIES CONTAINED IN THIS ARTICLE XI SHALL BE THE SOLE AND EXCLUSIVE REMEDIES OF THE PARTIES HERETO, THEIR AFFILIATES, SUCCESSORS AND ASSIGNS WITH RESPECT TO ANY AND ALL CLAIMS ARISING OUT OF OR RELATING TO THIS 18

AGREEMENT, THE TRANSACTIONS CONTEMPLATED HEREBY, ANY PROVISION HEREOF OR THE BREACH OR PERFORMANCE THEREOF. (d) Express Negligence. BUYER UNDERSTANDS AND AGREES THAT BUYER’S INDEMNITY OBLIGATIONS UNDER THIS ARTICLE XI INCLUDE AND COVER INDEMNIFICATION FOR CERTAIN CLAIMS ARISING FROM ITS INDEMNITEE’S NEGLIGENCE, AS AND TO THE EXTENT PROVIDED HEREIN. SELLER UNDERSTANDS AND AGREES THAT SELLER’S INDEMNITY OBLIGATIONS UNDER THIS ARTICLE XI INCLUDE AND COVER INDEMNIFICATION FOR CERTAIN CLAIMS ARISING FROM ITS INDEMNITEE’S NEGLIGENCE, AS AND TO THE EXTENT PROVIDED HEREIN. Section 11.3 Survival. (a) The indemnity and other obligations of Seller contained in Section 11.2(a) of this Agreement shall survive Closing only for the Survival Period. (b) The indemnity and other obligations of Buyer contained in Section 11.2(b) of this Agreement shall survive Closing until the statute of limitations for such matters expires (except for those indemnities and obligations with respect to the representations and warranties in Section 5.5 and Section 5.6 which will survive Closing only for the Survival Period). (c) All liability or obligation of any Party with respect to any indemnity or other obligation contained in Section 11.1 or Section 11.2(a), or (b) of this Agreement shall lapse and be of no further force or effect with respect to any matters not described in reasonable detail in a Claim Notice delivered to such Party by the other Party on or prior to the end of the applicable period described in Section 11.3(a) or (b). (d) The provisions of, Section 11.2(c) and (d), 11.3, 11.4, 11.5, 11.6, 11.7, 11.8 and 11.9 shall survive termination of this Agreement and Closing without limitation. Section 11.4 Procedure. The indemnifications contained in this Article XI shall be implemented as follows: (a) Claim Notice. The Party seeking indemnification under the terms of this Agreement (“Indemnified Party”) shall submit a written “Claim Notice” to the other Party (“Indemnifying Party”) which, to be effective, must state: (i) the amount of each payment claimed by an Indemnified Party to be owing, (ii) the basis for such claim, with supporting documentation, and (iii) a list identifying to the extent reasonably possible each separate item of Loss for which payment is so claimed. The amount claimed shall be paid by the Indemnifying Party to the extent required herein within 30 days after receipt of the Claim Notice, or after the amount of such payment has been finally established, whichever last occurs; provided, however, that any objection to the Claim Notice by the Indemnifying Party must be provided to the Indemnified Party within 15 days of receipt of the Claim Notice, or the Indemnifying Party waives its right to protest the Claim. Any undisputed portion of the Claim must be paid within 30 days of receipt of the Claim Notice. 19

(b) Information. Within 60 days after the Indemnified Party receives notice of a claim or legal action by a third party that may result in a Loss for which indemnification may be sought under this Agreement (a “Claim”), the Indemnified Party shall give written notice of such Claim to the Indemnifying Party. If the Indemnifying Party or its counsel so requests, the Indemnified Party shall furnish the Indemnifying Party with copies of all pleadings and other information with respect to such Claim. At the election of the Indemnifying Party made within 60 days after receipt of such notice, the Indemnified Party shall permit the Indemnifying Party to assume control of such Claim (to the extent only that such Claim, legal action or other matter relates to a Loss for which the Indemnifying Party is liable), including the determination of all appropriate actions, the negotiation of settlements on behalf of the Indemnified Party, and the conduct of litigation through attorneys of the Indemnifying Party’s choice. No settlement of a Claim can result in any liability or cost to the Indemnified Party for which it is entitled to be indemnified hereunder without its consent. If the Indemnifying Party elects to assume control, (i) any expense incurred by the Indemnifying Party thereafter for investigation or defense of the matter shall be borne by the Indemnifying Party, and (ii) the Indemnified Party shall give all reasonable information and assistance, other than pecuniary, that the Indemnifying Party shall deem necessary to the proper defense of such Claim, legal action, or other matter. In the absence of such an election to assume control by the Indemnifying Party, the Indemnified Party will use commercially reasonable efforts to defend, at the Indemnifying Party’s expense, any claim, legal action or other matter to which such other Party’s indemnification under this Article XI applies until the Indemnifying Party assumes such defense, and, if the Indemnifying Party fails to assume such defense within the time period provided above, settle the same in the Indemnified Party’s reasonable discretion at the Indemnifying Party’s expense. If such a Claim requires immediate action, the Parties agree to cooperate in good faith to take appropriate action so as not to jeopardize defense of such Claim or either Party’s position with respect to such Claim. Section 11.5 No Insurance; Subrogation. The indemnifications provided in this Agreement shall not be construed as a form of insurance. Buyer and Seller hereby waive for themselves, their successors or assigns including, without limitation, any insurers, any rights to subrogation for Losses for which each of them is respectively liable or against which each respectively indemnifies the other, and, if required by applicable policies, Buyer and Seller shall obtain waiver of such subrogation from their respective insurers. Section 11.6 Reservation as to Non-Parties. Nothing herein is intended to limit or otherwise waive any recourse Buyer or Seller may have against any Person not a Party to this Agreement for any obligations or liabilities that may be incurred with respect to the Assets. Section 11.7 Consequential Damages. Notwithstanding anything set forth in this Agreement, Buyer and Seller, on behalf of themselves and their respective Affiliates, expressly waive any and all rights to consequential, special, incidental, punitive, or exemplary damages and loss of profits resulting from a breach of this Agreement, including under or with respect to any indemnifications required hereby, and agree that the indemnifications set forth herein shall not include or cover any consequential, special, incidental, punitive, or exemplary damages or loss of profits (except to the extent constituting direct damages). Nothing in this Section 11.7 shall constitute a waiver by any Party to a claim under this Article XI with respect to diminution in value to the extent diminution in value is expressly included in the definition of the “Losses” covered by the Section of this Article under which the claim is made. 20

Section 11.8 No Derivative Liability. Notwithstanding anything set forth in this Agreement, the Closing Deliveries or otherwise, no direct or indirect (through tiered ownership or otherwise) advisor, trustee, director, officer, employee, beneficiary, shareholder, participant, partner, member, owner, investor, lender, representative or agent of a Party or its applicable Affiliates shall have any personal liability, directly or indirectly, under or in connection with this Agreement or any Closing Deliveries or any amendment or amendments to any of the foregoing made at any time or times, heretofore or hereafter, and the other Party and its successors and assigns and, without limitation, all other persons and entities, shall look solely to the assets of such Party (or, if expressly applicable, the assets of such Party’s Affiliate) for the payment of any claim or for any performance, and each other Party, on behalf of itself and its successors and assigns, hereby waive any and all such personal liability. Section 11.9 Attorneys’ Fees. If it shall be necessary for any Party to this Agreement to employ an attorney to enforce its rights pursuant to this Agreement, the non-prevailing Party shall reimburse the prevailing Party for its reasonable attorneys’ fees and the reasonable attorneys’ fees of the prevailing Party’s applicable Affiliates, if any, in such proceeding. ARTICLE XII MISCELLANEOUS Section 12.1 Expenses. Except as otherwise specifically provided, all fees, costs and expenses incurred by Buyer or Seller in negotiating this Agreement or in consummating the Transaction shall be paid by the Party incurring the same, including without limitation, engineering, land, title, legal and accounting fees, costs and expenses. This Section 12.1 shall survive termination of this Agreement and Closing. Section 12.2 Notices. All notices and communications required or permitted under this Agreement (a “Notice”) shall be in writing and addressed as set forth below. Any Notice shall be deemed to have been duly made and the receiving Party charged with notice (a) if personally delivered, or sent by registered or certified mail, or nationally recognized overnight courier, when received; (b) if sent by electronic transmission (with read receipt requested); and (c) if the addressee rejects or otherwise refuses to accept the Notice, or if the Notice cannot be delivered because of a change in address for which no Notice was given, then upon the rejection, refusal, or inability to deliver the Notice; provided, however, that if a Notice is sent by electronic transmission, the party sending the Notice also must send, on the same date, a confirmation copy of the Notice (including the acknowledgement/transmission report described above) by one of the other methods set forth in this Section. All Notices shall be addressed as follows: If to Seller. Pinedale Corridor, LP 1100 Walnut Street, Suite 3350 Kansas City, MO 64106 Attn: Rebecca M. Sandring Email: BSandring@corenergy.reit With a copy to: 21

Husch Blackwell LLP 4801 Main Street, Ste. 1000 Kansas City, MO 64112 Attn: Steven F. Carman Email: steve.carman@huschblackwell.com If to Buyer: Ultra Wyoming, LLC 116 Inverness Drive East, Suite 400, Englewood, CO 80112 Attention: David W. Honeyfield, Senior Vice President and Chief Financial Officer Email: dhoneyfield@ultrapetroleum.com With a copy to: Ultra Wyoming, LLC 116 Inverness Drive East, Suite 400, Englewood, CO 80112 Attention: Legal Department Email: kkerr@ultrapetroleum.com Kirkland & Ellis LLP 609 Main Street Houston TX 77002 Attention: Christopher Heasley Email: Christopher.Heasley@kirkland.com Any Party may, by written notice so delivered to the other Party, change the address or individual to which delivery shall thereafter be made. Section 12.3 Amendments. This Agreement may not be amended nor any rights hereunder waived except by an instrument in writing signed by the Party to be charged with such amendment or waiver and delivered by such Party to the Party claiming the benefit of such amendment or waiver. Section 12.4 Assignment. Neither Party may assign all or any portion of its rights or delegate all or any portion of its duties hereunder without the prior written consent of the other Party. Any assignment or delegation made in violation of this Section 12.4 shall be null and void. In the event a Party consents in writing to the other Party’s assignment or delegation of its rights or duties hereunder, the assigning or delegating Party shall not be released from any of its liabilities or obligations hereunder, and no such assignment or delegation shall increase the burden on the non-assigning or non-delegating Party, and the non-assigning or non-delegating Party may continue to look to the assigning or delegating Party for all purposes under this Agreement. Section 12.5 Counterparts/PDF and Fax Signatures. This Agreement may be executed by Buyer and Seller in any number of counterparts, each of which shall be deemed an original instrument, but all of which together shall constitute but one and the same instrument. PDF and facsimile signatures shall be considered binding. The Parties agree to exchange originally executed counterparts of this Agreement within three (3) Business Days of the request of a Party hereto. 22