Exhibit 99.2

PRESENTERS

Mark Byrne

Executive Chairman

David Brown

Chief Executive Officer

Gary Prestia

Chief Underwriting

Officer – North America

Guy Swayne

CEO, Flagstone

Réassurance Suisse SA

& Chief Underwriting

Officer - International

Patrick Boisvert

Chief Financial Officer

Brenton Slade

Chief Marketing Officer

& Director of Investor

Relations

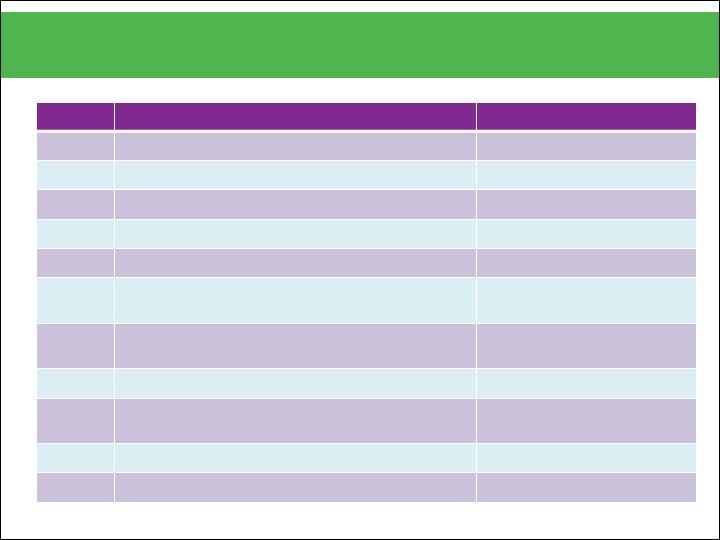

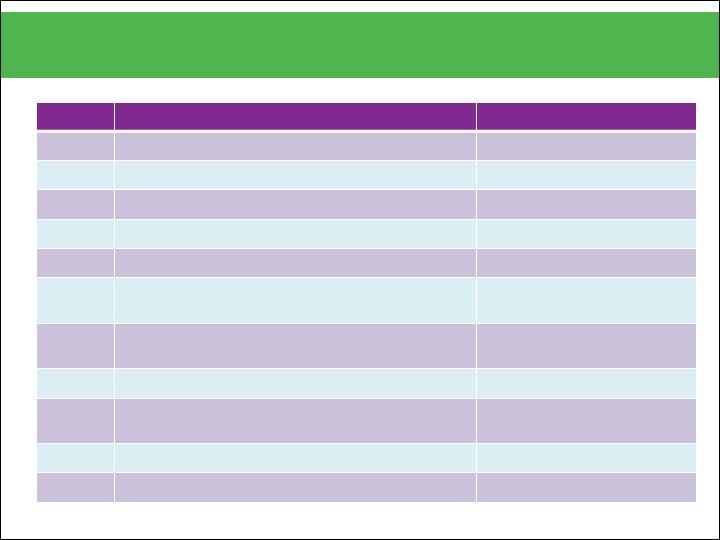

AGENDA

TIME

DISCUSSION

PRESENTER

8:30am

Breakfast & Registration

9:00am

Welcome & Company Intro

Brenton Slade

9:05am

The Flagstone Difference

Mark Byrne

9:30am

Flagstone’s Underwriting Philosophy

David Brown

10:00am

Refreshment Break

10:15am

North American Underwriting Review & Market

Update

Gary Prestia

10:35am

International & Specialty Lines Underwriting

Review & Market Update

Guy Swayne

10:55am

Financial Review

Patrick Boisvert

11:15am

So what does all this mean to you?

Closing commentary

Mark Byrne

11:35am

Q & A

12:00pm

Lunch – The Studio

FSR EXECUTIVE MANAGEMENT TEAM

MARK BYRNE

Executive Chairman

22 years industry

experience

Prior experience:

Chairman: West End

Capital Management

Director: White

Mountains, Terra Nova,

Markel

Significant Capital

Markets experience –

Salomon Brothers, Credit

Suisse, Lehman Brothers

5

ABOUT US

History:

Formed in Dec 05

IPO – April 07

Listed on NYSE & BSX

Acquisitions:

Island Heritage

Imperial Re/ FSR Africa

Alliance Re/ FSR Alliance

Lloyd’s – Syndicate 1861

Today:

$1.3B Underwriting Capital

500 + employees

13 offices in 12 countries

Operating Company and

capital in Switzerland

6

FSR STRATEGY & OBJECTIVES

Leverage our global operating

platform

Lead the industry in the utilization of

proprietary analytics

Expand our strong broker and

customer relationships through

industry leading service

Employ our capital markets

expertise to optimize our return

and expand our opportunities

effectively with the investor

community.

Maintain an energetic culture that

continuously challenges best

practices

Grow diluted book value per share

Obtain and maintain “A” level

ratings from multiples agencies

7

OUR STRATEGY

OUR OBJECTIVES

Communicate proactively and

OUR CURRENT POSITION

Clean, conservative

investment portfolio

No exposure to potential

casualty problems:

-D&O, E&O, Financial

institutions

Hard market for short-tail

property, property cat &

specialty lines

Profit from problems of

competitors

Ability to underwrite

worldwide

Very scalable operating

capabilities

8

THE FLAGSTONE DIFFERENCE

9

GLOBAL PLATFORM

Unique, efficient, and

scalable

TECHNOLOGY

Cutting - edge analytics for

superior risk analysis and

industry-leading service

DIVERSIFICATION

Balanced, conservative and

strategic

Consider the Flagstone

difference… .

THE FSR DIFFERENCE – GLOBAL PLATFORM

Offer fast, efficient service to

clients 24 hours a day.

Respond rapidly to submissions

Source more risks, and be more

selective in the risks we choose

Penetrate local markets – source

business that wouldn’t typically be

directed to larger markets

Retain more professional talent in

comparison to companies several

times our size

Leverage low cost jurisdictions –

cost efficiencies to analyze ALL

risks.

10

THROUGH THE EFFICIENCY

OF OUR GLOBAL PLATFORM,

FLAGSTONE IS ABLE TO:

THE FLAGSTONE DIFFERENCE - TECHNOLOGY

Entire company integrated

through technology

Centralized underwriting systems

and controls – single system

Fully integrated work flow,

underwriting & risk management

system

Combination of commercial

models and in-house analytics to

effectively control, monitor and

analyze risks

Real-time portfolio simulation

and analysis

Marginal pricing analysis &

underwriting

Assess capital adequacy relative

to internal risk tolerance and

regulatory criteria

11

WHERE TECHNOLOGY MEETS

UNDERWRITING

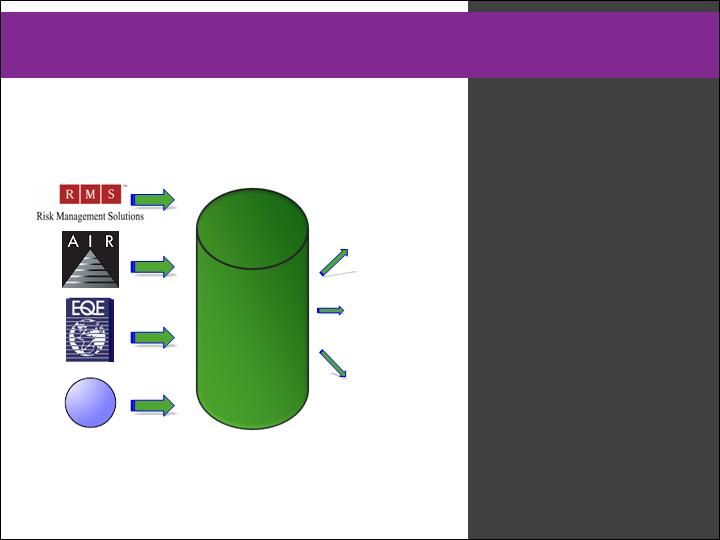

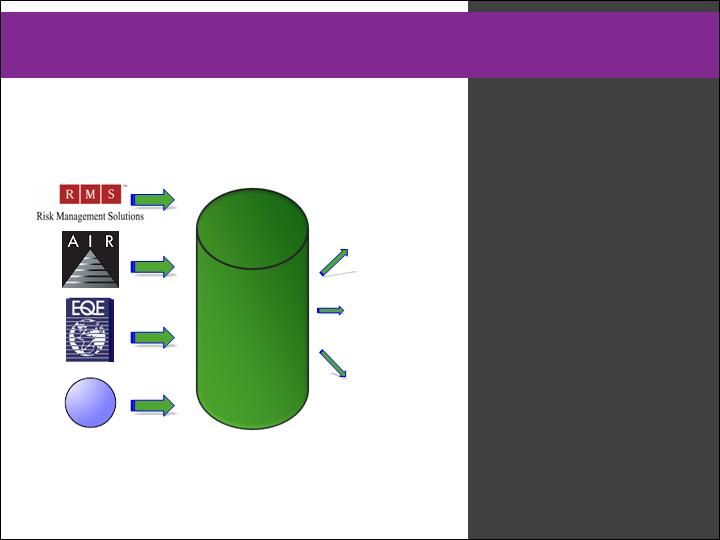

THE FLAGSTONE DIFFERENCE - ANALYTICS

12

MOSAIC

QUARTZ

CYCLONE

Loss portfolio analysis

Optimization of exposures by risk

Assess capital adequacy

Additional proprietary view of risks

Considers additional load factors

Higher quality and more

comprehensive risk analysis

Large volumes of risk

Quicker & more efficient results

Risk tolerance

Regulatory criteria

THE FLAGSTONE DIFFERENCE - ANALYTICS

MOSAIC PRICING MODEL

Identify attractive opportunities by

stand-alone pricing

MOSAIC LOSS PORTFOLIO

Optimize exposures by risk zone from

real-time marginal pricing simulations

MOSAIC DYNAMIC RISK

MODEL

Firm-wide dynamic risk model

simulation

Attractive risk adjusted

return on capital

13

Investment

Analysis

Systems

Mosaic

Pricing

Model

(MPM)

Mosaic

Loss Portfolio

(MLP)

Mosaic

Dynamic

Risk Model

(MDRM)

MOSAIC

Database

Engine

DATA SOURCES

PROPRIETARY ANALYTICS

THE FSR DIFFERENCE - DIVERSIFICATION

WE DIVERSIFY BY:

Lines of Business

Growing specialty lines

Moving towards:

50% Property Cat/50%

Specialty

Geographically

New offices

Talented teams

Strategic acquisitions

14

TURNING THE DIFFERENCE INTO RESULTS

How do these differences

help our clients &

shareholders?

Superior loss ratio

Industry-leading service

Shareholder value

15

FSR EXECUTIVE MANAGEMENT TEAM

DAVID BROWN

Chief Executive Officer

& Deputy Chairman

26 years industry experience

Prior experience:

Chairman: Merastar Insurance

CEO: Centre Solutions (Bermuda)

Partner: Ernst & Young

16

FSR’S UNDERWRITING PHILOSOPHY

Diversification globally

Diversification allows for

premium leverage

Premium leverage lessens

per event losses

More frequent small losses

but better annual loss ratio

Allocate capital tactically

Select best clients/blue chips

LOB that we understand and

can make use of our toolset

SERVICE

17

18

Balanced portfolio with

significant international

exposures – Not a BIG

reliance on US Wind

45% US, 55%

International

Limit on zonal exposures

to mitigate large event

losses

60% of underwriting

capital

Analyze large amounts of

risk – selective on the

risks we choose

UNDERWRITING PHILOSOPHY

DIVERSIFICATION

GLOBALLY

DIVERSIFIED

MULTI-LINE

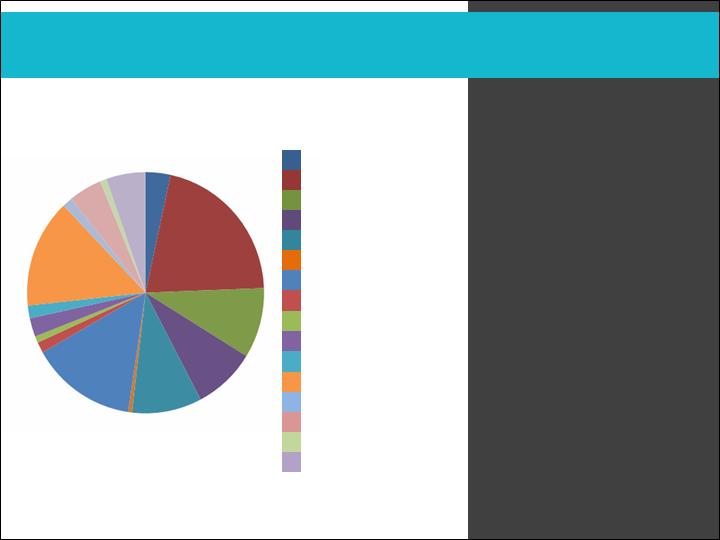

19

North America

45.1%

$406,737

Europe

12.2%

$110,138

Worldwide Risks

23.1%

$207,725

Caribbean

9.3%

$83,851

Japan & Australasia

5.6%

$50,492

Other

4.7%

$42,185

Property Catastrophe

54.8%

$493,673

Property

14.1%

$127,646

Short-Tail Specialty &

Casualty

22.8%

$205,265

Insurance

8.3%

$74,544

GROSS PREMIUMS WRITTEN BY GEOGRAPHIC AREA

For the period April 1st, 2008 – March 31st, 2009

GROSS PREMIUMS WRITTEN BY LINE OF BUSINESS

For the period April 1st, 2008 – March 31st, 2009

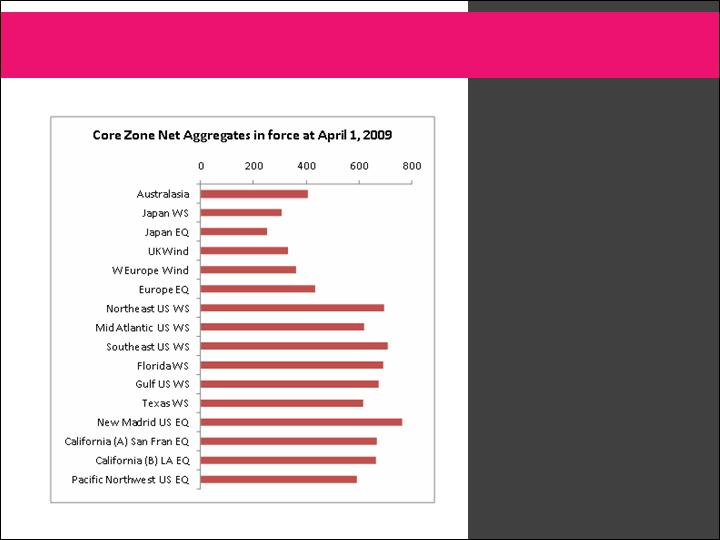

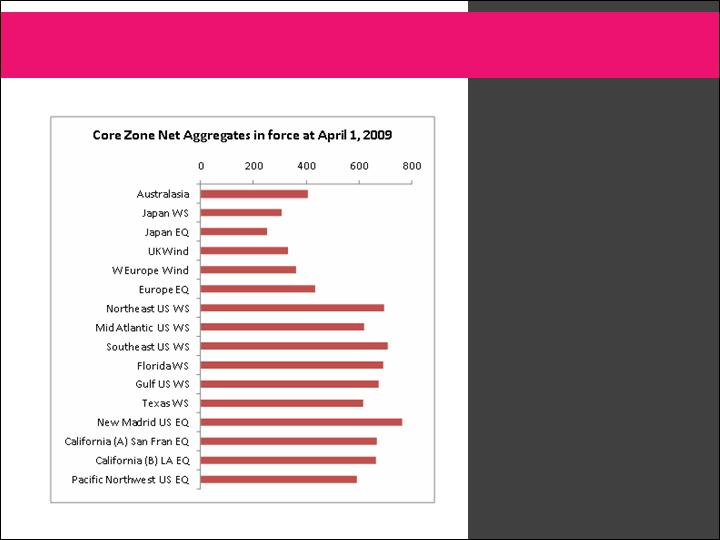

UNDERWRITING PHILOSOPHY

DIVERSIFICATION

Monitor zonal loss limits as

% of capital per zone

Monitor exposures in

adjacent combined zones

Per risk (cedant/layer)

Per event (1st event, 2nd

event, aggregate)

Per occurrence loss

estimates

Identifying potential loss

scenarios

Comparing & selecting risks

Conservative Methodology

As at 31 March, 2009:

1 in 100 PML of $236M

1 in 250 PML of $311M

20

UNDERWRITING PHILOSOPHY

RISK MANAGEMENT

UNDERWRITING PHILOSOPHY

SERVICE

Utilize proprietary technology

and global talent to provide

comprehensive risk analysis

and support to clients

Rapid turnaround and

response

Provide lead quote & price

Extend large capacity for risks

we like

Visit frequently – local

professionals

21

UNDERWRITING PHILOSOPHY

SERVICE

Entire submission,

underwriting &

accounting process

integrated in systems

Rigorous peer reviews

Differing levels of

authorization

Fully SOX compliant

22

Partner with Blue Chip

Companies

Prefer Regional exposures

vs. National exposures

Residential property vs.

Commercial property

Prefer XOL vs. Proportional

Approx 86% XOL

Generally conservative loss

estimates

Detailed cedant exposure:

Detailed data resolution vs.

aggregate resolution data

93% for US, 97.5% for

Europe

23

UNDERWRITING PHILOSOPHY

QUALITY PORTFOLIO

Traditionally mainly net

writer

Current 80% net retention

ratio

Specific purchases to

support business

expansion

Guideline on min rating

of A-

Collateralization if below

A-

24

UNDERWRITING PHILOSOPHY

REINSURANCE

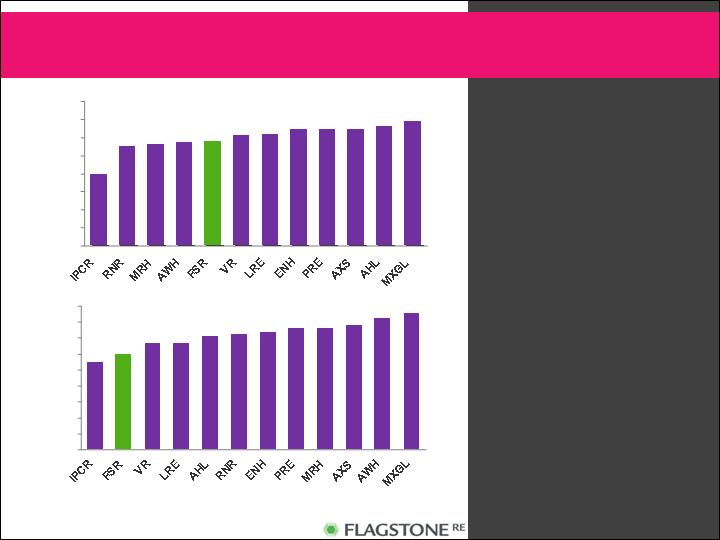

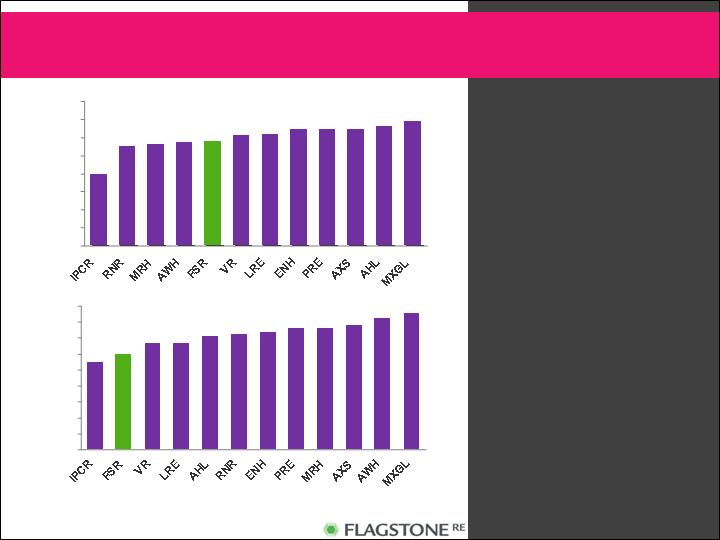

PERFORMANCE: PEER ANALYSIS

25

2008 | UNDERWRITING

PROFITABILITY – LOSS

RATIO (as reported)

2008 | UNDERWRITING

PROFITABILITY – LOSS

RATIO (ex releases)

Source: Company reports based on public company data

0%

10%

20%

30%

40%

50%

60%

70%

80%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

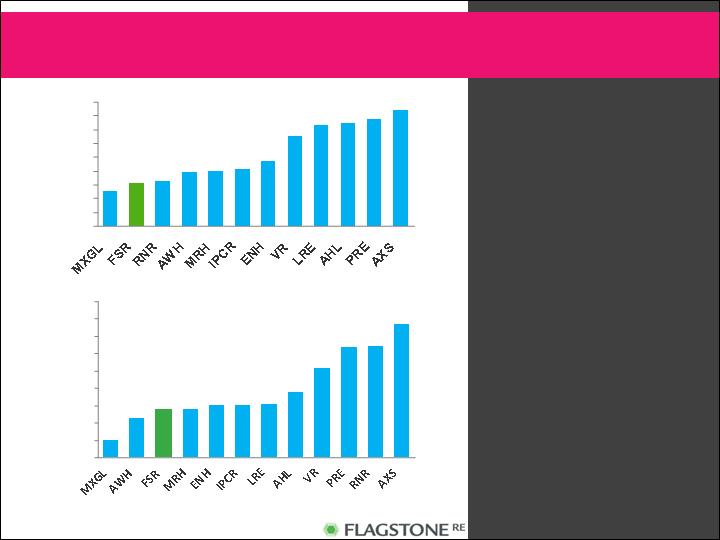

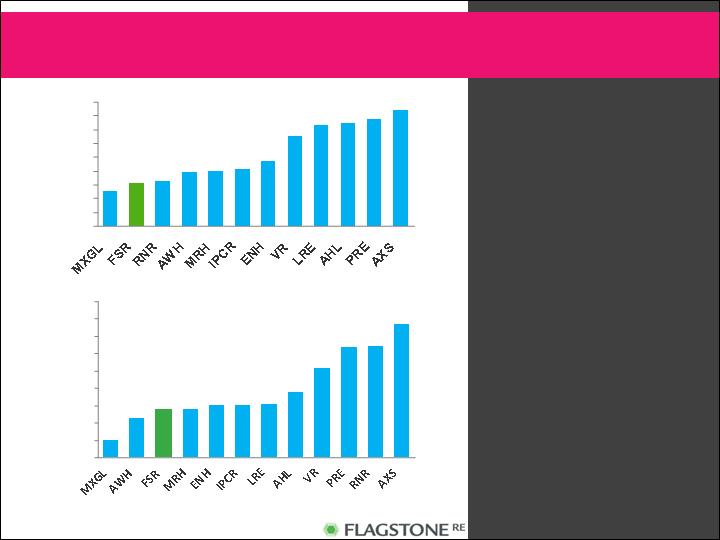

PERFORMANCE: PEER ANALYSIS

26

2008 | DILUTED BOOK

VALUE (ex investment

returns & dividends)

CHANGE IN DBV

2008 | GROWTH

TOP-LINE GROWTH

(ex –RP)

Source: Company reports based on public company data

-8%

-6%

-4%

-2%

0%

2%

4%

6%

-30%

-20%

-10%

0%

10%

20%

30%

40%

PERFORMANCE: PEER ANALYSIS

27

2008 | DIVERSIFICATION

& USE OF CAPITAL

NET HURRICANE LOSSES

TO CAT PREMIUMS

2008 | NET HURRICANE

(IKE/GUSTAV) LOSSES

(millions of USD)

Source: Company reports based on public company data

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

$0

$50

$100

$150

$200

$250

$300

$350

$400

$450

PERFORMANCE: PEER ANALYSIS

3 YEAR ANALYSIS |

UNDERWRITING

PROFITABILITY LOSS

RATIOS (as reported)

*Loss ratio for non-life segment

** Calculated as a straight average of 3 ratios

28

0%

10%

20%

30%

40%

50%

60%

70%

80%

FSR EXECUTIVE MANAGEMENT TEAM

GARY PRESTIA

Chief Underwriting Officer,

North America

24 years industry experience

Prior experience:

29

CEO: Alea North America

President: Converium

North America

Senior Vice President:

Transatlantic Re

NA UNDERWRITING PHILOSOPHY

Underwrite NA Cat in

Bermuda – one team, highly

coordinated

Selectively deploy capital in

most attractive market - US

Property Cat

Understand our clients

business

Favour long term clients –

reinsurance purchase is a

“must buy” vs.

“opportunistic buy”

Quality book - underwrite

for profit margin/ROE, not

premium

Industry leading service

fosters satisfaction, loyalty

& sustainability

Show pictures of homes

30

NA UNDERWRITING APPROACH

Become top choice of brokers

& clients by providing:

31

High level of technical expertise in

risks we write

Rapid & informed quoting

Large capacity within our

Underwriting guidelines on the

high quality clients we target

Clear and timely response on

submissions of business we will &

will not write – a quick “no” is

appreciated

Consistent approach – know what

to expect from us

Favorable broker feedback -

within a tight range of final pricing

on business we quote

NA PORTFOLIO

Profitable results since

inception

Q1 09 NA Premiums up

by 31.6%

Strong 6/1 renewals

High teens increase in

rate at June 1

North American portfolio

– aggregate exposures

similar to 08

Expect solid 7/1 renewals

32

NA MARKET UPDATE

Hardening US Property cat

reinsurance market first

half of 2009 due to:

33

IKE development

Severity of global financial crisis

and investment results

Difficulties of major market

participants – desire to syndicate

placement

Rating agency pressures

FHCF’s $2bn reduction in TICL =

growth in Florida demand

TWIA Assessment = greater

exposure to Texas companies

Reduced sidecar and hedge fund

capacity

NORTH AMERICA OPPORTUNITIES

Developed profitable &

maturing US Property

portfolio

Opportunity to refine and

optimize mix by program

Re-evaluate core clients

and brokers

Meet with clients prior to

renewal

Remain nimble in

accessing market

opportunities – “Live cat”

and post-event covers

Continue to profitably

grow as we have done

past 3 ½ years

34

FSR EXECUTIVE MANAGEMENT TEAM

GUY SWAYNE

Chief Executive Officer

Flagstone Réassurance

Suisse SA & CUO, International

22 years industry experience

Prior experience:

35

CUO: ACE Tempest

Reinsurance Ltd.

EVP: ACE Financial Solutions

International

INTERNATIONAL UNDERWRITING APPROACH

Targeted core clients =

foundation for portfolio

Focus on service level to

brokers & clients

Leveraged Bermuda Cat

business to expand other

relationships and develop

Specialty Lines

Focus on territories and

LOB with best returns

Internal coordination

36

LOCATIONS, TEAMS & LOB

Bermuda International

Catastrophe Team

Strong analytical & model

knowledge

37

Understand the models not

rely on them

Strong relationships =

targeted business

Quoting market status with

superior technical response

plus large capacity

Private deals enhance

relationships with improved

returns

Consistent approach – well

received by clients and

brokers

LOCATIONS, TEAMS & LOB

FLAGSTONE SUISSE SA

(MARTIGNY)

2008 established as European

Reinsurer

2009 excellent development :

Improved service level

Notable breakthrough in

German direct market

Complements Bermuda with

focus on proportional, risk &

local markets

Current offer to bind

ratio of 15% or less

Optimistic for next year’s

renewals with Competitor

problems driving greater

Reinsurer diversification

38

LOCATIONS, TEAMS & LOB

FLAGSTONE RE AFRICA

(ex IMPERIAL RE)

Experienced Managing

Director

20 yrs in local market

Strong team

New local reinsurer backed by

Parent rating & Group capacity

Focused plan – ahead of

expectations after 5 months

July 1’s look promising:

Many terms & conditions

tightened

Current offer to bind ratio

of approximately 25%

Drive for Reinsurer diversification -

gaining opportunities at expense

of others

Focus on service to clients

39

LOCATIONS, TEAMS & LOB

FLAGSTONE

PUERTO RICO

Experienced & technical

team – locals from Latin

American region - key to

be seen as local to

nurture relationships

1/09 first real renewal

season in tough market

conditions – signs of

improving conditions

Current offer to bind ratio

of approximately 12%

Opportunity - Reinsurer

diversification

40

LOCATIONS, TEAMS & LOB

FLAGSTONE RE DUBAI/

FLAGSTONE ALLIANCE

CYPRUS

Engineering & Energy,

current focus:

Capacity needed

Acceptable rates

Flagstone expertise

Focused plan with target

clients & countries

Current fire rates

challenging

Proportional leaders

beginning to respond

European passporting

41

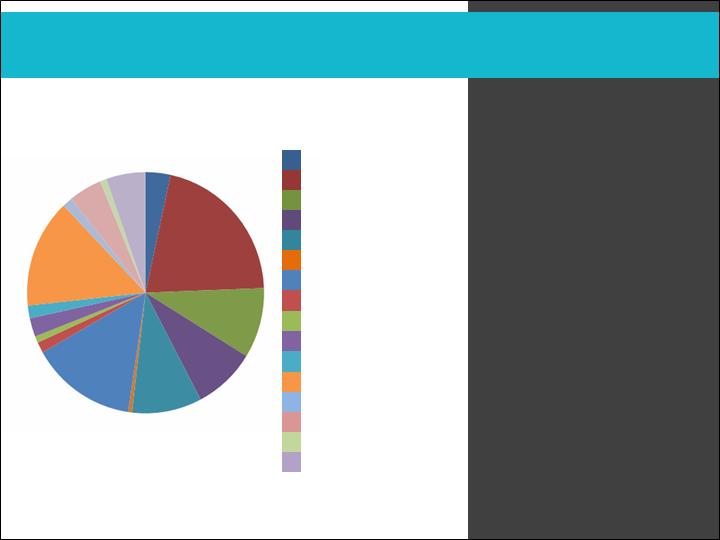

SPECIALTY PORTFOLIO

SPECIALTY LINES:

Airline exposure down since

January

Selected Motor accounts

Space portfolio consistent

Terrorism – modest plan

Energy & Engineering growing

Marine – London focus

42

In force business at April 1, 2009

Agricultural

3%

Aviation

21%

Commercial Auto

9%

Energy

8%

Engineering

9%

Industrial Aid

1%

Marine

14%

Marine & Energy

1%

Offshore Energy

1%

Personal Auto

2%

Professional Liability

2%

Space

14%

Surety

1%

Terrorism

4%

Warranty

1%

WC Cat

5%

Less than 1% in Accident & Health, Casualty Clash, Fire, General Liability,

Kidnap & Ransom, Marine – Cargo, Marine – Hull, Onshore Energy

LLOYD’S PLATFORM

BENEFITS:

Global distribution &

licenses

Lloyd’s branding

A+ Rating

Further diversifying short-

tail specialty lines

Extended market reach

Scalable platform

Experienced team with

deep relationships

Efficient capital structure

43

LLOYD’S PLATFORM

Specialist portfolio , short-

tail insurance &

reinsurance: marine,

energy, aviation and XOL

reinsurance

Fee based services –

Frameworks, Insurance

Admin and Turnkey

No legacy business

2008 – GPW of GBP 80m

($119m)

2009 – New Business for

FSR

Expect GPW of GBP 100m

($130/$140)

Currency benefit –

strengthening of $

44

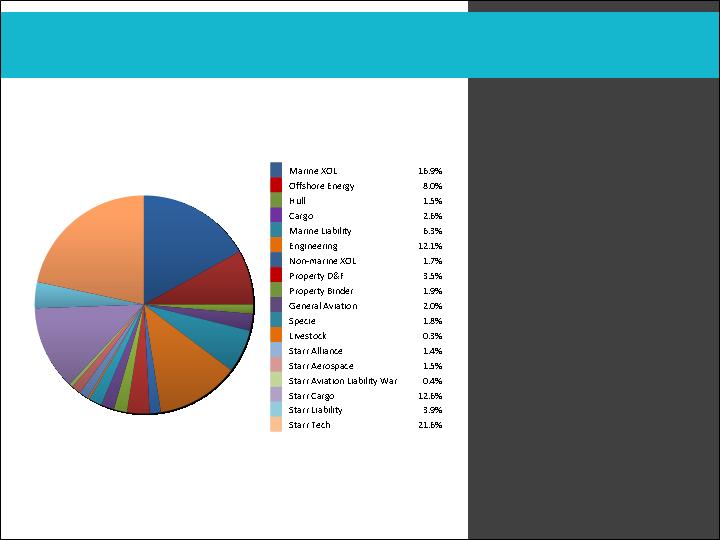

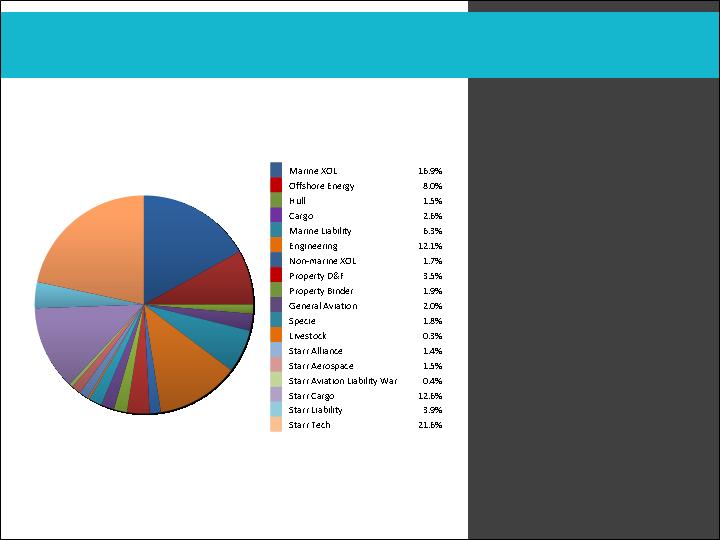

Expected 2009 Business Mix

Marlborough/Lloyd’s Syndicate 1861

Source: Lloyd’s approved 2009 business plan for Syndicate 1861

2009 & 2010 PROSPECTS

Global reach & high level

of marketing activities

Building solid reputation

Seeing high volume of

submissions

Reinsurance rates

improving

Some regions & LOB

already increased

Cedants diversifying

Reinsurer panel

Already seeing benefits in

Europe, Latin America &

South Africa

45

FSR EXECUTIVE MANAGEMENT TEAM

PATRICK BOISVERT

Chief Financial Officer

14 years industry experience

Past experience:

CFO: West End Capital

Management Limited

VP Fund Administration:

BISYS Hedge Fund Services

Limited

46

FINANCIAL SNAPSHOT

FINANCIAL HIGHLIGHTS

As at 31 March 2009

$ in thousands (except per

share data)

For 3 months ended

31 March 2009

47

Total Assets

$2,472,039

Long Term Debt

$265,306

Shareholder’s Equity

$1,024,123

Total Capital

$1,289,429

Debt/Capital

20.6%

Basic Book Value per Share

$12.04

Diluted Book Value per Share

$11.60

Gross Premiums Written

$361,485

Net Premiums Earned

$172,835

Loss Ratio

44.3%

Combined Ratio

80.4%

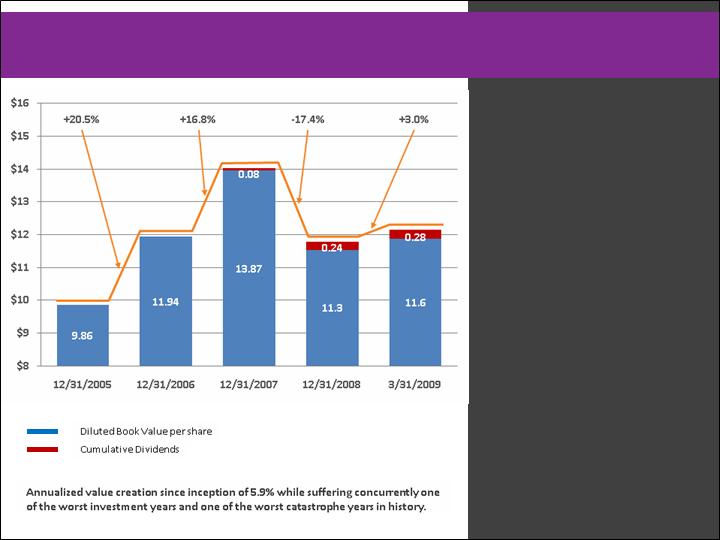

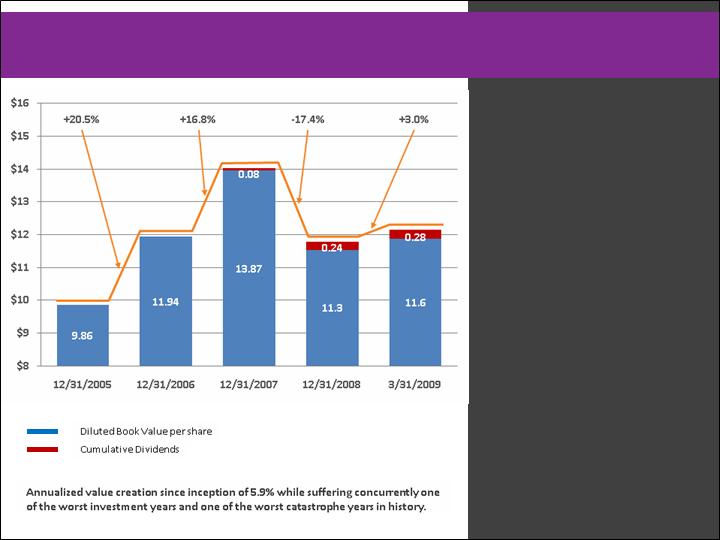

KEY METRIC – GROWTH IN DBV

Our Key metric is Growth

in Diluted Book Value per

share

Represents the value

creation

Board sets the target

annually

48

KEY METRIC – UNDERWRITING CONTRIBUTION

Companies build different

platforms…and

On a quarterly basis, isolated

events and reserve releases

may affect underwriting

performance… BUT

Over the long run, this

measure shows the value

created by underwriting

performance

Despite being only a “class of 2005” (therefore having a “ramp-up lag”) and

without having any benefits of KRW reserves releases, we have

outperformed our peers and believe this is a true reflection of the

underwriting platform we have built.

49

Peers: Axis, Endurance, IPC Re, Lancashire, Montpellier, Ren Re, Validus

FSR

Diluted Book Value Growth (Ex-Investments)

BALANCE SHEET HIGHLIGHTS

Robust balance sheet with

strong liquidity position

No long-tail writings

Controlled financial

leverage

Underwriting capital of

$1.3B

50

$ in millions

(except per share

data)

Mar 31

2009

Dec 31

2008

Dec 31

2007

Dec 31

2006

Investments & Cash

$1,762,846

$1,709,928

$1,833,863

$1,018,525

Total Assets

$2,472,039

$2,251,970

$2,103,773

$1,144,502

Loss Reserves

$429,802

$411,565

$180,978

$22,516

Debt

$265,306

$252,575

$264,889

$137,159

Shareholders’

Equity

$1,024,123

$986,013

$1,210,485

$864,519

Underwriting

Capital

$1,289,429

$1,238,588

$1,475,374

$1,001,678

Diluted BV per

share

$11.60

$11.30

$13.87

$11.94

FSR EXECUTIVE MANAGEMENT TEAM

MARK BYRNE

Executive Chairman

22 years industry experience

Prior experience:

Chairman: West End Capital

Management

Director: White Mountains,

Terra Nova, Markel

Significant Capital Markets

experience – Salomon

Brothers, Credit Suisse,

Lehman Brothers

51

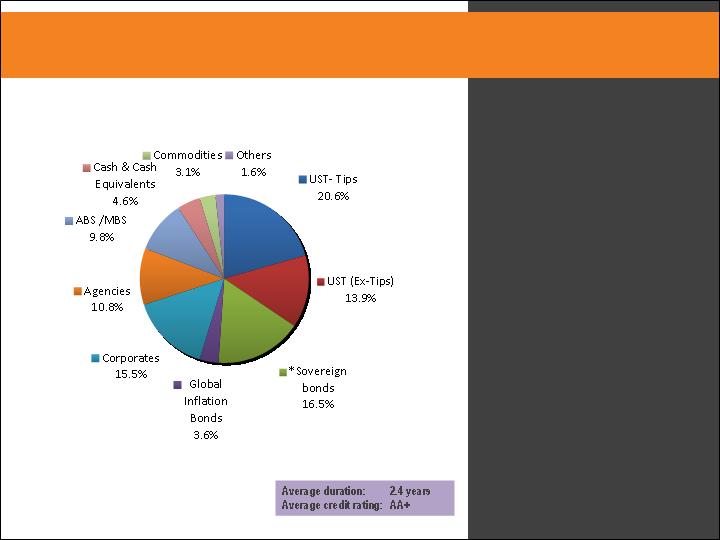

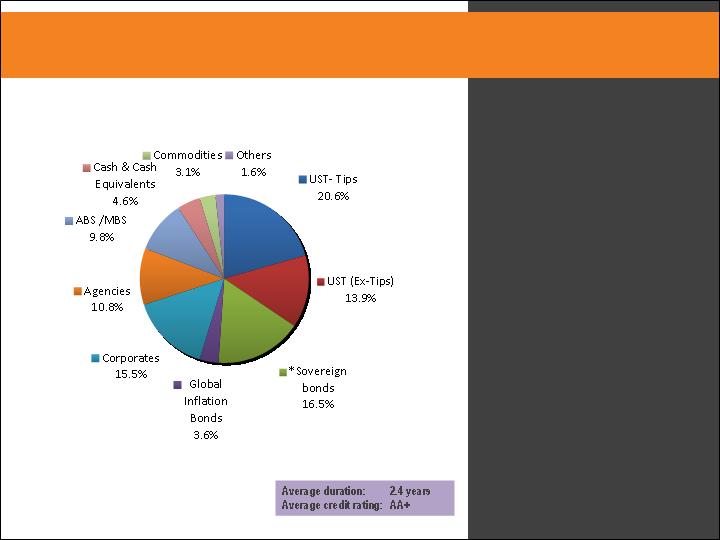

INVESTMENTS

October 2008 - de-risked

the portfolio

Conservative portfolio –

expect to stay here for

2009

At 3/31/09 - 94% of our

assets in high grade fixed

income securities & cash

No material exposure to

sub prime or Alt A

securities

Lower current returns –

focus on underwriting

Stable capital base with

which to underwrite

52

*Sovereign Bonds – Ex-US & Supranationals

CURRENT ALLOCATION – INVESTED ASSETS

THE FSR OPPORTUNITY

Ideally positioned to

take advantage of

opportunities in the

market

High Quality book of

business

Adequate capital &

strong balance sheet

Systems, global

locations & teams to

provide:

SHAREHOLDER VALUE

(Investors)

SERVICE

(clients/brokers)

53

FSR GOING FORWARD

54

Business continues to be

attractive

Hardening market

2009 Growth Plan:

Renewals

Increase participation

on programs

Develop new clients

especially with

Marlborough

Expand specialty

business

Global expansion

Brazil

Q & A

55

FLAGSTONE REINSURANCE HOLDINGS LIMITED

Crawford House, 23 Church Street,

Hamilton, HM 11, Bermuda

www.flagstonere.com