Exhibit 99.2

| THIRD QUARTER 2020 EARNINGS SUPPLEMENTAL NOVEMBER 5, 2020 |

| CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS This presentation contains forward-looking statements concerning our business operations and financial performance and conditions, as well as our plans, objectives, and expectations for our business operations and financial performance and conditions that are subject to risks and uncertainties. All statements other than those of historical fact are forward-looking statements. These types of statements typically contain words such as “aim,” “anticipate,” “assume,” “believe,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “potential,” “positioned,” “predict,” “should,” “target,” “will,” “would” and other similar expressions that are predictions of or indicate future events and future trends. Forward-looking statements are based on current expectations, estimates, forecasts, and projections about our business, the industry in which we operate, and our management’s beliefs and assumptions. These statements are not guarantees of future performance or development and involve known and unknown risks, uncertainties, and other factors that are in some cases beyond our control. All forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those estimated. Please refer to the “Risk Factors” in our Annual Report, Form 10-K filed on March 11, 2020 and in our subsequently filed Quarterly Report, Form 10-Q. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events, or otherwise, except as required by law. 2 |

| Q3 2020 BUSINESS HIGHLIGHTS • Remain focused on primary mission of reducing the harm caused by smoking • Intensified proactive efforts to secure Modified Risk Tobacco Product (MRTP) authorization from the U.S. Food and Drug Administration (FDA) for VLN® • Plans in place to commercialize VLN® in the U.S. 90 days after receiving MRTP designation • Commercial plans include a rollout through large, well-recognized retail chains in the U.S. and a marketing campaign to introduce adult smokers to the world’s lowest nicotine content cigarette • Refocused hemp/cannabis strategy to prioritize the upstream value chain segments of plant/seed biotechnology, breeding, cultivation, and purification of disruptive, proprietary plant lines • Identified a third plant-based franchise; securing valuable and necessary intellectual property and pursuing strategic partnerships to support the development of this franchise • Strong operating results for the third quarter, driven by year-over- year revenue growth and continued gross margin improvement; healthy balance sheet 3 |

| THIRD QUARTER 2020 FINANCIAL HIGHLIGHTS 1. Gross profit margin is calculated by dividing net sales revenue by gross profit. 2. Adjusted EBITDA, which the Company defines as earnings before interest, taxes, depreciation and amortization, as adjusted by the Company for certain non-cash and non-operating expenses, as well as certain one-time expenses, is a financial measure not prepared in accordance with generally accepted accounting principles (“GAAP”). In order to calculate Adjusted EBITDA, the Company adjusts the net (loss) income for certain non-cash and non-operating income and expense items in order to measure the Company’s operating performance. The Company believes that Adjusted EBITDA is an important measure that supplements discussions and analysis of its operations and enhances an understanding of its operating performance. While management considers Adjusted EBITDA to be important, it should be considered in addition to, but not as a substitute for or superior to, other measures of financial performance prepared in accordance with GAAP, such as operating loss, net (loss) income and cash flows from operations. Adjusted EBITDA is susceptible to varying calculations and the Company’s measurement of Adjusted EBITDA may not be comparable to those of other companies. 4 26% Improvement in Adjusted EBITDA2 YoY $7.3M Net sales revenue +13% YoY 530BPS Improvement in gross profit margin1 YoY $26.8M In cash, cash equivalents, and short-term investment securities $3.6M Improvement in operating loss YoY *For descriptive purposes only. Final trade dress subject to the FDA review and authorization. |

| YEAR-TO-DATE 2020 FINANCIAL HIGHLIGHTS 5 $5.1M Improvement in operating loss YoY $20.8M Net sales revenue +12% YoY 520BPS Improvement in gross profit margin1 YoY 23% Improvement in Adjusted EBITDA2 YoY $7.1M Improvement in net loss YoY 1. Gross profit margin is calculated by dividing net sales revenue by gross profit. 2. Adjusted EBITDA, which the Company defines as earnings before interest, taxes, depreciation and amortization, as adjusted by the Company for certain non-cash and non-operating expenses, as well as certain one-time expenses, is a financial measure not prepared in accordance with generally accepted accounting principles (“GAAP”). In order to calculate Adjusted EBITDA, the Company adjusts the net (loss) income for certain non-cash and non-operating income and expense items in order to measure the Company’s operating performance. The Company believes that Adjusted EBITDA is an important measure that supplements discussions and analysis of its operations and enhances an understanding of its operating performance. While management considers Adjusted EBITDA to be important, it should be considered in addition to, but not as a substitute for or superior to, other measures of financial performance prepared in accordance with GAAP, such as operating loss, net (loss) income and cash flows from operations. Adjusted EBITDA is susceptible to varying calculations and the Company’s measurement of Adjusted EBITDA may not be comparable to those of other companies. |

| TOBACCO FRANCHISE UPDATE • Securing MRTP authorization from the FDA for VLN® is our number one priority; intensified proactive efforts to secure MRTP designation • Launch plans include national roll-out with large, well-recognized retail chains in the U.S. and a marketing campaign; received extremely positive feedback on VLN® from many potential partners in the independent, regional, and national retail trade; finalizing distribution plans and agreements • Commercial product launch to commence within 90 days of receiving MRTP authorization • Continue to support and advance the FDA’s plan to require all cigarettes sold in the U.S. to be made “minimally or non-addictive”, a level already achieved by VLN® cigarettes • Successfully applied next generation non-GMO methodology of reducing nicotine levels in tobacco plants to several varieties of tobacco; developing non-GMO reduced nicotine content cigarette prototype • The FDA’s authorization of VLN® will open multiple licensing opportunities in the U.S. and globally; plan to execute on commercial opportunities for VLN® once MRTP authorization is secured • Granted highly valuable U.S. patent; breakthrough technology will enable rapid introduction of very low nicotine content traits into all varieties of tobacco used in the production of cigarettes and other tobacco products 6 *For descriptive purposes only. Final trade dress subject to the FDA review and authorization. |

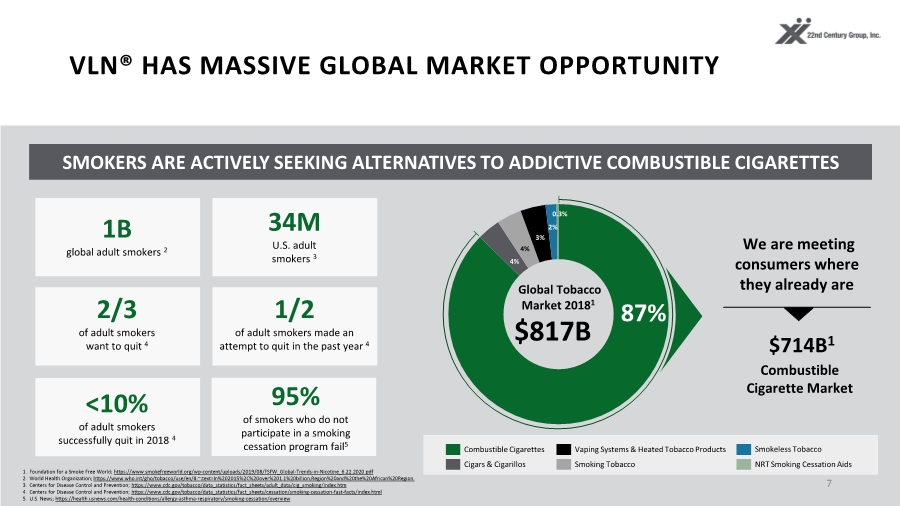

| VLN® HAS MASSIVE GLOBAL MARKET OPPORTUNITY 7 SMOKERS ARE ACTIVELY SEEKING ALTERNATIVES TO ADDICTIVE COMBUSTIBLE CIGARETTES 95% of smokers who do not participate in a smoking cessation program fail5 1. Foundation for a Smoke Free World; https://www.smokefreeworld.org/wp-content/uploads/2019/08/FSFW_Global-Trends-in-Nicotine_6.22.2020.pdf 2. World Health Organization; https://www.who.int/gho/tobacco/use/en/#:~:text=In%202015%2C%20over%201.1%20billion,Region%20and%20the%20African%20Region. 3. Centers for Disease Control and Prevention; https://www.cdc.gov/tobacco/data_statistics/fact_sheets/adult_data/cig_smoking/index.htm 4. Centers for Disease Control and Prevention; https://www.cdc.gov/tobacco/data_statistics/fact_sheets/cessation/smoking-cessation-fast-facts/index.html 5. U.S. News; https://health.usnews.com/health-conditions/allergy-asthma-respiratory/smoking-cessation/overview Cigars & Cigarillos Combustible Cigarettes Vaping Systems & Heated Tobacco Products Smoking Tobacco NRT Smoking Cessation Aids $817B Global Tobacco Market 20181 We are meeting consumers where they already are $714B1 3% 4% 4% 87% Combustible Cigarette Market 2% 0.3% 2/3 of adult smokers want to quit 4 1/2 of adult smokers made an attempt to quit in the past year 4 1B global adult smokers 2 34M U.S. adult smokers 3 <10% of adult smokers successfully quit in 2018 4 Smokeless Tobacco |

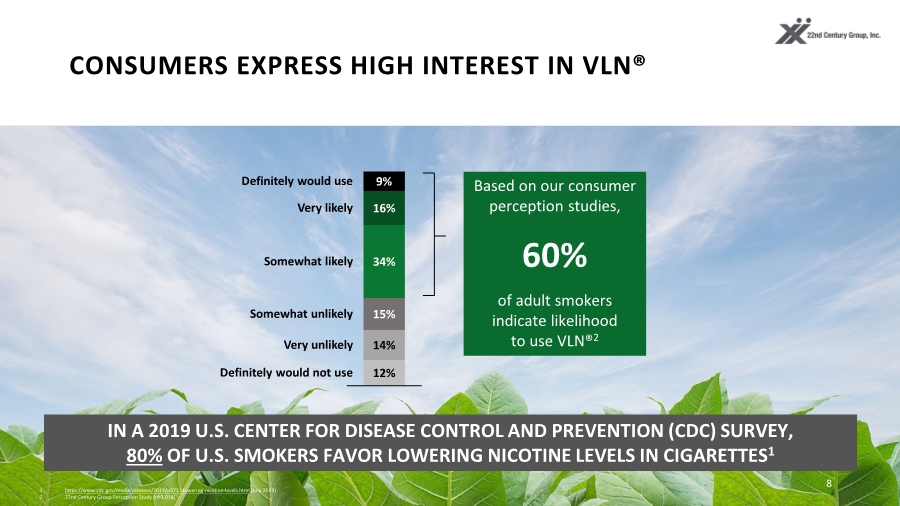

| CONSUMERS EXPRESS HIGH INTEREST IN VLN® 8 Based on our consumer perception studies, of adult smokers indicate likelihood to use VLN®2 IN A 2019 U.S. CENTER FOR DISEASE CONTROL AND PREVENTION (CDC) SURVEY, 80% OF U.S. SMOKERS FAVOR LOWERING NICOTINE LEVELS IN CIGARETTES1 12% 14% 15% 34% 16% 9% Somewhat likely Definitely would use Very likely Somewhat unlikely Very unlikely Definitely would not use 1. https://www.cdc.gov/media/releases/2019/p0711-lowering-nicotine-levels.html (July 2019) 2. 22nd Century Group Perception Study (n=3,018) 60% |

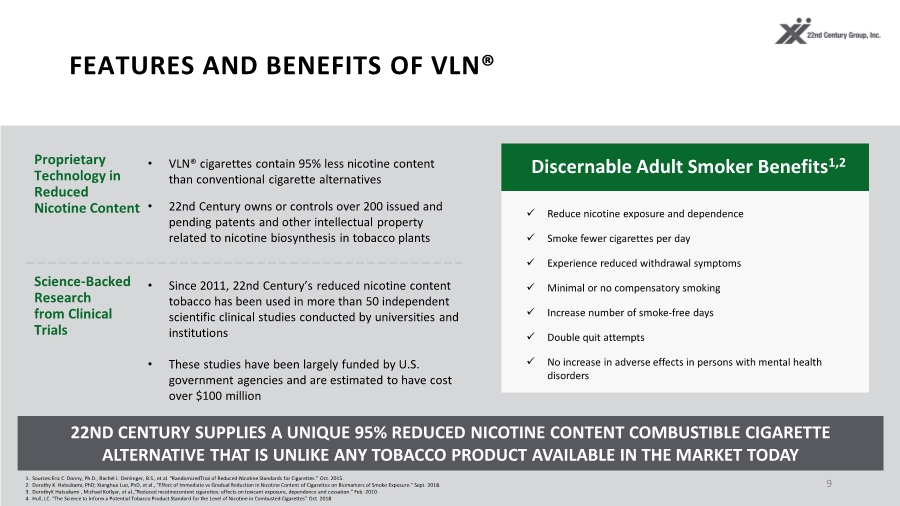

| FEATURES AND BENEFITS OF VLN® 9 22ND CENTURY SUPPLIES A UNIQUE 95% REDUCED NICOTINE CONTENT COMBUSTIBLE CIGARETTE ALTERNATIVE THAT IS UNLIKE ANY TOBACCO PRODUCT AVAILABLE IN THE MARKET TODAY Proprietary Technology in Reduced Nicotine Content • VLN® cigarettes contain 95% less nicotine content than conventional cigarette alternatives • 22nd Century owns or controls over 200 issued and pending patents and other intellectual property related to nicotine biosynthesis in tobacco plants Discernable Adult Smoker Benefits1,2 Science-Backed Research from Clinical Trials • Since 2011, 22nd Century’s reduced nicotine content tobacco has been used in more than 50 independent scientific clinical studies conducted by universities and institutions • These studies have been largely funded by U.S. government agencies and are estimated to have cost over $100 million Reduce nicotine exposure and dependence Smoke fewer cigarettes per day Experience reduced withdrawal symptoms Minimal or no compensatory smoking Increase number of smoke-free days Double quit attempts No increase in adverse effects in persons with mental health disorders 1. Sources:Eric C. Donny, Ph.D., Rachel L. Denlinger, B.S., et al. “RandomizedTrial of Reduced-Nicotine Standards for Cigarettes.” Oct. 2015. 2. Dorothy K. Hatsukami, PhD; Xianghua Luo, PhD, et al., “Effect of Immediate vs Gradual Reduction in Nicotine Content of Cigarettes on Biomarkers of Smoke Exposure.” Sept. 2018. 3. DorothyK Hatsukami , Michael Kotlyar, et al.,“Reduced nicotinecontent cigarettes: effects on toxicant exposure, dependence and cessation.” Feb. 2010. 4. Hull, LC. “The Science to Inform a Potential Tobacco Product Standard for the Level of Nicotine in Combusted Cigarettes” Oct. 2018 |

| OUR MANUFACTURING CAPABILITIES 10 62,000 sq. ft. manufacturing facility in NC Producing reduced nicotine content research cigarettes since 2011 Manufacturing capacity equal to approximately 1% of the U.S. tobacco market; ability to increase capacity to 2-3% of the market with minimal investments in additional equipment that is readily available FDA inspected and cleared as part of the Premarket Tobacco Application (PMTA) process Subsequent Participating Manufacturer of the Master Settlement Agreement 22nd Century is positioned to manufacture VLN® cigarettes in commercial quantities through existing facility footprint. *For descriptive purposes only. Final trade dress subject to the FDA review and authorization. |

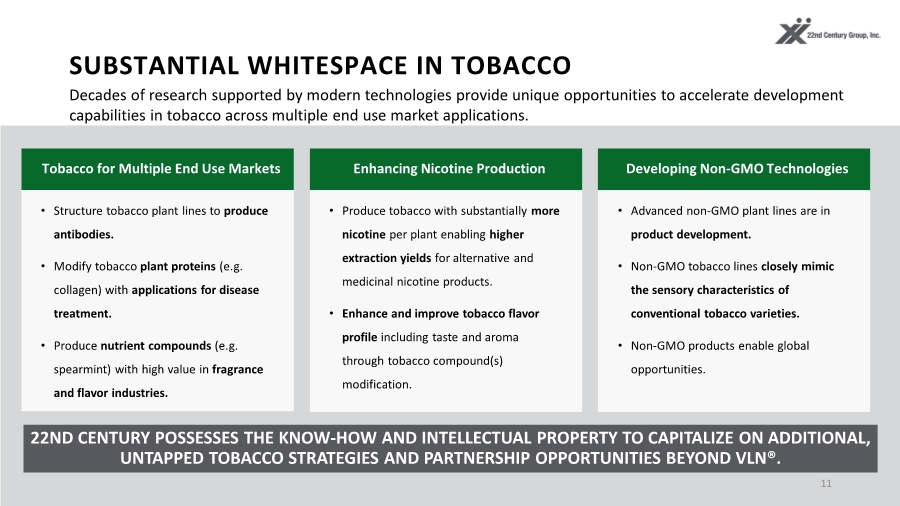

| SUBSTANTIAL WHITESPACE IN TOBACCO 11 Decades of research supported by modern technologies provide unique opportunities to accelerate development capabilities in tobacco across multiple end use market applications. 22ND CENTURY POSSESSES THE KNOW-HOW AND INTELLECTUAL PROPERTY TO CAPITALIZE ON ADDITIONAL, UNTAPPED TOBACCO STRATEGIES AND PARTNERSHIP OPPORTUNITIES BEYOND VLN®. Tobacco for Multiple End Use Markets • Structure tobacco plant lines to produce antibodies. • Modify tobacco plant proteins (e.g. collagen) with applications for disease treatment. • Produce nutrient compounds (e.g. spearmint) with high value in fragrance and flavor industries. Enhancing Nicotine Production • Produce tobacco with substantially more nicotine per plant enabling higher extraction yields for alternative and medicinal nicotine products. • Enhance and improve tobacco flavor profile including taste and aroma through tobacco compound(s) modification. Developing Non-GMO Technologies • Advanced non-GMO plant lines are in product development. • Non-GMO tobacco lines closely mimic the sensory characteristics of conventional tobacco varieties. • Non-GMO products enable global opportunities. Tobacco for Multiple End Use Markets Enhancing Nicotine Production Developing Non-GMO Technologies |

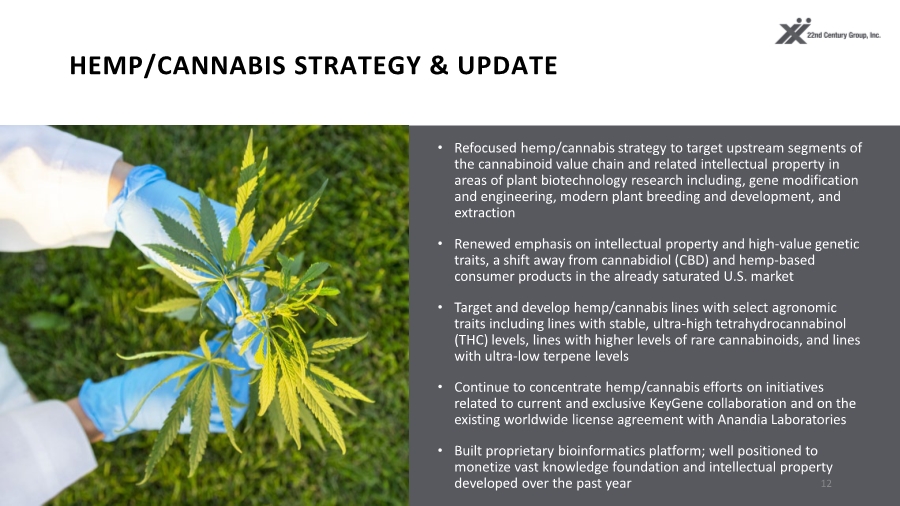

| HEMP/CANNABIS STRATEGY & UPDATE • Refocused hemp/cannabis strategy to target upstream segments of the cannabinoid value chain and related intellectual property in areas of plant biotechnology research including, gene modification and engineering, modern plant breeding and development, and extraction • Renewed emphasis on intellectual property and high-value genetic traits, a shift away from cannabidiol (CBD) and hemp-based consumer products in the already saturated U.S. market • Target and develop hemp/cannabis lines with select agronomic traits including lines with stable, ultra-high tetrahydrocannabinol (THC) levels, lines with higher levels of rare cannabinoids, and lines with ultra-low terpene levels • Continue to concentrate hemp/cannabis efforts on initiatives related to current and exclusive KeyGene collaboration and on the existing worldwide license agreement with Anandia Laboratories • Built proprietary bioinformatics platform; well positioned to monetize vast knowledge foundation and intellectual property developed over the past year 12 |

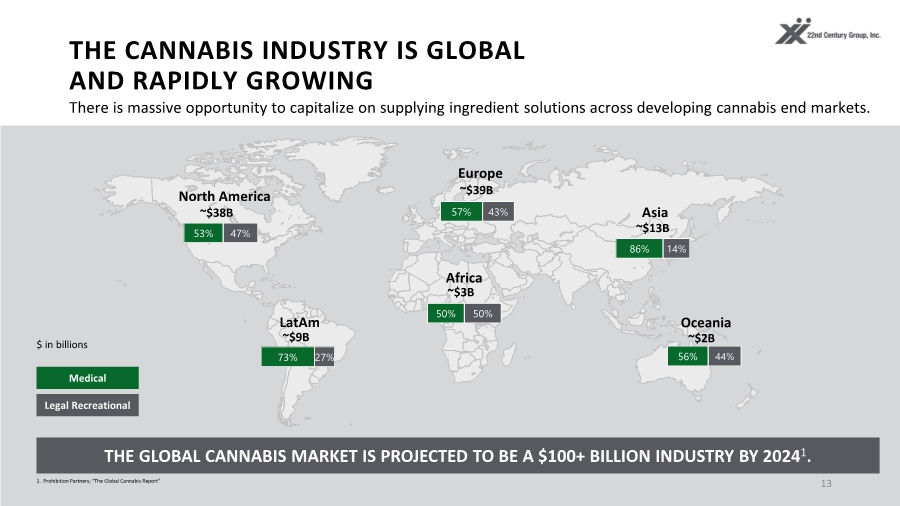

| THE CANNABIS INDUSTRY IS GLOBAL AND RAPIDLY GROWING 13 North America LatAm Europe Asia Africa Oceania Legal Recreational Medical $ in billions ~$38B 53% 47% 57% 43% ~$39B 86% 14% ~$13B 50% 50% ~$3B 73% 27% ~$9B 56% 44% ~$2B THE GLOBAL CANNABIS MARKET IS PROJECTED TO BE A $100+ BILLION INDUSTRY BY 20241. 1. Prohibition Partners; “The Global Cannabis Report” There is massive opportunity to capitalize on supplying ingredient solutions across developing cannabis end markets. |

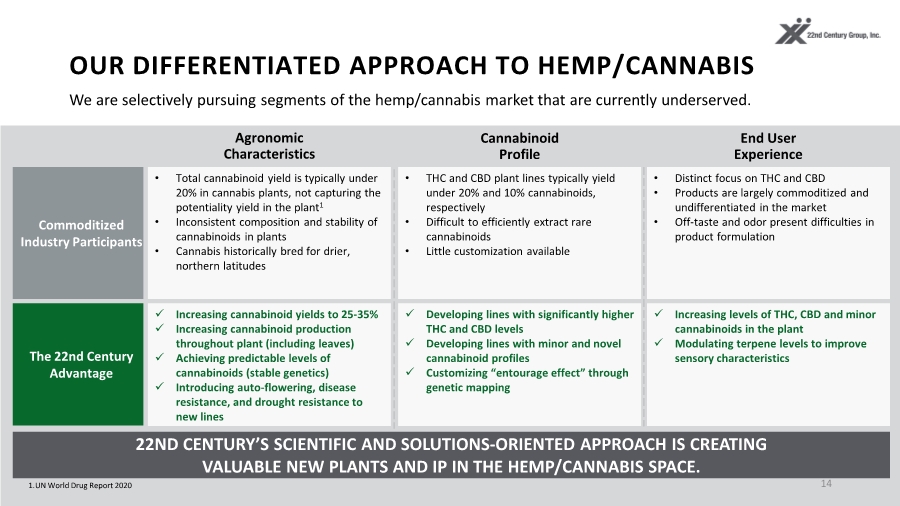

| OUR DIFFERENTIATED APPROACH TO HEMP/CANNABIS 14 1.UN World Drug Report 2020 22ND CENTURY’S SCIENTIFIC AND SOLUTIONS-ORIENTED APPROACH IS CREATING VALUABLE NEW PLANTS AND IP IN THE HEMP/CANNABIS SPACE. Commoditized Industry Participants The 22nd Century Advantage • Total cannabinoid yield is typically under 20% in cannabis plants, not capturing the potentiality yield in the plant1 • Inconsistent composition and stability of cannabinoids in plants • Cannabis historically bred for drier, northern latitudes Cannabinoid Profile Agronomic Characteristics End User Experience Increasing cannabinoid yields to 25-35% Increasing cannabinoid production throughout plant (including leaves) Achieving predictable levels of cannabinoids (stable genetics) Introducing auto-flowering, disease resistance, and drought resistance to new lines • THC and CBD plant lines typically yield under 20% and 10% cannabinoids, respectively • Difficult to efficiently extract rare cannabinoids • Little customization available Developing lines with significantly higher THC and CBD levels Developing lines with minor and novel cannabinoid profiles Customizing “entourage effect” through genetic mapping Increasing levels of THC, CBD and minor cannabinoids in the plant Modulating terpene levels to improve sensory characteristics • Distinct focus on THC and CBD • Products are largely commoditized and undifferentiated in the market • Off-taste and odor present difficulties in product formulation We are selectively pursuing segments of the hemp/cannabis market that are currently underserved. |

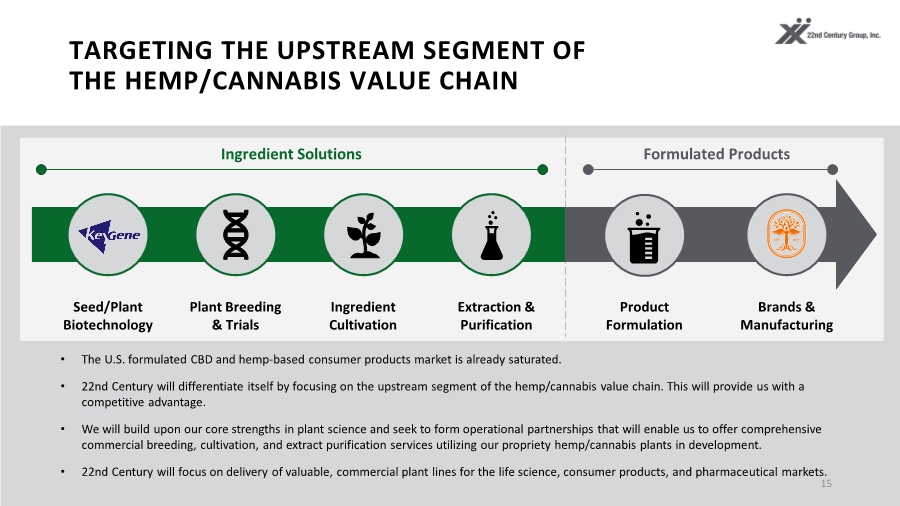

| TARGETING THE UPSTREAM SEGMENT OF THE HEMP/CANNABIS VALUE CHAIN 15 • The U.S. formulated CBD and hemp-based consumer products market is already saturated. • 22nd Century will differentiate itself by focusing on the upstream segment of the hemp/cannabis value chain. This will provide us with a competitive advantage. • We will build upon our core strengths in plant science and seek to form operational partnerships that will enable us to offer comprehensive commercial breeding, cultivation, and extract purification services utilizing our propriety hemp/cannabis plants in development. • 22nd Century will focus on delivery of valuable, commercial plant lines for the life science, consumer products, and pharmaceutical markets. Seed/Plant Biotechnology Ingredient Solutions Formulated Products Plant Breeding & Trials Ingredient Cultivation Product Formulation Brands & Manufacturing Extraction & Purification |

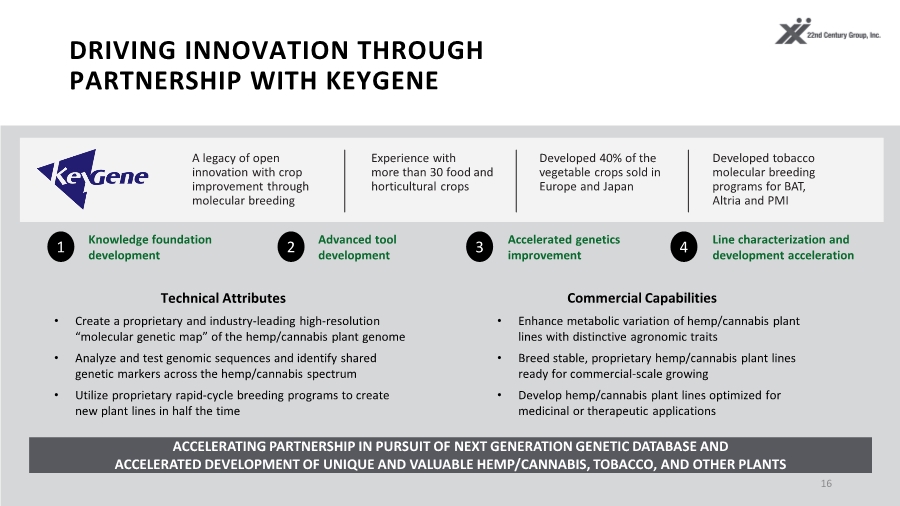

| DRIVING INNOVATION THROUGH PARTNERSHIP WITH KEYGENE 16 A legacy of open innovation with crop improvement through molecular breeding Experience with more than 30 food and horticultural crops Developed 40% of the vegetable crops sold in Europe and Japan Developed tobacco molecular breeding programs for BAT, Altria and PMI ACCELERATING PARTNERSHIP IN PURSUIT OF NEXT GENERATION GENETIC DATABASE AND ACCELERATED DEVELOPMENT OF UNIQUE AND VALUABLE HEMP/CANNABIS, TOBACCO, AND OTHER PLANTS • Enhance metabolic variation of hemp/cannabis plant lines with distinctive agronomic traits • Breed stable, proprietary hemp/cannabis plant lines ready for commercial-scale growing • Develop hemp/cannabis plant lines optimized for medicinal or therapeutic applications Technical Attributes Commercial Capabilities • Create a proprietary and industry-leading high-resolution “molecular genetic map” of the hemp/cannabis plant genome • Analyze and test genomic sequences and identify shared genetic markers across the hemp/cannabis spectrum • Utilize proprietary rapid-cycle breeding programs to create new plant lines in half the time Knowledge foundation development 1 Advanced tool development 2 Accelerated genetics improvement 3 Line characterization and development acceleration 4 |

| STRATEGIC SPOTLIGHT: PRIORITIES & OBJECTIVES Refocus hemp/cannabis strategy to target upstream segments of the cannabinoid value chain; concentrate efforts on initiatives related to exclusive partnership with KeyGene 03 Secure MRTP Authorization from the FDA and execute on commercial product launch and licensing initiatives within 90 days of receiving MRTP designation 01 Support and advance the FDA’s plan to limit nicotine content in all combustible cigarettes; plan to make very low nicotine content tobacco available to every major cigarette manufacturer in the U.S. 02 Develop a third franchise by securing valuable intellectual property and pursuing strategic partnerships; turn attention to this franchise after execution of tobacco and hemp/cannabis strategies 04 |

| 18 FINANCIAL DETAILS |

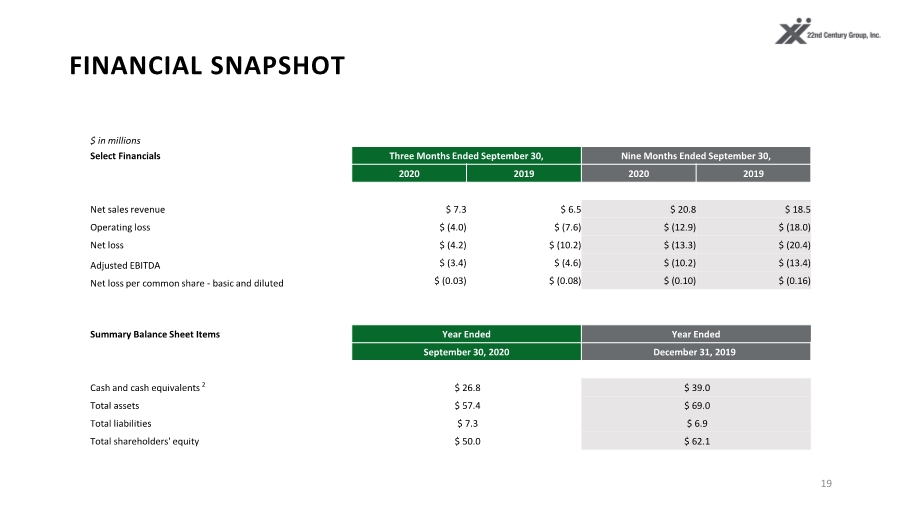

| FINANCIAL SNAPSHOT 19 $ in millions Select Financials Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 2020 2019 Net sales revenue $ 7.3 $ 6.5 $ 20.8 $ 18.5 Operating loss $ (4.0) $ (7.6) $ (12.9) $ (18.0) Net loss $ (4.2) $ (10.2) $ (13.3) $ (20.4) Adjusted EBITDA $ (3.4) $ (4.6) $ (10.2) $ (13.4) Net loss per common share - basic and diluted $ (0.03) $ (0.08) $ (0.10) $ (0.16) Summary Balance Sheet Items Year Ended Year Ended September 30, 2020 December 31, 2019 Cash and cash equivalents 2 $ 26.8 $ 39.0 Total assets $ 57.4 $ 69.0 Total liabilities $ 7.3 $ 6.9 Total shareholders' equity $ 50.0 $ 62.1 |

| ADJUSTED EBITDA DEFINITION Adjusted EBITDA, which the Company defines as earnings before interest, taxes, depreciation and amortization, as adjusted by the Company for certain non-cash and non-operating expenses, as well as certain one-time expenses, is a financial measure not prepared in accordance with generally accepted accounting principles (“GAAP”). In order to calculate Adjusted EBITDA, the Company adjusts the net (loss) income for certain non-cash and non-operating income and expense items in order to measure the Company’s operating performance. The Company believes that Adjusted EBITDA is an important measure that supplements discussions and analysis of its operations and enhances an understanding of its operating performance. While management considers Adjusted EBITDA to be important, it should be considered in addition to, but not as a substitute for or superior to, other measures of financial performance prepared in accordance with GAAP, such as operating loss, net (loss) income and cash flows from operations. Adjusted EBITDA is susceptible to varying calculations and the Company’s measurement of Adjusted EBITDA may not be comparable to those of other companies. 20 |

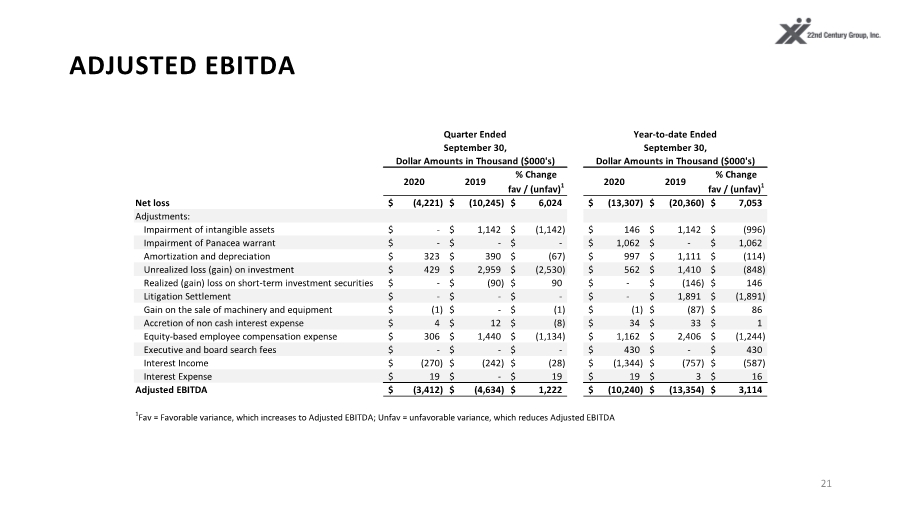

| ADJUSTED EBITDA 21 2020 2019 % Change fav / (unfav)1 2020 2019 % Change fav / (unfav)1 Net loss (4,221) $ (10,245) $ 6,024 $ (13,307) $ (20,360) $ 7,053 $ Adjustments: Impairment of intangible assets - $ 1,142 $ (1,142) $ 146 $ 1,142 $ (996) $ Impairment of Panacea warrant - $ - $ - $ 1,062 $ - $ 1,062 $ Amortization and depreciation 323 $ 390 $ (67) $ 997 $ 1,111 $ (114) $ Unrealized loss (gain) on investment 429 $ 2,959 $ (2,530) $ 562 $ 1,410 $ (848) $ Realized (gain) loss on short-term investment securities - $ (90) $ 90 $ - $ (146) $ 146 $ Litigation Settlement - $ - $ - $ - $ 1,891 $ (1,891) $ Gain on the sale of machinery and equipment (1) $ - $ (1) $ (1) $ (87) $ 86 $ Accretion of non cash interest expense 4 $ 12 $ (8) $ 34 $ 33 $ 1 $ Equity-based employee compensation expense 306 $ 1,440 $ (1,134) $ 1,162 $ 2,406 $ (1,244) $ Executive and board search fees - $ - $ - $ 430 $ - $ 430 $ Interest Income (270) $ (242) $ (28) $ (1,344) $ (757) $ (587) $ Interest Expense 19 $ - $ 19 $ 19 $ 3 $ 16 $ Adjusted EBITDA (3,412) $ (4,634) $ 1,222 $ (10,240) $ (13,354) $ 3,114 $ 1Fav = Favorable variance, which increases to Adjusted EBITDA; Unfav = unfavorable variance, which reduces Adjusted EBITDA Quarter Ended Year-to-date Ended September 30, Dollar Amounts in Thousand ($000's) September 30, Dollar Amounts in Thousand ($000's) |

| CONTACT INFORMATION INVESTOR RELATIONS & MEDIA CONTACT Mei Kuo Director, Communications & Investor Relations 22nd Century Group, Inc. (716) 300-1221 investorrelations@xxiicentury.com |