UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

| | |

| | | |

Filed by the Registrant ý |

| |

Filed by a Party other than the Registrant o |

| |

| Check the appropriate box: |

| | | |

| o | | Preliminary Proxy Statement |

| | | |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | |

| ý | | Definitive Proxy Statement |

| | | |

| o | | Definitive Additional Materials |

| | | |

| o | | Soliciting Material under §240.14a-12 |

|

| | | | | |

| Validus Holdings, Ltd. |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | (5) | | Total fee paid: |

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1 | ) | | Amount Previously Paid: |

| | | (2 | ) | | Form, Schedule or Registration Statement No.: |

| | | (3 | ) | | Filing Party: |

| | | (4 | ) | | Date Filed: |

VALIDUS HOLDINGS, LTD.

_______________________________________________________________________________

NOTICE OF ANNUAL GENERAL MEETING OF HOLDERS OF COMMON SHARES

TO BE HELD ON MAY 7, 2015

_______________________________________________________________________________

29 Richmond Road

Pembroke, HM 08

Bermuda

March 20, 2015

TO THE HOLDERS OF COMMON SHARES OF VALIDUS HOLDINGS, LTD.

Notice is hereby given that the Annual General Meeting of holders (the "Shareholders") of Common Shares of Validus Holdings, Ltd. (the "Company") will be held at the Company's offices located at 29 Richmond Road, Pembroke HM08, Bermuda, on Thursday, May 7, 2015 at 8:00 a.m. local time for the following purposes:

1. To elect three Class II Directors to hold office until 2018;

2. To approve, by a non-binding advisory vote, the executive compensation payable to the Company's named executive officers;

3. To approve the selection of PricewaterhouseCoopers Ltd. to act as the independent registered public accounting firm of the Company for the year ending December 31, 2015;

4. To approve the amendment and restatement of the Company's 2005 Amended and Restated Long-Term Incentive Plan (the "Plan") in order to make certain amendments to the Plan, including an increase in the aggregate number of shares of common stock authorized for issuance thereunder by 1,850,000 shares; and

5. To transact such other business as may properly come before the meeting or any adjournments thereof.

Only Shareholders of record at the close of business on March 13, 2015, are entitled to receive notice of and to vote at the Annual General Meeting. For instructions on voting, please refer to the instructions on the Notice Regarding the Availability of Proxy Materials you received in the mail or, if you requested a hard copy of the Proxy Statement, on your enclosed proxy card.

PLEASE VOTE YOUR PROXY AS PROMPTLY AS POSSIBLE, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING. IF YOU LATER DESIRE TO REVOKE YOUR PROXY FOR ANY REASON, YOU MAY DO SO IN THE MANNER DESCRIBED IN THE ATTACHED PROXY STATEMENT. YOUR SHARES WILL BE VOTED WITH THE INSTRUCTIONS CONTAINED IN THE PROXY CARD. IF NO INSTRUCTION IS GIVEN, YOUR SHARES WILL BE VOTED CONSISTENT WITH THE RECOMMENDATIONS OF THE BOARD OF DIRECTORS CONTAINED IN THE PROXY STATEMENT.

By Order of the Board of Directors,

Lorraine Dean

Secretary

VALIDUS HOLDINGS, LTD.

______________________________

PROXY STATEMENT

FOR THE

ANNUAL GENERAL MEETING OF HOLDERS OF COMMON SHARES

TO BE HELD ON MAY 7, 2015

______________________________

The accompanying proxy is solicited by the Board of Directors of Validus Holdings, Ltd. (the "Company") to be voted at the Annual General Meeting of holders (the "Shareholders") of the Company's common and restricted shares (the "Shares") to be held on May 7, 2015 and any adjournments thereof. Pursuant to rules adopted by the U.S. Securities and Exchange Commission (the "SEC"), the Company has elected to provide access to its proxy materials over the Internet. Accordingly, the Company is mailing a Notice Regarding the Availability of Proxy Materials (the "Notice") to Shareholders. The Notice, the Proxy Statement, the Notice of Annual General Meeting and the proxy card are first being made available to Shareholders on or about March 20, 2015. The Company has made available with this Proxy Statement the Company's Annual Report on Form 10-K (the "Annual Report to Shareholders"), although the Annual Report to Shareholders should not be deemed to be part of this Proxy Statement. All Shareholders will have the ability to access the proxy materials on a website referred to in the Notice. Shareholders may also request to receive a printed set of the proxy materials. In addition, Shareholders may specify how they would prefer to receive proxy materials in the future, including receiving proxy materials by e-mail or in hard copy format. Choosing to receive your future proxy materials by e-mail will save the Company the cost of printing and mailing documents to you and will also reduce the impact on the environment. If you choose to receive future proxy materials by e-mail, you will receive an e-mail next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by e-mail will remain in effect until you terminate it. Additionally, if you elect to receive future proxy materials in hard copy form by mail, this election will remain in effect until you terminate it.

When such proxy is properly executed and returned, the Shares of the Company it represents will be voted at the Annual General Meeting on the following:

(1) the election of the three nominees for Class II Directors identified herein;

(2) the approval, by a non-binding advisory vote, of the executive compensation payable to the Company's named executive officers as described in the Executive Compensation section of this Proxy Statement, including the Compensation Discussion and Analysis, summary compensation and other related tables;

(3) the approval of the selection of PricewaterhouseCoopers Ltd. (the "Independent Auditor"), to act as the independent registered public accounting firm of the Company for the year ending December 31, 2015; and

(4) the approval of the amendment and restatement of the Company’s 2005 Amended and Restated Long-Term Incentive Plan (the “Plan”) in order to make certain amendments to the Plan, including an increase in the aggregate number of shares of common stock authorized for issuance thereunder by 1,850,000 shares.

Any Shareholder giving a proxy has the power to revoke it prior to its exercise by giving notice of such revocation to the General Counsel of the Company in writing at Validus Holdings, Ltd., 29 Richmond Road, Pembroke, HM 08, Bermuda, by attending and voting in person at the Annual General Meeting or by executing a subsequent proxy, provided that such action is taken in sufficient time to permit the necessary examination and tabulation of the subsequent proxy or revocation before the votes are taken.

Shareholders of record as of the close of business on March 13, 2015 will be entitled to vote at the Annual General Meeting. As of March 13, 2015, there were 86,455,761 Shares outstanding. Each Share entitles the holder of record thereof to one vote at the Annual General Meeting; however, if, and for so long as, the Shares of a Shareholder, including any votes conferred by "controlled shares" (as defined below), would otherwise represent more than 9.09% of the aggregate voting power of all Shares entitled to vote on a matter, the votes conferred by such Shares will be reduced by whatever amount is necessary such that, after giving effect to any such reduction (and any other reductions in voting power required by our Amended and Restated Bye-laws ("Bye-laws")), the votes conferred by such shares represent 9.09% of the aggregate voting power of all Shares entitled to vote on such matter. "Controlled shares" include, among other things, all shares that a person is deemed to own directly, indirectly or constructively (within the meaning of Section 958 of the Internal Revenue Code of 1986 or Section 13(d)(3) of the Securities Exchange Act of 1934, as amended ("the Exchange Act")).

Other than the approval of the minutes of the 2014 Annual General Meeting, the Company knows of no specific matter to be brought before the Annual General Meeting that is not referred to in the Notice of Annual General Meeting. If any such

matter comes before the Annual General Meeting, including any Shareholder proposal properly made, the proxy holders will vote proxies in accordance with their judgment.

The election of each nominee for Director requires the affirmative vote of a plurality of the votes cast at the Annual General Meeting. The approval of the selection of the Independent Auditor referred to in Item 3 and the approval of the amendment and restatement of the Plan in Item 4 above requires the affirmative vote of a majority of the votes cast on such proposal at the Annual General Meeting, provided there is a quorum (consisting of two or more Shareholders present in person and representing in person or by proxy in excess of fifty percent (50%) of the total issued Shares of the Company throughout the meeting). Abstentions and broker non-votes (i.e., shares held by a broker which are represented at the Annual General Meeting but with respect to which such broker does not have discretionary authority to vote on a particular proposal) will be counted for purposes of determining whether a quorum exists, but will not be considered present and voting with respect to the election of nominees for Director or other matters to be voted upon at the Annual General Meeting. Therefore, abstentions will have no effect on the outcome of the proposals presented at the Annual General Meeting.

Our principal executive offices are located at 29 Richmond Road, Pembroke HM08, Bermuda (telephone number: (441) 278-9000).

OWNERSHIP OF COMMON STOCK BY

MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table sets forth information as of March 13, 2015 regarding the beneficial ownership of our common shares by:

| |

| • | each person known by us to beneficially own more than 5% of our outstanding common shares; |

| |

| • | each of our named executive officers; and |

| |

| • | all of our directors and executive officers as a group. |

The information provided in the table below with respect to each principal shareholder has been obtained from that shareholder. |

| | | | | | | | | | | | | | | | | | | | |

| Beneficial owner (1)(11)(15) | | | | Common shares (14) | | Shares subject to exercise of Warrants | | Unvested restricted shares and shares subject to exercise of options | | Total common shares and common share equivalents(10) | | Total beneficial ownership (%)(2) | | Fully diluted total beneficial ownership (%)(2) |

| Funds affiliated with or managed by The Vanguard Group | | (3) | | 5,878,015 |

| | — |

| | — |

| | 5,878,015 |

| | 7.03 | % | | 6.45 | % |

| Funds affiliated with or managed by Boston Partners | | (4) | | 5,849,346 |

| | — |

| | — |

| | 5,849,346 |

| | 7.00 | % | | 6.41 | % |

| Funds affiliated with or managed by LSV Asset Management | | (5) | | 4,651,880 |

| | — |

| | — |

| | 4,651,880 |

| | 5.56 | % | | 5.10 | % |

| Edward J. Noonan | | (6), (7) | | 1,254,392 |

| | 29,039 |

| | 135,524 |

| | 1,418,955 |

| | 1.53 | % | | 1.56 | % |

| Jeffrey D. Sangster | | (6) | | 54,593 |

| | — |

| | 98,087 |

| | 152,680 |

| | 0.07 | % | | 0.17 | % |

| C. N. Rupert Atkin | | (6) | | 388,469 |

| | — |

| | 107,989 |

| | 496,458 |

| | 0.46 | % | | 0.54 | % |

| Kean D. Driscoll | | (6) | | 3,041 |

| | — |

| | 118,840 |

| | 121,881 |

| | — | % | | 0.13 | % |

| John J. Hendrickson | | (6), (7) | | 33,993 |

| | — |

| | 77,559 |

| | 111,552 |

| | 0.04 | % | | 0.12 | % |

| Joseph E. (Jeff) Consolino | | (7), (13) | | 295,805 |

| | — |

| | — |

| | 295,805 |

| | 0.35 | % | | 0.32 | % |

| Michael E.A. Carpenter | | (7) | | 303,709 |

| | — |

| | 670 |

| | 304,379 |

| | 0.36 | % | | 0.33 | % |

| Matthew J. Grayson | | (7), (12) | | 7,739 |

| | 291,151 |

| | — |

| | 298,890 |

| | 0.36 | % | | 0.33 | % |

| Jeffrey W. Greenberg | | (7), (9) | | — |

| | 2,766,107 |

| | — |

| | 2,766,107 |

| | 3.20 | % | | 3.03 | % |

| Jean-Marie Nessi | | (7) | | 2,691 |

| | — |

| | — |

| | 2,691 |

| | — | % | | — | % |

| Mandakini Puri | | (7) | | 2,691 |

| | — |

| | — |

| | 2,691 |

| | — | % | | — | % |

| Dr. Therese M. Vaughan | | (7) | | 2,691 |

| | — |

| | — |

| | 2,691 |

| | — | % | | — | % |

| Mahmoud Abdallah | | (7) | | 2,691 |

| | — |

| | — |

| | 2,691 |

| | — | % | | — | % |

| Christopher E. Watson | | (7), (8) | | — |

| | 6,026 |

| | — |

| | 6,026 |

| | 0.01 | % | | 0.01 | % |

| Directors and Executive Officers as a group (20 persons) | | | | 2,463,300 |

| | 336,234 |

| | 875,864 |

| | 3,675,398 |

| | 3.33 | % | | 4.03 | % |

| Shares held by other persons owning less than 5% | | | | 64,776,601 |

| | 4,053,824 |

| | 2,313,547 |

| | 71,143,972 |

| | 78.51 | % | | 78.01 | % |

| Total | | | | 83,619,142 |

| | 4,390,058 |

| | 3,189,411 |

| | 91,198,611 |

| | 100.00 | % | | 100.00 | % |

To our knowledge, except as noted above, no person or entity is the beneficial owner of more than 5% of the voting power of the Company's stock.

____________________________________

| |

| (1) | All holdings in this beneficial ownership table have been rounded to the nearest whole share. |

| |

| (2) | The percentage of beneficial ownership for all holders has been rounded to the nearest 1/10th of a percentage. Total beneficial ownership is determined in accordance with the rules of the SEC and includes common shares issuable within 60 days of March 13, 2015 upon the exercise of all options and warrants and other rights beneficially owned by the indicated person on that date. Fully diluted total beneficial ownership is based upon all common shares and all common shares subject to exercise of options and warrants outstanding at March 13, 2015. Under our Bye-laws, if, and for so long as, the common shares of a shareholder, including any votes conferred by "controlled shares" would otherwise represent more than 9.09% of the aggregate voting power of all common shares entitled to vote on a matter, including an election of directors, the votes conferred by such shares will be reduced by whatever amount is necessary such that, after giving effect to any such reduction (and any other reductions in voting power required by our Bye-laws), the votes conferred by such shares represent 9.09% of the aggregate voting power of all common shares entitled to vote on such matter. |

| |

| (3) | As set forth in Form 13G filed on February 11, 2015. |

| |

| (4) | As set forth in Form 13G filed on February 12, 2015. Effective January 2014, Robeco Investment Management, Inc. adopted Boston Partners as a DBA designation reflecting the former name. |

| |

| (5) | As set forth in Form 13G filed on February 12, 2015. |

| |

| (6) | Unvested restricted shares held by our named executive officers accumulate dividends and may be voted. Unvested restricted shares held by our named executive officers are Mr. Noonan (135,524 shares), Mr. Sangster (80,694 shares), Mr. Atkin (107,989 shares), Mr. Driscoll (115,331 shares) and Mr. Hendrickson (77,559 shares). |

| |

| (7) | See "Election of Directors" for biographies of the directors, including their relationships with certain beneficial owners of common shares listed in this table. |

| |

| (8) | Does not include 2,756,088 warrants beneficially owned by Aquiline Capital Partners LLC and the funds it manages. Mr. Watson disclaims the existence of a group and beneficial ownership of the warrants owned by Aquiline Capital Partners LLC and the funds it manages. |

| |

| (9) | Includes 2,756,088 warrants beneficially owned by Aquiline Capital Partners LLC and the funds it manages. Mr. Greenberg disclaims existence of a group and disclaims beneficial ownership of the warrants owned by entities affiliated with or managed by Aquiline Capital Partners LLC. Aquiline Capital Partners LLC has pledged 2,216,939 warrants to a commercial bank as collateral for a credit facility. |

| |

| (10) | Total common shares and common share equivalents equal the sum of (i) common shares; (ii) unvested restricted shares; (iii) shares subject to the exercise of warrants; and (iv) shares subject to the exercise of options. |

| |

| (11) | Except as otherwise provided in these footnotes, excludes shares as to which beneficial ownership is disclaimed. |

| |

| (12) | Mr. Grayson has pledged 290,135 warrants to a commercial bank as collateral for a revolving loan. |

| |

| (13) | Does not include 459,298 shares beneficially owned by American Financial Group, Inc. ("AFG"), of which Mr. Consolino is an executive officer. Mr. Consolino disclaims the existence of a group and beneficial ownership of the warrants owned by AFG. |

| |

| (14) | Does not include 2,836,619 unvested Restricted Shares. |

| |

| (15) | The addresses of each beneficial owner are as follows: Funds affiliated with or managed by The Vanguard Group, 100 Vanguard Blvd. Malvern, PA 19335; funds affiliated with or managed by Boston Partners, One Beacon Street, Boston, MA 02108; and funds affiliated with LSV Asset Management, 155 N. Wacker Drive, Suite 4600, Chicago, IL, 60606. The address of each other beneficial owner listed is c/o Validus Holdings, Ltd., 29 Richmond Road, Pembroke HM08 Bermuda. |

BOARD OF DIRECTORS

The Company's Bye-laws provide that the Board of Directors (sometimes referred to herein as the "Board") shall consist of not less than nine nor more than 12 members as determined by resolution of the Board, divided into three classes, designated "Class I," "Class II" and "Class III," with each class consisting as nearly as possible of one-third of the total number of Directors constituting the entire Board of Directors.

The term of office for each Director in Class I expires at the 2017 Annual General Meeting; the term of office for each Director in Class II expires at the 2015 Annual General Meeting; and the term of office for each Director in Class III expires at the 2016 Annual General Meeting of the Company. At each Annual General Meeting, the successors of the class of Directors whose term expires at that meeting shall be elected to hold office for a term expiring at the Annual General Meeting to be held in the third year of their election. In 2014, there were 4 meetings of the Board. All incumbent Directors attended at least 75% of such meetings and of the meetings held by all committees of the Board of which they were a member. All then incumbent directors attended the 2014 Annual General Meeting. The Company expects all of the Directors to attend the 2015 Annual General Meeting.

Board Leadership Structure and Risk Oversight

Edward J. Noonan is the Chairman of the Board and the Company's CEO. The Company believes that this unitary leadership structure provides, among other things, more effective leadership for a growth company. As such, the Company believes that under this structure the CEO is able to respond more quickly to market conditions. The importance of the ability to act swiftly and decisively is apparent in situations such as business development and the addition of business teams and talented professionals where decisions have to be made within a very short period of time. As the Company is still at a growth stage of life, unitary leadership helps to lower the costs of information transfer from the CEO to the Chairman and enhances swift decision making in such a dynamic environment. In addition to his broad experience as both an executive and Director/Chairman in the global insurance and reinsurance industries, the CEO also has specialized knowledge regarding the strategic challenges and opportunities facing the Company that is valuable to the Chairman's job. The Company believes, therefore, that it is appropriate for the CEO, the person most familiar with these challenges and strategies, to lead discussions with the Board. In addition, the Company's experienced outside and independent Board, two of whom represent a significant shareholder, also acts as a counter-balance to any potential over influence that this unitary leadership structure might present.

In order to further counter-balance this leadership structure, in connection with each regularly scheduled meeting of the Board, the non-management Directors meet in executive session without any member of management in attendance. The Board considers annually the selection of a non-management Director to serve as presiding Director at executive sessions of non-management Directors. Mr. Greenberg is the non-management Director whom the Board has selected to preside over these sessions. In addition, the independent Directors meet as a group at least annually.

As noted below, the Board has established a separate Risk Committee that is governed by a charter which is updated and reviewed periodically by the Board. The Risk Committee is responsible for, among other things, approving the Company’s Enterprise Risk Management framework (the “Framework”), working with management to ensure ongoing, effective implementation of the Framework and reviewing the Company’s specific risk limits as defined in the Framework, including limits related to major categories of risk. The Company’s Chief Risk Officer prepares a quarterly presentation for the Risk Committee and communicates with the Chairman of the Risk Committee on an informal basis periodically throughout the year.

Independence Determination

The Board has adopted independence standards in accordance with the listing standards of the New York Stock Exchange ("NYSE") and Rule 10A-3 promulgated under the Exchange Act to assist it in making determinations as to whether Directors have any material relationships with the Company for purposes of determining such Directors' independence under the listing standards of the NYSE and Rule 10A-3 promulgated under the Exchange Act. These standards are available at the Company's website located at www.validusholdings.com. In accordance with these standards, in February of 2015, the Board of Directors determined that six of the eleven directors (Mahmoud Abdallah, Michael E.A. Carpenter, Matthew J. Grayson, Jean-Marie Nessi, Mandakini Puri and Dr. Therese M. Vaughan) are independent. In making such determination, the Board considered the matters described under "Certain Relationships and Related Party Transactions."

Website Access to Corporate Governance Documents

Copies of the charters for the Audit Committee, the Compensation Committee, the Corporate Governance and Nominating Committee, the Finance Committee and the Risk Committee, as well as the Company's Corporate Governance Guidelines, Code of Business Conduct and Ethics for Directors, Officers and Employees, which applies to all of the Company's directors, officers and employees, and Code of Ethics for Senior Officers, which applies to the Company's principal executive officer, principal accounting officer and other persons holding a comparable position, are available free of charge on the

Company's website located at www.validusholdings.com or by writing to Investor Relations, Validus Holdings, Ltd., 29 Richmond Road, Pembroke, HM 08, Bermuda. The Company will post on its website any amendment to or waiver under the Code of Business Conduct and Ethics for Directors, Officers and Employees or the Code of Ethics for Senior Officers granted to any of its Directors or executive officers that relates to any element of the code of ethics definition set forth in Item 406 of Regulation S-K of the Securities Act of 1933, as amended.

Board Committees

The Board has established an Audit Committee, a Compensation Committee, an Executive Committee, a Finance Committee, a Corporate Governance and Nominating Committee and a Risk Committee. Under the applicable requirements of the NYSE, each of the Audit, Compensation and Corporate Governance and Nominating Committees consists exclusively of members who qualify as independent directors.

The following table details the composition of our Board committees: |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Director Name | | Audit | | Compensation | | Executive | | Finance | | Governance | | Risk |

| Edward J. Noonan | | | | | | ü | | ü | | | | ü |

| John J. Hendrickson | | | | | | | | | | | | ü |

| Mahmoud Abdallah | | | | | | | | ü | | ü | | ü |

| Michael E.A. Carpenter | | Chair | | ü | | | | ü | | | | ü |

| Joseph E. (Jeff) Consolino | | | | | | | | ü | | | | |

| Matthew J. Grayson | | ü | | ü | | ü | | Chair | | | | ü |

| Jeffrey W. Greenberg | | | | | | ü | | | | | | |

| Jean-Marie Nessi | | ü | | | | | | | | Chair | | ü |

| Mandakini Puri | | | | Chair | | Chair | | | | ü | | |

| Dr. Therese M. Vaughan | | ü | | | | | | | | ü | | Chair |

| Christopher E. Watson | | | | | | | | | | | | ü |

Audit Committee. Our Audit Committee is currently composed of Michael E.A. Carpenter, Matthew J. Grayson, Jean-Marie Nessi and Dr. Therese M. Vaughan, and is chaired by Mr. Carpenter. The Audit Committee assists the Board of Directors in its oversight of the integrity of our financial statements and our system of internal controls, the independent auditors' qualifications, independence and performance, the performance of our internal audit function and our compliance with legal and regulatory requirements. The Audit Committee also prepares the report required to be included in this annual proxy statement. Each member of the Audit Committee is "independent" within the meaning of the rules of the NYSE. The duties and responsibilities of the Audit Committee are set forth in the committee's charter. The Audit Committee met 4 times during 2014. The Audit Committee was established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Board has determined that Mr. Carpenter is an "Audit Committee financial expert" (as that term is defined in Item 407(d)(5)(ii) of Regulation S-K).

Compensation Committee. Our Compensation Committee is composed of Michael E.A. Carpenter, Matthew J. Grayson and Mandakini Puri, and is chaired by Ms. Puri. The Compensation Committee assists the Board in matters relating to the compensation of our Chief Executive Officer, executive officers and other matters of non-executive officer compensation that are subject to Board approval. The Compensation Committee also prepares the report on executive officer compensation required to be included in this annual proxy statement, in accordance with applicable rules and regulations. Each member of the Compensation Committee is "independent" within the meaning of the rules of the NYSE. The duties and responsibilities of the Compensation Committee are set forth in the committee's charter. The Compensation Committee met 4 times during 2014.

The Compensation Committee has evaluated certain risks associated with the Company's compensation policies and has concluded that the existing compensation policies align management with shareholders (i) through the direct relationship of the annual component of compensation to the Company's financial performance and (ii) by providing an incentive for management to consider the consequences of decision making on the long-term value of the Company's stock through long-term restricted shareholdings and performance based restricted share awards. Based on this evaluation, the Compensation Committee has affirmatively determined that the Company's compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on the Company.

Corporate Governance and Nominating Committee. Our Corporate Governance and Nominating Committee is composed of Mahmoud Abdallah, Jean-Marie Nessi, Mandakini Puri and Dr. Therese M. Vaughan, and is chaired by Mr. Nessi. The Corporate Governance and Nominating Committee assists the Board in (i) identifying individuals qualified to become

board members or members of the committees of the Board, and recommending individuals that the Board of Directors selects as director nominees to be considered for election at the next annual general meeting of Shareholders or to fill vacancies; (ii) developing and recommending to the Board appropriate corporate governance guidelines; and (iii) overseeing the evaluation of the Board, management and the Board committees and taking a leadership role in shaping the Company's corporate governance policies. Each member of the Corporate Governance and Nominating Committee is "independent" within the meaning of the rules of the NYSE. The duties and responsibilities of the Corporate Governance and Nominating Committee are set forth in the committee's charter. The Corporate Governance and Nominating Committee met 4 times during 2014.

Identifying and Evaluating Nominees. The Corporate Governance and Nominating Committee is responsible for reviewing with the Board, on an annual basis, the skills and characteristics appropriate for new Board members as well as an assessment of the skills and characteristics of the Board as a whole. While there is no formal policy with respect to diversity of board members, when seeking a new member or evaluating the current membership, the Corporate Governance and Nominating Committee works with the Board to determine the appropriate characteristics, skills and experiences for the Board as a whole and its individual members. Characteristics expected of all directors include independence, integrity, high personal and professional ethics, sound business judgment, and the ability and willingness to commit sufficient time to the Board. In evaluating the suitability of individual Board members, the Corporate Governance and Nominating Committee takes into account many factors, including a candidate's experiences in and understanding of, the (re)insurance industry, corporate finance and investments as well as his or her business, educational and professional background. When the Board determines to seek a new member, whether to fill a vacancy or otherwise, the Corporate Governance and Nominating Committee may employ third-party search firms and will consider recommendations from Board members, management and others, including Shareholders. The committee has recently undertaken a review of the current composition of the Board with the objective of increasing the percentage of independent directors.

Nominees Recommended by Shareholders. The Corporate Governance and Nominating Committee will consider, for Director nominees, persons recommended by Shareholders, who may submit recommendations to the Corporate Governance and Nominating Committee in care of the General Counsel at Validus Holdings, Ltd., 29 Richmond Road, Pembroke, HM 08, Bermuda. To be considered by the Corporate Governance and Nominating Committee, such recommendations must be accompanied by a description of the qualifications of the proposed candidate and a written statement from the proposed candidate to the effect that he or she is willing to be nominated and desires to serve if elected. Nominees for Director who are recommended by Shareholders to the Corporate Governance and Nominating Committee will be evaluated in the same manner as any other nominee for Director.

Executive Committee. Our Executive Committee is composed of Edward J. Noonan, Matthew J. Grayson, Jeffrey W. Greenberg, and Mandakini Puri, and is chaired by Ms. Puri. The duties and responsibilities of the Executive Committee are set forth in the committee's charter. The Executive Committee exercises the power and authority of the Board when the entire Board is not available to meet. In furtherance of these purposes, the committee provides guidance and advice, as requested, to the Chairman of the Board and the Chief Executive Officer regarding business strategy and long range business planning. The Executive Committee did not meet during 2014.

Finance Committee. Our Finance Committee is composed of Edward J. Noonan, Mahmoud Abdallah, Michael E.A. Carpenter, Joseph E. (Jeff) Consolino and Matthew J. Grayson, and is chaired by Mr. Grayson. The duties and responsibilities of the Finance Committee are set forth in the committee's charter. The Finance Committee oversees the finance function of the Company, including the Company's capital position, the investment of funds and financing facilities. In furtherance of this purpose, the committee approves the appointment of the Company's investment managers, evaluates their performance and fees, and approves the investment policies and guidelines established by the Company. In addition, the committee approves the Company's strategic asset allocation plan, reviews the adequacy of existing financing facilities, monitors compliance with debt facility covenants and monitors the status of rating agency evaluations and discussions. The Finance Committee met 4 times during 2014.

Risk Committee. Our Risk Committee is composed of Edward J. Noonan, John J. Hendrickson, Mahmoud Abdallah, Michael E.A. Carpenter, Matthew J. Grayson, Jean-Marie Nessi, Dr. Therese M. Vaughan and Christopher E. Watson and is chaired by Ms. Vaughan. The duties and responsibilities of the Risk Committee are set forth in the committee's charter. The Risk Committee also oversees the underwriting function of the Company, including all aspects of risk and (re)insurance. The Risk Committee met 4 times during 2014.

Communications with Members of the Board of Directors

Shareholders and other interested parties may communicate directly with one or more Directors (including any presiding director or all non-management Directors as a group) by mail in care of the Company's Corporate Secretary, at Validus Holdings, Ltd., 29 Richmond Road, Pembroke, HM 08, Bermuda and specifying the intended recipient(s). All such

communications will be forwarded to the appropriate Director(s) for review, other than unsolicited commercial solicitations or communications.

DIRECTOR COMPENSATION

Director Compensation Table

The following table sets forth the compensation paid by the Company to Directors for services rendered in the fiscal year ended December 31, 2014: |

| | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash | | | | Stock Awards | | Total |

| Edward J. Noonan | | $ | — |

| | (1) | | $ | — |

| | $ | — |

|

| Mahmoud Abdallah | | 124,000 |

| | | | 50,000 |

| | 174,000 |

|

| Michael E.A. Carpenter | | 444,815 |

| | (2) | | 75,000 |

| | 519,815 |

|

| Joseph E. (Jeff) Consolino | | 49,558 |

| | | | 104,000 |

| (3 | ) | 153,558 |

|

| Matthew J. Grayson | | 165,000 |

| | | | 50,000 |

| | 215,000 |

|

| Jeffrey W. Greenberg | | — |

| | | | — |

| | — |

|

| John J. Hendrickson | | — |

| | (1) | | — |

| | — |

|

| Jean-Marie Nessi | | 126,000 |

| | | | 50,000 |

| | 176,000 |

|

| Mandakini Puri | | 138,000 |

| | | | 50,000 |

| | 188,000 |

|

| Alok Singh | | 13,770 |

| | (4) | | — |

| | 13,770 |

|

| Therese M. Vaughan | | 130,000 |

| | | | 50,000 |

| | 180,000 |

|

| Christopher E. Watson | | — |

| | | | — |

| | — |

|

____________________________________

| |

| (1) | Edward J. Noonan, the Chairman of the Board and the Chief Executive Officer and John J. Hendrickson, Director of Strategy, Risk Management and Corporate Development, received no separate compensation for their service as Directors. The compensation received by Messrs. Noonan and Hendrickson as officers of the Company is shown in the Summary Compensation Table. |

| |

| (2) | Mr. Carpenter received $166,534 in fees payable in connection with his service on the Company's Board, $258,447 in fees payable in connection with his service as Chairman of the Talbot board and $19,834 for his service as a director of Validus Risk Services (Ireland) Limited. |

| |

| (3) | Includes 60% of Mr. Consolino's annual retainer fees paid in the form of shares. |

| |

| (4) | Mr. Singh resigned from the Board on February 5, 2014. |

Cash Compensation Paid to Non-Employee, Non-Founder Related Directors

During the year ended December 31, 2014, Messrs. Abdallah, Carpenter, Consolino, Grayson, and Nessi, Dr. Vaughan and Ms. Puri, our non-employee, non-founder related Directors, each received an annual retainer of $90,000 for serving as a Director and $2,500 for each Board meeting that such Director attended. In addition, such Directors each received a fee of $2,000 for each committee meeting that they attended. Mr. Grayson received additional annual retainer fees of $25,000 for chairing the audit committee during the first half of 2014 and $20,000 for chairing the Finance Committee. Mr. Carpenter received an annual retainer of $25,000 for chairing the Audit Committee during the second half of 2014. Mr. Nessi received an annual retainer of $10,000 for chairing the Corporate Governance and Nominating Committee. Dr. Vaughan received an annual retainer of $10,000 for chairing the Risk Committee during the second half of 2014. Ms. Puri received an annual retainer of $20,000 for chairing the Compensation Committee and $10,000 for chairing the Executive Committee. Pursuant to our Director Stock Compensation Plan, Directors are able to elect to receive their annual retainers in the form of our common shares or to defer their annual retainers into share units (other than in the case where such a deferral would be subject to U.S. income tax). In addition, we reimburse each of our Directors for all reasonable expenses in connection with the attendance of meetings of our Board of Directors and any committees thereof.

Equity Based Compensation Paid to Non-Employee Directors

During the year ended December 31, 2014, each of our non-employee, non-founder related Directors received a fully vested stock award valued at $50,000.

We have a Director Stock Compensation Plan. Our Director Stock Compensation Plan is designed to attract, retain and motivate members and potential members of our Board of Directors. Under this plan, each Director may make an election in writing on or prior to each December 31 to receive his or her annual retainer fees payable in the following plan year in the form of shares instead of cash. The number of shares distributed in case of election under the plan is equal to the amount of the

annual retainer fee otherwise payable on such payment date divided by 100% of the fair market value of a share on such payment date.

This plan further provides that a Director who has elected to receive shares pursuant to the above may make an irrevocable election on or before the December 31 immediately preceding the beginning of a plan year to defer delivery of all or a designated percentage of the shares otherwise payable as his or her annual retainer for service as a Director for the plan year, provided that such deferral is not subject to U.S. income tax. All shares that a Director elects to defer will be credited in the form of share units to a bookkeeping account maintained by the Company in the name of the Director. Each such unit will represent the right to receive one share at the time determined pursuant to the terms of the plan.

During 2014, Mr. Consolino elected to receive 60% of his annual retainer fees in the form of shares instead of cash.

Compensation Committee Interlocks and Insider Participation

Our Compensation Committee is composed of Michael E.A. Carpenter, Matthew J. Grayson and Mandakini Puri. During the year ended December 31, 2014, none of our executive officers served as a member of the Compensation Committee or as a director of another entity, one of whose executive officers served on the Compensation Committee or as one of our directors.

During 2014, Mr. Carpenter's son was employed as a junior underwriter by Talbot Underwriting Services, Ltd., a subsidiary of the Company. Total compensation received by Mr. Carpenter's son during 2014 was $186,519.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Our compensation program is designed to motivate executives to maximize the creation of shareholder value, therefore aligning, as much as possible, our named executive officers' rewards with our shareholders' interests. Our compensation program is composed of three principal components:

| |

| • | Annual incentive compensation (annual incentive award); and |

| |

| • | Long-term incentive compensation typically in the form of time vested and/or performance based restricted shares. |

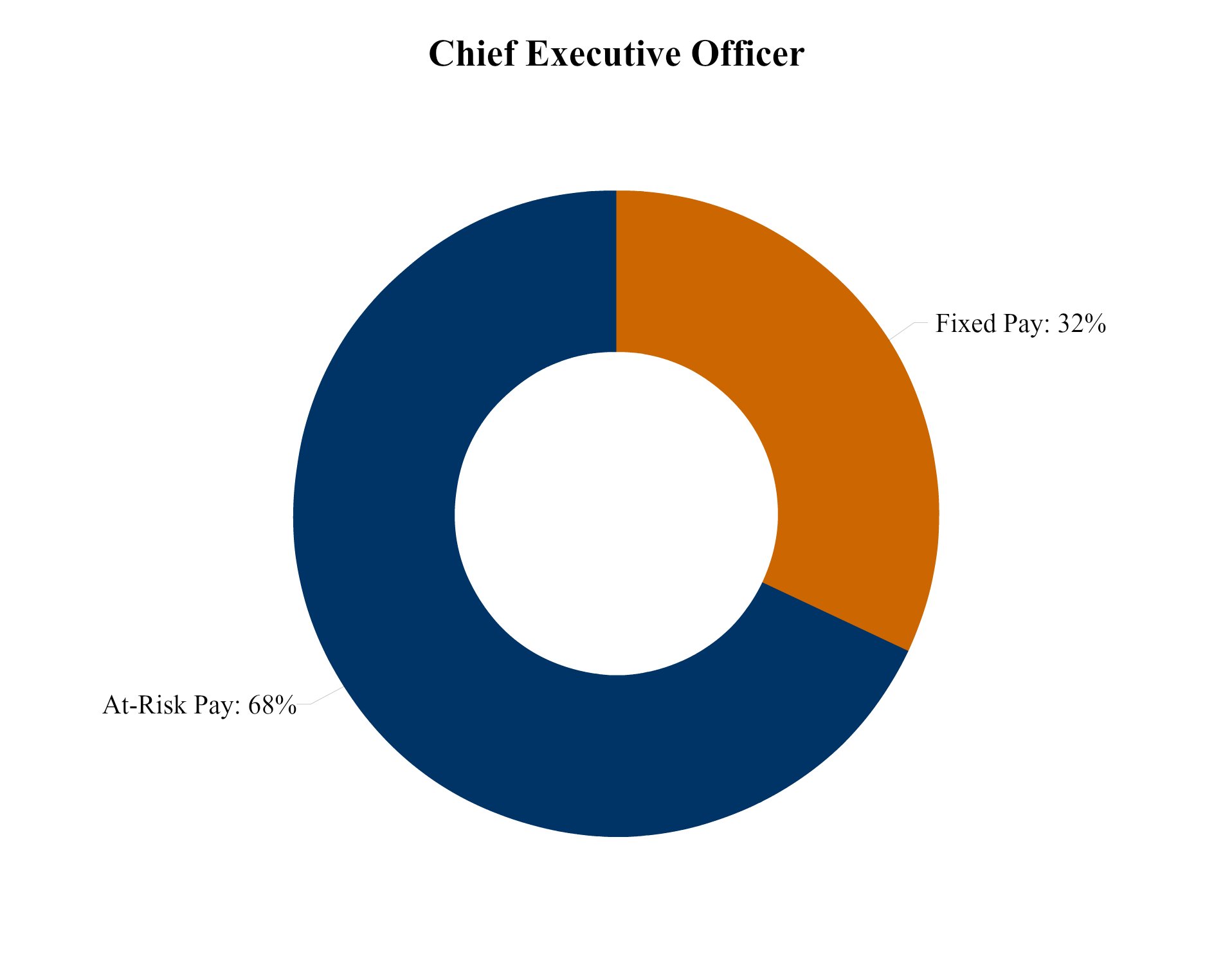

Our compensation plans are intended to offer opportunities that are competitive with our peer group and consistent with the Company's relative performance over time. In addition, we want our rewards to accommodate the risk and cyclicality of our business. At the time the Company negotiated its employment agreements with the named executive officers, the Company undertook to implement a performance based compensation strategy. To that end, the Company's compensation package includes a fixed component consisting of salary and benefits and two variable components consisting of annual incentive compensation and long-term incentive compensation. To better implement this strategy, a greater emphasis is placed on the variable elements that relate to performance and less of an emphasis is placed on the fixed elements of compensation that do not.

Our Chief Executive Officer makes recommendations to the Compensation Committee with respect to the compensation of our named executive officers other than himself. Our Compensation Committee reviews and, if appropriate, approves the compensation recommendation made for each of our named executive officers and determines the compensation for our Chief Executive Officer. In 2014, the annual incentive compensation for each of our named executive officers was primarily based on the results of the segment in which their respective services were rendered, Validus Re, AlphaCat, Talbot or Corporate. The compensation of the named executive officers is set forth in the Summary Compensation Table below and their employment agreements are described under "Employment Agreements."

The Compensation Committee designs the Company's compensation plans to be competitive with its peers in order to attract and retain talented individuals. The Compensation Committee and the Board regularly perform a review of the Company's compensation practices relative to the Company's peer group. In addition, the Compensation Committee has in the past engaged consultants to provide market data and to assist it in determining appropriate types and levels of compensation. The companies included in the Company's current peer group are: Allied World Assurance Company Holdings, Ltd., Arch Capital Group Ltd., Argo Group International Holdings, Ltd., Aspen Insurance Holdings Limited, Axis Capital Holdings Limited, Endurance Specialty Holdings Ltd., Everest Re Group, Ltd., Montpelier Re Holdings Ltd., PartnerRe Ltd., Platinum Underwriters Holdings, Ltd. and RenaissanceRe Holdings Ltd.

The following charts illustrate the fixed and at-risk composition of total compensation of our Chief Executive Officer and our other Named Executive Officers for the year ended December 31, 2014.

Fixed Components of Compensation

Salary. Our base salaries reflect each executive's level of experience, responsibilities and expected future contributions to the success of the Company. The salaries of our named executive officers were set initially in their employment agreements, and are reviewed on an annual basis. The Company considers factors such as individual performance, cost of living, the competitive environment and existing cash compensation in determining whether salary adjustments are warranted. There is no specific weighting applied to any one factor. The base salaries of our named executive officers are set forth in the Summary Compensation Table below.

Benefits. The Company seeks to provide benefit plans, such as medical coverage and life and disability insurance, in line with applicable market conditions. These health and welfare plans help ensure that the Company has a productive and focused workforce through reliable and competitive health and other benefits. The named executive officers are eligible for the same benefit plans provided to all other employees. Mr. Atkin participates in Talbot's benefit plans.

The Company provides our named executive officers with other benefits that the Company and the Compensation Committee believe are reasonable and consistent with its overall compensation program to better enable the Company to attract and retain key employees. These benefits are specified in our named executive officers' employment agreements. Many of these benefits relate to those executives who reside and/or work in Bermuda and are typical of such benefits provided to expatriates in Bermuda. Examples of these benefits for Bermuda-based expatriates include housing and housing gross up allowances, car and education allowances, club memberships, tax preparation services and home leave for executives and their families for those executives working outside their home country. These benefits are described under "Summary Compensation Table" and "Employment Agreements" below.

Variable Components of Compensation

Annual Incentive Compensation. The Company has an annual incentive compensation program in which employees of the Validus Re, AlphaCat, Talbot and Corporate segments participate. The Company's 2014 annual incentive program was based 80% on Company financial performance and 20% on the achievement of strategic objectives as evaluated by the Compensation Committee. The strategic objectives for 2014 varied by segment and included: (i) with respect to the Corporate Segment: to continue to grow the Company's diluted book value per share plus dividends; and (ii) with respect to the Validus Re, AlphaCat and Talbot segments: (a) to continue to focus on short-tail and specialty classes of business and (b) to continue to develop a robust enterprise risk management program to comply with corporate objectives and regulatory requirements. As more fully described below, the financial performance-based portion of our annual incentive pool for all participating employees, including our named executive officers, is generated based on financial guidelines for Validus Re, AlphaCat, Talbot and Corporate segment employees approved by the Compensation Committee.

The target aggregate annual incentive bonus pool is determined through the aggregation of annual target bonuses for all of the employees eligible to receive an annual incentive award. Separate annual incentive pools based on cumulative employee target bonus amounts are established for each of our segments: Validus Re, AlphaCat, Talbot and Corporate. For executive officers, target annual incentive bonuses are determined at the time that such executive officers enter into employment agreements and these employment agreements, including target annual incentive bonus amounts, are approved by the Compensation Committee. Factors considered by the Compensation Committee in approving executive target annual incentive bonus amounts at the time that the Compensation Committee approves executive employment agreements include experience, the executive's perceived ability to contribute to growth in the Company's profitability, compensation available to the executive elsewhere in a competitive labor market and the executive's role within the Company. For employees other than executive officers, target annual incentive bonuses are set as a percentage of base salary, and can range from 0% to 150% of base salary. The aggregation of these amounts establishes the respective segment target bonus pools.

The Company's current year annual budget, including the target annual incentive bonus pool, is presented to the Board at the February board of directors meeting. At this time, the Compensation Committee takes no specific action with respect to the target bonus pool within the current year budget, as the primary focus of the Committee is approving the aggregate annual incentive pools for the prior calendar year as described below. After full year results of operations are known for the Company, at the February board of directors meeting following the end of each calendar year, the Compensation Committee approves specific aggregate annual incentive pool amounts to be paid for the most recently completed calendar year. These amounts are determined using the financial scale established at the previous May board of directors meeting (as more fully described below) to evaluate the Company's actual results, including underwriting income (defined as net premiums earned less losses and loss expenses, policy acquisition costs and general and administrative expenses excluding target annual incentive accrual and share-based compensation expense), combined ratio, net operating income, consolidated operating return on average equity and growth in diluted book value per share plus dividends against the most recently completed year's budget as approved by the Board. After considering the Company's performance relative to budget, management recommends to the Compensation Committee annual incentive pools which can range from a 20% minimum to a 150% maximum of the target annual incentive

pool based solely on the percentage achievement of budget as measured on the financial scale. For example, a hypothetical 85% scaled achievement of budget would result in a management recommendation to the Compensation Committee that the annual incentive pool be set at up to 85% of the target annual incentive pool. In this hypothetical example, the Compensation Committee would consider approving a total aggregate annual incentive bonus pool of up to 85% of the target annual incentive bonus pool, made up of 68% (equal to 80% of 85%) based on financial performance and up to 17% (equal to 20% of 85%) based on assessment of performance against strategic objectives. The Company's Chief Executive Officer reports to the Compensation Committee on his assessment of the contribution of the operating segments to Company-wide objectives and based on this assessment will recommend a bonus pool funding for each segment of between 70% and 100% of the amount otherwise indicated by the financial guidelines approved by the Compensation Committee.

The Company's Chief Executive Officer then presents to the Compensation Committee a schedule of recommendations for actual bonuses to be paid for executive officers that report to the Chief Executive Officer. In preparing these recommendations, the Chief Executive Officer considers: (i) each individual's contribution to the success and growth of his or her department and/or the Company as a whole; and (ii) a subjective assessment of the individual's contributions to the Company's goals, as determined following the end of the calendar year by the Chief Executive Officer. For executive officers, the recommendation made by the Chief Executive Officer can range from 0% to 150% of the executive's target annual incentive bonus. While a named executive officer's target annual incentive percentage is used as a guide, the Chief Executive Officer has the latitude to recommend (for the other named executive officers) and the Compensation Committee has the authority to re-deploy, annual incentive awards by individual based on the views of the Chief Executive Officer and the Compensation Committee of the individual's contribution to the success of the Company. The target annual incentive for each of our named executive officers is 150% of base salary, as specified in each named executive officer's employment agreement. For other employees, the recommendation is based on discussions between the Chief Executive Officer and the executive officer managing the applicable employee's department. In each case, the actual percentage funding of the annual incentive bonus pool is an important element of the bonus to be paid.

At the May Board of Directors meeting, the Compensation Committee considers and establishes a financial scale which is used to determine the amount of funding for the then current year annual incentive bonus pool for bonus determinations to be made following the end of that calendar year based on the target annual incentive bonus pool and the Company's budgeted and actual financial results. The financial scale is derived using a hypothetical range of losses and loss expenses, which is the most variable item in the Company's performance. The financial scale is then used to determine the amount of funding for the annual incentive bonus pool. The resulting funding for the annual incentive bonus pool is further subdivided into two components—an 80% portion based on financial performance and a 20% portion based on the achievement of strategic objectives as determined retrospectively by the Compensation Committee. For the 2014 performance year, the primary financial guidelines were underwriting income (defined as net premiums earned less losses and loss expenses, policy acquisition costs and general and administrative expenses excluding target annual incentive accrual and share-based compensation expense), combined ratio, net operating income, consolidated operating return on average equity and growth in diluted book value per share plus dividends. The Compensation Committee reviews the financial guidelines during each year in light of market developments (for example, acquisitions, catastrophes and competitive pricing environment). We expect that the relative weighting of these guidelines will vary depending on market developments. The Compensation Committee has substantial flexibility to adjust the annual incentive compensation program to reflect unforeseen factors.

In February 2014, the Board approved a budget as follows:

|

| | | | | | | | | | | | | | | | |

($ in 000s) Financial Metric (1) | | Validus Re | | AlphaCat | | Talbot | | Consolidated (3) |

| Underwriting Income | | $ | 201,390 |

| | $ | 43,674 |

| | $ | 65,419 |

| | $ | 233,241 |

|

| Combined Ratio | | 78.4 | % | | 64.4 | % | | 92.4 | % | | 87.8 | % |

| Net Operating Income Available to Validus (2) | | $ | 258,668 |

| | $ | 18,855 |

| | $ | 78,769 |

| | $ | 228,182 |

|

| Operating Return on Average Equity (2), (4) | | 8.2 | % | | 5.0 | % | | 10.5 | % | | 6.5 | % |

| Growth in Diluted Book Value Per Share Plus Dividends | | |

| | | | |

| | 5.8 | % |

The Company's actual results for 2014 were as follows:

|

| | | | | | | | | | | | | | | | |

($ in 000s) Financial Metric (1) | | Validus Re | | AlphaCat | | Talbot | | Consolidated (3) |

| Underwriting Income | | $ | 383,846 |

| | $ | 109,256 |

| | $ | 107,044 |

| | $ | 519,398 |

|

| Combined Ratio | | 58.2 | % | | 17.5 | % | | 87.8 | % | | 73.1 | % |

| Net Operating Income Available to Validus (2) | | $ | 452,389 |

| | $ | 38,590 |

| | $ | 125,047 |

| | $ | 475,563 |

|

| Operating Return on Average Equity (2), (4) | | 14.0 | % | | 12.4 | % | | 15.9 | % | | 13.4 | % |

| Growth in Diluted Book Value Per Share Plus Dividends | | |

| | | | |

| | 12.8 | % |

____________________________________

| |

| (1) | Certain of these metrics are Non-GAAP financial measures. For reconciliations of these metrics to the most comparable GAAP financial measure, please see the Company's Annual Report on Form 10-K for the year ended December 31, 2014 filed with the SEC on February 24, 2015. |

| |

| (2) | Excludes net income attributable to noncontrolling interest. |

| |

| (3) | Excludes the results of Western World for the year ended December 31, 2014. |

| |

| (4) | Validus Re, AlphaCat and Talbot segmental average equity are based on allocations of the underlying legal entities equity across the Company. |

The Company's underwriting income, excluding the Western World segment, for the year ended December 31, 2014 was $519.4 million compared to $604.9 million for the year ended December 31, 2013, a decrease of $85.5 million or 14.1%.

The Company's combined ratio, excluding the Western World segment, for the year ended December 31, 2014 was 73.1%, compared to a combined ratio of 71.2% for the year ended December 31, 2013.

Net operating income available to the Company, excluding the Western World segment, for the year ended December 31, 2014 was $475.6 million compared to net operating income of $589.4 million for the year ended December 31, 2013, a decrease of $113.9 million, or 19.3%.

Operating return on average equity, excluding the Western World segment, was 13.4% for the year ended December 31, 2014 as compared to 15.5% for the year ended December 31, 2013. The decrease in operating return on average equity was driven primarily by the decrease in net operating income.

Annual incentive awards are made once the financial results for the year are available. Awards paid in excess of a named executive officer's target may, at the discretion of the Chief Executive Officer and the Compensation Committee, be based on exceptional performance by the executive, based on a review of the executive's achievements during the year, including strategic, financial and general performance considerations, without regard to the size of the pool and may be paid in the form of restricted stock. Annual incentive awards payable to employees of the Talbot segment are payable 100% in cash, with one-half of the amount payable in the year in which the award is granted and the other half payable the following year, subject to continued employment with the Company.

For the year ended December 31, 2014, the Compensation Committee considered the Company's financial results and strategic objectives described above and determined that: (i) the Validus Re segment exceeded its budgeted financial guidelines and satisfactorily achieved its strategic objectives; (ii) the AlphaCat segment exceeded its budgeted financial guidelines and satisfactorily achieved its strategic objectives; (iii) the Talbot segment exceeded its budgeted financial guidelines and satisfactorily achieved its strategic objectives; and (iv) the consolidated results of the Company exceeded the budgeted financial guidelines and the Corporate segment satisfactorily achieved its strategic objectives. In making this determination, the Compensation Committee considered each segment's strategic objectives as well as the Company's and the respective segments' financial performance relative to budget. As a result, the annual incentive pools were set at 150% of the target annual incentive pool for the Validus Re and AlphaCat segments, at 150% of target for the Corporate segment and at 150% of target for the Talbot segment. The Compensation Committee determined that these results merited incentive compensation at 150% of target for Mr. Noonan and, based in part on Mr. Noonan's recommendations to the Compensation Committee, at 150% of target for Mr. Sangster, 150% for Mr. Hendrickson, 150% for Mr. Driscoll and 150% for Mr. Atkin. Mr. Atkin's bonus is payable 100% in cash, with 50% of the amount payable in 2015 and the other 50% payable in one year subject to continued employment. The actual annual incentive paid to each of our named executive officers for service in 2014 is set forth in the "Summary Compensation Table" below.

Long-Term Incentive Compensation. The goal of our long-term incentive compensation plan is to align the interests of our executives and shareholders and to attract talented personnel. At the time the Company first negotiated employment agreements with Messrs. Noonan, Sangster, Driscoll and Hendrickson they were each awarded various levels of restricted shares and, in some cases, stock option grants. Since that time, each of our named executive officers has received various

awards of restricted stock. Mr. Atkin also received an initial equity award in connection with his employment agreement and received shares of the Company at the time of the acquisition of Talbot as partial consideration for his Talbot stock. The aforementioned grants and their terms are described under "Grants of Plan-Based Awards Table for the Fiscal Year Ended December 31, 2014" and "Restricted Share and Option Agreements" below.

The Compensation Committee has determined that including performance shares as a portion of the long-term incentive compensation grants would most closely align the named executive officers' long-term incentive compensation with results generated for shareholders. In considering the appropriate financial metric for these awards, the Compensation Committee determined that growth in diluted book value per share plus dividends was the most appropriate measure of increase in long-term shareholder value. On April 30, 2014, the Compensation Committee awarded each of the named executive officers long-term incentive awards in the amounts set forth below, effective as of June 1, 2014:

|

| | | | | | | | | | | | | |

| | | Time Vested Restricted Shares | | Performance Based

Restricted Shares | | Total Shares (1) | | Notional Amount |

| Name | | | |

| Edward J. Noonan | | 32,146 |

| | 8,036 |

| | 40,182 |

| | $ | 1,500,000 |

|

| Jeffrey D. Sangster | | 20,788 |

| | 5,197 |

| | 25,985 |

| | 970,000 |

|

| C. N. Rupert Atkin | | 31,503 |

| | 7,876 |

| | 39,379 |

| | 1,470,000 |

|

| Kean D. Driscoll | | 31,503 |

| | 7,876 |

| | 39,379 |

| | 1,470,000 |

|

| John J. Hendrickson | | 20,788 |

| | 5,197 |

| | 25,985 |

| | 970,000 |

|

____________________________________

| |

| (1) | Based on the Company's closing share price on May 30, 2014 of $37.33. |

Time vested restricted share awards issued in connection with performance share awards vest ratably over a three year period beginning on June 1, 2015.

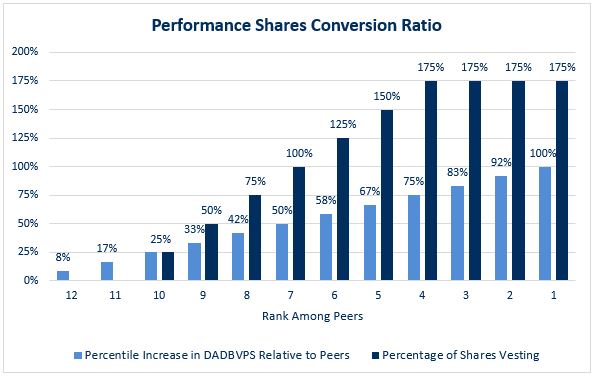

Each performance share award represents the right to receive, on the terms and conditions set forth in the award agreement evidencing the award, a specified number of common shares of the Company, par value $0.175 per share. Each performance share award will vest on June 1, 2017 only to the extent that the Company's Dividend Adjusted Performance Period End Diluted Book Value per Share ("DADBVPS") increases relative to peers during the performance period in the percentage amounts described below and certain service requirements are maintained. The grant date Diluted Book Value per Share for these awards is equal to $36.23 and the Performance Period End DADBVPS will be the Company's DADBVPS at December 31, 2016. No performance shares will become eligible for vesting if, at the end of the performance period, the Company's three-year compounded growth in DADBVPS is less than the 25th percentile relative to the peer group; provided, however, that the Compensation Committee has the discretion to allow up to 25% of the performance shares to vest should the foregoing be the result. If, at the end of the performance period, the Company's three-year compounded growth in DADBVPS is between the 25th and 49th percentile relative to the peer group, then the vesting of the performance shares will be scaled such that each percentage point above the 25th percentile shall increase the amount vesting by 3% resulting in 100% of the performance shares vesting at the 50th percentile. If, at the end of the performance period, the Company's three-year compounded growth in DADBVPS is between the 50th and 74th percentile relative to the peer group, then the vesting of the performance shares will be scaled such that each percentage point above the 50th percentile shall increase the amount vesting by 3%. If, at the end of the performance period, the Company's three-year compounded growth in DADBVPS is at or above the 75th percentile relative to the peer group, then each performance share award will vest at the maximum 175% of target. The Company's DADBVPS at December 31, 2014 was $40.86.

The foregoing is illustrated in the table below. The value of these awards to each named executive officer is set forth in the "Summary Compensation Table" below.

In the future, the Compensation Committee may make annual equity grants to our named executive officers, with an objective of the value of each award being between 50-150% of base salary.

Executive Share Ownership - Anti-hedging. The Company's Insider Trading Policy prohibits our employees, including our named executive officers and directors, from using short sales or put and call transactions to hedge their ownership of the Company's securities.

Clawback Policy. On February 5, 2014, the Board approved the establishment of an executive officer incentive compensation clawback policy or “Clawback Policy” to recover certain incentive-based compensation payouts in the event that the Company is required to restate its financial results because of material noncompliance with any financial reporting requirement under applicable securities law. The Board will review all incentive-based compensation made to current and former officers subject to the requirements of Section 16 of the U.S. Securities Exchange Act of 1934 for the three-year period immediately preceding the date on which the Company is required to prepare the restatement. If any such incentive-based compensation would have been lower as a result of the restated financial results, the Board will, to the extent permitted by applicable law, seek to recover for the benefit of the Company the difference between the amounts awarded or paid and the amounts which would have been awarded or paid based on the restated results. The Clawback Policy supplements the clawback provisions required under the Sarbanes-Oxley Act of 2002, which apply to our Chief Executive Officer and Chief Financial Officer.

REPORT OF THE COMPENSATION COMMITTEE ON THE

COMPENSATION DISCUSSION AND ANALYSIS

The Compensation Committee reviewed and discussed the "Compensation Discussion and Analysis" section included in this proxy statement with management. Based on such review and discussion, the Compensation Committee recommended to the Board of Directors that the "Compensation Discussion and Analysis" section be included in this proxy statement for filing with the SEC. |

| | |

| | | |

| | | Compensation Committee |

| | | Mandakini Puri (Chairperson) Michael E.A. Carpenter Matthew J. Grayson |

SUMMARY COMPENSATION TABLE

The following table sets forth for the fiscal years ended December 31, 2014, 2013 and 2012 the compensation of our Chief Executive Officer, Chief Financial Officer, our next three most highly compensated executive officers: |

| | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | Year | | Salary (1) | | Stock Awards (2) | | Non-Equity Incentive Plan Compensation | | All Other Compensation | | | | Total |

| Edward J. Noonan | 2014 | | $ | 985,625 |

| | $ | 1,500,000 |

| | $ | 2,217,656 |

| | $ | 793,339 |

| | (3) | | $ | 5,496,620 |

|

| Chairman and Chief | 2013 | | 976,719 |

| | 3,971,000 |

| | 2,005,057 |

| | 841,491 |

| | | | 7,794,267 |

|

| Executive Officer | 2012 | | 950,000 |

| | 2,265,009 |

| | 1,767,285 |

| | 584,895 |

| | | | 5,567,189 |

|

| Jeffrey D. Sangster | 2014 | | 625,000 |

| | 970,000 |

| | 1,406,250 |

| | 282,975 |

| | (4) | | 3,284,225 |

|

Chief Financial Officer (8) | 2013 | | 606,042 |

| | 2,250,000 |

| | 1,250,000 |

| | 224,536 |

| | | | 4,330,578 |

|

| C. N. Rupert Atkin | 2014 | | 870,410 |

| | 1,470,000 |

| | 753,500 |

| | 912,636 |

| | (5) | | 4,006,546 |

|

| Chief Executive Officer | 2013 | | 830,222 |

| | 2,988,000 |

| | 887,718 |

| | 929,032 |

| | | | 5,634,972 |

|

(Talbot Group) (9) | 2012 | | 793,082 |

| | 1,638,036 |

| | 902,500 |

| | 1,106,924 |

| | | | 4,440,542 |

|

| Kean D. Driscoll | 2014 | | 625,000 |

| | 1,470,000 |

| | 1,406,250 |

| | 460,233 |

| | (6) | | 3,961,483 |

|

| Chief Executive Officer | 2013 | | 606,250 |

| | 2,750,000 |

| | 1,247,813 |

| | 467,430 |

| | | | 5,071,493 |

|

| (Validus Reinsurance, Ltd.) | 2012 | | 522,325 |

| | 1,415,646 |

| | 918,060 |

| | 383,597 |

| | | | 3,239,628 |

|

| John J. Hendrickson | 2014 | | 650,000 |

| | 970,000 |

| | 1,462,500 |

| | 124,726 |

| | (7) | | 3,207,226 |

|

| Director of Strategy & | 2013 | | 568,750 |

| | 2,300,000 |

| | 1,322,295 |

| | 77,448 |

| | | | 4,268,493 |

|

Corp. Development (10) | | | | | | | | | | | | | |

____________________________________

| |

| (1) | The numbers presented represent earned salary for the full years ended December 31, 2014, 2013 and 2012. |

| |

| (2) | Amounts reflect the grant date fair value of grants made during the fiscal years ended December 31, 2014, 2013 and 2012 excluding the effect of forfeitures. See Note 18 in our consolidated financial statements filed on Form 10-K for the year ended December 31, 2014 for a discussion of the assumptions used in computing the grant date fair value of stock based compensation awards. |

| |

| (3) | Includes payments in lieu of defined contribution plan contributions ($98,562), personal use of the Company's corporate aircraft for travel from the U.S. to the Company's headquarters in Bermuda ($87,715), housing allowance ($246,000), housing tax gross up ($178,385), payroll tax benefit ($76,525), car allowance ($10,800), club dues, travel allowance, tax preparation services, internet access and medical, life and accidental death and dismemberment insurance. The Company calculates its incremental costs for personal use of the corporate aircraft based on variable operating costs, including fuel costs, crew travel, hourly costs, landing fees and other miscellaneous variable costs. Fixed costs that do not change based on usage are not included. |

| |

| (4) | Includes defined contribution plan contributions and allocations ($62,500), payroll tax benefit ($32,202), school tuition fees ($40,000), club dues ($20,000), and medical, life and accidental death and dismemberment insurance. |

| |

| (5) | Includes deferred bonus for 2013 pursuant to employment agreement ($887,718), medical, life and accidental death and dismemberment insurance. |

| |

| (6) | Includes defined contribution plan contributions and allocations ($62,500), housing allowance ($216,000), housing tax gross up ($42,000), payroll tax benefit ($50,173), travel allowance ($15,000), club dues, car allowance, tax preparation services, internet access and medical, life and accidental death and dismemberment insurance. |

| |

| (7) | Includes defined contribution plan contributions and allocations ($101,292) and medical, life and accidental death and dismemberment insurance. |

| |

| (8) | Mr. Sangster was appointed Chief Financial Officer on February 16, 2013. |

| |

| (9) | Mr. Atkin's base salary includes a pension allowance of $145,068. |

| |

| (10) | Mr. Hendrickson was hired on February 15, 2013. |

Grants of Plan-Based Awards Table for the Fiscal Year Ended December 31, 2014: |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Non-Equity Incentive Plan Compensation (1) | | Estimated Future Payout Under Equity Incentive Plan Awards (2) |

| | | | | | | | | | | | | | | | |

| Name | | Grant/ Payment Date | | Actual | | Target | | Threshold (# shares) | | Target (# shares) | | Maximum (# shares) | | All Other Stock Awards (# shares) | | Grant Date

Fair Value

of Stock

Awards |

| Edward J. Noonan | | March 13, 2015 | | $ | 2,217,656 |

| | $ | 1,478,438 |

| | |

| | |

| | |

| | |

| | |

| | | June 1, 2014 | | |

| | |

| | — |

| | 8,036 |

| | 14,063 |

| | |

| | $ | 300,000 |

|

| | | June 1, 2014 | | |

| | |

| | |

| | |

| | |

| | 32,146 |

| | 1,200,000 |

|

| Jeffrey D. Sangster | | March 13, 2015 | | 1,406,250 |

| | 937,500 |

| | | | | | | | | | |

| | | June 1, 2014 | | | | | | — |

| | 5,197 |

| | 9,095 |

| | | | 194,000 |

|

| | | June 1, 2014 | | | | | | | | | | | | 20,788 |

| | 776,000 |

|

| C. N. Rupert Atkin | | March 13, 2015 | | 753,500 |

| (3) | 997,223 |

| | |

| | |

| | |

| | |

| | |

|

| | | June 1, 2014 | | |

| | |

| | — |

| | 7,876 |

| | 13,783 |

| | |

| | 294,000 |

|

| | | June 1, 2014 | | |

| | |

| | |

| | |

| | |

| | 31,503 |

| | 1,176,000 |

|

| Kean D. Driscoll | | March 13, 2015 | | 1,406,250 |

| | 937,500 |

| | | | | | | | |

| | |

|

| | | June 1, 2014 | | |

| | |

| | — |

| | 7,876 |

| | 13,783 |

| | | | 294,000 |

|

| | | June 1, 2014 | | | | | | | | | | | | 31,503 |

| | 1,176,000 |

|

| John J. Hendrickson | | March 13, 2015 | | 1,462,500 |

| | 975,000 |

| | | | | | | | |

| | |

|

| | | June 1, 2014 | | |

| | |

| | — |

| | 5,197 |

| | 9,095 |

| | | | 194,000 |

|

| | | June 1, 2014 | | | | | | | | | | | | 20,788 |

| | 776,000 |

|

____________________________________

| |

| (1) | For metrics used in the determination of non-equity compensation, see "Compensation Discussion and Analysis - Annual Incentive Compensation." |

| |

| (2) | For a description of the metrics used to determine the minimum, target and maximum shares issuable at the end of the applicable performance period, see "Compensation Discussion and Analysis - Long-Term Incentive Compensation." |

| |

| (3) | Represents 50% of current year annual bonus pursuant to the terms of Mr. Atkin's employment agreement. |

Narrative Description of Summary Compensation Table and Grants of Plan-Based Awards

2005 Long-Term Incentive Plan

Our 2005 Amended and Restated Long-Term Incentive Plan (the "Plan") provides for the grant to our employees, consultants and directors of stock options, share appreciation rights ("SARs"), restricted shares, restricted share units, performance shares, performance share units, dividend equivalents, and other share-based awards. Subject to anti-dilution adjustments in the event of certain changes in the Company's capital structure, 903,292 shares remained available for issuance under the Plan as of December 31, 2014. To date, only non-qualified stock options, restricted shares, restricted share units and performance shares have been issued under the Plan.

The Plan is administered by the Compensation Committee of the Board of Directors. The Compensation Committee determines which employees, consultants and directors receive awards, the types of awards to be received and the terms and conditions thereof, including the vesting and exercisability provisions of the awards. However, the exercise price of stock options and SARs may not be less than the fair market value of the shares subject thereto on the date of grant, and their term may not be longer than ten years from the date of grant. Payment with respect to SARs may be made in cash or common shares, as determined by the Compensation Committee.