Western World Insurance Group INVESTOR PRESENTATION MAY 28, 2015

This presentation may include forward-looking statements, both with respect to us and our industry, that reflect our current views with respect to future events and financial performance. Statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “anticipate,” “will,” “may” and similar statements of a future or forward-looking nature identify forward-looking statements. All forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in such statements and, therefore, you should not place undue reliance on any such statements. We believe that these factors include, but are not limited to, the following: 1) unpredictability and severity of catastrophic events; 2) rating agency actions; 3) adequacy of our risk management and loss limitation methods; 4) cyclicality of demand and pricing in the insurance and reinsurance markets; 5) statutory or regulatory developments including tax policy, reinsurance and other regulatory matters; 6) our ability to implement its business strategy during “soft” as well as “hard” markets; 7) adequacy of our loss reserves; 8) continued availability of capital and financing; 9) retention of key personnel; 10) competition; 11) potential loss of business from one or more major insurance or reinsurance brokers; 12) our ability to implement, successfully and on a timely basis, complex infrastructure, distribution capabilities, systems, procedures and internal controls, and to develop accurate actuarial data to support the business and regulatory and reporting requirements; 13) general economic and market conditions (including inflation, volatility in the credit and capital markets, interest rates and foreign currency exchange rates); 14) the integration of businesses we may acquire or new business ventures we may start; 15) the effect on our investment portfolios of changing financial market conditions including inflation, interest rates, liquidity and other factors; 16) acts of terrorism or outbreak of war; and 17) availability of reinsurance and retrocessional coverage, as well as management’s response to any of the aforementioned factors. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the Risk Factors included in Validus Holdings, Ltd.'s most recent reports on Form 10-K and Form 10-Q and other documents on file with the Securities and Exchange Commission. Any forward-looking statements made in this presentation are qualified by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us or our business or operations. We undertake no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. Cautionary Note Regarding Forward-looking Statements 2

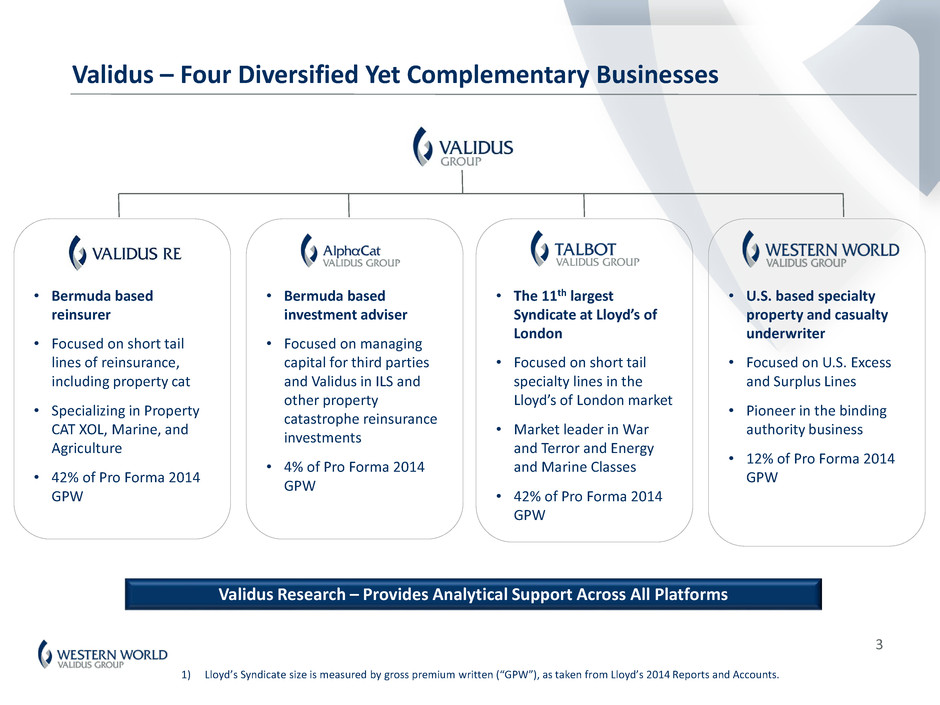

3 Validus – Four Diversified Yet Complementary Businesses • U.S. based specialty property and casualty underwriter • Focused on U.S. Excess and Surplus Lines • Pioneer in the binding authority business • 12% of Pro Forma 2014 GPW • Bermuda based investment adviser • Focused on managing capital for third parties and Validus in ILS and other property catastrophe reinsurance investments • 4% of Pro Forma 2014 GPW • The 11th largest Syndicate at Lloyd’s of London • Focused on short tail specialty lines in the Lloyd’s of London market • Market leader in War and Terror and Energy and Marine Classes • 42% of Pro Forma 2014 GPW • Bermuda based reinsurer • Focused on short tail lines of reinsurance, including property cat • Specializing in Property CAT XOL, Marine, and Agriculture • 42% of Pro Forma 2014 GPW Validus Research – Provides Analytical Support Across All Platforms 1) Lloyd’s Syndicate size is measured by gross premium written (“GPW”), as taken from Lloyd’s 2014 Reports and Accounts.

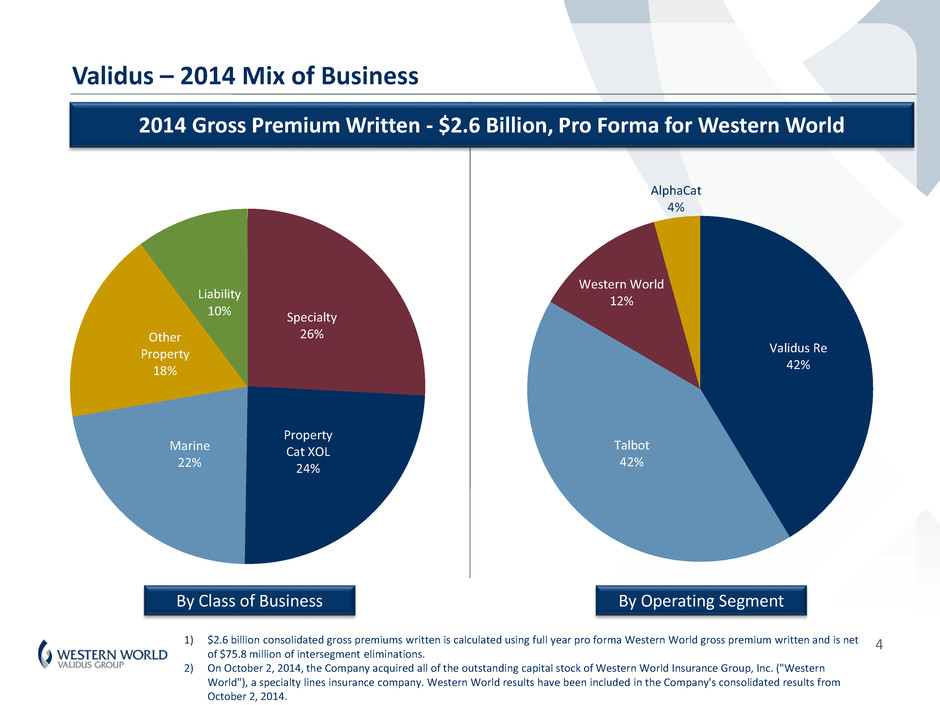

Validus – 2014 Mix of Business 2014 Gross Premium Written - $2.6 Billion, Pro Forma for Western World 1) $2.6 billion consolidated gross premiums written is calculated using full year pro forma Western World gross premium written and is net of $75.8 million of intersegment eliminations. 2) On October 2, 2014, the Company acquired all of the outstanding capital stock of Western World Insurance Group, Inc. ("Western World"), a specialty lines insurance company. Western World results have been included in the Company's consolidated results from October 2, 2014. Specialty 26% Property Cat XOL 24% Marine 22% Other Property 18% Liability 10% Validus Re 42% Talbot 42% Western World 12% AlphaCat 4% By Operating SegmentBy Class of Business 4

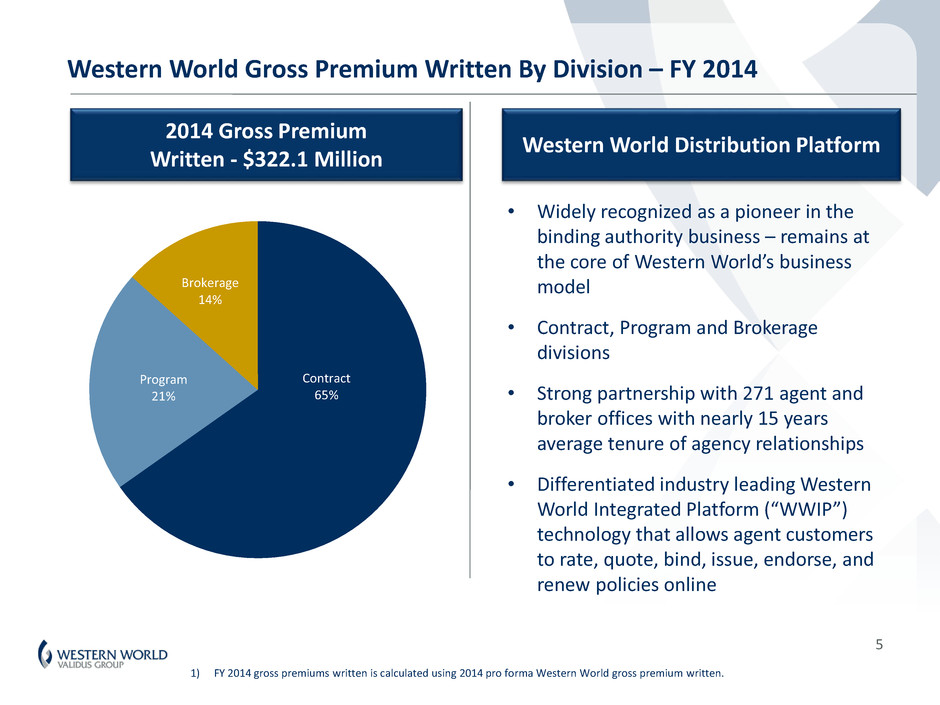

Western World Gross Premium Written By Division – FY 2014 2014 Gross Premium Written - $322.1 Million Western World Distribution Platform • Widely recognized as a pioneer in the binding authority business – remains at the core of Western World’s business model • Contract, Program and Brokerage divisions • Strong partnership with 271 agent and broker offices with nearly 15 years average tenure of agency relationships • Differentiated industry leading Western World Integrated Platform (“WWIP”) technology that allows agent customers to rate, quote, bind, issue, endorse, and renew policies online Contract 65% Program 21% Brokerage 14% 1) FY 2014 gross premiums written is calculated using 2014 pro forma Western World gross premium written. 5

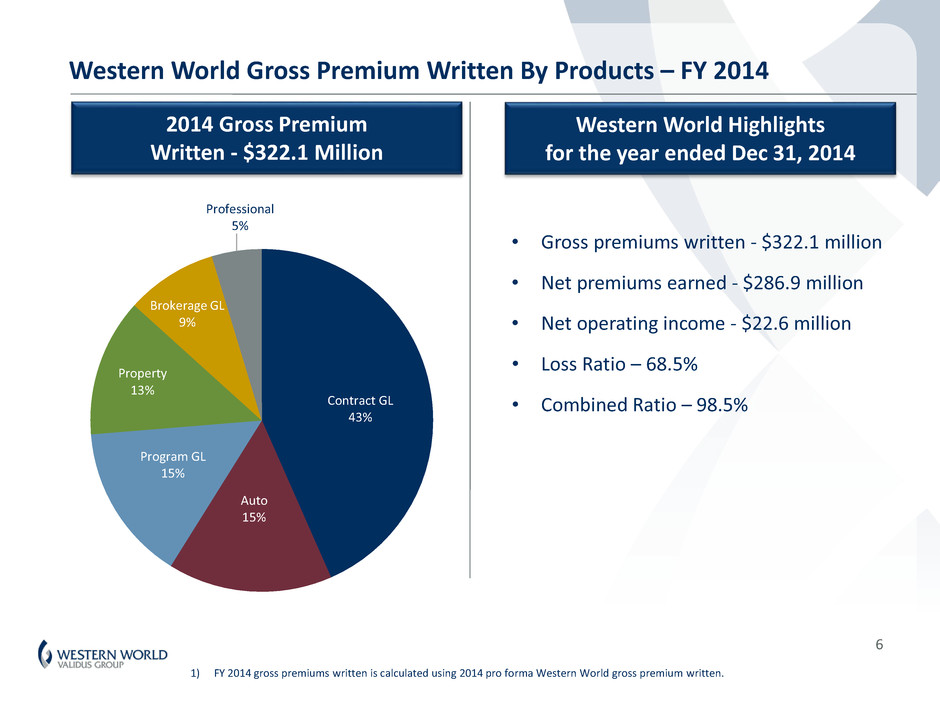

Western World Gross Premium Written By Products – FY 2014 2014 Gross Premium Written - $322.1 Million Western World Highlights for the year ended Dec 31, 2014 • Gross premiums written - $322.1 million • Net premiums earned - $286.9 million • Net operating income - $22.6 million • Loss Ratio – 68.5% • Combined Ratio – 98.5%Contract GL 43% Auto 15% Program GL 15% Property 13% Brokerage GL 9% Professional 5% 1) FY 2014 gross premiums written is calculated using 2014 pro forma Western World gross premium written. 6

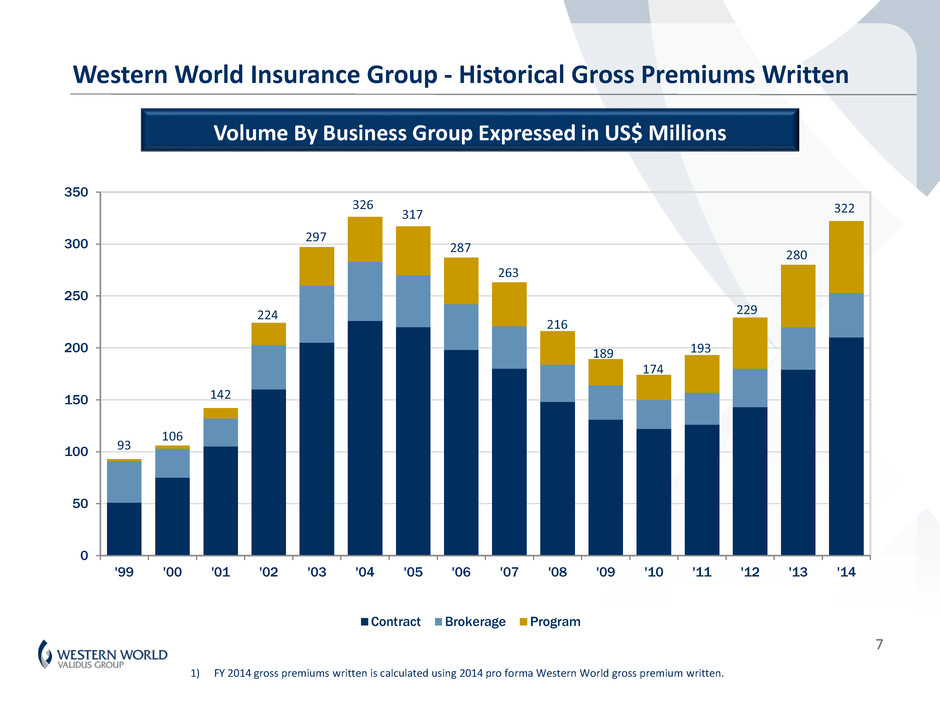

Western World Insurance Group - Historical Gross Premiums Written Volume By Business Group Expressed in US$ Millions 0 50 100 150 200 250 300 350 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 Contract Brokerage Program 93 106 142 224 297 326 317 287 263 216 189 174 193 229 280 322 1) FY 2014 gross premiums written is calculated using 2014 pro forma Western World gross premium written. 7

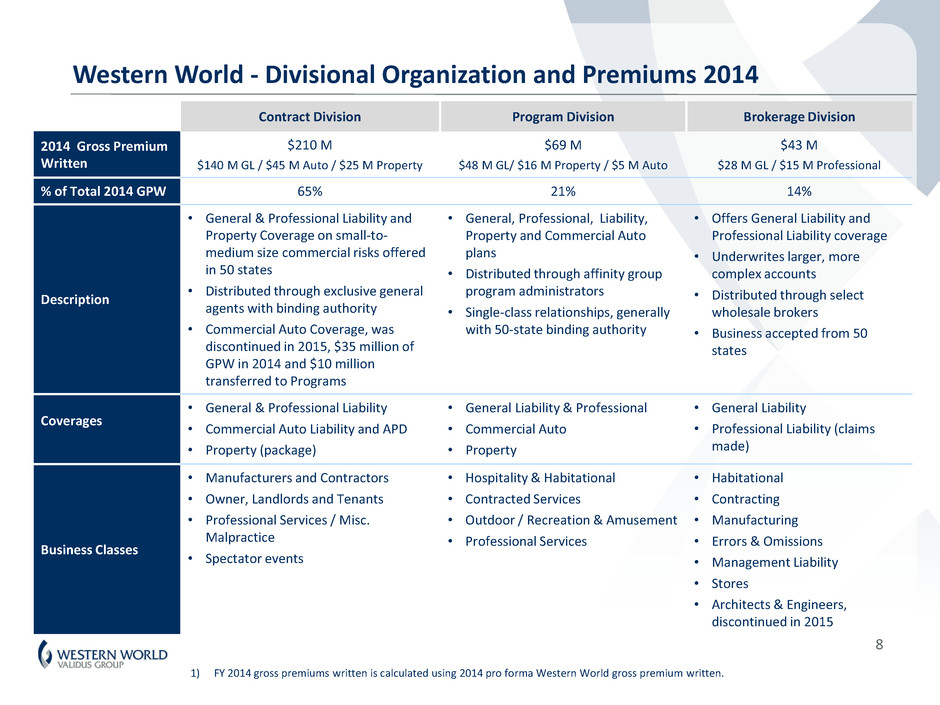

Western World - Divisional Organization and Premiums 2014 Contract Division Program Division Brokerage Division 2014 Gross Premium Written $210 M $140 M GL / $45 M Auto / $25 M Property $69 M $48 M GL/ $16 M Property / $5 M Auto $43 M $28 M GL / $15 M Professional % of Total 2014 GPW 65% 21% 14% Description • General & Professional Liability and Property Coverage on small-to- medium size commercial risks offered in 50 states • Distributed through exclusive general agents with binding authority • Commercial Auto Coverage, was discontinued in 2015, $35 million of GPW in 2014 and $10 million transferred to Programs • General, Professional, Liability, Property and Commercial Auto plans • Distributed through affinity group program administrators • Single-class relationships, generally with 50-state binding authority • Offers General Liability and Professional Liability coverage • Underwrites larger, more complex accounts • Distributed through select wholesale brokers • Business accepted from 50 states Coverages • General & Professional Liability • Commercial Auto Liability and APD • Property (package) • General Liability & Professional • Commercial Auto • Property • General Liability • Professional Liability (claims made) Business Classes • Manufacturers and Contractors • Owner, Landlords and Tenants • Professional Services / Misc. Malpractice • Spectator events • Hospitality & Habitational • Contracted Services • Outdoor / Recreation & Amusement • Professional Services • Habitational • Contracting • Manufacturing • Errors & Omissions • Management Liability • Stores • Architects & Engineers, discontinued in 2015 1) FY 2014 gross premiums written is calculated using 2014 pro forma Western World gross premium written. 8

Western World - Products and Premiums 2014 Product Type General Liability Occurrence • Written exclusively on an E&S basis in all states • Classes include general and artisan contractors, habitational risks, misc. professional and misc. malpractice, often packaged with property coverage • Limits of liability generally do not exceed $1 million and the majority of insureds are small-to medium size commercial businesses • The majority of business is distributed on a Contract and Program basis with binding authority. Business is also written on a transactional brokerage basis Commercial Auto • Commercial auto liability and physical damage coverage is currently offered in 39 states for small-to medium size commercial businesses • Commercial auto business is written on an E&S basis in several states where permitted by regulation • Major classes include tractor-trailers, food delivery program and tow trucks • Distributed on a Contract and Programs basis • As of 2015 Contract Auto was discontinued, $35 million premiums in 2014 Property • Written only on a package basis alongside the core general liability coverage • Concentrated in the owners, landlords and tenants classes with minimal catastrophe exposure • Distributed on a Contract and Programs basis in 2014 • As of 2015 Property is being written on a broker basis • Contract Property offering wind coverage in coastal states as of 2015 Professional Liability Claims Made • Major classes include Nonprofit D&O, A&E and misc. E&O • Concentration is on small to medium size risks • The majority of business is written on a transactional brokerage basis. Also distributed on a Contract and Programs basis with binding authority 9

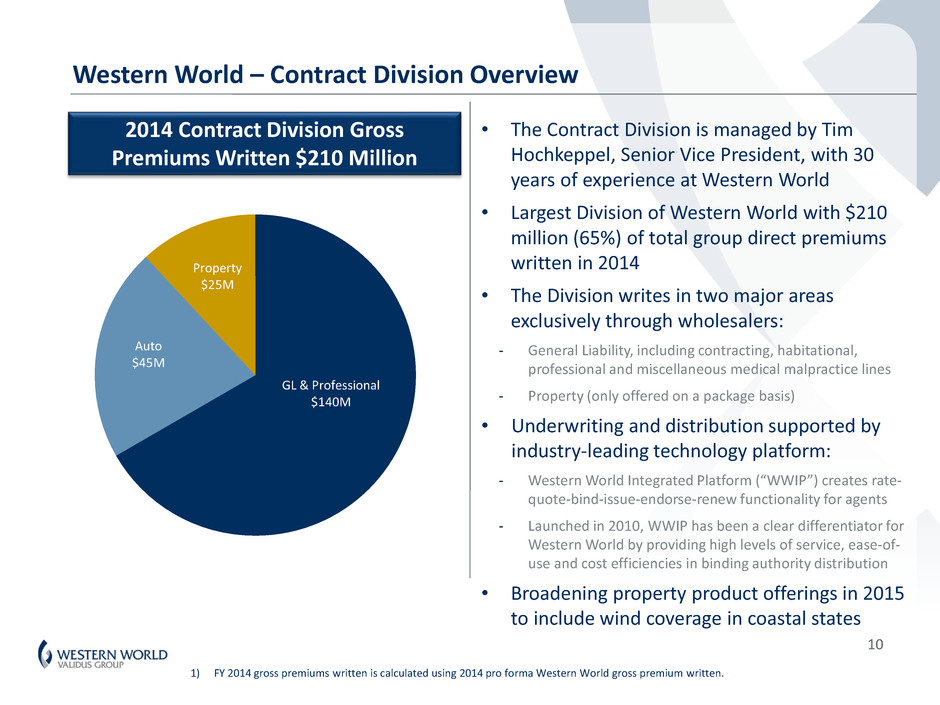

Western World – Contract Division Overview • The Contract Division is managed by Tim Hochkeppel, Senior Vice President, with 30 years of experience at Western World • Largest Division of Western World with $210 million (65%) of total group direct premiums written in 2014 • The Division writes in two major areas exclusively through wholesalers: - General Liability, including contracting, habitational, professional and miscellaneous medical malpractice lines - Property (only offered on a package basis) • Underwriting and distribution supported by industry-leading technology platform: - Western World Integrated Platform (“WWIP”) creates rate- quote-bind-issue-endorse-renew functionality for agents - Launched in 2010, WWIP has been a clear differentiator for Western World by providing high levels of service, ease-of- use and cost efficiencies in binding authority distribution • Broadening property product offerings in 2015 to include wind coverage in coastal states 2014 Contract Division Gross Premiums Written $210 Million GL & Professional $140M Auto $45M Property $25M 1) FY 2014 gross premiums written is calculated using 2014 pro forma Western World gross premium written. 10

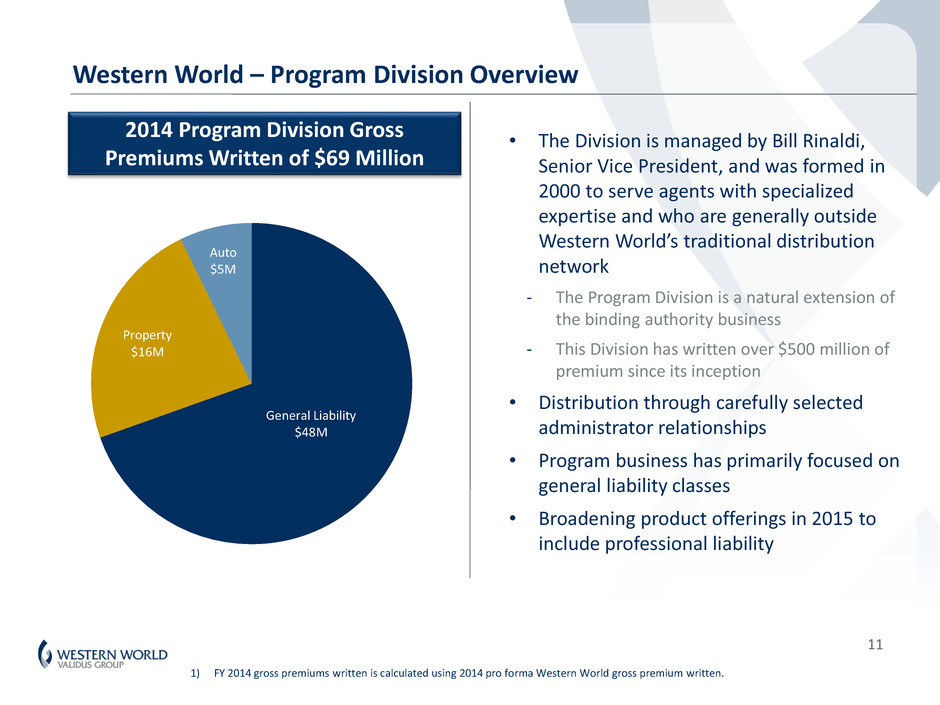

Western World – Program Division Overview • The Division is managed by Bill Rinaldi, Senior Vice President, and was formed in 2000 to serve agents with specialized expertise and who are generally outside Western World’s traditional distribution network - The Program Division is a natural extension of the binding authority business - This Division has written over $500 million of premium since its inception • Distribution through carefully selected administrator relationships • Program business has primarily focused on general liability classes • Broadening product offerings in 2015 to include professional liability 2014 Program Division Gross Premiums Written of $69 Million General Liability $48M Property $16M Auto $5M 1) FY 2014 gross premiums written is calculated using 2014 pro forma Western World gross premium written. 11

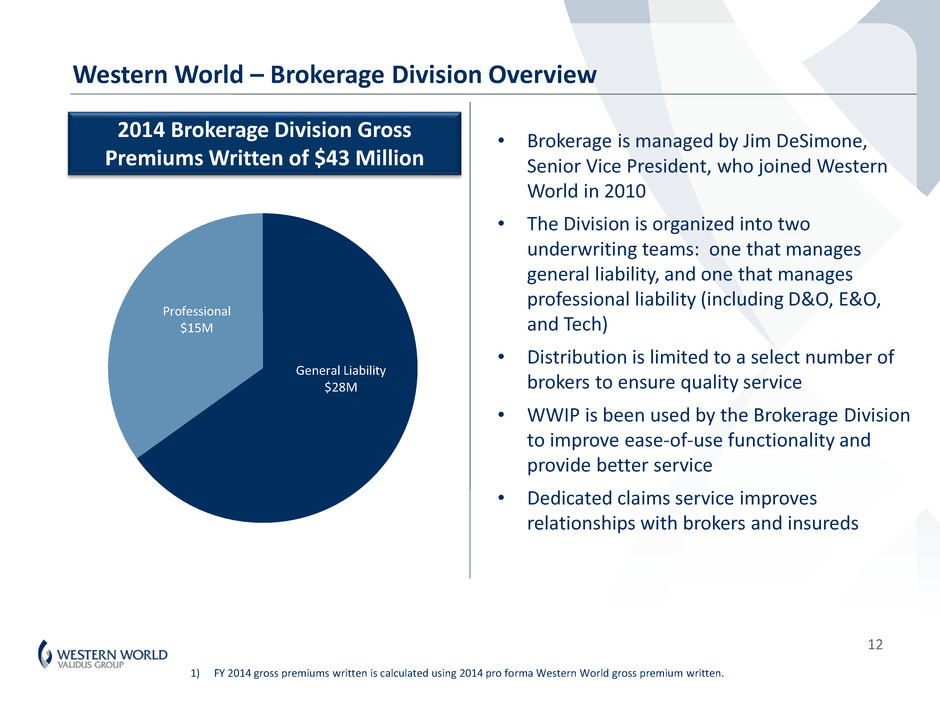

Western World – Brokerage Division Overview • Brokerage is managed by Jim DeSimone, Senior Vice President, who joined Western World in 2010 • The Division is organized into two underwriting teams: one that manages general liability, and one that manages professional liability (including D&O, E&O, and Tech) • Distribution is limited to a select number of brokers to ensure quality service • WWIP is been used by the Brokerage Division to improve ease-of-use functionality and provide better service • Dedicated claims service improves relationships with brokers and insureds 2014 Brokerage Division Gross Premiums Written of $43 Million General Liability $28M Professional $15M 1) FY 2014 gross premiums written is calculated using 2014 pro forma Western World gross premium written. 12

Western World – Validus Underwriters, Inc. • A newly formed E&S brokerage commercial property platform in the U.S., located in Boston, MA • The team is led by Bill Steinberg, Senior Vice President, and Steve Nadeau, Vice President, with the goal of becoming a consistent provider of E&S property capacity that underwrites profitably in all phases of the market • Wholesale distribution writing on Western World paper • Predominately cat exposed – wind and/or earthquake • Target space is “middle market” business with total insured values between $5 and $15 million and the number of locations between 1-10 13

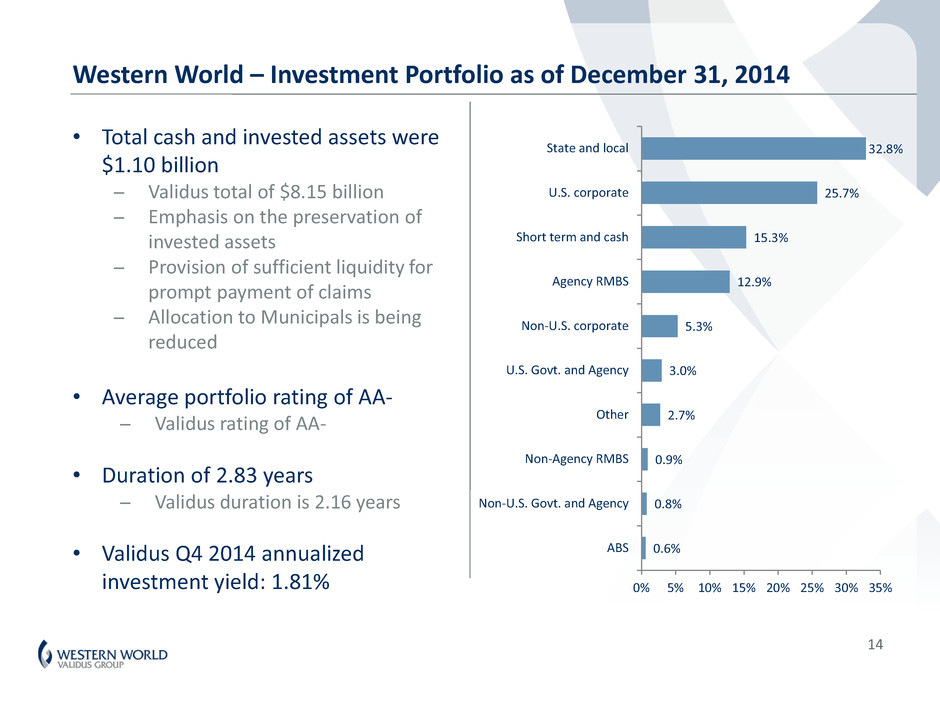

Western World – Investment Portfolio as of December 31, 2014 • Total cash and invested assets were $1.10 billion ̶ Validus total of $8.15 billion ̶ Emphasis on the preservation of invested assets ̶ Provision of sufficient liquidity for prompt payment of claims ̶ Allocation to Municipals is being reduced • Average portfolio rating of AA- ̶ Validus rating of AA- • Duration of 2.83 years ̶ Validus duration is 2.16 years • Validus Q4 2014 annualized investment yield: 1.81% 32.8% 25.7% 15.3% 12.9% 5.3% 3.0% 2.7% 0.9% 0.8% 0.6% 0% 5% 10% 15% 20% 25% 30% 35% State and local U.S. corporate Short term and cash Agency RMBS Non-U.S. corporate U.S. Govt. and Agency Other Non-Agency RMBS Non-U.S. Govt. and Agency ABS 14

Western World Insurance Group – Focus on 2015 & Beyond • Reviewing the underwriting performance in each division to improve underwriting profitability in 2015 – Ceased writing commercial auto in Contract Division – Terminated underperforming programs – Revised Brokerage general liability guidelines and selectively re-underwriting existing accounts • Enhance existing products and expand distribution in Contract, Programs and Brokerage • Expand product offering in short-tail products – Validus Underwriters (Boston) developing property brokerage product – Offering binding authority for wind coverage in catastrophe-exposed states on a packaged basis – Developing flood program • Leveraging the property capacity to increase general liability business in the Contract Division 15

In presenting the Company’s results herein, management has included and discussed certain schedules containing underwriting income (loss), net operating income (loss) available (attributable) to Validus, managed gross premiums written, annualized return on average equity and diluted book value per common share that are not calculated under standards or rules that comprise U.S. GAAP. Such measures are referred to as non-GAAP. Non-GAAP measures may be defined or calculated differently by other companies. We believe that these measures are important to investors and other interested parties. These measures should not be viewed as a substitute for those determined in accordance with U.S. GAAP. The underwriting results of an insurance or reinsurance company are often measured by reference to its underwriting income because underwriting income indicates the performance of the company’s core underwriting function. Underwriting income is reconciled to net income by the addition or subtraction of net investment income, finance expenses, transaction expenses, net realized gains (losses) on investments, net unrealized gains (losses) on investments, income (loss) from investment affiliates and foreign exchange gains (losses). Net operating income (loss) available (attributable) to Validus is calculated based on net income (loss) available (attributable) to Validus excluding net realized gains (losses), net unrealized gains (losses) on investments, income (loss) from investment affiliates, gains (losses) arising from translation of non-US$ denominated balances and non-recurring items. Net income is the most directly comparable GAAP measure. Net operating income focuses on the underlying fundamentals of our operations without the influence of realized gains (losses) from the sale of investments, net unrealized gains (losses) on investments, translation of non- US$ currencies and non-recurring items. Realized gains (losses) from the sale of investments are driven by the timing of the disposition of investments, not by our operating performance. Gains (losses) arising from translation of non-US$ denominated balances are unrelated to our underlying business. Investors should not rely on the information set forth in this presentation when considering an investment in the Company. The information contained in this presentation has not been audited nor has it been subject to independent verification. The estimates set forth herein speak only as of the date of this presentation and the Company undertakes no obligation to update or revise such information to reflect the occurrence of future events. The events presented reflect a specific set of prescribed calculations and do not necessarily reflect all events that may impact the Company. Notes on Non-GAAP and Other Financial and Exposure Measures 16

For more information on our company, products and management team please visit our website at: www.westernworld.com Address: 400 Parson’s Pond Drive Franklin Lakes NJ 07417-2600 USA Telephone: +1-201-847-8600 Email: investor.relations@validusholdings.com