Exhibit 99.2

AGREEMENT

OPTION AGREEMENT IN RESPECT OF THE

KALVISTA PHARMACEUTICALS LIMITED

ENTERPRISE MANAGEMENT INCENTIVES SCHEME

(1) KALVISTA PHARMACEUTICALS LIMITED

(2) [ ]

EMI OPTION

THIS DEED OF AGREEMENT is made the day of

BETWEEN:

(1) KALVISTA PHARMACEUTICALS LIMITED (registered number 7543947) whose registered office is 1 Venture Road, Southampton Science Park, Southampton, Hants, SO16 7NP (the “Company”); and

(2) [ ] of [EMPLOYEE ADDRESS] (the “Employee”).

WHEREAS

(A) The Company has agreed to grant to the Employee as at the date of this Agreement an Option to acquire ordinary shares of £0.001 each in the capital of the Company, on the terms set out in this Agreement.

(B) It is intended that this Option is granted under the provisions of Schedule 5 for commercial reasons in order to recruit or retain the Employee and is not granted as part of a scheme or arrangement the main purpose of which is to avoid tax and that it will be an EMI Option.

(D) The Employee is an eligible employee as defined in Part 4 of Schedule 5.

(E) The Company is a qualifying company as defined in Part 3 of Schedule 5.

(F) The Company will satisfy the exercise of the Option by issuing, transferring or procuring the transfer of Shares.

(G) The Option gives the Employee the right, subject to the terms of this Agreement, to acquire Shares but does not impose on the Employee any obligation to do so.

TERMS

1. The Rules contained in Appendix 1 to this Agreement shall be incorporated into this Agreement. Where there is any ambiguity or difference between the terms of the Agreement and the terms of the Rules, the terms of the Rules shall prevail. Terms defined in the Rules have the same meaning in the Agreement unless the context otherwise requires.

2. Subject to the provisions of this Agreement, the Company hereby grants to the Employee an Option to acquire up to [ ] Shares.

3. The Option Price shall be [ ].

4. Neither the Option nor any rights under it shall be transferable, chargeable or assignable except in accordance with the Rules, to the Employee’s personal representatives, following the Employee’s death.

5. The Employee hereby confirms that as at the date of this Agreement he does not hold any subsisting options granted by the Company or a member of the Group under a scheme approved under Schedule 4 to ITEPA.

6. Save as provided in the Rules, the Option, to the extent it has not lapsed, shall be exercisable in accordance with Rules 6, 7 and 9.

7. The Shares acquired on exercise of the Option are subject to the restrictions and provisions (including any conditions of forfeiture) set out in the Articles (a copy of which prevailing at the Date of Grant is attached at Appendix 3).

8. The Option shall Vest as follows:

8.1. as to 25% of the Shares the subject of the Option (rounded down to the nearest whole Share); and

8.2. as to the remainder of the Shares in 36 equal monthly instalments (in each case rounded down to the nearest whole Share save for the last instalment which is in respect of the remaining unvested Shares under Option) with the first instalment Vesting on .

9. The Option is not subject to any Performance Target(s).

10. The Employee hereby agrees that the provisions of Rule 7.3 shall apply in respect of the Option. In relation to Rule 7.3, the Employee hereby agrees to place the Company or, if different his Employer Company, in funds and to indemnify the relevant company in respect of all liability to employer’s social security including, but without limitation, to secondary class 1 (employer’s) national insurance contributions arising in respect of the Option.

11. The Employee agrees that, if the Directors so determine, the exercise of an Option shall be conditional on the Employee executing a tax election under section 431(1) of ITEPA to disapply fully the provisions of Chapter 2 of Part 7 of ITEPA in respect of restricted securities in such form as is approved by or agreed with HMRC under the terms of section 431(5) of ITEPA.

12. The Employee agrees to adhere to (including, if requested, by executing a deed of adherence) the terms of any applicable shareholders’ agreement or similar agreement (relevant extracts of which can be provided upon request) to which the Company may require him to adhere. The terms of any such agreement may be amended from time to time.

13. Without prejudice to any other term(s) contained in the Articles of Association of the Company, in the event of a Takeover, the Employee agrees, as a condition of exercise, to sell his Shares acquired as a result of the exercise of his Option on such reasonable terms as the Directors shall determine.

14. The Employee consents to the Company and (if different) his Employer Company from time to time collecting, holding and processing both electronically and manually, the data it collects, holds and/or processes which relate to the Employee for the purposes of the administration and management of its business and the administration of the Scheme.

2

15. It may be necessary for the Company and (if different) his Employer Company from time to time to forward personal information relating to the Employee outside the European Economic Area for processing data required for the purposes of the Scheme, and the Employee consents to the Company doing this as may be necessary.

16. The Employee hereby acknowledges that the Company is under no obligation to conduct the business of the Company in such a way as to ensure that a Disqualifying Event does not occur. Furthermore, the Employee agrees that he shall have no claim against the Company arising in relation to the change in the tax treatment of the Employee in respect of the EMI Option following a Disqualifying Event occurring. Although the Company intends this Option to rank as an EMI Option, no warranty is given by the Company that this Option does in fact qualify as an EMI Option nor that it will continue to so qualify up until the time when the Employee exercises this Option and subsequently sells the Shares acquired pursuant to this Option.

| | | | |

| EXECUTED AS A DEED by | | ) | | |

| for and on behalf of | | ) | | |

| KALVISTA PHARMACEUTICALS LIMITED | | ) | | |

| | ) | | |

| | | | Director |

| | | | Director/Company Secretary |

3

| | | | |

| EXECUTED AS A DEED by | | ) | | |

| [ ] | | ) | | |

in the presence of

|

|

|

| Witness Signature |

|

|

| Witness Name (PRINT) |

|

| Witness Address |

|

|

|

|

|

|

|

| Witness occupation |

|

|

To be completed in the presence of an independent witness (i.e. not a family member or spouse) who should be over 18. The witness should also sign where indicated and give details of his/her name, address and occupation.

4

APPENDIX 1

RULES OF THE KALVISTA PHARMACEUTICALS

ENTERPRISE MANAGEMENT INCENTIVES SCHEME

APPENDIX 2

APPENDIX 2

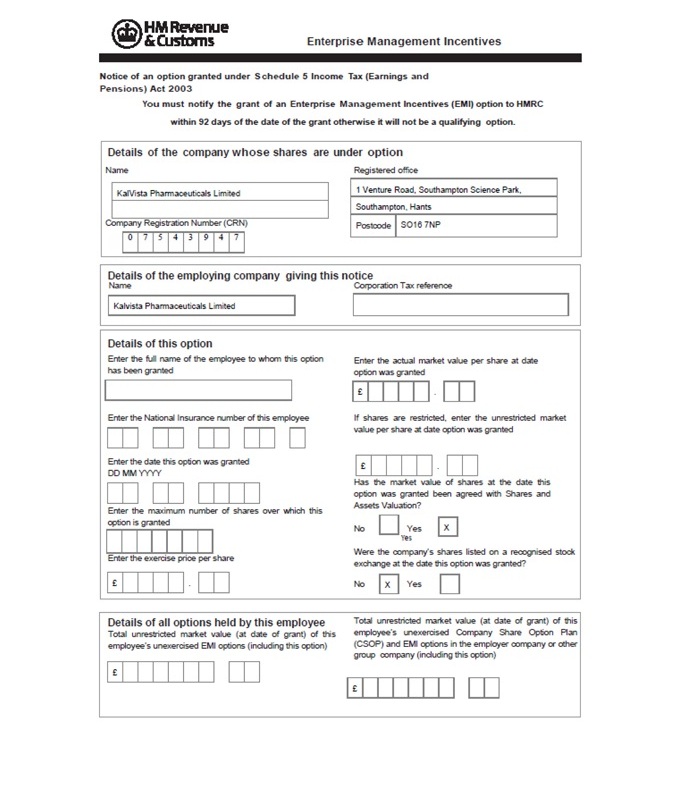

HM Revenue & Customs

Enterprise Management Incentives

Notice of an option granted under Schedule 5 Income Tax (Earnings and Pensions) Act 2003

You must notify the grant of an Enterprise Management Incentives (EMI) option to HMRC within 92 days of the date of the grant otherwise it will not be a qualifying option.

Details of the company whose shares are under option

Name

KalVista Pharmaceuticals Limited

Company Registration Number (CRN)

07543947

Registered office

1 Venture Road, Southampton Science Park,

Southampton, Hants

Postcode SO16 7NP

Details of the employing company giving this notice

Name

Kalvista Pharmaceuticals Limited

Corporation Tax reference

Details of the option

Enter the full name of the employee to whom this option has been granted

Enter the actual market value per share at date option was granted

£

Enter the National Insurance number of this employee

If shares are restricted, enter the unrestricted market value per share at date option was granted

£

Enter the date this option was granted

DD MM YYYY

Enter the maximum number of shares over which this option is granted

Enter the exercise price per share

£

Has the market value of shares at the date this option was granted been agreed with Shares and Assets Valuation?

No Yes Yes X

Were the company’s shares listed on a recognized stock exchange at the date this option was granted?

No X Yes

Details of all options held by this employee

Total unrestricted market value (at date of grant) of this employee’s unexercised EMI options (including this option)

£

Total unrestricted market value (at date of grant) of this employee’s unexercised Company Share Option Plan (CSOP) and EMI options in the employer company or other group company (including this option)

£

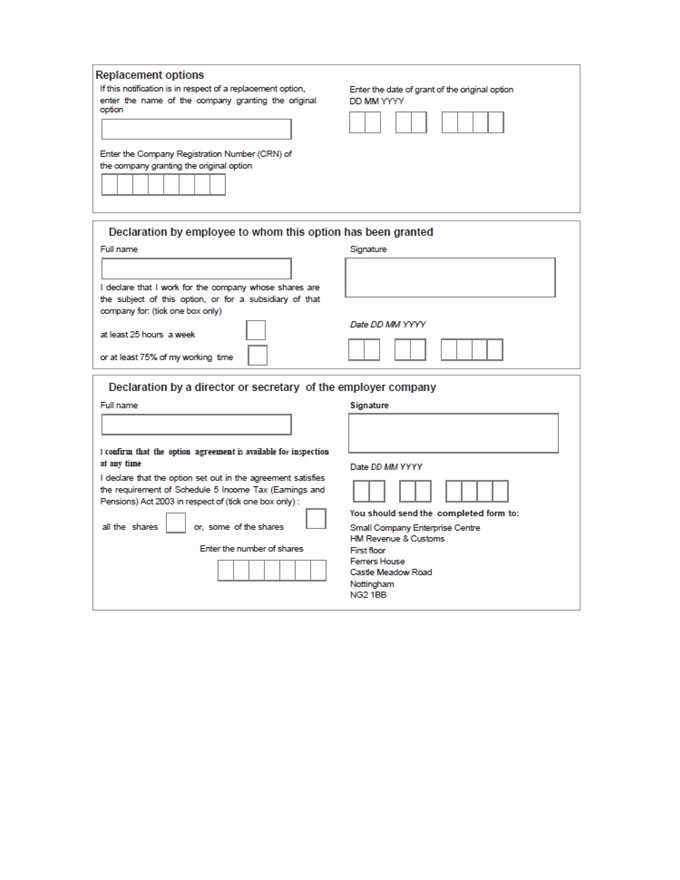

Replacement options

If this notification is in respect of an replacement option, enter the name of the company granting the original option

Enter the Company Registration Number (CRN) of the company granting the original option

Enter the date of grant of the original option DD MM YYYY

Declaration by employee to whom this option has been granted

Full name

Signature

I declare that I work for the company whose shares are the subject of this option, or for a subsidiary of that company for; (tick one box only)

at least 25 hours a week

or at least 75% of my working time

Date DD MM YYYY

Declaration by a director or secretary of the employer company

Full name

I confirm that the option agreement is available for inspection at any time

I declare that the option set out in the agreement satisfies the requirement of Schedule 5 Income Tax (Earnings and Pensions) Act 2003 in respect of (tick one box only):

all the shares or, some of the shares

Enter the number of shares

Signature

Date DD MM YYYY

You should send the completed form to:

Small Company Enterprise Centre

HM Revenue & Customs

First floor

Ferrers House

Castle Meadow Road

Nottingham

NG2 1BB

2

APPENDIX 3

ARTICLES OF ASSOCIATION

Provided Upon Request