QuickLinks -- Click here to rapidly navigate through this documentSubject to Completion and Modification

SLM FUNDING LLC HAS FILED A REGISTRATION STATEMENT (INCLUDING A PROSPECTUS) WITH THE SEC FOR THE OFFERING TO WHICH THIS COMMUNICATION RELATES. BEFORE YOU INVEST, YOU SHOULD READ THE PROSPECTUS IN THAT REGISTRATION STATEMENT AND THE OTHER DOCUMENTS SLM FUNDING LLC HAS FILED WITH THE SEC FOR MORE COMPLETE INFORMATION ABOUT SLM FUNDING LLC AND THIS OFFERING. YOU MAY GET THESE DOCUMENTS FOR FREE BY VISITING EDGAR ON THE SEC WEB SITE AT WWW.SEC.GOV. ALTERNATIVELY, SLM FUNDING LLC, ANY UNDERWRITER OR ANY DEALER PARTICIPATING IN THE OFFERING WILL ARRANGE TO SEND YOU THE PROSPECTUS IF YOU REQUEST IT BY CALLING 1-800-321-7179.

Term Sheet

$2,244,052,000

SLM Private Credit Student Loan Trust 2006-A

Issuing Entity

SLM Funding LLC

Depositor

Sallie Mae, Inc.

Sponsor, Servicer and Administrator

Student Loan-Backed Notes

On April 6, 2006, the trust will issue:

Class

| | Principal

| | Interest Rate

| | Maturity

|

|---|

| Floating Rate Class A-1 Notes | | $ | 434,000,000 | | 3-month LIBOR plus % | | March 16, 2020 |

| Floating Rate Class A-2 Notes | | $ | 207,000,000 | | 3-month LIBOR plus % | | December 15, 2020 |

| Floating Rate Class A-3 Notes | | $ | 355,000,000 | | 3-month LIBOR plus % | | June 15, 2022 |

| Floating Rate Class A-4 Notes | | $ | 373,267,000 | | 3-month LIBOR plus % | | December 15, 2023 |

| Floating Rate Class A-5 Notes | | $ | 700,000,000 | | 3-month LIBOR plus % | | June 15, 2039 |

| Floating Rate Class B Notes | | $ | 73,297,000 | | 3-month LIBOR plus % | | June 15, 2039 |

| Floating Rate Class C Notes | | $ | 101,488,000 | | 3-month LIBOR plus % | | June 15, 2039 |

The trust will make payments primarily from collections on a pool of private credit student loans. Private credit student loans are education loans made to students or parents of students that are not guaranteed or reinsured under the Federal Family Education Loan Program or any other federal student loan program. Payments on the notes will be made quarterly on the 15th day of each March, June, September and December, beginning on June 15, 2006. In general, the trust will pay principal, sequentially, to the class A-1 through class A-5 notes, in that order, until each such class is paid in full. Neither the class B nor the class C notes will receive principal until the stepdown date, which is expected to be the June 2011 quarterly distribution date. Payments of interest on the class B notes will be subordinate to the payment of interest and, to the extent described in the initial free-writing prospectus, to payments of principal on the class A notes. Payments of principal on the class B notes will be subordinate to the payment of both interest and principal on the class A notes. Payments of interest on the class C notes will be subordinate to the payment of interest and, to the extent described in the initial free-writing prospectus, to payments of principal on the class A and class B notes. Payments of principal on the class C notes will be subordinate to the payment of both interest and principal on the class A and class B notes. Credit enhancement for the notes consists of overcollateralization, cash on deposit in a reserve account and, for the class A notes, the subordination of the class B and class C notes and, for the class B notes, the subordination of the class C notes, as described in the initial free-writing prospectus. The trust will enter into two basis swap agreements. The trust will also make a deposit into a cash capitalization account, which will be available for a limited period of time. A description of how LIBOR is determined appears under "Additional Information Regarding the Notes—Determination of Indices—LIBOR" in the base prospectus.

We are offering the notes through the underwriters when and if issued. Application has been made for the notes to be listed on the Official List of the Luxembourg Stock Exchange and to be traded on the Luxembourg Stock Exchange's Euro MTF Market.

We are not offering the notes in any state or other jurisdiction where the offer is prohibited.

The notes are asset-backed securities issued by and are obligations of the issuing entity, which is a trust. They are not obligations of or interests in SLM Corporation, the sponsor, the administrator, the servicer, the depositor, any seller or any of their affiliates.

The notes are not guaranteed or insured by the United States or any governmental agency.

This term sheet constitutes a "free-writing prospectus" within the meaning of Rule 405 under the Securities Act of 1933, as amended.

Joint Book-Runners

| Credit Suisse | | Deutsche Bank Securities | | Merrill Lynch & Co. |

March 30, 2006

The Information in this Term Sheet

The information contained herein refers to and supplements certain of the information contained in the Free-Writing Prospectus, dated March 28, 2006 (the "initial free-writing prospectus"). Capitalized terms not defined herein shall have the meanings ascribed to such terms in the initial free-writing prospectus.

THE ISSUING ENTITY WILL NOT ISSUE EITHER THE CLASS A-3B NOTES OR THE CLASS A-4B NOTES REFERRED TO IN THE INITIAL FREE-WRITING PROSPECTUS. CONSEQUENTLY, (1) THERE WILL BE NO CLASSES OF AUCTION RATE NOTES, (2) THERE WILL BE NO AUCTION AGENT OR BROKER-DEALERS; (3) NO FUTURE DISTRIBUTION ACCOUNT WILL BE CREATED OR FUNDED AND (4) ANY OTHER TERMS AND CONDITIONS SET FORTH IN THE INITIAL FREE-WRITING PROSPECTUS THAT ARE APPLICABLE ONLY TO AUCTION RATE NOTES WILL NOT APPLY. THE CLASS A-3A NOTES REFERRED TO IN THE INITIAL FREE-WRITING PROSPECTUS ARE REFERRED TO IN THIS TERM SHEET AS THE CLASS A-3 NOTES. THE CLASS A-4A NOTES REFERRED TO IN THE INITIAL FREE-WRITING PROSPECTUS ARE REFERRED TO IN THIS TERM SHEET AS THE CLASS A-4 NOTES. THE FINAL STRUCTURE AND PRIORITY OF DISTRIBUTIONS ARE SET FORTH HEREIN.

The Notes

The trust is offering the following classes of notes, which are debt obligations of the trust:

Class A Notes:

- •

- Floating Rate Class A-1 Student Loan-Backed Notes in the amount of $434,000,000;

- •

- Floating Rate Class A-2 Student Loan-Backed Notes in the amount of $207,000,000;

- •

- Floating Rate Class A-3 Student Loan-Backed Notes in the amount of $355,000,000;

- •

- Floating Rate Class A-4 Student Loan-Backed Notes in the amount of $373,267,000; and

- •

- Floating Rate Class A-5 Student Loan-Backed Notes in the amount of $700,000,000.

Class B Notes:

- •

- Floating Rate Class B Student Loan-Backed Notes in the amount of $73,297,000.

Class C Notes:

- •

- Floating Rate Class C Student Loan-Backed Notes in the amount of $101,488,000.

Closing Date. The closing date for this offering will be April 6, 2006.

Interest Rates. The spreads to LIBOR for the notes will be set at the time of pricing.

Pricing Date. On or after March 31, 2006.

Initial Accrual Period: The initial accrual period for the notes will begin on the closing date and end on June 14, 2006, the day before the first quarterly distribution date. For each class of notes, LIBOR for the first accrual period will be determined by the following formula:

1

x = two-month LIBOR, and

y = three-month LIBOR.

Stepdown Date. The stepdown date is the earlier to occur of (a) the June 2011 quarterly distribution date, and (b) the quarterly distribution date following that date on which the outstanding balance of the class A notes is reduced to zero.

Maturity Dates. Each class of notes will mature no later than the date set forth for that class in the table below:

Class

| | Maturity Date

|

|---|

| Class A-1 | | March 16, 2020 |

| Class A-2 | | December 15, 2020 |

| Class A-3 | | June 15, 2022 |

| Class A-4 | | December 15, 2023 |

| Class A-5 | | June 15, 2039 |

| Class B | | June 15, 2039 |

| Class C | | June 15, 2039 |

Identification Numbers

The notes will have the following CUSIP Numbers and ISIN:

CUSIP Numbers

- •

- Class A-1 Notes: 78443C CE 2

- •

- Class A-2 Notes: 78443C CF 9

- •

- Class A-3 Notes: 78443C CG 7

- •

- Class A-4 Notes: 78443C CJ 1

- •

- Class A-5 Notes: 78443C CL 6

- •

- Class B Notes: 78443C CM 4

- •

- Class C Notes: 78443C CN 2

International Securities Identification Numbers (ISIN)

- •

- Class A-1 Notes: US78443CCE21

- •

- Class A-2 Notes: US78443CCF95

- •

- Class A-3 Notes: US78443CCG78

- •

- Class A-4 Notes: US78443CCJ18

- •

- Class A-5 Notes: US78443CCL63

- •

- Class B Notes: US78443CCM47

- •

- Class C Notes: US78443CCN20

The European Common Codes will be set forth in the prospectus supplement for these notes.

2

Capitalization of the Trust

| Floating Rate Class A-1 Student Loan-Backed Notes | | $ | 434,000,000 |

| Floating Rate Class A-2 Student Loan-Backed Notes | | | 207,000,000 |

| Floating Rate Class A-3 Student Loan-Backed Notes | | | 355,000,000 |

| Floating Rate Class A-4 Student Loan-Backed Notes | | | 373,267,000 |

| Floating Rate Class A-5 Student Loan-Backed Notes | | | 700,000,000 |

| Floating Rate Class B Student Loan-Backed Notes | | | 73,297,000 |

| Floating Rate Class C Student Loan-Backed Notes | | | 101,488,000 |

| Equity | | | 100 |

| | |

|

| Total | | $ | 2,244,052,100 |

| | |

|

Information About the Trust

Collection Account Initial Deposit. On the closing date, the trust will make an initial deposit from the net proceeds of the sale of the notes into the collection account in cash or eligible investments equal to approximately $2,300,000 plus the excess, if any, of the pool balance as of the statistical cutoff date over the pool balance as of the closing date.

Reserve Account Initial Deposit. On the closing date, the trust will make an initial deposit from the net proceeds of the sale of the notes into the reserve account in cash or eligible investments equal to approximately $5,000,679.

Specified Reserve Account Balance. The amount required to be on deposit in the reserve account at any time, or the specified reserve account balance, is the lesser of $5,000,679 and the outstanding balance of the notes.

Cash Capitalization Account

The cash capitalization account will be created with an initial deposit by the trust on the closing date of cash or eligible investments in an amount equal to $255,000,000. The initial deposit into the cash capitalization account will not be replenished.

Amounts held from time to time in the cash capitalization account will be held for the benefit of the noteholders. Funds will be withdrawn from the cash capitalization account on any quarterly distribution date prior to the September 2010 quarterly distribution date to the extent that the amount of Available Funds on the quarterly distribution date is insufficient to pay items (1) through (10) under "—Distributions—Quarterly Distributions from the Collection Account" set forth in the initial free-writing prospectus.

The cash capitalization account is intended to enhance the likelihood of timely distributions of interest and certain payments of principal to the noteholders through the September 2010 quarterly distribution date.

On each quarterly distribution date from the March 2008 quarterly distribution date through the December 2008 quarterly distribution date, any amount on deposit in the cash capitalization account (equal to "CI" for such quarterly distribution date in the definition of "Asset Balance" in the Glossary of the initial free-writing prospectus) that is in excess of 5.50% of the Asset Balance on the closing date (including the initial deposit into the collection account) will be released to the collection account and treated as Available Funds if:

- •

- the sum of (1) the Pool Balance as of the last day of the second preceding collection period and (2) the amount on deposit in the cash capitalization account immediately following the preceding

3

quarterly distribution date, minus the aggregate outstanding balance of the notes immediately following the preceding quarterly distribution date, is greater than or equal to $11,219,599, which is the amount of overcollateralization that existed on the closing date; and

- •

- at least 45% of the trust student loans by principal balance are in repayment and are not more than 30 days past due as of the end of the collection period for the current quarterly distribution date.

On each quarterly distribution date from the March 2009 quarterly distribution date through the December 2009 quarterly distribution date, any amount on deposit in the cash capitalization account (equal to "CI" for such quarterly distribution date in the definition of "Asset Balance" in the Glossary of the initial free-writing prospectus) that is in excess of 3.50% of the Asset Balance on the closing date (including the initial deposit into the collection account) will be released to the collection account and treated as Available Funds if:

- •

- the sum of (1) the Pool Balance as of the last day of the second preceding collection period and (2) the amount on deposit in the cash capitalization account immediately following the preceding quarterly distribution date, minus the aggregate outstanding balance of the notes immediately following the preceding quarterly distribution date, is greater than or equal to $22,439,199, which is twice the amount of overcollateralization that existed on the closing date; and

- •

- at least 60% of the trust student loans by principal balance are in repayment and are not more than 30 days past due as of the end of the collection period for the current quarterly distribution date.

On each quarterly distribution date from the March 2010 quarterly distribution date through the September 2010 quarterly distribution date, any amount on deposit in the cash capitalization account (equal to "CI" for such quarterly distribution date in the definition of "Asset Balance" in the Glossary of the initial free-writing prospectus) that is in excess of 1.50% of the Asset Balance on the closing date (including the initial deposit into the collection account) will be released to the collection account and treated as Available Funds if:

- •

- the sum of (1) the Pool Balance as of the last day of the second preceding collection period and (2) the amount on deposit in the cash capitalization account immediately following the preceding quarterly distribution date, minus the aggregate outstanding balance of the notes immediately following the preceding quarterly distribution date, is greater than or equal to $22,439,199, which is twice the amount of overcollateralization that existed on the closing date; and

- •

- at least 80% of the trust student loans by principal balance are in repayment and are not more than 30 days past due as of the end of the collection period for the current quarterly distribution date.

Any amount remaining on deposit in the cash capitalization account on the September 2010 quarterly distribution date will be released to the collection account and treated as Available Funds.

Monthly Distributions from the Collection Account. There will be no monthly distributions from the collection account for deposits into the future distribution account.

Quarterly Distributions from the Collection Account. On or before each monthly servicing payment date that is not a quarterly distribution date, the administrator will instruct the indenture trustee to pay to the servicer the primary servicing fee due for the period from and including the preceding monthly servicing payment date from amounts on deposit in the future distribution account (with respect to funds allocated to the servicer) and, if amounts on deposit therein are insufficient, from the collection account.

4

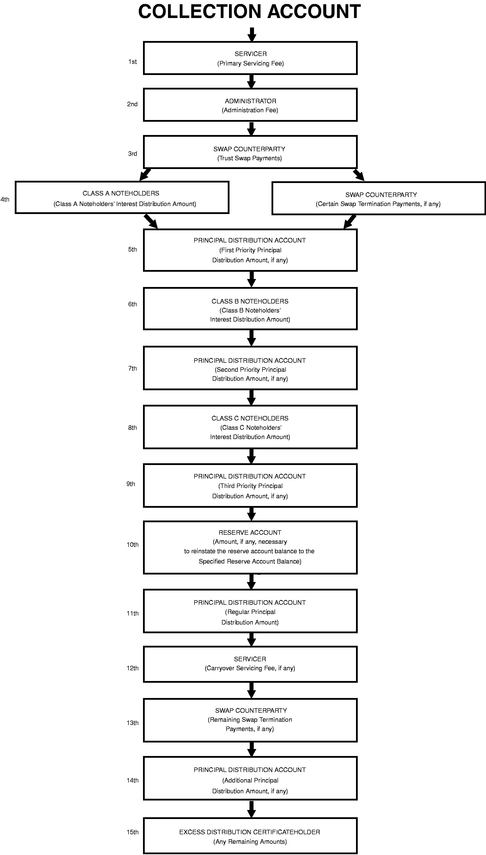

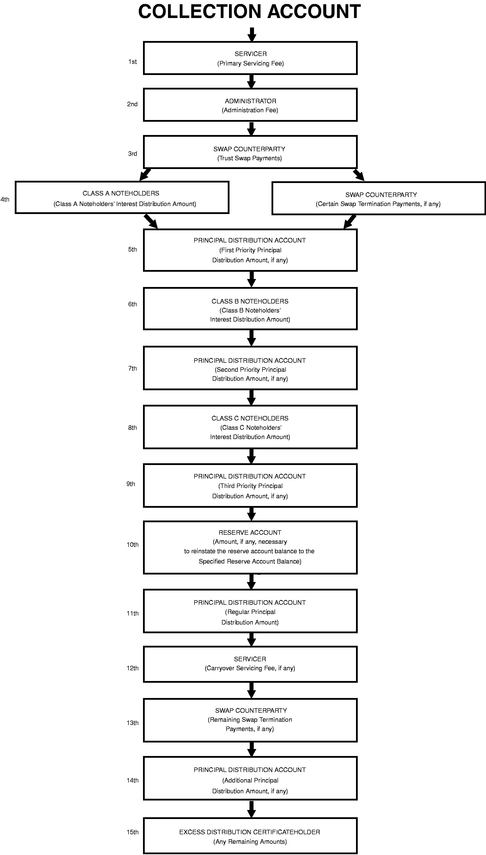

On each quarterly distribution date, the administrator will instruct the indenture trustee to make the deposits and distributions set forth in items (1) through (15) below, in the amounts and in the order of priority shown below, except as otherwise provided under"Principal Distributions." These deposits and distributions will be made to the extent of the Available Funds for that quarterly distribution date, plus funds, if any, deposited into the collection account from the cash capitalization account for payment of items (1) through (9); and funds, if any, deposited into the collection account from the reserve account for payment of items (1) through (4), (6) and (8) and on the respective maturity date of each class of notes, items (5), (7) and (9) to the extent necessary to reduce the outstanding balance of the related class of notes to zero:

- (1)

- to the servicer, the primary servicing fee due on that distribution date;

- (2)

- to the administrator, the administration fee due on that distribution date plus any unpaid administration fees from previous distribution dates;

- (3)

- to the swap counterparty, any swap payments payable to the swap counterparty by the trust under the swap agreements;

- (4)

- pro rata, based on the aggregate principal balance of the notes and the amount of any swap termination payment due and payable by the trust to the swap counterparty under this item (4):

- (a)

- to the class A noteholders, the Class A Noteholders' Interest Distribution Amount; and

- (b)

- to the swap counterparty, the amount of any swap termination payment due to the swap counterparty under the swap agreements due to a swap termination event resulting from a payment default by the trust or the insolvency of the trust; provided, that if any amounts allocable to the class A notes are not needed to pay the Class A Noteholders' Interest Distribution Amount as of such quarterly distribution date, such amounts will be applied to pay the portion, if any, of any swap termination payment referred to above remaining unpaid;

- (5)

- to the principal distribution account (for distribution as described under "Principal Distributions" below), the First Priority Principal Distribution Amount, if any;

- (6)

- to the class B noteholders, the Class B Noteholders' Interest Distribution Amount;

- (7)

- to the principal distribution account (for distribution as described under "Principal Distributions" below), the Second Priority Principal Distribution Amount, if any;

- (8)

- to the class C noteholders, the Class C Noteholders' Interest Distribution Amount;

- (9)

- to the principal distribution account (for distribution as described under "Principal Distributions" below), the Third Priority Principal Distribution Amount, if any;

- (10)

- to the reserve account, the amount required to reinstate the amount in the reserve account up to the Specified Reserve Account Balance;

- (11)

- to the principal distribution account (for distribution as described under "Principal Distributions" below), the Regular Principal Distribution Amount;

- (12)

- to the servicer, all carryover servicing fees, if any;

- (13)

- to the swap counterparty, the amount of any swap termination payments owed by the trust to the swap counterparty under the swap agreements and not payable in item (4) above;

- (14)

- to the principal distribution account (for distribution as described under "Principal Distributions" below), the Additional Principal Distribution Amount, if any; and

- (15)

- to the excess distribution certificateholder, any remaining funds.

The chart on the following page illustrates the application of funds in the collection account as described in this term sheet:

5

6

Principal Distributions. On each quarterly distribution date, the indenture trustee will pay principal on the notes from amounts on deposit in the principal distribution account.

With respect to each quarterly distribution date (a) before the Stepdown Date or (b) with respect to which a Trigger Event is in effect, the holders of the class A notes will be entitled to receive 100% of the Principal Distribution Amount for such quarterly distribution date, paid sequentially, first, to the class A-1 notes, second, to the class A-2 notes, third, to the class A-3 notes, fourth, to the class A-4 notes, and fifth, to the class A-5 notes, until the balances thereof have been reduced to zero;provided,however, that on any quarterly distribution date on which the Class A Note Parity Trigger is in effect, the Principal Distribution Amount will be distributed pro rata (based on the outstanding balances of the class A notes) to the class A-1 notes, class A-2 notes, class A-3 notes, class A-4 notes and class A-5 notes, until the balances thereof have been reduced to zero. Once the balances of the class A notes have been reduced to zero, the holders of the class B notes will be entitled to receive 100% of the Principal Distribution Amount for that quarterly distribution date until the balance of the class B notes has been reduced to zero. Similarly, if the balance of the class B notes has been reduced to zero, the holders of the class C notes will be entitled to receive 100% of the Principal Distribution Amount for that quarterly distribution date until the balance of the class C notes has been reduced to zero.

On each quarterly distribution date (a) on or after the Stepdown Date and (b) as long as a Trigger Event is not in effect, the holders of all classes of notes will be entitled to receive payments of principal, in the order of priority and in the amounts set forth below and to the extent of the funds in the principal distribution account:

First, an amount up to the Class A Noteholders' Principal Distribution Amount will be distributed sequentially, first, to the class A-1 notes, second, to the class A-2 notes, third, to the class A-3 notes, fourth, to the class A-4 notes, and fifth, to the class A-5 notes, until the balances thereof have been reduced to zero;provided, however, that on any quarterly distribution date on which the Class A Note Parity Trigger is in effect, the Principal Distribution Amount will be distributed pro rata (based on the outstanding balances of the class A notes) to the class A-1 notes, class A-2 notes, class A-3 notes, class A-4 notes and class A-5 notes, until the balances thereof have been reduced to zero;

Second, amounts remaining in the principal distribution account up to the Class B Noteholders' Principal Distribution Amount will be distributed to the class B notes, until the balance thereof has been reduced to zero;

Third, amounts remaining in the principal distribution account up to the Class C Noteholders' Principal Distribution Amount will be distributed to the class C notes, until the balance thereof has been reduced to zero; and

Fourth, amounts remaining in the principal distribution account after making all of the distributions in clausesFirst,Second andThird, above will be paid to the class C notes until the balance of the class C notes has been reduced to zero. Once the balance of the class C notes has been reduced to zero, holders of the class B notes will be entitled to receive all remaining amounts until the balance of the class B notes has been reduced to zero. Similarly, once the balance of the class B notes has been reduced to zero, the holders of the class A notes will be entitled to receive all remaining amounts, on a pro rata basis, until the balance of the class A notes has been reduced to zero.

Further, if the value of securities and cash in the reserve account and any other Available Funds on any quarterly distribution date is sufficient to pay the remaining principal balance of and interest accrued on the notes, any amount owing to the swap counterparty, any unpaid primary servicing fees and administration fees, and all other amounts due by the trust on that date, these assets will be so applied on that quarterly distribution date.

Priority Of Payments Following Certain Events Of Default Under The Indenture. After any of the following:

7

- •

- an event of default under the indenture relating to the payment of principal on any class at its maturity date or to the payment of interest on the controlling class of notes which has resulted in an acceleration of the notes;

- •

- an event of default under the indenture relating to an insolvency event or a bankruptcy with respect to the trust which has resulted in an acceleration of the notes; or

- •

- a liquidation of the trust assets following any event of default under the indenture;

the priority of the payment of the notes changes. In particular, payments on the notes on each quarterly distribution date following the acceleration of the notes as provided above will be made in the following order of priority:

- (1)

- pro rata, to the indenture trustee, for annual fees and any other amounts due and owing under the indenture, and to the trustee, for annual fees and any other amounts due and owing under the trust agreement (but, in each case, only to the extent not paid by the administrator or the depositor);

- (2)

- to the servicer, the primary servicing fee due on that quarterly distribution date;

- (3)

- to the administrator, the administration fee due on that quarterly distribution date plus any unpaid administration fees from previous distribution dates;

- (4)

- to the swap counterparty, any swap payments payable to the swap counterparty by the trust under the swap agreements;

- (5)

- pro rata, based on the aggregate principal balance of the notes and the amount of any swap termination payment due and payable by the trust to the swap counterparty under this item (5):

- (a)

- to the class A noteholders, the Class A Noteholders' Interest Distribution Amount; and

- (b)

- to the swap counterparty, the amount of any swap termination payment due to the swap counterparty under the swap agreements due to a swap termination event resulting from a payment default by the trust or the insolvency of the trust; provided, that if any amounts allocable to the class A notes are not needed to pay the Class A Noteholders' Interest Distribution Amount as of such quarterly distribution date, such amounts will be applied to pay the portion, if any, of any swap termination payment referred to above remaining unpaid;

- (6)

- pro rata, to the class A noteholders, an amount sufficient to reduce the balances of the class A notes to zero;

- (7)

- to the class B noteholders, all accrued and unpaid interest;

- (8)

- to the class B noteholders, an amount sufficient to reduce their balances to zero;

- (9)

- to the class C noteholders, all accrued and unpaid interest;

- (10)

- to the class C noteholders, an amount sufficient to reduce their balances to zero;

- (11)

- to the servicer, all carryover servicing fees, if any;

- (12)

- to the swap counterparty, the amount of any swap termination payments owed by the trust to the swap counterparty under the swap agreements and not payable in item (5) above; and

- (13)

- to the excess distribution certificateholder, any remaining funds.

Swap Agreements. On the closing date, the trust will enter into two interest rate swap agreements with Deutsche Bank AG, New York Branch. In exchange for the swap counterparty's payments under

8

the first swap agreement, the trust will pay to the swap counterparty, on or before each quarterly distribution date while such swap agreement is still in effect, prior to interest payments on the class A notes, an amount equal to the product of:

- •

- the prime rate published inThe Wall Street Journal in the "Interest Rates & Bonds" section, "Consumer Rates" table as of the 15th of the immediately preceding March, June, September or December (or ifThe Wall Street Journal is not published on that date the first preceding day for which that rate is published inThe Wall Street Journal) minus 2.70%;

- •

- a notional amount equal to the aggregate principal balance, as of the last day of the collection period preceding the beginning of the related accrual period (or, for the initial quarterly distribution date, the closing date), of the trust student loans bearing interest based upon the prime rate, reset quarterly; and

- •

- a fraction, the numerator of which is the actual number of days elapsed in the related accrual period and the denominator of which is 365 or 366, as the case may be.

In the event that the prime rate as of any date of determination is less than 2.70%, the rate payable by the swap counterparty will be correspondingly increased.

In exchange for the swap counterparty's payments under the second swap agreement, the trust will pay to the swap counterparty, on or before each quarterly distribution date while such swap agreement is still in effect, prior to interest payments on the class A notes, an amount equal to the product of:

- •

- the weighted average of the prime rates published inThe Wall Street Journal in the "Interest Rates & Bonds" section, "Consumer Rates" table as of the second business day before the first calendar day of each of the immediately preceding three months (or ifThe Wall Street Journal is not published on any such date the first preceding day for which that rate is published inThe Wall Street Journal) minus 2.72%;

- •

- a notional amount equal to the aggregate principal balance, as of the last day of the collection period preceding the beginning of the related accrual period (or, for the initial quarterly distribution date, the closing date), of the trust student loans bearing interest based upon the prime rate, reset monthly; and

- •

- a fraction, the numerator of which is the actual number of days elapsed in the related accrual period and the denominator of which is 365 or 366, as the case may be.

In the event that the weighted average of the prime rates as of any date of determination is less than 2.72%, the rate payable by the swap counterparty will be correspondingly increased.

The Significance Percentage of the swap agreements in the aggregate is less than 10%.

Unless terminated earlier pursuant to their terms, the swap agreements will terminate on the June 2021 quarterly distribution date.

Swap Counterparty. The swap counterparty is Deutsche Bank AG, New York Branch, a branch of Deutsche Bank Aktiengesellschaft ("Deutsche Bank" or the "Bank").

Deutsche Bank originated from the reunification of Norddeutsche Bank Aktiengesellschaft, Hamburg, Rheinisch-Westfälische Bank Aktiengesellschaft, Düsseldorf and Süddeutsche Bank Aktiengesellschaft, Munich; pursuant to the Law on the Regional Scope of Credit Institutions, these had been disincorporated in 1952 from Deutsche Bank, which was founded in 1870. The merger and the name were entered in the Commercial Register of the District Court Frankfurt am Main on May 2, 1957. Deutsche Bank is a banking company with limited liability incorporated under the laws of Germany under registration number HRB 30 000. The Bank has its registered office in Frankfurt am Main, Germany. It maintains its head office at Taunusanlage 12, 60325 Frankfurt am Main.

9

The Bank is the parent company of a group consisting of banks, capital market companies, fund management companies, a property finance company, installment financing companies, research and consultancy companies and other domestic and foreign companies.

Deutsche Bank AG, New York Branch (the "Branch") was established in 1978 and is licensed by the New York Superintendent of Banks. Its office is currently located at 60 Wall Street, New York, New York 10005-2858. The Branch is examined by the New York State Banking Department and is subject to the banking laws and regulations applicable to a foreign bank that operates a New York branch. The Branch is also examined by the Federal Reserve Bank of New York.

The long-term senior debt of Deutsche Bank has been assigned a rating of "AA-" (outlook stable) by S&P, "Aa3" (outlook stable) by Moody's and "AA-" (outlook stable) by Fitch. The swap counterparty is an affiliate of Deutsche Bank Securities Inc., one of the underwriters.

The information in the preceding five paragraphs has been provided by Deutsche Bank AG, New York Branch, and has not been verified by the depositor, the trust, the sponsor, the administrator, the service, the trustee, the indenture trustee or the underwriters. Except for the foregoing five paragraphs, Deutsche Bank AG, New York Branch has not been involved in the preparation of this term sheet or the initial free-writing prospectus.

Overcollateralization

On the closing date, the asset balance of the trust (which does not give effect to the reserve account but includes any amount deposited into the cash capitalization account on the closing date) will be approximately 100.50% of the aggregate balance of the notes.

Use of Proceeds

The trust will use the net proceeds from the sale of the notes to make the initial deposits to the collection account, the cash capitalization account and the reserve account and to purchase the trust student loans from the depositor on the closing date under the sale agreement.

The depositor will then use the proceeds paid to the depositor by the trust to pay to the sellers the respective purchase prices due to those sellers for the trust student loans purchased by the depositor.

Expenses incurred to establish the trust and issue the notes (other than fees that are due to the underwriters) are payable by the depositor. Expenses to be paid by the depositor are estimated to be $1,184,769.

Prepayments, Extensions, Weighted Average Lives and Expected Maturities of the Notes

Exhibit I attached hereto, "Prepayments, Extensions, Weighted Average Lives and Expected Maturities of the Notes," shows, for each class of notes, the weighted average lives, expected maturities and percentages of the original principal amount remaining at certain quarterly distribution dates based on various assumptions.

Underwriting

The notes listed below are offered severally by the underwriters, subject to receipt and acceptance by them and subject to their right to reject any order in whole or in part. It is expected that the notes will be ready for delivery in book-entry form only through the facilities of DTC, Clearstream, Luxembourg and Euroclear, as applicable, on or about April 6, 2006 against payment in immediately available funds.

10

Subject to the terms and conditions in the underwriting agreement to be dated on or about the pricing date, the depositor has agreed to cause the trust to sell to each of the underwriters named below, and each of the underwriters has severally agreed to purchase, the principal amounts of the notes shown opposite its name:

Underwriter

| | Class A-1 Notes

| | Class A-2 Notes

| | Class A-3 Notes

|

|---|

| Credit Suisse Securities (USA) LLC | | $ | 144,666,000 | | $ | 69,000,000 | | $ | 118,334,000 |

| Deutsche Bank Securities Inc. | | | 144,667,000 | | | 69,000,000 | | | 118,333,000 |

| Merrill Lynch, Pierce, Fenner & Smith Incorporated | | | 144,667,000 | | | 69,000,000 | | | 118,333,000 |

| | |

| |

| |

|

| Total | | $ | 434,000,000 | | $ | 207,000,000 | | $ | 355,000,000 |

| | |

| |

| |

|

Underwriter

| | Class A-4 Notes

| | Class A-5 Notes

|

|---|

| Credit Suisse Securities (USA) LLC | | $ | 124,423,000 | | $ | 233,333,000 |

| Deutsche Bank Securities Inc. | | | 124,422,000 | | | 233,334,000 |

| Merrill Lynch, Pierce, Fenner & Smith Incorporated | | | 124,422,000 | | | 233,333,000 |

| | |

| |

|

| Total | | $ | 373,267,000 | | $ | 700,000,000 |

| | |

| |

|

Underwriter

| | Class B Notes

| | Class C Notes

|

|---|

| Credit Suisse Securities (USA) LLC | | $ | 24,432,000 | | $ | 33,829,000 |

| Deutsche Bank Securities Inc. | | | 24,432,000 | | | 33,829,000 |

| Merrill Lynch, Pierce, Fenner & Smith Incorporated | | | 24,433,000 | | | 33,830,000 |

| | |

| |

|

| Total | | $ | 73,297,000 | | $ | 101,488,000 |

| | |

| |

|

The underwriters have agreed, subject to the terms and conditions of the underwriting agreement, to purchase all of the notes listed above if any of the notes are purchased. The offering prices, underwriter discounts and dealer concessions and reallowances will be set forth in the prospectus supplement.

The depositor and SLM ECFC have agreed to indemnify the underwriters against certain liabilities, including liabilities under the Securities Act of 1933, as amended.

The notes are new issues of securities with no established trading market. The seller has been advised by the underwriters that the underwriters intend to make a market in the notes but are not obligated to do so and may discontinue market making at any time without notice. No assurance can be given as to the liquidity of the trading market for the notes.

In the ordinary course of their business, the underwriters and certain of their affiliates have in the past, and may in the future, engage in commercial and investment banking activities with the sellers, the depositor and their respective affiliates.

The trust may, from time to time, invest the funds in the trust accounts in eligible investments acquired from the underwriters.

During and after the offering, the underwriters may engage in transactions, including open market purchases and sales, to stabilize the prices of the notes.

The underwriters, for example, may over-allot the notes for the account of the underwriting syndicate to create a syndicate short position by accepting orders for more notes than are to be sold.

In addition, the underwriters may impose a penalty bid on the broker-dealers who sell the notes. This means that if an underwriter purchases notes in the open market to reduce a broker-dealer's short

11

position or to stabilize the prices of the notes, it may reclaim the selling concession from the broker-dealers who sold those notes as part of the offering.

In general, over-allotment transactions and open market purchases of the notes for the purpose of stabilization or to reduce a short position could cause the price of a note to be higher than it might be in the absence of those transactions.

Each underwriter has represented and agreed that:

- •

- it has not offered or sold and will not offer or sell any notes to persons in the United Kingdom prior to the expiration of the period of six months from the issue date of the notes except to persons whose ordinary activities involve them in acquiring, holding, managing or disposing of investments, as principal or agent, for the purposes of their businesses or otherwise in circumstances which have not resulted and will not result in an offer to the public in the United Kingdom within the meaning of the Public Offers of Securities Regulations 1995, as amended (the "POS Regs");

- •

- it has only communicated or caused to be communicated and will only communicate or cause to be communicated any invitation or inducement to engage in investment activity, within the meaning of section 21 of the Financial Services and Markets Act 2000 (the "FSMA"), received by it in connection with the issue or sale of any notes in circumstances in which section 21(1) of the FSMA does not apply to the issuing entity; and

- •

- it has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to the notes in, from or otherwise involving the United Kingdom.

No action has been or will be taken by the depositor or the underwriters that would permit a public offering of the notes in any country or jurisdiction other than in the United States, where action for that purpose is required. Accordingly, the notes may not be offered or sold, directly or indirectly, and neither the initial free-writing prospectus and the base prospectus attached as Appendix I thereto (collectively, the "pre-pricing disclosure package"), nor any circular, prospectus, form of application, advertisement or other material may be distributed in or from or published in any country or jurisdiction, except under circumstances that will result in compliance with any applicable laws and regulations. Persons into whose hands all or any part of the pre-pricing disclosure package comes are required by the depositor and the underwriters to comply with all applicable laws and regulations in each country or jurisdiction in which they purchase, sell or deliver notes or have in their possession or distribute the pre-pricing disclosure package, in all cases at their own expense.

The depositor has not authorized any offer of the notes to the public in the United Kingdom within the meaning of the POS Regs and the FSMA. The notes may not lawfully be offered or sold to persons in the United Kingdom except in circumstances which do not result in an offer to the public in the United Kingdom within the meaning of these regulations or otherwise in compliance with all applicable provisions of these regulations and the FSMA.

Glossary

"Asset Balance" means, with respect to any quarterly distribution date, an amount equal to:

Where:

CI = the amount on deposit in the cash capitalization account on the last day of the related collection period less the excess for the quarterly distribution date of (i) interest due on the notes plus any primary servicing and administration fees, any swap payments owed to the swap counterparty by the trust, and any swap termination payments owed by the trust that

12

arepari passuwith interest payments on the class A notes due over (ii) Available Funds on deposit in the collection account. In no case shall CI be less than zero;

PB = the Pool Balance at the last day of the related collection period; and

R = the amount to be released from the cash capitalization account on such quarterly distribution date as described in the fourth, fifth and sixth paragraphs under "Information About the Trust—Cash Capitalization Account" in this term sheet.

provided, however, that, as of the closing date, the Asset Balance shall equal $2,255,271,599 and that, for all quarterly distribution dates occurring on or after the September 2010 quarterly distribution date, the Asset Balance will be equal to the Pool Balance as of the last day of the related collection period.

"Class A Noteholders' Principal Distribution Amount" means (a) as of any quarterly distribution date prior to the Stepdown Date or on which a Trigger Event is in effect, the lesser of (i) 100% of the excess, if any, of (x) the aggregate outstanding balance of all classes of notes immediately prior to any distributions of principal for such quarterly distribution date over (y) the excess, if any, of (1) the Asset Balance for such quarterly distribution date over (2) the Specified Overcollateralization Amount and (ii) the aggregate outstanding balance of the class A notes immediately prior to any distributions for such quarterly distribution date and (b) on or after the Stepdown Date and as long as a Trigger Event is not in effect for such quarterly distribution date, the excess, if any, of (x) the aggregate outstanding balance of the class A notes immediately prior to any distributions of principal for such quarterly distribution date over (y) the lesser of (A) the product of (i) 85.0% and (ii) the Asset Balance as of such quarterly distribution date and (B) the excess, if any, of the Asset Balance for such quarterly distribution date over the Specified Overcollateralization Amount. Notwithstanding the foregoing, on or after the maturity date for the class A-1, class A-2, class A-3, class A-4 or class A-5 notes, the Class A Noteholders' Principal Distribution Amount shall not be less than the amount that is necessary to reduce the balance of the class A-1, class A-2, class A-3, class A-4 or class A-5 notes, as applicable, to zero.

"Class B Noteholders' Principal Distribution Amount" means, as of any quarterly distribution date on or after the Stepdown Date and as long as a Trigger Event is not in effect on such quarterly distribution date, the excess, if any, of (x) the sum of (i) the aggregate outstanding balance of the class A notes (after taking into account the Class A Noteholders' Principal Distribution Amount due on such quarterly distribution date) and (ii) the outstanding balance of the class B notes immediately prior to such quarterly distribution date over (y) the lesser of (A) the product of (i) 89.875% and (ii) the Asset Balance for such quarterly distribution date and (B) the excess, if any, of the Asset Balance for such quarterly distribution date over the Specified Overcollateralization Amount. Prior to the Stepdown Date or on any quarterly distribution date for which a Trigger Event is in effect, the excess, if any, of (i) the amounts in clause (a)(i) of the definition of Class A Noteholders' Principal Distribution Amount over (ii) the aggregate outstanding balance of the class A notes. Notwithstanding the foregoing, on or after the maturity date for the class B notes, the Class B Noteholders' Principal Distribution Amount shall not be less than the amount that is necessary to reduce the outstanding balance of the class B notes to zero.

"Class C Noteholders' Principal Distribution Amount" means, as of any quarterly distribution date on or after the Stepdown Date and, as long as a Trigger Event is not in effect on such quarterly distribution date, the excess, if any, of (x) the sum of (i) the aggregate outstanding balance of the class A notes (after taking into account the Class A Noteholders' Principal Distribution Amount due on such quarterly distribution date), (ii) the outstanding balance of the class B notes (after taking into account the Class B Noteholders' Principal Distribution Amount due on such quarterly distribution date) and (iii) the outstanding balance of the class C notes immediately prior to such quarterly distribution date over (y) the lesser of (A) the product of (i) 97.0% and (ii) the Asset Balance for such distribution date and (B) the excess, if any, of the Asset Balance for such quarterly distribution date

13

over the Specified Overcollateralization Amount. Prior to the Stepdown Date or on any quarterly distribution date for which a Trigger Event is in effect, the excess, if any, of (i) the amounts in clause (a)(i) of the definition of Class A Noteholders' Principal Distribution Amount over (ii) the aggregate outstanding balance of the class A and class B notes. Notwithstanding the foregoing, on or after the maturity date for the class C notes, the Class C Noteholders' Principal Distribution Amount shall not be less than the amount that is necessary to reduce the outstanding balance of the class C notes to zero.

The "Cumulative Realized Losses Test" is satisfied for any quarterly distribution date on which the cumulative principal amount of Charged-Off Loans, net of Recoveries, is equal to or less than the percentage of the initial Pool Balance set forth below for the specified period:

Distribution Date

| | Percentage of Initial

Pool Balance

| |

|---|

| Closing Date through June 2011 quarterly distribution date | | 15 | % |

| September 2011 quarterly distribution date through June 2014 quarterly distribution date | | 18 | % |

| September 2014 quarterly distribution date and thereafter | | 20 | % |

"Significance Estimate" means, as of the closing date, with respect to the swap agreements collectively, the reasonable good faith estimate of the maximum probable exposure of the trust to the swap counterparty, which estimate is made in the same manner as that utilized in the sponsor's internal risk management process for similar instruments.

"Significance Percentage" means, as of the closing date, the percentage that the Significance Estimate represents of the notes.

"Specified Class A Enhancement" means, for any quarterly distribution date, the greater of (a) 15.00% of the Asset Balance for such quarterly distribution date or (b) the Specified Overcollateralization Amount for such quarterly distribution date.

"Specified Class B Enhancement" means, for any quarterly distribution date, the greater of (a) 10.125% of the Asset Balance for such quarterly distribution date or (b) the Specified Overcollateralization Amount for such quarterly distribution date.

"Specified Class C Enhancement" means, for any quarterly distribution date, the greater of (a) 3.00% of the Asset Balance for such quarterly distribution date or (b) the Specified Overcollateralization Amount for such quarterly distribution date.

"Specified Overcollateralization Amount" means, as of any quarterly distribution date, 2.00% of the initial Asset Balance.

14

EXHIBIT I

Prepayments, Extensions, Weighted Average Lives

and Expected Maturities of the Notes

EXHIBIT I

PREPAYMENTS, EXTENSIONS, WEIGHTED AVERAGE LIVES

AND EXPECTED MATURITIES OF THE NOTES

Prepayments on pools of student loans can be calculated based on a variety of prepayment models. The model used to calculate prepayments in this term sheet is based on prepayments assumed to occur at a constant prepayment rate ("CPR"). CPR is stated as an annualized rate and is calculated as the percentage of the loan amount outstanding at the beginning of a period (including accrued interest to be capitalized), after applying scheduled payments, that is paid during that period. The CPR model assumes that student loans will prepay in each month according to the following formula:

Monthly

Prepayments | | = | | Balance after scheduled payments | | x | | (1-(1-CPR)1/12) | | |

Accordingly, monthly prepayments assuming a $1,000 balance after scheduled payments would be as follows for various levels of CPR listed below:

CPR

| | 0%

| | 2%

| | 4%

| | 6%

| | 8%

|

|---|

| Monthly Prepayment | | $ | 0.00 | | $ | 1.68 | | $ | 3.40 | | $ | 5.14 | | $ | 6.92 |

| | |

| |

| |

| |

| |

|

The CPR model does not purport to describe historical prepayment experience or to predict the prepayment rate of any actual student loan pool. The student loans will not prepay at any constant level of CPR, nor will all of the student loans prepay at the same rate. You must make an independent decision regarding the appropriate principal prepayment scenarios to use in making any investment decision.

For purposes of calculating the information presented in the tables below, it is assumed, among other things, that:

- •

- the statistical cutoff date for the trust student loans is March 6, 2006;

- •

- the closing date will be April 6, 2006;

- •

- all trust student loans (as grouped within the "rep lines" described below) remain in their current status until their status end date and then move to repayment, with the exception of in-school status loans which are assumed to have a 36-month grace period (with respect to MEDLOANS), a 9-month grace period (with respect to LAWLOANS) or a 6-month grace period (with respect to all other trust student loans) before moving to repayment, and no trust student loan moves from repayment to any other status;

- •

- the trust student loans that are not in repayment status have interest accrued and capitalized upon entering repayment;

- •

- no delinquencies or defaults occur on any of the trust student loans, no repurchases for breaches of representations, warranties or covenants occur, and all borrower payments are collected in full;

- •

- index levels for calculation of payments are:

- •

- three-month LIBOR rate of 4.86%;

- •

- 91-day Treasury bill rate of 4.59%; and

- •

- prime rate of 7.50%;

I-1

- •

- quarterly distributions begin on June 15, 2006, and payments are made quarterly on the 15th day of every March, June, September and December thereafter, whether or not the 15th is a business day;

- •

- the interest rate for each class of outstanding notes at all times will be equal to:

- •

- class A-1 notes: 4.89%;

- •

- class A-2 notes: 4.96%;

- •

- class A-3 notes: 5.01%;

- •

- class A-4 notes: 5.06%;

- •

- class A-5 notes: 5.15%;

- •

- class B notes: 5.17%; and

- •

- class C notes: 5.44%;

- •

- an administration fee equal to $20,000 is paid quarterly by the trust to the administrator, beginning in May 2006;

- •

- a servicing fee equal to 1/12th of the then outstanding principal amount of the trust student loans times 0.70% is paid monthly by the trust to the servicer, beginning in June 2006;

- •

- the reserve account has an initial balance equal to $5,000,679 and at all times a balance equal to the lesser of (1) $5,000,679, and (2) the outstanding balance of the notes;

- •

- the collection account has an initial balance equal to $2,300,000;

- •

- the cash capitalization account has an initial balance equal to $255,000,000, and on the September 2010 distribution date, any amounts on deposit in the cash capitalization account that have not previously been released will be included in Available Funds;

- •

- under the first interest rate swap, the trust will pay prime rate minus 2.75% in exchange for three-month LIBOR, and under the second interest rate swap, the trust will pay prime rate minus 2.70% in exchange for three-month LIBOR,

- •

- the trust will enter into no other swap or other interest rate hedging agreements;

- •

- all payments are assumed to be made at the end of the month and amounts on deposit in the collection account, reserve account and cash capitalization account, including reinvestment income earned in the previous month, net of servicing fees, are reinvested in eligible investments at the assumed reinvestment rate of 4.76% per annum through the end of the collection period, and reinvestment earnings are available for distribution from the prior collection period;

- •

- an optional redemption by the servicer occurs on the distribution date immediately following the collection period during which the pool balance falls below 10% of the initial pool balance; and

- •

- the pool of trust student loans consists of 5,351 representative loans ("rep lines"), which have been created for modeling purposes from individual trust student loans based on combinations of similar individual student loan characteristics, which include, but are not limited to, loan status, interest rate, loan type, index, margin, rate cap and remaining term.

The following tables have been prepared based on the assumptions described above (including the assumptions regarding the characteristics and performance of the rep lines, which will differ from the characteristics and performance of the actual pool of trust student loans) and should be read in conjunction therewith. In addition, the diverse characteristics, remaining terms and loan ages of the trust student loans could produce slower or faster principal payments than indicated in the following

I-2

tables, even if the dispersions of weighted average characteristics, remaining terms and loan ages are the same as the assumed characteristics, remaining terms and loan ages.

The following tables show the weighted average remaining lives, expected maturity dates and percentages of original principal of each class of the notes at various levels of CPR from the closing date until the optional redemption date; all percentages have been rounded up or down to the nearest whole percent.

Weighted Average Lives and Expected Maturities of the Notes

at Various CPR Percentages(1)

Weighted Average Life (years)(2)

|

|---|

| | 0%

| | 2%

| | 4%

| | 6%

| | 8%

|

|---|

| Class A-1 Notes | | 5.70 | | 3.97 | | 3.00 | | 2.35 | | 1.88 |

| Class A-2 Notes | | 8.53 | | 6.50 | | 4.99 | | 4.14 | | 3.49 |

| Class A-3 Notes | | 10.51 | | 8.62 | | 7.00 | | 5.72 | | 4.80 |

| Class A-4 Notes | | 12.87 | | 11.42 | | 9.91 | | 8.52 | | 7.33 |

| Class A-5 Notes | | 15.81 | | 15.03 | | 14.19 | | 13.28 | | 12.27 |

| Class B Notes | | 13.99 | | 12.85 | | 11.65 | | 10.47 | | 9.39 |

| Class C Notes | | 13.28 | | 11.97 | | 10.59 | | 9.28 | | 8.13 |

Expected Maturity Date

|

|---|

| Class A-1 Notes | | December 2013 | | December 2011 | | September 2010 | | December 2009 | | March 2009 |

| Class A-2 Notes | | June 2015 | | June 2013 | | December 2011 | | September 2010 | | March 2010 |

| Class A-3 Notes | | December 2017 | | March 2016 | | September 2014 | | March 2013 | | March 2012 |

| Class A-4 Notes | | March 2020 | | December 2018 | | September 2017 | | June 2016 | | March 2015 |

| Class A-5 Notes | | June 2023 | | September 2022 | | March 2022 | | September 2021 | | December 2020 |

| Class B Notes | | September 2022 | | December 2021 | | June 2021 | | September 2020 | | September 2019 |

| Class C Notes | | December 2021 | | March 2021 | | June 2020 | | June 2019 | | March 2018 |

- (1)

- Assuming for purposes of this table that, among other things, the optional redemption by the servicer occurs on the quarterly distribution date immediately following the date on which the pool balance falls below 10% of the initial pool balance.

- (2)

- The weighted average life of the notes (assuming a 360-day year consisting of twelve 30-day months) is determined by: (1) multiplying the amount of each principal payment on the applicable class of notes by the number of years from the closing date to the related quarterly distribution date, (2) adding the results, and (3) dividing that sum by the aggregate principal amount of the applicable class of notes as of the closing date.

I-3

Class A-1 Notes

Percentages Of Original Principal Of The Notes Remaining At Certain Distribution

Dates At Various CPR Percentages(1)

Distribution Date

| | 0%

| | 2%

| | 4%

| | 6%

| | 8%

| |

|---|

| Closing Date | | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % |

| March 2007 | | 100 | | 100 | | 98 | | 95 | | 85 | |

| March 2008 | | 100 | | 92 | | 72 | | 53 | | 34 | |

| March 2009 | | 100 | | 75 | | 46 | | 19 | | 0 | |

| March 2010 | | 88 | | 49 | | 12 | | 0 | | 0 | |

| March 2011 | | 64 | | 17 | | 0 | | 0 | | 0 | |

| March 2012 | | 43 | | 0 | | 0 | | 0 | | 0 | |

| March 2013 | | 18 | | 0 | | 0 | | 0 | | 0 | |

| March 2014 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2015 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2016 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2017 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2018 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2019 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2020 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2021 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2022 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2023 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2024 | | 0 | | 0 | | 0 | | 0 | | 0 | |

- (1)

- Assuming for purposes of this table that, among other things, the optional redemption by the servicer occurs on the distribution date immediately following the collection period during which the pool balance falls below 10% of the initial pool balance.

I-4

Class A-2 Notes

Percentages Of Original Principal Of The Notes Remaining At Certain Distribution

Dates At Various CPR Percentages(1)

Distribution Date

| | 0%

| | 2%

| | 4%

| | 6%

| | 8%

| |

|---|

| Closing Date | | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % |

| March 2007 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2008 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2009 | | 100 | | 100 | | 100 | | 100 | | 83 | |

| March 2010 | | 100 | | 100 | | 100 | | 52 | | 0 | |

| March 2011 | | 100 | | 100 | | 44 | | 0 | | 0 | |

| March 2012 | | 100 | | 77 | | 0 | | 0 | | 0 | |

| March 2013 | | 100 | | 14 | | 0 | | 0 | | 0 | |

| March 2014 | | 79 | | 0 | | 0 | | 0 | | 0 | |

| March 2015 | | 15 | | 0 | | 0 | | 0 | | 0 | |

| March 2016 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2017 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2018 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2019 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2020 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2021 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2022 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2023 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2024 | | 0 | | 0 | | 0 | | 0 | | 0 | |

- (1)

- Assuming for purposes of this table that, among other things, the optional redemption by the servicer occurs on the distribution date immediately following the collection period during which the pool balance falls below 10% of the initial pool balance.

I-5

Class A-3 Notes

Percentages Of Original Principal Of The Notes Remaining At Certain Distribution

Dates At Various CPR Percentages(1)

Distribution Date

| | 0%

| | 2%

| | 4%

| | 6%

| | 8%

| |

|---|

| Closing Date | | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % |

| March 2007 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2008 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2009 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2010 | | 100 | | 100 | | 100 | | 100 | | 90 | |

| March 2011 | | 100 | | 100 | | 100 | | 77 | | 32 | |

| March 2012 | | 100 | | 100 | | 86 | | 35 | | 0 | |

| March 2013 | | 100 | | 100 | | 45 | | 0 | | 0 | |

| March 2014 | | 100 | | 70 | | 11 | | 0 | | 0 | |

| March 2015 | | 100 | | 33 | | 0 | | 0 | | 0 | |

| March 2016 | | 68 | | 0 | | 0 | | 0 | | 0 | |

| March 2017 | | 27 | | 0 | | 0 | | 0 | | 0 | |

| March 2018 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2019 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2020 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2021 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2022 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2023 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2024 | | 0 | | 0 | | 0 | | 0 | | 0 | |

- (1)

- Assuming for purposes of this table that, among other things, the optional redemption by the servicer occurs on the distribution date immediately following the collection period during which the pool balance falls below 10% of the initial pool balance.

I-6

Class A-4 Notes

Percentages Of Original Principal Of The Notes Remaining At Certain Distribution

Dates At Various CPR Percentages(1)

Distribution Date

| | 0%

| | 2%

| | 4%

| | 6%

| | 8%

| |

|---|

| Closing Date | | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % |

| March 2007 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2008 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2009 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2010 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2011 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2012 | | 100 | | 100 | | 100 | | 100 | | 94 | |

| March 2013 | | 100 | | 100 | | 100 | | 98 | | 58 | |

| March 2014 | | 100 | | 100 | | 100 | | 64 | | 25 | |

| March 2015 | | 100 | | 100 | | 78 | | 32 | | 0 | |

| March 2016 | | 100 | | 98 | | 45 | | 1 | | 0 | |

| March 2017 | | 100 | | 63 | | 12 | | 0 | | 0 | |

| March 2018 | | 86 | | 27 | | 0 | | 0 | | 0 | |

| March 2019 | | 42 | | 0 | | 0 | | 0 | | 0 | |

| March 2020 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2021 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2022 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2023 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2024 | | 0 | | 0 | | 0 | | 0 | | 0 | |

- (1)

- Assuming for purposes of this table that, among other things, the optional redemption by the servicer occurs on the distribution date immediately following the collection period during which the pool balance falls below 10% of the initial pool balance.

I-7

Class A-5 Notes

Percentages Of Original Principal Of The Notes Remaining At Certain Distribution Dates

At Various CPR Percentages(1)

Distribution Date

| | 0%

| | 2%

| | 4%

| | 6%

| | 8%

| |

|---|

| Closing Date | | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % |

| March 2007 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2008 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2009 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2010 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2011 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2012 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2013 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2014 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2015 | | 100 | | 100 | | 100 | | 100 | | 96 | |

| March 2016 | | 100 | | 100 | | 100 | | 100 | | 81 | |

| March 2017 | | 100 | | 100 | | 100 | | 85 | | 67 | |

| March 2018 | | 100 | | 100 | | 89 | | 69 | | 54 | |

| March 2019 | | 100 | | 94 | | 72 | | 55 | | 41 | |

| March 2020 | | 97 | | 73 | | 55 | | 41 | | 29 | |

| March 2021 | | 69 | | 51 | | 38 | | 26 | | 0 | |

| March 2022 | | 44 | | 31 | | 0 | | 0 | | 0 | |

| March 2023 | | 23 | | 0 | | 0 | | 0 | | 0 | |

| March 2024 | | 0 | | 0 | | 0 | | 0 | | 0 | |

- (1)

- Assuming for purposes of this table that, among other things, the optional redemption by the servicer occurs on the distribution date immediately following the collection period during which the pool balance falls below 10% of the initial pool balance.

I-8

Class B Notes

Percentages Of Original Principal Of The Notes Remaining At Certain Distribution

Dates At Various CPR Percentages(1)

Distribution Date

| | 0%

| | 2%

| | 4%

| | 6%

| | 8%

| |

|---|

| Closing Date | | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % |

| March 2007 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2008 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2009 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2010 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2011 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2012 | | 100 | | 100 | | 100 | | 94 | | 82 | |

| March 2013 | | 100 | | 100 | | 97 | | 83 | | 72 | |

| March 2014 | | 100 | | 100 | | 87 | | 74 | | 62 | |

| March 2015 | | 100 | | 93 | | 77 | | 64 | | 53 | |

| March 2016 | | 100 | | 83 | | 68 | | 55 | | 44 | |

| March 2017 | | 91 | | 73 | | 58 | | 46 | | 37 | |

| March 2018 | | 80 | | 63 | | 49 | | 38 | | 29 | |

| March 2019 | | 67 | | 51 | | 39 | | 30 | | 8 | |

| March 2020 | | 53 | | 40 | | 30 | | 7 | | 0 | |

| March 2021 | | 38 | | 25 | | 2 | | 0 | | 0 | |

| March 2022 | | 13 | | 0 | | 0 | | 0 | | 0 | |

| March 2023 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2024 | | 0 | | 0 | | 0 | | 0 | | 0 | |

- (1)

- Assuming for purposes of this table that, among other things, the optional redemption by the servicer occurs on the distribution date immediately following the collection period during which the pool balance falls below 10% of the initial pool balance.

I-9

Class C Notes

Percentages Of Original Principal Of The Notes Remaining At Certain Distribution

Dates At Various CPR Percentages(1)

Distribution Date

| | 0%

| | 2%

| | 4%

| | 6%

| | 8%

| |

|---|

| Closing Date | | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % |

| March 2007 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2008 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2009 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2010 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2011 | | 100 | | 100 | | 100 | | 100 | | 100 | |

| March 2012 | | 100 | | 100 | | 100 | | 96 | | 79 | |

| March 2013 | | 100 | | 100 | | 100 | | 81 | | 63 | |

| March 2014 | | 100 | | 100 | | 86 | | 66 | | 48 | |

| March 2015 | | 100 | | 95 | | 72 | | 52 | | 35 | |

| March 2016 | | 100 | | 81 | | 57 | | 38 | | 22 | |

| March 2017 | | 93 | | 65 | | 43 | | 25 | | 10 | |

| March 2018 | | 75 | | 49 | | 29 | | 13 | | 0 | |

| March 2019 | | 56 | | 33 | | 15 | | 1 | | 0 | |

| March 2020 | | 35 | | 15 | | * | | 0 | | 0 | |

| March 2021 | | 12 | | 0 | | 0 | | 0 | | 0 | |

| March 2022 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2023 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| March 2024 | | 0 | | 0 | | 0 | | 0 | | 0 | |

- (1)

- Assuming for purposes of this table that, among other things, the optional redemption by the servicer occurs on the distribution date immediately following the collection period during which the pool balance falls below 10% of the initial pool balance.

- *

- Represents a percentage greater than zero, but less than 0.50%

I-10

$2,244,052,000

SLM Private Credit Student Loan Trust 2006-A

Issuing Entity

$434,000,000 Floating Rate Class A-1 Student Loan-Backed Notes

$207,000,000 Floating Rate Class A-2 Student Loan-Backed Notes

$355,000,000 Floating Rate Class A-3 Student Loan-Backed Notes

$373,267,000 Floating Rate Class A-4 Student Loan-Backed Notes

$700,000,000 Floating Rate Class A-5 Student Loan-Backed Notes

$73,297,000 Floating Rate Class B Student Loan-Backed Notes

$101,488,000 Floating Rate Class C Student Loan-Backed Notes

SLM Funding LLC

Depositor

Sallie Mae, Inc.

Sponsor, Servicer and Administrator

Joint Book Runners

Credit Suisse

Deutsche Bank Securities

Merrill Lynch & Co.

March 30, 2006

QuickLinks

EXHIBIT I Prepayments, Extensions, Weighted Average Lives and Expected Maturities of the NotesEXHIBIT I PREPAYMENTS, EXTENSIONS, WEIGHTED AVERAGE LIVES AND EXPECTED MATURITIES OF THE NOTESWeighted Average Lives and Expected Maturities of the Notes at Various CPR Percentages(1)Class A-1 Notes Percentages Of Original Principal Of The Notes Remaining At Certain Distribution Dates At Various CPR Percentages(1)Class A-2 Notes Percentages Of Original Principal Of The Notes Remaining At Certain Distribution Dates At Various CPR Percentages(1)Class A-3 Notes Percentages Of Original Principal Of The Notes Remaining At Certain Distribution Dates At Various CPR Percentages(1)Class A-4 Notes Percentages Of Original Principal Of The Notes Remaining At Certain Distribution Dates At Various CPR Percentages(1)Class A-5 Notes Percentages Of Original Principal Of The Notes Remaining At Certain Distribution Dates At Various CPR Percentages(1)Class B Notes Percentages Of Original Principal Of The Notes Remaining At Certain Distribution Dates At Various CPR Percentages(1)Class C Notes Percentages Of Original Principal Of The Notes Remaining At Certain Distribution Dates At Various CPR Percentages(1)