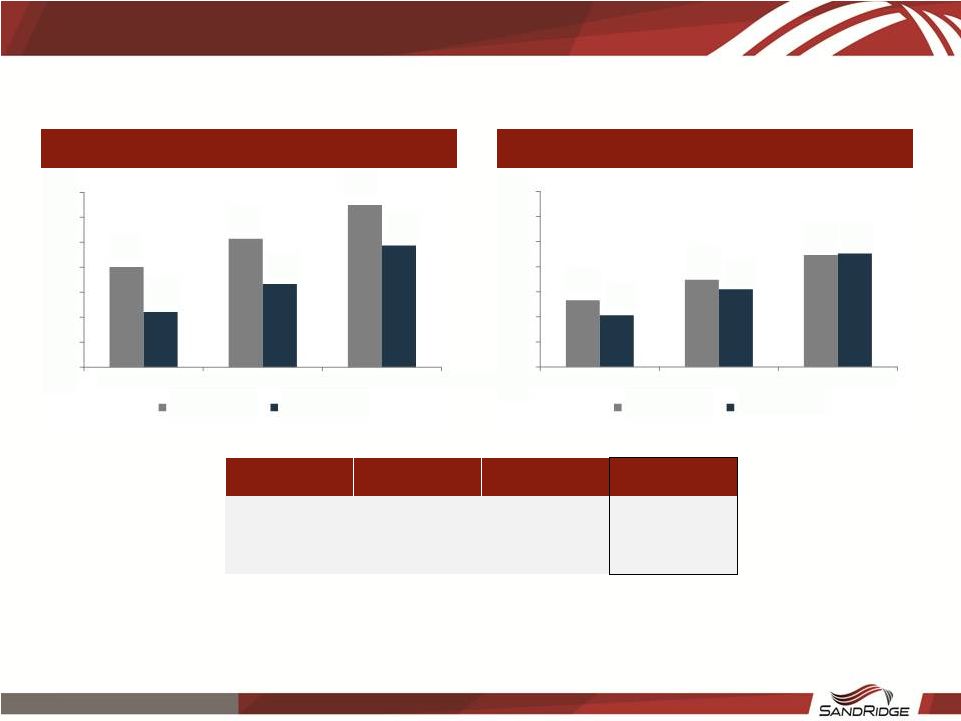

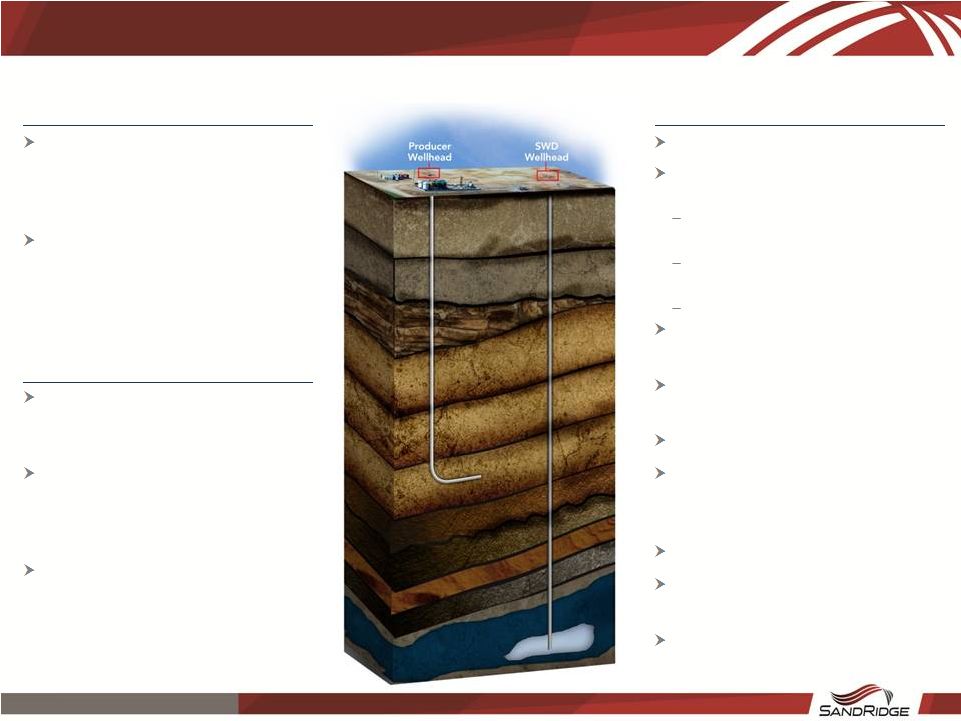

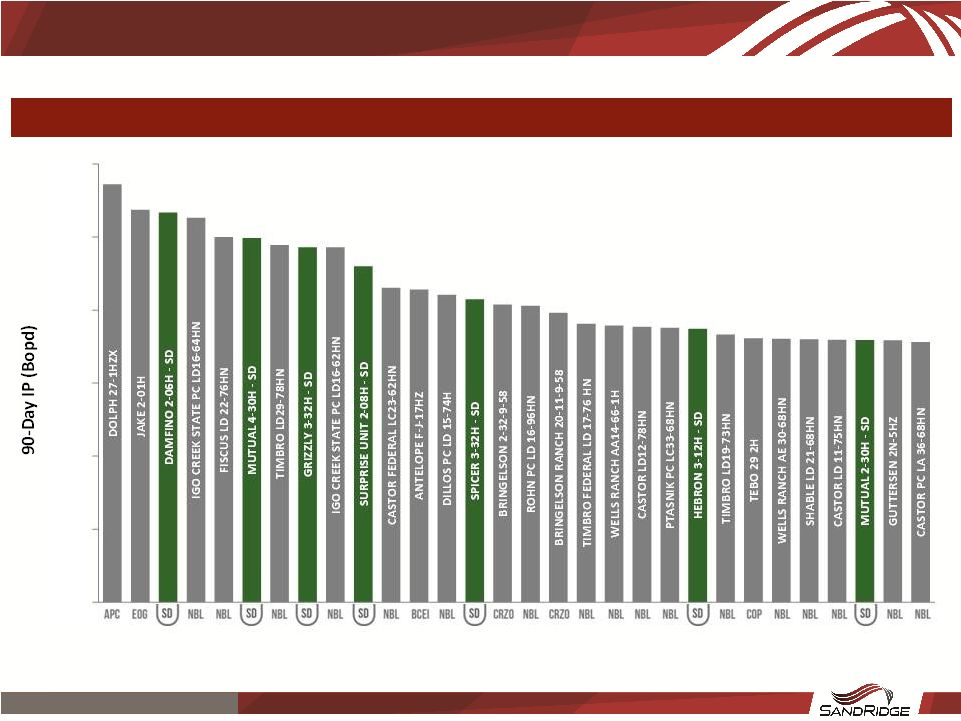

Business Highlights Experienced Developers with Culture of Innovation and Continuous Improvement Solid Base Returns / Substantial Upside MidCon provides derisked production base with high graded drilling inventory, under current pricing Growth potential with recent North Park acquisition and continued MidCon improvements Upsides: well costs, deployment of extended and multi laterals into North Park Basin (NPB), stacked zones in MidCon and NPB, NPB type curve and stimulation methods Deep Operating Experience Large scale efficient operator: Over 1,600 horizontal wells; 30+ rigs in 2014; market leading cost of $2.2MM per Mississippian lateral Infrastructure and logistics: building and optimizing extensive midstream and electrical systems Artificial lift: optimizing well returns via gas lift, ESPs, and rod pumps Engineering: pioneering application of multilaterals, extended laterals, full section development and new completion techniques to reduce costs and enhance recovery Business Minded Management Team Management background includes oil majors, independents and Wall Street Prudent management strategy to increase asset value through innovation and cost reduction Focused on asset base diversification and increasing oil mix; focused on fully loaded returns Positioned to Capitalize on Market Opportunities Strong tenured team focused on results and value. Proactive during the downturn with improved operating metrics, focus on capital efficiency and successes eliminating contractual and business overhang issues Ability to deploy skillsets into adjacent assets and selected consolidation opportunities Near Term Objectives Top decile in all operational execution measures Fierce capital discipline targeting a minimum 10% fully burdened IRR at strip Drive costs down further in MidCon, become cost leader in Niobrara Initiate Niobrara development targeting 12k bopd into 2017 Keep cost structure in-line with activity level 5 SandRidgeEnergy.com |