Investment Highlights

Disruptive wireless broadband pure-play (WiMAX) targeting SME's with

high-speed services at lower cost and higher bandwidth than the RBOCs

"Cookie-cutter" proven, recurring revenue model with six markets launched

(NYC, LA, SF, Chicago, Boston, Rhode Island).

70%+ gross margins, EBITDA+ since 2004, success-based capex model with

rapid time to market.

Typical market ramps to EBITDA+ within 12 months. Market expected to

generate $4.6MN revenues and $2.7MN EBITDA contribution within three

years.

Use of proceeds includes ramping telesales from 18 today to 200, launch four

more markets and purchase spectrum – Long-term goal of 30 markets

nationwide.

Comparable transactions suggest considerable upside, including

Fibertower (acquired for $1.5BN by First Avenue Networks; $6MN in annual

revenues)

Clearwire (sold 38% of $12MN run rate services business to Intel for $600MN,

suggesting a $1.6BN valuation).

Experienced management team

4

TowerStream Overview and History

TowerStream is the recognized leader in the fixed wireless and WiMAX

industry and is an established trusted provider of quality service

TowerStream is a provider of low-cost broadband access utilizing

wireless technology

History

Company founded in Rhode Island

Service launched in Boston and Providence

Service launched in New York

Service launched in Chicago

Service launched in Los Angeles

Successful completion of Mobile VOIP over Wi-Fi

Service launched in San Francisco

January 2000

April 2001

June 2003

March 2004

December 2004

March 2005

October 2005

5

Experienced Management Team

Founder & Vice President, eFortress; B.S.

Engineering, University of Massachusetts

Founder,

President &

CEO

Jeff Thompson

Director of Engineering, Sockeye Networks;

Director, Navisite; Director, Digital Broadband;

Engineer, Bell Atlantic

VP

Engineering

& Operations

Arthur Giftakis

CFO & Director, Stratos Global Corporation

(SGB.TO); VP, Fleet Investment Banking, AVP,

Bank of Boston; B.S Hartford University; MBA

University of Chicago

CFO

George E. Kilguss, III

Founder, eFortress; Founder, MCF

Communications; B.A. Northwestern University

Founder &

Chairman

Phillip Urso

Experience

Title

Name

6

TowerStream Solution

TowerStream provides an affordable, capital efficient, rapid time to market

alternative to traditional land based solutions

WiMAX technology advantages:

Not limited by existing telco infrastructure

Legacy T1 infrastructure has physical limitations

1.5 Mbps per circuit

Distance-based tariffs can become cost prohibitive

Service delivery average in U.S. is 26 business days

Supports last mile Quality of Service (“QOS”)

DSL is not a reliable way to deliver real time applications and does not support

QOS

Distance restrictions limit addressable market

Legacy copper infrastructure can be unreliable

Bypasses existing monopoly infrastructures

RBOCs control last mile and no longer have to offer high speed access at cost to

competitors

Cable MSOs remain deregulated

7

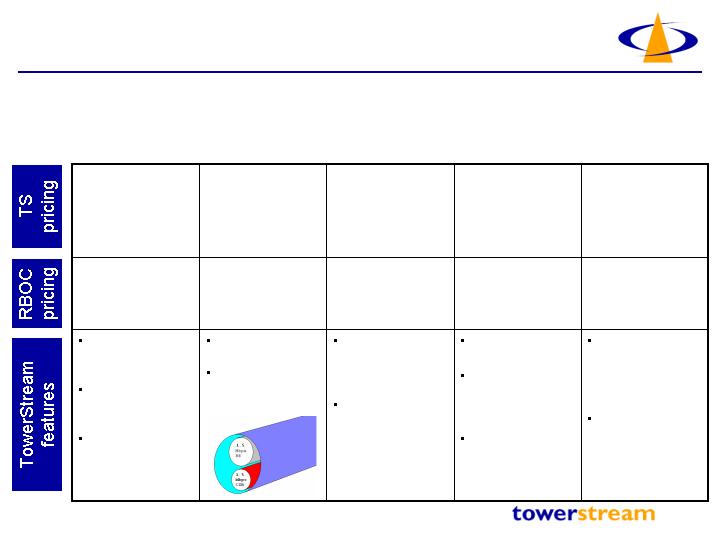

TowerStream Wins on Features and Price

TowerStream can deliver broadband solutions in any increment from 1-100MB

at 20-40% off RBOC pricing for comparable bandwidth

DS3 (45MB)

$4,500/month

4xT1 (6MB)

$2,500/month

Five 9’s product

not available

from RBOC

Not available

from RBOC

T1 (1.5MB)

$550-

$650/month

Two T1’s connected

to different WiMAX

base stations

Industry First “five

9’s” SLA

Hi-VI T1+

$600/month

SLA guarantees 1.5

Mbit/s of duplex

1.5 MB with

additional traffic

flow set at best effort

3 MB for

$500/month

Dynamic bandwidth

allocation

QOS allows users to

run VOIP

Low cost IP solution

for Data and/or

Voice

Full Duplex T1

w/ QOS

$398/month

Full duplex service

Upgradeable in

minutes using same

equipment

Mid-range product

not offered or

available from

RBOC

6MB scalable to

10MB starting

at $1,650/month

RBOCs only

required to offer

tariff rates up to

45MB

Same cost, twice the

speed and delivered

in days

10MB to

100MB from

$3,600 to

$5,000/month

8

TowerStream WiMAX Products (cont.)

High-Speed SME Broadband Solutions

512K – 4MB using point to multipoint base

stations

5Mbps – 25MB using high capacity point to

multipoint base stations

Enterprise Broadband

10MB - 1GB using high capacity point to

point connections

Fiber equivalent speeds at much lower cost

and quicker deployment

9

Rapid installation: can install in 3-5 business days, compared with

approximately 30 days with land based solutions

Value: 25-40% discount to embedded landline base

Single solution: TDM, Voice, Data and Video over a single

connection

Speed and scalability: Can offer bandwidth from 512k to 1 Gbps

Reliability: TowerStream delivers the most reliable last mile

solution in the marketplace today

First provider to offer “five 9’s” guarantee

Why Customers Choose Towerstream

Better – Faster – Cheaper

10

Existing WiMAX Installations

11

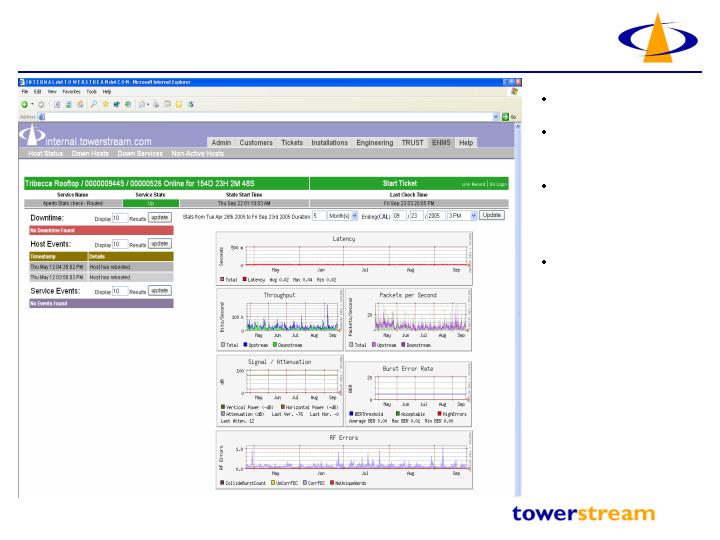

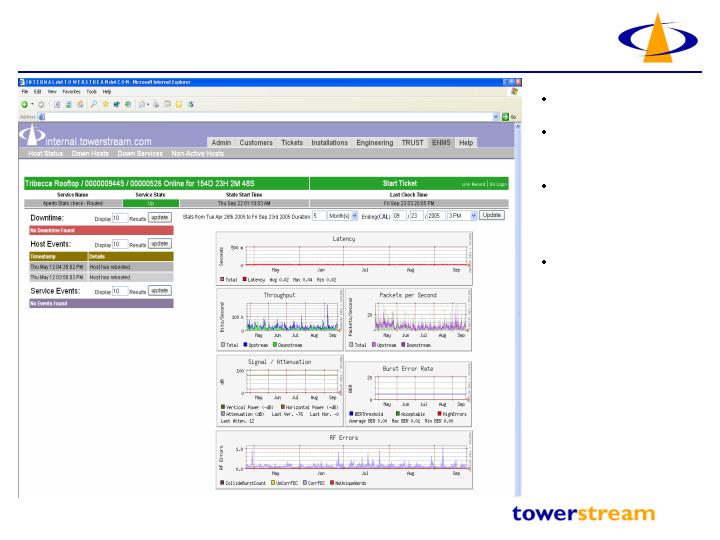

TowerVision – Effective Customer Sales Tool

Provisioning

Real time

monitoring

Web based

troubleshooting

tools

Full customer care

support tools

12

Addressable Market Opportunity Today

Source: Gartner Research and Towerstream estimates.

Businesses

with 5-249

Rank

Metro Area

Employees

1

Los Angeles

176,989

2

New York

127,089

3

Chicago

96,240

4

San Francisco

73,877

5

Washington DC

70,149

6

Miami

67,478

7

Dallas - Ft. Worth

65,671

8

Philadelphia

59,433

9

Atlanta

56,868

10

Detroit

51,284

11

Houston

51,110

12

Newark

49,424

13

Boston

48,036

14

Denver

42,795

15

Minneapolis

38,215

16

Phoenix

36,405

17

San Diego

33,017

18

Seattle

32,212

19

St. Louis

31,878

20

Baltimore

30,564

Total

1,238,734

IT services market is expected to grow from

$628.8BN in 2005 to $855.6BN in 2010

worldwide

U.S. T1 market $13BN+; wireless backhaul

market $2BN+

Source: Dunn and Bradstreet.

13

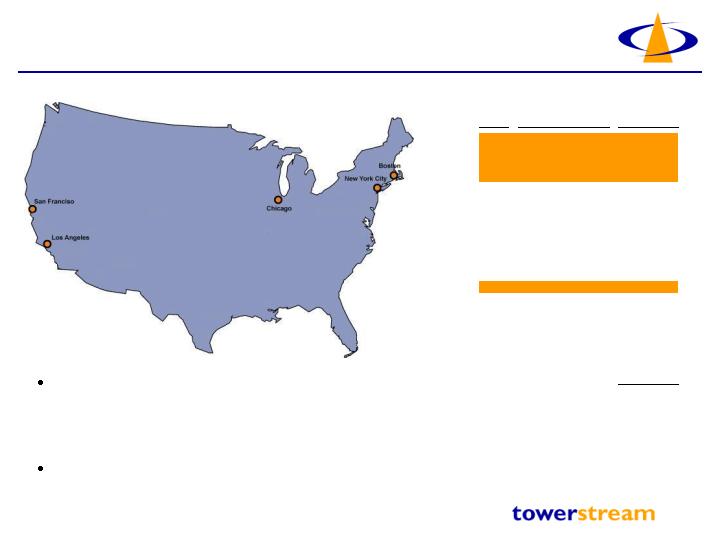

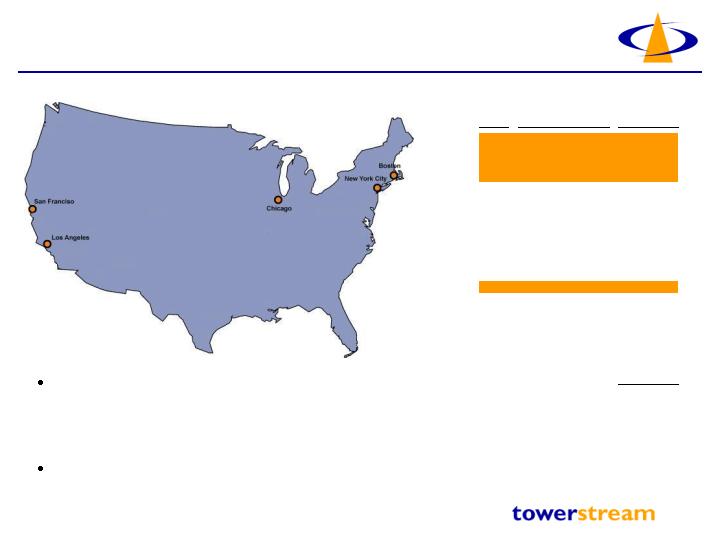

Nationwide Expansion Plan

Successfully rolled out six cities thus far:

New York, L.A., Chicago, Boston, San Francisco and Providence

Three phases of business plan will position Towerstream as the market leader in

WiMAX business services

Targeting 1-2 new markets per year during Phase I, with accelerated rollout of organic

growth plan thereafter

New cities projected EBITDA positive within 12 months

Mature market generates annual revenues of $6MM and EBITDA of $3.5MM

Phase I: 10 cities; Phase II: 20 cities; Phase III: 30 cities

Build world class sales organization to drive revenue

Hire head of sales

Expand inside salesforce

Continue securing the most desirable tower locations

First mover advantage allows the company to secure optimal locations with long term

leases; better locations, lower network OPEX and CAPEX

14

Cookie-Cutter Proven Model

Identify strategic rooftop locations in metropolitan area

Negotiations typically last 6-9 months

Rent per rooftop ranges from $2-8K per month

Deploy gigabit mesh metro backbone including multiple points

of presence

CapEx of $175K per POP

Total cost averages $700 thousand

Hire 20-30 salespeople per market to target the Small and

Medium sized enterprise (SME) market

Telesales model allows TowerStream to staff up quickly and prospect

for customers immediately after network deployment

Outsourced installation crews provide service/support

15

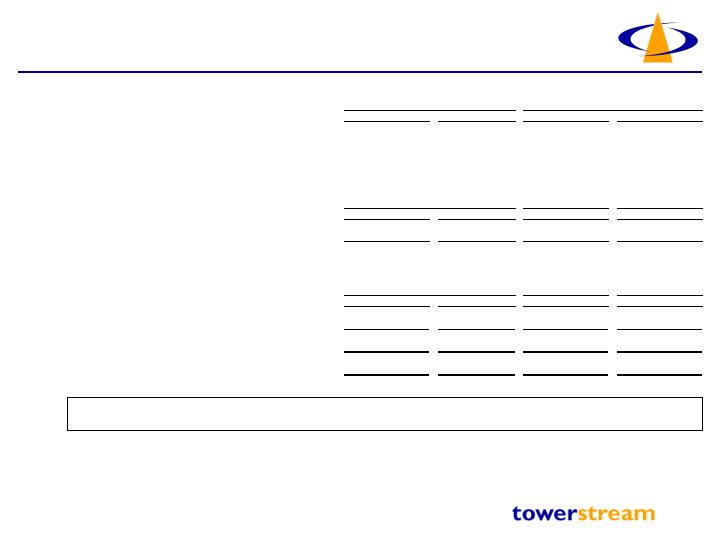

Target Market Operating Goals

Assume $700k in fixed cost to enter any given market

Target market operating goals within 36 months

EBITDA(1) positive 12 months from market entry

1.2

New Midsize product

$3.4

Existing WiMAX products

4.6

Total Revenue

$2.7

58.7%

Total EBITDA(1)

Market revenue 1,000 subs.

Note: Excludes corporate overhead.

Assume it takes 250

subscribers to become

EBITDA(1) break even

If TowerStream is able to sign

up 500 customers in any given

market, EBITDA (1) margins

reach 48%. If 1,000

subscribers, EBITDA (1)

margins approach 60%.

(1) EBITDA as calculated is based only on direct costs incurred in the markets and do not include allocations of centralized costs and overhead.

16

Use of Proceeds

7.0

New Metro market developments

$20.0

3.0

$10.0

Working capital

Total

Existing market salesforce expansion

17

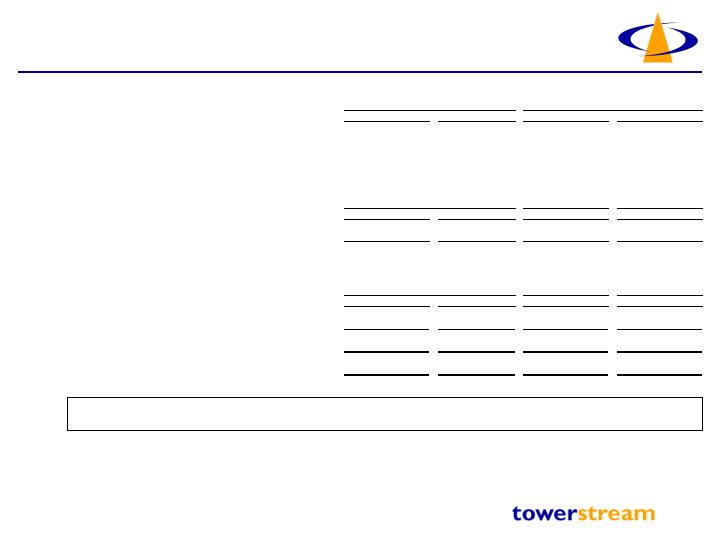

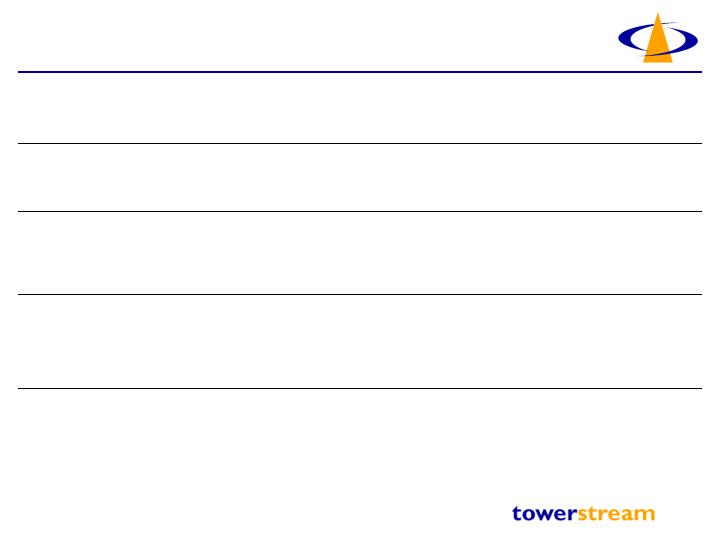

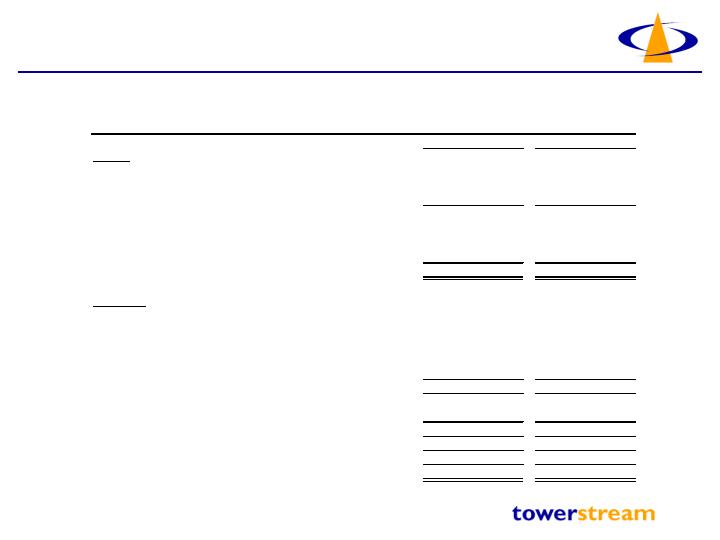

Summary Income Statement

(Unaudited)

Nine Months Ended

Year Ended

09/30/06

09/30/05

12/31/05

12/31/04

Revenues

4,733,028

$

3,995,550

$

5,397,510

$

4,602,109

$

Operating Expenses

Cost of revenues

1,242,038

1,080,937

1,509,505

1,026,068

Depreciation

876,792

686,908

933,557

742,636

Customer support services

411,088

315,219

419,356

378,767

Selling, general and administrative expenses (includes equity based

compensation expense of $61,298 in 2006 and $0 in 2005 and $0 in 2004)

2,334,307

2,334,246

3,265,352

2,980,400

TOTAL OPERATING EXPENSES

4,864,225

4,417,311

6,127,770

5,127,871

OPERATING INCOME/(LOSS)

(131,196)

(421,761)

(730,260)

(525,762)

Other Expense/(Income)

Interest expense, net

169,853

157,221

216,945

214,740

Other income and gain on retirement of debt

(114,339)

-

-

(40,838)

Other expense

-

-

-

-

TOTAL OTHER EXPENSE

55,514

157,221

216,945

173,902

NET LOSS

(186,711)

$

(578,982)

$

(947,205)

$

(699,664)

$

Net loss per common share - basic and diluted

(0.01)

$

(0.03)

$

(0.05)

$

(0.04)

$

Weighted average common shares outstanding

21,245,717

20,689,729

20,776,874

19,548,257

EBITDA

745,595

265,147

203,297

216,874

EBITDA margin

15.8%

6.6%

3.8%

4.7%

CAPITAL EXPENDITURES

(734,560)

(986,075)

(1,369,527)

(995,262)

18

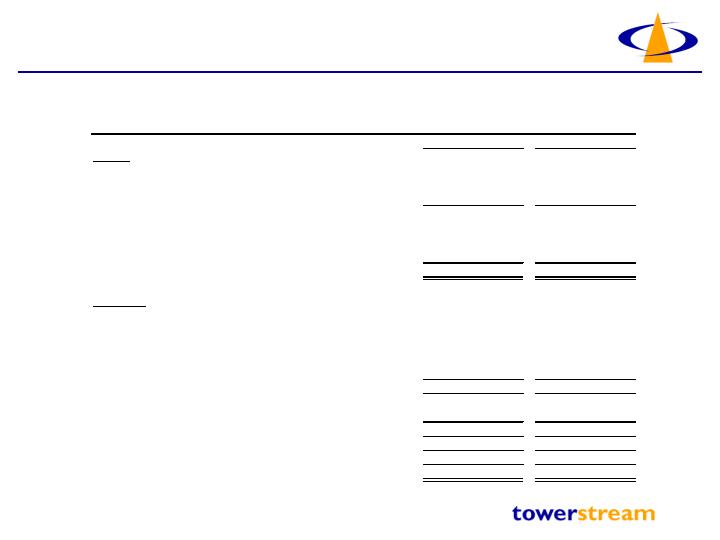

Summary Balance Sheet

CONDENSED BALANCE SHEET

As at September 30, 2006 and December 31, 2005

(Unaudited)

September 30,

December 31,

2006

2005

Assets

Cash

405,640

$

203,050

$

Accounts receivable, net

172,643

173,650

Prepaid & Other Expenses

19,386

44,354

Total Current Assets

597,669

421,054

Property and equipment, net

3,578,282

3,720,514

Other assets and security deposits

64,185

64,185

TOTAL ASSETS

4,240,136

$

4,205,752

$

Liabilities

Revolving note, stockholder

250,000

$

250,000

$

Current maturities of long-term debt

1,514,543

750,967

Accounts payable and accrued expenses

414,854

479,476

Deferred compensation

180,000

125,000

Deferred revenue

386,127

452,322

Total Current Liabilitites

2,745,524

2,057,765

Long-term debt, net of current maturities

310,504

1,071,931

TOTAL LIABILITIES

3,056,028

3,129,695

TOTAL STOCKHOLDERS' EQUITY

1,184,108

1,076,056

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

4,240,136

$

4,205,752

$

Draft

19

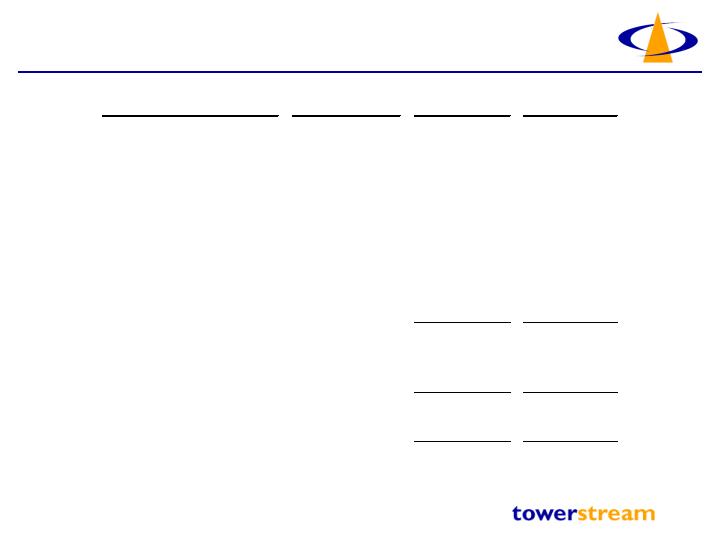

Current Capitalization/Ownership

Ownership

Holder

Description

Shares held

percentage

Phillip Urso

Chairman

4,940,206

23.2%

Jeff Thompson

CEO

2,879,190

13.5%

Howard Haronian

Director

2,459,198

11.5%

George Kilguss

CFO

1,330,000

6.2%

Urso relatives

10 individuals

2,869,846

13.5%

David Bourque

Individual

1,060,000

5.0%

Raymond Bourque

Individual

900,000

4.2%

Philip Norton

Individual

708,400

3.3%

Kevin Grills

Individual

607,754

2.9%

Two Cranes Trust

Trust

540,000

2.5%

All others

45 Individuals

3,010,383

14.1%

Total shares outstanding

21,304,977

100.0%

Capital

Percentage

Total equity dollars invested

8,746,178

$

79.4%

Total debt outstanding

2,273,432

20.6%

Total capitalization as of 09/30/06

11,019,610

$

100.0%

20

Summary

Opportunity – With a low cost IP based network, there is significant

opportunity to change the way broadband is delivered and to make a

significant return on investment

First Mover- We have developed a unique and hard to replicate business

model by staying away from the status quo of legacy telecom and being

capital efficient

Experience - Towerstream has spent the last 5 years operating and

deploying wireless networks in major urban markets - It has the know how,

proprietary systems, and management experience to be successful

Brand – Towerstream is the recognized leader in the fixed wireless and

WiMAX industry and is already a trusted provider of quality service

21

Investment Highlights

Experienced and proven operator of broadband wireless

networks (WiMAX)

Six markets currently deployed

Poised for rapid expansion in top markets across the country

High margin recurring revenue model

Cost efficient all IP network

EBITDA+

Regulatory environment favorable for WiMAX as alternative

last mile solution

Focus on intermodal competition (RBOC v. Cable v. Wireless)

Technology proven, platform highly scalable

Strong management team with extensive experience

Build world class sales organization – to capitalize on existing

network investments

22

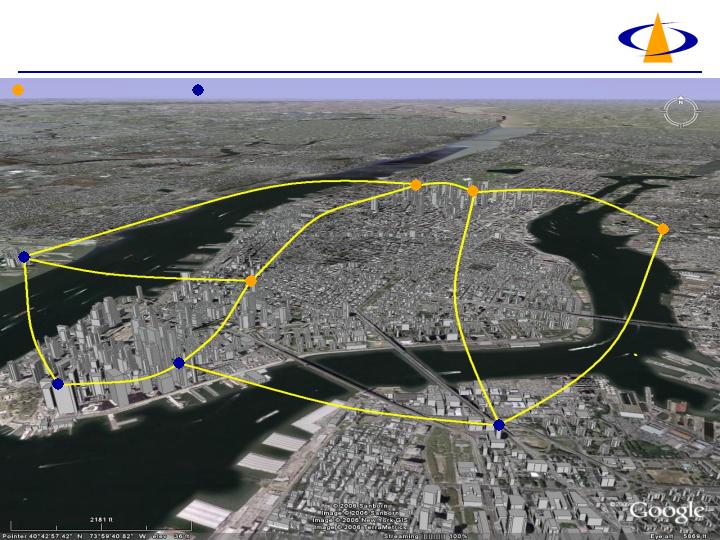

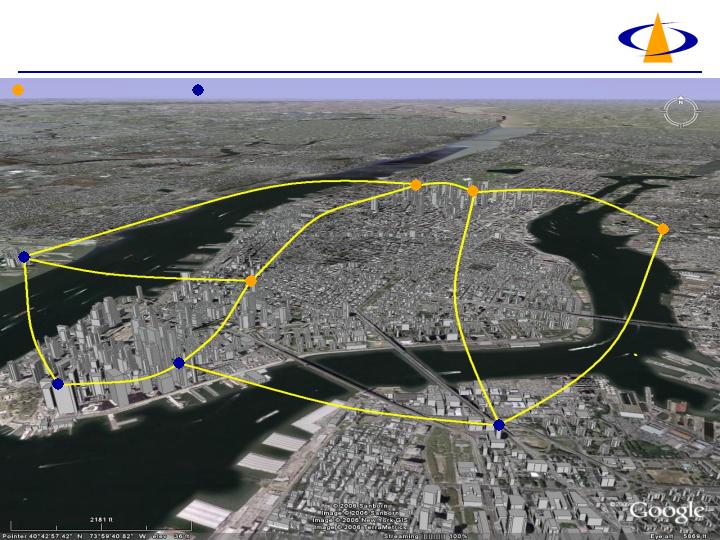

Gigabit Mesh Back-Bone Architecture

Existing POPs

Planned network expansion

23

towerstream®

24