UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| | |

| Filed by the Registrant | T |

| Filed by a Party other than the Registrant | ¨ |

| | |

| Check the appropriate box: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| T | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

TOWERSTREAM CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| T | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

| ¨ | Fee paid previously with preliminary materials: |

| | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| (1) | Amount previously paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

TOWERSTREAM CORPORATION

55 HAMMARLUND WAY

MIDDLETOWN, RHODE ISLAND 02842

TELEPHONE: (401) 848-5848

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The annual meeting of the stockholders of Towerstream Corporation (the “Company”) will be held on Friday, June 26, 2009, at 9:00 a.m. at 88 Silva Lane, Middletown, Rhode Island 02842 for the purposes of:

| | 1. | Electing the five (5) directors nominated by the Company to hold office until the next annual meeting of stockholders; and |

| | | |

| | 2. | Transacting such other business as may properly come before the meeting or any adjournments thereof. |

Only stockholders of record at the close of business on May 4, 2009, will be entitled to attend and vote at the meeting. A list of all stockholders entitled to vote at the annual meeting, arranged in alphabetical order and showing the address of and number of shares held by each stockholder, will be available at the principal office of the Company during usual business hours, for examination by any stockholder for any purpose germane to the annual meeting for 10 days prior to the date thereof. The proxy materials will be furnished to stockholders on or about May 15, 2009.

The Company is pleased to take advantage of the Securities and Exchange Commission rules that allow issuers to furnish proxy materials to their stockholders on the Internet. The Company believes these rules allow it to provide you with the information you need while lowering the Company’s costs.

| | By Order of the Board of Directors /s/ Philip Urso Chairman |

WHETHER OR NOT YOU PLAN ON ATTENDING THE MEETING IN PERSON, TO ENSURE THAT YOUR VOTE IS COUNTED, PLEASE VOTE AS PROMPTLY AS POSSIBLE.

TOWERSTREAM CORPORATION

55 HAMMARLUND WAY

MIDDLETOWN, RHODE ISLAND 02842

TELEPHONE: (401) 848-5848

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON FRIDAY, JUNE 26, 2009

SOLICITATION OF PROXIES

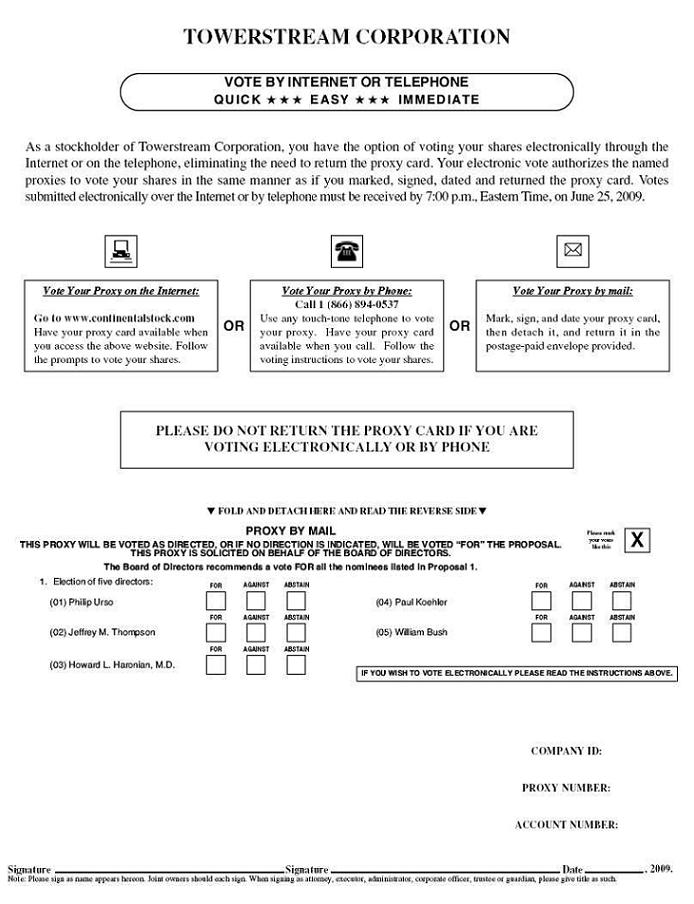

The enclosed proxy is solicited by the Board of Directors of Towerstream Corporation (herein after referred to as the “Company”, “we,” “us,” or “our”), for use at the annual meeting of the Company’s stockholders to be held at 88 Silva Lane, Middletown, Rhode Island 02842 on June 26, 2009, at 9:00 a.m. and at any adjournments thereof. Whether or not you expect to attend the meeting in person, please vote your shares as promptly as possible to ensure that your vote is counted. The proxy materials will be furnished to stockholders on or about May 15, 2009.

REVOCABILITY OF PROXY AND SOLICITATION

Any stockholder executing a proxy that is solicited hereby has the power to revoke it prior to the voting of the proxy. Revocation may be made by attending the annual meeting and voting the shares of stock in person, or by delivering to the Secretary of the Company at the principal office of the Company prior to the annual meeting a written notice of revocation or a later-dated, properly executed proxy. Solicitation of proxies may be made by directors, officers and other employees of the Company by personal interview, telephone, facsimile transmittal or electronic communications. No additional compensation will be paid for any such services. This solicitation of proxies is being made by the Company which will bear all costs associated with the mailing of this proxy statement and the solicitation of proxies.

INTERNET AND ELECTRONIC AVAILABILITY OF PROXY MATERIALS

Under new rules adopted by the Securities and Exchange Commission (the “SEC”), the Company is making this Proxy Statement and the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2008 available on the Internet instead of mailing a printed copy of these materials to each stockholder. Stockholders who received a Notice of Internet Availability of Proxy Materials (the “Notice”) by mail will not receive a printed copy of these materials other than as described below. Instead, the Notice contains instructions as to how stockholders may access and review all of the important information contained in the materials on the Internet, including how stockholders may submit proxies by telephone or over the Internet.

If you received the Notice by mail and would prefer to receive a printed copy of the Company’s proxy materials, please follow the instructions for requesting printed copies included in the Notice.

RECORD DATE

Stockholders of record at the close of business on May 4, 2009, will be entitled to receive notice of, to attend and to vote at the meeting.

ACTION TO BE TAKEN UNDER PROXY

Unless otherwise directed by the giver of the proxy, the persons named in the form of proxy, namely, Jeffrey M. Thompson, our Chief Executive Officer and President, and Joseph P. Hernon, our Chief Financial Officer, or either one of them who acts, will vote:

| | · | FOR the election of the persons named herein as nominees for directors of the Company, for a term expiring at the 2010 annual meeting of stockholders (or until successors are duly elected and qualified); and |

| | | |

| | · | According to their judgment, on the transaction of such matters or other business as may properly come before the meeting or any adjournments thereof. |

Should any nominee named herein for election as a director become unavailable for any reason, it is intended that the persons named in the proxy will vote for the election of such other person in his stead as may be designated by the Board of Directors. The Board of Directors is not aware of any reason that might cause any nominee to be unavailable.

WHO IS ENTITLED TO VOTE; VOTE REQUIRED; QUORUM

As of April 29, 2009, there were 34,587,854 shares of common stock issued and outstanding, which constitute all of the outstanding capital stock of the Company. The Company does not expect our shares of common stock issued and outstanding to change as of our record date. Stockholders are entitled to one vote for each share of common stock held by them.

A majority of the outstanding shares (estimated to be 17,293,928 shares), present in person or represented by proxy, will constitute a quorum at the meeting. For purposes of the quorum and the discussion below regarding the vote necessary to take stockholder action, stockholders of record who are present at the annual meeting in person or by proxy and who abstain, including brokers holding customers’ shares of record who cause abstentions to be recorded at the meeting, are considered stockholders who are present and entitled to vote and are counted towards the quorum.

Brokers holding shares of record for customers generally are not entitled to vote on “non-routine” matters, unless they receive voting instructions from their customers. As used herein, “uninstructed shares” means shares held by a broker who has not received voting instructions from its customers on a proposal. A “broker non-vote” occurs when a nominee holding uninstructed shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that non-routine matter. In connection with the treatment of abstentions and broker non-votes, since our proposal at this meeting is considered a “routine” matter, brokers are entitled to vote uninstructed shares with respect to this proposal.

Under Delaware state law and provisions of the Company’s Certificate of Incorporation and By-Laws, as amended, the vote required for the election of directors is a plurality of the votes of the issued and outstanding shares of common stock present in person or represented by proxy at the annual meeting of stockholders and entitled to vote on the election of directors. This means that the nominees who receive the most votes will be elected to the open director positions. Abstentions, broker non-votes and other shares that are not voted in person or by proxy will not be included in the vote count to determine if a plurality of shares voted in favor of each nominee.

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS

Why am I receiving these materials?

Towerstream Corporation has made these materials available to you on the Internet or, upon your request, has delivered printed versions of these materials to you by mail, in connection with the Company’s solicitation of proxies for use at the annual meeting of stockholders to be held on June 26, 2009 at 9:00 a.m. local time at 88 Silva Lane, Middletown, Rhode Island. These materials describe the proposal on which the Company would like you to vote and also give you information on this proposal so that you can make an informed decision. We are furnishing our proxy materials to all stockholders of record entitled to vote at the annual meeting on or about May 15, 2009.

What is included in these materials?

These materials include:

| | · | this proxy statement for the annual meeting; and |

| | | |

| | · | the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2008, as filed with the SEC on March 18, 2009. |

If you requested printed versions of these materials by mail, these materials also include the proxy card or vote instruction form for the annual meeting.

What is the proxy card?

The proxy card enables you to appoint Jeffrey M. Thompson, our Chief Executive Officer and President, and Joseph P. Hernon, our Chief Financial Officer, as your representative at the annual meeting. By completing and returning a proxy card, you are authorizing these individuals to vote your shares at the annual meeting in accordance with your instructions on the proxy card. This way, your shares will be voted whether or not you attend the annual meeting.

What items will be voted on?

You are being asked to vote on the election of the five nominated members of our Board of Directors. We will also transact any other business that properly comes before the annual meeting.

How does the Board of Directors recommend that I vote?

Our Board of Directors unanimously recommends that you vote your shares FOR each of the five persons nominated for director.

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials this year instead of a full set of proxy materials?

Pursuant to rules adopted by the SEC, the Company has elected to provide access to its proxy materials over the Internet. Accordingly, the Company is sending the Notice to the Company’s shareholders of record and beneficial owners. All shareholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. In addition, shareholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. The Company encourages you to take advantage of the availability of the proxy materials on the Internet.

What does it mean if I receive more than one Notice?

You may have multiple accounts at the transfer agent and/or with brokerage firms. Please follow directions on each Notice to ensure that all of your shares are voted.

How can I get electronic access to the proxy materials?

The Notice will provide you with instructions regarding how to:

| | · | view the Company’s proxy materials for the annual meeting on the Internet; |

| | | |

| | · | request hard copies of the materials; and |

| | · | instruct the Company to send future proxy materials to you electronically by email. |

Choosing to receive future proxy materials by email will save the Company the cost of printing and mailing documents to you and will reduce the impact of the Company’s annual meetings on the environment. If you choose to receive future proxy materials by email, you will receive an email message next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials by email will remain in effect until you terminate it.

Who can vote at the annual meeting of stockholders?

There were 34,587,854 shares of common stock outstanding on April 29, 2009 held by 62 holders of record. Only stockholders of record at the close of business on May 4, 2009 are entitled to receive notice of, to attend, and to vote at the annual meeting. Each share is entitled to one vote. All shares of common stock shall vote together as a single class. Information about the stockholdings of our directors and executive officers is contained in the section of this proxy statement entitled “Security Ownership of Certain Beneficial Owners and Management” on page 7 of this proxy statement.

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

Most of our stockholders hold their shares in an account at a brokerage firm, bank or other nominee holder, rather than holding share certificates in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially in street name.

Stockholder of Record

If on May 4, 2009, your shares were registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, you are considered a stockholder of record with respect to those shares, and the Notice was sent directly to you by the Company. If you request printed copies of the proxy materials by mail, you will receive a proxy card. As the stockholder of record, you have the right to direct the voting of your shares by returning the proxy card to us. Whether or not you plan to attend the annual meeting, if you do not vote over the Internet, please complete, date, sign and return a proxy card to ensure that your vote is counted.

Beneficial Owner of Shares Held in Street Name

If on May 4, 2009, your shares were held in an account at a brokerage firm, bank, broker-dealer, or other nominee holder, then you are considered the beneficial owner of shares held in “street name,” and the Notice was forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the annual meeting. As the beneficial owner, you have the right to direct that organization on how to vote the shares held in your account. However, since you are not the stockholder of record, you may not vote these shares in person at the annual meeting unless you receive a valid proxy from the organization. If you request printed copies of the proxy materials by mail, you will receive a vote instruction form.

How do I vote?

Shareholders of Record. If you are a stockholder of record, you may vote by any of the following methods:

| | Ÿ | Via the Internet. You may vote by proxy via the Internet by following the instructions provided in the Notice. |

| | | |

| | Ÿ | By Telephone. If you request printed copies of the proxy materials by mail, you may vote by calling the toll free number found on the proxy card. |

| | | |

| | Ÿ | By Mail. If you request printed copies of the proxy materials by mail, you may vote by completing, signing, dating and returning your proxy card in the pre-addressed, postage-paid envelope provided. |

| | | |

| | Ÿ | In Person. You may attend and vote at the annual meeting. The Company will give you a ballot when you arrive. |

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name, you may vote by any of the following methods:

| | Ÿ | Via the Internet. You may vote by proxy via the Internet by following the instructions provided in the Notice. |

| | | |

| | Ÿ | By Telephone. If you request printed copies of the proxy materials by mail, you may vote by proxy by calling the toll free number found on the vote instruction form. |

| | | |

| | Ÿ | By Mail. If you request printed copies of the proxy materials by mail, you may vote by proxy by filling out the vote instruction form and returning it in the pre-addressed, postage-paid envelope provided. |

| | | |

| | Ÿ | In Person. If you are a beneficial owner of shares held in street name and you wish to vote in person at the annual meeting, you must obtain a legal proxy from the organization that holds your shares. |

What if I change my mind after I have voted?

You may revoke your proxy and change your vote at any time before the final vote at the annual meeting. You may vote again on a later date via the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the annual meeting will be counted), by signing and returning a new proxy card or vote instruction form with a later date, or by attending the annual meeting and voting in person. However, your attendance at the meeting will not automatically revoke your proxy unless you vote again at the meeting or specifically request that your prior proxy be revoked by delivering to the Company’s Corporate Secretary at 55 Hammarlund Way, Middletown, Rhode Island 02842 a written notice of revocation prior to the annual meeting.

Please note, however, that if your shares are held of record by an organization, you must instruct them that you wish to change your vote by following the procedures on the voting form provided to you by the organization. If your shares are held in street name, and you wish to attend the annual meeting and vote at the annual meeting, you must bring to the annual meeting a legal proxy from the organization holding your shares, confirming your beneficial ownership of the shares and giving you the right to vote your shares.

How are proxies voted?

All valid proxies received prior to the annual meeting will be voted. All shares represented by a proxy will be voted and, where a stockholder specifies by means of the proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the stockholder’s instructions.

What happens if I do not give specific voting instructions?

Shareholders of Record. If you are a stockholder of record and you:

| | Ÿ | indicate when voting on the Internet or by telephone that you wish to vote as recommended by the Board, or |

| | | |

| | Ÿ | sign and return a proxy card without giving specific voting instructions, |

then the proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this proxy statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the annual meeting.

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters but cannot vote on non-routine matters.

How many votes are required to elect the nominated persons to our Board of Directors?

The affirmative vote of a plurality of the votes cast at the meeting of the stockholders by the holders of shares of common stock entitled to vote in the election are required to elect each director. This means that the nominees who receive the most votes will be elected to the open director positions, to serve until the next annual meeting of stockholders and until their successors are duly elected and qualified.

Is my vote kept confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except:

| | Ÿ | as necessary to meet applicable legal requirements; |

| | | |

| | Ÿ | to allow for the tabulation and certification of votes; and |

| | | |

| | Ÿ | to facilitate a successful proxy solicitation. |

| | | |

Occasionally, stockholders provide written comments on their proxy cards, which may be forwarded to the Company’s management and the Board.

Where do I find the voting results of the annual meeting?

We will announce voting results at the annual meeting and also in our Form 10-Q for the quarter ended June 30, 2009, which we anticipate filing in August 2009.

Who can help answer my questions?

You can contact our corporate headquarters, at Towerstream Corporation, 55 Hammarlund Way, Middletown, RI 02842, by phone at 401-848-5848 or by sending a letter to Joseph P. Hernon, our Secretary, with any questions about the proposal described in this proxy statement or how to execute your vote.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information with respect to the beneficial ownership of our common stock as of April 29, 2009 by:

| | · | each person known by us to beneficially own more than 5% of our common stock (based solely on our review of SEC filings); |

| | | |

| | · | each of our directors and nominees for director; |

| | · | each of our named executive officers listed in the table entitled “Summary Compensation Table” under the section entitled “Executive Compensation” below; and |

| | | |

| | · | all of our directors and executive officers as a group. |

The percentages of common stock beneficially owned are reported on the basis of regulations of the SEC governing the determination of beneficial ownership of securities. Under the rules of the SEC, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or to direct the voting of the security, or investment power, which includes the power to dispose of or to direct the disposition of, with respect to the security. Except as indicated in the footnotes to this table, each beneficial owner named in the table below has sole voting and sole investment power with respect to all shares beneficially owned and each person’s address is c/o Towerstream Corporation, 55 Hammarlund Way, Middletown, Rhode Island 02842, unless otherwise indicated.

| Name and Address of Beneficial Owner | | | Amount and Nature of Beneficial Ownership(1) | | | Percent of Class(1) | |

| | | | | | | | | | |

| 5% Stockholders: | | | | | | | | | |

| | | | | | | | | | |

| Stephens Investment Management, LLC | | | 3,151,584 | | (2) | | | 9.1 | % |

| One Ferry Building, Suite 225 | | | | | | | | | |

| San Francisco, CA 94111 | | | | | | | | | |

| | | | | | | | | | |

| Directors and Named Executive Officers: | | | | | | | | | |

| Philip Urso | | | 4,127,361 | | (3) | | | 11.8 | % |

| William Bush | | | 63,333 | | (4) | | | * | |

| Howard L. Haronian | | | 1,032,690 | | (5) | | | 3.0 | % |

| Paul Koehler | | | 56,666 | | (6) | | | * | |

| Jeffrey M. Thompson | | | 2,646,483 | | (7) | | | 7.5 | % |

| Joseph P. Hernon | | | 81,171 | | (8) | | | * | |

| Bruce E. Grinnell | | | 10,136 | | (9) | | | * | |

| Melvin L. Yarbrough, Jr. | | | 182,932 | | (10) | | | * | |

| All directors and executive officers as a group (8 persons) | | | 8,200,772 | | (3)(4)(5)(6)(7)(8)(9)(10) | | | 22.7 | % |

| | | | | | | | | | | |

* Less than 1%.

| (1) | Shares of common stock beneficially owned and the respective percentages of beneficial ownership of common stock assumes the exercise of all options, warrants and other securities convertible into common stock beneficially owned by such person or entity currently exercisable or exercisable within 60 days of April 29, 2009. Shares issuable pursuant to the exercise of stock options and warrants exercisable within 60 days are deemed outstanding and held by the holder of such options or warrants for computing the percentage of outstanding common stock beneficially owned by such person, but are not deemed outstanding for computing the percentage of outstanding common stock beneficially owned by any other person. As of April 29, 2009, there were 34,587,854 shares of our common stock outstanding. |

| (2) | Based on a Schedule 13G/A filed with the SEC on February 13, 2009. These shares of common stock are beneficially owned by certain investment limited partnerships, including Orphan Fund, L.P., for which Stephens Investment Management, LLC (“SIM”) serves as general partner and investment manager. SIM, as those investment limited partnerships’ general partner and investment manager, and Paul H. Stephens, W. Bradford Stephens and P. Bartlett Stephens, as managing members and owners of SIM, may therefore be deemed to beneficially own the shares owned by such investment limited partnerships, insofar as they may be deemed to have the power to direct the voting or disposition of those shares. Each of SIM, Paul H. Stephens, W. Bradford Stephens and P. Bartlett Stephens disclaims beneficial ownership as to these shares, except to the extent of his or its pecuniary interests therein. |

| (3) | Includes 350,386 shares of common stock held by Mr. Urso’s minor children, for whom Mr. Urso and his wife are the trustees, and 408,719 shares of common stock issuable upon the exercise of options that are currently exercisable or exercisable within 60 days. |

| (4) | Includes 58,333 shares of common stock issuable upon the exercise of options that are currently exercisable or exercisable within 60 days. |

| (5) | Includes 83,359 shares of common stock issuable upon the exercise of options that are currently exercisable or exercisable within 60 days. |

| (6) | Includes 56,666 shares of common stock issuable upon the exercise of options that are currently exercisable or exercisable within 60 days. |

| (7) | Includes 739,786 shares of common stock issuable upon the exercise of options that are currently exercisable or exercisable within 60 days. |

| (8) | Includes 69,797 shares of common stock issuable upon the exercise of options that are currently exercisable or exercisable within 60 days. |

| (9) | Includes 10,136 shares of common stock issuable upon the exercise of options that are currently exercisable or exercisable within 60 days. |

| (10) | Includes 175,349 shares of common stock issuable upon the exercise of options that are currently exercisable or exercisable within 60 days. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) requires our executive officers and directors, and persons who beneficially own more than 10% of our equity securities, to file reports of ownership and changes in ownership with the SEC. Such officers, directors and greater than 10% stockholders also are required by rules promulgated by the SEC to furnish the Company with copies of all Section 16(a) forms they file. Based solely on our review of copies of such reports and representations from our executive officers and directors, we believe that our executive officers and directors complied with all Section 16(a) filing requirements during the year ended December 31, 2008, except that Jeffrey M. Thompson, our President, Chief Executive Officer and a director, failed to timely file a Form 4 reporting the grant of an option to purchase shares of our common stock on March 3, 2008 and Maria Perry, our former Interim Chief Financial Officer, also failed to timely file a Form 4 reporting the grant of an option to purchase shares of our common stock on March 3, 2008.

PROPOSAL 1 — ELECTION OF DIRECTORS

Information about the Nominees

Our By-laws currently specify that the number of directors shall be at least one and no more than 15 persons, unless otherwise determined by a vote of the majority of the Board of Directors. Our Board of Directors currently consists of five (5) persons and all of them have been nominated by the Company to stand for re-election. Each director is elected or nominated to the Board of Directors until the following annual meeting of stockholders and until his successor has been elected and qualified or until the director’s earlier resignation or removal.

The following table shows for each nominee his age, his principal occupation for at least the last five years, his present position with the Company, the year in which he was first elected or appointed as director (each serving continuously since first elected or appointed except as set forth in the footnotes hereto), and his directorships with other companies whose securities are registered with the SEC.

| Name | Age | Position |

| Jeffrey M. Thompson | 44 | Chief Executive Officer, President and Director |

| Philip Urso | 50 | Chairman of the Board of Directors |

| Howard L. Haronian, M.D. (1)(2)(3) | 47 | Director |

| Paul Koehler (1)(3) | 49 | Director |

| William Bush (1)(2) | 44 | Director |

| | | |

| (1) Member of our Audit Committee. |

| (2) Member of our Compensation Committee. |

| (3) Member of our Nominating Committee. |

The biographies below include information related to service by the persons below to Towerstream Corporation and our subsidiary, Towerstream I, Inc. On January 4, 2007, we merged with and into a wholly-owned Delaware subsidiary, for the sole purpose of changing our state of incorporation to Delaware. On January 12, 2007, a wholly-owned subsidiary of ours completed a reverse merger with and into a private company, Towerstream Corporation, with Towerstream Corporation (the private company) being the surviving company and becoming a wholly-owned subsidiary of ours. Upon closing of the merger, we discontinued our former business and succeeded to the business of Towerstream Corporation as our sole line of business. At the same time, we also changed our name from University Girls Calendar Ltd to Towerstream Corporation and, our newly acquired subsidiary, Towerstream Corporation, changed its name to Towerstream I, Inc.

Jeffrey M. Thompson co-founded Towerstream I, Inc. in December 1999 with Philip Urso. Mr. Thompson has served as a director since inception and as chief operating officer from inception until November 2005 when Mr. Thompson became president and chief executive officer. Since the completion of our reverse merger in January 2007, Mr. Thompson has been our president, chief executive officer and a director. In 1995, Mr. Thompson co-founded and was vice president of operations of EdgeNet Inc., a privately held Internet service provider (which was sold to Citadel Broadcasting Corporation in 1997 and became eFortress (“eFortress”)) through 1999. Mr. Thompson holds a B.S. from the University of Massachusetts.

Philip Urso co-founded Towerstream I, Inc. in December 1999 with Jeffrey M. Thompson. Mr. Urso has served as a director and chairman since inception and as chief executive officer from inception until November 2005. Since the completion of our reverse merger in January 2007, Mr. Urso has been our chairman and a director. In 1995, Mr. Urso co-founded eFortress (previously EdgeNet Inc.) and served as its president through 1999. From 1983 until 1997, Mr. Urso owned and operated a group of radio stations. In addition, Mr. Urso co-founded the regional cell-tower company, MCF Communications, Inc.

Howard L. Haronian, M.D., has served as a director of Towerstream I, Inc. since inception in December 1999. Since the completion of our reverse merger in January 2007, Dr. Haronian has been a director. Dr. Haronian is an interventional cardiologist and has been president of Cardiology Specialists, Ltd. of Rhode Island since 1994. Dr. Haronian has served on the clinical faculty of the Yale School of Medicine since 1994. Dr. Haronian has directed the cardiac catheterization program at Westerly Hospital since founding such program in 2003.

Paul Koehler has been a director since January 2007. Mr. Koehler has served as vice president of corporate development of Pacific Ethanol, Inc. (NasdaqGM: PEIX) since June 2005. Mr. Koehler has over twenty years of experience in the power and renewable fuels industries and in marketing, trading and project development. Prior to working for Pacific Ethanol Inc., from 2001 to 2005, Mr. Koehler developed wind power projects for PPM Energy Inc., a wind power producer and marketer. Mr. Koehler was president and co-founder of Kinergy Corporation, a consulting firm focused on renewable energy, project development and risk management from 1993 to 2003. During the 1990s, Mr. Koehler worked for Portland General Electric Company and Enron Corp. in marketing and origination of long term transactions, risk management, and energy trading. Mr. Koehler holds a B.A. from the Honors College at the University of Oregon.

William Bush has been a director since January 2007. Since October 2008, Mr. Bush has served as the chief financial officer of Solar Semiconductor, Ltd., a global distributor of photovoltaic products and services. From January 2006 through December 2007, Mr. Bush served as chief financial officer of ZVUE Corporation (formerly known as Handheld Entertainment, Inc. (Pink Sheets: ZVUE.PK)), a distributor of user generated content. Mr. Bush has over twenty years of experience in accounting, financial support and business development. From 2002 to 2005, Mr. Bush was the chief financial officer and secretary for International Microcomputer Software, Inc. (OTCBB: IMSI.OB), a developer and distributor of precision design software, content and on-line services. Prior to that he was a director of business development and corporate controller for Buzzsaw.com, Inc. Mr. Bush was one of the founding members of Buzzsaw.com, Inc., a privately held company spun off from Autodesk, Inc. in 1999, focusing on online collaboration, printing and procurement applications. From 1997 to 1999, Mr. Bush worked as corporate controller at Autodesk, Inc. (NasdaqGM: ADSK), the fourth largest software applications company in the world. Prior to that, Mr. Bush worked for seven years in public accounting, first with Ernst & Young, and later with Price Waterhouse in Munich, Germany. Mr. Bush holds a B.S. in Business Administration from U.C. Berkeley and is a Certified Public Accountant. Mr. Bush currently serves on the Board of Directors of FindEx.com (OTCBB: FIND), a Bible study software provider.

Except for Howard L. Haronian and Philip Urso, who are cousins, there are no family relationships among our directors and executive officers.

Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF ITS NOMINEES.

Board Committees

Since January 2007, the standing committees of our Board of Directors consist of an Audit Committee, a Compensation Committee and a Nominating Committee. Each member of our committees is “independent” as such term is defined under and required by the federal securities laws and the rules of The NASDAQ Stock Market. The charters of each of the committees have been approved by the Board and are available on our website at www.towerstream.com.

Audit Committee

The Audit Committee is comprised of three Directors: William Bush, Howard L. Haronian, M.D., and Paul Koehler. Mr. Bush is the Chairman of the Audit Committee. The Audit Committee’s duties are to recommend to our Board of Directors the engagement of independent auditors to audit our financial statements and to review our accounting and auditing principles. The Audit Committee reviews the scope, timing and fees for the annual audit and the results of audit examinations performed by independent public accountants, including their recommendations to improve the system of accounting and internal controls. The Audit Committee oversees the independent auditors, including their independence and objectivity. However, the committee members are not acting as professional accountants or auditors, and their functions are not intended to duplicate or substitute for the activities of management and the independent auditors. The Audit Committee is empowered to retain independent legal counsel and other advisors as it deems necessary or appropriate to assist the Audit Committee in fulfilling its responsibilities, and to approve the fees and other retention terms of the advisors. Each of our Audit Committee members possesses an understanding of financial statements and generally accepted accounting principles. Our Board of Directors has determined that Mr. Bush is an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K.

Compensation Committee

The Compensation Committee is comprised of Howard L. Haronian, M.D., and William Bush. Dr. Haronian is the Chairman of the Compensation Committee. The Compensation Committee has certain duties and powers as described in its charter, including but not limited to periodically reviewing and approving our salary and benefits policies, compensation of executive officers, administering our stock option plans and recommending and approving grants of stock options under such plans.

Nominating Committee

The Nominating Committee is comprised of Howard L. Haronian, M.D., and Paul Koehler. Dr. Haronian is Chairman of the Nominating Committee. The Nominating Committee considers and makes recommendations on matters related to the practices, policies and procedures of the Board and takes a leadership role in shaping our corporate governance. As part of its duties, the Nominating Committee assesses the size, structure and composition of the Board and its committees, coordinates evaluation of Board performance and reviews Board compensation. The Nominating Committee also acts as a screening and nominating committee for candidates considered for election to the Board.

Director Nominations

Part of our Nominating Committee’s duties is to screen and nominate candidates considered for election to our Board of Directors. In this capacity, it concerns itself with the composition of the Board with respect to depth of experience, balance of professional interests, required expertise and other factors. The Nominating Committee evaluates prospective nominees identified on its own initiative or referred to it by other Board members, management, stockholders or external sources and all self-nominated candidates. The Nominating Committee uses the same criteria for evaluating candidates nominated by stockholders and self-nominated candidates as it does for those proposed by other Board members, management and search companies.

Stockholders who wish to recommend a candidate for election to the Board of Directors may submit such nominations pursuant to timely notice in writing. To be timely, a stockholder's notice shall be delivered to or mailed and received at our principal executive offices, not less than 60 days nor more than 90 days prior to the first anniversary of the preceding year's annual meeting; provided, however, that in the event that the date of the annual meeting is changed by more than 30 days from such anniversary date, notice by the stockholder to be timely must be received not later than the close of business on the 10th day following the earlier of the day on which notice of the date of the meeting was mailed or public disclosure was made. Such stockholder's notice shall set forth (a) as to the proposed candidate, the name, contact information, background, experience and other pertinent information; (b) as to the stockholder giving the notice (i) the name and address, as they appear on the books of the Company, of such stockholder and (ii) the class and number of shares which are beneficially owned by such stockholder and also which are owned of record by such stockholder; and (c) as to the beneficial owner, if any, on whose behalf the nomination is made, (i) the name and address of the beneficial owner and (ii) the class and number of shares of the Company which are beneficially owned by the beneficial owner.

Meetings of the Board of Directors and Committees

During the fiscal year ended December 31, 2008, the Board held seven meetings and acted by written consent on three occasions, the Audit Committee held four meetings and acted by written consent on one occasion, the Compensation Committee held eleven meetings and the Nominating Committee held one meeting. Each incumbent director attended or participated in 75% or more of the aggregate number of meetings of the Board and the Committees on which he served during the fiscal year.

Policy Regarding Attendance at Annual Meetings of Stockholders

Our Board of Directors has adopted a policy which states that each director is expected to attend annual meetings of its stockholders. Last year, all of our directors attended the annual meeting of stockholders and we expect that all of them will attend this year’s annual meeting as well.

Director Compensation Table – Fiscal 2008

The following table summarizes the compensation awarded during the fiscal year ended December 31, 2008 to our directors who are not named executive officers in the Summary Compensation Table under “Executive Compensation” below:

| Name | | Fees Earned or Paid in Cash | | | Option Awards (1)(2) | | | Total | |

| Philip Urso | | $ | 32,000 | | | $ | 38,924 | | | $ | 70,924 | |

| Howard L. Haronian, M.D. | | $ | 40,000 | (3) | | $ | 38,924 | | | $ | 78,924 | |

| Paul Koehler | | $ | 33,500 | | | $ | 38,924 | | | $ | 72,424 | |

| William Bush | | $ | 39,000 | (3) | | $ | 38,924 | | | $ | 77,924 | |

| | (1) | Based upon the aggregate grant date fair value calculated in accordance with the Financial Accounting Standards Board Statement of Financial Accounting Standard No. 123R, Share-Based Payment. Our policy and assumptions made in the valuation of share-based payments are contained in Note 8 to our December 31, 2008 financial statements. |

| | (2) | Information provided relates to the issuance in 2008 of options to purchase 50,000 shares each for Messrs. Urso, Koehler and Bush, and Dr. Haronian. Does not include outstanding options to purchase an aggregate of 362,886, 50,039, 10,000 and 12,500 shares held by Mr. Urso, Dr. Haronian, Mr. Koehler and Mr. Bush respectively, which options were granted in prior fiscal years. |

| | (3) | Includes $500 of fees earned during fiscal year 2008 that were not paid until fiscal year 2009. |

Narrative Disclosure to Director Compensation Table

The table entitled “Director Compensation Table - Fiscal 2008” above quantifies the value of the different forms of compensation of each of the directors for services rendered during fiscal 2008. The primary elements of each director’s total compensation reported in the table are cash fees earned and stock option awards.

Pursuant to the 2008 Non-Employee Directors Compensation Plan, each non-employee director is entitled to receive five-year options to purchase 50,000 shares of our common stock at an exercise price equal to the fair market value of our common stock on the date of grant upon such non-employee director’s election or appointment to our Board of Directors and thereafter each year on the first business day in June, subject to such director remaining on the Board. Non-employee directors also receive $25,000 per annum in cash and an additional $1,000 per meeting attended in person or by telephone, and $500 per committee meeting attended in person or by telephone.

Code of Ethics

Our Board of Directors has adopted a code of conduct and ethics that establishes the standards of ethical conduct applicable to all directors, officers and employees of our Company. The code addresses, among other things, conflicts of interest, compliance with disclosure controls and procedures, and internal control over financial reporting, corporate opportunities and confidentiality requirements. The Audit Committee is responsible for applying and interpreting our code of conduct and ethics in situations where questions are presented to it. Our code of ethics is available for review on our website at www.towerstream.com. There were no amendments or waivers to this code in fiscal 2008.

Stockholder Communication with Directors

Our Board of Directors has established procedures for stockholders or other interested parties to send communications to the Board of Directors. Such parties can contact the Board of Directors by electronic mail at Board@towerstream.com.

AUDIT COMMITTEE REPORT

The following Audit Committee Report shall not be deemed to be “soliciting material” or to be “filed” with the SEC, or to the liabilities of Section 18 of the Exchange Act. Notwithstanding anything to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933, as amended, or the Exchange Act, that might incorporate by reference future filings, including this Proxy Statement, in whole or in part, the following Audit Committee Report shall not be incorporated by reference into any such filings.

The Audit Committee is comprised of three independent directors (as defined under Rule 4200 of the NASDAQ Stock Market). The Audit Committee operates under a written charter adopted by the Board of Directors on January 12, 2007, which can be found in the Corporate Governance section of our website, www.towerstream.com, and is also available in print to any stockholder upon request to the Corporate Secretary.

We have reviewed and discussed with management the Company’s audited consolidated financial statements as of and for the fiscal year ended December 31, 2008.

We have reviewed and discussed with management and Marcum and Kliegman LLP, our independent registered public accounting firm, the quality and the acceptability of the Company’s financial reporting and internal controls.

We have discussed with Marcum and Kliegman LLP, the overall scope and plans for their audit as well as the results of their examinations, their evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

We have discussed with management and Marcum and Kliegman LLP, such other matters as required to be discussed with the Audit Committee under Statement on Auditing Standards No. 61, as amended, as adopted by the Public Company Accounting Oversight Board (the “PCAOB”) in Rule 3200T, and other auditing standards generally accepted in the United States, the corporate governance standards of the NASDAQ Stock Market and the Audit Committee’s Charter.

We have received and reviewed the written disclosures and the letter from Marcum and Kliegman LLP, required by applicable requirements of the PCAOB regarding Marcum and Kliegman LLP’s communications with the Audit Committee concerning independence, and have discussed with Marcum and Kliegman LLP, their independence from management and the Company.

Based on the reviews and discussions referred to above, we recommended to the Board of Directors that the financial statements referred to above be included in the Company’s Annual Report on Form 10-K, for the fiscal year ended December 31, 2008 for filing with the SEC.

| | William Bush, Audit Committee Chairman Howard L. Haronian, M.D. Paul Koehler |

Dated as of April 29, 2009

EXECUTIVE OFFICERS

The following table sets forth information regarding our executive officers. Officers are elected annually by the Board of Directors and serve at the discretion of the Board.

| Name | Age | Position |

| Jeffrey M. Thompson | 44 | Chief Executive Officer, President and Director |

| Joseph P. Hernon | 49 | Chief Financial Officer |

| Bruce E. Grinnell | 54 | Chief Operations Officer |

| Melvin L. Yarbrough, Jr. | 43 | Chief Revenue Officer |

Information pertaining to Mr. Thompson, who is both a director and an executive officer of the Company, may be found in the section entitled “Information about the Nominees.”

Joseph P. Hernon has been our chief financial officer, principal financial officer and principal accounting officer since joining the Company in May 2008. From November 2007 until May 2008, Mr. Hernon was a financial consultant to a high technology company. From November 2005 until October 2007, Mr. Hernon served as the chief financial officer of Aqua Bounty Technologies Inc., a biotechnology company dedicated to the improvement of productivity in the acquaculture industry through the application of biotechnology. From August 1996 until October 2005, Mr. Hernon served as vice president, chief financial officer and secretary of Boston Life Sciences Inc., a biotechnology company focused on developing therapeutics and diagnostics for central nervous system diseases. From January 1987 until August 1996, Mr. Hernon held various positions while employed at Price Waterhouse Coopers LLP, an international accounting firm. Mr. Hernon holds a B.S. in Business Administration from the University of Lowell, MA and a Masters degree in Accounting from Bentley College in Waltham, MA.

Bruce E. Grinnell has been our chief operations officer since joining the Company in August 2008. Prior to joining Towerstream, Mr. Grinnell was the Chief Operating Officer for VBS, Inc., a closely-held capital equipment and logistics company, since February 2006. Before VBS, Mr. Grinnell had leadership roles with several technology and engineering services providers, including serving as the Director of Business Operations for Perot Systems where he was responsible for delivering mission-critical solutions to both government and commercial customers. Mr. Grinnell previously served as a commissioned officer, pilot and engineer in the U.S. Coast Guard, where his career included assignments as Chief of Programming and Budgeting for Aeronautical Engineering and later as Chief, Aviation Information Systems. Mr. Grinnell holds a Master of Science in Industrial Administration from the Krannert School of Management at Purdue University.

Melvin L. Yarbrough, Jr. has been our chief revenue officer since August 2008. Mr. Yarbrough has been employed by Towerstream since April 2007, serving as Vice President of Sales until his new appointment as Chief Revenue Officer. Mr. Yarbrough came to Towerstream from Hoovers (Dun and Bradstreet (“D&B”)), where he first served as Vice President of Business Development and then Vice President of Subscription Sales from 2005 until 2007. Prior to joining D&B, Mr. Yarbrough spent nearly a decade in several executive sales positions, including serving as Senior Vice President of Sales, Marketing and Alliance Channel at StarCite, an on-demand global meetings management company, and as Vice President of Sales at Handango, a handheld and wireless software solutions company. Mr. Yarbrough holds a B.A. from Southern Methodist University and a J.D. from Vanderbilt University School of Law.

EXECUTIVE COMPENSATION

Summary Compensation Table – Fiscal 2008 and Fiscal 2007

The following table summarizes the annual and long-term compensation paid to our chief executive officer and our two other most highly compensated executive officers who were serving at the end of 2008, whom we refer to collectively in this prospectus as the “named executive officers”:

| Name and Principal Position | Year | | Salary | | | Bonus | | | | Option Awards (1) | | | | Other Compensation (2) | | | Total | |

| Jeffrey M. Thompson | 2008 | | $ | 225,000 | | | $ | 121,533 | (3 | ) | | $ | 43,095 | (4 | ) | | $ | − | | | $ | 389,628 | |

| President and Chief Executive Officer | 2007 | | $ | 225,000 | | | $ | 137,800 | (5 | ) | | $ | 31,949 | (6 | ) | | $ | − | | | $ | 394,749 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Melvin L. Yarbrough, Jr. | 2008 | | $ | 179,480 | | | $ | 95,053 | (7 | ) | | $ | 108,142 | (8 | ) | | $ | 2,172 | | | $ | 384,847 | |

| Chief Revenue Officer | 2007 | | $ | 116,875 | | | $ | 59,400 | (9 | ) | | $ | 902,204 | (10 | ) | | $ | 23,026 | | | $ | 1,101,505 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Joseph P. Hernon | 2008 | | $ | 114,487 | | | $ | 60,715 | (11 | ) | | $ | 197,055 | (12 | ) | | $ | 4,156 | | | $ | 376,413 | |

| Chief Financial Officer (13) | | | | | | | | | | | | | | | | | | | | | | | |

(1) | Based upon the aggregate grant date fair value calculated in accordance with the Financial Accounting Standards Board Statement of Financial Accounting Standard No. 123R, Share-Based Payment. Our policy and assumptions made in the valuation of share-based payments are contained in Note 8 to our December 31, 2008 financial statements. |

| | |

| (2) | Includes reimbursement for relocation costs, including travel. |

| (3) | Consists of $113,276 paid in cash and $8,257 paid in common stock. The cash bonus included $85,590 awarded to Mr. Thompson in 2008 in recognition of services performed during 2008 and $27,686 awarded to Mr. Thompson in January 2009 in recognition of services performed during 2008. |

| (4) | Represents (i) a ten-year option to purchase 75,000 shares of common stock at an exercise price of $0.69 per share granted on December 31, 2008 in recognition of services performed during 2008, with vesting occurring annually as to one-third of the option, commencing December 31, 2009, and (ii) a ten-year option to purchase 18,406 shares of common stock at an exercise price of $0.77 per share granted in March 2009 in recognition of services performed in 2008, which option was fully vested and exercisable on the date of grant. |

| (5) | Consists of $69,400 awarded in cash in 2007 in recognition of services performed during 2007, $34,200 awarded in cash in January 2008 in recognition of services performed during 2007, and $34,200 awarded in cash in February 2008 in recognition of services performed during 2007. |

| | |

(6) | Represents (i) a ten-year option to purchase 12,010 shares of common stock at an exercise price of $2.00 per share granted in December 2007 in recognition of services performed during 2007, which option was fully vested and exercisable on the date of grant, and (ii) a ten-year option to purchase 11,032 shares of common stock at an exercise price of $2.00 per share granted on March 3, 2008 in recognition of services performed in 2007, with vesting occurring annually as to one-third of the option, commencing March 3, 2009. |

| | |

(7) | Consists of $89,897 paid in cash and $5,156 paid in common stock. The cash bonus included $61,796 awarded to Mr. Yarbrough in 2008 in recognition of services performed during 2008 and $28,101 awarded to Mr. Yarbrough in January 2009 in recognition of services performed during 2008. |

| (8) | Represents (i) a ten-year option to purchase 65,000 shares of common stock at an exercise price of $1.45 per share granted on June 2, 2008 in recognition of services performed during 2008, with vesting occurring annually as to one-third of the option, commencing June 2, 2009, (ii) a ten-year option to purchase 50,000 shares of common stock at an exercise price of $0.69 per share granted on December 31, 2008 in recognition of services performed during 2008, with vesting occurring annually as to one-third of the option, commencing December 31, 2009, and (iii) a ten-year option to purchase 18,683 shares of common stock at an exercise price of $0.77 per share granted in March 2009 in recognition of services performed in 2008, which option was fully vested and exercisable on the date of grant. |

| (9) | Consists of $30,000 awarded in cash in 2007 in recognition of services performed during 2007 and $29,400 awarded in cash to Mr. Yarbrough in January 2008 in recognition of services performed during 2007. |

| (10) | Represents (i) a ten-year option to purchase 135,000 shares of common stock at an exercise price of $7.05 per share granted on May 10, 2007 in recognition of the commencement of employment with the Company, with vesting occurring annually as to one-third of the option, commencing May 10, 2008, and (ii) a ten-year option to purchase 135,000 shares of common stock at an exercise price of $3.70 per share granted on June 29, 2007 in recognition of services performed during 2007, with vesting occurring annually as to one-third of the option, commencing June 29, 2008. |

| (11) | Consists of $52,981 paid in cash and $7,734 paid in stock. The cash bonus included $23,203 awarded to Mr. Hernon in 2008 in recognition of services performed during 2008 and $29,778 awarded to Mr. Hernon in January 2009 in recognition of services performed during 2008. |

| (12) | Represents (i) a ten-year option to purchase 150,000 shares of common stock at an exercise price of $1.45 per share granted on June 2, 2008 in recognition of the commencement of employment with the Company, with vesting occurring annually as to one-third of the option, commencing June 2, 2009, (ii) a ten-year option to purchase 25,000 shares of common stock at an exercise price of $0.69 per share granted on December 31, 2008 in recognition of services performed during 2008, vesting occurring annually as to one-third of the option, commencing December 31, 2009, and (iii) a ten-year option to purchase 19,797 shares of common stock at an exercise price of $0.77 per share granted in March 2009 in recognition of services performed in 2008, which option was fully vested and exercisable on the date of grant. |

| | |

(13) | Mr. Hernon joined the Company in May 2008. |

Narrative Disclosure to Summary Compensation Table

The table entitled “Summary Compensation Table - Fiscal 2008 and Fiscal 2007” above quantifies the value of the different forms of compensation of each of the named executive officers for services rendered during fiscal 2008 and fiscal 2007, to the extent applicable. The primary elements of each named executive officer’s total compensation reported in the table are base salary, an annual bonus, and stock option awards. For a description of the material terms of the employment agreements with the named executive officers, see section entitled “Employment Agreements and Change-in-Control Agreements” below.

Outstanding Equity Awards at 2008 Fiscal Year-End

The following table summarizes the outstanding equity awards to our named executive officers as of December 31, 2008:

| | | Option Awards |

| | | |

| Name | | Number of Securities Underlying Unexercised Options Exercisable | | | | | Number of Securities Underlying Unexercised Options Unexercisable | | | | | Option Exercise Price | | Option Expiration Date |

| Jeffrey M. Thompson | | | 280,309 | | (1 | ) | | | − | | | | | $ | 0.78 | | 2/27/13 |

| | | | 175,193 | | (2 | ) | | | − | | | | | $ | 1.14 | | 12/14/14 |

| | | | 175,193 | | (3 | ) | | | − | | | | | $ | 1.43 | | 4/28/15 |

| | | | 65,625 | | (4 | ) | | | 9,375 | | | | | $ | 9.74 | | 2/13/12 |

| | | | 12,010 | | (5 | ) | | | − | | | | | $ | 2.00 | | 12/2/17 |

| | | | − | | | | | | 11,032 | | (6 | ) | | $ | 2.00 | | 3/2/18 |

| | | | − | | | | | | 75,000 | | (7 | ) | | $ | 0.69 | | 12/30/18 |

| Joseph P. Hernon | | | − | | | | | | 150,000 | | (8 | ) | | $ | 1.45 | | 6/1/18 |

| | | | − | | | | | | 25,000 | | (7 | ) | | $ | 0.69 | | 12/30/18 |

| Melvin L. Yarbrough, Jr. | | | 45,000 | | (9 | ) | | | 90,000 | | | | | $ | 7.05 | | 5/9/17 |

| | | | 45,000 | | (10 | ) | | | 90,000 | | | | | $ | 3.70 | | 6/28/17 |

| | | | − | | | | | | 65,000 | | (8 | ) | | $ | 1.45 | | 6/1/18 |

| | | | − | | | | | | 50,000 | | (7 | ) | | $ | 0.69 | | 12/30/18 |

(1) Such option vested as to one-third of the shares subject to the option annually, commencing February 28, 2004.

(2) Such option was fully vested and exercisable on December 15, 2004, the date of grant.

(3) Such option was fully vested and exercisable on April 29, 2005, the date of grant.

(4) Such option vested in equal quarterly installments over a two-year period commencing April 1, 2007.

(5) Such option was fully vested and exercisable on December 3, 2007, the date of grant.

(6) Such option vests as to one-third of the shares subject to the option annually, commencing March 3, 2009.

(7) Such option vests as to one-third of the shares subject to the option annually, commencing December 31, 2009.

(8) Such option vests as to one-third of the shares subject to the option annually, commencing June 2, 2009.

(9) Such option vests as to one-third of the shares subject to the option annually, commencing May 10, 2008.

(10) Such option vests as to one-third of the shares subject to the option annually, commencing June 29, 2008.

Employment Agreements and Change-in-Control Agreements

On December 21, 2007, we entered into an employment agreement with Jeffrey M. Thompson, our principal executive officer. Pursuant to the terms of the agreement, Mr. Thompson will serve as our chief executive officer and president for a period of two years, with automatic one-year renewals, subject to either party electing not to renew. For such services, Mr. Thompson will receive a base salary of $225,000 per annum, which may be increased annually by our Board of Directors in its discretion, but which increase shall not be less than the greater of (i) the annual increase in the consumer price index or (ii) 5%. Mr. Thompson is also eligible for a bonus of up to 75% of his base salary, as determined by our Board of Directors. In addition, we will pay 100% of all costs associated with Mr. Thompson’s employee benefits, including without limitation health insurance.

If Mr. Thompson’s employment is terminated (i) by us without “cause,” (ii) by him for “good reason” or (iii) by us within two years of a “change of control” (as such terms are defined in the agreement), then (a) we will be required to pay Mr. Thompson twenty-four months base salary in monthly installments, (b) any unvested options to purchase shares of our common stock would immediately vest and become exercisable and any restrictions on restricted stock would immediately lapse, and (c) we must continue to provide employee benefits, including without limitation health insurance, to Mr. Thompson for a period of five years following such termination.

During Mr. Thompson’s employment with us, and for a period of twelve months following his termination (the “Restricted Period”), except for a termination by Mr. Thompson for “good reason,” he is prohibited from engaging in any line of business in which we were engaged or had a formal plan to enter during the period of his employment with us. We will continue to pay Mr. Thompson his base salary then in effect in accordance with our customary payroll practices for the duration of any such Restricted Period in the event that Mr. Thompson’s employment is terminated voluntarily by him, except for “good reason,” or by us for “cause.”

In May 2008, Joseph P. Hernon joined the Company as Chief Financial Officer. His employment offer provided for a base annual salary of $190,000 and bonus payments up to 58% of base salary, as determined by the Board of Directors. Upon joining the Company, Mr. Hernon was granted options to purchase 150,000 shares of common stock at an exercise price of $1.45 per share, vesting in three annual installments commencing upon the first anniversary of the grant. He is eligible to receive additional awards at the discretion of the Board of Directors and as provided under the Company’s stock based incentive plans. He is also eligible to participate in the Company’s health and other employee benefit plans. Mr. Hernon is an employee at will.

In April 2007, Mel Yarbrough joined the Company as Vice President of Sales. His employment offer provided for a base annual salary of $165,000 and bonus payments up to 61% of base salary, as determined by the Chief Executive Officer. Upon joining the Company, Mr. Yarbrough was granted options to purchase 135,000 shares of common stock at an exercise price of $7.05 per share, vesting in three annual installments commencing upon the first anniversary of the grant. He is eligible to receive additional awards at the discretion of the Board of Directors and as provided under the Company’s stock based incentive plans. He is also eligible to participate in the Company’s health and other employee benefit plans. Mr. Yarbrough moved from Texas to Rhode Island to join the Company which agreed to reimburse him for reasonable relocation costs including moving expenses, up to 90 days of temporary housing, and other related costs. Mr. Yarbrough is an employee at will.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Related parties can include any of our directors or executive officers, certain of our stockholders and their immediate family members. Each year, we prepare and require our directors and executive officers to complete Director and Officer Questionnaires identifying any transactions with us in which the officer or director or their family members have an interest. This helps us identify potential conflicts of interest. A conflict of interest occurs when an individual’s private interest interferes, or appears to interfere, in any way with the interests of the company as a whole. Our code of ethics requires all directors, officers and employees who may have a potential or apparent conflict of interest to immediately notify our Audit Committee of the Board of Directors, which is responsible for considering and reporting to the Board any questions of possible conflicts of interest of Board members. Our code of ethics further requires pre-clearance before any employee, officer or director engages in any personal or business activity that may raise concerns about conflict, potential conflict or apparent conflict of interest. Copies of our code of ethics and the Audit Committee charter are posted on the corporate governance section of our website at www.towerstream.com.

In evaluating related party transactions and potential conflicts of interest, our compliance officer and independent directors apply the same standards of good faith and fiduciary duty they apply to their general responsibilities. They will approve a related party transaction only when, in their good faith judgment, the transaction is in the best interest of the Company.

On August 2, 2002, we borrowed $250,000 from Natale and Elizabeth Urso, the parents of Philip Urso, our Chairman, and issued a promissory note in the original principal amount of $250,000. This note provided for interest at the rate of 10% per annum and was due and payable within 60 days of demand.

On April 1, 2003, we borrowed $253,000 from Philip Urso and issued Mr. Urso a promissory note, dated April 1, 2003, in the original principal amount of $253,000. On November 30, 2004, we borrowed an additional $100,000 from Mr. Urso and issued Mr. Urso a promissory note, dated November 30, 2004, in the original principal amount of $100,000. On August 1, 2005, we consolidated all of our outstanding obligations to Mr. Urso under one instrument, by cancelling each of the foregoing promissory notes and issuing Mr. Urso a single consolidated note for the principal sum of $360,564 to account for the $65,251 then outstanding under the April 1, 2003 note, the $106,694 then outstanding under the November 30, 2004 note, $111,959 of deferred compensation earned in 2004 and $76,659 of deferred compensation earned in 2005. This consolidated note provided for interest at the rate of 5% per annum and was due and payable on August 1, 2008. Mr. Urso, however, had the right to convert up to 50% of the note’s unpaid balance into shares of common stock at a conversion price of $1.00 per share.

On December 7, 2005, we borrowed $250,000 from Mr. Urso and issued Mr. Urso a promissory note, dated December 7, 2005, in the original principal amount of $250,000. This note provided for interest at the rate of 10% per annum and was due and payable on December 7, 2006. Mr. Urso, however, had the right to convert all of the note’s unpaid balance into shares of common stock at a conversion price of $1.00 per share.

On January 13, 2006, we borrowed $250,000 from Mr. Urso and issued Mr. Urso a promissory note, dated January 13, 2006, in the original principal amount of $250,000. This note provided for interest at the rate of 10% per annum and was due and payable within 60 days of demand.

On July 12, 2006, we borrowed $50,000 from Mr. Urso and issued Mr. Urso a promissory note, dated July 12, 2006, in the original principal amount of $50,000. This note provided for interest at the rate of 10% per annum and was due and payable within 60 days of demand.

On October 1, 2006, we borrowed $125,000 from Mr. Urso and issued Mr. Urso a promissory note, dated October 1, 2006, in the original principal amount of $125,000. This note provided for interest at the rate of 10% per annum and was due and payable within 60 days of demand.

On September 7, 2004, we borrowed $150,000 from George E. Kilguss, III, our then Chief Financial Officer, and issued Mr. Kilguss a promissory note, dated September 7, 2004, in the original principal amount of $150,000. This note provided for interest at the rate of 10% per annum and was due and payable on September 7, 2007. Mr. Kilguss, however, had the right to convert all of the note’s unpaid balance into shares of common stock at a purchase price of $0.80 per share.

On January 1, 2005, Mr. Kilguss agreed to defer $125,000 of his 2005 compensation. The deferred compensation accrued interest at a rate of 10% per annum. The deferred compensation and accrued interest was due on December 31, 2006. Mr. Kilguss, however, had the right to convert any amount of the balance not paid into shares of common stock at a conversion price of $1.00 per share.

On January 1, 2006, Mr. Kilguss agreed to defer $45,000 of his 2006 compensation. The deferred compensation accrued interest at a rate of 10% per annum. The deferred compensation and accrued interest was due on December 31, 2006. Mr. Kilguss, however, had the right to convert any amount of the balance not paid into shares of common stock at a conversion price of $1.00 per share.

On November 10, 2005, we borrowed $250,000 from Howard L. Haronian, one of our directors, and issued Dr. Haronian a promissory note, dated November 10, 2005, in the original principal amount of $250,000. The note provided for interest at the rate of 10% per annum and was due and payable on November 10, 2006. Dr. Haronian, however, had the right to convert all of the note’s unpaid balance into shares of common stock at a conversion price of $1.00 per share. On January 12, 2007, Dr. Haronian converted this note into 174,825 shares of our common stock at an adjusted conversion price of $1.43 per share

On October 1, 2006, we borrowed $150,000 from Howard L. Haronian and issued Dr. Haronian a promissory note, dated October 1, 2006, in the original principal amount of $150,000. This note provided for interest at the rate of 10% per annum and was due and payable within 60 days of demand.

On January 4, 2007, the aggregate outstanding principal and interest on all of the above promissory notes was $1,691,636. On such date, each of the noteholders sold their notes to a group of unaffiliated third parties pursuant to our issuing each of the note purchasers new notes that:

| | · | were due and payable on January 4, 2008; |

| | | |

| | · | accrued interest at the rate of 10% per annum; and |

| | · | became automatically convertible into shares of common stock at a conversion price of $1.50 per share upon a merger. |

When Towerstream Corporation, a private company, merged with the Company on January 12, 2007, these new January 4, 2007 notes converted into 1,127,575 shares of our common stock.

Appointment of Independent Registered Public Accounting Firm

The Audit Committee annually reviews the appointment of the Company’s independent registered public accounting firm. Under the Sarbanes-Oxley Act of 2002 and applicable regulations, the lead partner and concurring partner of the Company’s audit firm must rotate off the account every five years. Marcum & Kliegman LLP has served as the Company’s independent registered public accounting firm since fiscal 2007. As part of its current review, the Audit Committee intends to invite Marcum & Kliegman LLP and other independent registered public accounting firms to be considered for the engagement to serve as the Company’s independent registered public accounting firm for fiscal 2009. The Company therefore is not asking shareholders to ratify at the annual meeting the appointment of Marcum & Kliegman LLP as the Company’s independent registered public accounting firm for fiscal 2009. Representatives of Marcum & Kliegman LLP will be present at the meeting, will have the opportunity to make a statement if they desire to do so, and will have an opportunity to respond to appropriate questions.

Fees Paid to Auditors

The following table sets forth the fees that the Company accrued or paid to Marcum & Kliegman LLP during fiscal 2008 and fiscal 2007.

| | | 2008 | | | 2007 | |

| Audit Fees(1) | | $ | 178,550 | | | $ | 316,088 | |

| Audit-Related Fees(2) | | | − | | | | − | |

| Tax Fees(3) | | | − | | | | − | |

| All Other Fees | | | − | | | | − | |

| | | | | | | | | |

| Total | | $ | 178,550 | | | $ | 316,088 | |

(1) Audit fees relate to professional services rendered in connection with the audit of the Company’s annual financial statements and internal control over financial reporting, quarterly review of financial statements included in the Company’s Quarterly Reports on Form 10-Q, and audit services provided in connection with other statutory and regulatory filings.

(2) Audit-related fees relate to professional services rendered in connection with assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements, including due diligence.

(3) Tax fees relate to professional services rendered for tax compliance, tax advice and tax planning for the Company. The Company does not engage Marcum & Kliegman LLP to perform personal tax services for its executive officers.

Administration of the Engagement; Pre-Approval of Audit and Permissible Non-Audit Services

Before the independent registered public accounting firm is engaged by the Company to perform audit or permissible non-audit services, the engagement is approved by the Audit Committee. These services may include audit services, audit-related services, tax services and other services. The Audit Committee may establish, either on an ongoing or case-by-case basis, pre-approval policies and procedures providing for delegated authority to approve the engagement of the independent registered public accounting firm, provided that the policies and procedures are detailed as to the particular services to be provided, the Audit Committee is informed about each service, and the policies and procedures do not result in the delegation of the Audit Committee's authority to management. In accordance with these procedures, the Audit Committee pre-approved all services performed by Marcum & Kliegman LLP.

FUTURE PROPOSALS OF SECURITY HOLDERS

Stockholders who wish to present proposals for inclusion in the Company’s proxy materials for the 2010 Annual Meeting of Stockholders may do so by following the procedures prescribed in Rule 14a-8 under the Exchange Act. To be eligible, the stockholder proposals must be received by our Secretary at our principal executive office on or before January 15, 2010. Under SEC rules, you must have continuously held for at least one year prior to the submission of the proposal (and continue to hold through the date of the meeting) at least $2,000 in market value, or 1%, of our outstanding stock in order to submit a proposal which you seek to have included in the Company’s proxy materials. We may, subject to SEC review and guidelines, decline to include any proposal in our proxy materials.

Stockholders who wish to make a proposal at the 2010 Annual Meeting of Stockholders, other than one that will be included in our proxy materials, must notify us no later than March 31, 2010 (see Rule 14a-4(c)(1) under the Exchange Act). If a stockholder who wishes to present a proposal fails to notify us by March 31, 2010, the proxies that management solicits for the meeting will confer discretionary authority to vote on the stockholder’s proposal if it is properly brought before the meeting.

HOUSE HOLDING OF MATERIALS