Corporate Overview

Safe Harbor Statements Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of 1995: Statements made in this presentation that relate to future plans, events or performances are forward - looking statements . Any statement containing words such as "believes,” "anticipates," "plans," "projections," "expects," and similar words, is forward looking, and these statements involve risks and uncertainties and are based on current expectations . Although the Company believes that the expectations reflected in such forward - looking statements are reasonable, it can give no assurance that such expectations in such forward - looking statements will prove to be correct . 1

Company Overview Leading wireless broadband IP service provider to businesses delivering high speed Internet access in 12 large U.S. markets Bandwidth options range from T - 1 to 1.5Gbps, and support VoIP, cloud computing, bandwidth on demand, wireless redundancy, VPNs, disaster recovery, bundled data and video services We have very simple products that customers understand and can buy over the phone We own and control our entire network Building a portable network that has speeds up to 200 MB 2

Investment Highlights Recurring revenue model provides stability and visibility Gross margins stable at 73% or higher for 10 consecutive quarters, excluding Wi - Fi network expenses Low churn rate Improving adjusted EBITDA for 14 consecutive quarters, became EBITDA positive second quarter 2010 Building scale through organic growth, accretive acquisitions and other growth initiatives 3

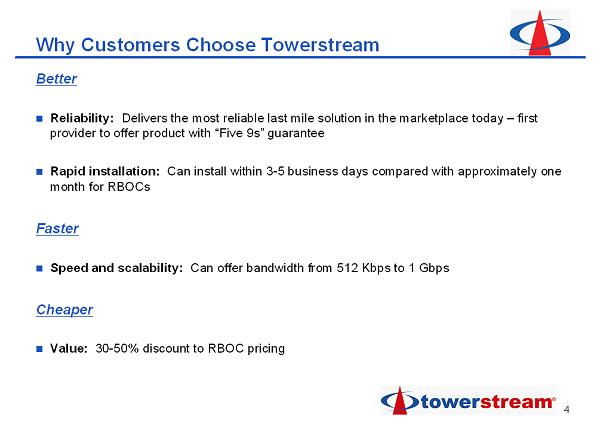

Why Customers Choose Towerstream Better Reliability: Delivers the most reliable last mile solution in the marketplace today – first provider to offer product with “ Five 9s ” guarantee Rapid installation: Can install within 3 - 5 business days compared with approximately one month for RBOCs Faster Speed and scalability: Can offer bandwidth from 512 Kbps to 1 Gbps Cheaper Value: 30 - 50% discount to RBOC pricing 4

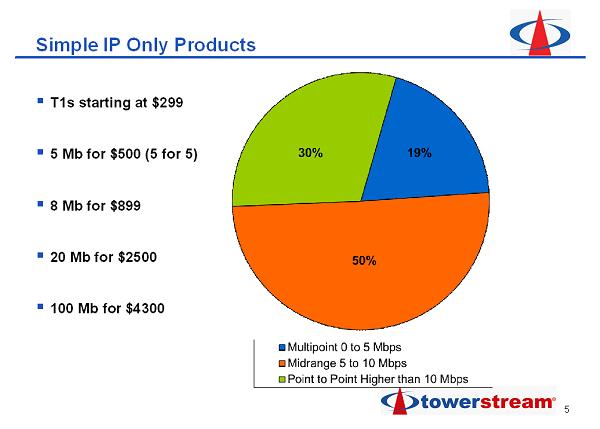

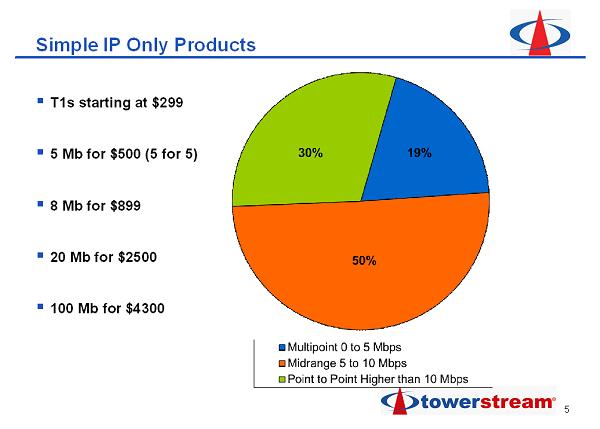

Simple IP Only Products ▪ T1s starting at $299 ▪ 5 Mb for $500 (5 for 5) ▪ 8 Mb for $899 ▪ 20 Mb for $2500 ▪ 100 Mb for $4300 5

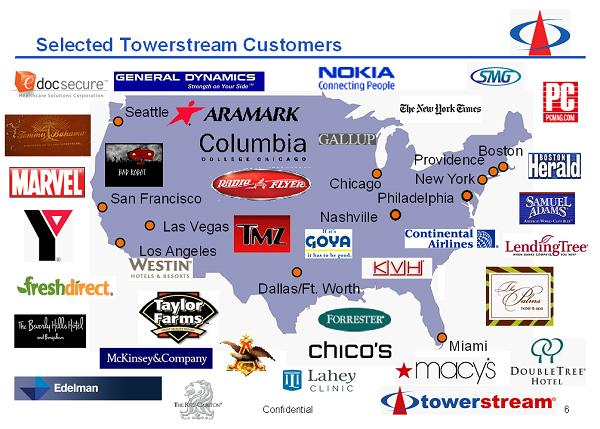

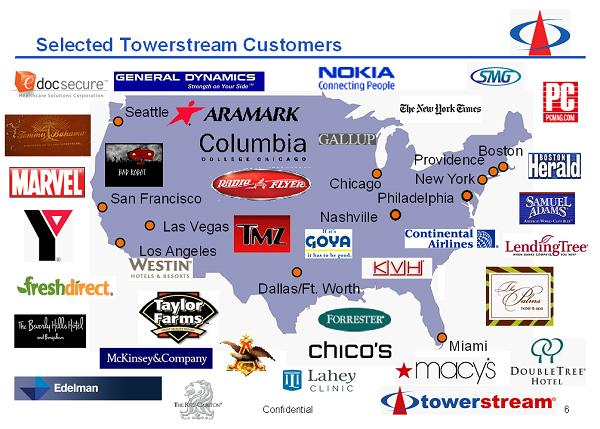

Selected Towerstream Customers Dallas/Ft. Worth Seattle San Francisco Las Vegas Chicago New York Providence Miami Boston Confidential Philadelphia Nashville Los Angeles 6

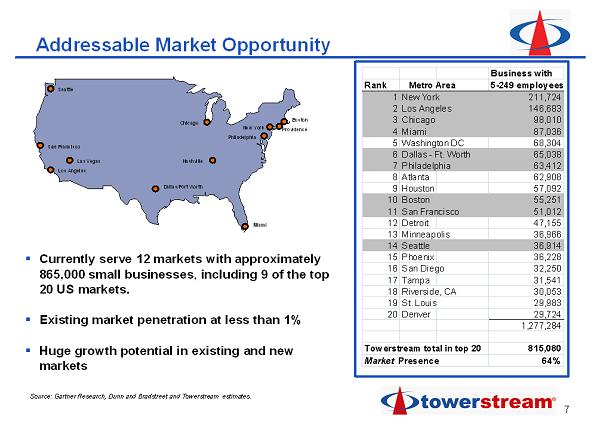

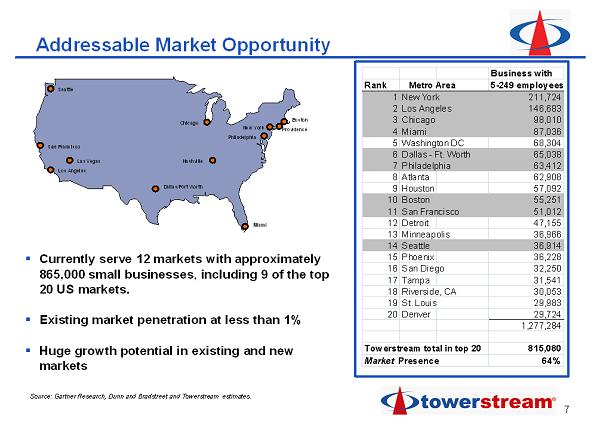

Addressable Market Opportunity Source: Gartner Research, Dunn and Bradstreet and Towerstream estimates. ▪ Currently serve 12 markets with approximately 865,000 small businesses , including 9 of the top 20 US markets. ▪ Existing market penetration at less than 1% ▪ Huge growth potential in existing and new markets Seattle San Francisco Los Angeles Miami Chicago New York Boston Providence Dallas/Fort Worth Business with Rank Metro Area 5-249 employees 1New York 211,724 2Los Angeles 146,683 3Chicago 98,010 4Miami 87,036 5Washington DC 68,304 6Dallas - Ft. Worth 65,038 7Philadelphia 63,412 8Atlanta 62,908 9Houston 57,092 10Boston 55,251 11San Francisco 51,012 12Detroit 47,155 13Minneapolis 36,966 14Seattle 36,914 15Phoenix 36,228 16San Diego 32,250 17Tampa 31,541 18Riverside, CA 30,053 19St. Louis 29,983 20Denver 29,724 1,277,284 Towerstream total in top 20 815,080 Market Presence 64% Nashville Philadelphia Las Vegas 7

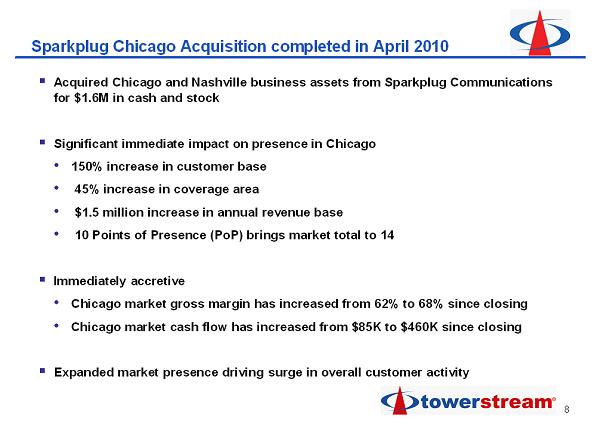

Sparkplug Chicago Acquisition completed in April 2010 ▪ Acquired Chicago and Nashville business assets from Sparkplug Communications for $1.6M in cash and stock ▪ Significant immediate impact on presence in Chicago • 150% increase in customer base • 45% increase in coverage area • $1.5 million increase in annual revenue base • 10 Points of Presence (PoP) brings market total to 14 ▪ Immediately accretive • Chicago market gross margin has increased from 62% to 68% since closing • Chicago market cash flow has increased from $85K to $460K since closing ▪ Expanded market presence driving surge in overall customer activity 8

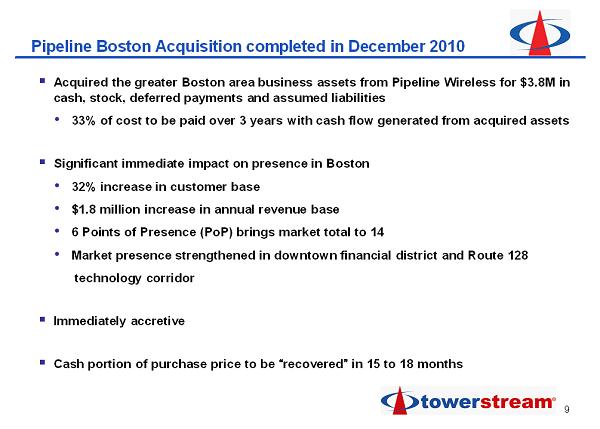

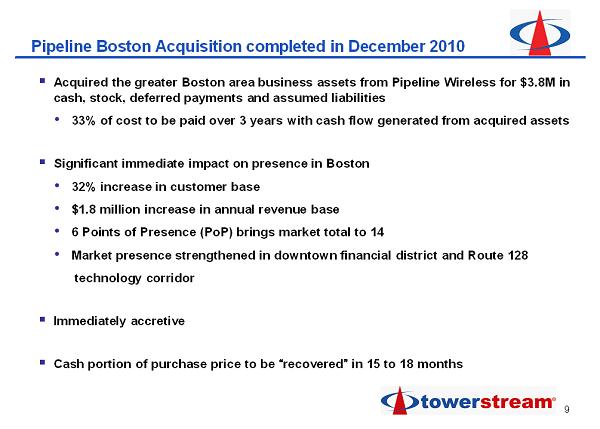

Pipeline Boston Acquisition completed in December 2010 ▪ Acquired the greater Boston area business assets from Pipeline Wireless for $3.8M in cash, stock, deferred payments and assumed liabilities • 33% of cost to be paid over 3 years with cash flow generated from acquired assets ▪ Significant immediate impact on presence in Boston • 32% increase in customer base • $1.8 million increase in annual revenue base • 6 Points of Presence (PoP) brings market total to 14 • Market presence strengthened in downtown financial district and Route 128 technology corridor ▪ Immediately accretive ▪ Cash portion of purchase price to be “ recovered ” in 15 to 18 months 9

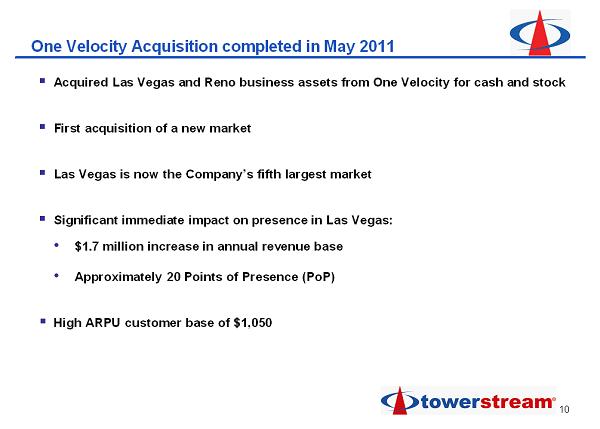

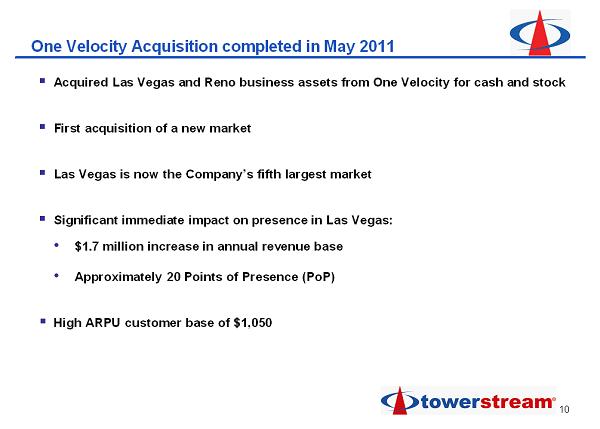

One Velocity Acquisition completed in May 2011 ▪ Acquired Las Vegas and Reno business assets from One Velocity for cash and stock ▪ First acquisition of a new market ▪ Las Vegas is now the Company’s fifth largest market ▪ Significant immediate impact on presence in Las Vegas: • $1.7 million increase in annual revenue base • Approximately 20 Points of Presence (PoP) ▪ High ARPU customer base of $1,050 10

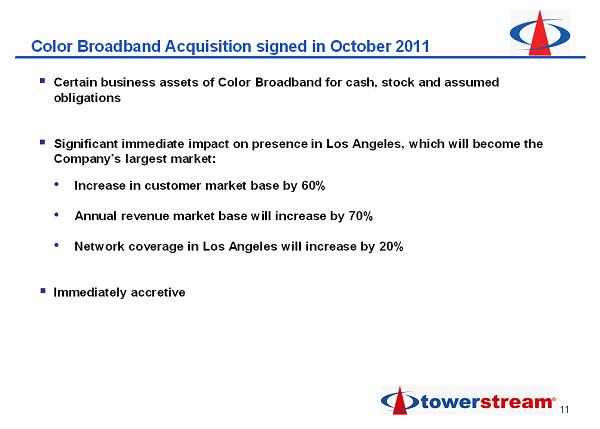

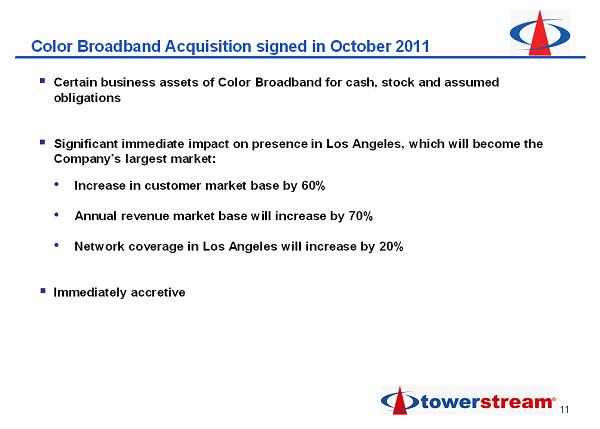

Color Broadband Acquisition signed in October 2011 ▪ Certain business assets of Color Broadband for cash, stock and assumed obligations ▪ Significant immediate impact on presence in Los Angeles, which will become the Company’s largest market: • Increase in customer market base by 60% • Annual revenue market base will increase by 70% • Network coverage in Los Angeles will increase by 20% ▪ Immediately accretive 11

Financial Trends 12

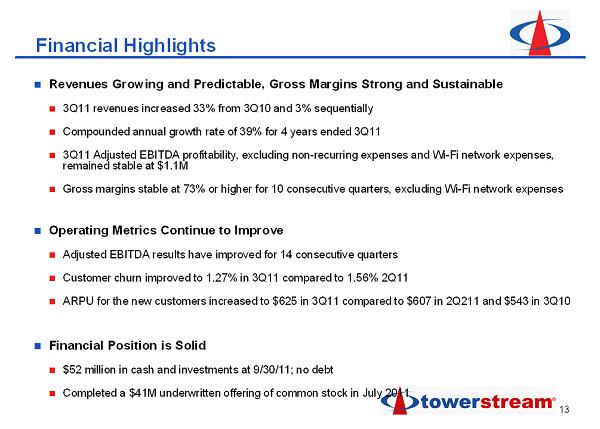

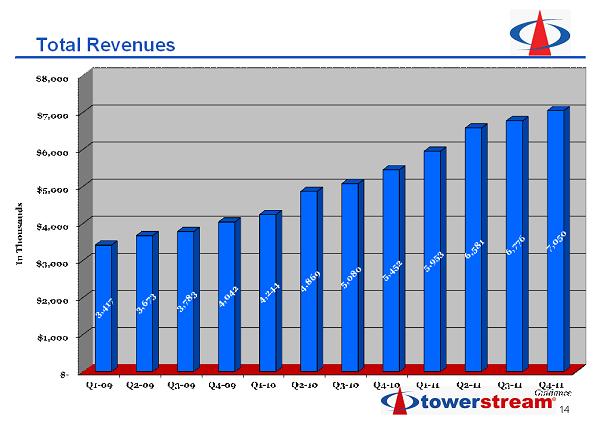

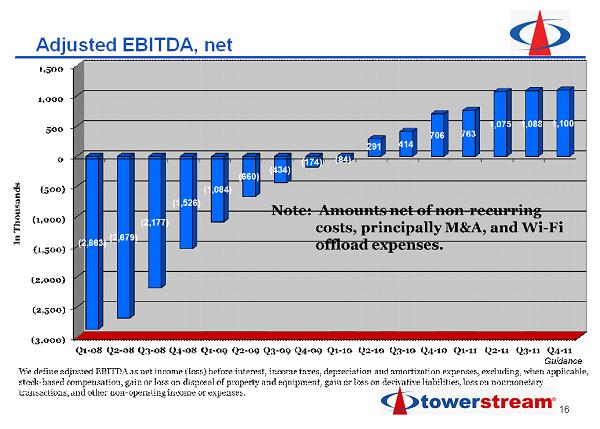

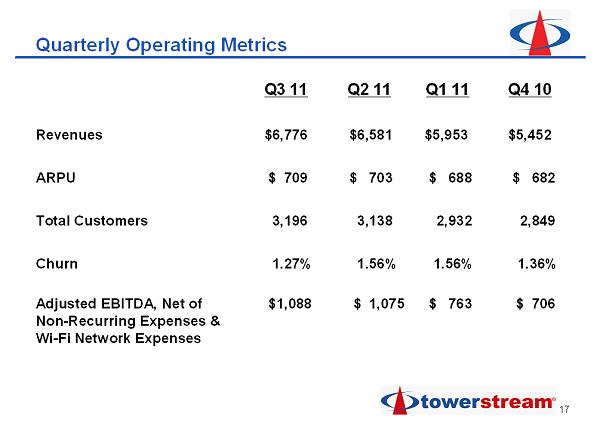

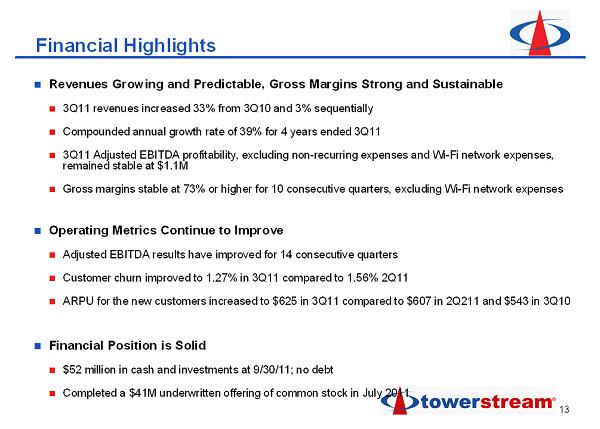

Revenues Growing and Predictable, Gross Margins Strong and Sustainable 3Q11 revenues increased 33% from 3Q10 and 3% sequentially Compounded annual growth rate of 39% for 4 years ended 3Q11 3Q11 Adjusted EBITDA profitability, excluding non - recurring expenses and Wi - Fi network expenses, remained stable at $1.1M Gross margins stable at 73% or higher for 10 consecutive quarters, excluding Wi - Fi network expenses Operating Metrics Continue to Improve Adjusted EBITDA results have improved for 14 consecutive quarters Customer churn improved to 1.27% in 3Q11 compared to 1.56 % 2Q11 ARPU for the new customers increased to $625 in 3Q11 compared to $607 in 2Q211 and $543 in 3Q10 Financial Position is Solid $52 million in cash and investments at 9/30/11; no debt Completed a $41M underwritten offering of common stock in July 2011 Financial Highlights 13

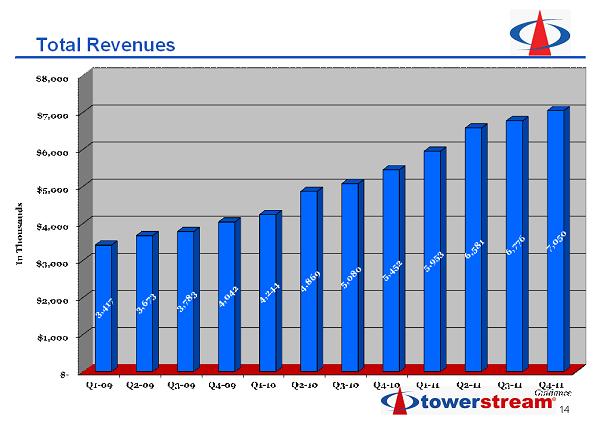

Total Revenues 14

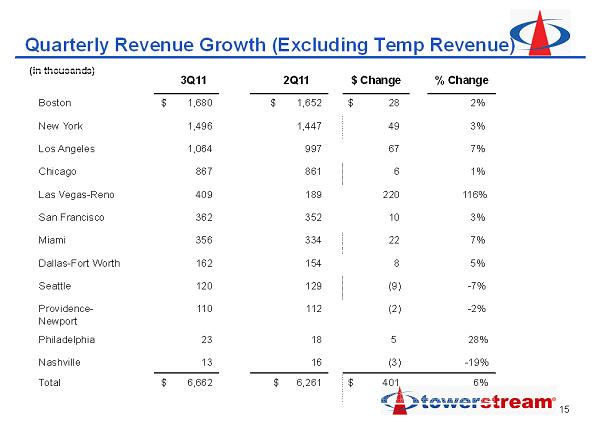

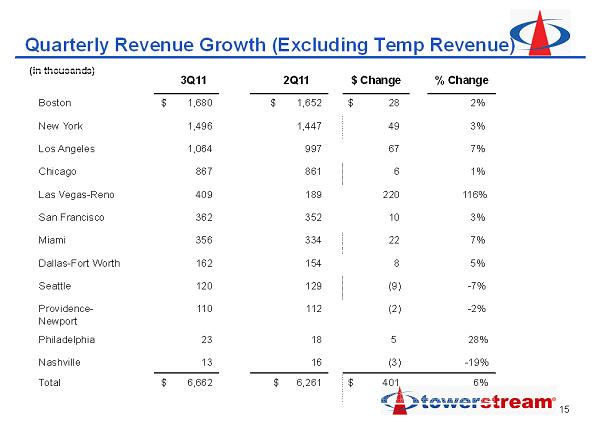

Quarterly Revenue Growth (Excluding Temp Revenue) (in thousands) 3Q11 2Q11 $ Change % Change Boston $ 1,680 $ 1,652 $ 28 2% New York 1,496 1,447 49 3% Los Angeles 1,064 997 67 7% Chicago 867 861 6 1% Las Vegas - Reno 409 189 220 116% San Francisco 362 352 10 3% Miami 356 334 22 7% Dallas - Fort Worth 162 154 8 5% Seattle 120 129 (9) - 7% Providence - Newport 110 112 (2) - 2% Philadelphia 23 18 5 28% Nashville 13 16 (3) - 19% Total $ 6,662 $ 6,261 $ 401 6% 15

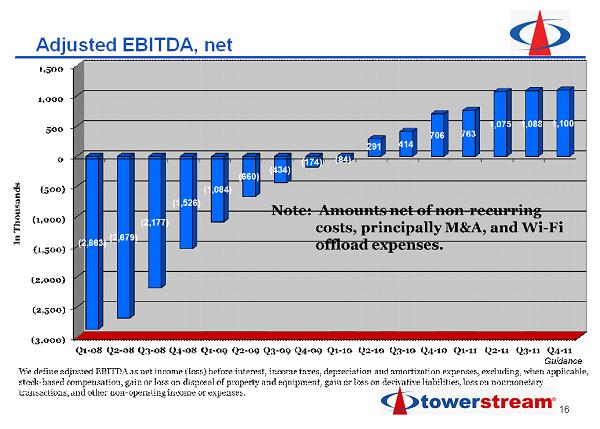

Adjusted EBITDA, net 16

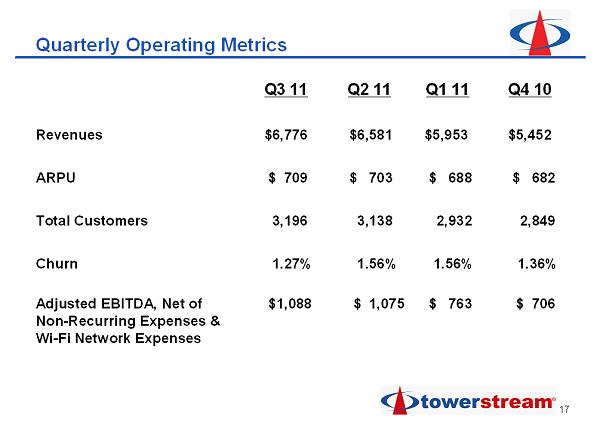

Quarterly Operating Metrics Q3 11 Q2 11 Q1 11 Q4 10 Revenues $6,776 $6,581 $5,953 $5,452 ARPU $ 709 $ 703 $ 688 $ 682 Total Customers 3,196 3,138 2,932 2,849 Churn 1.27% 1.56% 1.56% 1.36% Adjusted EBITDA, Net of $1,088 $ 1,075 $ 763 $ 706 Non - Recurring Expenses & Wi - Fi Network Expenses 17

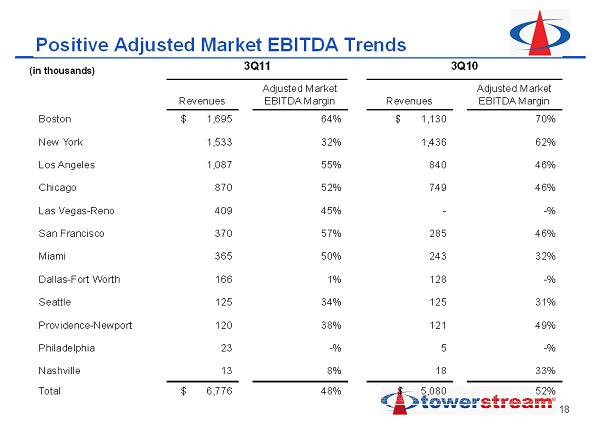

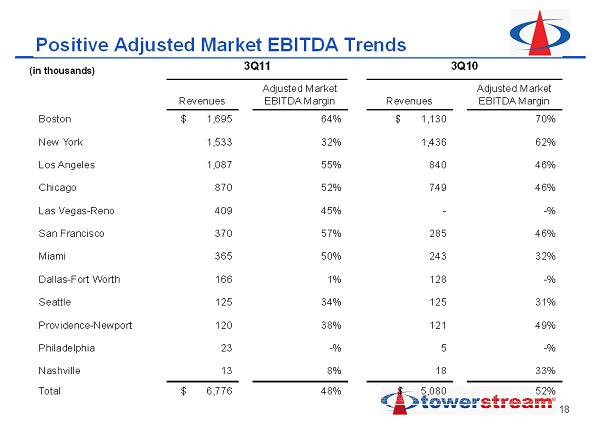

Positive Adjusted Market EBITDA Trends (in thousands) 3Q11 3Q10 Revenues Adjusted Market EBITDA Margin Revenues Adjusted Market EBITDA Margin Boston $ 1,695 64% $ 1,130 70% New York 1,533 32% 1,436 62% Los Angeles 1,087 55% 840 46% Chicago 870 52% 749 46% Las Vegas - Reno 409 45% - - % San Francisco 370 57% 285 46% Miami 365 50% 243 32% Dallas - Fort Worth 166 1% 128 - % Seattle 125 34% 125 31% Providence - Newport 120 38% 121 49% Philadelphia 23 - % 5 - % Nashville 13 8% 18 33% Total $ 6,776 48% $ 5,080 52% 18

Smartphone Offload 19

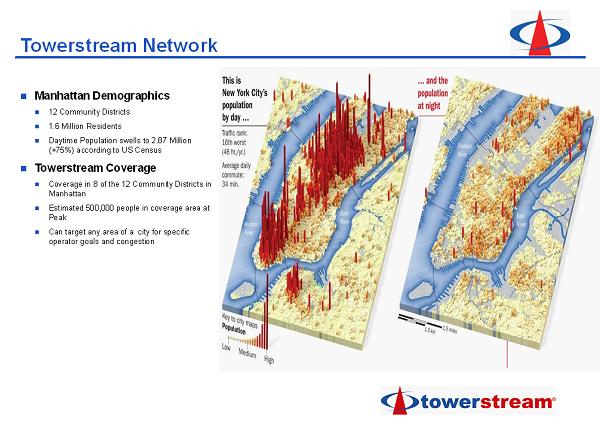

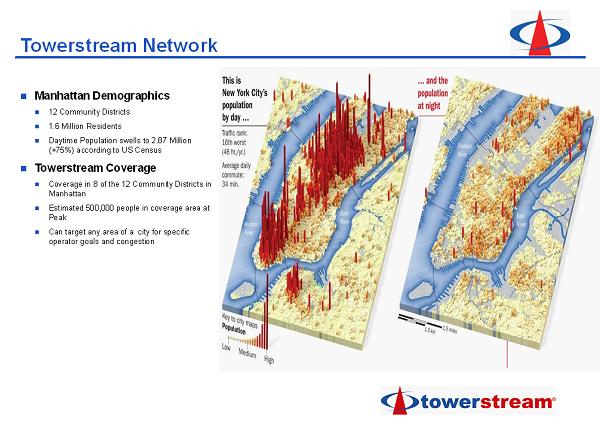

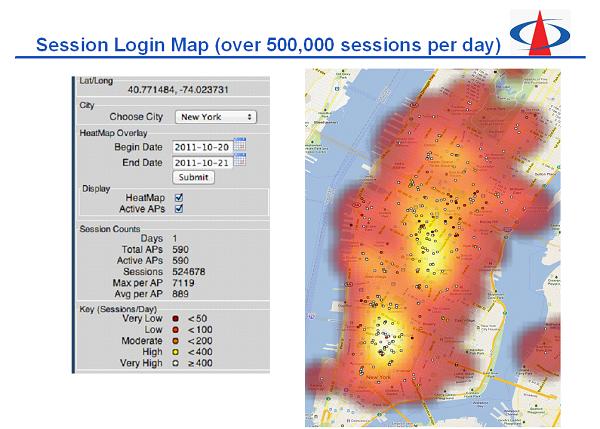

Towerstream Network Manhattan Demographics 12 Community Districts 1.6 Million Residents Daytime Population swells to 2.87 Million (+75%) according to US Census Towerstream Coverage Coverage in 8 of the 12 Community Districts in Manhattan Estimated 500,000 people in coverage area at Peak Can target any area of a city for specific operator goals and congestion

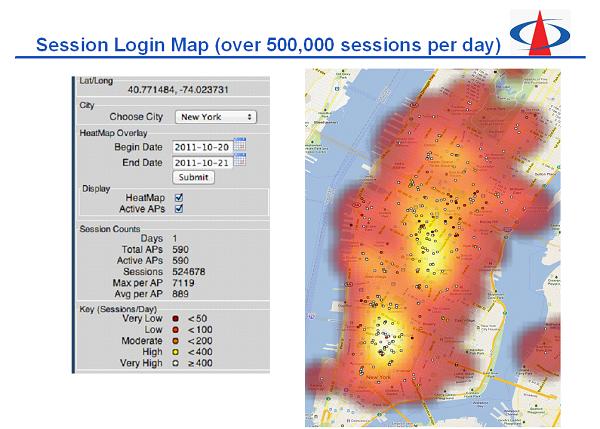

Session Login Map (over 500,000 sessions per day)

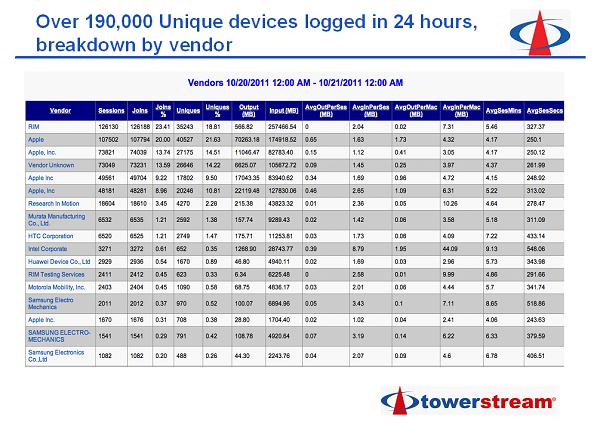

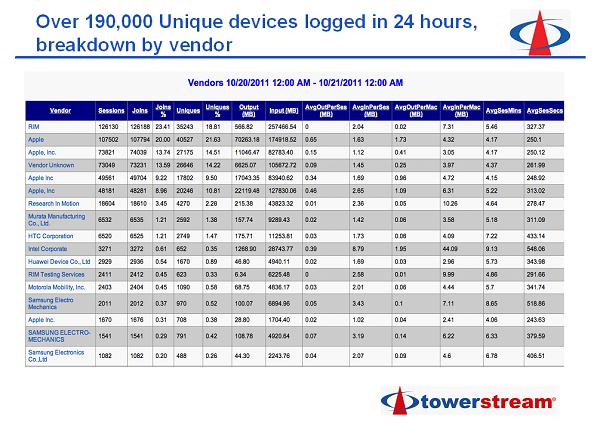

Over 190,000 Unique devices logged in 24 hours, breakdown by vendor

Towerstream Smartphone Actual Speed test results

Towerstream WiFi notebook results

Tower stream Better Faster Cheaper