Filed Pursuant to Rule 433

Registration No. 333-118843

Because the asset-backed securities are being offered on a “when, as and if issued” basis, any contract of sale will terminate, by its terms, without any further obligation or liability between us, if the securities themselves, or the particular class to which the contract relates, are not issued. Because the asset-backed securities are subject to modification or revision, any such contract also is conditioned upon the understanding that no material change will occur with respect to the relevant class of securities prior to the closing date. If a material change does occur with respect to such class, our contract will terminate, by its terms, without any further obligation or liability between us (the “Automatic Termination”). If an Automatic Termination occurs, we will provide you with revised offering materials reflecting the material change and give you an opportunity to purchase such class. To indicate your interest in purchasing the class, you must communicate to us your desire to do so within such timeframe as may be designated in connection with your receipt of the revised offering materials.

Mortgage Pass-Through Certificates, Series 2006-1

Banc of America Alternative Loan Trust 2006-1

Issuing Entity

Banc of America Mortgage Securities, Inc.

Depositor

Bank of America, National Association

Sponsor and Servicer

January 12, 2006

The depositor has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the depositor has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-294-1322 or you e-mail a request to dg.prospectus_distribution@bofasecurities.com. The securities may not be suitable for all investors. Banc of America Securities LLC and its affiliates may acquire, hold or sell positions in these securities, or in related derivatives, and may have an investment or commercial banking relationship with the issuer.

The information contained in these materials may be based on assumptions regarding market conditions and other matters as reflected herein. Banc of America Securities LLC (the “Underwriter”) makes no representation regarding the reasonableness of such assumptions or the likelihood that any such assumptions will coincide with actual market conditions or events, and these materials should not be relied upon for such purposes. The Underwriter and its affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of these materials, may, from time to time, have long or short positions in, and buy and sell, the securities mentioned herein or derivatives thereof (including options). Information in these materials is current as of the date appearing on the material only. Information in these materials regarding any securities discussed herein supersedes all prior information regarding such securities. These materials are not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

DISCLAIMER

This free writing prospectus is being delivered to you solely to provide you with information about the offering of the securities referred to in this free writing prospectus and to solicit an offer to purchase the securities, when, as and if issued. Any such offer to purchase made by you will not be accepted and will not constitute a contractual commitment by you to purchase any of the securities until we have accepted your offer to purchase securities. We will not accept any offer by you to purchase the securities, and you will not have any contractual commitment to purchase any of the securities until after you have received the preliminary prospectus. You may withdraw your offer to purchase securities at any time prior to our acceptance of your offer.

The information in this free writing prospectus supersedes information contained in any prior similar free writing prospectus relating to these securities prior to the time of your commitment to purchase.

This free writing prospectus is not an offer to sell or solicitation of an offer to buy these securities in any state where such offer, solicitation or sale is not permitted.

IRS CIRCULAR 230 NOTICE

THIS FREE WRITING PROSPECTUS IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, FOR THE PURPOSE OF AVOIDING U.S. FEDERAL, STATE OR LOCAL TAX PENALTIES. THIS FREE WRITING PROSPECTUS IS WRITTEN AND PROVIDED BY THE UNDERWRITER IN CONNECTION WITH THE PROMOTION OR MARKETING OF THE TRANSACTIONS OR MATTERS ADDRESSED HEREIN. INVESTORS SHOULD SEEK ADVICE BASED ON THEIR PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISOR.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW THIS DOCUMENT ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-294-1322 or you e-mail a request to dg.prospectus_distribution@bofasecurities.com. The securities may not be suitable for all investors. Banc of America Securities LLC and its affiliates may acquire, hold or sell positions in these securities, or in related derivatives, and may have an investment or commercial banking relationship with the issuer.

The information contained in these materials may be based on assumptions regarding market conditions and other matters as reflected herein. Banc of America Securities LLC (the “Underwriter”) makes no representation regarding the reasonableness of such assumptions or the likelihood that any such assumptions will coincide with actual market conditions or events, and these materials should not be relied upon for such purposes. The Underwriter and its affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of these materials, may, from time to time, have long or short positions in, and buy and sell, the securities mentioned herein or derivatives thereof (including options). Information in these materials is current as of the date appearing on the material only. Information in these materials regarding any securities discussed herein supersedes all prior information regarding such securities. These materials are not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

| | |

| | Banc of America Alternative Loan Trust 2006-1 Mortgage Pass-Through Certificates, Series 2006-1 |

Preliminary Summary of Terms

| | |

| Transaction: | | Banc of America Alternative Loan Trust 2006-1 Mortgage Pass-Through Certificates, Series 2006-1 |

| |

| Issuing Entity: | | Banc of America Alternative Loan Trust 2006-1 |

| |

| Depositor: | | Banc of America Mortgage Securities, Inc. |

| |

| Underwriter: | | Banc of America Securities LLC |

| |

| Sponsor and Servicer: | | Bank of America, National Association |

| |

| Trustee: | | Wells Fargo Bank, N.A. |

| |

| Rating Agencies: | | Two of Standard & Poor’s, Moody’s and/or Fitch Ratings will rate the offered Senior Certificates. At least one of the above Rating Agencies will rate the offered Subordinate Certificates. |

| |

| Senior Certificates: | | The Senior Certificates will consist of three or more classes of certificates, one of which will be the residual certificate and at least one of which will be ratio strip certificates. One or more classes of certificates may be comprised of two or more components. The components of a class are not severable. The Senior Certificates (or in the case of a class of Senior Certificates comprised of components, the components) may be divided into two or more groups in which case each group will have a corresponding group of Subordinate Certificates which may or may not be shared with one or more other groups of Senior Certificates. |

| |

| Subordinate Certificates: | | If the Senior Certificates are divided into multiple groups, the Subordinate Certificates may or may not consist of multiple groups. If there is only one group of Subordinate Certificates, the Subordinate Certificates will support all of the Senior Certificates. If there are multiple groups of Subordinate Certificates, each group will support one or more groups of Senior Certificates. Each class of Subordinate Certificates is also subordinated to each class of Subordinate Certificates within its group, if any, with a lower number. |

| |

| Offered Certificates: | | Senior Certificates and Subordinate Certificates rated BBB - or Baa3 or better |

| |

| Expected Closing Date: | | January 30, 2006 |

| |

| Expected Investor Closing Date: | | January 31, 2006 |

| |

| Distribution Date: | | 25th of each month, or the next succeeding business day (First Distribution Date: February 27, 2006) |

| |

| Cut-off Date: | | January 1, 2006. |

| |

| Determination Date: | | For any Distribution Date, the 16th day of the month in which the Distribution Date occurs or, if that day is not a business day, the immediately preceding business day. |

| | |

Banc of America Securities LLC | | 3 |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-294-1322 or you e-mail a request to dg.prospectus_distribution@bofasecurities.com. The securities may not be suitable for all investors. Banc of America Securities LLC and its affiliates may acquire, hold or sell positions in these securities, or in related derivatives, and may have an investment or commercial banking relationship with the issuer.

The information contained in these materials may be based on assumptions regarding market conditions and other matters as reflected herein. Banc of America Securities LLC (the “Underwriter”) makes no representation regarding the reasonableness of such assumptions or the likelihood that any such assumptions will coincide with actual market conditions or events, and these materials should not be relied upon for such purposes. The Underwriter and its affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of these materials, may, from time to time, have long or short positions in, and buy and sell, the securities mentioned herein or derivatives thereof (including options). Information in these materials is current as of the date appearing on the material only. Information in these materials regarding any securities discussed herein supersedes all prior information regarding such securities. These materials are not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

| | |

| | Banc of America Alternative Loan Trust 2006-1 Mortgage Pass-Through Certificates, Series 2006-1 |

|

| Preliminary Summary of Terms |

| | | | | | |

| Record Date: | | For any Distribution Date, the close of business on the last business day of the month preceding the month of that Distribution Date. |

| |

| Day Count: | | 30/360 |

| |

| Clearing: | | DTC, Clearstream and Euroclear. |

| | | |

| Denominations: | | Original Certificate Form | | Minimum Denominations | | Incremental

Denominations |

| | | |

| Senior Certificates (other than any Principal Only Certificates, Interest Only Certificates and Special Retail Certificates) | | Book Entry | | $1,000 | | $1 |

| | | |

| Interest Only Certificates | | Book Entry | | $1,000,000 (notional amount) or size of class, if less than $1,000,000 | | $1 or N/A |

| | | |

| Special Retail Certificates | | Book Entry | | $1,000 | | $1,000 |

| | | |

| Principal Only Certificates and Subordinate Certificates | | Book Entry | | $25,000 | | $1 |

| |

| SMMEA Eligibility: | | The Senior Certificates and the most senior class or classes of Subordinate Certificates are expected to constitute “mortgage related securities” for purposes of SMMEA. |

| | |

Banc of America Securities LLC | | 4 |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-294-1322 or you e-mail a request to dg.prospectus_distribution@bofasecurities.com. The securities may not be suitable for all investors. Banc of America Securities LLC and its affiliates may acquire, hold or sell positions in these securities, or in related derivatives, and may have an investment or commercial banking relationship with the issuer.

The information contained in these materials may be based on assumptions regarding market conditions and other matters as reflected herein. Banc of America Securities LLC (the “Underwriter”) makes no representation regarding the reasonableness of such assumptions or the likelihood that any such assumptions will coincide with actual market conditions or events, and these materials should not be relied upon for such purposes. The Underwriter and its affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of these materials, may, from time to time, have long or short positions in, and buy and sell, the securities mentioned herein or derivatives thereof (including options). Information in these materials is current as of the date appearing on the material only. Information in these materials regarding any securities discussed herein supersedes all prior information regarding such securities. These materials are not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

| | |

| | Banc of America Alternative Loan Trust 2006-1 Mortgage Pass-Through Certificates, Series 2006-1 |

|

| Preliminary Summary of Terms |

| | |

ERISA Eligibility:

| | A fiduciary or other person acting on behalf of any employee benefit plan or arrangement, including an individual retirement account , subject to the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), the Code or any federal, state or local law (“Similar Law”) which is similar to ERISA or the Code (collectively, a “Plan”) should carefully review with its legal advisors whether the purchase or holding of an Offered Certificate could give rise to a transaction prohibited or not otherwise permissible under ERISA, the Code or Similar Law. The U.S. Department of Labor has extended to Banc of America Securities LLC an administrative exemption (the “Exemption”) from certain of the prohibited transaction rules of ERISA and the related excise tax provisions of Section 4975 of the Code with respect to the initial purchase, the holding and the subsequent resale by certain Plans of certificates in pass-through trusts that consist of certain receivables, loans and other obligations that meet the conditions and requirements of the Exemption. The Exemption may cover the acquisition and holding of the Offered Certificates by the Plans to which it applies provided that all conditions of the Exemption other than those within the control of the investors are met. In addition, as of the date hereof, there is no single mortgagor that is the obligor on 5% of the initial balance of the Mortgage Pool. If there are Mortgage Loans with loan-to-value ratios in excess of 100% in the Mortgage Pool or in a loan group within the Mortgage Pool, the Exemption will not cover the acquisition and holding of the related offered Subordinate Certificates. Prospective Plan investors should consult with their legal advisors concerning the impact of ERISA, the Code and Similar Law, the applicability of PTE 83-1 and the Exemption, and the potential consequences in their specific circumstances, prior to making an investment in the Offered Certificates. Moreover, each Plan fiduciary should determine whether under the governing plan instruments and the applicable fiduciary standards of investment prudence and diversification, an investment in the Offered Certificates is appropriate for the Plan, taking into account the overall investment policy of the Plan and the composition of the Plan’s investment portfolio. |

| |

| Tax Structure: | | For federal income tax purposes, one or more elections will be made to treat the Trust as one or more “real estate mortgage investment conduits” (each, a “REMIC”). |

| | |

Banc of America Securities LLC | | 5 |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-294-1322 or you e-mail a request to dg.prospectus_distribution@bofasecurities.com. The securities may not be suitable for all investors. Banc of America Securities LLC and its affiliates may acquire, hold or sell positions in these securities, or in related derivatives, and may have an investment or commercial banking relationship with the issuer.

The information contained in these materials may be based on assumptions regarding market conditions and other matters as reflected herein. Banc of America Securities LLC (the “Underwriter”) makes no representation regarding the reasonableness of such assumptions or the likelihood that any such assumptions will coincide with actual market conditions or events, and these materials should not be relied upon for such purposes. The Underwriter and its affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of these materials, may, from time to time, have long or short positions in, and buy and sell, the securities mentioned herein or derivatives thereof (including options). Information in these materials is current as of the date appearing on the material only. Information in these materials regarding any securities discussed herein supersedes all prior information regarding such securities. These materials are not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

| | |

| | Banc of America Alternative Loan Trust 2006-1 Mortgage Pass-Through Certificates, Series 2006-1 |

|

| Preliminary Summary of Terms |

| | |

| Optional Termination Date: | | On any Distribution Date on which the aggregate Stated Principal Balance of the Mortgage Loans is less than 10% of the initial aggregate unpaid principal balance of the Mortgage Loans as of the Cut-off Date, the Depositor may, at its option, subject to certain conditions, purchase the Mortgage Loans, which would effect an early retirement of the Certificates. If the Mortgage Loans are divided into multiple loan groups with more than one set of Subordinate Certificates, the Depositor may, at its option, subject to certain conditions, purchase the Mortgage Loans in one or some but not all of the loan groups, which would effect an early retirement of only the related Certificates. |

| |

| The Pooling Agreement: | | The Certificates will be issued pursuant to a Pooling and Servicing Agreement (the “Pooling Agreement”) to be dated the Closing Date, among the Depositor, the Servicer and the Trustee. |

| |

| The Mortgage Pool: | | The “Mortgage Pool” will consist of fixed rate, conventional, fully-amortizing mortgage loans (the “Mortgage Loans”) secured by first liens on one- to four-family properties. All of the Mortgage Loans were originated or acquired by Bank of America, National Association, which is an affiliate of the Depositor and Banc of America Securities LLC. In addition, certain of the Mortgage Loans were originated using underwriting standards that are different from, and in certain respects, less stringent than the general underwriting standards of Bank of America, National Association. The Mortgage Pool may be divided into multiple loan groups. |

| |

| The Mortgage Loans: | | The Mortgage Loans consist of fixed rate, conventional, fully amortizing mortgage loans secured by first liens on one- to four-family residential properties. Substantially all of the Mortgage Loans will have original terms to stated maturity of approximately 20 to 30 years. Borrowers are permitted to prepay their Mortgage Loans, in whole or in part, at any time. If indicated in the Collateral Summary at the end of this Free Writing Prospectus, certain of the Mortgage Loans may be subject to prepayment premiums. Accordingly, the actual date on which any Mortgage Loan is paid in full may be earlier than the stated maturity date due to unscheduled payments of principal. See the Collateral Summary at the end of this Free Writing Prospectus for more information about the Mortgage Loans. |

| | |

Banc of America Securities LLC | | 6 |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-294-1322 or you e-mail a request to dg.prospectus_distribution@bofasecurities.com. The securities may not be suitable for all investors. Banc of America Securities LLC and its affiliates may acquire, hold or sell positions in these securities, or in related derivatives, and may have an investment or commercial banking relationship with the issuer.

The information contained in these materials may be based on assumptions regarding market conditions and other matters as reflected herein. Banc of America Securities LLC (the “Underwriter”) makes no representation regarding the reasonableness of such assumptions or the likelihood that any such assumptions will coincide with actual market conditions or events, and these materials should not be relied upon for such purposes. The Underwriter and its affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of these materials, may, from time to time, have long or short positions in, and buy and sell, the securities mentioned herein or derivatives thereof (including options). Information in these materials is current as of the date appearing on the material only. Information in these materials regarding any securities discussed herein supersedes all prior information regarding such securities. These materials are not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

| | |

| | Banc of America Alternative Loan Trust 2006-1 Mortgage Pass-Through Certificates, Series 2006-1 |

|

| Preliminary Summary of Terms |

| | |

| Yield Maintenance Agreements: | | The Trustee on behalf of the Trust may enter into one or more yield maintenance agreements (the “Yield Maintenance Agreements”) with one or more counterparties (each, a “Counterparty”). With respect to each Yield Maintenance Agreement for any Distribution Date (other than the initial Distribution Date) if LIBOR, as calculated for the Interest Accrual Period related to such Distribution Date, exceeds a designated strike percentage, the Counterparty will be obligated to pay to the Trustee, for deposit into the related Reserve Fund, an amount equal to the product of (a) the amount by which (i) the lesser of LIBOR and a designated maximum percentage exceeds (ii) the designated strike percentage, (b) the related notional amount as set forth for such Distribution Date in the related Yield Maintenance Agreement and (c) one-twelfth. Pursuant to the Pooling Agreement, the Trustee will establish a separate trust account (the “Reserve Fund”) for deposit of any payments that it may receive under a Yield Maintenance Agreement. Each Reserve Fund is part of the trust fund but will not be an asset of any REMIC. |

| |

| Compensating Interest: | | Pursuant to the Pooling Agreement, the aggregate Servicing Fee payable to the Servicer for any month will be reduced (but not below zero) by an amount equal to the lesser of (i) the aggregate of the Prepayment Interest Shortfalls for such Distribution Date and (ii) one-twelfth of 0.25% of the aggregate Stated Principal Balance of the Mortgage Loans as of the due date in the month preceding the month of such Distribution Date (such amount, the “Compensating Interest”). If a group of Subordinate Certificates supports multiple groups of Senior Certificates, Compensating Interest will be determined on an aggregate basis with respect to all related loan groups. If a group of Subordinate Certificates supports one group of Senior Certificates, Compensating Interest will be determined for the related loan group. |

| |

| Advances: | | Subject to the certain limitations, the Servicer will be required pursuant to the Pooling Agreement to advance (any such advance, an “Advance”) prior to each Distribution Date an amount equal to the aggregate of payments of principal and interest (net of the Servicing Fee) which were due on the related due date on the Mortgage Loans and which were delinquent on the related Determination Date. Advances made by the Servicer will be made from its own funds or funds available for future distribution. The obligation to make an Advance with respect to any Mortgage Loan will continue until the ultimate disposition of the REO Property or Mortgaged Property relating to such Mortgage Loan. |

| | |

Banc of America Securities LLC | | 7 |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-294-1322 or you e-mail a request to dg.prospectus_distribution@bofasecurities.com. The securities may not be suitable for all investors. Banc of America Securities LLC and its affiliates may acquire, hold or sell positions in these securities, or in related derivatives, and may have an investment or commercial banking relationship with the issuer.

The information contained in these materials may be based on assumptions regarding market conditions and other matters as reflected herein. Banc of America Securities LLC (the “Underwriter”) makes no representation regarding the reasonableness of such assumptions or the likelihood that any such assumptions will coincide with actual market conditions or events, and these materials should not be relied upon for such purposes. The Underwriter and its affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of these materials, may, from time to time, have long or short positions in, and buy and sell, the securities mentioned herein or derivatives thereof (including options). Information in these materials is current as of the date appearing on the material only. Information in these materials regarding any securities discussed herein supersedes all prior information regarding such securities. These materials are not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

| | |

| | Banc of America Alternative Loan Trust 2006-1 Mortgage Pass-Through Certificates, Series 2006-1 |

|

| Preliminary Summary of Terms |

| | |

| Interest Accrual: | | Interest will accrue on the Certificates during each one-month period (i) ending on the last day of the month preceding the month in which each Distribution Date occurs (each, a “Regular Interest Accrual Period”) or (ii) commencing on the 25th day of the month preceding the month in which each Distribution Date occurs and ending on the 24th day of the month in which each Distribution Date occurs (each, a “LIBOR Based Interest Accrual Period” or “No Delay Interest Accrual Period” and together with a Regular Interest Accrual Period, an “Interest Accrual Period”). The initial Regular Interest Accrual Period will be deemed to have commenced on January 1, 2006 and any initial LIBOR Based Interest Accrual Period or No Delay Interest Accrual Period will be deemed to have commenced on January 25, 2006. On each Distribution Date, to the extent of the applicable Pool Distribution Amount or Amounts, each class of interest-bearing Certificates will be entitled to receive interest (as to each such class, the “Interest Distribution Amount”) with respect to the related Interest Accrual Period. The Interest Distribution Amount for any interest-bearing class of Certificates will be equal to the sum of (i) interest accrued during the related Interest Accrual Period at the applicable pass-through rate on the related Class Balance or notional amount and (ii) the sum of the amounts, if any, by which the amount described in clause (i) above on each prior Distribution Date exceeded the amount actually distributed in respect of interest on such prior Distribution Dates and not subsequently distributed. The interest entitlement described in clause (i) of the Interest Distribution Amount for each class of interest-bearing Senior Certificates and each class of Subordinate Certificates will be reduced by the amount of Net Interest Shortfalls for the related Mortgage Loans for such Distribution Date. Allocations of the interest portion of Realized Losses on the Mortgage Loans in a loan group first to the related Subordinate Certificates in reverse numerical order will result from the priority of distributions first to the related Senior Certificates and then to the classes of related Subordinate Certificates in numerical order of the applicable Pool Distribution Amount as described below under “Priority of Distributions.” After the date on which the aggregate Class Balance of the related Subordinate Certificates has been reduced to zero, the interest-bearing related Senior Certificates will bear the interest portion of any Realized Losses on such Mortgage Loanspro rata based on the interest entitlement described in clause (i) of the applicable Interest Distribution Amount. |

| | |

Banc of America Securities LLC | | 8 |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-294-1322 or you e-mail a request to dg.prospectus_distribution@bofasecurities.com. The securities may not be suitable for all investors. Banc of America Securities LLC and its affiliates may acquire, hold or sell positions in these securities, or in related derivatives, and may have an investment or commercial banking relationship with the issuer.

The information contained in these materials may be based on assumptions regarding market conditions and other matters as reflected herein. Banc of America Securities LLC (the “Underwriter”) makes no representation regarding the reasonableness of such assumptions or the likelihood that any such assumptions will coincide with actual market conditions or events, and these materials should not be relied upon for such purposes. The Underwriter and its affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of these materials, may, from time to time, have long or short positions in, and buy and sell, the securities mentioned herein or derivatives thereof (including options). Information in these materials is current as of the date appearing on the material only. Information in these materials regarding any securities discussed herein supersedes all prior information regarding such securities. These materials are not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

| | |

| | Banc of America Alternative Loan Trust 2006-1 Mortgage Pass-Through Certificates, Series 2006-1 |

|

| Preliminary Summary of Terms |

| | |

| Distributions to the Subordinate Certificates: | | On each Distribution Date, each class of Subordinate Certificates that is entitled to receive a principal distribution will receive its pro rata share (based on the Class Balances of all the Subordinate Certificates (or the Subordinate Certificates in the same group, if there is more than one group of Subordinate Certificates) that are entitled to receive a principal distribution) of the Subordinate Principal Distribution Amount(s), to the extent that the remaining Pool Distribution Amount(s) are sufficient therefor. With respect to each class of Subordinate Certificates, if on any Distribution Date the Fractional Interest is less than the Fractional Interest for that class on the Closing Date, no classes of Subordinate Certificates in the same group, if there is more than one group of Subordinate Certificates, junior to such class will be entitled to receive a principal distribution. Distributions of principal on the Subordinate Certificates that are entitled to receive a principal distribution on a Distribution Date will be made sequentially to each class of Subordinate Certificates in the order of their numerical class designations until each such class has received its respective pro rata share for the Distribution Date. However, the Class PO Deferred Amounts will be paid to the ratio strip components or certificates from amounts otherwise payable as principal to the related Subordinate Certificates, beginning with the amounts otherwise distributable as principal to the class of related Subordinate Certificates with the highest numerical designation. |

| |

| Shifting Interest Structure: | | Additional credit enhancement is provided by the allocation of the applicable Non-PO Percentages of principal prepayments on the Mortgage Loans in the Mortgage Pool or a loan group in the Mortgage Pool to the related Senior Certificates for the first five years and the disproportionately greater allocation of prepayments to such Senior Certificates over the following four years. The disproportionate allocation of the applicable Non-PO Percentages of prepayments on the Mortgage Loans in the Mortgage Pool or a loan group in the Mortgage Pool will accelerate the amortization of those Senior Certificates relative to the amortization of the Subordinate Certificates. As a result, the credit support percentage for the Senior Certificates should be maintained and may be increased during the first nine years. |

| | |

Banc of America Securities LLC | | 9 |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-294-1322 or you e-mail a request to dg.prospectus_distribution@bofasecurities.com. The securities may not be suitable for all investors. Banc of America Securities LLC and its affiliates may acquire, hold or sell positions in these securities, or in related derivatives, and may have an investment or commercial banking relationship with the issuer.

The information contained in these materials may be based on assumptions regarding market conditions and other matters as reflected herein. Banc of America Securities LLC (the “Underwriter”) makes no representation regarding the reasonableness of such assumptions or the likelihood that any such assumptions will coincide with actual market conditions or events, and these materials should not be relied upon for such purposes. The Underwriter and its affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of these materials, may, from time to time, have long or short positions in, and buy and sell, the securities mentioned herein or derivatives thereof (including options). Information in these materials is current as of the date appearing on the material only. Information in these materials regarding any securities discussed herein supersedes all prior information regarding such securities. These materials are not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

| | |

| | Banc of America Alternative Loan Trust 2006-1 Mortgage Pass-Through Certificates, Series 2006-1 |

|

| Preliminary Summary of Terms |

| | |

| Allocation of Losses: | | On each Distribution Date, the applicable PO Percentage of any Realized Loss on a Discount Mortgage Loan will be allocated to the ratio strip certificate or ratio strip component of the related group until its Class Balance or principal balance is reduced to zero. Such allocation will be effected on each Distribution Date by reducing the Class Balance of the ratio strip certificate or principal balance of the ratio strip component of the related group if and to the extent that such balance (after taking into account the amount of all distributions to be made on such Distribution Date) exceeds the Adjusted Pool Amount (PO Portion) for such Distribution Date. The amount of any such Realized Loss allocated to a ratio strip certificate or ratio strip component of the related group will be treated as a “Class PO Deferred Amount.” To the extent funds are available on such Distribution Date or on any future Distribution Date from amounts that would otherwise be allocable to the related Subordinate Principal Distribution Amount or Amounts, the Class PO Deferred Amounts for the ratio strip certificate or ratio strip component of the related group will be paid on such ratio strip certificate or ratio strip component of the related group prior to distributions of principal on the related Subordinate Certificates. Payments of the Class PO Deferred Amounts will be made from the principal payable to the related Subordinate Certificates beginning with the principal payable to the class of Subordinate Certificates with the highest numerical class designation. Any distribution in respect of unpaid Class PO Deferred Amounts for a ratio strip certificate or ratio strip component of the related group will not further reduce the principal balance of such ratio strip certificate or ratio strip component of the related group. The Class PO Deferred Amounts will not bear interest. The Class Balance of the class of related Subordinate Certificates then outstanding with the highest numerical class designation will be reduced by the amount of any payments in respect of Class PO Deferred Amounts for the ratio strip certificate or ratio strip component of the related group. Any excess of these Class PO Deferred Amounts over the Class Balance of that class will be allocated to the next most subordinate class of related Subordinate Certificates to reduce its Class Balance and so on, as necessary. On each Distribution Date, the applicable Non-PO Percentage of any Realized Loss will be allocated first to the related Subordinate Certificates in the reverse order of their numerical class designations (beginning with the class of related Subordinate Certificates then outstanding with the highest numerical class designation), in each case until the Class Balance of such class of Certificates has been reduced to zero, and then to the Senior Certificates or to the Senior Certificates of the related group, if there are multiple groups of Senior Certificatespro ratabased on their respective Class Balances. |

| | |

Banc of America Securities LLC | | 10 |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-294-1322 or you e-mail a request to dg.prospectus_distribution@bofasecurities.com. The securities may not be suitable for all investors. Banc of America Securities LLC and its affiliates may acquire, hold or sell positions in these securities, or in related derivatives, and may have an investment or commercial banking relationship with the issuer.

The information contained in these materials may be based on assumptions regarding market conditions and other matters as reflected herein. Banc of America Securities LLC (the “Underwriter”) makes no representation regarding the reasonableness of such assumptions or the likelihood that any such assumptions will coincide with actual market conditions or events, and these materials should not be relied upon for such purposes. The Underwriter and its affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of these materials, may, from time to time, have long or short positions in, and buy and sell, the securities mentioned herein or derivatives thereof (including options). Information in these materials is current as of the date appearing on the material only. Information in these materials regarding any securities discussed herein supersedes all prior information regarding such securities. These materials are not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

| | |

| | Banc of America Alternative Loan Trust 2006-1 Mortgage Pass-Through Certificates, Series 2006-1 |

|

| Preliminary Summary of Terms |

| | |

| Allocation of Losses (Continued): | | Such allocation will be effected on each such Distribution Date by reducing the Class Balance of the class of related Subordinate Certificates then outstanding with the highest numerical class designation if and to the extent that the aggregate of the Class Balances of all classes of Senior Certificates or the Senior Certificates in a group (other than any ratio strip class or component) and the related Subordinate Certificates (after taking into account the amount of all distributions to be made on such Distribution Date) exceeds the Adjusted Pool Amount (Non-PO Portion) or sum of the Adjusted Pool Amounts (Non-PO Portion) for such Distribution Date. After the date on which the aggregate Class Balance of the related Subordinate Certificates has been reduced to zero, on each Distribution Date, the aggregate of the Class Balances of all classes of Senior Certificates or all Senior Certificates of a group then outstanding will be reduced if and to the extent that such aggregate Class Balance (after taking into account the amount of all distributions to be made on such Distribution Date) exceeds the Adjusted Pool Amount (Non-PO Portion) for such Distribution Date. The amount of any such reduction will be allocated among the Senior Certificates or Senior Certificates of such group pro rata based on their respective Class Balances (or their initial Class Balances, if lower, in the case of a class of Accrual Certificates). After the date on which the aggregate Class Balance of the related Subordinate Certificates has been reduced to zero, the Class Balance of any class of Super Senior Support Certificates will be reduced not only by the principal portion of Realized Losses allocated to such class as provided in the preceding paragraph, but also by the portion allocated to the related class or classes of Super Senior Certificates. |

| | |

Banc of America Securities LLC | | 11 |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-294-1322 or you e-mail a request to dg.prospectus_distribution@bofasecurities.com. The securities may not be suitable for all investors. Banc of America Securities LLC and its affiliates may acquire, hold or sell positions in these securities, or in related derivatives, and may have an investment or commercial banking relationship with the issuer.

The information contained in these materials may be based on assumptions regarding market conditions and other matters as reflected herein. Banc of America Securities LLC (the “Underwriter”) makes no representation regarding the reasonableness of such assumptions or the likelihood that any such assumptions will coincide with actual market conditions or events, and these materials should not be relied upon for such purposes. The Underwriter and its affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of these materials, may, from time to time, have long or short positions in, and buy and sell, the securities mentioned herein or derivatives thereof (including options). Information in these materials is current as of the date appearing on the material only. Information in these materials regarding any securities discussed herein supersedes all prior information regarding such securities. These materials are not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

| | |

| | Banc of America Alternative Loan Trust 2006-1 Mortgage Pass-Through Certificates, Series 2006-1 |

|

| Preliminary Summary of Terms |

| | |

| Cross-Collateralization: | | If one group of Subordinate Certificates support multiple groups of Senior Certificates, on each Distribution Date prior to the date on which the aggregate Class Balance of such Subordinate Certificates has been reduced to zero but on or after the date on which the Class Balances of the Senior Certificates of a group have been reduced to zero, amounts otherwise distributable as principal payments on such Subordinate Certificates will be paid as principal to the remaining classes of Senior Certificates of each group supported by such Subordinate Certificates together with the Senior Principal Distribution Amount(s) in accordance with the principal payment priorities provided that on such Distribution Date (a) the Aggregate Subordinate Percentage for such Distribution Date is less than twice the initial Aggregate Subordinate Percentage or (b) the average outstanding principal balance of the Mortgage Loans (including, for this purpose, any Mortgage Loan in foreclosure, any REO Property and any Mortgage Loan for which the mortgagor has filed for bankruptcy after the Closing Date) delinquent 60 days or more over the last six months as a percentage of the aggregate Class Balance of the Subordinate Certificates is greater than or equal to 50%. If the Senior Certificates of two or more groups remain outstanding, the distributions described above will be made to such Senior Certificates of such groups, pro rata, in proportion to the aggregate Class Balance of such Senior Certificates. The “Aggregate Subordinate Percentage” for any Distribution Date will be the percentage equal to the aggregate Class Balance of the Subordinate Certificates divided by the related aggregate Pool Principal Balance (Non-PO Portion). In addition, if on any Distribution Date, after giving effect to the preceding paragraph, the aggregate Class Balance of the Senior Certificates after giving effect to distributions to be made on such Distribution Date is greater than the Adjusted Pool Amount (Non-PO Portion) (any such group, the “Undercollateralized Group” and any such excess, the “Undercollateralized Amount”), all amounts otherwise distributable as principal on the Subordinate Certificates, in reverse order of their numerical designations, will be paid as principal to the Senior Certificates of the Undercollateralized Group together with the Senior Principal Distribution Amount(s) in accordance with the principal payment priorities until the aggregate Class Balance of the Senior Certificates of the Undercollateralized Group equals the Adjusted Pool Amount (Non-PO Portion). If two or more groups are Undercollateralized Groups, the distributions described above will be made, pro rata, in proportion to the amount by which the aggregate Class Balance of the Senior Certificates of each such group exceeds the related Pool Principal Balance (Non-PO Portion). The amount of any unpaid interest shortfall amounts with respect to the Undercollateralized Group (including any interest shortfall amount for such Distribution Date) will be paid to the Undercollateralized Group, including the interest only component of such group, if any, prior to the payment of any Undercollateralized Amount from amounts otherwise distributable as principal on the Subordinate Certificates, in reverse order of their numerical designations. |

| | |

Banc of America Securities LLC | | 12 |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-294-1322 or you e-mail a request to dg.prospectus_distribution@bofasecurities.com. The securities may not be suitable for all investors. Banc of America Securities LLC and its affiliates may acquire, hold or sell positions in these securities, or in related derivatives, and may have an investment or commercial banking relationship with the issuer.

The information contained in these materials may be based on assumptions regarding market conditions and other matters as reflected herein. Banc of America Securities LLC (the “Underwriter”) makes no representation regarding the reasonableness of such assumptions or the likelihood that any such assumptions will coincide with actual market conditions or events, and these materials should not be relied upon for such purposes. The Underwriter and its affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of these materials, may, from time to time, have long or short positions in, and buy and sell, the securities mentioned herein or derivatives thereof (including options). Information in these materials is current as of the date appearing on the material only. Information in these materials regarding any securities discussed herein supersedes all prior information regarding such securities. These materials are not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

| | |

| | Banc of America Alternative Loan Trust 2006-1 Mortgage Pass-Through Certificates, Series 2006-1 |

|

| Preliminary Summary of Terms |

| | |

| Adjusted Pool Amount: | | The “Adjusted Pool Amount” of the Mortgage Pool or a loan group in the Mortgage Pool will equal the aggregate unpaid principal balance of the Mortgage Loans in the Mortgage Pool or a loan group in the Mortgage Pool as of the Cut-off Date minus the sum of (i) all amounts in respect of principal received in respect of such Mortgage Loans (including amounts received as Advances, principal prepayments and Liquidation Proceeds in respect of principal) and distributed on the Certificates on such Distribution Date and all prior Distribution Dates and (ii) the principal portion of all Realized Losses (other than debt service reductions) incurred on such Mortgage Loans from the Cut-off Date through the end of the month preceding the month in which such Distribution Date occurs. |

| |

| Adjusted Pool Amount (PO Portion): | | The “Adjusted Pool Amount (PO Portion)” of the Mortgage Pool or a loan group in the Mortgage Pool will equal the sum as to each Mortgage Loan in the Mortgage Pool or a loan group in the Mortgage Pool as of the Cut-off Date of the product of (A) the PO Percentage for such Mortgage Loan and (B) the principal balance of such Mortgage Loan as of the Cut-off Date less the sum of (i) all amounts in respect of principal received in respect of such Mortgage Loan (including amounts received as Advances, principal prepayments and Liquidation Proceeds in respect of principal) and distributed on the Certificates on such Distribution Date and all prior Distribution Dates and (ii) the principal portion of any Realized Loss (other than a debt service reduction) incurred on such Mortgage Loan from the Cut-off Date through the end of the month preceding the month in which such Distribution Date occurs. |

| |

| Adjusted Pool Amount (Non-PO Portion): | | The “Adjusted Pool Amount (Non-PO Portion)” of the Mortgage Pool or a loan group in the Mortgage Pool will equal the difference between the Adjusted Pool Amount of the Mortgage Pool or a loan group in the Mortgage Pool and the Adjusted Pool Amount (PO Portion) of the Mortgage Pool or a loan group in the Mortgage Pool. |

| |

| Class Balance: | | The “Class Balance” of a class of Certificates at any time will equal (a) its initial Class Balance less (i) all distributions of principal made to such class, and (ii) losses allocated to such class plus (b) in the case of a class of Accrual Certificates, any amounts added to such class balance as a result of the application of the accrual distribution amount. |

| |

| Fractional Interest: | | The “Fractional Interest” with respect to any Distribution Date and each class of Subordinate Certificates will equal (i) the aggregate of the Class Balances immediately prior to such Distribution Date of all classes of Subordinate Certificates in the same group that have higher numerical class designations than such class, divided by (ii) the aggregate Pool Principal Balance (Non-PO Portion) (if there is only one group of Subordinate Certificates) or the related Pool Principal Balance (Non-PO Portion) or sum of the related Pool Principal Balance (Non-PO Portion) (if there is more than one group of Subordinate Certificates). |

| | |

Banc of America Securities LLC | | 13 |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-294-1322 or you e-mail a request to dg.prospectus_distribution@bofasecurities.com. The securities may not be suitable for all investors. Banc of America Securities LLC and its affiliates may acquire, hold or sell positions in these securities, or in related derivatives, and may have an investment or commercial banking relationship with the issuer.

The information contained in these materials may be based on assumptions regarding market conditions and other matters as reflected herein. Banc of America Securities LLC (the “Underwriter”) makes no representation regarding the reasonableness of such assumptions or the likelihood that any such assumptions will coincide with actual market conditions or events, and these materials should not be relied upon for such purposes. The Underwriter and its affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of these materials, may, from time to time, have long or short positions in, and buy and sell, the securities mentioned herein or derivatives thereof (including options). Information in these materials is current as of the date appearing on the material only. Information in these materials regarding any securities discussed herein supersedes all prior information regarding such securities. These materials are not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

| | |

| | Banc of America Alternative Loan Trust 2006-1 Mortgage Pass-Through Certificates, Series 2006-1 |

|

| Preliminary Summary of Terms |

| | |

| Net Interest Shortfall: | | With respect to any Distribution Date, the “Net Interest Shortfall” is equal to the sum of (i) the shortfall in interest received with respect to any Mortgage Loan as a result of a Relief Act Reduction and (ii) any Non-Supported Interest Shortfalls. Net Interest Shortfalls on any Distribution Date will be allocated pro rata among all such classes of interest-bearing Senior Certificates or if there are Crossed Group, the interest-bearing Senior Certificates of the Crossed Groups and each class of related Subordinate Certificates, based on the amount of interest accrued on each such class of Certificates on such Distribution Date before taking into account any reduction in such amounts resulting from such Net Interest Shortfalls. |

| |

| Net Mortgage Interest Rate: | | The “Net Mortgage Interest Rate” of a Mortgage Loan is the excess of its mortgage interest rate over the sum of the servicing fee rate (which is 0.25%) and the trustee fee rate (which is 0.0065%). |

| |

| Non-PO Percentage: | | The “Non-PO Percentage” with respect to any Mortgage Loan in the Mortgage Pool or loan group in the Mortgage Pool with a Net Mortgage Interest Rate as of the Cut-off Date less than [ ]% (each such Mortgage Loan, a “Discount Mortgage Loan”) will be equal to the Net Mortgage Interest Rate as of the Cut-off Date divided by [ ]%. The Non-PO Percentage with respect to any Mortgage Loan in the Mortgage Pool or loan group in the Mortgage Pool with a Net Mortgage Interest Rate as of the Cut-off Date equal to or greater than [ ]% will be 100%. The “PO Percentage” for any Discount Mortgage Loan will be equal to 100% minus the Non-PO Percentage for such Mortgage Loan. |

| | |

Banc of America Securities LLC | | 14 |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-294-1322 or you e-mail a request to dg.prospectus_distribution@bofasecurities.com. The securities may not be suitable for all investors. Banc of America Securities LLC and its affiliates may acquire, hold or sell positions in these securities, or in related derivatives, and may have an investment or commercial banking relationship with the issuer.

The information contained in these materials may be based on assumptions regarding market conditions and other matters as reflected herein. Banc of America Securities LLC (the “Underwriter”) makes no representation regarding the reasonableness of such assumptions or the likelihood that any such assumptions will coincide with actual market conditions or events, and these materials should not be relied upon for such purposes. The Underwriter and its affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of these materials, may, from time to time, have long or short positions in, and buy and sell, the securities mentioned herein or derivatives thereof (including options). Information in these materials is current as of the date appearing on the material only. Information in these materials regarding any securities discussed herein supersedes all prior information regarding such securities. These materials are not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

| | |

| | Banc of America Alternative Loan Trust 2006-1 Mortgage Pass-Through Certificates, Series 2006-1 |

|

| Preliminary Summary of Terms |

| | |

| Non-PO Principal Amount: | | The “Non-PO Principal Amount” for any Distribution Date and the Mortgage Pool or any loan group in the Mortgage Pool will equal the sum of the applicable Non-PO Percentage of: (a) all monthly payments of principal due on each Mortgage Loan in the Mortgage Pool or loan group in the Mortgage Pool on the related due date; (b) the principal portion of the purchase price (net of unreimbursed Advances and other amounts as to which the Servicer is entitled to be reimbursed pursuant to the Pooling Agreement) of each Mortgage Loan in the Mortgage Pool or loan group in the Mortgage Pool that was repurchased by the Depositor pursuant to the Pooling Agreement during the calendar month preceding the month of that Distribution Date; (c) amounts received with respect to such Distribution Date as a substitution adjustment amount (net of unreimbursed Advances and other amounts as to which the Servicer is entitled to be reimbursed pursuant to the Pooling Agreement) in connection with a Mortgage Loan in the Mortgage Pool or loan group in the Mortgage Pool received during the calendar month preceding the month of that Distribution Date; (d) any Liquidation Proceeds (net of unreimbursed expenses and unreimbursed Advances, if any) allocable to recoveries of principal of the Mortgage Loans in the Mortgage Pool or loan group in the Mortgage Pool that have not yet been liquidated received during the calendar month preceding the month of that Distribution Date; (e) with respect to each Mortgage Loan in the Mortgage Pool or loan group in the Mortgage Pool that was liquidated during the calendar month preceding the month of that Distribution Date, the amount of the Liquidation Proceeds (other than any profits retained by the Servicer in connection with the foreclosure and net of unreimbursed expenses and unreimbursed Advances, if any) allocable to principal received with respect to that Mortgage Loan; and (f) all partial and full principal prepayments on the Mortgage Loans in the Mortgage Pool or loan group in the Mortgage Pool by mortgagors received during the calendar month preceding the month of that Distribution Date. The amounts described in clauses (a) through (d) are referred to as “Scheduled Principal Payments.” The amounts described in clauses (e) and (f) are referred to as “Unscheduled Principal Payments.” |

| | |

Banc of America Securities LLC | | 15 |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-294-1322 or you e-mail a request to dg.prospectus_distribution@bofasecurities.com. The securities may not be suitable for all investors. Banc of America Securities LLC and its affiliates may acquire, hold or sell positions in these securities, or in related derivatives, and may have an investment or commercial banking relationship with the issuer.

The information contained in these materials may be based on assumptions regarding market conditions and other matters as reflected herein. Banc of America Securities LLC (the “Underwriter”) makes no representation regarding the reasonableness of such assumptions or the likelihood that any such assumptions will coincide with actual market conditions or events, and these materials should not be relied upon for such purposes. The Underwriter and its affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of these materials, may, from time to time, have long or short positions in, and buy and sell, the securities mentioned herein or derivatives thereof (including options). Information in these materials is current as of the date appearing on the material only. Information in these materials regarding any securities discussed herein supersedes all prior information regarding such securities. These materials are not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

| | |

| | Banc of America Alternative Loan Trust 2006-1 Mortgage Pass-Through Certificates, Series 2006-1 |

|

| Preliminary Summary of Terms |

| | |

| Non-Supported Interest Shortfall: | | With respect to any Distribution Date, the “Non-Supported Interest Shortfall” is the amount by which the aggregate of Prepayment Interest Shortfalls for the Mortgage Loans in the Mortgage Pool or the Mortgage Loans in any Crossed Loan Groups during the calendar month preceding the month of such Distribution Date exceeds the applicable Compensating Interest for such period. |

| |

| Notional Amount: | | The “Notional Amount” of any Interest Only Certificates (or any components of an Interest Only Certificates) will be equal to either (I) the product of (i) the aggregate of the Stated Principal Balances of the Mortgage Loans in the Mortgage Pool or loan group with Net Mortgage Interest Rates as of the Cut-off Date greater than or equal to [ ]% as of the due date in the month preceding the month of such Distribution Date and (ii) a fraction, (a) the numerator of which is equal to the weighted average of the Net Mortgage Interest Rates of the these Mortgage Loans (based on the Stated Principal Balances of these Mortgage Loans as of the due date in the month preceding the month of such Distribution Date) minus [ ]% and (b) the denominator of which is equal to [ ]% or (II) a percentage or all of the Class Balance(s) of another class or classes. |

| | |

Banc of America Securities LLC | | 16 |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-294-1322 or you e-mail a request to dg.prospectus_distribution@bofasecurities.com. The securities may not be suitable for all investors. Banc of America Securities LLC and its affiliates may acquire, hold or sell positions in these securities, or in related derivatives, and may have an investment or commercial banking relationship with the issuer.

The information contained in these materials may be based on assumptions regarding market conditions and other matters as reflected herein. Banc of America Securities LLC (the “Underwriter”) makes no representation regarding the reasonableness of such assumptions or the likelihood that any such assumptions will coincide with actual market conditions or events, and these materials should not be relied upon for such purposes. The Underwriter and its affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of these materials, may, from time to time, have long or short positions in, and buy and sell, the securities mentioned herein or derivatives thereof (including options). Information in these materials is current as of the date appearing on the material only. Information in these materials regarding any securities discussed herein supersedes all prior information regarding such securities. These materials are not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

| | |

| | Banc of America Alternative Loan Trust 2006-1 Mortgage Pass-Through Certificates, Series 2006-1 |

|

| Preliminary Summary of Terms |

| | |

| Pool Distribution Amount: | | The “Pool Distribution Amount” with respect to any Distribution Date will be determined by reference to amounts received and expenses incurred in connection with the Mortgage Loans in the Mortgage Pool or any loan group in the Mortgage Pool and will be equal to the sum of: (i) all scheduled installments of interest (net of the related Servicing Fee) and principal due on such Mortgage Loans on the due date in the month in which such Distribution Date occurs and received prior to the related Determination Date, together with any Advances in respect thereof and any Compensating Interest allocable to such Mortgage Loans; (ii) all proceeds of any primary mortgage guaranty insurance policies and any other insurance policies with respect to such Mortgage Loans, to the extent such proceeds are not applied to the restoration of the related mortgaged property or released to the mortgagor in accordance with the Servicer’s normal servicing procedures and all other cash amounts received and retained in connection with the liquidation of defaulted Mortgage Loans in the Mortgage Pool or any loan group in the Mortgage Pool, by foreclosure or otherwise (collectively, “Liquidation Proceeds”), during the calendar month preceding the month of such Distribution Date (in each case, net of unreimbursed expenses incurred in connection with a liquidation or foreclosure and unreimbursed Advances, if any); (iii) all partial or full prepayments received on such Mortgage Loans during the calendar month preceding the month of such Distribution Date; and (iv) amounts received with respect to such Distribution Date as a substitution adjustment amount or purchase price in respect of any deleted Mortgage Loan in the Mortgage Pool or any loan group in the Mortgage Pool or amounts received in connection with the optional termination of the Trust or a portion of the Trust as of such Distribution Date, reduced by amounts in reimbursement for Advances previously made and other amounts as to which the Servicer is entitled to be reimbursed pursuant to the Pooling Agreement. |

| | |

Banc of America Securities LLC | | 17 |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-294-1322 or you e-mail a request to dg.prospectus_distribution@bofasecurities.com. The securities may not be suitable for all investors. Banc of America Securities LLC and its affiliates may acquire, hold or sell positions in these securities, or in related derivatives, and may have an investment or commercial banking relationship with the issuer.

The information contained in these materials may be based on assumptions regarding market conditions and other matters as reflected herein. Banc of America Securities LLC (the “Underwriter”) makes no representation regarding the reasonableness of such assumptions or the likelihood that any such assumptions will coincide with actual market conditions or events, and these materials should not be relied upon for such purposes. The Underwriter and its affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of these materials, may, from time to time, have long or short positions in, and buy and sell, the securities mentioned herein or derivatives thereof (including options). Information in these materials is current as of the date appearing on the material only. Information in these materials regarding any securities discussed herein supersedes all prior information regarding such securities. These materials are not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

| | |

| | Banc of America Alternative Loan Trust 2006-1 Mortgage Pass-Through Certificates, Series 2006-1 |

|

| Preliminary Summary of Terms |

| | |

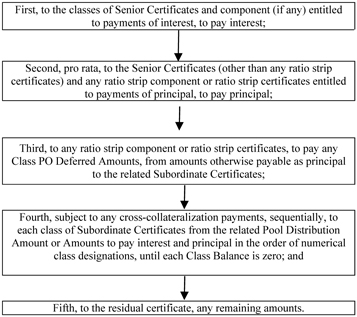

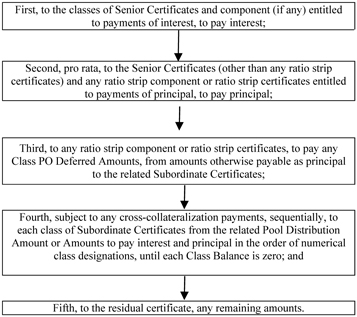

| |

| Pool Principal Balance: | | The “Pool Principal Balance” for the Mortgage Pool or a loan group in the Mortgage Pool with respect to any Distribution Date equals the aggregate Stated Principal Balances of the Mortgage Loans in the Mortgage Pool or loan group in the Mortgage Pool outstanding on the due date in the month preceding the month of such Distribution Date. |

| |

| Pool Principal Balance (Non-PO Portion): | | The “Pool Principal Balance (Non-PO Portion)” for the Mortgage Pool or a loan group in the Mortgage Pool and any Distribution Date equals the sum of the product, for each Mortgage Loan in the Mortgage Pool or loan group in the Mortgage Pool, of the Non-PO Percentage of such Mortgage Loan multiplied by its Stated Principal Balance on the due date in the month preceding the month of such Distribution Date. |

| |