An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Offering Circular was filed may be obtained.

Preliminary Offering Circular

Subject to Completion. Dated January ___, 2020

SStarTradeTech Inc.

(Exact name of issuer as specified in its charter)

Las Vegas, Nevada

(State or other jurisdiction of incorporation or organization)

www.sstartradetech.com

3773 Howard Hughes Parkway

South Tower

Suite 500

Las Vegas, Nevada 89169

+41 (0) 91 941 8758

(Address, including zip code, and telephone number, including area code of issuer’s principal executive office)

| 8742 | | 80-736106 |

| (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

Maximum offering of 50,000,000 Shares

This is a public offering of up to $20,000,000.00 in shares of Common Stock of SStarTradeTech Inc. at a price $0.40 for a maximum of 50,000,000 shares.

The offering price per share is expected to be priced at $0.40. Offering price will be disclosed via a supplemental filing within 2 days of Qualification. The end date of the offering will be exactly 365 days from the date the Offering Circular is approved by the Attorney General of the state of New York (unless extended by the Company, in its own discretion, for up to another 90 days).

Our Common Stock currently trades on the OTC Pink market under the symbol “SSTT” and the closing price of our Common Stock on December 27, 2019 was $0.064. Our Common Stock currently trades on a sporadic and limited basis.

We are offering our shares without the use of an exclusive placement agent; however, the Company reserves the right to retain a placement agent. Upon the approval of any subscription to this Offering Circular, the Company shall immediately deposit said proceeds into the bank account of the Company and may dispose of the proceeds in accordance with the Use of Proceeds. If the offering does not close, for any reason, the proceeds for the offering will be promptly returned to investors without interest.

We expect to commence the sale of the shares within two calendar days of the date on which the Offering Statement of which this Offering Circular is qualified by the U.S. Securities Exchange Commission (SEC).

See “Risk Factors” to read about factors you should consider before buying shares of Common Stock.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

The SEC does not pass upon the merits of or give its approval to any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation materials. These securities are offered pursuant to an exemption from registration with the Commission; however, the Commission has not made an independent determination that the securities offered are exempt from registration.

This Offering Circular is following the offering circular format described in Part II (a)(1)(ii) of Form 1-A.

Offering Circular dated January ___, 2020

TABLE OF CONTENTS

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this Offering Circular. You must not rely on any unauthorized information or representations. This Offering Circular is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this Offering Circular is current only as of its date.

SUMMARY

This summary highlights information contained elsewhere in this Offering Circular. This summary does not contain all of the information that you should consider before deciding to invest in our Common Stock. You should read this entire Offering Circular carefully, including the “Risk Factors” section, our historical consolidated financial statements and the notes thereto, and unaudited pro forma financial information, each included elsewhere in this Offering Circular. Unless the context requires otherwise, references in this Offering Circular to “the Company,” “we,” “us” and “our” refer to SStarTrade Tech, Inc.

Our Company

SStarTrade Tech, Inc., (“SSTT” “we”, “our”, “us”) was originally incorporated on December 6, 2005 as Smart Holdings, Inc. (SMHS) under the laws of the State of Nevada. As more fully described in Item 7 below, since our inception we have undergone three changes in control and related changes in its business focus and operations. On August 3, 2017, the Company changed its name from Smart Holdings, Inc. to SStarTrade Tech, Inc as a result of a change in control.

Our principal headquarters is located at 3773 Howard Hughes Parkway, South Tower, Suite 500, Las Vegas, NV 89169.

Common Stock

As of December 30, 2019 we are authorized to issue up to 1,975,000,000 shares of our common stock with a par value of $0.0001, of which 99,610,855 shares were issued and outstanding as of December 30, 2019.

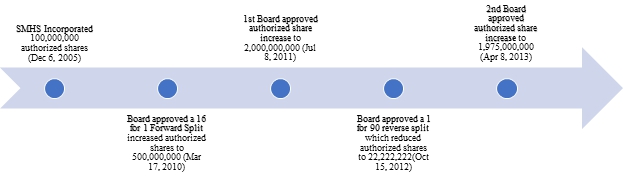

Our changes in authorized shares and common stock transactions are described in further detail below.

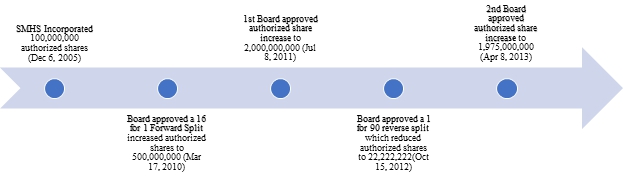

Authorized Common Stock

Since inception, our authorized share count changed over time as a result of board approved increases to fund acquisitions and stock splits. The following timeline illustrates changes in our authorized shares:

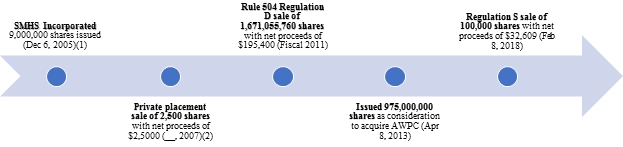

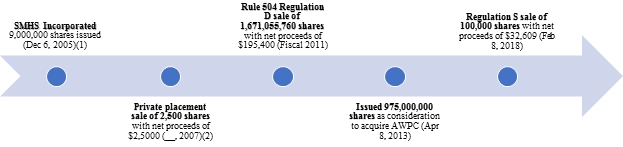

Issued Common Stock

Since inception, we issued common stock to fund our operations and acquisitions. The following timeline illustrates our capital raise activity since inception:

Preferred Stock

As of December 30, 2019, there were 30,000 authorized shares of preferred stock, of which 10,000 are available for issuance and 20,000 were previously issued and cancelled. Our historical stock transactions are described in further detail below.

On July 11, 2011, the board of directors authorized the issuance of up to 30,000 preferred stock. On July 19, 2011, we issued 20,000 shares of preferred stock with 10,000 for 1 common voting rights. On April 8, 2013, all issued and outstanding shares of preferred stock were transferred to our new owners in connection with the acquisition of AWPC. On June 30, 2017, all issued and outstanding shares of preferred stock were cancelled in connection with a change in control that occurred when our prior shareholder sold us to Mr. Bruno Horn and Mrs. Carla Horn.

Overview

We are a holding company that uses investor capital to acquire businesses that align with our investment strategy. We enhance the value of those businesses by funding their growth and providing management advisory services to support the business, with the end goal of selling our investment and earning a return on investment. Our current investment strategy is to create value by identifying and acquiring high potential mineral properties, which, hopefully, will contain gold, silver, copper and other high value economic minerals in the Russian Federation. Our preliminary geological estimate is that our Kadara project in the Russian Federation could have up to 100 tons of gold reserves with a potential market value of up to $500 million at the current spot rate for gold.

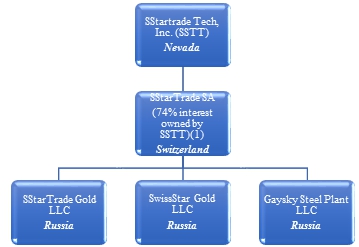

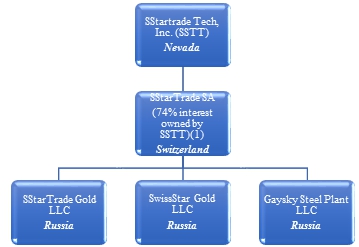

Our current organizational structure and equity investments are shown below.

(1) SStarTrade SA, runs a steel mill operation and holds license for part of large-scale Kadara gold field. SStarTrade SA filed for additional mineral site licenses for four more bordered gold fields, which would enable us to conduct geological exploration and production of gold. We require capital in order to finance the geological exploration and confirmation of estimated gold reserves and to construct an onsite or nearby gold processing facility.

(2) SStarTrade Gold LLC is a development stage gold mining company that has yet to commence significant operations. The viability of this operation is dependent upon the issuance of all required licenses by relevant Russian governmental authorities in Russia.

(3) SwissStar Gold LLC is a development stage gold mining company that has yet to commence significant operations. The viability of this operation is dependent upon the issuance of all required licenses by relevant Russian governmental authorities in Russia.

(4) Gaysky Steel Mill LLC is an active steel mill that has been in operation and produces cast parts and rolled parts for the mechanics industry. Gaysky LLC currently sells its products in Russia and in the Commonwealth of Independent States.

12-Month Outlook

In January of 2019, SStartrade SA’s board of directors voted to focus on pursuing gold mining operations and use available capital to pursue that business and simultaneously prepare Gaysky LLC for sale to free up investment capital required to pursue the ongoing investment objective of funding and developing a gold mining operation with SStarTradeGold LLC.

THE OFFERING

| Common Stock we are offering | Maximum offering of $20,000,000.00 at $0.40 per share up to a maximum of 50,000,000 shares. Minimum investment of $40.00. |

| Common Stock outstanding before this Offering | 99,610,855 Shares of Common Stock with a par value of $0.0001. |

| | |

| Use of Proceeds | The funds raised per this offering will be utilized to finance the acquisition and development of goldmining projects in the Russian Federation conducted by SStarTrade SA. We do not have agreements or commitments for any acquisition or development projects at this time. Other than the payment of the Company’s officers and directors’ salaries, some of the proceeds of this offering will be used to compensate or otherwise make payments to our subsidiaries’ officers or directors or staff. General corporate purposes may include, but are not limited to, the costs of this offering, including our outside legal and accounting expenses, employee payroll, rent and real estate expenses, utilities, computer hardware and software and promotion and marketing. See “Use of Proceeds” for more details. |

| | |

| Risk Factors | See “Risk Factors” and other information appearing elsewhere in this Offering Circular for a discussion of factors you should carefully consider before deciding whether to invest in our Common Stock. |

This offering is being made on a self-underwritten basis without the use of an exclusive placement agent, although the Company reserves the right to engage a placement agent at its sole discretion. As there is no minimum offering, upon the approval of any subscription to this Offering Circular, the Company shall immediately deposit said proceeds into the bank account of the Company and may dispose of the proceeds in accordance with the Use of Proceeds.

Management will make its best effort to fill the subscription in the states of Delaware, New York, Colorado, and North Carolina. However, in the event that management is unsuccessful in raising the required funds in these states, the Company may file a post qualification amendment to include additional jurisdictions that management has determined to be in the best interest of the Company for the purpose of raising the maximum offer.

In the event that the Offering Circular is fully subscribed, any additional subscriptions shall be rejected and returned to the subscribing party along with any funds received.

In order to subscribe to purchase the shares, a prospective investor must complete a subscription agreement and send payment by check, wire transfer or ACH. Investors must answer certain questions to determine compliance with the investment limitation set forth in Regulation A Rule 251(d)(2)(i)(C) under the Securities Act of 1933, which states that in offerings such as this one, where the securities will not be listed on a registered national securities exchange upon qualification, the aggregate purchase price to be paid by the investor for the securities cannot exceed 10% of the greater of the investor’s annual income or net worth. In the case of an investor who is not a natural person, revenues or net assets for the investors’ most recently completed fiscal year are used instead.

The Company has not currently engaged any party for the public relations or promotion of this offering.

As of the date of this filing, there are no additional offers for shares, nor any options, warrants, or other rights for the issuance of additional shares except those described herein.

Item 3. Summary and Risk Factors

RISK FACTORS

Investing in our Common Stock involves a high degree of risk. You should carefully consider each of the following risks, together with all other information set forth in this Offering Circular, including the consolidated financial statements and the related notes, before making a decision to buy our Common Stock. If any of the following risks actually occurs, our business could be harmed. In that case, the trading price of our Common Stock could decline, and you may lose all or part of your investment.

We make forward-looking statements under the “Summary,” “Risk Factors,” “Business,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in other sections of this Offering Circular. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or “continue,” and the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to known and unknown risks, uncertainties and assumptions about us, may include projections of our future financial performance based on our growth strategies and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. In particular, you should consider the numerous risks and uncertainties described under “Risk Factors.”

While we believe we have identified material risks, these risks and uncertainties are not exhaustive. Other sections of this Offering Circular describe additional factors that could adversely impact our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible to predict all risks and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Forward-looking statements include, but are not limited to, statements about:

| § | Our ability to determine the feasibility and economic viability of commencing mining and discover any deposits of minerals which can be mined at a profit; |

| § | Our ability to raise the necessary capital to finance exploration and potential expansion; |

| § | Our ability to obtain or amend the necessary permits, consents, or authorizations needed to advance expansion of the deposit or any processing facility; |

| § | Our ability to acquire additional mineral targets; |

| § | Our ability to obtain additional external funding; |

| § | Our ability to achieve any meaningful revenue; |

| § | Our ability to engage or retain geologists, engineers, consultants and other key management and mining personnel and resources necessary to successfully operate and grow our business; |

| § | The volatility of the market price of our common stock or our intention not to pay any cash dividends in the foreseeable future; |

| § | Changes in any federal, state or local laws and regulations or possible challenges by third parties or contests by the federal government that increase costs of operation or limit our ability to explore on certain portions of our property; |

| § | The market price for minerals and political events affecting the market prices for minerals which may be found on our exploration properties; |

| § | The impact of future legislation and regulatory changes on our business; and |

| § | The other factors set forth under this “Risk Factors” section. |

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. We are under no duty to update any of these forward-looking statements after the date of this Offering Circular to conform our prior statements to actual results or revised expectations, and we do not intend to do so.

This prospectus also contains market data related to our business and industry. This market data includes projections that are based on a number of assumptions. If these assumptions turn out to be incorrect, actual results may differ from the projections based on these assumptions. As a result, our markets may not grow at the rates projected by these data, or at all. The failure of these markets to grow at these projected rates may have a material adverse effect on our business, results of operations, financial condition and the market price of our Common Stock.

We caution you not to place undue reliance on the forward-looking statements, which speak only as of the date of this Offering Circular.

Risks Related to our Company and our Business

Our investment strategy involves taking a position in non-marketable equity investments in develop stage mining operations which are inherently risky and require a substantial amount of capital to operate.

Non-marketable equity investments are inherently risky, and their success depends on product development, market acceptance, operational efficiency, the ability of the investee companies to raise additional funds in financial markets that can be volatile, and other key business factors. These companies could fail or not be able to raise additional funds when needed, or they may receive lower valuations with less favorable investment terms than previous financings. These events could cause our investments to become impaired. In addition, financial market volatility could negatively affect our ability to realize value in our investments through liquidity events such as initial public offerings, mergers, and private sales.

SStarTrade SA (“equity investee”) is an early stage development company that is focused on developing a gold exploration and mining operation.

To date, our equity investee SStarTrade SA has principally operated as a steel mill and has not conducted any significant gold exploration or mining activities and as such it has not generated any revenues. SStarTrade SA is in the preliminary stages of development of its gold exploration activities; and we expect that it will to continue to incur negative cash-flows and significant expenses over the next several years. Negative cash flows will have an adverse effect on the value of our investment in SStarTrade SA and on our reported stockholders’ deficit and working capital. We anticipate the need to raise additional capital primarily through private investments in our common stock in order to support the development and eventual operation of planned gold mining operations of SStarTrade SA. Our ability to generate a positive return on our investment in SStarTrade SA heavily depends upon their ability generate profitable revenues from anticipated gold mining operations.

Our equity investee is subject to risks relating to exploration, development and operations in the Russian Federation.

Our equity investee SStarTrade SA’s assets and operations are affected by various political and economic uncertainties in the Russian Federation where we operate, including:

| § | war, civil unrest, terrorism, coups or other violent or unexpected changes in government; |

| § | political instability and violence; |

| § | expropriation and nationalization; |

| § | renegotiation or nullification of existing concessions, licenses, permits, and contracts; |

| § | changes in taxation policies; |

| § | unilaterally imposed increases in royalty rates; |

| § | restrictions on foreign exchange and repatriation; and |

| § | changing political conditions, currency controls, and governmental regulations that favor or require the awarding of contracts to local contractors or require foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction. |

Gold exploration is highly speculative, involves substantial expenditures, and is frequently non-productive.

Gold exploration involves a high degree of risk. Exploration projects are frequently unsuccessful. Few prospects that are explored are ultimately developed into producing mines. We cannot assure you that gold exploration efforts undertaken by our equity investee will be successful. The success of gold exploration is dependent in part on the following factors:

| § | the identification of potential gold mineralization based on surface analysis; |

| § | availability of prospective land; |

| § | availability of government-granted exploration and exploitation permits; |

| § | the quality of our management and our geological and technical expertise; and |

| § | the funding available for exploration and development. |

Substantial expenditures are required to determine if a project has economically mineable mineralization. It could take several years to establish Proven and Probable Mineral Reserves and to develop and construct mining and processing facilities. Because of these uncertainties, we cannot assure you that current and future exploration programs will result in the discovery of Mineral Reserves, the expansion of our existing Mineral Reserves or the development of mines.

Estimates of proven and probable reserves are uncertain and the volume and grade of ore actually recovered may vary significantly from estimates.

The exploration and estimation of gold and other minerals requires the use of expensive subject matter experts such as geologists, environmentalists and other relevant subject matter experts to conduct necessary feasibility studies and develop estimates of probable reserves. Producers use feasibility studies to derive estimates of capital and operating costs based upon anticipated tonnage and grades of ore to be mined and processed, the predicted configuration of the ore body, expected recovery rates of metals from the ore, the costs of comparable facilities, the costs of operating and processing equipment and other factors. Estimates of proven and probable reserves are subject to considerable uncertainty and are, to a large extent, based on the prices of gold and interpretations of geologic data obtained from drill holes and other exploration techniques. Further, it may take many years from the initial phases of exploration until commencement of production, during which time, the economic feasibility of production may change. Actual operating and capital cost and economic returns on projects may differ significantly from original estimates. Consequently, if actual mineral reserves are less than current estimates, our equity investees’ business, prospects, results of operations and financial position may be materially impaired.

Increased operating and capital costs could affect our ability to develop and run a profitable mining operation.

We could have significant unexpected increases in capital and operating costs over the next several years in our efforts to obtain the necessary licenses to conduct geological surveys to estimate potential gold reserves, conduct gold extraction and production operations at the Kadara Gold deposit in the Trans-Baikal Territory in the Russian Federation. Costs associated with capital expenditures have escalated on an industry-wide basis over the last several years, as a result of factors beyond our control, including the prices of steel and other commodities and labor, as well as the demand for certain mining and processing equipment. Commodity costs are, at times, subject to volatile price movements, including increases that could make mining production at certain operations less profitable. Further, changes in laws and regulations can affect commodity prices, uses and transport.

Additionally, costs at any particular mining location are subject to variation due to a number of factors, such as variable ore grade, changing metallurgy and revisions to mine plans in response to the physical shape and location of the ore body, as well as the age and utilization rates for the mining and processing related facilities and equipment. In addition, costs are affected by the price and availability of input commodities, such as fuel, electricity, labor, chemical reagents, explosives, steel and concrete and mining and processing related equipment and facilities. Increased capital expenditures may have an adverse effect on the profitability of and cash flow generated from existing operations, as well as the economic returns anticipated from new projects.

We may require additional funds in the future to achieve our current business strategy and our inability to obtain funding may cause our business plan to fail.

We may need to raise additional funds through public or private debt or equity sales in order to fund our equity investee’s future operations and fulfill contractual obligations in the future. Our management cannot predict the extent to which we will require additional financing and can provide no assurance that additional financing will be available on favorable terms or at all. The rights of the holders of any debt or equity that may be issued in the future could be senior to the rights of common shareholders, and any future issuance of equity could result in the dilution of our common shareholders’ proportionate equity interests in our company. Failure to obtain financing or an inability to obtain financing on unattractive terms could have a material adverse effect on our business, prospects, results of operation and financial condition.

Even if these financings are available, it may be on terms that we deem unacceptable or are materially adverse to your interests with respect to dilution of book value, dividend preferences, liquidation preferences, or other terms. Our inability to obtain financing would have an adverse effect on our ability to implement our current business plan and develop our products, and as a result, could require us to diminish or suspend our operations and possibly cease our existence.

We are dependent on the continued services and performance of our senior management, the loss of any of whom could adversely affect our business, operating results and financial condition.

Our future performance depends on the continued services and continuing contributions of our senior management to execute our business plan, and to identify and pursue new opportunities and product innovations. The loss of services of senior management, could significantly delay or prevent the achievement of our strategic objectives. The loss of the services of senior management for any reason could adversely affect our business, prospects, financial condition and results of operations.

Our equity investees’ ability to attract and retain qualified geological experts, mining personnel, subcontractors and qualified management could affect its ability to successfully execute its gold exploration and mining activities, which could materially affect the value of our investment in SStarTrade SA.

We have been and expect to be significantly dependent on agreements for the development of our exploratory gold mining activities, which exposes us to the risk of reliance on the performance of third parties. Our ability to compete in the highly competitive mining industry depends in large part upon our ability to attract highly qualified managerial, geological, and mining personnel. In order to induce valuable employees to remain with us, we intend to provide employees with stock options that vest over time. The value to employees of stock options that vest over time will be significantly affected by movements in our stock price that we will not be able to control and may at any time be insufficient to counteract more lucrative offers from other companies.

Our equity investee may be unable to replace gold and copper reserves as they become depleted.

Gold producers must continually replace reserves depleted by production to maintain production levels over the long term and provide a return on invested capital. Depleted reserves can be replaced in several ways, including expanding known ore bodies, by locating new deposits, or acquiring interests in reserves from third parties. Exploration is highly speculative in nature, involves many risks and uncertainties and is frequently unsuccessful in discovering significant mineralization. Accordingly, our equity investee’s current or future exploration programs may not result in new mineral producing operations. Even if significant mineralization is discovered, it will likely take many years from the initial phases of exploration until commencement of production, during which time the economic feasibility of production may change.

We may consider, from time to time, the acquisition of ore reserves from others related to development properties and operating mines as a business growth strategy for our equity investee. Such acquisitions are typically based on an analysis of a variety of factors including historical operating results, estimates of and assumptions regarding the extent of ore reserves, the timing of production from such reserves and cash and other operating costs. Other factors that affect our decision to make any such acquisitions may also include our assumptions for future gold prices or other mineral prices and the projected economic returns and evaluations of existing or potential liabilities associated with the property and its operations and projections of how these may change in the future. In addition, in connection with future acquisitions we may rely on data and reports prepared by third parties and which may contain information or data that we are unable to independently verify or confirm. Other than historical operating results, all of these factors are uncertain and may have an impact on our revenue, our cash flow and other operating issues, as well as contributing to the uncertainties related to the process used to estimate ore reserves. In addition, there may be intense competition for the acquisition of attractive mining properties.

As a result of these uncertainties, our equity investee’s exploration programs and any acquisitions which we may pursue on behalf of our equity investee may not result in the expansion or replacement of current production with new ore reserves or operations, which could have a material adverse effect on our equity investees’ business, prospects, results of operations and financial position.

Our activities are subject to complex laws, regulations and accounting standards that can adversely affect operating and development costs, the timing of operations, the ability to operate our mines and our financial results.

Our business, mining operations and exploration and development activities are subject to local laws and regulations in the Russian Federation and countries in which we intend to sell our products that govern exploration, development, production, exports, taxes, labor standards, waste disposal, protection of the environment, reclamation, historic and cultural resource preservation, mine safety and occupational health, toxic substances, reporting and other matters, as well as accounting standards. Compliance with these laws, regulations and standards or the imposition of new such requirements could adversely affect operating and development costs, the timing of operations and the ability to operate and financial results.

Litigation may harm our business.

Substantial, complex or extended litigation could cause us to incur significant costs and distract our management. For example, lawsuits by employees, stockholders, collaborators, distributors, customers, competitors or others could be very costly and substantially disrupt our business. Disputes from time to time with such companies, organizations or individuals are not uncommon, and we cannot assure you that we will always be able to resolve such disputes or on terms favorable to us. Unexpected results could cause us to have financial exposure in these matters in excess of recorded reserves and insurance coverage, requiring us to provide additional reserves to address these liabilities, therefore impacting profits.

Risks Related to Our Business and Industry

Mineral exploration is a highly competitive and speculative business and we may not be successful in seeking available opportunities.

The process of mineral exploration is a highly competitive, speculative, capital- and labor-intensive business to run. Our equity investee will compete with a number of other companies, including established, multi-national companies that have substantially more experience and resources than us. Because we may not have the financial and managerial resources to compete with other companies, we may not be successful in our efforts to acquire projects of value, which, ultimately, become productive.

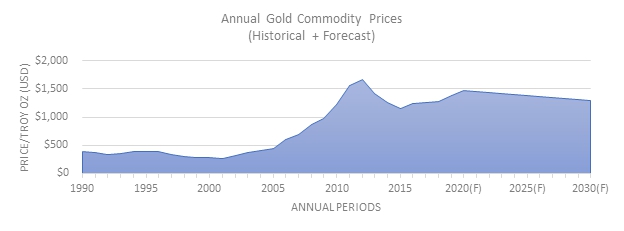

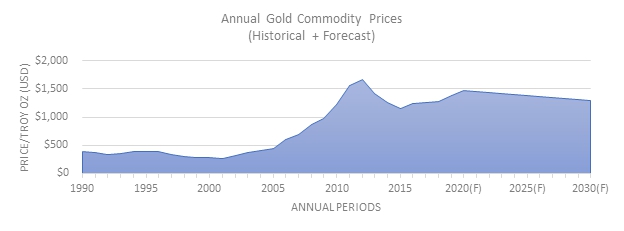

A substantial or extended decline in gold, silver or copper prices would have a material adverse effect on our ability to earn a profit from our planned gold mining exploration and extraction business.

Any potential revenues we may realize as a result of our proposed mining exploration and extraction operation will be heavily dependent on the prices of gold, which fluctuate on a daily basis and are affected by numerous factors beyond our control. Factors tending to influence prices include:

| § | Gold sales, purchases or leasing by governments and central banks; |

| § | Speculative short positions taken by significant investors or traders in gold and complementary commodities; |

| § | The relative strength of the U.S. dollar; |

| § | The monetary policies employed by the world’s major Central Banks; |

| § | The fiscal policies employed by the world’s major industrialized economies; |

| § | Expectations of the future rate of inflation; |

| § | Recession or reduced economic activity in the United States, China, India and other industrialized or developing countries that use our commodities to produce their products; |

| § | Decreased industrial, jewelry or investment demand; |

| § | Increased import and export taxes; |

| § | Increased supply from production, disinvestment and scrap; |

| § | Forward sales by producers in hedging or similar transactions; and |

| § | Availability of cheaper substitute materials |

Any decline in our realized gold price adversely impacts our revenues, net income and operating cash flows, particularly in light of our strategy of not engaging in hedging transactions with respect to gold or copper sales. We have recorded asset write-downs in the past and may experience additional write-downs as a result of lower gold or copper prices in the future.

In addition, sustained lower gold prices can:

| § | Reduce revenues further through production declines due to cessation of the mining of deposits, or portions of deposits, that have become uneconomic at sustained lower gold or copper prices; |

| § | Reduce or eliminate the profit that we currently expect from ore stockpiles and ore on leach pads and increase the likelihood and amount that the Company might be required to record as an impairment charge related to the carrying value of its stockpiles; |

| § | Halt or delay the development of new projects; |

| § | Reduce funds available for exploration and advanced projects with the result that depleted reserves may not be replaced; and |

| § | Reduce existing reserves by removing ores from reserves that can no longer be economically processed at prevailing prices. |

Estimates relating to new development projects are uncertain and we may incur higher costs and lower economic returns than estimated.

Mine development projects typically require a number of years and significant expenditures during the development phase before production is possible. Such projects could experience unexpected problems and delays during development, construction and mine start-up. Our decision to develop a project is typically based on the results of feasibility studies, which estimate the anticipated economic returns of a project. The actual project profitability or economic feasibility may differ from such estimates as a result of any of the following factors, among others:

| § | Changes in tonnage, grades and metallurgical characteristics of ore to be mined and processed; |

| § | Changes in input commodity and labor costs; |

| § | The quality of the data on which engineering assumptions were made; |

| § | Adverse geotechnical conditions; |

| § | Availability of adequate and skilled labor force; |

| § | Availability, supply and cost of water and power; |

| § | Fluctuations in inflation and currency exchange rates; |

| § | Availability and terms of financing; |

| § | Delays in obtaining environmental or other government permits or approvals or changes in the laws and regulations related to our operations or project development; |

| § | Changes in tax laws, the laws and/or regulations around royalties and other taxes due to the regional and national governments and royalty agreements; |

| § | Weather or severe climate impacts, including without limitation, prolonged or unexpected precipitation and/or sub-zero temperatures; and |

| § | Potential delays relating to social and community issues, including, without limitation, issues resulting in protests, road blockages or work stoppages. |

Our future development activities may not result in the expansion or replacement of current production with new production, or one or more of these new production sites or facilities may be less profitable than currently anticipated or may not be profitable at all, any of which could have a material adverse effect on our results of operations and financial position.

We may experience increased costs or losses resulting from the hazards and uncertainties associated with mining.

The exploration for natural resources and the development and production of mining operations are activities that involve a high level of uncertainty. These can be difficult to predict and are often affected by risks and hazards outside of our control. These factors include, but are not limited to:

| § | Environmental hazards, including discharge of metals, concentrates, pollutants or hazardous chemicals; |

| § | Industrial accidents, including in connection with the operation of mining transportation equipment, milling equipment and/or conveyor systems and accidents associated with the preparation and ignition of large-scale blasting operations, milling, processing and transportation of chemicals, explosions or other materials; |

| § | Surface or underground fires or floods; |

| § | Unexpected geological formations or conditions (whether in mineral or gaseous form); |

| § | Ground and water conditions; |

| § | Fall-of-ground accidents in underground operations; |

| § | Failure of mining pit slopes and tailings dam walls; |

| § | Other natural phenomena, such as lightning, cyclonic or tropical storms, floods or other inclement weather conditions. |

The occurrence of one or more of these events in connection with our exploration activities and development and production of mining operations may result in the death of, or personal injury to, our employees, other personnel or third parties, the loss of mining equipment, damage to or destruction of mineral properties or production facilities, monetary losses, deferral or unanticipated fluctuations in production, environmental damage and potential legal liabilities, all of which may adversely affect our reputation, business, prospects, results of operations and financial position.

Shortages of critical parts and equipment may adversely affect our development projects.

The mining industry has been impacted, from time to time, by increased demand for critical resources such as input commodities, drilling equipment, trucks, shovels and tires. These shortages have, at times, impacted the efficiency of our operations, and resulted in cost increases and delays in construction of projects; thereby impacting operating costs, capital expenditures and production and construction schedules.

A competitor with a stronger or more suitable financial position may enter our marketplace.

Other mining companies with which we compete for qualified personnel have greater financial and other resources, different risk profiles, and a longer history in the industry than we do. They also may provide more diverse opportunities and better chances for career advancement. Some of these characteristics may be more appealing to high-quality candidates than what we have to offer. If we are unable to continue to attract and retain high-quality personnel, the rate and success at which we can develop and commercialize product candidates would be limited.

Our business and the industries we serve are highly sensitive to global and regional economic conditions.

Technology, energy, transportation, luxury goods and mining industries are major potential users of our products. Potential business customers in these industries frequently base their decisions to purchase based on their expected future demand for their products and services, which in turn are dependent in part on commodity prices. Prices of commodities are frequently volatile and can change abruptly and unpredictably in response to general economic conditions and trends, government actions, regulatory actions, commodity inventories, production and consumption levels, technological innovations, commodity substitutions, market expectations and any disruptions in production or distribution or changes in consumption. Economic conditions affecting the industries we serve may in the future also lead to reduced capital expenditures by our customers. Reduced capital expenditures by our customers are likely to lead to a decrease in the demand for our products and services. Our commodity products are an integral component of our customers manufacturing and production activities, and as these activities decrease, demand for our commodities may be significantly impacted, which could negatively impact our results.

Governmental and Regulatory Risks

Compliance with environmental considerations and permitting could have a material adverse effect on the costs or the viability of our projects.

All mining is regulated by the government agencies. Compliance with such regulation has a material effect on the economics of our operations and the timing of project development. Our primary regulatory costs have been related to obtaining licenses and permits from government agencies before the commencement of mining activities. An environmental impact study that must be obtained on each property in order to obtain governmental approval to mine on the properties is also a part of the overall operating costs of a mining company. The possibility of more stringent regulations exists in the areas of worker health and safety, the dispositions of wastes, the decommissioning and reclamation of mining and milling sites and other environmental matters, each of which could have an adverse material effect on the costs or the viability of a particular project. Compliance with environmental considerations and permitting could have a material adverse effect on the costs or the viability of our projects. The historical trend toward stricter environmental regulation may continue, and, as such, represents an unknown factor in our planning process and could adversely affect our results of operations in a particular mining operation, for a particular period of time or affect our long-term business prospects in our industry.

Mining and exploration activities are subject to extensive governmental regulation. Future changes in governments, regulations and policies, could adversely affect our result of operations for a particular period and our long-term business prospects.

Mining and exploration activities are subject to extensive regulation by government. Such regulation relates to production, development, exploration, exports, taxes and royalties, labor standards, occupational health, waste disposal, protection and remediation of the environment, mine and mill reclamation, mine and mill safety, toxic substances and other matters. Compliance with such laws and regulations has increased the costs of exploring, drilling, developing, constructing, operating mines and other facilities. Furthermore, future changes in governments, regulations and policies, could adversely affect our results of operations in a particular period and our long-term business prospects.

The development of mines and related facilities is contingent upon governmental approvals, which are complex and time consuming to obtain and which, depending upon the location of the project, involve various governmental agencies. The duration and success of such approvals are subject to many variables outside our control.

We also anticipate becoming subject to other laws and regulations governing our international operations, including regulations administered in the U.S., Canada and in the EU, including applicable export control regulations, economic sanctions on countries and persons, customs requirements and currency exchange regulations (collectively, “Trade Control Laws”).

There can be no assurance that we will be completely effective in ensuring our compliance with all applicable anticorruption laws, including the FCPA or other legal requirements, such as Trade Control Laws. Any investigation of potential violations of the FCPA, other anti-corruption laws or Trade Control Laws by U.S., Canada, EU or other authorities could have an adverse impact on our reputation, our business, results of operations and financial condition. Furthermore, should we be found not to be in compliance with the FCPA, other anti-corruption laws or Trade Control Laws, we may be subject to criminal and civil penalties, disgorgement and other sanctions and remedial measures, as well as the accompanying legal expenses, any of which could have a material adverse effect on our reputation and liquidity, as well as on our business, results of operations and financial condition.

Risks Related to the Securities Markets and Ownership of our Equity Securities

As a holding company, limitations on the ability of our operating subsidiaries to make distributions to us could adversely affect the funding of our operations.

We are a holding company that conducts operations through direct investments in foreign operating companies and joint ventures, and substantially all of our assets consist of equity in these entities. Accordingly, any limitation on the transfer of cash or other assets between the parent corporation and these entities, or among these entities, could restrict our ability to fund our equity investees’ operations efficiently, or to repay debt or other borrowings. Any such limitations, or the perception that such limitations might exist now or in the future, could have an adverse impact on available credit and our valuation and stock price.

Our Common Stock is thinly traded, so you may be unable to sell at or near ask prices or at all if you need to sell your shares to raise money or otherwise desire to liquidate your shares.

The Common Stock has historically been sporadically traded on the OTC Pink Sheets, meaning that the number of persons interested in purchasing our shares at or near ask prices at any given time may be relatively small or non-existent. This situation is attributable to a number of factors, including the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our shares until such time as we became more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common shares will develop or be sustained, or that current trading levels will be sustained.

The market price for the Common Stock is particularly volatile given our status as a relatively unknown company with a small and thinly traded public float, limited operating history and lack of revenue, which could lead to wide fluctuations in our share price. The price at which you purchase our shares may not be indicative of the price that will prevail in the trading market. You may be unable to sell your common shares at or above your purchase price, which may result in substantial losses to you.

The market for our shares of Common Stock is characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. The volatility in our share price is attributable to a number of factors. First, as noted above, our shares are sporadically traded. Because of this lack of liquidity, the trading of relatively small quantities of shares may disproportionately influence the price of those shares in either direction. The price for our shares could, for example, decline precipitously in the event that a large number of our shares is sold on the market without commensurate demand, as compared to a seasoned issuer which could better absorb those sales without adverse impact on its share price. Secondly, we are a speculative investment due to, among other matters, our limited operating history and lack of revenue or profit to date, and the uncertainty of future market acceptance for our potential products. As a consequence of this enhanced risk, more risk-averse investors may, under the fear of losing all or most of their investment in the event of negative news or lack of progress, be more inclined to sell their shares on the market more quickly and at greater discounts than would be the case with the securities of a seasoned issuer. The following factors may add to the volatility in the price of our shares: actual or anticipated variations in our quarterly or annual operating results; acceptance of our inventory of games; government regulations, announcements of significant acquisitions, strategic partnerships or joint ventures; our capital commitments and additions or departures of our key personnel. Many of these factors are beyond our control and may decrease the market price of our shares regardless of our operating performance. We cannot make any predictions or projections as to what the prevailing market price for our shares will be at any time, including as to whether our shares will sustain their current market prices, or as to what effect the sale of shares or the availability of shares for sale at any time will have on the prevailing market price.

Shareholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility of our share price.

The market price of our common stock may be volatile and adversely affected by several factors.

The market price of our common stock could fluctuate significantly in response to various factors and events, including, but not limited to:

| § | our ability to integrate operations, technology, products and services; |

| § | our ability to execute our business plan; |

| § | operating results below expectations; |

| § | our issuance of additional securities, including debt or equity or a combination thereof; |

| § | announcements of technological innovations or new products by us or our competitors; |

| § | loss of any strategic relationship; |

| § | industry developments, including, without limitation, changes in healthcare policies or practices; |

| § | economic and other external factors; |

| § | period-to-period fluctuations in our financial results; and |

| § | whether an active trading market in our common stock develops and is maintained. |

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock. Issuers using the Alternative Reporting standard for filing financial reports with OTC Markets are often subject to large volatility unrelated to the fundamentals of the company.

Our issuance of additional shares of Common Stock, or options or warrants to purchase those shares, would dilute your proportionate ownership and voting rights.

The number of authorized shares available for issuance is limited by our articles of incorporation. We are currently entitled under our amended and restated articles of incorporation to issue up to 1,975,000,000 shares of Common Stock. Since our inception, we amended our articles of incorporation to increase the number of authorized shares in fiscal 2011to raise capital for our business and then again in fiscal 2013 to fund an acquisition of an operating company. We have issued and outstanding, as of the date of this prospectus, 99,610,855 shares of Common Stock. Our board may generally issue shares of Common Stock, preferred stock or options or warrants to purchase those shares, without further approval by our shareholders based upon such factors as our board of directors may deem relevant at that time. It is likely that we will be required to issue a large amount of additional securities to raise capital to further our development. It is also likely that we will issue a large amount of additional securities to directors, officers, employees and consultants as compensatory grants in connection with their services, both in the form of stand-alone grants or under our stock plans. We cannot give you any assurance that we will not issue additional shares of Common Stock, or options or warrants to purchase those shares, under circumstances we may deem appropriate at the time.

The elimination of monetary liability against our directors, officers and employees under our Articles of Incorporation and the existence of indemnification rights to our directors, officers and employees may result in substantial expenditures by our company and may discourage lawsuits against our directors, officers and employees.

Our articles of incorporation contain provisions that eliminate the liability of our directors for monetary damages to our company and shareholders. Our bylaws also require us to indemnify our officers and directors. We may also have contractual indemnification obligations under our agreements with our directors, officers and employees. The foregoing indemnification obligations could result in our company incurring substantial expenditures to cover the cost of settlement or damage awards against directors, officers and employees that we may be unable to recoup. These provisions and resultant costs may also discourage our company from bringing a lawsuit against directors, officers and employees for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders against our directors, officers and employees even though such actions, if successful, might otherwise benefit our company and shareholders.

Anti-takeover provisions may impede the acquisition of our company.

Nevada general statutes have anti-takeover effects and may inhibit a non-negotiated merger or other business combination. These provisions are intended to encourage any person interested in acquiring us to negotiate with, and to obtain the approval of, our board of directors in connection with such a transaction. However, certain of these provisions may discourage a future acquisition of us, including an acquisition in which the shareholders might otherwise receive a premium for their shares. As a result, shareholders who might desire to participate in such a transaction may not have the opportunity to do so.

We may become involved in securities class action litigation that could divert management’s attention and harm our business.

The stock market in general, and the shares of early stage development companies in particular, have experienced extreme price and volume fluctuations. These fluctuations have often been unrelated or disproportionate to the operating performance of the companies involved. If these fluctuations occur in the future, the market price of our shares could fall regardless of our operating performance. In the past, following periods of volatility in the market price of a particular company’s securities, securities class action litigation has often been brought against that company. If the market price or volume of our shares suffers extreme fluctuations, then we may become involved in this type of litigation, which would be expensive and divert management’s attention and resources from managing our business.

As a public company, we may also from time to time make forward-looking statements about future operating results and provide some financial guidance to the public markets. Our management has limited experience as a management team in a public company and as a result, projections may not be made timely or set at expected performance levels and could materially affect the price of our shares. Any failure to meet published forward-looking statements that adversely affect the stock price could result in losses to investors, stockholder lawsuits or other litigation, sanctions or restrictions issued by the SEC.

Our Common Stock is currently deemed a “penny stock,” which makes it more difficult for our investors to sell their shares.

The SEC has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer approve a person’s account for transactions in penny stocks, and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience objectives of the person and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination, and that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our Common Stock if and when such shares are eligible for sale and may cause a decline in the market value of its stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commission payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock.

As an issuer of “penny stock,” the protection provided by the federal securities laws relating to forward-looking statements does not apply to us.

Although federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to issuers of penny stocks. As a result, we will not have the benefit of this safe harbor protection in the event of any legal action based upon a claim that the material provided by us contained a material misstatement of fact or was misleading in any material respect because of our failure to include any statements necessary to make the statements not misleading. Such an action could hurt our financial condition.

As an issuer not required to make reports to the Securities and Exchange Commission under Section 13 or 15(d) of the Securities Exchange Act of 1934, holders of restricted shares may not be able to sell shares into the open market as Rule 144 exemptions may not apply.

Under Rule 144 of the Securities Act of 1933 holders of restricted shares, may avail themselves of certain exemption from registration is the holder and the issuer meet certain requirements. As a company that is not required to file reports under Section 13 or 15(d) of the Securities Exchange Act, referred to as a non-reporting company, we may not, in the future, meet the requirements for an issuer under 144 that would allow a holder to qualify for Rule 144 exemptions. In such an event, holders of restricted stock would have to utilize another exemption from registration or rely on a registration statement to be filed by the Company registered the restricted stock. Currently, the Company has no plans of filing a registration statement with the Commission.

Securities analysts may elect not to report on our Common Stock or may issue negative reports that adversely affect the stock price.

At this time, no securities analysts provide research coverage of our Common Stock, and securities analysts may not elect not to provide such coverage in the future. It may remain difficult for our company, with its small market capitalization, to attract independent financial analysts that will cover our Common Stock. If securities analysts do not cover our Common Stock, the lack of research coverage may adversely affect the stock’s actual and potential market price. The trading market for our Common Stock may be affected in part by the research and reports that industry or financial analysts publish about our business. If one or more analysts elect to cover our company and then downgrade the stock, the stock price would likely decline rapidly. If one or more of these analysts cease coverage of our company, we could lose visibility in the market, which, in turn, could cause our stock price to decline. This could have a negative effect on the market price of our Common Stock.

We have not paid cash dividends in the past and do not expect to pay cash dividends in the foreseeable future. Any return on investment may be limited to the value of our Common Stock.

We have never paid cash dividends on our capital stock and do not anticipate paying cash dividends on our capital stock in the foreseeable future. The payment of dividends on our capital stock will depend on our earnings, financial condition and other business and economic factors affecting us at such time as the board of directors may consider relevant. If we do not pay dividends, our Common Stock may be less valuable because a return on your investment will only occur if the Common Stock price appreciates.

We may be unable to maintain an effective system of internal control over financial reporting, and as a result, we may be unable to accurately report our financial results.

If we fail to maintain an effective system of internal control over financial reporting, we could experience delays or inaccuracies in our reporting of financial information, or non-compliance with the Commission, reporting and other regulatory requirements. This could subject us to regulatory scrutiny and result in a loss of public confidence in our management, which could, among other things, cause our stock price to drop.

Item 4. Dilution

Purchasers of our Common Stock in this offering will experience an immediate dilution of net tangible book value per share from the public offering price. Dilution in net tangible book value per share represents the difference between the amount per share paid by the purchasers of shares of Common Stock and the net tangible book value per share immediately after this offering.

The following table sets forth the estimated net tangible book value per share after the offering and the dilution to persons purchasing Common Stock based on the foregoing maximum offering assumptions based on an offering price of $0.40 per share based upon our balance sheet as of December 31, 2018. The numbers are based on the total issued and outstanding shares of Common Stock as of December 30, 2019 was 99,610,855.

| | | 25% | | | 50.0% | | | 75% | | | 100% | |

| Net Value | | $ | 5,124,891.00 | | | $ | 10,124,891.00 | | | $ | 15,124,891.00 | | | $ | 20,124,891.00 | |

| # Total Shares | | | 112,110,855 | | | | 124,610,855 | | | | 137,110,855 | | | | 149,610,855 | |

| Net Book Value Per Share | | $ | 0.0457 | | | $ | 0.0813 | | | $ | 0.1103 | | | $ | 0.1345 | |

| Increase in NBV/Share | | $ | 0.0441 | | | $ | 0.0796 | | | $ | 0.1087 | | | $ | 0.1329 | |

| Dilution to new shareholders | | $ | 0.3543 | | | $ | 0.3187 | | | $ | 0.2897 | | | $ | 0.2655 | |

| Percentage Dilution to New | | | 88.57 | % | | | 79.69 | % | | | 72.42 | % | | | 66.37 | % |

n/a – Indicates that no meaningful value can be calculated as the net book value prior to the offering is zero.

Item 5. Plan of Distribution and Selling Securityholder

The Offering will be sold by our officers and directors.

This is a self-underwritten offering. This Offering Circular is part of an exemption under Regulation A that permits our officers and directors to sell the Shares directly to the public in those jurisdictions where the Offering Circular is approved, with no commission or other remuneration payable for any Shares sold. There are no plans or arrangements to enter into any contracts or agreements to sell the Shares with a broker or dealer. After the qualification by the Commission and acceptance by those states where the offering will occur, the officers and directors intends to advertise through personal contacts, telephone, and hold investment meetings in those approved jurisdictions only. We do not intend to use any mass-advertising methods such as the Internet or print media. Officers and directors will also distribute the prospectus to potential investors at meetings, to their business associates and to their friends and relatives who are interested the Company as a possible investment, so long as the Company has provided notice filing in the jurisdiction where such communications have taken place. In offering the securities on our behalf, the Officers and Directors will rely on the safe harbor from broker dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934.

Terms of the Offering

This offering is being conducted on a best-efforts, self-underwritten basis, for up to 50,000,000 shares of its common stock at a fixed price of $0.40 per share. The price shall be fixed for the duration of the offering, unless an amendment is properly filed with the Commission. There is no minimum investment required from any individual investor. The shares are intended to be sold directly through the efforts of our officers and directors. The shares are being offered for a period not to exceed 360 days. The offering will terminate on the earlier of: (i) the date when the sale of all shares is completed, or (ii) 360 days from the effective date of this document (unless extended by the Board of Directors for an additional 90 days). For more information, see the section titled “Use of Proceeds” herein.

Item 6. Use of Proceeds to Issuer

There is no minimum amount of shares necessary to be sold hereunder. Because the offering is a “best efforts” offering without a minimum offering amount, we may close the offering without sufficient funds for all the intended purposes set out below.

The net proceeds of a fully subscribed offering, after total offering expenses, will be approximately $20.0 million. Caliber plans to use these proceeds as follows towards the development of Kadara goldmine project:

| | USD | |

| Geological exploration works | | | 6,995,740 | |

| Research and development | | | 680,000 | |

| Shift camp and auxillary infrastructure buildings, roads and electrical power | | | 1,430,340 | |

| Start of developing of open pit, mining machinery acquisition | | | 5,858,380 | |

| Ordering equipment for gold extraction factory | | | 4,385,540 | |

| General and administrative expenses | | | 650,000 | |

| Total | | | 20,000,000 | |

We do not have agreements or commitments for any acquisition or development projects at this time. Other than the payment of the Company’s officers and directors’ salaries, some of the proceeds of this offering will be used to compensate or otherwise make payments to our subsidiaries’ officers or directors or staff. General corporate purposes may include, but are not limited to, the costs of this offering, including our outside legal and accounting expenses, employee payroll, rent and real estate expenses, utilities, computer hardware and software and promotion and marketing. For a more detailed explanation of our use of proceeds, please see Exhibit 15.1.

We reserve the right to change the use of proceeds as business demands dictate.

Item 7. Description of Business

This Prospectus includes market and industry data that we have developed from publicly available information; various industry publications and other published industry sources and our internal data and estimates. Although we believe the publications and reports are reliable, we have not independently verified the data. Our internal data, estimates and forecasts are based upon information obtained from trade and business organizations and other contacts in the market in which we operate and our management’s understanding of industry conditions.

As of the date of the preparation of this Prospectus, these and other independent government and trade publications cited herein are publicly available on the Internet without charge. Upon request, we will also provide copies of such sources cited herein.

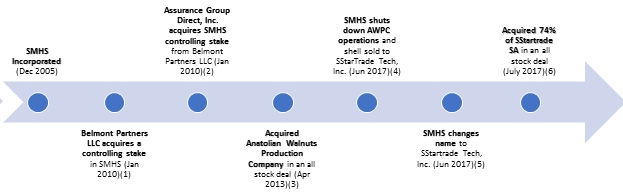

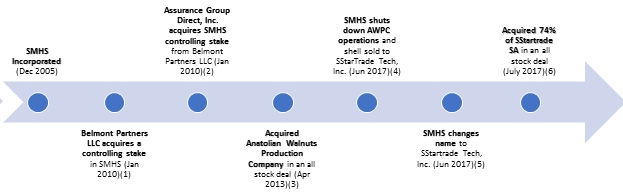

Company Overview

We were originally incorporated on December 6, 2005 as Smart Holdings, Inc. (SMHS) under the laws of the State of Nevada; and we are currently operating as SStarTrade Tech, Inc. (SSTT). Significant organizational changes in our organization and business since inception is shown below:

(1) On January 5, 2010, Belmont Partners, LLC acquired 7 million shares of our common stock, which resulted in a change in control of SMHS. Upon completion of the change in control, our new owners discontinued our consulting business, appointed new management and transitioned us to the business of selling automotive extended service warranties.

(2) On January 18, 2010, SMHS was acquired by Assurance Group Direct, Inc. by directly purchasing 4,302,111 shares of our common stock held by Belmont Partners, LLC at a price of $0.0671 per share. This transaction resulted in a change in control of SMHS. Upon completion of the change in control our new owners appointed new management.

(3) On April 8, 2013, SMHS acquired Anatolian Walnuts Production Company (AWPC), a Turkish company which owned and operated walnut plantations in Turkey. In connection with this transaction SMHS issued 975,000,000 shares of SMHS common stock as purchase consideration. Upon completion of the change in control, our new owners (Messer’s Ismail Uslu and Mustafa Laz) discontinued our automotive extended warranty business, appointed new management and transitioned us into the walnut farming and distribution business.

(4) On June 30, 2017, SMHS discontinued its walnut farming and distribution business and sold all of the outstanding common shares and preferred shares to Mr. Bruno Horn and Mrs. Carla Horn. Simultaneously SMHS sold its interest in AWPC back to Messer’s Uslu and Laz for $1 and exited the walnut farm and production business.

(5) In connection with the sale of SMHS, we amended our Articles of Incorporation and changed our name to SStartrade Tech, Inc., and authorized a 1-for-10 reverse split.

(6) In connection with the sale of SMHS, Mr. Horn entered into a reorganization agreement on behalf of SMHS with SStarTrade SA, a swiss corporation, pursuant to which SMHS acquired a 74% controlling equity interest in exchange for (need to be edited geragding the attached file)(pre-reverse split) shares of SMHS common stock.

Our Mining Operations

We are a US-based holding company that invests in development stage exploration mining companies that focus on developing mineral property assets in the Russian Federation. Our primary investment purpose is to evaluate, acquire and explore mineral properties, which, hopefully, will contain gold, silver, copper and other economic minerals. Our strategy is to create value by identifying and acquiring high potential gold mining assets.

We presently hold a 74 percent controlling interest in the voting shares of the Swiss corporation, SStarTrade SA, whose business is developing gold deposits in the Russian Federation, one of the most gold rich asset areas in the world. SStarTrade SA has interests in the prospect of gold mining (through the ownership of 100% of the shares in two Russian gold mining companies – SStartrade Gold LLC and SwisStarGold LLC) and the steel business (through the possession of 100% of the shares in the Gaysky Steel Plant LLC located in Russia).

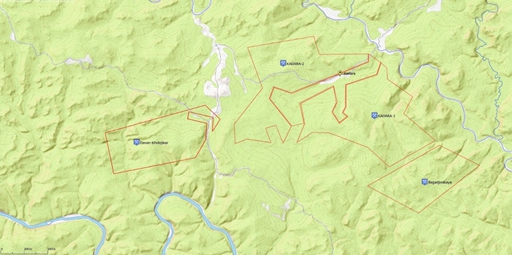

Company now is concentrating on the primary business of organizing, according to the business plan, financing and execution of the project aiming at extraction of ore gold in the Trans-Baikal Territory of the Russian Federation (project “Kadara”).

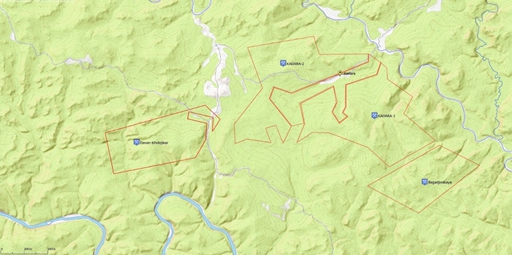

SStarTrade SA, through its wholly-owned subsidiaries, holds a license for part of large-scale Kadara gold field and submitted claims for licenses to four more bordered gold fields to conduct geological exploration and further production of gold. The Kadara project is estimated to contain an initial mineral resource base of 177 tons of gold. The project envisages financing of prospecting works for confirmation of the gold reserves and construction of a gold-processing complex.

Our preliminary geological estimate is that our Kadara project in the Russian Federation could have up to 100 tons of gold resources with a potential market value of up to $500 million at the current spot rate for gold.

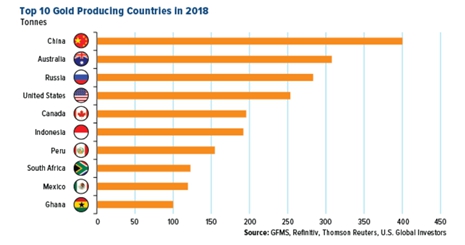

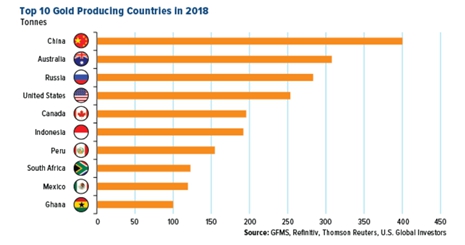

Global Gold Mining Industry Overview