Searchable text section of graphics shown above

[LOGO]

Filed Pursuant to Rule 433

Issuer Free Writing Prospectus dated March 21, 2006

Relating to Preliminary Prospectus dated March 13, 2006

Registration No. 333-131216

Ascent Solar Technologies, Inc.

The issuer has filed a registration statement (including a prospectus) with the Securities and Exchange

Commission (“Commission”) for the offering to which this communication relates. Before you invest, you

should read the prospectus in that registration statement and other documents the issuer has filed with the

Commission for more complete information about the issuer and this offering. You may get these documents

for free by visiting EDGAR on the Commission’s website at www.sec.gov. Alternatively, the issuer, any

underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request

it by calling toll-free 1-800-433-9045.

Ascent Solar Technologies, Inc.

Matthew Foster

President and CEO

Safe Harbor Statement

This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. “Forward-looking statements” describe future expectations, plans, results or strategies and are generally preceded by words such as “future,” “plan” or “planned,” “will” or “should,” “expected,” “anticipates,” “draft,” “eventually” or “projected.” You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including risks that our products may not achieve customer acceptance or that they will not perform as expected, and other risks identified in our prospectus and other filings with the SEC. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements are made as of the date hereof and Ascent Solar Technologies Inc. undertakes no obligation to update such statements.

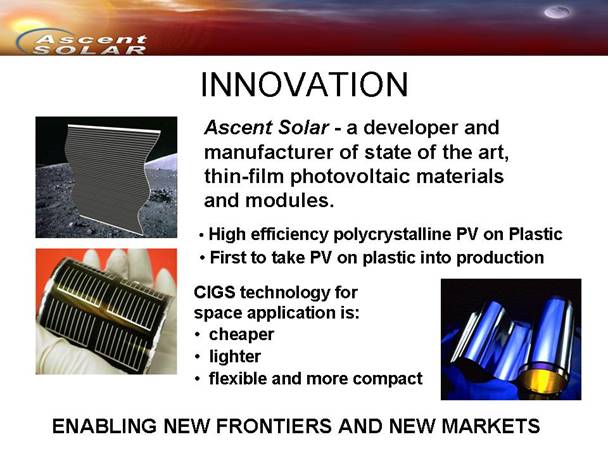

INNOVATION

Ascent Solar - a developer and manufacturer of state of the art, thin-film photovoltaic materials and modules.

• High efficiency polycrystalline PV on Plastic

• First to take PV on plastic into production

CIGS technology for space application is:

• cheaper

• lighter

• flexible and more compact

ENABLING NEW FRONTIERS AND NEW MARKETS

EXPERIENCE

• Thin film photovoltaic development began in 1994 at ITN Energy Systems, Inc.

• Over $60 million invested in R&D with key civil and government customers

• Air Force

• NASA

• Department of Energy

• Current contracts total over $3.0 million

• Developer of PV roll-to-roll manufacturing with intelligent process controls

• Second generation technology READY TO ROLL

MARKETS

High Altitude Airship

(70,000 to 100,000 ft.)

• Defense

• Homeland Security

• Commercial Communications

Spacecraft

Terrestrial

HAA OPPORTUNITY

• Lockheed Martin wins $180 Million HAA Development Program

• Lockheed Martin requested Ascent Solar to submit a PV proposal

• Multiple supplier awards anticipated in June 2006

• $4 Million initial development program begins October 2006

• Follow-on production order of 1MW of photovoltaic modules

• Operational High Altitude Airships each require 1MW of power

• 1MW = 1 million watts

• 1MW x $50-100/Watt = $50 Million to $100 Million per airship

• Government and commercial demand to exceed 10 airships per year

• Ascent Solar is uniquely positioned to meet challenging power demands

• Lockheed requires a minimum of 400Watts/kg and 125Watts/m² for HAA

• PV on plastic is 50% lighter than metal foils

• Ascent Solar has a Super High Efficiency technology in the pipeline

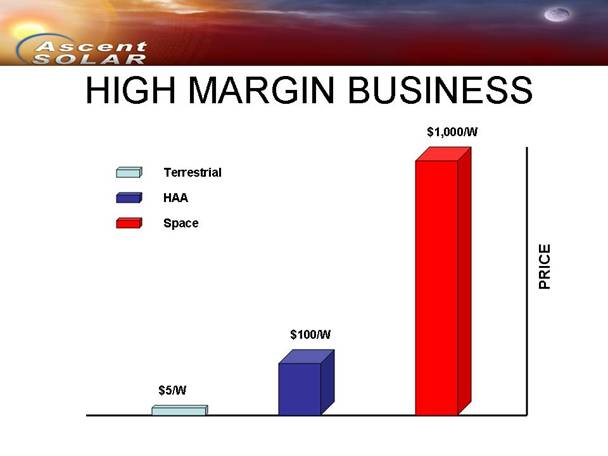

HIGH MARGIN BUSINESS

[CHART]

SOLAR IS HOT

[LOGO]

SUNPOWER CORPORATION

Symbol: SPWR

Market Cap.: $2.44 B

52 Week Range: $24.30 - $45.09

Recent Price: $40.78 (2/14/06)

[LOGO]

DAYSTAR TECHNOLOGIES

Symbol: DSTI

Market Cap.: $81.0M

52 Week range: $5.15 - $17.50

Recent Price: $12.90 (3/17/06)

[LOGO]

SUNTECH POWER HLDGS

Symbol: STP

Market Cap.: $5.09B

52 Week Range: $19.00 - $45.95

Recent Price: $35.20 (3/17/06)

[LOGO]

ENERGY CONV DEVICE

Symbol: ENER

Market Cap.: $1.31B

52 Week Range: $16.27- 57.84

Recent Price: $42.45 (3/17/06)

KEY MILESTONES

• IPO Closing | April 2006 | |

• Lockheed Martin HAA Award | June 2006 | |

• Lockheed Martin HAA Program Start | Oct 2006 | |

• R&D Contracts Transfer to Ascent Solar | 4th QTR ‘06 | |

• New R&D Contracts Submitted/Awarded | Ongoing | |

• Equipment Delivery (500kW/shift/yr) | 1st QTR ‘07 | |

• Plant Commissioning | 2nd QTR ‘07 | |

• Initial production deliveries | 1st QTR ‘08 | |

Management Team

Executive Officers:

• Matthew B. Foster, President & CEO,

— » 20 plus years with Lockheed Martin

• Joseph Armstrong, Ph.D., VP & Chief Technology Officer

— 10 plus years with Lockheed Martin and 10 plus years with ITN managing Photovoltaic Division

• Janet Casteel, Treasurer & Controller

— 9 plus years with ITN managing Business Operations & Contract Administration

Board of Directors:

• Mohan Misra, Ph.D., Chairman

— 19 years with Lockheed Martin, Space Systems Company, Materials & Structures Group manager

— Founded ITN in 1994, since then ITN has spun off 4 companies

• T W Fraser Russell, Ph.D.

— co-inventor on four U.S. patents for thin-films and photovoltaic

— serves on photovoltaics R&D committee of the National Renewable Energy Laboratory (“NREL”)

• Stanley Gallery

• Mark Waller

• Ashutosh Misra

Technical Advisory Group:

• Rajeewa R. Arya, Ph.D.

— 18 years with BP Solar, led their establishment of BP Solar’s thin-film photovoltaic manufacturing line

• Bruce Lanning, Ph.D.

— 25 years of professional experience in materials research specializing in thin film devices and processing

• Robert W. Birkmire, Ph.D.

— Director of the University of Delaware’s Institute of Energy, managing research and development of thin-film PV solar cells and other photonic devices. Dr. Birkmire is the co-author of more than 100 technical papers and holds five U.S. patents.

OFFERING

Offering: | | 3,000,000 Units: |

| | — One Common Share |

| | — One Redeemable ‘A’ Warrant |

| | — Two Non-Callable ‘B’ Warrants |

| | |

Expected Price: | | $5-6 per Unit |

| | |

Timing: | | March/April |

| | |

Shares Outstanding: | | 5,290,909 shares |

(Post Offering) | | |

| | |

Proposed Symbols: | | ASTIU, ASTI |

» Nasdaq Small-Cap | | ASTIW, ASTIZ |

ADDITIONAL INFORMATION

Jim Blackman

PR Financial Marketing

(713) 398-4694

jim@prfonline.com

Nick Bales

Paulson Investment Company

(800) 433 9045

nbales@paulsoninvestment.com