Exhibit 99.1

Item 1. Business

Overview

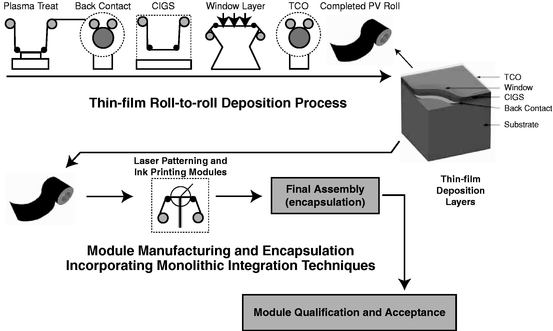

We are a development stage company formed in October 2005 to commercialize flexible photovoltaic (“PV”) modules using proprietary technology. Our technology was initially developed at ITN Energy Systems, Inc. (“ITN”) by our founder and core scientific team beginning in 1994 and subsequently assigned and licensed to us. Our proprietary manufacturing process deposits multiple layers of materials, including a thin film of highly efficient copper-indium-gallium-diselenide (“CIGS”) semiconductor material, on a flexible, lightweight, plastic substrate and then laser patterns the layers to create interconnected PV cells, or PV modules, in a process known as monolithic integration. We believe that our technology and manufacturing process provides us with significant advantages over both the crystalline silicon (“c-Si”) based PV manufacturers that currently dominate the PV market, as well as other thin-film PV manufacturers that use rigid and/or heavier substrate materials such as glass, stainless steel or other metals.

Our thin-film PV modules require less than 1% of the semiconductor material currently needed to achieve the same power output as a c-Si-based PV device. Consequently, we do not face the supply constraints and raw material costs that may affect silicon-based PV manufacturers. Also, we believe that our use of CIGS on a flexible, durable, lightweight, high-tech plastic substrate should allow for integration of our PV modules into a variety of building materials, electronic products, military and space applications, as well as other products and applications that may emerge. We believe that the unique attributes of our materials will enable a reduction in the overall system cost, installation cost and logistical cost-per-watt ratios. For markets that place a high premium on weight, like space and near-space markets, our materials should provide attractive increases in the power-to-weight ratio, and we believe that our materials have higher power-to-area ratios and voltage-to-area ratios than do competing flexible PV thin-films. These metrics will be critical as we position ourselves to compete in commercial roof-top applications and high value-added markets like military, space and electronic integrated PV (“EIPV”) solar module applications. We believe that, when employed on a sufficiently large commercial scale, our large-format, roll-to-roll manufacturing process and proprietary monolithic integration techniques will allow us to achieve a per watt manufacturing cost lower than most of our flexible, lightweight, thin-film competitors. At sufficiently large commercial scale, we believe overall grid parity is possible—i.e., the point at which the system level cost of our PV-generated power is equal to that of retail power distributed from the electric utility grid—in certain geographic markets within five years.

Commercialization and Manufacturing Expansion Plan

We intend to be the first company to manufacture large, roll-format, PV modules in commercial quantities that use CIGS on a flexible, plastic substrate. Our manufacturing expansion plan entails the design, installation, qualification, testing and operation of additional production tools to increase our rated production capacity. We began commercial production on our 1.5 megawatt (“MW”) production line in the first quarter of 2009. We intend to incrementally expand our aggregate rated production capacity to 30 MW by attaining the following milestones within the time frames indicated:

| • | Fourth quarter of 2009: Complete internal testing for certification and begin product certification with products from our 1.5 MW production line, and begin qualification of production tools for the first 15 MW. |

| • | First half of 2010: Begin production and ramp up of the first half of initial 30 MW of annual rated production capacity, and complete installation of 30 MW tools. |

| • | Second half of 2010: Ramp up to full 30 MW of annual rated production capacity. |

Although we currently plan to expand our production capacity in accordance with the timeline above and further plan to expand our production capacity to 110 MW or more, the actual timing and amount of production capacity that we install may significantly deviate from the above plan due to market conditions, availability of financing, timeliness of delivery of production tools, product performance and other factors described in this prospectus supplement, the accompany prospectus and the documents that they incorporate by reference.

Rated production capacity refers to our expected level of annual production upon optimization of our production process and is based on assumed production yields and module efficiencies. The actual production levels that we are able to realize at any point during our planned expansion will depend on a variety of factors, including our ability to optimize our production process to achieve targeted production yields and module efficiencies.

Advantages of CIGS on a Flexible Plastic Substrate

Thin-film PV solutions differ based on the type of semiconductor material chosen to act as a sunlight absorbing layer, and also on the type of substrate on which the sunlight absorbing layer is affixed. We believe that we are the only company currently focused on commercial scale production of PV modules using CIGS on a flexible, plastic substrate. We utilize CIGS as a semiconductor material because, at the laboratory level, it has a higher demonstrated cell conversion efficiency than amorphous silicon (“a-Si”) and cadmium telluride (“CdTe”). We also believe that CIGS offers other compelling advantages over both a-Si and CdTe, including:

| • | CIGS versus a-Si:Although a-Si, like CIGS, can be deposited on a flexible substrate, its conversion efficiency, which already is generally much lower than that of CIGS, measurably degrades when it is exposed to ultraviolet light, including natural sunlight. To mitigate such degradation, manufacturers of a-Si solar cells are required to implement measures that add cost and complexity to their manufacturing processes. |

| • | CIGS versus CdTe:Although CdTe modules have achieved conversion efficiencies that are generally comparable to CIGS in production, we believe that CdTe has never been successfully applied to a flexible substrate on a commercial scale. We believe that the use of CdTe on a rigid, transparent substrate, such as glass, makes CdTe unsuitable for a number of the applications that we are targeting in the building integrated PV (“BIPV”) and other markets. We also believe that CIGS can achieve higher conversion efficiencies than CdTe. |

Our choice of substrate material further differentiates us from other thin-film PV manufacturers. We believe that the use of a flexible, lightweight substrate which is easier to install provides clear advantages for commercial rooftops, higher value-added BIPV and other markets, where rigid substrates are unsuitable for many applications. We also believe that our use of a flexible, plastic substrate provides us significant cost advantages because it enables us to employ monolithic integration techniques that we believe are unavailable to manufacturers who use flexible, metal substrates. Accordingly, we are able to eliminate the need for costly back-end assembly of inter-cell connections. As the only company, to our knowledge, focused on the commercial production of PV modules using CIGS on a flexible, plastic substrate, we believe we have the opportunity both to penetrate the BIPV, aerospace, and other markets with a high quality, value-added product and also to compete in the commodity solar panel market as a low-cost producer.

Competitive Strengths

We believe we possess a number of competitive strengths that provide us with an advantage over our competitors.

| • | We are an early mover in CIGS technology with a proprietary, flexible, lightweight, high efficiency PV thin film product that positions us to penetrate a wide range of attractive high value-added markets such as BIPV, military, space and other markets. By applying CIGS to a flexible, plastic substrate, we have developed a PV module that is efficient, lightweight and malleable, providing unique opportunities for integration into building material products (such as roofing membranes, shingles, siding and facades, metal and composite panels). Commercial rooftops alone are a major segment of the world solar market. The market for electronic components (such as electronic packages, casings, and accessories as well as military portable power systems and space and near space solar power application solutions) also may prove to be a significant premium market. Relative to our thin film competitors, we believe that our early mover advantage in thin film CIGS on plastic technology has placed us on an accelerated path to commercialization with a superior product offering for these strategic market segments. |

| • | We have the ability to manufacture PV modules for different markets and for customized applications without altering our production processes. Our ability to produce PV modules in customized shapes and sizes or in a variety of shapes and sizes simultaneously without interrupting our production flow provides us with flexibility in determining target markets and product applications, and allows us to respond quickly to changing market conditions. Many of our competitors are limited by their technology and/or their manufacturing processes to a more restricted set of product opportunities. |

| • | Our integrated, roll-to-roll manufacturing process and proprietary monolithic integration techniques provide us a cost advantage over our competitors. Historically, manufacturers have formed PV modules by manufacturing individual solar cells and then interconnecting them. Our large-format, roll-to-roll manufacturing process allows for integrated production. In addition, our proprietary monolithic integration techniques allow us to utilize laser patterning to create interconnects, thereby creating PV modules at the same time we create PV cells. In so doing, we are able to eliminate an entire back-end processing step, saving time as well as labor and manufacturing costs relative to our competitors. |

| • | Our strategic relationship with Norsk Hydro Produksjon AS (“Norsk Hydro”) provides us with direct access to a potentially large customer base in the global BIPV market. Norsk Hydro is a major global supplier of aluminum-based building systems, and our relationship provides us with a strong, established development and marketing partner for accessing the BIPV market in an accelerated manner. Together with Norsk Hydro, we are in the process of developing a product line that would incorporate our PV modules into various Norsk Hydro products such as sun-shading systems, wall systems and facades. |

| • | Our proven research and development capabilities position us to continue the development of next-generation PV modules and technologies. Our ability to produce CIGS-based PV modules on a flexible plastic substrate is the result of a concerted research and development effort that began more than fourteen years ago. We continue to pursue research and development in an effort to drive efficiency improvements in our current PV modules and to work toward next-generation technologies and additional applications. |

Markets and Marketing Strategy

Our target markets include the BIPV market, the EIPV market, the military and governmental portable power markets and the space and near-space markets.

In BIPV applications, solar modules are incorporated directly into building and construction materials. For BIPV we intend to be the supplier of choice by offering high-performance, lightweight, durable and flexible PV modules that can be integrated directly into building material products such as roofing membranes, roofing shingles, siding, facades, shading devices, parking structures, and metal and composite panels. We anticipate that when integrated with our solar modules, traditional building materials will produce electricity from the integrated PV modules. Commercial rooftop applications may become an important market for the Company’s laminated solar products where we are cooperating with three important strategic partners.

In EIPV applications, solar modules are incorporated directly into portable electronic devices or the surface of their accessories. For EIPV, we intend to supply high voltages in small spaces for PV integration directly into electronic packages, casings, and accessories in the consumer electronics market.

Military and governmental portable power is an attractive market opportunity for us to provide lightweight power generating products like solar blankets and solar tents that can be field deployed for powering the military’s increasing energy requirements. By displacing conventional fuels, the military can become more cost effective by utilizing our PV materials where there is no reliable operating electric grid. We intend to continue to develop the existing military portable power market by developing relationships with key strategic players currently serving this market as existing large military and governmental contractors. We envision the military market as a likely early market entry point for our lightweight portable power products because similar products have been in development and qualification testing for a number of years.

In space and near-space market applications, solar PV modules are incorporated into satellites, aircraft or high altitude air ships. In the space, near-space and military portable power markets, we believe that our power-producing modules are uniquely suited for applications requiring mobility, durability and light weight. In the space and near-space market, we intend to use our durable and lightweight technology to provide both higher value and more capable solutions at cost-effective system prices. We hope to develop customers in these markets based upon strategic relationships with large players in those application areas.

Our marketing and distribution strategy is based on the formation of strategic relationships with key partners, including original equipment manufacturers (“OEMs”), system integrators and distributors, who deal directly with installers, contractors or end-users in our target markets. Since 2007, we have entered into a number of strategic relationships with companies active in the BIPV and other markets; we are also in discussions with other market participants to establish similar relationships in a variety of geographic markets worldwide.

Until we commence commercial production at our new Thornton, Colorado production facility, which we currently expect will occur in the first half of 2010, we intend to supply our strategic partners with PV module samples produced on our 1.5 MW production line to support our partners’ efforts to develop, test and certify new integrated flexible PV products. This should enable them to identify and cultivate promising market segments. By cooperating with our strategic partners in this way, we hope to create sufficient and consistent demand for our PV modules by the time we commence large scale commercial production of our PV modules using our planned production tools for approximately 30 MW of rated capacity. We also intend to initiate sales of PV modules to these partners from our 1.5 MW production line. We envision that we ultimately will serve as a provider of high value-added thin-film solar components to our strategic partners, who will be solely responsible for the marketing, sales and distribution of their integrated building and electronics products, as well as our key partners in the government, military, space and near-space application markets. In so doing, we intend to position ourselves as a leading manufacturer and supplier of value-added lightweight, durable, and flexible

PV components to these markets. By capitalizing on the lightweight features of our thin-film PV products, we believe that we can reduce overall system installation and logistics costs, making our PV solutions more attractive to our strategic partners and their customers.

Although the BIPV, EIPV and military and governmental portable power markets comprise our immediate target markets, in the longer-term, we also intend to pursue opportunities in the space satellite and near-space markets. We expect the space satellite and the near-space markets to evolve more gradually than the terrestrial market principally due to the higher degree of product qualifications and flight testing that will be required. We anticipate that our pathway to the space and near-space markets will be through development of modules for experimental space qualification tests and then actual flight experiments with governmental customers, followed by full scale flight arrays on operational systems once the technology and arrays have been fully space qualified. We intend to pursue these opportunities because we believe that the space and near-space markets place a premium on performance and offer a correspondingly high-value opportunity for our technology.

Manufacturing and Manufacturing Strategy

We manufacture our products by affixing a thin CIGS layer to a flexible, plastic substrate, and by using proprietary monolithic integration techniques that enable us to form complete PV modules without engaging in costly back-end assembly of inter-cell connections. Historically, PV manufacturers made PV modules by bonding or soldering discrete PV cells together. This manufacturing step typically increased manufacturing costs and at times proved detrimental to the overall yield and reliability of the finished product. By eliminating this added step using our proprietary monolithic integration techniques, we believe that we can achieve cost savings in, and increase the reliability of, our PV modules. We also use a large-format, roll-to-roll manufacturing process that permits us to fabricate our flexible PV modules in an integrated sequential operation.

The following diagram is a general illustration of our manufacturing process:

While focused on speed to market, we believe that quality and consistency of product will be paramount to our success in the marketplace. Consequently, our path to commercialization is defined by a highly disciplined, staged progression. In keeping with this philosophy, we completed construction of our 1.5 MW production line in December 2007. During the first quarter of 2009, we began regular production of monolithically integrated flexible CIGS modules on that line. In June 2009, we announced that, using the 1.5 MW production line, we had manufactured a five- meter long, monolithically integrated, PV module on a flexible, plastic substrate that weighed 2 kilograms and produced 123 watts (under standard test conditions) with a 9.1% aperture efficiency. In July 2009, the National Renewable Energy Laboratory (“NREL”) independently verified that standard 429 cm2 modules produced on our 1.5 MW production line yielded conversion efficiencies as high as 10.4%. Over time and with further refinement of our existing processes, we hope that our PV modules will achieve efficiencies of up to 12.0%.

The design of the production equipment to be installed in our 30 MW expansion is based on our existing 1.5 MW production line. Our production parameters are currently being developed as we increase throughput rates on the 1.5 MW production line; once proven, we expect that they will be implemented in the 30 MW expansion line. Economies of scale should be achieved by applying these increased throughput rates to multiple lines and through increased utilization of ancillary equipment.

We have taken delivery of a one-meter wide CIGS deposition system. Deployment of the one- meter wide configuration into commercial production will depend on the outcome of the development work and the timing of our expansion. However, we currently consider the one- meter web as a research and development project offering the potential for long-term cost reduction. Commercial expansion to 30 MW is currently planned with the existing one-third meter web used in the 1.5 MW production line.

We intend to continue to optimize our manufacturing processes including throughput, efficiency and yield to improve product performance and reduce manufacturing costs. We also intend to identify and evaluate suitable locations for new production lines, domestically and abroad, that we believe will best serve our target markets and customers.

Competition

Today the market for PV products is dominated by large manufacturers of crystalline silicon technology. In 2008, the five largest of these manufacturers were: Q-cells (Germany), Suntech Power Holdings Co., Ltd. (China), Sharp (Japan), Kyocera (Japan), and Motech Industries (Taiwan). In all, there are over 25 manufacturers with annual cell production capacities in excess of 25 MW. We anticipate that while these leaders may continue to dominate the market with their silicon-based products for several years, thin-film manufacturers will begin to capture an increasingly larger share of the market.

The landscape of thin-film manufacturers encompasses a broad mix of technology platforms at various stages of development, and consists of a large and growing number of medium and small sized companies. Some of the established crystalline silicon manufacturers have also pursued thin film technologies, either in conjunction with their crystalline efforts, or more recently as a way to diversify their technology portfolios and insulate themselves from silicon supply shocks.

The two largest thin-film PV manufacturers are First Solar, Inc. and Energy Conversion Devices, Inc. First Solar manufactures PV modules by depositing CdTe onto rigid glass plates using monolithic integration techniques similar to ours. Relative to our lightweight, flexible plastic substrates, PV modules using glass substrates are rigid and heavy. First Solar therefore primarily serves the commodity module markets initially targeting large scale, grid-connected solar power projects. Energy Conversion Devices manufactures thin-film a-Si cells on flexible metal foil. These cells must be individually assembled in series and parallel to form an integrated module similar to how c-Si products are manufactured. The additional integration steps required to produce Energy Conversion Devices modules add significant weight and cost, and c-Si does not offer the same efficiency upside as CIGS. Both Energy Conversion Devices and First Solar are well-established market leaders having occupied top 20 solar manufacturing positions since 2006.

We believe that our modules offer unique advantages. Our modules have no glass and thus have potentially lower installed balance of systems costs. We use monolithic integration, which eliminates the expensive back-end process of wiring cells into modules. We believe that our features combine low cost and flexibility for monolithically integrated lightweight flexible modules suitable for many market sectors with particular application to rooftops.

Competitors currently developing or selling CIGS-based PV modules include AVANCIS GmbH & Co. KG, Global Solar Energy, Inc., HelioVolt Corporation, Honda Soltec Co. Ltd., MiaSolé, NanoSolar, Inc., Solibra GmbH, Solyndra Inc., SoloPower, Inc. and Würth Solar GmbH & Co. A number of manufacturers that traditionally have manufactured and sold c-Si-based modules have entered, or in the future may enter, the market for thin-film PV modules and, potentially, CIGS-based PV modules. These efforts have been initiated both through internal development and the acquisition of external companies.

Market conditions from 2004 until mid-2008 were ideal for new entrants looking to supply PV technology. The prevalence of capital and manufacturing subsidies led to a significant increase in the number of new companies pursuing crystalline and thin-film technologies. As market dynamics have almost completely reversed in conjunction with the current economic downturn, those companies that do not have a sufficiently differentiated product, particularly those offering low efficiency glass-based modules, may find themselves unable to compete with establish players and unique technologies.

Research and Development and Intellectual Property

Our core group of scientists has worked together since 1994 in the research and development of CIGS and related PV technologies. We intend to continue to invest in research and development in order to provide near-term improvements to our manufacturing process and products, as well as to identify next-generation technologies relevant to both our existing and potential new markets. Our near-term R&D is focused on simplifying the manufacturing process even further. With regard to our next-generation technologies, we are pursuing multi-junction CIGS designs that we believe, if successfully deployed, would significantly increase the conversion efficiencies of our existing PV modules. We also are engaged in limited research and development activities related to longer-term opportunities in the evolving space satellite and near-space markets. During 2008 and 2007, approximately 85% of our research and development activities related to optimizing our manufacturing process and the remaining 15% related to next generation technology including space and near-space research and development activities funded through our awarded government contracts. During 2008 and 2007, we incurred approximately $10.1 million and $4.8 million in research and development activities.

Our technology was initially developed at ITN by our founder and core scientific team beginning in 1994. In early 2006, ITN assigned to us certain CIGS PV-specific technologies, and granted to us a perpetual, exclusive, royalty-free, worldwide license to use, in connection with the manufacture, development, marketing and commercialization of CIGS PV to produce solar power, certain of ITN’s existing and future proprietary process and control technologies that, although non-specific to CIGS PV, we believe will be useful in our production of PV modules for our target markets. ITN retained the right to conduct research and development activities in connection with PV materials, and we agreed to grant a license back to ITN of improvements to the licensed technologies and intellectual property that are outside of the CIGS PV field.

We protect our intellectual property through a combination of trade secrets and patent protections. We own the following patents and published patent applications:

| 1. | “Apparatus and method of production of thin film photovoltaic modules “(US Patent No. 7,271,333) (issued September 18, 2007) |

| 2. | “Flexible High-Voltage Adaptable Current Photovoltaic Modules and Associated Methods” (US—11/877,632) (filed October 23, 2007) (co-owned with PermaCity Corporation) |

| 3. | “Flexible Photovoltaic Array With Integrated Wiring And Control Circuitry, And Associated Methods” (US—11/877,625) (filed October 23, 2007) (co-owned with PermaCity Corporation) |

| 4. | “Array of Monolithically Integrated Thin Film Photovoltaic Cells and Associated Methods” (PCT/US08/67772; US—12/143,713) (filed June 20, 2008) |

| 5. | “Methods for Fabricating p-Type Cadmium Selenide” (PCT/US08/70240) (filed July 16, 2008) |

| 6. | “Hybrid Multi-Junction Photovoltaic Cells and Associated Methods” (PCT/US08/70239; US—12/174,626) (filed July 16, 2008) |

In addition, we have one unpublished provisional patent in a related area filed February 5, 2009.

In early April 2006, we entered into a non-exclusive patent license agreement with Midwest Research Institute (“MRI”). MRI manages and serves as operating contractor for NREL under a prime contract with the U.S. Department of Energy. Pursuant to the prime contract, MRI acquired the rights to license certain inventions developed at NREL. We have acquired a world-wide, non-exclusive, royalty-bearing, commercial license to the following U.S. patents and their foreign counterparts: U.S. Patent Nos. 5,356,839, 5,441,897 and 5,436,204; European Patent No. EP0694209 (validated Belgium, France, United Kingdom, Germany and Netherlands) and European patent application serial No. 95929367.1 (designated Belgium, France, United Kingdom, Germany and Netherlands); Japanese Patent Nos. 3130943 and 3258667 and Japanese patent application serial no. 8-508088. Products made under this license for use or sale in the United States must be substantially manufactured in the United States, and we are subject to specific development and commercialization requirements. The license is effective so long as any claim of the licensed inventions is enforceable, unless terminated earlier for cause as specified in the agreement. We also have obtained a non-exclusive, royalty-bearing license from the University of Delaware’s Institute of Energy Conversion for U.S. Patent Nos. 6,310,281, 6,372,538, 6,537,845 and 6,562,405, as well as U.S. patent application serial No. 60/620,352. The agreement requires us to use commercially reasonable efforts to practice the licensed patents, and we agree not to assert any rights in our improvements to the licensed patents against the University of Delaware and its other licensees and their customers. These patents and patent applications relate to the fabrication of CIGS on flexible plastic substrates, the use of laser patterning and thin-film deposition during the fabrication of flexible monolithically-integrated CIGS PV devices and certain process steps that we may use during the manufacturing process.

Suppliers

We rely on several unaffiliated companies to supply certain raw materials used during the fabrication of our PV modules. We acquire these materials on a purchase order basis and do not have long-term contracts with the suppliers, although we may enter into such contracts in the future. We currently acquire all of our high-temperature plastic from Ube Industries, Ltd. (Japan), although alternative suppliers of similar materials exist. We purchase component molybdenum, copper, indium, gallium, selenium and indium tin oxides from a variety of suppliers. We also currently are in the process of identifying and negotiating arrangements with alternative suppliers of materials in the United States and Asia. We also have announced our intent to explore a strategic relationship with ITOCHU Corporation (“ITOCHU”) whereby, among other things, ITOCHU would help us source raw materials for our operations. The manufacturing equipment and tools used in our production process have been purchased from various suppliers in Europe, the United States and Asia. Although we have had good relations with our existing equipment and tools suppliers, we intend to monitor and explore opportunities for developing alternative sources.

Employees

As of September 23, 2009, we had 84 employees, of which 9 were executive officers and 2 were part-time. We expect the number of employees to grow significantly as we install additional equipment and increase manufacturing capacity.

Company History

We were formed in October 2005 from the separation by ITN of its Advanced Photovoltaic Division and all of that division’s key personnel and core technologies. ITN, a private company incorporated in 1994, is an incubator dedicated to the development of thin-film, PV, battery, fuel cell and nano technologies. Through its work on research and development contracts for private and government entities, ITN developed proprietary processing and manufacturing know-how applicable to PV products generally, and to CIGS PV products in particular. ITN formed us to commercialize its investment in CIGS PV technologies. In January 2006, ITN assigned to us certain CIGS PV-specific technologies, and granted to us a perpetual, exclusive, royalty-free worldwide license to use, in connection with the manufacture, development, marketing and commercialization of CIGS PV to produce solar power, certain of ITN’s existing and future proprietary process and control technologies in the production of CIGS PV modules. Upon receipt of the necessary government approvals in January 2007, ITN assigned government-funded research and development contracts to us and also transferred the key personnel working on the contracts to us. Today, ITN still provides to us a variety of administrative and technical services such as facilities management, equipment maintenance, procurement, information technology and technical support services. ITN is wholly owned by Inica, Inc. (“Inica”). Dr. Mohan Misra, Chairman of our Board of Directors and our Chief Strategy Officer, and an immediate family member own all of the outstanding shares of Inica.

Corporate Information

We are incorporated under the laws of Delaware, our principal business office is located at 12300 Grant Street, Thornton, Colorado, and our telephone number is (720) 872-5000. Our website address iswww.ascentsolar.com. Information contained on our website or any other website does not constitute part of this prospectus supplement.

Item 1.A. Risk Factors

The risks included here are not exhaustive or exclusive. We operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time, and it is not possible for management to predict all such risk factors, nor can it assess the impact of all such risk factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results.

Risks Relating to Our Business

We have a limited history of operations, have not generated any revenue from operations and have not commenced commercial production of our PV modules.

We have a limited operating history and have not generated any revenue from operations. Our plans call for expansion of production capacity, but we do not expect to begin production using equipment with an annual rated production capacity of approximately 15 MW until the first half of 2010, and a full 30 MW of annual rated production capacity until the end of 2010. Our ability to achieve our business, commercialization and expansion objectives will depend on a number of factors, including whether:

| • | we successfully begin commercial production on equipment with an annual rated production capacity of 30 MW within our planned time frame; |

| • | our products are successfully and timely certified for use in our target markets; |

| • | we successfully qualify production tools to achieve the efficiencies and yields necessary to reach our cost targets as we expand our rated production capacity; |

| • | the cost models on which we intend to rely for the manufacture of our PV modules prove accurate; |

| • | we raise sufficient capital to expand our total rated capacity to approximately 110 MW or more, and whether such capacity will enable us to reach the economies of scale we believe necessary to achieve profitability; |

| • | we receive timely delivery of production tools from our equipment suppliers; |

| • | we effectively manage the planned expansion of our operations; and |

| • | we successfully develop and maintain strategic relationships with key partners, including original equipment manufacturers (“OEMs”), system integrators and distributors, who deal directly with end-users in our target markets. |

Each of these factors is critical to our success, and accomplishing each of these tasks may take longer or cost more than expected, or may never be accomplished. It also is likely that problems that we cannot now anticipate will arise. If we cannot overcome these problems, our business, results of operations and financial condition could be materially and adversely affected.

We have to date incurred net losses and may be unable to generate sufficient sales in the future to become profitable.

We incurred net losses of $13.2 million in the fiscal year ended December 31, 2008 and $8.9 million in the six months ended June 30, 2009 and reported an accumulated deficit of $34.0 million as of June 30, 2009. We expect to incur net losses for the foreseeable future. Our ability to achieve profitability depends on a number of factors, including the growth rate of the solar energy industry, market acceptance of thin-film and other PV modules, the competitiveness of our PV modules and our ability to increase production volumes. If we are unable to generate sufficient revenue to achieve profitability and positive cash flows, we might be unable to satisfy our commitments and may have to discontinue operations. We cannot assure you that we will be successful in establishing ourselves as a profitable enterprise.

Our business is based on a new and unproven technology, and if our PV modules or processes fail to achieve the performance and cost metrics that we expect, then we may be unable to develop demand for our PV modules and generate sufficient revenue to support our operations.

Our CIGS on flexible plastic substrate technology is a new and unproven technology in commercial scale production. Our business plan and strategies assume that we will be able to achieve certain milestones and metrics in terms of throughput, uniformity of cell efficiencies, yield, encapsulation, packaging, cost and other production parameters. We cannot assure you that our technology will prove to be commercially viable in accordance with our plan and strategies. Further, we may experience operational problems with such technology after its commercial introduction that could delay or defeat the ability of such technology to generate revenue or operating profits. If we are unable to achieve our targets on time and within our planned budget, then we may not be able to develop adequate demand for our PV modules, and our business, results of operations and financial condition could be materially and adversely affected.

We currently do not have certified PV modules and have recorded no sales of such products; further, we expect that significant PV module sales will not occur for some time.

We have recorded no sales of PV modules and have no contracts for such sales. Because we do not plan to commence commercial production using equipment with rated capacity of 15 MW until the first half of 2010 and equipment with total rated capacity of 30 MW until the end of 2010, and because we believe that our PV modules will need to be certified in order for them to be commercially viable for sales into certain markets, it will be several months before we record significant PV module sales, if ever. We expect that it will be some time before we can determine whether our expectations relating to our products and their target markets are justified. Further, because we will be required to invest substantial resources in pursuing our target markets in advance of any significant revenue stream that may result from such investments, an unanticipated or longer than expected delay of revenue ramp-up could put a strain on our resources, adversely affecting our business, results of operation and financial condition, and could require us to seek additional capital. See “Risk Factors—Our planned expansion to approximately 110 MW of rated capacity will require additional capital which we may not be able to obtain on favorable terms, if at all or without dilution to our stockholders.”

Our failure to further refine our technology and develop and introduce improved PV products could render our PV modules uncompetitive or obsolete and reduce our net sales and market share.

Our success requires that we invest significant financial resources in research and development to keep pace with technological advances in the solar energy industry. However, research and development activities are inherently uncertain, and we could encounter practical difficulties in commercializing our research results. Our expenditures on research and development may not be sufficient to produce the desired technological advances, or they may not produce corresponding benefits. Our PV modules may be rendered obsolete by the technological advances of our competitors, which could harm our results of operations and adversely impact our net sales and market share.

If the supply of PV modules exceeds the demand for those modules, then we may be forced to reduce the price of our PV modules in order to compete effectively.

Some industry reports forecast overcapacity in the PV module market in ensuing years. In an overcapacity scenario, the supply of PV modules by manufacturers would outstrip demand for those products. If either the overall PV module market or our target markets encounter an overcapacity scenario, we may be forced to scale back production or reduce the price of our PV modules in order to generate sales. In either case, our business, results of operations and financial condition could be materially and adversely affected.

A significant increase in the supply of silicon feedstock or the significant reduction in the manufacturing cost of c-Si-based PV modules could lead to pricing pressures on PV modules generally and force us to reduce the sales price of our PV modules.

During 2008 there was a significant increase in the supply of silicon feedstock and a significant reduction in the cost of c-Si-based PV modules. This led to pricing pressures on PV modules generally. In the face of such current and future downward pricing pressures, we might be forced to reduce the sales prices of our PV modules, which, absent a commensurate decrease in our manufacturing costs, could materially and adversely affect our results of operations and financial condition and prevent us from achieving profitability.

A failure or unanticipated delay in securing any necessary or desired certification for our PV modules from government or regulatory organizations could impair sales of our PV modules and materially and adversely affect our results of operations and financial condition.

In order for our PV modules to be commercially sold for use in certain target markets, they must first be certified by certain government or regulatory organizations, such as Underwriters Laboratory (“UL”) and Technischer Überwachungs-Verein (“TÜV”). We believe that in some cases, these certifications would be sought by our customers and, in other cases, by us. A failure or unanticipated delay in securing any necessary or desired certification for our PV modules could impair sales of our PV modules and materially and adversely affect our business, results of operations and financial condition.

Existing regulations and policies and changes to these regulations and policies may present technical, regulatory and economic barriers to the purchase and use of PV products, which may significantly reduce demand for our PV modules.

The market for electricity generation products is heavily influenced by foreign, federal, state and local government regulations and policies concerning the electric utility industry, as well as policies promulgated by electric utilities. These regulations and policies often relate to electricity pricing and technical interconnection of customer-owned electricity generation. In the United States and in a number of other countries, these regulations and policies have been modified in the past and may be modified again in the future. These regulations and policies could deter end-user purchases of PV products and investment in the research and development of PV technology. For example, without a mandated regulatory exception for PV systems, utility customers are often charged interconnection or standby fees for putting distributed power generation on the electric utility grid. These fees could increase the cost to our end-users of using PV systems and make them less desirable, thereby harming our business, prospects, results of operations and financial condition. In addition, electricity generated by PV systems mostly competes with expensive peak hour electricity, rather than the less expensive average price of electricity. Modifications to the peak hour pricing policies of utilities, such as to a flat rate, would require PV systems to achieve lower prices in order to compete with the price of electricity from other sources.

We anticipate that our PV modules and their use in installations will be subject to oversight and regulation in accordance with national and local ordinances relating to building codes, safety, environmental protection, utility interconnection and metering and related matters. It is difficult to track the requirements of individual states and design equipment to comply with the varying standards. Any new government regulations or utility policies pertaining to PV modules may result in significant additional expenses to us, our business partners and their customers and, as a result, could cause a significant reduction in demand for our PV modules.

Failure to receive timely delivery of production tools from our equipment suppliers could delay our planned expansion of manufacturing capacity and materially and adversely affect our results of operations and financial condition.

Our planned expansion of manufacturing capacity and commercialization timeline depend on the timely delivery of production tools from our equipment suppliers. The relationships with our chosen equipment suppliers are relatively new, and at this point in time we cannot be certain that the equipment orders we place with these suppliers will be fulfilled as we expect or in a timely manner. If delivery of production tools is not made on schedule or at all, then we might be unable to carry out our commercialization and manufacturing expansion plans, produce PV modules in the volumes and at the times that we expect or generate sufficient revenue from operations, and our business, results of operations and financial condition could be materially and adversely affected.

Failure to expand our manufacturing capacity successfully would adversely impact our ability to sell PV modules into our target markets and would materially and adversely affect our business, results of operations and financial condition.

Our growth plan calls for the installation and operation of additional production tools to achieve the manufacturing capacities and cost efficiencies necessary to compete in our target markets. The successful completion and operation of future production tools will require substantial engineering resources and is subject to significant risks, including risks of cost overruns and delays, risks that we may not be able to successfully acquire, install, combine or operate the equipment needed, or the possibility that one or more of the production tools may never be qualified or become operational. Furthermore, we may never be able to operate our production processes in high volume, make planned process and equipment improvements, attain projected manufacturing yields or desired annual capacity, obtain timely delivery of production tools, obtain on reasonable terms adequate facilities in which to install the production tools, or hire and train the additional employees and management needed to operate and maintain the production tools. Failure to meet these objectives on time and within our planned budget could materially and adversely affect our business, results of operations and financial condition.

Failure to consummate strategic relationships with key partners in our various target market segments, such as portable power applications for military and governmental agencies or space and near-space high value added solar applications markets as well as the unique BIPV and EIPV markets, and the respective implementations of the right strategic partnerships to enter these various specified markets, could adversely affect our projected sales, growth and revenues.

We intend to sell thin-film PV modules for use in BIPV and EIPV products, such as roofing shingles, siding and facades, metal and composite panels, roofing membranes, electronic packages, casings and accessories, as well as for military and governmental portable power systems and space and near-space solar panel applications. Our marketing and distribution strategy is to form strategic relationships with suppliers to provide a foothold in these target markets. If we are unable to successfully establish working relationships with such market participants or if due to cost, technical or other factors, our PV modules prove unsuitable for use in such applications; our projected revenues and operating results could be adversely affected. Further, to the extent that we are able to establish strategic relationships with key partners and distributors, those relationships may be on a non-exclusive basis (for example, our strategic relationship with Norsk Hydro is non-exclusive), which means that our partners are not obligated to use us as their sole source of PV modules, and may instead choose to use the products of our competitors. Any such reduction in demand for our PV modules may have a material adverse effect on our revenues, results of operations and financial condition.

Our planned expansion to approximately 110 MW or more of rated capacity will require additional capital which we may not be able to obtain on favorable terms, if at all or without dilution to our stockholders.

Our planned expansion to approximately 110 MW or more of total rated capacity will require additional capital. We currently are unable to determine what forms of financing, if any, will be available to us. If we raise additional funds through the issuance of equity or convertible debt securities, the percentage ownership of our existing stockholders could be significantly diluted, and these newly issued securities may have rights, preferences or privileges senior to those of existing stockholders. If we raise additional funds through debt financing, which may involve restrictive covenants, our ability to operate our business may be restricted. We cannot assure you that additional financing will be available on terms favorable to us, or at all. If adequate funds are not available or are not available on acceptable terms, if and when needed, our ability to fund our operations, take advantage of unanticipated opportunities, develop or enhance our products, expand capacity to approximately 110 MW or more of total rated capacity, or otherwise respond to competitive pressures could be significantly limited, and our business, results of operations and financial condition could be materially and adversely affected.

In addition, the terms of a loan we obtained from the Colorado Housing and Finance Authority (“CHFA”) in connection with our purchase and improvement of our Thornton, Colorado facility contain covenants that limit our ability, without the consent of CHFA, to create or incur additional indebtedness (other than obligations created or incurred in the ordinary course of business); merge or consolidate with any other entity; or make loans or advances to our officers, shareholders, directors or employees. The presence of these negative covenants gives CHFA the ability to bar us from engaging in certain transactions in the future that we may determine are necessary or advisable to meet our business objectives, including debt offerings and acquisitions of or by other companies. If CHFA were to withhold its written consent under these or other circumstances, we could be forced to prepay such loans at a premium, which could adversely affect our business, results of operation and financial condition.

We may be unable to manage the expansion of our operations effectively.

We will need to significantly expand our operations in order to reduce the incremental manufacturing costs of our PV modules, secure contracts of commercially material amounts with reputable customers and capture a meaningful share of our target markets. To manage the rapid expansion of our operations, we will be required to improve our operational and financial systems, procedures and controls and expand, train and manage our growing employee base. Our management team will also be required to maintain and cultivate our relationships with customers, suppliers and other third parties and attract new customers and suppliers. In addition, our current and planned operations, personnel, facility size and configuration, systems and internal procedures and controls might be inadequate or insufficient to support our future growth. If we cannot manage our growth effectively, we may be unable to take advantage of market opportunities, execute our business strategies or respond to competitive pressures, resulting in a material and adverse effect to our business, results of operations and financial condition.

If the U.S. government terminates or delays any of our revenue-generating contracts with it, then the reduced funding could materially and adversely affect our results of operation and financial condition.

To date, we have relied heavily upon contracts with the U.S. government and federal agencies for our revenues and to fund our research and development activities. The U.S. government, as a counterparty to our agreements, generally has the right to unilaterally terminate or modify these contracts. If the U.S. government terminates or delays any of our contracts with it – for example, because of

changed government priorities, budgets or appropriations – then our ability to perform or adequately fund ongoing research and development activities may be adversely affected. Further, such termination or delay could materially and adversely affect our results of operation and financial condition.

The recent financial crisis could negatively affect our business, results of operations, and financial condition.

The recent financial crisis affecting the banking system and financial markets has resulted in a tightening in the credit markets; a low level of liquidity in many financial markets; and extreme volatility in credit, fixed income, and equity markets. There could be a number of follow-on effects from the credit crisis on our business, including increased expense or inability to obtain debt financing or raise additional capital; insolvency of key suppliers, resulting in product delays; inability of customers to obtain credit to finance purchases of our products; and/or customer insolvencies. The current volatility in the financial markets and continued economic uncertainty increase the risk that the actual amounts realized in the future on our assets will differ significantly from the fair values currently assigned to them.

Our PV modules may never gain market acceptance, in which case we would be unable to sell our PV modules or achieve profitability.

Demand for our PV modules may never develop, and our PV modules may never gain market acceptance, if we fail to produce PV modules that compete favorably against competing products on the basis of cost, quality, weight, efficiency and performance. Demand for our PV modules also will depend on our ability to develop and maintain successful relationships with key partners, including OEMs, system integrators and distributors. If our PV modules fail to gain market acceptance as quickly as we envision or at all, our business, results of operations and financial condition could be materially and adversely affected.

If sufficient demand for PV solutions does not develop or takes longer to develop than we anticipate, we may be unable to grow our business, generate sufficient revenue to attain profitability or continue operations.

The solar energy industry is at a relatively early stage of development, and the extent to which PV modules, including our own, will be widely adopted is uncertain. If PV technology proves unsuitable for widespread adoption or if demand for PV modules fails to develop sufficiently, we may be unable to grow our business, generate sufficient sales to attain profitability or continue operations. Many factors, many of which are outside of our control, may affect the viability of widespread adoption of PV technology and demand for PV modules, including:

| • | the cost effectiveness of PV modules and installed PV systems relative to other renewable energy sources, such as wind, geothermal, tidal power and other PV technologies; |

| • | the cost effectiveness of PV modules and installed PV systems relative to conventional carbon-based and other energy sources, such as coal, oil, natural gas and nuclear, and whether the levelized cost of PV can approach that of these conventional energy sources; |

| • | whether PV-generated power reaches grid parity in the geographic markets where our products will be used; |

| • | the availability and amount of government subsidies and incentives to support development of the solar energy industry; |

| • | the deregulation of the electric power industry and the broader energy industry; |

| • | the emergence of other disruptive technologies in the energy industry; |

| • | the ease with which PV solutions can penetrate and adapt to existing energy industry infrastructure; |

| • | the availability of raw materials used in the manufacture of PV products; and |

| • | availability of capital to fund development of technology in the solar energy market. |

Reduced growth in or the reduction, elimination, modification or expiration of government subsidies and economic incentives for solar electricity applications could reduce demand for our products.

National, regional and local governmental bodies in many countries, most notably Germany, Italy, Spain, France, South Korea, Japan, Canada and the United States, have provided support in the form of feed-in tariffs, rebates, tax write-offs and other incentives to end-users, distributors, system integrators and manufacturers of PV products. If any of these subsidies or incentives is discontinued,

reduced or substantially modified, if growth in any such subsidies or incentives is reduced, or if renewable portfolio standards or similar production requirements are changed or eliminated, demand for our PV modules in the affected country or countries could decline or never develop, and our results of operations and financial condition could be materially and adversely affected as a result.

We face intense competition from manufacturers of c-Si-based PV modules, other manufacturers of thin-film PV modules and other companies in the solar energy industry.

The solar energy and renewable energy industries are both highly competitive and continually evolving as participants strive to distinguish themselves within their markets and compete with the larger electric power industry. We believe that our main sources of competition are c-Si PV manufacturers, other thin-film PV manufacturers and companies developing other solar solutions, such as solar thermal and concentrated PV technologies.

The thin-film component of the industry is largely made up of a broad mix of technology platforms at various stages of development, and consists of a large and growing number of medium- and small-sized companies. Two of the largest thin-film PV manufacturers are First Solar, Inc. (“First Solar”) and Energy Conversion Devices, Inc., (“Energy Conversion”) each of which has reported an installed capacity of 100 MW or greater. First Solar manufactures PV modules using cadmium telluride (“CdTe”) affixed to glass. Energy Conversion manufactures PV modules using amorphous silicon (“a-Si”) affixed to flexible metal foil. Competitors currently developing or selling CIGS-based PV modules include AVANCIS GmbH & Co. KG, Global Solar Energy, Inc., HelioVolt Corporation, Honda Soltec Co. Ltd., MiaSolé, NanoSolar, Inc., Solibro GmbH, Solyndra, Inc., SoloPower, Inc. and Würth Solar GmbH & Co. We believe that a number of manufacturers that traditionally have manufactured and sold c-Si-based modules have entered, or in the future may enter, the market for thin-film PV modules and, potentially, CIGS-based PV modules.

Many of our existing and potential competitors have substantially greater financial, technical, manufacturing and other resources than we do. A competitor’s greater size provides them with a competitive advantage because they often can realize economies of scale and purchase certain raw materials at lower prices. Many of our competitors also have greater brand name recognition, established distribution networks and large customer bases. In addition, many of our competitors have well-established relationships with our current and potential partners and distributors and have extensive knowledge of our target markets. As a result of their greater size, these competitors may be able to devote more resources to the research, development, promotion and sale of their products or respond more quickly to evolving industry standards and changes in market conditions than we can. Our failure to adapt to changing market conditions and to compete successfully with existing or future competitors could materially and adversely affect our business, results of operations and financial condition.

The interests of our largest stockholder, Norsk Hydro, may conflict with our interests or your interests now or in the future.

Norsk Hydro currently owns approximately 35% of all issued and outstanding shares of our common stock. See “Certain Relationships and Related Transactions, and Director Independence—Transactions Involving Norsk Hydro Produksjon AS” in our Annual Report for the fiscal year ended December 31, 2008. Norsk Hydro has agreed to purchase approximately $5.0 million of our common stock in the Concurrent Private Placement. As a result of its large holding of our shares, Norsk Hydro may have the ability to prevent any transaction that requires the approval of stockholders regardless of whether other stockholders believe that any such transaction is in their own best interests. Additionally, Norsk Hydro currently holds two seats on our Board of Directors, which afford Norsk Hydro greater control and influence over matters affecting our business.

Norsk Hydro may from time to time acquire and hold interests in businesses that compete directly or indirectly with us. Norsk Hydro also may pursue opportunities (including by acquisition) that may be adverse to, or be in direct or indirect competition with, us. Additionally, our potential customers may be competitors of Norsk Hydro and our interests in selling to those customers could be divergent from Norsk Hydro’s competitive interests. So long as Norsk Hydro continues to own a significant amount of the outstanding shares of our common stock, Norsk Hydro may be able to strongly influence or effectively control our decisions.

Currency translation risk may negatively affect our net sales, cost of equipment, cost of sales, gross margin or profitability and could result in exchange losses.

Although our reporting currency is the U.S. dollar, we may conduct business and incur costs in the local currencies of other countries in which we operate, make sales or buy equipment or materials. As a result, we are subject to currency translation risk. For example, in 2007 we purchased equipment from suppliers in Japan, the United Kingdom and Germany, and our capital expenditures exceeded budgeted amounts due to the decline of the U.S. dollar versus the British pound and the euro. We continue to be exposed to Japanese Yen-based currency risk. The majority of our equipment contracts in 2008 and 2009 were hedged to protect us against fluctuations in

currency exchange rates. However, our future contracts and obligations may be exposed to fluctuations in currency exchange rates; and, as a result, our capital expenditures or other costs may exceed what we have budgeted. Further, changes in exchange rates between foreign currencies and the U.S. dollar could affect our net sales and cost of sales and could result in exchange losses. We cannot accurately predict future exchange rates or the overall impact of future exchange rate fluctuations on our business, results of operations and financial condition.

We depend on a limited number of third-party suppliers for key raw materials, and their failure to perform could cause manufacturing delays and impair our ability to deliver PV modules to customers in the required quality and quantity and at a price that is profitable to us.

Our failure to obtain raw materials and components that meet our quality, quantity and cost requirements in a timely manner could interrupt or impair our ability to manufacture our PV modules or increase our manufacturing cost. Most of our key raw materials are either sole-sourced or sourced by a limited number of third-party suppliers. As a result, the failure of any of our suppliers to perform could disrupt our supply chain and impair our operations. For example, we currently obtain our plastic substrate material solely from Ube Industries, Ltd. (Japan), and we have qualified only one type of encapsulation material for use with our PV modules, although we are actively identifying and evaluating additional suppliers of these materials. In addition, many of our suppliers are small companies that may be unable to supply our increasing demand for raw materials as we implement our planned expansion. We may be unable to identify new suppliers in a timely manner or on commercially reasonable terms. Raw materials from new suppliers may also be less suited for our technology and yield PV modules with lower conversion efficiencies, higher failure rates and higher rates of degradation than PV modules manufactured with the raw materials from our current suppliers.

Any change to our relationship with ITN could disrupt certain aspects of our business operations, including our research and development activities.

Pursuant to a Service Center Agreement in place until December 31, 2009, we have the right to use certain of ITN’s laboratories, equipment and research and development tools on an as needed basis. Also, pursuant to an Administrative Services Agreement in place until December 31, 2009, ITN provides us with certain administrative services at cost, such as facilities management, equipment maintenance, procurement, information technology and technical support. See “Certain Relationships and Related Transactions, and Director Independence—Transactions with ITN Energy Systems, Inc.” in our Annual Report for the fiscal year ended December 31, 2008. We intend to renew these agreements as and when they expire if we determine that the services are still needed or warranted. We have relied on these arrangements to conduct a large portion of our research and development activities, including those related to development and improvements of new PV technologies that may affect the viability of our products in the future. We also have relied on these arrangements for back office support services at what we believe are competitive prices. Although we expect the value of these agreements with ITN to diminish significantly with time as we hire additional personnel and internalize many of the functions previously outsourced to ITN, any change to our existing relationship with ITN, including the sale of ITN to a third party or termination or alteration of the Service Center Agreement or Administrative Services Agreement, could disrupt our research and development activities and other aspects of our business. Among other things, we may be forced to seek and obtain access to different sources of laboratory equipment and tools, or we may be forced to find alternative providers of affected administrative services, or to perform administrative services ourselves. We cannot guarantee that we would be able to do so on the same or as favorable terms than we currently have with ITN, or at all; and the increased costs of alternative arrangements may materially and adversely affect our business, results of operations and financial condition.

Our future success depends on retaining our existing management team and hiring and assimilating new key employees and our inability to attract or retain key personnel would materially harm our business and results of operations.

Our success depends on the continuing efforts and abilities of our executive officers, including Dr. Farhad Moghadam, our President and Chief Executive Officer, Dr. Mohan Misra, our Chief Strategy Officer, Dr. Prem Nath, our Senior Vice President of Production Operations, and Dr. Joseph Armstrong, our Chief Technology Officer. Our future success also will depend on our ability to attract and retain highly skilled employees, including management, technical and sales personnel. The loss of any of our key personnel, the inability to attract, retain or assimilate key personnel in the future, or delays in hiring required personnel could materially harm our business, results of operations and financial condition.

Problems with product quality or performance may cause us to incur warranty expenses, damage our market reputation and prevent us from maintaining or increasing our market share.

We do not have sufficient life cycle data for our thin-film PV modules to reliably predict their lifespan in the field. Pending collection of such data over time, we may not be able to offer customers warranty terms equivalent to those of our competitors, which may adversely impact sales or market acceptance of our PV modules. Further, even if we offer warranty terms equivalent to those of our

competitors, at this time we cannot guarantee that our PV modules will perform as expected during the lifespan that our customers will expect. If our PV modules fail to perform as expected while under warranty, or if we are unable to support the warranties, sales of our PV modules may be adversely affected or our costs may increase, and our business, results of operations and financial condition could be materially and adversely affected.

We may also be subject to warranty or product liability claims against us that are not covered by insurance or are in excess of our available insurance limits. In addition, quality issues can have various other ramifications, including delays in the recognition of revenue, loss of revenue, loss of future sales opportunities, increased costs associated with repairing or replacing products, and a negative impact on our goodwill and reputation. The possibility of future product failures could cause us to incur substantial expenses to repair or replace defective products. Furthermore, widespread product failures may damage our market reputation and reduce our market share and cause sales to decline.

Our PV modules contain limited amounts of cadmium sulfide, and claims of human exposure or future regulations could have a material adverse effect on our business, results of operations and financial condition.

Our PV modules contain limited amounts of cadmium sulfide, which is regulated as a hazardous material due to the adverse health effects that may arise from human exposure. We cannot assure you that human or environmental exposure to cadmium sulfide used in our PV modules will not occur. Any such exposure could result in third-party claims against us, damage to our reputation and heightened regulatory scrutiny of our PV modules. Future regulation relating to the use of cadmium in various products could force us to seek regulatory exemptions or impact the manufacture and sale of our PV modules and could require us to incur unforeseen environmental-related costs. The occurrence of future events such as these could limit our ability to sell and distribute our PV modules, and could have a material adverse effect on our business, results of operations and financial condition.

Environmental obligations and liabilities could have a substantial negative impact on our financial condition, cash flows and profitability.

We are subject to a variety of federal, state, local and foreign laws and regulations relating to the protection of the environment, including those governing the use, handling, generation, processing, storage, transportation and disposal of, or human exposure to, hazardous and toxic materials, the discharge of pollutants into the air and water, and occupational health and safety. We are also subject to environmental laws which allow regulatory authorities to compel, or seek reimbursement for, cleanup of environmental contamination at sites now or formerly owned or operated by us and at facilities where our waste is or has been disposed. We may incur significant costs and capital expenditures in complying with these laws and regulations. In addition, violations of, or liabilities under, environmental laws or permits may result in restrictions being imposed on our operating activities or in our being subjected to substantial fines, penalties, criminal proceedings, third party property damage or personal injury claims, cleanup costs or other costs. Also, future developments such as more aggressive enforcement policies, the implementation of new, more stringent laws and regulations, or the discovery of presently unknown environmental conditions or non-compliance may require expenditures that could have a material adverse effect on our business, results of operations and financial condition. Further, greenhouse gas emissions have increasingly become the subject of international, national, state and local attention. Although future regulations could potentially lead to an increased use of alternative energy, there can be no guarantee that such future regulations will encourage solar technology. Given our limited history of operations, it is difficult to predict future environmental expenses.

Our intellectual property rights or our means of enforcing those rights may be inadequate to protect our business, which may result in the unauthorized use of our products or reduced sales or otherwise reduce our ability to compete.

Our business and competitive position depends upon our ability to protect our intellectual property rights and proprietary technology, including any PV modules that we develop. We attempt to protect our intellectual property rights, both in the United States and in foreign countries, through a combination of patent, trade secret and other intellectual property laws, as well as licensing agreements and third-party nondisclosure and assignment agreements. Because of the differences in foreign patent and other laws concerning intellectual property rights, our intellectual property rights may not receive the same degree of protection in foreign countries as they would in the United States. Our failure to obtain or maintain adequate protection of our intellectual property rights for any reason could have a material adverse effect on our business, results of operations and financial condition. Further, any patents issued in connection with our efforts to develop new technology for PV modules may not be broad enough to protect all of the potential uses of our technology.

We have applied for patent protection in the United States relating to certain existing and proposed technologies and processes and services. While we generally apply for patents in those countries where we intend to make, have made, use, or sell patented products, we may not accurately predict all of the countries where patent protection will ultimately be desirable. If we fail to timely file a patent application in any such country, we may be precluded from doing so at a later date. Furthermore, we cannot assure you that any of our

patent applications will be approved. We also cannot assure you that the patents issued as a result of our foreign patent applications will have the same scope of coverage as our U.S. patents. The patents we own could be challenged invalidated or circumvented by others and may not be of sufficient scope or strength to provide us with any meaningful protection or commercial advantage. Further, we cannot assure you that competitors will not infringe our patents, or that we will have adequate resources to enforce our patents.

Many patent applications in the United States are maintained in secrecy for a period of time after they are filed, and since publication of discoveries in the scientific or patent literature tends to lag behind actual discoveries by several months, we cannot be certain that we will be the first creator of inventions covered by any patent application we make or that we will be the first to file patent applications on such inventions. Because some patent applications are maintained in secrecy for a period of time, there is also a risk that we could adopt a technology without knowledge of a pending patent application, which technology would infringe a third party patent once that patent is issued.

We also rely on unpatented proprietary technology. It is possible that others will independently develop the same or similar technology or otherwise obtain access to our unpatented technology. To protect our trade secrets and other proprietary information, we require our employees, consultants and advisors to execute proprietary information and invention assignment agreements when they begin working for us. We cannot assure you that these agreements will provide meaningful protection of our trade secrets, know-how or other proprietary information in the event of any unauthorized use, misappropriation or disclosure of any such trade secrets, know-how or other proprietary information. Despite our efforts to protect this information, unauthorized parties may attempt to obtain and use information that we regard as proprietary. If we are unable to maintain the proprietary nature of our technologies, we could be materially adversely affected.

Although we rely on copyright laws to protect the works of authorship created by us, we do not register the copyrights in all of our copyrightable works. Copyrights of U.S. origin must be registered before the copyright owner may bring an infringement suit in the United States. Furthermore, if a copyright of U.S. origin is not registered within three months of publication of the underlying work, the copyright owner is precluded from seeking statutory damages or attorneys’ fees in any United States enforcement action, and is limited to seeking actual damages and lost profits. Accordingly, if one of our unregistered copyrights of U.S. origin is infringed by a third party, we will need to register the copyright before we can file an infringement suit in the United States, and our remedies in any such infringement suit may be limited.