Exhibit 99.1

Exhibit 99.1

InnerWorkings Investor Day Presentation

February 22, 2010

Safe Harbor Statement

This presentation contains statements relating to future results. These statements are forward-looking statements under the federal securities laws. We can give no assurance that any future results discussed in these statements will be achieved. Any forward-looking statements represent our views only as of today and should not be relied upon as representing our views as of any subsequent date. These statements are subject to a variety of risks and uncertainties that could cause our actual results to differ materially from the statements contained in this presentation. For a discussion of important factors that could affect our actual results, please refer to the most recent Form 10-K, including the “Risk Factors” section, we filed with the SEC.

2

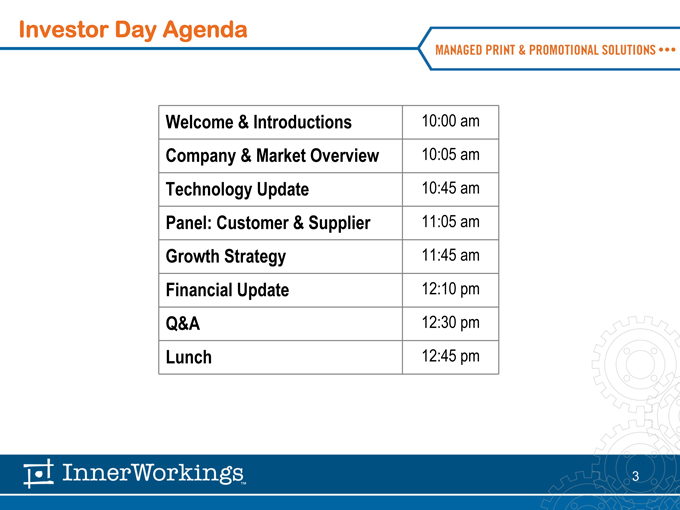

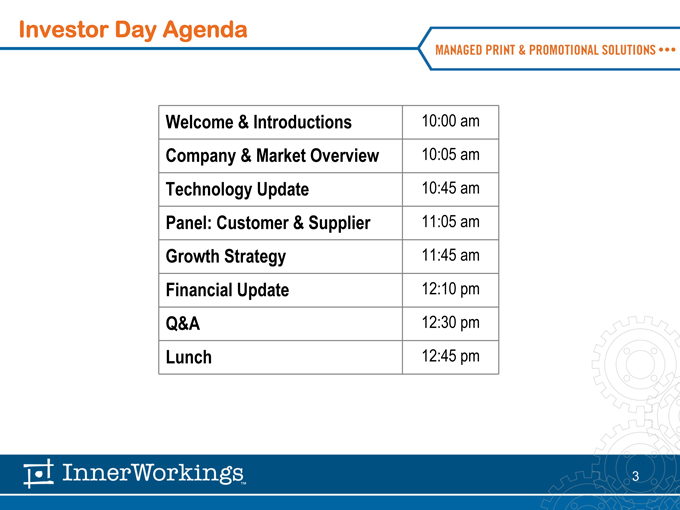

Investor Day Agenda

Welcome & Introductions 10:00 am

Company & Market Overview 10:05 am

Technology Update 10:45 am

Panel: Customer & Supplier 11:05 am

Growth Strategy 11:45 am

Financial Update 12:10 pm

Q&A 12:30 pm

Lunch 12:45 pm

3

Speakers

Eric Belcher

Chief Executive Officer

Joe Busky

Chief Financial Officer

Jonathan Shean

Senior Vice President, Operations

4

Company and Market Overview

Eric Belcher, CEO

5

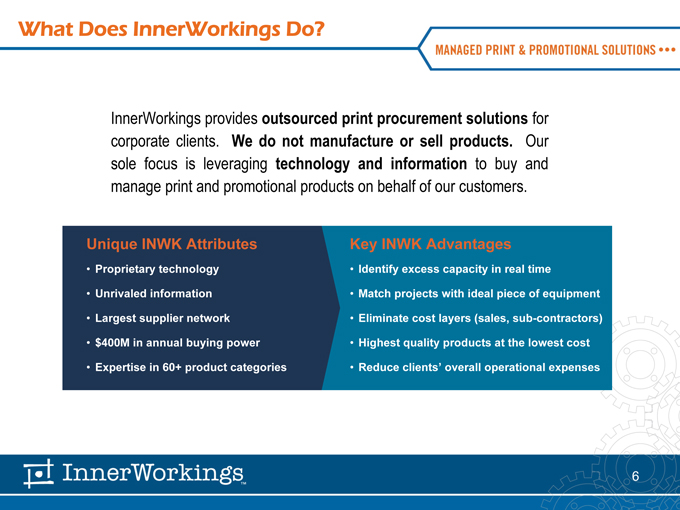

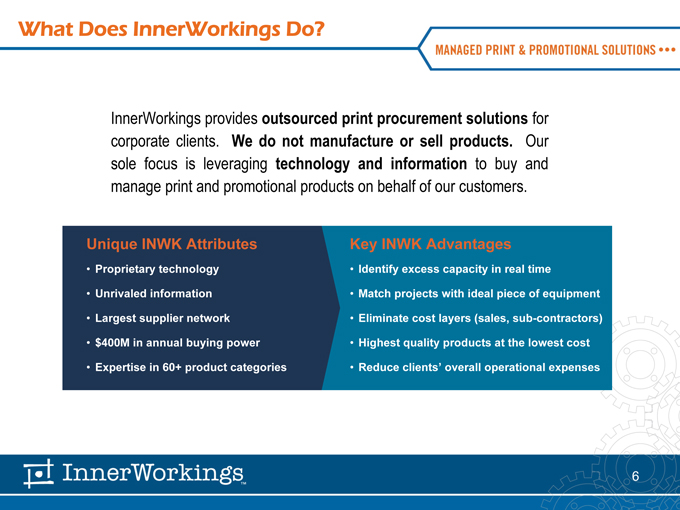

What Does InnerWorkings Do?

InnerWorkings provides outsourced print procurement solutions for corporate clients. We do not manufacture or sell products. Our sole focus is leveraging technology and information to buy and manage print and promotional products on behalf of our customers.

Unique INWK Attributes Key INWK Advantages

• Proprietary technology • Identify excess capacity in real time

• Unrivaled information • Match projects with ideal piece of equipment

• Largest supplier network • Eliminate cost layers (sales, sub-contractors)

• $400M in annual buying power • Highest quality products at the lowest cost

• Expertise in 60+ product categories • Reduce clients’ overall operational expenses

6

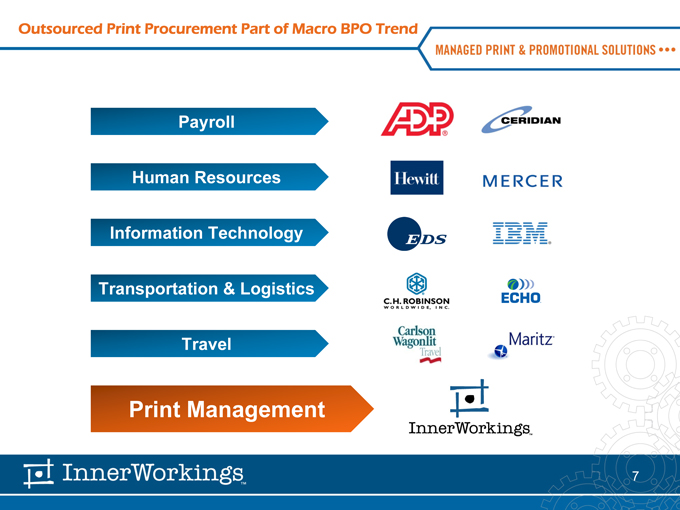

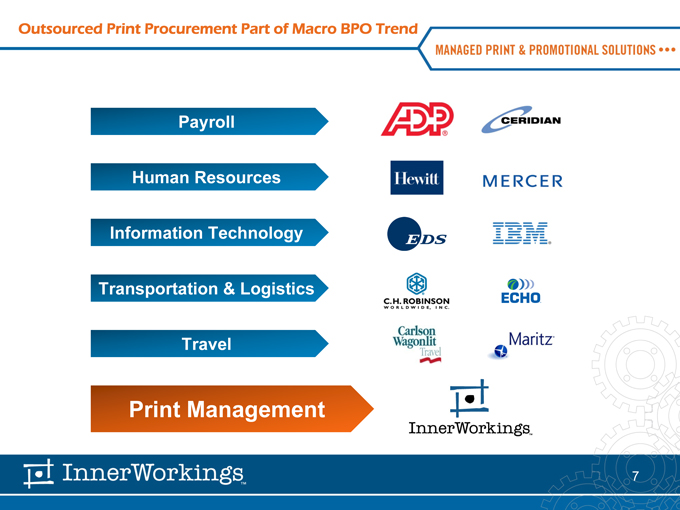

Outsourced Print Procurement Part of Macro BPO Trend

Payroll Human Resources Information Technology Transportation & Logistics Travel

Print Management

7

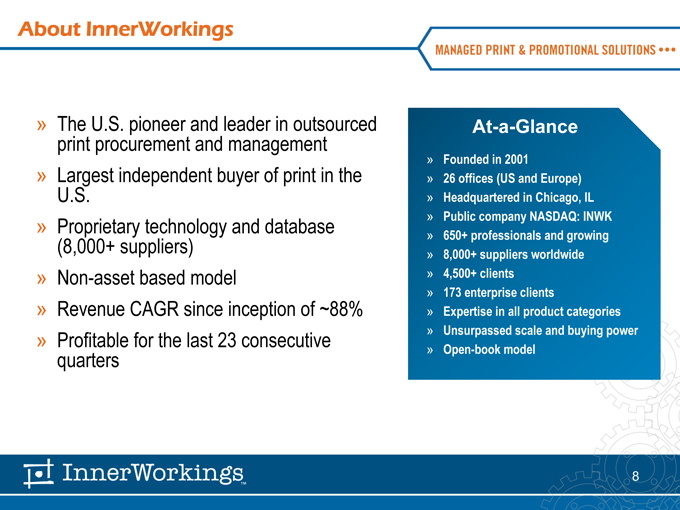

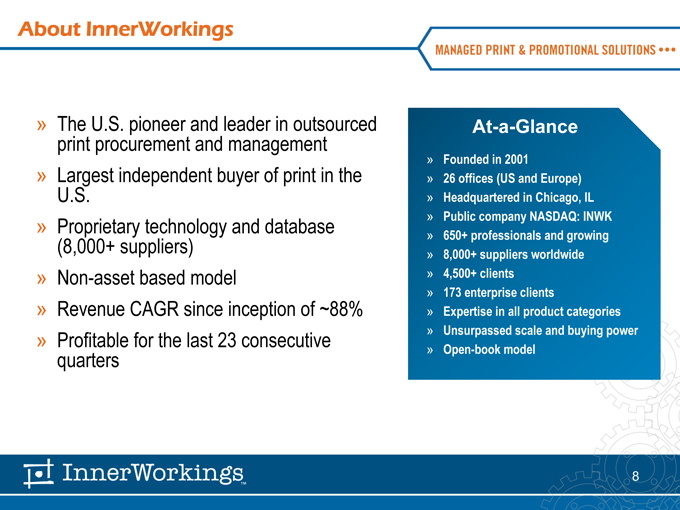

About InnerWorkings

The U.S. pioneer and leader in outsourced print procurement and management

Largest independent buyer of print in the U.S.

Proprietary technology and database (8,000+ suppliers)

Non-asset based model

Revenue CAGR since inception of ~88%

Profitable for the last 23 consecutive quarters

At-a-Glance

Founded in 2001

26 offices (US and Europe)

Headquartered in Chicago, IL

Public Company NASDAQ: INWK

650+ professionals and growing

8,000+ suppliers worldwide

4,500+ clients

173 enterprise clients

Expertise in all products categories

Unsurpassed scale and buying power

Open-book model

8

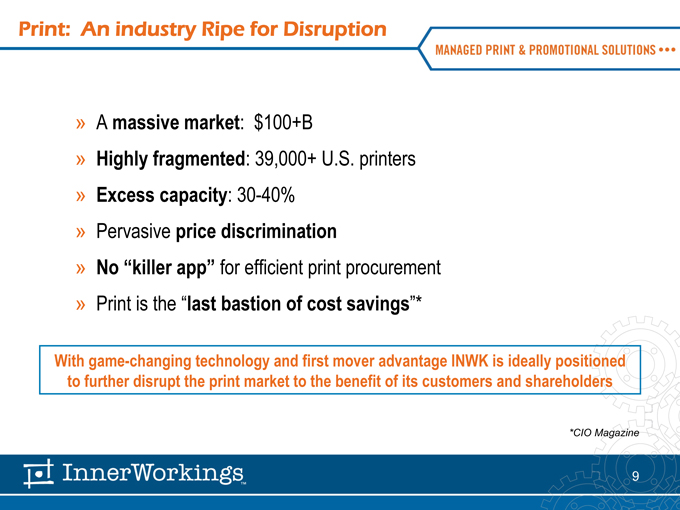

Print: An industry Ripe for Disruption

A massive market: $100+B

Highly fragmented: 39,000+ U.S. printers

Excess capacity: 30-40%

Pervasive price discrimination

No “killer app” for efficient print procurement

Print is the “last bastion of cost savings”*

With game-changing technology and first mover advantage INWK is ideally positioned to further disrupt the print market to the benefit of its customers and shareholders

*CIO Magazine

9

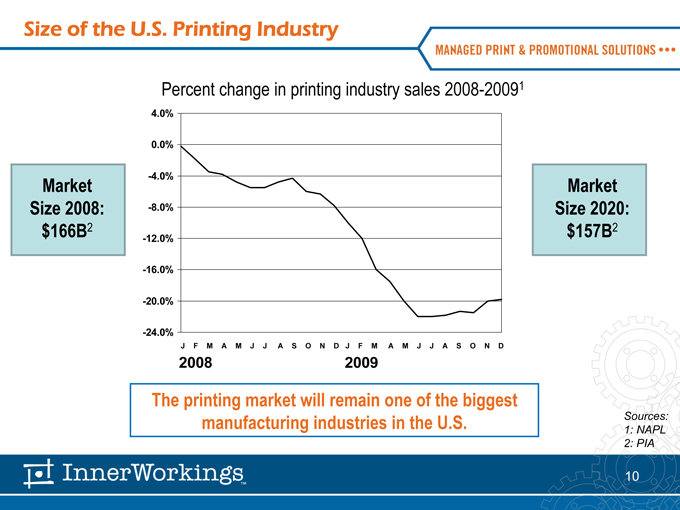

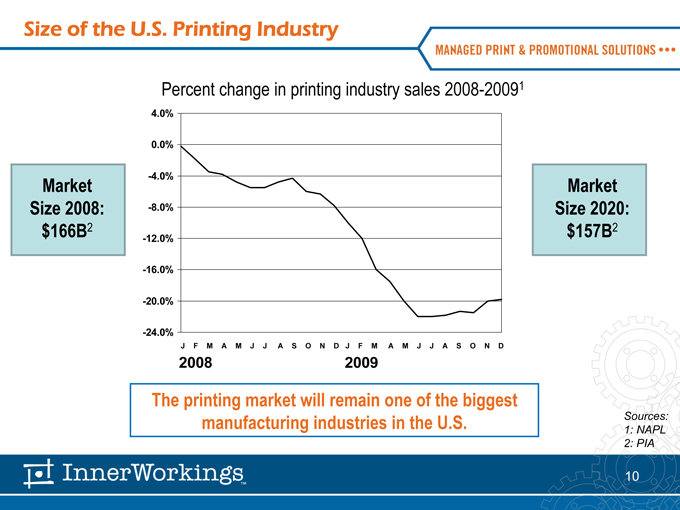

Size of the U.S. Printing Industry

J F M A M J J A S O N D J F M A M J J A S O N D

2008 2009

The printing market will remain one of the biggest manufacturing industries in the U.S. Sources:

1: NAPL

2: PIA

Market Size 2008: $166B2

Market Size 2020: $157B2

Percent change in printing industry sales 2008-20091

4.0% 0.0% -4.0% -8.0%

-12.0% -16.0% -20.0% -24.0%

10

A Huge Growth Opportunity

Approximately 2% of all print in North America is currently run through a print management channel

In the U.K. outsourced print management has a 15-20% share

INWK currently stands at less than one half of 1% share of our addressable market

The market share opportunity for INWK remains enormous

11

Our Competitive Advantage

PPM4 (Print Procurement Manager v4)

Proprietary supplier database & sourcing technology

One of the largest repositories of equipment profiles and pricing data for print suppliers in the U.S.

1 million historical pricing records (searchable)

Optimal supplier & equipment identification

Real-time competitive bid process

Audit and compliance cost management

Customized order entry & reporting

Efficient project management and workflow tools

InnerWorkings buyers use PPM4 every day to get our clients’ projects produced on the right asset at the right time and at a lower cost

12

Select Enterprise Clients

Enterprise client success encompasses many industries across the Fortune 2000 including finance, retail, healthcare, CPG and more

13

Sample 2009 Enterprise Client Wins

Thirty enterprise wins in 2009 expected to drive more than $50M in new 2010 revenue

14

Ink On Any Substrate

CDs Letterhead

Checks Magnets

Coupons Manuals

Data Forms Magazines

Decals Maps

Direct Mail Newsletters

Annual Reports DVDs FSIs Packaging

Bags Envelopes Fulfillment Pads POD / Digital

Banners E-Stores Forms Paper POP/POS Displays

Binders Finishing Folders Plastic Cards Postcards

Booklets Flyers Games Posters

Books Greeting Cards Promotional Products

Boxes Index Tabs Shipping

Brochures Inserts Statements

Business Cards Lenticular Stationery

Calendars Labels Tickets

Catalogues Large Format Wearables

CD Sleeves

15

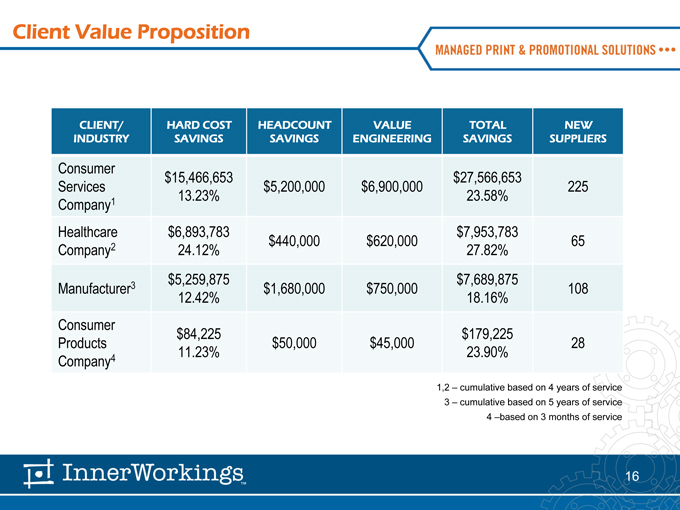

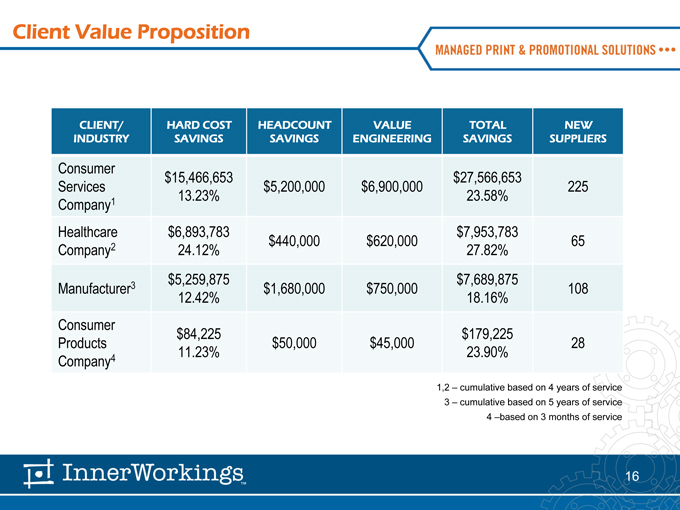

Client Value Proposition

CLIENT/ HARD COST HEADCOUNT VALUE TOTAL NEW

INDUSTRY SAVINGS SAVINGS ENGINEERING SAVINGS SUPPLIERS

Consumer $15,466,653 $27,566,653

Services $5,200,000 $6,900,000 225

Company1 13.23% 23.58%

Healthcare $6,893,783 $7,953,783

$440,000 $620,000 65

Company2 24.12% 27.82%

$5,259,875 $7,689,875

Manufacturer3 $1,680,000 $750,000 108

12.42% 18.16%

Consumer $84,225 $179,225

Products $50,000 $45,000 28

Company4 11.23% 23.90%

1,2 – cumulative based on 4 years of service

3 – cumulative based on 5 years of service

4 –based on 3 months of service

16

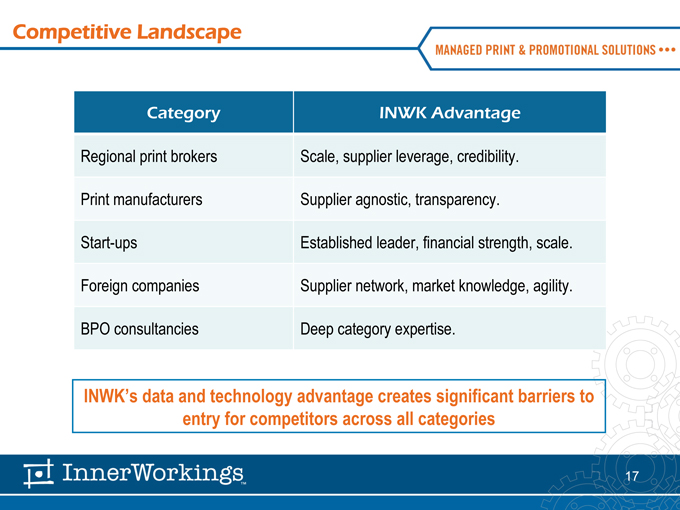

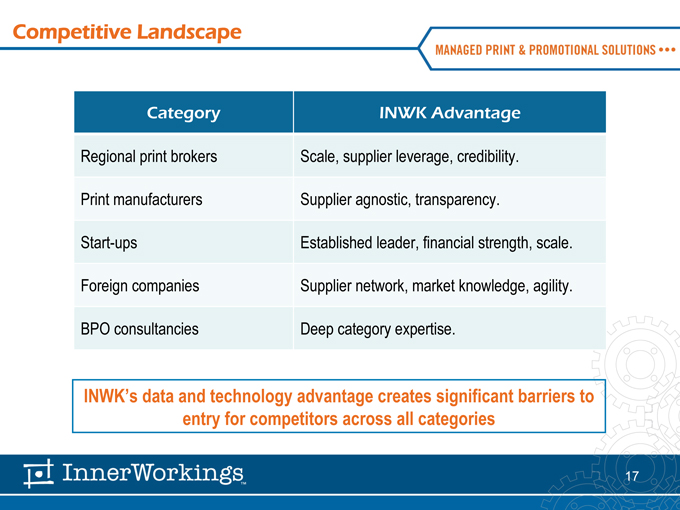

Competitive Landscape

Category INWK Advantage

Regional print brokers Scale, supplier leverage, credibility.

Print manufacturers Supplier agnostic, transparency.

Start-ups Established leader, financial strength, scale.

Foreign companies Supplier network, market knowledge, agility.

BPO consultancies Deep category expertise.

INWK’s data and technology advantage creates significant barriers to entry for competitors across all categories

17

Technology Update

Jonathan Shean, SVP Operations

18

Agenda

PPM4 sourcing and procurement technology

Certified supplier portal

IW eStore demo

19

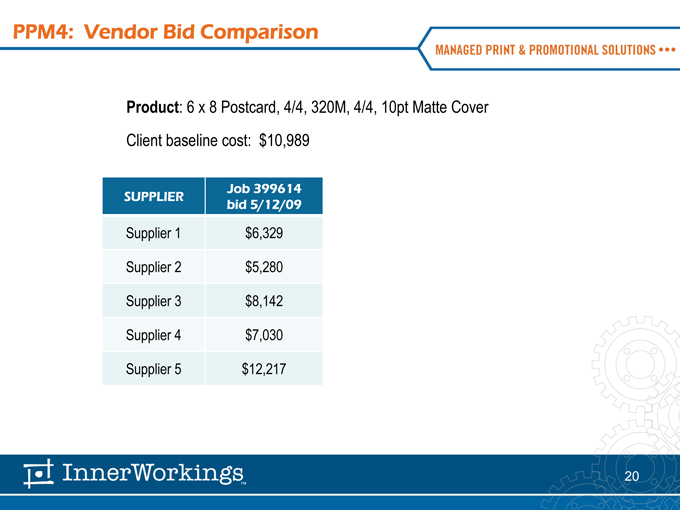

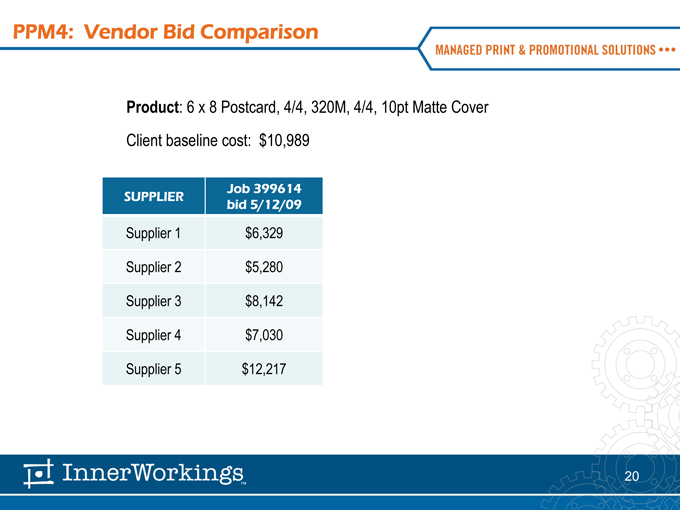

PPM4: Vendor Bid Comparison

Product: 6 x 8 Postcard, 4/4, 320M, 4/4, 10pt Matte Cover Client baseline cost: $10,989

Job 399614

SUPPLIER bid 5/12/09

Supplier 1 $6,329

Supplier 2 $5,280

Supplier 3 $8,142

Supplier 4 $7,030

Supplier 5 $12,217

20

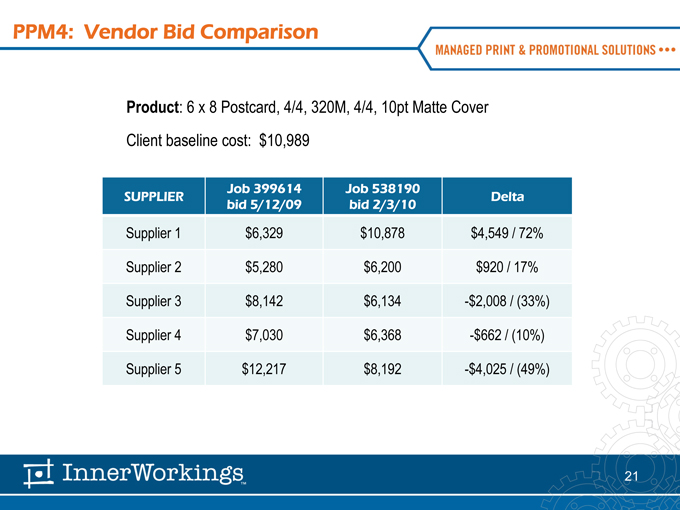

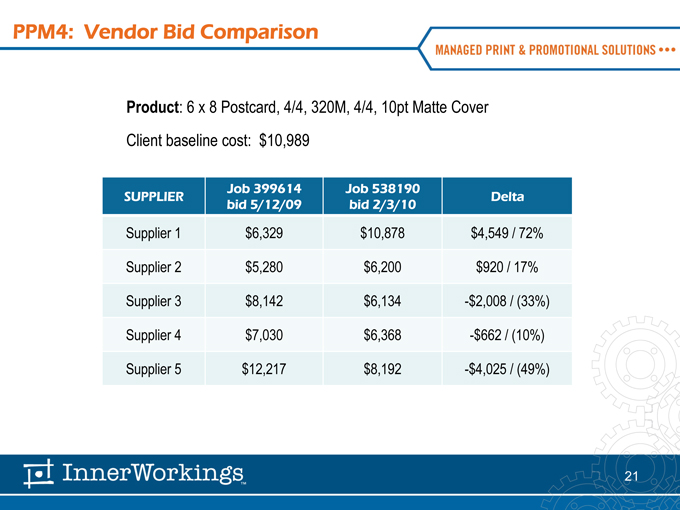

PPM4: Vendor Bid Comparison

Product: 6 x 8 Postcard, 4/4, 320M, 4/4, 10pt Matte Cover Client baseline cost: $10,989

Job 399614 Job 538190

SUPPLIER Delta

bid 5/12/09 bid 2/3/10

Supplier 1 $6,329 $10,878 $4,549 / 72%

Supplier 2 $5,280 $6,200 $920 / 17%

Supplier 3 $8,142 $6,134 -$2,008 / (33%)

Supplier 4 $7,030 $6,368 -$662 / (10%)

Supplier 5 $12,217 $8,192 -$4,025 / (49%)

21

IW eStores

IW eStore Benefits

Sourcing: best practices

Costs: shared leverage

Brand Mgmt.: consistency

Efficiency: automation

Time: ease of use

Access: 24/7 on the web

Quality: pipeline control

Measurement: reporting

22

Panel Discussion

Amy Deveau, Freedom Graphic Systems David Brown, InterContinental Hotels Group

23

A Strategy for Growth

Eric Belcher, CEO

24

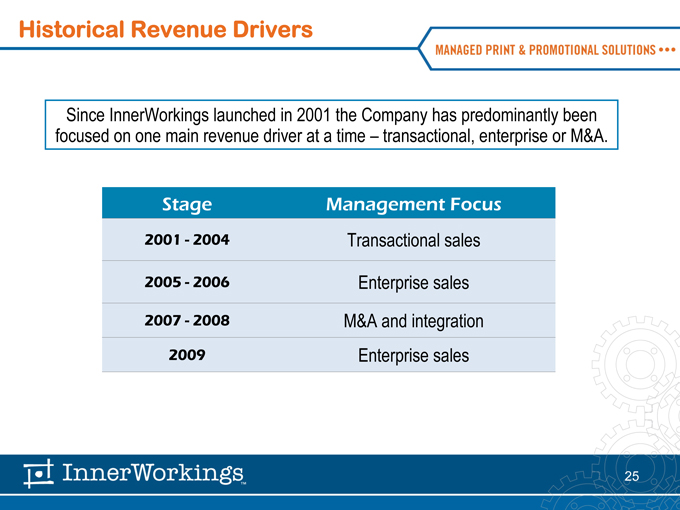

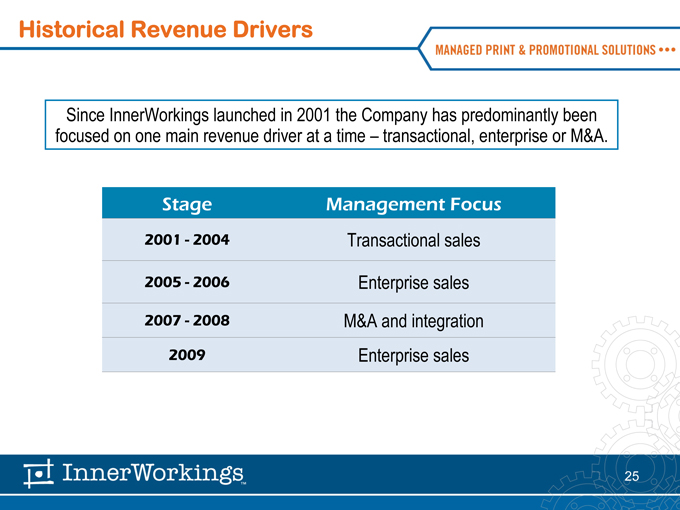

Historical Revenue Drivers

Since InnerWorkings launched in 2001 the Company has predominantly been focused on one main revenue driver at a time – transactional, enterprise or M&A.

Stage Management Focus

2001 - 2004 Transactional sales

2005 - 2006 Enterprise sales

2007 - 2008 M&A and integration

2009 Enterprise sales

25

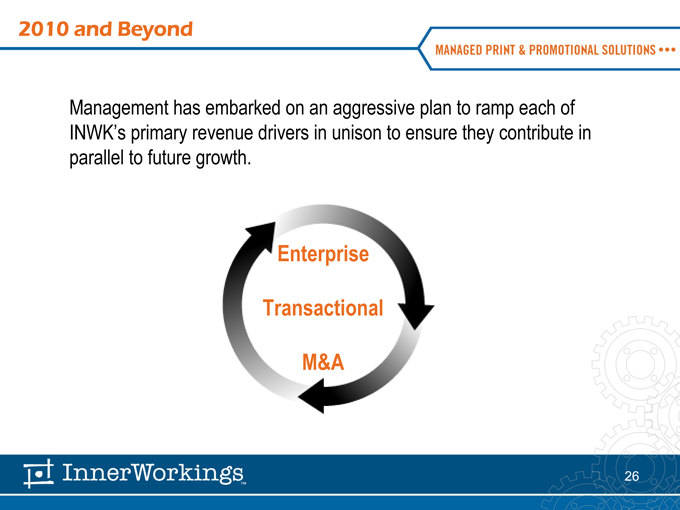

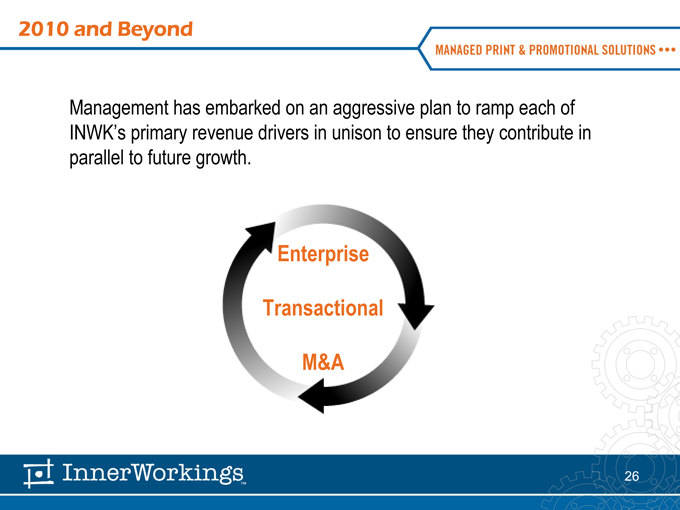

2010 and Beyond

Management has embarked on an aggressive plan to ramp each of INWK’s primary revenue drivers in unison to ensure they contribute in parallel to future growth.

Enterprise

Transactional

M&A

26

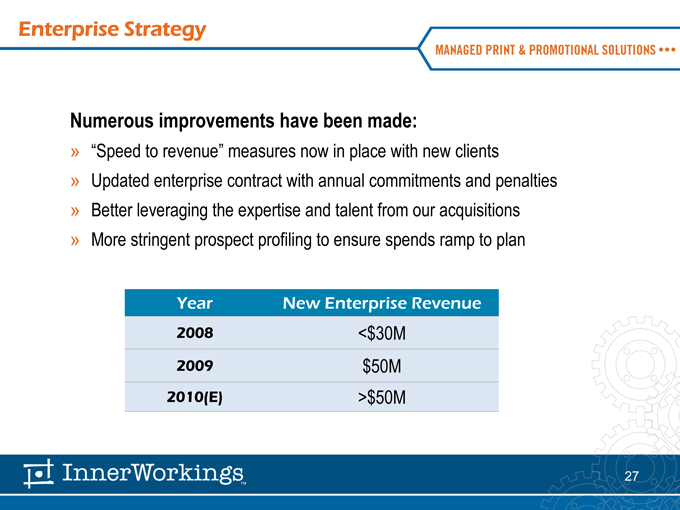

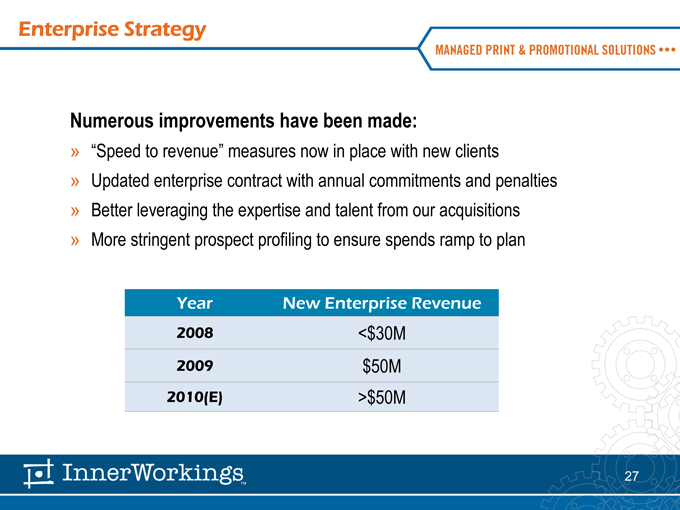

Enterprise Strategy

Numerous improvements have been made:

“Speed to revenue” measures now in place with new clients

Updated enterprise contract with annual commitments and penalties

Better leveraging the expertise and talent from our acquisitions

More stringent prospect profiling to ensure spends ramp to plan

Year New Enterprise Revenue

2008 <$30M

2009 $50M

2010(E) >$50M

27

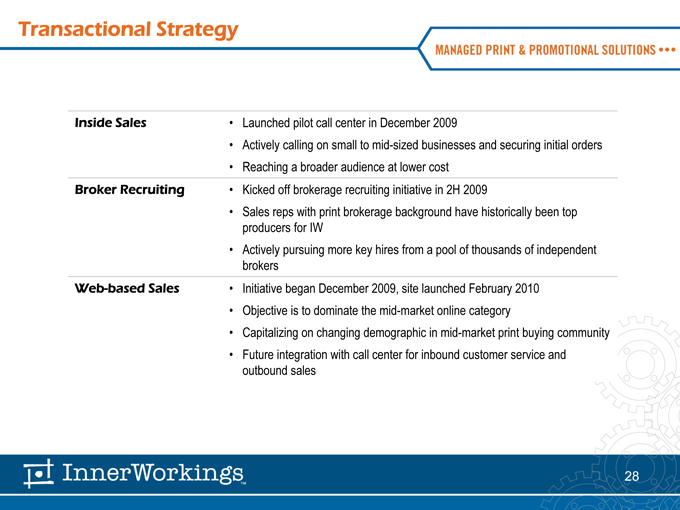

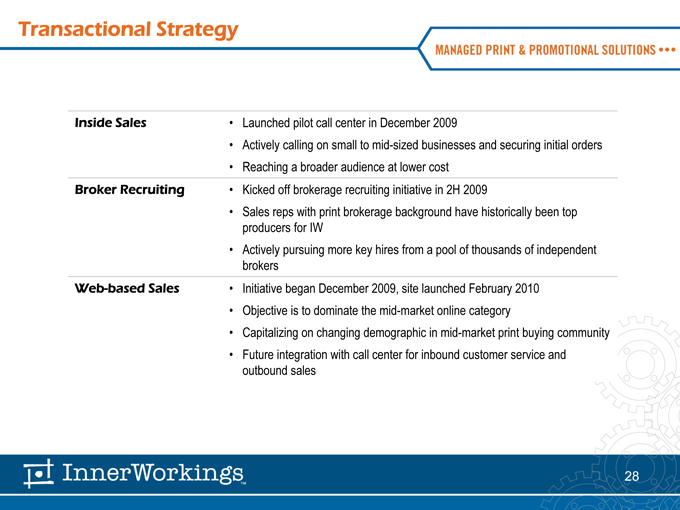

Transactional Strategy

Inside Sales • Launched pilot call center in December 2009

• Actively calling on small to mid-sized businesses and securing initial orders

• Reaching a broader audience at lower cost

Broker Recruiting • Kicked off brokerage recruiting initiative in 2H 2009

• Sales reps with print brokerage background have historically been top

producers for IW

• Actively pursuing more key hires from a pool of thousands of independent

brokers

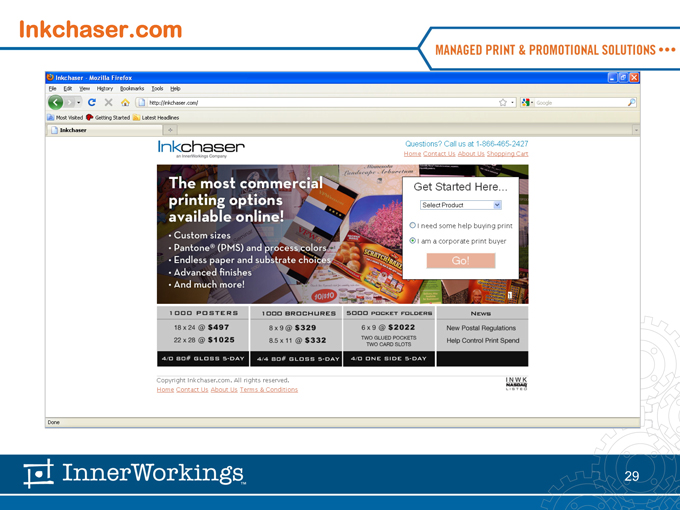

Web-based Sales • Initiative began December 2009, site launched February 2010

• Objective is to dominate the mid-market online category

• Capitalizing on changing demographic in mid-market print buying community

• Future integration with call center for inbound customer service and

outbound sales

28

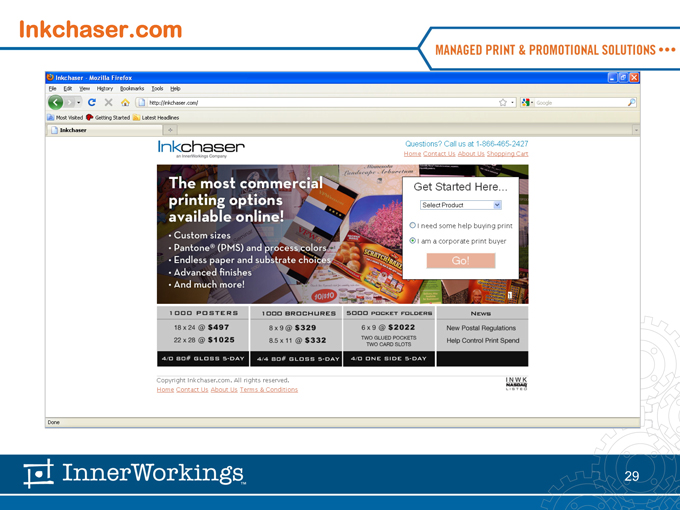

Inkchaser.com

29

M&A Strategy

Build on prior M&A success:

Successful integrations

Primary source of sales professionals

Acquired talent contributed to 18 of 30 enterprise wins in 2009

Retention post earn-out of key performers has been outstanding

Revamping M&A activity:

Requiring more favorable terms, ROIC for INWK shareholders

Focused on small, tuck-in deals

Still the only credible buyer in a buyers’ market

Going forward expect more activity than in ’09 and less than ’07 and ’08

30

Financials

Joe Busky, CFO

31

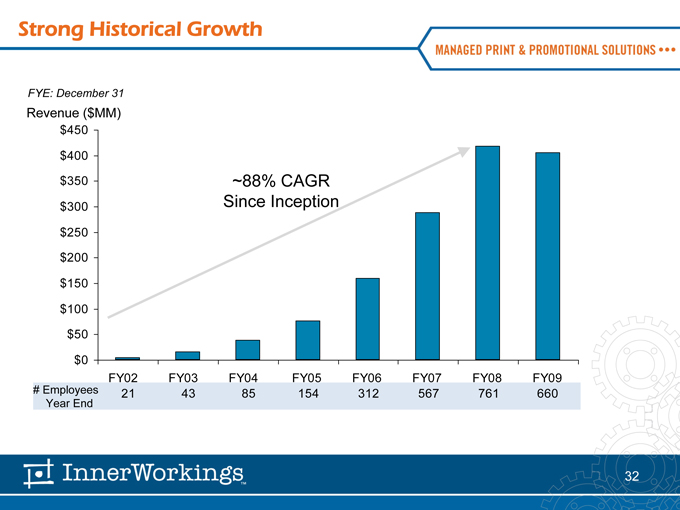

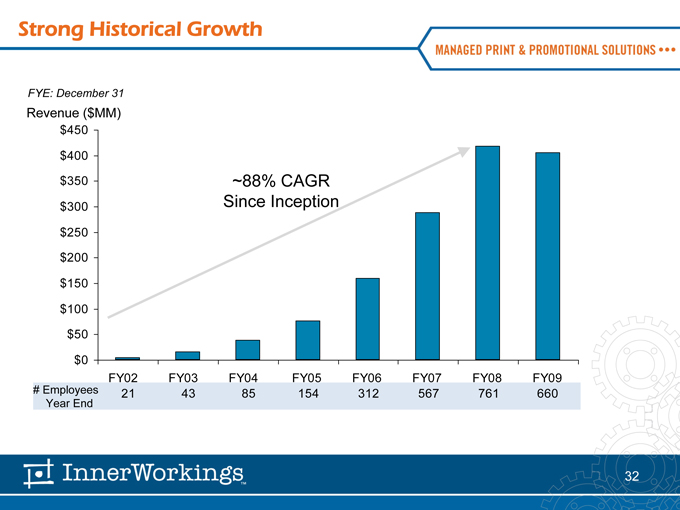

Strong Historical Growth

FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09

21 43 85 154 312 567 761 660

# Employees Year End

FYE: December 31

Revenue ($MM)

$450 $400 $350 $300 $250 $200 $150 $100 $50 $0

~88% CAGR Since Inception

32

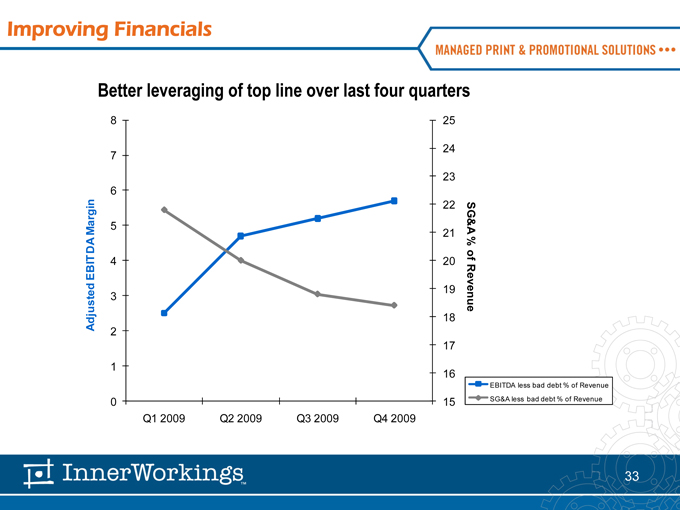

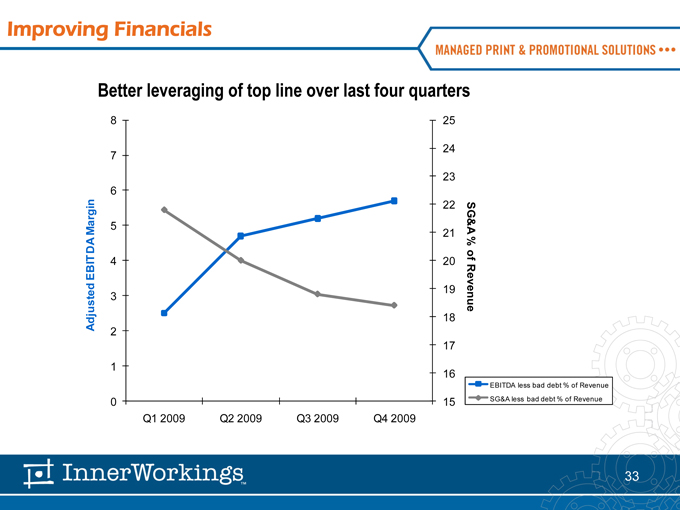

Improving Financials

Better leveraging of top line over last four quarters

Adjusted EBITDA Margin

25 24 23 22 21 20 19 18 17 16 15

SG&A % of Revenue

EBITDA less bad debt % of Revenue SG&A less bad debt % of Revenue

Q1 2009 Q2 2009 Q3 2009 Q4 2009

8 7 6 5 4 3 2 1 0

33

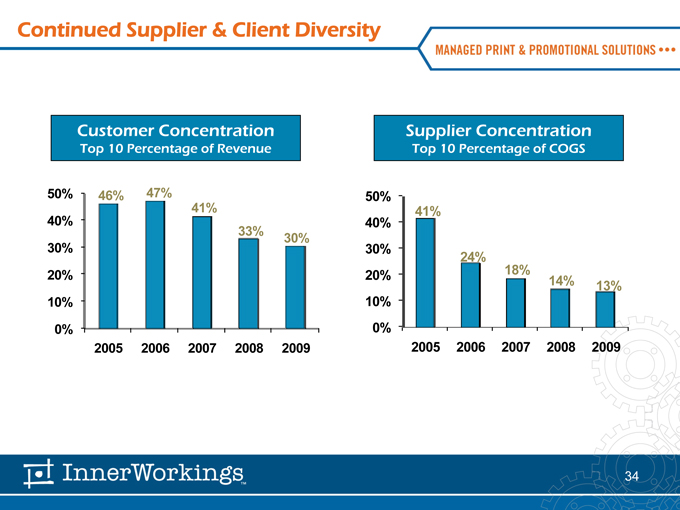

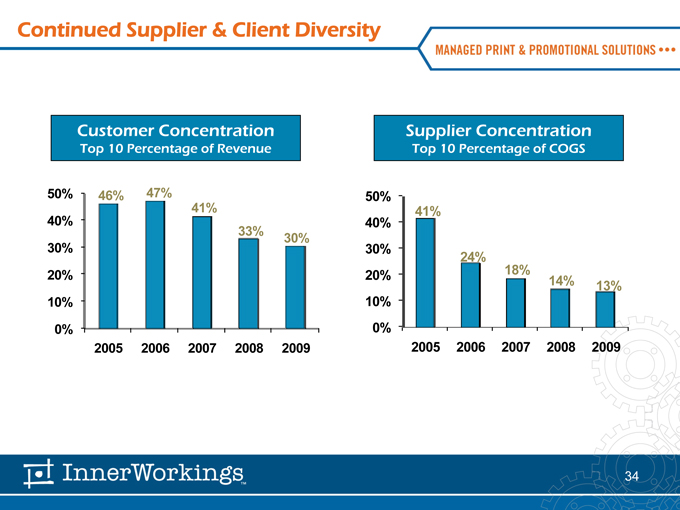

Continued Supplier & Client Diversity

Customer Concentration Supplier Concentration

Top 10 Percentage of Revenue Top 10 Percentage of COGS

50% 46% 47% 50% 41% 41% 40% 40% 33% 30% 30% 30% 24% 20% 20% 18%

14% 13% 10% 10% 0% 0%

2005 2006 2007 2008 2009 2005 2006 2007 2008 2009

34

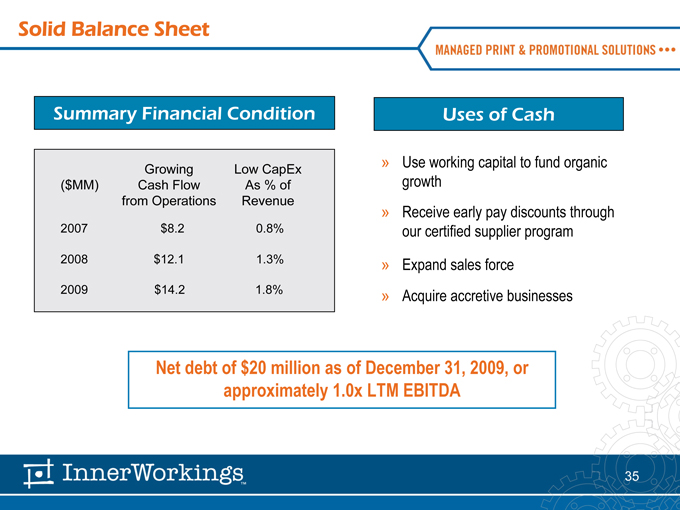

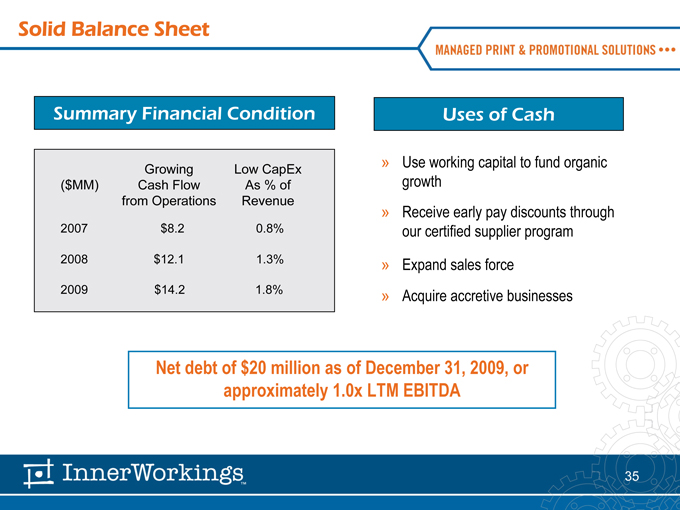

Solid Balance Sheet

Summary Financial Condition

Growing Low CapEx

($MM) Cash Flow As % of

from Operations Revenue

2007 $8.2 0.8%

2008 $12.1 1.3%

2009 $14.2 1.8%

Uses of Cash

Use working capital to fund organic growth

Receive early pay discounts through our certified supplier program

Expand sales force

Acquire accretive businesses

Net debt of $20 million as of December 31, 2009, or approximately 1.0x LTM EBITDA

35

Creating Shareholder Value

We are focused on improving Return on Invested Capital:

Decreased DSOs

Invoicing/collecting faster

Improved terms on current/future enterprise deals

Increase Operating Margins

Continued headcount rationalization

Technology enhanced productivity

Increased use of certified vendors - early pay discounts & rebates

Goal is to return to pre-recession levels

Management incentives aligned with goal

36

2010 Financial Guidance

37

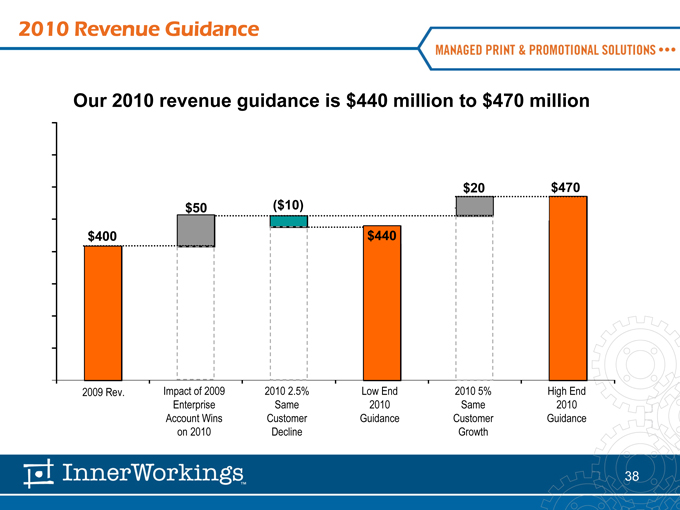

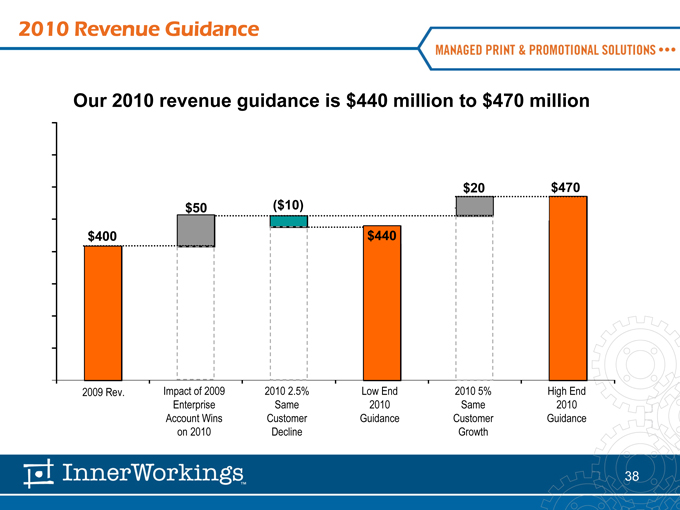

2010 Revenue Guidance

2009 Rev. Impact of 2009 2010 2.5% Low End 2010 5% High End

Enterprise Same 2010 Same 2010

Account Wins Customer Guidance Customer Guidance

on 2010 Decline Growth

Our 2010 revenue guidance is $440 million to $470 million

$20 $470

$50 ($10)

$400

38

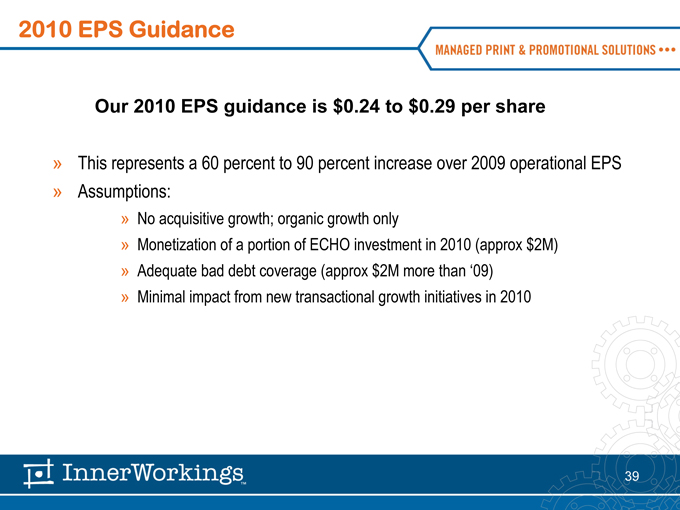

2010 EPS Guidance

Our 2010 EPS guidance is $0.24 to $0.29 per share

This represents a 60 percent to 90 percent increase over 2009 operational EPS

Assumptions:

No acquisitive growth; organic growth only

Monetization of a portion of ECHO investment in 2010 (approx $2M)

Adequate bad debt coverage (approx $2M more than ‘09)

Minimal impact from new transactional growth initiatives in 2010

39

Increased Operating Leverage

Improved operating margins will be driven by the following:

Productivity gains from growth of the company

Economic rebound leading to larger customer order sizes

Technology productivity enhancements

Autoquote

eStores

Process efficiencies

Prudent growth of G&A expense with top line growth; lessons learned from 2009

40

Moving Forward 3-5 Years

Organic growth rate of ~15% per year

Gross margins of 24-26%

EBITDA margins of 8-9%

ROIC the primary financial metric used to manage the business

41

Why InnerWorkings

Market opportunity remains huge

Established leadership position

Game changing technology

Sustainable competitive advantage

Proven asset-light business model

Proven track record of performance and growth

Solid balance sheet and cash flow

Strong pipeline of enterprise clients

Clear, achievable growth strategy

42

Experienced Management Team

Eric D. Belcher President and Chief Executive Officer

Mr. Belcher is the President and Chief Executive Officer of InnerWorkings. Prior to January 2009, he served as the President and Chief Operating Officer. He joined InnerWorkings in June 2005 as Executive Vice President of Operations. Previously, Mr. Belcher held the positions of Chief Operating Officer and Chief Financial Officer at manroland, a printing equipment manufacturer and distributor. From 1995 to 2000, he led project teams at Marakon Associates, an international management consulting firm. Mr. Belcher holds a B.A. from Bucknell University and an M.B.A. from the University of Chicago Graduate School of Business.

Joseph M. Busky Chief Financial Officer

Mr. Busky is the Chief Financial Officer of InnerWorkings. Previously, Mr. Busky served as Corporate Vice President, Chief Accounting Officer at Dade Behring, Inc. Upon the purchase of Dade Behring by Siemens Healthcare in November 2007, Mr. Busky assumed the role of Vice President, Corporate Controller for the Siemens Healthcare Diagnostics division. Mr. Busky also served in various roles of increasing responsibility at Dade Behring, including as Vice President, Treasurer, Vice President, Corporate Controller, and Vice President, Corporate Planning. Before joining Dade Behring in 1997, Mr. Busky worked in the audit function at Price Waterhouse for nine years. Mr. Busky is a Certified Public Accountant and holds a B.B.A. in Accounting and an M.B.A. from Loyola College. Mr. Busky joined InnerWorkings in July 2008.

Jonathan M. Shean Senior Vice President, Operations

Jonathan M. Shean has served as our Senior Vice President of Operations since October 2007. Prior to joining the Company, Mr. Shean held a senior management position at Domtar Corporation, a global producer of paper. Mr. Shean served in various management roles with increasing responsibilities at Domtar for over 12 years. Mr. Shean holds a Bachelor’s of Business Administration in Marketing from the University of Notre Dame and a Master’s of Business Administration from the University of Michigan Ross School of Business.

43

44