UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

|

| | |

| | Filed by a Party other than the Registrant | o |

Check the appropriate box:

|

| | |

| | o | Preliminary Proxy Statement |

| | o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | þ | Definitive Proxy Statement |

| | o | Definitive Additional Materials |

| | o | Soliciting Material Pursuant to §240.14a-12 |

InnerWorkings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | |

| | þ | No fee required. |

| | o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| (1) | Title of each class of securities to which transaction applies: |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) | Proposed maximum aggregate value of transaction: |

|

| | |

| | o | Fee paid previously with preliminary materials. |

| | o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| (1) | Amount Previously Paid: |

| |

| (2) | Form, Schedule or Registration Statement No.: |

InnerWorkings, Inc.

203 N. LaSalle Street, Suite 1800

Chicago, Illinois 60601

September 24, 2019

To Our Stockholders:

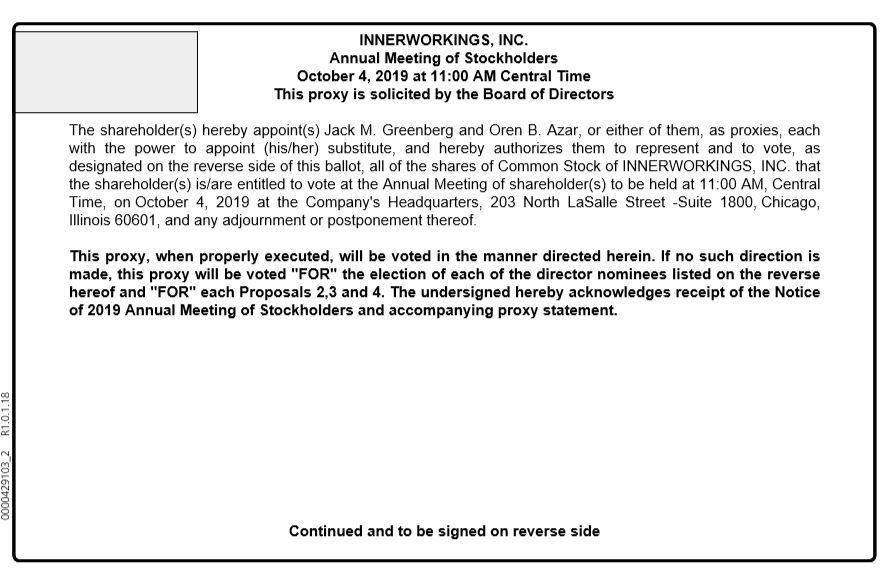

On behalf of the Board of Directors (the "Board") and management, we cordially invite you to attend the 2019 annual meeting of stockholders (including any adjournments or postponements thereof, the “Annual Meeting”) of InnerWorkings, Inc. (the “Company”) to be held on Friday, October 4, 2019, at 11:00 a.m., Central Time, at our corporate headquarters, 203 N. LaSalle Street, Suite 1800, Chicago, Illinois 60601.

The following pages contain the formal notice of the Annual Meeting, the proxy statement and the proxy card. Please review this material for information concerning the business to be conducted at the meeting and the nominees for election as directors. You may also find copies of these items online at www.inwk.com.

The purpose of the meeting is to consider and vote upon proposals to (i) elect nine director candidates who have been nominated for election, (ii) approve, on an advisory, non-binding basis, the compensation of our named executive officers, (iii) ratify an amendment to our bylaws establishing state and federal courts in Delaware as the exclusive forum for certain stockholder litigation (the "Exclusive Forum Bylaw Amendment"), and (iv) ratify the appointment of our independent registered public accounting firm for 2019. In addition to the specific items to be acted upon, there will be a report on the progress of the Company and an opportunity for questions of general interest to the stockholders.

Whether or not you plan to attend the meeting, your vote is important and we encourage you to vote promptly. You may vote your shares via a toll-free telephone number, over the Internet or by mail. We urge you to fill out and submit the enclosed proxy card today.

If you have any questions or require any assistance with voting your proxy card, please contact our proxy solicitor Morrow Sodali LLC at:

470 West Avenue

Stamford, Connecticut 06902

Stockholders call toll free: (800) 662-5200

Banks and Brokerage Firms, please call: (203) 658-9400

Email: INWK@morrowsodali.com

On behalf of your Board of Directors, we thank you for your continued support.

Sincerely yours,

|

| | |

| | |

Jack M. Greenberg Chairman of the Board | | Richard S. Stoddart Chief Executive Officer, President and Director |

This proxy statement is dated September 24, 2019 and is first being mailed to stockholders on or about September 25, 2019.

Notice of 2019 Annual Meeting of Stockholders

203 N. LaSalle Street, Suite 1800

Chicago, Illinois 60601

October 4, 2019, 11:00 a.m., Central Time

September 24, 2019

Fellow stockholders:

Notice is hereby given that the Annual Meeting of the stockholders (including any adjournments or postponements thereof, the “Annual Meeting”) of InnerWorkings, Inc. (the “Company”), a Delaware corporation, will be held on Friday, October 4, 2019 at 11:00 a.m., Central Time, at our corporate headquarters, 203 N. LaSalle Street, Suite 1800, Chicago, Illinois 60601 for the following purposes:

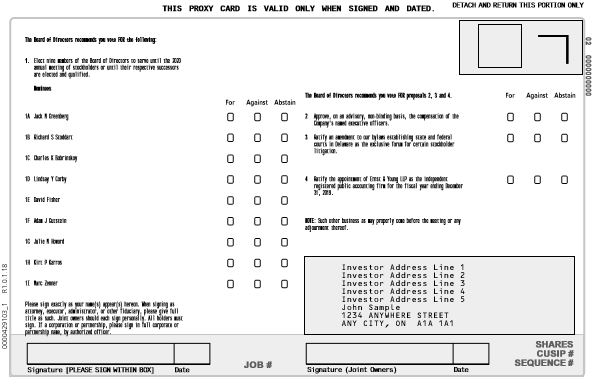

| |

| 1. | to elect nine members of the Board of Directors (the “Board”) to serve until the 2020 annual meeting of stockholders or until their respective successors are elected and qualified; |

| |

| 2. | to approve, on an advisory, non-binding basis, the compensation of our named executive officers; |

| |

| 3. | to ratify an amendment to our bylaws establishing state and federal courts in Delaware as the exclusive forum for certain stockholder litigation (the "Exclusive Forum Bylaw Amendment"); |

| |

| 4. | to ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2019; and |

| |

| 5. | to transact any other business properly brought before the Annual Meeting. |

These items of business, including the nominees for director, are more fully described in the proxy statement accompanying this notice.

You are cordially invited to attend the Annual Meeting in person. In accordance with our security procedures, all persons attending the Annual Meeting will be required to present a form of government-issued photo identification. If you hold your shares in “street name,” you must also provide proof of ownership, such as a recent brokerage statement. If you are a holder of record and attend the Annual Meeting, you may vote by ballot in person even if you have previously returned your proxy card. If you hold your shares in “street name” and wish to vote in person, you must provide a “legal proxy” from your bank, broker or other nominee.

The Board has fixed the close of business on September 19, 2019 as the record date for determining the stockholders of the Company entitled to notice of and to vote at the Annual Meeting. Such stockholders are urged to submit the enclosed proxy card, even if your shares were sold after such date. If your bank, broker or other nominee is the holder of record of your shares (i.e., your shares are held in “street name”), you will receive voting instructions from the holder of record. You must follow these instructions in order for your shares to be voted. We recommend that you instruct your bank, broker or other nominee to vote your shares “FOR” each of the items listed on the enclosed proxy card.

IF YOU CANNOT ATTEND THE ANNUAL MEETING, PLEASE TAKE THE TIME TO PROMPTLY VOTE YOUR PROXY BY CAREFULLY FOLLOWING THE INSTRUCTIONS ON THE ENCLOSED PROXY CARD. Even if you plan to attend the Annual Meeting, we recommend that you vote using the enclosed proxy card prior to the Annual Meeting to ensure that your shares will be represented. If you submit your proxy and then decide to attend the Annual Meeting to vote your shares in person, you may still do so. Your proxy is revocable in accordance with the procedures set forth in the proxy statement. Only stockholders of record as of the close of business on September 19, 2019 are entitled to receive notice of, and to attend and to vote at, the meeting.

THE BOARD UNANIMOUSLY RECOMMENDS VOTING "FOR" THE ELECTION OF EACH OF THE BOARD'S NOMINEES UNDER PROPOSAL 1 AND "FOR" PROPOSALS 2, 3 AND 4 USING THE ENCLOSED PROXY CARD.

By Order of the Board of Directors,

Oren B. Azar

General Counsel & Corporate Secretary

PROXY SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information you should consider, and you should read the entire proxy statement carefully before voting.

Annual Meeting Information

|

| |

| Date, Time and Location: | October 4, 2019 at 11:00 a.m. Central Time, at our corporate headquarters, 203 N. LaSalle Street, Suite 1800, Chicago, Illinois 60601 |

| Record Date: | September 19, 2019 |

Items to be Voted on at the 2019 Annual Meeting of Stockholders

|

| | | |

| | Proposal | | Board of Directors’ Recommendation |

| • | Elect nine members of the Board of Directors to serve until the 2020 annual meeting of stockholders or until their respective successors are elected and qualified. | | FOR |

| • | Approve, on an advisory, non-binding basis, the compensation of the Company’s named executive officers. | | FOR |

| • | Ratify an amendment to our bylaws establishing state and federal courts in Delaware as the exclusive forum for certain stockholder litigation (the "Exclusive Forum Bylaw Amendment"). | | FOR |

| • | Ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2019.

| | FOR |

Director Nominees

|

| | | | | | | | | | | | |

| Name | | Director Since | | Independent | | Other Public Boards(1) | | Committee Memberships |

| AC | | CC | | NCG |

| Jack M. Greenberg (Chairman of the Board) | | 2005 | | Yes | | — | | | | M | | M |

| Richard S. Stoddart (Chief Executive Officer) | | 2018 | | No | | 1 | | | | | | |

| Charles K. Bobrinskoy | | 2008 | | Yes | | — | | C, F | | M | | |

| Lindsay Y. Corby | | 2018 | | Yes | | — | | M, F | | | | |

| David Fisher | | 2011 | | Yes | | 2 | | M | | M | | |

| Adam J. Gutstein | | 2018 | | Yes | | — | | | | | | C |

| Julie M. Howard | | 2012 | | Yes | | 2 | | M | | C | | M |

| Kirt P. Karros | | 2019 | | Yes | | — | | | | M | | |

| Marc Zenner | | 2019 | | Yes | | 2 | | M | | | | |

| |

| (1) | Other Public Boards reflects directorships as of the date of this proxy statement. |

|

| | | | | |

| AC | Audit Committee | C | Chair | NCG | Nominating and Corporate Governance Committee |

| CC | Compensation Committee | M | Member | F | Financial expert |

Corporate Governance and Compensation Practices

Governance

|

| | | |

| | | | Location |

| | • | All directors except the CEO are independent | |

| | • | All directors are elected annually | |

| | • | Directors are elected by majority vote, with plurality standard for contested elections | |

| | • | No shareholder rights plan or poison pill | |

| | • | No cumulative voting | |

| | • | Proactive stockholder governance outreach | |

| | • | Published corporate governance guidelines summarizing key governance practices | |

Compensation

|

| | | |

| | | | Location |

| | • | Pay for performance approach | |

| | • | Independent compensation committee | |

| | • | Independent compensation consultant | |

| | • | Directors and officers subject to stock ownership guidelines and stock holding policy | |

| | • | Policy against hedging/pledging | |

| | • | Officers subject to compensation clawback policy | |

| | • | Long-term focus and stockholder alignment through equity compensation | |

| | • | No problematic pay practices, such as excise tax gross-up provisions | |

| | • | No “single trigger” change in control severance arrangements | |

Proxy Statement for the Annual Meeting of Stockholders of InnerWorkings, Inc.

To Be Held on October 4, 2019

TABLE OF CONTENTS

|

| |

| PROXY STATEMENT | |

| Annual Meeting Information | |

| Voting Information | |

| PROPOSALS TO BE VOTED ON | |

| Proposal 1: Election of Directors | |

| Proposal 2: Advisory Approval of Named Executive Officer Compensation | |

| Proposal 3: Ratification of Bylaw Amendment | |

| Proposal 4: Ratification of Appointment of Independent Registered Public Accounting Firm | |

| BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | |

| Summary of Corporate Governance Practices | |

| Board Leadership Structure | |

| Board of Directors Role in Risk Oversight | |

| Meetings and Committees of the Board of Directors | |

| Director Independence | |

| Governance Documents | |

| Compensation Committee Interlocks and Insider Participation | |

| Attendance at Annual Meeting | |

| STOCK OWNERSHIP | |

| Security Ownership of Certain Beneficial Owners and Management | |

| Section 16(a) Beneficial Ownership Reporting Compliance | |

| CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | |

| EXECUTIVE OFFICERS | |

| EXECUTIVE AND DIRECTOR COMPENSATION | |

| Compensation Discussion and Analysis | |

| Executive Compensation | |

| Employee Benefit Plans | |

| Employment and Other Related Agreements | |

| Summary of Director Compensation | |

| REPORT OF THE COMPENSATION COMMITTEE | |

| AUDIT COMMITTEE REPORT | |

| FEES BILLED FOR SERVICES RENDERED BY PRINCIPAL REGISTERED PUBLIC ACCOUNTING FIRM | |

| OTHER INFORMATION | |

| Stockholder Proposals for the 2020 Annual Meeting | |

| Expenses of Solicitation | |

| “Householding” of Proxy Materials | |

| Proxy Voting Card | |

| APPENDIX A | |

203 N. LaSalle Street, Suite 1800

Chicago, Illinois 60601

PROXY STATEMENT

This proxy statement and enclosed proxy card are being furnished commencing on or about September 24, 2019 in connection with the solicitation by the Board of Directors of InnerWorkings, Inc., a Delaware corporation of proxies for our 2019 annual meeting of stockholders (including any postponements or adjournments thereof, the “Annual Meeting”). In this proxy statement, we refer to InnerWorkings, Inc. as the “Company,” “we,” “our” or “us” and the Board of Directors as the “Board.” We are sending the proxy materials because the Board is seeking your permission (or proxy) to vote your shares at the Annual Meeting on your behalf. This proxy statement presents information that is intended to help you in reaching a decision on voting your shares of common stock. Only stockholders of record at the close of business on September 19, 2019, the record date, are entitled to vote at the meeting, with each share entitled to one vote. We have no other voting securities.

Annual Meeting Information

Date and Location. We will hold the Annual Meeting on Friday, October 4, 2019 at 11:00 a.m., Central Time, at our corporate headquarters at 203 N. LaSalle Street, Suite 1800, Chicago, Illinois 60601.

Admission. Only record or beneficial owners of the Company’s common stock or their duly authorized proxies may attend the Annual Meeting in person.

All persons attending the Annual Meeting will be required to present a valid government-issued picture identification, such as a driver’s license or passport, to gain admittance to the Annual Meeting. Beneficial owners must also provide evidence of stock holdings, such as a recent brokerage account or bank statement.

Voting Information

Record Date. The record date for the Annual Meeting is September 19, 2019. You may vote all shares of the Company’s common stock that you owned as of the close of business on that date. Each share of common stock entitles you to one vote on each item to be voted on at the Annual Meeting. Cumulative voting is not permitted. As of September 19, 2019, 51,947,385 shares of our common stock were outstanding.

Confidential Voting. Your vote is confidential and will not be disclosed to any officer, director or employee, except in certain limited circumstances, such as when you request or consent to disclosure.

Vote by Proxy. If your shares of common stock are held in your name, you can vote your shares on items presented at the Annual Meeting or by proxy. There are three ways to vote by proxy:

| |

| 1. | By Telephone — Stockholders can vote by telephone by calling 1-800-690-6903 and following the instructions on the proxy card; |

| |

| 2. | By Internet — You can vote over the Internet at www.proxyvote.com by following the instructions on the proxy card; or |

| |

| 3. | By Mail — You can vote by mail by signing, dating and mailing a proxy card. |

Submitting Voting Instructions for Shares Held Through a Broker. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and your broker, bank or nominee is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or nominee on how to vote and are also invited to attend the Annual Meeting with proper evidence of stock holdings, such as a recent brokerage account or bank statement. Street name stockholders should check the voting instruction cards used by their brokers or nominees for specific instructions on methods of voting. If your shares are held in street name, you must contact your broker or nominee to revoke your proxy.

If you hold shares through a broker, follow the voting instructions you receive from your broker. If you want to vote in person at the Annual Meeting, you must obtain a legal proxy from your broker and present it at the Annual Meeting. If you do not submit

voting instructions to your broker, your broker may still be permitted to vote your shares in certain cases. Brokers may vote your shares as described below.

| |

| • | Non-discretionary Items. All items, other than the ratification of the appointment of the Company’s independent registered public accounting firm, are “non-discretionary” items. It is critically important that you submit your voting instructions if you want your shares to count for non-discretionary items, such as the election of directors. Your shares will remain unvoted for such items if your broker does not receive instructions from you. |

| |

| • | Discretionary Item. The ratification of the appointment of the Company’s independent registered public accounting firm is a “discretionary” item. Brokers that do not receive instructions from beneficial owners may vote uninstructed shares in their discretion. |

In order to carry on the business of the meeting, we must have a quorum. This means that stockholders representing at least a majority of the common stock issued and outstanding as of the record date must be present at the Annual Meeting, either in person or by proxy, for there to be a quorum at the Annual Meeting. Abstentions and broker non-votes are counted as present for purposes of establishing a quorum but broker non-votes are not considered “present” for purposes of voting on non-discretionary items, such as the election of directors. A broker non-vote occurs when a broker or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the broker or nominee does not have discretionary voting power and has not received instructions from the beneficial owner.

Revoking Your Proxy. You can revoke your proxy at any time before your shares are voted by (1) delivering a written revocation notice prior to the Annual Meeting to Oren B. Azar, Corporate Secretary, InnerWorkings, Inc., 203 N. LaSalle Street, Suite 1800, Chicago, Illinois 60601; (2) submitting a later-dated proxy that we receive no later than the conclusion of voting at the Annual Meeting; or (3) voting in person at the Annual Meeting. Attending the Annual Meeting does not revoke your proxy unless you vote in person at the meeting.

Votes Required to Elect Directors. In order to be elected, director nominees must receive the affirmative vote of a majority of the votes cast in the election of directors. In other words, a nominee for director must receive more votes “FOR” his or her election than votes “AGAINST” such nominee. The size of the Board is currently set at nine members.

Votes Required to Adopt Other Proposals. The approval, on an advisory, non-binding basis, of the compensation of our named executive officers, the ratification of the Exclusive Forum Bylaw Amendment, and the ratification of Ernst & Young LLP’s appointment as independent registered public accounting firm require the affirmative vote of a majority of the shares of common stock represented at the Annual Meeting and entitled to vote thereon.

“Abstaining” and “Broker Non-Votes.” You may “abstain” from voting for any nominee in the election of directors and on the other proposals. Shares “abstaining” from voting on any proposal will be counted as present at the Annual Meeting for purposes of establishing the presence of a quorum. Your abstention will have no effect on the election of directors and will have the effect of a vote against the approval, on an advisory, non-binding basis, of the compensation of our named executive officers, against the ratification of the Exclusive Forum Bylaw Amendment and against the ratification of the appointment of Ernst & Young LLP as independent registered public accounting firm. Broker non-votes will have no effect on the election of directors, the approval, on an advisory, non-binding basis, of the compensation of our named executive officers, and the ratification of the Exclusive Forum Bylaw Amendment. There will be no broker non-votes with respect to the ratification of Ernst & Young LLP’s appointment as independent registered public accounting firm, as it is a discretionary item.

Other Matters. If you have any questions or require any assistance with voting your shares, or if you need additional copies of the proxy materials, please contact our proxy solicitor Morrow Sodali LLC (“Morrow Sodali”) using the below contact information:

470 West Avenue

Stamford, Connecticut 06902

Stockholders call toll free: (800) 662-5200

Banks and Brokerage Firms, please call: (203) 658-9400

Email: INWK@morrowsodali.com

PROPOSALS TO BE VOTED ON

Proposal 1: Election of Directors

Nominees

The size of the Board is currently set at nine members. The Board resolved to expand the Board from nine to eleven members in connection with the appointment of Mr. Karros and Mr. Zenner as independent directors on August 9, 2019. At the Annual Meeting, the stockholders will elect nine directors to serve until the 2020 annual meeting of stockholders or until their respective successors are elected and qualified. All of the nominees are currently directors. Any director vacancy occurring after the election may be filled by a majority vote of the remaining directors. In accordance with the Company’s Bylaws, a director appointed to fill a vacancy will be appointed to serve until the next annual meeting of stockholders.

If a quorum is present, the election of each director nominee requires the affirmative vote of a majority of the votes cast. In other words, a director nominee must receive more votes “FOR” his or her election than votes “AGAINST” such nominee. Abstentions and broker non-votes (if any) will not constitute votes cast on Proposal 1 and will accordingly have no effect on the outcome of the vote on Proposal 1. If an incumbent nominee fails to receive the vote needed to be re-elected, Delaware law provides that such nominee would continue to serve on the Board as a “holdover director,” which means that such director would remain in office until a successor is elected and qualified or until such director’s earlier resignation or removal.

Our Corporate Governance Guidelines require that prior to each annual stockholder meeting, incumbent directors submit a contingent resignation in writing to the Chairman of the Nominating and Corporate Governance Committee to become effective only if the director receives a greater number of votes “AGAINST” his or her election than votes “FOR” his or her election. Following the stockholder vote, the Nominating and Corporate Governance Committee will promptly consider the resignation submitted by such director and will recommend to the Board whether to accept or reject the tendered resignation. In considering whether to accept or reject the tendered resignation, the Committee will consider all factors deemed relevant by its members. The Board will act on the Committee’s recommendation no later than 90 days following the date of the stockholder meeting where the election occurred. In considering the Committee’s recommendation, the Board will consider the factors considered by the Committee and such additional information and factors as the Board deems to be relevant. Any director who tenders his or her resignation pursuant to our Corporate Governance Guidelines will not participate in the Committee recommendation or Board consideration regarding whether or not to accept the tendered resignation.

All nominees of the Board have consented to serve as directors, if elected. If any such nominee is unable or unwilling to serve as a director at the time of the Annual Meeting, the persons who are designated as proxies intend to vote, in their discretion, for such other persons, if any, as may be designated by the Board. As of the date of this proxy statement, the Board has no reason to believe that any of the director nominees named herein will be unable or unwilling to serve as a director if elected.

The Company believes that its Board, as a whole, should encompass a range of talent, skill, diversity, experience and expertise enabling it to provide sound guidance with respect to the Company’s operations and interests. In addition to considering a candidate’s background, experience and accomplishments, candidates are reviewed in the context of the current composition of the Board and the evolving needs of our business. Although the Company does not have a formal policy with regard to the consideration of diversity in identifying candidates, the Nominating and Corporate Governance Committee strives to nominate candidates with a variety of complementary skills so that, as a group, the Board will possess the appropriate level of talent, skills and expertise to oversee the Company’s business. The Company regularly assesses the size of the Board, whether any vacancies are expected due to retirement or otherwise, and the need for particular expertise on the Board. The Company’s policy is to have at least a majority of our directors qualify as “independent directors” as defined in the rules of NASDAQ. Currently, eight of our nine directors are independent.

The Nominating and Corporate Governance Committee seeks candidates with strong reputations and experience in areas relevant to the strategy and operations of the Company, particularly in industries and growth segments that the Company serves, as well as key geographic markets where it operates. Each of the Board’s director nominees holds or has held senior positions in complex organizations and has operating experience that meets this objective, as described below. In these positions, they have also gained experience in core management skills, such as strategic and financial planning, financial reporting, corporate governance, risk management and leadership development. Each of our director nominees also has experience serving on boards of directors and committees of other organizations.

The Nominating and Corporate Governance Committee also believes that each of the nominees has the experience, expertise, integrity, sound judgment and ability to engage management in a collaborative fashion to collectively comprise an effective Board. In addition, the Nominating and Corporate Governance Committee believes that each of the nominees are committed to devoting significant time and energy to service on the Board and its committees.

The names of the director nominees, their ages as of September 24, 2019, their recent employment or principal occupation, the names of other public companies for which they currently serve as a director or have served as a director within the past five years, and their period of service as an InnerWorkings director are set forth below.

|

| | | | |

| Name | | Age | | Position |

Jack M. Greenberg (1)(2) | | 76 | | Chairman of the Board |

| Richard S. Stoddart | | 56 | | Chief Executive Officer, President and Director |

Charles K. Bobrinskoy(1)(3) | | 60 | | Director |

Lindsay Y. Corby (3) | | 41 | | Director |

David Fisher(1)(3) | | 50 | | Director |

Adam J. Gutstein(2) | | 56 | | Director |

Julie M. Howard(1)(2)(3) | | 56 | | Director |

Kirt P. Karros(1) | | 49 | | Director |

Marc Zenner(3) | | 56 | | Director |

| |

| (1) | Current member of our Compensation Committee. |

| |

| (2) | Current member of our Nominating and Corporate Governance Committee. |

| |

| (3) | Current member of our Audit Committee |

DIRECTOR NOMINEES

Jack M. Greenberg has served on our Board since October 2005 and has served as Chairman of the Board since September 2018. Mr. Greenberg was Lead Independent Director from April to September 2018 and Chairman of the Board from June 2010 to April 2018. Mr. Greenberg served on the Board of IQVIA until April 2019, and was Chairman of The Western Union Company until his retirement in May 2017. He retired as Chairman and Chief Executive Officer of McDonald’s Corporation, a publicly traded global food service retailer, at the end of 2002. He had served as McDonald’s Chairman since May 1999, and as its Chief Executive Officer since August 1998. Mr. Greenberg served as McDonald’s President from August 1998 to May 1999, and as its Vice-Chairman from December 1991 to August 1998. He also served as Chairman from October 1996, and Chief Executive Officer, from July 1997, of McDonald’s USA until August 1998. Before joining McDonald’s, Mr. Greenberg was a Partner and Director of Tax Services for both the Midwest Region and Chicago office of Arthur Young & Company, and served on the firm’s management committee. He is a member of the American Institute of Certified Public Accountants, the Illinois CPA Society, and the Chicago Bar Association. He also served as a Director of The Allstate Corporation and of Hasbro, Inc. until 2015 and as a Director of Manpower, Inc. until 2014. Mr. Greenberg’s civic involvement includes service on the board of DePaul University, where he previously served as Chairman, the Institute of International Education, and the Field Museum. Mr. Greenberg is a graduate of DePaul University’s School of Commerce and School of Law. Mr. Greenberg’s various leadership positions, including Chief Executive Officer of a major global corporation, brings to the Board extensive management experience and economics expertise and strengthens the Board’s global perspective. In addition to Mr. Greenberg’s significant public company experience, he is a certified public accountant and an attorney, which provides additional value and perspective to the Board.

Richard S. Stoddart has served on our Board and as our Chief Executive Officer and President since April 2018. Prior to his appointment as Chief Executive Officer, from February 2016 through April 2018, Mr. Stoddart served as Global President and the Chief Executive Officer of Leo Burnett Worldwide, a global advertising agency. He previously served as Chief Executive Officer of Leo Burnett North America from 2013 to 2016 and as President of Leo Burnett North America from 2005 to 2013. From 2001 to 2005, he was Manager of Marketing Communications of Ford Motor Company (NYSE). He currently serves on the Board of Directors of Hasbro, Inc. (NASDAQ) and is a member of its Audit and Finance Committees. Mr. Stoddart also served as a member of the Board of Directors of Carbon Media Group, LLC, the largest outdoor sports digital media company, until its acquisition in 2018. Mr. Stoddart holds a Bachelor of Arts from Dartmouth College. As Chief Executive Officer of the Company, Mr. Stoddart brings to the Board the critical link to management’s perspective in Board discussions regarding the business and strategic direction of the Company.

Charles K. Bobrinskoy has served on our Board since August 2008. Mr. Bobrinskoy is currently Vice Chairman, Head of Investment Group at Ariel Investments, a global financial institution. Additionally, he is a Portfolio Manager of Ariel Focus Fund, a concentrated portfolio investing in mid-to-large cap companies. Prior to Ariel, Mr. Bobrinskoy spent 21 years as an investment banker at Salomon Brothers, a global financial institution, and its successor company, Citigroup, a global financial institution, where he held many leadership positions, most recently Managing Director and Head of North American Investment Banking Branch Offices. Mr. Bobrinskoy currently serves as a director of State Farm Automobile Insurance Company. In addition to his work at Ariel, Mr. Bobrinskoy serves on the boards of the Museum of Science and Industry, La Rabida Children’s Foundation, Big Shoulders Fund, Abraham Lincoln Presidential Library Foundation, Chicago Club, and Lakeshore Athletic Club. He is also a member of the Executive Committee of the Commercial Club of Chicago. He is a member of the Economic Club of Chicago and is a Henry Crown Fellow of the Aspen Institute. He holds a bachelor’s degree from Duke University and a Master of Business Administration from the University of Chicago Booth School of Business. Mr. Bobrinskoy’s extensive financial knowledge obtained through his various leadership positions within global financial institutions brings valuable perspectives to the Company in connection with its financial strategies and reporting, particularly in his role as Chairman and financial expert of the Board’s Audit Committee.

Lindsay Y. Corby has served on our Board since July 2018. Ms. Corby is currently Executive Vice President and Chief Financial Officer of Byline Bank (NYSE: BY), a role she has held since July 2015. Ms. Corby joined Byline in June 2013, serving as Chief Administrative Officer until July 2015. From February 2011 to June 2013, Ms. Corby served as a Principal at BXM Holdings, Inc., an investment fund specializing in community bank investments. Prior to joining BXM Holdings, Ms. Corby was a Vice President of Keefe, Bruyette & Woods, Inc., an investment bank. From 2012 to 2016, Ms. Corby also served as a Director on the Board of QCR Holdings, Inc., a public bank holding company. Ms. Corby holds a master’s degree in accounting and a bachelor’s degree in accounting and Spanish from Southern Methodist University. She is also a Registered Certified Public Accountant. Ms. Corby’s financial acumen and experience as a chief financial officer and her prior service on the board of a public company provides the Board and Audit Committee with valuable knowledge and insight on financial strategies, reporting, and controls.

David Fisher has served on our Board since November 2011. Mr. Fisher is currently Chairman and Chief Executive Officer of Enova International, Inc., a global consumer lending company. He has served as Enova’s Chief Executive Officer since January 2013. From September 2011 through February 2012, Mr. Fisher served as both President of optionsXpress online brokerage, which was acquired by The Charles Schwab Corporation, a leading provider of financial services, in September 2011, and as Senior Vice President of Derivatives at The Charles Schwab Corporation. From 2007 until the acquisition, Mr. Fisher served as Chief Executive Officer and a member of the optionsXpress Board of Directors. Mr. Fisher is a member of the Board of Directors of GrubHub, Inc. and serves as chairman of its audit committee and a member of its compensation committee, and is a member of the Board of Directors of FRISS. From January 2008 through October 2011, Mr. Fisher served as a member of the Board of Directors of CBOE Holdings, Inc. From 2001 through 2004, Mr. Fisher served as Chief Financial Officer at Potbelly Sandwich Works. Mr. Fisher also served as Chief Financial Officer of RBC Mortgage from 2000 through 2001 and of Prism Financial from December 1998 through January 2001. Mr. Fisher is also a member of the Board of Trustees for the Museum of Science and Industry. Mr. Fisher received his bachelor’s degree in Finance from the University of Illinois at Champaign and his Juris Doctor from Northwestern University School of Law. Mr. Fisher’s experience as Chief Executive Officer of a public company and his previous years of service as the Chief Financial Officer of several organizations provide valuable financial knowledge and valuable insight on reporting to the Board as well as to the Company’s Audit Committee on which he serves.

Adam J. Gutstein has served on our Board since October 2018. From June 2012 to September 2018, Mr. Gutstein served as Vice Chairman at PricewaterhouseCoopers US (“PwC”), a professional services firm and network, where he led PwC’s Eastern Region from June 2016 to September 2018. He joined PwC in 2010 and became a member of the US Advisory Leadership Group where he held various roles, including leading the integration of Diamond Management & Technology Consultants and other large transactions, leading the firms’ Management Consulting practice, and serving as a Director of PwC Hispanic America Advisory. From April 2006 to November 2010, Mr. Gutstein served as the President and Chief Executive Officer of Diamond Management & Technology Consultants, Inc., and a member of the board of directors of Diamond, and from March 1994 to March 2006, he served as Vice President and Partner of that company. At times during his tenure as CEO and a board member of Diamond, Mr. Gutstein served on the boards of two other public companies, HealthAxis and InnerWorkings. Before joining Diamond as a founding partner in 1994, Mr. Gutstein was an officer of Technology Solutions Company, and he began his career at Andersen Consulting. Mr. Gutstein holds a bachelor’s degree in economics from Haverford College. Mr. Gutstein’s experience at PwC and Diamond leading global teams to deliver client and shareholder value through growth strategies, improving operations, and capitalizing on technology provides valuable knowledge and operational strategy insight to the Company.

Julie M. Howard has served on our Board since October 2012. Ms. Howard is currently Chairman and Chief Executive Officer of Navigant Consulting, Inc. Prior to becoming Chief Executive Officer of Navigant Consulting in March 2012, Ms. Howard served as President beginning in 2006 and Chief Operating Officer beginning in 2003. Ms. Howard serves on the Board of Directors

of ManpowerGroup Inc., including its Nominating and Governance Committee. Ms. Howard also serves as a member of the Medical Center Board for Lurie Children's Hospital. Ms. Howard formerly served on the Board of Directors for Kemper Corporation, including service on its Audit, Compensation and Nominating and Governance Committees, the Board of Directors for the Association of Management Consulting Firms, the Dean's Advisory Board of the Business School at the University of Wisconsin-Madison, and the Board of Governors for the Metropolitan Planning Council of Chicago. Ms. Howard is a founding member and serves on the board of the Women’s Leadership and Mentoring Alliance. Ms. Howard holds a Bachelor of Science in Finance from the University of Wisconsin. She has also participated in Harvard Business School Executive Education programs and completed the Corporate Governance program at Stanford University. Ms. Howard’s business experience and involvement with strategic and operational programs, development of growth and profitability initiatives and regular interaction with a wide range of corporate constituents contributes unique perspectives and skill sets to the Board in its oversight of the Company’s business and its respective strategic initiatives.

Kirt P. Karros has served on our Board since August 2019. Mr. Karros has served as Senior Vice President, Finance and Treasurer at Hewlett Packard Enterprise since November 2015. Prior to that, Mr. Karros performed a similar role at Hewlett Packard Co., as well as leading Investor Relations, from May 2015 to October 2015. Previously, Mr. Karros served as a Principal and Managing Director of Research for Relational Investors LLC, an investment manager, from 2001 to May 2015. Prior to joining Relational in 1997, Mr. Karros was a Tax Manager at Arthur Andersen LLP, primarily providing tax consulting to public and private entities. From August 2013 to May 2015, Mr. Karros served on the Board of Directors of PMC-Sierra, Inc., a semiconductor company, including on its compensation committee. Mr. Karros holds a master’s degree in accounting and bachelor’s degree in business administration (summa cum laude) from San Diego State University. He is a Certified Public Accountant and holds the professional designation of Chartered Financial Analyst. Mr. Karros’ financial expertise and his shareholder perspective enable him to offer valuable contributions in his service to the Board as well as the Compensation Committee.

Marc Zenner has served on our Board since August 2019. Until his retirement in September 2017, Mr. Zenner was Global co-head of Corporate Finance Advisory within J.P. Morgan’s Investment Bank, where he was a managing director from 2007 to 2017. Before joining J.P. Morgan, Mr. Zenner was managing director and Global Head of the Financial Strategy Group (FSG), the corporate finance advisory group within the Investment Banking Division of Citi’s Global Markets. Prior to his career in investment banking, Mr. Zenner was the Chairman of the Finance and Economics Area and a Professor of Finance at the University of North Carolina’s Kenan-Flagler Business School. Mr. Zenner received an undergraduate degree in business engineering from the Katholieke Universiteit in Leuven, Belgium, an MBA from City University in London, and a Ph.D. in Financial Economics from Purdue University. Mr. Zenner currently serves on the board of directors of Sentinel Energy Services Inc. where he is the Chairman of the Audit Committee and a member of the Nominating and Corporate Governance Committee and OneSpan Inc. where he is a member of the Audit Committee, Compensation Committee and Corporate Governance and Nominating Committee. Mr. Zenner also provides strategic advice to various public and private companies. We believe that Mr. Zenner’s background in corporate finance make him well qualified to serve on our Board of Directors and Audit Committee.

Cooperation Agreement with Engaged Capital

On August 9, 2019, the Company entered into a cooperation agreement (the “Cooperation Agreement”) with Engaged Capital, LLC and certain of its affiliates (collectively, “Engaged Capital”). Pursuant to the Cooperation Agreement, the Board temporarily increased its size from nine members to 11 members and appointed Kirt P. Karros and Marc Zenner to the Board, effective immediately. Messrs. Karros and Zenner will stand for election at the Annual Meeting. Mr. Karros has been appointed to the Compensation Committee and Mr. Zenner has been appointed to the Audit Committee.

Following the conclusion of the Annual Meeting, the size of the Board will be reduced from 11 members to nine members. Afterwards and until the conclusion of the 2020 annual meeting of stockholders, for so long as Engaged Capital continuously beneficially owns at least the lesser of (1) 2.5% and (2) 1,298,537 shares of the Company’s then outstanding common stock, the size of the Board will not exceed nine directors, unless at least two-thirds of the directors then serving in office, including both Messrs. Karros and Zenner, approves such increase.

With respect to the shares of the Company’s common stock it owns, Engaged Capital has agreed to certain standstill, voting and other similar provisions in connection with the entry into the Cooperation Agreement. During the term of the Cooperation Agreement, Engaged Capital agreed that it will not, among other things, acquire beneficial ownership of more than 9.9% of the Company’s common stock, nominate or recommend for nomination any persons for election to the Board (except as expressly permitted by the Cooperation Agreement), submit any proposal for consideration at any stockholder meeting or solicit any proxy, consent or other authority to vote from stockholders.

During the term of the Cooperation Agreement, Engaged Capital will vote all of its shares of the Company’s common stock at all annual and special meetings as well as in any consent solicitations of the Company’s stockholders (1) in favor of the slate of directors recommended by the Board, against the election of any director nominee not approved, recommended and nominated by the Board for election and against any removal of any director of the Board, (2) at the Annual Meeting only, in favor of the named executive officer compensation proposal, (3) at the Annual Meeting only, in favor of ratification of the exclusive forum provision in the Company’s Second Amended and Restated By-Laws, and (4) in accordance with the Board’s recommendation for any other matter (unless Institutional Shareholder Services, Inc. issues a contrary recommendation). Engaged Capital will be permitted to vote on any proposals relating to an extraordinary transaction in its sole discretion.

The full text of the Cooperation Agreement and a summary description thereof may be found in the Current Report on Form 8-K filed by the Company with the U.S. Securities and Exchange Commission (the “SEC”) on August 9, 2019.

Required Vote

A nominee for director must receive more votes “FOR” his or her election than votes “AGAINST” such nominee as described above. Abstentions and broker non-votes will not constitute votes cast on Proposal 1 and will accordingly have no effect on the outcome of the vote on Proposal 1.

Recommendation of the Board of Directors

THE BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL NOMINEES NAMED ABOVE.

Proposal 2: Advisory Approval of Named Executive Officer Compensation

Under Section 14A of the Securities Exchange Act of 1934, enacted pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, the Company is providing a stockholder advisory vote to approve the compensation of the Company’s named executive officers, as disclosed in our Compensation Discussion and Analysis, related compensation tables, and other related material under the compensation disclosure rules of the Securities and Exchange Commission, as set forth in this proxy statement. As most recently approved by stockholders at our 2017 annual meeting and consistent with the Board’s recommendation, we are submitting this proposal for a non-binding vote on an annual basis. Holders of approximately 99% of our shares present and entitled to vote at our 2018 annual meeting approved the compensation of our named executive officers.

The Company maintains executive compensation and governance best practices and a long-term, pay-for-performance approach, as described more fully in the Compensation Discussion and Analysis section of this proxy statement. These practices include eliminating all “single trigger” or “modified single trigger” change in control severance benefits, the Compensation Committee’s retention of an independent compensation consultant, stock ownership guidelines for our executive officers and directors, no excise tax gross-up provisions, and prohibition of hedging transactions and pledging of our stock by our executive officers and directors.

This vote will not be binding on or overrule any decisions by our Board of Directors, will not create or imply any additional fiduciary duty on the part of the Board, and will not restrict or limit the ability of our stockholders to make proposals related to executive compensation for inclusion in proxy materials. However, our Compensation Committee will take into account the outcome of the vote when considering future executive compensation arrangements. Our Board of Directors has determined to ask our stockholders to vote on the Company’s executive pay programs and policies through the following resolution:

“RESOLVED, that the stockholders approve the Company’s compensation of its named executive officers as disclosed in this proxy statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission (which includes the Compensation Discussion and Analysis, the compensation tables, and related material).”

Required Vote

The affirmative vote of the holders of a majority of the shares of common stock of the Company represented at the Annual Meeting in person or by proxy and entitled to vote on this proposal is required to approve this proposal. Abstentions will have the same effect as votes against this proposal. Broker non-votes if any will have no effect on the outcome of the proposal.

Recommendation of the Board of Directors

THE BOARD RECOMMENDS A VOTE “FOR” THE ADVISORY APPROVAL OF THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY STATEMENT.

Proposal 3: Ratification of an Amendment to the Company's Bylaws

On October 30, 2018, the Board amended and restated our bylaws to add a new Article IX to provide, with certain exceptions, that the Court of Chancery of the State of Delaware (the “Delaware Court of Chancery”) shall be the exclusive forum for certain types of legal actions (the “Exclusive Forum Amendment”). Although our bylaws allow the Board to adopt the Exclusive Forum Amendment without stockholder approval or ratification, and the Exclusive Forum Amendment became effective upon its adoption by the Board on October 30, 2018, the Board believes it is important for our stockholders to have the opportunity to consider and vote upon, on a non-binding advisory basis, whether the Exclusive Forum Amendment is appropriate for the Company. Therefore, the Board has decided to request that stockholders ratify the Exclusive Forum Amendment on an advisory basis.

The full text of the Exclusive Forum Amendment is set forth below:

ARTICLE IX

EXCLUSIVE FORUM

Unless the Corporation consents in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware (or, if the Court of Chancery lacks jurisdiction, the federal district court for the District of Delaware unless said court lacks subject matter jurisdiction in which case, the Superior Court of the State of Delaware) shall be the sole and exclusive forum for (a) any derivative action or proceeding brought on behalf of the Corporation, (b) any action asserting a claim of breach of a fiduciary duty owed by any director, officer or other employee of the Corporation to the Corporation or the Corporation’s stockholders, (c) any action asserting a claim arising under any provision of the General Corporation Law of the State of Delaware, the Certificate of Incorporation or these by-laws or (d) any action asserting a claim governed by the internal affairs doctrine, in each case subject to the Court of Chancery of the State of Delaware having personal jurisdiction over the indispensable parties. If any action the subject matter of which is within the scope of the preceding sentence is filed in a court other than a court located within the State of Delaware (a “foreign action”) in the name of any stockholder, such stockholder shall be deemed to have consented to (i) the personal jurisdiction of the state and federal courts located within the State of Delaware in connection with any action brought in any such court to enforce the preceding sentence and (ii) having service of process made upon such stockholder in any such action by service upon such stockholder’s counsel in the foreign action as agent for such stockholder.

The Exclusive Forum Amendment does not apply to claims arising under the Securities Act of 1933, as amended (the “Securities Act”), the Exchange Act of 1934, as amended (the “Exchange Act”) or other federal securities laws for which there is exclusive federal or concurrent federal and state jurisdiction. Stockholders cannot waive, and will not be deemed to have waived under the exclusive forum provision, the Company’s compliance with the federal securities laws and the rules and regulations thereunder.

The Exclusive Forum Amendment may limit a stockholder’s ability to bring a claim in a judicial forum that it finds favorable for disputes with us or our directors, officers or other employees, which may discourage such lawsuits. Alternatively, if a court were to find the Exclusive Forum Amendment to be inapplicable or unenforceable in an action, we may incur additional costs associated with resolving such action in other jurisdictions, which could have a material adverse effect on our business, financial condition and results of operations.

The Board believes that it is beneficial to the Company to require that certain disputes involving the Company or its directors or officers be litigated in Delaware courts, such as: (i) certain derivative actions; (ii) certain claims of a breach of fiduciary duty owed by a director, officer or other employee to the Company or its stockholders; or (iii) actions asserting a claim arising under the Delaware General Corporation Law or governed by the internal affairs doctrine. The Company believes that its ability to require claims to be brought in a single forum for disputes of this kind will help ensure consistent consideration of the issues by courts with expertise in the applicable laws, and increase efficiency and cost effectiveness in the resolution of such claims, all of which are in the best interests of the Company and its stockholders. Further, the Board believes that Delaware courts are best suited to address disputes involving such matters given the Company’s incorporation in Delaware and the Delaware courts’ reputation for expertise in corporate law matters.

Specifically, Delaware offers a specialized court system uniquely equipped to deal with corporate law questions, with streamlined procedures and processes which help provide consistent, relatively quick decisions. Such efficiency can limit the time, cost and uncertainty of litigation for all parties. These courts have also developed considerable expertise in dealing with corporate law issues, as well as a substantial and influential body of case law construing Delaware’s corporate law and long-standing precedent regarding corporate governance.

Exclusive forum provisions, such as our Exclusive Forum Amendment, are becoming increasingly common. Without a bylaw or similar provision like the Exclusive Forum Amendment, the Company would be exposed to the possibility of plaintiffs using the Company’s diverse operational base to bring claims against the Company in multiple jurisdictions or choosing a forum state for litigation that may not apply Delaware law to the Company’s internal affairs in the same manner as the Delaware courts would be expected to do so. Although no assurance can be given that courts in all jurisdictions outside of Delaware will be willing to enforce the terms of the Exclusive Forum Amendment, certain jurisdictions have enforced exclusive forum provisions and the Board believes that the Exclusive Forum Amendment will reduce the risk that the Company could become subject to duplicative litigation in multiple forums, as well as the risk that the outcome of cases in multiple forums could be inconsistent, even though each forum purports to follow Delaware law. Any of these could expose the Company to increased expenses or losses.

The Board believes the Exclusive Forum Amendment will have no impact on the kind of remedy a stockholder may obtain and does not deprive stockholders of legitimate claims; rather it attempts to prevent the Company from being forced to waste corporate assets defending against duplicative suits. In addition, as discussed above, we believe the Delaware Court of Chancery offers a specialized system that can limit the time, cost and uncertainty of litigation for all parties, including stockholder plaintiffs. At the same time, the Board believes that the Company should retain the ability to consent to an alternative forum on a case-by-case basis where the Company determines that its interest and those of its stockholders are best served by permitting such a dispute to proceed in a forum other than Delaware.

The Board is aware that certain proxy advisors and institutional investors have taken the position that, in general, they may not support an exclusive forum clause until the company proposing it can show it already has suffered material harm as a result of multiple stockholder suits filed in different jurisdictions regarding the same matter. However, the Board believes that it is far more prudent to take preventive measures now, before the Company and the interests of its stockholders are harmed by the increasing practice of the plaintiffs’ bar to file selectively their claims in favorable jurisdictions, rather than wait to incur the litigation and related costs of attempting to have the cases consolidated or risk that foreign jurisdictions may misapply Delaware law to the detriment of the Company and its stockholders.

After considering the foregoing, the Board determined that the Exclusive Forum Amendment is in the best interests of the Company and its stockholders.

Required Vote

Stockholder approval is not required for the Exclusive Forum Amendment; however, the Board believes this is an important issue and that it is in the best interests of the Company and its stockholders to seek a non-binding, advisory stockholder vote to ratify the Exclusive Forum Amendment. The ratification of the Exclusive Forum Amendment requires the affirmative vote of a majority of the votes cast at the annual meeting. If the proposal to ratify the Exclusive Forum Amendment is not approved, the Board will consider whether to propose at the 2020 annual meeting of stockholders an amendment to eliminate the Exclusive Forum Amendment.

Recommendation of the Board of Directors

THE BOARD RECOMMENDS A VOTE “FOR” THE RATIFICATION, BY NON-BINDING, ADVISORY VOTE, OF AN AMENDMENT TO THE COMPANY’S BYLAWS TO DESIGNATE DELAWARE AS THE EXCLUSIVE FORUM FOR CERTAIN LEGAL ACTIONS.

Proposal 4: Ratification of Appointment of Independent Registered Public Accounting Firm

Ernst & Young LLP has served as the Company’s independent registered public accounting firm since March 2006 and has been appointed by the Audit Committee to continue as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019. In the event that ratification of this selection is not approved by the affirmative vote of the holders of a majority of the shares of common stock of the Company represented at the Annual Meeting in person or by proxy and entitled to vote on the item, the Audit Committee and the Board of Directors will review the Audit Committee’s future selection of an independent registered public accounting firm.

Representatives of Ernst & Young LLP will be present at the Annual Meeting. The representatives will have an opportunity to make a statement and will be available to respond to appropriate questions.

Required Vote

The affirmative vote of the holders of a majority of the shares of common stock of the Company represented at the Annual Meeting in person or by proxy and entitled to vote on this proposal is required to approve the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the current fiscal year. Abstentions will have the same effect as votes against this proposal. There will be no broker non-votes for this proposal because this is a discretionary item.

Recommendation of the Board of Directors

THE BOARD RECOMMENDS A VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2019.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Summary of Corporate Governance Practices

We are committed to high standards of ethical and business conduct and strong corporate governance practices. This commitment is highlighted by the practices described below as well as the Corporate Governance Guidelines contained on our website at www.inwk.com on the “Investor” page under the link “Corporate Governance.” In addition, we engage in shareholder outreach activities, which have informed our Board’s decisions concerning governance and related practices, as described below.

| |

| • | Our directors are elected annually by majority vote for one-year terms. |

| |

| • | A nominee for director must receive more votes “FOR” his or her election than votes “AGAINST” such director. |

| |

| • | We currently separate the roles of Chairman of the Board and Chief Executive Officer. |

| |

| • | Our Board and its committees have an advisory role in risk oversight for the Company. |

| |

| • | Eight of our nine director nominees are independent. |

| |

| • | Each of our key Board committees (Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee) is comprised entirely of independent directors and operates under a written charter. |

| |

| • | We do not currently have in place, nor have we ever had, a shareholder rights plan, commonly known as a “poison pill.” |

Board Leadership Structure

Our Board is led by an independent Chairman, Jack M. Greenberg. We believe that such Board leadership structure for the Company is appropriate in light of the differences between the roles of Chairman of the Board and Chief Executive Officer. The Chief Executive Officer is responsible for setting the strategic direction of the Company and for the day-to-day leadership and performance of the Company, whereas the Chairman of the Board provides guidance to the Chief Executive Officer, is responsible for chairing Board meetings, including executive sessions with Board members, and advising on agenda topics and corporate governance matters. We have had this leadership structure for the majority of our existence; however, the Board recognizes that other leadership structures could be appropriate depending on the circumstances and, therefore, regularly re-evaluates this structure.

Board of Directors Role in Risk Oversight

Our Board and its committees have an advisory role in risk oversight for the Company. Company management maintains primary responsibility for the risk management of the Company, however, the Audit Committee and the Board review a risk assessment of the Company on a regular basis. While it is not possible to identify and mitigate all potential risks, the Board relies on the representations of management, the external audit of the financial information, the Company’s systems of internal controls and the historically conservative practices of the Company to provide comfort on the Company’s ability to manage its risks. Management’s discussion of current risk factors is set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018.

Meetings and Committees of the Board of Directors

During 2018, the Board held eleven meetings. During 2018, each director attended at least 75% of the aggregate of the total number of meetings of the Board held during the period in which he or she was a director and the total number of meetings held by all of the committees of the Board on which he or she served. The Board has an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee and an Executive Committee. The Audit, Compensation and Nominating and Corporate Governance Committees were formally established in August 2006 in connection with the Company’s initial public offering and operate under written charters adopted by the Board. The Executive Committee was established in April 2010.

Audit Committee. Charles K. Bobrinskoy, Lindsay Y. Corby, David Fisher, Julie M. Howard, Marc Zenner and Linda S. Wolf serve on the Audit Committee. Mr. Bobrinskoy serves as the chairman of our Audit Committee. Linda S. Wolf has chosen not to stand for re-election as a director at the Annual Meeting. The Audit Committee is composed of independent non-employee directors and is responsible for, among other things, supervising internal audit and reviewing internal financial controls and accounting principles to be employed in the preparation and review of our financial statements. In addition, the Audit Committee has authority to engage public accountants to audit our annual financial statements and determine the scope of the audit to be undertaken by such accountants. Each member of the Audit Committee is financially literate and Charles K. Bobrinskoy and Lindsay Y. Corby are Audit Committee financial experts under the SEC rule implementing Section 404 of the Sarbanes-Oxley Act of 2002. During 2018, the Audit Committee held eight meetings.

Compensation Committee. Charles K. Bobrinskoy, David Fisher, J. Patrick Gallagher, Jr., Jack M. Greenberg, Julie M. Howard, Kirt P. Karros and Linda S. Wolf serve on the Compensation Committee. J. Patrick Gallagher, Jr. and Linda S. Wolf have

chosen not to stand for re-election as directors at the Annual Meeting. Ms. Howard serves as the chairman of our Compensation Committee. Prior to Ms. Howard's election as chairman on February 21, 2019, Mr. Gallagher had served as chairman of our Compensation Committee since March 2012. The Compensation Committee is composed of independent non-employee directors, each of whom is an “independent director” as required by the applicable listing standards of NASDAQ (including the specific independence requirements for compensation committee members), and is responsible for, among other things, reviewing and approving compensation of our Chief Executive Officer and our other executive officers. Additionally, the Compensation Committee reviews and recommends to our Chief Executive Officer and the Board policies, practices and procedures relating to the compensation of managerial employees and the establishment and administration of certain employee benefit plans for managerial employees. The Compensation Committee has the authority to administer our Stock Incentive Plan, and to advise and consult with our officers regarding managerial personnel policies. In 2018, the Compensation Committee engaged Willis Towers Watson to perform certain compensation consulting services related to benchmarking the Company’s executive compensation. In connection with this engagement, the Compensation Committee requested that Willis Towers Watson:

| |

| • | review the appropriateness of our proxy peer group based on an evaluation of our size and operations; |

| |

| • | provide advice on executive compensation issues; and |

| |

| • | assess the extent to which our executive compensation is aligned with performance and market practices. |

Willis Towers Watson provided compensation consulting services to the Compensation Committee only on matters for which the Compensation Committee is responsible. While the Compensation Committee sought input from Willis Towers Watson on the matters described above, the Compensation Committee is solely responsible for determining the final amount and form of compensation and the level of performance targets. Willis Towers Watson is directly engaged by and reports to the Compensation Committee, although it does interact with Company management at the Compensation Committee’s direction. A different division of Willis Towers Watson provides non-executive benefits and insurance brokerage services to the Company. For 2018, we paid Willis Towers Watson approximately $125,000 for services provided to the Compensation Committee, and we paid approximately $439,000 for the non-executive benefits and insurance brokerage services provided to the Company. In accordance with the requirements of Regulation S-K, the Company has determined that no conflict has arisen in connection with the work of Willis Towers Watson as compensation consultant to the Compensation Committee. See the “EXECUTIVE AND DIRECTOR COMPENSATION - Compensation Discussion and Analysis” section of this proxy statement for discussion of the Company’s processes and procedures for considering and determining executive and director compensation. During 2018, the Compensation Committee held six meetings.

Nominating and Corporate Governance Committee. Adam J. Gutstein, J. Patrick Gallagher, Jr., Jack M. Greenberg, Julie M. Howard and Linda S. Wolf serve on the Nominating and Corporate Governance Committee. J. Patrick Gallagher, Jr. and Linda S. Wolf have chosen not to stand for re-election as directors at the 2019 annual meeting of stockholders. Mr. Gutstein serves as the chairman of our Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is composed of independent non-employee directors and is responsible for, among other things, assisting the Board with its responsibilities regarding:

| |

| • | the identification of individuals qualified to become directors; |

| |

| • | the selection of the director nominees for the next annual meeting of stockholders; |

| |

| • | the selection of director candidates to fill any vacancies on the Board; |

| |

| • | the performance, composition, duties and responsibilities of the Board and the committees of the Board; |

| |

| • | succession planning for the Chief Executive Officer; and |

| |

| • | the operation of the Board with respect to corporate governance matters. |

In evaluating and determining whether to nominate a candidate for a position on the Company’s Board, the Nominating and Corporate Governance Committee will consider the candidate’s professional ethics and values, relevant management experience and a commitment to enhancing stockholder value. The Company regularly assesses the size of the Board, whether any vacancies are expected due to retirement or otherwise, and the need for particular expertise on the Board. Candidates may come to the attention of the Nominating and Corporate Governance Committee from current Board members, stockholders, professional search firms, officers or other persons. The Nominating and Corporate Governance Committee will review all candidates in the same manner regardless of the source of recommendation. During 2018, the Nominating and Corporate Governance Committee held four meetings.

The Nominating and Corporate Governance Committee will consider stockholder recommendations of candidates when the recommendations are properly submitted. Any stockholder recommendations which are submitted under the criteria summarized above should include the candidate’s name and qualifications for Board membership and should be addressed to Oren B. Azar, Corporate Secretary, InnerWorkings, Inc., 203 N. LaSalle Street, Suite 1800, Chicago, Illinois 60601.

Director Independence

There are no family relationships among any of the directors or executive officers of the Company. Our Board of Directors has affirmatively determined that the following eight of our nine director nominees are “independent directors” as defined in the rules of NASDAQ: Jack M. Greenberg, Charles K. Bobrinskoy, Lindsay Y. Corby, David Fisher, Adam J. Gutstein, Julie M. Howard, Kirt P. Karros and Marc Zenner. In making the independence determination, the Board considered the current and prior relationships that each non-employee director has with the Company and all other facts and circumstances that the Board deemed relevant, including the beneficial ownership of the Company’s capital stock by each non-employee director and the transactions involving them as described in the section titled “CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS.”

In particular, the Board considered the Company’s business relationship with Enova International, Inc., of which Mr. Fisher serves as Chairman, President and Chief Executive Officer. The Board noted that:

| |

| • | Mr. Fisher is not involved in the transactions or ongoing discussions or negotiations between parties. |

| |

| • | The transactions between the companies are on terms and conditions no more favorable than what is to be expected of an arm's length transaction. |

| |

| • | The relationship between the companies is transactional in nature and does not involve sensitive professional services such as legal or accounting services. The Company’s services to Enova International, Inc. are marketing execution and procurement services. Enova International, Inc. does not provide any services to the Company. |

| |

| • | Amounts involved represent less than 0.9% of each company’s revenue in 2018. |

After assessing the relationship, the Board concluded that such relationship was not material, would not interfere with Mr. Fisher’s ability to exercise independent judgment as a director and would not give rise to any undue influence. Therefore, the Board concluded that Mr. Fisher continues to be an independent director.

Governance Documents

The Company’s Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee charters are available at www.inwk.com on the “Investors” page under the link “Corporate Governance.” In addition, the Board has adopted corporate governance guidelines, which are available at www.inwk.com on the “Investors” page under the link “Corporate Governance.” Information on, or accessible through, our website is not a part of, or incorporated by reference into, this proxy statement. For a further discussion of compensation and governance updates, see “EXECUTIVE AND DIRECTOR COMPENSATION - Compensation Discussion and Analysis - Executive Summary.”

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee serves, or has at any time served, as an officer or employee of us or any of our subsidiaries. None of our executive officers has served as a member of the Compensation Committee, or other committee serving an equivalent function, of any other entity, one of whose executive officers served as a member of our Compensation Committee.

Communications with Directors

We value shareholder outreach activities, which serve to inform our Board’s decisions concerning governance and related practices. For a discussion of our shareholder outreach activities, see “EXECUTIVE AND DIRECTOR COMPENSATION - Compensation Discussion and Analysis - Executive Summary - Shareholder Outreach.”

The Board has also established a process to receive communications from stockholders. Stockholders and other interested parties may contact any member (or all members) of the Board, or the non-management directors as a group, any Board committee or any chair of any such committee by mail. To communicate with the Board, any individual directors or any group or committee of directors, correspondence should be addressed to the Board or any such individual directors or group or committee of directors by either name or title. All such correspondence should be sent “c/o Oren B. Azar, Corporate Secretary” at 203 N. LaSalle Street, Suite 1800, Chicago, Illinois 60601.

All communications received as set forth in the preceding paragraph will be opened by the Corporate Secretary for the sole purpose of determining whether the contents represent a message to our directors. The Corporate Secretary will forward copies of all correspondence that, in the opinion of the Corporate Secretary, deals with the functions of the Board or its committees or that he otherwise determines requires the attention of any member, group or committee of the Board.

Attendance at Annual Meeting

Directors are encouraged, but not required, to attend our annual stockholders’ meeting. Messrs. Greenberg, Stoddart and Bobrinskoy attended the 2018 annual meeting of stockholders.

STOCK OWNERSHIP

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding the beneficial ownership of our common stock as of September 19, 2019 (except as indicated below) by:

| |

| • | all persons known by us to own beneficially 5% or more of our outstanding common stock; |

| |

| • | each of our directors and director nominees; |

| |

| • | each of the named executive officers listed in the “EXECUTIVE AND DIRECTOR COMPENSATION — Executive Compensation — Summary Compensation Table” section of this proxy statement; and |

| |

| • | all of our directors, director nominees and executive officers as a group. |

Unless otherwise indicated, the address of each beneficial owner listed below is c/o InnerWorkings, Inc., 203 N. LaSalle Street, Suite 1800, Chicago, Illinois 60601.

|

| | | | | | | |

| Name and Address | | Number of Shares Beneficially Owned(1) | | Approximate Percent of Class(1) |

| CERTAIN BENEFICIAL OWNERS (not including directors and executive officers): | | | | | |

|

ArrowMark Colorado Holdings LLC

100 Fillmore Street, Suite 325

Denver, CO 80206 | | 6,766,499 |

| (2) | | 13.0 | % |

Richard A. Heise, Jr.

2221 Old Willow Road

Northfield, IL 60093 | | 6,344,907 |

| (3) | | 12.2 | % |

Dimensional Fund Advisors LP

Building One 6300 Bee Cave Road

Austin, TX, 78746 | | 4,468,407 |

| (4) | | 8.6 | % |

American Century Capital Portfolios, Inc.

4500 Main Street

9th Floor

Kansas City, Missouri 64111 | | 3,940,880 |

| (5) | | 7.6 | % |

The Vanguard Group

100 Vanguard Blvd

Malvern, PA 19355 | | 3,130,039 |

| (6) | | 6.0 | % |

BlackRock, Inc.

55 East 52nd Street

New York, New York 10055 | | 3,084,027 |

| (7) | | 5.9 | % |

| DIRECTORS, DIRECTOR NOMINEES AND NAMED EXECUTIVE OFFICERS: | | | | |

|

|

| Eric D. Belcher | | 423,029 |

| | | * |

|

| Ronald C. Provenzano | | 352,323 |

| (8) | | * |

|

| Richard S. Stoddart | | 200,172 |

| (9) | | * |

|