UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21864

WisdomTree Trust

(Exact name of registrant as specified in charter)

245 Park Avenue, 35th Floor

New York, NY 10167

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (866) 909-9473

Date of fiscal year end: June 30

Date of reporting period: June 30, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

The Reports to Shareholders are attached hereto.

WisdomTree Trust

Annual Report

June 30, 2020

International Equity ETFs:

WisdomTree Dynamic Currency Hedged International Equity Fund (DDWM)

WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund (DDLS)

WisdomTree Emerging Markets ESG Fund (RESE)

(formerly, WisdomTree Emerging Markets Dividend Fund (DVEM))

WisdomTree International ESG Fund (RESD)

(formerly, WisdomTree Dynamic Currency Hedged International Quality Dividend Growth Fund (DHDG))

Fixed Income ETFs:

WisdomTree U.S. Corporate Bond Fund (WFIG)

(formerly, WisdomTree Fundamental U.S. Corporate Bond Fund)

WisdomTree U.S. High Yield Corporate Bond Fund (WFHY)

(formerly, WisdomTree Fundamental U.S. High Yield Corporate Bond Fund)

WisdomTree U.S. Short-Term Corporate Bond Fund (SFIG)

(formerly, WisdomTree Fundamental U.S. Short-Term Corporate Bond Fund)

WisdomTree U.S. Short-Term High Yield Corporate Bond Fund (SFHY)

(formerly, WisdomTree Fundamental U.S. Short-Term High Yield Corporate Bond Fund)

Asset Allocation ETF:

WisdomTree 90/60 U.S. Balanced Fund (NTSX)

Thematic ETF:

WisdomTree Cloud Computing Fund (WCLD)

IMPORTANT NOTE: Beginning on January 1, 2021, as permitted by regulations adopted by the SEC, paper copies of the WisdomTree Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, annual and semi-annual shareholder reports will be available on the WisdomTree Funds’ website (www.wisdomtree.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank).

You may elect to receive all future reports in paper free of charge. Please contact your financial intermediary to request to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account.

Table of Contents

| 1 | ||||

Information about Performance and Shareholder Expense Examples (unaudited) | 6 | |||

| 7 | ||||

| 17 | ||||

| Schedules of Investments |

| |||

WisdomTree Dynamic Currency Hedged International Equity Fund | 21 | |||

WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund | 32 | |||

| 44 | ||||

| 49 | ||||

| 53 | ||||

| 61 | ||||

| 67 | ||||

| 72 | ||||

| 75 | ||||

| 82 | ||||

| 83 | ||||

| 85 | ||||

| 87 | ||||

| 91 | ||||

| 96 | ||||

| 110 | ||||

| 112 | ||||

| 113 | ||||

| 115 | ||||

| 117 | ||||

“WisdomTree” is a registered mark of WisdomTree Investments, Inc. and is licensed for use by the WisdomTree Trust.

(unaudited)

U.S. Markets

The U.S. equity market, as measured by the S&P 500® Index, returned 7.51% for the 12-month fiscal year that ended June 30, 2020 (the “fiscal year”).

U.S. equities began the fiscal year with a modest, but still positive trajectory in the third quarter of 2019 and returned +1.70%, as measured by the S&P 500® Index. The GDP “advance” estimate for the second quarter of 2019 showed that U.S. economic growth slowed to 2.1% from 3.1% in the first quarter of 2019. Strong consumer spending provided a tailwind for U.S. GDP, while a decline in investment and inventories as well as an increase in the trade deficit depressed economic growth. At the end of July 2019, the Fed cut the benchmark rate by 0.25% for the first time since 2008. Despite easing monetary policy, the U.S. equity market was disappointed that the Fed did not commit to future stimulus measures. A slower pace of job growth, indications of moderating economic activity in the service sector, and the first decline in manufacturing activity since 2009 were negative overhangs on market sentiment. Ultimately, these negative overhangs were more than offset by the positive reaction to further easing in monetary policy in September 2019 when the Fed cut the benchmark rate by an additional 0.25%.

U.S. equities rallied +9.07% in the fourth quarter of 2019, as measured by the S&P 500® Index. Trade uncertainty between U.S. and China continued to weigh on economic activity and labor market growth continued to trend lower. Falling core producer prices, declining retail sales, and a mild report of 1.9% GDP growth for the third quarter of 2019, according to the “advance” estimate, showed slowing consumer spending. The Fed again took action to ease monetary policy by lowering the benchmark rate by an additional 0.25%, although it signaled a pause in future actions. In mid-December 2019, President Trump announced a limited trade agreement with China including the cancellation of new tariffs and a reduction in existing tariffs. The preliminary trade pact was the major catalyst driving positive U.S. equity performance in the fourth quarter of 2019.

Previous gains in U.S. equities over the preceding six months were rapidly offset during the first quarter of 2020 as the world grappled with the fallout from the spread of the novel coronavirus (“COVID-19”) outbreak. Sentiment was relatively positive early in the first quarter of 2020 as the U.S.-China trade resolution progressed, consumer spending growth remained moderate, the trade deficit contracted, and the Fed left its benchmark interest rate unchanged.

At the end of January 2020, China announced the lock down of select cities due to COVID-19. Over the next month, the global rate of infection accelerated as the virus spread around the world. Large international corporations announced disruptions to operations and forecasted meaningful reductions in financial expectations.

On February 19, 2020, the first case of COVID-19 in the U.S. was reported, marking the peak level for U.S. equities. By February 27, 2020, U.S. equities entered correction territory, marking a 10% decline from their peak. Meanwhile, the Cboe Volatility Index, a benchmark index that measures the market’s expectation of future volatility, rose to the highest level since 2011. On March 3, 2020, the Fed took emergency action to stem the negative economic impact from COVID-19 and cut the benchmark rate by 0.50%. Amidst virus related market volatility, Saudi Arabia and Russia engaged in an oil price war. Following a failed agreement on production cuts, Saudi Arabia sought to increase market share, which drove the largest daily decline in energy stocks within the S&P 500® Index on record.

On March 15, 2020, the Fed again took unprecedented emergency actions, including a cut to the benchmark rate by 1.00% to a range of 0% to 0.25%. The Fed also instituted quantitative easing measures with the purchase of $700 billion in U.S. government debt, along with other tools to provide stimulus, liquidity, and to promote lending. As the virus continued to spread, local governments began to institute lock downs grinding economic activity to a halt. In the final week of March 2020, U.S. equities rebounded modestly as

| WisdomTree Trust | 1 |

Market Environment Overview

(unaudited) (continued)

the Fed announced new lending facilities to support credit markets and as U.S. Congress passed a $2 trillion fiscal stimulus package. Overall, U.S. equities declined -19.60% in the first quarter of 2020, as measured by the S&P 500® Index.

Following the market lows in March of 2020, the second quarter of 2020 saw a strong resurgence in both performance and a reopening of the global economy. The S&P 500® Index rallied 20.54% in the second quarter of 2020 due to COVID-19 case counts broadly subsiding, encouraging developments with treatments and vaccines, and businesses and states implementing phased reopening plans. Many growth and technology companies’ (sometimes dubbed the “work from home” businesses) long-term growth initiatives greatly accelerated and were brought to the forefront. This has led to many growth companies, and the growth market as a whole, to ultimately achieve and surpass all-time highs. For example, the NASDAQ Composite Index increased 30.63% in the second quarter of 2020 and had hit an all-time new high. In June of 2020, total nonfarm payroll employment rose by 4.8 million and the unemployment rate declined to 11.1% as reported by the U.S. Bureau of Labor Statistics. Both figures were among the largest “beats” in economic data history when compared to their largely negative expectations, highlighting the improving economy as people are getting back to work.

Fixed Income

Over the fiscal year, the decrease in short-term U.S. interest rates exceeded the decrease in long-term rates, reflecting the negative near-term impact on the U.S. economy from COVID-19. This resulted in a steepening of the U.S. Treasury yield curve. The Fed funds rate decreased from 2.25% to a range of 0% to 0.25%, as the Fed decreased rates to help ease monetary policy and combat the economic effects of COVID-19 on the U.S. economy. The 2-Year U.S. Treasury Note yield decreased from 1.75% to 0.16% and the U.S. 10-Year Treasury Note yield fell from 2.00% to 0.66%. The closely monitored spread between the 2- and 10-year U.S. Treasury Note yields increased from 0.25% at the beginning of the fiscal year to 0.50% at the end of the fiscal year. Corporate spreads for both investment grade and high yield bonds rose dramatically and peaked on March 23, 2020 as a result of the market turbulence. Investment grade spreads saw a high of 4.01% and high yield spreads saw a high of 10.87%, but both have seen significant tightening since then.

Emerging Markets

Emerging market (“EM”) equities, as measured by the MSCI Emerging Markets Index, returned 1.37% in local currency terms and -3.39% in U.S. dollar terms for the fiscal year that ended June 30, 2020. EM currencies broadly weakened versus the U.S. dollar during the fiscal year, primarily driven by strengthening of the U.S. dollar in the first quarter of 2020. The currencies of Argentina and Brazil weakened 30-40% versus the U.S. dollar during the fiscal year. A confluence of factors drove these currencies lower, including the negative economic impact from COVID-19, a rapid decline in oil prices, falling interest rates with little room for further cuts to monetary policy rates, and civil unrest. The Argentine peso was especially hurt as the currency weakened 39.71% versus the U.S. dollar over ongoing concerns about the country’s ability to fulfill its debt obligations.

EM equity returns were negative in the third quarter of 2019, as measured by the MSCI Emerging Markets Index, returning -4.25% in U.S. dollar terms and -2.07% in local currency terms. Slowing growth in major global economies, and U.S. President Trump’s announcement of additional tariffs on Chinese goods negatively impacted EM equities. Signs of economic slowdown in China was a major headwind on EM equity returns. The escalation of the U.S.-China trade dispute in early August 2019 led China’s currency to weaken. Central banks in several other EM countries, including South Korea, Indonesia, South Africa, India, Mexico, Turkey, Brazil, and Thailand, cut their benchmark rates, reflecting weakening global trade and demand. Notably, the Indian government implemented a series of additional measures aimed at stimulating economic growth, including a corporate tax cut. Meanwhile, South Korea was especially negatively impacted

| 2 | WisdomTree Trust |

Market Environment Overview

(unaudited) (continued)

by trade disputes on two fronts: 1) U.S.-China trade tensions dampened exports of technology inputs and other components to China, and 2) Japan removed South Korea from its list of preferred trading partners. Argentina experienced notable negative performance driven by the surprise defeat of the incumbent president in a primary election. Falling oil prices were also a drag on EM equity returns as concerns about oversupply were a headwind for oil exporters.

EM equities rebounded 11.84% in U.S. dollar terms and 9.54% in local currency terms in the fourth quarter of 2019, as measured by the MSCI Emerging Markets Index. Key global developments, including a preliminary agreement in U.S.-China trade negotiations as well as a clearer path to the United Kingdom’s exit from the European Union, helped to reduce global uncertainty and improve sentiment in emerging markets. A rebound in oil prices following an announced cut in global production also benefited EM equities in December 2019. Additionally, continued easing of monetary policy by EM central banks supported EM equities during the fourth quarter of 2019.

EM equities experienced a meaningful drawdown alongside global equities in the first quarter of 2020. As measured by the MSCI Emerging Markets Index, EM equities fell -23.60% in U.S. dollar terms and fell -19.05% in local currency terms, driven by the negative impact from COVID-19 and collapsing oil prices. Beginning in early January 2020, news of the spread of COVID-19 in Wuhan, China began to emerge and by the end of January 2020, China announced the lock down of select infected cities. Over time the global rate of infection spread along with the impact on the global economy. Large international corporations announced disruptions to operations and forecasted meaningful reductions in financial expectations — a signal of the heavy economic toll from the spread of the virus and the consequent halt to business activity. In early February 2020, China’s central bank lowered interest rates to support the economy. The first official datapoint after China was impacted by the virus showed a significant contraction in Chinese manufacturing activity. Amidst virus related market volatility, Saudi Arabia and Russia entered an oil price war. Following a failed agreement on production cuts, Saudi Arabia sought to increase market share.

In March 2020, Chinese equity performance began to positively diverge from broader EM and global equity market performance. China reopened portions of its economy while most other nations began to lock down to prevent spread of the virus. During this time, EM nations implemented both fiscal and monetary stimulus measures, including cuts to interest rates and reserve requirements as well as unprecedented spending packages to aid households and businesses.

Following the market lows in March of 2020, the second quarter of 2020 saw a strong resurgence in both performance and a reopening of the global economy. MSCI Emerging Markets Index rallied 18.08% in local currency terms and 16.78% in U.S. dollar terms, due to case counts broadly subsiding, encouraging developments with treatments and vaccines, and businesses and countries implementing phased reopening plans around the world. Many countries and regions around the world have enacted various governmental and fiscal stimulus plans to help combat the economic effects of COVID-19.

International Markets

International equity markets, as measured by the MSCI EAFE Index, a broad measure of equity performance for the developed world outside the U.S. and Canada, returned -5.13% in U.S. dollar terms during the fiscal year. Measured in local currency, the MSCI EAFE Index returned -4.24% over the same period. International currency performance was mixed in the fiscal year, and the largest currency moves occurred during the first quarter of 2020, when financial markets became increasingly volatile due to the COVID-19 outbreak and subsequent economic ramifications. Most international currencies weakened versus the U.S. dollar during the fiscal year. However, the Japanese yen and Swiss franc, which are widely regarded as safe-haven currencies during periods of volatility, strengthened relative to the U.S. dollar.

| WisdomTree Trust | 3 |

Market Environment Overview

(unaudited) (continued)

International equity performance was positive, although slightly subdued in the third quarter of 2019. During this period, the MSCI EAFE Index returned +1.75% in local currency terms, but broad strengthening of the U.S. dollar resulted in a -1.07% return in U.S. dollar terms for the same period. In July 2019, Japanese election results confirmed that incumbent Prime Minister Shinzo Abe and the democratic party would remain in power, providing political stability within the nation. Meanwhile, the German manufacturing sector continued to lag, posting its lowest level of activity in seven years, which was slightly offset by services sector expansion. These contracting economic indicators and signals from new leadership at the European Central Bank drove expectations for easing monetary policy in the Eurozone. In the U.K., Boris Johnson was elected as Britain’s Prime Minister, pledging that the U.K. would exit the European Union (known as “Brexit”) by October 31, 2019. Late August 2019 brought a trade resolution between the U.S. and Japan, but escalating tensions between the U.S. and China remained in focus and were largely to blame for a reported contraction in German GDP as well as a sizable drop in Japanese exports. Additionally, Italy narrowly avoided political collapse with the formation of a new governing coalition between the Democratic party and the populist Five Star Movement. European market volatility calmed in September 2019, despite increasing Brexit uncertainty, after the European Central Bank cut the deposit rate to a record low alongside the introduction of a new quantitative easing program.

International equity markets rallied in the fourth quarter of 2019, returning +8.17% in U.S. dollar terms and +5.19% in local currency terms. This period was characterized by a reduction in global uncertainty and accommodative monetary policy. In October 2019, Japan increased the sales tax rate by 2% to 10%, which partially drove slowing economic activity alongside a reduction in exports from U.S.-China trade frictions. In October 2019, the European Union delayed Brexit for the third time to January 2020, beyond U.K. Prime Minister Boris Johnson’s October 31, 2019 goal. Meanwhile, the trend of stagnating economic activity across Europe persisted through November 2019. In early December 2019, Japan announced a substantial stimulus package aimed at boosting the nation’s GDP by 1.4% through March 2022. By mid-December 2019, a preliminary trade agreement between the U.S. and China buoyed international equities. European economic activity began to show signs of bottoming and potential recovery, including modest economic growth in Germany.

At the end of the fourth quarter of 2019, U.K. Prime Minister Boris Johnson’s Conservative Party secured a majority in the House of Commons, providing a clearer path for the U.K. to exit the European Union. The European Central Bank left its monetary policy rate unchanged in response to early signs of an economic recovery.

Positive international equity performance sharply reversed during the first quarter of 2020. The MSCI EAFE Index returned -20.55% in local currency terms and -22.83% in U.S. dollar terms. In early January 2020, news of the spread of COVID-19 emerged. Before the virus spread, Germany and the Eurozone reported that 2019 GDP growth hit a 6-year low of 0.6% and 1.2%, respectively. Additionally, the U.K. formally exited the European Union on January 31, 2020.

At the end of January 2020, China announced the lock down of select cities due to COVID-19. In the ensuing days and weeks, the global rate of COVID-19 infection spread; along with the impact on the global economy. Large international corporations announced disruptions to operations and forecasted meaningful reductions in financial expectations. Amid the virus outbreak, Japan reported a 6.3% contraction in GDP for the fourth quarter of 2019, driven by a sharp decline in household consumption from a higher sales tax rate. At the end of February 2020, many countries within the European Union began reporting COVID-19 infections, with the most significant increase in Northern Italy. An oil price war between Saudi Arabia and Russia added to the market volatility experienced by international equities.

In March 2020, the spread of COVID-19 in Japan was relatively more contained than in other developed nations. The infection rate in Europe worsened, and many nations

| 4 | WisdomTree Trust |

Market Environment Overview

(unaudited) (concluded)

began implementing lock down measures, halting economic activity. Notably, Italy became the country with the highest COVID-19 related death rate. The Bank of England announced large cuts in interest rates to a record low and agreed to purchase £200 billion in U.K. government bonds. Similarly, the European Central Bank increased bond purchases under its current program and announced a new €750 billion bond-buying program.

International equity markets began to rally from the late-first quarter volatility to begin the second quarter of 2020, and the final quarter of the fiscal year. During the second quarter of 2020, the MSCI EAFE Index returned 12.60% in local currency terms and 14.88% in U.S. dollar terms. As governments and central banks coordinated their fiscal and monetary policy efforts in order to mitigate the economic impact of the pandemic, equity markets became more optimistic. While the economic data from late first quarter 2020 into the second quarter 2020 was historically abysmal, the economic downturn appeared to be transient, as many local economies quickly began to reopen as new COVID-19 infections and mortality rates began to decline. This resulted in improvements in many readings of economic activity, including Producer Manufacturing Indexes (PMIs), which excited equity markets even further. Though developed markets still had a negative return for the entire fiscal year, three straight months of modest gains in the second quarter of 2020 helped to pare losses. The quarter ended with a feeling of cautious optimism, with markets anticipating that the worst of the global pandemic is already in the past, hopefully leading to improvements in local economic activity. Likewise, the joint presence and coordinated policy efforts of governments and central banks (including the prospect of a €750 billion stimulus package from the European Union) continued to restore confidence in equity markets amid the pandemic.

Each WisdomTree Fund’s performance as set forth in “Management’s Discussion of Funds’ Performance” in the pages that follow should also be viewed in light of the foregoing market environment.

| WisdomTree Trust | 5 |

Information about Performance and Shareholder Expense Examples (unaudited)

Performance

The performance tables on the following pages are provided for comparative purposes and represent the period noted. Each Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the midpoint of the bid and ask price for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities.

Fund shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Fund NAV returns are calculated using a Fund’s daily 4:00 p.m. eastern time NAV. Market price returns reflect the midpoint of the bid and ask price as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and an index is not available for direct investment. In comparison, the Funds’ performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or taxes that a shareholder would pay on Fund distributions. Past performance is no guarantee of future results. For the most recent month-end performance information visit www.wisdomtree.com.

Shareholder Expense Examples

Each Fund’s performance table is accompanied by a shareholder expense example. As a shareholder of a WisdomTree Fund, you incur two types of cost: (1) transaction costs, including brokerage commissions on purchases and sales of your Fund shares and (2) ongoing costs, including management fees and other Fund expenses. The examples are intended to help you understand your ongoing costs (in dollars and cents) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2020 to June 30, 2020. Except where noted, expenses are calculated using each Fund’s annualized expense ratio (after the effect of contractual or voluntary fee waivers, if any), multiplied by the average account value for the period, multiplied by 182/366 (to reflect the one-half year period). The annualized expense ratio does not include acquired fund fees and expenses (“AFFEs”), which are fees and expenses incurred indirectly by a Fund through its investments in certain underlying investment companies.

Actual expenses

The first line in the shareholder expense example table shown on the following pages provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for your Fund under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during the period.

Hypothetical example for comparison purposes

The second line in the shareholder expense example table shown on the following pages provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line in the table is useful in comparing ongoing Fund costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| 6 | WisdomTree Trust |

Management’s Discussion of Funds’ Performance

as of June 30, 2020 (unaudited)

WisdomTree Dynamic Currency Hedged International Equity Fund (DDWM)

Sector Breakdown†

| Sector | % of Net Assets | |||

Financials | 16.4% | |||

Industrials | 12.5% | |||

Health Care | 11.7% | |||

Consumer Staples | 11.0% | |||

Consumer Discretionary | 10.6% | |||

Communication Services | 9.4% | |||

Materials | 7.9% | |||

Energy | 6.5% | |||

Utilities | 6.5% | |||

Information Technology | 4.7% | |||

Real Estate | 2.5% | |||

Other Assets less Liabilities‡ | 0.3% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

Nestle S.A., Registered Shares | 1.7% | |||

Roche Holding AG, Genusschein | 1.5% | |||

Novartis AG, Registered Shares | 1.4% | |||

Toyota Motor Corp. | 1.4% | |||

British American Tobacco PLC | 1.3% | |||

China Mobile Ltd. | 1.3% | |||

TOTAL S.A. | 1.1% | |||

GlaxoSmithKline PLC | 1.1% | |||

Sanofi | 1.0% | |||

BP PLC | 1.0% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

The WisdomTree Dynamic Currency Hedged International Equity Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Dynamic Currency Hedged International Equity Index (the ‘‘Index’’). In seeking to track the Index, the Fund invests in dividend-paying companies in the industrialized world outside the U.S. and Canada while at the same time dynamically hedging exposure to fluctuations of the value of the applicable foreign currencies relative to the U.S. dollar. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

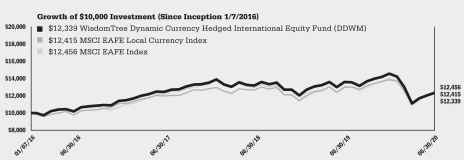

The Fund returned -9.34% at net asset value (“NAV”) for the fiscal year ending June 30, 2020 (for more complete performance information please see the table below). During the fiscal year, the Fund benefited from its allocations to the Real Estate and Utilities sectors. The benefit from Utilities was attributable to a slight overweight position, whereas the benefit from Real Estate resulted from a combination of being underweight and stock selection. The sector allocations that detracted from performance the most were Financials, Health Care, and Energy. Regionally, the only additive position was an allocation to Sweden, while allocations and stock selection effects in France, Japan, and the United Kingdom negatively impacted performance. The Fund’s performance was positively impacted by its dynamic currency hedge. Over the fiscal year, the U.S. dollar modestly strengthened relative to a broad basket of developed market currencies, which aided performance as compared to a static, unhedged benchmark. During the fiscal year, the Fund’s currency hedging strategy contributed positively to performance as the U.S. dollar strengthened against the Euro and British Pound, while the U.S. dollar’s relative weakening against the Japanese Yen detracted slightly from Fund performance.

Shareholder Expense Example (for the six-month period ended June 30, 2020)

| Beginning Account Value | Ending Account Value | Annualized Net Expense Ratio | Expenses Paid During the Period | |||||||||||||

Actual | $ | 1,000.00 | $ | 847.20 | 0.35 | %1 | $ | 1.61 | ||||||||

Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,023.12 | 0.35 | %1 | $ | 1.76 | ||||||||

| 1 | WisdomTree Asset Management, Inc. has contractually agreed to limit the management fee to 0.35% through October 31, 2020, unless earlier terminated by the Board of Trustees of the WisdomTree Trust for any reason. |

Performance

| Average Annual Total Return | ||||||||||||

| 1 Year | 3 Year | Since Inception1 | ||||||||||

Fund NAV Returns | -9.34 | % | -0.29 | % | 4.80 | % | ||||||

Fund Market Price Returns | -9.76 | % | -0.46 | % | 4.84 | % | ||||||

WisdomTree Dynamic Currency Hedged International Equity Index | -8.88 | % | -0.03 | % | 4.98 | % | ||||||

MSCI EAFE Local Currency Index | -4.24 | % | 1.26 | % | 4.94 | % | ||||||

MSCI EAFE Index | -5.13 | % | 0.81 | % | 5.02 | % | ||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the Cboe BZX Exchange, Inc. on January 7, 2016. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| WisdomTree Trust | 7 |

Management’s Discussion of Funds’ Performance

as of June 30, 2020 (unaudited)

WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund (DDLS)

Sector Breakdown†

| Sector | % of Net Assets | |||

Industrials | 19.8% | |||

Financials | 16.6% | |||

Consumer Discretionary | 14.1% | |||

Materials | 11.1% | |||

Information Technology | 9.6% | |||

Real Estate | 6.3% | |||

Consumer Staples | 6.2% | |||

Communication Services | 5.6% | |||

Health Care | 5.1% | |||

Utilities | 4.0% | |||

Energy | 2.0% | |||

Other Assets less Liabilities‡ | -0.4% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

BE Semiconductor Industries N.V. | 0.9% | |||

Siltronic AG | 0.8% | |||

Bolsas y Mercados Espanoles SHMSF S.A. | 0.6% | |||

Freenet AG | 0.6% | |||

Vistry Group PLC | 0.6% | |||

Azimut Holding SpA | 0.6% | |||

TietoEVRY Oyj | 0.5% | |||

JB Hi-Fi Ltd. | 0.5% | |||

bpost S.A. | 0.5% | |||

Spark Infrastructure Group | 0.5% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

The WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Dynamic Currency Hedged International SmallCap Equity Index (the ‘‘Index’’). In seeking to track the Index, the Fund invests in the small-capitalization segment of dividend-paying companies in the industrialized world outside the U.S. and Canada while at the same time dynamically hedging exposure to fluctuations of the value of the applicable foreign currencies relative to the U.S. dollar. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

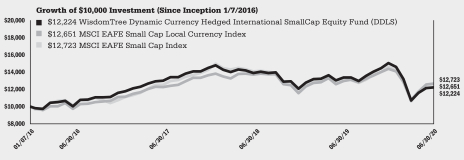

The Fund returned -8.70% at net asset value (“NAV”) for the fiscal year ending June 30, 2020 (for more complete performance information please see the table below). During the fiscal year, the Fund only benefited from an allocation to the Utilities sector, while positions to the Information Technology, Health Care, and Industrials sectors were the largest detractors, primarily due to stock selection. None of the country positions were additive for performance during the fiscal year, though positions in France and Singapore detracted the least. Positions in the United Kingdom and Japan negatively impacted performance the most, primarily due to stock selection once again. The Fund’s performance was positively affected by its dynamic currency hedge. Throughout the fiscal year, the U.S. dollar modestly strengthened relative to a broad basket of developed market currencies, which aided performance as compared to a static, unhedged benchmark. The Fund was more than 60% hedged on average in its three biggest currency positions, which were the Euro, British Pound, and Japanese Yen. Of those three, the U.S. dollar strengthened relative to the Euro and Pound, which aided performance, while it weakened slightly against the Japanese Yen, which detracted from performance.

Shareholder Expense Example (for the six-month period ended June 30, 2020)

| Beginning Account Value | Ending Account Value | Annualized Net Expense Ratio | Expenses Paid During the Period | |||||||||||||

Actual | $ | 1,000.00 | $ | 810.80 | 0.43 | %1 | $ | 1.94 | ||||||||

Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,022.73 | 0.43 | %1 | $ | 2.16 | ||||||||

| 1 | WisdomTree Asset Management, Inc. has contractually agreed to limit the management fee to 0.43% through October 31, 2020, unless earlier terminated by the Board of Trustees of the WisdomTree Trust for any reason. |

Performance

| Average Annual Total Return | ||||||||||||

| 1 Year | 3 Year | Since Inception1 | ||||||||||

Fund NAV Returns | -8.70 | % | -2.10 | % | 4.58 | % | ||||||

Fund Market Price Returns | -8.90 | % | -2.45 | % | 4.65 | % | ||||||

WisdomTree Dynamic Currency Hedged International SmallCap Equity Index | -8.68 | % | -1.75 | % | 4.97 | % | ||||||

MSCI EAFE Small Cap Local Currency Index | -2.38 | % | 1.04 | % | 5.39 | % | ||||||

MSCI EAFE Small Cap Index | -3.52 | % | 0.53 | % | 5.52 | % | ||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the Cboe BZX Exchange, Inc. on January 7, 2016. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| 8 | WisdomTree Trust |

Management’s Discussion of Funds’ Performance

as of June 30, 2020 (unaudited)

WisdomTree Emerging Markets ESG Fund (RESE)

(formerly, WisdomTree Emerging Markets Dividend Fund (DVEM))

Sector Breakdown†

| Sector | % of Net Assets | |||

Information Technology | 20.4% | |||

Consumer Discretionary | 17.1% | |||

Communication Services | 16.6% | |||

Financials | 15.9% | |||

Consumer Staples | 8.9% | |||

Materials | 7.2% | |||

Industrials | 4.7% | |||

Health Care | 4.4% | |||

Real Estate | 3.1% | |||

Utilities | 1.3% | |||

Other Assets less Liabilities‡ | 0.4% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

Tencent Holdings Ltd. | 5.9% | |||

Taiwan Semiconductor Manufacturing Co., Ltd. | 5.1% | |||

Alibaba Group Holding Ltd., ADR | 5.0% | |||

Samsung Electronics Co., Ltd. | 4.1% | |||

Ping An Insurance Group Co. of China Ltd., Class H | 1.4% | |||

JD.com, Inc., ADR | 1.0% | |||

Baidu, Inc., ADR | 0.9% | |||

NAVER Corp. | 0.9% | |||

SK Hynix, Inc. | 0.8% | |||

NetEase, Inc., ADR | 0.8% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

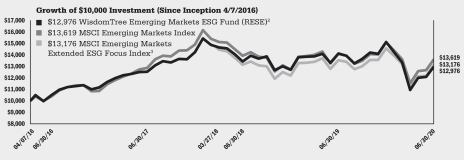

The WisdomTree Emerging Markets ESG Fund (the “Fund”) is actively managed using a model-based approach seeking capital appreciation. The Fund seeks to achieve its investment objective by investing primarily in equity securities of issuers in emerging markets that exhibit certain characteristics believed to be indicative of positive future returns as well as incorporating favorable environmental, social, and governance (“ESG”) characteristics based on a model developed by WisdomTree Asset Management, Inc. The Fund’s investment objective and strategies changed effective March 16, 2020. Prior to March 16, 2020, Fund performance reflects the investment objective of the Fund when it was the WisdomTree Emerging Markets Dividend Fund and tracked the price and yield performance, before fees and expenses, of the WisdomTree Emerging Markets Dividend Index (the “Former Index”). In seeking to track the Former Index, the Fund invested in dividend-paying companies in the emerging markets. The Fund generally used a representative sampling strategy to achieve its investment objective, meaning it generally invested in a sample of securities in the Former Index.

The Fund returned -8.19% at net asset value (“NAV”) for the fiscal year ended June 30, 2020 (for more complete performance information please see the table below). The Fund’s position in Information Technology contributed positively to performance while its position in Materials negatively impacted performance. The Fund’s position in China contributed positively to performance while its position in Russia negatively impacted performance. From the beginning of the fiscal year to March 16, 2020, when the Fund had a different objective, the Fund returned -16.98% based on NAV. Emerging Markets took a hard hit as uncertainties spread globally. The Fund’s focus on high dividend paying stocks also caused its negative performance as many dividend companies’ shares dropped in price along with dividend cancellations. After March 16, 2020, the market gradually started rebounding, yet the emerging markets economy never reached the point of reopening which also negatively affected the Fund’s performance.

Shareholder Expense Example (for the six-month period ended June 30, 2020)

| Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the Period | |||||||||||||

Actual | $ | 1,000.00 | $ | 857.50 | 0.32 | % | $ | 1.48 | ||||||||

Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,023.27 | 0.32 | % | $ | 1.61 | ||||||||

Performance

| Average Annual Total Return | ||||||||||||

| 1 Year | 3 Year | Since Inception1 | ||||||||||

Fund NAV Returns2 | -8.19 | % | 1.14 | % | 6.35 | % | ||||||

Fund Market Price Returns2 | -8.85 | % | 0.70 | % | 6.26 | % | ||||||

MSCI Emerging Markets Extended ESG Focus Index3 | -2.65 | % | N/A | N/A | ||||||||

MSCI Emerging Markets Index | -3.39 | % | 1.90 | % | 7.57 | % | ||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the Cboe BZX Exchange, Inc. on April 7, 2016. |

| 2 | The Fund’s objective and strategies changed effective March 16, 2020. Prior to March 16, 2020, Fund performance reflects the investment objective of the Fund when it was the WisdomTree Emerging Markets Dividend Fund (DVEM) and tracked the performance, before fees and expenses, of the WisdomTree Emerging Markets Dividend Index. |

| 3 | The MSCI Emerging Markets Extended ESG Focus Index began on March 27, 2018, and the line graph for the Index begins at the same value as the Fund on that date. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| WisdomTree Trust | 9 |

Management’s Discussion of Funds’ Performance

as of June 30, 2020 (unaudited)

WisdomTree International ESG Fund (RESD)

(formerly, WisdomTree Dynamic Currency Hedged International Quality Dividend Growth Fund (DHDG))

Sector Breakdown†

| Sector | % of Net Assets | |||

Health Care | 17.8% | |||

Industrials | 16.1% | |||

Financials | 14.3% | |||

Consumer Staples | 14.0% | |||

Information Technology | 10.2% | |||

Consumer Discretionary | 9.0% | |||

Communication Services | 7.6% | |||

Materials | 6.2% | |||

Real Estate | 2.6% | |||

Utilities | 1.9% | |||

Other Assets less Liabilities‡ | 0.3% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

Nestle S.A., Registered Shares | 3.1% | |||

Roche Holding AG, Genusschein | 2.4% | |||

Novartis AG, Registered Shares | 1.9% | |||

ASML Holding N.V. | 1.6% | |||

SAP SE | 1.5% | |||

Novo Nordisk A/S, Class B | 1.3% | |||

Sanofi | 1.2% | |||

GlaxoSmithKline PLC | 1.1% | |||

Sony Corp. | 1.0% | |||

AIA Group Ltd. | 1.0% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

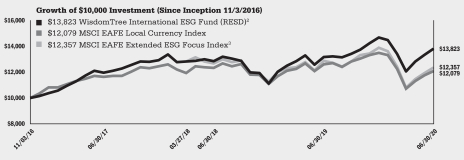

The WisdomTree International ESG Fund (the “Fund”) is actively managed using a model-based approach seeking capital appreciation. The Fund seeks to achieve its investment objective by investing primarily in equity securities of issuers in developed markets excluding the U.S. and Canada that exhibit certain characteristics believed to be indicative of positive future returns as well as incorporating favorable environmental, social, and governance (“ESG”) characteristics based on a model developed by WisdomTree Asset Management, Inc. The Fund’s investment objective and strategies changed effective March 16, 2020. Prior to March 16, 2020, Fund performance reflects the investment objective of the Fund when it was the WisdomTree Dynamic Currency Hedged International Quality Dividend Growth Fund and tracked the performance, before fees and expenses, of the WisdomTree Dynamic Currency Hedged International Quality Dividend Growth Index (the ‘‘Former Index’’). In seeking to track the Former Index, the Fund primarily invested in companies from developed market countries, excluding the U.S. and Canada, with growth and quality characteristics while at the same time dynamically hedging exposure to fluctuations between the value of the foreign currencies relative to the U.S. dollar. The Fund generally used a representative sampling strategy to achieve its investment objective, meaning it generally invested in a sample of securities in the Former Index (including indirect investments through the WisdomTree International Quality Dividend Growth Fund (IQDG) (the ‘‘Underlying Fund’’)) whose risk, return and other characteristics resemble the risk, return, and other characteristics of the Former Index as a whole.

The Fund returned 4.88% at net asset value (“NAV”) for the fiscal year ended June 30, 2020 (for more complete performance information please see the table below). The Fund’s position in Health Care contributed positively to performance while its position in Energy negatively impacted performance. The Fund’s position in Switzerland contributed positively to performance while its position in United Kingdom negatively affected performance. From the beginning of the fiscal year to March 16, 2020, when the Fund had a different objective, the Fund returned -9.63% based on NAV. The global stocks had negative performance during the first quarter of 2020. However, the Fund’s focus on high quality companies provided some downside protection. After March 16, 2020, the market gradually started rebounding, which helped generate a positive return to the Fund.

Shareholder Expense Example (for the six-month period ended June 30, 2020)

| Beginning Account Value | Ending Account Value | Annualized Net Expense Ratio | Expenses Paid During the Period | |||||||||||||

Actual | $ | 1,000.00 | $ | 941.60 | 0.20 | %1 | $ | 0.97 | ||||||||

Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,023.87 | 0.20 | %1 | $ | 1.01 | ||||||||

| 1 | Prior to March 16, 2020, WisdomTree Asset Management, Inc. had contractually agreed to waive a portion of its management fee in an amount equal to the acquired fund fees and expenses (“AFFEs”) attributable to the Fund’s investments in the Underlying Fund, as well as an additional 0.10%, through October 31, 2020, unless earlier terminated by the Board of Trustees of the WisdomTree Trust for any reason. Effective March 16, 2020, the contractual fee waiver was terminated in relation to the change in the Fund’s objective and the advisory fee was lowered. The “Annualized Net Expense Ratio” does not include the impact of AFFEs. Had AFFEs been included (as shown in the net expense ratio in the Fund’s prospectus) the “Annualized Net Expense Ratio” would have been higher. Prior to March 16, 2020, the Fund’s net expense ratio was 0.48% including AFFEs (0.10% per annum excluding AFFEs) and, thereafter, was reduced to 0.30% per annum. |

Performance

| Average Annual Total Return | ||||||||||||

| 1 Year | 3 Year | Since Inception1 | ||||||||||

Fund NAV Returns2 | 4.88 | % | 4.94 | % | 9.25 | % | ||||||

Fund Market Price Returns2 | 4.85 | % | 5.00 | % | 9.28 | % | ||||||

MSCI EAFE Extended ESG Focus Index3 | -4.04 | % | N/A | N/A | ||||||||

MSCI EAFE Local Currency Index | -4.24 | % | 1.26 | % | 5.30 | % | ||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the Cboe BZX Exchange, Inc. on November 3, 2016. |

| 2 | The Fund’s objective and strategies changed effective March 16, 2020. Prior to March 16, 2020, Fund performance reflects the investment objective of the Fund when it was the WisdomTree Dynamic Currency Hedged International Quality Dividend Growth Fund (DHDG) and tracked the performance, before fees and expenses, of the WisdomTree Dynamic Currency Hedged International Quality Dividend Growth Index. |

| 3 | The MSCI EAFE Extended ESG Focus Index began on March 27, 2018, and the line graph for the Index begins at the same value as the Fund on that date. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| 10 | WisdomTree Trust |

Management’s Discussion of Funds’ Performance

as of June 30, 2020 (unaudited)

WisdomTree U.S. Corporate Bond Fund (WFIG)

(formerly, WisdomTree Fundamental U.S. Corporate Bond Fund)

Sector Breakdown†

| Sector | % of Net Assets | |||

Financials | 23.9% | |||

Health Care | 10.9% | |||

Industrials | 10.3% | |||

Communication Services | 9.5% | |||

Utilities | 8.6% | |||

Information Technology | 8.4% | |||

Consumer Discretionary | 7.6% | |||

Consumer Staples | 7.0% | |||

Energy | 6.4% | |||

Materials | 2.2% | |||

Real Estate | 1.3% | |||

U.S. Government Obligations | 0.1% | |||

Other Assets less Liabilities‡ | 3.8% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

AT&T, Inc., | 1.0% | |||

Boeing Co. (The), | 0.9% | |||

Oracle Corp., | 0.9% | |||

Verizon Communications, Inc., 4.50%, 8/10/33 | 0.7% | |||

Enterprise Products Operating LLC, | 0.7% | |||

Dominion Energy South Carolina, Inc., | 0.7% | |||

Wells Fargo & Co., | 0.6% | |||

Truist Financial Corp., | 0.6% | |||

Southern Co. (The), | 0.6% | |||

Comcast Corp., | 0.6% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

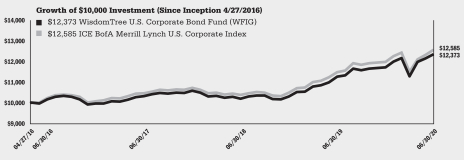

The WisdomTree U.S. Corporate Bond Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree U.S. Corporate Bond Index (the ‘‘Index’’). In seeking to track the Index, the Fund primarily invests in issuers in the U.S. investment grade corporate bond market that are deemed to exhibit favorable fundamentals and opportunities for income. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 9.54% at net asset value (“NAV”) for the fiscal year ending June 30, 2020 (for more complete performance information please see the table below). The corporate bond market saw a large downturn in performance along with the rest of the markets in late March 2020 when many companies were forced to close their businesses entirely. However, since the lows in late March, many economies and businesses have started reopening again. This, alongside massive government assistance programs and encouraging vaccine developments, catapulted many markets on recovery trajectories. Investment grade companies, given their stronger balance sheets and cash flows, were better protected from this market turbulence than their riskier, high yield (‘junk’ status) counterparts, thus resulting in positive performance. This Fund also benefited from its fundamental screening process, in which it attempts to screen out potentially unfavorable companies that are susceptible to downgrades and defaults. This resulted in a higher quality basket of bonds that had fewer downgrades than the broader corporate bond market. The Fund outperformed relative to its benchmark due to its underweight in more at-risk sectors like Energy and Consumer Discretionary. The Fund also benefited from interest rates broadly declining, as the Fund maintained a longer duration level than its short-term maturity counterparts.

Shareholder Expense Example (for the six-month period ended June 30, 2020)

| Beginning Account Value | Ending Account Value | Annualized Net Expense Ratio | Expenses Paid During the Period | |||||||||||||

Actual | $ | 1,000.00 | $ | 1,053.40 | 0.18 | %1 | $ | 0.92 | ||||||||

Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,023.97 | 0.18 | %1 | $ | 0.91 | ||||||||

| 1 | WisdomTree Asset Management, Inc. has contractually agreed to limit the management fee to 0.18% through October 31, 2020, unless earlier terminated by the Board of Trustees of the WisdomTree Trust for any reason. |

Performance

| Average Annual Total Return | ||||||||||||

| 1 Year | 3 Year | Since Inception1 | ||||||||||

Fund NAV Returns | 9.54 | % | 6.15 | % | 5.23 | % | ||||||

Fund Market Price Returns | 9.60 | % | 6.50 | % | 5.28 | % | ||||||

WisdomTree U.S. Corporate Bond Index2 | 9.46 | % | 6.32 | % | 5.55 | % | ||||||

ICE BofA Merrill Lynch U.S. Corporate Index | 9.30 | % | 6.26 | % | 5.66 | % | ||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the Cboe BZX Exchange, Inc. on April 27, 2016. |

| 2 | Formerly, WisdomTree Fundamental U.S. Corporate Bond Index prior to September 27, 2019. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| WisdomTree Trust | 11 |

Management’s Discussion of Funds’ Performance

as of June 30, 2020 (unaudited)

WisdomTree U.S. High Yield Corporate Bond Fund (WFHY)

(formerly, WisdomTree Fundamental U.S. High Yield Corporate Bond Fund)

Sector Breakdown†

| Sector | % of Net Assets | |||

Consumer Discretionary | 24.5% | |||

Industrials | 11.2% | |||

Communication Services | 8.8% | |||

Health Care | 8.6% | |||

Materials | 7.8% | |||

Energy | 7.7% | |||

Consumer Staples | 7.2% | |||

Information Technology | 7.1% | |||

Financials | 6.4% | |||

Real Estate | 5.9% | |||

Utilities | 2.6% | |||

Other Assets less Liabilities‡ | 2.2% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

Community Health Systems, Inc., | 1.3% | |||

DISH DBS Corp., | 1.1% | |||

Western Digital Corp., | 0.9% | |||

Tenet Healthcare Corp., | 0.9% | |||

CommScope Technologies LLC, | 0.8% | |||

Tenet Healthcare Corp., | 0.7% | |||

MGM Resorts International, | 0.7% | |||

Ford Motor Co., | 0.7% | |||

Occidental Petroleum Corp., | 0.7% | |||

MEDNAX, Inc., | 0.7% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

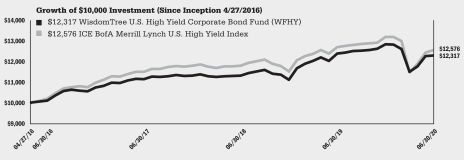

The WisdomTree U.S. High Yield Corporate Bond Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree U.S. High Yield Corporate Bond Index (the ‘‘Index’’). In seeking to track the Index, the Fund primarily invests in issuers in the U.S. non-investment grade corporate bond (‘‘junk bond’’ or “high yield”) market that are deemed to exhibit favorable fundamentals and opportunities for income. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned -0.72% at net asset value (“NAV”) for the fiscal year ending June 30, 2020 (for more complete performance information please see the table below). The corporate bond market, particularly in the high yield market, saw a large downturn in performance as many corporations faced economic pressures caused by the global pandemic. However, since the lows in late March, many economies and businesses have started reopening again. While high yield companies broadly speaking are well off of their lows, they are still lagging their investment grade counterparts in performance. The Fund benefited from its fundamental screening process, in which it attempts to screen out potentially unfavorable companies that are susceptible to defaults. This resulted in a higher quality basket of bonds that had far fewer defaults than the broader high yield corporate bond market. The Fund had outperformed its benchmark due to its relative underweight in more at-risk sectors like Energy. The Fund also benefited from interest rates broadly declining, as the Fund maintains a longer duration level than its short-term maturity counterparts.

Shareholder Expense Example (for the six-month period ended June 30, 2020)

| Beginning Account Value | Ending Account Value | Annualized Net Expense Ratio | Expenses Paid During the Period | |||||||||||||

Actual | $ | 1,000.00 | $ | 957.70 | 0.38 | %1 | $ | 1.85 | ||||||||

Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,022.97 | 0.38 | %1 | $ | 1.91 | ||||||||

| 1 | WisdomTree Asset Management, Inc. has contractually agreed to limit the management fee to 0.38% through October 31, 2020, unless earlier terminated by the Board of Trustees of the WisdomTree Trust for any reason. |

Performance

| Average Annual Total Return | ||||||||||||

| 1 Year | 3 Year | Since Inception1 | ||||||||||

Fund NAV Returns | -0.72 | % | 3.31 | % | 5.11 | % | ||||||

Fund Market Price Returns | -0.16 | % | 4.08 | % | 5.23 | % | ||||||

WisdomTree U.S. High Yield Corporate Bond Index2 | -1.27 | % | 3.43 | % | 5.74 | % | ||||||

ICE BofA Merrill Lynch U.S. High Yield Index | -1.10 | % | 2.94 | % | 5.64 | % | ||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the Cboe BZX Exchange, Inc. on April 27, 2016. |

| 2 | Formerly, WisdomTree Fundamental U.S. High Yield Corporate Bond Index prior to September 27, 2019. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| 12 | WisdomTree Trust |

Management’s Discussion of Funds’ Performance

as of June 30, 2020 (unaudited)

WisdomTree U.S. Short-Term Corporate Bond Fund (SFIG)

(formerly, WisdomTree Fundamental U.S. Short-Term Corporate Bond Fund)

Sector Breakdown†

| Sector | % of Net Assets | |||

Financials | 33.6% | |||

Industrials | 9.5% | |||

Health Care | 8.7% | |||

Information Technology | 8.6% | |||

Consumer Discretionary | 8.2% | |||

Consumer Staples | 7.9% | |||

Utilities | 6.2% | |||

Communication Services | 5.3% | |||

Energy | 5.3% | |||

Materials | 1.6% | |||

Real Estate | 1.1% | |||

U.S. Government Obligations | 0.2% | |||

Other Assets less Liabilities‡ | 3.8% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

MUFG Union Bank NA, | 1.3% | |||

Interpublic Group of Cos., Inc. (The), | 0.9% | |||

Eversource Energy, | 0.8% | |||

Exxon Mobil Corp., | 0.8% | |||

Truist Financial Corp., | 0.8% | |||

Ally Financial, Inc., | 0.8% | |||

Wells Fargo & Co., | 0.8% | |||

Morgan Stanley, | 0.8% | |||

Boeing Co. (The), | 0.8% | |||

Lincoln National Corp., | 0.8% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

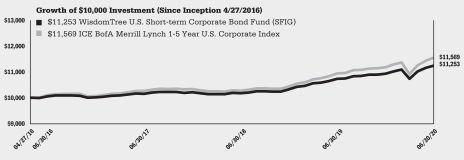

The WisdomTree U.S. Short-Term Corporate Bond Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree U.S. Short-Term Corporate Bond Index (the ‘‘Index’’). In seeking to track the Index, the Fund primarily invests in issuers in the short-term U.S. investment grade corporate bond market that are deemed to exhibit favorable fundamentals and opportunities for income. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 4.75% at net asset value (“NAV”) for the fiscal year ending June 30, 2020 (for more complete performance information please see the table below). The corporate bond market saw a large downturn in performance along with the rest of the markets in late March 2020 when many companies were forced to close their businesses entirely. However, since the lows in late March, many economies and businesses have started reopening again. This, alongside massive government assistance programs and encouraging vaccine developments, catapulted many markets on recovery trajectories. Investment grade companies, given their stronger balance sheets and cash flows, were better protected from this market turbulence than their riskier, high yield (‘junk’ status) counterparts, thus resulting in positive performance. This Fund also benefited from its fundamental screening process, in which it attempts to screen out potentially unfavorable companies that are susceptible to downgrades and defaults. This resulted in a higher quality basket of bonds that had fewer downgrades than the broader corporate bond market. The Fund benefited marginally from interest rates broadly declining, but would have benefited more so if the strategy had a longer maturity focus.

Shareholder Expense Example (for the six-month period ended June 30, 2020)

| Beginning Account Value | Ending Account Value | Annualized Net Expense Ratio | Expenses Paid During the Period | |||||||||||||

Actual | $ | 1,000.00 | $ | 1,027.90 | 0.18 | %1 | $ | 0.91 | ||||||||

Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,023.97 | 0.18 | %1 | $ | 0.91 | ||||||||

| 1 | WisdomTree Asset Management, Inc. has contractually agreed to limit the management fee to 0.18% through October 31, 2020, unless earlier terminated by the Board of Trustees of the WisdomTree Trust for any reason. |

Performance

| Average Annual Total Return | ||||||||||||

| 1 Year | 3 Year | Since Inception1 | ||||||||||

Fund NAV Returns | 4.75 | % | 3.43 | % | 2.87 | % | ||||||

Fund Market Price Returns | 4.96 | % | 3.72 | % | 2.85 | % | ||||||

WisdomTree U.S. Short-Term Corporate Bond Index2 | 5.12 | % | 3.78 | % | 3.30 | % | ||||||

ICE BofA Merrill Lynch 1-5 Year U.S. Corporate Index | 5.61 | % | 4.04 | % | 3.55 | % | ||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the Cboe BZX Exchange, Inc. on April 27, 2016. |

| 2 | Formerly, WisdomTree Fundamental U.S. Short-Term Corporate Bond Index prior to September 27, 2019. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| WisdomTree Trust | 13 |

Management’s Discussion of Funds’ Performance

as of June 30, 2020 (unaudited)

WisdomTree U.S. Short-Term High Yield Corporate Bond Fund (SFHY)

(formerly, WisdomTree Fundamental U.S. Short-Term High Yield Corporate Bond Fund)

Sector Breakdown†

| Sector | % of Net Assets | |||

Consumer Discretionary | 25.3% | |||

Financials | 10.3% | |||

Materials | 10.1% | |||

Health Care | 9.2% | |||

Energy | 8.9% | |||

Communication Services | 8.9% | |||

Industrials | 8.7% | |||

Information Technology | 6.3% | |||

Real Estate | 4.9% | |||

Consumer Staples | 4.0% | |||

Utilities | 0.0% | * | ||

Other Assets less Liabilities‡ | 3.4% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

| * | Represents less than 0.1%. |

Top Ten Holdings*

| Description | % of Net Assets | |||

Nielsen Finance LLC, 5.00%, 4/15/22 | 1.9% | |||

Springleaf Finance Corp., 6.13%, 5/15/22 | 1.9% | |||

Freeport-McMoRan, Inc., 3.88%, 3/15/23 | 1.8% | |||

NCR Corp., | 1.8% | |||

Newmark Group, Inc., 6.13%, 11/15/23 | 1.5% | |||

Tenet Healthcare Corp., 6.75%, 6/15/23 | 1.4% | |||

Goodyear Tire & Rubber Co. (The), | 1.4% | |||

CSC Holdings LLC, 5.88%, 9/15/22 | 1.4% | |||

DISH DBS Corp., 5.88%, 7/15/22 | 1.4% | |||

MGM Resorts International, 6.00%, 3/15/23 | 1.4% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

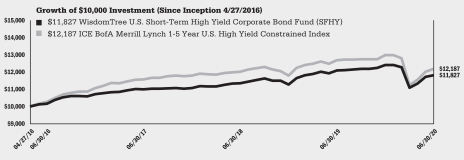

The WisdomTree U.S. Short-Term High Yield Corporate Bond Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree U.S. Short-Term High Yield Corporate Bond Index (the ‘‘Index’’). In seeking to track the Index, the Fund primarily invests in issuers in the short-term U.S. non-investment-grade corporate bond (‘‘junk bond’’ or “high yield”) market that are deemed to exhibit favorable fundamentals and opportunities for income. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned -2.34% at net asset value (“NAV”) for the fiscal year ending June 30, 2020 (for more complete performance information please see the table below). The corporate bond market, particularly in the high yield market, saw a large downturn in performance as many corporations faced economic pressures caused by the global pandemic. However, since the lows in late March, many economies and businesses have started reopening again. While high yield companies broadly speaking are well off of their lows, they are still lagging their investment grade counterparts in performance. The Fund benefited from its fundamental screening process, in which it attempts to screen out potentially unfavorable companies that are susceptible to defaults. This resulted in a higher quality basket of bonds that had far fewer defaults than the broader high yield corporate bond market. The Fund had outperformed its benchmark due to its relative underweight in more at-risk sectors like Energy. The Fund benefited marginally from interest rates broadly declining but would have benefited more so if the strategy had a longer maturity focus.

Shareholder Expense Example (for the six-month period ended June 30, 2020)

| Beginning Account Value | Ending Account Value | Annualized Net Expense Ratio | Expenses Paid During the Period | |||||||||||||

Actual | $ | 1,000.00 | $ | 951.80 | 0.38 | %1 | $ | 1.84 | ||||||||

Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,022.97 | 0.38 | %1 | $ | 1.91 | ||||||||

| 1 | WisdomTree Asset Management, Inc. has contractually agreed to limit the management fee to 0.38% through October 31, 2020, unless earlier terminated by the Board of Trustees of the WisdomTree Trust for any reason. |

Performance

| Average Annual Total Return | ||||||||||||

| 1 Year | 3 Year | Since Inception1 | ||||||||||

Fund NAV Returns | -2.34 | % | 2.43 | % | 4.10 | % | ||||||

Fund Market Price Returns | -2.50 | % | 3.15 | % | 4.15 | % | ||||||

WisdomTree U.S. Short-Term High Yield Corporate Bond Index2 | -4.47 | % | 1.84 | % | 4.40 | % | ||||||

ICE BofA Merrill Lynch 1-5 Year U.S. High Yield Constrained Index | -3.98 | % | 1.72 | % | 4.85 | % | ||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the Cboe BZX Exchange, Inc. on April 27, 2016. |

| 2 | Formerly, WisdomTree Fundamental U.S. Short-Term High Yield Corporate Bond Index prior to September 27, 2019. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| 14 | WisdomTree Trust |

Management’s Discussion of Funds’ Performance

as of June 30, 2020 (unaudited)

WisdomTree 90/60 U.S. Balanced Fund (NTSX)

Sector Breakdown†

| Sector | % of Net Assets | |||

Information Technology | 25.7% | |||

Health Care | 12.4% | |||

Consumer Discretionary | 10.3% | |||

Communication Services | 10.3% | |||

Financials | 8.9% | |||

Industrials | 7.1% | |||

Consumer Staples | 6.3% | |||

Utilities | 2.6% | |||

Real Estate | 2.4% | |||

Energy | 2.2% | |||

Materials | 2.0% | |||

U.S. Government Obligations | 0.8% | |||

Other Assets less Liabilities‡ | 9.0% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

Microsoft Corp. | 5.6% | |||

Apple, Inc. | 5.4% | |||

Amazon.com, Inc. | 4.1% | |||

Facebook, Inc., Class A | 1.9% | |||

Alphabet, Inc., Class C | 1.6% | |||

Alphabet, Inc., Class A | 1.5% | |||

Johnson & Johnson | 1.3% | |||

Berkshire Hathaway, Inc., Class B | 1.3% | |||

Visa, Inc., Class A | 1.2% | |||

Procter & Gamble Co. (The) | 1.0% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

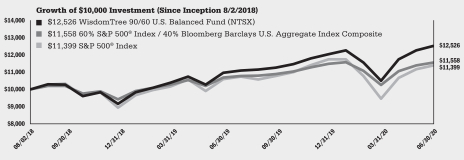

The WisdomTree 90/60 U.S. Balanced Fund (the ‘‘Fund’’) is actively managed using a model-based approach seeking total return. The Fund seeks to achieve its investment objective by investing in large-capitalization U.S. equity securities and U.S. Treasury futures contracts. Under normal circumstances, the Fund will invest approximately 90% of its net assets in U.S. equity securities and the notional exposure to the U.S. Treasury futures contracts’ positions will represent approximately 60% of the Fund’s net assets.

The Fund returned 14.25% at net asset value (“NAV”) for the fiscal year ended June 30, 2020 (for more complete performance information please see the table below). The Fund’s position in the equity asset class contributed most positively to performance while its position in short-term U.S. Treasury bills contributed minimally to performance. The Fund’s exposure to fixed income investments through its investments in U.S. Treasury futures contracts also contributed positively to performance during the fiscal year. Over the course of the fiscal year, the Fund benefited from broad based positive equity performance, albeit with a temporary market drop primarily in February 2020 due to the continued volatility. Broad based fixed income also had positive performance, due in large part to the volatile market environment and investors’ flight to safety assets. The Fund’s 90% weight in equity and 60% weight in fixed income captured the positive gains of both asset classes. The enhanced exposure compared to traditional 60% equity and 40% bond portfolios magnified the Fund’s returns and resulted in the overall positive performance of the Fund.

Shareholder Expense Example (for the six-month period ended June 30, 2020)

| Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the Period | |||||||||||||

Actual | $ | 1,000.00 | $ | 1,038.90 | 0.20 | % | $ | 1.01 | ||||||||

Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,023.87 | 0.20 | % | $ | 1.01 | ||||||||

Performance

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | 14.25 | % | 12.50 | % | ||||

Fund Market Price Returns | 14.32 | % | 12.52 | % | ||||

60% S&P 500® Index / 40% Bloomberg Barclays U.S. Aggregate Index Composite | 8.12 | % | 7.87 | % | ||||

S&P 500® Index | 7.51 | % | 7.09 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on August 2, 2018. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| WisdomTree Trust | 15 |

Management’s Discussion of Funds’ Performance

as of June 30, 2020 (unaudited)

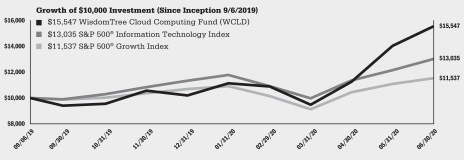

WisdomTree Cloud Computing Fund (WCLD)

Sector Breakdown†

| Sector | % of Net Assets | |||

Information Technology | 97.7% | |||

Health Care | 2.1% | |||

Other Assets less Liabilities‡ | 0.2% | |||