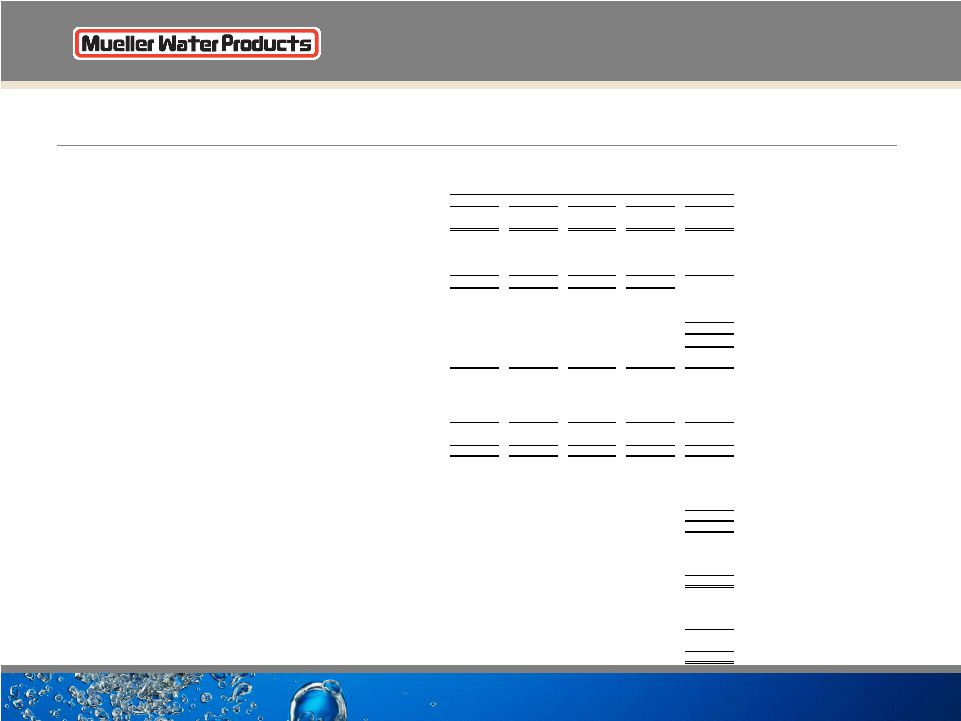

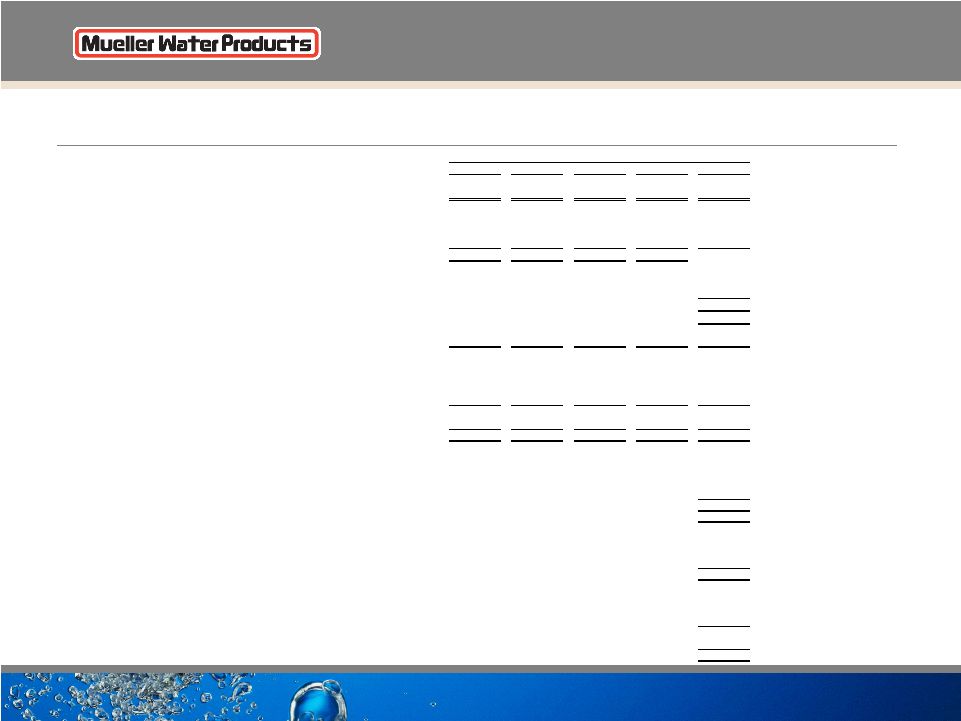

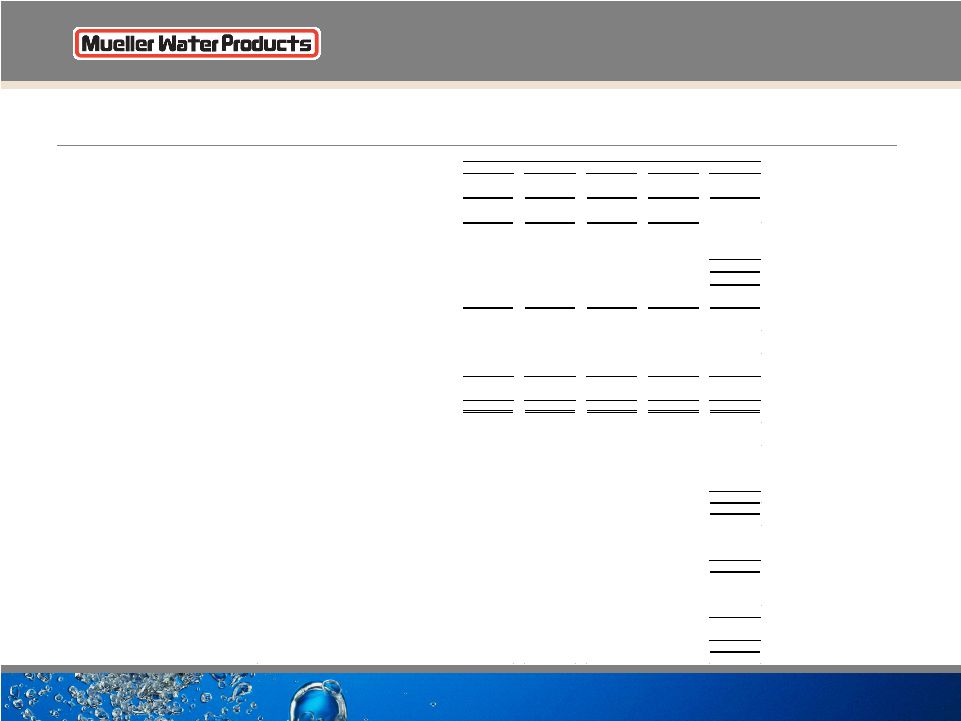

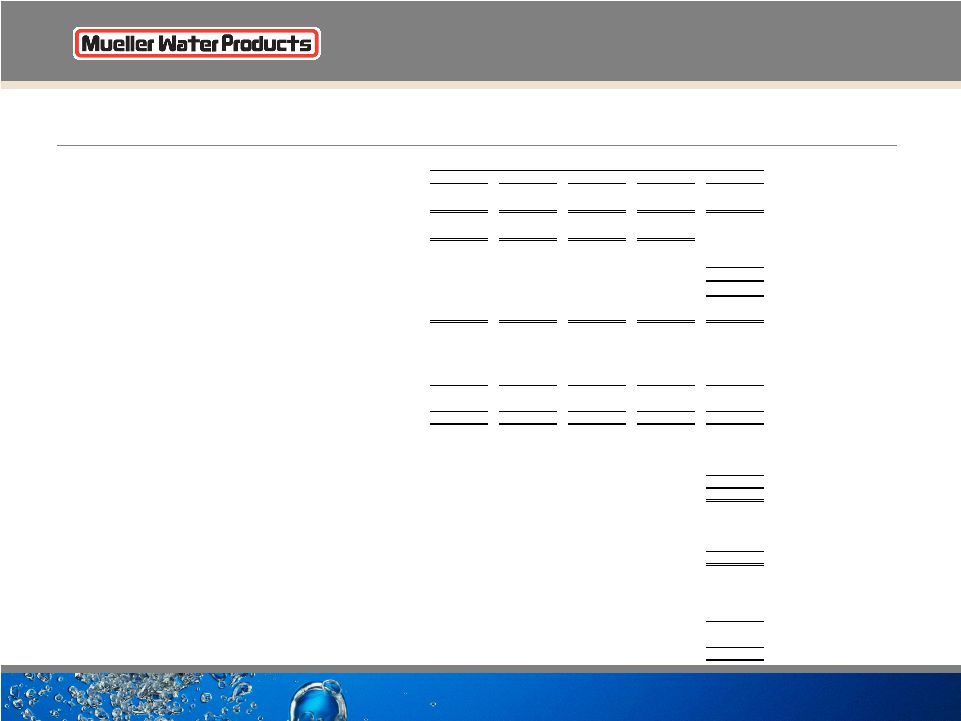

31 Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures (in millions, except per share amounts) Nine months ended June 30, 2010 Mueller Co. U.S. Pipe Anvil Corporate Total GAAP results: Net sales 449.1 $ 282.9 $ 258.8 $ - $ 990.8 $ Gross profit (loss) 121.2 $ (19.6) $ 63.0 $ 0.1 $ 164.7 $ Selling, general and administrative expenses 66.7 22.3 48.0 26.0 163.0 Restructuring 0.1 11.6 0.1 - 11.8 Income (loss) from operations 54.4 $ (53.5) $ 14.9 $ (25.9) $ (10.1) Interest expense, net 47.4 Loss on early extinguishment of debt 0.5 Income tax benefit (19.8) Net loss (38.2) $ Net loss per diluted share (0.25) $ Capital expenditures 9.8 $ 7.4 $ 4.1 $ 0.1 $ 21.4 $ Non-GAAP results: Adjusted income (loss) from operations and EBITDA: Income (loss) from operations 54.4 $ (53.5) $ 14.9 $ (25.9) $ (10.1) $ Restructuring 0.1 11.6 0.1 - 11.8 Adjusted income (loss) from operations 54.5 (41.9) 15.0 (25.9) 1.7 Depreciation and amortization 37.2 14.0 11.5 0.6 63.3 Adjusted EBITDA 91.7 $ (27.9) $ 26.5 $ (25.3) $ 65.0 $ Adjusted net loss: Net loss (38.2) $ Restructuring, net of tax 7.1 Tax on repatriation on Canadian earnings 2.2 Interest rate settlement costs, net of tax (0.7) Loss on early extinguishment of debt, net of tax 0.3 Adjusted net loss (29.3) $ Adjusted net loss per diluted share (0.19) $ Free cash flow: Net cash provided by operating activities 35.7 $ Capital expenditures (21.4) Free cash flow 14.3 $ Net debt (end of period): Current portion of long-term debt 10.5 $ Long-term debt 682.2 Total debt 692.7 Less cash and cash equivalents (77.1) Net debt 615.6 $ |