Exhibit 99.1

BB&T Capital Markets Commercial and

Industrial Conference

April 7, 2011

Mueller Water Products

Safe Harbor Statement

Safe Harbor Statement

This presentation contains certain statements that may be deemed “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements that address activities, events or developments that the Company intends, expects, plans, projects, believes or anticipates will or may occur in the future are forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements the Company makes regarding general economic conditions, spending by municipalities, the outlook for the residential and non-residential construction markets, improvements related to capacity utilization, the recovery, if any, of the Company’s end markets, and the potential effect of the refinancing on the Company’s operations, and the impact of these factors on the Company’s businesses. Forward-looking statements are based on certain assumptions and assessments made by the Company in light of its experience and perception of historical trends, current conditions and expected future developments. Actual results and the timing of events may differ materially from those contemplated by the forward-looking statements due to a number of factors, including regional, national or global political, economic, business, competitive, market and regulatory conditions and the following:

• the spending level for water and wastewater infrastructure;

• the demand level of manufacturing and construction activity;

• the Company’s ability to service its debt obligations; and

• the other factors that are described in the section entitled “RISK FACTORS” in Item 1A of our Annual Report on Form 10-K.

Undue reliance should not be placed on any forward-looking statements. The Company does not have any intention or obligation to update forward-looking statements, except as required by law.

2

Mueller Water Products

Non-GAAP Financial Measures

Non-GAAP Financial Measures

The Company presents adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per share, free cash flow and net debt as non-GAAP measures. Adjusted income (loss) from operations represents income (loss) from operations excluding impairment and restructuring. Adjusted EBITDA represents income (loss) from operations excluding impairment, restructuring, depreciation and amortization. The company presents adjusted EBITDA because it is a measure of performance management and believes it is frequently used by securities analysts, investors and interested parties in the evaluation of financial performance. Adjusted net income (loss) and adjusted net income (loss) per share exclude impairment, restructuring, loss on early extinguishment of debt, certain costs to settle interest rate swap contracts, the tax on the repatriation of earnings from Canada and the income tax effects of the previously mentioned items. These items are excluded because they are not considered indicative of recurring operations. Free cash flow represents cash flows from operating activities, less capital expenditures. It is presented as a measurement of cash flow because it is commonly used by the investment community. Net debt represents total debt less cash and cash equivalents. Net debt is commonly used by the investment community as a measure of indebtedness. Adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per share, free cash flow and net debt have limitations as analytical tools, and investors should not consider any of these non-GAAP measures in isolation or as a substitute for analysis of the Company’s results as reported under accounting principles generally accepted in the United States (“GAAP”).

A reconciliation of non-GAAP to GAAP results in included as an attachment to this presentation and has been posted online at www.muellerwaterproducts.com

3

Mueller Water Products Investment Highlights

Leading North American provider of water infrastructure and flow control products and services

Increasing investment needed in water infrastructure industry

One of the largest installed bases in the U.S.

Leading brands in water infrastructure

Leveraging brands to expand smart water infrastructure offering for diagnostic and data management

Low-cost manufacturing processes

Mueller Water Products

4

Mueller Water Products

Our Business

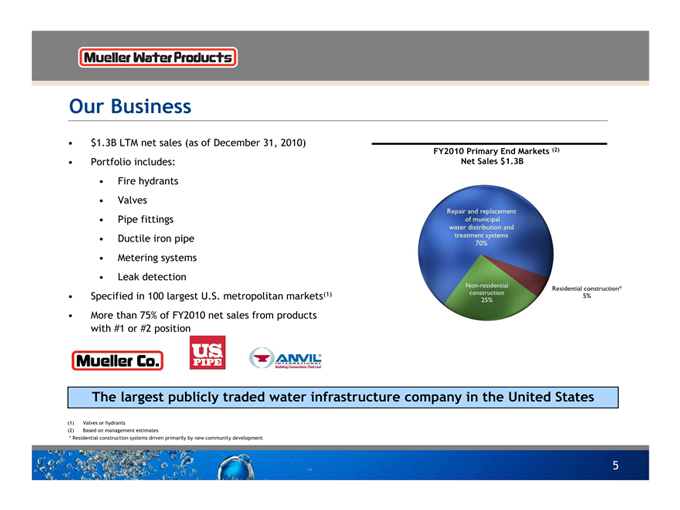

• $1.3B LTM net sales (as of December 31, 2010)

• Portfolio includes:

• Fire hydrants

• Valves

• Pipe fittings

• Ductile iron pipe

• Metering systems

• Leak detection

• Specified in 100 largest U.S. metropolitan markets(1)

• More than 75% of FY2010 net sales from products with #1 or #2 position

Mueller Co. US PIPE ANVIL International Building Connections That Last

FY2010 Primary End Markets (2)

Net Sales $1.3B

Repair and replacement of municipal water distribution and treatment systems 70%

Non-residential construction 25%

Residential construction* 5%

The largest publicly traded water infrastructure company in the United States

(1) Valves or hydrants

(2) Based on management estimates

* Residential construction systems driven primarily by new community development

5

Mueller Water Products

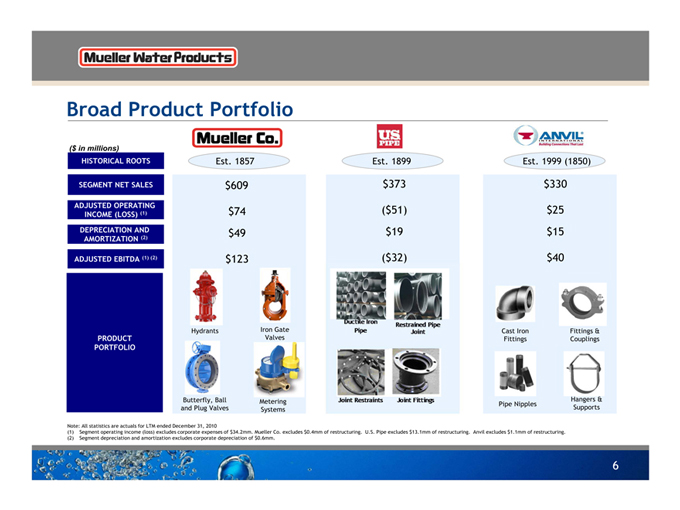

Broad Product Portfolio

($ in millions)

HISTORICAL ROOTS

SEGMENT NET SALES

ADJUSTED OPERATING INCOME (LOSS) (1)

DEPRECIATION AND AMORTIZATION (2)

ADJUSTED EBITDA (1) (2)

PRODUCT

PORTFOLIO

Mueller Co.

Est. 1857

$609

$74

$49

$123

Hydrants

Iron Gate Valves

Butterfly, Ball and Plug Valves

Metering Systems

US PIPE

Est. 1899

$373

($51)

$19

($32)

Ductile Iron Pipe

Restrained Pipe Joint

Joint Restraints

Joint Fittings

Anvil International Building Connections That Last

Est. 1999 (1850)

$330

$25

$15

$40

Cast Iron Fittings

Fittings & Couplings

Pipe Nipples

Hangers & Supports

Note: All statistics are actuals for LTM ended December 31, 2010

(1) Segment operating income (loss) excludes corporate expenses of $34.2mm. Mueller Co. excludes $0.4mm of restructuring. U.S. Pipe excludes $13.1mm of restructuring. Anvil excludes $1.1mm of restructuring.

(2) Segment depreciation and amortization excludes corporate depreciation of $0.6mm.

6

Mueller Water Products

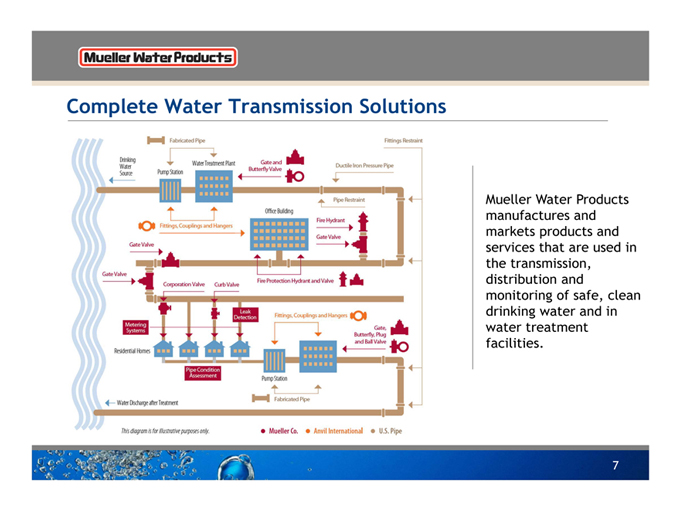

Complete Water Transmission Solutions

Fabricated Pipe Fittings Restraint

Drinking Water Source

Pump Station

Water Treatment Plant

Gate and Butterfly Valve

Ductile Iron Pressure Pipe

Pipe Restraint

Fittings, Couplings and Hangers

Office Building

Fire Hydrant

Gate Valve

Gate Valve

Gate Valve

Fire Protection Hydrant and Valve

Corporation Valve

Curb Valve

Leak Detection

Fittings, Couplings and Hangers

Metering Systems

Gate, Butterfly, Plug and Ball Valve

Residential Homes

Pipe Condition Assessment

Pump Station

Fabricated Pipe

Water Discharge after Treatment

This diagram is for illustrative purposes only.

• Muller Co.

• Anvil International

• U.S. Pipe

Mueller Water Products manufactures and markets products and services that are used in the transmission, distribution and monitoring of safe, clean drinking water and in water treatment facilities.

Mueller Water Products

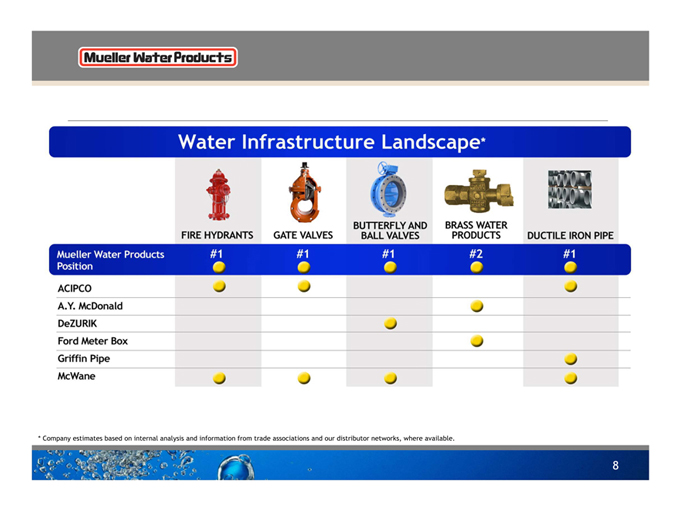

Water Infrastructure Landscape*

FIRE HYDRANTS

GATE VALVES

BUTTERFLY AND BALL VALVES

BRASS WATER PRODUCTS

DUCTILE IRON PIPE

Mueller Water Products Position #1 #1 #1 #2 #1

ACIPCO

A.Y. McDonald

DeZURIK

Ford Meter Box

Griffin Pipe

McWane

* Company estimates based on internal analysis and information from trade associations and our distributor networks, where available.

Mueller Water Products

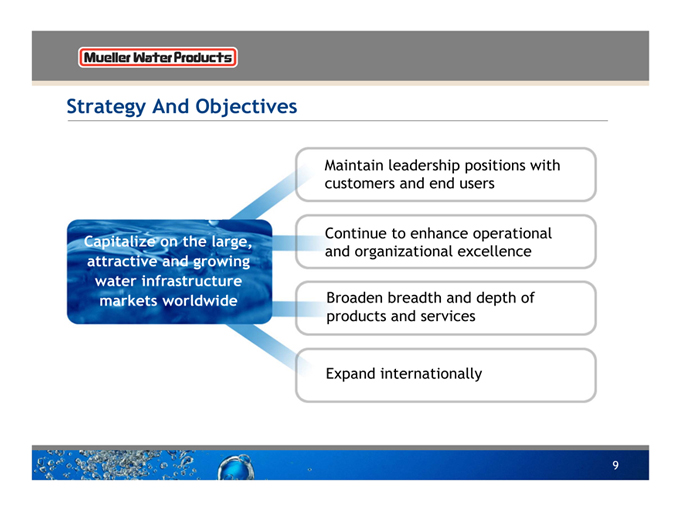

Strategy And Objectives

Capitalize on the large, attractive and growing water infrastructure markets worldwide

Maintain leadership positions with customers and end users

Continue to enhance operational and organizational excellence

Broaden breadth and depth of products and services

Expand internationally

9

Mueller Water Products

Our End Markets

Mueller Water Products

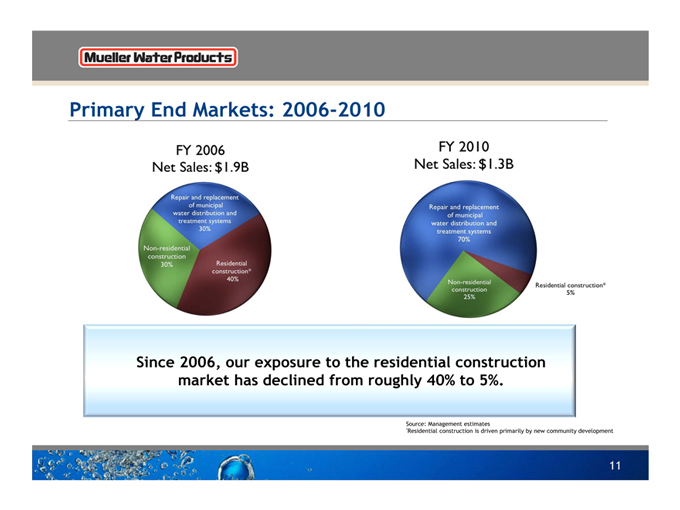

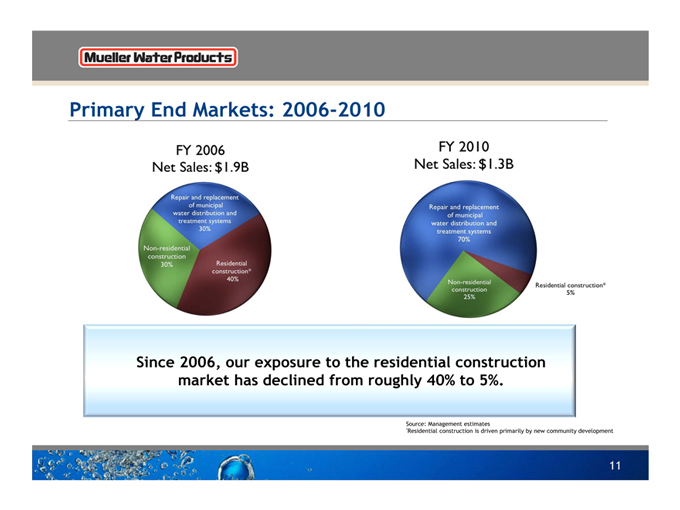

Primary End Markets: 2006-2010

FY 2006

Net Sales: $1.9B

FY 2010

Net Sales: $1.3B

Repair and replacement of municipal water distribution and treatment systems 30%

Non-residenetial construction 30%

Residential construction* 40%

Repair and replacement of municipal water distribution and treatment systems 70%

Non-residential construction 25%

Residential construction* 5%

Since 2006, our exposure to the residential construction market has declined from roughly 40% to 5%.

Source: Management estimates

*Residential construction is driven primarily by new community development

11

Mueller Water Products

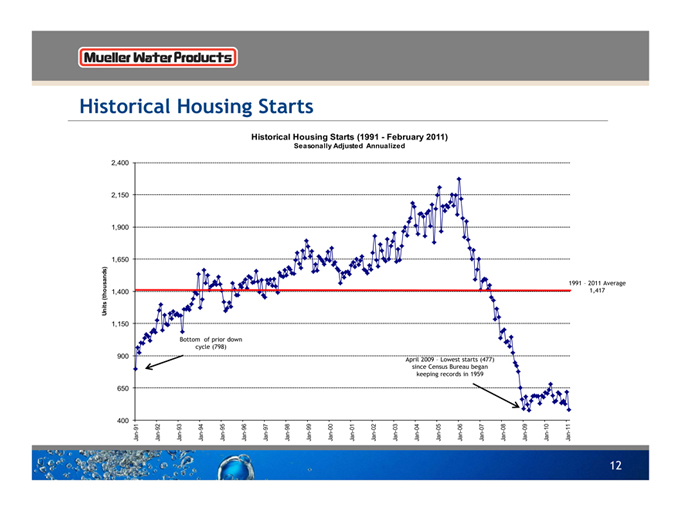

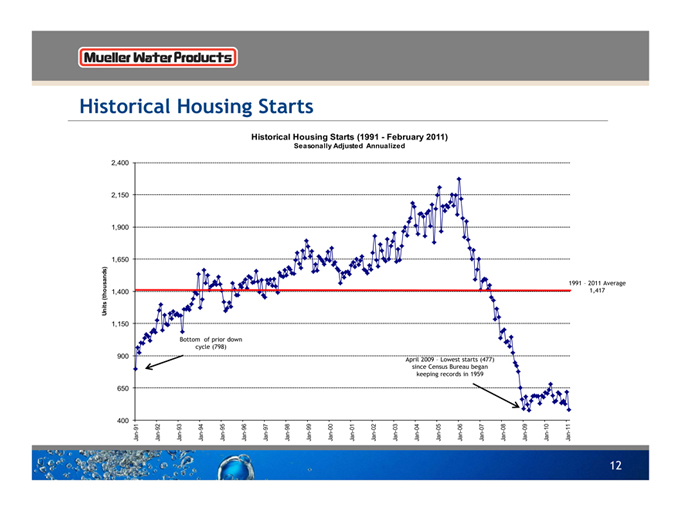

Historical Housing Starts

Historical Housing Starts (1991 - February 2011)

Seasonally Adjusted Annualized

2,400 2,150 1,900 1,650

Units (thousands)

1,400 1,150 900 650 400

Bottom of prior down cycle (798)

April 2009 – Lowest starts (477) since Census Bureau began keeping records in 1959

1991 – 2011 Average 1,417

Jan-91 Jan-92 Jan-93 Jan-94 Jan-95 Jan-96 Jan-97 Jan-98 Jan-99 Jan-00 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11

12

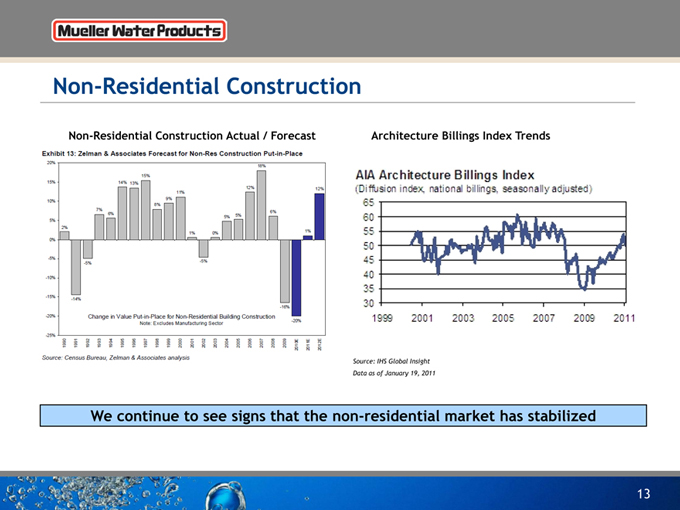

Non-Residential Construction

Non-Residential Construction Actual / Forecast

Exhibit 13: Zelman & Associates Forecast for Non-Res Construction Put-in-Place

20% 15% 10% 5% 0% -5% -10% -15% -20% -25%

2% -14% -5% 7% 6% 14% 13% 15% 8% 9% 11% 1% -5% 0% 5% 5% 12% 18% 6% -16% -20% 1% 12%

Change in Value Put-in-Place for Non-Residential Building Construction

Note: Excludes Manufacturing Sector

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010E 2011E 2012E

Source: Census Bureau, Zelman & Associates analysis

Architecture Billings Index Trends

AIA Architecture Billings Index

(Diffusion index, national billings, seasonally adjusted)

65 60 55 50 45 40 35 30

1999 2001 2003 2005 2007 2009 2011

Source: IHS Global Insight Data as of January 19, 2011

We continue to see signs that the non-residential market has stabilized

13

Mueller Water Products

A Significant Market Opportunity

Mueller Water Products

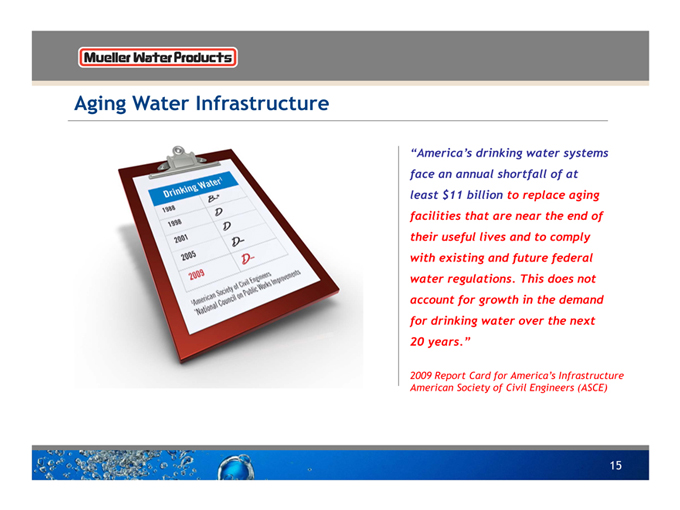

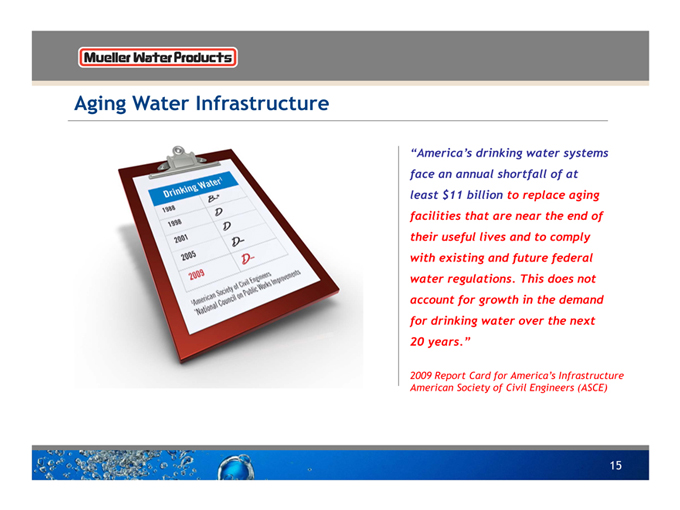

Aging Water Infrastructure

Drinking Water1

1988 B*

1998 D

2001 D

2005 D-

2009 D-

1American Society of Civil Engineers

*National Council on Public Works Improvements

“America’s drinking water systems face an annual shortfall of at least $11 billion to replace aging facilities that are near the end of their useful lives and to comply with existing and future federal water regulations. This does not account for growth in the demand for drinking water over the next 20 years.”

2009 Report Card for America’s Infrastructure American Society of Civil Engineers (ASCE)

15

Mueller Water Products

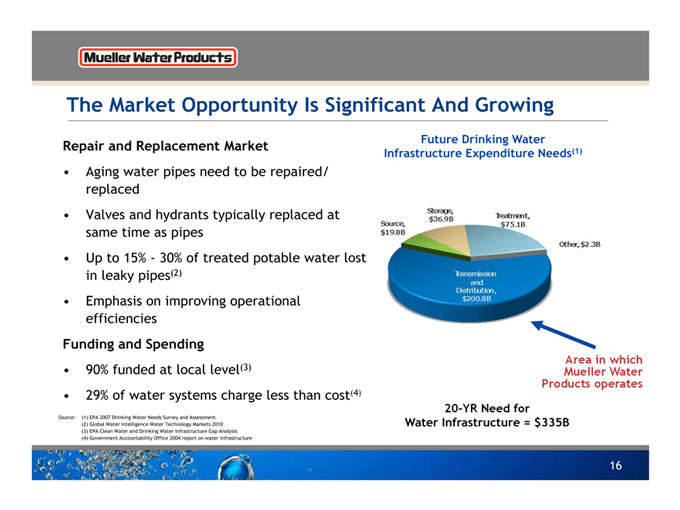

The Market Opportunity Is Significant And Growing

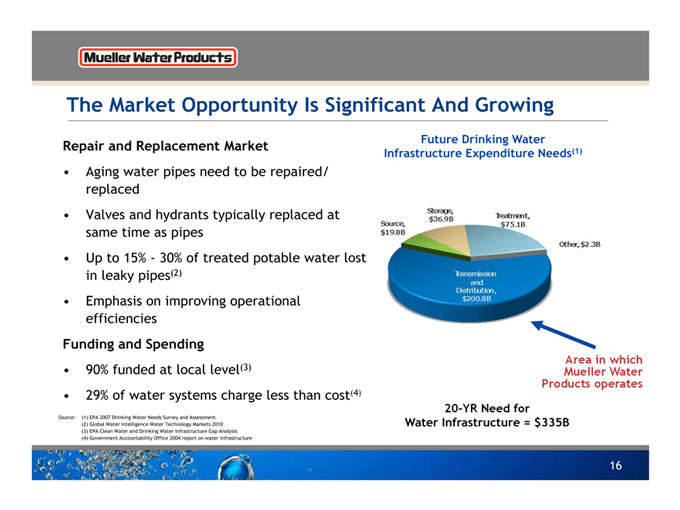

Repair and Replacement Market

• Aging water pipes need to be repaired/ replaced

• Valves and hydrants typically replaced at same time as pipes

• Up to 15% - 30% of treated potable water lost in leaky pipes(2)

• Emphasis on improving operational efficiencies

Funding and Spending

• 90% funded at local level(3)

• 29% of water systems charge less than cost(4)

Source: (1) EPA 2007 Drinking Water Needs Survey and Assessment

(2) Global Water Intelligence Water Technology Markets 2010

(3) EPA Clean Water and Drinking Water Infrastructure Gap Analysis

(4) Government Accountability Office 2004 report on water infrastructure

Future Drinking Water

Infrastructure Expenditure Needs(1)

Source, $19.8B

Storage, $36.9B

Treatment, $75.1B

Other, $2.3B

Transmission and Distribution, $200.8B

Area in which Mueller Water Products operates

20-YR Need for Water Infrastructure = $335B

16

Mueller Water Products

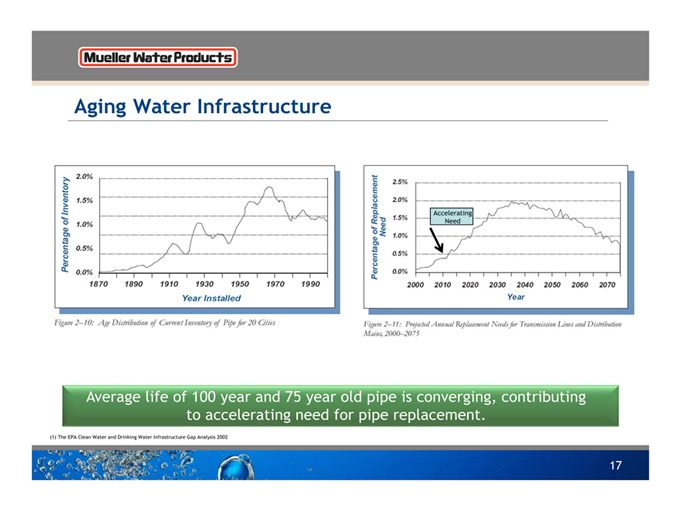

Aging Water Infrastructure

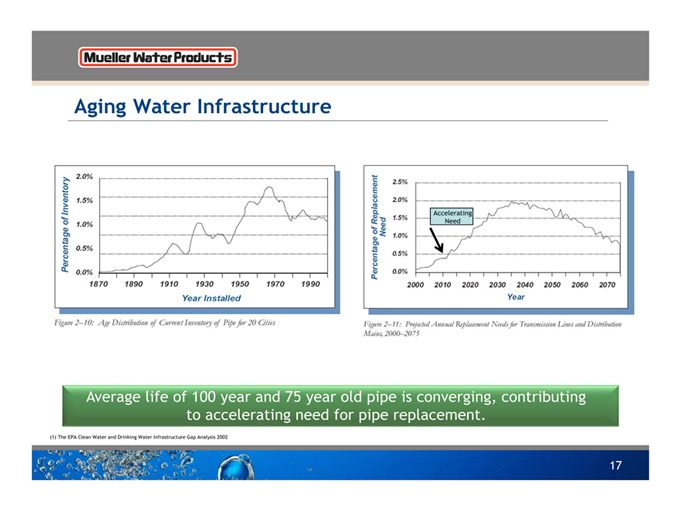

Percentage of Inventory

2.0% 1.5% 1.0% 0.5% 0.0% 1870 1890 1910 1930 1950 1970 1990

Year Installed

Figure 2–10: Age Distribution of Current Inventory of Pipe for 20 Cities

Percentage of Replacement Need

2.5% 2.0% 1.5% 1.0% 0.5% 0.0%

Accelerating Need

2000 2010 2020 2030 2040 2050 2060 2070

Year

Figure 2–11: Projected Annual Replacement Needs for Transmission Lines and Distribution Mains, 2000-2075

Average life of 100 year and 75 year old pipe is converging, contributing to accelerating need for pipe replacement.

(1) The EPA Clean Water and Drinking Water Infrastructure Gap Analysis 2002

17

Mueller Water Products

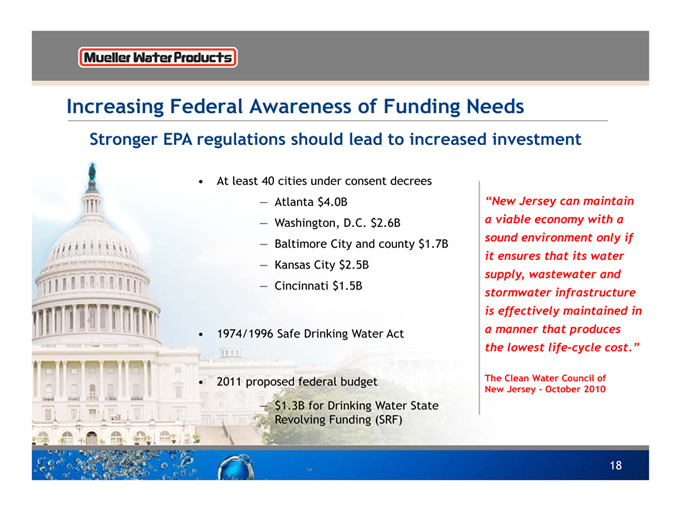

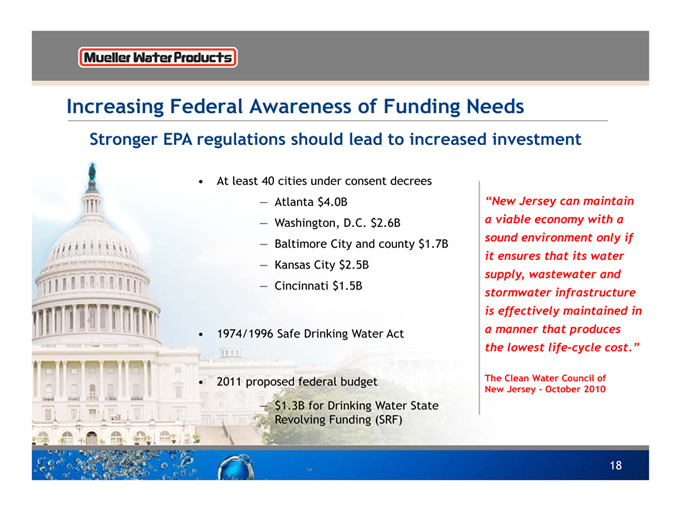

Increasing Federal Awareness of Funding Needs

Stronger EPA regulations should lead to increased investment

• At least 40 cities under consent decrees

— Atlanta $4.0B

— Washington, D.C. $2.6B

— Baltimore City and county $1.7B

— Kansas City $2.5B

— Cincinnati $1.5B

• 1974/1996 Safe Drinking Water Act

• 2011 proposed federal budget

— $1.3B for Drinking Water State Revolving Funding (SRF)

“New Jersey can maintain a viable economy with a sound environment only if it ensures that its water supply, wastewater and stormwater infrastructure is effectively maintained in a manner that produces the lowest life-cycle cost.”

The Clean Water Council of New Jersey - October 2010

18

Mueller Water Products

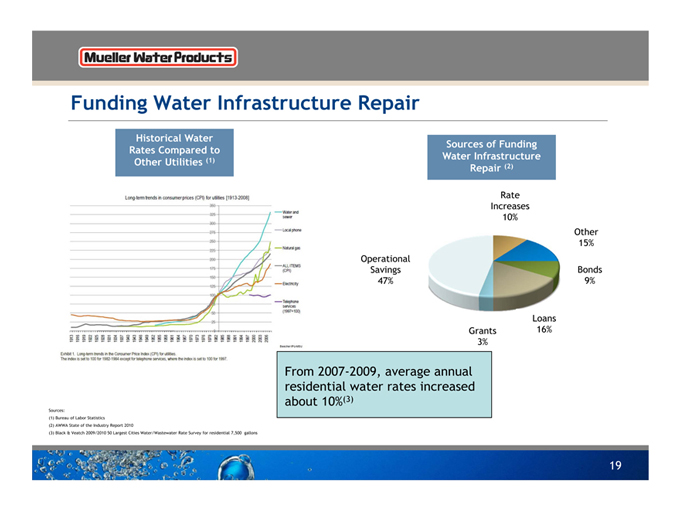

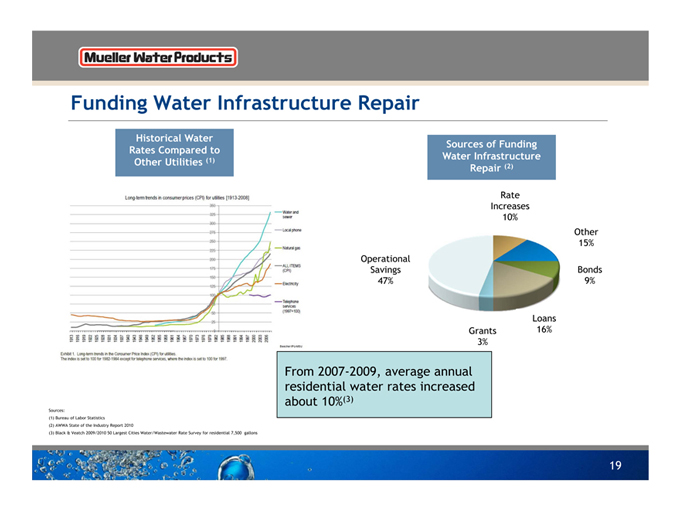

Funding Water Infrastructure Repair

Historical Water Rates Compared to Other Utilities (1)

Long-term trends in consumer prices (CPI) for utilities [1913-2008]

350 325 300 275 250 225 200 175 150 125 100 75 50 25 0

1913 1916 1919 1922 1925 1931 1934 1937 1940 1943 1946 1949 1952 1955 1958 1961 1964 1967 1970 1973 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 2006

—Water and sewer

—Local Phone

—Natural gas

—ALL ITEMS

(CPI)

—Electricity

—Telephone services (1997=100)

Exhibit 1. Long-term trends in the Consumer Price Index (CPI) for Utilities.

The index is set to 100 for 1982-1984 except for telephone services, where the index is set to 100 for 1997.

Sources:

(1) Bureau of Labor Statistics

(2) AWWA State of the Industry Report 2010

(3) Black & Veatch 2009/2010 50 Largest Cities Water/Wastewater Rate Survey for residential 7,500 gallons

Sources of Funding Water Infrastructure Repair (2)

Operational Savings 47%

Rate Increases 10%

Other 15%

Bonds 9%

Grants 3%

Loans 16%

From 2007-2009, average annual residential water rates increased about 10%(3)

19

Mueller Water Products

Actions & Business Results

Mueller Water Products

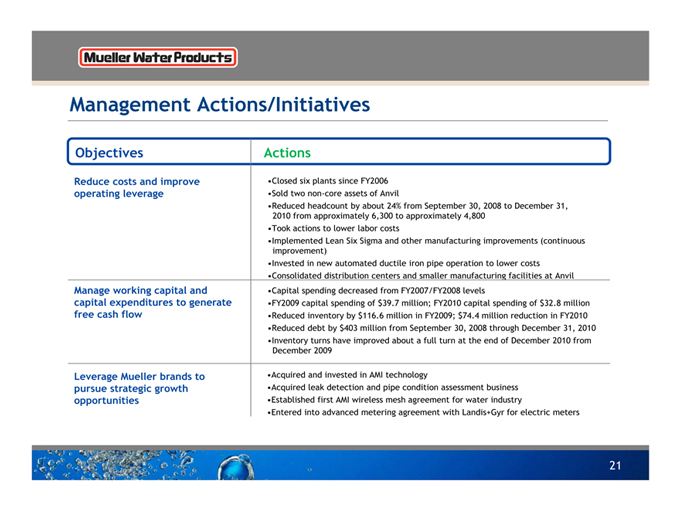

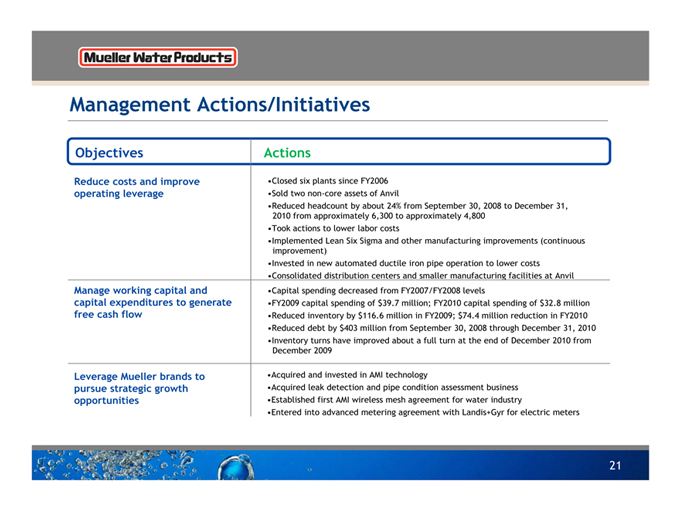

Management Actions/Initiatives

Objectives

Reduce costs and improve operating leverage

Manage working capital and capital expenditures to generate free cash flow

Leverage Mueller brands to pursue strategic growth opportunities

Actions

•Closed six plants since FY2006 •Sold two non-core assets of Anvil

•Reduced headcount by about 24% from September 30, 2008 to December 31, 2010 from approximately 6,300 to approximately 4,800 •Took actions to lower labor costs •Implemented Lean Six Sigma and other manufacturing improvements (continuous improvement) •Invested in new automated ductile iron pipe operation to lower costs •Consolidated distribution centers and smaller manufacturing facilities at Anvil •Capital spending decreased from FY2007/FY2008 levels •FY2009 capital spending of $39.7 million; FY2010 capital spending of $32.8 million •Reduced inventory by $116.6 million in FY2009; $74.4 million reduction in FY2010 •Reduced debt by $403 million from September 30, 2008 through December 31, 2010 •Inventory turns have improved about a full turn at the end of December 2010 from December 2009

•Acquired and invested in AMI technology

•Acquired leak detection and pipe condition assessment business •Established first AMI wireless mesh agreement for water industry

•Entered into advanced metering agreement with Landis+Gyr for electric meters

21

Mueller Water Products

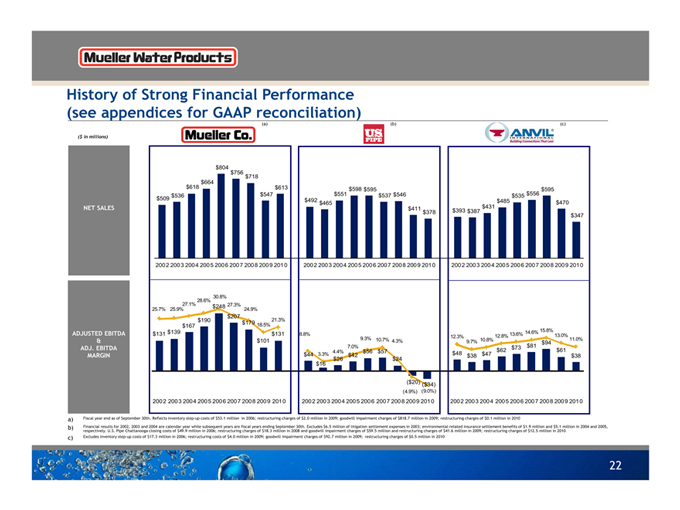

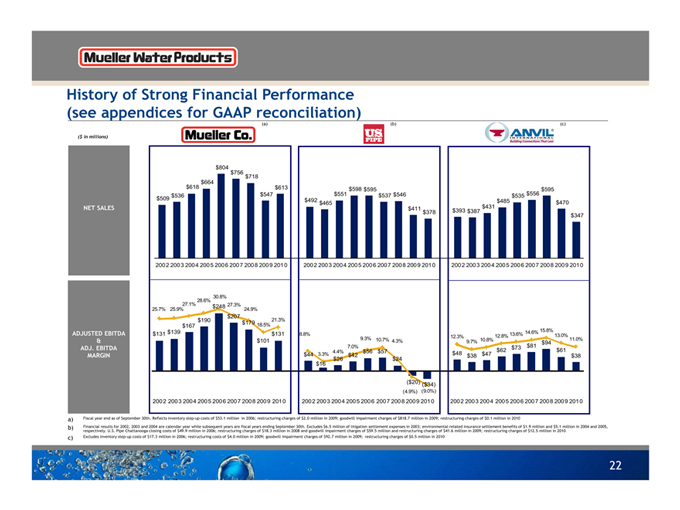

History of Strong Financial Performance

(see appendices for GAAP reconciliation)

($ in millions) Mueller Co. (a) US PIPE (b) ANVIL INTERNATIONAL Building Connections That Last

NET SALES

$509 $536 $618 $664 $804 $756 $718 $547 $613

2002 2003 2004 2005 2006 2007 2008 2009 2010

$492 $465 $551 $598 $595 $537 $546 $411 $378

2002 2003 2004 2005 2006 2007 2008 2009 2010

$393 $387 $431 $485 $535 $556 $595 $470 $347

2002 2003 2004 2005 2006 2007 2008 2009 2010

ADJUSTED EBITDA & ADJ. EBITDA MARGIN

25.7% 25.9% 27.1% 28.6% 30.8% 27.3% 24.9% 18.5% 21.3%

$131 $139 $167 $190 $248 $207 $179 $101 $131

2002 2003 2004 2005 2006 2007 2008 2009 2010

8.8% 3.3% 4.4% 7.0% 9.3% 10.7% 4.3%

$44 $16 $26 $42 $56 $57 $24 ($20) ($34) (4.9%) (9.0%)

2002 2003 2004 2005 2006 2007 2008 2009 2010

12.3% 9.7% 10.8% 12.8% 13.6% 14.6% 15.8% 13.0% 11.0%

$48 $38 $47 $62 $73 $81 $94 $61 $38

2002 2003 2004 2005 2006 2007 2008 2009 2010

a) Fiscal year end as of September 30th. Reflects inventory step-up costs of $53.1 million in 2006; restructuring charges of $2.0 million in 2009; goodwill impairment charges of $818.7 million in 2009; restructuring charges of $0.1 million in 2010

b) Financial results for 2002, 2003 and 2004 are calendar year while subsequent years are fiscal years ending September 30th. Excludes $6.5 million of litigation settlement expenses in 2003; environmental-related insurance settlement benefits of $1.9 million and $5.1 million in 2004 and 2005, respectively. U.S. Pipe Chattanooga closing costs of $49.9 million in 2006; restructuring charges of $18.3 million in 2008 and goodwill impairment charges of $59.5 million and restructuring charges of $41.6 million in 2009; restructuring charges of $12.5 million in 2010

c) Excludes inventory step-up costs of $17.3 million in 2006; restructuring costs of $4.0 million in 2009; goodwill impairment charges of $92.7 million in 2009; restructuring charges of $0.5 million in 2010

22

Mueller Water Products

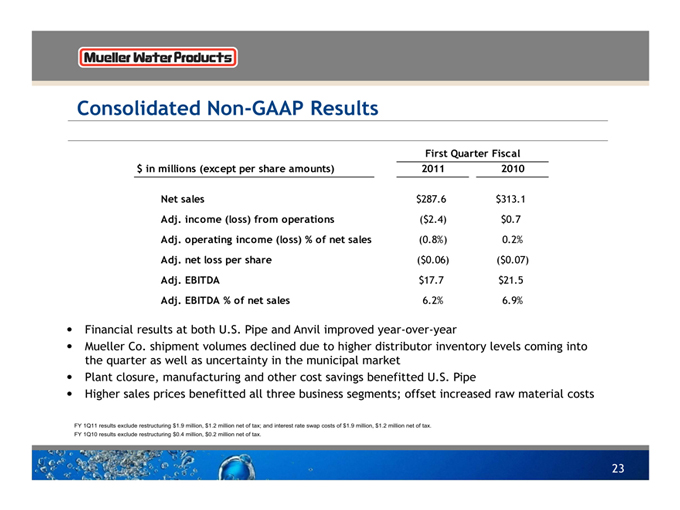

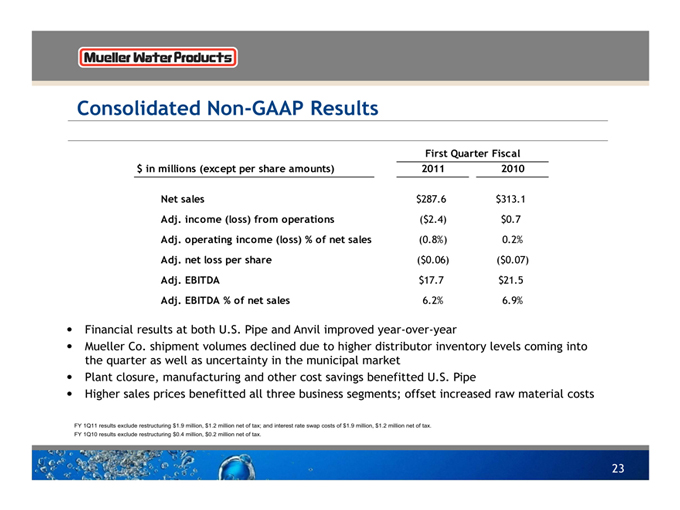

Consolidated Non-GAAP Results

First Quarter Fiscal

$ in millions (except per share amounts) 2011 2010

Net sales $287.6 $313.1

Adj. income (loss) from operations ($2.4) $0.7

Adj. operating income (loss) % of net sales (0.8%) 0.2%

Adj. net loss per share ($0.06) ($0.07)

Adj. EBITDA $17.7 $21.5

Adj. EBITDA % of net sales 6.2% 6.9%

• Financial results at both U.S. Pipe and Anvil improved year-over-year

• Mueller Co. shipment volumes declined due to higher distributor inventory levels coming into the quarter as well as uncertainty in the municipal market

• Plant closure, manufacturing and other cost savings benefitted U.S. Pipe

• Higher sales prices benefitted all three business segments; offset increased raw material costs

FY 1Q11 results exclude restructuring $1.9 million, $1.2 million net of tax; and interest rate swap costs of $1.9 million, $1.2 million net of tax.

FY 1Q10 results exclude restructuring $0.4 million, $0.2 million net of tax.

23

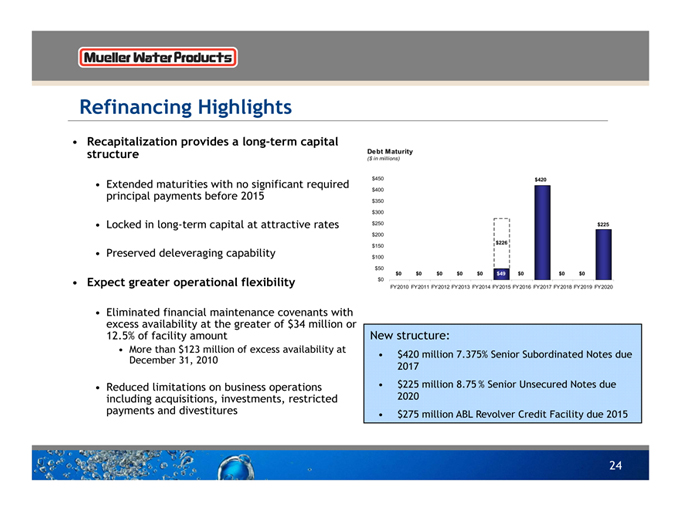

Mueller Water Products

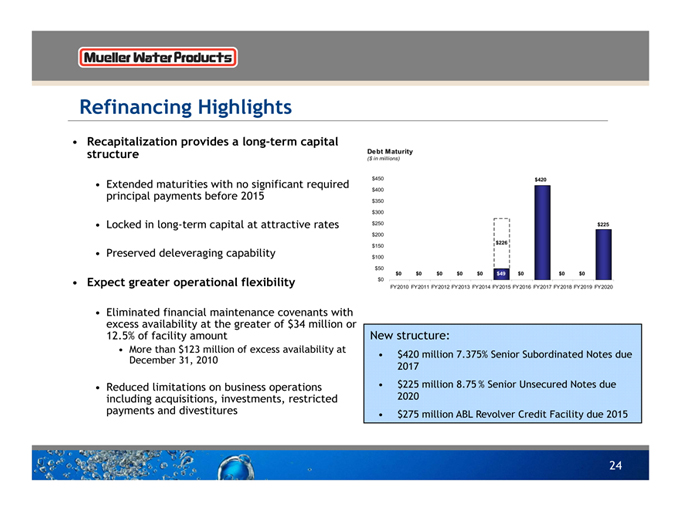

Refinancing Highlights

• Recapitalization provides a long-term capital structure

• Extended maturities with no significant required principal payments before 2015

• Locked in long-term capital at attractive rates

• Preserved deleveraging capability

• Expect greater operational flexibility

• Eliminated financial maintenance covenants with excess availability at the greater of $34 million or 12.5% of facility amount

• More than $123 million of excess availability at December 31, 2010

• Reduced limitations on business operations including acquisitions, investments, restricted payments and divestitures

Debt Maturity

($ in millions)

$450 $400 $350 $300 $250 $200 $150 $100 $50 $0

$226 $420 $225

$0 $0 $0 $0 $0 $49 $0 $0 $0

FY2010 FY2011 FY2012 FY2013 FY2014 FY2015 FY2016 FY2017 FY2018 FY2019 FY2020

New structure:

• $420 million 7.375% Senior Subordinated Notes due 2017

• $225 million 8.75% Senior Unsecured Notes due 2020

• $275 million ABL Revolver Credit Facility due 2015

24

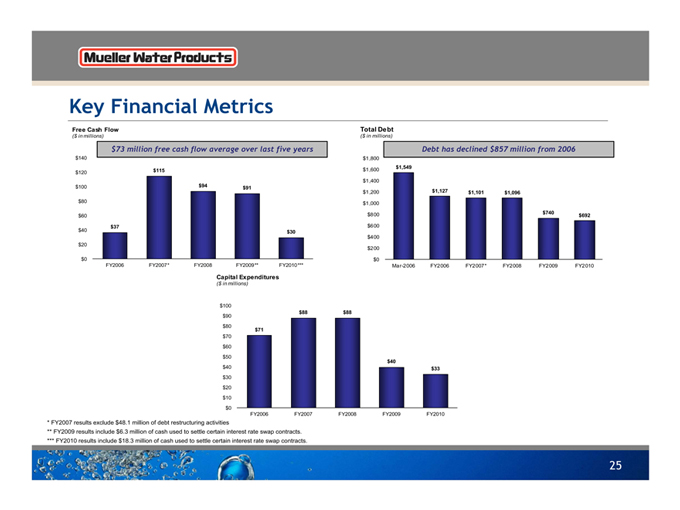

Mueller Water Products

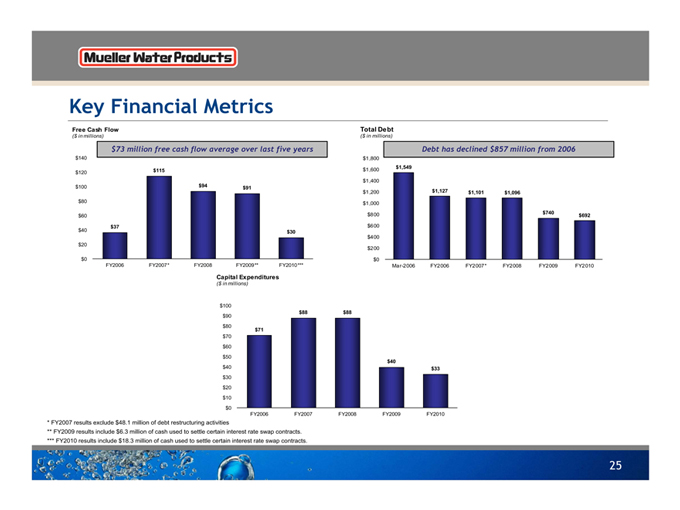

Key Financial Metrics

Free Cash Flow

($ in millions)

$73 million free cash flow average over last five years

$140 $120 $100 $80 $60 $40 $20 $0

$37 $115 $94 $91 $30

FY2006 FY2007* FY2008 FY2009** FY2010***

Total Debt

($ in millions)

Debt has declined $857 million from 2006

$1,800 $1,600 $1,400 $1,200 $1,000 $800 $600 $400 $200 $0

$1,549 $1,127 $1,101 $1,096 $740 $692

Mar-2006 FY2006 FY2007* FY2008 FY2009 FY2010

Capital Expenditures

($ in millions)

$100 $90 $80 $70 $60 $50 $40 $30 $20 $10 $0

$71 $88 $88 $40 $33

FY2006 FY2007 FY2008 FY2009 FY2010

* FY2007 results exclude $48.1 million of debt restructuring activities

** FY2009 results include $6.3 million of cash used to settle certain interest rate swap contracts.

*** FY2010 results include $18.3 million of cash used to settle certain interest rate swap contracts.

25

Mueller Water Products

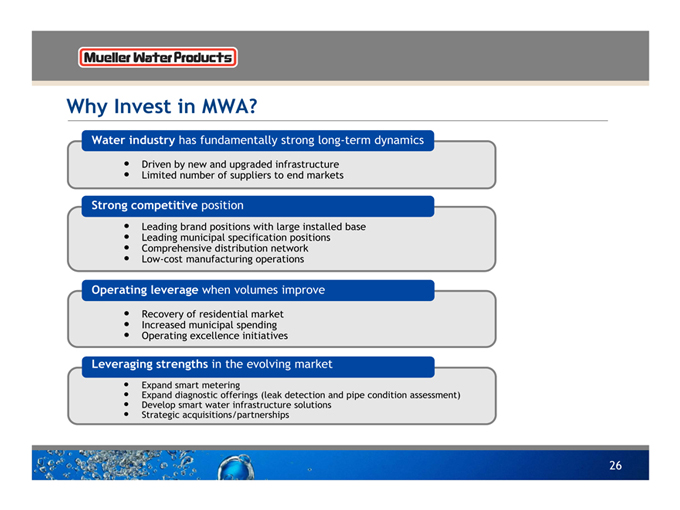

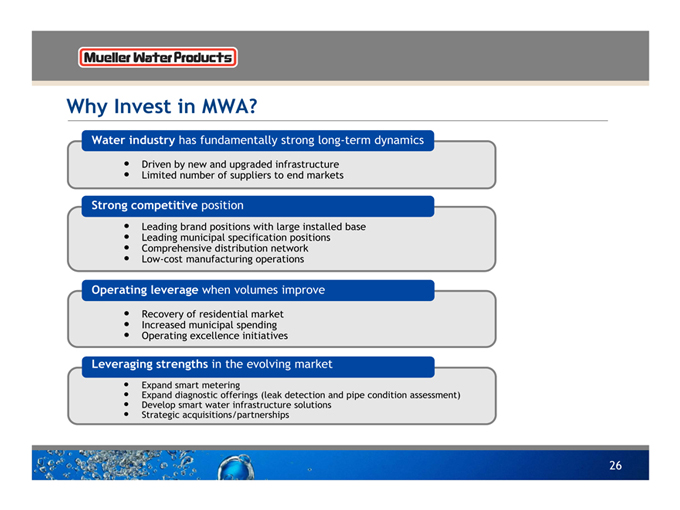

Why Invest in MWA?

Water industry has fundamentally strong long-term dynamics

• Driven by new and upgraded infrastructure

• Limited number of suppliers to end markets

Strong competitive position

• Leading brand positions with large installed base

• Leading municipal specification positions

• Comprehensive distribution network

• Low-cost manufacturing operations

Operating leverage when volumes improve

• Recovery of residential market

• Increased municipal spending

• Operating excellence initiatives

Leveraging strengths in the evolving market

• Expand smart metering

• Expand diagnostic offerings (leak detection and pipe condition assessment)

• Develop smart water infrastructure solutions

• Strategic acquisitions/partnerships

26

Mueller Water Products

Supplemental Data

Mueller Water Products

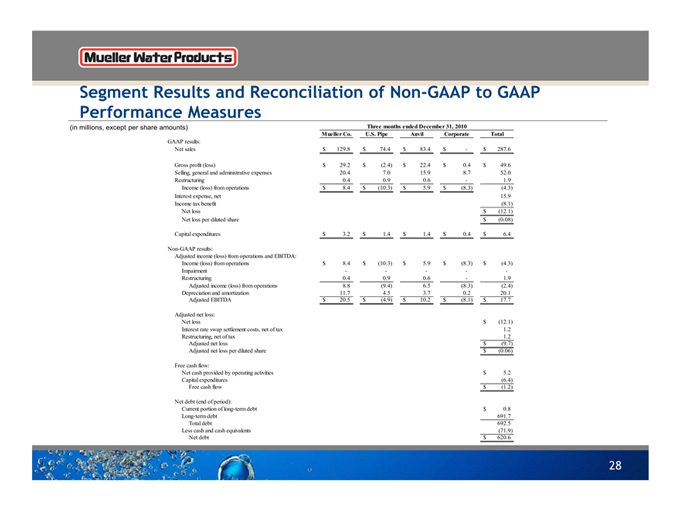

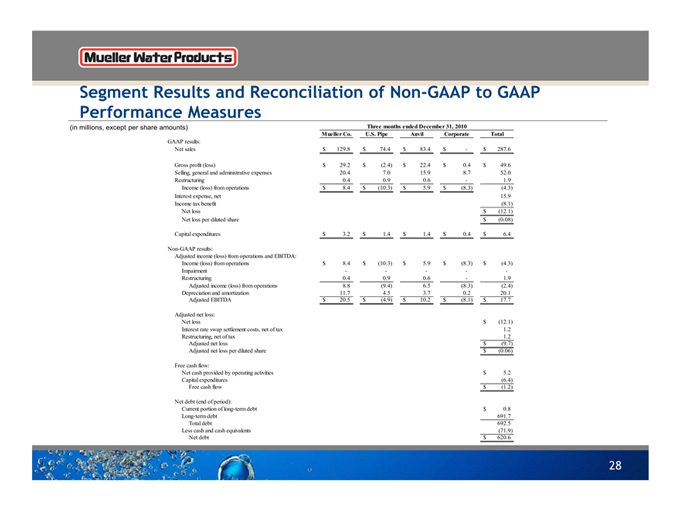

Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures

(in millions, except per share amounts)

Three months ended December 31, 2010

Mueller Co. U.S. Pipe Anvil Corporate Total

GAAP results:

Net sales $ 129.8 $ 74.4 $ 83.4 $ - $ 287.6

Gross profit (loss) $ 29.2 $ (2.4) $ 22.4 $ 0.4 $ 49.6

Selling, general and administrative expenses 20.4 7.0 15.9 8.7 52.0

Restructuring 0.4 0.9 0.6 - 1.9

Income (loss) from operations $ 8.4 $ (10.3) $ 5.9 $ (8.3) (4.3)

Interest expense, net 15.9

Income tax benefit (8.1)

Net loss $ (12.1)

Net loss per diluted share $ (0.08)

Capital expenditures $ 3.2 $ 1.4 $ 1.4 $ 0.4 $ 6.4

Non-GAAP results:

Adjusted income (loss) from operations and EBITDA:

Income (loss) from operations $ 8.4 $ (10.3) $ 5.9 $ (8.3) $ (4.3)

Impairment - - - - -

Restructuring 0.4 0.9 0.6 -1.9

Adjusted income (loss) from operations 8.8 (9.4) 6.5 (8.3) (2.4)

Depreciation and amortization 11.7 4.5 3.7 0.2 20.1

Adjusted EBITDA $ 20.5 $ (4.9) $ 10.2 $ (8.1) $ 17.7

Adjusted net loss:

Net loss $ (12.1)

Interest rate swap settlement costs, net of tax 1.2

Restructuring, net of tax 1.2

Adjusted net loss $ (9.7)

Adjusted net loss per diluted share $ (0.06)

Free cash flow:

Net cash provided by operating activities $ 5.2

Capital expenditures (6.4)

Free cash flow $ (1.2)

Net debt (end of period):

Current portion of long-term debt $ 0.8

Long-term debt 691.7

Total debt 692.5

Less cash and cash equivalents (71.9)

Net debt $ 620.6

28

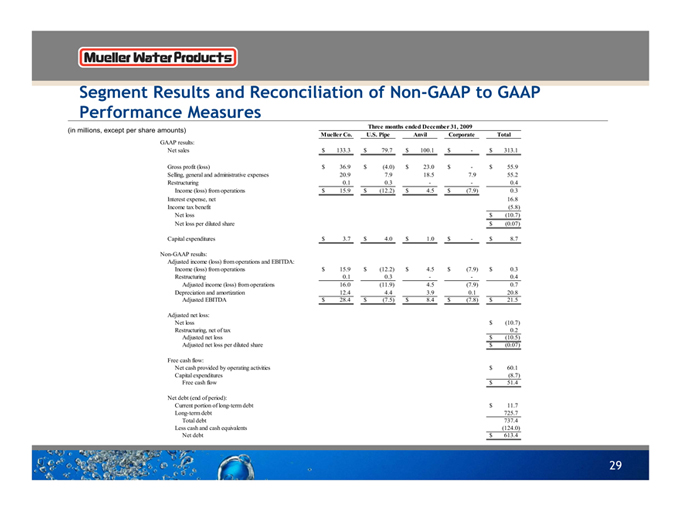

Mueller Water Products

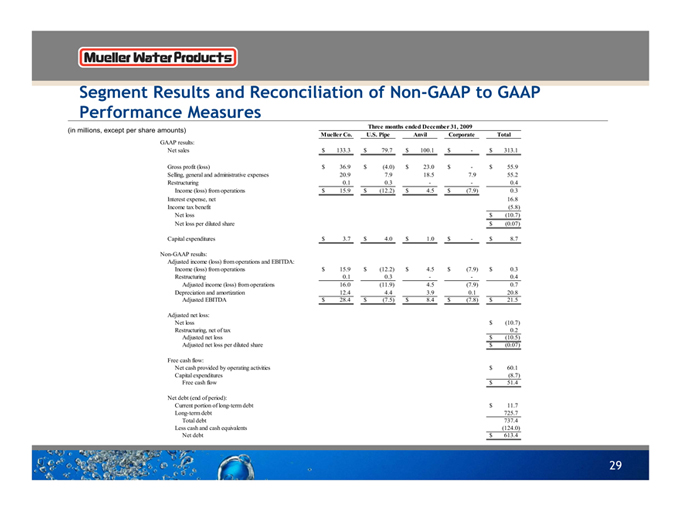

Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures

(in millions, except per share amounts)

Three months ended December 31, 2009

Mueller Co. U.S. Pipe Anvil Corporate Total

GAAP results:

Net sales $ 133.3 $ 79.7 $ 100.1 $ - $ 313.1

Gross profit (loss) $ 36.9 $ (4.0) $ 23.0 $ - $ 55.9

Selling, general and administrative expenses 20.9 7.9 18.5 7.9 55.2

Restructuring 0.1 0.3 - - 0.4

Income (loss) from operations $ 15.9 $ (12.2) $ 4.5 $ (7.9) 0.3

Interest expense, net 16.8

Income tax benefit (5.8)

Net loss $ (10.7)

Net loss per diluted share $ (0.07)

Capital expenditures $ 3.7 $ 4.0 $ 1.0 $ - $ 8.7

Non-GAAP results:

Adjusted income (loss) from operations and EBITDA:

Income (loss) from operations $ 15.9 $ (12.2) $ 4.5 $ (7.9) $ 0.3

Restructuring 0.1 0.3 - - 0.4

Adjusted income (loss) from operations 16.0 (11.9) 4.5 (7.9) 0.7

Depreciation and amortization 12.4 4.4 3.9 0.1 20.8

Adjusted EBITDA $ 28.4 $ (7.5) $ 8.4 $ (7.8) $ 21.5

Adjusted net loss:

Net loss $ (10.7)

Restructuring, net of tax 0.2

Adjusted net loss $ (10.5)

Adjusted net loss per diluted share $ (0.07)

Free cash flow:

Net cash provided by operating activities $ 60.1

Capital expenditures (8.7)

Free cash flow $ 51.4

Net debt (end of period):

Current portion of long-term debt $ 11.7

Long-term debt 725.7

Total debt 737.4

Less cash and cash equivalents (124.0)

Net debt $ 613.4

29

Mueller Water Products

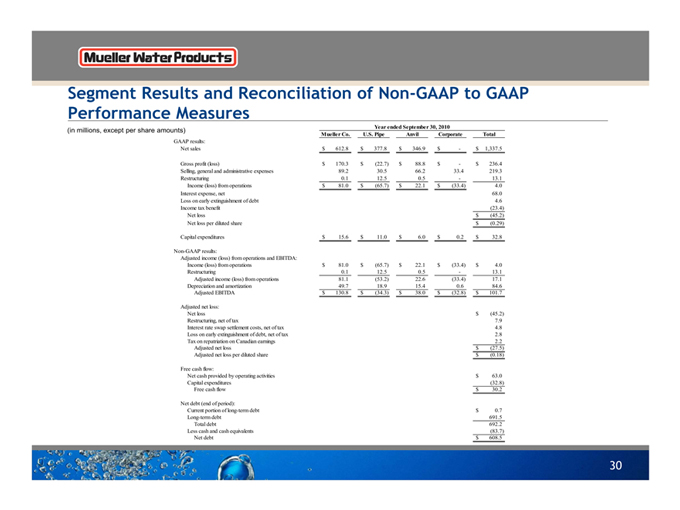

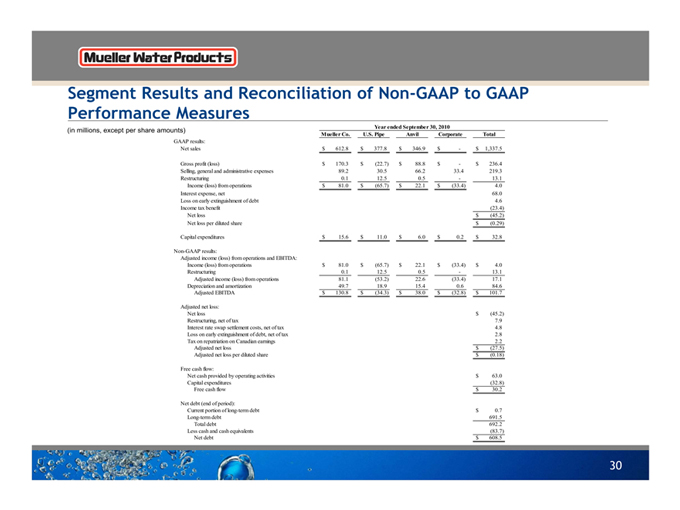

Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures

(in millions, except per share amounts) Year ended September 30, 2010

Mueller Co. U.S. Pipe Anvil Corporate Total

GAAP results:

Net sales $ 612.8 $ 377.8 $ 346.9 $ - $ 1,337.5

Gross profit (loss) $ 170.3 $ (22.7) $ 88.8 $ - $ 236.4

Selling, general and administrative expenses 89.2 30.5 66.2 33.4 219.3

Restructuring 0.1 12.5 0.5 - 13.1

Income (loss) from operations $ 81.0 $ (65.7) $ 22.1 $ (33.4) 4.0

Interest expense, net 68.0

Loss on early extinguishment of debt 4.6

Income tax benefit (23.4)

Net loss $ (45.2)

Net loss per diluted share $ (0.29)

Capital expenditures $ 15.6 $ 11.0 $ 6.0 $ 0.2 $ 32.8

Non-GAAP results:

Adjusted income (loss) from operations and EBITDA:

Income (loss) from operations $ 81.0 $ (65.7) $ 22.1 $ (33.4) $ 4.0

Restructuring 0.1 12.5 0.5 - 13.1

Adjusted income (loss) from operations 81.1 (53.2) 22.6 (33.4) 17.1

Depreciation and amortization 49.7 18.9 15.4 0.6 84.6

Adjusted EBITDA $ 130.8 $ (34.3) $ 38.0 $ (32.8) $ 101.7

Adjusted net loss:

Net loss $ (45.2)

Restructuring, net of tax 7.9

Interest rate swap settlement costs, net of tax 4.8

Loss on early extinguishment of debt, net of tax 2.8

Tax on repatriation on Canadian earnings 2.2

Adjusted net loss $ (27.5)

Adjusted net loss per diluted share $ (0.18)

Free cash flow:

Net cash provided by operating activities $ 63.0

Capital expenditures (32.8)

Free cash flow $ 30.2

Net debt (end of period):

Current portion of long-term debt $ 0.7

Long-term debt 691.5

Total debt 692.2

Less cash and cash equivalents (83.7)

Net debt $ 608.5

30

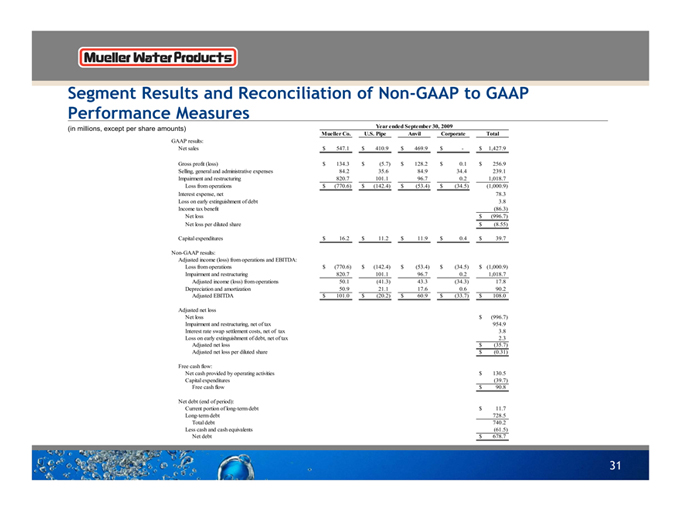

Mueller Water Products

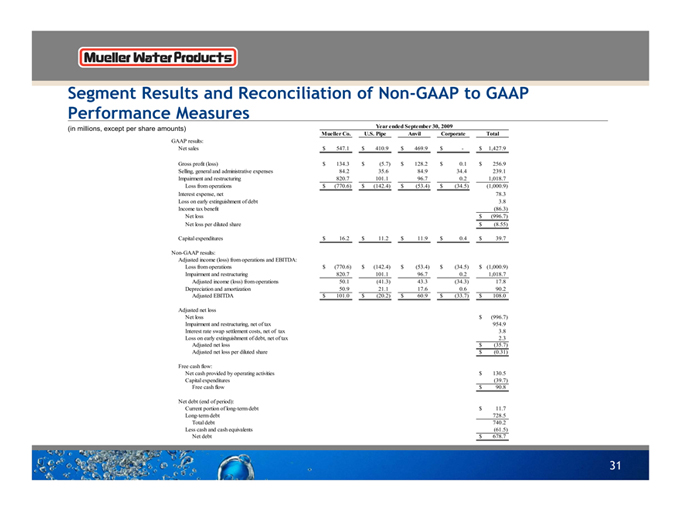

Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures

(in millions, except per share amounts) Year ended September 30, 2009

Mueller Co. U.S. Pipe Anvil Corporate Total

GAAP results:

Net sales $ 547.1 $ 410.9 $ 469.9 $ - $ 1,427.9

Gross profit (loss) $ 134.3 $ (5.7) $ 128.2 $ 0.1 $ 256.9

Selling, general and administrative expenses 84.2 35.6 84.9 34.4 239.1

Impairment and restructuring 820.7 101.1 96.7 0.2 1,018.7

Loss from operations $ (770.6) $ (142.4) $ (53.4) $ (34.5) (1,000.9)

Interest expense, net 78.3

Loss on early extinguishment of debt 3.8

Income tax benefit (86.3)

Net loss $ (996.7)

Net loss per diluted share $ (8.55)

Capital expenditures $ 16.2 $ 11.2 $ 11.9 $ 0.4 $ 39.7

Non-GAAP results:

Adjusted income (loss) from operations and EBITDA:

Loss from operations $ (770.6) $ (142.4) $ (53.4) $ (34.5) $ (1,000.9)

Impairment and restructuring 820.7 101.1 96.7 0.2 1,018.7

Adjusted income (loss) from operations 50.1 (41.3) 43.3 (34.3) 17.8

Depreciation and amortization 50.9 21.1 17.6 0.6 90.2

Adjusted EBITDA $ 101.0 $ (20.2) $ 60.9 $ (33.7) $ 108.0

Adjusted net loss

Net loss $ (996.7)

Impairment and restructuring, net of tax 954.9

Interest rate swap settlement costs, net of tax 3.8

Loss on early extinguishment of debt, net of tax 2.3

Adjusted net loss $ (35.7)

Adjusted net loss per diluted share $ (0.31)

Free cash flow:

Net cash provided by operating activities $ 130.5

Capital expenditures (39.7)

Free cash flow $ 90.8

Net debt (end of period):

Current portion of long-term debt $ 11.7

Long-term debt 728.5

Total debt 740.2

Less cash and cash equivalents (61.5)

Net debt $ 678.7

31

Mueller Water Products

Questions