Where Intelligence Meets Infrastructure® Baird Global Industrials Conference November 10, 2021

2 NON-GAAP Financial Measures In an effort to provide investors with additional information regarding the Company’s results as determined by accounting principles generally accepted in the United States (“GAAP”), the Company also provides non-GAAP information that management believes is useful to investors. These non-GAAP measures have limitations as analytical tools, and securities analysts, investors and other interested parties should not consider any of these non-GAAP measures in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. These non-GAAP measures may not be comparable to similarly titled measures used by other companies. The Company presents adjusted net income, adjusted net income per diluted share, adjusted operating income, adjusted operating margin, adjusted EBITDA and adjusted EBITDA margin as performance measures because management uses these measures in evaluating the Company’s underlying performance on a consistent basis across periods and in making decisions about operational strategies. Management also believes these measures are frequently used by securities analysts, investors and other interested parties in the evaluation of the Company’s recurring performance. The Company presents net debt and net debt leverage as performance measures as management uses them in evaluating its capital management, and the investment community commonly uses them as measures of indebtedness. The Company presents free cash flow as management believes it is commonly used by the investment community to measure the Company’s ability to create liquidity. The calculations of these non-GAAP measures and reconciliations to GAAP results are included as an attachment to this press release and have been posted online at www.muellerwaterproducts.com. The Company does not reconcile forward-looking adjusted EBITDA to the comparable GAAP measure, as permitted by Regulation S-K, as certain items, e.g., expenses related to corporate development activities, pension benefits and corporate restructuring, may have not yet occurred, are out of the Company’s control and/or cannot be reasonably predicted without unreasonable efforts. Additionally, such reconciliation would imply a degree of precision and certainty regarding relevant items that may be confusing to investors. Such items could have a substantial impact on GAAP measures of the Company's financial performance

3 Forward-Looking Statements This press release contains certain statements that may be deemed “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements that address activities, events or developments that the Company intends, expects, plans, projects, believes or anticipates will or may occur in the future are forward-looking statements, including, without limitation, statements regarding outlooks, projections, forecasts, trend descriptions, the COVID-19 pandemic, go-to-market strategies, operational excellence, acceleration of new product development, end market performance, net sales performance, adjusted operating income and adjusted EBITDA performance, margins, capital expenditure plans, litigation outcomes, capital allocation and growth strategies, restructuring efficiencies and warranty charges. Forward-looking statements are based on certain assumptions and assessments made by the Company in light of the Company’s experience and perception of historical trends, current conditions and expected future developments. Actual results and the timing of events may differ materially from those contemplated by the forward-looking statements due to a number of factors, including the extent, duration and severity of the impact of the COVID-19 pandemic on the Company’s operations and results, including effects on the financial health of customers (including collections), the Company and the financial/capital markets, government-mandated facility closures, COVID-19 related facility closures and other manufacturing restrictions, logistical challenges and supply chain disruptions, potential litigation and claims emanating from the COVID-19 pandemic and vaccine mandates, and health, safety and employee/labor issues in Company facilities around the world; an inability to realize the benefits from our operational initiatives, including our reorganization and related strategic realignment activities; an inability to attract or retain a skilled and diverse workforce, increased competition related to the workforce and market levels of wage increases; an inability to protect the Company’s information systems against service interruption, misappropriation of data or breaches of security; failure to comply with personal data protection and privacy laws; regional, national or global political, economic, market and competitive conditions; cyclical and changing demand in core markets such as municipal spending; government monetary or fiscal policies; residential and non-residential construction, and natural gas distribution; adverse weather conditions; manufacturing and product performance; expectations for changes in volumes, continued execution of cost productivity initiatives and improved pricing; commodity and raw materials price inflation; warranty exposures (including the adequacy of warranty reserves); an inability to successfully resolve significant legal proceedings, claims, lawsuits or government investigations; compliance with environmental, trade and anti-corruption laws and regulations; climate change and legal or regulatory responses thereto; changing regulatory, trade and tariff conditions; failure to achieve expected cost savings, net sales expectations, profitability expectations and manufacturing efficiencies from our large capital investments in Chattanooga and Kimball, Tennessee and Decatur, Illinois and plant closures; the failure to integrate and/or realize any of the anticipated benefits of recent acquisitions or divestitures; and other factors that are described in the section entitled “RISK FACTORS” in Item 1A of the Company’s most recently filed Quarterly Reports on Form 10-Q and Annual Report on Form 10-K (all of which risks may be amplified by the COVID-19 pandemic). Forward-looking statements do not guarantee future performance and are only as of the date they are made. The Company undertakes no duty to update its forward-looking statements except as required by law. Undue reliance should not be placed on any forward-looking statements. You are advised to review any further disclosures the Company makes on related subjects in subsequent Forms 10-K, 10-Q, 8-K and other reports filed with the U.S. Securities and Exchange Commission.

4 Mueller Water Products at a Glance KEY PRODUCTS (2) END MARKETS (2) • Founded over 160 years ago • Spun off from Walter Industries in 2006 • Listed on NYSE (MWA) June 1, 2006 • Divested U.S. Pipe (April 2012) and Anvil (Jan. 2017) • Acquired Singer Valve (Feb. 2017) • Acquired Krausz Industries (Dec. 2018) • Acquired i20 Water (June 2021) $ in millions Net sales $1,111.0 Adjusted EBITDA $203.6 % of net sales (3) 18.4% Cash Flow from Operations $156.7 Free Cash Flow $94.0 Total Debt $446.9 Total Cash $227.5 Net Debt to Adjusted EBITDA 1.1 x Total Liquidity $386.2 LTM FINANCIALS (1) (1) Provided with Q4FY21 earnings press release and presentation on November 8 & 9, 2021. (2) Key product categories and end market data based on fiscal 2021 information and estimates and includes sales for Infrastructure and Technologies segments. (3) For FY21, the denominator in the adjusted margin calculations shown for Infrastructure and Consolidated excludes net sales of $6.0M associated with the elimination of the one-month reporting lag. <10% Natural gas utilities AS OF SEPTEMBER 30, 2021 60-65% Repair and replacement of municipal water systems 25-30% Residential construction Brass Products Hydrants & Gate Valves Specialty Valve & Repair Technologies HISTORY % of Consolidated Net Sales WATER-FOCUSED COMPANY WITH APPROXIMATELY TWO-THIRDS OF NET SALES RELATED TO REPAIR AND REPLACEMENT ACTIVITIES OF UTILITIES

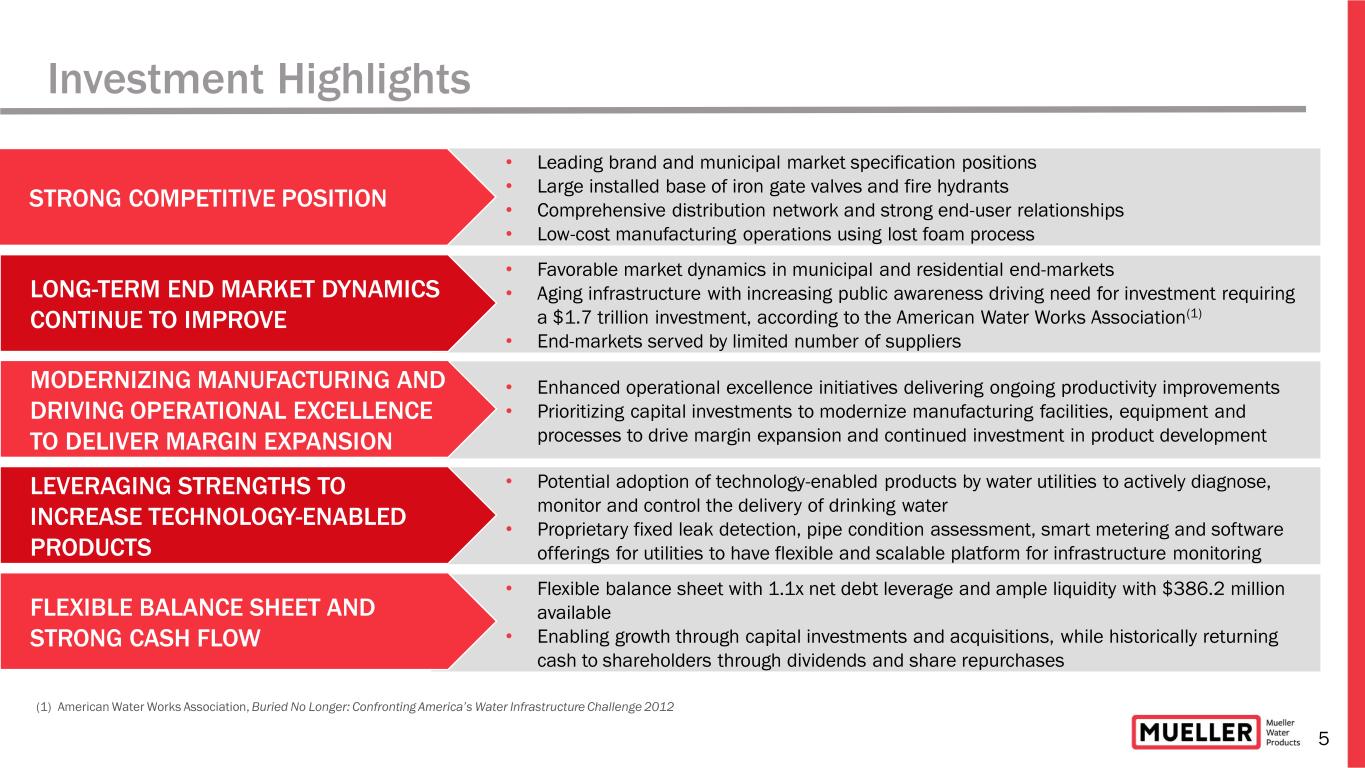

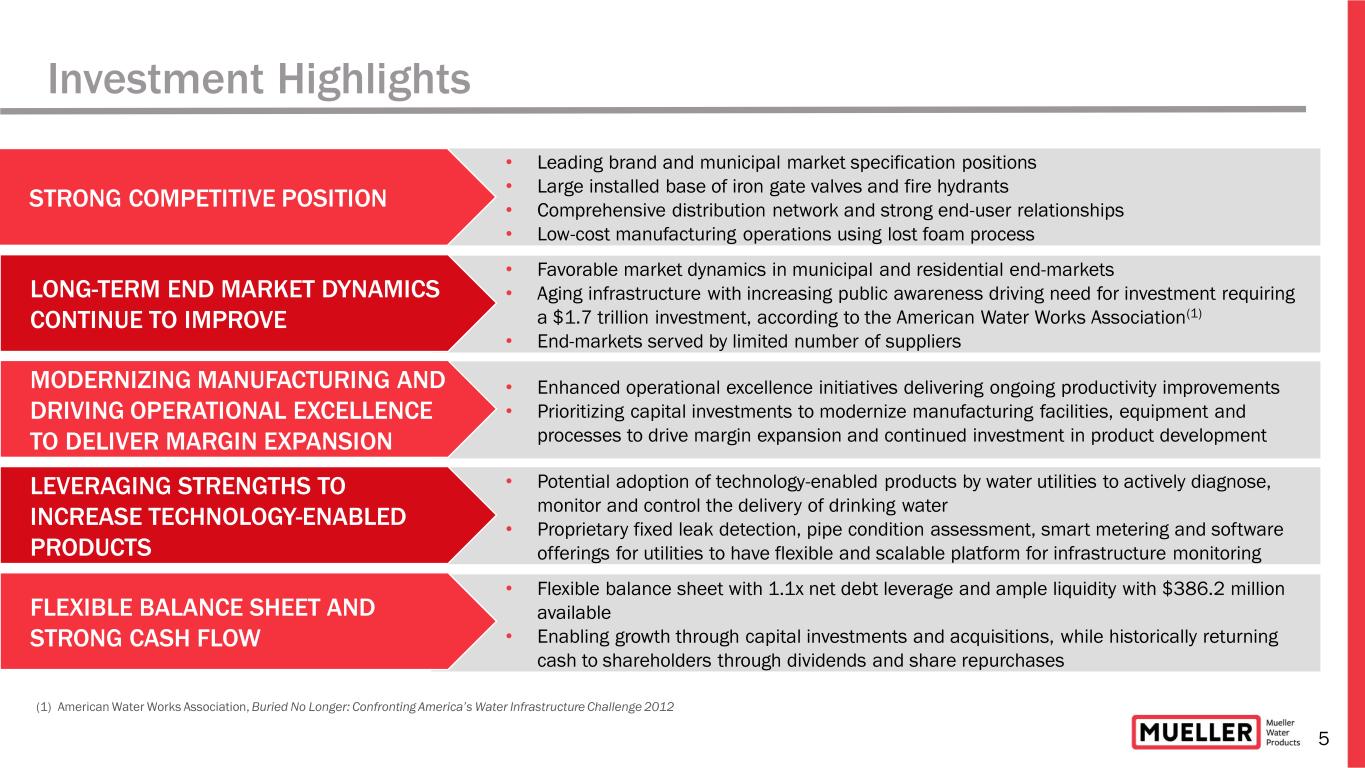

5 Investment Highlights • Leading brand and municipal market specification positions • Large installed base of iron gate valves and fire hydrants • Comprehensive distribution network and strong end-user relationships • Low-cost manufacturing operations using lost foam process • Favorable market dynamics in municipal and residential end-markets • Aging infrastructure with increasing public awareness driving need for investment requiring a $1.7 trillion investment, according to the American Water Works Association(1) • End-markets served by limited number of suppliers • Enhanced operational excellence initiatives delivering ongoing productivity improvements • Prioritizing capital investments to modernize manufacturing facilities, equipment and processes to drive margin expansion and continued investment in product development • Potential adoption of technology-enabled products by water utilities to actively diagnose, monitor and control the delivery of drinking water • Proprietary fixed leak detection, pipe condition assessment, smart metering and software offerings for utilities to have flexible and scalable platform for infrastructure monitoring • Flexible balance sheet with 1.1x net debt leverage and ample liquidity with $386.2 million available • Enabling growth through capital investments and acquisitions, while historically returning cash to shareholders through dividends and share repurchases LONG-TERM END MARKET DYNAMICS CONTINUE TO IMPROVE LEVERAGING STRENGTHS TO INCREASE TECHNOLOGY-ENABLED PRODUCTS MODERNIZING MANUFACTURING AND DRIVING OPERATIONAL EXCELLENCE TO DELIVER MARGIN EXPANSION FLEXIBLE BALANCE SHEET AND STRONG CASH FLOW STRONG COMPETITIVE POSITION (1) American Water Works Association, Buried No Longer: Confronting America’s Water Infrastructure Challenge 2012

6 Executing Strategic Priorities to Improve Culture of Execution and Become World Class Water Technologies Company Where Intelligence Meets Infrastructure® Mueller is committed to manufacturing innovative products and creating smart solutions that will solve future challenges, whether it's at the source, at the plant, below the ground, on the street or in the cloud. Every day, we help deliver safe, clean drinking water to millions of people. Our Commitment to Sustainability As we look to the future, our commitment to advancing our environmental, social and governance (ESG) goals will remain at the forefront of how we operate our business and positively impact our world. • Remain focused on keeping our employees safe, protecting our communities, delivering exceptional products and support to our customers and generating strong cash flow

7 Commitment to Sustainability • Inaugural report released in December 2020 reflects how sustainability has been an integral part of Mueller Water Products for many years • Highlights our sustainability achievements to date, discussed some of the ongoing initiatives to strengthen Mueller’s focus and commitment to sustainability • Entire organization is committed to minimizing our water and energy footprints while delivering smart products that are more efficient for our customers and safer for the environment • Will share our strategies, goals and progress in our second ESG report to be published in January 2022 As we look to the future, our commitment to advancing our environmental, social and governance (ESG) goals will remain at the forefront of how we operate our business and positively impact our world. To learn more about Mueller Water Products’ ESG efforts, please visit the ESG page on our website.

Products and Markets

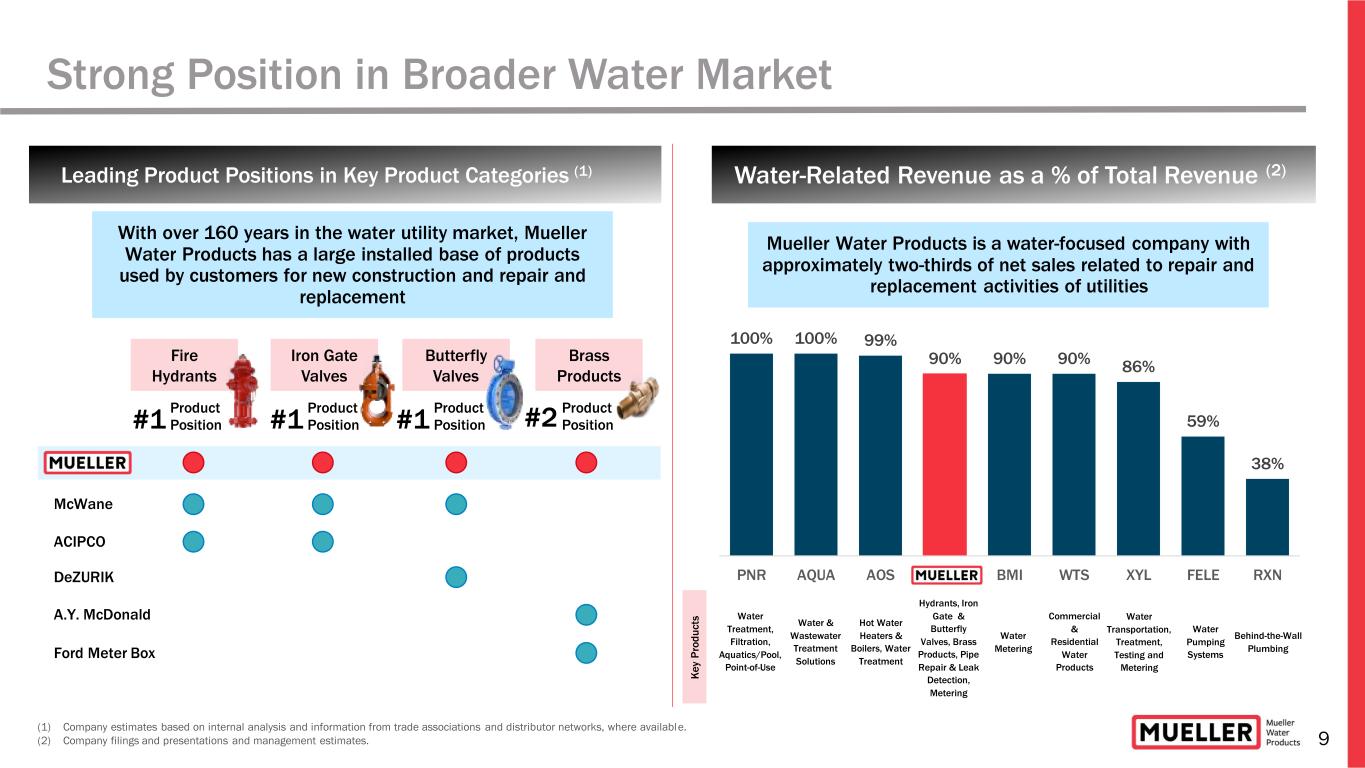

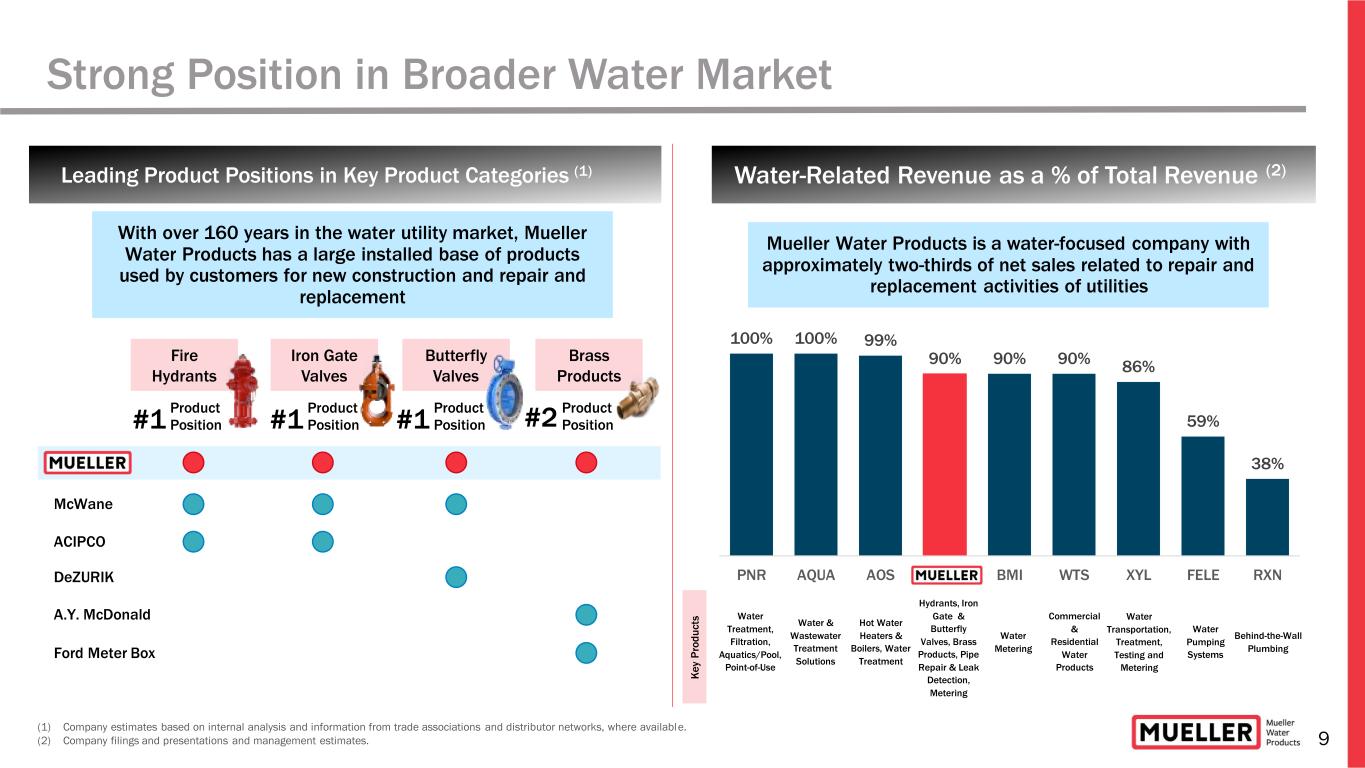

9 Strong Position in Broader Water Market Leading Product Positions in Key Product Categories (1) (1) Company estimates based on internal analysis and information from trade associations and distributor networks, where available. (2) Company filings and presentations and management estimates. Fire Hydrants Iron Gate Valves Butterfly Valves Brass Products #1 Product Position A.Y. McDonald ACIPCO DeZURIK Ford Meter Box McWane #1 Product Position #1 Product Position #2 Product Position With over 160 years in the water utility market, Mueller Water Products has a large installed base of products used by customers for new construction and repair and replacement Water-Related Revenue as a % of Total Revenue (2) 100% 100% 99% 90% 90% 90% 86% 59% 38% PNR AQUA AOS MWA BMI WTS XYL FELE RXN Mueller Water Products is a water-focused company with approximately two-thirds of net sales related to repair and replacement activities of utilities Water Treatment, Filtration, Aquatics/Pool, Point-of-Use Water & Wastewater Treatment Solutions K e y P ro d u c ts Hot Water Heaters & Boilers, Water Treatment Hydrants, Iron Gate & Butterfly Valves, Brass Products, Pipe Repair & Leak Detection, Metering Water Metering Water Transportation, Treatment, Testing and Metering Commercial & Residential Water Products Water Pumping Systems Behind-the-Wall Plumbing

10 Mueller is Uniquely Positioned to Address Opportunities with Utilities with its Leading Infrastructure Products and Installed Base

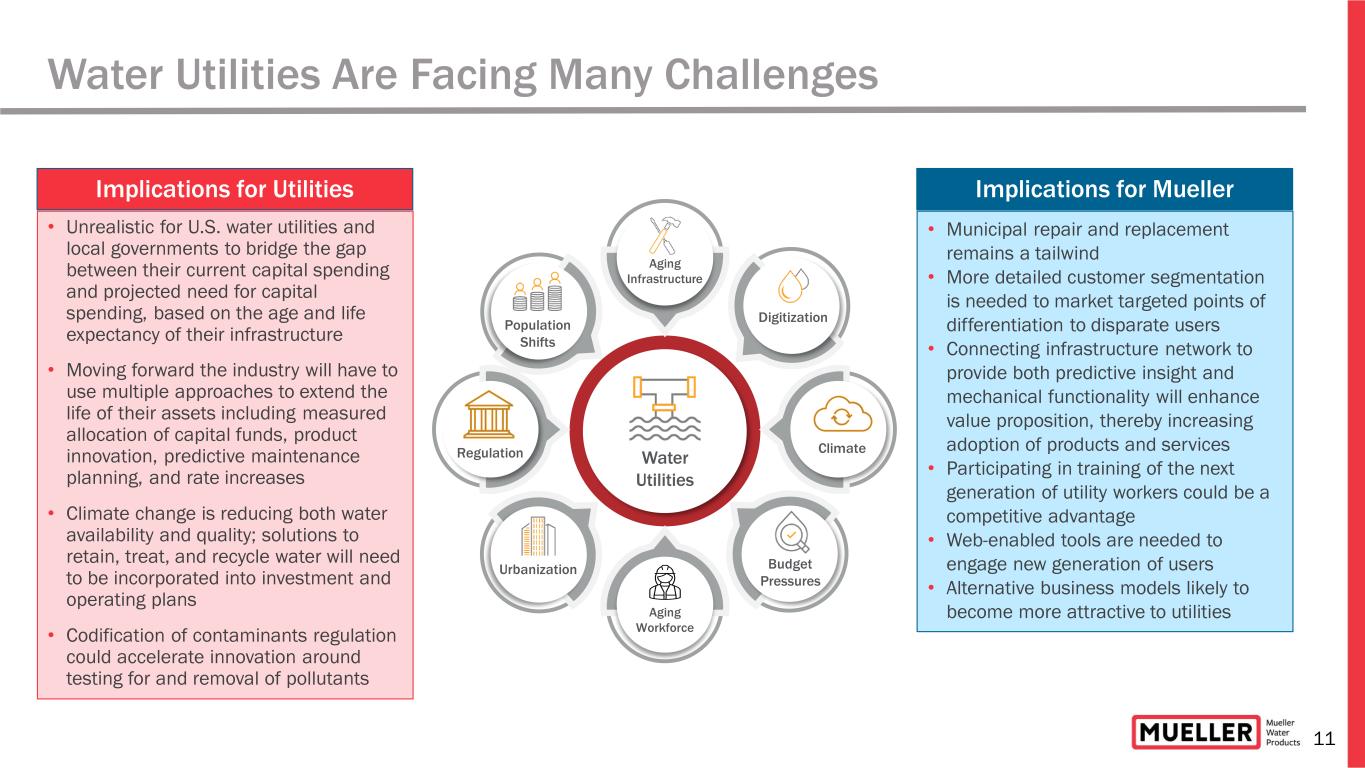

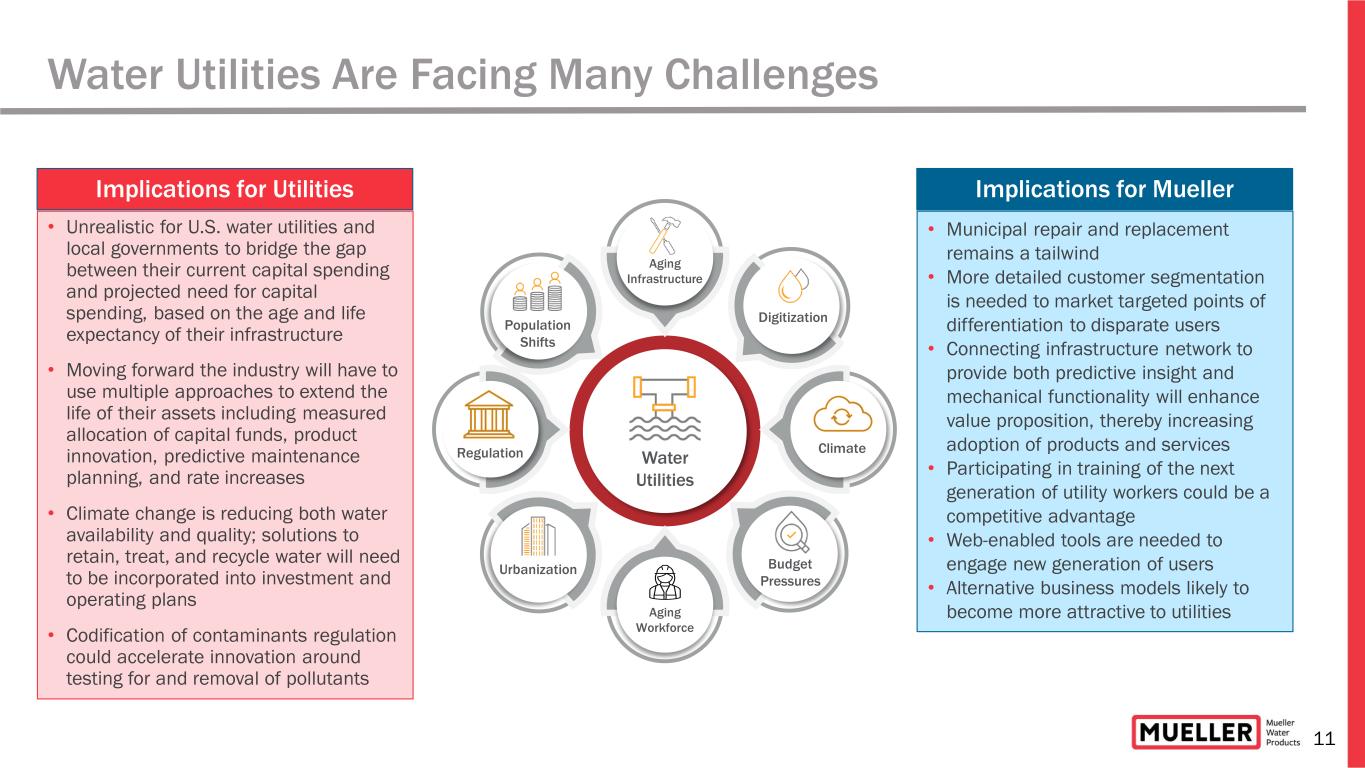

11 Water Utilities Are Facing Many Challenges • Unrealistic for U.S. water utilities and local governments to bridge the gap between their current capital spending and projected need for capital spending, based on the age and life expectancy of their infrastructure • Moving forward the industry will have to use multiple approaches to extend the life of their assets including measured allocation of capital funds, product innovation, predictive maintenance planning, and rate increases • Climate change is reducing both water availability and quality; solutions to retain, treat, and recycle water will need to be incorporated into investment and operating plans • Codification of contaminants regulation could accelerate innovation around testing for and removal of pollutants Aging Infrastructure Digitization Budget Pressures Aging Workforce Urbanization Population Shifts Water Utilities Implications for Utilities • Municipal repair and replacement remains a tailwind • More detailed customer segmentation is needed to market targeted points of differentiation to disparate users • Connecting infrastructure network to provide both predictive insight and mechanical functionality will enhance value proposition, thereby increasing adoption of products and services • Participating in training of the next generation of utility workers could be a competitive advantage • Web-enabled tools are needed to engage new generation of users • Alternative business models likely to become more attractive to utilities Implications for Mueller Regulation Climate

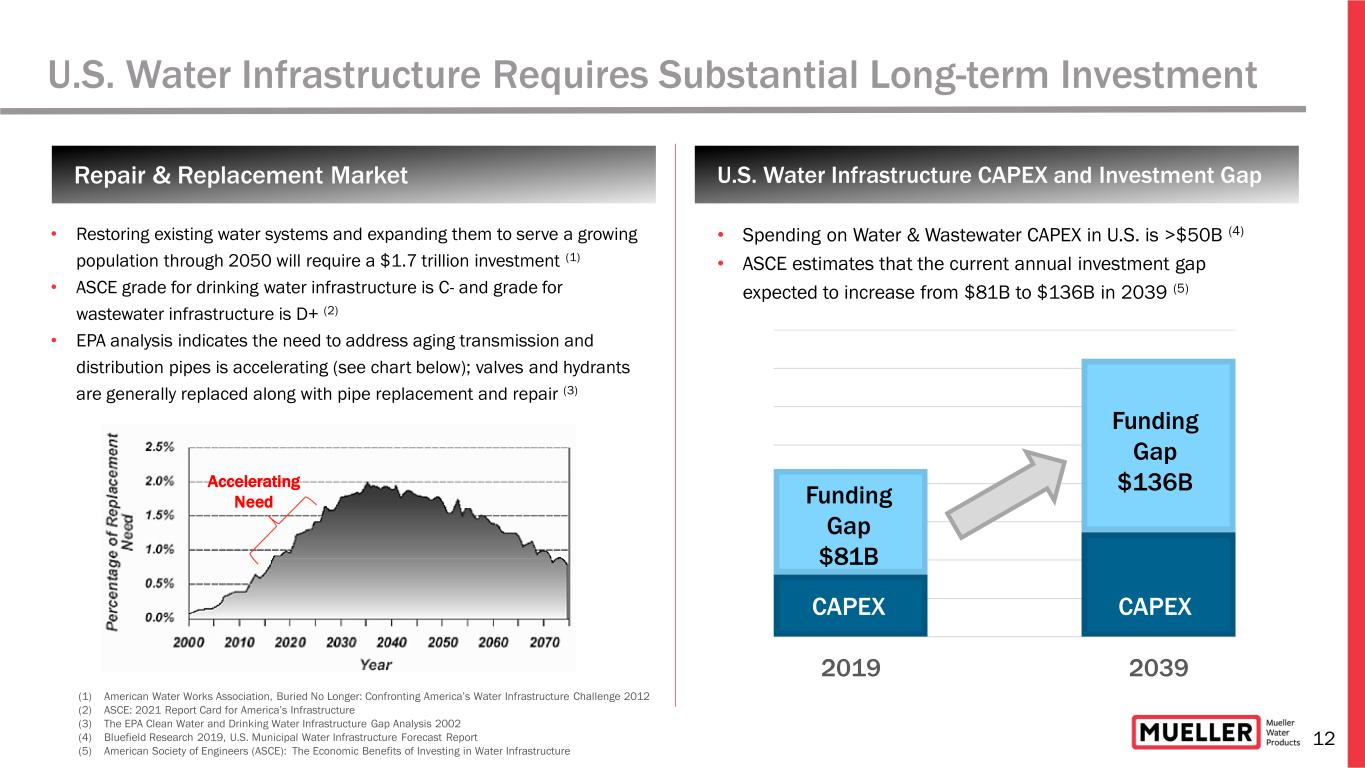

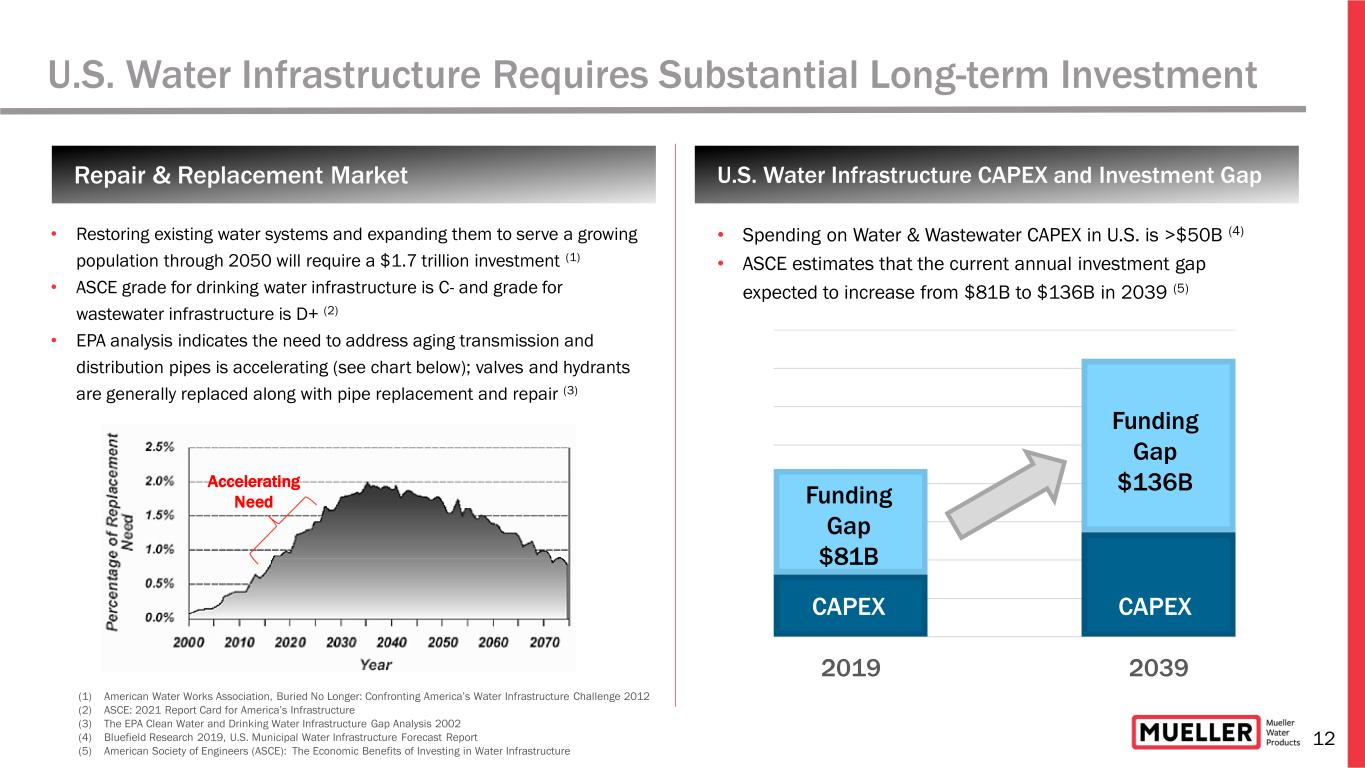

12 U.S. Water Infrastructure Requires Substantial Long-term Investment U.S. Water Infrastructure CAPEX and Investment GapRepair & Replacement Market (1) American Water Works Association, Buried No Longer: Confronting America’s Water Infrastructure Challenge 2012 (2) ASCE: 2021 Report Card for America’s Infrastructure (3) The EPA Clean Water and Drinking Water Infrastructure Gap Analysis 2002 (4) Bluefield Research 2019, U.S. Municipal Water Infrastructure Forecast Report (5) American Society of Engineers (ASCE): The Economic Benefits of Investing in Water Infrastructure • Restoring existing water systems and expanding them to serve a growing population through 2050 will require a $1.7 trillion investment (1) • ASCE grade for drinking water infrastructure is C- and grade for wastewater infrastructure is D+ (2) • EPA analysis indicates the need to address aging transmission and distribution pipes is accelerating (see chart below); valves and hydrants are generally replaced along with pipe replacement and repair (3) 2019 2039 • Spending on Water & Wastewater CAPEX in U.S. is >$50B (4) • ASCE estimates that the current annual investment gap expected to increase from $81B to $136B in 2039 (5) Accelerating Need Funding Gap $81B Funding Gap $136B CAPEX CAPEX

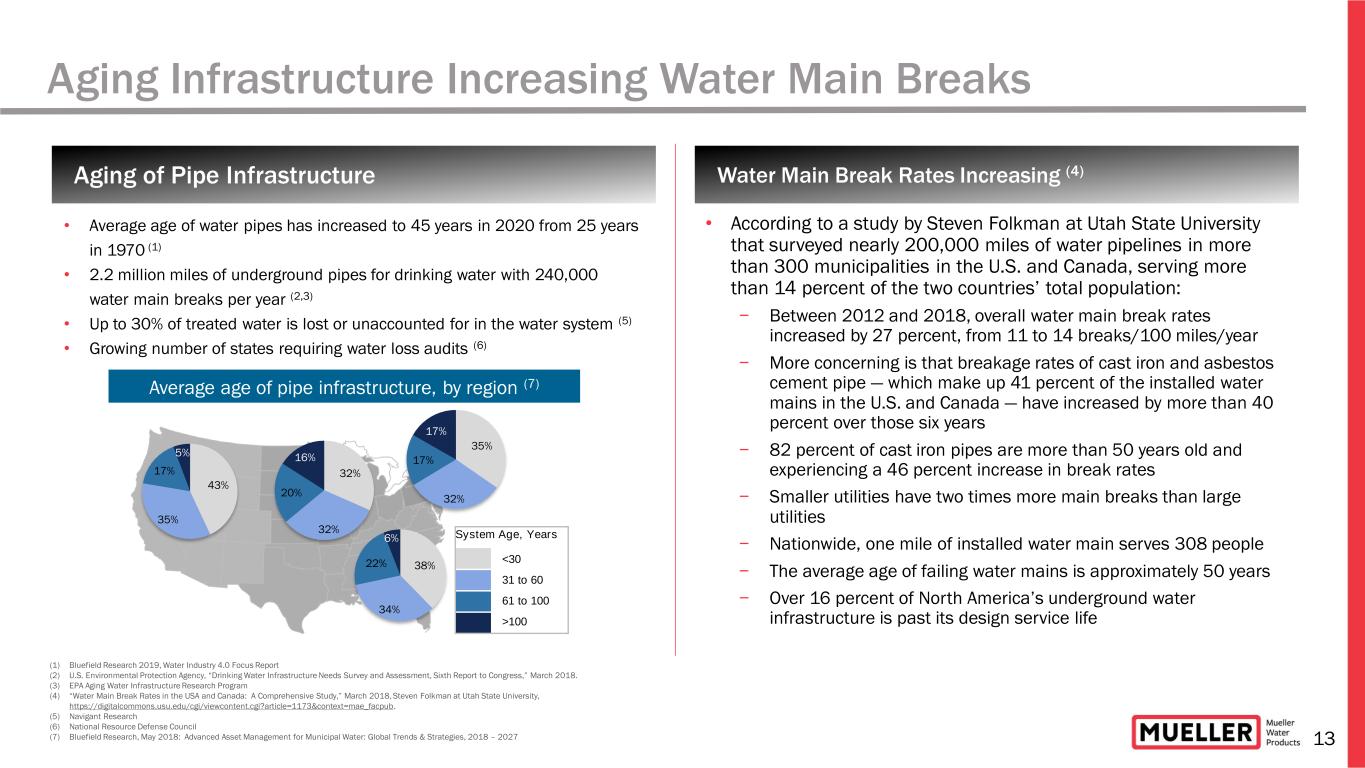

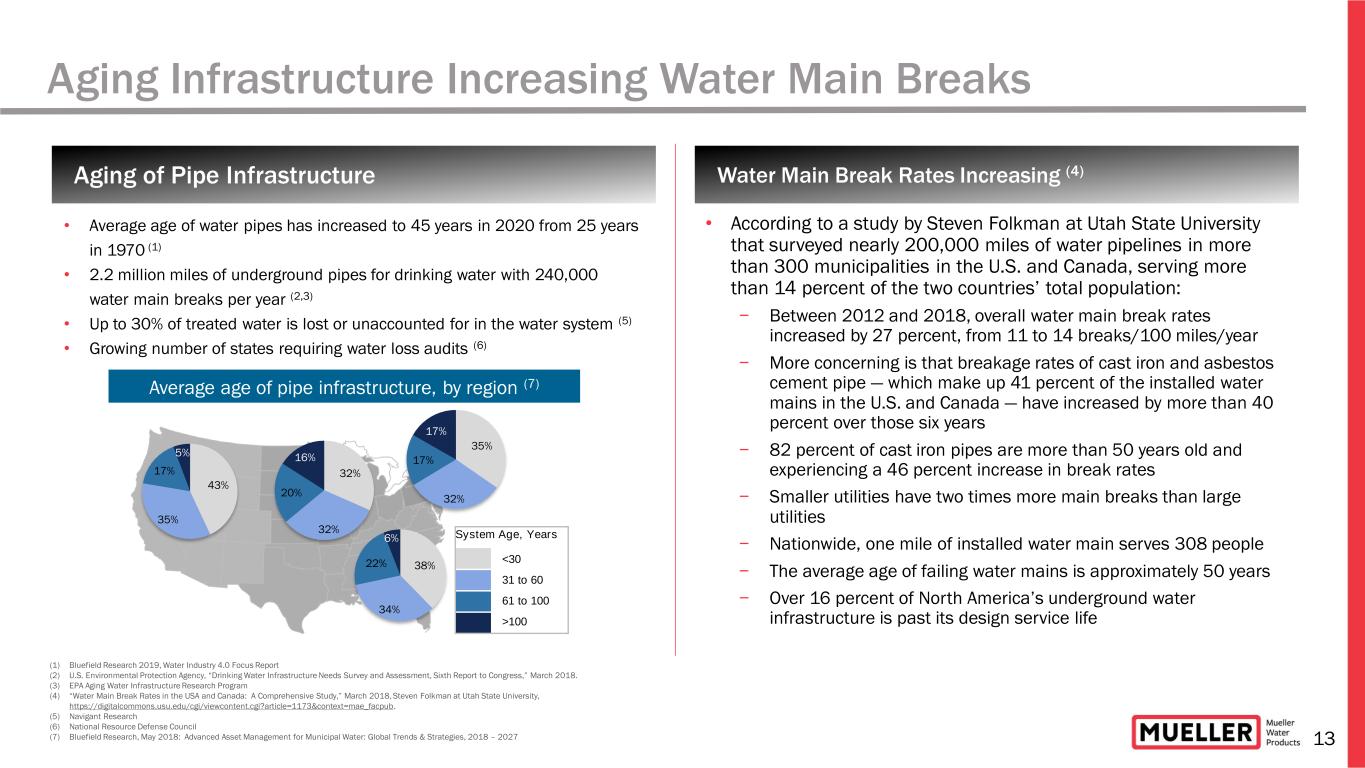

13 Aging Infrastructure Increasing Water Main Breaks (1) Bluefield Research 2019, Water Industry 4.0 Focus Report (2) U.S. Environmental Protection Agency, “Drinking Water Infrastructure Needs Survey and Assessment, Sixth Report to Congress,” March 2018. (3) EPA Aging Water Infrastructure Research Program (4) “Water Main Break Rates in the USA and Canada: A Comprehensive Study,” March 2018, Steven Folkman at Utah State University, https://digitalcommons.usu.edu/cgi/viewcontent.cgi?article=1173&context=mae_facpub. (5) Navigant Research (6) National Resource Defense Council (7) Bluefield Research, May 2018: Advanced Asset Management for Municipal Water: Global Trends & Strategies, 2018 – 2027 • Average age of water pipes has increased to 45 years in 2020 from 25 years in 1970 (1) • 2.2 million miles of underground pipes for drinking water with 240,000 water main breaks per year (2,3) • Up to 30% of treated water is lost or unaccounted for in the water system (5) • Growing number of states requiring water loss audits (6) 38% 34% 22% 6% 43% 35% 5% 17% 32% 32% 20% 16% System Age, Years <30 31 to 60 61 to 100 >100 35% 32% 17% 17% Water Main Break Rates Increasing (4)Aging of Pipe Infrastructure • According to a study by Steven Folkman at Utah State University that surveyed nearly 200,000 miles of water pipelines in more than 300 municipalities in the U.S. and Canada, serving more than 14 percent of the two countries’ total population: − Between 2012 and 2018, overall water main break rates increased by 27 percent, from 11 to 14 breaks/100 miles/year − More concerning is that breakage rates of cast iron and asbestos cement pipe — which make up 41 percent of the installed water mains in the U.S. and Canada — have increased by more than 40 percent over those six years − 82 percent of cast iron pipes are more than 50 years old and experiencing a 46 percent increase in break rates − Smaller utilities have two times more main breaks than large utilities − Nationwide, one mile of installed water main serves 308 people − The average age of failing water mains is approximately 50 years − Over 16 percent of North America’s underground water infrastructure is past its design service life Average age of pipe infrastructure, by region (7)

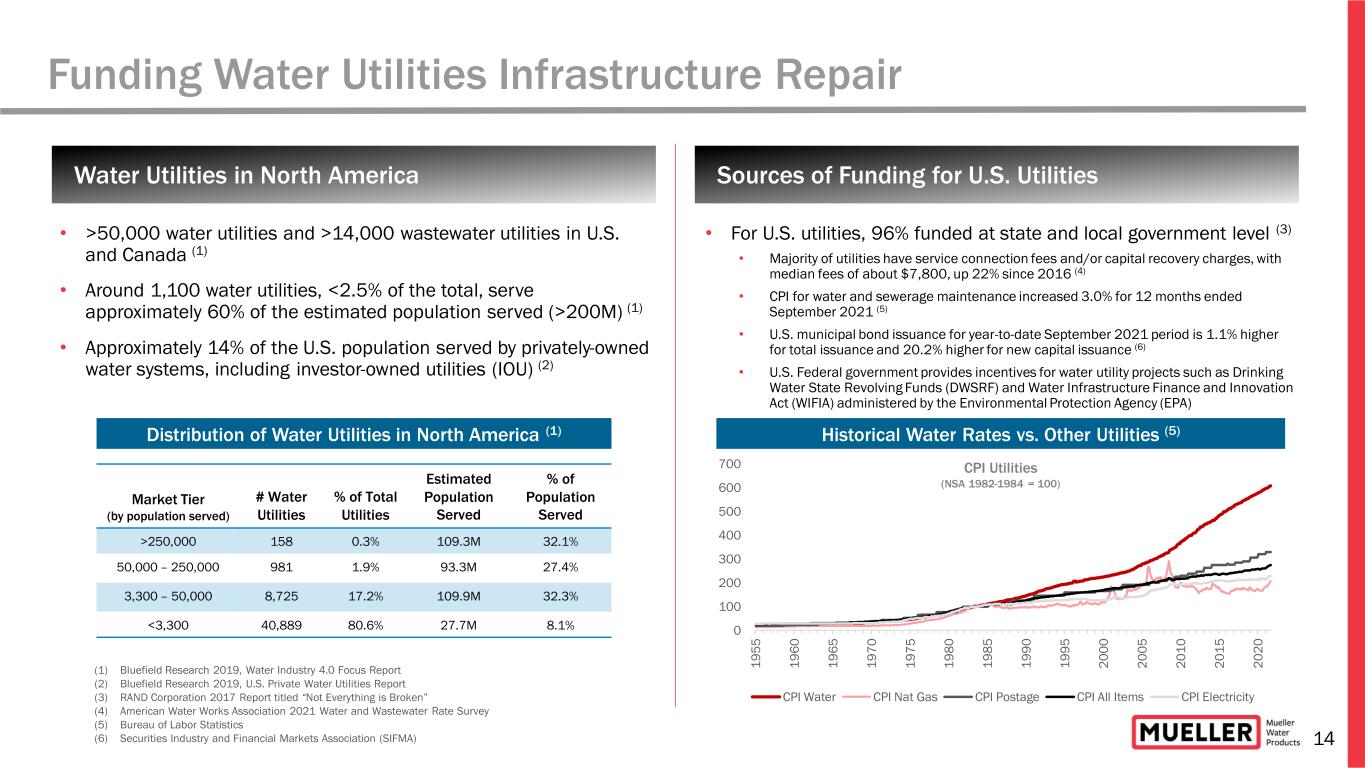

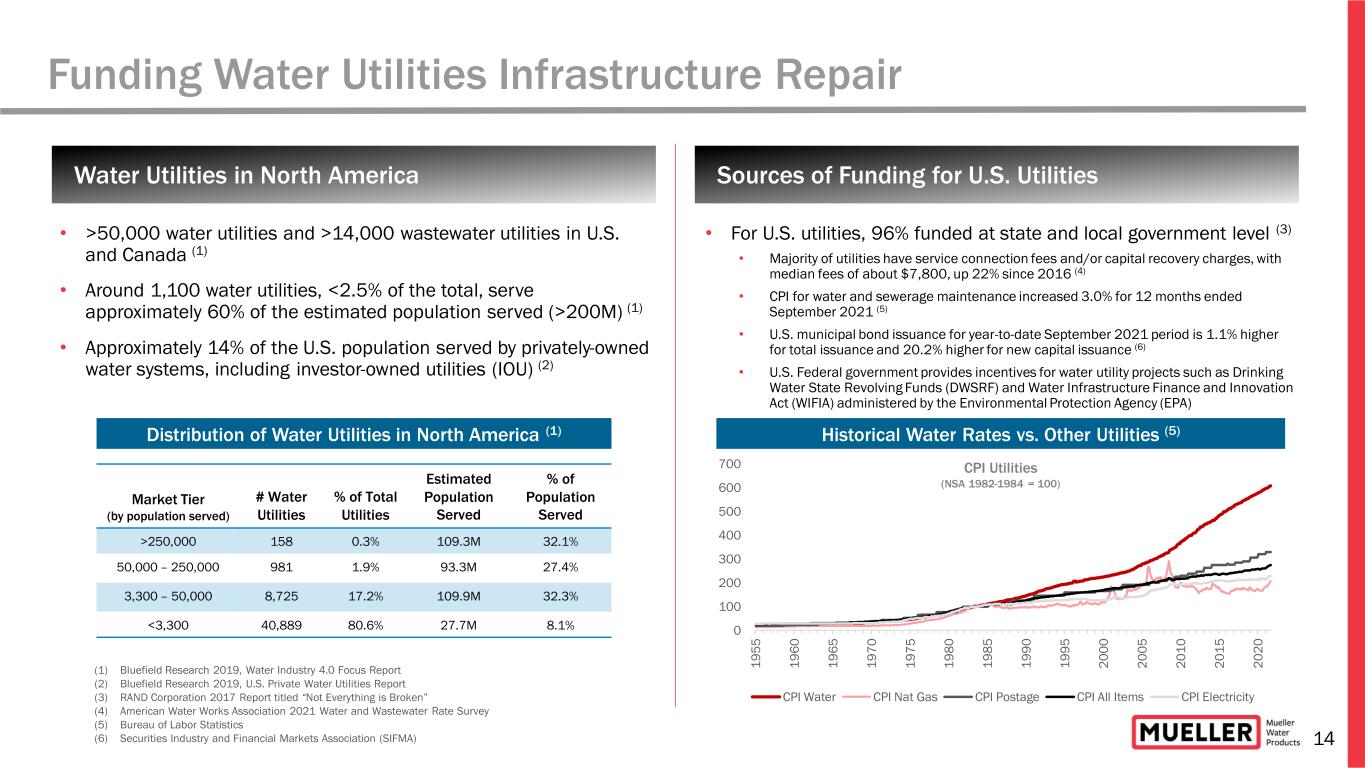

14 Funding Water Utilities Infrastructure Repair (1) Bluefield Research 2019, Water Industry 4.0 Focus Report (2) Bluefield Research 2019, U.S. Private Water Utilities Report (3) RAND Corporation 2017 Report titled “Not Everything is Broken” (4) American Water Works Association 2021 Water and Wastewater Rate Survey (5) Bureau of Labor Statistics (6) Securities Industry and Financial Markets Association (SIFMA) Sources of Funding for U.S. Utilities • >50,000 water utilities and >14,000 wastewater utilities in U.S. and Canada (1) • Around 1,100 water utilities, <2.5% of the total, serve approximately 60% of the estimated population served (>200M) (1) • Approximately 14% of the U.S. population served by privately-owned water systems, including investor-owned utilities (IOU) (2) Water Utilities in North America Market Tier (by population served) # Water Utilities % of Total Utilities Estimated Population Served % of Population Served >250,000 158 0.3% 109.3M 32.1% 50,000 – 250,000 981 1.9% 93.3M 27.4% 3,300 – 50,000 8,725 17.2% 109.9M 32.3% <3,300 40,889 80.6% 27.7M 8.1% Distribution of Water Utilities in North America (1) • For U.S. utilities, 96% funded at state and local government level (3) • Majority of utilities have service connection fees and/or capital recovery charges, with median fees of about $7,800, up 22% since 2016 (4) • CPI for water and sewerage maintenance increased 3.0% for 12 months ended September 2021 (5) • U.S. municipal bond issuance for year-to-date September 2021 period is 1.1% higher for total issuance and 20.2% higher for new capital issuance (6) • U.S. Federal government provides incentives for water utility projects such as Drinking Water State Revolving Funds (DWSRF) and Water Infrastructure Finance and Innovation Act (WIFIA) administered by the Environmental Protection Agency (EPA) Historical Water Rates vs. Other Utilities (5) 0 100 200 300 400 500 600 700 1 9 5 5 1 9 6 0 1 9 6 5 1 9 7 0 1 9 7 5 1 9 8 0 1 9 8 5 1 9 9 0 1 9 9 5 2 0 0 0 2 0 0 5 2 0 1 0 2 0 1 5 2 0 2 0 CPI Water CPI Nat Gas CPI Postage CPI All Items CPI Electricity CPI Utilities (NSA 1982-1984 = 100)

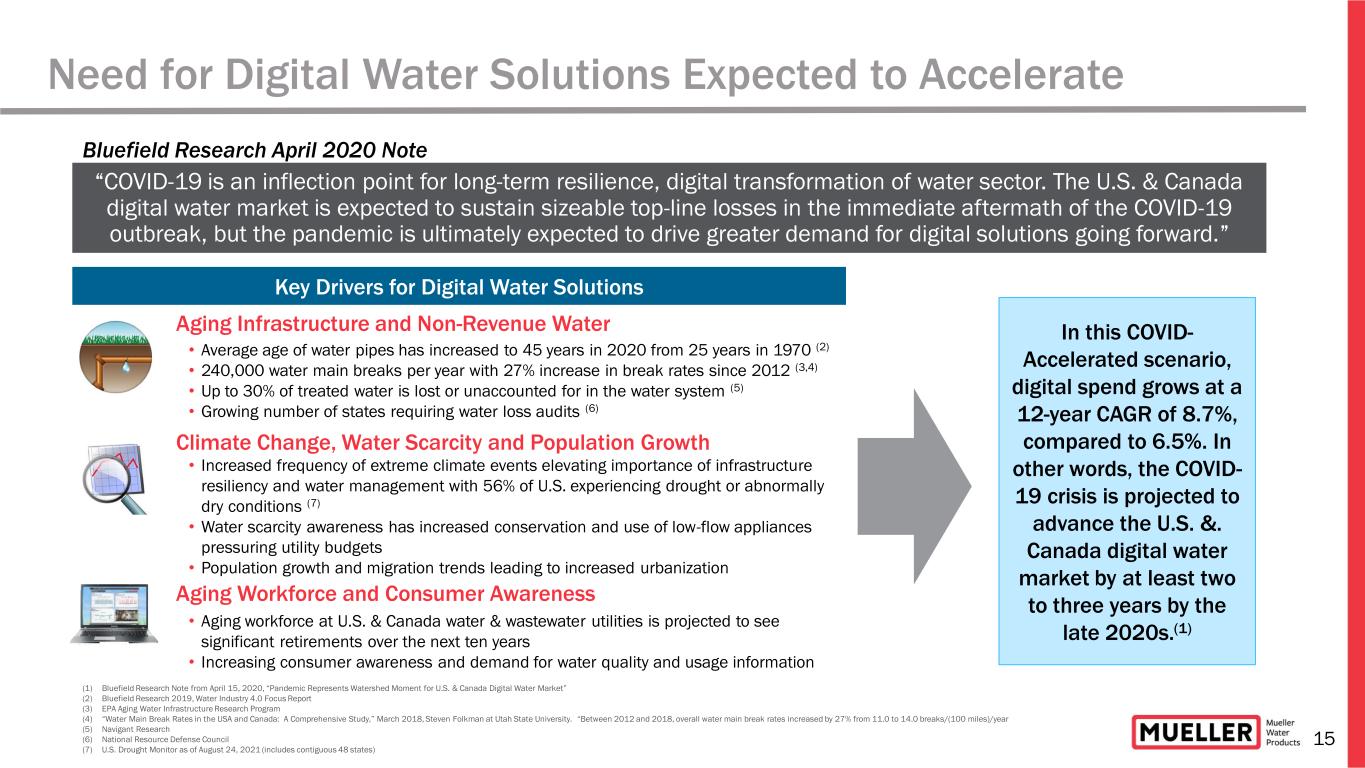

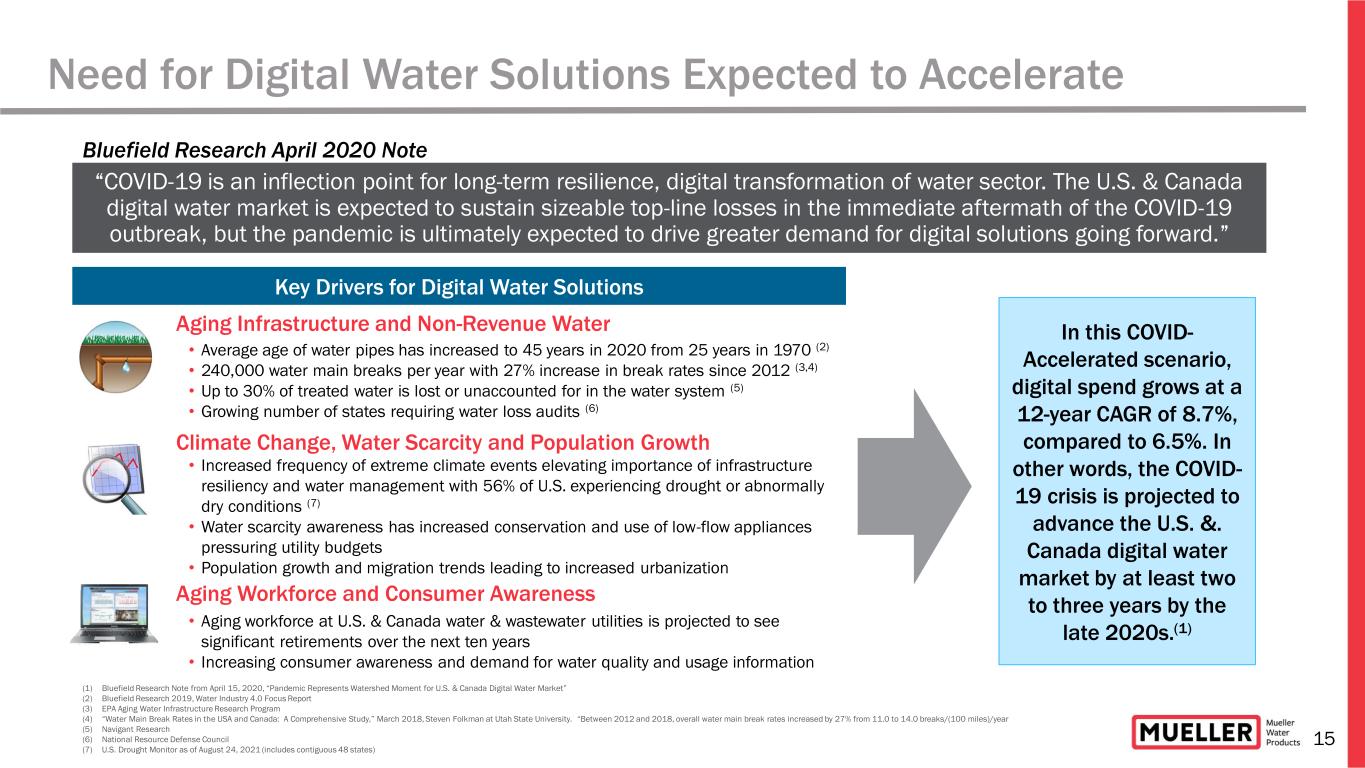

15 Need for Digital Water Solutions Expected to Accelerate “COVID-19 is an inflection point for long-term resilience, digital transformation of water sector. The U.S. & Canada digital water market is expected to sustain sizeable top-line losses in the immediate aftermath of the COVID-19 outbreak, but the pandemic is ultimately expected to drive greater demand for digital solutions going forward.” Bluefield Research April 2020 Note Climate Change, Water Scarcity and Population Growth • Aging workforce at U.S. & Canada water & wastewater utilities is projected to see significant retirements over the next ten years • Increasing consumer awareness and demand for water quality and usage information (1) Bluefield Research Note from April 15, 2020, “Pandemic Represents Watershed Moment for U.S. & Canada Digital Water Market” (2) Bluefield Research 2019, Water Industry 4.0 Focus Report (3) EPA Aging Water Infrastructure Research Program (4) “Water Main Break Rates in the USA and Canada: A Comprehensive Study,” March 2018, Steven Folkman at Utah State University. “Between 2012 and 2018, overall water main break rates increased by 27% from 11.0 to 14.0 breaks/(100 miles)/year (5) Navigant Research (6) National Resource Defense Council (7) U.S. Drought Monitor as of August 24, 2021 (includes contiguous 48 states) • Increased frequency of extreme climate events elevating importance of infrastructure resiliency and water management with 56% of U.S. experiencing drought or abnormally dry conditions (7) • Water scarcity awareness has increased conservation and use of low-flow appliances pressuring utility budgets • Population growth and migration trends leading to increased urbanization Aging Workforce and Consumer Awareness Aging Infrastructure and Non-Revenue Water • Average age of water pipes has increased to 45 years in 2020 from 25 years in 1970 (2) • 240,000 water main breaks per year with 27% increase in break rates since 2012 (3,4) • Up to 30% of treated water is lost or unaccounted for in the water system (5) • Growing number of states requiring water loss audits (6) In this COVID- Accelerated scenario, digital spend grows at a 12-year CAGR of 8.7%, compared to 6.5%. In other words, the COVID- 19 crisis is projected to advance the U.S. &. Canada digital water market by at least two to three years by the late 2020s.(1) Key Drivers for Digital Water Solutions

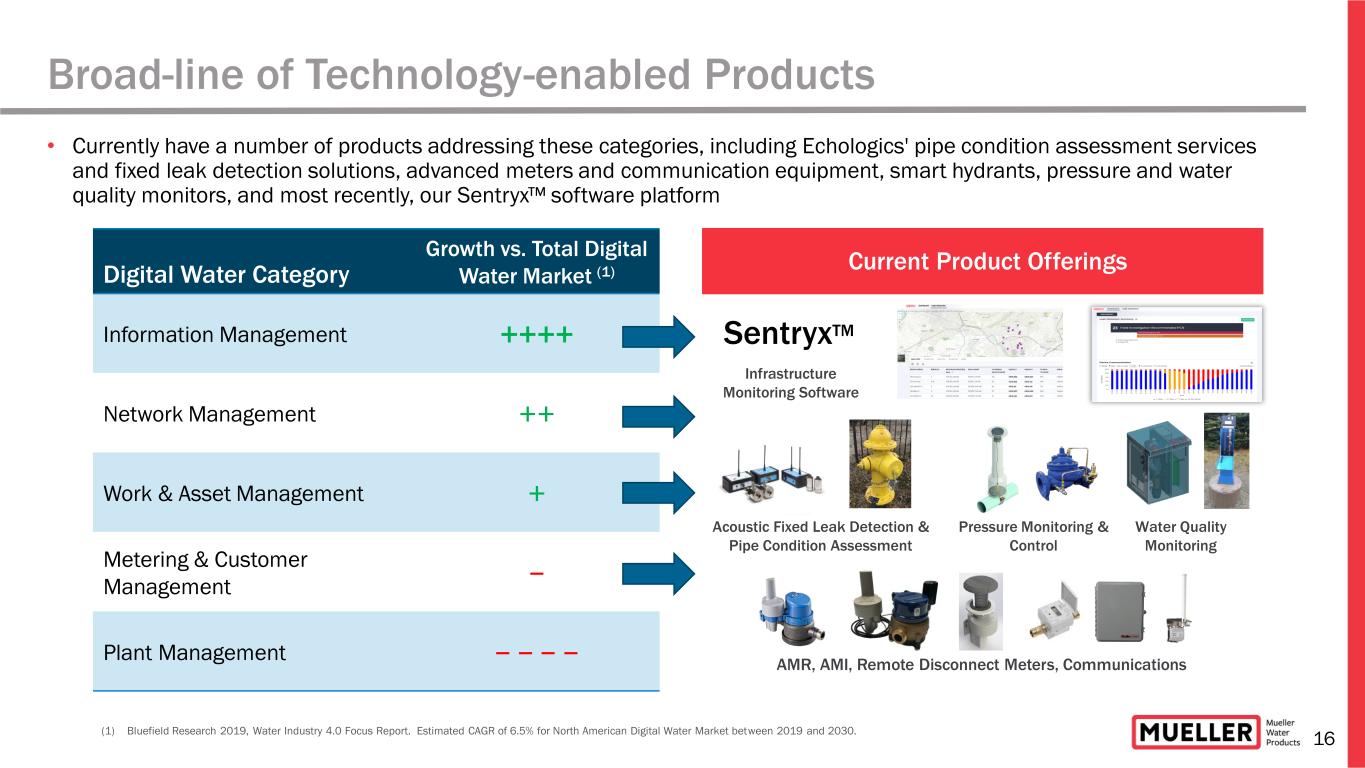

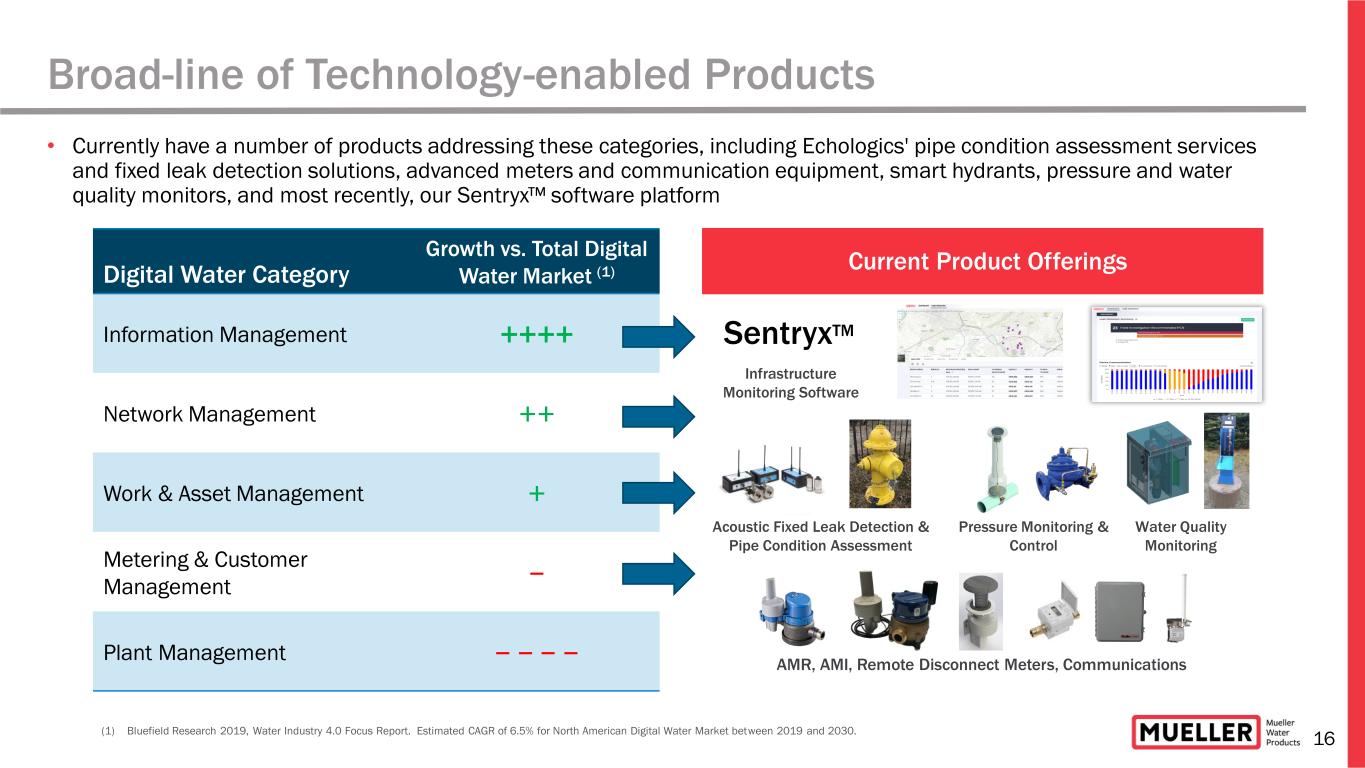

16 Broad-line of Technology-enabled Products • Currently have a number of products addressing these categories, including Echologics' pipe condition assessment services and fixed leak detection solutions, advanced meters and communication equipment, smart hydrants, pressure and water quality monitors, and most recently, our Sentryx™ software platform Digital Water Category Growth vs. Total Digital Water Market (1) Information Management ++++ Network Management ++ Work & Asset Management + Metering & Customer Management − Plant Management − − − − Current Product Offerings Acoustic Fixed Leak Detection & Pipe Condition Assessment Infrastructure Monitoring Software SentryxTM (1) Bluefield Research 2019, Water Industry 4.0 Focus Report. Estimated CAGR of 6.5% for North American Digital Water Market between 2019 and 2030. Water Quality Monitoring Pressure Monitoring & Control AMR, AMI, Remote Disconnect Meters, Communications

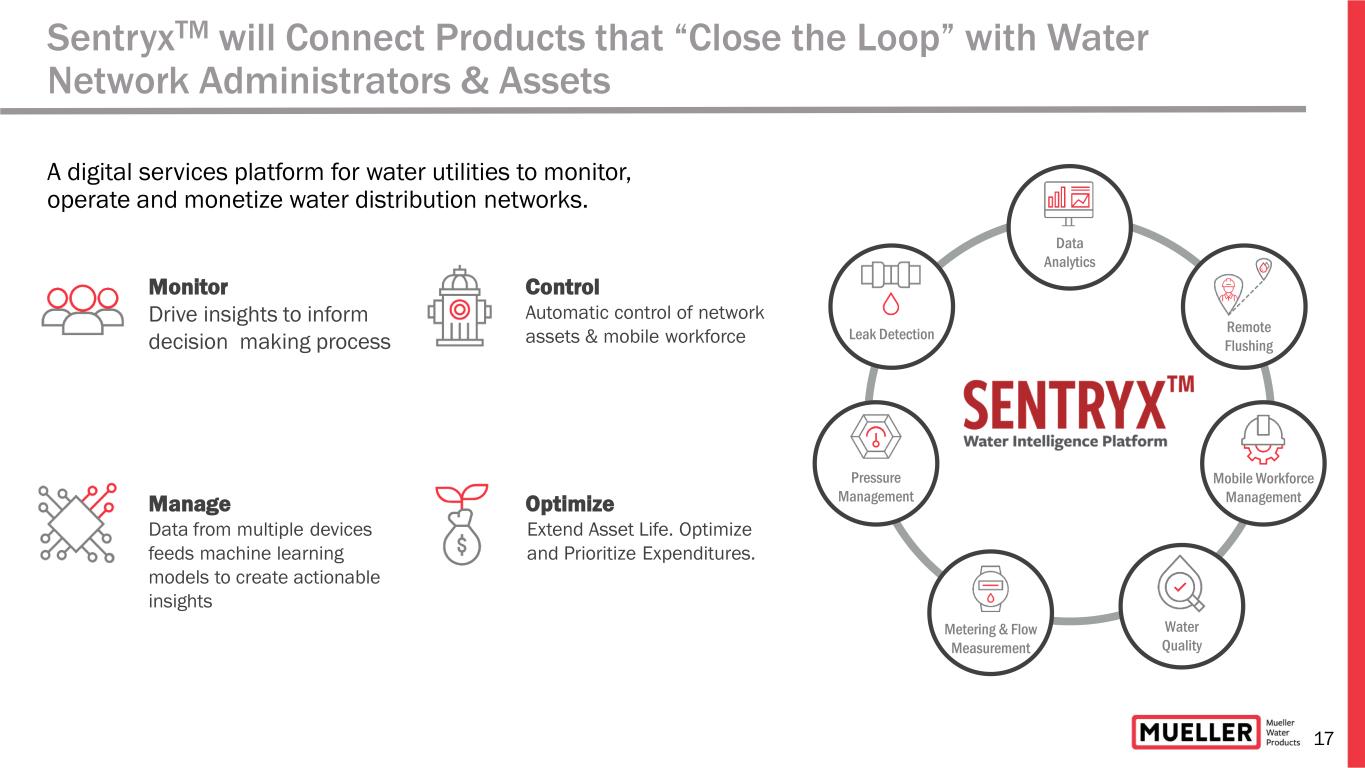

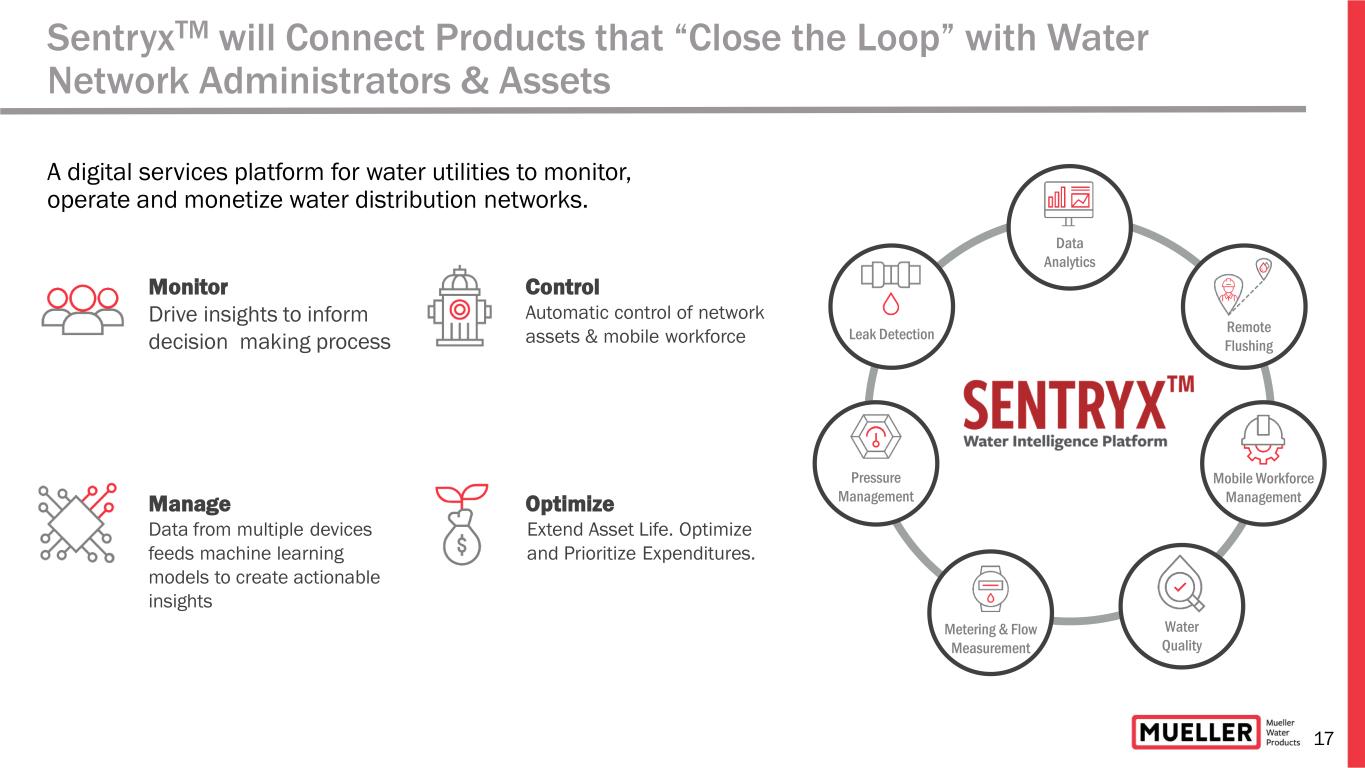

17 SentryxTM will Connect Products that “Close the Loop” with Water Network Administrators & Assets A digital services platform for water utilities to monitor, operate and monetize water distribution networks. Remote Flushing Mobile Workforce Management Water Quality Metering & Flow Measurement Pressure Management Leak Detection Data Analytics Monitor Drive insights to inform decision making process Control Automatic control of network assets & mobile workforce Manage Data from multiple devices feeds machine learning models to create actionable insights Optimize Extend Asset Life. Optimize and Prioritize Expenditures.

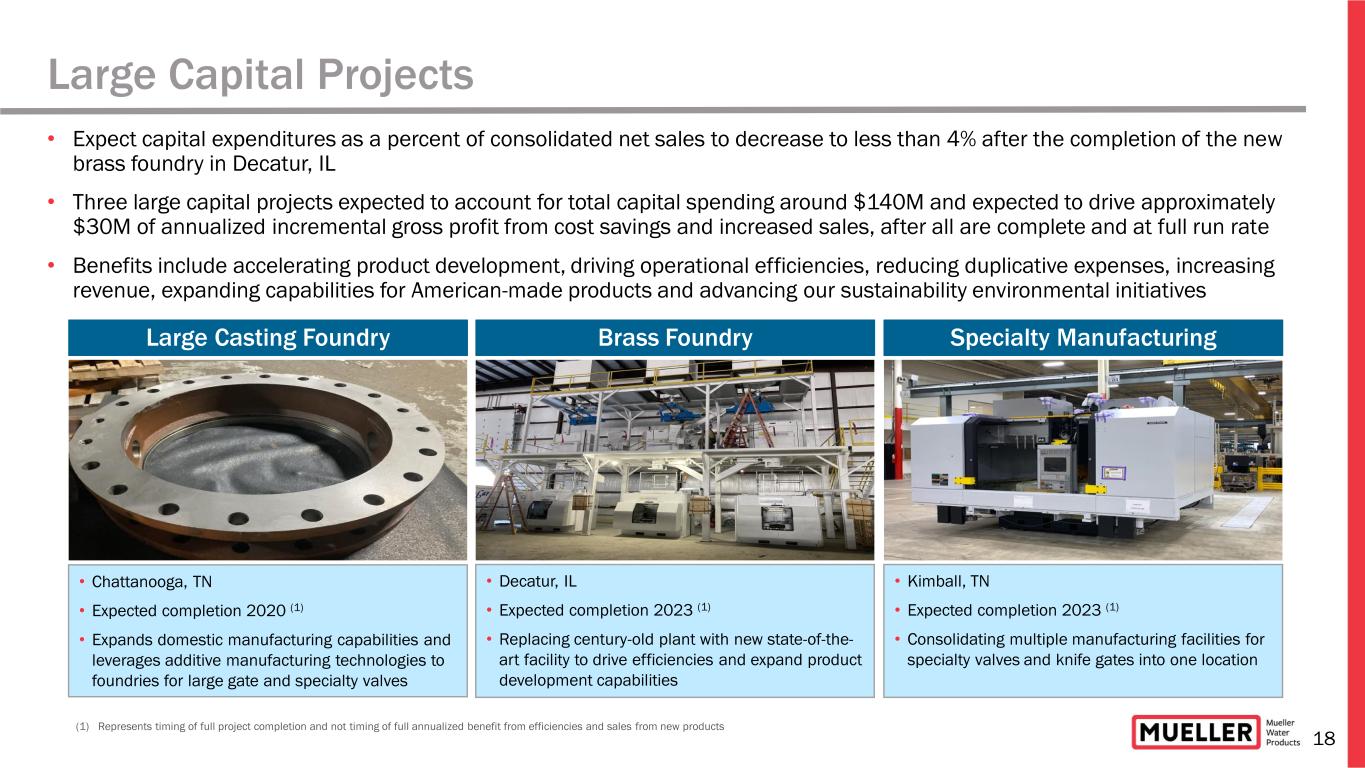

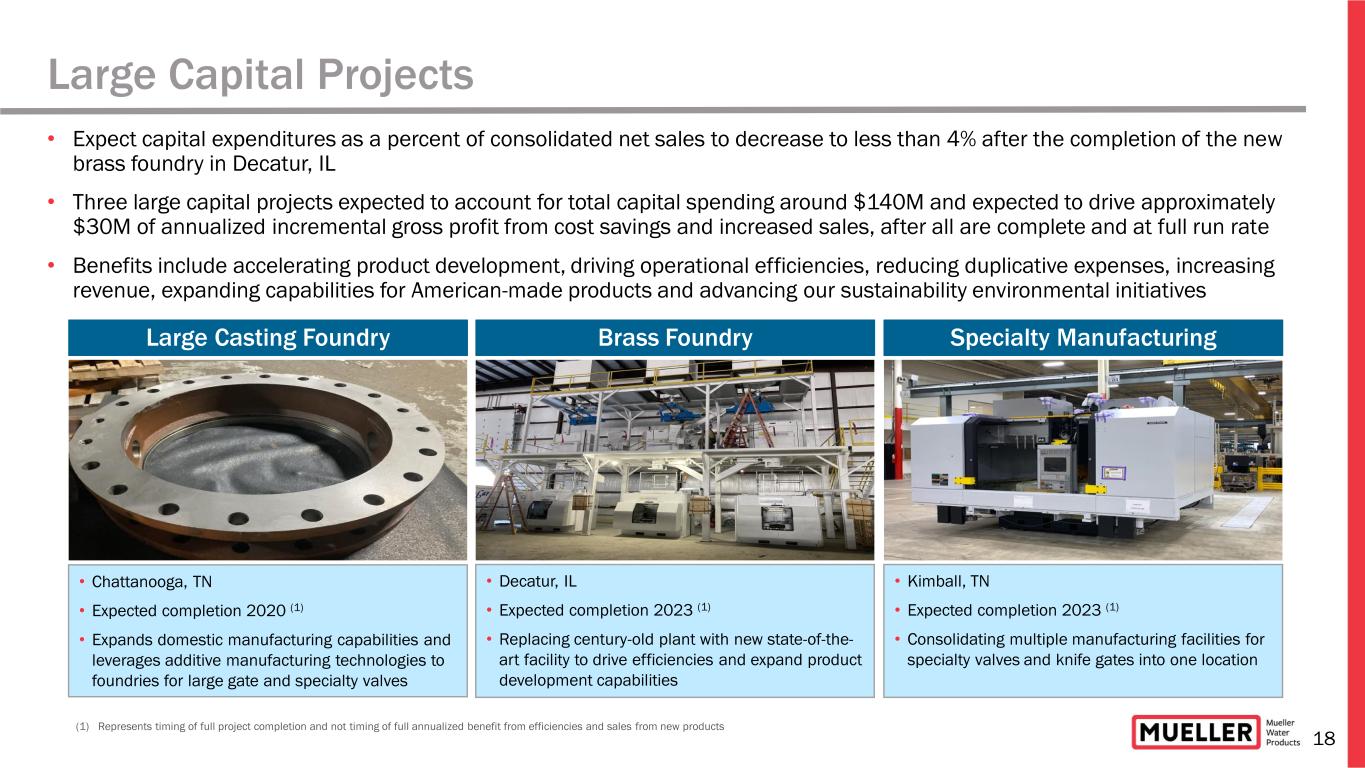

18 Large Capital Projects Large Casting Foundry Brass Foundry Specialty Manufacturing • Expect capital expenditures as a percent of consolidated net sales to decrease to less than 4% after the completion of the new brass foundry in Decatur, IL • Three large capital projects expected to account for total capital spending around $140M and expected to drive approximately $30M of annualized incremental gross profit from cost savings and increased sales, after all are complete and at full run rate • Benefits include accelerating product development, driving operational efficiencies, reducing duplicative expenses, increasing revenue, expanding capabilities for American-made products and advancing our sustainability environmental initiatives • Chattanooga, TN • Expected completion 2020 (1) • Expands domestic manufacturing capabilities and leverages additive manufacturing technologies to foundries for large gate and specialty valves • Decatur, IL • Expected completion 2023 (1) • Replacing century-old plant with new state-of-the- art facility to drive efficiencies and expand product development capabilities • Kimball, TN • Expected completion 2023 (1) • Consolidating multiple manufacturing facilities for specialty valves and knife gates into one location (1) Represents timing of full project completion and not timing of full annualized benefit from efficiencies and sales from new products

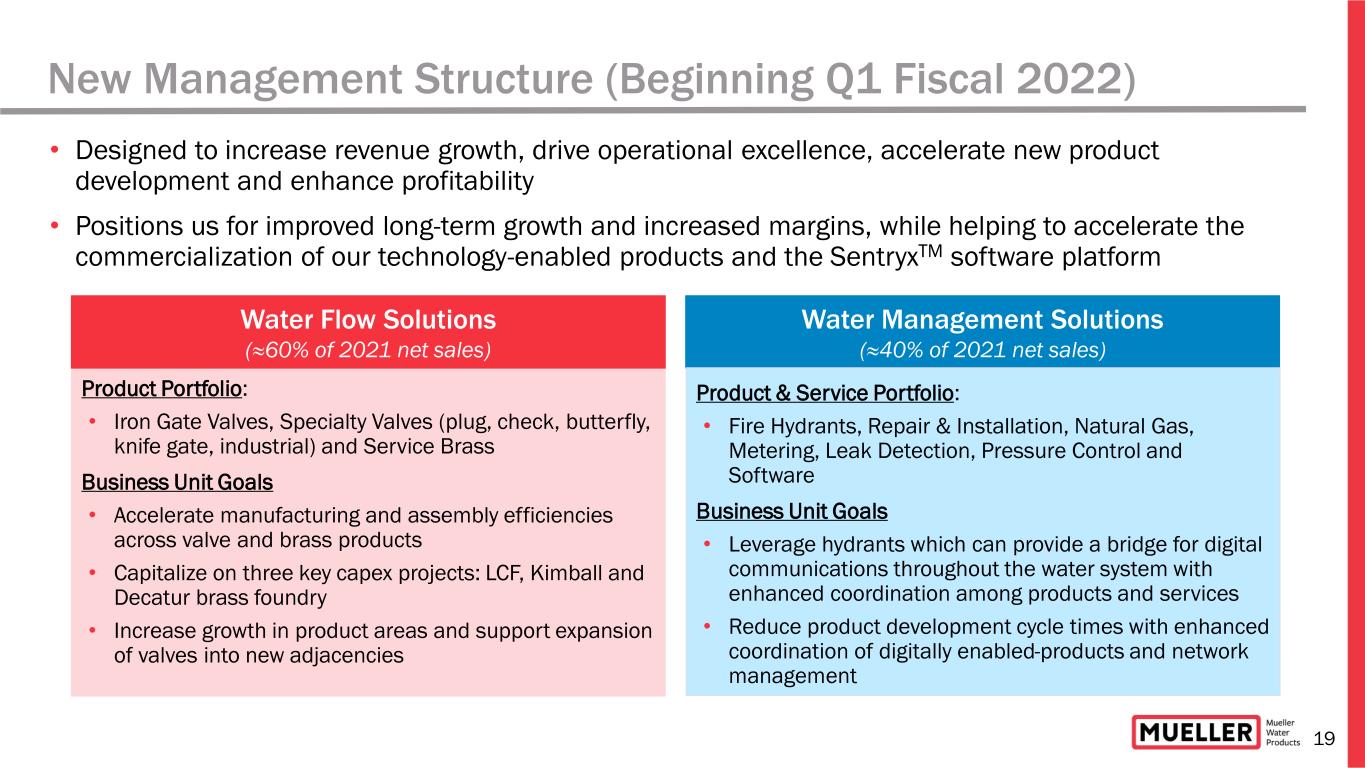

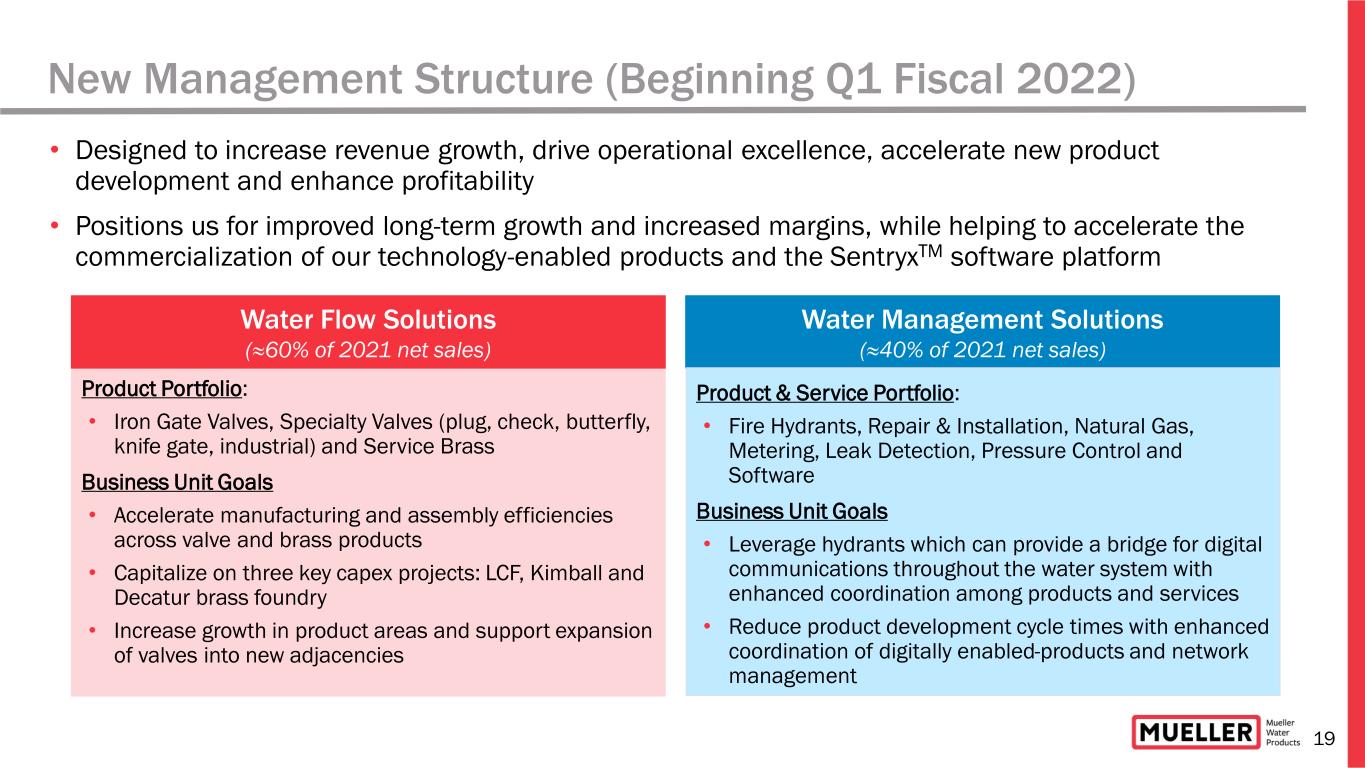

19 • Designed to increase revenue growth, drive operational excellence, accelerate new product development and enhance profitability • Positions us for improved long-term growth and increased margins, while helping to accelerate the commercialization of our technology-enabled products and the SentryxTM software platform Product Portfolio: • Iron Gate Valves, Specialty Valves (plug, check, butterfly, knife gate, industrial) and Service Brass Business Unit Goals • Accelerate manufacturing and assembly efficiencies across valve and brass products • Capitalize on three key capex projects: LCF, Kimball and Decatur brass foundry • Increase growth in product areas and support expansion of valves into new adjacencies Water Flow Solutions (≈60% of 2021 net sales) Water Management Solutions (≈40% of 2021 net sales) Product & Service Portfolio: • Fire Hydrants, Repair & Installation, Natural Gas, Metering, Leak Detection, Pressure Control and Software Business Unit Goals • Leverage hydrants which can provide a bridge for digital communications throughout the water system with enhanced coordination among products and services • Reduce product development cycle times with enhanced coordination of digitally enabled-products and network management New Management Structure (Beginning Q1 Fiscal 2022)

Financial Performance

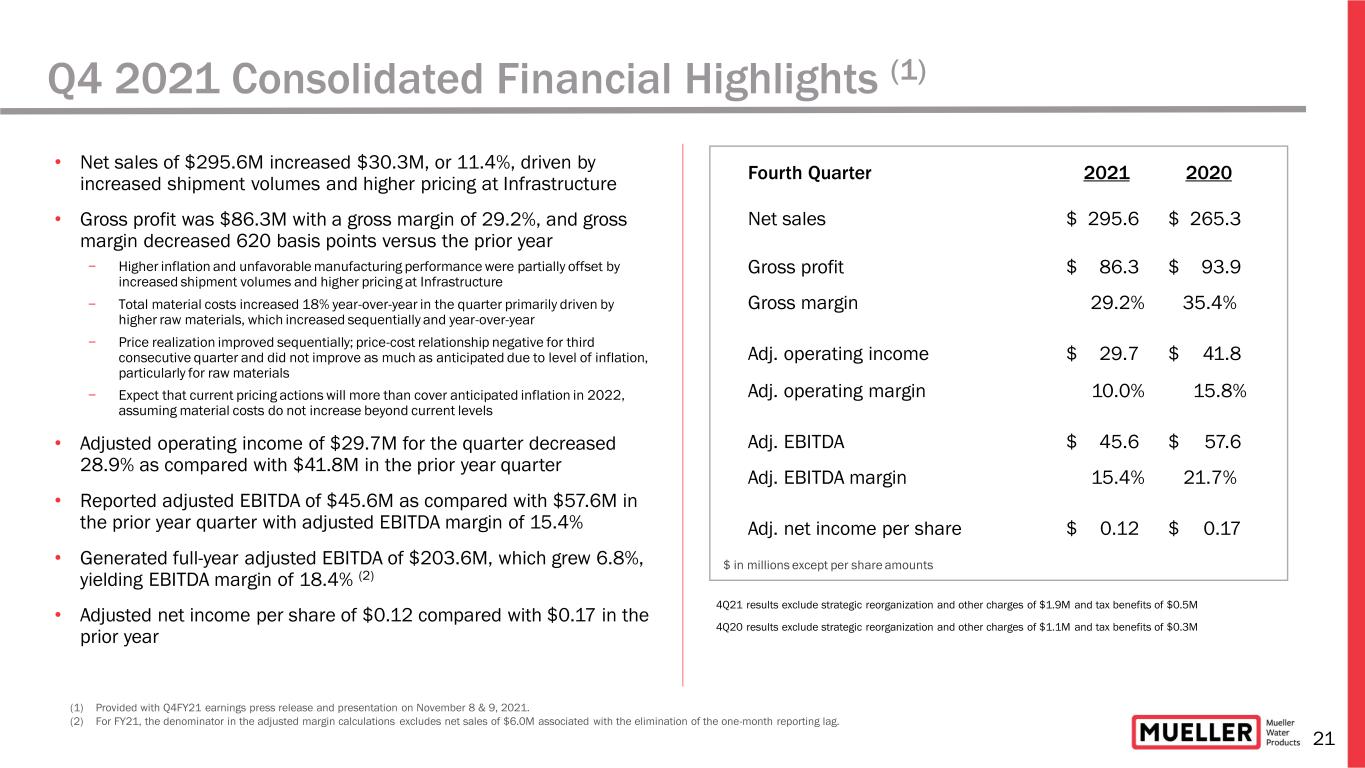

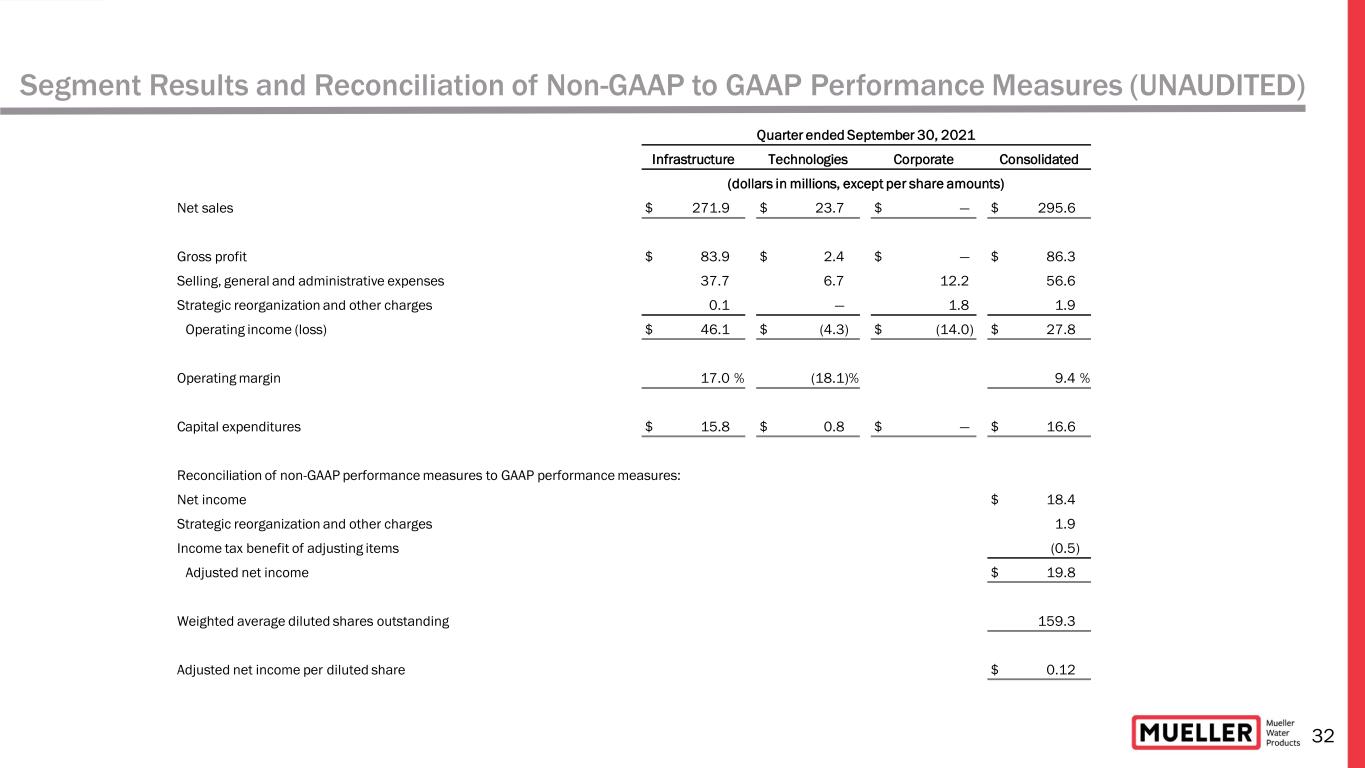

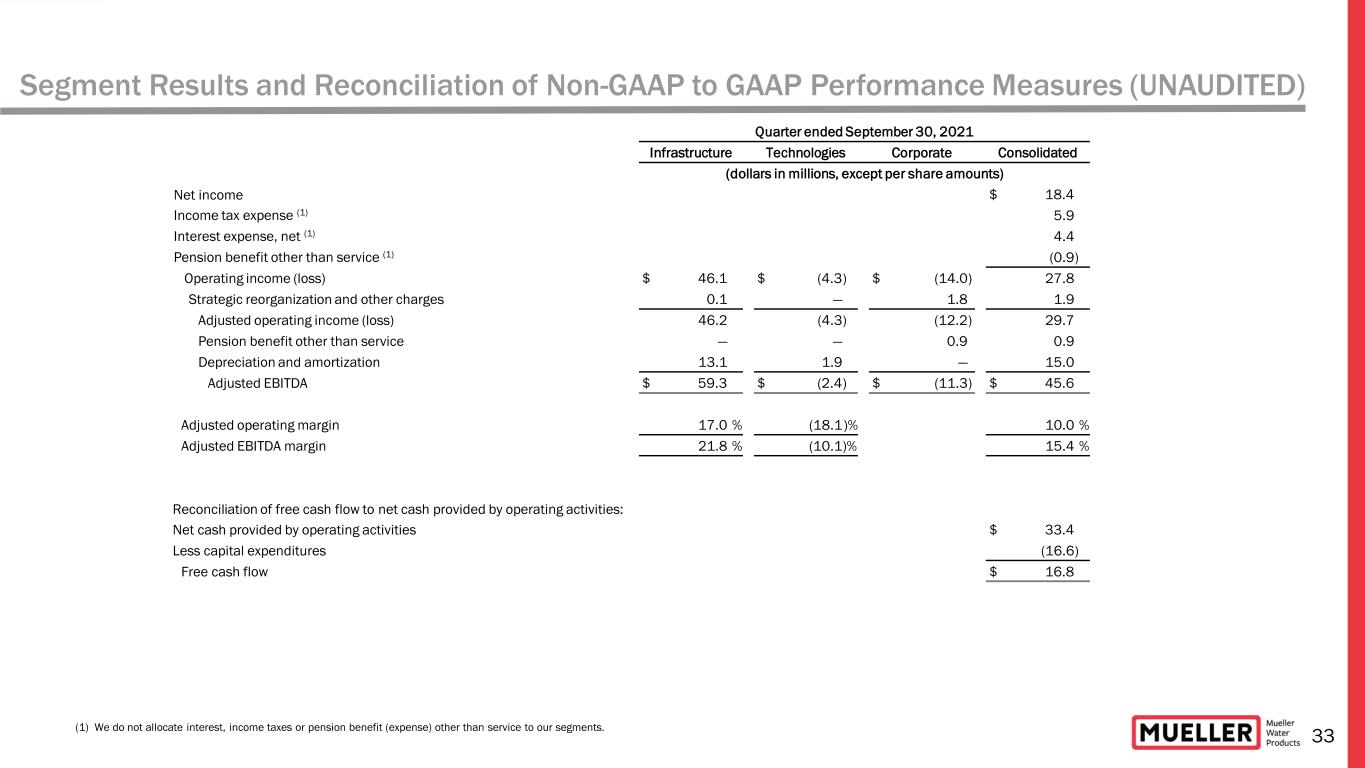

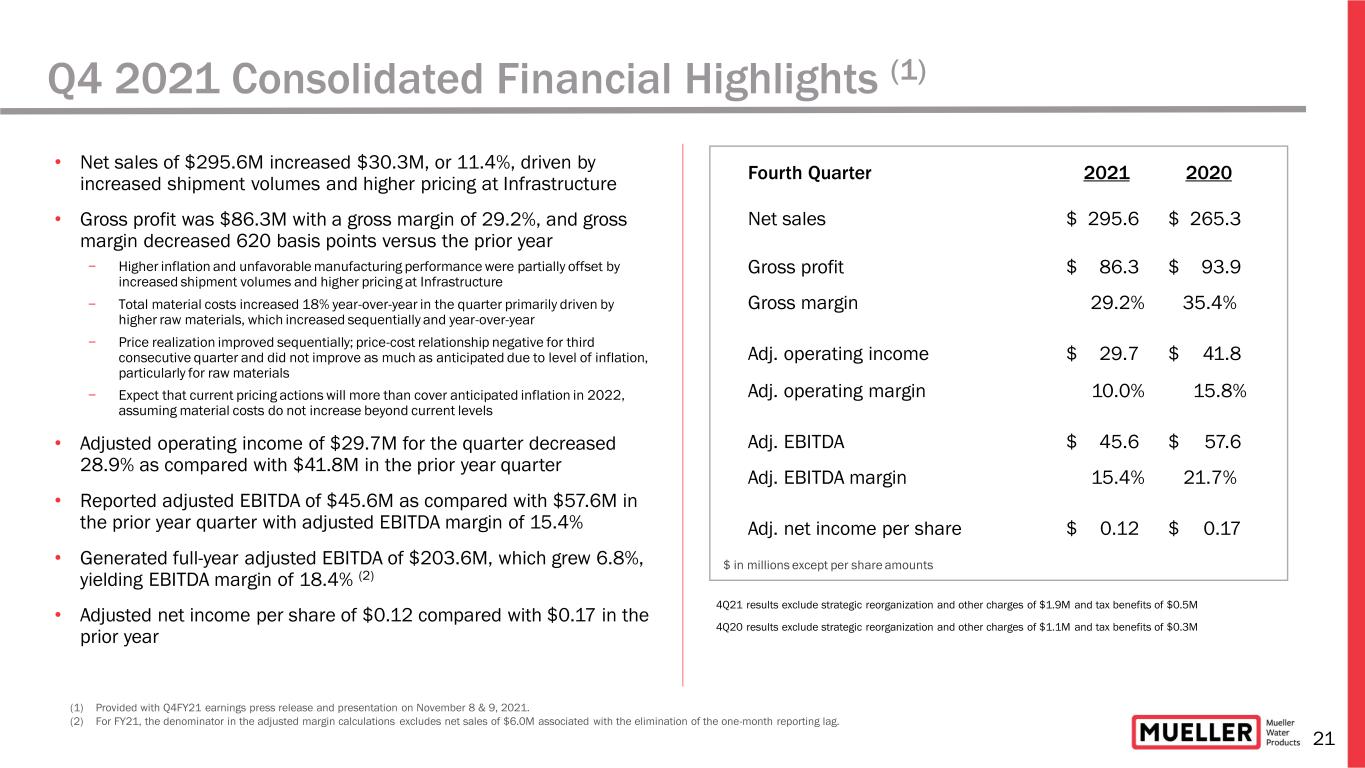

21 Q4 2021 Consolidated Financial Highlights (1) • Net sales of $295.6M increased $30.3M, or 11.4%, driven by increased shipment volumes and higher pricing at Infrastructure • Gross profit was $86.3M with a gross margin of 29.2%, and gross margin decreased 620 basis points versus the prior year − Higher inflation and unfavorable manufacturing performance were partially offset by increased shipment volumes and higher pricing at Infrastructure − Total material costs increased 18% year-over-year in the quarter primarily driven by higher raw materials, which increased sequentially and year-over-year − Price realization improved sequentially; price-cost relationship negative for third consecutive quarter and did not improve as much as anticipated due to level of inflation, particularly for raw materials − Expect that current pricing actions will more than cover anticipated inflation in 2022, assuming material costs do not increase beyond current levels • Adjusted operating income of $29.7M for the quarter decreased 28.9% as compared with $41.8M in the prior year quarter • Reported adjusted EBITDA of $45.6M as compared with $57.6M in the prior year quarter with adjusted EBITDA margin of 15.4% • Generated full-year adjusted EBITDA of $203.6M, which grew 6.8%, yielding EBITDA margin of 18.4% (2) • Adjusted net income per share of $0.12 compared with $0.17 in the prior year $ in millions except per share amounts Fourth Quarter 2021 2020 Net sales $ 295.6 $ 265.3 Gross profit $ 86.3 $ 93.9 Gross margin 29.2% 35.4% Adj. operating income $ 29.7 $ 41.8 Adj. operating margin 10.0% 15.8% Adj. EBITDA $ 45.6 $ 57.6 Adj. EBITDA margin 15.4% 21.7% Adj. net income per share $ 0.12 $ 0.17 4Q21 results exclude strategic reorganization and other charges of $1.9M and tax benefits of $0.5M 4Q20 results exclude strategic reorganization and other charges of $1.1M and tax benefits of $0.3M (1) Provided with Q4FY21 earnings press release and presentation on November 8 & 9, 2021. (2) For FY21, the denominator in the adjusted margin calculations excludes net sales of $6.0M associated with the elimination of the one-month reporting lag.

22 • Challenges during quarter impacted our gross margin and led to the disappointing adjusted EBITDA conversion, which was below our expectations − Gross margin gap was approximately $15M with labor challenges making up more than one-third of gap − Higher inflation, freight and electricity costs combined also accounted for more than one-third of the gap; and of the other drivers, operational challenges for our specialty valve product portfolio had the largest impact along with unfavorable inventory adjustments • Labor challenges have led to an increase in costs associated with overtime and benefits − Provided additional performance incentives for team members at the plants recognizing hard work throughout this exceptionally challenging operating environment − Working closely to manage our relationships with our employees and enhance our efforts around hiring, training and retention • Raw material inflation continued to be a headwind; experienced another sequential increase in raw material prices (scrap steel and brass ingot with prices up over 50% versus prior year) − Anticipate impact from raw material inflation could be higher again in 2022 since prices didn’t start to accelerate higher until Q2FY21 − Pricing actions during this past year, which include three price increases across most product lines, are helping to offset inflation − Record backlogs extending timing for continued price benefits; do not expect to be in a positive price-cost position on a quarterly basis until the middle of 2022 − Expect current pricing actions will more than cover anticipated inflation in 2022, assuming material costs do not increase beyond current levels • Increased output leading to higher energy costs at foundries running during peak periods • Supply chain disruptions have led to higher freight costs and extended lead times for some third party purchased parts − Supply chain teams have been focused on obtaining needed supplies and working to find alternative sources where possible • Operational challenges even greater for specialty valve product portfolio, which accounts for approximately 15% of annual sales − Products typically used in large projects with long lead times; gap between material cost inflation and pricing improvements can be more than 9 months − Announced a major plant restructuring project in Q2FY21 anticipating a different operating environment − Supply chain disruptions and labor challenges have impacted shipments and increased the transition costs for our plant restructuring − Remain confident that we will fully complete the transition and ramp-up in 2023 with the margin benefits following accordingly Q4 2021 Insights (1) (1) Provided with Q4FY21 earnings press release and presentation on November 8 & 9, 2021.

23 • Experienced strong demand and order growth in Q4 driven by both new residential construction and municipal repair and replacement activity • Expect end markets to remain healthy in 2022 and growth will slow down relative to strong recovery experienced during 2021 • Believe that municipal repair and replacement activity will continue to be healthy − Water utilities maintain recovery and state and local budgets appear to be in good shape, especially at larger municipalities − Aging water infrastructure will continue to be a driver of repair and replacement activity at water utilities • Federal infrastructure bill passed over the weekend is an important step forward for the needed investment in our aging water infrastructure − Have not built any benefits from the bill into our assumptions for our 2022 guidance • Expect residential construction activity to continue to be healthy relative to pre-pandemic levels; however, it will be difficult to achieve significant growth in 2022 − Residential construction activity was incredibly strong during our 2021 highlighted by total housing starts increasing approximately 18% and single family starts increasing around 23% − Supply chain challenges, which are extending the overall build cycles for new residential construction, could extend the healthy demand environment well beyond 2022 Q4 2021 End Markets (1) (1) Provided with Q4FY21 earnings press release and presentation on November 8 & 9, 2021.

24 Full-Year Fiscal 2022 Outlook (1) • Record backlog across our short-cycle products and expected realization from higher pricing position us to deliver net sales growth in 2022, continuing strong net sales growth achieved in 2021 • Believe operating environment will remain challenging, especially in the first half of the year, with the potential for gradual improvement during the second half of the year • Anticipate consolidated net sales will increase between 4% and 8% with adjusted EBITDA also increasing between 4% and 8% as compared with the prior year • Expect to generate solid free cash flow during the fiscal year • Other items include: − Total SG&A expenses between $230M and $240M − Interest expense, net between $18M and $19M − Effective income tax rate between 25% and 27% − Depreciation and amortization between $62M and $64M − Capital expenditures between $70M and $80M • Expectations assume that challenges associated with higher inflation, labor availability and supply chain disruptions and the pandemic’s impact on end markets modestly improve relative to 2021 and that raw material costs do not increase beyond current levels (1) Provided with Q4FY21 earnings press release and presentation on November 8 & 9, 2021.

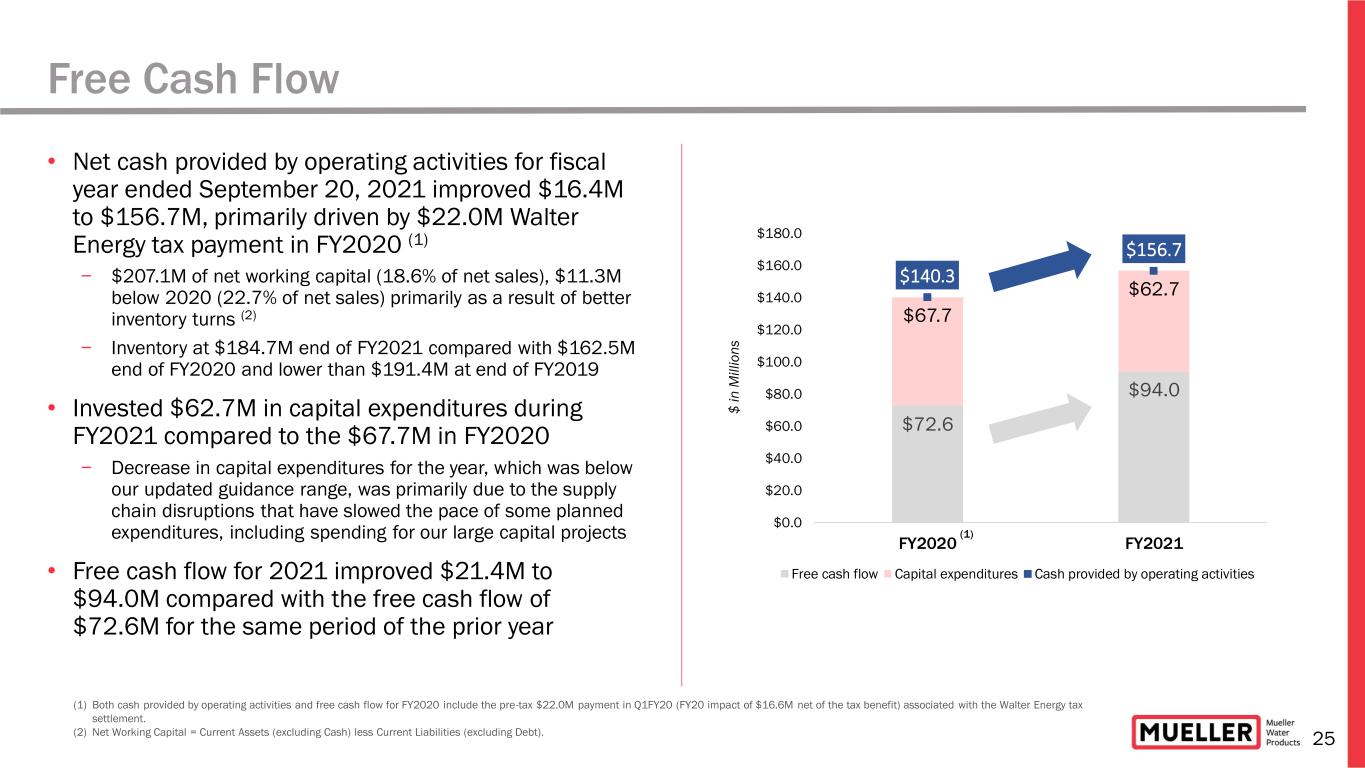

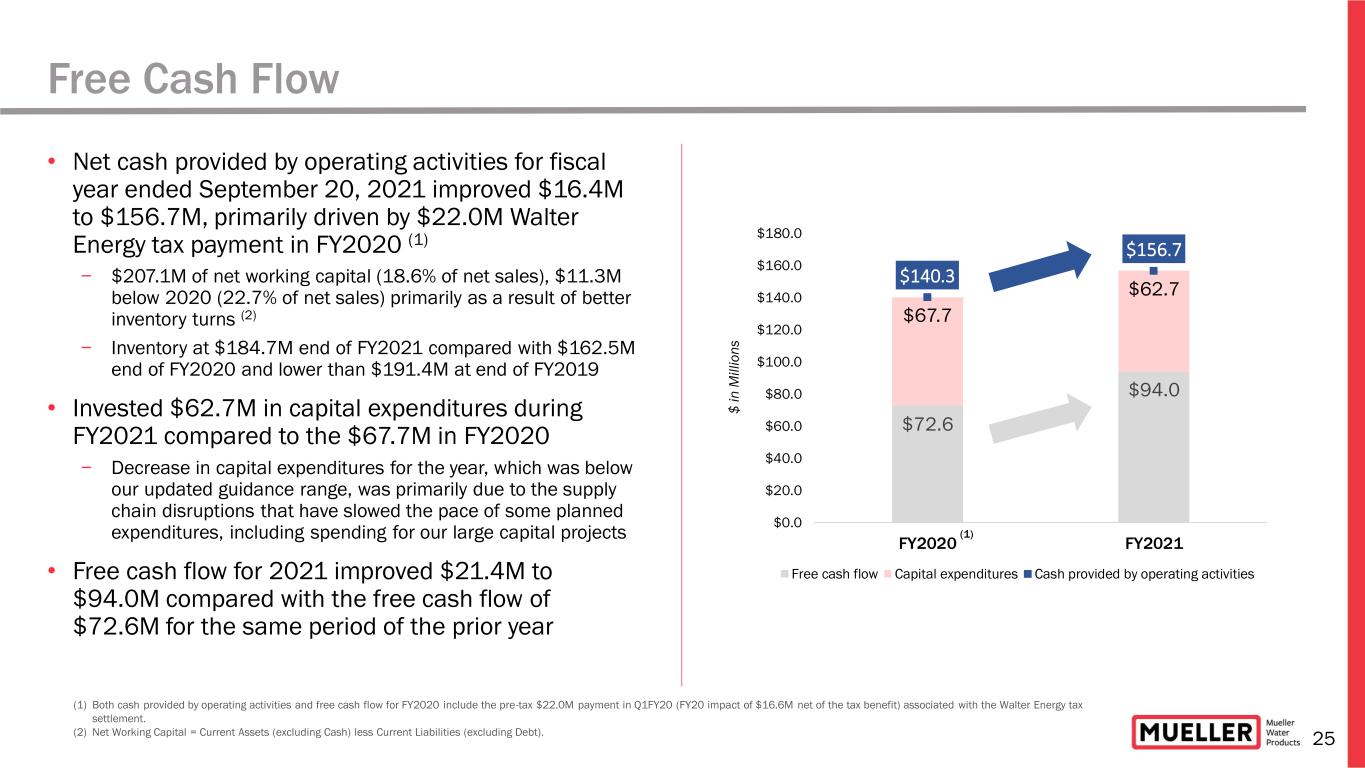

25 $72.6 $94.0 $67.7 $62.7 $140.3 $156.7 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 $180.0 FY2020 FY2021 Free cash flow Capital expenditures Cash provided by operating activities (1) Both cash provided by operating activities and free cash flow for FY2020 include the pre-tax $22.0M payment in Q1FY20 (FY20 impact of $16.6M net of the tax benefit) associated with the Walter Energy tax settlement. (2) Net Working Capital = Current Assets (excluding Cash) less Current Liabilities (excluding Debt). $ i n M il li o n s Free Cash Flow • Net cash provided by operating activities for fiscal year ended September 20, 2021 improved $16.4M to $156.7M, primarily driven by $22.0M Walter Energy tax payment in FY2020 (1) − $207.1M of net working capital (18.6% of net sales), $11.3M below 2020 (22.7% of net sales) primarily as a result of better inventory turns (2) − Inventory at $184.7M end of FY2021 compared with $162.5M end of FY2020 and lower than $191.4M at end of FY2019 • Invested $62.7M in capital expenditures during FY2021 compared to the $67.7M in FY2020 − Decrease in capital expenditures for the year, which was below our updated guidance range, was primarily due to the supply chain disruptions that have slowed the pace of some planned expenditures, including spending for our large capital projects • Free cash flow for 2021 improved $21.4M to $94.0M compared with the free cash flow of $72.6M for the same period of the prior year (1)

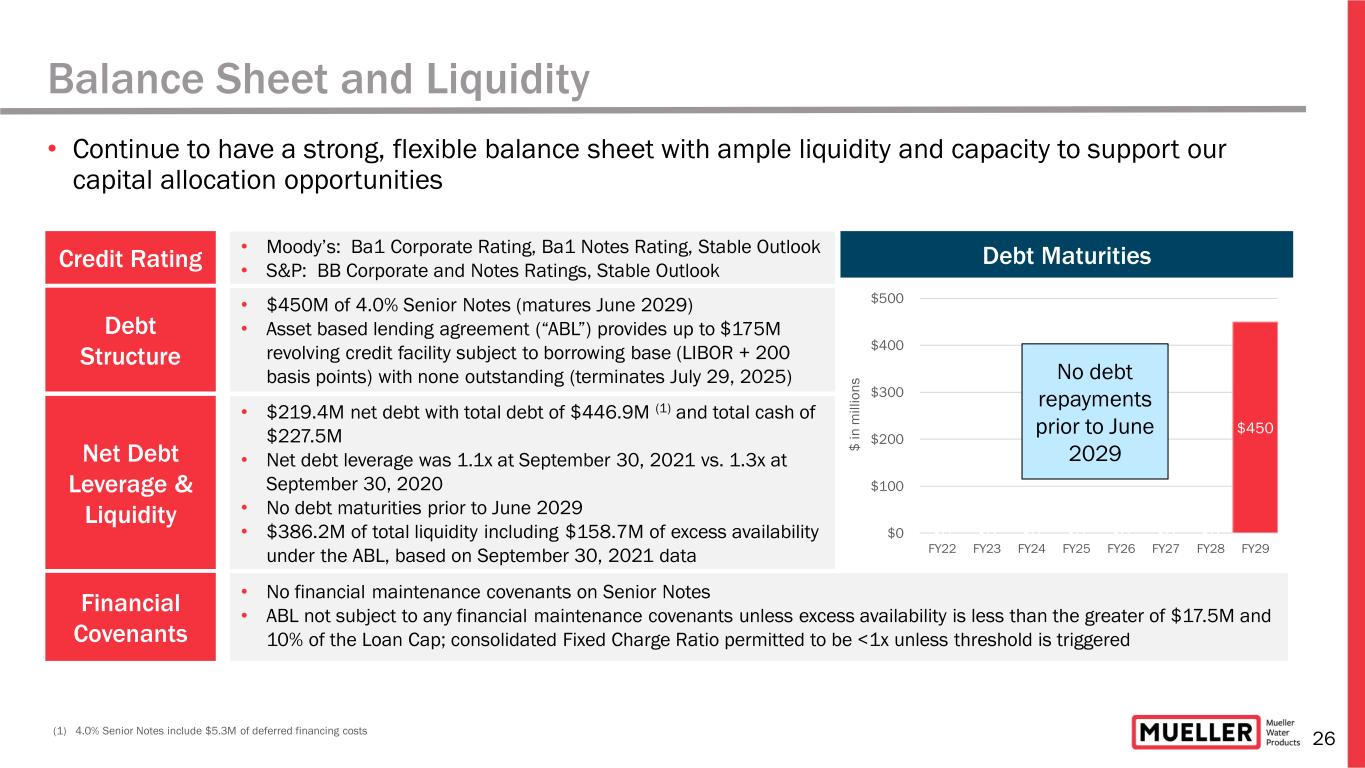

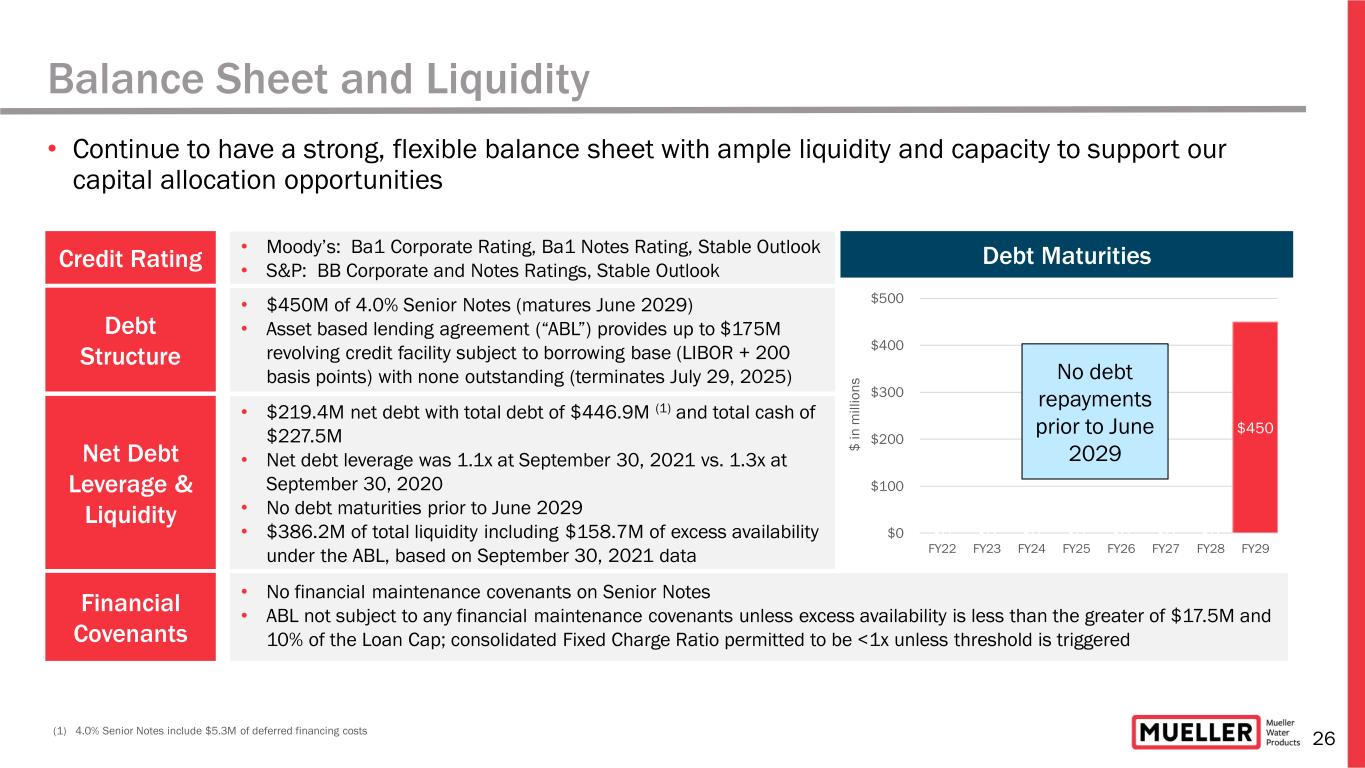

26 Balance Sheet and Liquidity Credit Rating Debt Structure Debt Maturities Financial Covenants • $450M of 4.0% Senior Notes (matures June 2029) • Asset based lending agreement (“ABL”) provides up to $175M revolving credit facility subject to borrowing base (LIBOR + 200 basis points) with none outstanding (terminates July 29, 2025) • No financial maintenance covenants on Senior Notes • ABL not subject to any financial maintenance covenants unless excess availability is less than the greater of $17.5M and 10% of the Loan Cap; consolidated Fixed Charge Ratio permitted to be <1x unless threshold is triggered Net Debt Leverage & Liquidity • $219.4M net debt with total debt of $446.9M (1) and total cash of $227.5M • Net debt leverage was 1.1x at September 30, 2021 vs. 1.3x at September 30, 2020 • No debt maturities prior to June 2029 • $386.2M of total liquidity including $158.7M of excess availability under the ABL, based on September 30, 2021 data (1) 4.0% Senior Notes include $5.3M of deferred financing costs $0 $0 $0 $0 $0 $0 $0 $450 $0 $100 $200 $300 $400 $500 FY22 FY23 FY24 FY25 FY26 FY27 FY28 FY29 $ i n m il li o n s No debt repayments prior to June 2029 • Continue to have a strong, flexible balance sheet with ample liquidity and capacity to support our capital allocation opportunities • Moody’s: Ba1 Corporate Rating, Ba1 Notes Rating, Stable Outlook • S&P: BB Corporate and Notes Ratings, Stable Outlook

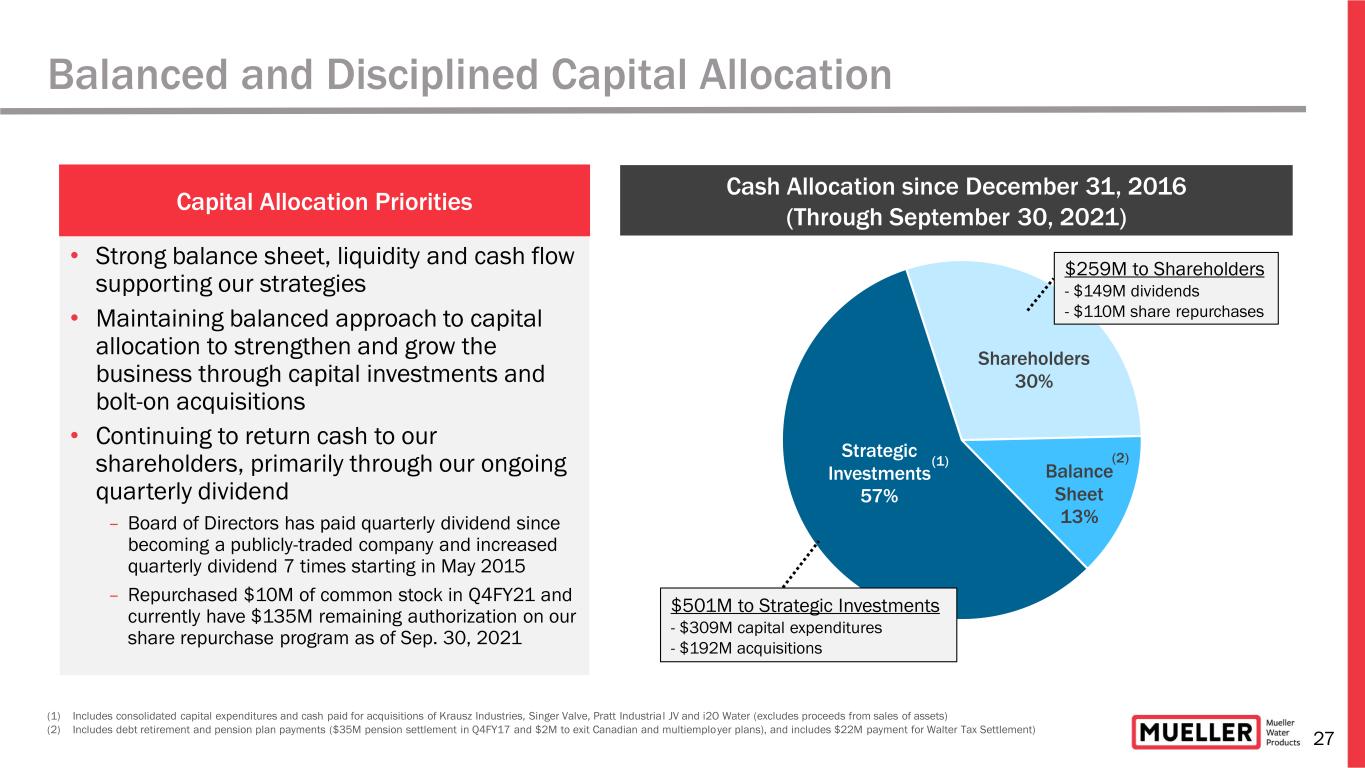

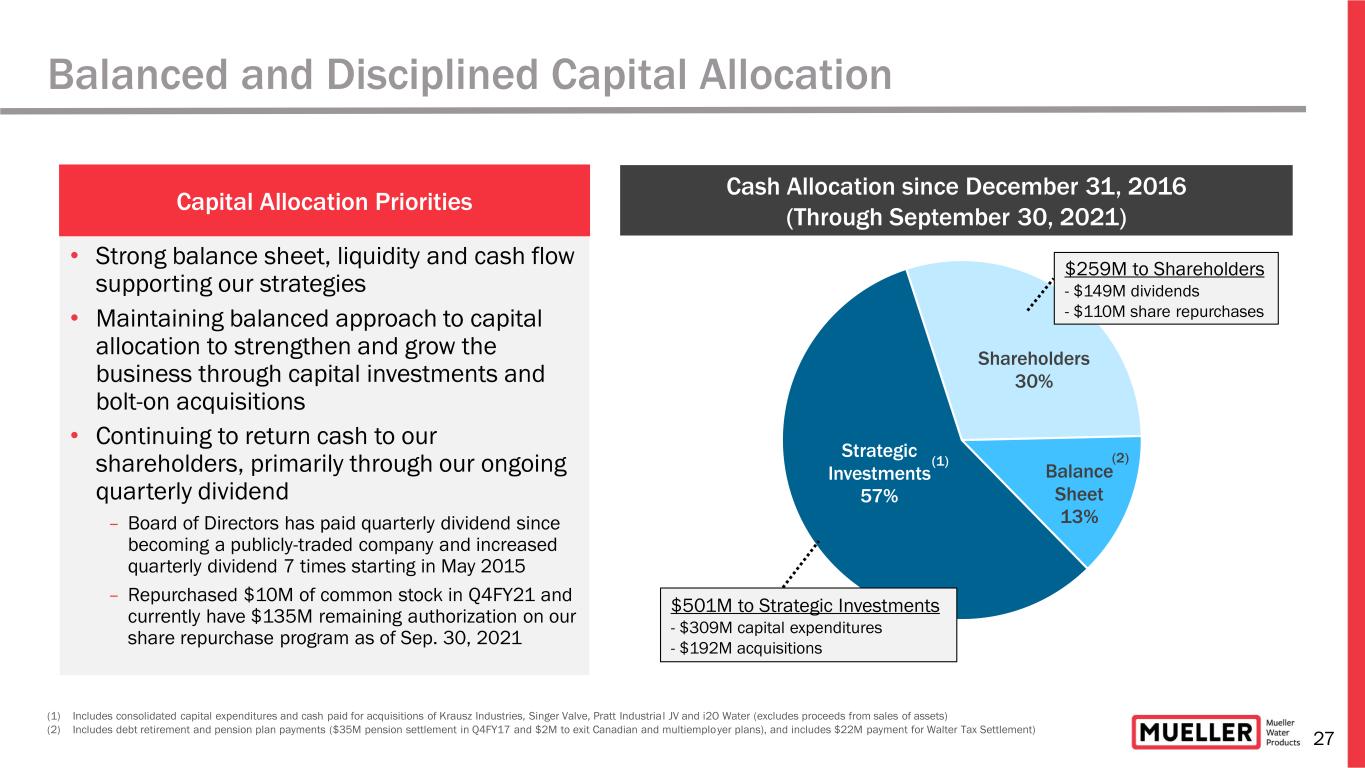

27 Balanced and Disciplined Capital Allocation • Strong balance sheet, liquidity and cash flow supporting our strategies • Maintaining balanced approach to capital allocation to strengthen and grow the business through capital investments and bolt-on acquisitions • Continuing to return cash to our shareholders, primarily through our ongoing quarterly dividend – Board of Directors has paid quarterly dividend since becoming a publicly-traded company and increased quarterly dividend 7 times starting in May 2015 – Repurchased $10M of common stock in Q4FY21 and currently have $135M remaining authorization on our share repurchase program as of Sep. 30, 2021 Shareholders 30% Balance Sheet 13% Strategic Investments 57% $259M to Shareholders - $149M dividends - $110M share repurchases Cash Allocation since December 31, 2016 (Through September 30, 2021) $501M to Strategic Investments - $309M capital expenditures - $192M acquisitions (1) (2) (1) Includes consolidated capital expenditures and cash paid for acquisitions of Krausz Industries, Singer Valve, Pratt Industrial JV and i2O Water (excludes proceeds from sales of assets) (2) Includes debt retirement and pension plan payments ($35M pension settlement in Q4FY17 and $2M to exit Canadian and multiemployer plans), and includes $22M payment for Walter Tax Settlement) Capital Allocation Priorities

28 Investment Highlights LONG-TERM END MARKET DYNAMICS CONTINUE TO IMPROVE LEVERAGING STRENGTHS TO INCREASE TECHNOLOGY-ENABLED PRODUCTS MODERNIZING MANUFACTURING AND DRIVING OPERATIONAL EXCELLENCE TO DELIVER MARGIN EXPANSION FLEXIBLE BALANCE SHEET AND STRONG CASH FLOW STRONG COMPETITIVE POSITION

Supplemental Data

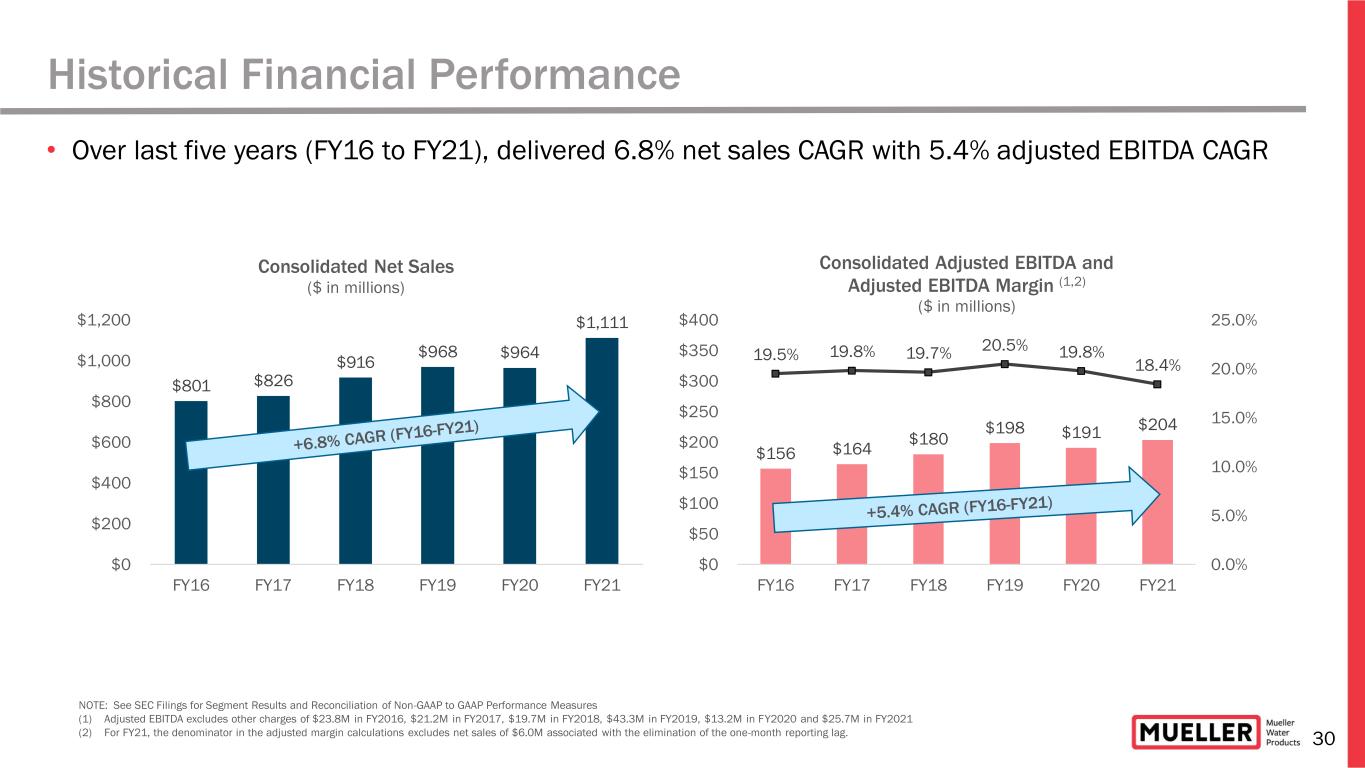

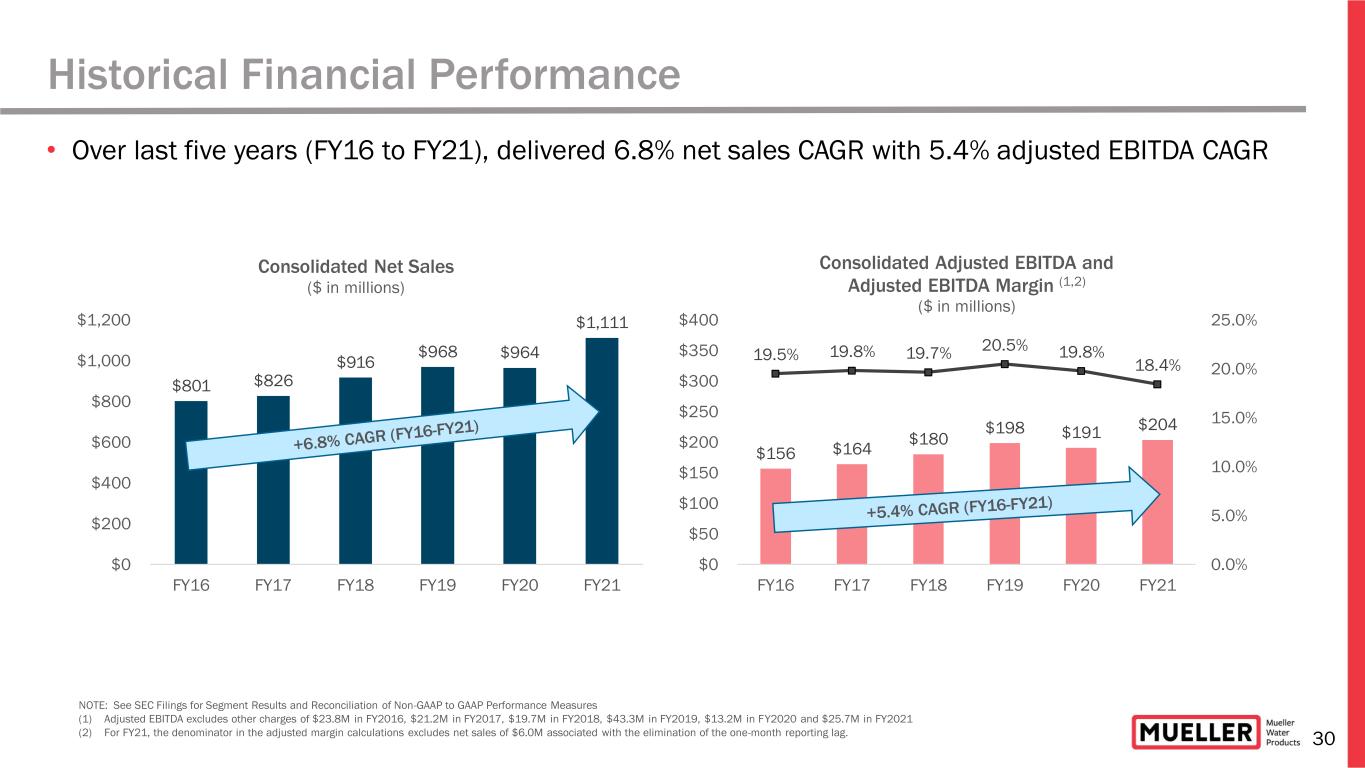

30 Historical Financial Performance $801 $826 $916 $968 $964 $1,111 $0 $200 $400 $600 $800 $1,000 $1,200 FY16 FY17 FY18 FY19 FY20 FY21 Consolidated Net Sales ($ in millions) $156 $164 $180 $198 $191 $204 19.5% 19.8% 19.7% 20.5% 19.8% 18.4% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% $0 $50 $100 $150 $200 $250 $300 $350 $400 FY16 FY17 FY18 FY19 FY20 FY21 Consolidated Adjusted EBITDA and Adjusted EBITDA Margin (1,2) ($ in millions) NOTE: See SEC Filings for Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures (1) Adjusted EBITDA excludes other charges of $23.8M in FY2016, $21.2M in FY2017, $19.7M in FY2018, $43.3M in FY2019, $13.2M in FY2020 and $25.7M in FY2021 (2) For FY21, the denominator in the adjusted margin calculations excludes net sales of $6.0M associated with the elimination of the one-month reporting lag. • Over last five years (FY16 to FY21), delivered 6.8% net sales CAGR with 5.4% adjusted EBITDA CAGR

31 Strong Balance Sheet with Significant Flexibility • Reduced debt by $1.1B since March 31, 2006 and $650M since September 30, 2008 • Total debt of $446.9M and total cash of $227.5M leading to net debt leverage of 1.1x at September 30, 2021 with $158.7M of excess availability under the ABL, based on September 30, 2021 data • Capital structure and net leverage position provide flexibility to support capital investments, quarterly dividend and acquisitions $1,549 $1,127 $1,101 $1,096 $740 $692 $678 $623 $601 $541 $489 $484 $481 $445 $446 $448 $447 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 Mar-06 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 Total Debt ($ in millions)

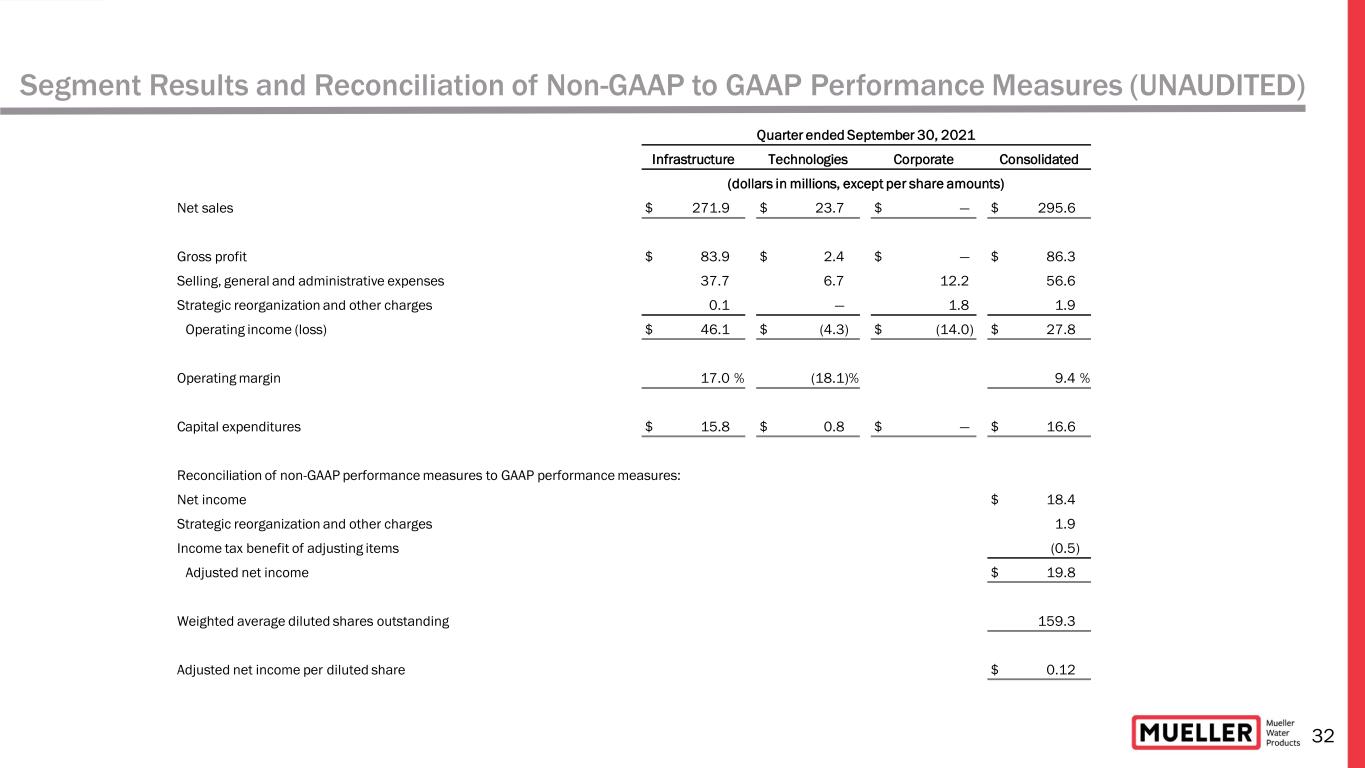

‹#›32 Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures (UNAUDITED) Quarter ended September 30, 2021 Infrastructure Technologies Corporate Consolidated (dollars in millions, except per share amounts) Net sales $ 271.9 $ 23.7 $ — $ 295.6 Gross profit $ 83.9 $ 2.4 $ — $ 86.3 Selling, general and administrative expenses 37.7 6.7 12.2 56.6 Strategic reorganization and other charges 0.1 — 1.8 1.9 Operating income (loss) $ 46.1 $ (4.3) $ (14.0) $ 27.8 Operating margin 17.0 % (18.1)% 9.4 % Capital expenditures $ 15.8 $ 0.8 $ — $ 16.6 Reconciliation of non-GAAP performance measures to GAAP performance measures: Net income $ 18.4 Strategic reorganization and other charges 1.9 Income tax benefit of adjusting items (0.5) Adjusted net income $ 19.8 Weighted average diluted shares outstanding 159.3 Adjusted net income per diluted share $ 0.12

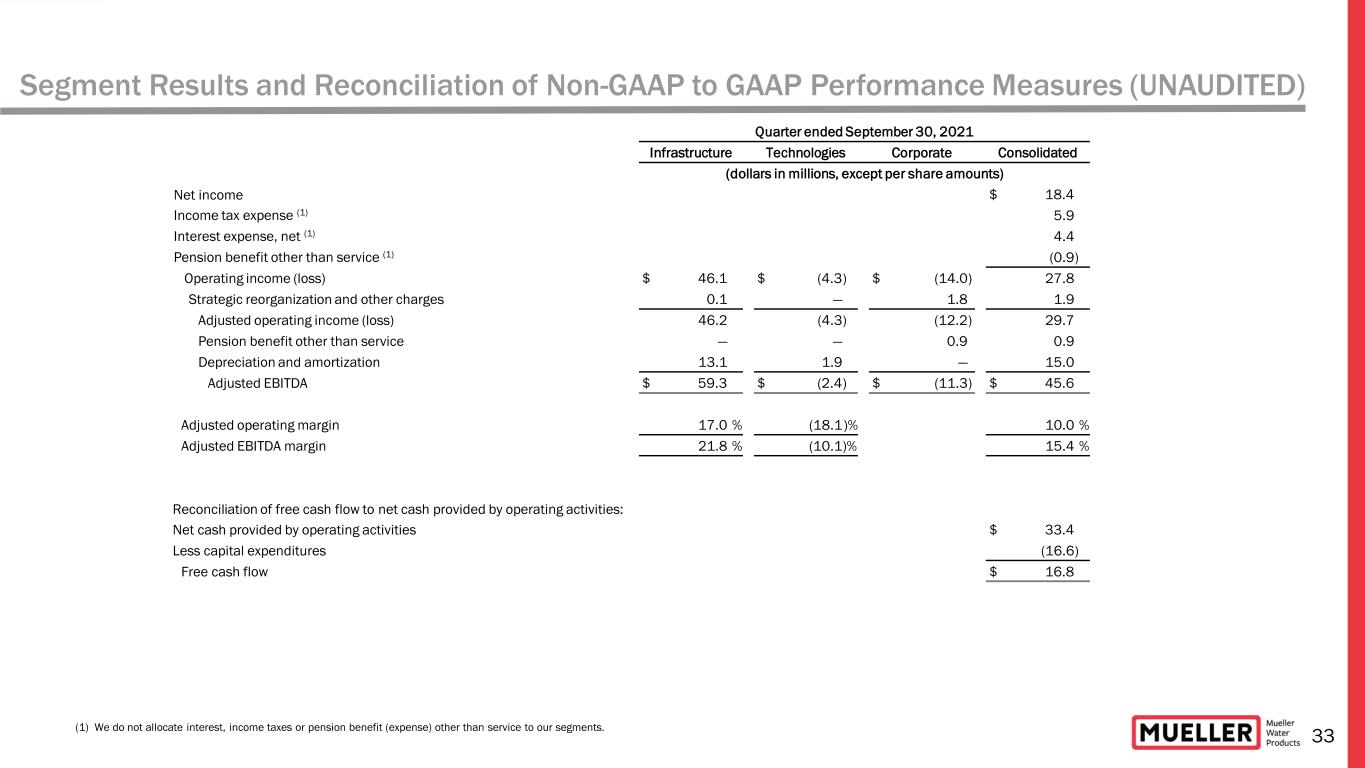

‹#›33 Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures (UNAUDITED) Quarter ended September 30, 2021 Infrastructure Technologies Corporate Consolidated (dollars in millions, except per share amounts) Net income $ 18.4 Income tax expense (1) 5.9 Interest expense, net (1) 4.4 Pension benefit other than service (1) (0.9) Operating income (loss) $ 46.1 $ (4.3) $ (14.0) 27.8 Strategic reorganization and other charges 0.1 — 1.8 1.9 Adjusted operating income (loss) 46.2 (4.3) (12.2) 29.7 Pension benefit other than service — — 0.9 0.9 Depreciation and amortization 13.1 1.9 — 15.0 Adjusted EBITDA $ 59.3 $ (2.4) $ (11.3) $ 45.6 Adjusted operating margin 17.0 % (18.1)% 10.0 % Adjusted EBITDA margin 21.8 % (10.1)% 15.4 % Reconciliation of free cash flow to net cash provided by operating activities: Net cash provided by operating activities $ 33.4 Less capital expenditures (16.6) Free cash flow $ 16.8 (1) We do not allocate interest, income taxes or pension benefit (expense) other than service to our segments.

‹#›34 Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures (UNAUDITED) Quarter ended September 30, 2020 Infrastructure Technologies Corporate Consolidated (dollars in millions, except per share amounts) Net sales (1) $ 242.0 $ 23.3 $ — $ 265.3 Gross profit (1) $ 90.3 $ 3.6 $ — $ 93.9 Selling, general and administrative expenses 33.5 5.9 12.7 52.1 Strategic reorganization and other charges 0.2 0.1 0.8 1.1 Operating income (loss) $ 56.6 $ (2.4) $ (13.5) $ 40.7 Operating margin 23.4 % (10.3)% 15.3 % Capital expenditures $ 15.4 $ 1.0 $ 0.1 $ 16.5 Reconciliation of non-GAAP performance measures to GAAP performance measures: Net income $ 26.7 Strategic reorganization and other charges 1.1 Income tax benefit of adjusting items (0.3) Adjusted net income $ 27.5 Weighted average diluted shares outstanding 158.7 Adjusted net income per diluted share $ 0.17 (1) Net sales and gross profit associated with certain products have been reclassified as Technologies segment items to conform to the current period presentation. (2) We do not allocate interest, income taxes or pension benefit (expense) other than service to our segments.

‹#›35 Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures (UNAUDITED) Quarter ended September 30, 2020 Infrastructure Technologies Corporate Consolidated (dollars in millions, except per share amounts) Net income $ 26.7 Income tax expense (2) 8.8 Interest expense, net (2) 6.0 Pension benefit other than service (2) (0.8) Operating income (loss) $ 56.6 $ (2.4) $ (13.5) 40.7 Strategic reorganization and other charges 0.2 0.1 0.8 1.1 Adjusted operating income (loss) 56.8 (2.3) (12.7) 41.8 Pension benefit other than service — — 0.8 0.8 Depreciation and amortization 12.8 2.1 0.1 15.0 Adjusted EBITDA $ 69.6 $ (0.2) $ (11.8) $ 57.6 Adjusted operating margin 23.5 % (9.9)% 15.8 % Adjusted EBITDA margin 28.8 % (0.9)% 21.7 % Reconciliation of free cash flow to net cash provided by operating activities: Net cash provided by operating activities $ 62.5 Less capital expenditures (16.5) Free cash flow $ 46.0 (1) Net sales and gross profit associated with certain products have been reclassified as Technologies segment items to conform to the current period presentation. (2) We do not allocate interest, income taxes or pension benefit (expense) other than service to our segments.

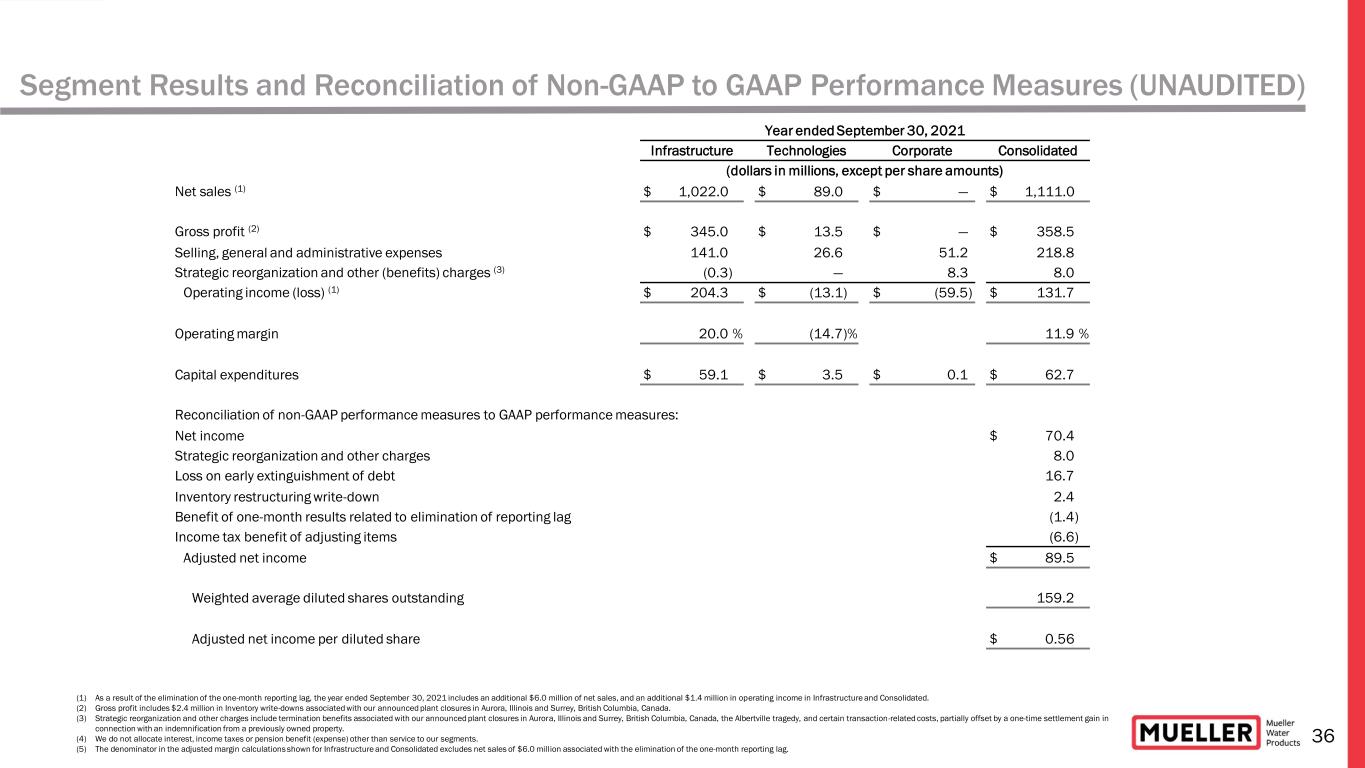

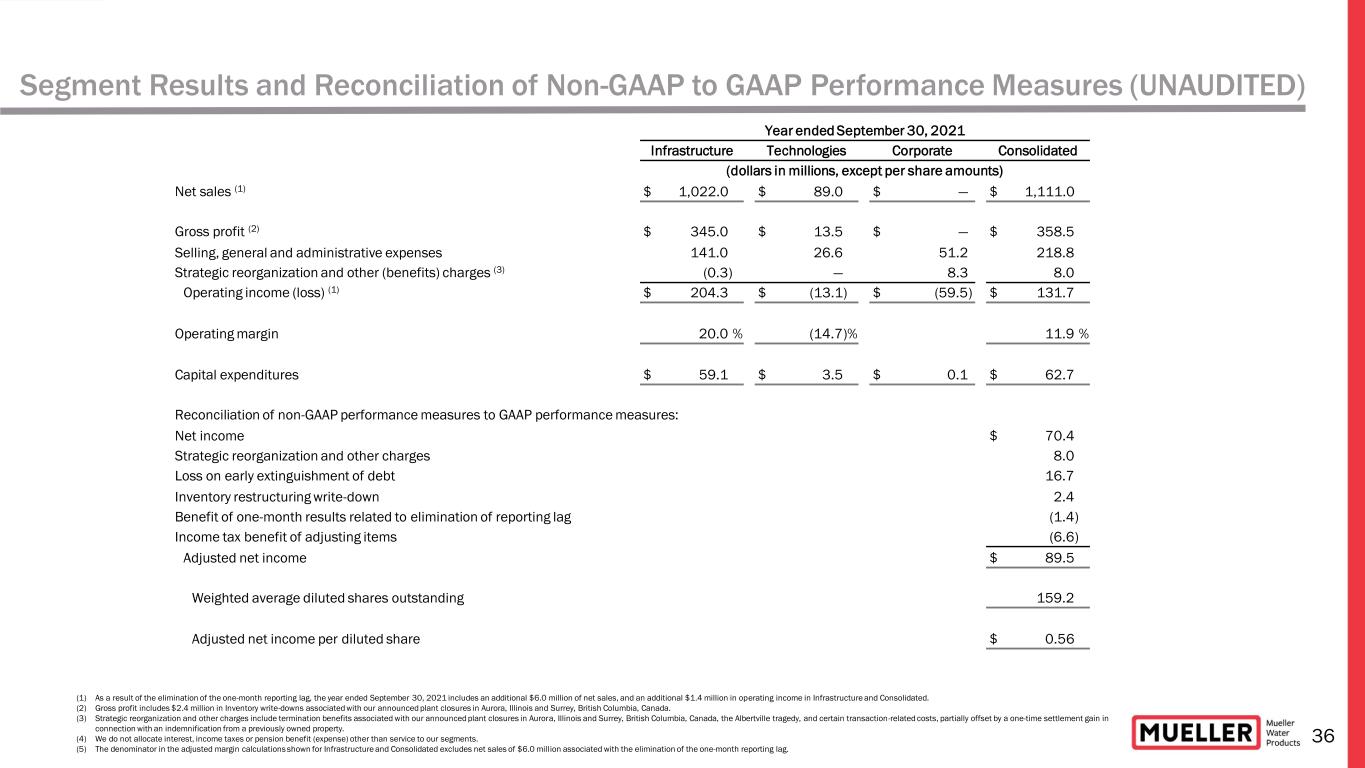

‹#›36 Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures (UNAUDITED) Year ended September 30, 2021 Infrastructure Technologies Corporate Consolidated (dollars in millions, except per share amounts) Net sales (1) $ 1,022.0 $ 89.0 $ — $ 1,111.0 Gross profit (2) $ 345.0 $ 13.5 $ — $ 358.5 Selling, general and administrative expenses 141.0 26.6 51.2 218.8 Strategic reorganization and other (benefits) charges (3) (0.3) — 8.3 8.0 Operating income (loss) (1) $ 204.3 $ (13.1) $ (59.5) $ 131.7 Operating margin 20.0 % (14.7)% 11.9 % Capital expenditures $ 59.1 $ 3.5 $ 0.1 $ 62.7 Reconciliation of non-GAAP performance measures to GAAP performance measures: Net income $ 70.4 Strategic reorganization and other charges 8.0 Loss on early extinguishment of debt 16.7 Inventory restructuring write-down 2.4 Benefit of one-month results related to elimination of reporting lag (1.4) Income tax benefit of adjusting items (6.6) Adjusted net income $ 89.5 Weighted average diluted shares outstanding 159.2 Adjusted net income per diluted share $ 0.56 (1) As a result of the elimination of the one-month reporting lag, the year ended September 30, 2021 includes an additional $6.0 million of net sales, and an additional $1.4 million in operating income in Infrastructure and Consolidated. (2) Gross profit includes $2.4 million in Inventory write-downs associated with our announced plant closures in Aurora, Illinois and Surrey, British Columbia, Canada. (3) Strategic reorganization and other charges include termination benefits associated with our announced plant closures in Aurora, Illinois and Surrey, British Columbia, Canada, the Albertville tragedy, and certain transaction-related costs, partially offset by a one-time settlement gain in connection with an indemnification from a previously owned property. (4) We do not allocate interest, income taxes or pension benefit (expense) other than service to our segments. (5) The denominator in the adjusted margin calculations shown for Infrastructure and Consolidated excludes net sales of $6.0 mill ion associated with the elimination of the one-month reporting lag.

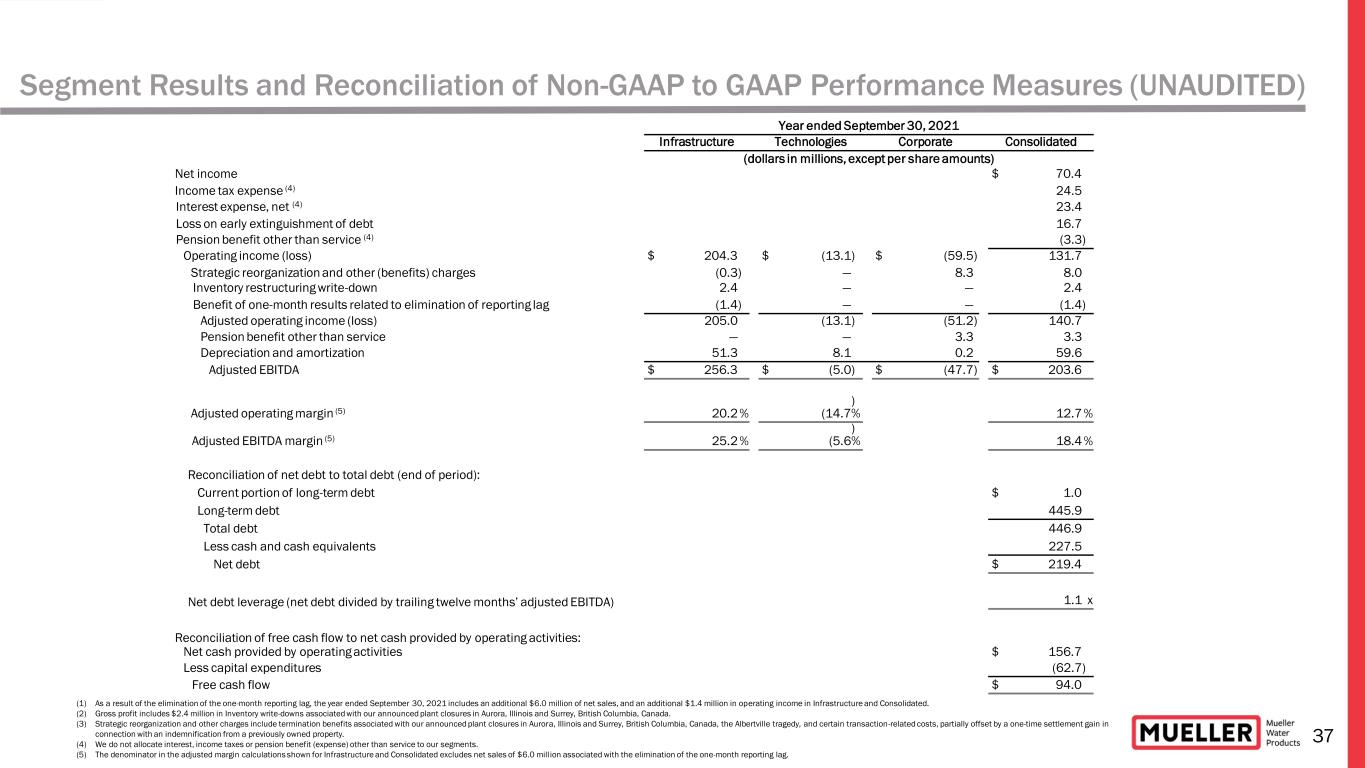

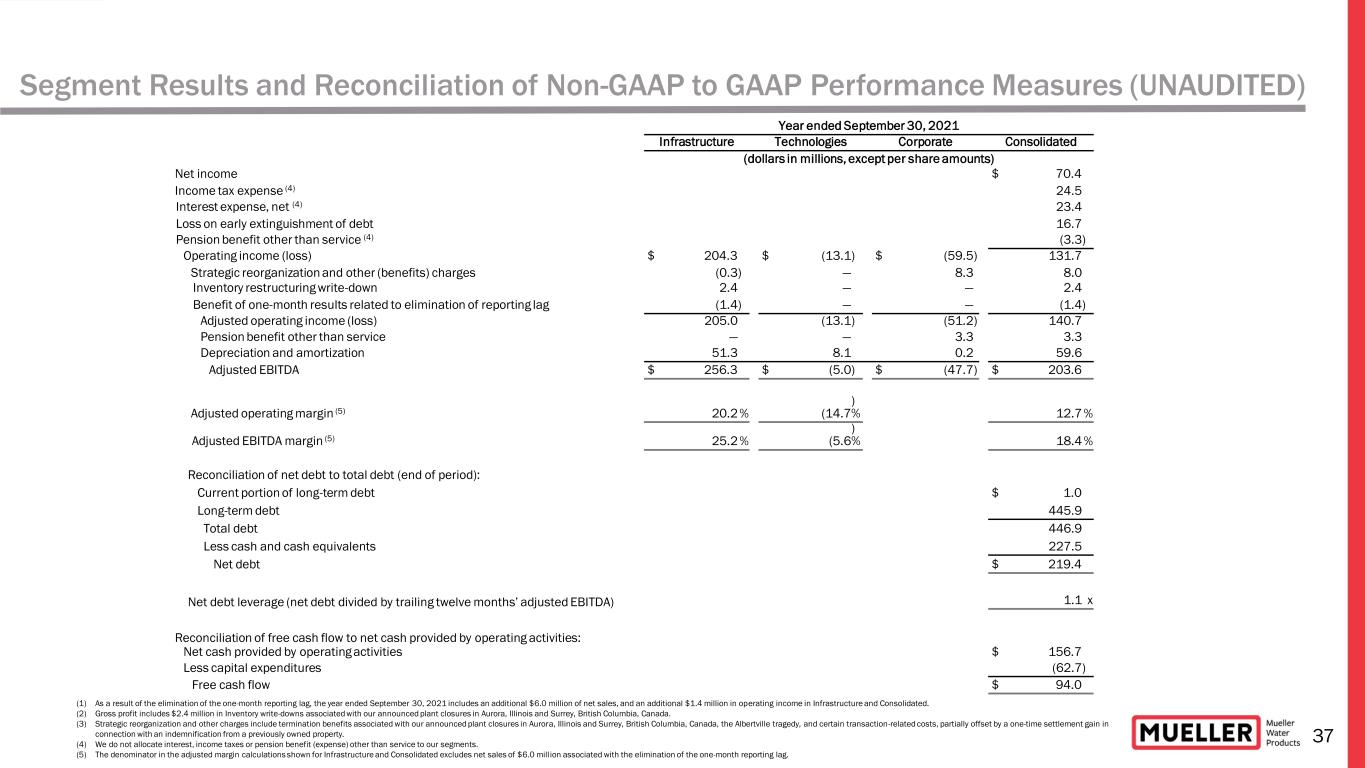

‹#›37 Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures (UNAUDITED) Year ended September 30, 2021 Infrastructure Technologies Corporate Consolidated (dollars in millions, except per share amounts) Net income $ 70.4 Income tax expense (4) 24.5 Interest expense, net (4) 23.4 Loss on early extinguishment of debt 16.7 Pension benefit other than service (4) (3.3) Operating income (loss) $ 204.3 $ (13.1) $ (59.5) 131.7 Strategic reorganization and other (benefits) charges (0.3) — 8.3 8.0 Inventory restructuring write-down 2.4 — — 2.4 Benefit of one-month results related to elimination of reporting lag (1.4) — — (1.4) Adjusted operating income (loss) 205.0 (13.1) (51.2) 140.7 Pension benefit other than service — — 3.3 3.3 Depreciation and amortization 51.3 8.1 0.2 59.6 Adjusted EBITDA $ 256.3 $ (5.0) $ (47.7) $ 203.6 Adjusted operating margin (5) 20.2% (14.7 ) % 12.7% Adjusted EBITDA margin (5) 25.2% (5.6 ) % 18.4% Reconciliation of net debt to total debt (end of period): Current portion of long-term debt $ 1.0 Long-term debt 445.9 Total debt 446.9 Less cash and cash equivalents 227.5 Net debt $ 219.4 Net debt leverage (net debt divided by trailing twelve months’ adjusted EBITDA) 1.1 x Reconciliation of free cash flow to net cash provided by operating activities: Net cash provided by operating activities $ 156.7 Less capital expenditures (62.7) Free cash flow $ 94.0 (1) As a result of the elimination of the one-month reporting lag, the year ended September 30, 2021 includes an additional $6.0 million of net sales, and an additional $1.4 million in operating income in Infrastructure and Consolidated. (2) Gross profit includes $2.4 million in Inventory write-downs associated with our announced plant closures in Aurora, Illinois and Surrey, British Columbia, Canada. (3) Strategic reorganization and other charges include termination benefits associated with our announced plant closures in Aurora, Illinois and Surrey, British Columbia, Canada, the Albertville tragedy, and certain transaction-related costs, partially offset by a one-time settlement gain in connection with an indemnification from a previously owned property. (4) We do not allocate interest, income taxes or pension benefit (expense) other than service to our segments. (5) The denominator in the adjusted margin calculations shown for Infrastructure and Consolidated excludes net sales of $6.0 mill ion associated with the elimination of the one-month reporting lag.

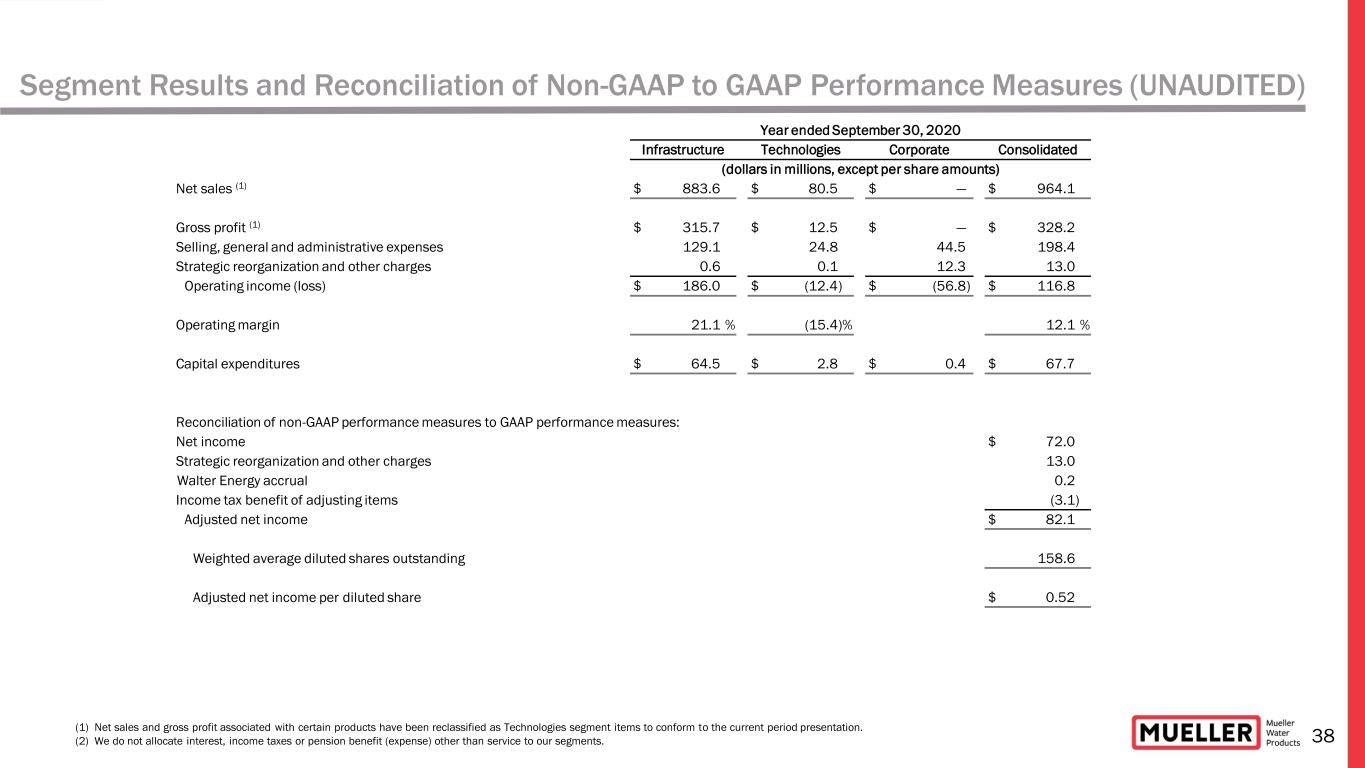

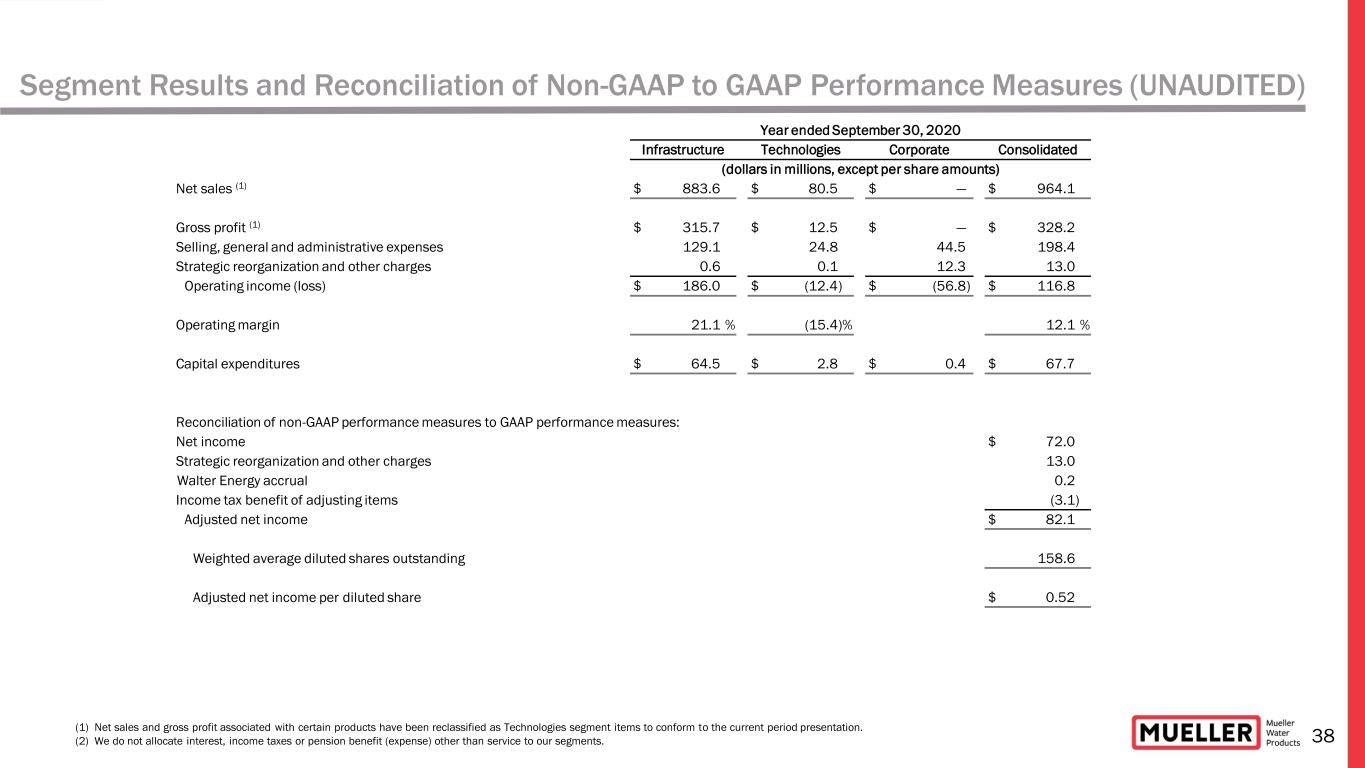

‹#›38 Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures (UNAUDITED) Year ended September 30, 2020 Infrastructure Technologies Corporate Consolidated (dollars in millions, except per share amounts) Net sales (1) $ 883.6 $ 80.5 $ — $ 964.1 Gross profit (1) $ 315.7 $ 12.5 $ — $ 328.2 Selling, general and administrative expenses 129.1 24.8 44.5 198.4 Strategic reorganization and other charges 0.6 0.1 12.3 13.0 Operating income (loss) $ 186.0 $ (12.4) $ (56.8) $ 116.8 Operating margin 21.1 % (15.4)% 12.1 % Capital expenditures $ 64.5 $ 2.8 $ 0.4 $ 67.7 Reconciliation of non-GAAP performance measures to GAAP performance measures: Net income $ 72.0 Strategic reorganization and other charges 13.0 Walter Energy accrual 0.2 Income tax benefit of adjusting items (3.1) Adjusted net income $ 82.1 Weighted average diluted shares outstanding 158.6 Adjusted net income per diluted share $ 0.52 (1) Net sales and gross profit associated with certain products have been reclassified as Technologies segment items to conform to the current period presentation. (2) We do not allocate interest, income taxes or pension benefit (expense) other than service to our segments.

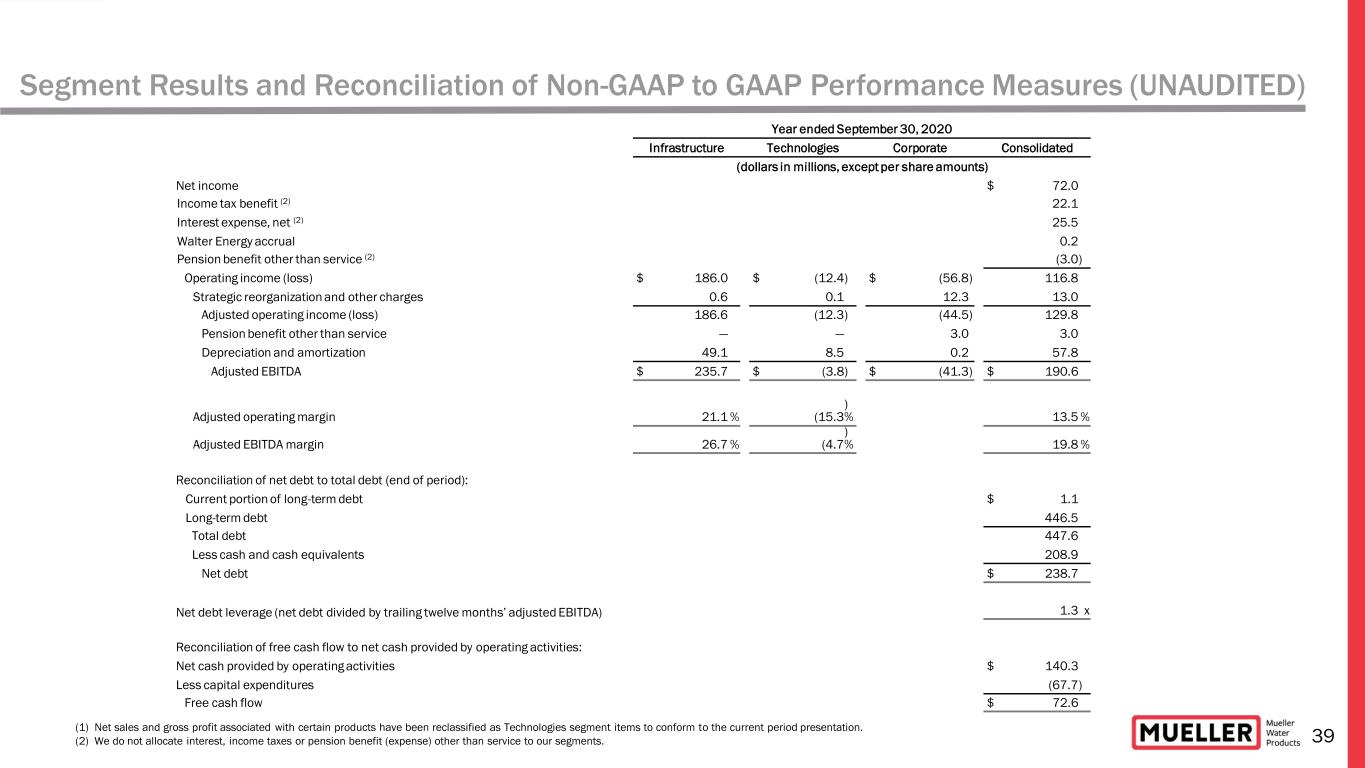

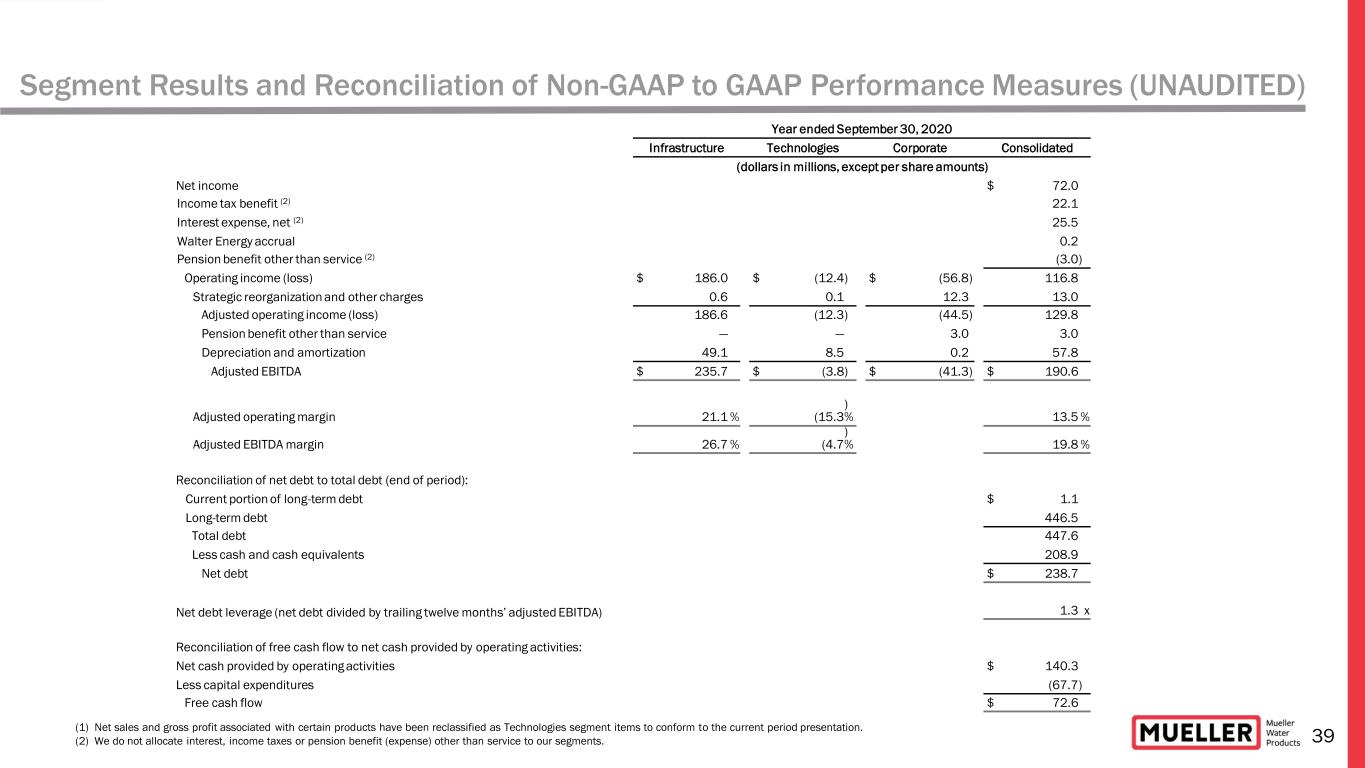

‹#›39 Segment Results and Reconciliation of Non-GAAP to GAAP Performance Measures (UNAUDITED) Year ended September 30, 2020 Infrastructure Technologies Corporate Consolidated (dollars in millions, except per share amounts) Net income $ 72.0 Income tax benefit (2) 22.1 Interest expense, net (2) 25.5 Walter Energy accrual 0.2 Pension benefit other than service (2) (3.0) Operating income (loss) $ 186.0 $ (12.4) $ (56.8) 116.8 Strategic reorganization and other charges 0.6 0.1 12.3 13.0 Adjusted operating income (loss) 186.6 (12.3) (44.5) 129.8 Pension benefit other than service — — 3.0 3.0 Depreciation and amortization 49.1 8.5 0.2 57.8 Adjusted EBITDA $ 235.7 $ (3.8) $ (41.3) $ 190.6 Adjusted operating margin 21.1 % (15.3 ) % 13.5 % Adjusted EBITDA margin 26.7 % (4.7 ) % 19.8 % Reconciliation of net debt to total debt (end of period): Current portion of long-term debt $ 1.1 Long-term debt 446.5 Total debt 447.6 Less cash and cash equivalents 208.9 Net debt $ 238.7 Net debt leverage (net debt divided by trailing twelve months’ adjusted EBITDA) 1.3 x Reconciliation of free cash flow to net cash provided by operating activities: Net cash provided by operating activities $ 140.3 Less capital expenditures (67.7) Free cash flow $ 72.6 (1) Net sales and gross profit associated with certain products have been reclassified as Technologies segment items to conform to the current period presentation. (2) We do not allocate interest, income taxes or pension benefit (expense) other than service to our segments.

Where Intelligence Meets Infrastructure®