- ATEC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Alphatec (ATEC) DEF 14ADefinitive proxy

Filed: 28 Apr 23, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

ALPHATEC HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

ALPHATEC HOLDINGS, INC.

1950 Camino Vida Roble

Carlsbad, CA 92008

(760) 431-9286

April 28, 2023

Dear Stockholder:

We cordially invite you to attend our 2023 Annual Meeting of Stockholders to be held at 10:00 a.m., Pacific Time, on Wednesday, June 14, 2023, at our corporate headquarters, which are located at 1950 Camino Vida Roble, Carlsbad, CA 92008.

Details regarding the meeting, the business to be conducted at the meeting, and information about Alphatec Holdings, Inc. that you should consider when you vote your shares are described in this proxy statement.

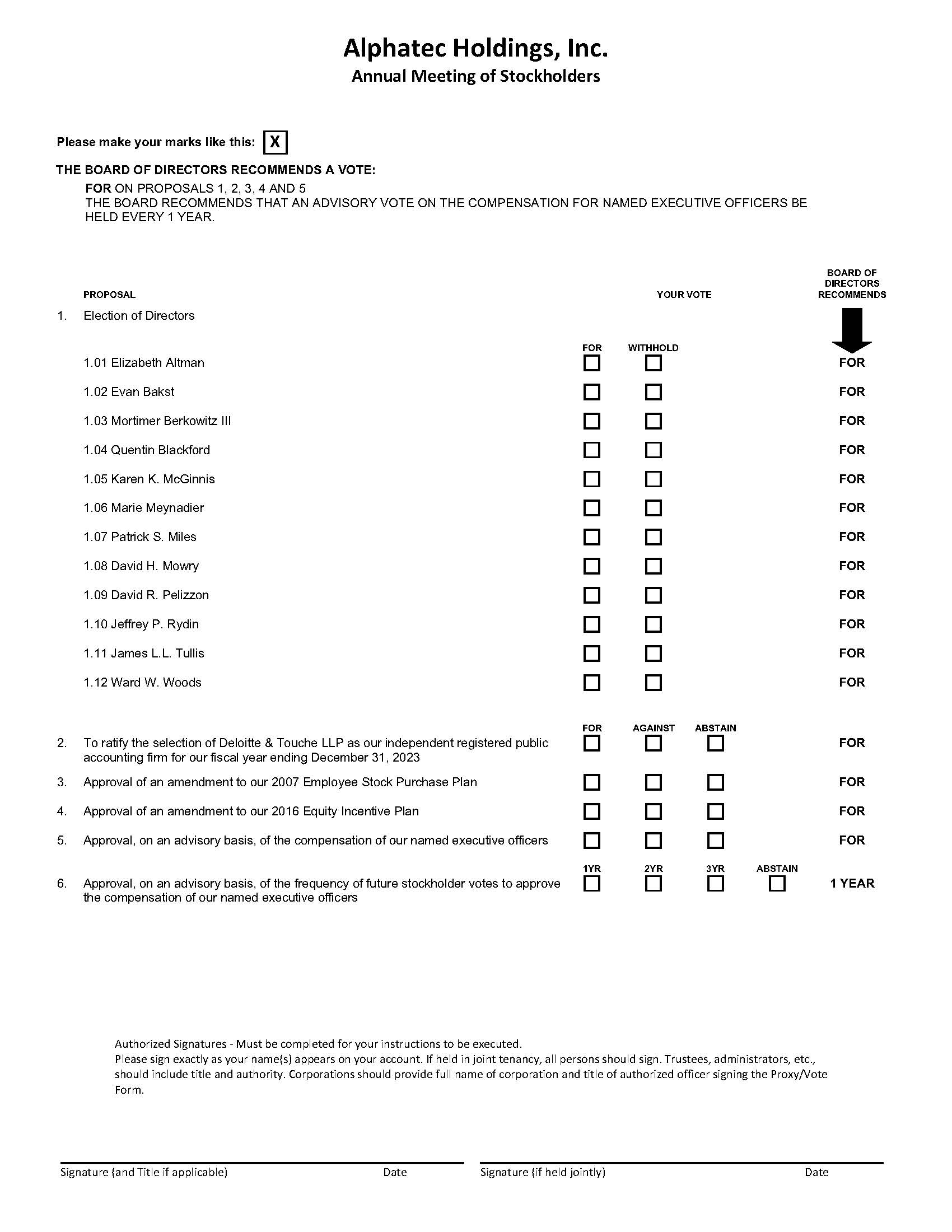

We are asking stockholders of Alphatec Holdings, Inc.:

The Board of Directors recommends for advisory votes on compensation of our named executive officers to occur “every year,” and recommends the approval of each of the other proposals. Such other business will be transacted as may properly come before the annual meeting.

Under Securities and Exchange Commission rules that allow companies to furnish proxy materials to stockholders over the Internet, we have elected to deliver our proxy materials to the majority of our stockholders over the Internet. This delivery process allows us to provide stockholders with the information they need, while at the same time conserving natural resources and lowering the cost of delivery. On May 5, 2023, we intend to begin sending to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement for our 2023 Annual Meeting of Stockholders and our 2022 Annual Report to Stockholders, which are located online at www.proxydocs.com/ATEC. The Notice also provides instructions on how to vote online or by telephone and includes instructions on how to receive a paper copy of the proxy materials by mail.

We hope you will be able to attend the annual meeting. Whether you plan to attend the annual meeting or not, it is important that you cast your vote either in person or by proxy. You may vote over the Internet as well as by telephone or by mail. When you have finished reading the proxy statement, you are urged to vote in accordance with the instructions set forth in this proxy statement. We encourage you to vote by proxy so that your shares will be represented and voted at the meeting, whether or not you can attend.

Thank you for your continued support of Alphatec Holdings, Inc.

Sincerely,

Patrick S. Miles

President, Chief Executive Officer and Chairman of the Board

Table of Contents

ALPHATEC HOLDINGS, INC.

1950 Camino Vida Roble

Carlsbad, CA 92008

(760) 431-9286

April 28, 2023

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

TIME: 10:00 a.m. Pacific Time

DATE: Wednesday, June 14, 2023

PLACE: Alphatec Holdings, Inc., 1950 Camino Vida Roble, Carlsbad, CA 92008

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders of Alphatec Holdings, Inc. (the “Annual Meeting”) will be held on Wednesday, June 14, 2023, for the following purposes:

The foregoing items of business are more fully described in the proxy statement accompanying this Notice.

Our Board of Directors has fixed the close of business on April 19, 2023, as the record date for the Annual Meeting. Only stockholders of record at the close of business on that date may vote at the Annual Meeting or any adjournment or postponement thereof. A total of 113,760,845 shares of our common stock were issued and outstanding as of the record date. Each share of common stock entitles its holder to one vote. Cumulative voting of shares of common stock is not permitted.

At the Annual Meeting and for the ten-day period immediately prior to the Annual Meeting, the list of our stockholders entitled to vote at the Annual Meeting will be available for inspection at our corporate headquarters, which are located at 1950 Camino Vida Roble, Carlsbad, CA 92008 for such purposes as are set forth in the General Corporation Law of the State of Delaware.

At least a majority of all issued and outstanding shares of common stock entitled to vote at a meeting is required to constitute a quorum for the conduct of business at the Annual Meeting. Accordingly, whether you plan to attend the Annual Meeting or not, we ask that you vote by following the instructions in the accompanying proxy statement and submit your proxy by the Internet, telephone or mail in order to ensure the presence of a quorum. You may change or revoke your proxy at any time before it is voted at the meeting.

BY ORDER OF THE BOARD OF DIRECTORS

Patrick S. Miles

President, Chief Executive Officer and Chairman of the Board

1

ALPHATEC HOLDINGS, INC.

1950 Camino Vida Roble

Carlsbad, CA 92008

(760) 431-9286

PROXY STATEMENT FOR THE ALPHATEC HOLDINGS, INC.

2023 ANNUAL MEETING OF STOCKHOLDERS

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

This proxy statement, along with the accompanying Notice of 2023 Annual Meeting of Stockholders, contains information about the 2023 annual meeting of stockholders of Alphatec Holdings, Inc. (the “Annual Meeting”), including any adjournments or postponements thereof. We are holding the Annual Meeting at 10:00 a.m., Pacific Time, on Wednesday, June 14, 2023, at our corporate headquarters, which are located at 1950 Camino Vida Roble, Carlsbad, CA 92008.

In this proxy statement, we refer to Alphatec Holdings, Inc. as the “Company,” “we” and “us.”

This proxy statement relates to the solicitation of proxies by our Board of Directors (the “Board of Directors”) for use at the Annual Meeting.

On or about May 5, 2023, we will begin sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to all stockholders entitled to vote at the Annual Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON June 14, 2023

This proxy statement, our Annual Report and the proxy card for the Annual Meeting are available for viewing, printing and downloading at www.proxydocs.com/ATEC. To view these materials, please have your 12-digit control number available that appears on your Notice or proxy card. On this website, you can also elect to receive future distributions of our proxy statements, annual reports to stockholders and proxy cards by electronic delivery.

Additionally, you can find a copy of our Annual Report, which includes our financial statements, for the fiscal year ended December 31, 2022 on the website of the Securities and Exchange Commission (the “SEC”) at www.sec.gov, or in the “Financial Information” section of the “Investor Relations” section of our website at www.atecspine.com.

2

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why is the Company Soliciting My Proxy?

The Board of Directors is soliciting your proxy to vote at the Annual Meeting to be held at our corporate headquarters, located at 1950 Camino Vida Roble, Carlsbad, CA 92008 on Wednesday, June 14, 2023 at 10:00 a.m., Pacific Time, and any adjournments or postponements of the meeting. The proxy statement along with the accompanying Notice of 2023 Annual Meeting of Stockholders summarizes the purposes of the Annual Meeting and the information you need to know in order to vote at the Annual Meeting.

We have made available to you on the Internet or have sent you this proxy statement, the Notice of 2023 Annual Meeting of Stockholders, the proxy card and a copy of our Annual Report for the fiscal year ended December 31, 2022 because you owned shares of our common stock on the record date. We intend to commence distribution of the Notice and, if applicable, the proxy materials to stockholders on or about May 5, 2023.

Why Did I Receive a Notice in the Mail Regarding the Internet Availability of Proxy Materials Instead of a Full Set of Proxy Materials?

As permitted by the rules of the SEC, we may furnish our proxy materials to our stockholders by providing access to such documents on the Internet, rather than mailing printed copies of these materials to each stockholder. Most stockholders will not receive printed copies of the proxy materials unless they request them. We believe that this process should expedite stockholders’ receipt of proxy materials, lower the costs of the Annual Meeting and help to conserve natural resources. If you received a Notice by mail or electronically, you will not receive a printed or email copy of the proxy materials, unless you request one by following the instructions included in the Notice. Instead, the Notice instructs you as to how you may access and review all of the proxy materials and submit your proxy on the Internet. If you requested a paper copy of the proxy materials, you may authorize the voting of your shares by following the instructions on the proxy card, in addition to the other methods of voting described in this proxy statement.

Who Can Vote?

Only stockholders who owned our common stock at the close of business on April 19, 2023 are entitled to vote at the Annual Meeting. On the record date, there were 113,760,845 shares of our common stock outstanding and entitled to vote. Our common stock is our only class of voting stock.

You do not need to attend the Annual Meeting to vote your shares. Shares represented by valid proxies, received in time for and not revoked prior to the Annual Meeting, will be voted at the Annual Meeting. For instructions on how to change or revoke your proxy, see “May I Change or Revoke My Proxy?” below.

How Many Votes Do I Have?

Each share of our common stock that you own entitles you to one vote.

How Do I Vote?

Whether you plan to attend the Annual Meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via Internet or telephone. You may specify whether your shares should be voted for or withheld for each nominee for director and whether your shares should be voted for, against or abstain with respect to each of the other proposals. If you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the Board of Directors’ recommendations as noted below. Voting by proxy will not affect your right to attend the Annual Meeting. If your shares are registered directly in your name through our stock transfer agent, Computershare, Inc. (“Computershare”), or you have stock certificates registered in your name, you may vote:

3

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern Time on Tuesday, June 13, 2023.

If your shares are held in “street name” (held in the name of a bank, broker or other holder of record), you will receive instructions from the holder of record. You must follow the instructions of the holder of record in order for your shares to be voted. Telephone and Internet voting also will be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you plan to vote your shares in person at the meeting, you should contact the broker or agent to obtain a legal proxy or broker’s proxy card and bring it with you to the Annual Meeting in order to vote. You will not be able to vote at the Annual Meeting unless you have a proxy card from your broker.

How Does the Board of Directors Recommend That I Vote on the Proposals?

The Board of Directors recommends that you vote as follows:

If any other matter is presented at the Annual Meeting, your proxy provides that your shares will be voted by the proxy holder listed in the proxy in accordance with his or her best judgment. At the time this proxy statement was first made available to our stockholders, we knew of no matters that needed to be acted on at the Annual Meeting, other than those discussed in this proxy statement.

May I Change or Revoke My Proxy?

If you give us your proxy, you may change or revoke it at any time before the Annual Meeting. Stockholders of record may change or revoke your proxy in any one of the following ways:

4

Beneficial owners of shares held in street name must follow the instructions provided by your bank, broker, trustee or other nominee if you wish to change your vote.

Attending the Annual Meeting in person will not in and of itself revoke a previously submitted proxy. You must specifically request at the Annual Meeting that the proxy be revoked.

Your most current vote, whether by telephone, Internet or proxy card is the one that will be counted.

What if I Receive More Than One Notice or Proxy Card?

You may receive more than one Notice or proxy card if you hold shares of our common stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described above under “How Do I Vote?” for each account to ensure that all of your shares are voted.

Will My Shares be Voted if I Do Not Vote?

If your shares are registered in your name or if you have stock certificates, they will not be counted if you do not vote as described above under “How Do I Vote?”

If your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares as described above under “How Do I Vote?,” the bank, broker or other nominee that holds your shares has the authority to vote your uninstructed shares only on the ratification of the appointment of our independent registered public accounting firm (Proposal 2) if it does not receive instructions from you, as this is considered a routine matter on which the bank, broker or other nominee has discretionary authority to vote. Therefore, we encourage you to provide voting instructions to your bank, broker or other nominee. This ensures your shares will be voted at the Annual Meeting and in the manner you desire. A “broker non-vote” will occur if your broker cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter or because your broker chooses not to vote on a matter for which it does have discretionary voting authority.

Your bank, broker or other nominee does not have the ability to vote your uninstructed shares in respect of Proposals 1, 3, 4, 5 or 6. Thus, if you hold your shares in street name, it is critical that you cast your vote if you want your vote to be counted for the foregoing proposals. If you do not instruct your bank, broker or other nominee how to vote with respect to the foregoing proposals, no votes will be cast on these proposals on your behalf.

What Vote is Required to Approve Each Proposal and How are Votes Counted?

Proposal 1: Election of Directors | The nominees for director who receive the most votes (also known as a “plurality” of the votes cast) will be elected. You may vote either FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one or more of the nominees. Votes that are withheld will not be included in the vote tally for the election of directors. Brokerage firms do not have authority to vote customers’ uninstructed shares held by the firms in street name for the election of directors. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

5

Proposal 2: Ratify Selection of Independent Registered Public Accounting Firm | The affirmative vote of a majority of the votes cast affirmatively or negatively for this proposal is required to ratify the selection of our independent registered public accounting firm. Abstentions will have no effect on the results of this vote. Brokerage firms have authority to vote customers’ uninstructed shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. We are not required to obtain the approval of our stockholders to select our independent registered public accounting firm. However, if our stockholders do not ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ended December 31, 2023, the Audit Committee of our Board of Directors will reconsider whether or not to retain Deloitte & Touche LLP. |

Proposal 3: Approval of Amendment to our 2007 Employee Stock Purchase Plan | The affirmative vote of a majority of the shares cast affirmatively or negatively for this proposal is required to amend our 2007 Employee Stock Purchase Plan. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ uninstructed shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

Proposal 4: Approval of Amendment to our 2016 Equity Incentive Plan | The affirmative vote of a majority of the shares cast affirmatively or negatively for this proposal is required to amend our 2016 Equity Incentive Plan. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ uninstructed shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

Proposal 5: Approval, on an Advisory Basis, of the Compensation of our Named Executive Officers | The affirmative vote of a majority of the votes cast affirmatively or negatively for this proposal is required to approve, on an advisory basis, the compensation of our named executive officers. Abstentions have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ uninstructed shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. Although the advisory vote is non-binding, the Compensation Committee and the Board of Directors will review the voting results and take them into consideration when making future decisions regarding executive compensation. |

6

Proposal 6: Approval, on an Advisory Basis, of the Frequency of Future Stockholder Votes to Approve the Compensation of our Named Executive Officers | The frequency of holding future stockholder votes to approve the compensation of our named executive officers—every year, every two years or every three years—receiving the greatest number of votes (also known as a “plurality” of the votes cast) will be the frequency approved by our stockholders. Brokerage firms do not have authority to vote customers’ uninstructed shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes, as well as abstentions, will have no effect on the results of this vote. Although the advisory vote is non-binding, the Nominating and Corporate Governance and Compensation Committees of the Board of Directors will review the voting results and take them into consideration when making future decisions regarding the frequency of holding an advisory vote on executive compensation. |

Where Can I Find the Voting Results of the Annual Meeting?

The preliminary voting results will be announced at the Annual Meeting and we will publish preliminary results, or final results if then available, by filing a Current Report on Form 8-K within four business days after the Annual Meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended Current Report on Form 8-K to disclose the final voting results within four business days after the final voting results are known.

If we Solicit Proxies, Who will Pay the Costs of Soliciting these Proxies?

If we solicit proxies, we will pay all of the costs of soliciting these proxies. Our directors and employees may solicit proxies in person or by telephone, fax or email. We will pay these employees and directors no additional compensation for these services. If we ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies, then we will reimburse them for their expenses. We have not engaged and do not currently intend to engage a proxy solicitor to assist us with the solicitation of proxies. If we later determine to engage a proxy solicitor, then we will pay the costs of the solicitor, including its fee and the reimbursement of its expenses.

What Constitutes a Quorum for the Annual Meeting?

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of our common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the meeting. Votes of stockholders of record who are present at the Annual Meeting in person or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists.

Attending the Annual Meeting

The Annual Meeting will be held at 10:00 a.m., Pacific Time, on Wednesday, June 14, 2023 at our corporate headquarters, which are located at 1950 Camino Vida Roble, Carlsbad, CA 92008. When you arrive at our headquarters, signs will direct you to the appropriate meeting room. You need not attend the Annual Meeting in order to vote.

7

Householding of Annual Disclosure Documents

SEC rules concerning the delivery of annual disclosure documents allow us or your broker to send a single Notice or, if applicable, a single set of our Annual Report and proxy materials to any household at which two or more of our stockholders reside, if we or your broker believe that the stockholders are members of the same family. This practice, referred to as “householding,” benefits both you and us. It reduces the volume of duplicate information received at your household and helps to reduce our expenses. The rule applies to our Notices, annual reports, proxy statements and information statements. Once you receive notice from your broker or from us that communications to your address will be “householded,” the practice will continue until you are otherwise notified or until you revoke your consent to the practice. Stockholders who participate in householding will continue to have access to and utilize separate proxy voting instructions.

If your household received a single Notice or, if applicable, a set of proxy materials this year, but you would prefer to receive your own copy, please contact our transfer agent, Computershare, by calling their toll-free number, 1-866-265-1875.

If you do not wish to participate in “householding” and would like to receive your own Notice or, if applicable, set of our proxy materials in future years, follow the instructions described below. Conversely, if you share an address with another Alphatec Holdings, Inc. stockholder and together both of you would like to receive only a single notice of Internet availability of proxy materials or, if applicable, set of proxy materials, follow these instructions:

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of April 19, 2023 for (a) each of our named executive officers, (b) each of our directors, (c) all of our current directors and executive officers as a group and (d) each stockholder known by us to own beneficially more than 5% of our common stock. Except as indicated in footnotes to this table, we believe that the stockholders named in this table have sole voting and investment power with respect to all shares of common stock shown to be beneficially owned by them based on information provided to us by these stockholders.

The share amounts set forth in the column below entitled “Number of Shares of Common Stock Beneficially Owned” represent the number of shares of common stock beneficially owned by such holder as of April 19, 2023. Applicable percentage of ownership in the column below entitled “Percentage of Outstanding Common Stock” is based on 113,760,845 shares of common stock outstanding on April 19, 2023.

The holders of certain of our outstanding warrants are restricted from exercising such warrants to the extent such exercise would cause such holder, together with its affiliates and attribution parties, to beneficially own a number of shares of common stock which would exceed 4.99% of our then outstanding common stock following such exercise (subject to adjustment up to 9.99% upon the fulfillment of certain conditions), excluding for purposes of such determination shares of common stock issuable upon exercise of such warrants which have not been exercised. The disclosures contained in the table below and in the footnotes to the table below reflect these limitations.

Name of Beneficial Owner |

| Number of Shares of |

|

| Percentage of |

| ||

Directors and Named Executive Officers |

|

|

|

|

|

| ||

Elizabeth Altman |

|

| 26,415 |

| (2) | * |

| |

Evan Bakst |

|

| 1,087,830 |

| (2) | * |

| |

Andy S. Barnett |

|

| 18,546 |

| (2) | * |

| |

Mortimer Berkowitz III |

|

| 1,274,160 |

| (3) |

| 1.12 | % |

Quentin Blackford |

|

| 542,697 |

| (2) | * |

| |

Karen K. McGinnis |

|

| 69,206 |

| (2) | * |

| |

Marie Meynadier |

|

| 42,396 |

| (4) | * |

| |

Patrick S. Miles |

|

| 6,852,795 |

| (5) |

| 5.90 | % |

David H. Mowry |

|

| 120,063 |

| (6) | * |

| |

David R. Pelizzon |

|

| 15,087,555 |

| (7) |

| 12.88 | % |

Jeffrey P. Rydin |

|

| 543,655 |

| (2) | * |

| |

James L.L. Tullis |

|

| 1,954,246 |

| (8) |

| 1.71 | % |

Ward W. Woods |

|

| 2,168,816 |

| (9) |

| 1.91 | % |

Eric Dasso |

|

| 295,278 |

| (10) | * |

| |

Craig E. Hunsaker |

|

| 1,272,035 |

| (11) |

| 1.11 | % |

J. Todd Koning |

|

| 129,574 |

|

| * |

| |

David P. Sponsel |

|

| 435,513 |

| (12) | * |

| |

All current executive officers and directors as a group (21 persons) |

|

| 33,124,546 |

| (13) |

| 29.12 | % |

|

|

|

|

|

| |||

Five Percent Stockholders |

|

|

|

|

|

| ||

L-5 Healthcare Partners, LLC |

|

| 12,781,538 |

| (14) |

| 11.24 | % |

Paul Segal |

|

|

|

|

|

| ||

c/o LS Power Development, LLC |

|

|

|

|

|

| ||

New York, NY 10019 |

|

|

|

|

|

| ||

|

|

|

|

|

|

| ||

Squadron Capital LLC |

|

| 14,808,310 |

| (15) |

| 12.64 | % |

c/o Squadron Capital LLC |

|

|

|

|

|

| ||

Chicago, IL 60603 |

|

|

|

|

|

| ||

* Represents beneficial ownership of less than 1% of the outstanding shares of common stock.

9

10

11

MANAGEMENT

Board of Directors

Our Board of Directors currently consists of thirteen directors, all of whose terms of office expire at the Annual Meeting. Two of our current directors—Evan Bakst and Andy S. Barnett—were appointed to the Board of Directors by L-5 Healthcare pursuant a right held by L-5 Healthcare to appoint up to two members of the Board of Directors so long as L-5 Healthcare and its affiliates beneficially own at least 12.5% of our common stock on a fully diluted basis. Additionally, in compliance with Nasdaq Rule 5640, the number of directors L-5 Healthcare is entitled to appoint is to be reduced to one if the beneficial ownership of L-5 Healthcare and its affiliates falls below 12.5% but is at least 7.5%. Notwithstanding anything set forth above, L-5 Healthcare shall not have the right to appoint any directors directly unless it and its affiliates beneficially own at least 7.5% of our common stock on a fully diluted basis.

As of the date of distribution of the Notice and these proxy materials to stockholders on or about May 5, 2023, L-5 Healthcare and its affiliates beneficially own less than 12.5% (but more than 7.5%) of our common stock on a fully diluted basis. Accordingly, our Nominating and Corporate Governance Committee recommended, and our Board of Directors approved, the nomination of the following twelve nominees for election at the Annual Meeting: Elizabeth Altman, Evan Bakst, Mortimer Berkowitz III, Quentin Blackford, Karen K. McGinnis, Marie Meynadier, Patrick S. Miles, David H. Mowry, David R. Pelizzon, Jeffrey P. Rydin, James L.L. Tullis, and Ward W. Woods. Set forth below are their ages, their offices in the Company, if any, their principal occupations or employment for the past five years, the length of their tenure as directors and the names of other public companies in which such persons hold or have held directorships during the past five years. Each nominated director is elected to serve until our next annual meeting of stockholders or the sooner of his or her resignation or the date when his or her successor is duly appointed and qualified. Additionally, set forth below is information about the specific experience, qualifications, attributes or skills that led to our Board of Directors’ conclusion at the time of filing of this proxy statement that each person listed below should serve as a director.

Name | Age |

Elizabeth Altman (2)(4) | 52 |

Evan Bakst (4) | 56 |

Mortimer Berkowitz III, Lead Director (1)(4) | 69 |

Quentin Blackford (2)(3)(4) | 44 |

Karen K. McGinnis (3)(4) | 56 |

Marie Meynadier (4) | 61 |

Patrick S. Miles, President, Chief Executive Officer and Chairman of the Board | 57 |

David H. Mowry (2)(4) | 60 |

David R. Pelizzon (4) | 67 |

Jeffrey P. Rydin (4) | 56 |

James L.L. Tullis (1)(4) | 76 |

Ward W. Woods (3)(4) | 80 |

12

Elizabeth Altman has served as a director and Chair of the Company’s Audit Committee since August 2021. Ms. Altman worked at the accounting firm KPMG LLP from 1993 to 2019, serving as Managing Partner of its San Diego office from 2014 to 2019, where she led a team of over 260 professionals and 23 partners providing an array of assurance, tax and advisory services to public and private companies across all industry sectors, and served as lead audit partner on numerous early stage, middle market and large global clients in the private and public markets predominately in the life sciences, consumer and technology business sectors. Ms. Altman serves on the board of directors of Veradigm, Inc. (formerly Allscripts Healthcare Solutions, Inc.) where she is chair of the audit committee and a member of the nominating and governance committee. Ms. Altman also serves on the board of directors of Papyrus Therapeutics, Inc. where she is chair of the audit committee. Additionally, Ms. Altman served on the board of directors of CV Sciences, Inc. through June 2022 and was Chair of its audit committee and a member of its compensation committee. Ms. Altman has also served as a board member of the Corporate Directors Forum, a 501(c)(6) nonprofit organization focused on helping directors, and those who support them, build more effective boards through continuous learning and peer networking, and has held a leadership position in the Women Corporate Directors, San Diego Chapter, the world’s largest membership organization and community of today’s preeminent women leaders in business. Ms. Altman earned a B.S. in Accounting from Indiana University and is a Certified Public Accountant (inactive).

The Board of Directors selected Ms. Altman to serve on the Board of Directors because it believes her knowledge and expertise in public accounting as well as her operating and financial experience contribute to the breadth of knowledge of the Board of Directors.

Evan Bakst has served as a director since March 2018. Mr. Bakst is the Founder and Portfolio Manager of Treetop Capital since 2013, a fundamental, value-oriented investment firm focused primarily on small to midcap healthcare companies. Before launching Treetop, Mr. Bakst spent seven years (2005-2012) at Tremblant Capital, a long/short equity hedge fund, most recently as a Partner where he led the healthcare group. Prior to joining Tremblant, Mr. Bakst was a Principal at JPMorgan Partners, LLC (2000-2005), where he shared the day-to-day responsibility for managing the healthcare buyout practice. Previously, Mr. Bakst was a Managing Director at The Beacon Group, a private equity/M&A boutique and, prior to that, Mr. Bakst worked as a Consultant at Bain and Company, providing strategic and operational advice to a major healthcare company. Mr. Bakst was formerly on the Boards of Accordant Health Services, Cadent Holdings, Inc., FundsXpress Inc., Iasis Healthcare, MedQuest Associates, National Surgical Care, Quality Tubing Inc., Sonacare Medical, LLC and ValueOptions. Mr. Bakst earned a B.A. in Economics from the University of California, Berkeley, and an M.B.A. from the Harvard Business School.

The Board of Directors selected Mr. Bakst to serve on the Board of Directors because it believes his investment and financial expertise and experience in the healthcare industries contribute to the breadth of knowledge of the Board of Directors.

Mortimer Berkowitz III has served as Lead Director since October 2017 and as a Director since March 2005. Mr. Berkowitz served as the Chair of the Board of Directors from April 2007 through July 2011 and again from December 2016 to October 2017. He is President and Chief Executive Officer of InnovaHealth Partners, LP, a private equity firm he founded in January 2017. Mr. Berkowitz also is a Managing Member of HGP, LLC — the general partner of HealthpointCapital Partners, LP, a private equity firm — and President, a member of the Board of Managers and a Managing Director of HealthpointCapital, LLC. He has held the position with HGP, LLC from its formation in August 2002, the positions of Managing Director and member of the Board of Managers of HealthpointCapital, LLC from its formation in July 2002 and the position of President of HealthpointCapital, LLC beginning February 2005. From 1990 to 2002, Mr. Berkowitz was Managing Director and co-founder of BPI Capital Partners, LLC, a private equity firm. Prior to 1990, Mr. Berkowitz spent 11 years in the investment banking industry with Goldman, Sachs & Co. (1979-1982), Lehman Brothers Incorporated (1982-1987) and Merrill Lynch & Co. (1987-1990). Mr. Berkowitz has served as Chairman of the Board of Directors of Blue Belt Holdings, Inc., a surgical robotics company, since 2011, of BioHorizons, Inc., a dental implant company, since 2006 and of OrthoSpace, a sports medicine company, since 2015, and as a director of ProSomnus, Inc., a sleep technology company, from 2006 to 2022, all of which are or were (prior to acquisition) HealthpointCapital portfolio companies. He has served as Chairman of Koelis, S.A., a prostate cancer diagnosis and treatment company since 2019 and as a director of Radiaction Medical, a radiation protection technology company since January 2020, both of which are InnovaHealth Partners portfolio companies. Mr. Berkowitz earned an M.B.A. degree from the Columbia Graduate School of Business and a B.A. degree from Harvard.

13

The Board of Directors selected Mr. Berkowitz to serve on the Board of Directors because it believes his investment and financial expertise and experience in the orthopedics and spine industries contribute to the breadth of knowledge of the Board of Directors.

Quentin Blackford has served as a Director since October 2017. He currently serves as the Chief Executive Officer of iRhythm Technologies, Inc., a leading digital healthcare solutions company focused on the advancement of cardiac care. Prior to joining iRhythm in October 2021, Mr. Blackford served (from March 2021) as Chief Operating Officer and (from August 2017 to March 2021) as Chief Financial Officer of DexCom, Inc., a company focused on developing and marketing continuous glucose monitoring systems for ambulatory use by people with diabetes and by healthcare providers. Prior to joining DexCom, Inc. in August 2017, Mr. Blackford served since August 2016 as the Executive Vice President, Chief Financial Officer, Head of Strategy and Corporate Integrity of NuVasive, Inc., a medical device company focused on developing minimally disruptive surgical products and procedures for the spine. In this role, Mr. Blackford was responsible for leading NuVasive, Inc.’s Finance, Strategy and Corporate Development, Compliance and Regulatory functions. From August 2014 until August 2016, Mr. Blackford served as NuVasive, Inc.’s Executive Vice President and Chief Financial Officer. From July 2012 to August 2014, Mr. Blackford served as NuVasive, Inc.’s Executive Vice President of Finance and Investor Relations, and from January 2011 to June 2012, he served as NuVasive, Inc.’s Vice President, Finance. Mr. Blackford joined NuVasive, Inc. in 2009 as its Corporate Controller and was previously employed at Zimmer Holdings, Inc., including most recently as the Director of Finance and Controller for Zimmer’s Dental Division. Since July 2022, Mr. Blackford has served as a director of Paragon 28, Inc., a global leader in developing and marketing innovative surgical solutions for the foot and ankle. He obtained his Certified Public Accounting license (currently inactive) following the achievement of dual B.S. degrees in Accounting and Business Administration, with an emphasis in Accounting, from Grace College.

The Board of Directors selected Mr. Blackford to serve on the Board of Directors because it believes that his knowledge and experience in the areas of finance, strategy and corporate development, along with his knowledge and experience in the medical device industry contribute to the breadth of knowledge of the Board of Directors.

Karen K. McGinnis has served as a director since June 2019. Ms. McGinnis has over 30 years of experience, including serving in executive operational and finance roles at international public companies. In April 2021, Ms. McGinnis retired from Illumina, Inc., a leader in sequencing- and array-based solutions for genetic and genomic analysis, where she served as Chief Accounting Officer since November 2017. She currently serves on the boards of Absci Corporation, a leading synthetic biology company enabling drug discovery and biomanufacturing of next generation biotherapeutics and Sonendo, Inc., a medical technology company focused on saving teeth from tooth decay. She previously served on the board of Biosplice Therapeutics, Inc., a clinical-stage biotechnology company pioneering therapeutics based on alternative pre-mRNA splicing for major diseases. Prior to joining Illumina in November 2017, Ms. McGinnis served from February 2016 to April 2017 as Director, President and Chief Executive Officer of Mad Catz Interactive, Inc. a global provider of innovative interactive entertainment products. From June 2013 through February 2016, Ms. McGinnis served as Mad Catz’ Chief Financial Officer. Prior to joining Mad Catz, Ms. McGinnis served from November 2009 through May 2013 as Chief Accounting Officer of Cymer, Inc., the world’s leading supplier of light sources used in the photolithography process for semiconductor or chip manufacturing until its acquisition in 2013. Ms. McGinnis also served as Chief Accounting Officer for Insight Enterprises, Inc., from September 2006 until March 2009, its Senior Vice President of Finance from 2001 through September 2006 and its Vice President of Finance from 2000 through 2001. McGinnis is a Certified Public Accountant and earned her BBA in Accounting from the University of Oklahoma.

The Board of Directors selected Ms. McGinnis to serve on the Board of Directors because it believes that her knowledge and experience in international public companies as well as her operating, investment and financial expertise contribute to the breadth of knowledge of the Board of Directors.

14

Marie Meynadier has served as a director since June 2021. Ms. Meynadier is the founder of EOS Imaging S.A. and served as its CEO until December 2018, after which she transitioned to a Board of Directors role, serving as the Chair of the Strategic Committee. She currently serves on the Boards of Directors of EDAP-TMS, a Nasdaq-listed company developing robotically assisted high-intensity focused ultrasound (“HIFU”) for prostate cancer; Pixium, a Euronext-listed company developing an artificial retina for DMLA patients; Corwave, a Paris-based company developing a left ventricular assist device (“LVAD”) pump for heart failure; Damae Medical, a Paris-based company developing non-invasive tools for skin cancer screening and surgery, and SpinoModulation, a Montreal-based company developing tether-based surgical solutions for scoliosis treatment. Ms. Meynadier is a Sup Telecom Paris engineer and received her PhD in Physics from Ecole Normale Supérieure in Paris. She started her career in the semiconductor industry at Bellcore (Red Bank, NJ) and ATT Bell Labs (Murray Hill, NJ). She is a member of the French Académie des Technologies.

The Board of Directors selected Ms. Meynadier to serve on the Board of Directors because it believes that her knowledge and experience in international public companies as well as her knowledge and expertise in the medical device industry contribute to the breadth of knowledge of the Board of Directors.

Patrick S. Miles has served as the Chairman and Chief Executive Officer since March 2018. He served as the Executive Chairman from October 2017 to March 2018. Mr. Miles has over 20 years of experience in the orthopedic industry and most recently served, from September 2016 to September 2017, as the Vice Chairman of NuVasive, Inc. where he was responsible for enhancing that company’s strategic plans for the future of spine surgery and supporting technology development. Mr. Miles also served as a member of NuVasive, Inc.’s Board of Directors from August 2015 until his resignation in September 2017. From February 2015 to August 2016, Mr. Miles served as NuVasive Inc.’s President and Chief Operating Officer. He previously served as NuVasive Inc.’s President of Global Products and Services from October 2011 to January 2015, President of the Americas from January 2010 to September 2011, Executive Vice President of Product Marketing and Development from January 2007 to December 2009, Senior Vice President of Marketing from December 2004 to January 2007, and as its Vice President, Marketing from January 2001 to December 2004. Prior to those positions, he served as Director of Marketing for ORATEC Interventions, Inc., a medical device company, and as a Director of Marketing for Minimally Invasive Systems and Cervical Spine Systems for Medtronic Sofamor Danek and held several positions with Smith & Nephew. Mr. Miles received a B.S. in Finance from Mercer University.

The Board of Directors selected Mr. Miles to serve on the Board of Directors because it believes that he possesses specific attributes, perspective and experience gained as an executive and director of both private and publicly traded medical device companies, as well as the perspective and experience he brings as Chairman and Chief Executive Officer of the Company, that qualify him to serve as the Chairman of the Board of Directors.

David H. Mowry has served as a director since February 2017. From July 2019 until April 2023, Mr. Mowry served as the Chief Executive Officer of Cutera, Inc., a leading provider of energy-based aesthetic systems for physicians and other qualified practitioners worldwide. Prior to joining Cutera in July 2019, Mr. Mowry served, since May 2016, as President and Chief Executive Officer, as well as a member of the Board of Directors, of Vyaire Medical, a global leader in the respiratory diagnostics, ventilation, and anesthesia delivery and patient monitoring market segments. Prior to his assignment at Vyaire, Mr. Mowry served from October 2015 to May 2016 as Executive Vice President and Chief Operating Officer and member of the Board of Directors of Wright Medical Group N.V., a global medical device company focused on extremities and biologics products, and during this time period he was also a member of the Board of Directors of EndoChoice Holdings, Inc., a company focused on the manufacturing and commercialization of platform technologies relating to the treatment of gastrointestinal conditions. Prior to Mr. Mowry’s assignment at Wright Medical Group, he served as President and Chief Executive Officer and member of the Board of Directors of Tornier N.V. from February 2013 until October 2015, at which time Tornier and Wright Medical Group merged, and prior to that, as Chief Operating Officer of Tornier from 2011 to 2013. Within the spine industry, Mr. Mowry served as Vice President of Operations and Logistics at Zimmer Spine from February 2002 until October 2006. Mr. Mowry has held executive leadership positions over his 30-year medical device career at Covidien plc, ev3, Inc. and Zimmer. Mr. Mowry received a B.S. degree in Engineering from the United States Military Academy at West Point.

The Board of Directors selected Mr. Mowry to serve on the Board of Directors because it believes his knowledge and expertise in the medical device industry contribute to the breadth of knowledge of the Board of Directors.

15

David R. Pelizzon has served as a member of the Board of Directors since June 2020. Mr. Pelizzon has served since 2008 as President and member of the Managing Committee of Squadron Capital, an investment firm that primarily manages direct investments in operating companies, private equity funds and special situations. He also has served since 2011 as a member of the Board of Directors of OrthoPediatrics, a company exclusively focused on advancing the field of pediatric orthopedics. From 2005 to 2008, Mr. Pelizzon served as the Managing Director of Precision Edge Holdings, a subsidiary of Colson Associates. Mr. Pelizzon is a retired U.S. Army officer who served nearly 30 years on active duty in airborne and special operations units. Mr. Pelizzon is a graduate of the U.S. Military Academy and earned advanced degrees from Harvard University and the U.S. Naval War College.

The Board of Directors selected Mr. Pelizzon to serve on the Board of Directors because it believes his investment and financial expertise and experience in the orthopedics and spine industries contribute to the breadth of knowledge of the Board of Directors.

Jeffrey P. Rydin has served as a director since June 2017. Prior to joining the Board of Directors, Mr. Rydin served as a Special Advisor to the Board of Directors from September 2016 to June 2017. Mr. Rydin has spent over 30 years in the medical device and healthcare industries. Prior to joining the Company as Special Advisor to the Board of Directors, Mr. Rydin served as Chief Sales Officer of Ellipse Technologies, Inc., a medical technology company, from September 2015 until its purchase by NuVasive, Inc. in February 2016. Before joining Ellipse, Mr. Rydin served as President of Global Sales at NuVasive, Inc. (October 2011 to March 2013), where he was responsible for NuVasive, Inc.’s worldwide sales efforts, including the oversight of strategic sales development, sales administration, Area Vice Presidents and sales training. Prior to his position of President of Global Sales, he served as Executive Vice President of Sales-Americas and Senior Vice President, U.S. Sales since joining NuVasive, Inc. in December 2005. Prior to joining NuVasive, Mr. Rydin served as Area Vice President, Sales (US Southeast region) at DePuy Spine, Inc. from January 2003 to December 2005. Mr. Rydin also served as Vice President of Sales at Orquest, Inc. from December 2001 to January 2003, Director of Sales at Symphonix Devices, Inc. from April 2000 to December 2001 and Director of Sales at General Surgical Innovations, Inc. from October 1996 to March 2000. Mr. Rydin also has served in various executive and leadership sales roles at General Surgical Innovations, Baxter Healthcare, US Surgical Corporation and Xerox. He currently serves as director of DuraStat, LLC, which has created a unique device for dural repair. Mr. Rydin received a B.A. degree in Social Ecology from the University of California, Irvine.

The Board of Directors selected Mr. Rydin to serve on the Board of Directors because it believes his experience and expertise in the medical device and spine industries contribute to the breadth of knowledge of the Board of Directors.

James L.L. Tullis has served as a director since March 2018. With a career of over 40 years in healthcare investing, he served until January 2019 as both the Chairman and Chief Executive Officer at Tullis Health Investors (aka Tullis-Dickerson & Co., Inc.), a position he held since 1990 – he continues to serve as its Chairman. Prior to founding Tullis Health Investors, Mr. Tullis was senior vice president of E.F. Hutton &Co. from 1983 to 1986 and a principal at Morgan Stanley & Co. where he worked from 1974 to 1983 and led healthcare investment research and, later, healthcare investment banking. During his tenure at Morgan Stanley, he received recognition fourteen times on the Institutional Investor All-Star list of Wall Street’s top securities analysts and was twice named #1 Drug Analyst and was a featured guest on the Wall Street Week television program. He also serves as Chairman of the Board of the Lord Abbett family of mutual funds, is Chairman of the Board of Crane Co., and is a director of Crane NXT. Mr. Tullis also currently serves as a director of Exagen, Inc., but has informed the board of directors of that company, and that company has filed a current report on Form 8-K with the SEC disclosing, that he will resign from that position effective at that company’s 2023 annual meeting of stockholders (anticipated to be June 9, 2023). Mr. Tullis earned an M.B.A. from Harvard Business School and B.A. from Stanford University.

The Board of Directors selected Mr. Tullis to serve on the Board of Directors because it believes his experience and expertise as a director on other Boards and in the healthcare industries contribute to the breadth of knowledge of the Board of Directors.

16

Ward W. Woods has served as a Director since October 2017. He currently serves as Chairman of the Advisory Board of the Stanford Woods Institute and has been a director of such board since 2005, as Chair Emeritus and Life Trustee of the Wildlife Conservation Society and has been a member of such society since 2000. He is also a member of the Council on Foreign Relations. He is former President and Chief Executive Officer of Bessemer Securities Corporation and Founding Partner of Bessemer Holdings, L.P. (1989-2003), a private equity firm. From 1978-1989, Mr. Woods was a senior partner and member of the Management Committee of Lazard Freres & Company. Prior to joining Lazard, Mr. Woods was a Managing Director and a Partner of Lehman Brothers and was co-head of the Corporate Finance Department. He joined Lehman Brothers in 1967 and was elected partner in 1973. He is a former trustee of Stanford University, former Chairman of The Stanford Management Company, a former trustee of the David and Lucille Packard Foundation and the National Fish and Wildlife Foundation. Mr. Woods has also served as former Governor and Treasurer of The Nature Conservancy, Vice-Chair and trustee of The Asia Society and a trustee of The Boys Club of New York. He is a graduate of Stanford University, 1964.

The Board of Directors selected Mr. Woods to serve on the Board of Directors because it believes that his knowledge and experience in the areas of financial management and services, strategy and growth and special situation opportunities contribute to the breadth of knowledge of the Board of Directors.

Executive Officers

Set forth below is certain information regarding our executive officers who are not also directors. We have entered into employment agreements with all of our executive officers. All executive officers are at-will employees, subject to the termination provisions of their respective employment agreements.

Name | Age | Position |

J. Todd Koning | 50 | Executive Vice President and Chief Financial Officer |

Eric Dasso | 50 | Executive Vice President, Adjunctive Technologies |

Kelli M. Howell | 49 | Executive Vice President, Clinical Strategies |

Craig E. Hunsaker | 59 | Executive Vice President, People & Culture and General Counsel |

David P. Sponsel | 44 | Executive Vice President, Sales |

Scott Lish | 42 | Senior Vice President, Research and Development |

Joseph Walland | 45 | Senior Vice President, Global Imaging Solutions |

Ali Shorooghi | 37 | Senior Vice President, Marketing |

J. Todd Koning has served as Executive Vice President and Chief Financial Officer since April 2021. Prior to joining us, Mr. Koning most recently served as Senior Vice President, Finance (since 2018) and Chief Accounting Officer (since 2020) at Masimo Corporation, a global medical technology company that develops and produces a wide array of industry-leading monitoring technologies. Prior to his roles at Masimo, Mr. Koning was the Vice President, Finance at NuVasive, Inc. from 2016 to 2018, where he spent the majority of his tenure abroad as the International CFO and partnered with the head of Global Commercial to lead the global commercial organization. Prior to joining NuVasive, Mr. Koning was the Vice President, Finance and Human Resources at Ellipse Technologies from 2014 until its acquisition by NuVasive in 2016. Prior to joining Ellipse, Mr. Koning served in various roles of increasing responsibility, based both domestically and internationally, with Boston Scientific from 2006 to 2014 and, before that, Guidant Corporation from 2001 to 2006. Mr. Koning is an M.B.A. graduate of Purdue University and holds a B.S. in Engineering from Michigan State University.

17

Eric Dasso has served as Executive Vice President, Adjunctive Technologies since August 2019. Prior to joining the Company, Mr. Dasso held various marketing leadership and global product management roles within NuVasive, Inc. from 2001 to 2018. He most recently served as NuVasive’s Vice President, Global Implant Systems (February 2015 to June 2018), which included overall responsibility for that company’s product development, commercialization and marketing functions of its $750 million global implant franchise. Prior to leading Global Implant Systems, Mr. Dasso oversaw the marketing and development of NuVasive’s thoracolumbar portfolio in various roles of increasing responsibility from February 2005 to February 2015, including as Project Manager, Thoracolumbar Fixation (February 2005 to July 2007), Senior Project Manager, Thoracolumbar Fixation (July 2007 to September 2008), Director, Marketing, Thoracolumbar Fixation (September 2008 to June 2010), Senior Director, Thoracolumbar (June 2010 to January 2014) and as Vice President, Thoracolumbar Posterior (January 2014 to February 2015). Prior to NuVasive, Mr. Dasso held various positions at Johnson & Johnson and Acxiom Inc. Mr. Dasso received a B.S. degree in Business Administration from California Polytechnic State University San Luis Obispo.

Kelli M. Howell has served as Executive Vice President, Clinical Strategies since March 2018. For the 18 years prior to joining us, she held various management positions at NuVasive, Inc., including Vice President, Research & Health Informatics from January 2017 to March 2018, Vice President, Research & Education from February 2015 to January 2017, and Vice President, Research from April 2012 to February 2015. Prior to NuVasive, Ms. Howell was involved in research at Orthopedic Biomechanics Laboratory, Beth Israel Deaconess Medical Center in Boston. Ms. Howell received a M.S. degree in Biomedical Engineering from Boston University and a B.A. degree in Engineering Sciences from Dartmouth College.

Craig E. Hunsaker has served as Executive Vice President, People & Culture since September 2016, and General Counsel since March 2017. Prior to joining us, from April 2014 until September 2016, Mr. Hunsaker was a consultant in the areas of human resources and employment law including, from April 2014 to September 2014, Senior Advisor, Human Resources, for General Atomics, a San Diego-based defense contractor. Prior to that, from August 2009 until March 2014, he served as Senior Vice President, Global Human Resources and Vice President, Legal Affairs at NuVasive, Inc. Before joining NuVasive, Inc., Mr. Hunsaker was a practicing lawyer, specializing in trade secret protection and employment law. He was a partner in, and Managing Member of, the San Diego offices of law firms Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C., and Fish & Richardson, P.C., and an associate in the San Diego offices of law firms Brobeck, Phleger & Harrison, LLP and Cooley LLP, and the Los Angeles office of Morgan, Lewis and Bockius, LLP. He received his Juris Doctorate from Columbia University School of Law, and a B.S. degree in Finance and International Business from Brigham Young University. He is admitted to practice law in all state and federal courts in the State of California.

David P. Sponsel has served as Executive Vice President, Sales since April 2019, having previously held the position of Area Vice President, Sales, South since May 2018. Prior to joining us, Mr. Sponsel held the position of General Manager, Spine Division for Medacta, USA from April 2015 to May 2018, where he was responsible for sales, marketing, product management and product development. Prior to that, he had an exceedingly successful 11-year experience in sales and sales leadership with Stryker Spine, where he was recognized as Sales Director of the Year in 2014. Mr. Sponsel received a B.S. from Indiana State University in Business Management.

Scott Lish has served as Senior Vice President, Research and Development since October 2020, having previously held the position of Vice President, Research and Development since October 2017. Prior to joining us, Mr. Lish held various product development roles at NuVasive, Inc. from 2009 to 2017. He most recently held the position of Director, Development at NuVasive, Inc. where he was responsible for product development of the company’s Thoracolumbar Fixation products. Prior to joining NuVasive, Inc., Mr. Lish worked for 2 years as a Manufacturing Engineer for Zimmer Dental. Mr. Lish received a M.S. degree in Material Science and a B.E. degree in Mechanical Engineering from the Thayer School of Engineering at Dartmouth, as well as a B.A. degree in Engineering Sciences from Dartmouth College.

18

Joseph Walland has served as Senior Vice President, Global Imaging Solutions since January 2022, having previously held the position of Vice President, Sales Channel Development since December 2020. Prior to joining us, Mr. Walland held the position of U.S. Chief Executive Officer at Medicrea, a full-service spinal technology company focused on data-driven surgical planning and personalized implant offerings, where he led the sale of that company to Medtronic in November 2020. For the thirteen years prior to joining Medicrea, Mr. Walland held various sales and marketing leadership positions at Stryker Spine from 2004 to 2017. He most recently held the position of Area Vice President of Sales-West, where he was responsible for the development and growth of the sales channel for the western half of the U.S. Mr. Walland received a bachelor’s degree in History from Yale University.

Ali Shorooghi has served as Senior Vice President, Marketing since November 2022, having previously held the positions of Vice President, Marketing (from June 2020 to November 2022) and Senior Director, Marketing (from December 2017 to June 2020). Prior to joining us in 2017, Mr. Shorooghi served (from April 2016 to December 2017) as Director, Product Management and Marketing for Casetabs Inc., a provider of Cloud-based surgery coordination and communication applications, which completed a successful exit to Bain Capital in 2017. Prior to Casetabs, Mr. Shorooghi held various Marketing and Product Management roles with increasing responsibility at NuVasive, Inc. from 2009 to 2016, most recently as Senior Group Manager. Mr. Shorooghi received a B.S. degree in Industrial & Systems Engineering with an emphasis in Information & Operations Management from the University of Southern California.

Family Relationships

None of the directors or executive officers is related to any other director or executive officer of the Company by blood, marriage or adoption.

19

CORPORATE GOVERNANCE MATTERS

Board of Directors Independence

The Board of Directors has determined that the following directors are independent directors within the meaning of the applicable Nasdaq listing requirements: Elizabeth Altman, Evan Bakst, Mortimer Berkowitz III, Quentin Blackford, Karen K. McGinnis, Marie Meynadier, David H. Mowry, David R. Pelizzon, Jeffrey P. Rydin, James L.L. Tullis, and Ward W. Woods.

Board of Directors Leadership Structure

The Board of Directors has no written policy with respect to the separation of the offices of Chairman and the Chief Executive Officer. Our bylaws and corporate governance guidelines provide the Board of Directors with the flexibility to change the structure of the Chairman and Chief Executive Officer positions as and when appropriate. Our Board of Directors makes determinations about leadership structure based on what it believes is best for the Company given specific circumstances. This flexibility allows the Board of Directors to review the structure of the Board of Directors periodically and determine whether to separate the two roles of Chairman and Chief Executive Officer based upon the Company’s needs and circumstances from time to time. The Board of Directors’ decision to combine such roles by appointing Mr. Miles as Chief Executive Officer and Chairman is based on Mr. Miles’ experience successfully serving as both an executive and a director of both private and publicly traded medical device companies and on what the Board of Directors believes is best for the Company.

Under our current governance guidelines, if the director holding the Chairman position is not independent, a Lead Director may be appointed by the independent directors. The Lead Director, among other things, works with the Chairman to set and approve agendas and schedules for meetings of the Board of Directors, serves as a liaison between the Chairman and the independent directors, presides at any meetings of the Board of Directors at which the Chairman is not present, including executive sessions of the independent directors and monitors conflicts of interests of all directors. Our governance guidelines provide that independent directors will meet in executive session without management present at the time of each regular Board of Directors meeting and additionally as deemed appropriate or necessary. The Board of Directors believes that this leadership structure helps provide a well-functioning and effective balance between strong company leadership, an independent Lead Director and oversight by active, independent directors. The Board of Directors believes that given the Company’s corporate governance structures and processes, a combined Chairman and Chief Executive Officer position in conjunction with an independent Lead Director provides effective oversight of management by the Board of Directors and results in a high level of management accountability to stockholders. The Board of Directors believes the current leadership structure is appropriate for the Company and promotes the development of long-term strategic plans and facilitates the implementation of such plans.

We believe that we have a strong governance structure in place, including independent directors, to help ensure the powers and duties of each of the Chairman, Chief Executive Officer and Lead Director roles are handled responsibly. Furthermore, consistent with Nasdaq listing requirements, the independent directors regularly have the opportunity to meet as an independent group, with Mr. Berkowitz serving as the Lead Director.

The Chairman of the Board of Directors, with the aid of the Lead Director, provides leadership to the Board of Directors and works with the Board of Directors to define its activities and the calendar for fulfillment of its responsibilities. The Chairman of the Board of Directors approves the meeting agendas after input from management, facilitates communication among members of the Board of Directors and presides at meetings of our Board of Directors and stockholders.

20

The Chairman of the Board of Directors, the Chair of the Audit Committee, the Chair of the Nominating and Corporate Governance Committee, the Chair of the Compensation Committee, the Chair of the Finance Committee (until it was dissolved in February 2023), and the other members of the Board of Directors work in concert to provide oversight of our management and affairs. The leadership of Mr. Miles fosters a collaborative culture of open discussion and deliberation, with a thoughtful evaluation of risk, to support our decision-making. Our Board of Directors encourages communication among its members and between management and the Board of Directors to facilitate productive working relationships. Working with the Lead Director and other members of the Board of Directors, Mr. Miles also strives to ensure that there is an appropriate balance and focus among key Board of Directors responsibilities such as strategic development, review of operations and risk oversight.

The Board of Directors’ Role in Risk Oversight

The Board of Directors plays an important role in risk oversight through direct decision-making authority with respect to significant matters and the oversight of management by the Board of Directors and its committees. In particular, the Board of Directors administers its risk oversight function through: (1) the review and discussion of regular reports to the Board of Directors from its committees and our management team on topics relating to the risks that we face; (2) the required approval by the Board of Directors (or a committee of the Board of Directors) of significant transactions and other decisions; (3) the direct oversight of specific areas of our business by the Audit Committee, the Nominating and Corporate Governance Committee and the Compensation Committee; and (4) regular reports from our auditors and outside advisors regarding various areas of potential risk, including, among others, those relating to our internal control over financial reporting. The Board of Directors also relies on management to bring significant matters impacting us to the Board of Directors’ attention.

Pursuant to the Audit Committee’s charter, the Audit Committee is responsible for discussing the guidelines and policies that govern the process by which our exposure to risk is assessed and managed by management. As part of this process, the Audit Committee discusses our major financial risk exposures and steps that management has taken to monitor and control such exposure. In addition, we, under the supervision of the Audit Committee, have established procedures available to all employees for the anonymous and confidential submission of complaints relating to any matter in order to encourage employees to report questionable activities directly to our senior management and the Audit Committee.

Because of the role of the Board of Directors in risk oversight, the Board of Directors believes that any leadership structure that it adopts must allow it to effectively oversee the management of the risks relating to our operations. The Board of Directors recognizes that there are multiple leadership structures that could allow it to effectively oversee the management of the risks relating to our operations. The Board of Directors believes its current leadership structure enables it to effectively provide oversight with respect to such risks.

21

Committees of the Board of Directors and Meetings

Our Board of Directors currently has a standing Audit Committee, Nominating and Corporate Governance Committee and Compensation Committee. Throughout 2022, and until February 2, 2023, our Board of Directors also had a standing Finance Committee. On February 2, 2023, the Board of Directors dissolved the Finance Committee and discharged its members from their roles on that committee. Only independent directors serve on the committees. The table below indicates the current members of each board committee and, in the case of the Finance Committee, the members of that committee during 2022 and until February 2, 2023:

Director | Audit Committee | Nominating and Corporate Governance Committee | Compensation Committee | Finance Committee |

|

|

|

|

|

Elizabeth Altman | Chair |

|

|

|

|

|

|

|

|

Mortimer Berkowitz III, Lead Director |

| Chair |

|

|

|

|

|

|

|

Quentin Blackford | ✓ |

| ✓ | Chair |

|

|

|

|

|

Karen K. McGinnis |

|

| ✓ | ✓ |

|

|

|

|

|

David H. Mowry | ✓ |

|

| ✓ |

|

|

|

|

|

James L.L. Tullis |

| ✓ |

|

|

|

|

|

|

|

Ward W. Woods |

|

| Chair |

|

Meeting Attendance. During 2022, our full Board of Directors met four times. In addition, the Audit Committee met four times, the Nominating and Corporate Governance Committee met twice, the Compensation Committee met three times and the Finance Committee met three times. During 2022, no director attended fewer than 75% of the total number of meetings of the Board of Directors or committees of the Board of Directors on which he or she served that were held during the periods in which such director served. The Board of Directors has adopted a policy under which each member of the Board of Directors is strongly encouraged, but not required, to attend each annual meeting of our stockholders. Nine directors attended our Annual Meeting of Stockholders held in 2022.

Audit Committee. This committee currently has three members: Elizabeth Altman (Chair), Quentin Blackford and David H. Mowry. Our Audit Committee’s role and responsibilities are set forth in the Audit Committee’s written charter and include the authority to retain and terminate the services of our independent registered public accounting firm, review annual and quarterly financial statements, consider matters relating to accounting policy and internal controls and review the scope of annual audits.

All members of the Audit Committee satisfy the current independence standards promulgated by the SEC and Nasdaq, as such standards apply specifically to members of audit committees. The Board of Directors has designated Ms. Altman and Mr. Blackford as “audit committee financial experts,” as the SEC has defined that term in Item 407 of Regulation S-K.

A copy of the Audit Committee’s written charter is publicly available on our website at www.atecspine.com under “Investor Relations-Governance.” Please also see the report of the Audit Committee set forth elsewhere in this proxy statement.

Nominating and Corporate Governance Committee. This committee currently has two members: Mortimer Berkowitz III (Chair) and James L.L. Tullis. Our Nominating and Corporate Governance Committee’s role and responsibilities are set forth in the committee’s written charter and include, among other things: (1) evaluating and making recommendations to the full Board of Directors as to the size and composition of the Board of Directors and its committees and (2) evaluating and making recommendations to the full Board of Directors as to potential director candidates.

22

With respect to nominations for persons to be elected to our Board of Directors, the committee may consider Board of Directors candidates recommended by our stockholders as well as from other appropriate sources, such as other directors or officers, or third-party search firms. For all potential candidates, the committee may consider all factors it deems relevant, such as a candidate’s personal integrity and sound judgment, business and professional skills and experience, independence, knowledge of the industry in which we operate, possible conflicts of interest, diversity, the extent to which the candidate would fill a present need on the Board of Directors, and concern for the long-term interests of our stockholders. Although the Board of Directors has no formal policy regarding diversity, the committee seeks a broad range of perspectives and considers both the personal characteristics (such as gender, ethnicity, and age) and experience (such as industry, professional, and public service) of directors and prospective nominees to the Board of Directors. In general, persons recommended by stockholders will be considered on the same basis as candidates from other sources.

If a stockholder wishes to nominate a candidate to be considered for election as a director at the 2024 Annual Meeting of Stockholders, it must comply with the procedures set forth in our Bylaws and described under “Stockholder Proposals and Nominations for Directors,” including giving timely notice of the nomination in writing to our Corporate Secretary not less than 45 nor more than 75 days prior to the date that is one year from the date on which we first mail our proxy statement relating to our 2023 Annual Meeting of Stockholders. If a stockholder wishes simply to propose a candidate for consideration as a nominee by the Nominating and Corporate Governance Committee, it must make such proposal for such candidate in writing, addressed to the Nominating and Corporate Governance Committee in care of our Corporate Secretary, 1950 Camino Vida Roble, Carlsbad, CA 92008. Submissions must be made by mail, courier or personal delivery and must contain the information set forth in our Nominating and Corporate Governance Committee’s written charter. All members of the Nominating and Corporate Governance Committee qualify as independent directors under the standards promulgated by Nasdaq.

A copy of the Nominating and Corporate Governance Committee’s written charter is publicly available on our website at www.atecspine.com under “Investor Relations-Governance.”

Compensation Committee. This committee currently has three members: Ward W. Woods (Chair), Quentin Blackford and Karen K. McGinnis. Our Compensation Committee’s role and responsibilities are set forth in the committee’s written charter and include, among other things, reviewing, approving, and making recommendations regarding our compensation policies, practices and procedures to ensure that legal and fiduciary responsibilities of the Board of Directors are carried out and that such policies, practices and procedures contribute to our success. The Compensation Committee is responsible for the determination of the compensation of our Chief Executive Officer and conducts its decision-making process with respect to that determination without the presence of the Chief Executive Officer. This committee also administers our equity compensation plans.

A copy of the Compensation Committee’s written charter is publicly available on our website at www.atecspine.com under “Investor Relations-Governance.”

Finance Committee. Throughout 2022, and until February 2, 2023, this committee had three members: Quentin Blackford (Chair), Karen K. McGinnis, and David H. Mowry. The Finance Committee’s role and responsibilities consisted of reviewing, considering, evaluating and approving or making recommendations to the Board of Directors with respect to possible strategic transactions, including, without limitation, debt and equity financing transactions, including with respect to the Company’s outstanding credit facilities and any other debt restructuring activities.

Stockholder Communications to the Board of Directors