Exhibit 99.1 FC-GEN Operations Investment, LLC and Subsidiaries Consolidated Financial Statements December 31, 2014

1 Index to Consolidated Financial Statements Page Independent Auditors’ Report…………………………….……………………………………………………. 2 Consolidated Balance Sheets as of December 31, 2014 and 2013 …………………………………………….. 3 Consolidated Statements of Operations for the years ended December 31, 2014, 2013 and 2012 ..………….. 4 Consolidated Statements of Comprehensive Income (Loss) for the years ended December 31, 2014, 2013 and 2012 ……………………………………………………….……………………………………………………. 5 Consolidated Statements of Members’ Interest for the years ended December 31, 2014, 2013 and 2012 ..…... 6 Consolidated Statements of Cash Flows for the years ended December 31, 2014, 2013 and 2012 ………….... 7 Notes to Consolidated Financial Statements……………………………………………………………………. 8

2 Independent Auditors’ Report The Board of Directors Genesis Healthcare, Inc.: Report on the Financial Statements We have audited the accompanying consolidated financial statements of FC-GEN Operations Investment, LLC and its subsidiaries (the Company), which comprise the consolidated balance sheets as of December 31, 2014 and 2013, and the related consolidated statements of operations, comprehensive income (loss), members’ interest and cash flows for each of the years in the three-year period ended December 31, 2014 and the related notes to the consolidated financial statements. Management's Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with U.S. generally accepted accounting principles; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. Auditors’ Responsibility Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditors’ judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of FC-GEN Operations Investment, LLC and its subsidiaries as of December 31, 2014 and 2013, and the results of their operations and their cash flows for each of the years in the three-year period ended December 31, 2014 in accordance with U.S. generally accepted accounting principles. /s/ KPMG LLP Philadelphia, Pennsylvania February 26, 2015

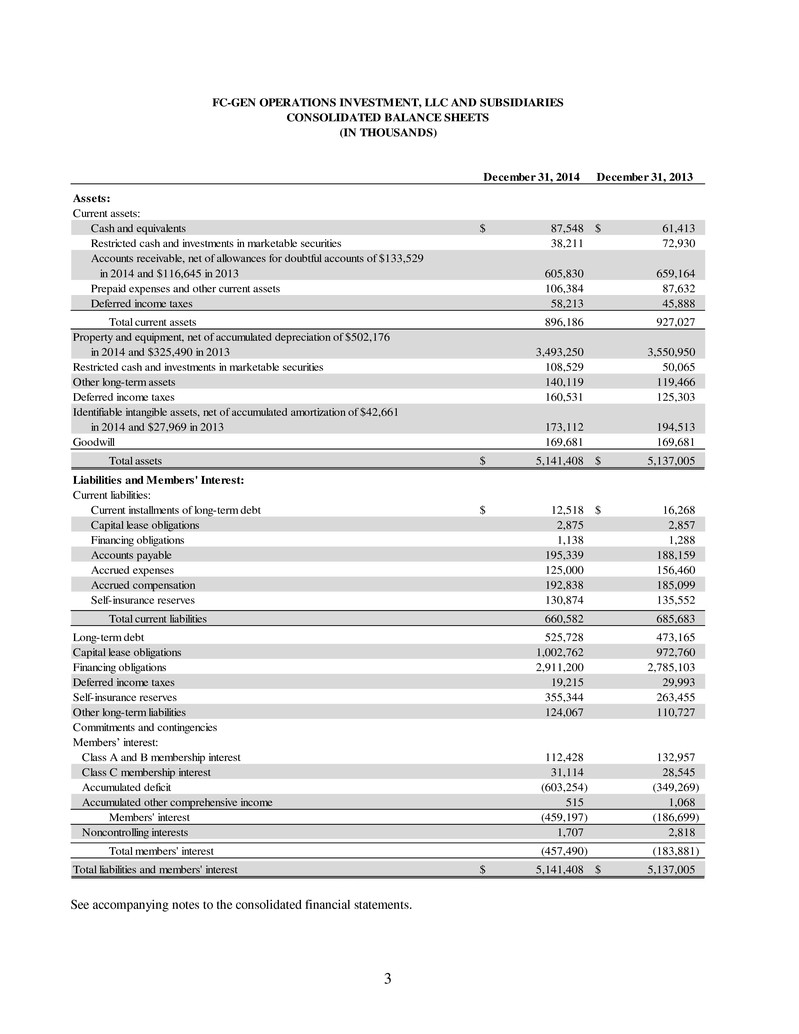

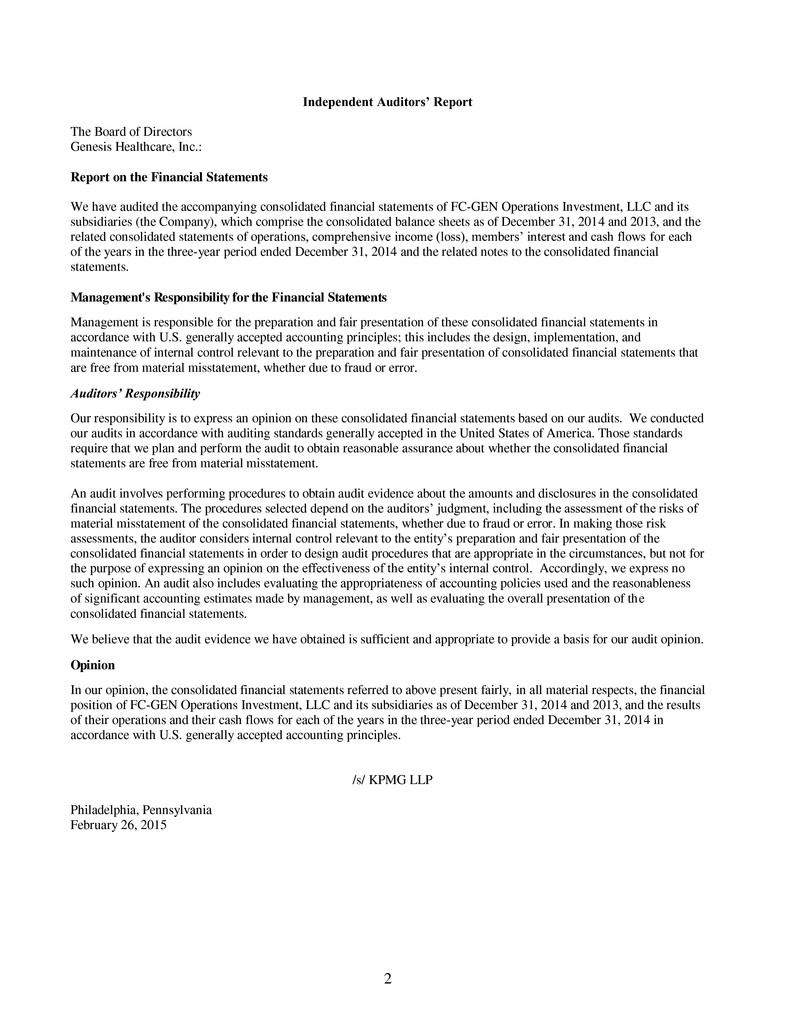

3 December 31, 2014 December 31, 2013 Assets: Current assets: Cash and equivalents 87,548$ 61,413$ Restricted cash and investments in marketable securities 38,211 72,930 Accounts receivable, net of allowances for doubtful accounts of $133,529 in 2014 and $116,645 in 2013 605,830 659,164 Prepaid expenses and other current assets 106,384 87,632 Deferred income taxes 58,213 45,888 Total current assets 896,186 927,027 Property and equipment, net of accumulated depreciation of $502,176 in 2014 and $325,490 in 2013 3,493,250 3,550,950 Restricted cash and investments in marketable securities 108,529 50,065 Other long-term assets 140,119 119,466 Deferred income taxes 160,531 125,303 Identifiable intangible assets, net of accumulated amortization of $42,661 in 2014 and $27,969 in 2013 173,112 194,513 Goodwill 169,681 169,681 Total assets 5,141,408$ 5,137,005$ Liabilities and Members' Interest: Current liabilities: Current installments of long-term debt 12,518$ 16,268$ Capital lease obligations 2,875 2,857 Financing obligations 1,138 1,288 Accounts payable 195,339 188,159 Accrued expenses 125,000 156,460 Accrued compensation 192,838 185,099 Self-insurance reserves 130,874 135,552 Total current liabilities 660,582 685,683 Long-term debt 525,728 473,165 Capital lease obligations 1,002,762 972,760 Financing obligations 2,911,200 2,785,103 Deferred income taxes 19,215 29,993 Self-insurance reserves 355,344 263,455 Other long-term liabilities 124,067 110,727 Commitments and contingencies Members’ interest: Class A and B membership interest 112,428 132,957 Class C membership interest 31,114 28,545 Accumulated deficit (603,254) (349,269) Accumulated other comprehensive income 515 1,068 Members' interest (459,197) (186,699) Noncontrolling interests 1,707 2,818 Total members' interest (457,490) (183,881) Total liabilities and members' interest 5,141,408$ 5,137,005$ FC-GEN OPERATIONS INVESTMENT, LLC AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (IN THOUSANDS) See accompanying notes to the consolidated financial statements.

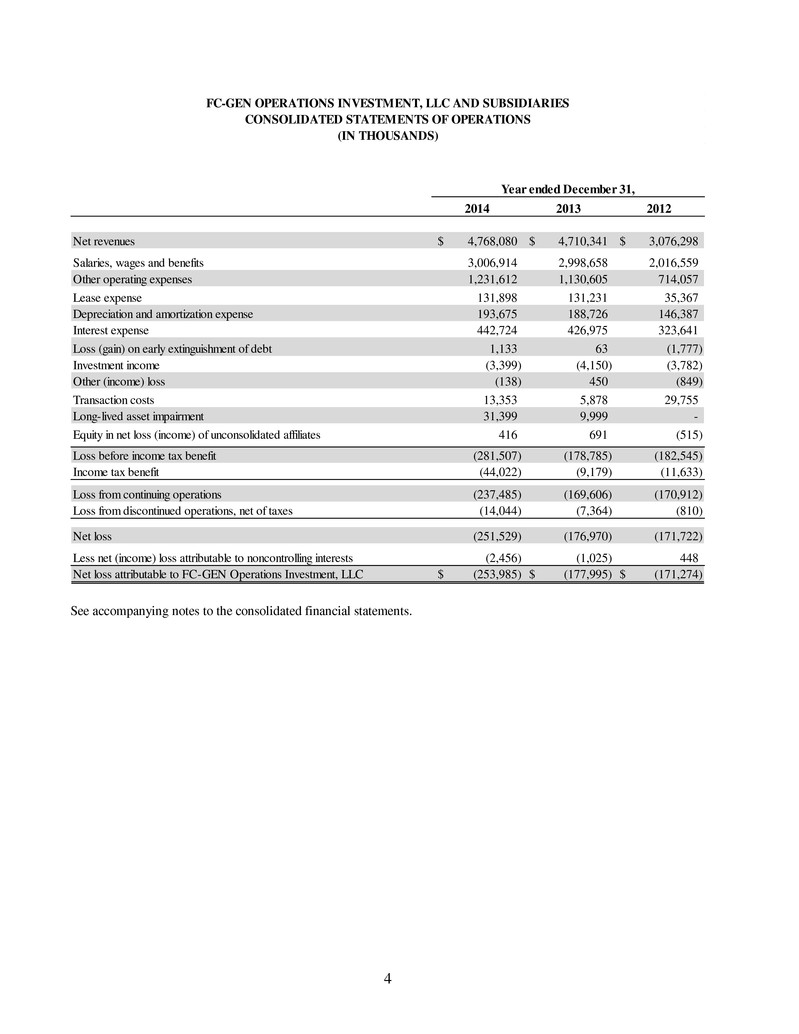

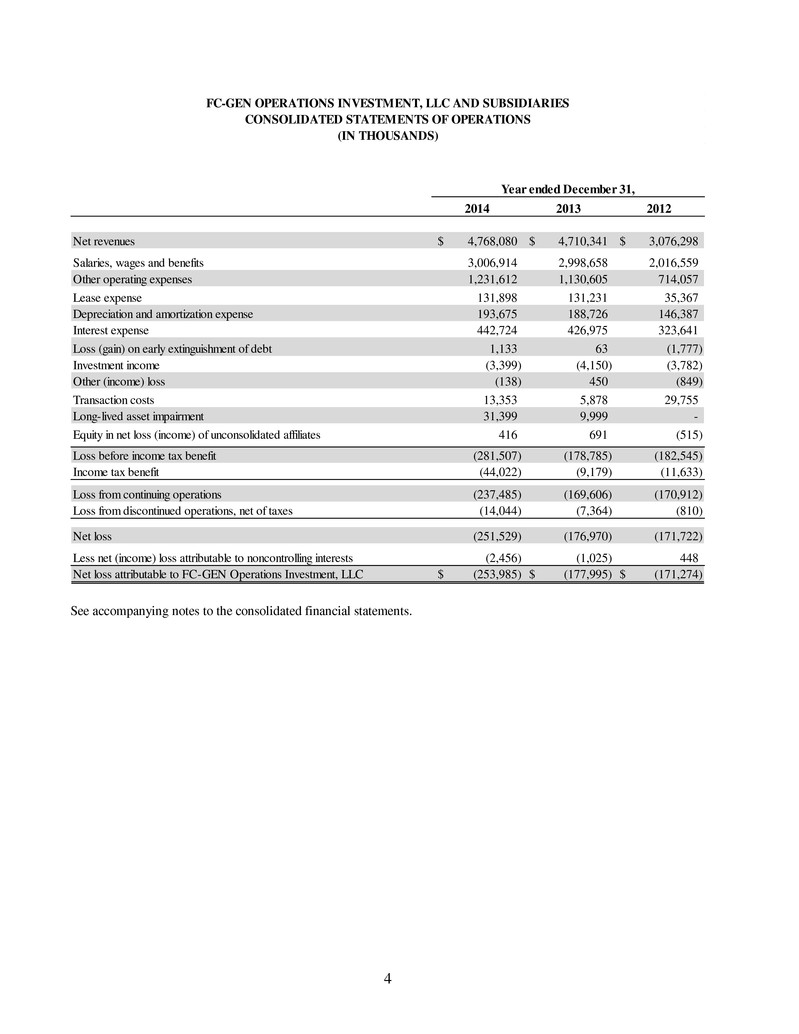

4 2014 2013 2012 Net revenues 4,768,080$ 4,710,341$ 3,076,298$ Salaries, wages and benefits 3,006,914 2,998,658 2,016,559 Other operating expenses 1,231,612 1,130,605 714,057 Lease expense 131,898 131,231 35,367 Depreciation and amortization expense 193,675 188,726 146,387 Interest expense 442,724 426,975 323,641 Loss (gain) on early extinguishment of debt 1,133 63 (1,777) Investment income (3,399) (4,150) (3,782) Other (income) loss (138) 450 (849) Transaction costs 13,353 5,878 29,755 Long-lived asset impairment 31,399 9,999 - Equity in net loss (income) of unconsolidated affiliates 416 691 (515) Loss before income tax benefit (281,507) (178,785) (182,545) Income tax benefit (44,022) (9,179) (11,633) Loss from continuing operations (237,485) (169,606) (170,912) Loss from discontinued operations, net of taxes (14,044) (7,364) (810) Net loss (251,529) (176,970) (171,722) Less net (income) loss attributable to noncontrolling interests (2,456) (1,025) 448 Net loss attributable to FC-GEN Operations Investment, LLC (253,985)$ (177,995)$ (171,274)$ FC-GEN OPERATIONS INVESTMENT, LLC AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (IN THOUSANDS) Year ended December 31, See accompanying notes to the consolidated financial statements.

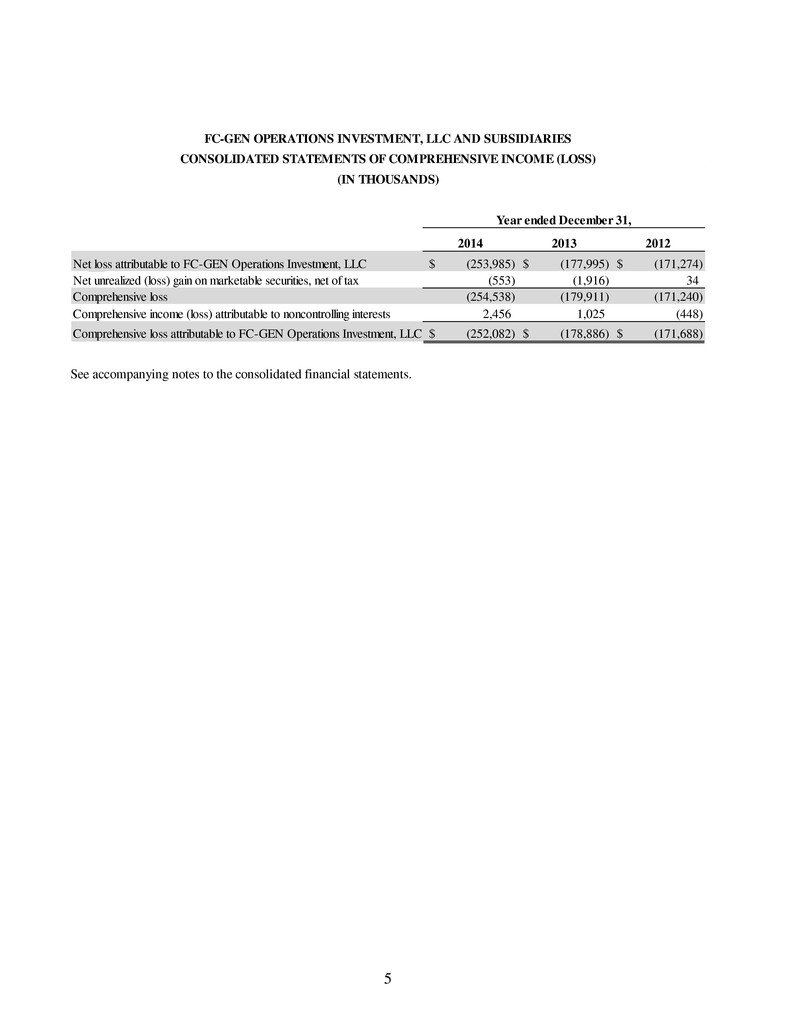

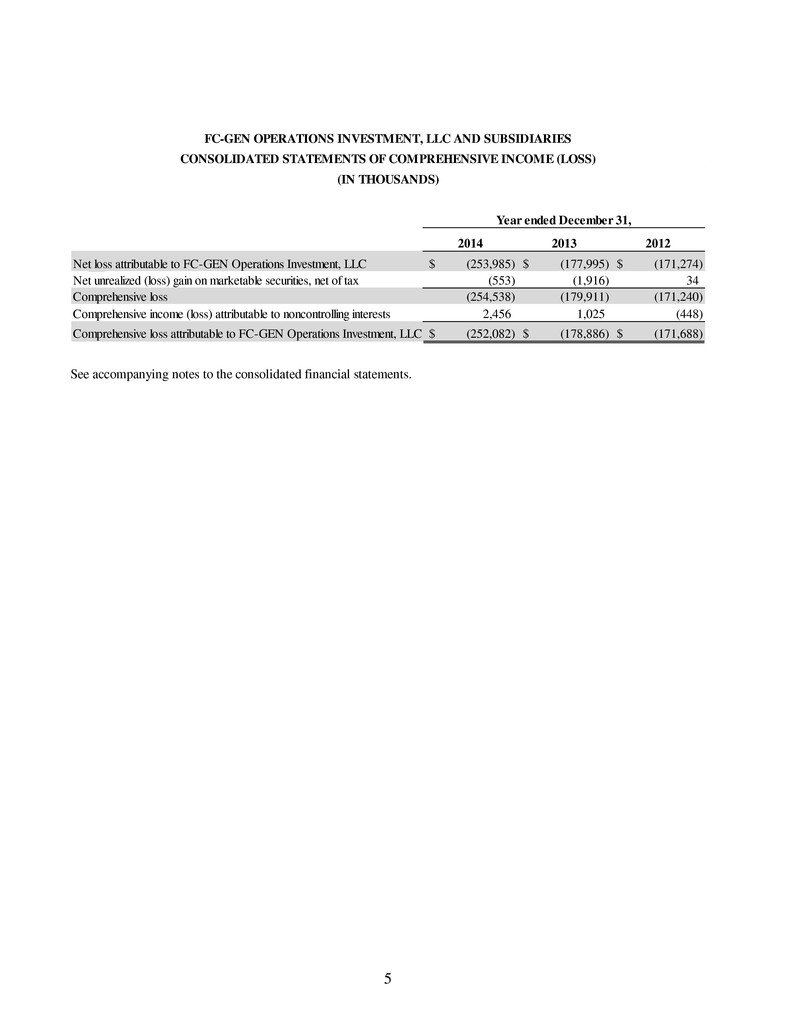

5 FC-GEN OPERATIONS INVESTMENT, LLC AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (IN THOUSANDS) 2014 2013 2012 Net loss attributable to FC-GEN Operations Investment, LLC (253,985)$ (177,995)$ (171,274)$ Net unrealized (loss) gain on marketable securities, net of tax (553) (1,916) 34 Comprehensive loss (254,538) (179,911) (171,240) Comprehensive income (loss) attributable to noncontrolling interests 2,456 1,025 (448) Comprehensive loss attributable to FC-GEN Operations Investment, LLC (252,082)$ (178,886)$ (171,688)$ Year ended December 31, See accompanying notes to the consolidated financial statements.

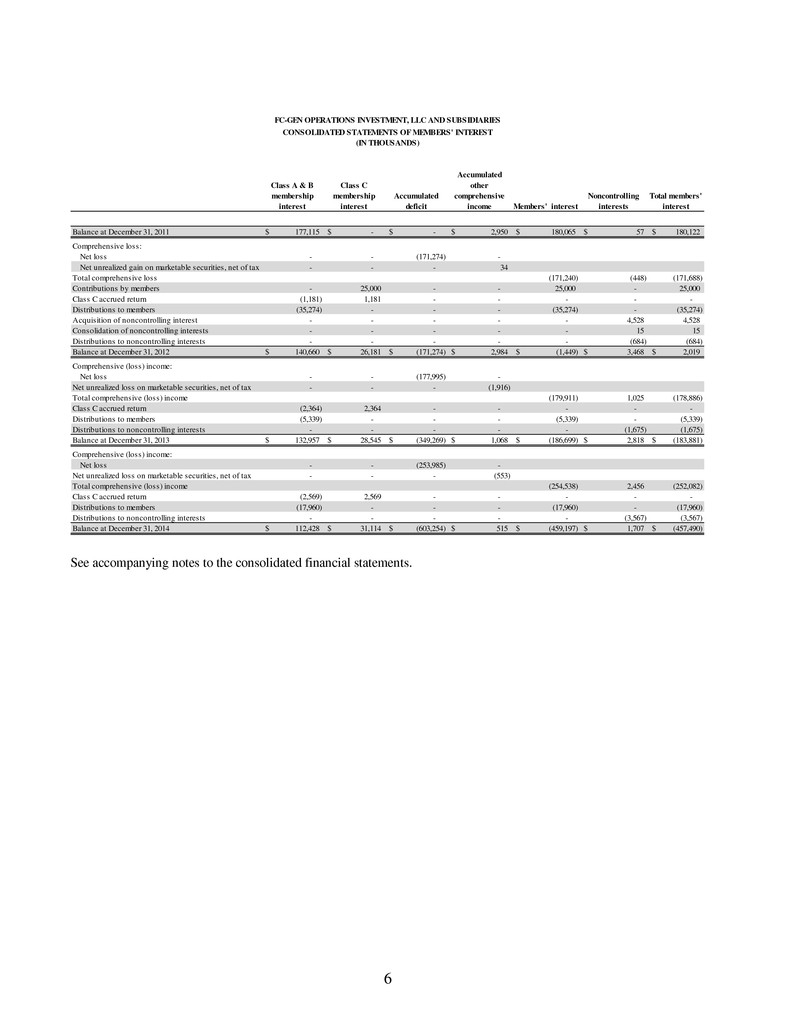

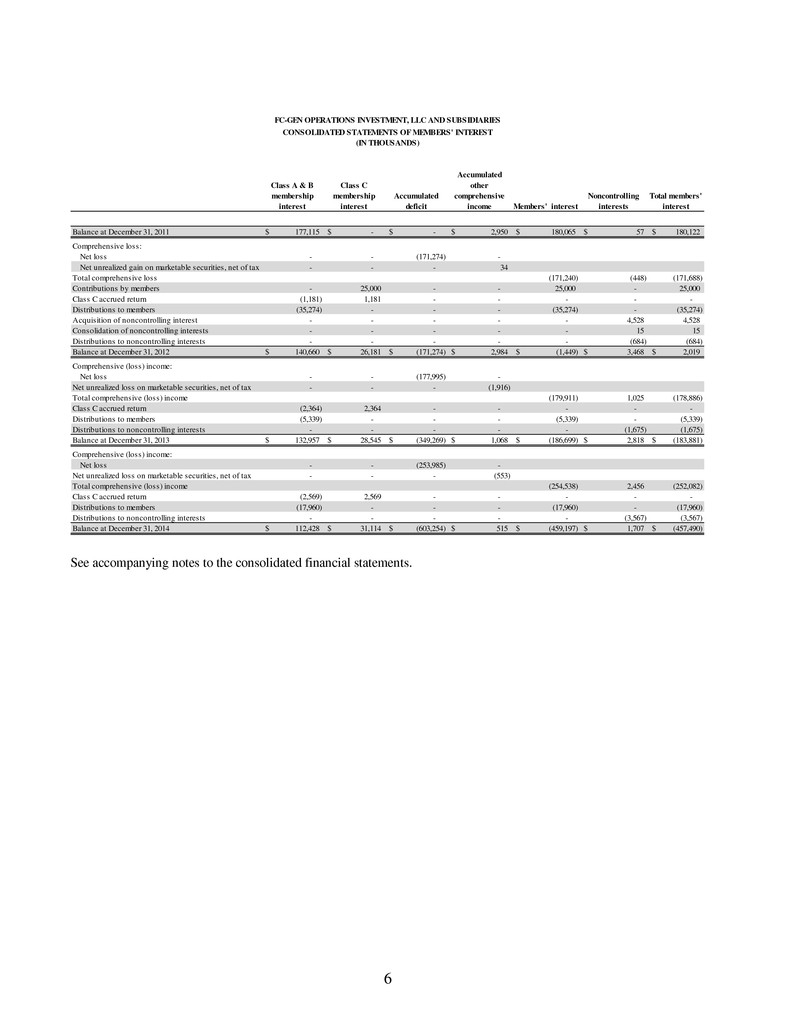

6 Class A & B membership interest Class C membership interest Accumulated deficit Accumulated other comprehensive income Members' interest Noncontrolling interests Total members' interest Balance at December 31, 2011 177,115$ -$ -$ 2,950$ 180,065$ 57$ 180,122$ Comprehensive loss: Net loss - - (171,274) - Net unrealized gain on marketable securities, net of tax - - - 34 Total comprehensive loss (171,240) (448) (171,688) Contributions by members - 25,000 - - 25,000 - 25,000 Class C accrued return (1,181) 1,181 - - - - - Distributions to members (35,274) - - - (35,274) - (35,274) Acquisition of noncontrolling interest - - - - - 4,528 4,528 Consolidation of noncontrolling interests - - - - - 15 15 Distributions to noncontrolling interests - - - - - (684) (684) Balance at December 31, 2012 140,660$ 26,181$ (171,274)$ 2,984$ (1,449)$ 3,468$ 2,019$ Comprehensive (loss) income: Net loss - - (177,995) - Net unrealized loss on marketable securities, net of tax - - - (1,916) Total comprehensive (loss) income (179,911) 1,025 (178,886) Class C accrued return (2,364) 2,364 - - - - - Distributions to members (5,339) - - - (5,339) - (5,339) Distributions to noncontrolling interests - - - - - (1,675) (1,675) Balance at December 31, 2013 132,957$ 28,545$ (349,269)$ 1,068$ (186,699)$ 2,818$ (183,881)$ Comprehensive (loss) income: Net loss - - (253,985) - Net unrealized loss on marketable securities, net of tax - - - (553) Total comprehensive (loss) income (254,538) 2,456 (252,082) Class C accrued return (2,569) 2,569 - - - - - Distributions to members (17,960) - - - (17,960) - (17,960) Distributions to noncontrolling interests - - - - - (3,567) (3,567) Balance at December 31, 2014 112,428$ 31,114$ (603,254)$ 515$ (459,197)$ 1,707$ (457,490)$ FC-GEN OPERATIONS INVESTMENT, LLC AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF MEMBERS' INTEREST (IN THOUSANDS) See accompanying notes to the consolidated financial statements.

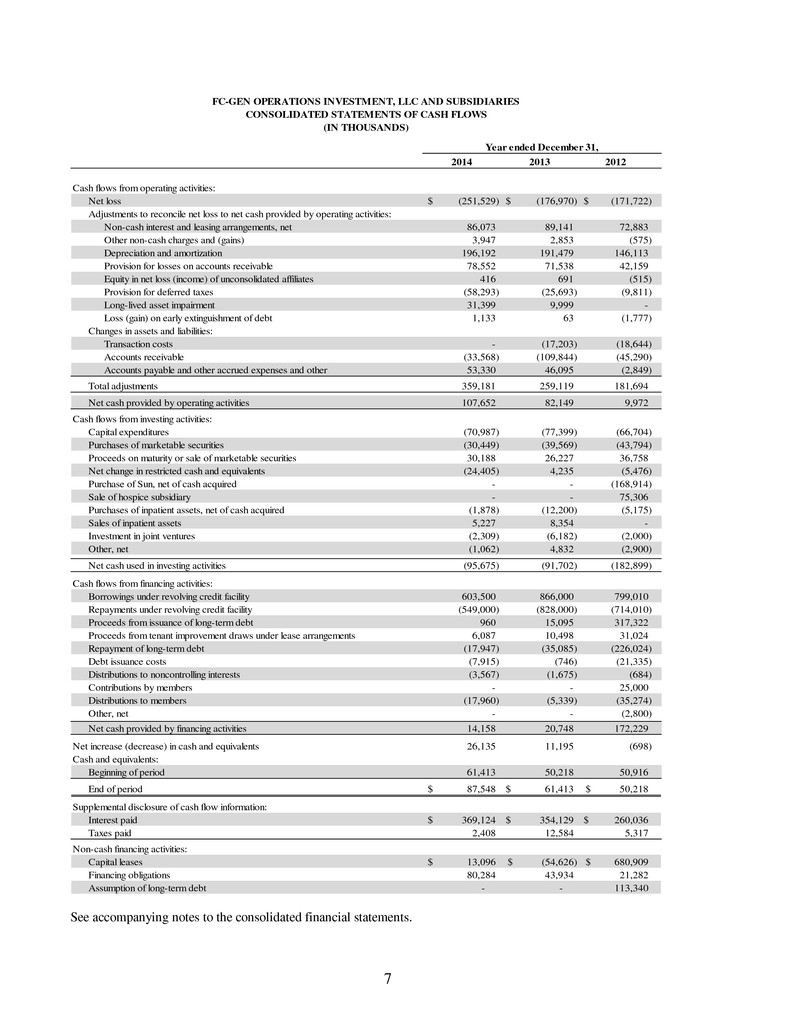

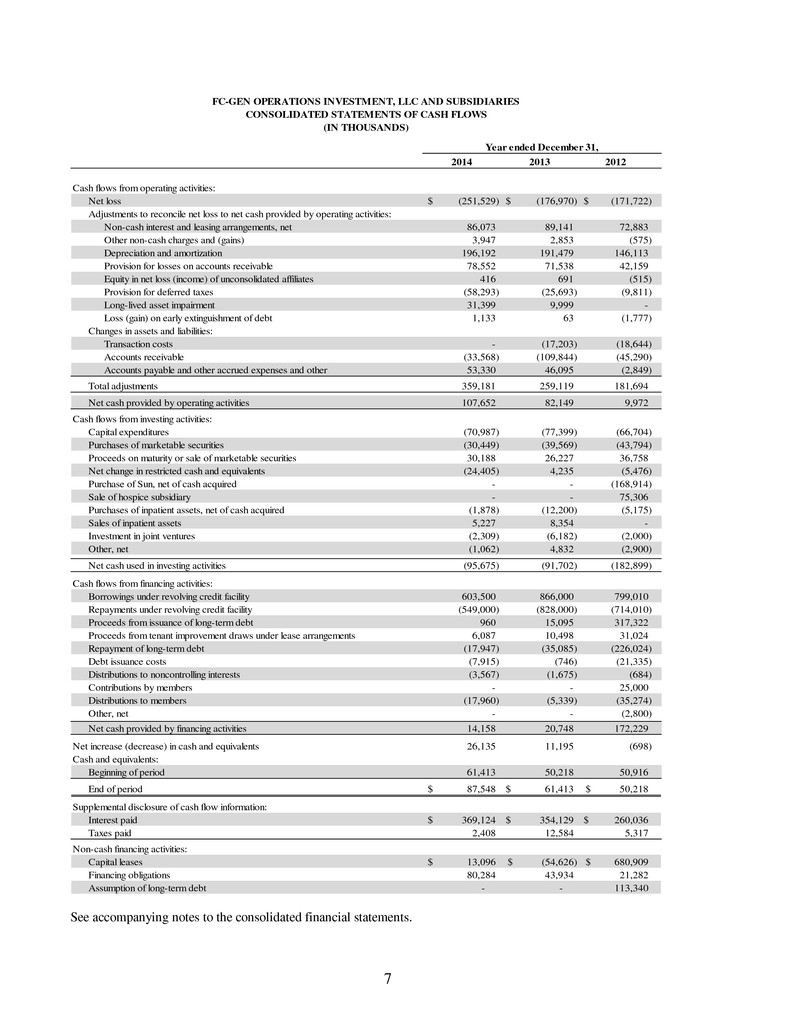

7 2014 2013 2012 Cash flows from operating activities: Net loss (251,529)$ (176,970)$ (171,722)$ Adjustments to reconcile net loss to net cash provided by operating activities: Non-cash interest and leasing arrangements, net 86,073 89,141 72,883 Other non-cash charges and (gains) 3,947 2,853 (575) Depreciation and amortization 196,192 191,479 146,113 Provision for losses on accounts receivable 78,552 71,538 42,159 Equity in net loss (income) of unconsolidated affiliates 416 691 (515) Provision for deferred taxes (58,293) (25,693) (9,811) Long-lived asset impairment 31,399 9,999 - Loss (gain) on early extinguishment of debt 1,133 63 (1,777) Changes in assets and liabilities: Transaction costs - (17,203) (18,644) Accounts receivable (33,568) (109,844) (45,290) Accounts payable and other accrued expenses and other 53,330 46,095 (2,849) Total adjustments 359,181 259,119 181,694 Net cash provided by operating activities 107,652 82,149 9,972 Cash flows from investing activities: Capital expenditures (70,987) (77,399) (66,704) Purchases of marketable securities (30,449) (39,569) (43,794) Proceeds on maturity or sale of marketable securities 30,188 26,227 36,758 Net change in restricted cash and equivalents (24,405) 4,235 (5,476) Purchase of Sun, net of cash acquired - - (168,914) Sale of hospice subsidiary - - 75,306 Purchases of inpatient assets, net of cash acquired (1,878) (12,200) (5,175) Sales of inpatient assets 5,227 8,354 - Investment in joint ventures (2,309) (6,182) (2,000) Other, net (1,062) 4,832 (2,900) Net cash used in investing activities (95,675) (91,702) (182,899) Cash flows from financing activities: Borrowings under revolving credit facility 603,500 866,000 799,010 Repayments under revolving credit facility (549,000) (828,000) (714,010) Proceeds from issuance of long-term debt 960 15,095 317,322 Proceeds from tenant improvement draws under lease arrangements 6,087 10,498 31,024 Repayment of long-term debt (17,947) (35,085) (226,024) Debt issuance costs (7,915) (746) (21,335) Distributions to noncontrolling interests (3,567) (1,675) (684) Contributions by members - - 25,000 Distributions to members (17,960) (5,339) (35,274) Other, net - - (2,800) Net cash provided by financing activities 14,158 20,748 172,229 Net increase (decrease) in cash and equivalents 26,135 11,195 (698) Cash and equivalents: Beginning of period 61,413 50,218 50,916 End of period 87,548$ 61,413$ 50,218$ Supplemental disclosure of cash flow information: Interest paid 369,124$ 354,129$ 260,036$ Taxes paid 2,408 12,584 5,317 Non-cash financing activities: Capital leases 13,096$ (54,626)$ 680,909$ Financing obligations 80,284 43,934 21,282 Assumption of long-term debt - - 113,340 FC-GEN OPERATIONS INVESTMENT, LLC AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (IN THOUSANDS) Year ended December 31, See accompanying notes to the consolidated financial statements.

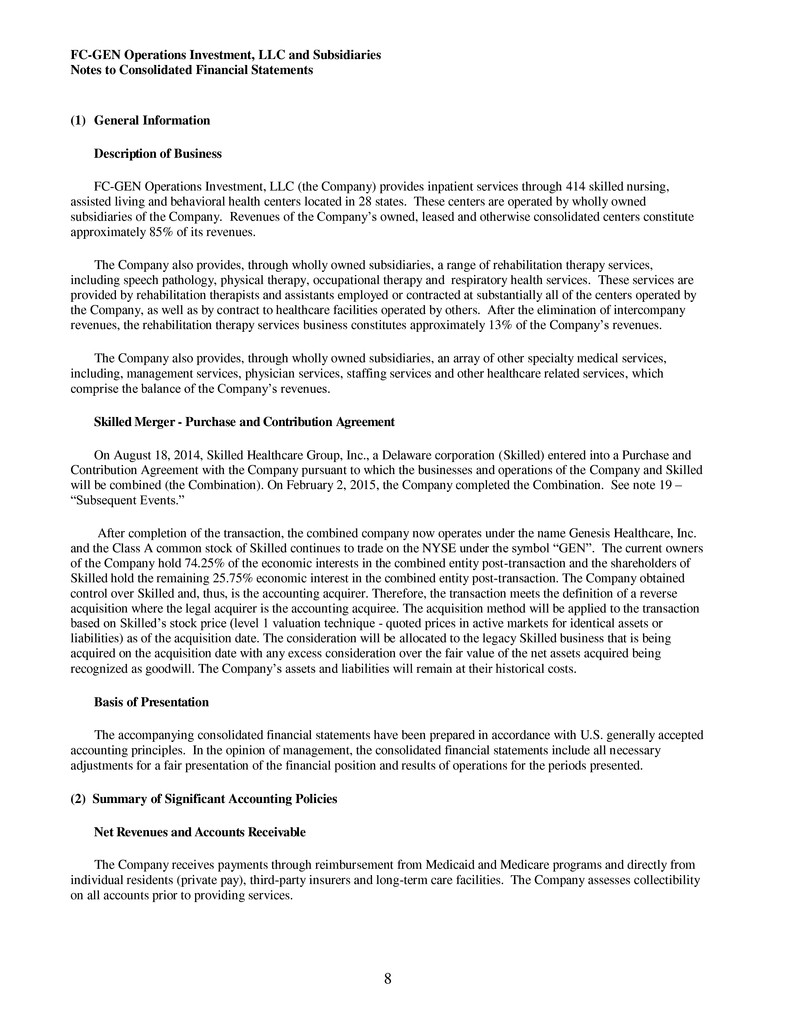

FC-GEN Operations Investment, LLC and Subsidiaries Notes to Consolidated Financial Statements 8 (1) General Information Description of Business FC-GEN Operations Investment, LLC (the Company) provides inpatient services through 414 skilled nursing, assisted living and behavioral health centers located in 28 states. These centers are operated by wholly owned subsidiaries of the Company. Revenues of the Company’s owned, leased and otherwise consolidated centers constitute approximately 85% of its revenues. The Company also provides, through wholly owned subsidiaries, a range of rehabilitation therapy services, including speech pathology, physical therapy, occupational therapy and respiratory health services. These services are provided by rehabilitation therapists and assistants employed or contracted at substantially all of the centers operated by the Company, as well as by contract to healthcare facilities operated by others. After the elimination of intercompany revenues, the rehabilitation therapy services business constitutes approximately 13% of the Company’s revenues. The Company also provides, through wholly owned subsidiaries, an array of other specialty medical services, including, management services, physician services, staffing services and other healthcare related services, which comprise the balance of the Company’s revenues. Skilled Merger - Purchase and Contribution Agreement On August 18, 2014, Skilled Healthcare Group, Inc., a Delaware corporation (Skilled) entered into a Purchase and Contribution Agreement with the Company pursuant to which the businesses and operations of the Company and Skilled will be combined (the Combination). On February 2, 2015, the Company completed the Combination. See note 19 – “Subsequent Events.” After completion of the transaction, the combined company now operates under the name Genesis Healthcare, Inc. and the Class A common stock of Skilled continues to trade on the NYSE under the symbol “GEN”. The current owners of the Company hold 74.25% of the economic interests in the combined entity post-transaction and the shareholders of Skilled hold the remaining 25.75% economic interest in the combined entity post-transaction. The Company obtained control over Skilled and, thus, is the accounting acquirer. Therefore, the transaction meets the definition of a reverse acquisition where the legal acquirer is the accounting acquiree. The acquisition method will be applied to the transaction based on Skilled’s stock price (level 1 valuation technique - quoted prices in active markets for identical assets or liabilities) as of the acquisition date. The consideration will be allocated to the legacy Skilled business that is being acquired on the acquisition date with any excess consideration over the fair value of the net assets acquired being recognized as goodwill. The Company’s assets and liabilities will remain at their historical costs. Basis of Presentation The accompanying consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles. In the opinion of management, the consolidated financial statements include all necessary adjustments for a fair presentation of the financial position and results of operations for the periods presented. (2) Summary of Significant Accounting Policies Net Revenues and Accounts Receivable The Company receives payments through reimbursement from Medicaid and Medicare programs and directly from individual residents (private pay), third-party insurers and long-term care facilities. The Company assesses collectibility on all accounts prior to providing services.

FC-GEN Operations Investment, LLC and Subsidiaries Notes to Consolidated Financial Statements 9 The Company records revenue for inpatient services and the related receivables in the accounting records at the Company’s established billing rates in the period the related services are rendered. The provision for contractual adjustments, which represents the differences between the established billing rates and predetermined reimbursement rates, is deducted from gross revenue to determine net revenue. Retroactive adjustments that are likely to result from future examinations by third party payors are accrued on an estimated basis in the period the related services are rendered and adjusted as necessary in future periods based upon new information or final settlements. The Company records revenue for rehabilitation therapy services and other ancillary services and the related receivables at the time services or products are provided or delivered to the customer. Upon delivery of products or services, the Company has no additional performance obligation to the customer. Use of Estimates The preparation of consolidated financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates. Significant items subject to such estimates and assumptions include the useful lives of fixed assets, allowances for doubtful accounts and provisions for contractual adjustments, deferred tax assets, fixed assets, goodwill, identifiable intangible assets, investments, as well as reserves for employee benefit obligations, self-insurance liabilities, income tax uncertainties, asset retirement obligations and other contingencies. These estimates and assumptions are based on management’s best estimates and judgment. Management evaluates its estimates and assumptions on an ongoing basis using historical experience and other factors, including the current economic environment. Management believes its estimates to be reasonable under the circumstances. The current economic environment has increased the degree of uncertainty inherent in these estimates and assumptions. As future events and their effects cannot be determined with precision, actual results could differ significantly from these estimates. Cash and Equivalents Short-term investments that have a maturity of ninety days or less at acquisition are considered cash equivalents. Investments in cash equivalents are carried at cost, which approximates fair value. Restricted Cash and Investments in Marketable Securities Restricted cash includes cash and money market funds principally held by the Company’s wholly owned captive insurance subsidiary, which is substantially restricted to securing outstanding claims losses. The restricted cash and investments in marketable securities balances at December 31, 2014 and 2013 were $146.7 million and $123.0 million, respectively. Restricted investments in marketable securities, comprised of fixed interest rate securities, are considered to be available-for-sale and accordingly are reported at fair value with unrealized gains and losses, net of related tax effects, included within accumulated other comprehensive income, a separate component of members’ interest. Fair values for fixed interest rate securities are based on quoted market prices. A decline in the market value of any security below cost that is deemed other-than-temporary is charged to income, resulting in the establishment of a new cost basis for the security. Realized gains and losses for securities classified as available for sale are derived using the specific identification method for determining the cost of securities sold. Allowance for Doubtful Accounts The Company evaluates the adequacy of its allowance for doubtful accounts by estimating allowance requirement percentages for each accounts receivable aging category for each type of payor. The Company has developed estimated allowance requirement percentages by utilizing historical collection trends and its understanding of the nature and

FC-GEN Operations Investment, LLC and Subsidiaries Notes to Consolidated Financial Statements 10 collectibility of receivables in the various aging categories and the various lines of the Company’s business. The allowance percentages are developed by payor type as the accounts receivable from each payor type have unique characteristics. The allowance for doubtful accounts also considers accounts specifically identified as uncollectible. Accounts receivable that Company management specifically estimates to be uncollectible, based upon the age of the receivables, the results of collection efforts, or other circumstances, are reserved in the allowance for doubtful accounts until written-off. Prepaid Expenses and Other Current Assets Prepaid expenses and other current assets principally consist of expenses paid in advance of the provision of services, inventories of nursing center food and supplies, non-trade receivables and $9.0 million and $9.3 million of escrowed funds held by third parties at December 31, 2014 and 2013, respectively, in accordance with loan and other contractual agreements. Property and Equipment Property and equipment are recorded at cost. Depreciation is calculated using the straight-line method over estimated useful lives of 20-35 years for buildings, building improvements and land improvements, and 3-15 years for equipment, furniture and fixtures and information systems. Depreciation expense on leasehold improvements and assets held under capital leases is calculated using the straight-line method over the lesser of the lease term or the estimated useful life of the asset. Expenditures for maintenance and repairs necessary to maintain property and equipment in efficient operating condition are charged to operations as incurred. Costs of additions and betterments are capitalized. Total depreciation expense from continuing operations for the years ended December 31, 2014, 2013 and 2012 was $184.3 million, $179.4 million, and $140.2 million, respectively. Long-Lived Assets The Company’s long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by comparison of the carrying amount of an asset to the future cash flows expected to be generated by the asset. If the carrying amount of an asset exceeds its estimated future undiscounted cash flows, an impairment charge is recognized to the extent the carrying amount of the asset exceeds the fair value of the asset. Assets to be disposed of are reported at the lower of the carrying amount or the fair value less costs to sell. The Company performs an assessment of qualitative factors prior to the use of the two step quantitative method to determine if goodwill has been impaired. If such qualitative assessment does not indicate that it is more likely than not the fair value of the reporting is less than its carrying value, no further analysis is required. The Company performs its annual impairment assessment as of September 30, of each year or more frequently if adverse events or changes in circumstances indicate that the asset may be impaired. See note 17 – “Asset Impairment Charges.” Self-Insurance Risks The Company provides for self-insurance risks for both general and professional liability and workers’ compensation claims based on estimates of the ultimate costs for both reported claims and claims incurred but not reported. Estimated losses from asserted and incurred but not reported claims are accrued based on the Company’s estimates of the ultimate costs of the claims, which includes costs associated with litigating or settling claims, and the relationship of past reported incidents to eventual claims payments. All relevant information, including the Company’s own historical experience, the nature and extent of existing asserted claims and reported incidents, and independent actuarial analyses of this information is used in estimating the expected amount of claims. The reserves for loss for workers’ compensation risks are discounted based on actuarial estimates of claim payment patterns whereas the reserves for general and professional liability are recorded on an undiscounted basis. The Company also considers amounts that may be recovered from excess insurance carriers in estimating the ultimate net liability for such risks.

FC-GEN Operations Investment, LLC and Subsidiaries Notes to Consolidated Financial Statements 11 Income Taxes The Company is treated as a partnership for federal and state income tax purposes. Therefore, the consolidated financial statements do not include any provision for federal or state income taxes, except for the subsidiaries that continued to be treated as corporations for federal and state income tax purposes and for the few jurisdictions that tax partnership income. The Company’s financial results are allocated to the Company’s members. The Company’s members include these results on their separate tax returns. For the Company’s subsidiaries treated as corporations for federal and state income tax purposes, deferred income taxes arise from the recognition of the tax consequences of temporary differences between the tax basis of assets and liabilities and their reported amounts in the consolidated financial statements. These temporary differences will result in taxable or deductible amounts in future years when the reported amounts of the assets are recovered or liabilities are settled. The Company also recognizes as deferred tax assets the future tax benefits from net operating loss (NOL) carryforwards. A valuation allowance is provided for these and other deferred tax assets if it is more likely than not that some portion or all of the net deferred tax assets will not be realized. Leases Leasing transactions are a material part of the Company’s business. The following discussion summarizes various aspects of the Company’s accounting for leasing transactions and the related balances. Capital Leases Lease arrangements are capitalized when such leases convey substantially all the risks and benefits incidental to ownership. Capital leases are amortized over either the lease term or the life of the related assets, depending upon available purchase options and lease renewal features. Amortization related to capital leases is included in the consolidated statements of operations within depreciation and amortization expense. Operating Leases For operating leases, minimum lease payments, including minimum scheduled rent increases, are recognized as lease expense on a straight-line basis over the applicable lease terms and any periods during which the Company has use of the property but is not charged rent by a landlord. Lease terms, in most cases, provide for rent escalations and renewal options. When the Company purchases businesses that have operating lease agreements, it recognizes the fair value of the lease arrangements as either favorable or unfavorable and records these amounts as other identifiable intangible assets or other long-term liabilities, respectively. Favorable and unfavorable leases are amortized to lease expense on a straight- line basis over the remaining term of the leases. Sale/Leaseback Financing Obligation Prior to recognition as a sale, or profit/loss thereon, sale/leaseback transactions are evaluated to determine if their terms transfer all of the risks and rewards of ownership as demonstrated by the absence of any other continuing involvement by the seller-lessee. A sale/leaseback transaction that does not qualify for sale/leaseback accounting because of any form of continuing involvement by the seller-lessee is accounted for as a financing transaction. Under the financing method: (1) the assets and accumulated depreciation remain on the consolidated balance sheet and continue to be depreciated over the remaining useful lives; (2) no gain is recognized; and (3) proceeds received by the Company from these transactions are recorded as a financing obligation. Asset Retirement Obligations The fair value of a liability for an asset retirement obligation is recognized in the period when the asset is placed in service. The fair value of the liability is estimated using discounted cash flows. In subsequent periods, the retirement

FC-GEN Operations Investment, LLC and Subsidiaries Notes to Consolidated Financial Statements 12 obligation is accreted to its future value or the estimate of the obligation at the asset retirement date. The accretion charge is reflected separately on the consolidated statement of operations. A corresponding retirement asset equal to the fair value of the retirement obligation is also recorded as part of the carrying amount of the related long-lived asset and depreciated over the asset’s useful life. Recent Accounting Pronouncements In April 2014, the FASB issued ASU No. 2014-08, Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity, (ASU 2014-08). This ASU requires an entity to report disposed components or components held-for-sale in discontinued operations if such components represent a strategic shift that has or will have a significant effect on operations and financial results. Additionally, expanded disclosure about discontinued operations and disposals of significant components that do not qualify for discontinued operations presentation will be required. The adoption of ASU 2014-08 is effective prospectively for disposals that occur within annual periods beginning on or after December 15, 2014, with early adoption permitted. The Company adopted ASU 2014-08 in the fourth quarter of 2014 and its adoption did not have a material impact on the consolidated financial statements. In May 2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers, (ASU 2014-08). This ASU requires an entity to recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. To achieve this core principle, the guidance provides that an entity should apply the following steps: (1) identify the contract(s) with a customer; (2) identify the performance obligations in the contract; (3) determine the transaction price; (4) allocate the transaction price to the performance obligations in the contract; and (5) recognize revenue when, or as, the entity satisfies a performance obligation. The ASU is effective beginning in the first quarter of our fiscal year 2017. Early adoption is not permitted. The Company is currently evaluating the impact to the consolidated financial statements. (3) Significant Transactions and Events Sun Merger Effective December 1, 2012, the Company completed the Sun Merger. Upon consummation of the Sun Merger, each issued and outstanding share of Sun common stock and common stock equivalent was tendered for $8.50 in cash. The purchase price totaled $228.4 million before considering cash acquired in connection with the Sun Merger. The Company also assumed $88.8 million of long-term debt in the Sun Merger, of which $87.5 million was refinanced on December 3, 2012. The operating results of Sun have been included in the accompanying consolidated financial statements of the Company since December 1, 2012. Simultaneous with the Sun Merger, Sun’s hospice segment was sold to Life Choice Hospice, a provider of in-home hospice care, for approximately $85 million. Net cash sale proceeds of $75 million were used to repay the Term Loan Facility. The Company retained an approximate one-third interest in the sold hospice segment since it owned an approximate one-third interest in Life Choice Hospice’s parent company. Life Choice Hospice has since been merged into FC PAC Holdings, LLC. See note 13 – “Related Party Transactions.” (4) Certain Significant Risks and Uncertainties Revenue Sources The Company receives revenues from Medicare, Medicaid, private insurance, self-pay residents, other third-party payors and long-term care facilities that utilize its rehabilitation therapy and other services. The Company’s inpatient services derives approximately 79% of its revenue from the Medicare and various state Medicaid programs. The sources and amounts of the Company’s revenues are determined by a number of factors, including licensed bed capacity and occupancy rates of its inpatient facilities, the mix of patients and the rates of reimbursement among payors. Likewise, payment for ancillary medical services, including services provided by the Company’s rehabilitation therapy

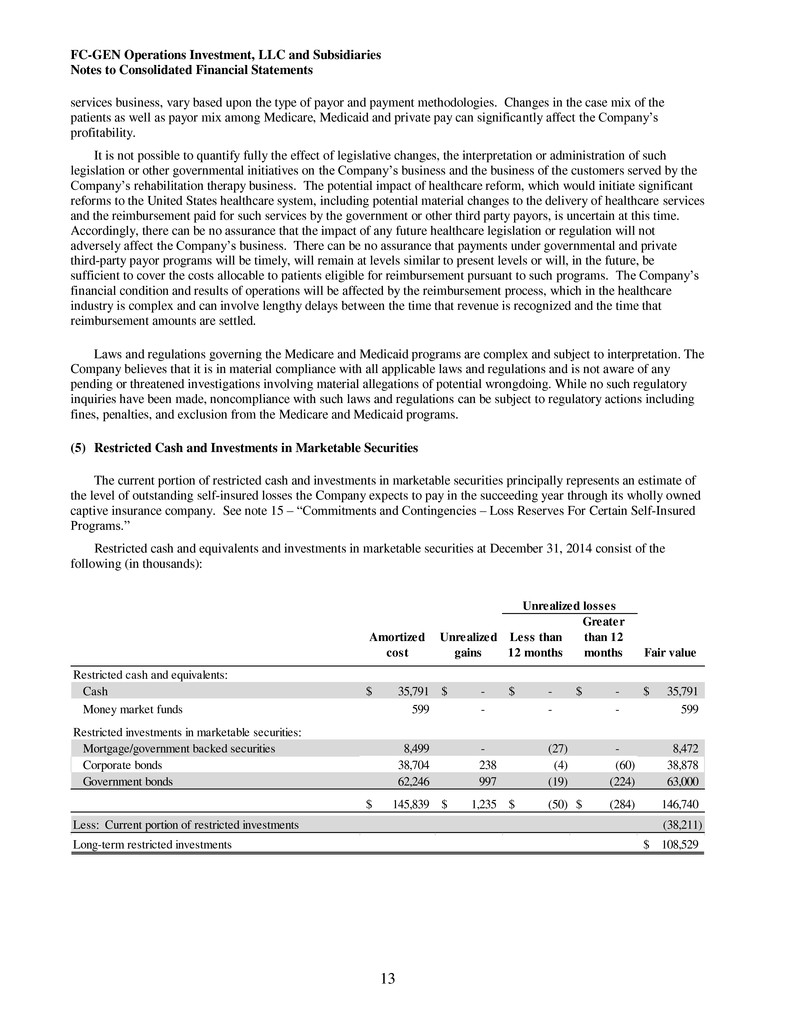

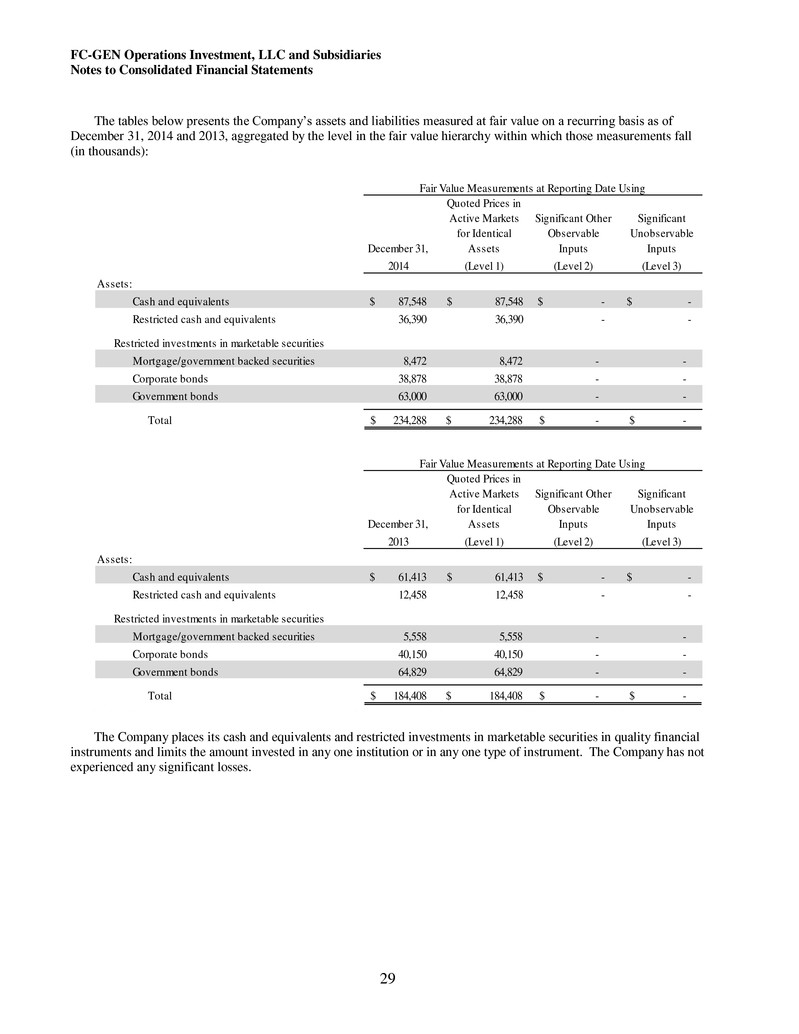

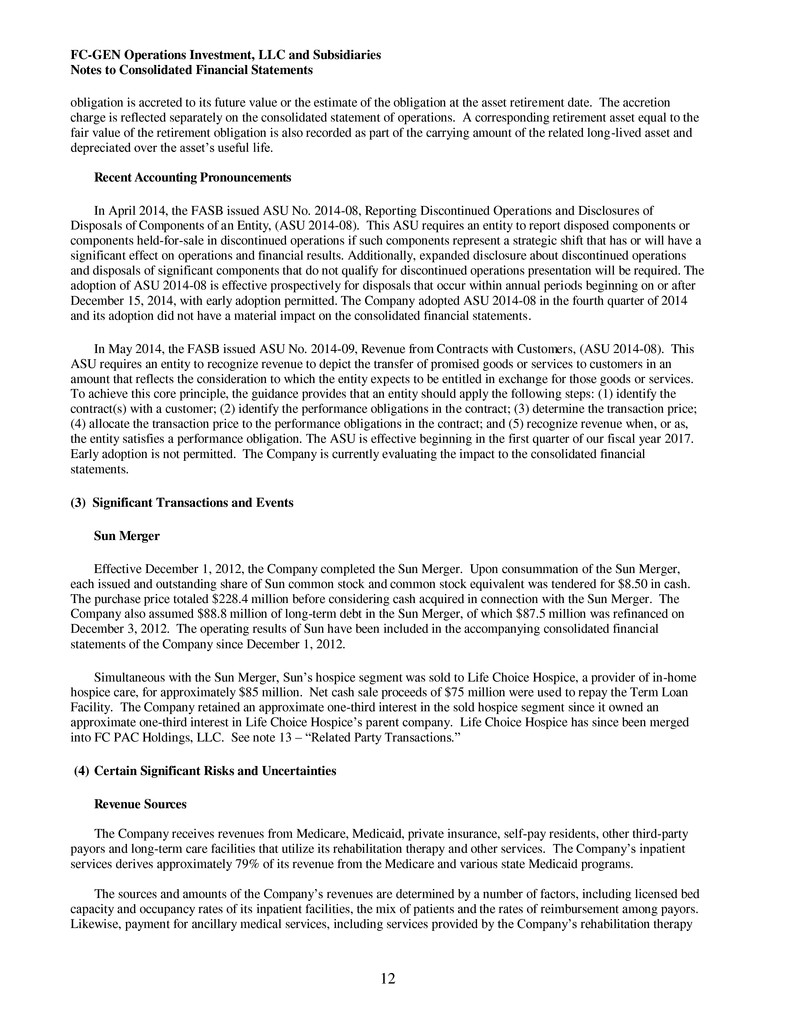

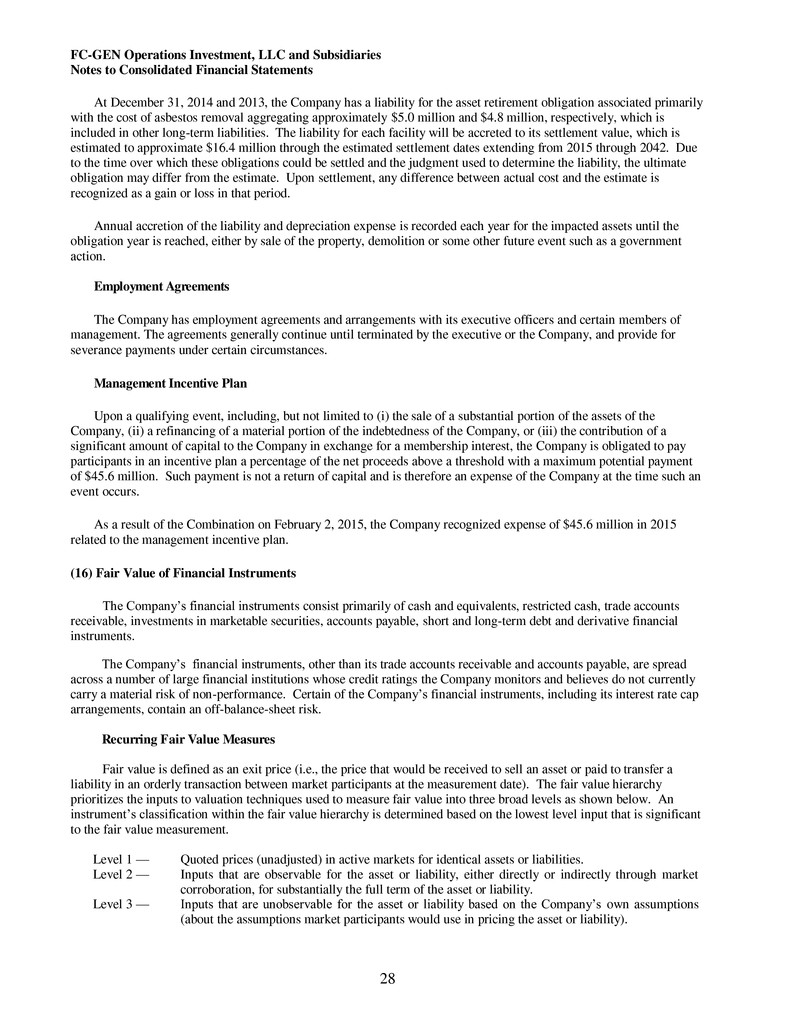

FC-GEN Operations Investment, LLC and Subsidiaries Notes to Consolidated Financial Statements 13 services business, vary based upon the type of payor and payment methodologies. Changes in the case mix of the patients as well as payor mix among Medicare, Medicaid and private pay can significantly affect the Company’s profitability. It is not possible to quantify fully the effect of legislative changes, the interpretation or administration of such legislation or other governmental initiatives on the Company’s business and the business of the customers served by the Company’s rehabilitation therapy business. The potential impact of healthcare reform, which would initiate significant reforms to the United States healthcare system, including potential material changes to the delivery of healthcare services and the reimbursement paid for such services by the government or other third party payors, is uncertain at this time. Accordingly, there can be no assurance that the impact of any future healthcare legislation or regulation will not adversely affect the Company’s business. There can be no assurance that payments under governmental and private third-party payor programs will be timely, will remain at levels similar to present levels or will, in the future, be sufficient to cover the costs allocable to patients eligible for reimbursement pursuant to such programs. The Company’s financial condition and results of operations will be affected by the reimbursement process, which in the healthcare industry is complex and can involve lengthy delays between the time that revenue is recognized and the time that reimbursement amounts are settled. Laws and regulations governing the Medicare and Medicaid programs are complex and subject to interpretation. The Company believes that it is in material compliance with all applicable laws and regulations and is not aware of any pending or threatened investigations involving material allegations of potential wrongdoing. While no such regulatory inquiries have been made, noncompliance with such laws and regulations can be subject to regulatory actions including fines, penalties, and exclusion from the Medicare and Medicaid programs. (5) Restricted Cash and Investments in Marketable Securities The current portion of restricted cash and investments in marketable securities principally represents an estimate of the level of outstanding self-insured losses the Company expects to pay in the succeeding year through its wholly owned captive insurance company. See note 15 – “Commitments and Contingencies – Loss Reserves For Certain Self-Insured Programs.” Restricted cash and equivalents and investments in marketable securities at December 31, 2014 consist of the following (in thousands): Amortized cost Unrealized gains Less than 12 months Greater than 12 months Fair value R tr d cash and equivalents: Cash 35,791$ -$ -$ -$ 35,791$ M y rket funds 599 - - - 599 es rict d investments in marketable securities: M r gag /government backed securities 8,499 - (27) - 8,472 Corpora b nds 38,704 238 (4) (60) 38,878 Government bonds 62,246 997 (19) (224) 63,000 145,839$ 1,235$ (50)$ (284)$ 146,740 Less: Current portion of restricted investments (38,211) Long-term restricted investments 108,529$ Unrealized losses

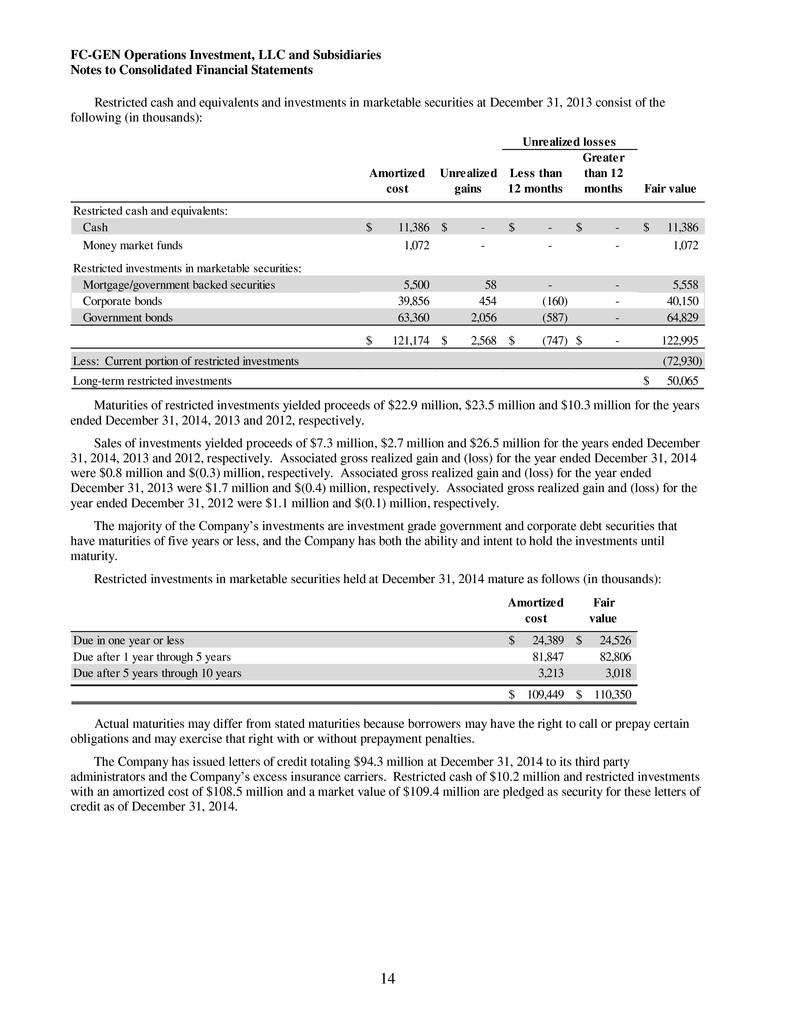

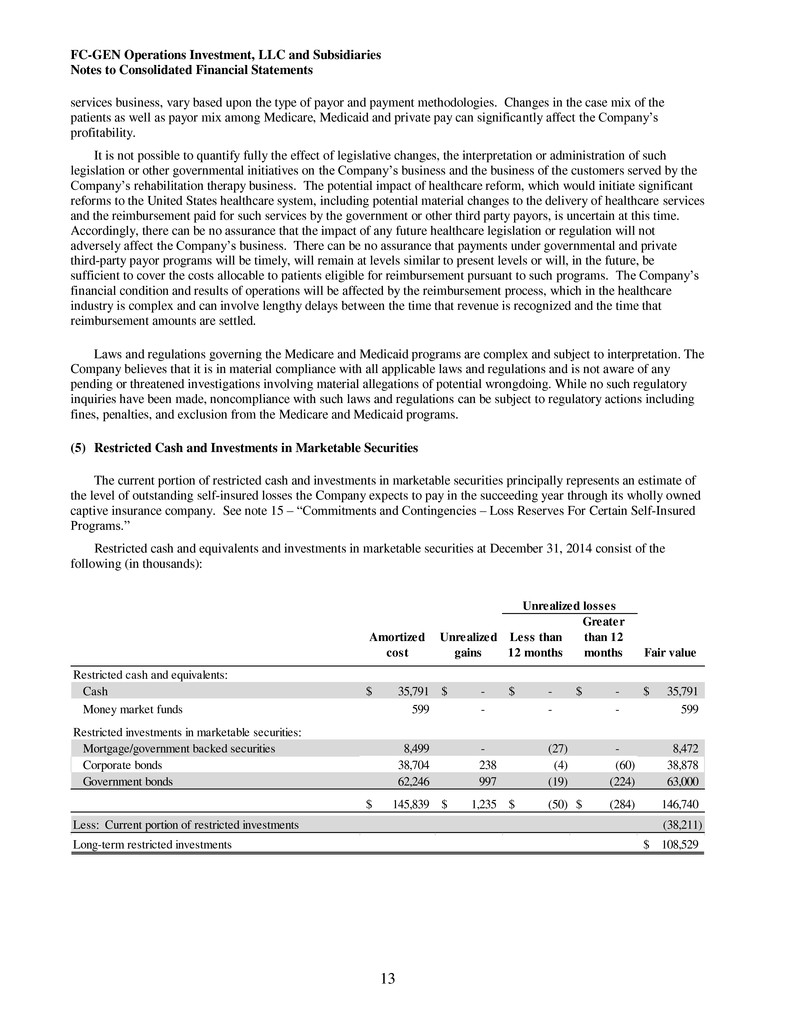

FC-GEN Operations Investment, LLC and Subsidiaries Notes to Consolidated Financial Statements 14 Restricted cash and equivalents and investments in marketable securities at December 31, 2013 consist of the following (in thousands): Amortized cost Unrealized gains Less than 12 months Greater than 12 months Fair value Restricted cash and equivalents: Cash 11,386$ -$ -$ -$ 11,386$ Money market funds 1,072 - - - 1,072 Restricted investments in marketable securities: Mortgage/government backed securities 5,500 58 - - 5,558 Corpora b nds 39,856 454 (160) - 40,150 Government bonds 63,360 2,056 (587) - 64,829 121,174$ 2,568$ (747)$ -$ 122,995 Less: Current portion of restricted investments (72,930) Long-term restricted investments 50,065$ Unrealized losses Maturities of restricted investments yielded proceeds of $22.9 million, $23.5 million and $10.3 million for the years ended December 31, 2014, 2013 and 2012, respectively. Sales of investments yielded proceeds of $7.3 million, $2.7 million and $26.5 million for the years ended December 31, 2014, 2013 and 2012, respectively. Associated gross realized gain and (loss) for the year ended December 31, 2014 were $0.8 million and $(0.3) million, respectively. Associated gross realized gain and (loss) for the year ended December 31, 2013 were $1.7 million and $(0.4) million, respectively. Associated gross realized gain and (loss) for the year ended December 31, 2012 were $1.1 million and $(0.1) million, respectively. The majority of the Company’s investments are investment grade government and corporate debt securities that have maturities of five years or less, and the Company has both the ability and intent to hold the investments until maturity. Restricted investments in marketable securities held at December 31, 2014 mature as follows (in thousands): Amortized cost Fair value Due in one year or less 24,389$ 24,526$ ue after 1 year through 5 years 81,847 82,806 Due after 5 years through 10 years 3,213 3,018 109,449$ 110,350$ Actual maturities may differ from stated maturities because borrowers may have the right to call or prepay certain obligations and may exercise that right with or without prepayment penalties. The Company has issued letters of credit totaling $94.3 million at December 31, 2014 to its third party administrators and the Company’s excess insurance carriers. Restricted cash of $10.2 million and restricted investments with an amortized cost of $108.5 million and a market value of $109.4 million are pledged as security for these letters of credit as of December 31, 2014.

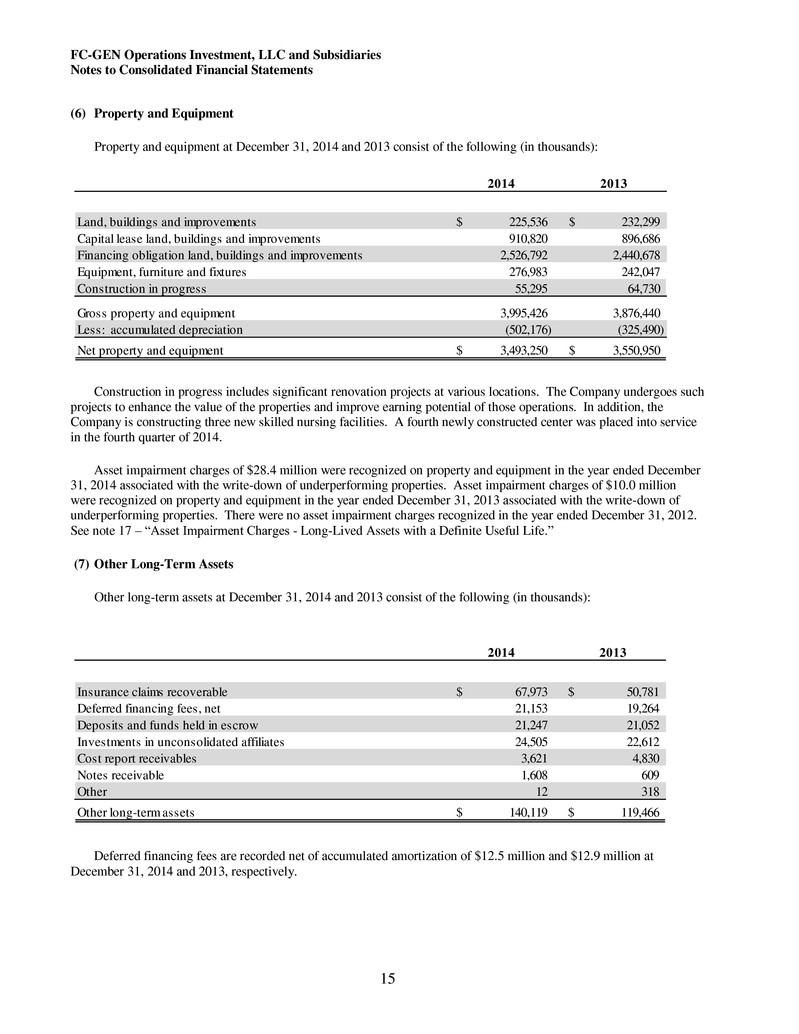

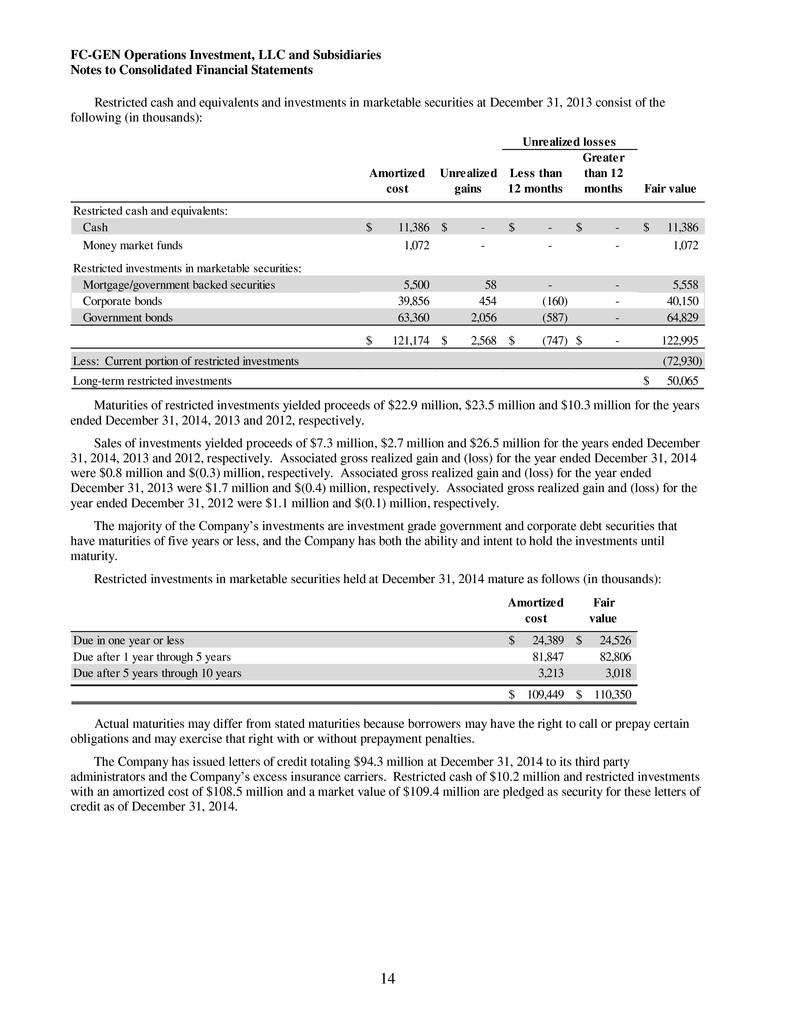

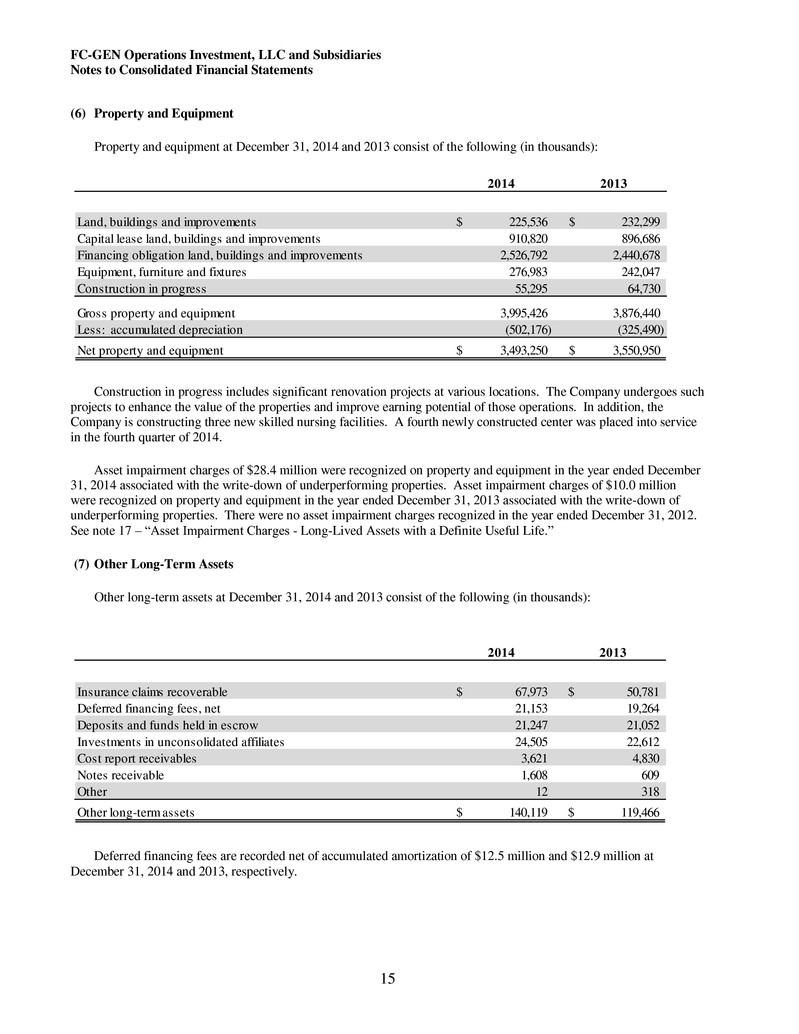

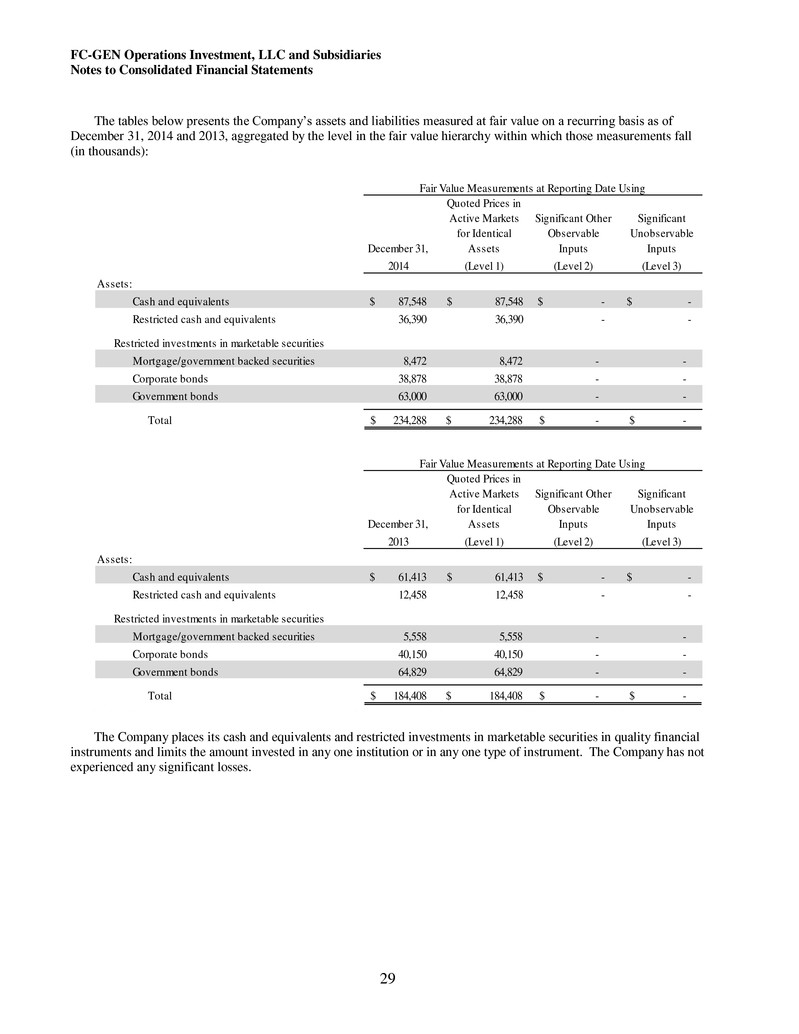

FC-GEN Operations Investment, LLC and Subsidiaries Notes to Consolidated Financial Statements 15 (6) Property and Equipment Property and equipment at December 31, 2014 and 2013 consist of the following (in thousands): 2014 2013 Land, buildings and improvements 225,536$ 232,299$ C pital lease land, buildings and improvements 910,820 896,686 Fi ancing bligation land, buildings and improvements 2,526,792 2,440,678 Equipment, furniture and fixtures 276,983 242,047 Construction in progress 55,295 64,730 Gross property and equipment 3,995,426 3,876,440 Less: accumulated depreciation (502,176) (325,490) Net property and equipment 3,493,250$ 3,550,950$ Construction in progress includes significant renovation projects at various locations. The Company undergoes such projects to enhance the value of the properties and improve earning potential of those operations. In addition, the Company is constructing three new skilled nursing facilities. A fourth newly constructed center was placed into service in the fourth quarter of 2014. Asset impairment charges of $28.4 million were recognized on property and equipment in the year ended December 31, 2014 associated with the write-down of underperforming properties. Asset impairment charges of $10.0 million were recognized on property and equipment in the year ended December 31, 2013 associated with the write-down of underperforming properties. There were no asset impairment charges recognized in the year ended December 31, 2012. See note 17 – “Asset Impairment Charges - Long-Lived Assets with a Definite Useful Life.” (7) Other Long-Term Assets Other long-term assets at December 31, 2014 and 2013 consist of the following (in thousands): 2014 2013 In ura c cla ms recoverable 67,973$ 50,781$ Def rred financing fees, net 21,153 19,264 D posits and funds held in escrow 21,247 21,052 Investments in unconsolidated affiliates 24,505 22,612 Cost report receivables 3,621 4,830 Notes receivable 1,608 609 Other 12 318 Other long-term assets 140,119$ 119,466$ Deferred financing fees are recorded net of accumulated amortization of $12.5 million and $12.9 million at December 31, 2014 and 2013, respectively.

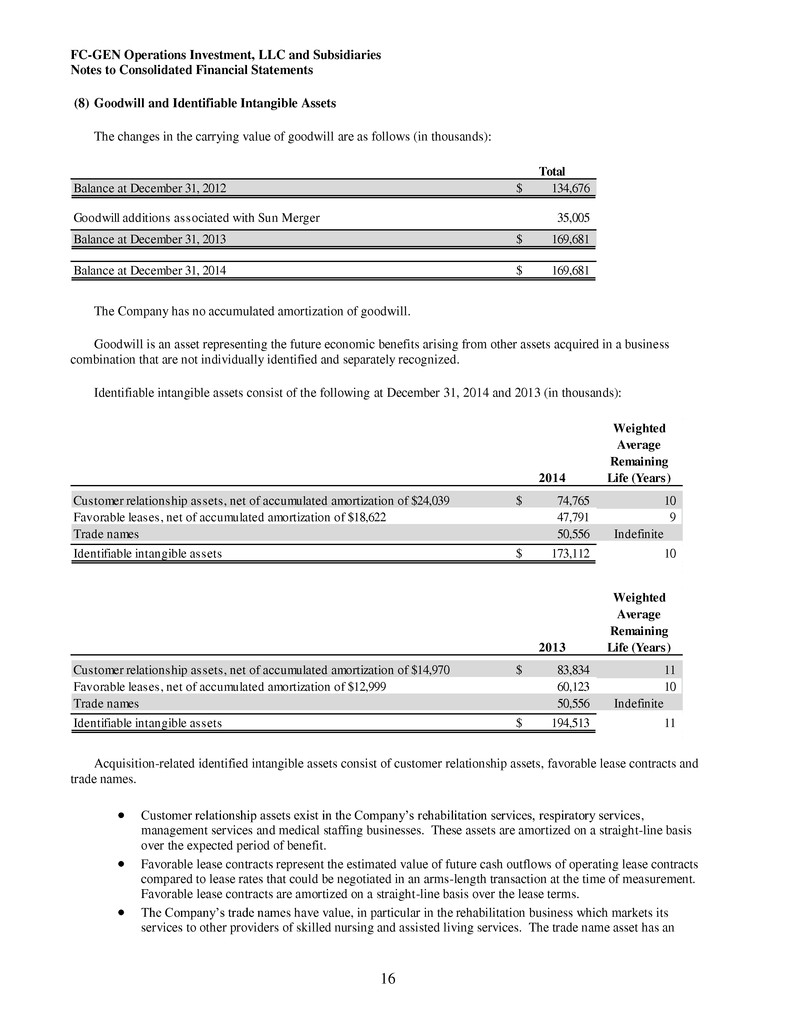

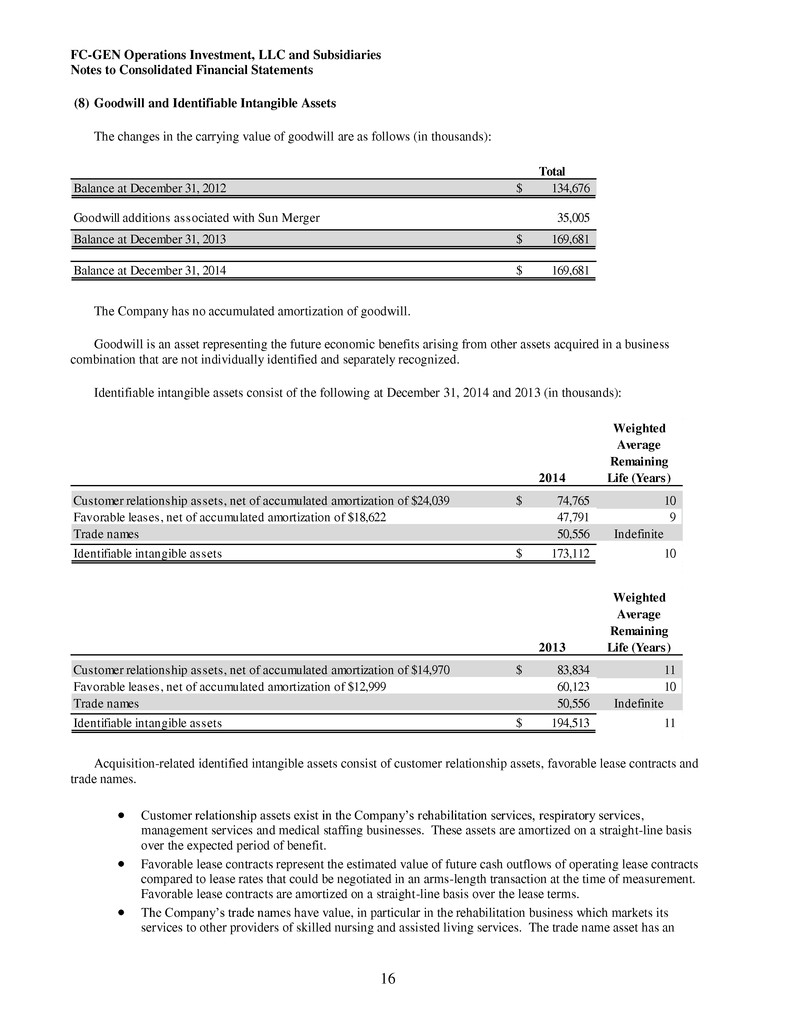

FC-GEN Operations Investment, LLC and Subsidiaries Notes to Consolidated Financial Statements 16 (8) Goodwill and Identifiable Intangible Assets The changes in the carrying value of goodwill are as follows (in thousands): Total Balance at December 31, 2012 134,676$ Goodwill additions associated with Sun Merger 35,005 Balance at December 31, 2013 169,681$ Balance at December 31, 2014 169,681$ The Company has no accumulated amortization of goodwill. Goodwill is an asset representing the future economic benefits arising from other assets acquired in a business combination that are not individually identified and separately recognized. Identifiable intangible assets consist of the following at December 31, 2014 and 2013 (in thousands): 2014 Weighted Average Remaining Life (Years) Customer relationship assets, net of accumulated amortization of $24,039 74,765$ 10 Favorable leases, net of accumulated amortization of $18,622 47,791 9 T ade mes 50,556 Indefinite Identifiable intangible assets 173,112$ 10 2013 Weighted Average Remaining Life (Years) Customer relationship assets, net of accumulated amortization of $14,970 83,834$ 11 Favorable leases, net of accumulated amortization of $12,999 60,123 10 Trade names 50,556 Indefinite Identifiable intangible assets 194,513$ 11 Acquisition-related identified intangible assets consist of customer relationship assets, favorable lease contracts and trade names. Customer relationship assets exist in the Company’s rehabilitation services, respiratory services, management services and medical staffing businesses. These assets are amortized on a straight-line basis over the expected period of benefit. Favorable lease contracts represent the estimated value of future cash outflows of operating lease contracts compared to lease rates that could be negotiated in an arms-length transaction at the time of measurement. Favorable lease contracts are amortized on a straight-line basis over the lease terms. The Company’s trade names have value, in particular in the rehabilitation business which markets its services to other providers of skilled nursing and assisted living services. The trade name asset has an

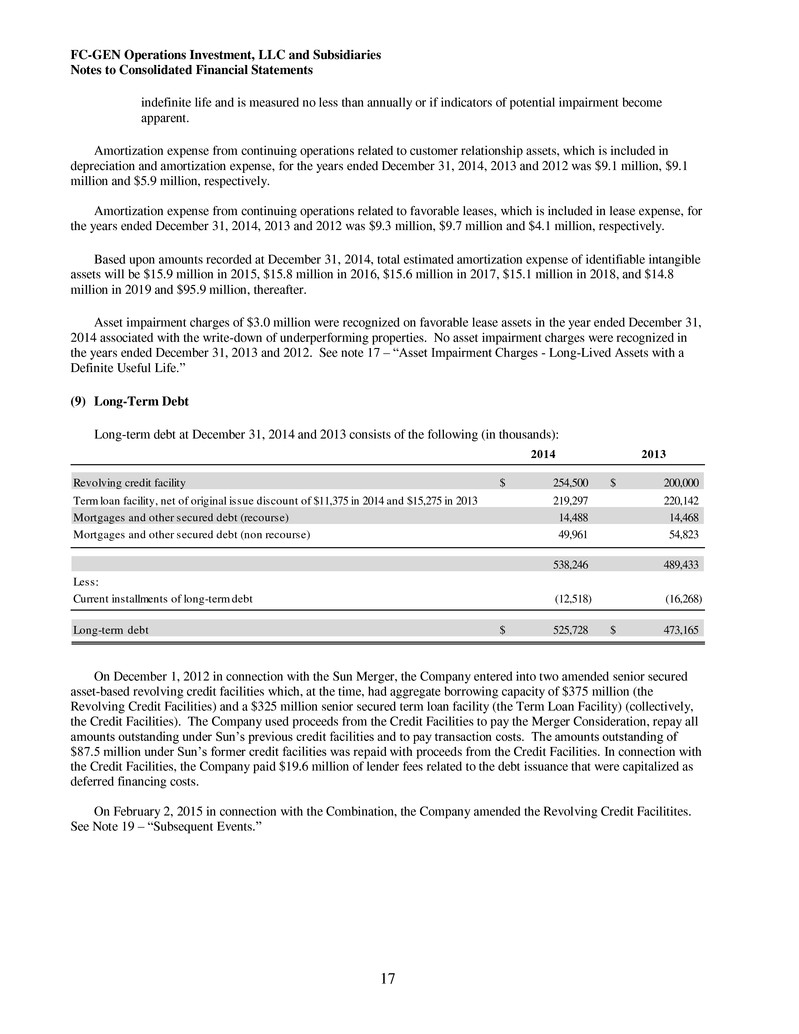

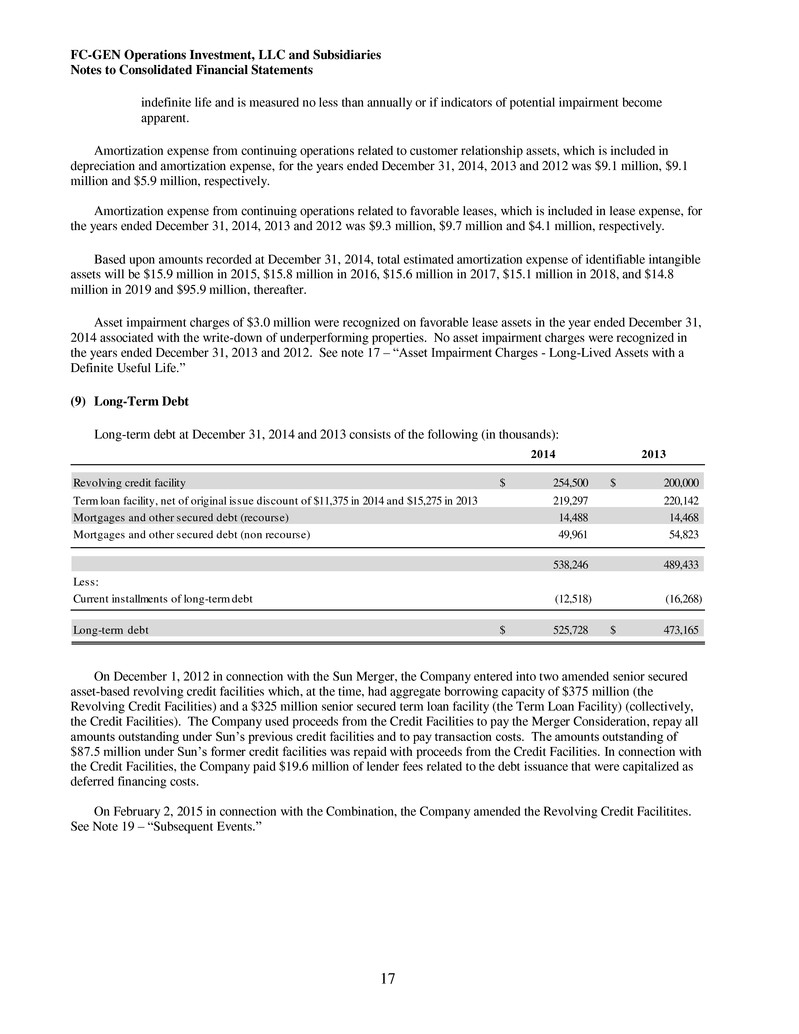

FC-GEN Operations Investment, LLC and Subsidiaries Notes to Consolidated Financial Statements 17 indefinite life and is measured no less than annually or if indicators of potential impairment become apparent. Amortization expense from continuing operations related to customer relationship assets, which is included in depreciation and amortization expense, for the years ended December 31, 2014, 2013 and 2012 was $9.1 million, $9.1 million and $5.9 million, respectively. Amortization expense from continuing operations related to favorable leases, which is included in lease expense, for the years ended December 31, 2014, 2013 and 2012 was $9.3 million, $9.7 million and $4.1 million, respectively. Based upon amounts recorded at December 31, 2014, total estimated amortization expense of identifiable intangible assets will be $15.9 million in 2015, $15.8 million in 2016, $15.6 million in 2017, $15.1 million in 2018, and $14.8 million in 2019 and $95.9 million, thereafter. Asset impairment charges of $3.0 million were recognized on favorable lease assets in the year ended December 31, 2014 associated with the write-down of underperforming properties. No asset impairment charges were recognized in the years ended December 31, 2013 and 2012. See note 17 – “Asset Impairment Charges - Long-Lived Assets with a Definite Useful Life.” (9) Long-Term Debt Long-term debt at December 31, 2014 and 2013 consists of the following (in thousands): 2014 2013 Revolving credit facility 254,500$ 200,000$ Ter l an facility, net of original issue discount of $11,375 in 2014 and $15,275 in 2013 219,297 220,142 Mo tga s d other secured debt (recourse) 14,488 14,468 Mortgages and other secured debt (non recourse) 49,961 54,823 538,246 489,433 Less: Current installments of long-term debt (12,518) (16,268) Long-term debt 525,728$ 473,165$ On December 1, 2012 in connection with the Sun Merger, the Company entered into two amended senior secured asset-based revolving credit facilities which, at the time, had aggregate borrowing capacity of $375 million (the Revolving Credit Facilities) and a $325 million senior secured term loan facility (the Term Loan Facility) (collectively, the Credit Facilities). The Company used proceeds from the Credit Facilities to pay the Merger Consideration, repay all amounts outstanding under Sun’s previous credit facilities and to pay transaction costs. The amounts outstanding of $87.5 million under Sun’s former credit facilities was repaid with proceeds from the Credit Facilities. In connection with the Credit Facilities, the Company paid $19.6 million of lender fees related to the debt issuance that were capitalized as deferred financing costs. On February 2, 2015 in connection with the Combination, the Company amended the Revolving Credit Facilitites. See Note 19 – “Subsequent Events.”

FC-GEN Operations Investment, LLC and Subsidiaries Notes to Consolidated Financial Statements 18 Credit Facilities The Credit Facilities, contain a number of restrictive covenants that, among other things, impose operating and financial restrictions on the Company and its subsidiaries. The Credit Facilities also require the Company to meet defined financial covenants, including a minimum level of consolidated liquidity, a maximum consolidated net leverage ratio and a minimum consolidated fixed charge coverage ratio, all as defined. The Credit Facilities also contain other customary covenants and events of default. At December 31, 2014, the Company is in compliance with its covenants. On January 21, 2014, the Company amended the Credit Facilities redefining certain restrictive covenants in exchange for fees of $4.3 million. In 2013, pursuant to the Credit Facilities, the Company entered into an interest rate cap agreement for a notional amount of $250 million limiting the Company’s exposure to LIBOR interest rate fluctuations at 1.5%. The interest rate cap agreement expired on December 31, 2014. Revolving Credit Facilities The Revolving Credit Facilities had a combined maximum borrowing capacity of $375 million in 2012 and five- year terms. The larger of the two facilities is a $368 million facility and the smaller is a $7 million facility. The $7 million facility was established by certain wholly owned subsidiaries of the Company through which the Company leases real estate. This separate revolving credit facility was required when the owner of the real estate refinanced the outstanding debt, which is secured through the U.S. Department of Housing and Urban Development. The Revolving Credit Facilities were amended in 2013 increasing the maximum borrowing capacity to $425 million. The larger of the two facilities is a $415 million facility and the smaller is a $10 million facility. The Revolving Credit Facilities were established to provide the Company a source of financing to fund general working capital requirements. The Revolving Credit Facilities are secured by a first priority lien on eligible accounts receivable, cash, deposit accounts and certain other assets and property (the Revolving Credit Facility First Priority Collateral). The Revolving Credit Facilities have a second priority lien on the membership interests in the Company and substantially all of the Company’s assets. Borrowings under the Revolving Credit Facilities may be in the form of revolving loans or swing line loans. Aggregate outstanding swing line loans have a sub-limit of $20 million. The Revolving Credit Facilities also provide a sub-limit of $125 million for letters of credit. Borrowing levels under the Revolving Credit Facilities are limited to a borrowing base that is computed based upon the level of Company eligible accounts receivable, as defined. In addition to paying interest on the outstanding principal borrowed under the revolving credit facilities, the Company is required to pay a commitment fee to the lenders for any unutilized commitments. The commitment fee rate is 0.375% per annum when the unused commitment is greater than $200 million and 0.50% per annum when the unused commitment is less than $200 million. As of December 31, 2014, the Company had outstanding borrowings under the Revolving Credit Facilities of $254.5 million and had $101.1 million of drawn letters of credit securing insurance and lease obligations, leaving the Company with approximately $37.6 million of available borrowing capacity under the revolving credit facilities. Borrowings under the revolving credit facility, as amended, bear interest at a rate equal to, at the Company’s option, either a base rate plus an applicable margin or at LIBOR plus an applicable margin. The base rate is determined by reference to the highest of (i) a lender-defined prime rate, (ii) the federal funds rate plus 3.0%, and (iii) the sum of LIBOR plus an applicable margin. The applicable margin with respect to base rate borrowings is 3.0% at December 31, 2014. The applicable margin with respect to LIBOR borrowings is 3.3% at December 31, 2014. Base rate borrowings under the revolving credit facility bore interest of approximately 6.3% at December 31, 2014. One-month LIBOR borrowings under the revolving credit facility bore interest of approximately 3.4% at December 31, 2014.

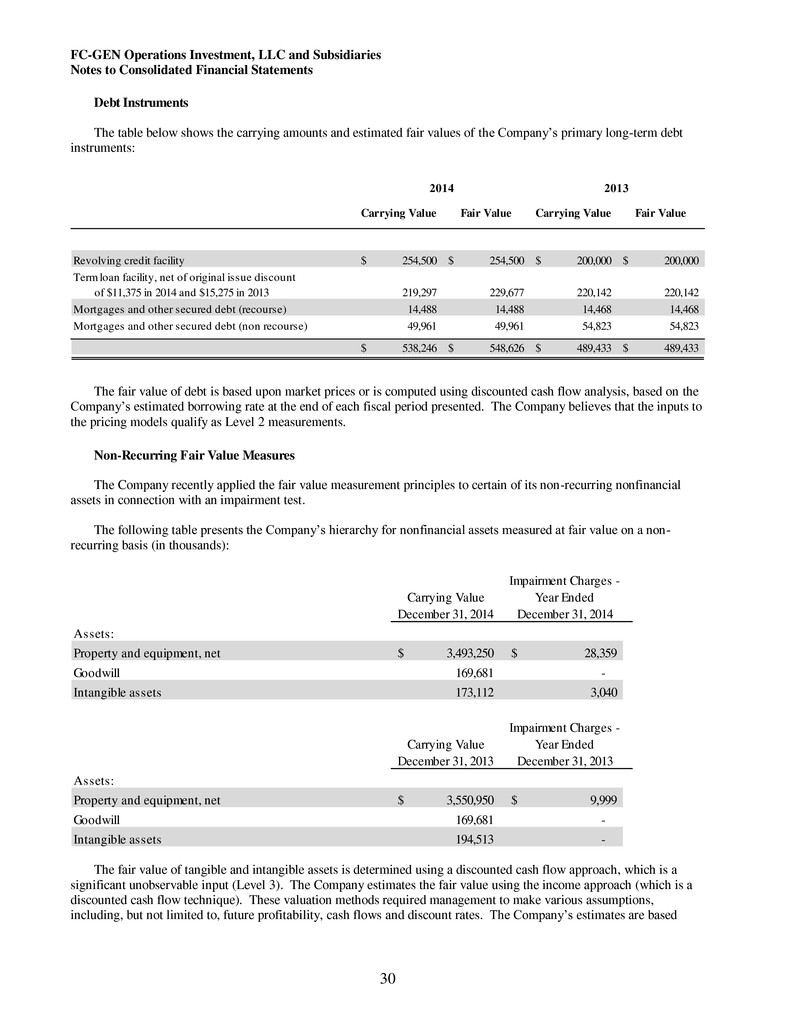

FC-GEN Operations Investment, LLC and Subsidiaries Notes to Consolidated Financial Statements 19 Term Loan Facility The Term Loan Facility has a five-year term and is secured by a first priority lien on the membership interests in the Company, substantially all of the Company’s assets other than the Revolving Credit Facility First Priority Collateral and a second priority lien on the Revolving Credit Facility First Priority Collateral. The Term Loan Facility proceeds totaled $305.5 million, net of a $19.5 million original issue discount that will be amortized over the term of the Term Loan Facility. The term loan amortizes at a rate of $12.5 million per year. Beginning in 2014, the lenders have the right to elect ratable principal payments or defer principal recoupment until the end of the term. Principal payments for the year ended December 31, 2014 were $4.7 million. Borrowings under the Term Loan Facility bear interest at a rate per annum equal to the applicable margin plus, at the Company’s option, either (1) LIBOR determined by reference to the costs of funds for Eurodollar deposits for the interest period relevant to such borrowings, or (2) a base rate determined by reference to the highest of (a) the lender defined prime rate, (b) the federal funds rate effective plus one half of one percent and (c) LIBOR described in sub clause (1) plus 1.0%. LIBOR based loans are subject to an interest rate floor of 1.5% and base rate loans are subject to a floor of 2.5%. Base rate borrowings under the Term Loan Facility bore interest of approximately 10.8% at December 31, 2014. One-month LIBOR borrowings under the Term Loan Facility bore interest of approximately 10.0% at December 31, 2014. Other Debt Mortgages and other secured debt (recourse). The Company carries two mortgage loans on two of its corporate office buildings. The loans are secured by the underlying real property and have fixed or variable rates of interest ranging from 1.9% to 4.3% at December 31, 2014, with maturity dates ranging from 2018 to 2019. The Company is a named co-borrower on a loan with a fixed interest rate of 5.5% with an anticipated settlement in 2015. The loan is offset with a receivable recorded on the consolidated balance sheet in prepaid expenses and other current assets. Mortgages and other secured debt (non-recourse). Loans are carried by certain of the Company’s consolidated joint ventures. The loans consist principally of revenue bonds and secured bank loans. Loans are secured by the underlying real and personal property of individual facilities and have fixed or variable rates of interest ranging from 2.5% to 21.9% at December 31, 2014, with maturity dates ranging from 2018 to 2036. Loans are labeled “non-recourse” because neither the Company nor a wholly owned subsidiary is obligated to perform under the respective loan agreements. The maturity of total debt of $538.2 million at December 31, 2014 is as follows: $12.5 million in fiscal 2015, $10.9 million in fiscal 2016, $458.9 million in fiscal 2017, $23.3 million in fiscal 2018, $2.3 million in fiscal 2019 and $30.3 million thereafter.

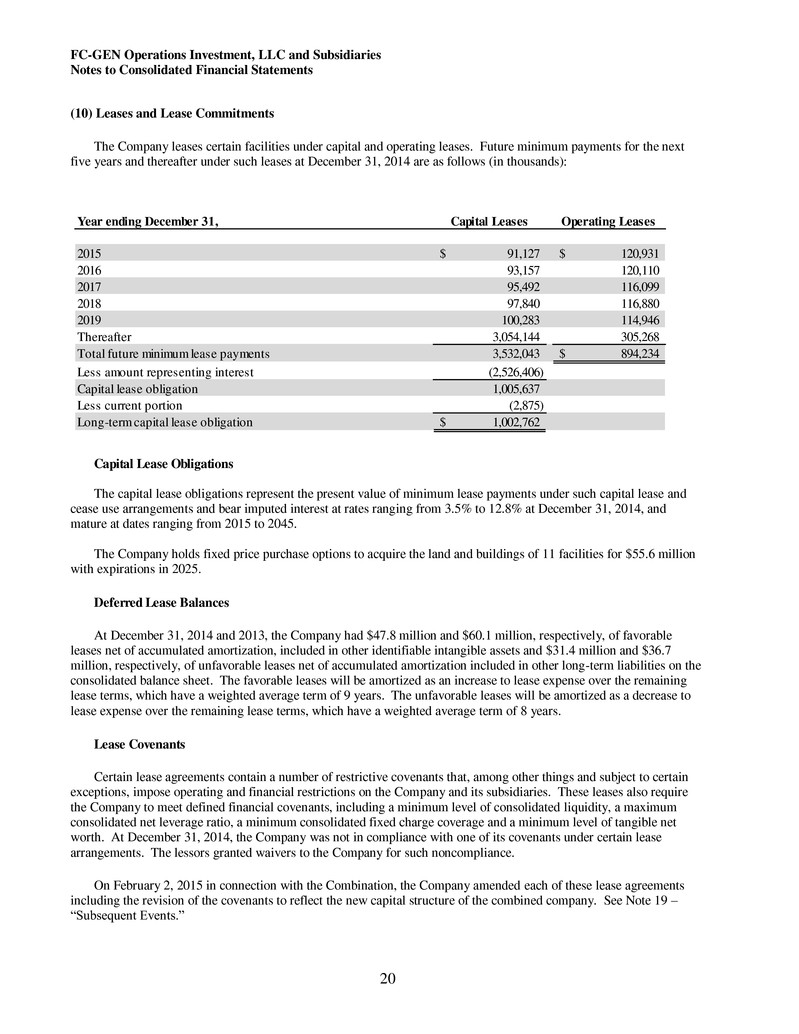

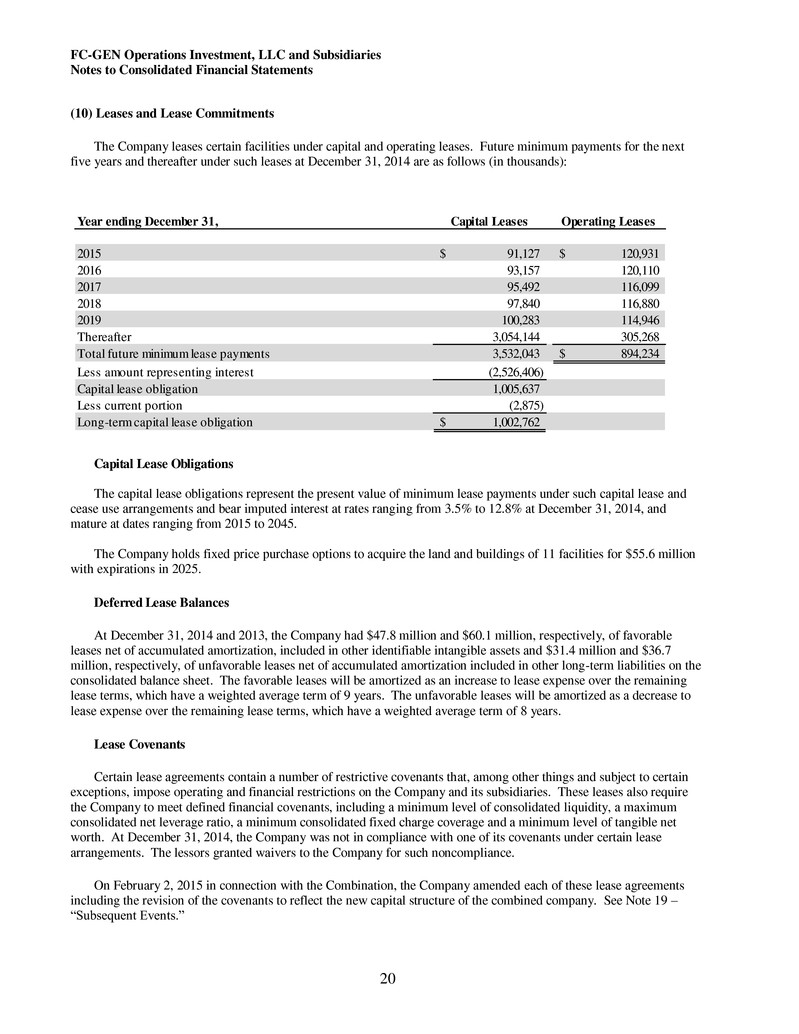

FC-GEN Operations Investment, LLC and Subsidiaries Notes to Consolidated Financial Statements 20 (10) Leases and Lease Commitments The Company leases certain facilities under capital and operating leases. Future minimum payments for the next five years and thereafter under such leases at December 31, 2014 are as follows (in thousands): Year ending December 31, Capital Leases Operating Leases 2015 91,127$ 120,931$ 2016 93,157 120,110 2017 95,492 116,099 2018 97,840 116,880 2019 100,283 114,946 T ereafter 3,054,144 305,268 Total future minimum lease payments 3,532,043 894,234$ Less amount representing interest (2,526,406) Capital lease obligation 1,005,637 Less current portion (2,875) Long-term capital lease obligation 1,002,762$ Capital Lease Obligations The capital lease obligations represent the present value of minimum lease payments under such capital lease and cease use arrangements and bear imputed interest at rates ranging from 3.5% to 12.8% at December 31, 2014, and mature at dates ranging from 2015 to 2045. The Company holds fixed price purchase options to acquire the land and buildings of 11 facilities for $55.6 million with expirations in 2025. Deferred Lease Balances At December 31, 2014 and 2013, the Company had $47.8 million and $60.1 million, respectively, of favorable leases net of accumulated amortization, included in other identifiable intangible assets and $31.4 million and $36.7 million, respectively, of unfavorable leases net of accumulated amortization included in other long-term liabilities on the consolidated balance sheet. The favorable leases will be amortized as an increase to lease expense over the remaining lease terms, which have a weighted average term of 9 years. The unfavorable leases will be amortized as a decrease to lease expense over the remaining lease terms, which have a weighted average term of 8 years. Lease Covenants Certain lease agreements contain a number of restrictive covenants that, among other things and subject to certain exceptions, impose operating and financial restrictions on the Company and its subsidiaries. These leases also require the Company to meet defined financial covenants, including a minimum level of consolidated liquidity, a maximum consolidated net leverage ratio, a minimum consolidated fixed charge coverage and a minimum level of tangible net worth. At December 31, 2014, the Company was not in compliance with one of its covenants under certain lease arrangements. The lessors granted waivers to the Company for such noncompliance. On February 2, 2015 in connection with the Combination, the Company amended each of these lease agreements including the revision of the covenants to reflect the new capital structure of the combined company. See Note 19 – “Subsequent Events.”

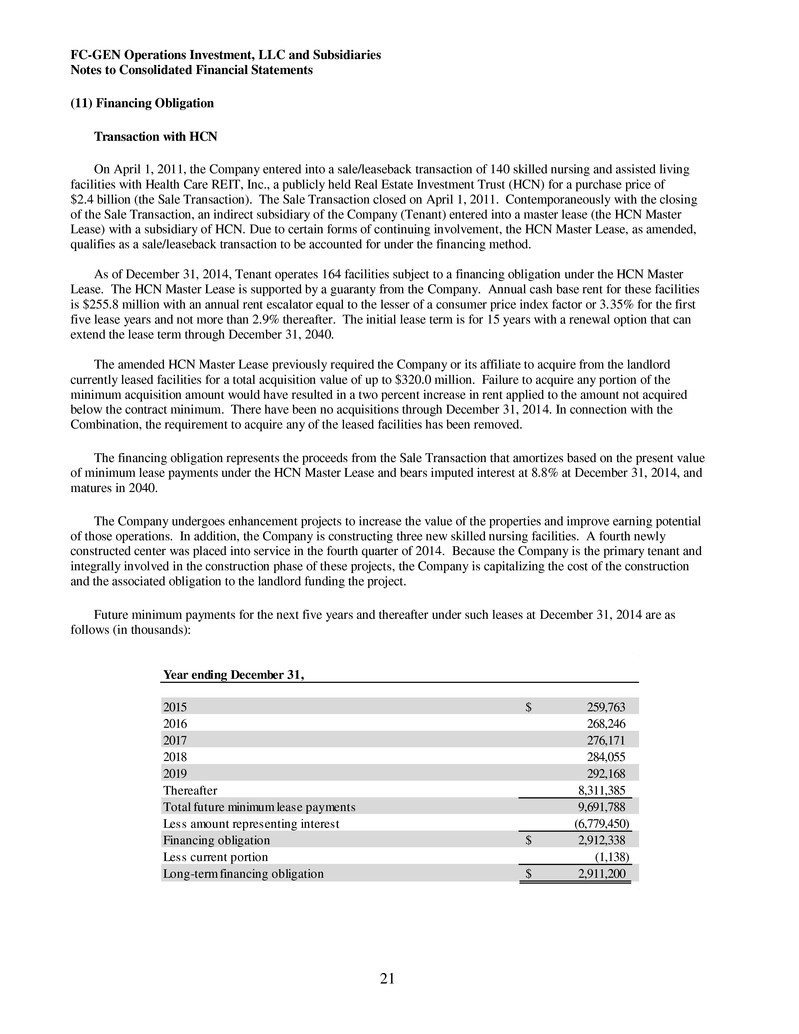

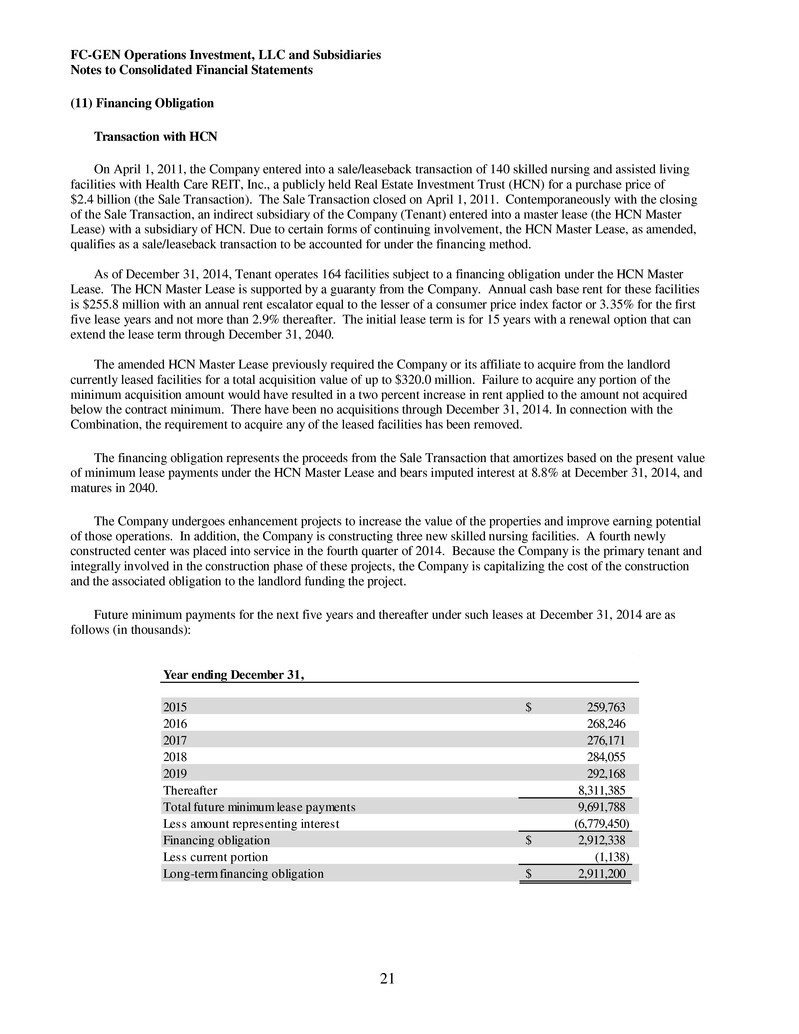

FC-GEN Operations Investment, LLC and Subsidiaries Notes to Consolidated Financial Statements 21 (11) Financing Obligation Transaction with HCN On April 1, 2011, the Company entered into a sale/leaseback transaction of 140 skilled nursing and assisted living facilities with Health Care REIT, Inc., a publicly held Real Estate Investment Trust (HCN) for a purchase price of $2.4 billion (the Sale Transaction). The Sale Transaction closed on April 1, 2011. Contemporaneously with the closing of the Sale Transaction, an indirect subsidiary of the Company (Tenant) entered into a master lease (the HCN Master Lease) with a subsidiary of HCN. Due to certain forms of continuing involvement, the HCN Master Lease, as amended, qualifies as a sale/leaseback transaction to be accounted for under the financing method. As of December 31, 2014, Tenant operates 164 facilities subject to a financing obligation under the HCN Master Lease. The HCN Master Lease is supported by a guaranty from the Company. Annual cash base rent for these facilities is $255.8 million with an annual rent escalator equal to the lesser of a consumer price index factor or 3.35% for the first five lease years and not more than 2.9% thereafter. The initial lease term is for 15 years with a renewal option that can extend the lease term through December 31, 2040. The amended HCN Master Lease previously required the Company or its affiliate to acquire from the landlord currently leased facilities for a total acquisition value of up to $320.0 million. Failure to acquire any portion of the minimum acquisition amount would have resulted in a two percent increase in rent applied to the amount not acquired below the contract minimum. There have been no acquisitions through December 31, 2014. In connection with the Combination, the requirement to acquire any of the leased facilities has been removed. The financing obligation represents the proceeds from the Sale Transaction that amortizes based on the present value of minimum lease payments under the HCN Master Lease and bears imputed interest at 8.8% at December 31, 2014, and matures in 2040. The Company undergoes enhancement projects to increase the value of the properties and improve earning potential of those operations. In addition, the Company is constructing three new skilled nursing facilities. A fourth newly constructed center was placed into service in the fourth quarter of 2014. Because the Company is the primary tenant and integrally involved in the construction phase of these projects, the Company is capitalizing the cost of the construction and the associated obligation to the landlord funding the project. Future minimum payments for the next five years and thereafter under such leases at December 31, 2014 are as follows (in thousands): Ye endi g D c mber 31, 2015 259,763$ 2016 268,246 2017 276,171 2018 284,055 2019 292,168 Thereafter 8,311,385 Total future minimum lease payments 9,691,788 Less amount representing interest (6,779,450) Financing obligation 2,912,338$ Less current portion (1,138) Long-term financing obligation 2,911,200$

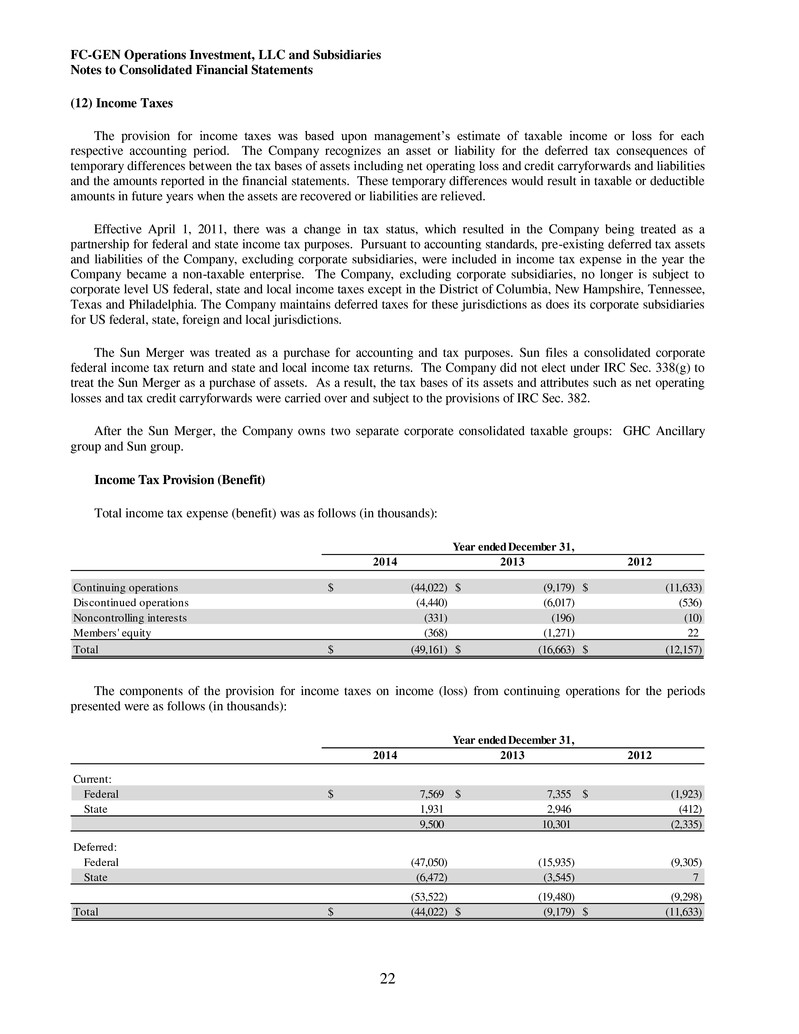

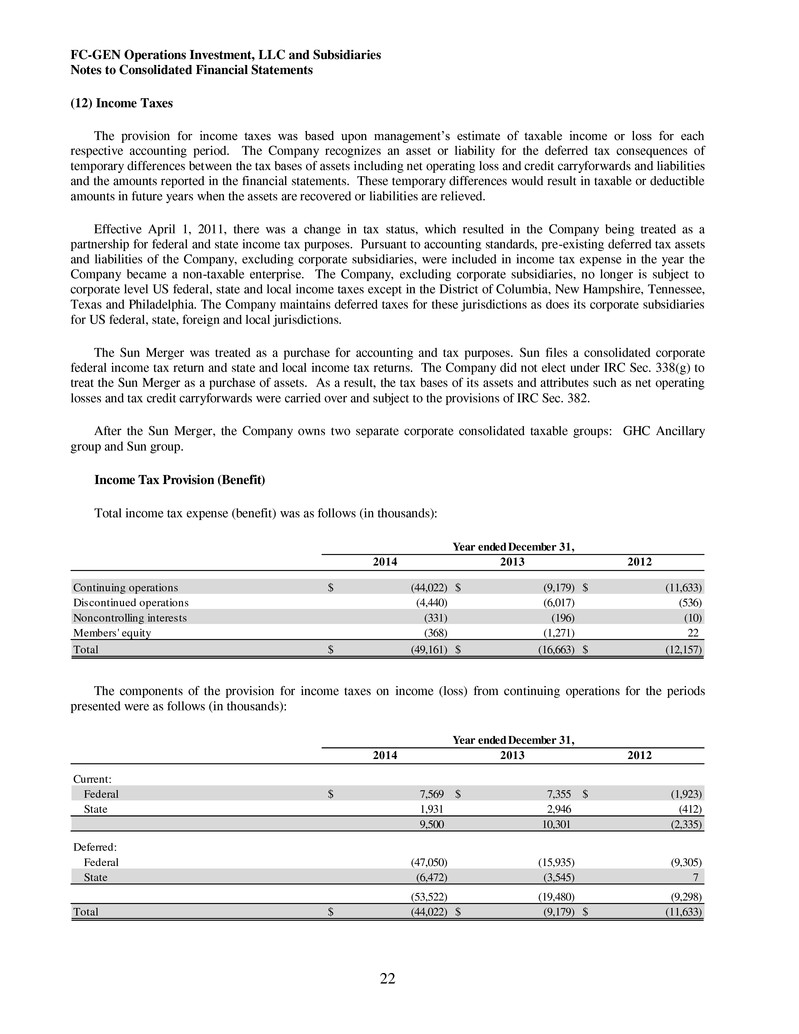

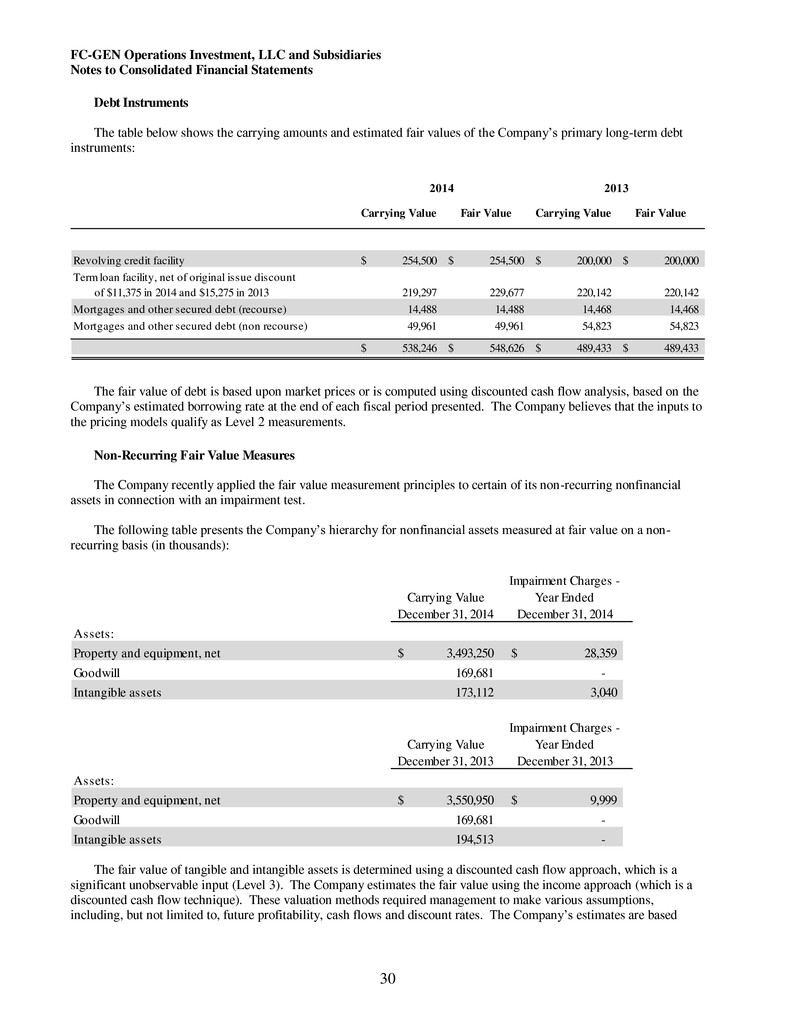

FC-GEN Operations Investment, LLC and Subsidiaries Notes to Consolidated Financial Statements 22 (12) Income Taxes The provision for income taxes was based upon management’s estimate of taxable income or loss for each respective accounting period. The Company recognizes an asset or liability for the deferred tax consequences of temporary differences between the tax bases of assets including net operating loss and credit carryforwards and liabilities and the amounts reported in the financial statements. These temporary differences would result in taxable or deductible amounts in future years when the assets are recovered or liabilities are relieved. Effective April 1, 2011, there was a change in tax status, which resulted in the Company being treated as a partnership for federal and state income tax purposes. Pursuant to accounting standards, pre-existing deferred tax assets and liabilities of the Company, excluding corporate subsidiaries, were included in income tax expense in the year the Company became a non-taxable enterprise. The Company, excluding corporate subsidiaries, no longer is subject to corporate level US federal, state and local income taxes except in the District of Columbia, New Hampshire, Tennessee, Texas and Philadelphia. The Company maintains deferred taxes for these jurisdictions as does its corporate subsidiaries for US federal, state, foreign and local jurisdictions. The Sun Merger was treated as a purchase for accounting and tax purposes. Sun files a consolidated corporate federal income tax return and state and local income tax returns. The Company did not elect under IRC Sec. 338(g) to treat the Sun Merger as a purchase of assets. As a result, the tax bases of its assets and attributes such as net operating losses and tax credit carryforwards were carried over and subject to the provisions of IRC Sec. 382. After the Sun Merger, the Company owns two separate corporate consolidated taxable groups: GHC Ancillary group and Sun group. Income Tax Provision (Benefit) Total income tax expense (benefit) was as follows (in thousands): 2014 2013 2012 Continuing operations (44,022)$ (9,179)$ (11,633)$ Discontinued operations (4,440) (6,017) (536) Noncontrolling interests (331) (196) (10) Members' equity (368) (1,271) 22 Total (49,161)$ (16,663)$ (12,157)$ Year ended December 31, The components of the provision for income taxes on income (loss) from continuing operations for the periods presented were as follows (in thousands): 2014 2013 2012 Current: Federal 7,5 9$ 7,355$ (1,9 3)$ State 1,931 2,946 (412) 9,500 10,301 (2,335) Deferred: Federal (47,050) (15,935) (9,305) State (6,472) (3,545) 7 (53,522) (19,480) (9,298) Total (44,022)$ (9,179)$ (11,633)$ e r e e ece er ,

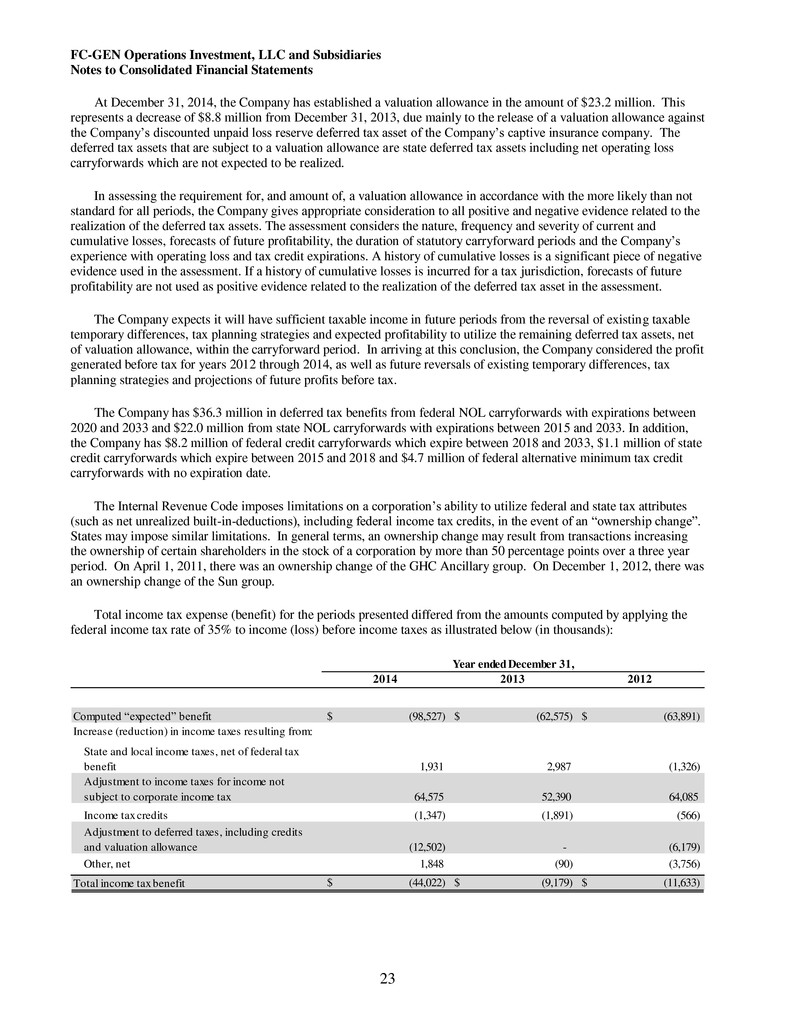

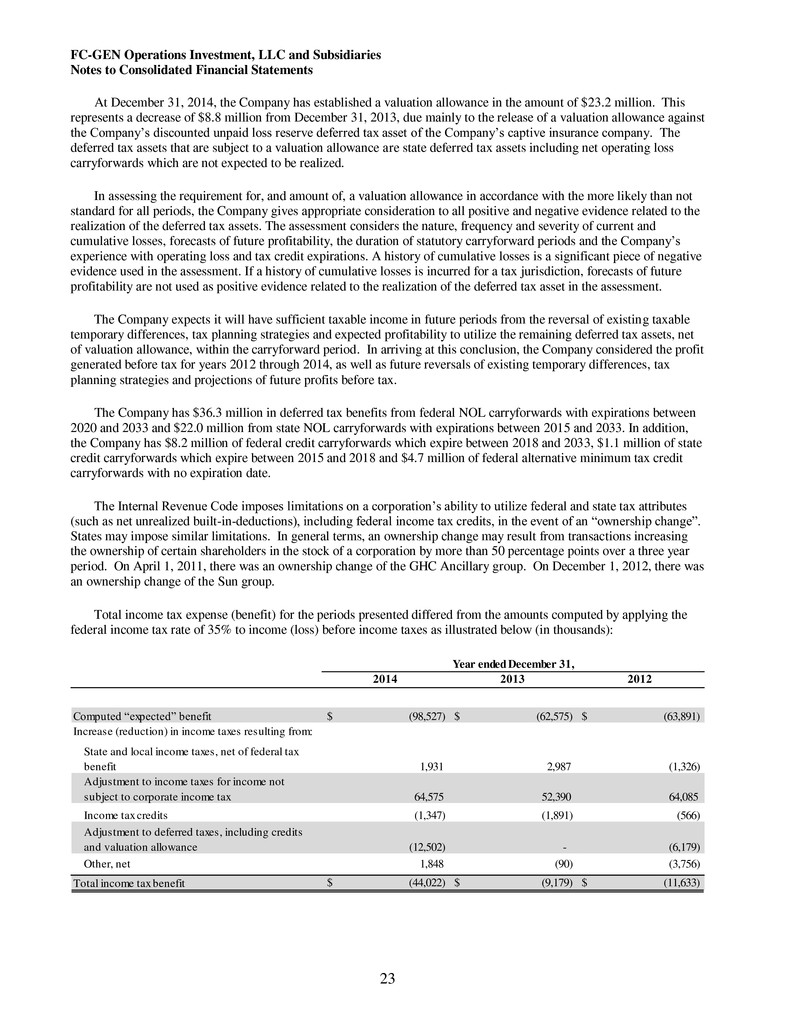

FC-GEN Operations Investment, LLC and Subsidiaries Notes to Consolidated Financial Statements 23 At December 31, 2014, the Company has established a valuation allowance in the amount of $23.2 million. This represents a decrease of $8.8 million from December 31, 2013, due mainly to the release of a valuation allowance against the Company’s discounted unpaid loss reserve deferred tax asset of the Company’s captive insurance company. The deferred tax assets that are subject to a valuation allowance are state deferred tax assets including net operating loss carryforwards which are not expected to be realized. In assessing the requirement for, and amount of, a valuation allowance in accordance with the more likely than not standard for all periods, the Company gives appropriate consideration to all positive and negative evidence related to the realization of the deferred tax assets. The assessment considers the nature, frequency and severity of current and cumulative losses, forecasts of future profitability, the duration of statutory carryforward periods and the Company’s experience with operating loss and tax credit expirations. A history of cumulative losses is a significant piece of negative evidence used in the assessment. If a history of cumulative losses is incurred for a tax jurisdiction, forecasts of future profitability are not used as positive evidence related to the realization of the deferred tax asset in the assessment. The Company expects it will have sufficient taxable income in future periods from the reversal of existing taxable temporary differences, tax planning strategies and expected profitability to utilize the remaining deferred tax assets, net of valuation allowance, within the carryforward period. In arriving at this conclusion, the Company considered the profit generated before tax for years 2012 through 2014, as well as future reversals of existing temporary differences, tax planning strategies and projections of future profits before tax. The Company has $36.3 million in deferred tax benefits from federal NOL carryforwards with expirations between 2020 and 2033 and $22.0 million from state NOL carryforwards with expirations between 2015 and 2033. In addition, the Company has $8.2 million of federal credit carryforwards which expire between 2018 and 2033, $1.1 million of state credit carryforwards which expire between 2015 and 2018 and $4.7 million of federal alternative minimum tax credit carryforwards with no expiration date. The Internal Revenue Code imposes limitations on a corporation’s ability to utilize federal and state tax attributes (such as net unrealized built-in-deductions), including federal income tax credits, in the event of an “ownership change”. States may impose similar limitations. In general terms, an ownership change may result from transactions increasing the ownership of certain shareholders in the stock of a corporation by more than 50 percentage points over a three year period. On April 1, 2011, there was an ownership change of the GHC Ancillary group. On December 1, 2012, there was an ownership change of the Sun group. Total income tax expense (benefit) for the periods presented differed from the amounts computed by applying the federal income tax rate of 35% to income (loss) before income taxes as illustrated below (in thousands): 2014 2013 2012 Computed “expected” benefit $ (98,527) $ (62,575) $ (63,891) I cre se (r ducti n) in income taxes resulting from: State nd loc l income taxes, net of federal tax be fit 1,931 2,987 (1,326) Adjustment to income taxes for income not subj t corporate income tax 64,575 52,390 64,085 Income tax credits (1,347) (1,891) (566) Adjustment to deferred taxes, including credits and valuation allowance (12,502) - (6,179) Other, net 1,848 (90) (3,756) Total income tax benefit $ (44,022) $ (9,179) $ (11,633) Year ended December 31,

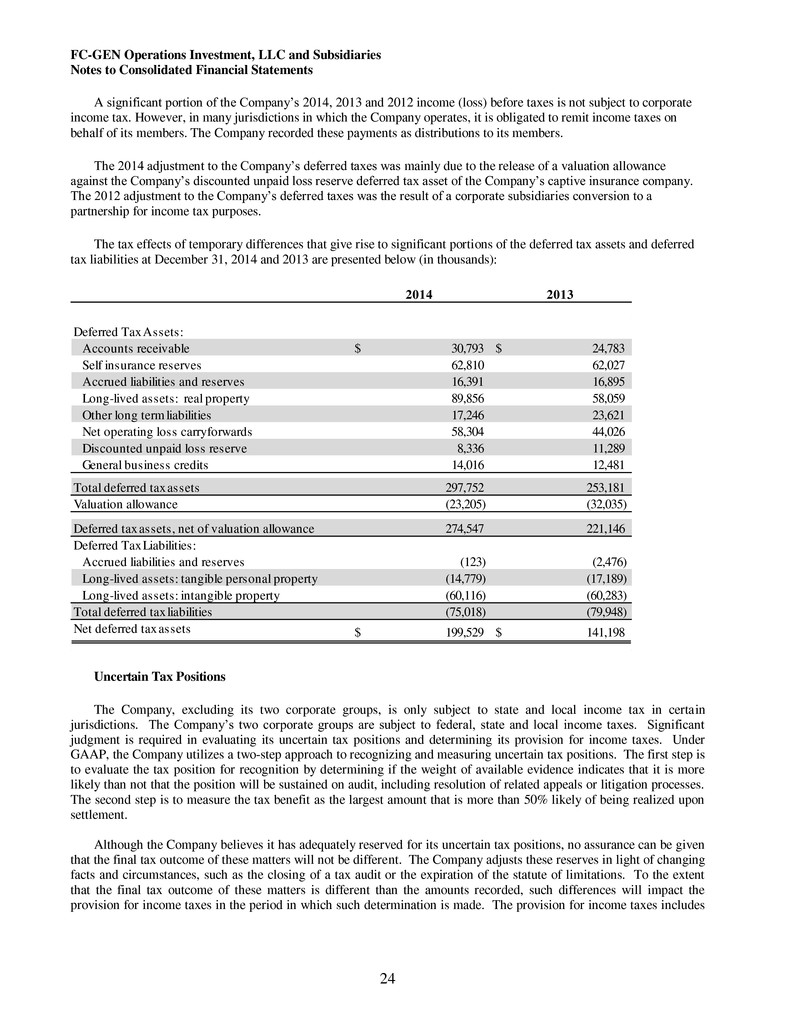

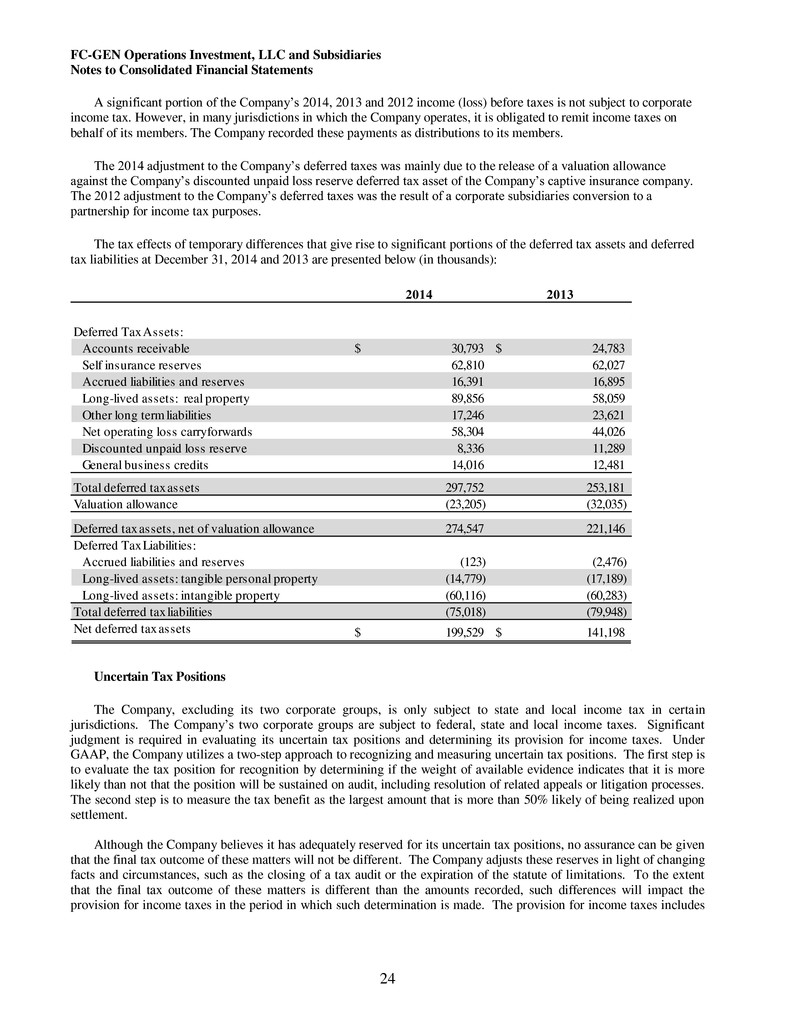

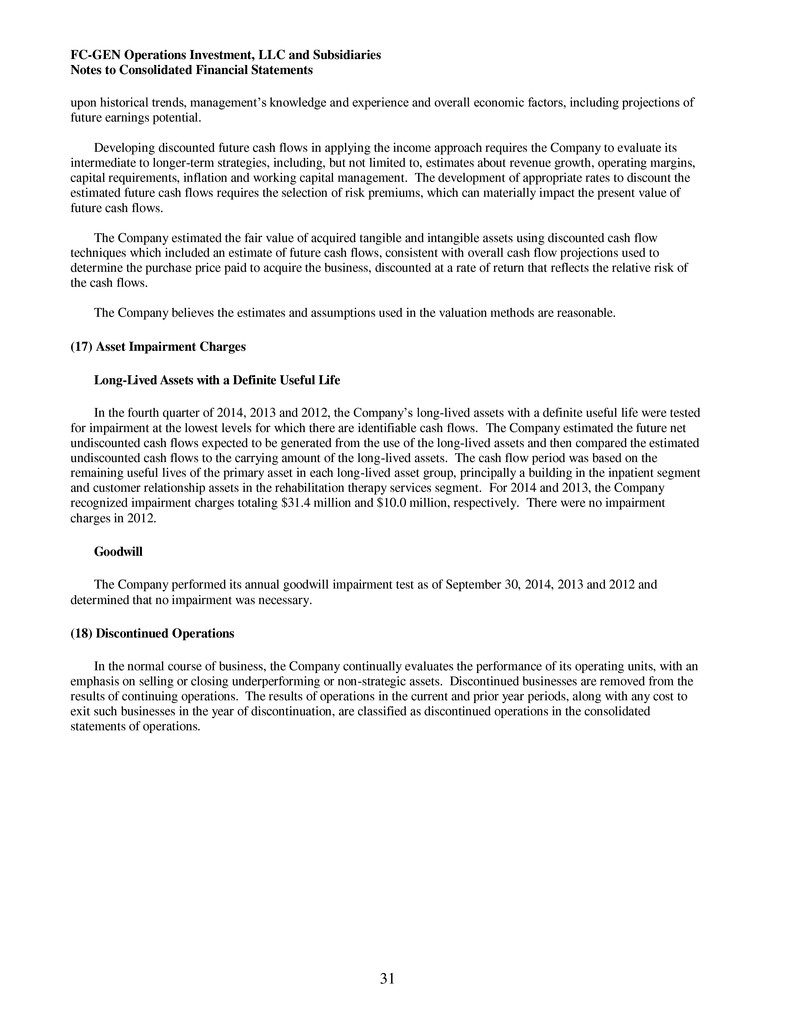

FC-GEN Operations Investment, LLC and Subsidiaries Notes to Consolidated Financial Statements 24 A significant portion of the Company’s 2014, 2013 and 2012 income (loss) before taxes is not subject to corporate income tax. However, in many jurisdictions in which the Company operates, it is obligated to remit income taxes on behalf of its members. The Company recorded these payments as distributions to its members. The 2014 adjustment to the Company’s deferred taxes was mainly due to the release of a valuation allowance against the Company’s discounted unpaid loss reserve deferred tax asset of the Company’s captive insurance company. The 2012 adjustment to the Company’s deferred taxes was the result of a corporate subsidiaries conversion to a partnership for income tax purposes. The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and deferred tax liabilities at December 31, 2014 and 2013 are presented below (in thousands): 2014 2013 Deferred Tax Assets: Accounts receivable $ 30,793 $ 24,783 Self insurance reserves 62,810 62,027 Accrued liabilities and reserves 16,391 16,895 Long-lived assets: real property 89,856 58,059 Other long term liabilities 17,246 23,621 Net operating loss carryforwards 58,304 44,026 Discounted unpaid loss reserve 8,336 11,289 General business credits 14,016 12,481 Total deferred tax assets 297,752 253,181 V luation all wan (23,205) (32,035) Def rred t x a s ts, net of valuation allowance 274,547 221,146 D f rr d T x Liabilities: Accrued liabilities and reserves (123) (2,476) Long-lived assets: tangible personal property (14,779) (17,189) Long-lived assets: intangible property (60,116) (60,283) Total deferred tax liabilities (75,018) (79,948) Net deferred tax assets $ 199,529 $ 141,198 Uncertain Tax Positions The Company, excluding its two corporate groups, is only subject to state and local income tax in certain jurisdictions. The Company’s two corporate groups are subject to federal, state and local income taxes. Significant judgment is required in evaluating its uncertain tax positions and determining its provision for income taxes. Under GAAP, the Company utilizes a two-step approach to recognizing and measuring uncertain tax positions. The first step is to evaluate the tax position for recognition by determining if the weight of available evidence indicates that it is more likely than not that the position will be sustained on audit, including resolution of related appeals or litigation processes. The second step is to measure the tax benefit as the largest amount that is more than 50% likely of being realized upon settlement. Although the Company believes it has adequately reserved for its uncertain tax positions, no assurance can be given that the final tax outcome of these matters will not be different. The Company adjusts these reserves in light of changing facts and circumstances, such as the closing of a tax audit or the expiration of the statute of limitations. To the extent that the final tax outcome of these matters is different than the amounts recorded, such differences will impact the provision for income taxes in the period in which such determination is made. The provision for income taxes includes

FC-GEN Operations Investment, LLC and Subsidiaries Notes to Consolidated Financial Statements 25 the impact of reserve provisions and changes to reserves that are considered appropriate, as well as the related net interest. The Company has recorded a $27.2 million reserve for uncertain tax positions primarily relating to certain tax exposure items acquired as a result of the Sun Merger. As such, the liability related to these amounts was accounted for as part of the purchase price and was not charged to income tax expense. All of the gross unrecognized tax benefits would affect the effective tax rate if recognized. Unrecognized tax benefits are adjusted in the period in which new information about a tax position becomes available or the final outcome differs from the amount recorded. Unrecognized tax benefits are not expected to change significantly over the next twelve months. The Company recognizes potential accrued interest related to unrecognized tax benefits in income tax expense. Penalties, if incurred, would also be recognized as a component of income tax expense. The amount of accrued interest related to unrecognized tax benefits as of December 31, 2014, 2013, and 2012 was $0.4 million, $0.4 million, and $0.3 million, respectively. Generally, the Company has open tax years for state purposes subject to tax audit on average of between three years to six years. The Company’s U.S. income tax returns from 2010 through 2013 are open and could be subject to examination. (13) Related Party Transactions The Company is wholly owned by private investors sponsored by affiliates of Formation Capital, LLC. The Company made an investment of $1.0 million and received an approximate 6.8% interest in National Home Care Holdings, LLC, an unconsolidated joint venture affiliated with one of the Company’s sponsors. The Company maintains an approximately 5.4% interest in FC PAC Holdings, LLC (FC PAC), an unconsolidated joint venture, affiliated with one of the Company’s sponsors. The Company contracts with FC PAC to provide hospice and diagnostic services in the normal course of business. The Company provides rehabilitation services to certain facilities owned and operated by affiliates of the Company’s sponsors. These services resulted in revenue of $161.2 million, $148.5 million and $92.9 million in the years ended December 31, 2014, 2013, and 2012, respectively. The services resulted in accounts receivable balances of $37.6 million and $61.2 million at December 31, 2014 and 2013, respectively. The Company is billed by an affiliate of the Company’s sponsors a monthly fee for the provision of administrative services. The fees billed were $2.5 million, $2.5 million and $2.6 million for the years ended December 31, 2014, 2013 and 2012, respectively. On February 2, 2015 in connection with the Combination, an affiliate of the Company’s sponsors received a transaction advisory fee of $3.0 million and the administrative services monthly fee was discontinued. (14) Members’ Interest Membership Interest The Company is a Delaware limited liability company. Under the terms of the operating agreement, as amended, the Company will continue in existence until December 31, 2059, unless sooner dissolved by the members. During 2012, the Formation Sponsors and certain members of management contributed $25 million in exchange for all of the newly created Class C equity membership interests. The Class C membership interests earn an accrued return on the outstanding Class C membership interests in an amount equal to 9% per annum, compounded annually. The Class C membership interests have a redemption value equal to the outstanding Class C membership interests plus the unpaid portions of the accrued return. The Class C membership interests have no voting rights on decisions impacting the Company. Class C members can vote on certain matters that impact Class C members only, such as the admission of new Class C members, additional capital calls for Class C members, and the creation of additional Class C membership

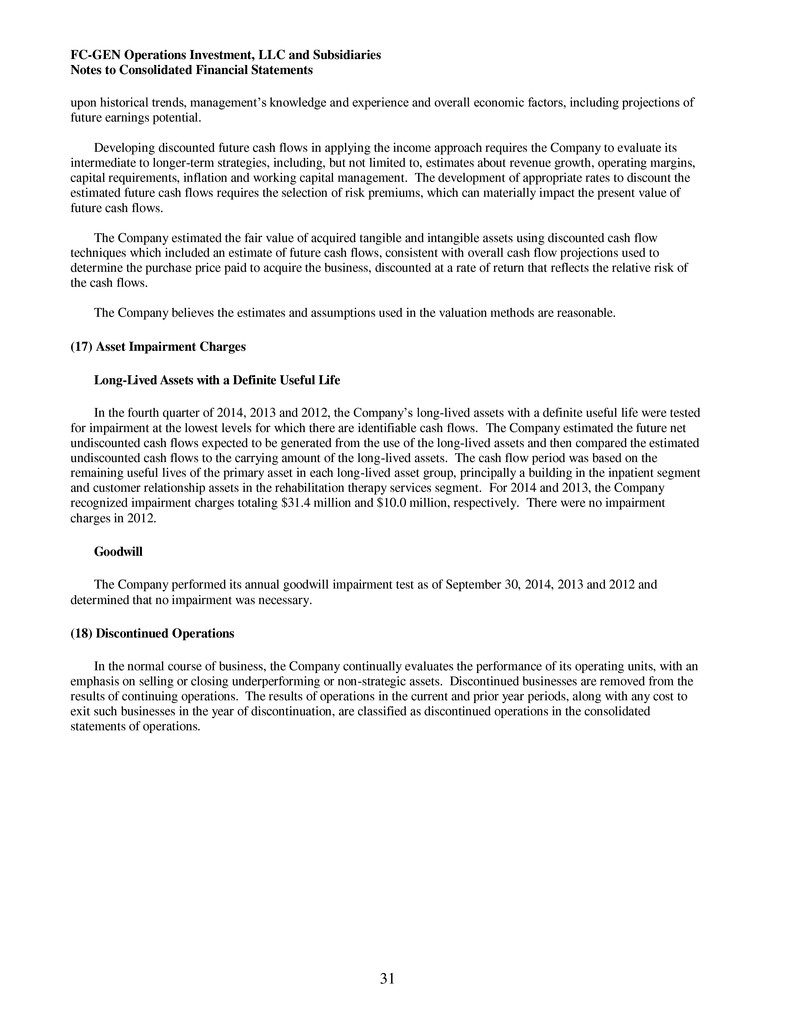

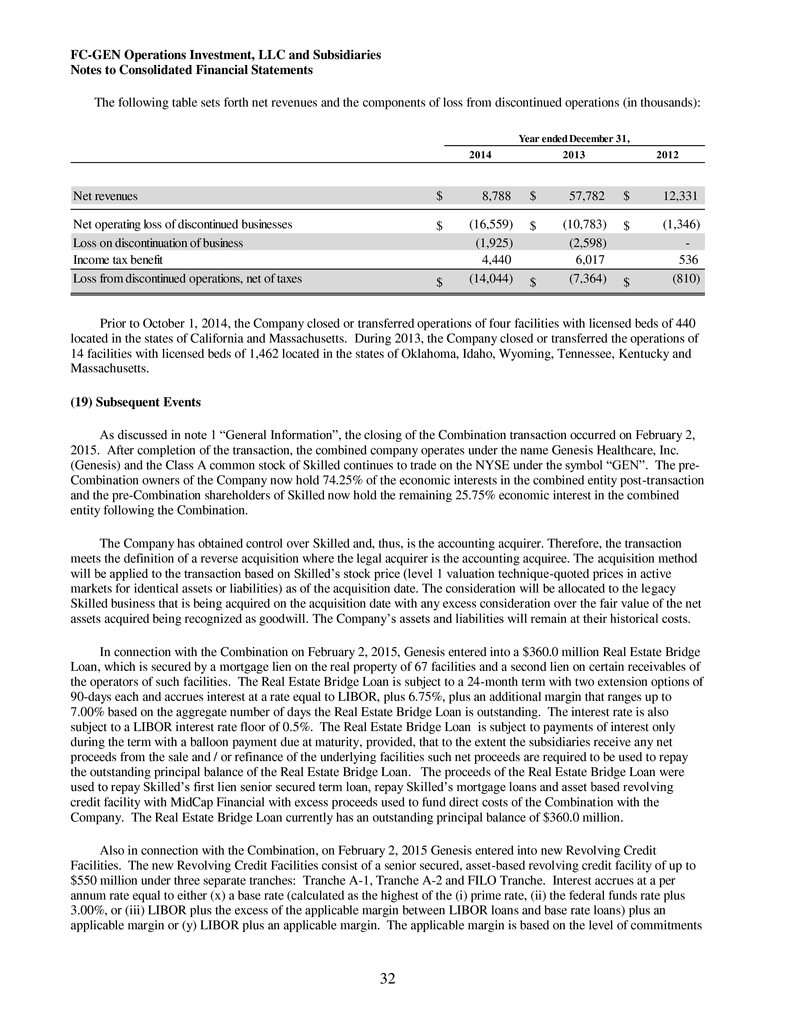

FC-GEN Operations Investment, LLC and Subsidiaries Notes to Consolidated Financial Statements 26 interests, among other things. A vote equal to at least 70% of the outstanding class C membership interests is required to effect a change in the operating agreement with respect to Class C members. The Class C membership interests have a voluntary redemption feature at the sole option and discretion of the Company any time after December 31, 2014 equal to the amount of outstanding Class C membership interests plus the accumulated accrued return. The Class C membership interests have a mandatory redemption feature upon the occurrence of a capital event, as defined. Such capital events include the sale of the Company or a material debt refinancing. The redemption features may only be consummated to the extent the contemplated transaction does not impact compliance with the Company’s debt or lease covenants. The Class C members have a preference over other members with respect to the receipt of distributions of operating cash flows or proceeds from capital events. The Class C membership interests are not convertible. Capital Transaction with the Members During the years ended December 31, 2014, 2013 and 2012, the Company distributed $18.0 million, $5.3 million and $35.3 million, respectively, to the members. In 2012, the members contributed $25.0 million to the Company. (15) Commitments and Contingencies Loss Reserves For Certain Self-Insured Programs General and Professional Liability and Workers’ Compensation The Company self-insures for certain insurable risks, including general and professional liabilities and workers’ compensation liabilities through the use of self-insurance or retrospective and self-funded insurance policies and other hybrid policies, which vary by the states in which it operates, including a wholly owned captive insurance subsidiary that is domiciled in Bermuda, to provide for potential liabilities for general and professional liability claims and workers’ compensation claims. Policies are typically written for a duration of twelve months and are measured on a “claims made” basis. Regarding workers’ compensation, the Company self-insures to its deductible and purchases statutory required insurance coverage in excess of its deductible. There is a risk that amounts funded to the Company’s self- insurance programs may not be sufficient to respond to all claims asserted under those programs. Insurance reserves represent estimates of future claims payments. This liability includes an estimate of the development of reported losses and losses incurred but not reported. Provisions for changes in insurance reserves are made in the period of the related coverage. The Company also considers amounts that may be recovered from excess insurance carriers in estimating the ultimate net liability for such risks. The Company’s management employs its judgment and periodically independent actuarial analysis in determining the adequacy of certain self-insured workers’ compensation and general and professional liability obligations booked as liabilities in the Company’s financial statements. The Company evaluates the adequacy of its self-insurance reserves on a quarterly basis or more often when it is aware of changes to its incurred loss patterns that could impact the accuracy of those reserves. The methods of making such estimates and establishing the resulting reserves are reviewed periodically and are based on historical paid claims information and nationwide nursing home trends. The foundation for most of these methods is the Company’s actual historical reported and/or paid loss data, over which it has effective internal controls. Any adjustments resulting therefrom are reflected in current earnings. Claims are paid over varying periods, and future payments may be different than the estimated reserves. The Company utilizes third-party administrators (TPAs) to process claims and to provide it with the data utilized in its assessments of reserve adequacy. The TPAs are under the oversight of the Company’s in-house risk management and legal functions. These functions ensure that the claims are properly administered so that the historical data is reliable for estimation purposes. Case reserves, which are approved by the Company’s legal and risk management departments, are determined based on its estimate of the ultimate settlement and/or ultimate loss exposure of individual claims. The reserves for loss for workers’ compensation risks are discounted based on actuarial estimates of claim payment patterns using a discount rate of approximately 1% for each policy period presented. The discount rate for the 2014