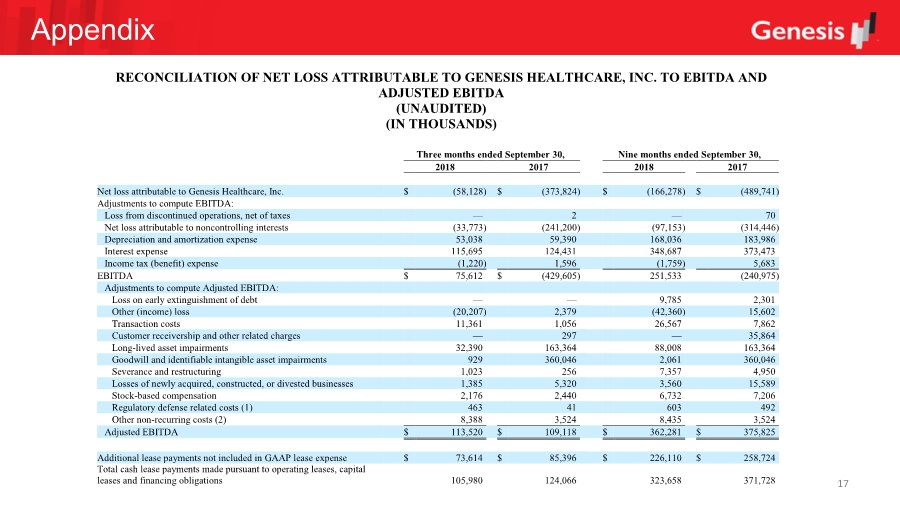

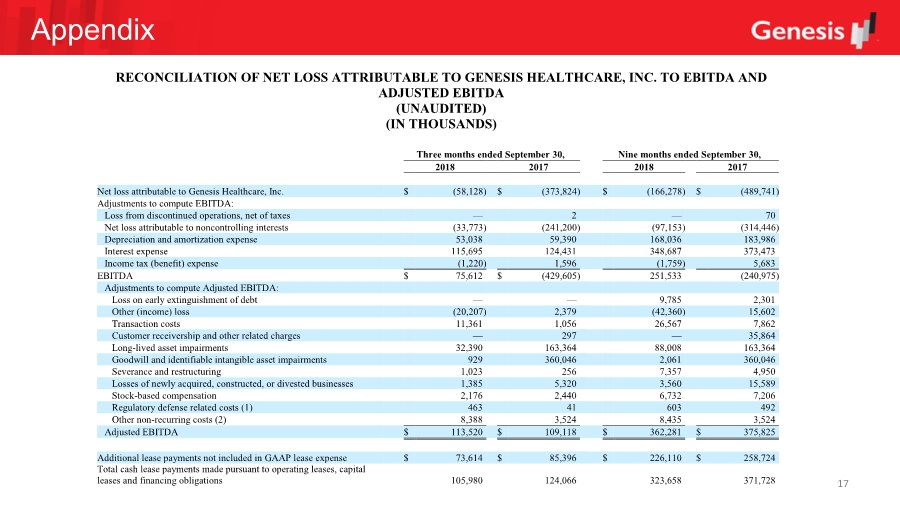

| 17 Appendix RECONCILIATION OF NET LOSS ATTRIBUTABLE TO GENESIS HEALTHCARE, INC. TO EBITDA AND ADJUSTED EBITDA (UNAUDITED) (IN THOUSANDS) Three months ended September 30, Nine months ended September 30, 2018 2017 2018 2017 Net loss attributable to Genesis Healthcare, Inc. $ (58,128) $ (373,824) $ (166,278) $ (489,741) Adjustments to compute EBITDA: Loss from discontinued operations, net of taxes — 2 — 70 Net loss attributable to noncontrolling interests (33,773) (241,200) (97,153) (314,446) Depreciation and amortization expense 53,038 59,390 168,036 183,986 Interest expense 115,695 124,431 348,687 373,473 Income tax (benefit) expense (1,220) 1,596 (1,759) 5,683 EBITDA $ 75,612 $ (429,605) 251,533 (240,975) Adjustments to compute Adjusted EBITDA: Loss on early extinguishment of debt — — 9,785 2,301 Other (income) loss (20,207) 2,379 (42,360) 15,602 Transaction costs 11,361 1,056 26,567 7,862 Customer receivership and other related charges — 297 — 35,864 Long-lived asset impairments 32,390 163,364 88,008 163,364 Goodwill and identifiable intangible asset impairments 929 360,046 2,061 360,046 Severance and restructuring 1,023 256 7,357 4,950 Losses of newly acquired, constructed, or divested businesses 1,385 5,320 3,560 15,589 Stock-based compensation 2,176 2,440 6,732 7,206 Regulatory defense related costs (1) 463 41 603 492 Other non-recurring costs (2) 8,388 3,524 8,435 3,524 Adjusted EBITDA $ 113,520 $ 109,118 $ 362,281 $ 375,825 Additional lease payments not included in GAAP lease expense $ 73,614 $ 85,396 $ 226,110 $ 258,724 Total cash lease payments made pursuant to operating leases, capital leases and financing obligations 105,980 124,066 323,658 371,728 |