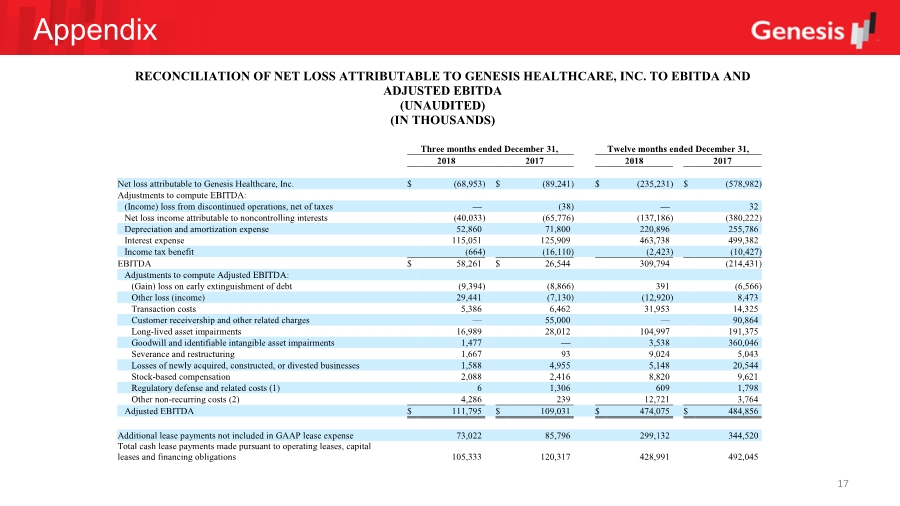

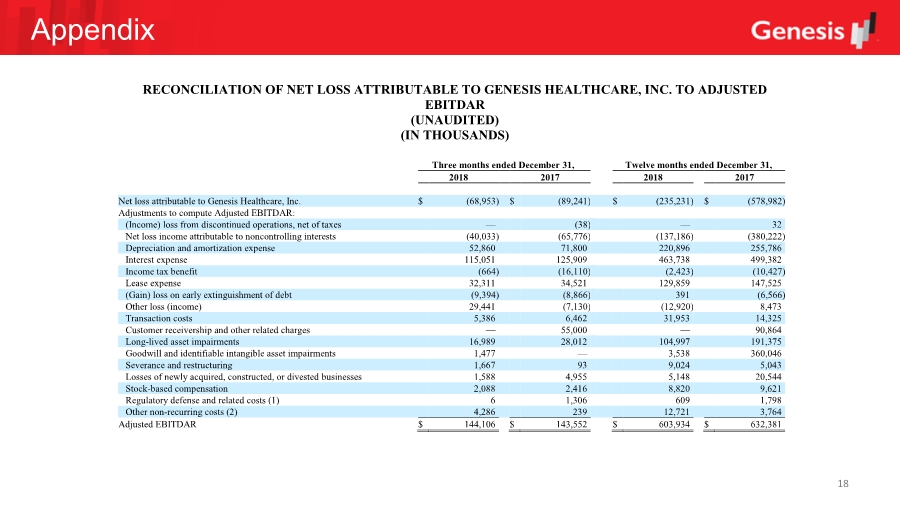

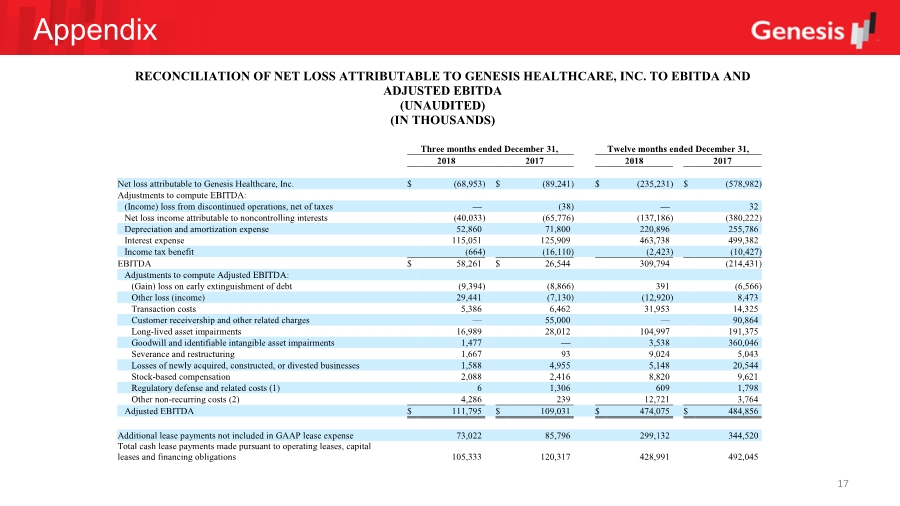

| Appendix 17 RECONCILIATION OF NET LOSS ATTRIBUTABLE TO GENESIS HEALTHCARE, INC. TO EBITDA AND ADJUSTED EBITDA (UNAUDITED) (IN THOUSANDS) Three months ended December 31, Twelve months ended December 31, 2018 2017 2018 2017 Net loss attributable to Genesis Healthcare, Inc. $ (68,953) $ (89,241) $ (235,231) $ (578,982) Adjustments to compute EBITDA: (Income) loss from discontinued operations, net of taxes — (38) — 32 Net loss income attributable to noncontrolling interests (40,033) (65,776) (137,186) (380,222) Depreciation and amortization expense 52,860 71,800 220,896 255,786 Interest expense 115,051 125,909 463,738 499,382 Income tax benefit (664) (16,110) (2,423) (10,427) EBITDA $ 58,261 $ 26,544 309,794 (214,431) Adjustments to compute Adjusted EBITDA: (Gain) loss on early extinguishment of debt (9,394) (8,866) 391 (6,566) Other loss (income) 29,441 (7,130) (12,920) 8,473 Transaction costs 5,386 6,462 31,953 14,325 Customer receivership and other related charges — 55,000 — 90,864 Long-lived asset impairments 16,989 28,012 104,997 191,375 Goodwill and identifiable intangible asset impairments 1,477 — 3,538 360,046 Severance and restructuring 1,667 93 9,024 5,043 Losses of newly acquired, constructed, or divested businesses 1,588 4,955 5,148 20,544 Stock-based compensation 2,088 2,416 8,820 9,621 Regulatory defense and related costs (1) 6 1,306 609 1,798 Other non-recurring costs (2) 4,286 239 12,721 3,764 Adjusted EBITDA $ 111,795 $ 109,031 $ 474,075 $ 484,856 Additional lease payments not included in GAAP lease expense 73,022 85,796 299,132 344,520 Total cash lease payments made pursuant to operating leases, capital leases and financing obligations 105,333 120,317 428,991 492,045 |