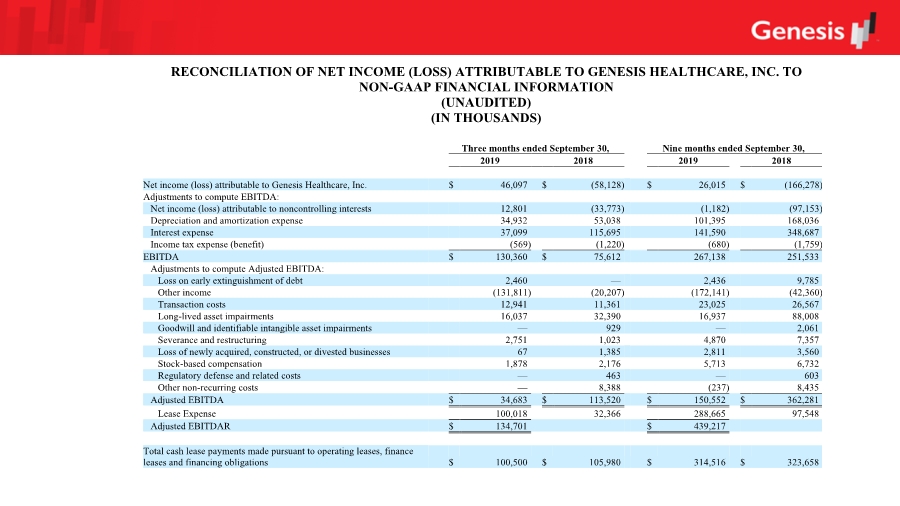

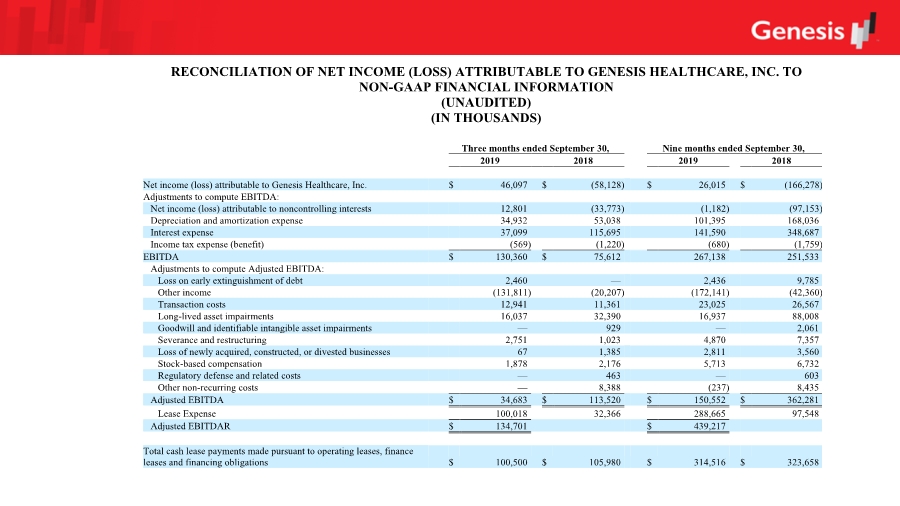

| RECONCILIATION OF NET INCOME (LOSS) ATTRIBUTABLE TO GENESIS HEALTHCARE, INC. TO NON-GAAP FINANCIAL INFORMATION (UNAUDITED) (IN THOUSANDS) Three months ended September 30, Nine months ended September 30, 2019 2018 2019 2018 Net income (loss) attributable to Genesis Healthcare, Inc. $ 46,097 $ (58,128) $ 26,015 $ (166,278) Adjustments to compute EBITDA: Net income (loss) attributable to noncontrolling interests 12,801 (33,773) (1,182) (97,153) Depreciation and amortization expense 34,932 53,038 101,395 168,036 Interest expense 37,099 115,695 141,590 348,687 Income tax expense (benefit) (569) (1,220) (680) (1,759) EBITDA $ 130,360 $ 75,612 267,138 251,533 Adjustments to compute Adjusted EBITDA: Loss on early extinguishment of debt 2,460 — 2,436 9,785 Other income (131,811) (20,207) (172,141) (42,360) Transaction costs 12,941 11,361 23,025 26,567 Long-lived asset impairments 16,037 32,390 16,937 88,008 Goodwill and identifiable intangible asset impairments — 929 — 2,061 Severance and restructuring 2,751 1,023 4,870 7,357 Loss of newly acquired, constructed, or divested businesses 67 1,385 2,811 3,560 Stock-based compensation 1,878 2,176 5,713 6,732 Regulatory defense and related costs — 463 — 603 Other non-recurring costs — 8,388 (237) 8,435 Adjusted EBITDA $ 34,683 $ 113,520 $ 150,552 $ 362,281 Lease Expense 100,018 32,366 288,665 97,548 Adjusted EBITDAR $ 134,701 $ 439,217 Total cash lease payments made pursuant to operating leases, finance leases and financing obligations $ 100,500 $ 105,980 $ 314,516 $ 323,658 |