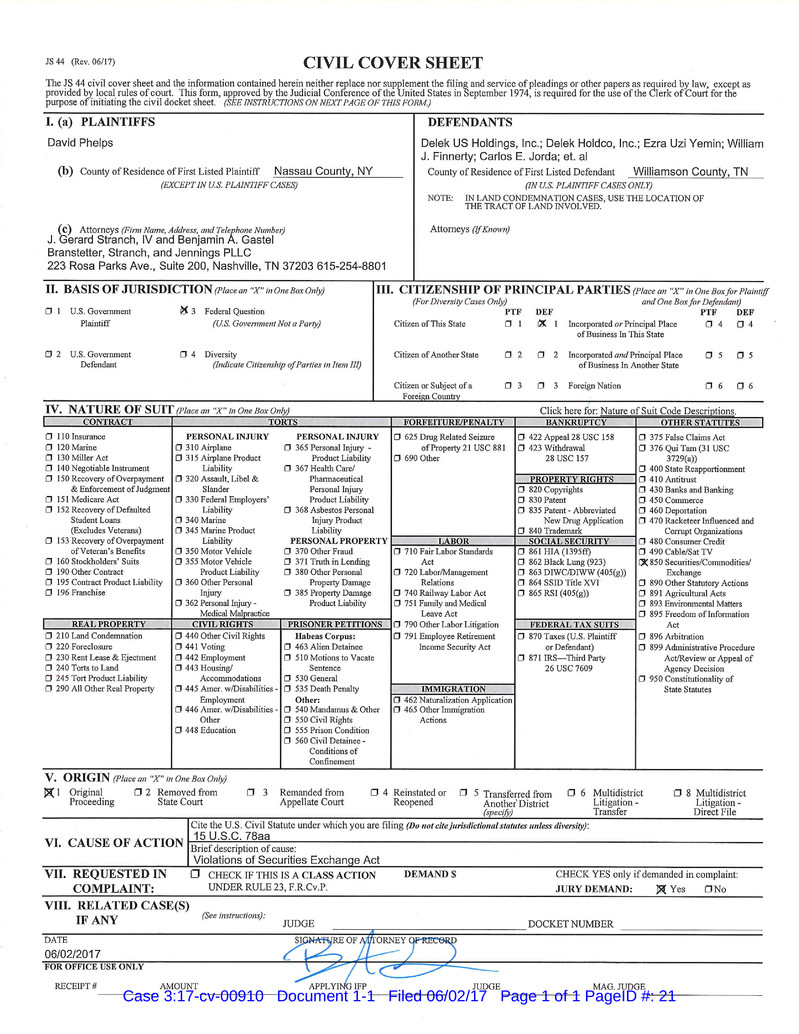

1 IN THE UNITED STATES DISTRICT COURT FOR THE MIDDLE DISTRICT OF TENNESSEE NASHVILLE DIVISION DAVID PHELPS, Individually and on Behalf of All Others Similarly Situated, Plaintiff, v. DELEK US HOLDINGS, INC., DELEK HOLDCO, INC. EZRA UZI YEMIN, WILLIAM J. FINNERTY, CARLOS E. JORDA, CHARLES H. LEONARD, GARY M. SULLIVAN, JR., SHLOMO ZOHAR, and AVI GEFFEN, Defendants. ))))))))))))))) ) ) Case No. CLASS ACTION COMPLAINT FOR VIOLATIONS OF SECTIONS 14(a) AND 20(a) OF THE SECURITIES EXCHANGE ACT OF 1934 JURY TRIAL DEMANDED Plaintiff David Phelps (“Plaintiff”), by his undersigned attorneys, alleges upon personal knowledge with respect to himself, and upon information and belief based upon, inter alia, the investigation of counsel as to all other allegations herein, as follows: NATURE OF THE ACTION 1. This action is brought as a class action by Plaintiff on behalf of himself and the other public holders of the common stock of Delek US Holdings, Inc., (“Delek” or the “Company”) against the Company and the members of the Company’s board of directors (collectively, the “Board” or “Individual Defendants,” and, together with Delek, the “Defendants”) for their violations of Sections 14(a) and 20(a) of the Securities Exchange Act of 1934 (the “Exchange Act”), 15 U.S.C. §§ 78n(a), 78t(a), SEC Rule 14a-9, 17 C.F.R. 240.14a-9, Case 3:17-cv-00910 Document 1 Filed 06/02/17 Page 1 of 20 PageID #: 1

2 and Regulation G, 17 C.F.R. § 244.100, in connection with the proposed merger (the “Proposed Merger”) between Delek, and Alon USA Energy, Inc. (“Alon”).1 2. On January 2, 2017, the Board caused the Company to enter into an agreement and plan of merger (“Merger Agreement”), pursuant to which the Company’s shareholders stand to receive one (1) share of “New Delek common stock” for each issued and outstanding share of Delek common stock they own (the “Merger Consideration”). 3. On May 30, 2017, in order to convince Delek shareholders to vote in favor of the Proposed Merger, the Board authorized the filing of a materially incomplete and misleading Definitive Proxy Statement on a Schedule 14A (the “Proxy”) with the Securities and Exchange Commission (“SEC”), in violation of Sections 14(a) and 20(a) of the Exchange Act. 4. While Defendants are touting the fairness of the Merger Consideration to the Company’s shareholders in the Proxy, they have failed to disclose certain material information that is necessary for shareholders to properly assess the fairness of the Proposed Merger, thereby rendering certain statements in the Proxy incomplete and misleading. 5. In particular, the Proxy contains materially incomplete and misleading information concerning: (i) financial projections for the Company, and (ii) the valuation analyses performed by the Company’s financial advisor, Tudor, Pickering, Holt & Co. Securities, Inc. (“Tudor”), in support of their respective fairness opinions. 1 Under the terms and subject to the conditions set forth in the merger agreement, Dione Mergeco, Inc. (“Delek Merger Sub”), a wholly owned subsidiary of Delek Holdco, Inc. (“HoldCo”) which in turn is a wholly owned subsidiary of Delek, will merge with and into Delek (the “Delek Merger”), with Delek surviving as a wholly owned subsidiary of HoldCo, a new holding company formed by Delek, and Astro Mergeco, Inc. will merge with and into Alon (the “Alon Merger”), with Alon surviving (collectively, the “Mergers”). After the distribution of stock, and the closing of the Mergers, HoldCo will be the publicly traded parent company of Delek and Alon, and will be named “Delek US Holdings, Inc.” Case 3:17-cv-00910 Document 1 Filed 06/02/17 Page 2 of 20 PageID #: 2

3 6. The special meeting of Delek shareholders to vote on the Proposed Merger is scheduled for June 29, 2017. It is imperative that the material information that has been omitted from the Proxy is disclosed to the Company’s shareholders prior to the forthcoming shareholder vote, so that they can properly exercise their corporate suffrage rights. 7. For these reasons, and as set forth in detail herein, Plaintiff asserts claims against Defendants for violations of Sections 14(a) and 20(a) of the Exchange Act, and Rule 14a-9 and Regulation G, 17 C.F.R. § 244.100. Plaintiff seeks to enjoin Defendants from holding the shareholder vote on the Proposed Merger and taking any steps to consummate the Proposed Merger unless and until the material information discussed below is disclosed to Delek shareholders sufficiently in advance of the vote on the Proposed Merger or, in the event the Proposed Merger is consummated, to recover damages resulting from the Defendants’ violations of the Exchange Act. JURISDICTION AND VENUE 8. This Court has subject matter jurisdiction pursuant to Section 27 of the Exchange Act (15 U.S.C. § 78aa) and 28 U.S.C. § 1331 (federal question jurisdiction) as Plaintiff alleges violations of Section 14(a) and 20(a) of the Exchange Act. 9. Personal jurisdiction exists over each Defendant either because the Defendant conducts business in or maintains operations in this District, or is an individual who is either present in this District for jurisdictional purposes or has sufficient minimum contacts with this District as to render the exercise of jurisdiction over Defendant by this Court permissible under traditional notions of fair play and substantial justice. 10. Venue is proper in this District under Section 27 of the Exchange Act, 15 U.S.C. § 78aa, as well as under 28 U.S.C. § 1391, because: (i) the conduct at issue took place and had an Case 3:17-cv-00910 Document 1 Filed 06/02/17 Page 3 of 20 PageID #: 3

4 effect in this District; (ii) Delek maintains its primary place of business in this District; (iii) a substantial portion of the transactions and wrongs complained of herein, including Defendants’ primary participation in the wrongful acts detailed herein, occurred in this District; and (iv) Defendants have received substantial compensation in this District by doing business here and engaging in numerous activities that had an effect in this District. PARTIES 11. Plaintiff is, and at all relevant times has been, an Delek shareholder. 12. Defendant Delek is incorporated in Delaware and maintains its principal executive offices at 7102 Commerce Way, Brentwood, Tennessee 37027. The Company is an integrated downstream energy business focused on petroleum refining and the transportation, storage and wholesale of crude oil, intermediate and refined products. 13. Defendant Delek Holdco Inc. (“Holdco”) is a Delaware corporation and currently a wholly owned subsidiary of Delek. As set forth in the merger agreement, Holdco will become the ultimate parent after the merger is consummated. 14. Individual Defendant Ezra Uzi Yemin (“Yemin”) has served as a President, Chief Executive Officer and Chairman of the Board of Delek since 2012. 15. Individual Defendant William J. Finnerty (“Finnerty”) has served as a director of Delek since April 2014. 16. Individual Defendant Carlos E. Jorda (“Jorda”) has served as a director of Delek since May 2006. 17. Individual Defendant Charles H. Leonard (“Leonard”) has served as a director of Delek since May 2006. Case 3:17-cv-00910 Document 1 Filed 06/02/17 Page 4 of 20 PageID #: 4

5 18. Individual Defendant Gary M. Sullivan, Jr. (“Crockett”) has served as a director of Delek since August 2015. 19. Individual Defendant Shlomo Zohar (“Davis”) has served as a director of Delek since May 2010. 20. Individual Defendant Avi Geffen (“Geffen”) became a director in May 2017. CLASS ACTION ALLEGATIONS 21. Plaintiff brings this class action pursuant to Fed. R. Civ. P. 23 on behalf of himself and the other public shareholders of Delek (the “Class”). Excluded from the Class are Defendants herein and any person, firm, trust, corporation, or other entity related to or affiliated with any Defendant. 22. This action is properly maintainable as a class action because: a. The Class is so numerous that joinder of all members is impracticable. As of January 2, 2017, there were approximately 62,032,476 shares of Delek common stock outstanding, held by hundreds to thousands of individuals and entities scattered throughout the country. The actual number of public shareholders of Delek will be ascertained through discovery; b. There are questions of law and fact that are common to the Class that predominate over any questions affecting only individual members, including the following: i) whether Defendants have misrepresented or omitted material information concerning the Proposed Merger in the Proxy in violation of Section 14(a) of the Exchange Act; Case 3:17-cv-00910 Document 1 Filed 06/02/17 Page 5 of 20 PageID #: 5

6 ii) whether the Individual Defendants have violated Section 20(a) of the Exchange Act; and iii) whether Plaintiff and other members of the Class will suffer irreparable harm if compelled to vote their shares regarding the Proposed Merger based on the materially incomplete and misleading Proxy. c. Plaintiff is an adequate representative of the Class, has retained competent counsel experienced in litigation of this nature, and will fairly and adequately protect the interests of the Class; d. Plaintiff’s claims are typical of the claims of the other members of the Class and Plaintiff does not have any interests adverse to the Class; e. The prosecution of separate actions by individual members of the Class would create a risk of inconsistent or varying adjudications with respect to individual members of the Class, which would establish incompatible standards of conduct for the party opposing the Class; f. Defendants have acted on grounds generally applicable to the Class with respect to the matters complained of herein, thereby making appropriate the relief sought herein with respect to the Class as a whole; and g. A class action is superior to other available methods for fairly and efficiently adjudicating the controversy. SUBSTANTIVE ALLEGATIONS I. The Proposed Transaction 23. On January 3, 2017, Delek and Alon issued a press release announcing the Proposed Transaction, which states in pertinent part: Case 3:17-cv-00910 Document 1 Filed 06/02/17 Page 6 of 20 PageID #: 6

7 BRENTWOOD, Tenn. and Dallas, Texas—January 3, 2017 -- Delek US Holdings, Inc. (NYSE: DK) (“Delek US”) and Alon USA Energy, Inc. (NYSE: ALJ) (“Alon”) today announced a definitive agreement under which Delek US will acquire all of the outstanding shares of Alon common stock which Delek US does not already own in an all-stock transaction. Based on a closing price of $24.07 per share for Delek US common stock on Friday, December 30, 2016, the implied price for Alon common stock is $12.13 per share, or $464 million in equity value for the remaining shares. The enterprise value of this transaction to acquire the remaining 53 percent of Alon shares of common stock not already owned by Delek US is approximately $675 million including the proportionate assumption of $152 million of net debt related to this transaction and $59 million of market value for the non-controlling interest in Alon USA Partners, LP (NYSE: ALDW). This transaction was unanimously approved by the Special Committee of Alon’s board of directors and by the board of directors of Delek US. Additionally, the board of directors of Alon approved the transaction, excluding Delek employed directors which abstained from voting on this matter. The combination will create a company with a strong financial position and significant access to the Permian Basin. Delek US currently owns approximately 33.7 million shares of common stock of Alon. Under terms of the agreement, the owners of the remaining outstanding shares in Alon that Delek US does not currently own will receive a fixed exchange ratio of 0.5040 Delek US shares for each share of Alon. This represents a 5.6 percent premium to the 20 trading day volume weighted average ratio through and including December 30, 2016, of 0.477. Upon closing, the combined company will be primarily led by Delek US’ management team. In conjunction with the Merger Agreement, the Special Committee of Alon’s board of directors will nominate one new director that will be appointed to the Delek US board, and one new director that will be added to the board of Delek Logistics Partners LP’s (NYSE: DKL) (“Delek Logistics”) general partner. Concurrently with the execution of the Merger Agreement, Delek US entered into three separate voting agreements with Alon USA, David Wiessman and Jeff Morris, pursuant to which each of Delek US, Mr. Wiessman and Mr. Morris have agreed to, among other things, vote their shares of Alon in favor of this transaction. Uzi Yemin, Chairman, President and Chief Executive Officer of Delek US stated, “We are excited to reach this agreement and believe this strategic combination will result in a larger, more diverse company that is well positioned to take advantage of opportunities in the market and better navigate the cyclical nature of our business. We expect to be able to achieve meaningful synergies across the organization and the combination will create a refining system that will be one of the largest buyers of crude from the Permian Basin among the independent refiners. Additionally, we expect the combined company will have the ability to unlock logistics value from Alon’s assets through future potential drop downs to Delek Logistics Partners and create a platform for future logistics projects to support a larger refining system. The combination of an all equity transaction, Case 3:17-cv-00910 Document 1 Filed 06/02/17 Page 7 of 20 PageID #: 7

8 which will enable both Alon’s and Delek US’ shareholders to participate in future performance of the company, and Delek US’ strong financial position should provide the combined company financial flexibility as it moves forward with initiatives to invest in the business to create value for the shareholders. I would like to thank the employees of Delek US and Alon for their hard work on the transaction and the members of Alon’s Special Committee for their cooperation during this process.” “We are excited to be joining Delek US and believe this agreement represents an excellent opportunity for Alon’s shareholders,” said David Wiessman, Chairman of Alon’s Special Committee. “The economies of scale, financial strength, and synergies generated through this merger create the opportunity to drive long-term value for shareholders and the all-stock transaction allows all shareholders to participate in the future performance of the combined company. I would like to thank Alon’s employees for their efforts, and our customers, suppliers and banks that supported our company, as we worked together to create value for our shareholders.” The combined company will have a broad platform consisting of refining, logistics, retail, wholesale marketing, as well as renewables and asphalt operations. The refining system will have approximately 300,000 barrels per day of crude throughput capacity consisting of four locations and an integrated retail platform that includes 307 locations serving central and west Texas and New Mexico. Logistics operations include Delek Logistics which can benefit from future drop downs and organic projects to support a larger refining system. This combination will create a larger marketing operation with 600,000 barrels per month of space on the Colonial Pipeline System and a wholesale business with over 1.2 billion gallons of sales volume annually in the southwest. II. The Materially Incomplete and Misleading Proxy 24. On May 30, 2017, Defendants caused the Proxy to be filed with the SEC in connection with the Proposed Merger. The Proxy solicits the Company’s shareholders to vote in favor of the Proposed Merger. Defendants were obligated to carefully review the Proxy before it was filed with the SEC and disseminated to the Company’s shareholders to ensure that it did not contain any material misrepresentations or omissions. However, the Proxy misrepresents and/or omits material information that is necessary for the Company’s shareholders to make an informed decision concerning whether to vote in favor of the Proposed Merger, in violation of Sections 14(a) and 20(a) of the Exchange Act. Case 3:17-cv-00910 Document 1 Filed 06/02/17 Page 8 of 20 PageID #: 8

9 25. First, the Proxy fails to provide material information concerning the Company’s and Delek’s financial projections. Specifically, the Proxy provides non-GAAP (generally accepted accounting principles) projections, leverage free cash flow (see below), but fails to provide line item projections for the metrics used to calculate these non-GAAP measures or otherwise reconcile the non-GAAP projections to the most comparable GAAP measures. 26. When a company discloses non-GAAP financial measures in a Proxy, the Company must also disclose all projections and information necessary to make the non-GAAP measures not misleading, and must provide a reconciliation (by schedule or other clearly understandable method) of the differences between the non-GAAP financial measure disclosed or released with the most comparable financial measure or measures calculated and presented in accordance with GAAP. 17 C.F.R. § 244.100. 27. Indeed, the SEC has recently increased its scrutiny of the use of non-GAAP financial measures in communications with shareholders. The former SEC Chairwoman, Mary Jo White, recently stated that the frequent use by publicly traded companies of unique company- specific non-GAAP financial measures (as Delek and Alon included in the Proxy here), implicates the centerpiece of the SEC’s disclosures regime: In too many cases, the non-GAAP information, which is meant to supplement the GAAP information, has become the key message to investors, crowding out and effectively supplanting the GAAP presentation. Jim Schnurr, our Chief Accountant, Mark Kronforst, our Chief Accountant in the Division of Corporation Finance and I, along with other members of the staff, have spoken out frequently about our concerns to raise the awareness of boards, management and investors. And last month, the staff issued guidance addressing a number of troublesome practices which can make non-GAAP disclosures misleading: the lack of equal or greater prominence for GAAP measures; exclusion of normal, recurring cash operating expenses; individually tailored non-GAAP revenues; lack of consistency; cherry-picking; and the use of cash per share data. I strongly urge companies to carefully consider this guidance and revisit their approach to non- GAAP disclosures. I also urge again, as I did last December, that appropriate Case 3:17-cv-00910 Document 1 Filed 06/02/17 Page 9 of 20 PageID #: 9

10 controls be considered and that audit committees carefully oversee their company’s use of non-GAAP measures and disclosures.2 28. Last year, the SEC has repeatedly emphasized that disclosure of non-GAAP projections can be inherently misleading, and has therefore heightened its scrutiny of the use of such projections.3 Indeed, on May 17, 2016, the SEC’s Division of Corporation Finance released new and updated Compliance and Disclosure Interpretations (“C&DIs”) on the use of non- GAAP financial measures that demonstrate the SEC’s tightening policy.4 One of the new C&DIs regarding forward-looking information, such as financial projections, explicitly requires companies to provide any reconciling metrics that are available without unreasonable efforts. 29. As previously mentioned, the Proxy discloses projections of non-GAAP metrics such as “leverage free cash flows.” However, it is unclear whether this is equivalent to the commonly used non-GAAP metric “unlevered free cash flows.” In either instance, in order to make the projections for Delek included on pages 155 of the Proxy materially complete and not misleading, Defendants must provide a reconciliation table of the non-GAAP measures to the most comparable GAAP measures. 2 Mary Jo White, Keynote Address, International Corporate Governance Network Annual Conference: Focusing the Lens of Disclosure to Set the Path Forward on Board Diversity, Non-GAAP, and Sustainability (June 27, 2016), https://www.sec.gov/news/speech/chair-white-icgn-speech.html. 3 See, e.g., Nicolas Grabar and Sandra Flow, Non-GAAP Financial Measures: The SEC’s Evolving Views, Harvard Law School Forum on Corporate Governance and Financial Regulation (June 24, 2016), https://corpgov.law.harvard.edu/2016/06/24/non-gaap-financial-measures-the-secs-evolving-views/; Gretchen Morgenson, Fantasy Math Is Helping Companies Spin Losses Into Profits, N.Y. Times, Apr. 22, 2016, http://www.nytimes.com/ 2016/04/24/business/fantasy-math-is-helping-companies-spin-losses-into-profits.html?_r=0. 4 Non-GAAP Financial Measures, Compliance & Disclosure Interpretations, U.S. SECURITIES AND EXCHANGE COMMISSION (May 17, 2017), https://www.sec.gov/divisions/corpfin/guidance/nongaapinterp.htm. Case 3:17-cv-00910 Document 1 Filed 06/02/17 Page 10 of 20 PageID #: 10

11 30. At the very least, the Company must disclose the line item projections for the financial metrics that were used to calculated the non-GAAP measures. Such projections are necessary to make the non-GAAP projections included in the Proxy not misleading. Indeed, the Defendants acknowledge that disclosing non-GAAP projections may mislead shareholders in the Proxy: “However, this information is not fact and should not be relied upon as being necessarily indicative of future results, and readers of this joint proxy statement/prospectus are cautioned not to place undue reliance on the unaudited forecasted financial information.” Proxy 152. 31. Such projections were specifically based on each company’s forecasts and were relied upon by the bankers in connection with their valuation analyses. Proxy 126. Delek shareholders would find such cash flow projections material in assessing the fairness of the Merger Consideration. The omission of the cash flow projections renders the projections set forth in the Proxy materially incomplete and misleading. If a proxy discloses projections, such projections must be complete and accurate. 32. The Proxy also omits certain key inputs necessary for shareholders to assess the valuation analyses performed by Tudor in support of their fairness opinions, rendering the summaries of such analyses in the Proxy incomplete and misleading. 33. With respect to Tudor’s Discounted Cash Flow Analysis, the Proxy discloses that the ranges of “estimated free cash flow” were discounted to present values as of December 31, 2016. However, the summary of this analysis does not define whether “leverage free cash flow,” was utilized, or “unlevered free cash flows.” As a result of these omissions, shareholders are unable to assess whether Tudor’s discounted cash flow analysis, generally considered the most useful analysis, should be considered in deciding whether or not to vote. The omission of such Case 3:17-cv-00910 Document 1 Filed 06/02/17 Page 11 of 20 PageID #: 11

12 information renders the summaries of these valuation analyses and the ranges of implied share price on pages 126 of the Proxy Statement misleading. 34. In sum, the omission of the above-referenced information renders statements in the Proxy materially incomplete and misleading, in contravention of the Exchange Act. Absent disclosure of the foregoing material information prior to the special shareholder meeting to vote on the Proposed Merger, Plaintiff and the other members of the Class will be unable to make a fully-informed decision regarding whether to vote in favor of the Proposed Merger, and they are thus threatened with irreparable harm, warranting the injunctive relief sought herein. COUNT I (Against All Defendants for Violations of Section 14(a) of the Exchange Act and Rule 14a-9 and 17 C.F.R. § 244.100 Promulgated Thereunder) 35. Plaintiff incorporates each and every allegation set forth above as if fully set forth herein. 36. Section 14(a)(1) of the Exchange Act makes it “unlawful for any person, by the use of the mails or by any means or instrumentality of interstate commerce or of any facility of a national securities exchange or otherwise, in contravention of such rules and regulations as the Commission may prescribe as necessary or appropriate in the public interest or for the protection of investors, to solicit or to permit the use of his name to solicit any proxy or consent or authorization in respect of any security (other than an exempted security) registered pursuant to section 78l of this title.” 15 U.S.C. § 78n(a)(1). 37. Rule 14a-9, promulgated by the SEC pursuant to Section 14(a) of the Exchange Act, provides that Proxy communications with shareholders shall not contain “any statement which, at the time and in the light of the circumstances under which it is made, is false or misleading with respect to any material fact, or which omits to state any material fact necessary in order to make the statements therein not false or misleading.” 17 C.F.R. § 240.14a-9. Case 3:17-cv-00910 Document 1 Filed 06/02/17 Page 12 of 20 PageID #: 12

13 38. SEC Regulation G has two requirements: (1) a general disclosure requirement; and (2) a reconciliation requirement. The general disclosure requirement prohibits “mak[ing] public a non-GAAP financial measure that, taken together with the information accompanying that measure, contains an untrue statement of a material fact or omits to state a material fact necessary in order to make the presentation of the non-GAAP financial measure…not misleading.” 17 C.F.R. § 244.100(b). The reconciliation requirement requires an issuer that chooses to disclose a non-GAAP measure to provide a presentation of the “most directly comparable” GAAP measure, and a reconciliation “by schedule or other clearly understandable method” of the non-GAAP measure to the “most directly comparable” GAAP measure. 17 C.F.R. § 244.100(a). As set forth above, the Proxy omits information required by SEC Regulation G, 17 C.F.R. § 244.100. 39. The omission of information from a proxy statement will violate Section 14(a) and Rule 14a-9 if other SEC regulations specifically require disclosure of the omitted information. 40. Defendants have issued the Proxy with the intention of soliciting shareholder support for the Proposed Merger. Each of the Defendants reviewed and authorized the dissemination of the Proxy, which fails to provide critical information regarding, amongst other things: (i) the company’s projections, (ii) the valuation analyses performed by its financial advisor. 41. In so doing, Defendants made untrue statements of fact and/or omitted material facts necessary to make the statements made not misleading. Each of the Individual Defendants, by virtue of their roles as officers and/or directors, were aware of the omitted information but failed to disclose such information, in violation of Section 14(a). The Individual Defendants Case 3:17-cv-00910 Document 1 Filed 06/02/17 Page 13 of 20 PageID #: 13

14 were therefore negligent, as they had reasonable grounds to believe material facts existed that were misstated or omitted from the Proxy, but nonetheless failed to obtain and disclose such information to shareholders although they could have done so without extraordinary effort. 42. The Individual Defendants knew or were negligent in not knowing that the Proxy is materially misleading and omits material facts that are necessary to render it not misleading. The Individual Defendants undoubtedly reviewed and relied upon the omitted information identified above in connection with their decision to approve and recommend the Proposed Merger; indeed, the Proxy states that Tudor reviewed and discussed its financial analyses with the Board, and further states that the Board considered both the financial analysis provided by Tudor as well as its fairness opinion and the assumptions made and matters considered in connection therewith. 43. The Individual Defendants knew or were negligent in not knowing that the material information identified above has been omitted from the Proxy, rendering the sections of the Proxy identified above to be materially incomplete and misleading. Indeed, the Individual Defendants were required to review Tudor’s analysis in connection with their receipt of the fairness opinion, question Tudor as to its derivation of fairness, and be particularly attentive to the procedures followed in preparing the Proxy and review it carefully before it was disseminated, to corroborate that there are no material misstatements or omissions. 44. The Individual Defendants were, at the very least, negligent in preparing and reviewing the Proxy. The preparation of a proxy statement by corporate insiders containing materially false or misleading statements or omitting a material fact constitutes negligence. The Individual Defendants were negligent in choosing to omit material information from the Proxy or failing to notice the material omissions in the Proxy upon reviewing it, which they were required Case 3:17-cv-00910 Document 1 Filed 06/02/17 Page 14 of 20 PageID #: 14

15 to do carefully as the Company’s directors. Indeed, the Individual Defendants were intricately involved in the process leading up to the signing of the Merger Agreement and the preparation of the Company’s financial projections. 45. Delek is also deemed negligent as a result of the Individual Defendants’ negligence in preparing and reviewing the Proxy. 46. The misrepresentations and omissions in the Proxy are material to Plaintiff and the Class, who will be deprived of their right to cast an informed vote if such misrepresentations and omissions are not corrected prior to the vote on the Proposed Merger. 47. Plaintiff and the Class have no adequate remedy at law. Only through the exercise of this Court’s equitable powers can Plaintiff and the Class be fully protected from the immediate and irreparable injury that Defendants’ actions threaten to inflict. COUNT II (Against the Individual Defendants for Violations of Section 20(a) of the Exchange Act) 48. Plaintiff incorporates each and every allegation set forth above as if fully set forth herein. 49. The Individual Defendants acted as controlling persons of Delek within the meaning of Section 20(a) of the Exchange Act as alleged herein. By virtue of their positions as officers and/or directors of Delek, and participation in and/or awareness of the Company’s operations and/or intimate knowledge of the incomplete and misleading statements contained in the Proxy filed with the SEC, they had the power to influence and control and did influence and control, directly or indirectly, the decision making of the Company, including the content and dissemination of the various statements that Plaintiff contends are materially incomplete and misleading. Case 3:17-cv-00910 Document 1 Filed 06/02/17 Page 15 of 20 PageID #: 15

16 50. Each of the Individual Defendants was provided with or had unlimited access to copies of the Proxy and other statements alleged by Plaintiff to be misleading prior to and/or shortly after these statements were issued and had the ability to prevent the issuance of the statements or cause the statements to be corrected. 51. In particular, each of the Individual Defendants had direct and supervisory involvement in the day-to-day operations of the Company, and, therefore, is presumed to have had the power to control or influence the particular transactions giving rise to the Exchange Act violations alleged herein, and exercised the same. The Proxy at issue contains the unanimous recommendation of each of the Individual Defendants to approve the Proposed Merger. They were thus directly involved in preparing this document. 52. In addition, as the Proxy sets forth at length, and as described herein, the Individual Defendants were involved in negotiating, reviewing, and approving the Merger Agreement. The Proxy purports to describe the various issues and information that the Individual Defendants reviewed and considered. The Individual Defendants participated in drafting and/or gave their input on the content of those descriptions. 53. By virtue of the foregoing, the Individual Defendants have violated Section 20(a) of the Exchange Act. 54. As set forth above, the Individual Defendants had the ability to exercise control over and did control a person or persons who have each violated Section 14(a) and Rule 14a-9 by their acts and omissions as alleged herein. By virtue of their positions as controlling persons, these Defendants are liable pursuant to Section 20(a) of the Exchange Act. As a direct and proximate result of Individual Defendants’ conduct, Plaintiff and the Class will be irreparably harmed. Case 3:17-cv-00910 Document 1 Filed 06/02/17 Page 16 of 20 PageID #: 16

17 55. Plaintiff and the Class have no adequate remedy at law. Only through the exercise of this Court’s equitable powers can Plaintiff and the Class be fully protected from the immediate and irreparable injury that Defendants’ actions threaten to inflict. PRAYER FOR RELIEF WHEREFORE, Plaintiff prays for judgment and relief as follows: A. Declaring that this action is properly maintainable as a Class Action and certifying Plaintiff as Class Representative and his counsel as Class Counsel; B. Enjoining Defendants and all persons acting in concert with them from proceeding with the shareholder vote on the Proposed Merger or consummating the Proposed Merger, unless and until the Company discloses the material information discussed above which has been omitted from the Proxy; C. Directing the Defendants to account to Plaintiff and the Class for all damages sustained as a result of their wrongdoing; D. Awarding Plaintiff the costs and disbursements of this action, including reasonable attorneys’ and expert fees and expenses; E. Granting such other and further relief as this Court may deem just and proper. Case 3:17-cv-00910 Document 1 Filed 06/02/17 Page 17 of 20 PageID #: 17

18 JURY DEMAND Plaintiff demands a trial by jury on all issues so triable. Dated: June 2, 2017 By: BRANSTETTER, STRANCH & JENNINGS, PLLC /s/ J. Gerard Stranch, IV J. Gerard Stranch, IV, BPR# 23045 The Freedom Center 223 Rosa L. Parks Avenue, Suite 200 Nashville, TN 37203 Phone: (615) 254-8801 Email: gerards@bsjfirm.com OF Counsel: MONTEVERDE & ASSOCIATES PC Juan E. Monteverde The Empire State Building 350 Fifth Avenue, 59th Floor New York, NY 10118 Tel: (212) 971-1341 E-mail: jmonteverde@monteverdelaw.com Attorneys for Plaintiffs Case 3:17-cv-00910 Document 1 Filed 06/02/17 Page 18 of 20 PageID #: 18

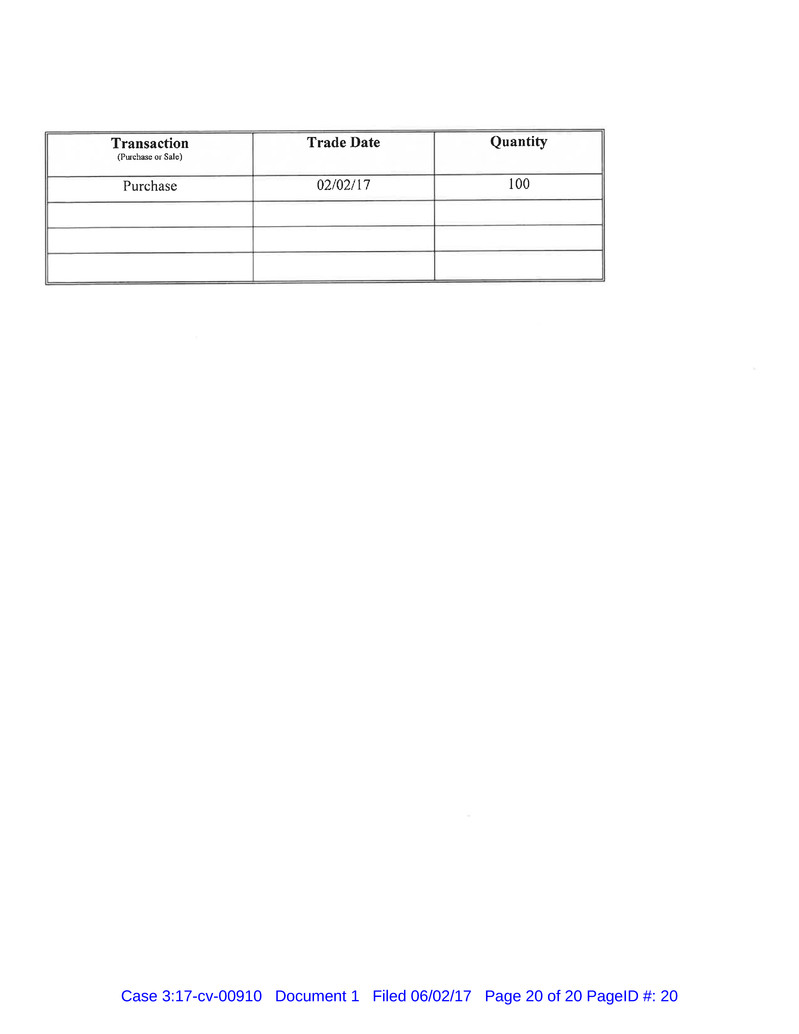

Case 3:17-cv-00910 Document 1 Filed 06/02/17 Page 19 of 20 PageID #: 19

Case 3:17-cv-00910 Document 1 Filed 06/02/17 Page 20 of 20 PageID #: 20

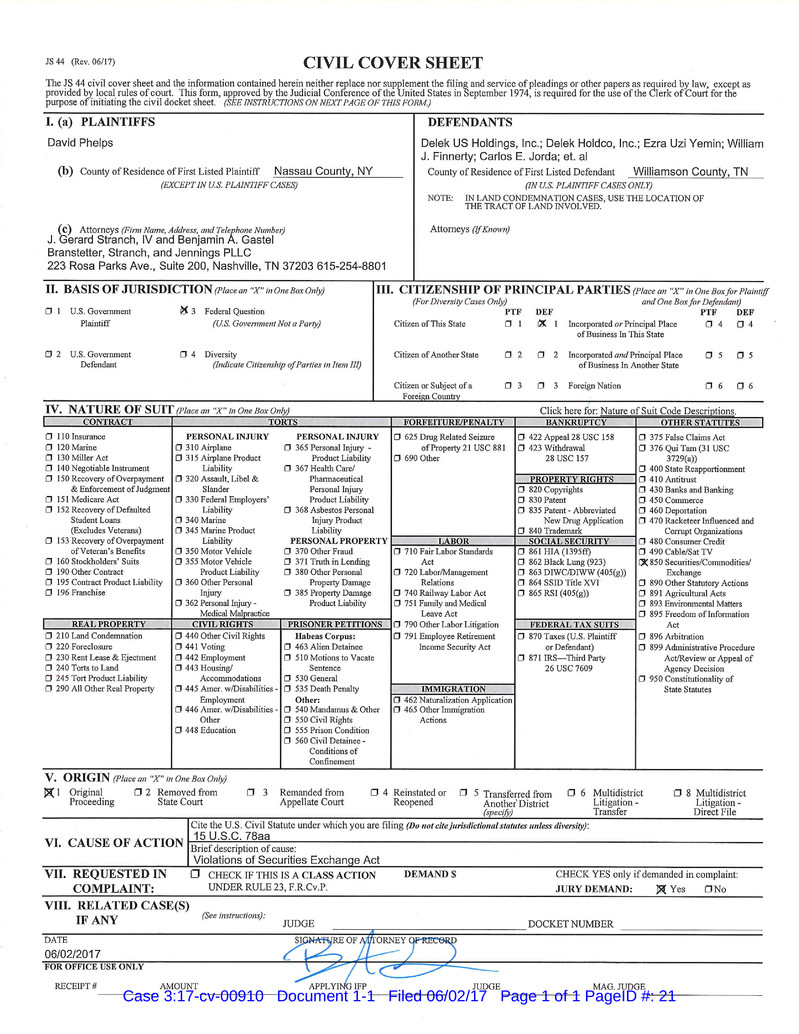

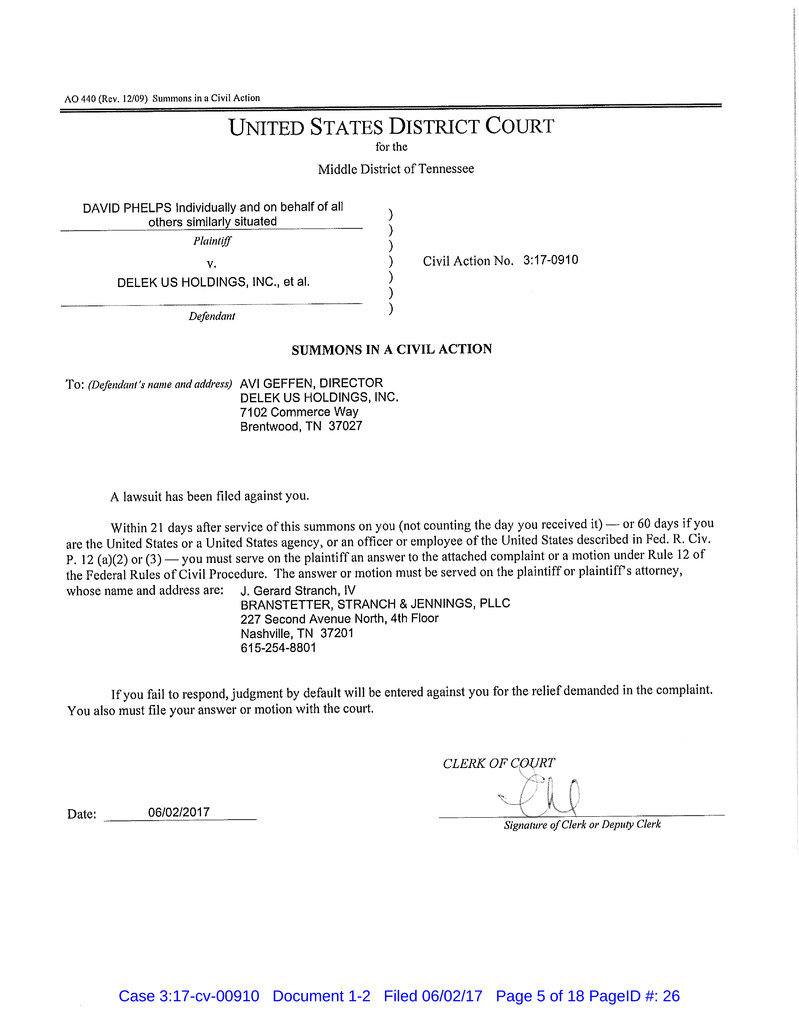

Case 3:17-cv-00910 Document 1-1 Filed 06/02/17 Page 1 of 1 PageID #: 21

Case 3:17-cv-00910 Document 1-2 Filed 06/02/17 Page 1 of 18 PageID #: 22

Case 3:17-cv-00910 Document 1-2 Filed 06/02/17 Page 2 of 18 PageID #: 23

Case 3:17-cv-00910 Document 1-2 Filed 06/02/17 Page 3 of 18 PageID #: 24

Case 3:17-cv-00910 Document 1-2 Filed 06/02/17 Page 4 of 18 PageID #: 25

Case 3:17-cv-00910 Document 1-2 Filed 06/02/17 Page 5 of 18 PageID #: 26

Case 3:17-cv-00910 Document 1-2 Filed 06/02/17 Page 6 of 18 PageID #: 27

Case 3:17-cv-00910 Document 1-2 Filed 06/02/17 Page 7 of 18 PageID #: 28

Case 3:17-cv-00910 Document 1-2 Filed 06/02/17 Page 8 of 18 PageID #: 29

Case 3:17-cv-00910 Document 1-2 Filed 06/02/17 Page 9 of 18 PageID #: 30

Case 3:17-cv-00910 Document 1-2 Filed 06/02/17 Page 10 of 18 PageID #: 31

Case 3:17-cv-00910 Document 1-2 Filed 06/02/17 Page 11 of 18 PageID #: 32

Case 3:17-cv-00910 Document 1-2 Filed 06/02/17 Page 12 of 18 PageID #: 33

Case 3:17-cv-00910 Document 1-2 Filed 06/02/17 Page 13 of 18 PageID #: 34

Case 3:17-cv-00910 Document 1-2 Filed 06/02/17 Page 14 of 18 PageID #: 35

Case 3:17-cv-00910 Document 1-2 Filed 06/02/17 Page 15 of 18 PageID #: 36

Case 3:17-cv-00910 Document 1-2 Filed 06/02/17 Page 16 of 18 PageID #: 37

Case 3:17-cv-00910 Document 1-2 Filed 06/02/17 Page 17 of 18 PageID #: 38

Case 3:17-cv-00910 Document 1-2 Filed 06/02/17 Page 18 of 18 PageID #: 39