UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2022

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO

Commission File Number 001-38107

ShotSpotter, Inc.

(Exact Name of Registrant as Specified in its Charter)

| |

Delaware | 47-0949915 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

39300 Civic Center Dr., Suite 300 Fremont, California | 94538 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (510) 794-3100

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.005 par value per share | SSTI | Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | |

Large accelerated filer | ☐ | | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | | Smaller reporting company | ☒ |

Emerging growth company | ☐ | | | |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ���

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate by check mark whether the Registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered independent public accounting firm that prepared or issued its audit report ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ◻

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ◻

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on a closing price of $26.91 per share of the Registrant’s common stock as reported on the Nasdaq Capital Market on June 30, 2022 was $246,884,476.

The number of shares of Registrant’s common stock outstanding as of March 7, 2023 was 12,266,468.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Definitive Proxy Statement relating to the Annual Meeting of Stockholders, scheduled to be held on June, 21, 2023, are incorporated by reference into Part III of this Report. Such Proxy Statement will be filed with the Securities and Exchange Commission no later than 120 days following the end of the Registrant’s fiscal year ended December 31, 2022.

Table of Contents

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that involve substantial risks and uncertainties. The forward-looking statements are contained principally in the sections of this Annual Report on Form 10-K entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” but are also contained elsewhere in this Annual Report on Form 10-K. Often, you can identify forward-looking statements by the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “objective,” “ongoing,” “plan,” “predict,” “project,” “potential,” “should,” “will,” or “would,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. Forward-looking statements include statements about:

•our ability to continue to increase revenues, secure customer renewals and expand coverage areas of existing public safety customers;

•our ability to continue to add new customers for our public safety and security solutions;

•our ability to grow both domestically and internationally;

•our ability to effectively manage or sustain our growth;

•our ability to maintain, increase or strengthen awareness of our solutions;

•our ability to achieve and maintain service level agreement standards in our customer contracts;

•our ability to increase revenues, which has been impacted by supply chain disruptions and delays;

•future revenues, hiring plans, expenses, capital expenditures, capital requirements and stock performance;

•our ability to service outstanding debt, if any, and satisfy covenants associated with outstanding debt facilities;

•our ability to attract and retain qualified employees and key personnel and further expand our overall headcount;

•our ability to comply with new or modified laws and regulations that currently apply or become applicable to our business both in the United States and internationally; and

•our ability to maintain, protect and enhance our intellectual property.

We caution you that the foregoing list may not contain all of the forward-looking statements made in this Annual Report on Form 10-K.

These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Although we believe that we have a reasonable basis for each forward-looking statement contained in this Annual Report on Form 10-K, we caution you that these statements are based on a combination of facts and factors currently known by us and our expectations of the future, about which we cannot be certain. You should refer to the “Risk Factors” section of this Annual Report on Form 10-K for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Annual Report on Form 10-K will prove to be accurate. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. You should read this Annual Report on Form 10-K and the documents that we reference in this Annual Report on Form 10-K completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

1

Summary of Risk Factors

Investing in our common stock involves risks, including those discussed in the section titled “Risk Factors”. These risks include, among others:

•If our business does not grow as we expect, or if we fail to manage our growth effectively, our operating results and business prospects would suffer.

•Interruptions or delays in service from our third-party providers, including delays in the delivery of new sensors as a result of an industry-wide chip shortage, could impair our ability to make our solutions available to our customers, resulting in customer dissatisfaction, damage to our reputation, loss of customers, limited growth and reduction in revenues.

•If we are unable to sell our solutions into new markets, our revenues may not grow.

•Our success depends on maintaining and increasing our sales, which depends on factors we cannot control, including the availability of funding to our customers.

•Our quarterly results of operations may fluctuate significantly due to a wide range of factors, which makes our future results difficult to predict.

•Because we generally recognize our subscription revenues ratably over the term of our contract with a customer, fluctuations in sales will not be fully reflected in our operating results until future periods.

•We have not been profitable in the past and may not achieve or maintain profitability in the future.

•We may require additional capital to fund our business and support our growth, and our inability to generate and obtain such capital on acceptable terms, or at all, could harm our business, operating results, financial condition and prospects.

•Contracting with government entities can be complex, expensive, and time-consuming.

•If we are unable to further penetrate the public safety market, our revenues may not grow.

•Our sales cycle can be lengthy, time-consuming and costly, and our inability to successfully complete sales could harm our business.

•Changes in the availability of federal funding to support local law enforcement efforts could impact our business.

•The failure of our solutions to meet our customers’ expectations could harm our reputation, which may have a material adverse effect on our business, operating results and financial condition.

•Real or perceived false positive gunshot alerts or failure or perceived failure to generate alerts for actual gunfire could adversely affect our customers and their operations, damage our brand and reputation and adversely affect our growth prospects and results of operations.

•The nature of our business may result in undesirable press coverage or other negative publicity, which could adversely affect our growth prospects and results of operations.

•Economic uncertainties or downturns, or political changes, could limit the availability of funds available to our customers and potential customers, which could materially adversely affect our business.

•The nature of our business exposes us to inherent liability risks.

•As a result of our use of outdoor acoustic sensors, we are subject to governmental regulation and other legal obligations, particularly related to privacy, data protection and information security, and our actual or

2

perceived failure to comply with such obligations could harm our business. Compliance with such laws could impair our efforts to maintain and expand our customer base, and thereby decrease our revenues.

•Failure to protect our intellectual property rights could adversely affect our business.

•Systems and Organizations Controls 2 ("SOC2") and Criminal Justice Information Services (“CJIS”) requirements could potentially cause obligations that we are not able to completely perform which could adversely affect our reputation and sales, as well as the availability of our solutions in certain markets.

•Cyber-attacks, malicious internet-based activity, online and offline fraud, and other similar activities threaten the confidentiality, integrity, and availability of our sensitive information and information technology systems, and those of the third parties upon which we rely. These attacks could materially disrupt our systems and operations, supply chain, and ability to produce, sell and distribute our goods and services.

•The COVID-19 pandemic has had a material adverse effect on our business, and may have an adverse effect on our business in the future.

•Ongoing social unrest may result in a material adverse effect on our business, the future magnitude or duration of which we cannot predict with accuracy.

3

PART I.

Item 1. BUSINESS

Overview

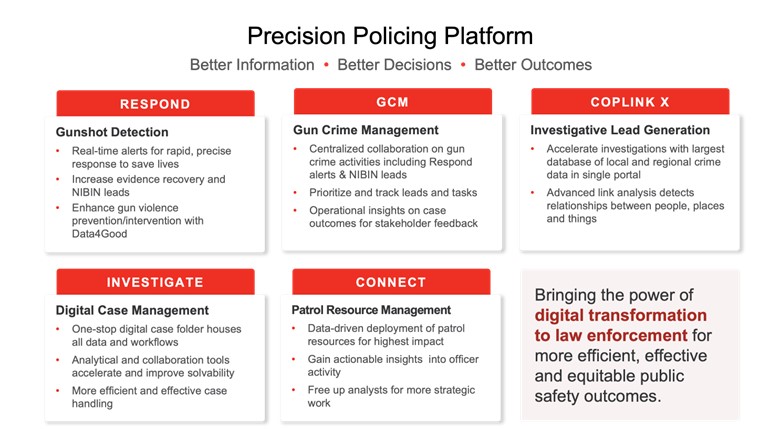

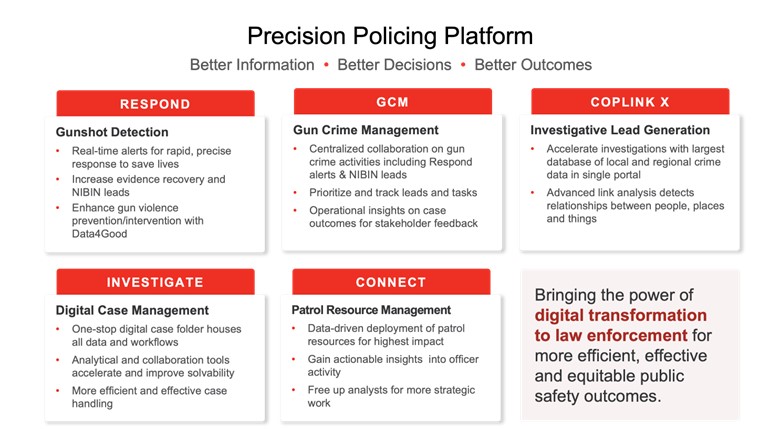

We bring the power of digital transformation to law enforcement and security personnel by providing precision-policing and security solutions. As of December 31, 2022 we had approximately 250 customers and to date have worked with approximately 2,100 agencies to help drive more efficient, effective, and equitable public safety outcomes. Our Precision Policing Platform™ includes ShotSpotter Respond™, COPLINK X, ShotSpotter Investigate™, ShotSpotter GCM™, and ShotSpotter Connect®. Our security solutions include ShotSpotter SecureCampus® and ShotSpotter SiteSecure™.

Our flagship public safety solution, ShotSpotter Respond, is the leading outdoor gunshot detection, location and alerting system. ShotSpotter Investigate and ShotSpotter GCM (case management software to help produce courtroom-ready cases) and COPLINK X (an investigative lead search tool to accelerate crime solving) provide agencies with a cloud-based investigative digital case folder and analytical and collaboration tools to improve case closure rates. Our patrol management software, ShotSpotter Connect, uses artificial intelligence-driven analysis to help strategically plan directed patrols for maximum impact across a diverse set of crime types. Our security solutions, ShotSpotter SecureCampus and ShotSpotter SiteSecure, are typically smaller-scale deployments of ShotSpotter Respond vertically marketed to universities, corporate campuses, highways and key infrastructure centers to mitigate risk and enhance security by notifying authorities of outdoor gunfire incidents, saving critical minutes for first responders to arrive. In 2019, we created a technology innovation unit, ShotSpotter Labs, to expand our efforts supporting innovative uses of our technology to help protect wildlife and the environment.

As of December 31, 2022, ShotSpotter Respond, ShotSpotter SecureCampus and ShotSpotter SiteSecure had coverage areas under contract for over 1,060 square miles, of which 980 square miles had gone live. Coverage areas under contract for ShotSpotter Respond included over 151 cities and and coverage under contract for ShotSpotter SecureCampus and ShotSpotter SiteSecure included 19 campuses/sites across the United States, South Africa and the Bahamas, including some of the largest cities in the United States. Most of our revenues are attributable to customers based in the United States.

Since our founding 26 years ago, ShotSpotter has been and continues to be a purpose-led company. We are a mission-driven organization that is focused on improving public safety outcomes. We accomplish this by earning the trust of law enforcement and providing them solutions to help them better engage and strengthen the police-community relationships in fulfilling their sworn obligation to serve and protect all. Our inspiration comes from our principal founder, Dr. Bob Showen, who believes that the highest and best use of technology is to promote social good. We are committed to developing comprehensive, respectful and engaged partnerships with law enforcement agencies, elected officials and communities focused on making a positive difference in the world.

Industry Background: The Public Safety Gap

Local police departments are challenged to serve and protect in an increasingly transparent fashion without unintentionally over-policing and under serving their communities. This mandate must be met while facing municipal budget pressures and community activist calls to defund the police while violent crime is on a measurable uptick and case closure rates are at all-time lows. There are three distinct problems associated with the public safety gap, which are discussed below.

The Violent Crime Problem

The majority of urban gunfire goes unreported. A 2016 report published by The Brookings Institute analyzing data collected from ShotSpotter Respond and our customers suggests that approximately 80% of the gunshots detected by our public safety solution are not reported to 911 by residents. Even in the instances when 911 calls are made, the information reported by the caller is often incomplete or inaccurate as to the time and location of the gunshot. Furthermore, in many cases it is often difficult for the caller to authenticate the incident as gunfire. In addition, we believe that in communities plagued by gun violence, there is often a lack of trust between the community’s residents and its police force, which can exacerbate the underreporting of gunfire and create a vicious cycle of underreporting,

4

lack of response and increased mistrust due to continued unaddressed gun violence in the community. When gunfire is not reported or is reported inaccurately, law enforcement and medical personnel cannot address injuries nor effectively investigate and solve related crimes or prevent future incidents.

The communities in which gun violence occurs suffer significant economic loss. A 2017 report by the Urban Institute, which studied the effect of gun violence in Minneapolis, Minnesota, Oakland, California and Washington, D.C., noted that the perceived risk of gun violence imposed heavy social, psychological and monetary damages in communities, including fewer jobs and lower economic vitality. The study concluded:

•In Minneapolis, each additional gun homicide in a given year was statistically correlated with 80 fewer jobs.

•In Oakland, every additional gun homicide in a given year was statistically associated with five fewer job opportunities in contracting businesses in the next year.

•In Washington, D.C., every additional gun homicide in a given year was statistically associated with two fewer retail and service establishments the next year.

In addition, several studies have suggested that property values are inversely correlated with violent crime. For example, the Center for American Progress conducted a study of changes in homicide incidents and housing prices in Boston, Seattle, Chicago, Philadelphia, and Milwaukee, and found that a reduction in a given year of one homicide in a ZIP code caused a 1.5% increase in housing values in that same ZIP code the following year.

Gut-based Patrolling Problem

Agencies face a resource deficit and need more efficient ways to patrol and prevent crime. Most departments use old patrolling methods that are non data-driven, have limited visibility to officer activity and no controls to reduce over-policing. We believe the category is ripe for AI-based automation for more efficient and effective patrolling done in a way that better engages the community and reduces crime.

Low Case Closure/Victim Resolution Problem

According to a report published by The Marshall Project in 2022, homicide clearance rates in the United States reached a 40-year low of less than 50% in 2021. Too many suspects do not face the consequences and are free to commit additional crimes while victims and their families suffer without closure. Police use a mix of manual, homegrown and limited function record management system ("RMS") modules for case management. To solve cases, detectives must access multiple, siloed sources of data with limited automation tools for analytical support or collaboration. We believe investigative case management can significantly benefit from greater automation to improve clearance rates and solves cases faster.

Our Vision

We see a world where data is converted into actionable intelligence thereby enabling police departments to implement modern 21st century policing practices. These practices can help police be more efficient directing law enforcement interventions toward the few that commit crimes and more effective in building community trust and engagement while co-producing public safety outcomes. We believe the ShotSpotter Precision Policing Suite of Solutions can be a valuable set of tools in implementing 21st century policing practices. Our precision policing

5

solutions include ShotSpotter Respond, ShotSpotter Connect, ShotSpotter Investigate, ShotSpotter GCM, which launched in 2022, and COPLINK X which was introduced in 2022.

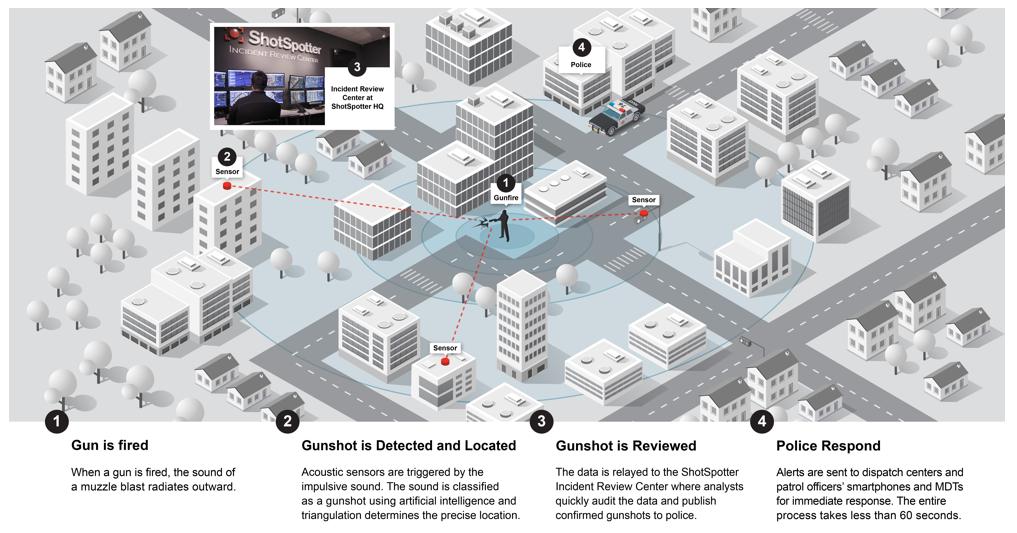

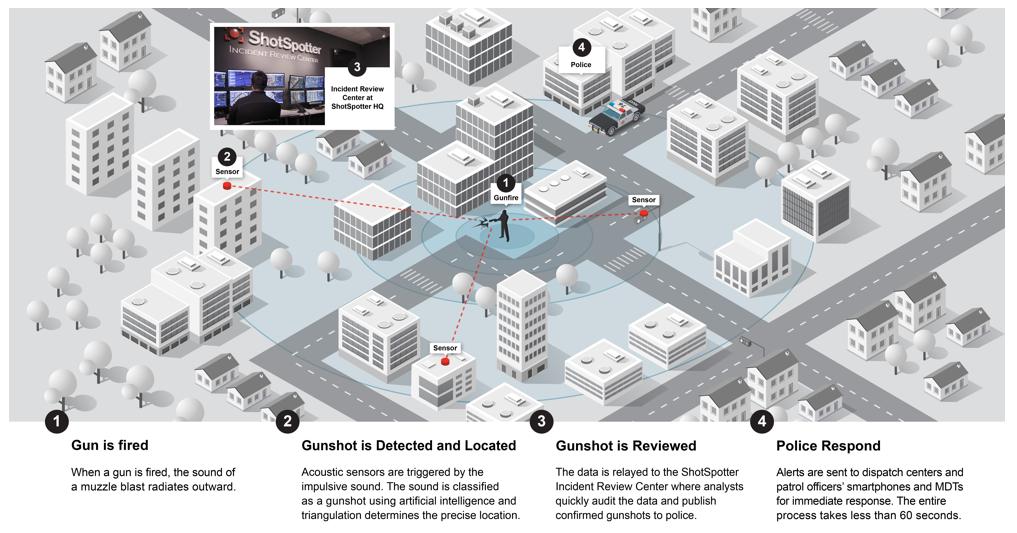

ShotSpotter Respond

ShotSpotter Respond, our acoustic gunshot detection technology serves cities and municipalities seeking to identify, locate and deter persistent, localized gun violence by incorporating a real-time gunshot detection system into their policing systems. ShotSpotter Respond is used by local police departments and a version of ShotSpotter Respond, branded as SiteSecure and SecureCampus is used by security personnel in the protection of critical assets such as colleges, universities and commercial campuses.

Our gunshot detection solutions consist of highly-specialized, cloud-based software integrated with proprietary, internet-enabled sensors designed to detect outdoor gunfire. The speed and accuracy of our gunfire alerts enable law enforcement and security personnel to consistently and quickly respond to shooting events including those unreported through 911, which can increase the chances of apprehending the shooter, providing timely aid to victims, and identifying witnesses before they scatter, as well as aid in evidentiary collection and serve as an overall deterrent. When an impulsive sound is detected by our sensors, our system precisely locates where the incident occurred, and if it determines there is a possibility the sound was caused by gunfire, sends its data for human review to analyze and validate the incident. An alert containing a location on a map and critical information about the incident is sent directly to subscribing law enforcement or security personnel through an internet-connected computer or iPhone or Android mobile devices.

Our software sends validated gunfire data along with the audio of the triggering sound to our Incident Review Center (“IRC”) that has locations in Fremont, CA and Washington, D.C. where our trained incident review specialists are on duty 24 hours a day, seven days a week, 365 days a year to screen and confirm actual gunfire incidents. Our trained incident review specialists can supplement alerts with additional tactical information, such as the potential presence of multiple shooters or the use of high-capacity weapons. Gunshot incidents reviewed by our IRC result in alerts typically sent within approximately 45 seconds of the report of the gunfire incident.

Specialized Gunshot Detection Software

The heart of our gunshot detection solutions is our sophisticated and specialized software. Our software analyzes audio signals for potential gunshots detected by our intelligent sensors. Our sensor filters out ambient background

6

noise, such as traffic or wind, and looks for impulsive sounds characteristic of gunfire. If the sensor detects such an impulse, it extracts pulse features of the soundwave, such as sharpness, strength, duration, rise time and decay time. Then, the sensor sends these features to our cloud servers as part of a data packet that includes the location coordinates of the reporting sensor and the precise time of arrival and angle of arrival of the sound.

When the data reaches our cloud servers, our software assesses whether three or more of our outdoor sensors detected the same sound impulse and, if so, finds the location coordinates of the sound source based on the time of arrival and the angle of arrival of the sound using the technique of multilateration. The accuracy of the coordinates derived from our proprietary software is significantly improved when, as is typically the case, more than three sensors participate. We deploy our sensor arrays such that, on average, six to eight sensors participate in the detection of a gunshot.

After the software determines the location of the sound source, our machine classifier algorithms analyze the pulse features to filter out sounds that are unlikely to be gunfire. Our algorithms consider pulse features, the distance from the sound source, pattern matching and other heuristic methods to evaluate and classify the sound. The machine classifier algorithm is periodically trained and validated against our large database of known gunfire and other community sounds that are impulsive in nature. We continue to add new data to our machine learning database from the incidents reviewed by our incident review specialists in our IRC process. Incidents that are determined by the machine classifier algorithms to be obviously non-gunfire are filtered out and not presented for human classification.

All incidents not filtered out by our machine classifier algorithms are sent to the incident review specialists in our IRC for analysis and human classification. Incident notifications are sent when the incident is confirmed as gunfire by one of our incident review specialists and may include additional information that may be helpful to first responders, such as the possibility of multiple shooters or use of a high-capacity or fully automatic weapon. Alerts are delivered using push notifications to our mobile, desktop or browser applications and through email or SMS text messages. The time from a report of an outdoor trigger-pull to a notification being sent to our customers is typically 45 seconds or less.

Intelligent and Ruggedized Sensors

Our rugged gunshot detection sensor is an intelligent, internet-enabled device that is specially built to ignore ambient noise and respond to impulsive sounds, accurately time-stamping their arrival times. Advanced digital signal processing algorithms filter out background sounds such as traffic, and extract pulse features from the audio signal

7

that, along with the time and angle of arrival of the sound, are sent to our servers where algorithms compute the location of the sound source.

The sensors do not have the ability to live stream audio. Sounds captured by the secure sensors are permanently deleted after 30 hours. When a sensor is triggered by an impulsive sound, the “incident” that is created includes a recording including no more than one second before the incident and one second after the incident. This audio snippet is preserved indefinitely for potential evidentiary use.

Our sensors are designed and tested against international standards for installation in unprotected outdoor environments. Special consideration is given to minimize the sound of wind, rain and hail, which could otherwise limit the range of detection and produce false results. Environmental condition tests performed on the sensors include temperature cycling, temperature soak, shock, vibration, and salt, fog and moisture ingress protection.

We typically design and deploy arrays of 10 to 25 sensors per square mile taking into consideration the unique acoustic environment in which we are deploying. The cumulative experience of deploying in various cities with different acoustic properties has provided a distinct advantage in tailoring our sensor arrays to perform at high levels. We have full telemetry to each sensor that provides detailed data to our system to monitor each sensor’s health and availability. Sensor firmware is maintained with over-the-air updates. Because we design our networks with a certain amount of redundancy to ensure durability, in our sensor arrays, multiple sensors can be offline at any given time without affecting the overall performance of the system.

Incident Review Centers- Classification

Our IRC operates 24 hours a day, seven days a week, 365 days a year. When a loud impulsive sound triggers enough of our outdoor sensors that an incident is detected and located, audio from the incident is sent to our IRC via secure, high-speed network connections for real-time confirmation. Within seconds of an incident, one of our incident review specialists analyzes audio data and recordings of the potential gunfire. When gunfire is confirmed, our IRC team sends an alert directly to emergency dispatch centers and field personnel through a computer or mobile device with access to the Internet. This process typically takes less than 45 seconds from the report of the gunfire incident. Alerts include:

•the precise location of gunfire, including both latitude/longitude and approximate street address;

•the number and exact time of shots fired;

•if detectable, the involvement of multiple shooters; and

•if detectable, the use of fully automatic or high-capacity weapons.

Our IRC operates primarily out of our principal facilities in Fremont, CA and Washington, D.C. and receives audio from incidents detected by our outdoor sensors regardless of where such incidents occur. Although our IRC normally operates from our offices, our trained personnel can perform IRC functions from any location that has a high-speed internet connection. During the COVID-19 pandemic, which continues worldwide, IRC personnel have performed their job function from our IRC facilities and/or remote locations.

Gunshot Detection Alerts

Our alerts are delivered in the following forms:

Real-Time Alerts

Our IRC sends real-time notifications of outdoor gunfire incidents to the ShotSpotter Dispatch application, which is specifically designed for emergency communications centers, dispatch centers, and other public safety answering points.

The ShotSpotter Respond alert received by the ShotSpotter Dispatch application includes a unique identification number (Respond ID number), a precise time and date of the gunfire (trigger time), approximate street address of the gunfire, number of shots and police district and beat identification. One of our incident review specialists may add

8

other contextual information related to the incident such as the possibility of multiple shooters, high-capacity or fully automatic weapons and vehicles.

The 911 dispatcher may add their own notes relating to the incident in which case the notes are time- and date-stamped and indicate the operator’s identification. A comprehensive audit trail of all changes to the incident is maintained that includes the time the alert was received and acknowledged by the dispatcher. These data may be used to measure KPIs by dispatch personnel.

ShotSpotter Respond

We also offer a robust ShotSpotter Respond application for use by patrol officers and security personnel that is available on iPhone or Android mobile devices and computers installed in patrol vehicles and dispatch centers. This application allows field personnel to directly receive alerts of outdoor gunshots and related critical information. The alert includes a unique identification number (Respond ID number), a precise time and date of the gunfire (trigger time), nearest street address to the location of the gunfire, number of shots and police district and beat identification. One of our incident review specialists may add other contextual information related to the incident such as the possibility of multiple shooters, or high-capacity or fully automatic weapons. In addition, the dispatcher may add their own notes. The alert also includes an audio snippet of the incident.

| | | |

| | | |

|

|

|

|

Mobile Device Support-Apple iOS and Android-phones/tablets and watches |

Related Applications and Services

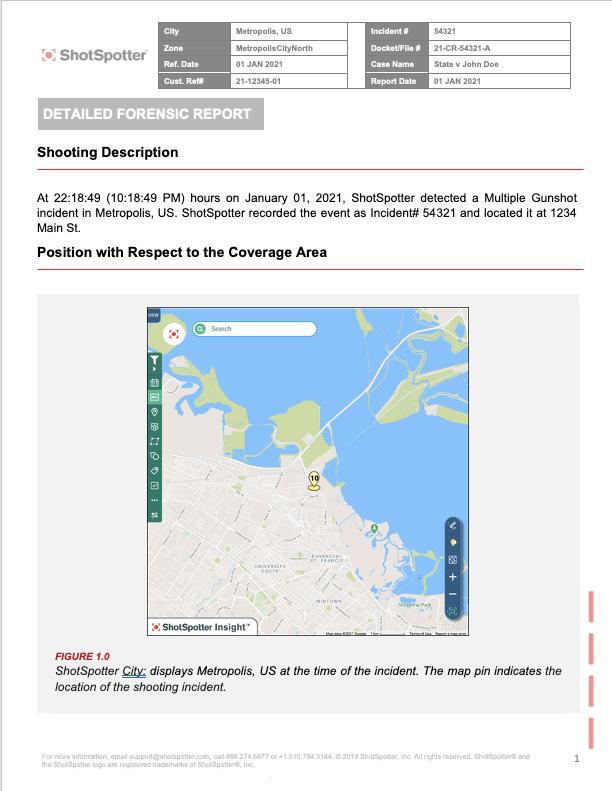

ShotSpotter Insight

All historical incident data in our database can be viewed, searched, sorted, and filtered using our ShotSpotter Insight application. The Insight application can create an investigative lead summary report that describes the specifics of a single incident as reported by the IRC staff or a multiple incident report that lists groups of such incidents. Complex filters may be defined using multiple search criteria and the filters named and saved for recurring use. Incident data may be exported for use in third-party applications such as Excel, currently the tool of choice for police department crime analysts.

Integration Services

We believe that integrating our solutions with other tools and technologies enhances the value of our solutions to our customers. For example, our solutions can be used in connection with computer-aided dispatch systems, video surveillance cameras, National Integrated Ballistic Information Network (“NIBIN”), and automated license plate

9

readers used by law enforcement to improve the effectiveness of police response and investigation efforts. We continue to evaluate new technologies that may integrate with our solutions to generate additional value for our customers.

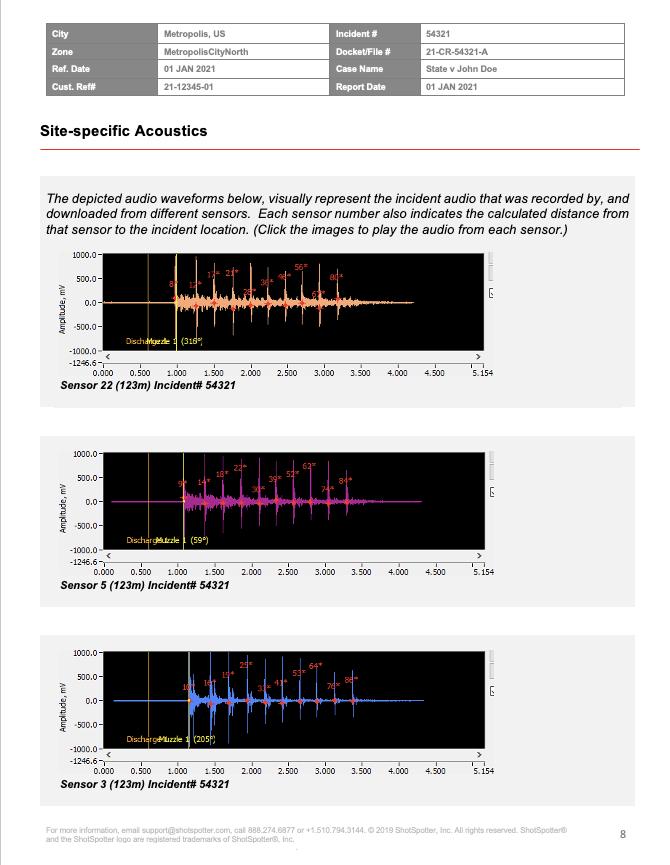

Detailed Forensic Reports and Certified Expert Witness Services

As part of our solution, we offer Detailed Forensic Reports (“DFRs”). These provide investigators and attorneys with comprehensive, court-admissible analysis of a shooting incident, including the gunfire audio. We also offer expert witness testimony to introduce the forensic analysis of the DFRs at trial and to provide technical expertise regarding our technology. Our forensic employees have testified in over 250 cases throughout the United States. Our forensic analyses have survived dozens of challenges in numerous states, under both the Frye and Daubert standards of admissibility. The following is an example of a DFR.

Detailed Forensic Report:

ShotSpotter Respond Results and Benefits

•Expedited Response to Gunfire. In 2022, we issued over 270,000 gunshot alerts to our customers. In areas where gun violence is persistent, we believe most gunshots are not otherwise reported. Even when calls are made, many callers are unable to provide a location of the gunshot or other relevant details. Human response time to unfolding violence often delays calls for several minutes in circumstances where response time can be critical. By contrast, our solutions typically alert emergency dispatch centers and field personnel within 45 seconds of the report of the gunfire incident and provide an exact location, enabling them to respond faster and to a specific location. The ability to respond more quickly increases the chances of apprehending the shooter and assisting victims of violence, in addition to aiding in evidence collection.

•Prevention and Deterrence of Gun Violence. We believe increasing the speed and accuracy of law enforcement responses to gunfire can act as a long-term deterrent that can decrease the overall prevalence of gunfire. We also believe that knowledge of the existence of our solutions may have a deterrent effect on localized gun violence. When elected officials and law enforcement have an enhanced awareness of gun violence activity and patterns, they have tools to facilitate a rapid and accurate response to gunfire incidents

10

and improve relations between law enforcement and these communities, potentially increasing crime reporting and community cooperation with investigations, which can result in improved public safety.

•Improved Community Relations and Collaboration. We believe that persistent gun violence limits the ability of police and other community leaders to serve their constituents and improve their communities. Many cities struggle to establish and foster a cooperative and trusting relationship between their police department and the communities they serve. Our public safety solution provides cities with the ability to react quickly to gun violence, thus providing the ability to improve their responses and residents’ perception of their responses. This provides our customers with the opportunity to foster improved community relations and collaboration with their residents.

•Improved Police Officer Safety. We believe that our solutions provide additional and valuable information regarding gunshot incidents as the alerts we provide give additional insight and situational awareness, including round count, potential multiple shooters and potential use of an automatic weapon, that allow the responders to be better prepared to respond appropriately.

ShotSpotter Helps Save Lives

The below graphic demonstrates positive impact results observed at a few of our customers.

| | |

| 1 Omaha PD statistics from NE district where ShotSpotter is deployed (2011-2019) 2 Pittsburgh.org City Crime Rates Drop Again. January 30, 2020 3 NBC WITN. January 22, 2020 4 ShotSpotter found to reduce gun violence in 2020. Fox 4. February 26, 2021 | |

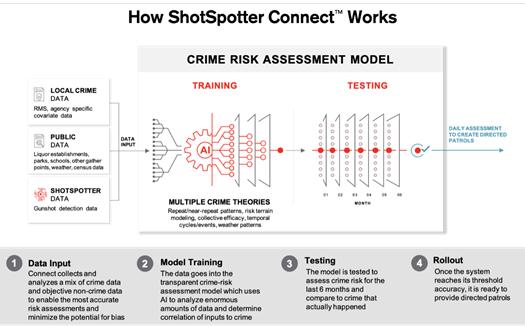

ShotSpotter Connect

Law enforcement agencies are increasingly facing challenges in maintaining a functional level of staffing due to early retirements and a more limited ability to recruit new officers. ShotSpotter Connect helps address this new reality by helping agencies make their largest cost center – patrol – more efficient and effective in reducing crime and better engaging with the community.

ShotSpotter Connect automates the planning of directed patrols for all serious crime data across an entire jurisdiction on a daily basis. With ShotSpotter Connect, analysts and supervisors review pre-generated directed patrol assignments that ensure officers are at the right place at the right time to maximize crime prevention while also guarding against over- and under-policing. Pre-patrol briefings provide situational awareness to officers and recommend patrol tactics, facilitating optimal outcomes even with limited staffing and resources.

11

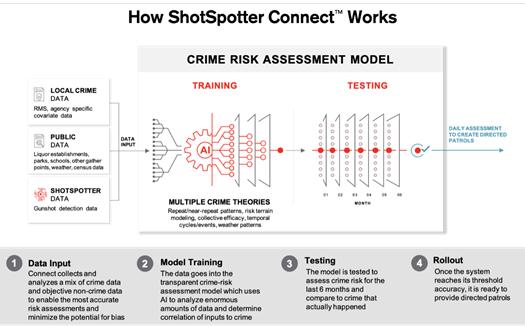

ShotSpotter Connect uses AI-driven analysis to direct officers to patrol a location within their beat that is likely to have the highest risk for crime during their shift. A timer guides officers to patrol this area for a short period of time, often 15 minutes, to create a deterrent effect that can last for hours. ShotSpotter Connect collects time, place, and tactical data from all directed patrol sessions which can be analyzed to determine the impact on crime as well as provide a level of oversight that can be used to optimize future assignments, policies, and strategies.

The system combines carefully selected historical crime data that is less susceptible to enforcement bias ingested through the agency RMS feeds along with objective temporal, location and event-based inputs including ShotSpotter data for cities that use our ShotSpotter Respond solution, to create crime risk assessments. The system ingests multiple years’ worth of agency data and is “trained” using machine learning to determine correlations across variables. The models are then tested against recent crime data to calibrate forecast accuracy. We believe these light-touch, non-enforcement tactics help agencies interact with the community in a more standardized, positive and respectful manner.

12

Results and Benefits:

•Directed patrol planning to maximize crime deterrence.

•Non-enforcement tactics guidance by crime type.

•Reports on officer activity for impact and accountability.

•Better community engagement.

ShotSpotter Investigative Tools Portfolio

ShotSpotter’s investigative tools portfolio includes COPLINK X, ShotSpotter Investigate, and ShotSpotter GCM.

COPLINK X

COPLINK X is a powerful law enforcement search engine and information platform that enables law enforcement to search data from agencies across the United States using natural language speech terms and concepts. With COPLINK X, officers have instant access to information they need, enabling them to strike the right balance between crime reduction, community engagement, and personal safety. COPLINK X provides law enforcement with the abilities to:

•Search through structured and unstructured data to obtain immediate tactical leads.

•Access law enforcement data records from a centralized, user-friendly interface.

•Leverage advanced link analysis to quickly detect relationships between people, places and events.

•Link leads to reports, suspects and other entities.

•Identify crime trends to make operational and resource decisions.

COPLINK X was added to our investigative tools portfolio in January 2022 through the acquisition of Forensic Logic, LLC ("Forensic Logic").

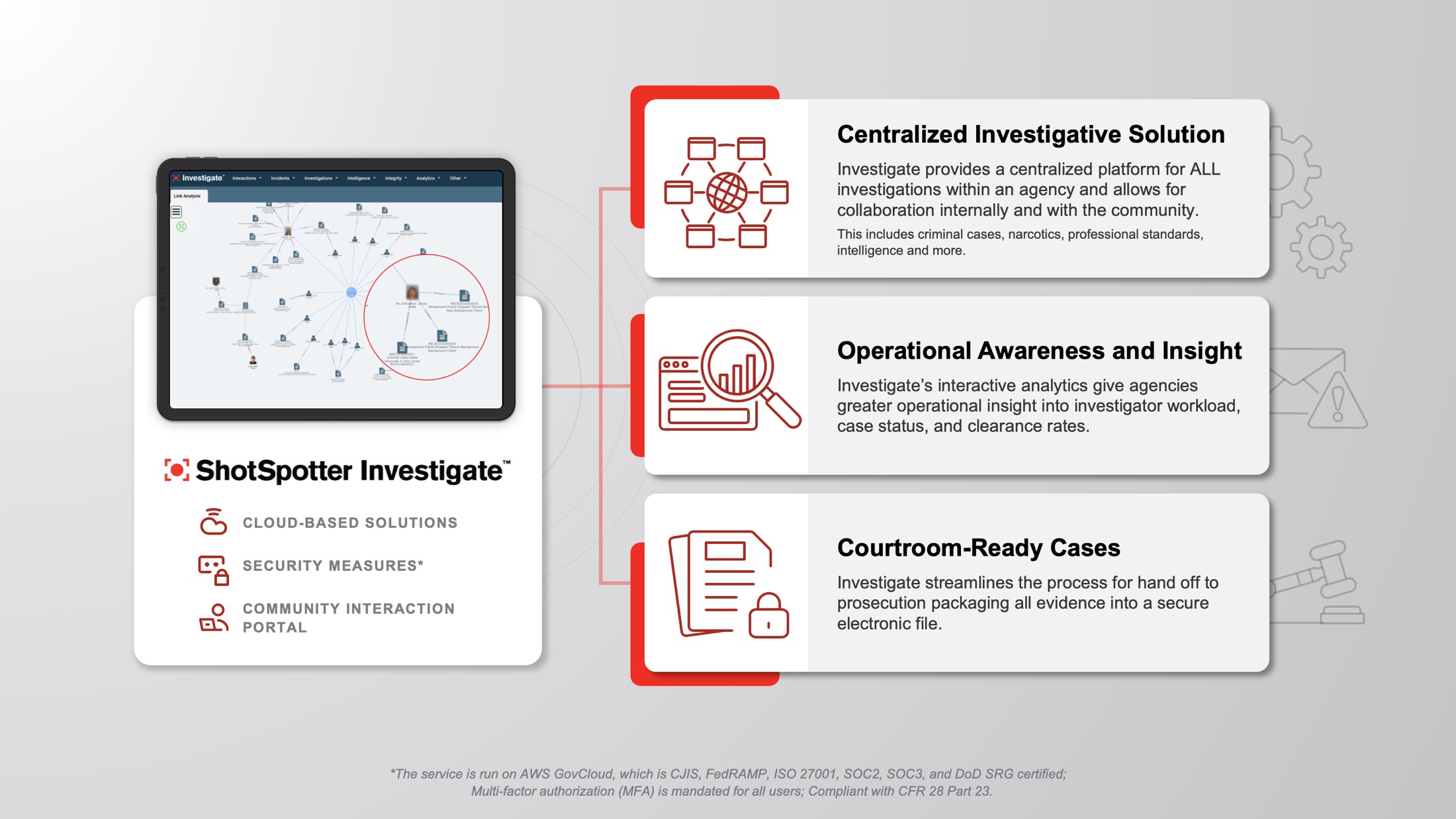

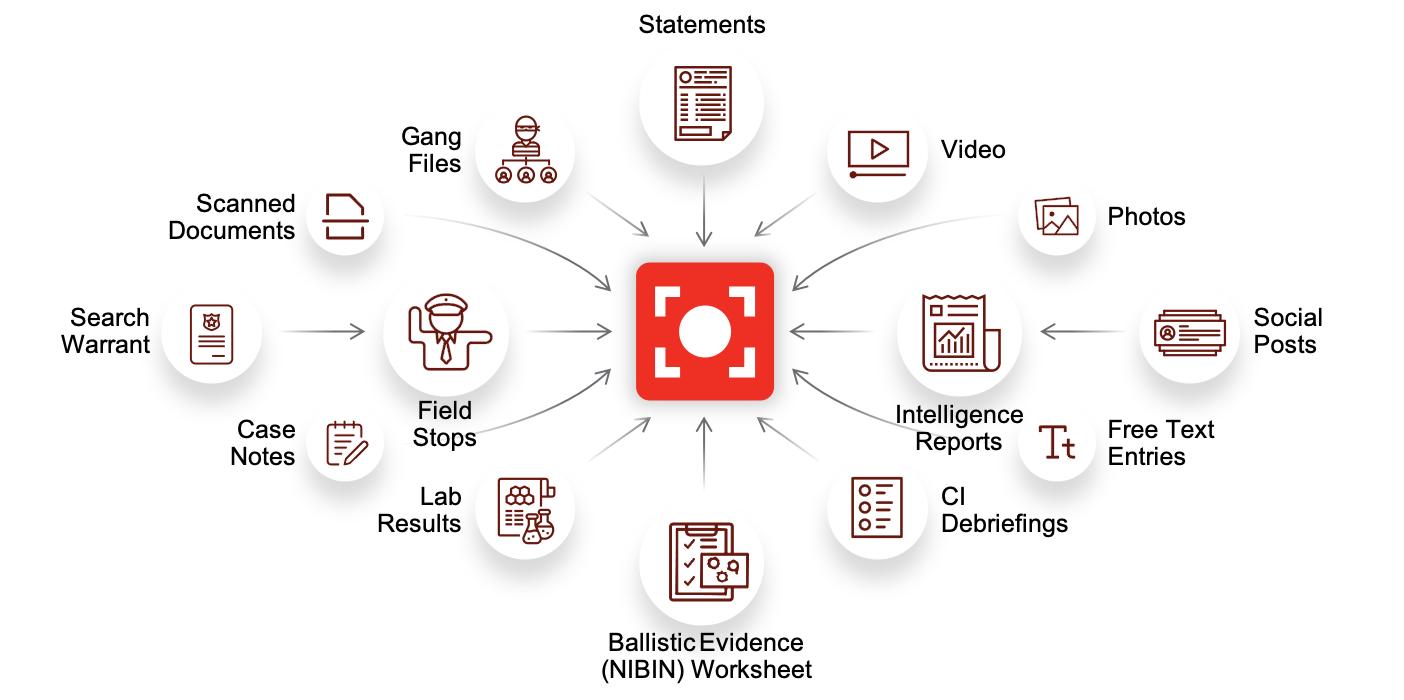

ShotSpotter Investigate

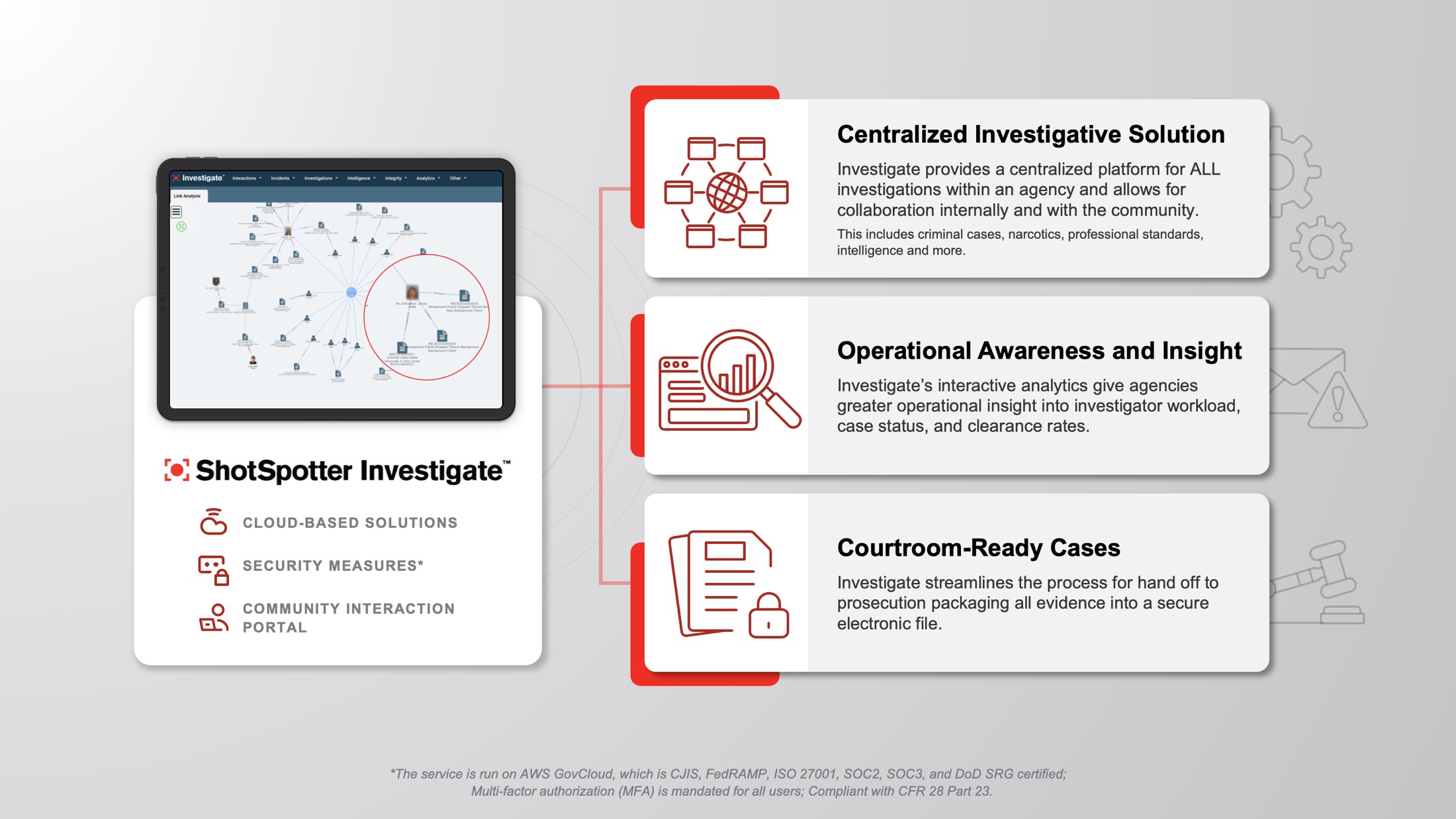

We acquired the CrimeCenter investigative case management solution in November 2020. We reconfigured and integrated the product to create the ability to use gunfire incident data from ShotSpotter Respond to populate cases automatically and launched the solution as ShotSpotter Investigate in July 2021.

The average homicide clearance rate in the United States is less than 50% in 2021, according to a report published by The Marshall Project in 2022. This means that in more than half the cases the suspect is not held accountable and is free to commit another crime while victims’ families don’t get closure. A low clearance rate is a self-perpetuating problem for a law enforcement agency. The problem starts when detectives can’t quickly close cases and clear up their case load, while they continue to catch new ones. Soon they are overloaded with cases and as they attempt to juggle a high caseload they get spread too thin and then leads start to slip through the cracks and the opportunity to solve the case diminishes. In the longer term, this can create a moral problem within the investigative arm of the agency and they are exposed to losing experienced detectives. This exacerbates the low clearance rates meaning victims are denied justice and the mistrust of law enforcement increases.

The most common tools that departments use to manage, track and solve cases range from purely manual to homegrown to limited function RMS modules or a mix of these. These approaches lack robust collaboration features, have poor data security features and the inability for supervisors to track case progress. We believe there is an opportunity to bring a complete digital case management solution to the market to help improve clearance rates of all crime types and accelerate solvability under the ShotSpotter brand and sell to both our installed base and new potential customers, such as prisons.

13

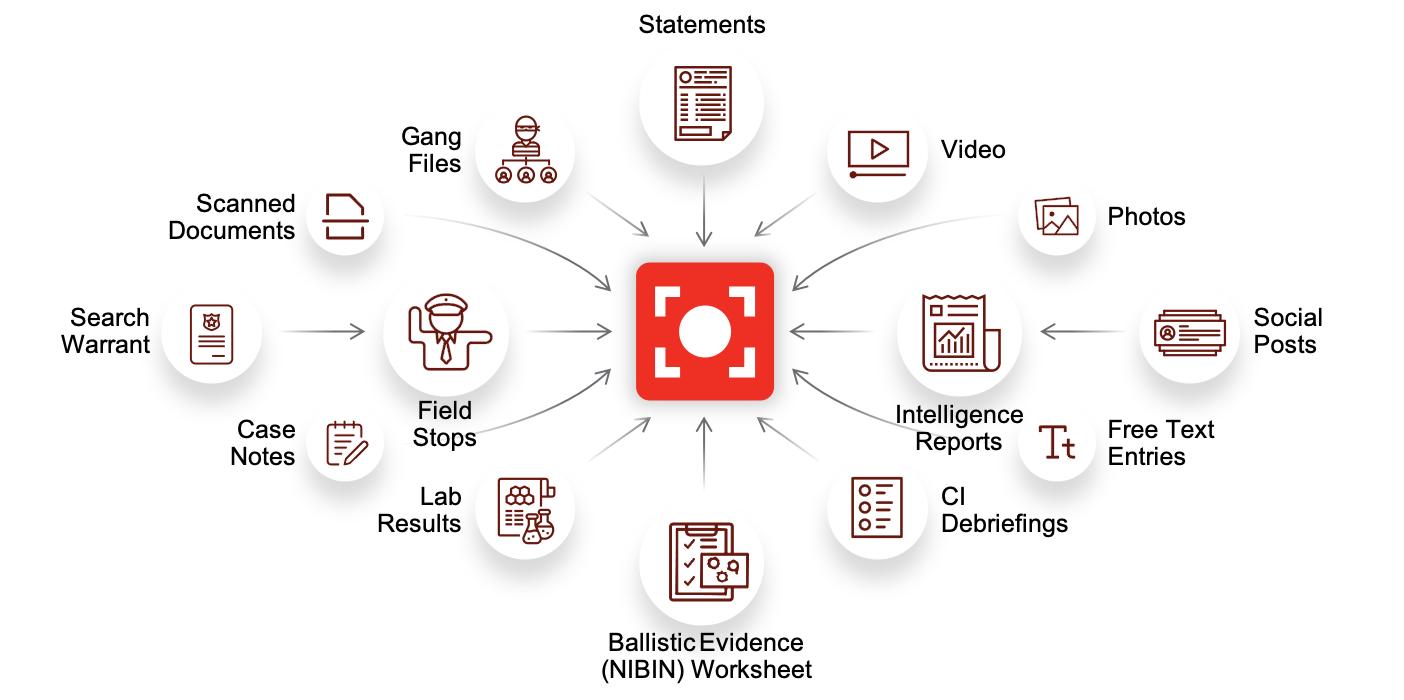

ShotSpotter Investigate provides a complete case management solution for detectives and supervisors in local, state and federal law enforcement agencies. It has been used by the New York Police Department for years at scale by thousands of officers as an on-premise solution. The solution provides:

•Complete Digital Case Management. ShotSpotter Investigate addresses the challenges investigators and supervisors face in conducting and documenting investigations. It enables police to have all case-related data in one place in a digital and structured format so that it is quickly searchable and able to be used to drive analysis and reporting. We believe law enforcement agencies can use this tool to be more efficient and effective at solving crimes and close more cases to provide resolution for victims and keep offenders from committing additional crimes.

•Analytical and Collaboration Tools. The ability to have the system automatically show linkages between people, property, and places can identify connections more quickly and help solve cases faster. Collaboration tools make investigators aware when new relevant evidence is submitted for the same or unrelated cases, and able to more easily communicate on a case across a police department or other city agency such as the district attorney’s office.

•Supervisor Reporting. Supervisor dashboards and reports ensure they have visibility into the status of every case and are aware of roadblocks so they know when to get involved and can more easily provide updates to command staff.

How ShotSpotter Investigate Works

14

ShotSpotter GCM (Gun Crime Management)

ShotSpotter GCM is a first-of-its-kind digital case management solution that focuses specifically on gun crime and was launched in June 2022. This is a new offering subset of ShotSpotter Investigate focused on gun violence. The solution automates the process by which key information is inputted, captured and used to identify associated gun crime cases leading to the identification of persons of interest. The solution also supports streamlined collaboration and generation of operational insights that we believe enables detectives and investigative supervisors to solve gun crime more efficiently and effectively.

Our Markets

We believe there is significant demand for advanced gunfire detection and location notification solutions that accurately and quickly report instances of gunfire, based on two primary use cases:

•Law enforcement— for domestic and international law enforcement serving communities plagued by persistent, localized gun violence, in order to identify, locate and deter gun violence; and

•Security— for security personnel (which may include law enforcement personnel) serving universities, corporate campuses, key infrastructure, transportation centers and other areas in which authorities desire to prepare for and mitigate risks related to an active-shooter event, and desire to provide a zone of detection coverage surrounding the respective campus or secured area.

Based on data from the Federal Bureau of Investigation's (the “FBI”) 2018 Uniform Crime Report, we estimate that the domestic market for our public safety solution consists of the approximately 1,400 cities that had four or more homicides per 100,000 residents in 2016. The Uniform Crime Report includes information reported directly to the FBI by 18,000 city, university and college, county, state, tribal and federal law enforcement agencies. We believe that four or more homicides per 100,000 residents represents a significant gun violence problem. We estimate that a customer in this market could invest an average of approximately $400,000 per year for ShotSpotter Respond. In 2021, we also started focusing on smaller cities that may not be included in the 1,400 cities list and expect this could add another several hundred potential customers. We believe these smaller cities could invest an average of approximately $50,000 to $100,000 per year for ShotSpotter Respond.

Based on data made available by the National Center for Education Statistics and the Federal Aviation Administration, we believe that the domestic market for our security solutions includes approximately 5,000 college campuses and airports. We estimate that, on average, a customer in this market could invest approximately

15

$50,000-$75,000 per year for one of our security solutions. In addition, we believe that there exists a broader market for our security solutions that include, primarily the outdoor areas of college campuses and airports outside of the United States as well as large corporate campuses, train stations and other highly-trafficked areas worldwide. In 2021, we started to focus on commercial opportunities, initially targeting certain major companies and their associated locations, such as their corporate offices and potentially even parking areas for major “big-box” retailers. Investments by customers in this market for our security solutions continue to be evaluated but could be similar or even greater than those made by our larger city customers.

Outside of the United States, we estimate that the market for ShotSpotter Respond includes approximately 200 cities in Central America, the Caribbean, South America and southern Africa that have at least 500,000 residents. We estimate that a customer in this market could invest an average of approximately $1.0 million per year for our public safety solution. We estimate the average investment amounts for prospective customers based on our experience with existing customers, our anticipated demand for our solutions and the corresponding coverage areas that we expect prospective customers would elect to cover with our solutions.

We believe there is demand for ShotSpotter Connect both within our existing ShotSpotter Respond customer base and within a broader set of police departments that are not ShotSpotter customers today. We estimate that the market for our ShotSpotter Connect solution includes up to 1,500 cities, based on cities that have a population above 25,000 people. We expect that, on average, a customer could invest approximately $50,000-$100,000 per year for our ShotSpotter Connect solution. We expect that ShotSpotter Connect may also be needed by potential international customers as well, who could invest over $100,000 per year for the solution.

We believe there is demand for a robust tool that would empower law enforcement agencies to solve more crime and close more cases. Every law enforcement agency has the duty and mandate to document and investigate alleged crimes in order to hold perpetrators accountable and provide resolution for victims. Unfortunately, the options to do this in a digitized and automated way are generally lacking. We believe ShotSpotter Investigate offers the most complete investigative case management solution on the market that has been proven to be effective with one of the leading law enforcement agencies in the country. We estimate the market for our solution consists of over nearly 3,000 local, state and federal agencies in the United States and potentially thousands internationally. We expect that, on average, United States customers could invest approximately $100,000 per year for our ShotSpotter Investigate solution and international customers could invest approximately $500,000 per year.

Our Growth Strategy

We intend to drive growth in our business by continuing to build on our position and brand as the leading provider of outdoor gunshot detection, location and alerting solutions. We also plan to leverage our large and growing installed base of customers with high net promoter attributes that consider ShotSpotter a trusted partner, to grow adoption of our newer products ShotSpotter Connect, ShotSpotter Investigate, ShotSpotter GCM and COPLINK X not only within the installed base, but outside of it. Key elements of our strategy include:

•Accelerate Our Acquisition of Public Safety Customers. We believe that we continue to be in the early stages of penetrating the markets for our public safety solutions. We serve law enforcement agencies in three of the ten largest U.S. cities as ShotSpotter Respond customers. Over the last few years we expanded our direct sales force and customer success teams and added marketing lead-generation capabilities to accelerate growth in this market. Moreover, as we add new public safety customers, publicity and the number of potential references for our solutions increase, which results in our brand and our solutions becoming more well known. We intend to capitalize on this momentum to grow sales.

•Expand ShotSpotter Respond Revenue within Our Existing Customer Base. As customers realize the benefits of our solutions, we believe that we have a significant opportunity to increase the lifetime value of our customer relationships by expanding coverage within their communities through a “land and expand” strategy. For example, of our ShotSpotter Respond customers, approximately 43% have expanded their coverage areas from their original deployment areas by an average of almost nine square miles as of December 31, 2022. Our overall revenue retention rate was 124% for 2022, 125% for 2021 and was 107% for 2020.

16

•Expand Our International Footprint. With only two currently deployed ShotSpotter Respond customers outside of the United States in South Africa and the Bahamas, we believe that we have a significant opportunity to expand internationally. We estimate that the market outside the United States for our public safety solutions includes approximately 200 cities in Central America, the Caribbean, South America and southern Africa that have at least 500,000 residents. In addition, we believe that there is a market for our security solution, ShotSpotter Connect and ShotSpotter Investigate outside the United States. We intend to increase our investment in our international product, sales and marketing efforts to penetrate new geographies over the coming years.

•Drive Additional Revenue per Customer with the Development or Acquisition of New Products and Services. We are transforming the company from a domestic acoustic gunshot detection company to a global precision policing technology solutions company. We evaluate opportunities to develop or acquire complementary products and services. For example, our acquisition of HunchLab in 2018, renamed ShotSpotter Connect, provides an opportunity to increase our revenue per customer with a related and value-added technology that helps deter crime through strategically planned patrols. Our 2020 acquisition of LEEDS, LLC ("LEEDS") provided entry into a comprehensive investigative case management solution, with our ShotSpotter Investigate solution. Our 2022 acquisition of Forensic Logic added investigative lead generation and search and analysis technology to our investigative tools portfolio. Our current approach is to leverage trusted relationships with current customers to drive initial adoption and increase revenue and lifetime value per customer.

•Maintain Passionate Focus on Customer Success. Given the specialized nature of our market, a key component of our strategy is to maintain our passionate focus on customer success and satisfaction. We pride ourselves on our execution of customer on-boarding as well as ongoing consulting and customer support, all of which are critical to ensure not only high customer retention rates, but new customer acquisitions. We implement our customer success initiative early in the sales process in order to ensure that we are aligned with the customer’s objectives and can positively impact their defined outcomes. We apply consultative best practices and policy development at the command staff level as well as tactical training for field patrol officers. We also consistently measure our performance with customers through an annual Net Promoter Survey. We have extremely high agency participation rates and our scores the last two years have ranked between “excellent” and “world class” according to our Survey partner benchmarks. All of our efforts are focused on driving positive measurable outcomes on gun violence reduction and prevention, which we know leads to positive word of mouth referrals that can attract new customers and drive an increase in sales.

•Grow Our Security Business. We have developed our ShotSpotter SecureCampus solution for universities and other educational institutions. We have also developed ShotSpotter SiteSecure for customers such as corporations trying to safeguard their employees, customers, brand and profits, and public agencies focused on protecting citizens on highways. As of December 31, 2022, we had 19 ShotSpotter SecureCampus and ShotSpotter SiteSecure customers. While we will still plan to sell to educational institutions, we are shifting our primary focus to highways and certain commercial customers.

ShotSpotter Labs

ShotSpotter Labs houses our advanced technology efforts to adapt and extend our commercial technology to address significant wildlife and environmental issues. Our current focus is on combating rhino poaching in Kruger National Park, South Africa and blast fishing that threatens coral reefs and food security in Southeast Asia. We have been able to collect revenues from philanthropic entities to cover direct and indirect costs. Innovations have made their way back into our commercial business such as the development of a solar-powered sensor from the Kruger deployment; that technology is similar to those now being used for our freeway deployment.

The use of guns to poach rhinos is a significant environmental concern in Africa where the horn of a single rhino can be worth hundreds of thousands of dollars. In the vast expanse of Kruger National Park, most poaching incidents go undetected with carcasses found days or weeks after the fact. The problem is particularly acute in that due to cumulative impact of years of poaching the rhino population is on the tipping point of becoming extinct as a species. ShotSpotter Labs is deployed in 100 square kilometers of inside the Intensified Protection Zone (IPZ) where 60% of the world's remaining rhinos live.

17

Since the introduction of ShotSpotter Labs to detect and locate gunfire incidents and alert park rangers in less than 60 seconds with precise location accuracy, there have been multiple poacher apprehensions of some of the more prolific and notorious poaching syndicates within the coverage area. The ShotSpotter impact has been measurable with a 58% reduction in the number of rhinos killed due to an estimated 50%+ interception rate within the ShotSpotter coverage area.

“ShotSpotter has allowed us to take back the night,” said Ken Maggs, Head Ranger of the Kruger National Park. “We now have an interception rate well above 50% within the coverage area, which means the poachers are literally flipping a coin when they come in.”

Fish blasting results in the destruction the coral reef habitat that may not recover for many decades if at all. Coral reefs are not only home to a myriad of marine organisms including fish but also provide significant livelihood support and form an invaluable protective barrier offshore (protecting the land from heavy storms, tsunamis, and wave action).

The potential decline in fish catch which is the protein source for approximately 1 billion coastal residents is a strategic food security issue. In addition, coral reefs form the basis of coastal and marine tourism, a valuable national income sector. It is estimated that, coral reefs around the globe provide services valued between US $172 to $375 billion annually. Reefs must be protected for economic sustainability and food security. Our work in the Coral Triangle also known as the Amazon Forest of the Ocean has shown some promising results. The precise detection and alerting of incidents of fish blasting provides a real time awareness to the extent of fish blasting and helps target enforcement interventions designed to deter and prevent fish blasting activities.

Customer Revenue Model

We generate annual subscription revenues from the deployment of ShotSpotter Respond on a per-square-mile basis. Our security solutions, ShotSpotter SecureCampus and ShotSpotter SiteSecure are typically sold on a subscription basis, each with a customized deployment plan. ShotSpotter Connect, ShotSpotter Investigate, ShotSpotter GCM and COPLINK X are also sold on a subscription basis generally customized based on the number of sworn officers in a particular city. As of December 31, 2022, we had ShotSpotter Respond, Shotspotter SecureCampus and ShotSpotter SiteSecure coverage areas under contract of over 1,060 square miles in the aggregate, of which 980 miles have gone live. Coverage areas under contract for ShotSpotter Respond included over 151 cities and coverage areas under contract for ShotSpotter SecureCampus and ShotSpotter SiteSecure included 19 campuses/sites across the United States, South Africa and the Bahamas, including some of the largest cities in the United States. For the year ended December 31, 2022, our two largest customers, the City of New York and the City of Chicago accounted for 30% and 10% of our revenues, respectively. For the year ended December 31, 2021, our two largest customers, the City of New York and the City of Chicago accounted for 28% and 14% of our revenues, respectively. For the year ended December 31, 2020, our two largest customers, the City of Chicago and the City of New York accounted for 18% and 15% of our revenues, respectively. Delivery of ShotSpotter Investigate in the City of New York will add additional professional services requirements and revenue.

Go-To-Market

We sell our solutions through our direct sales teams, and starting in 2022, two reseller organizations. Our sales teams focus on both new customer acquisition, customer renewal, add-on sales, and coverage expansion. Our sales team identifies communities with the opportunity to benefit from our solutions, communicates with key stakeholders, navigates the challenges associated with our customers’ complex funding and procurement cycles, and establishes a foundation for a successful customer relationship. In addition, our sales team works with customers to identify and procure funds from alternate sources, including state and federal government grants. The two reseller organizations focus on COPLINK X sales efforts and university security sales. Our security solutions sales efforts focus primarily on highways, and corporate campuses, national retailers, and in some cases, stadiums, arenas, and venues supporting large groups of employees and/or patrons. We intend to continue to invest in building a global sales organization as we further penetrate the market for ShotSpotter Respond and expand the customer base for our security solutions.

18

Marketing

Our marketing function has several focus areas, with demand generation being the largest investment. It is designed to drive a new and qualified pipeline for each product in our Precision Policing Platform. The program consists of a series of targeted email, digital and offline campaigns to key personas in prospective agencies, as well as influencers, to drive interest in our suite of products. This effort is supplemented by content marketing to target search engine keywords that buyers are using to raise the ranking of relevant digital content the company is now producing in greater quantities to educate them on our products. The awareness efforts are supported by a team of sales development representatives who make outbound calls to further drive interest and qualify leads. Conversions from marketing leads to sales qualified opportunities continue to increase as the team has gained more experience and tested various approaches. The demand generation efforts are tracked and measured with a robust marketing technology automation platform.

In general, due to the high visibility of shootings, the media’s interest in covering them, and ShotSpotter’s key role in alerting police for a quick response to these events to save lives, we benefit from significant broadcast, online and print press that is generated at little to no cost. Members of the media have access to a self-serve, comprehensive media kit to easily capture video and photos that depict the service and its benefits in a compelling fashion to enhance broadcast TV segments and print/online articles. This exposure creates awareness for our solutions and lends credibility to our market leadership position. In 2021, we expanded our strategic communications capacity in response to false assertions made by certain media outlets and other organizations about our gunshot detection product.

In the areas of content and branding, we leverage our customer base to create a growing catalog of success stories, videos and articles that convey the value of our solutions to prospective customers, often with tangible examples and aggregated data on results. We continue to expand the breadth and depth of our content library that is on display primarily in the Resource Center and Results page of our website and make the information easier to find and share for prospective customers and influencers.

Research and Development

We focus our research and development efforts on enhancing our advanced signal processing and classification algorithms, updating our sensor hardware technology, reducing manufacturing costs, developing mobile, web and desktop applications, evolving our cloud-deployed back-end infrastructure and integration with “smart cities” initiatives. ShotSpotter Connect crime forecasting uses machine learning and has led to additional investment in data science resources. As of December 31, 2022, we had 56 employees in our research and development organization. In addition, we engage in research and development activities with manufacturing partners and outsource certain activities to engineering firms to further supplement our internal team.

Competition

The markets for public safety and security solutions are highly fragmented and evolving. Whether installed in local communities, on critical infrastructure or on a campus, for a gunfire detection system to be effective, the protection zone must be comprehensive. We believe our gunshot detection solutions represent the most effective public safety and security solutions on the market.

We compete on the basis of a number of factors, including:

•product functionality, including the ability to cover broad outdoor geographic spaces;

•solution performance, including the rapid capture of multiple acoustic incidents and accuracy;

•ease of implementation, use and maintenance;

•total cost of ownership; and

•customer support and customer success initiatives.

19

ShotSpotter Respond Competitors

ShotSpotter Respond is unique because it provides scalable wide area gunshot detection over large and geographically diverse areas, provides immediate and precise data on gunfire, helps communities define the scope of illegal gunfire, and provides cities with detailed forensic data for investigation, prosecution and analysis. While we are not aware of any direct competitors offering wide-area solutions comparable to ShotSpotter Respond, we believe the primary competitors in the broader gunfire detection space are V5 Systems, Safety Dynamics, Inc., Wi-Fiber, Inc., Databouy, EAGL Technology, Alarm.com and Flock Safety.

Most of these other outdoor solutions on the market offer limited scope point protection, proximity sensors, or “counter-sniper systems.” These systems are designed primarily for covering small areas, or for defined military or SWAT team applications, where the target is known in advance and it is possible to put a sensor directionally toward the target. However, urban areas and critical infrastructure require a wider system of protection that can cover a large area.

We also compete with other possible uses of the limited funding available to our ShotSpotter Respond customers. Because law enforcement agencies or government entities have limited funds, they may have to choose among resources or solutions that help them to meet their overall mission such as video management systems, and other security solutions. Accordingly, we compete not only with our customers’ internal budget decisions, but with other companies vying for these limited funds. We believe that in areas with significant levels of gun activity, ShotSpotter Respond is uniquely positioned to assist customers in interrupting, detecting and preventing gun violence.

ShotSpotter SiteSecure and ShotSpotter SecureCampus Competitors

Our security solutions operate in a highly competitive environment. In addition to other gunfire detection companies, we may face competition from companies offering alternative security technologies, such as video surveillance, access control, alarm and lighting systems. The direct competitors for security solutions include the Alarm.com, Safety Dynamics Inc., V5 Systems, EAGL, Wi-fiber, AmberBox, Inc and Flock Safety. We believe none of our security solutions competitors is able to offer the comprehensive outdoor coverage we offer.

ShotSpotter Connect Competitors

ShotSpotter Connect operates in a developing and potentially competitive environment. The direct competitors to our Connect solution include Geolitica, Inc. and may include CAD providers and other third-party solutions providers, such as CentralSquare Technologies, Mark 43, Genetec, Inc., and Motorola Solutions, Inc. In addition, we may face competition from companies offering alternative solutions as well as solutions developed internally by our customers.

COPLINK X competitors

COPLINK X has a few direct competitors and also competes with a few alternative approaches to develop investigative leads. Direct competitors include Lexis Nexis Accurint Virtual Crime Center, Peregrine, and Finder Software Solutions. Alternative approaches to law enforcement data sharing include federal government-built applications like the FBI's National Data Exchange ("N-DEx") System, and the Navy’s NCIS Law Enforcement Information Exchange ("LInX"). Both of these platforms are available to U.S. law enforcement agencies at little to no cost. An additional alternative to develop investigative leads is using the law enforcement agency's existing Record Management System ("RMS") search function. We believe COPLINK X is uniquely positioned due to its comprehensive and regularly enhanced features and functions, and our large private Criminal Justice Information Standard data set which we believe to be the largest available. Further, COPLINK X is integrated with the Thomson Reuters CLEARTM platform for CLEAR and COPLINK X subscribers, allowing access to billions of additional public data records in a seamless experience.

ShotSpotter GCM Competitors

There are many competitors in the market for investigative case management. The direct competitors include companies offering a case management module as part of their RMS such as Mark43, Tyler, and Soma Global. There are several purpose-built case management solutions such as Kaseware and CaseClosed. Also, many agencies use manual or homegrown methods. We believe that our solutions are superior in terms of comprehensiveness of

20

functionality, analytical and collaboration tools, workflow process and proven effectiveness at scale. We also believe the market suffers from a lack of awareness and understanding of what is available from vendors for this type of solution and that our brand and feature-rich application has the potential to capture a sizeable piece of the market over time.

Intellectual Property

Our future success and competitive position depend in part on our ability to protect our intellectual property and proprietary technologies. To safeguard these rights, we rely on a combination of patent, trademark, copyright and trade secret laws, and contractual protections in the United States and other jurisdictions.

As of December 31, 2022, we had 38 issued patents, 31 in the United States, two in Brazil, and one each in Israel, Mexico, the United Kingdom, France and Germany.

The issued patents expire on various dates from 2023 to 2034. We also license one patent from a third party, which expires in 2023.

We also license software from third parties for integration into our offerings, including open source software and other software available on commercially reasonable terms.

Facilities

Our principal facilities consist of office space for our corporate headquarters in Fremont, California, as of December 31, 2022. We also have offices in Washington, D.C., Walnut Creek, California and Tucson, Arizona.

We lease our facilities and do not own any real property. We may procure additional space as we add employees and expand geographically. We believe that our facilities are adequate to meet our needs for the immediate future and that should it be needed, suitable additional space will be available to accommodate expansion of our operations. Although most of our employees operate from our offices, normally they can perform their functions from any location. In response to the COVID-19 pandemic, most of our personnel have performed their job function entirely from home.

Human Capital

Our values encourage us to be genuine, innovative, engaged and exceptional. They are built on the foundation that our people and the way we treat one another promote creativity, innovation and productivity, which spur the Company’s success. We are continually investing in our global workforce to further drive diversity and inclusion, provide fair and competitive pay and benefits to support our employees’ well-being, and to foster the growth and development of all employees. As of December 31, 2022, we employed 213 people, all of whom were based in the United States. Our total attrition rate in 2022 was less than 18%, we have not experienced work stoppages, and we believe our employee relations are good. We have been designated a Great Place to Work® Company for the last five years.

Diversity, Equity and Inclusion

Our vision is to advance diversity, equity and inclusion across the company. We recognize that everyone deserves respect and equal treatment, regardless of gender, race, ethnicity, age, disability, sexual orientation, gender identity, cultural background or religious belief. As of December 31, 2022, women represented 32% of our employees, and underrepresented minorities, defined as those who identify as Black/African American, Hispanic/Latinx, Native American, Pacific Islander and/or two or more races, represented 44% of our employees.

In order to create products that solve challenging problems for people all over the world, we need employees who can bring diverse perspectives and life experiences. We are committed to bringing more women and underrepresented and underserved groups into technology careers. We employ inclusive recruitment practices to source diverse candidates and mitigate potential bias. We have a three-pronged strategy to grow our diversity over time by (1) attracting diverse talent and ensuring fair hiring through inclusive and strategic recruitment practices, (2)

21

creating an inclusive workplace environment for employees, and (3) joining forces with our customers, partners and peers to drive industry progress.

We have invested in analysis and transparency to demonstrate our commitment to equity and inclusion through fair compensation and opportunity for professional advancement. We define pay parity as ensuring that employees in the same job and location are paid fairly regardless of their gender or ethnicity. We make efforts to ensure our employees receive access to advanced opportunities within the company.

Board Composition and Refreshment

As stated in our Corporate Governance Guidelines, our board of directors values diversity and recognizes the importance of having unique and complementary backgrounds and perspectives in the board room. Our board of directors endeavors to bring together diverse skills, professional experience, perspectives, age, race, ethnicity, gender, and cultural backgrounds that reflect our customer base and the citizens served by our customers, and to guide us in a way that reflects the best interests of all of our stockholders. There are currently seven members on our board of directors. As of December 31, 2022, 43% of our board members were women and 71% of our board members were from underrepresented communities.

Compensation, Benefits and Well-being

We strive to offer fair, competitive compensation and benefits that support our employees’ overall well-being. To ensure alignment with our short- and long-term objectives, our compensation programs for all employees include base pay, short-term incentives, and opportunities for long-term incentives, including equity incentives offered under our employee equity incentive plans and employee stock purchase program. Our well-being and benefit programs focus on four key pillars: physical, emotional, financial and community health. We offer a wide array of benefits including comprehensive health and welfare insurance, paid time-off and leave, and we sponsor a 401(k) plan to provide defined contribution retirement benefits.

Growth and Development

Career development is a primary reason new hires decide to join ShotSpotter. We actively foster a learning culture where employees are empowered to drive their career progression, supporting professional development and providing on-demand learning platforms. Our development programs play a critical role in engaging and retaining our employees as these programs offer opportunities to continually enhance their skills for a variety of career opportunities across the Company.

Corporate Information

We were formed as ShotSpotter, Inc., a California corporation, in 2001 and reincorporated as ShotSpotter, Inc., a Delaware corporation, in 2004. We have also done business as “SST” pursuant to a registered trade name.

Our principal executive offices are located at 39300 Civic Center Drive, Fremont, California 94538 and our telephone number is (510) 794-3100. Our website address is www.shotspotter.com. The information contained on, or that can be accessed through, our website is not incorporated by reference into this Annual Report on Form 10-K, and you should not consider any information contained on, or that can be accessed through, our website as part of this Annual Report on Form 10-K.

ShotSpotter, the ShotSpotter logo, ShotSpotter RespondTM, ShotSpotter SecureCampusTM, ShotSpotter SiteSecureTM, ShotSpotter Connect®, ShotSpotter InvestigateTM, ShotSpotter GCMTM, COPLINK X, ShotSpotter Labs and other trade names, trademarks or service marks of ShotSpotter appearing in this Annual Report on Form 10-K are the property of ShotSpotter, Inc. Trade names, trademarks and service marks of other companies appearing in this Annual Report on Form 10-K are the property of their respective holders.

Where You Can Find More Information

You can read our SEC filings, including this Annual Report on Form 10-K, over the internet at the SEC’s website at www.sec.gov.

22

We are subject to the information reporting requirements of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and we are required to file reports, proxy statements and other information with the SEC. We also maintain a website at www.shotspotter.com, at which you may access these materials, free of charge, as reasonably practicable after they are electronically filed with, or furnished to, the SEC. We are not, however, including the information contained on our website, or information that may be accessed through links on our website, as part of, or incorporating such information by reference into, this Annual Report on Form 10-K.

23

Item 1A. RISK FACTORS