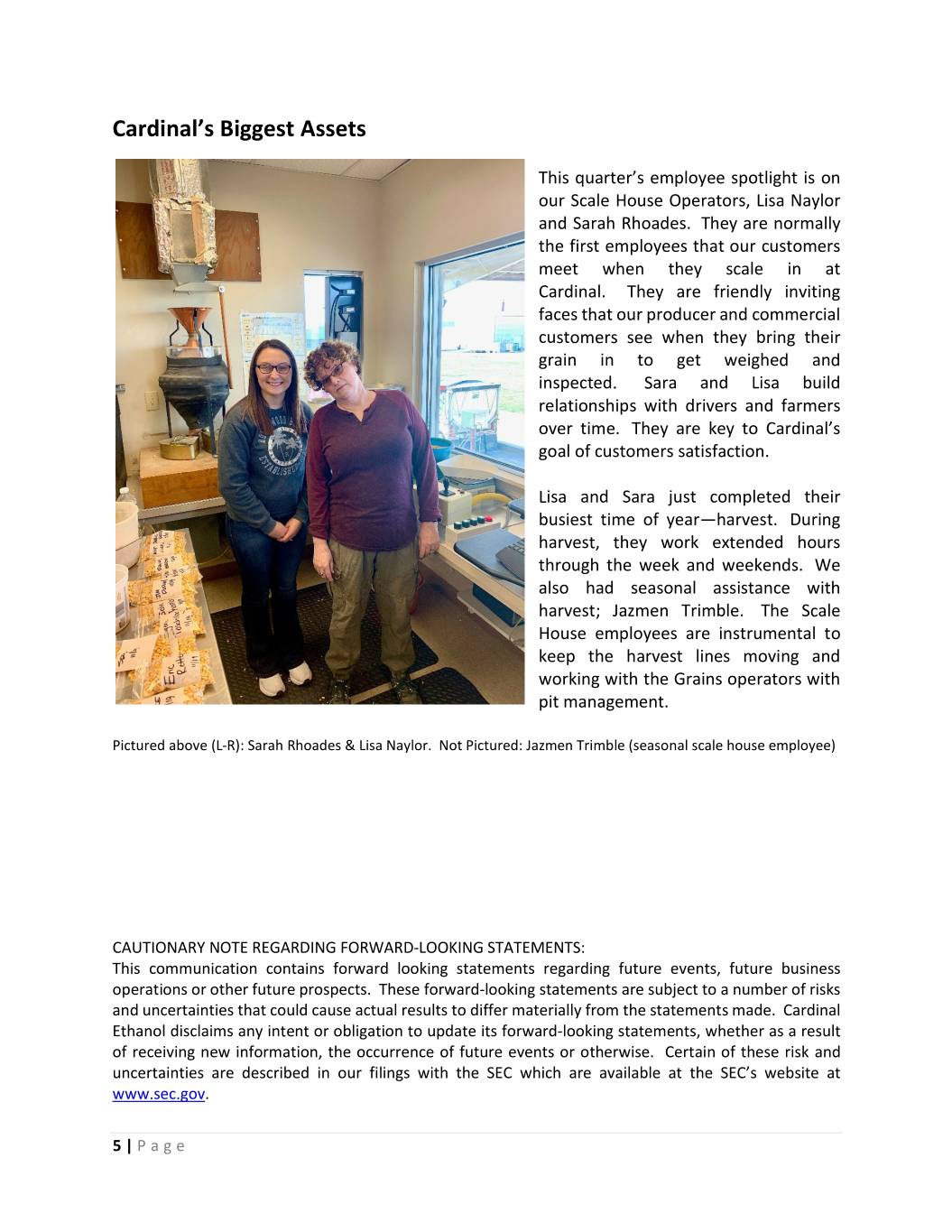

November 2020 Cardinal Ethanol Receives Randolph County YMCA Strong Community Award Cardinal Ethanol was humbled this year to be the recipient of this year’s Randolph County YMCA’s Strong Community Award. “The Strong Community Award goes to a recipient that has been instrumental in supporting the Y, either financially or through in-kind assistance, with that support aiding the Y in continuing its mission in Randolph County”, Tom Byrum, Senior Program Director, Randolph County YMCA. Cardinal joins past recipients of recent years including: The City of Union City, Randolph Nursing Home, Winchester Golf Club and Randolph County Solid Waste Management. Cardinal strives to make a positive presence in the community and support organizations whose missions radiate good virtues, such as the Randolph County YMCA. Estimated Taxable Income Per Unit for Calendar Year 2020 As we mentioned in the Member Distribution letter you received in February, Cardinal Ethanol is a limited liability company that, for income tax purposes, passes its taxable income to its members. This means that each unit holder must report their prorated share of Cardinal’s taxable income on their personal tax return. As an aid to you for your 2020 tax planning, we are providing an ESTIMATE of company taxable income for the calendar year ending December 31, 2020. This ESTIMATE is not a guarantee of future results; it is only our best prediction and involves numerous assumptions, risks and uncertainties. Our actual results may differ. 1 | Page

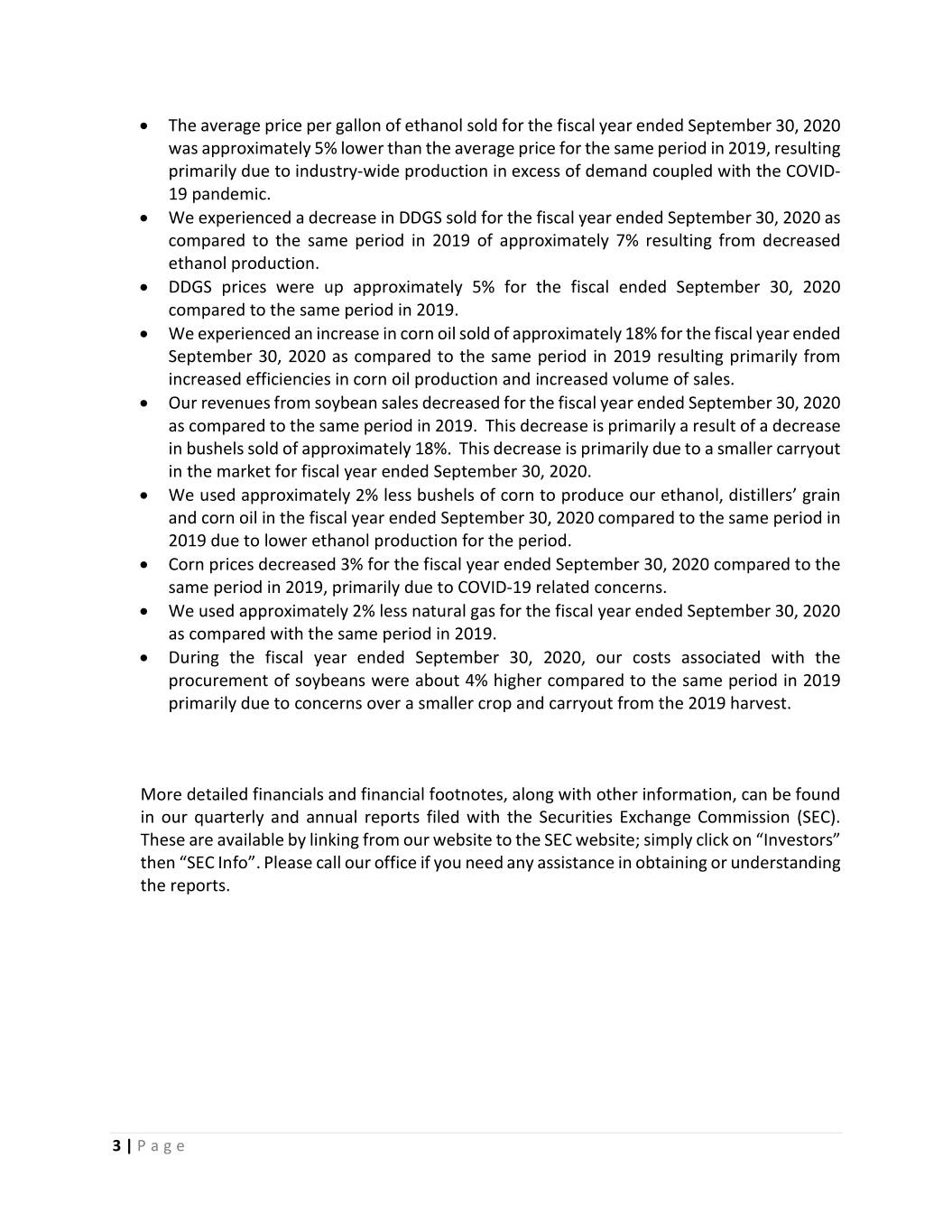

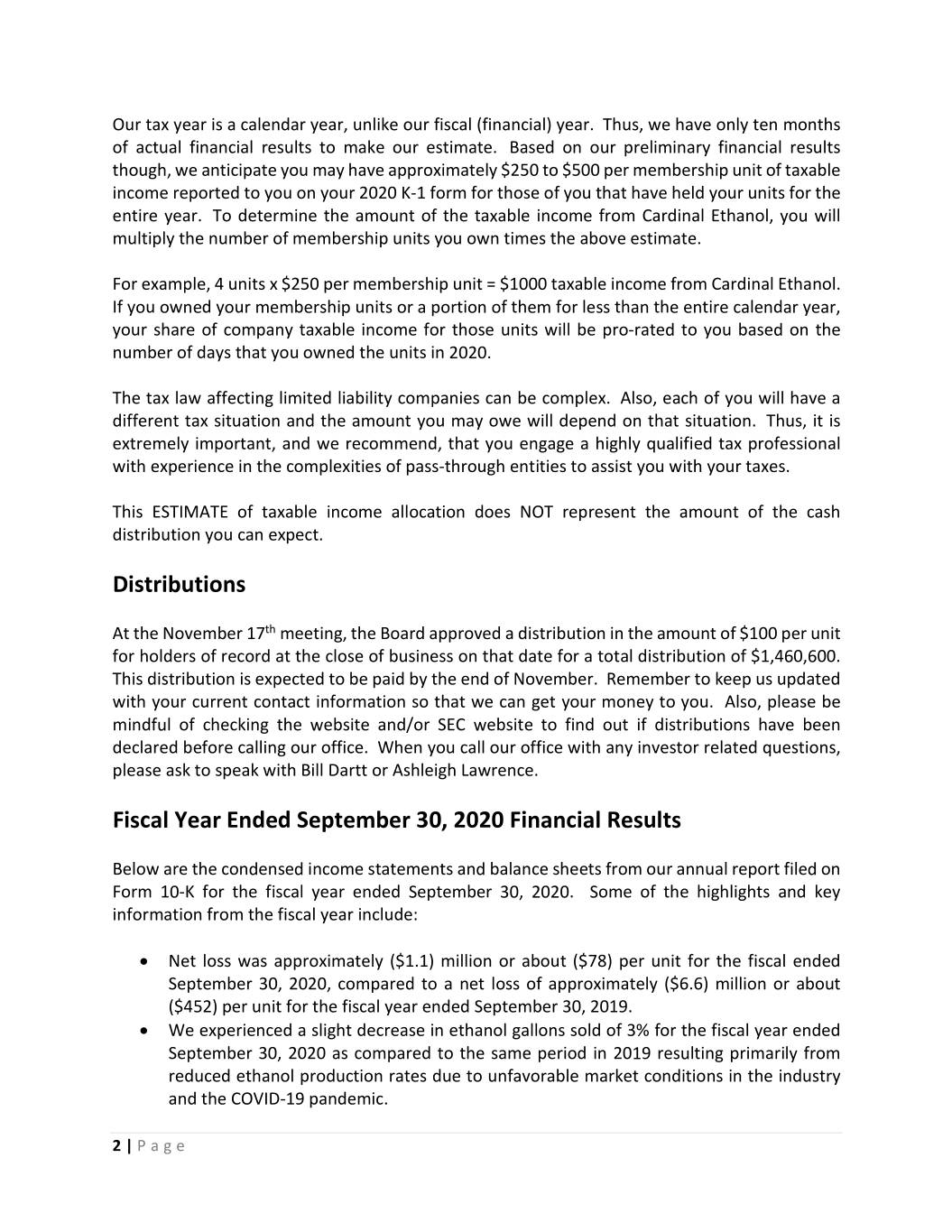

Our tax year is a calendar year, unlike our fiscal (financial) year. Thus, we have only ten months of actual financial results to make our estimate. Based on our preliminary financial results though, we anticipate you may have approximately $250 to $500 per membership unit of taxable income reported to you on your 2020 K-1 form for those of you that have held your units for the entire year. To determine the amount of the taxable income from Cardinal Ethanol, you will multiply the number of membership units you own times the above estimate. For example, 4 units x $250 per membership unit = $1000 taxable income from Cardinal Ethanol. If you owned your membership units or a portion of them for less than the entire calendar year, your share of company taxable income for those units will be pro-rated to you based on the number of days that you owned the units in 2020. The tax law affecting limited liability companies can be complex. Also, each of you will have a different tax situation and the amount you may owe will depend on that situation. Thus, it is extremely important, and we recommend, that you engage a highly qualified tax professional with experience in the complexities of pass-through entities to assist you with your taxes. This ESTIMATE of taxable income allocation does NOT represent the amount of the cash distribution you can expect. Distributions At the November 17th meeting, the Board approved a distribution in the amount of $100 per unit for holders of record at the close of business on that date for a total distribution of $1,460,600. This distribution is expected to be paid by the end of November. Remember to keep us updated with your current contact information so that we can get your money to you. Also, please be mindful of checking the website and/or SEC website to find out if distributions have been declared before calling our office. When you call our office with any investor related questions, please ask to speak with Bill Dartt or Ashleigh Lawrence. Fiscal Year Ended September 30, 2020 Financial Results Below are the condensed income statements and balance sheets from our annual report filed on Form 10-K for the fiscal year ended September 30, 2020. Some of the highlights and key information from the fiscal year include: • Net loss was approximately ($1.1) million or about ($78) per unit for the fiscal ended September 30, 2020, compared to a net loss of approximately ($6.6) million or about ($452) per unit for the fiscal year ended September 30, 2019. • We experienced a slight decrease in ethanol gallons sold of 3% for the fiscal year ended September 30, 2020 as compared to the same period in 2019 resulting primarily from reduced ethanol production rates due to unfavorable market conditions in the industry and the COVID-19 pandemic. 2 | Page

• The average price per gallon of ethanol sold for the fiscal year ended September 30, 2020 was approximately 5% lower than the average price for the same period in 2019, resulting primarily due to industry-wide production in excess of demand coupled with the COVID- 19 pandemic. • We experienced a decrease in DDGS sold for the fiscal year ended September 30, 2020 as compared to the same period in 2019 of approximately 7% resulting from decreased ethanol production. • DDGS prices were up approximately 5% for the fiscal ended September 30, 2020 compared to the same period in 2019. • We experienced an increase in corn oil sold of approximately 18% for the fiscal year ended September 30, 2020 as compared to the same period in 2019 resulting primarily from increased efficiencies in corn oil production and increased volume of sales. • Our revenues from soybean sales decreased for the fiscal year ended September 30, 2020 as compared to the same period in 2019. This decrease is primarily a result of a decrease in bushels sold of approximately 18%. This decrease is primarily due to a smaller carryout in the market for fiscal year ended September 30, 2020. • We used approximately 2% less bushels of corn to produce our ethanol, distillers’ grain and corn oil in the fiscal year ended September 30, 2020 compared to the same period in 2019 due to lower ethanol production for the period. • Corn prices decreased 3% for the fiscal year ended September 30, 2020 compared to the same period in 2019, primarily due to COVID-19 related concerns. • We used approximately 2% less natural gas for the fiscal year ended September 30, 2020 as compared with the same period in 2019. • During the fiscal year ended September 30, 2020, our costs associated with the procurement of soybeans were about 4% higher compared to the same period in 2019 primarily due to concerns over a smaller crop and carryout from the 2019 harvest. More detailed financials and financial footnotes, along with other information, can be found in our quarterly and annual reports filed with the Securities Exchange Commission (SEC). These are available by linking from our website to the SEC website; simply click on “Investors” then “SEC Info”. Please call our office if you need any assistance in obtaining or understanding the reports. 3 | Page

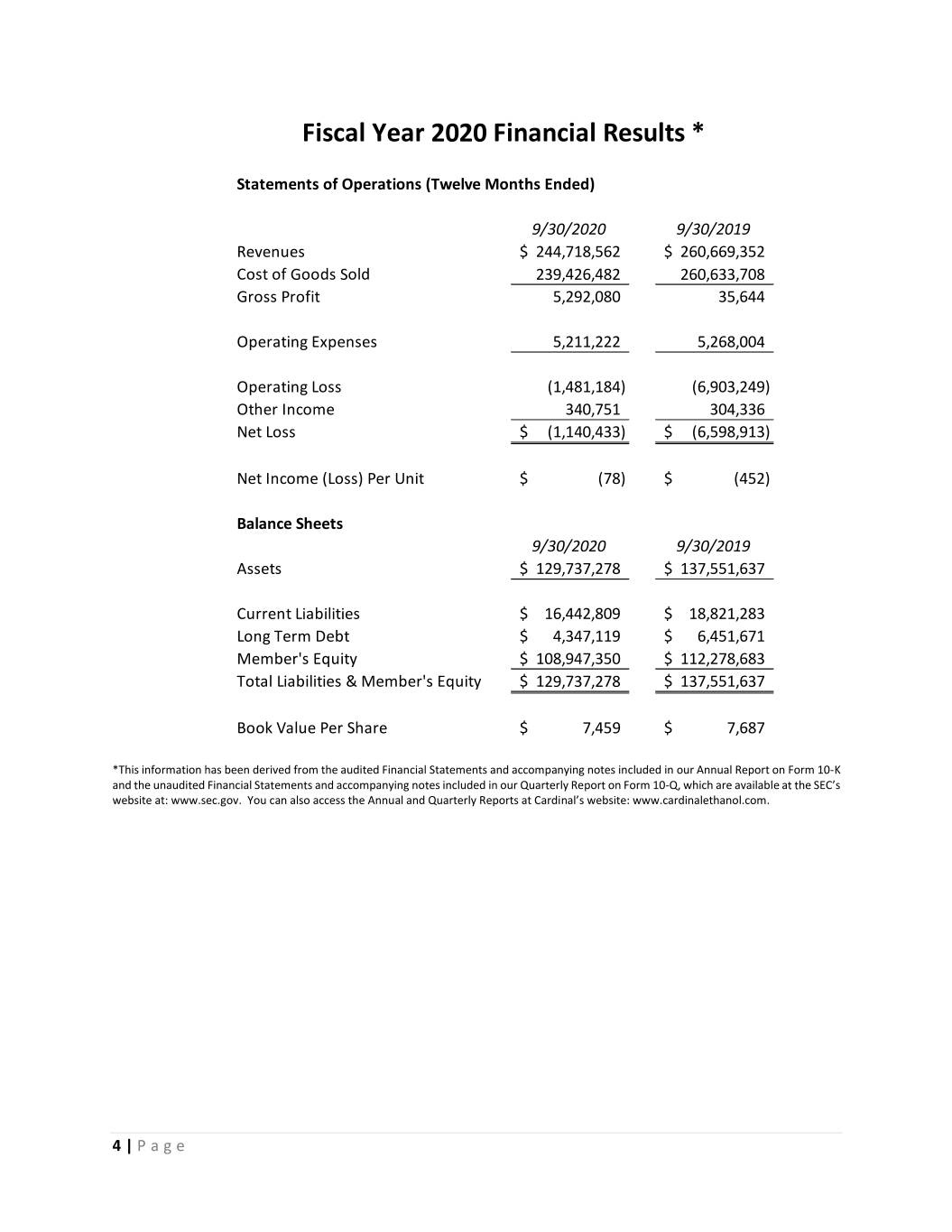

Fiscal Year 2020 Financial Results * Statements of Operations (Twelve Months Ended) 9/30/2020 9/30/2019 Revenues $ 244,718,562 $ 260,669,352 Cost of Goods Sold 239,426,482 260,633,708 Gross Profit 5,292,080 35,644 Operating Expenses 5,211,222 5,268,004 Operating Loss (1,481,184) (6,903,249) Other Income 340,751 304,336 Net Loss $ (1,140,433) $ (6,598,913) Net Income (Loss) Per Unit $ (78) $ (452) Balance Sheets 9/30/2020 9/30/2019 Assets $ 129,737,278 $ 137,551,637 Current Liabilities $ 16,442,809 $ 18,821,283 Long Term Debt $ 4,347,119 $ 6,451,671 Member's Equity $ 108,947,350 $ 112,278,683 Total Liabilities & Member's Equity $ 129,737,278 $ 137,551,637 Book Value Per Share $ 7,459 $ 7,687 *This information has been derived from the audited Financial Statements and accompanying notes included in our Annual Report on Form 10-K and the unaudited Financial Statements and accompanying notes included in our Quarterly Report on Form 10-Q, which are available at the SEC’s website at: www.sec.gov. You can also access the Annual and Quarterly Reports at Cardinal’s website: www.cardinalethanol.com. 4 | Page

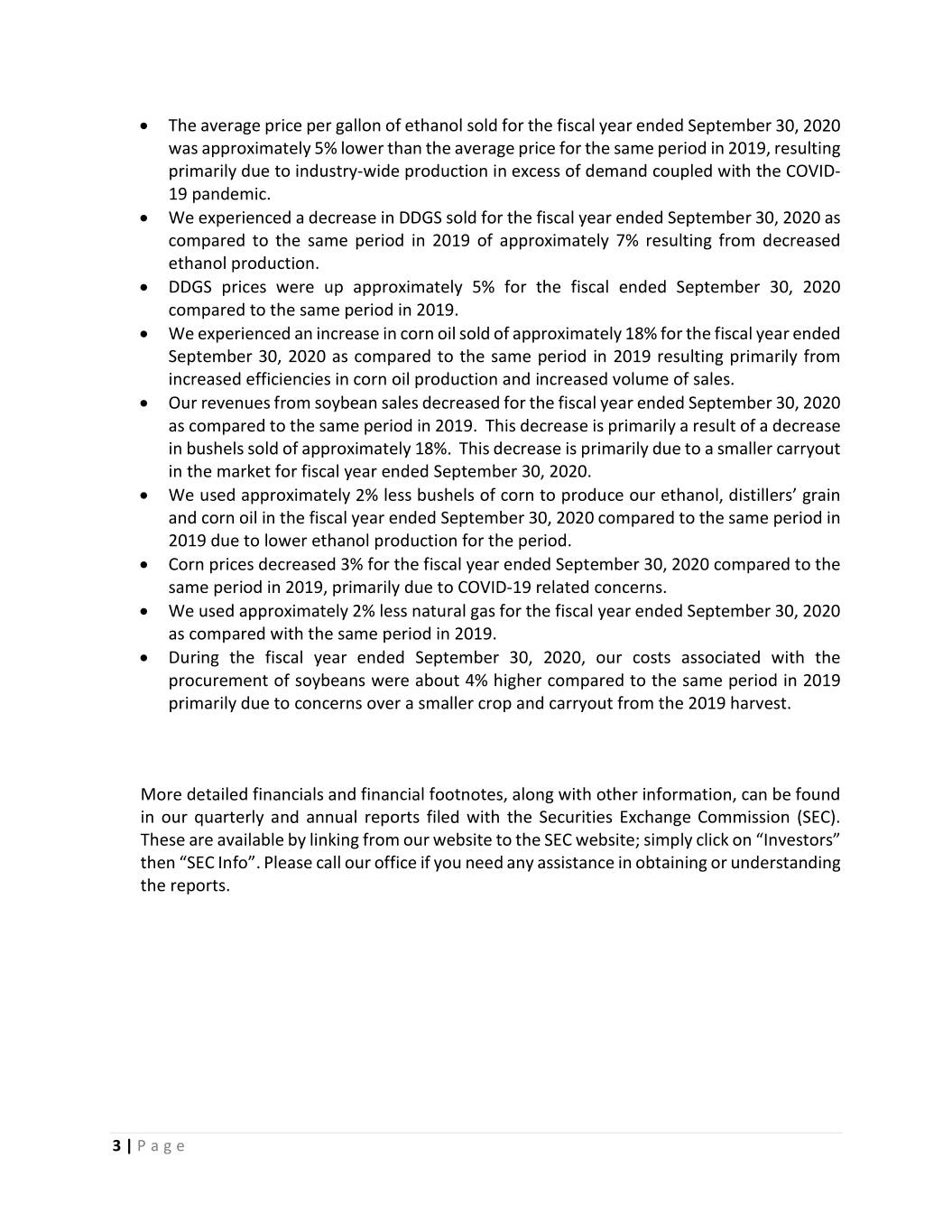

Cardinal’s Biggest Assets This quarter’s employee spotlight is on our Scale House Operators, Lisa Naylor and Sarah Rhoades. They are normally the first employees that our customers meet when they scale in at Cardinal. They are friendly inviting faces that our producer and commercial customers see when they bring their grain in to get weighed and inspected. Sara and Lisa build relationships with drivers and farmers over time. They are key to Cardinal’s goal of customers satisfaction. Lisa and Sara just completed their busiest time of year—harvest. During harvest, they work extended hours through the week and weekends. We also had seasonal assistance with harvest; Jazmen Trimble. The Scale House employees are instrumental to keep the harvest lines moving and working with the Grains operators with pit management. Pictured above (L-R): Sarah Rhoades & Lisa Naylor. Not Pictured: Jazmen Trimble (seasonal scale house employee) CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS: This communication contains forward looking statements regarding future events, future business operations or other future prospects. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from the statements made. Cardinal Ethanol disclaims any intent or obligation to update its forward-looking statements, whether as a result of receiving new information, the occurrence of future events or otherwise. Certain of these risk and uncertainties are described in our filings with the SEC which are available at the SEC’s website at www.sec.gov. 5 | Page