1 | P a g e August 2022 Capital Projects Delivering Value to Cardinal Later this month, we will break ground on our high protein project. ICM is the process designer and technology provider of the Advanced Processing Package™ (APP™) for high protein production that we will be implementing. Cardinal and ICM have been planning and preparing over the last 7 months prior to construction. There are 5 separate buildings that will house the various technologies of the APP™ project. The Team at Cardinal continues to look for ways to maximize our efficiencies and lower production cost. This year, although not a large capital spend, we have been able to finish a few projects that have delivered value to the business. We have added a new bulk chemical tank that will allow us to receive bulk material and reduce cost when compared to totes. We are finishing up a project to increase the capacity of our finished product corn oil tanks. Technology, enzymes and demulsifiers have enabled us to achieve better corn oil yields and volume. Extra storage capacity is needed to keep pace with production rates. We continue to operate at the top of our production capacity and more of our products can be shipped via rail to enhance value and help keep product moving logistically. In addition to ethanol, DDGS and soybeans, we can now ship corn oil over rail. The need to upgrade our on-site rail capacity is critical. We are adding space for an additional 100 rail cars to accommodate more flexibility in shipping and to help to facilitate better logistics. With cyber security breaches becoming more common in today’s corporate environment, we have undergone extensive review of our systems and have begun upgrades and enhancements to our IT systems to protect the business and operations against cyber-attacks.

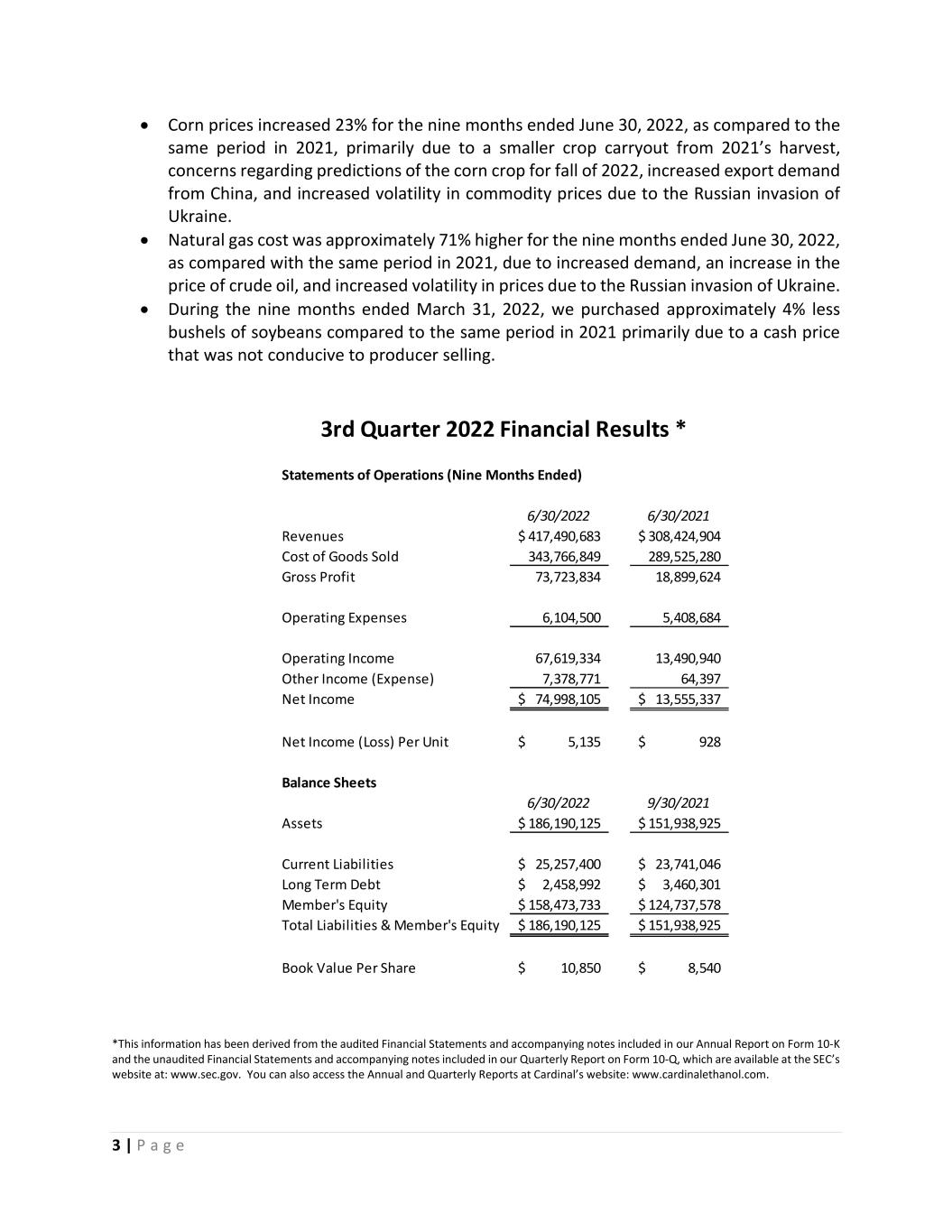

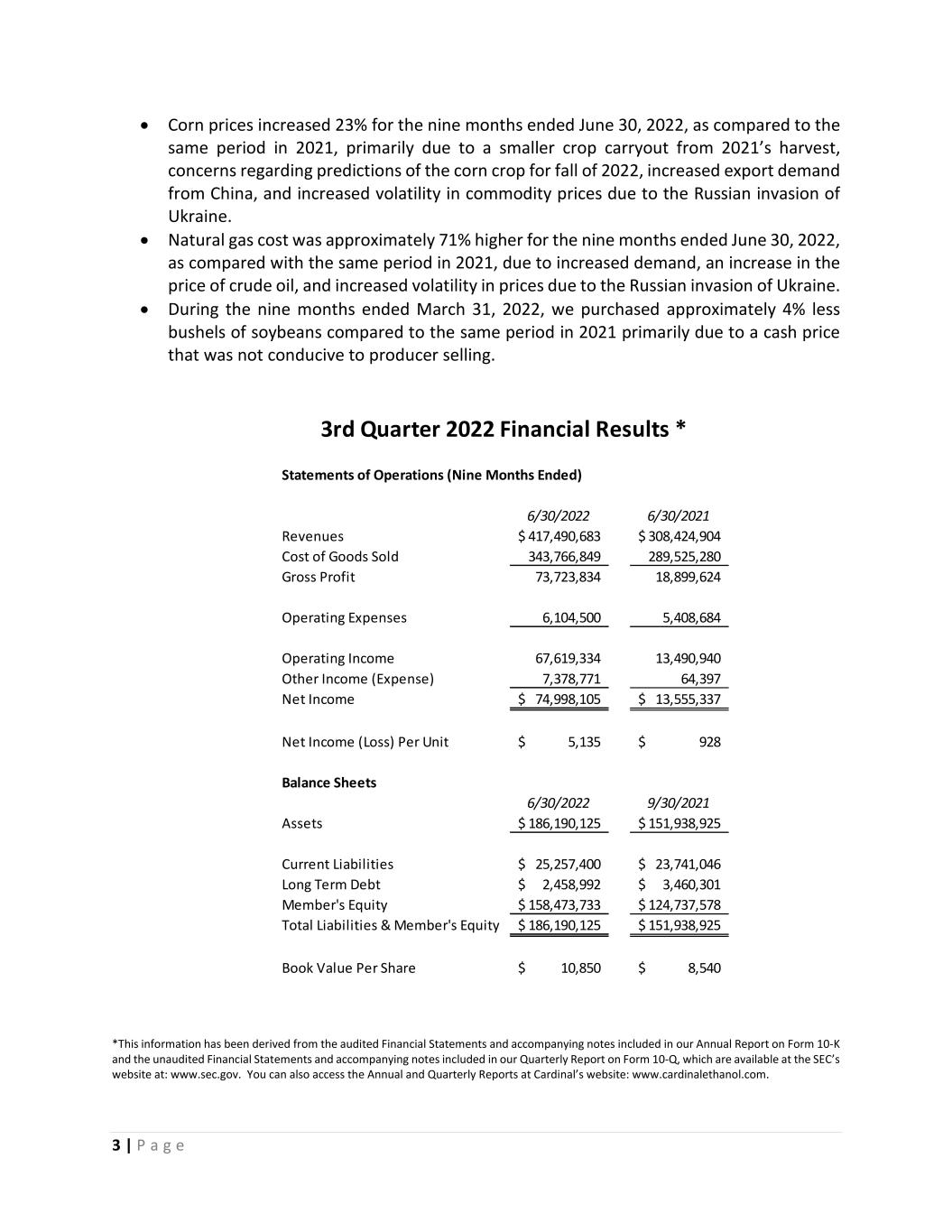

2 | P a g e Distributions At the August 16th meeting, the Board approved a distribution of $1,500 per unit for holders of record at the close of business on that date for a total distribution of $21,909,000. This distribution is expected to be paid by the end of August. Please remember to keep us updated with your current contact information for accurate distribution posting. Also, please be mindful of checking Cardinal’s website and/or SEC website to find out current distribution status prior to calling the office. For investor related questions, please call Cardinal’s office and ask to speak with Bill Dartt or Ashleigh Lawrence. Fiscal Quarter Ended June 30, 2022, Financial Results Below are the condensed income statements and balance sheets from our quarterly report filed on Form 10-Q for the period ended June 30, 2022. Some of the highlights and key information include: Net income was nearly $75 million or about $5,135 per unit for the nine months ended June 30, 2022, compared to a net income of just over $13.5 million or about $928 per unit for same period in fiscal year 2021. We experienced an increase in ethanol gallons sold of 3% for the nine months ended June 30, 2022, as compared to the same period in 2021 resulting primarily from increased ethanol production rates for the period. The average price per gallon of ethanol sold for the nine months ended June 30, 2022, was approximately 45% higher than the average price for the same period in 2021, resulting primarily from an increase in fuel demand coupled with labor shortages and higher corn and oil prices. The average price per ton of DDGS sold for the nine months ended June 30, 2022, was approximately 9% higher as compared to the same period in 2021, resulting primarily from higher corn and soybean meal prices. Corn oil prices were approximately 68% higher in the nine months ended June 30, 2022, as compared to the nine months ended June 30, 2021, due to higher soybean oil prices and increased biodiesel production. Our revenues from soybean sales increased for the nine months ended June 30, 2022, as compared to the same period in 2021. This increase is primarily a result of an increase in average price per bushel of approximately 15%. This increase was partially offset by a decrease in bushels sold for the nine months ended June 30, 2022, of approximately 4% as compared to the nine months ended June 30, 2021. We used approximately 1% more bushels of corn to produce our ethanol, distillers’ grain and corn oil in the nine months ended June 30, 2022, as compared to the same period in 2021 due to higher ethanol production for the period.

3 | P a g e Corn prices increased 23% for the nine months ended June 30, 2022, as compared to the same period in 2021, primarily due to a smaller crop carryout from 2021’s harvest, concerns regarding predictions of the corn crop for fall of 2022, increased export demand from China, and increased volatility in commodity prices due to the Russian invasion of Ukraine. Natural gas cost was approximately 71% higher for the nine months ended June 30, 2022, as compared with the same period in 2021, due to increased demand, an increase in the price of crude oil, and increased volatility in prices due to the Russian invasion of Ukraine. During the nine months ended March 31, 2022, we purchased approximately 4% less bushels of soybeans compared to the same period in 2021 primarily due to a cash price that was not conducive to producer selling. *This information has been derived from the audited Financial Statements and accompanying notes included in our Annual Report on Form 10-K and the unaudited Financial Statements and accompanying notes included in our Quarterly Report on Form 10-Q, which are available at the SEC’s website at: www.sec.gov. You can also access the Annual and Quarterly Reports at Cardinal’s website: www.cardinalethanol.com. Statements of Operations (Nine Months Ended) 6/30/2022 6/30/2021 Revenues 417,490,683$ 308,424,904$ Cost of Goods Sold 343,766,849 289,525,280 Gross Profit 73,723,834 18,899,624 Operating Expenses 6,104,500 5,408,684 Operating Income 67,619,334 13,490,940 Other Income (Expense) 7,378,771 64,397 Net Income 74,998,105$ 13,555,337$ Net Income (Loss) Per Unit 5,135$ 928$ Balance Sheets 6/30/2022 9/30/2021 Assets 186,190,125$ 151,938,925$ Current Liabilities 25,257,400$ 23,741,046$ Long Term Debt 2,458,992$ 3,460,301$ Member's Equity 158,473,733$ 124,737,578$ Total Liabilities & Member's Equity 186,190,125$ 151,938,925$ Book Value Per Share 10,850$ 8,540$ 3rd Quarter 2022 Financial Results *

4 | P a g e More detailed financials and financial footnotes, along with other information, can be found in our quarterly and annual reports filed with the Securities Exchange Commission (SEC). These are available by linking from our website to the SEC website; simply click on “Investors” then “SEC Info”. Please call our office if you need any assistance in obtaining or understanding the reports. Corporate Challenge Champions Every summer the local Randolph County YMCA holds an event called Corporate Challenge. Corporations from all over the county participate in different events including wiffleball, corn hole, horseshoes, euchre, trivia, shuffleboard, egg toss relay, and many more. This year, for the first time ever, your Cardinal team won the challenge! Employees and their families showed superb participation throughout the summer. We competed in every event while running neck and neck with other local businesses. The team worked its way up from third, to second to first place and finally pulled away with a win by merely two points. The Corporate Challenge is a great way for businesses to support the YMCA, but beyond that, it promotes teambuilding skills and networking with other business in the community. Great job Cardinals! Pictured Above (L: R) Row 1: Rob Bowen, Tyler Barbour, Justin McElhany, Sarah Rhoades, Lisa Naylor, Ashleigh Lawrence Row 2: Casey Bruns, Ryan Bussell, Chris Tucker, Lacy Addington, Jeff Painter, Brian McEldowney, Bill Dartt, Sam Rhoades, Chad Lindow, Jeremey Herlyn CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS: This communication contains forward looking statements regarding future events, future business operations or other future prospects. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from the statements made. Cardinal

5 | P a g e Ethanol disclaims any intent or obligation to update its forward-looking statements, whether as a result of receiving new information, the occurrence of future events or otherwise. Certain of these risk and uncertainties are described in our filings with the SEC which are available at the SEC’s website at www.sec.gov.